Definitions and References of Management Accounting System

VerifiedAdded on 2021/02/19

|20

|7021

|229

AI Summary

MANAGEMENT ACCOUNTING INTRODUCTION 3 PART (A) 3 PART (B) 12 CONCLUSION 16 REFERENCES 16 INTRODUCTION Management accounting system is a systematic process which generates or provide useful information and data for management in order to assist them in decision making process. This report consist of management accounting definitions and its various aspects along with various type of management accounting systems, kind of management accounting reporting and different type of planning tools used by business organisation inducing their advantages and disadvantages in aspect of TPG Processing company

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

MANAGEMENT

ACCOUNTING

ACCOUNTING

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Table of Contents

INTRODUCTION ..........................................................................................................................3

PART (A).........................................................................................................................................3

PART (B).......................................................................................................................................12

CONCLUSION .............................................................................................................................16

REFERENCES..............................................................................................................................16

INTRODUCTION ..........................................................................................................................3

PART (A).........................................................................................................................................3

PART (B).......................................................................................................................................12

CONCLUSION .............................................................................................................................16

REFERENCES..............................................................................................................................16

INTRODUCTION

Management accounting system is a systematic process which generates or provide

useful information and data for management in order to assist them in decision making process.

It is system which provide a framework for effectively formulation and implementation of

strategies and action plan. This report consist of management accounting definitions and its

various aspects along with various type of management accounting systems, kind of management

accounting reporting and different type of planning tools used by business organisation inducing

their advantages and disadvantages in aspect of TPG Processing company. The report also

provide an explanation about financial problems and in which manner management accounting,

in responding to financial problems, can drive organisations to sustainable success.

PART (A)

1 Explanation of management accounting.

MAS refers to set of activities which generates relevant information for managers. Such

information ultimately assist them in effective internal management (Sisaye, Birnberg, 2012).

Following are significant definition of management accounting system, as follows:

As per IMAs, “ Management accounting defined as field or area of profession that

involves contribution towards management and strategic decision making, effective planning,

professionalism in financial reporting and performance management” (Jakobsen, 2012).

Comment- According to the above definition of IMAs it is analysed that MAS is most

significant aspect of business enterprise's management. Managerial personnel can use this

process for effective decision making. In TPG processing company, management accounting

system is adopted by company to formulate action plan and strategies.

As per CIMA “ Management accounting system can be explained as a systematic set of

activities of choosing, collecting, assessing, and communicating financial or accounting

information to managerial personnels for effective decision making” (Gibassier, 2017).

Comment- According to the definition of CIMA, it is analysed that management

accounting system provides a systematic presentation of raw financial information to top

management for taking business.

Management accounting system is a systematic process which generates or provide

useful information and data for management in order to assist them in decision making process.

It is system which provide a framework for effectively formulation and implementation of

strategies and action plan. This report consist of management accounting definitions and its

various aspects along with various type of management accounting systems, kind of management

accounting reporting and different type of planning tools used by business organisation inducing

their advantages and disadvantages in aspect of TPG Processing company. The report also

provide an explanation about financial problems and in which manner management accounting,

in responding to financial problems, can drive organisations to sustainable success.

PART (A)

1 Explanation of management accounting.

MAS refers to set of activities which generates relevant information for managers. Such

information ultimately assist them in effective internal management (Sisaye, Birnberg, 2012).

Following are significant definition of management accounting system, as follows:

As per IMAs, “ Management accounting defined as field or area of profession that

involves contribution towards management and strategic decision making, effective planning,

professionalism in financial reporting and performance management” (Jakobsen, 2012).

Comment- According to the above definition of IMAs it is analysed that MAS is most

significant aspect of business enterprise's management. Managerial personnel can use this

process for effective decision making. In TPG processing company, management accounting

system is adopted by company to formulate action plan and strategies.

As per CIMA “ Management accounting system can be explained as a systematic set of

activities of choosing, collecting, assessing, and communicating financial or accounting

information to managerial personnels for effective decision making” (Gibassier, 2017).

Comment- According to the definition of CIMA, it is analysed that management

accounting system provides a systematic presentation of raw financial information to top

management for taking business.

Origin of management accounting- The origin of management accounting can be track in time

period of early industrial revolution. In addition, this accounting was evolved with help of cost

accounting techniques (Schaltegger and Zvezdov, 2015).

Principles of management accounting-

Relevance- As per this principle of management accounting, the information included in

management accounting systems and reports should be reliable to business transactions.

Influence- According to this principle, information of management accounting reports

should be communicated with all members of business.

Value- The management accounting is linked with various kind of operations of

companies. Hence, information included in this system should be valuable.

Credibility- As per this principle, the management accountant is expected to be ethical,

reliable and well aware of accounting concepts.

Roles of management accounting system:

Provide detailed information- This is one of the important role of management

accounting that is related with providing detailed information including financials and

non financial information. Such as in the TPG processing company, their managers get

complete information related to financial and non financial transactions.

Helpful in decision-making- Another role of management accounting is that it is linked

with the effective decision-making by providing various kind of reports. Like in above

company, they take better decisions by use of internal reports (Soltes, 2014).

Enables better planning- The management accounting is useful for better planning and

strategy formulation. Same as in above company, their managers plans the strategies

effectively by help of MA reports.

Helps in resolving financial issues- With help of management accounting systems,

companies get able to solve any kind of financial issue that occurs. Such as in above

company, their financial issues such as higher expenditure can be resolve by cost

accounting system.

Improves organisational performance- In addition, the management accounting plays an

important role in context of managing financial and non financial performance. Like in

period of early industrial revolution. In addition, this accounting was evolved with help of cost

accounting techniques (Schaltegger and Zvezdov, 2015).

Principles of management accounting-

Relevance- As per this principle of management accounting, the information included in

management accounting systems and reports should be reliable to business transactions.

Influence- According to this principle, information of management accounting reports

should be communicated with all members of business.

Value- The management accounting is linked with various kind of operations of

companies. Hence, information included in this system should be valuable.

Credibility- As per this principle, the management accountant is expected to be ethical,

reliable and well aware of accounting concepts.

Roles of management accounting system:

Provide detailed information- This is one of the important role of management

accounting that is related with providing detailed information including financials and

non financial information. Such as in the TPG processing company, their managers get

complete information related to financial and non financial transactions.

Helpful in decision-making- Another role of management accounting is that it is linked

with the effective decision-making by providing various kind of reports. Like in above

company, they take better decisions by use of internal reports (Soltes, 2014).

Enables better planning- The management accounting is useful for better planning and

strategy formulation. Same as in above company, their managers plans the strategies

effectively by help of MA reports.

Helps in resolving financial issues- With help of management accounting systems,

companies get able to solve any kind of financial issue that occurs. Such as in above

company, their financial issues such as higher expenditure can be resolve by cost

accounting system.

Improves organisational performance- In addition, the management accounting plays an

important role in context of managing financial and non financial performance. Like in

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

TPG processing company, their performance is being managed by help of various kind of

internal reports such as performance report.

Linked with forecasting of income and expenditures- This is very important role of

management accounting that is associated with projection of income and expenditures by

help of planning tools. Same as in above company their managers forecast income and

expenditures by help of planning tools.

2. Types of management accounting system.

Management accounting systems: Below types of MAS are mentioned:

Cost accounting system- It is a type of accounting system that is involved in the process

of estimating future cost of various activities as well as providing detailed information

about occurred cost in different operations (Adisetiawan and Surono, 2016). By

implementation of this accounting system, companies get able to know about each

activities' cost separately. It is essentially required in organisations by finance department

for tracking and keeping overall expenditures lower from standards. Like in the above

company, they are using this accounting system for keeping an additional control over

costs. In addition under Starbuck and Ikea company, they are using this accounting

system for tracking and estimating future cost of their operations. The starbuck company,

manage the cost of coffee manufacturing as well as the Ikea allocate the financial

resources in operations of furniture.

Inventory management system- It has been defined as a kind of accounting system that

is linked with the tracking available quantity of raw material, prepared products, work in

process goods etc. The key role of this accounting system is to keeping cost of storage

lower as much as possible. Eventually, this system is essentially required for companies

in providing detailed information to production managers about quantitative aspect of

available material. Such as in Starbuck, their managers use this accounting system for

tracking the availability of material for coffee preparation and on the basis of it they

make order for purchasing. Same as in Ikea company, their production department

manage the stock of prepared furniture and raw material such as woods, fevicoal and

many more (About use of inventory management system in IKEA, 2019).

internal reports such as performance report.

Linked with forecasting of income and expenditures- This is very important role of

management accounting that is associated with projection of income and expenditures by

help of planning tools. Same as in above company their managers forecast income and

expenditures by help of planning tools.

2. Types of management accounting system.

Management accounting systems: Below types of MAS are mentioned:

Cost accounting system- It is a type of accounting system that is involved in the process

of estimating future cost of various activities as well as providing detailed information

about occurred cost in different operations (Adisetiawan and Surono, 2016). By

implementation of this accounting system, companies get able to know about each

activities' cost separately. It is essentially required in organisations by finance department

for tracking and keeping overall expenditures lower from standards. Like in the above

company, they are using this accounting system for keeping an additional control over

costs. In addition under Starbuck and Ikea company, they are using this accounting

system for tracking and estimating future cost of their operations. The starbuck company,

manage the cost of coffee manufacturing as well as the Ikea allocate the financial

resources in operations of furniture.

Inventory management system- It has been defined as a kind of accounting system that

is linked with the tracking available quantity of raw material, prepared products, work in

process goods etc. The key role of this accounting system is to keeping cost of storage

lower as much as possible. Eventually, this system is essentially required for companies

in providing detailed information to production managers about quantitative aspect of

available material. Such as in Starbuck, their managers use this accounting system for

tracking the availability of material for coffee preparation and on the basis of it they

make order for purchasing. Same as in Ikea company, their production department

manage the stock of prepared furniture and raw material such as woods, fevicoal and

many more (About use of inventory management system in IKEA, 2019).

Job costing system- This is an accounting system that is associated to the allocation of

cost separately to various kind of jobs. With the use of this costing system, companies

can compute each unit's cost and can take decisions further. The job costing system is

essentially required in those companies in which there are large number of products are

products different from each other (Hörisch, 2015). For example in Starbuck company,

they get able to calculate per unit cost of jobs involved in manufacturing of coffee. As

well as in Ikea company, their production department gets able to know about per unit

cost of manufactured furniture.

Price optimisation system- It is a kind of accounting system that is associated with the

analysis of customer's behaviour on various prices so that an effective price of products

and services can be assigned by companies. This is widely used in most of companies in

which sales is lower. In addition, it is essentially required by organisations for setting the

prices at a level on which they can't bear any loss (Zheng and Alver, 2015). Such as in

starbuck company, they set the price of coffee on the basis of demand of customers and

their reaction on various pricing patterns (About use of price optimisation system in

Starbuck, 2019). Same as in the Ikea company, they evaluate demand of their products in

market and as per it set the prices on basis of it.

3. Different method of management accounting reporting.

MA reporting is process under which various managers communicates the relevant

information generated though MAS to top management for strategic decision making. In TPG,

MA reporting is made by production or divisional managers to top management, which assist

them in decision making:

Cost accounting reports- Under this reporting system a detailed information of various

costs are provided by production and divisional managers. Cost accounting report assist

mangers in optimisation of various cost to ensure profitability. So basically it is important

in providing detailed information about cost of different activities of organisation. As

well as this report enables to companies in making aware about how much cost is

occurring in various kind of activities. In TPG processing company, managers with help

of this system identify any additional or unproductive cost in manufacturing and

cost separately to various kind of jobs. With the use of this costing system, companies

can compute each unit's cost and can take decisions further. The job costing system is

essentially required in those companies in which there are large number of products are

products different from each other (Hörisch, 2015). For example in Starbuck company,

they get able to calculate per unit cost of jobs involved in manufacturing of coffee. As

well as in Ikea company, their production department gets able to know about per unit

cost of manufactured furniture.

Price optimisation system- It is a kind of accounting system that is associated with the

analysis of customer's behaviour on various prices so that an effective price of products

and services can be assigned by companies. This is widely used in most of companies in

which sales is lower. In addition, it is essentially required by organisations for setting the

prices at a level on which they can't bear any loss (Zheng and Alver, 2015). Such as in

starbuck company, they set the price of coffee on the basis of demand of customers and

their reaction on various pricing patterns (About use of price optimisation system in

Starbuck, 2019). Same as in the Ikea company, they evaluate demand of their products in

market and as per it set the prices on basis of it.

3. Different method of management accounting reporting.

MA reporting is process under which various managers communicates the relevant

information generated though MAS to top management for strategic decision making. In TPG,

MA reporting is made by production or divisional managers to top management, which assist

them in decision making:

Cost accounting reports- Under this reporting system a detailed information of various

costs are provided by production and divisional managers. Cost accounting report assist

mangers in optimisation of various cost to ensure profitability. So basically it is important

in providing detailed information about cost of different activities of organisation. As

well as this report enables to companies in making aware about how much cost is

occurring in various kind of activities. In TPG processing company, managers with help

of this system identify any additional or unproductive cost in manufacturing and

production process which ultimately assist company to optimise costs and increase profit

margin. Through usage of the information included in this report, organisation have an

ability to made changes and improve efficiency of operations. The main essential

requirement of this system towards TPG that it helps in determination of the most

profitable determinant after comparison of all information present in cost centre report in

respect of the expenses and revenues associated with the same. This will results in

improvement of profitability

Performance Report – These types report produced to review the performance of a

company as well as for each employee at the end of financial term. In every organisation

consist of various types of department so analysis of performance of these sections need

to prepare performance report. As per it, companies can analyse the efficiency of the

different activities as well as of the employees. With the help of this report, companies

can take corrective actions as per the areas in which improvement is needed. Manager of

TPG processing can use the report to know strength and weakness to make strategic

decision for the potential period of time. In addition, this report is required in company

for focusing on those activities whose performance is lower and as per it organisations

take corrective actions. Like in above TPG processing company, their managers get

detailed information about critical evaluation of each production activity that help in

better decision-making for future.

Budget report – The particular report provide performance of company and help to

generate of small business, departments and large organization. A budget can based on

the predetermination where estimate of income and expenses of each department which

can help to unforeseen to circumstances of TPG processing company. Apart from it, this

report provide information about comparison between estimated income and actual

income which leads management of performance. Through particular report company try

to achieve their set goals and objectives. This report is essentially required for making

improvement in the operational capacity of above company.

Inventory management report: It is mainly prepared by production and warehouse

manager of respective company mainly prepare this report. The reports holds the detail

information about the stock available in warehouses, goods in transits and finished goods

that are available for sales. It also provide the strength to supply chain of company so that

margin. Through usage of the information included in this report, organisation have an

ability to made changes and improve efficiency of operations. The main essential

requirement of this system towards TPG that it helps in determination of the most

profitable determinant after comparison of all information present in cost centre report in

respect of the expenses and revenues associated with the same. This will results in

improvement of profitability

Performance Report – These types report produced to review the performance of a

company as well as for each employee at the end of financial term. In every organisation

consist of various types of department so analysis of performance of these sections need

to prepare performance report. As per it, companies can analyse the efficiency of the

different activities as well as of the employees. With the help of this report, companies

can take corrective actions as per the areas in which improvement is needed. Manager of

TPG processing can use the report to know strength and weakness to make strategic

decision for the potential period of time. In addition, this report is required in company

for focusing on those activities whose performance is lower and as per it organisations

take corrective actions. Like in above TPG processing company, their managers get

detailed information about critical evaluation of each production activity that help in

better decision-making for future.

Budget report – The particular report provide performance of company and help to

generate of small business, departments and large organization. A budget can based on

the predetermination where estimate of income and expenses of each department which

can help to unforeseen to circumstances of TPG processing company. Apart from it, this

report provide information about comparison between estimated income and actual

income which leads management of performance. Through particular report company try

to achieve their set goals and objectives. This report is essentially required for making

improvement in the operational capacity of above company.

Inventory management report: It is mainly prepared by production and warehouse

manager of respective company mainly prepare this report. The reports holds the detail

information about the stock available in warehouses, goods in transits and finished goods

that are available for sales. It also provide the strength to supply chain of company so that

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

goods are always available in market. Such as in the above TPG processing company,

this report is essentially required to control inventories and for effective utilisation of

resources. For example the above company, get in touch about how much quantity of raw

material is available and on the basis of it they allocate it into various activities.

Accounts Receivable Ageing Report: It is a kind of report which is associated to keeping

the record of all debtors which are occurred due to credit transactions. With the help of

this report companies can determine total collective amount in the market and

accordingly make plans. Apart from it, this report enables in determining those debtors

who are going to be insolvent. In the above selected company, they prepare it for keeping

record of due amount by debtors. As well as for enhancing the credit policies to minimise

the bad debts amounts. For example this report highlights the name of those debtors

whose amount is due even after the determined date of payment.

Job cost report- This is a kind of report which consists detailed information about the cost

of different jobs associated in various activities. Eventually, the main purpose of this

type of report is to classify the cost of job in a systematic manner. Due to this report,

companies can aware about each job cost of each activities into multi-pal operations.

Hence, this report is essentially required in companies for minimisation cost of job as

much as possible. Such as in the TPG processing company, they prepare this report to get

the information about cost of job and to assess the information about how much part of

fund is allocated in the various activities of company's production activities.

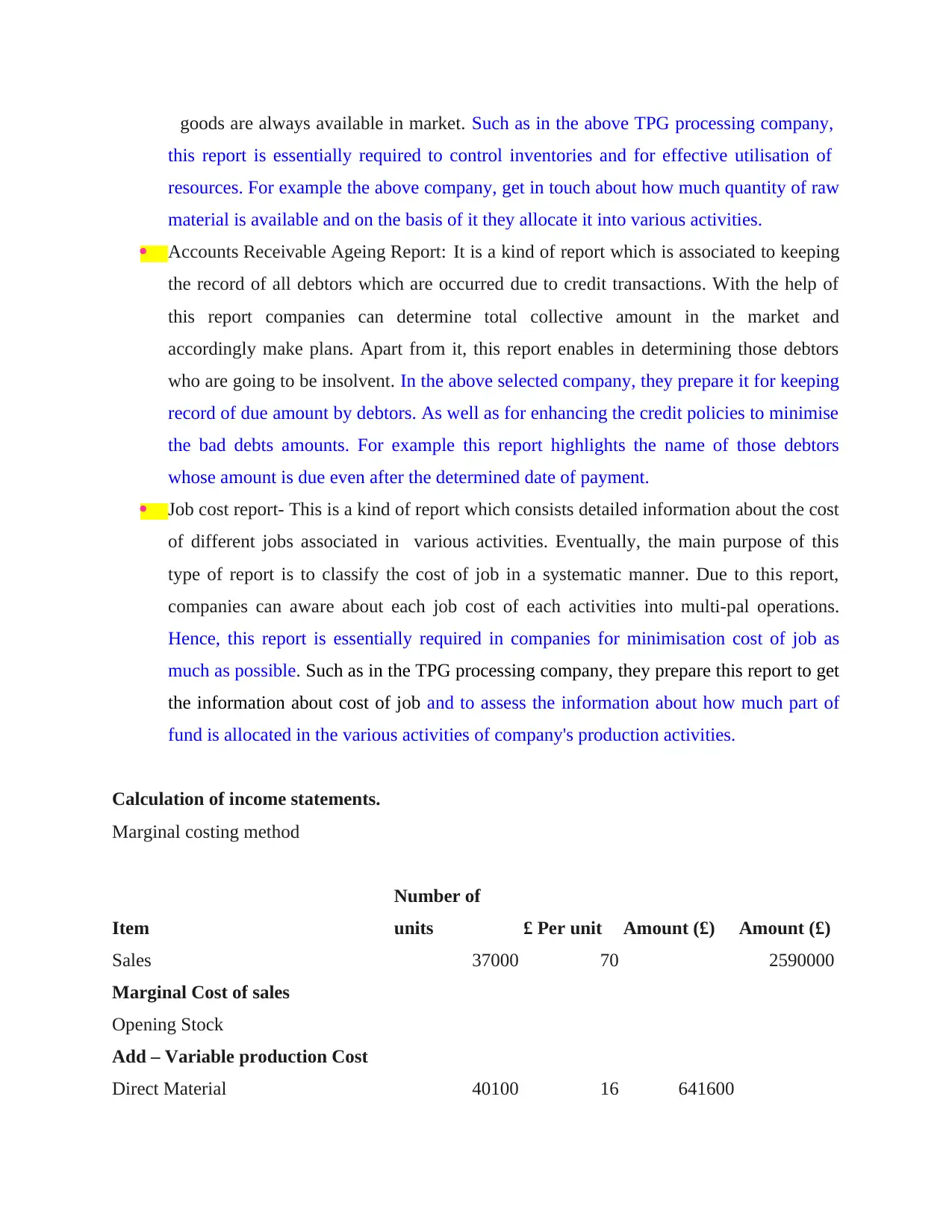

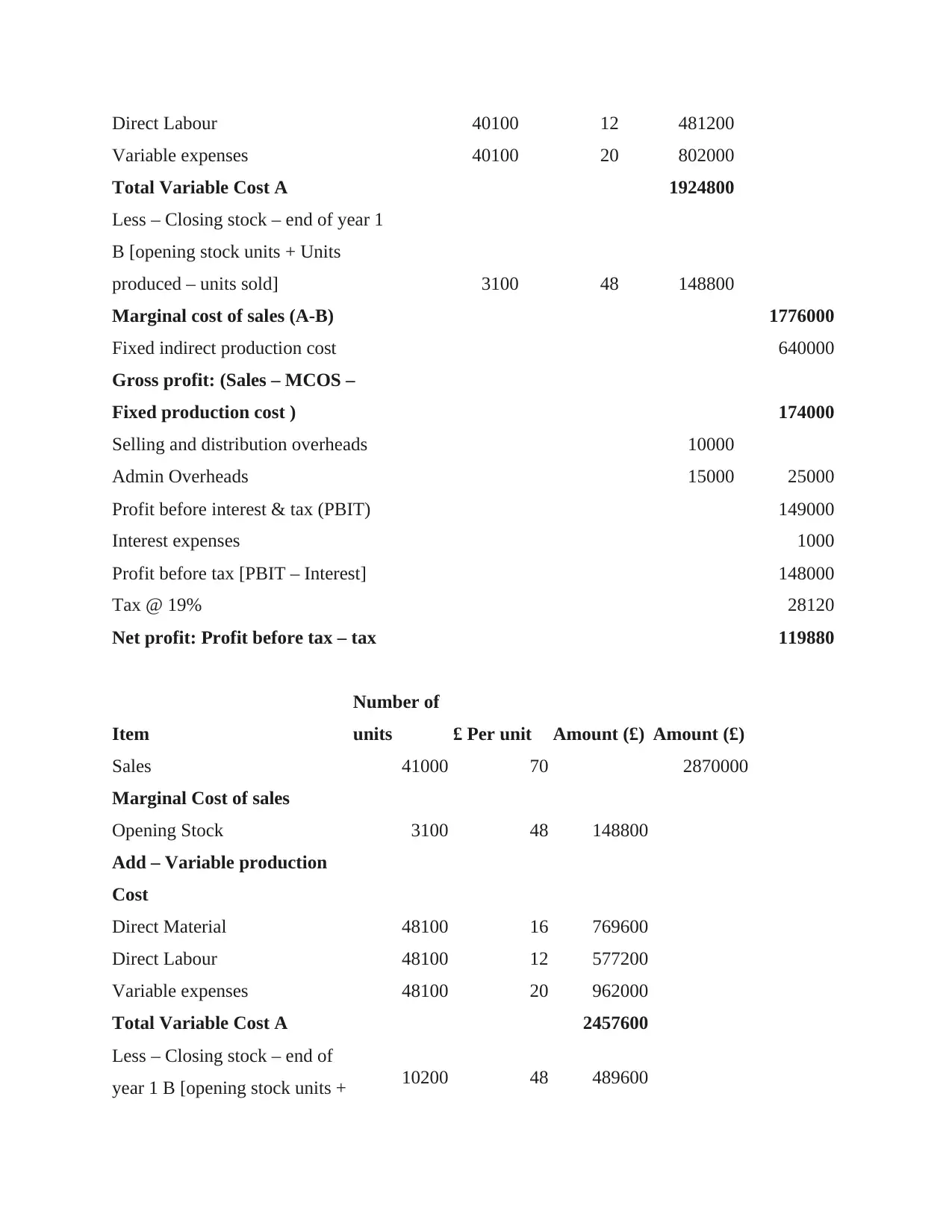

Calculation of income statements.

Marginal costing method

Item

Number of

units £ Per unit Amount (£) Amount (£)

Sales 37000 70 2590000

Marginal Cost of sales

Opening Stock

Add – Variable production Cost

Direct Material 40100 16 641600

this report is essentially required to control inventories and for effective utilisation of

resources. For example the above company, get in touch about how much quantity of raw

material is available and on the basis of it they allocate it into various activities.

Accounts Receivable Ageing Report: It is a kind of report which is associated to keeping

the record of all debtors which are occurred due to credit transactions. With the help of

this report companies can determine total collective amount in the market and

accordingly make plans. Apart from it, this report enables in determining those debtors

who are going to be insolvent. In the above selected company, they prepare it for keeping

record of due amount by debtors. As well as for enhancing the credit policies to minimise

the bad debts amounts. For example this report highlights the name of those debtors

whose amount is due even after the determined date of payment.

Job cost report- This is a kind of report which consists detailed information about the cost

of different jobs associated in various activities. Eventually, the main purpose of this

type of report is to classify the cost of job in a systematic manner. Due to this report,

companies can aware about each job cost of each activities into multi-pal operations.

Hence, this report is essentially required in companies for minimisation cost of job as

much as possible. Such as in the TPG processing company, they prepare this report to get

the information about cost of job and to assess the information about how much part of

fund is allocated in the various activities of company's production activities.

Calculation of income statements.

Marginal costing method

Item

Number of

units £ Per unit Amount (£) Amount (£)

Sales 37000 70 2590000

Marginal Cost of sales

Opening Stock

Add – Variable production Cost

Direct Material 40100 16 641600

Direct Labour 40100 12 481200

Variable expenses 40100 20 802000

Total Variable Cost A 1924800

Less – Closing stock – end of year 1

B [opening stock units + Units

produced – units sold] 3100 48 148800

Marginal cost of sales (A-B) 1776000

Fixed indirect production cost 640000

Gross profit: (Sales – MCOS –

Fixed production cost ) 174000

Selling and distribution overheads 10000

Admin Overheads 15000 25000

Profit before interest & tax (PBIT) 149000

Interest expenses 1000

Profit before tax [PBIT – Interest] 148000

Tax @ 19% 28120

Net profit: Profit before tax – tax 119880

Item

Number of

units £ Per unit Amount (£) Amount (£)

Sales 41000 70 2870000

Marginal Cost of sales

Opening Stock 3100 48 148800

Add – Variable production

Cost

Direct Material 48100 16 769600

Direct Labour 48100 12 577200

Variable expenses 48100 20 962000

Total Variable Cost A 2457600

Less – Closing stock – end of

year 1 B [opening stock units + 10200 48 489600

Variable expenses 40100 20 802000

Total Variable Cost A 1924800

Less – Closing stock – end of year 1

B [opening stock units + Units

produced – units sold] 3100 48 148800

Marginal cost of sales (A-B) 1776000

Fixed indirect production cost 640000

Gross profit: (Sales – MCOS –

Fixed production cost ) 174000

Selling and distribution overheads 10000

Admin Overheads 15000 25000

Profit before interest & tax (PBIT) 149000

Interest expenses 1000

Profit before tax [PBIT – Interest] 148000

Tax @ 19% 28120

Net profit: Profit before tax – tax 119880

Item

Number of

units £ Per unit Amount (£) Amount (£)

Sales 41000 70 2870000

Marginal Cost of sales

Opening Stock 3100 48 148800

Add – Variable production

Cost

Direct Material 48100 16 769600

Direct Labour 48100 12 577200

Variable expenses 48100 20 962000

Total Variable Cost A 2457600

Less – Closing stock – end of

year 1 B [opening stock units + 10200 48 489600

Units produced – units sold]

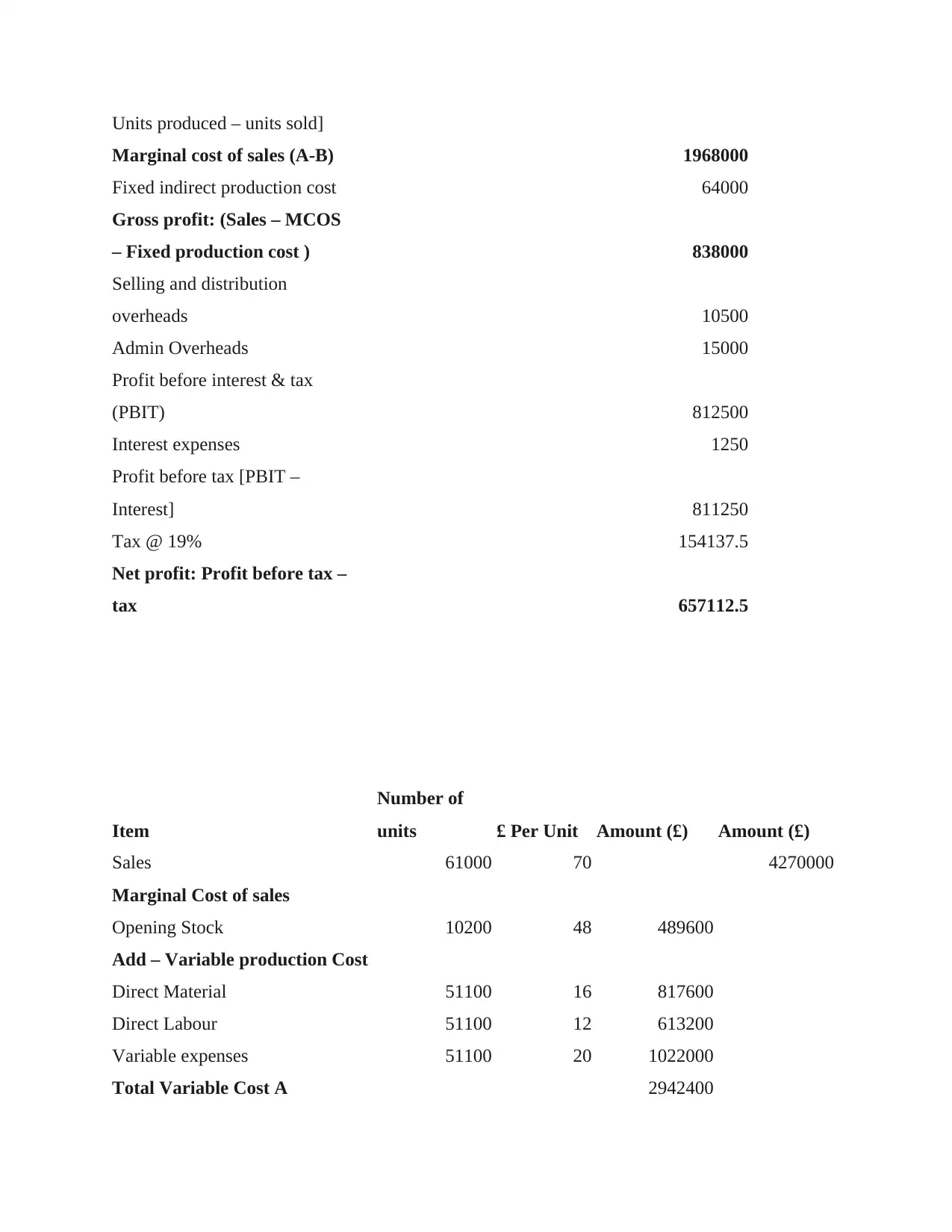

Marginal cost of sales (A-B) 1968000

Fixed indirect production cost 64000

Gross profit: (Sales – MCOS

– Fixed production cost ) 838000

Selling and distribution

overheads 10500

Admin Overheads 15000

Profit before interest & tax

(PBIT) 812500

Interest expenses 1250

Profit before tax [PBIT –

Interest] 811250

Tax @ 19% 154137.5

Net profit: Profit before tax –

tax 657112.5

Item

Number of

units £ Per Unit Amount (£) Amount (£)

Sales 61000 70 4270000

Marginal Cost of sales

Opening Stock 10200 48 489600

Add – Variable production Cost

Direct Material 51100 16 817600

Direct Labour 51100 12 613200

Variable expenses 51100 20 1022000

Total Variable Cost A 2942400

Marginal cost of sales (A-B) 1968000

Fixed indirect production cost 64000

Gross profit: (Sales – MCOS

– Fixed production cost ) 838000

Selling and distribution

overheads 10500

Admin Overheads 15000

Profit before interest & tax

(PBIT) 812500

Interest expenses 1250

Profit before tax [PBIT –

Interest] 811250

Tax @ 19% 154137.5

Net profit: Profit before tax –

tax 657112.5

Item

Number of

units £ Per Unit Amount (£) Amount (£)

Sales 61000 70 4270000

Marginal Cost of sales

Opening Stock 10200 48 489600

Add – Variable production Cost

Direct Material 51100 16 817600

Direct Labour 51100 12 613200

Variable expenses 51100 20 1022000

Total Variable Cost A 2942400

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

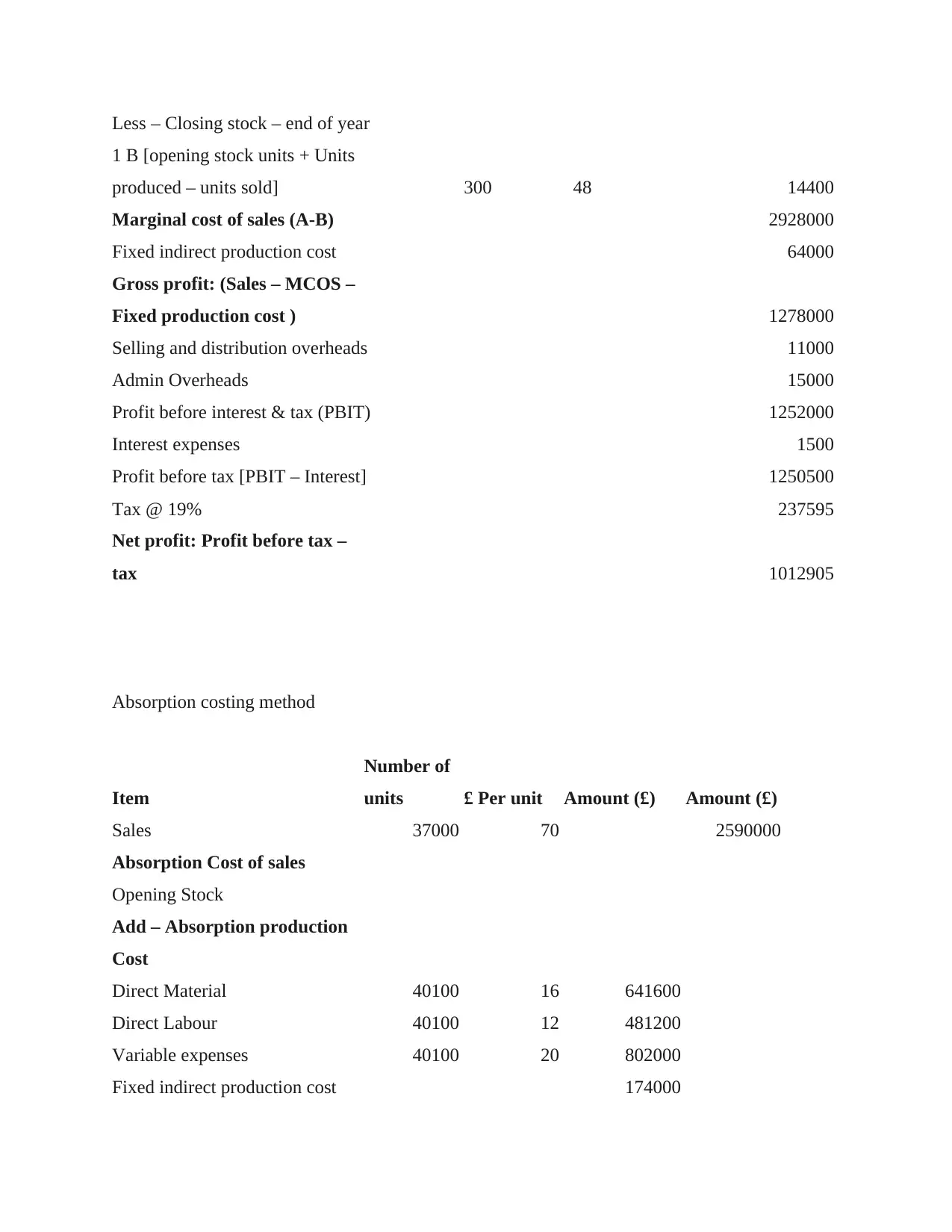

Less – Closing stock – end of year

1 B [opening stock units + Units

produced – units sold] 300 48 14400

Marginal cost of sales (A-B) 2928000

Fixed indirect production cost 64000

Gross profit: (Sales – MCOS –

Fixed production cost ) 1278000

Selling and distribution overheads 11000

Admin Overheads 15000

Profit before interest & tax (PBIT) 1252000

Interest expenses 1500

Profit before tax [PBIT – Interest] 1250500

Tax @ 19% 237595

Net profit: Profit before tax –

tax 1012905

Absorption costing method

Item

Number of

units £ Per unit Amount (£) Amount (£)

Sales 37000 70 2590000

Absorption Cost of sales

Opening Stock

Add – Absorption production

Cost

Direct Material 40100 16 641600

Direct Labour 40100 12 481200

Variable expenses 40100 20 802000

Fixed indirect production cost 174000

1 B [opening stock units + Units

produced – units sold] 300 48 14400

Marginal cost of sales (A-B) 2928000

Fixed indirect production cost 64000

Gross profit: (Sales – MCOS –

Fixed production cost ) 1278000

Selling and distribution overheads 11000

Admin Overheads 15000

Profit before interest & tax (PBIT) 1252000

Interest expenses 1500

Profit before tax [PBIT – Interest] 1250500

Tax @ 19% 237595

Net profit: Profit before tax –

tax 1012905

Absorption costing method

Item

Number of

units £ Per unit Amount (£) Amount (£)

Sales 37000 70 2590000

Absorption Cost of sales

Opening Stock

Add – Absorption production

Cost

Direct Material 40100 16 641600

Direct Labour 40100 12 481200

Variable expenses 40100 20 802000

Fixed indirect production cost 174000

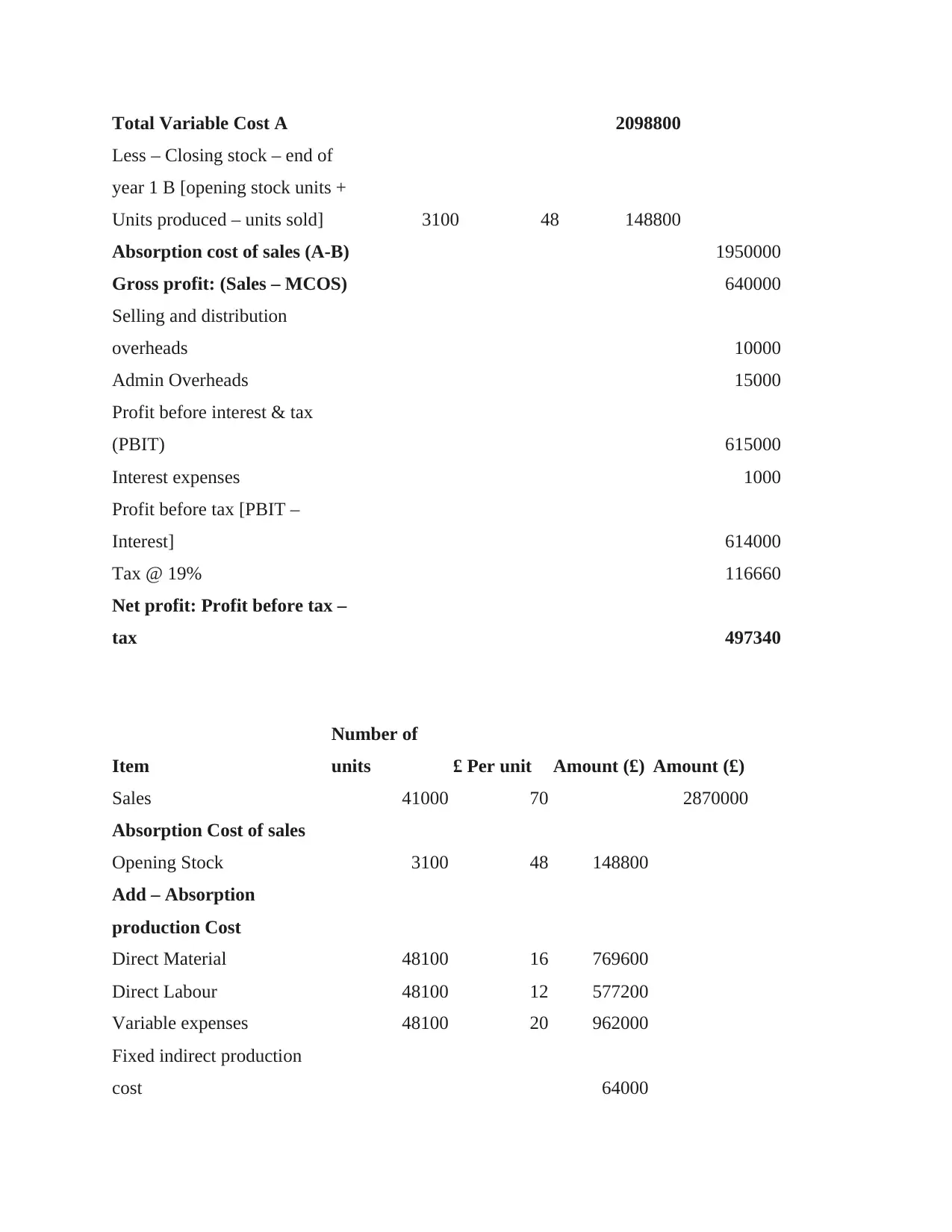

Total Variable Cost A 2098800

Less – Closing stock – end of

year 1 B [opening stock units +

Units produced – units sold] 3100 48 148800

Absorption cost of sales (A-B) 1950000

Gross profit: (Sales – MCOS) 640000

Selling and distribution

overheads 10000

Admin Overheads 15000

Profit before interest & tax

(PBIT) 615000

Interest expenses 1000

Profit before tax [PBIT –

Interest] 614000

Tax @ 19% 116660

Net profit: Profit before tax –

tax 497340

Item

Number of

units £ Per unit Amount (£) Amount (£)

Sales 41000 70 2870000

Absorption Cost of sales

Opening Stock 3100 48 148800

Add – Absorption

production Cost

Direct Material 48100 16 769600

Direct Labour 48100 12 577200

Variable expenses 48100 20 962000

Fixed indirect production

cost 64000

Less – Closing stock – end of

year 1 B [opening stock units +

Units produced – units sold] 3100 48 148800

Absorption cost of sales (A-B) 1950000

Gross profit: (Sales – MCOS) 640000

Selling and distribution

overheads 10000

Admin Overheads 15000

Profit before interest & tax

(PBIT) 615000

Interest expenses 1000

Profit before tax [PBIT –

Interest] 614000

Tax @ 19% 116660

Net profit: Profit before tax –

tax 497340

Item

Number of

units £ Per unit Amount (£) Amount (£)

Sales 41000 70 2870000

Absorption Cost of sales

Opening Stock 3100 48 148800

Add – Absorption

production Cost

Direct Material 48100 16 769600

Direct Labour 48100 12 577200

Variable expenses 48100 20 962000

Fixed indirect production

cost 64000

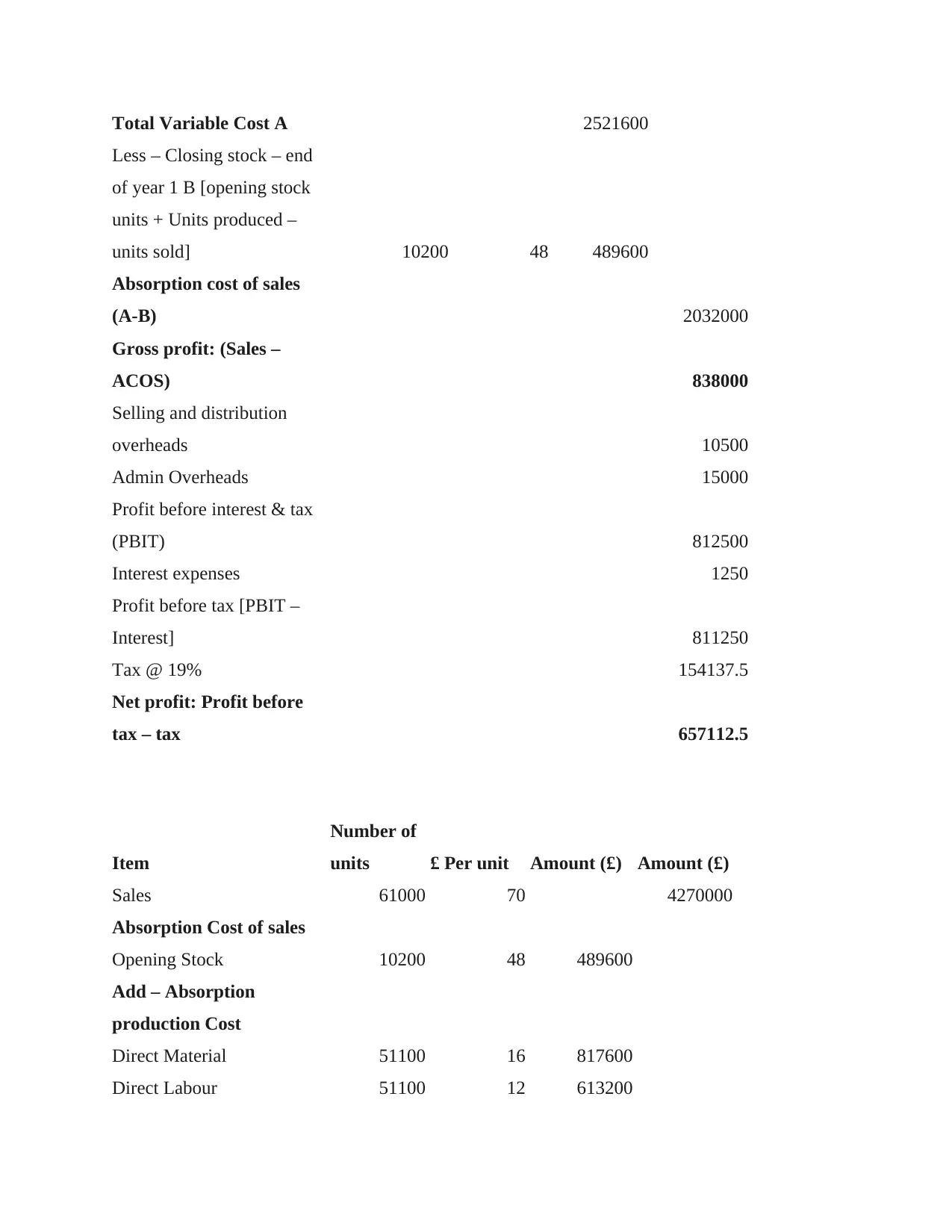

Total Variable Cost A 2521600

Less – Closing stock – end

of year 1 B [opening stock

units + Units produced –

units sold] 10200 48 489600

Absorption cost of sales

(A-B) 2032000

Gross profit: (Sales –

ACOS) 838000

Selling and distribution

overheads 10500

Admin Overheads 15000

Profit before interest & tax

(PBIT) 812500

Interest expenses 1250

Profit before tax [PBIT –

Interest] 811250

Tax @ 19% 154137.5

Net profit: Profit before

tax – tax 657112.5

Item

Number of

units £ Per unit Amount (£) Amount (£)

Sales 61000 70 4270000

Absorption Cost of sales

Opening Stock 10200 48 489600

Add – Absorption

production Cost

Direct Material 51100 16 817600

Direct Labour 51100 12 613200

Less – Closing stock – end

of year 1 B [opening stock

units + Units produced –

units sold] 10200 48 489600

Absorption cost of sales

(A-B) 2032000

Gross profit: (Sales –

ACOS) 838000

Selling and distribution

overheads 10500

Admin Overheads 15000

Profit before interest & tax

(PBIT) 812500

Interest expenses 1250

Profit before tax [PBIT –

Interest] 811250

Tax @ 19% 154137.5

Net profit: Profit before

tax – tax 657112.5

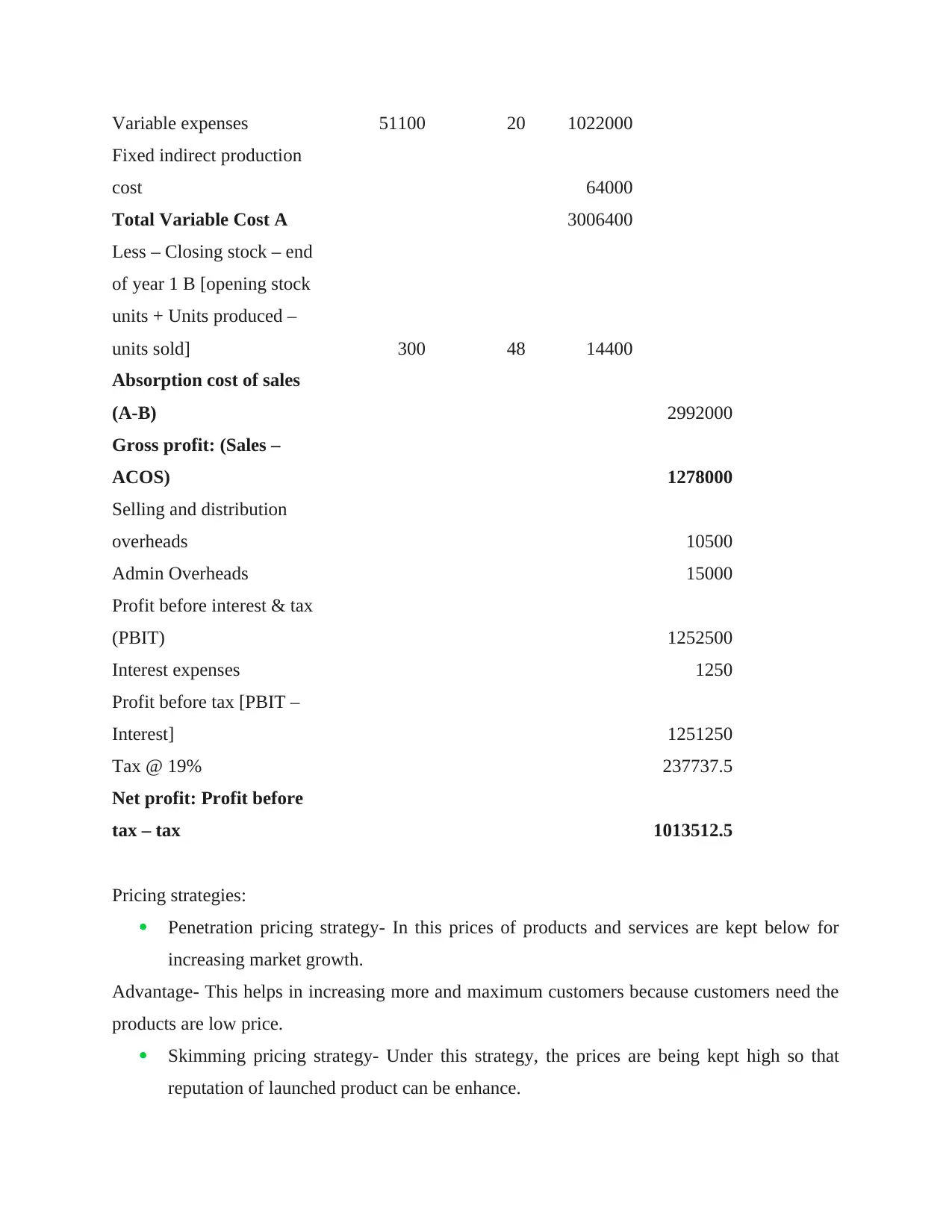

Item

Number of

units £ Per unit Amount (£) Amount (£)

Sales 61000 70 4270000

Absorption Cost of sales

Opening Stock 10200 48 489600

Add – Absorption

production Cost

Direct Material 51100 16 817600

Direct Labour 51100 12 613200

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Variable expenses 51100 20 1022000

Fixed indirect production

cost 64000

Total Variable Cost A 3006400

Less – Closing stock – end

of year 1 B [opening stock

units + Units produced –

units sold] 300 48 14400

Absorption cost of sales

(A-B) 2992000

Gross profit: (Sales –

ACOS) 1278000

Selling and distribution

overheads 10500

Admin Overheads 15000

Profit before interest & tax

(PBIT) 1252500

Interest expenses 1250

Profit before tax [PBIT –

Interest] 1251250

Tax @ 19% 237737.5

Net profit: Profit before

tax – tax 1013512.5

Pricing strategies:

Penetration pricing strategy- In this prices of products and services are kept below for

increasing market growth.

Advantage- This helps in increasing more and maximum customers because customers need the

products are low price.

Skimming pricing strategy- Under this strategy, the prices are being kept high so that

reputation of launched product can be enhance.

Fixed indirect production

cost 64000

Total Variable Cost A 3006400

Less – Closing stock – end

of year 1 B [opening stock

units + Units produced –

units sold] 300 48 14400

Absorption cost of sales

(A-B) 2992000

Gross profit: (Sales –

ACOS) 1278000

Selling and distribution

overheads 10500

Admin Overheads 15000

Profit before interest & tax

(PBIT) 1252500

Interest expenses 1250

Profit before tax [PBIT –

Interest] 1251250

Tax @ 19% 237737.5

Net profit: Profit before

tax – tax 1013512.5

Pricing strategies:

Penetration pricing strategy- In this prices of products and services are kept below for

increasing market growth.

Advantage- This helps in increasing more and maximum customers because customers need the

products are low price.

Skimming pricing strategy- Under this strategy, the prices are being kept high so that

reputation of launched product can be enhance.

Advantage- Its benefit is that it is useful for increasing profits for companies because high priced

products are considered quality products.

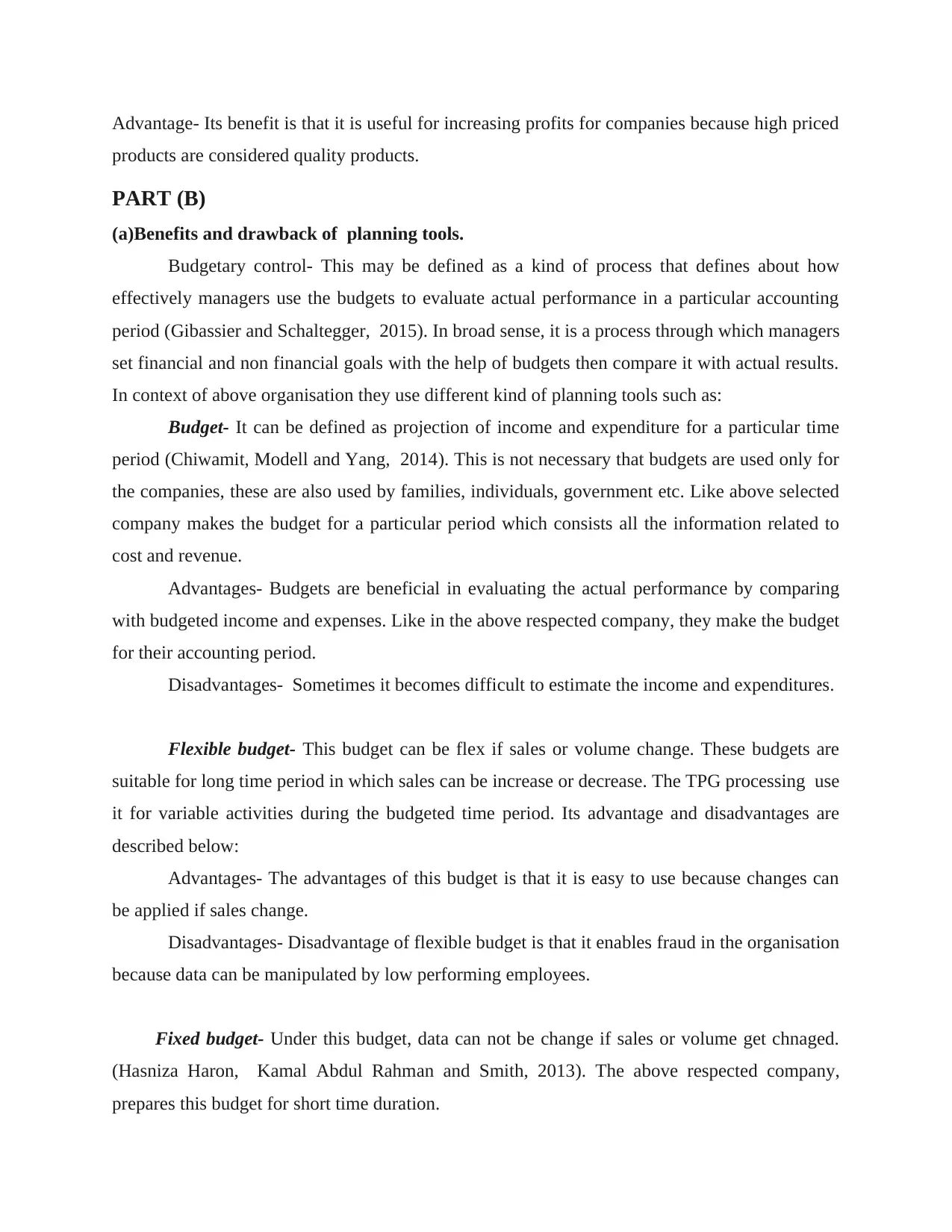

PART (B)

(a)Benefits and drawback of planning tools.

Budgetary control- This may be defined as a kind of process that defines about how

effectively managers use the budgets to evaluate actual performance in a particular accounting

period (Gibassier and Schaltegger, 2015). In broad sense, it is a process through which managers

set financial and non financial goals with the help of budgets then compare it with actual results.

In context of above organisation they use different kind of planning tools such as:

Budget- It can be defined as projection of income and expenditure for a particular time

period (Chiwamit, Modell and Yang, 2014). This is not necessary that budgets are used only for

the companies, these are also used by families, individuals, government etc. Like above selected

company makes the budget for a particular period which consists all the information related to

cost and revenue.

Advantages- Budgets are beneficial in evaluating the actual performance by comparing

with budgeted income and expenses. Like in the above respected company, they make the budget

for their accounting period.

Disadvantages- Sometimes it becomes difficult to estimate the income and expenditures.

Flexible budget- This budget can be flex if sales or volume change. These budgets are

suitable for long time period in which sales can be increase or decrease. The TPG processing use

it for variable activities during the budgeted time period. Its advantage and disadvantages are

described below:

Advantages- The advantages of this budget is that it is easy to use because changes can

be applied if sales change.

Disadvantages- Disadvantage of flexible budget is that it enables fraud in the organisation

because data can be manipulated by low performing employees.

Fixed budget- Under this budget, data can not be change if sales or volume get chnaged.

(Hasniza Haron, Kamal Abdul Rahman and Smith, 2013). The above respected company,

prepares this budget for short time duration.

products are considered quality products.

PART (B)

(a)Benefits and drawback of planning tools.

Budgetary control- This may be defined as a kind of process that defines about how

effectively managers use the budgets to evaluate actual performance in a particular accounting

period (Gibassier and Schaltegger, 2015). In broad sense, it is a process through which managers

set financial and non financial goals with the help of budgets then compare it with actual results.

In context of above organisation they use different kind of planning tools such as:

Budget- It can be defined as projection of income and expenditure for a particular time

period (Chiwamit, Modell and Yang, 2014). This is not necessary that budgets are used only for

the companies, these are also used by families, individuals, government etc. Like above selected

company makes the budget for a particular period which consists all the information related to

cost and revenue.

Advantages- Budgets are beneficial in evaluating the actual performance by comparing

with budgeted income and expenses. Like in the above respected company, they make the budget

for their accounting period.

Disadvantages- Sometimes it becomes difficult to estimate the income and expenditures.

Flexible budget- This budget can be flex if sales or volume change. These budgets are

suitable for long time period in which sales can be increase or decrease. The TPG processing use

it for variable activities during the budgeted time period. Its advantage and disadvantages are

described below:

Advantages- The advantages of this budget is that it is easy to use because changes can

be applied if sales change.

Disadvantages- Disadvantage of flexible budget is that it enables fraud in the organisation

because data can be manipulated by low performing employees.

Fixed budget- Under this budget, data can not be change if sales or volume get chnaged.

(Hasniza Haron, Kamal Abdul Rahman and Smith, 2013). The above respected company,

prepares this budget for short time duration.

Advantages- The advantage of this budget that financial managers do not require to

change or update the budget which saves time and cost.

Disadvantage- Companies can not change this budget if sales changes.

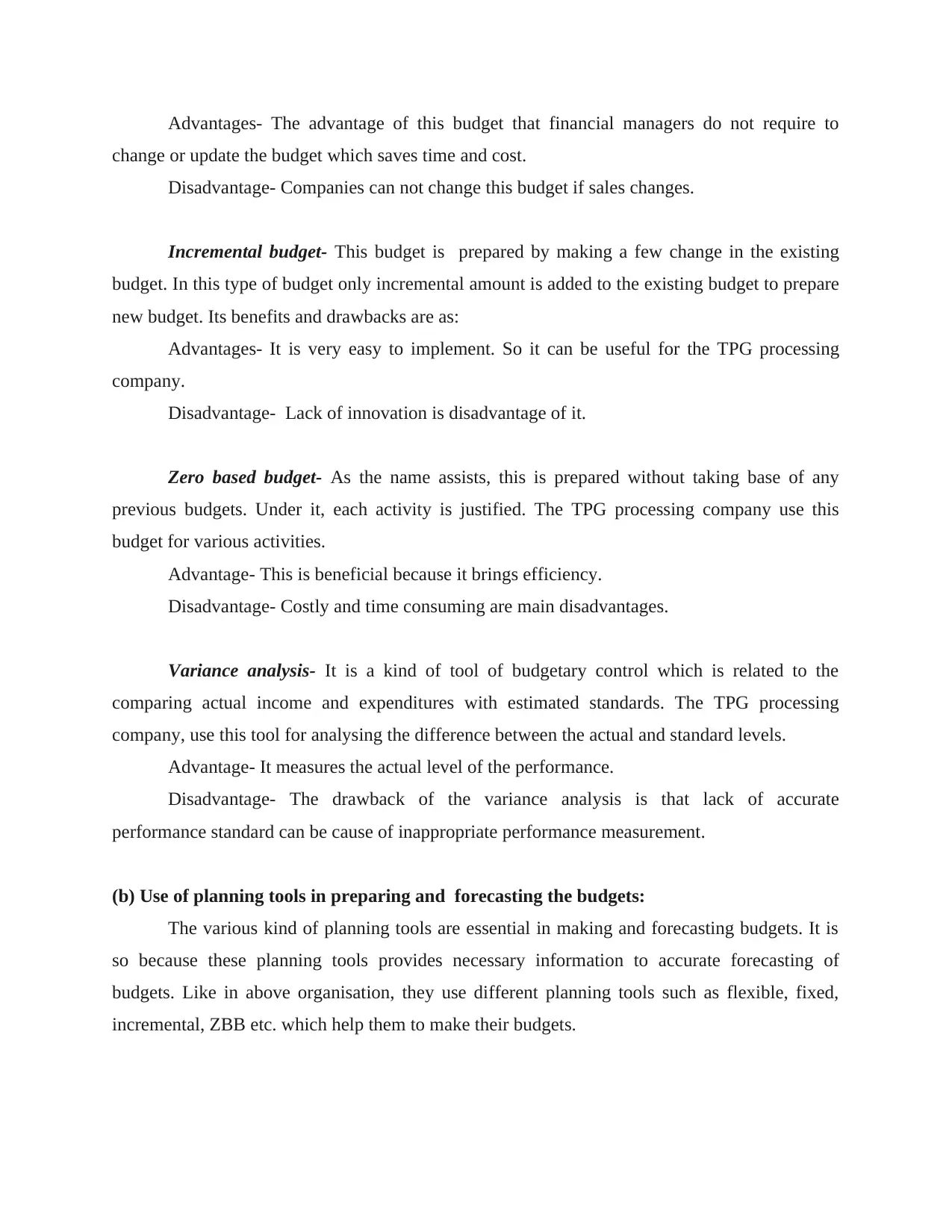

Incremental budget- This budget is prepared by making a few change in the existing

budget. In this type of budget only incremental amount is added to the existing budget to prepare

new budget. Its benefits and drawbacks are as:

Advantages- It is very easy to implement. So it can be useful for the TPG processing

company.

Disadvantage- Lack of innovation is disadvantage of it.

Zero based budget- As the name assists, this is prepared without taking base of any

previous budgets. Under it, each activity is justified. The TPG processing company use this

budget for various activities.

Advantage- This is beneficial because it brings efficiency.

Disadvantage- Costly and time consuming are main disadvantages.

Variance analysis- It is a kind of tool of budgetary control which is related to the

comparing actual income and expenditures with estimated standards. The TPG processing

company, use this tool for analysing the difference between the actual and standard levels.

Advantage- It measures the actual level of the performance.

Disadvantage- The drawback of the variance analysis is that lack of accurate

performance standard can be cause of inappropriate performance measurement.

(b) Use of planning tools in preparing and forecasting the budgets:

The various kind of planning tools are essential in making and forecasting budgets. It is

so because these planning tools provides necessary information to accurate forecasting of

budgets. Like in above organisation, they use different planning tools such as flexible, fixed,

incremental, ZBB etc. which help them to make their budgets.

change or update the budget which saves time and cost.

Disadvantage- Companies can not change this budget if sales changes.

Incremental budget- This budget is prepared by making a few change in the existing

budget. In this type of budget only incremental amount is added to the existing budget to prepare

new budget. Its benefits and drawbacks are as:

Advantages- It is very easy to implement. So it can be useful for the TPG processing

company.

Disadvantage- Lack of innovation is disadvantage of it.

Zero based budget- As the name assists, this is prepared without taking base of any

previous budgets. Under it, each activity is justified. The TPG processing company use this

budget for various activities.

Advantage- This is beneficial because it brings efficiency.

Disadvantage- Costly and time consuming are main disadvantages.

Variance analysis- It is a kind of tool of budgetary control which is related to the

comparing actual income and expenditures with estimated standards. The TPG processing

company, use this tool for analysing the difference between the actual and standard levels.

Advantage- It measures the actual level of the performance.

Disadvantage- The drawback of the variance analysis is that lack of accurate

performance standard can be cause of inappropriate performance measurement.

(b) Use of planning tools in preparing and forecasting the budgets:

The various kind of planning tools are essential in making and forecasting budgets. It is

so because these planning tools provides necessary information to accurate forecasting of

budgets. Like in above organisation, they use different planning tools such as flexible, fixed,

incremental, ZBB etc. which help them to make their budgets.

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

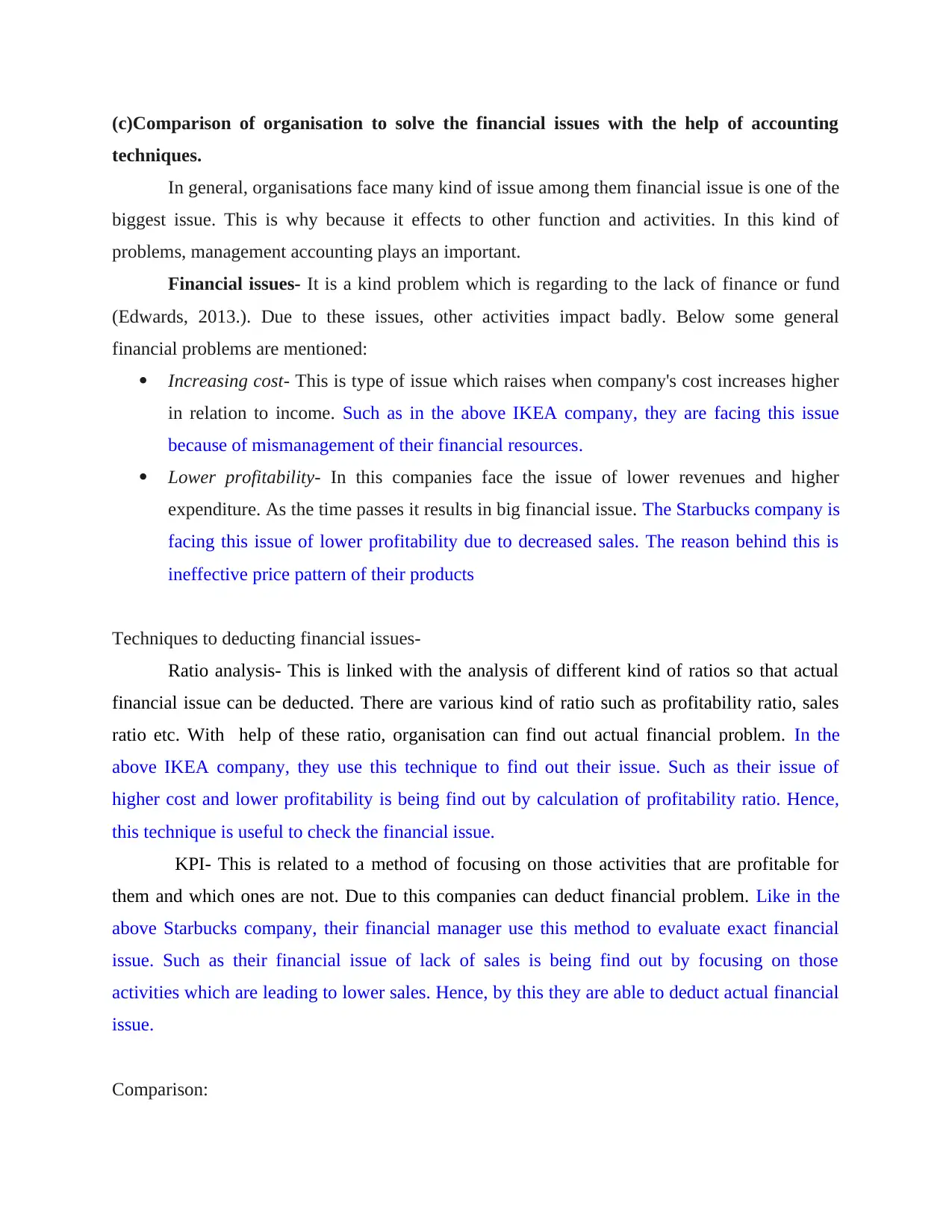

(c)Comparison of organisation to solve the financial issues with the help of accounting

techniques.

In general, organisations face many kind of issue among them financial issue is one of the

biggest issue. This is why because it effects to other function and activities. In this kind of

problems, management accounting plays an important.

Financial issues- It is a kind problem which is regarding to the lack of finance or fund

(Edwards, 2013.). Due to these issues, other activities impact badly. Below some general

financial problems are mentioned:

Increasing cost- This is type of issue which raises when company's cost increases higher

in relation to income. Such as in the above IKEA company, they are facing this issue

because of mismanagement of their financial resources.

Lower profitability- In this companies face the issue of lower revenues and higher

expenditure. As the time passes it results in big financial issue. The Starbucks company is

facing this issue of lower profitability due to decreased sales. The reason behind this is

ineffective price pattern of their products

Techniques to deducting financial issues-

Ratio analysis- This is linked with the analysis of different kind of ratios so that actual

financial issue can be deducted. There are various kind of ratio such as profitability ratio, sales

ratio etc. With help of these ratio, organisation can find out actual financial problem. In the

above IKEA company, they use this technique to find out their issue. Such as their issue of

higher cost and lower profitability is being find out by calculation of profitability ratio. Hence,

this technique is useful to check the financial issue.

KPI- This is related to a method of focusing on those activities that are profitable for

them and which ones are not. Due to this companies can deduct financial problem. Like in the

above Starbucks company, their financial manager use this method to evaluate exact financial

issue. Such as their financial issue of lack of sales is being find out by focusing on those

activities which are leading to lower sales. Hence, by this they are able to deduct actual financial

issue.

Comparison:

techniques.

In general, organisations face many kind of issue among them financial issue is one of the

biggest issue. This is why because it effects to other function and activities. In this kind of

problems, management accounting plays an important.

Financial issues- It is a kind problem which is regarding to the lack of finance or fund

(Edwards, 2013.). Due to these issues, other activities impact badly. Below some general

financial problems are mentioned:

Increasing cost- This is type of issue which raises when company's cost increases higher

in relation to income. Such as in the above IKEA company, they are facing this issue

because of mismanagement of their financial resources.

Lower profitability- In this companies face the issue of lower revenues and higher

expenditure. As the time passes it results in big financial issue. The Starbucks company is

facing this issue of lower profitability due to decreased sales. The reason behind this is

ineffective price pattern of their products

Techniques to deducting financial issues-

Ratio analysis- This is linked with the analysis of different kind of ratios so that actual

financial issue can be deducted. There are various kind of ratio such as profitability ratio, sales

ratio etc. With help of these ratio, organisation can find out actual financial problem. In the

above IKEA company, they use this technique to find out their issue. Such as their issue of

higher cost and lower profitability is being find out by calculation of profitability ratio. Hence,

this technique is useful to check the financial issue.

KPI- This is related to a method of focusing on those activities that are profitable for

them and which ones are not. Due to this companies can deduct financial problem. Like in the

above Starbucks company, their financial manager use this method to evaluate exact financial

issue. Such as their financial issue of lack of sales is being find out by focusing on those

activities which are leading to lower sales. Hence, by this they are able to deduct actual financial

issue.

Comparison:

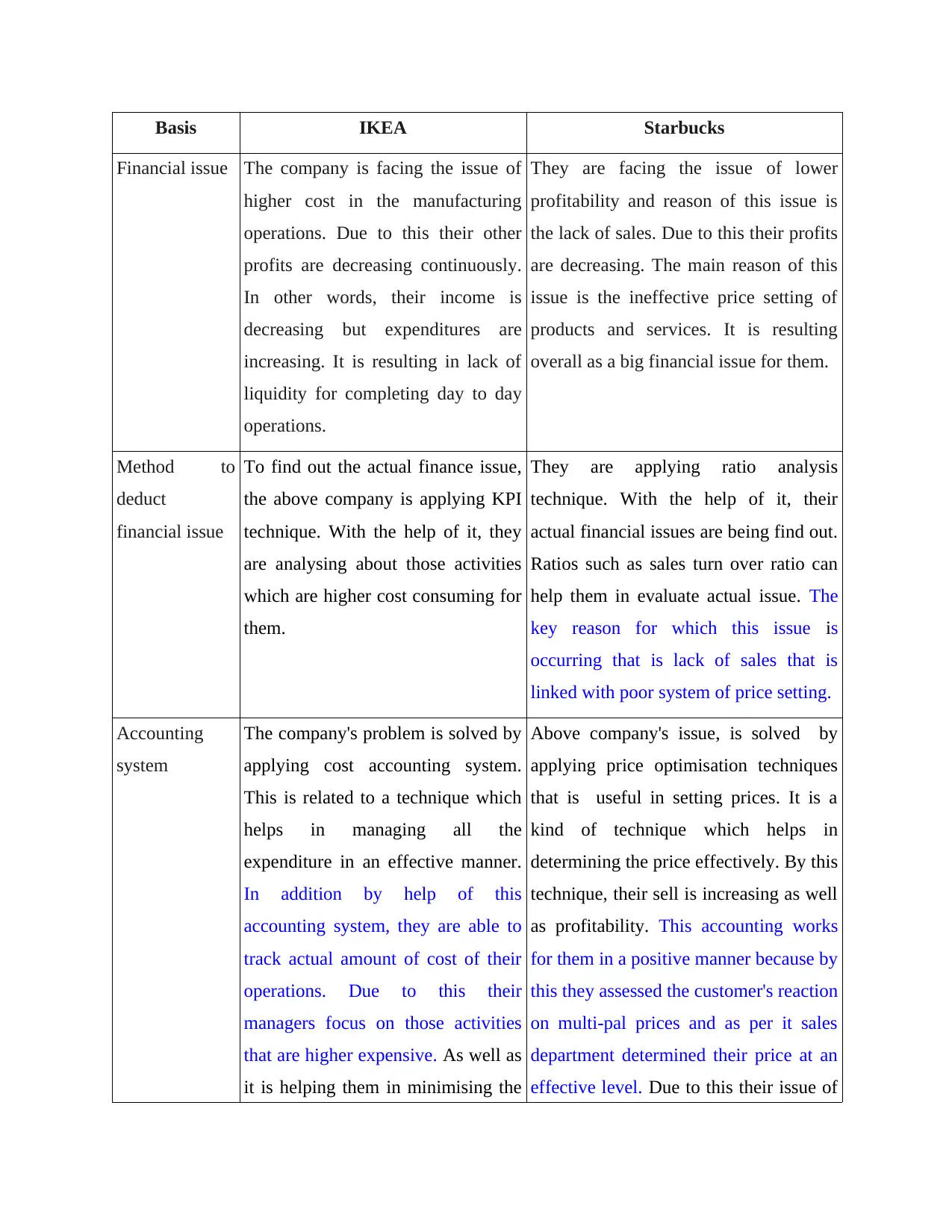

Basis IKEA Starbucks

Financial issue The company is facing the issue of

higher cost in the manufacturing

operations. Due to this their other

profits are decreasing continuously.

In other words, their income is

decreasing but expenditures are

increasing. It is resulting in lack of

liquidity for completing day to day

operations.

They are facing the issue of lower

profitability and reason of this issue is

the lack of sales. Due to this their profits

are decreasing. The main reason of this

issue is the ineffective price setting of

products and services. It is resulting

overall as a big financial issue for them.

Method to

deduct

financial issue

To find out the actual finance issue,

the above company is applying KPI

technique. With the help of it, they

are analysing about those activities

which are higher cost consuming for

them.

They are applying ratio analysis

technique. With the help of it, their

actual financial issues are being find out.

Ratios such as sales turn over ratio can

help them in evaluate actual issue. The

key reason for which this issue is

occurring that is lack of sales that is

linked with poor system of price setting.

Accounting

system

The company's problem is solved by

applying cost accounting system.

This is related to a technique which

helps in managing all the

expenditure in an effective manner.

In addition by help of this

accounting system, they are able to

track actual amount of cost of their

operations. Due to this their

managers focus on those activities

that are higher expensive. As well as

it is helping them in minimising the

Above company's issue, is solved by

applying price optimisation techniques

that is useful in setting prices. It is a

kind of technique which helps in

determining the price effectively. By this

technique, their sell is increasing as well

as profitability. This accounting works

for them in a positive manner because by

this they assessed the customer's reaction

on multi-pal prices and as per it sales

department determined their price at an

effective level. Due to this their issue of

Financial issue The company is facing the issue of

higher cost in the manufacturing

operations. Due to this their other

profits are decreasing continuously.

In other words, their income is

decreasing but expenditures are

increasing. It is resulting in lack of

liquidity for completing day to day

operations.

They are facing the issue of lower

profitability and reason of this issue is

the lack of sales. Due to this their profits

are decreasing. The main reason of this

issue is the ineffective price setting of

products and services. It is resulting

overall as a big financial issue for them.

Method to

deduct

financial issue

To find out the actual finance issue,

the above company is applying KPI

technique. With the help of it, they

are analysing about those activities

which are higher cost consuming for

them.

They are applying ratio analysis

technique. With the help of it, their

actual financial issues are being find out.

Ratios such as sales turn over ratio can

help them in evaluate actual issue. The

key reason for which this issue is

occurring that is lack of sales that is

linked with poor system of price setting.

Accounting

system

The company's problem is solved by

applying cost accounting system.

This is related to a technique which

helps in managing all the

expenditure in an effective manner.

In addition by help of this

accounting system, they are able to

track actual amount of cost of their

operations. Due to this their

managers focus on those activities

that are higher expensive. As well as

it is helping them in minimising the

Above company's issue, is solved by

applying price optimisation techniques

that is useful in setting prices. It is a

kind of technique which helps in

determining the price effectively. By this

technique, their sell is increasing as well

as profitability. This accounting works

for them in a positive manner because by

this they assessed the customer's reaction

on multi-pal prices and as per it sales

department determined their price at an

effective level. Due to this their issue of

costs as much as possible. Thus their

income is increasing and expenditure

are decreasing which is resulting in

solving financial problem.

lower profitability is resolved

automatically because if sells will

increase then profitability will raised.

(d) MA for resolving financial problems:

MA is useful for solving any kind of financial problems. For example above mentioned

organisation, use cost accounting technique. Due to this their financial issue is resolved easily.

As well as another competitive company also apply price optimisation technique in resolving

their financial problems.

CONCLUSION

From above project report it has been concluded that management accounting is very

important in management of any kind of business. Under report, benefits and application of

various accounting systems like cost accounting system, inventory management system is

concluded. Along with different accounting reports like inventory reports, performance reports

etc. also defined. Additionally, drawbacks and limits of planning tools and use of MAS in

overcoming from financial problems is also mentioned.

income is increasing and expenditure

are decreasing which is resulting in

solving financial problem.

lower profitability is resolved

automatically because if sells will

increase then profitability will raised.

(d) MA for resolving financial problems:

MA is useful for solving any kind of financial problems. For example above mentioned

organisation, use cost accounting technique. Due to this their financial issue is resolved easily.

As well as another competitive company also apply price optimisation technique in resolving

their financial problems.

CONCLUSION

From above project report it has been concluded that management accounting is very

important in management of any kind of business. Under report, benefits and application of

various accounting systems like cost accounting system, inventory management system is

concluded. Along with different accounting reports like inventory reports, performance reports

etc. also defined. Additionally, drawbacks and limits of planning tools and use of MAS in

overcoming from financial problems is also mentioned.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

REFERENCES

Books and journals:

Arnaboldi, M., Lapsley, I. and Steccolini, I., 2015. Performance management in the public

sector: The ultimate challenge. Financial Accountability & Management. 31(1). pp.1-

22.

Sisaye, S. and Birnberg, J. G. Eds., 2012. An organizational learning approach to process

innovations: The extent and scope of diffusion and adoption in management accounting

systems. Emerald Group Publishing Limited.

Jakobsen, M., 2012. Intra-organisational management accounting for inter-organisational control

during negotiation processes. Qualitative Research in Accounting & Management. 9(2).

pp.96-122.

Gibassier, D., 2017. From écobilan to LCA: The elite’s institutional work in the creation of an

environmental management accounting tool. Critical Perspectives on Accounting. 42.

pp.36-58.

Schaltegger, S. and Zvezdov, D., 2015. Expanding material flow cost accounting. Framework,

review and potentials. Journal of Cleaner Production. 108. pp.1333-1341.

Soltes, E., 2014. Private interaction between firm management and sell‐side analysts. Journal of

Accounting Research. 52(1). pp.245-272.

Evans, E.E., Burritt, R.O.G.E.R. and Guthrie, J., 2013. The virtual university: impact on

Australian accounting and business education.

Morillo, J.G., Díaz, J.A.R., Camacho, E. and Montesinos, P., 2015. Linking water footprint

accounting with irrigation management in high value crops. Journal of cleaner

production. 87. pp.594-602.

Rieckhof, R., Bergmann, A. and Guenther, E., 2015. Interrelating material flow cost accounting

with management control systems to introduce resource efficiency into strategy. Journal

of Cleaner Production. 108. pp.1262-1278.

Derchi, G. B., Burkert, M. and Oyon, D., 2013. Environmental management accounting systems:

A review of the evidence and propositions for future research. In Accounting and

Control for Sustainability. (pp. 197-229). Emerald Group Publishing Limited.

Gibassier, D. and Schaltegger, S., 2015. Carbon management accounting and reporting in

practice: a case study on converging emergent approaches. Sustainability Accounting,

Management and Policy Journal. 6(3). pp.340-365.

Chiwamit, P., Modell, S. and Yang, C. L., 2014. The societal relevance of management

accounting innovations: economic value added and institutional work in the fields of

Chinese and Thai state-owned enterprises. Accounting and Business Research. 44(2).

pp.144-180.

Hasniza Haron, N., Kamal Abdul Rahman, I. and Smith, M., 2013. Management accounting

practices and the turnaround process. Asian Review of Accounting. 21(2). pp.100-112.

Edwards, J .R., 2013. A History of Financial Accounting (RLE Accounting). Routledge.

Adisetiawan, R. and Surono, Y., 2016. Earnings Management and Accounting Information

Value: Impact and Relevance. Business, Management and Economics Research. 2(10).

pp.170-179.

Hörisch, J., Johnson, M .P. and Schaltegger, S., 2015. Implementation of sustainability

management and company size: a knowledge‐based view. Business Strategy and the

Environment. 24(8). pp.765-779.

Books and journals:

Arnaboldi, M., Lapsley, I. and Steccolini, I., 2015. Performance management in the public

sector: The ultimate challenge. Financial Accountability & Management. 31(1). pp.1-

22.

Sisaye, S. and Birnberg, J. G. Eds., 2012. An organizational learning approach to process

innovations: The extent and scope of diffusion and adoption in management accounting

systems. Emerald Group Publishing Limited.

Jakobsen, M., 2012. Intra-organisational management accounting for inter-organisational control

during negotiation processes. Qualitative Research in Accounting & Management. 9(2).

pp.96-122.

Gibassier, D., 2017. From écobilan to LCA: The elite’s institutional work in the creation of an

environmental management accounting tool. Critical Perspectives on Accounting. 42.

pp.36-58.

Schaltegger, S. and Zvezdov, D., 2015. Expanding material flow cost accounting. Framework,

review and potentials. Journal of Cleaner Production. 108. pp.1333-1341.

Soltes, E., 2014. Private interaction between firm management and sell‐side analysts. Journal of

Accounting Research. 52(1). pp.245-272.

Evans, E.E., Burritt, R.O.G.E.R. and Guthrie, J., 2013. The virtual university: impact on

Australian accounting and business education.

Morillo, J.G., Díaz, J.A.R., Camacho, E. and Montesinos, P., 2015. Linking water footprint

accounting with irrigation management in high value crops. Journal of cleaner

production. 87. pp.594-602.

Rieckhof, R., Bergmann, A. and Guenther, E., 2015. Interrelating material flow cost accounting

with management control systems to introduce resource efficiency into strategy. Journal

of Cleaner Production. 108. pp.1262-1278.

Derchi, G. B., Burkert, M. and Oyon, D., 2013. Environmental management accounting systems:

A review of the evidence and propositions for future research. In Accounting and

Control for Sustainability. (pp. 197-229). Emerald Group Publishing Limited.

Gibassier, D. and Schaltegger, S., 2015. Carbon management accounting and reporting in

practice: a case study on converging emergent approaches. Sustainability Accounting,

Management and Policy Journal. 6(3). pp.340-365.

Chiwamit, P., Modell, S. and Yang, C. L., 2014. The societal relevance of management

accounting innovations: economic value added and institutional work in the fields of

Chinese and Thai state-owned enterprises. Accounting and Business Research. 44(2).

pp.144-180.

Hasniza Haron, N., Kamal Abdul Rahman, I. and Smith, M., 2013. Management accounting

practices and the turnaround process. Asian Review of Accounting. 21(2). pp.100-112.

Edwards, J .R., 2013. A History of Financial Accounting (RLE Accounting). Routledge.

Adisetiawan, R. and Surono, Y., 2016. Earnings Management and Accounting Information

Value: Impact and Relevance. Business, Management and Economics Research. 2(10).

pp.170-179.

Hörisch, J., Johnson, M .P. and Schaltegger, S., 2015. Implementation of sustainability

management and company size: a knowledge‐based view. Business Strategy and the

Environment. 24(8). pp.765-779.

1 out of 20

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.