Management Accounting: Costing and Budgeting

VerifiedAdded on 2020/02/19

|18

|4938

|121

Report

AI Summary

This report delves into management accounting, specifically focusing on costing and budgeting. It covers various aspects such as cost identification, classification, and performance measures for a clothing company named Smart Looks. The report includes detailed analyses of production costs, inventory methods, and budget preparation, providing insights into effective financial management and operational efficiency.

Management Accounting

Costing and Budgeting

Costing and Budgeting

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Task 1

Question 1

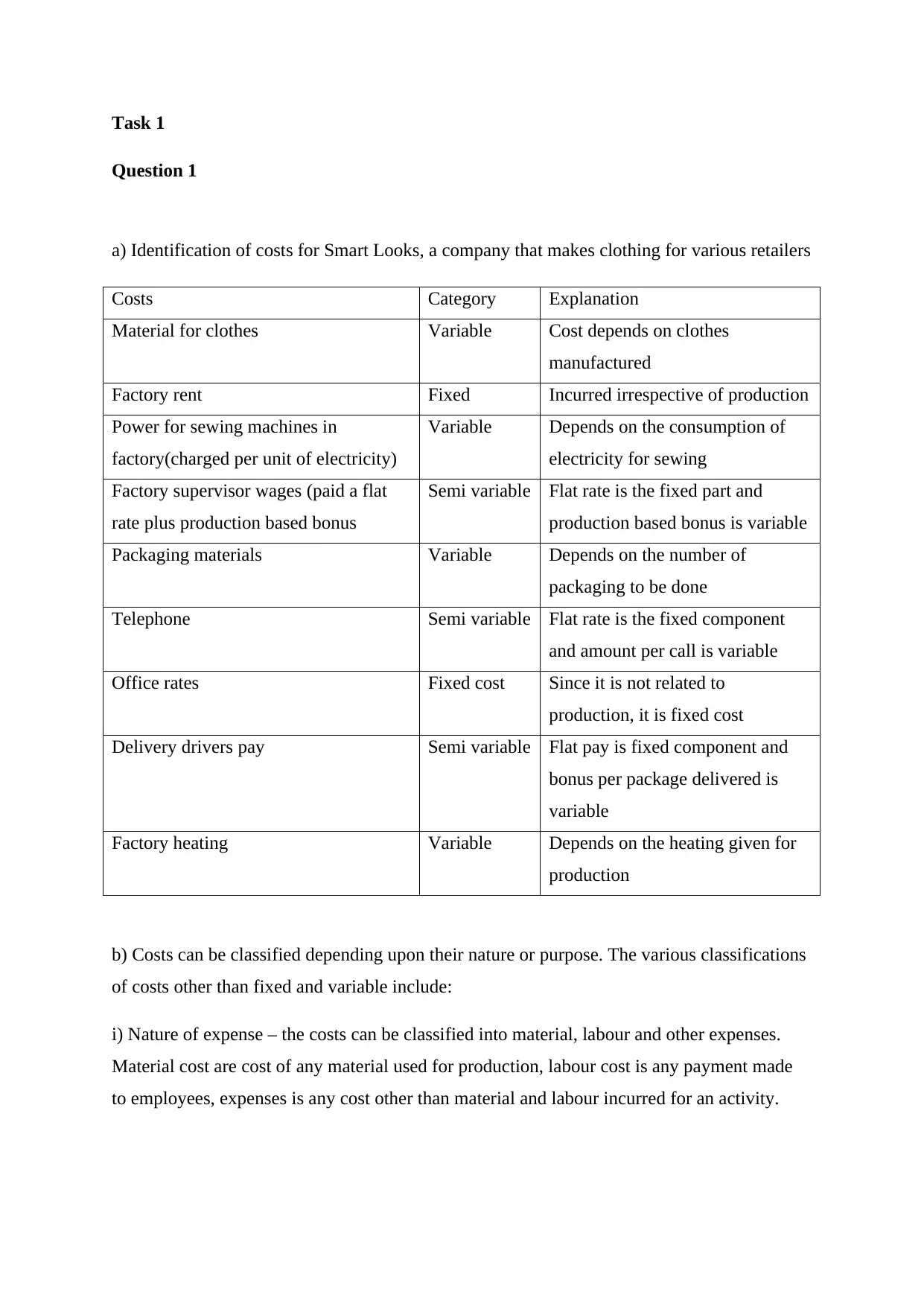

a) Identification of costs for Smart Looks, a company that makes clothing for various retailers

Costs Category Explanation

Material for clothes Variable Cost depends on clothes

manufactured

Factory rent Fixed Incurred irrespective of production

Power for sewing machines in

factory(charged per unit of electricity)

Variable Depends on the consumption of

electricity for sewing

Factory supervisor wages (paid a flat

rate plus production based bonus

Semi variable Flat rate is the fixed part and

production based bonus is variable

Packaging materials Variable Depends on the number of

packaging to be done

Telephone Semi variable Flat rate is the fixed component

and amount per call is variable

Office rates Fixed cost Since it is not related to

production, it is fixed cost

Delivery drivers pay Semi variable Flat pay is fixed component and

bonus per package delivered is

variable

Factory heating Variable Depends on the heating given for

production

b) Costs can be classified depending upon their nature or purpose. The various classifications

of costs other than fixed and variable include:

i) Nature of expense – the costs can be classified into material, labour and other expenses.

Material cost are cost of any material used for production, labour cost is any payment made

to employees, expenses is any cost other than material and labour incurred for an activity.

Question 1

a) Identification of costs for Smart Looks, a company that makes clothing for various retailers

Costs Category Explanation

Material for clothes Variable Cost depends on clothes

manufactured

Factory rent Fixed Incurred irrespective of production

Power for sewing machines in

factory(charged per unit of electricity)

Variable Depends on the consumption of

electricity for sewing

Factory supervisor wages (paid a flat

rate plus production based bonus

Semi variable Flat rate is the fixed part and

production based bonus is variable

Packaging materials Variable Depends on the number of

packaging to be done

Telephone Semi variable Flat rate is the fixed component

and amount per call is variable

Office rates Fixed cost Since it is not related to

production, it is fixed cost

Delivery drivers pay Semi variable Flat pay is fixed component and

bonus per package delivered is

variable

Factory heating Variable Depends on the heating given for

production

b) Costs can be classified depending upon their nature or purpose. The various classifications

of costs other than fixed and variable include:

i) Nature of expense – the costs can be classified into material, labour and other expenses.

Material cost are cost of any material used for production, labour cost is any payment made

to employees, expenses is any cost other than material and labour incurred for an activity.

ii) By relation to cost centre – the costs are classified into direct or indirect. Direct costs can

be directly allocated to a cost centre whereas indirect cost cannot be allocated to a cost centre

or cost object.

iii) By function – the costs can be classified on the basis of function which includes

production, administration, selling, distribution, and research and development.

iv) By management decision making – the costs are classified differently under different

circumstances and for the purpose of management decision making. The various costs

include marginal cost, opportunity cost, sunk cost, differential cost, replacement cost,

avoidable cost, unavoidable cost, normal cost and abnormal cost (M. Oberholzer, 2004)

v) By nature of production process – the costs are classified on the basis of nature of

production process and can be categorized into batch cost, process cost, conversion cost, joint

cost, contract cost.

vi) By time – the costs can be classified depending on specific time period to which it relates

like historical cost, standard cost, estimated cost and pre-determined cost (Kumar)

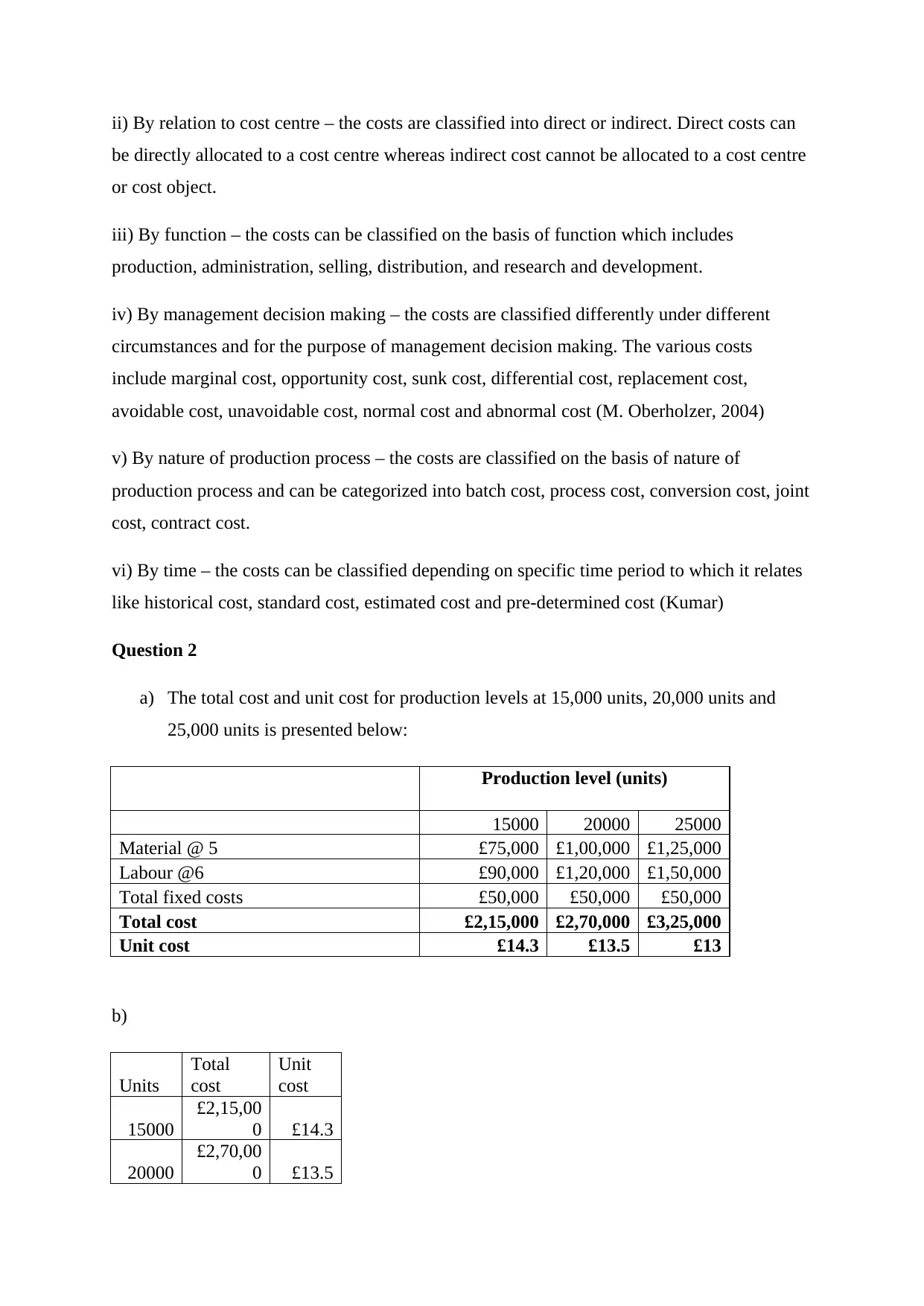

Question 2

a) The total cost and unit cost for production levels at 15,000 units, 20,000 units and

25,000 units is presented below:

Production level (units)

15000 20000 25000

Material @ 5 £75,000 £1,00,000 £1,25,000

Labour @6 £90,000 £1,20,000 £1,50,000

Total fixed costs £50,000 £50,000 £50,000

Total cost £2,15,000 £2,70,000 £3,25,000

Unit cost £14.3 £13.5 £13

b)

Units

Total

cost

Unit

cost

15000

£2,15,00

0 £14.3

20000

£2,70,00

0 £13.5

be directly allocated to a cost centre whereas indirect cost cannot be allocated to a cost centre

or cost object.

iii) By function – the costs can be classified on the basis of function which includes

production, administration, selling, distribution, and research and development.

iv) By management decision making – the costs are classified differently under different

circumstances and for the purpose of management decision making. The various costs

include marginal cost, opportunity cost, sunk cost, differential cost, replacement cost,

avoidable cost, unavoidable cost, normal cost and abnormal cost (M. Oberholzer, 2004)

v) By nature of production process – the costs are classified on the basis of nature of

production process and can be categorized into batch cost, process cost, conversion cost, joint

cost, contract cost.

vi) By time – the costs can be classified depending on specific time period to which it relates

like historical cost, standard cost, estimated cost and pre-determined cost (Kumar)

Question 2

a) The total cost and unit cost for production levels at 15,000 units, 20,000 units and

25,000 units is presented below:

Production level (units)

15000 20000 25000

Material @ 5 £75,000 £1,00,000 £1,25,000

Labour @6 £90,000 £1,20,000 £1,50,000

Total fixed costs £50,000 £50,000 £50,000

Total cost £2,15,000 £2,70,000 £3,25,000

Unit cost £14.3 £13.5 £13

b)

Units

Total

cost

Unit

cost

15000

£2,15,00

0 £14.3

20000

£2,70,00

0 £13.5

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

25000

£3,25,00

0 £13.0

From the above table we see that the total cost is increasing with the increase in production

levels, however the per unit cost is decreasing with an increase in the production level. This is

because of the fixed cost component. The variable cost of labour and material will increase

with the level of production but the fixed cost per unit will decrease will increasing

production levels. The fixed cost remains the same at any production level, hence at higher

production level, the fixed cost per unit is lower thus reducing the per unit cost. The total cost

is increasing due to higher variable costs as the fixed costs remains the same.

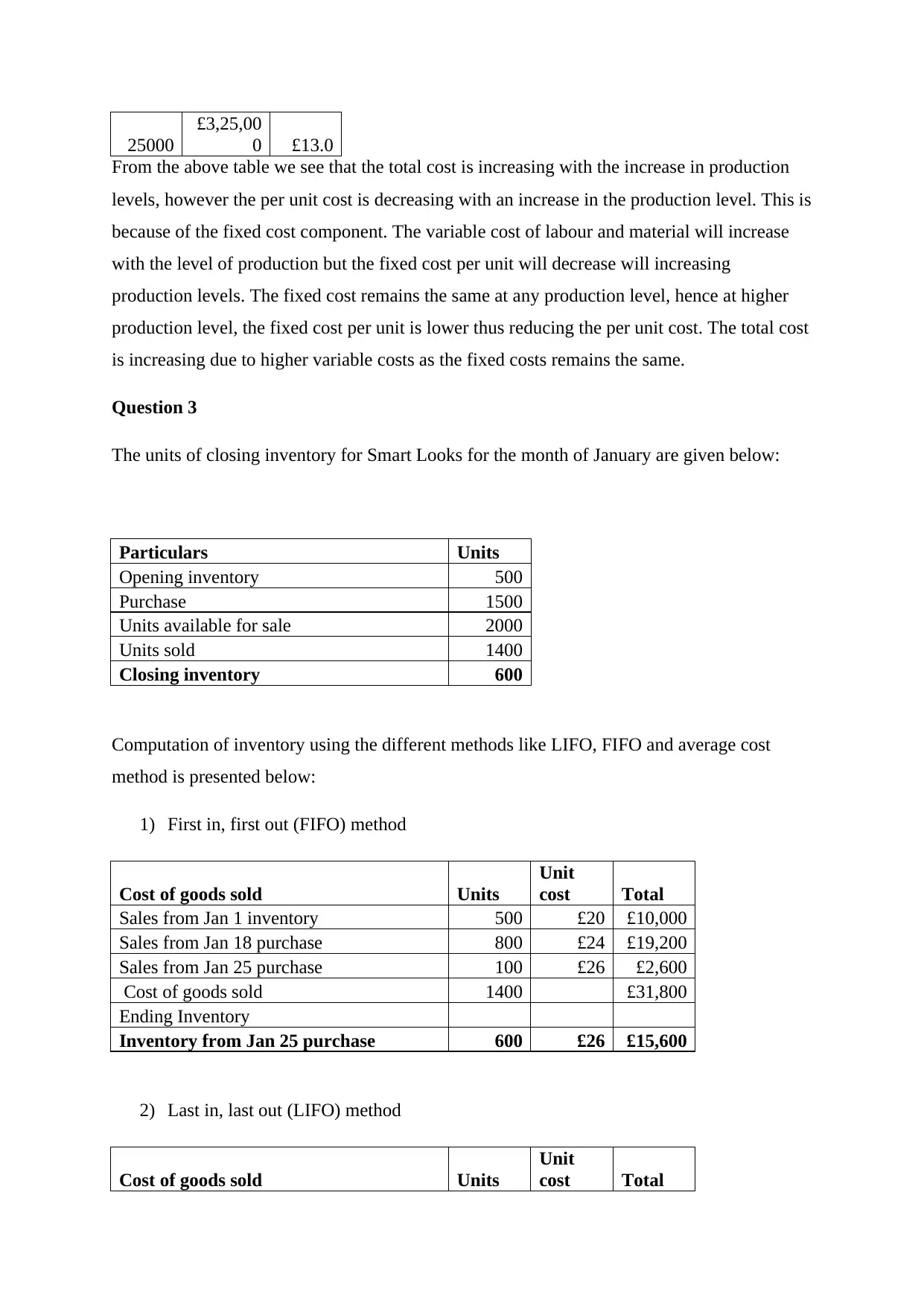

Question 3

The units of closing inventory for Smart Looks for the month of January are given below:

Particulars Units

Opening inventory 500

Purchase 1500

Units available for sale 2000

Units sold 1400

Closing inventory 600

Computation of inventory using the different methods like LIFO, FIFO and average cost

method is presented below:

1) First in, first out (FIFO) method

Cost of goods sold Units

Unit

cost Total

Sales from Jan 1 inventory 500 £20 £10,000

Sales from Jan 18 purchase 800 £24 £19,200

Sales from Jan 25 purchase 100 £26 £2,600

Cost of goods sold 1400 £31,800

Ending Inventory

Inventory from Jan 25 purchase 600 £26 £15,600

2) Last in, last out (LIFO) method

Cost of goods sold Units

Unit

cost Total

£3,25,00

0 £13.0

From the above table we see that the total cost is increasing with the increase in production

levels, however the per unit cost is decreasing with an increase in the production level. This is

because of the fixed cost component. The variable cost of labour and material will increase

with the level of production but the fixed cost per unit will decrease will increasing

production levels. The fixed cost remains the same at any production level, hence at higher

production level, the fixed cost per unit is lower thus reducing the per unit cost. The total cost

is increasing due to higher variable costs as the fixed costs remains the same.

Question 3

The units of closing inventory for Smart Looks for the month of January are given below:

Particulars Units

Opening inventory 500

Purchase 1500

Units available for sale 2000

Units sold 1400

Closing inventory 600

Computation of inventory using the different methods like LIFO, FIFO and average cost

method is presented below:

1) First in, first out (FIFO) method

Cost of goods sold Units

Unit

cost Total

Sales from Jan 1 inventory 500 £20 £10,000

Sales from Jan 18 purchase 800 £24 £19,200

Sales from Jan 25 purchase 100 £26 £2,600

Cost of goods sold 1400 £31,800

Ending Inventory

Inventory from Jan 25 purchase 600 £26 £15,600

2) Last in, last out (LIFO) method

Cost of goods sold Units

Unit

cost Total

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Sales from Jan 25 purchase 700 £26 £18,200

Sales from Jan 18 purchase 700 £24 £16,800

Cost of goods sold 1400 £35,000

Ending Inventory

Inventory from Jan 18 purchase 100 24 2400

Inventory from beginning inventory 500 £20 £10,000

600 £12,400

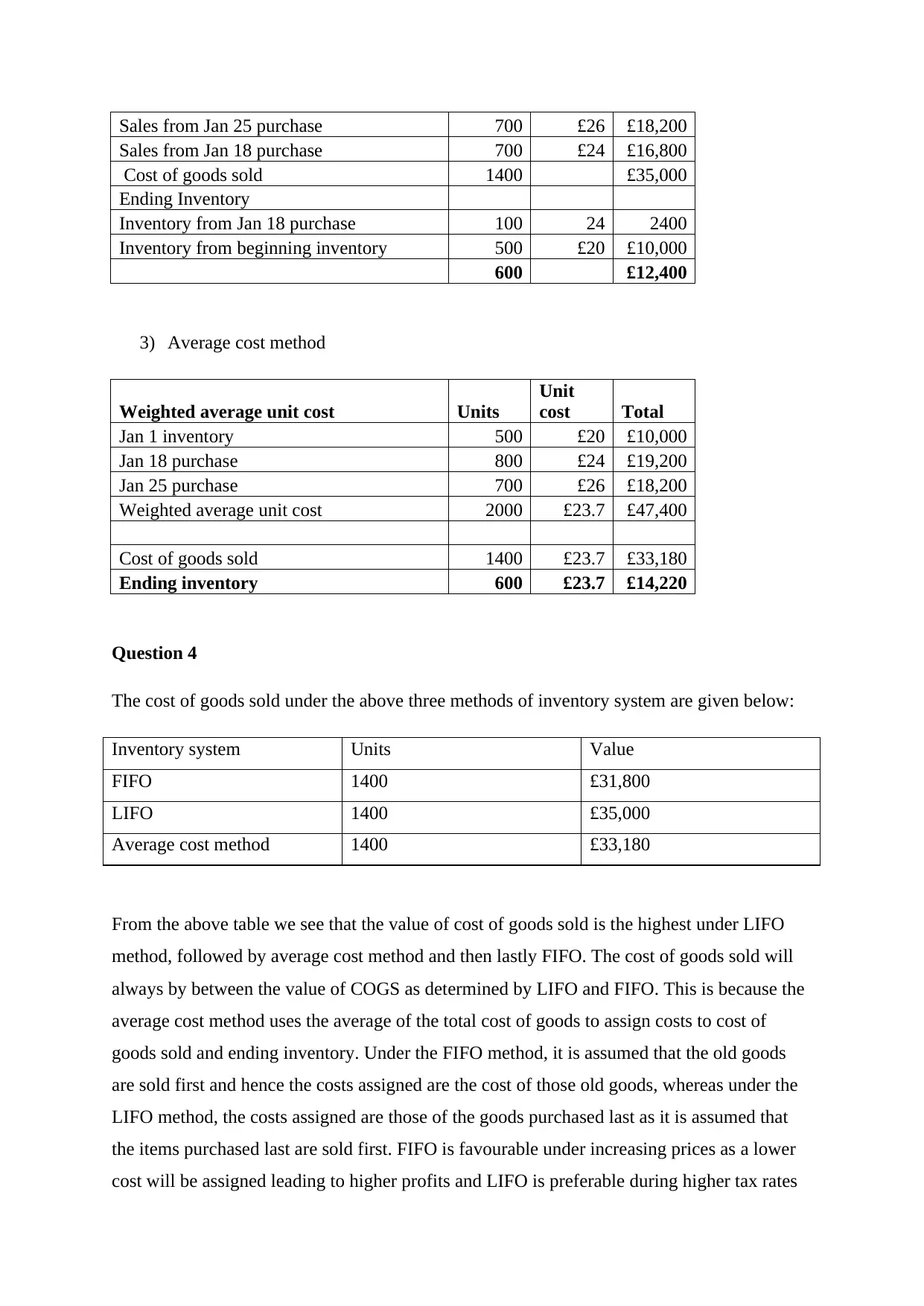

3) Average cost method

Weighted average unit cost Units

Unit

cost Total

Jan 1 inventory 500 £20 £10,000

Jan 18 purchase 800 £24 £19,200

Jan 25 purchase 700 £26 £18,200

Weighted average unit cost 2000 £23.7 £47,400

Cost of goods sold 1400 £23.7 £33,180

Ending inventory 600 £23.7 £14,220

Question 4

The cost of goods sold under the above three methods of inventory system are given below:

Inventory system Units Value

FIFO 1400 £31,800

LIFO 1400 £35,000

Average cost method 1400 £33,180

From the above table we see that the value of cost of goods sold is the highest under LIFO

method, followed by average cost method and then lastly FIFO. The cost of goods sold will

always by between the value of COGS as determined by LIFO and FIFO. This is because the

average cost method uses the average of the total cost of goods to assign costs to cost of

goods sold and ending inventory. Under the FIFO method, it is assumed that the old goods

are sold first and hence the costs assigned are the cost of those old goods, whereas under the

LIFO method, the costs assigned are those of the goods purchased last as it is assumed that

the items purchased last are sold first. FIFO is favourable under increasing prices as a lower

cost will be assigned leading to higher profits and LIFO is preferable during higher tax rates

Sales from Jan 18 purchase 700 £24 £16,800

Cost of goods sold 1400 £35,000

Ending Inventory

Inventory from Jan 18 purchase 100 24 2400

Inventory from beginning inventory 500 £20 £10,000

600 £12,400

3) Average cost method

Weighted average unit cost Units

Unit

cost Total

Jan 1 inventory 500 £20 £10,000

Jan 18 purchase 800 £24 £19,200

Jan 25 purchase 700 £26 £18,200

Weighted average unit cost 2000 £23.7 £47,400

Cost of goods sold 1400 £23.7 £33,180

Ending inventory 600 £23.7 £14,220

Question 4

The cost of goods sold under the above three methods of inventory system are given below:

Inventory system Units Value

FIFO 1400 £31,800

LIFO 1400 £35,000

Average cost method 1400 £33,180

From the above table we see that the value of cost of goods sold is the highest under LIFO

method, followed by average cost method and then lastly FIFO. The cost of goods sold will

always by between the value of COGS as determined by LIFO and FIFO. This is because the

average cost method uses the average of the total cost of goods to assign costs to cost of

goods sold and ending inventory. Under the FIFO method, it is assumed that the old goods

are sold first and hence the costs assigned are the cost of those old goods, whereas under the

LIFO method, the costs assigned are those of the goods purchased last as it is assumed that

the items purchased last are sold first. FIFO is favourable under increasing prices as a lower

cost will be assigned leading to higher profits and LIFO is preferable during higher tax rates

as LIFO leads to higher assignment of costs which reduces the profit level and hence lower

taxes are to be paid (College, 2013)

In the current scenario, the purchase price of inventory has been rising. As a result, the prices

under FIFO are lower as lower costs are assigned to goods sold and higher costs are assigned

to the ending inventory. Under LIFO method, the cost of goods sold is higher as higher costs

have been assigned to the goods sold first and lower cost to the ending inventory.

Question 5

a) Smart Looks has decided on the various performance measures. The indicators to be

used for determining the success of each measure is discussed below:

1) Customer experience

Customer experience is a very important measure of a company’s performance as a company

exists to serve the customers and in turn makes profits. Customer experience is a very

complex area and requires the right vision and execution to be successful. The customer

experience can be measured by three major areas which include acquisition, retention and

efficiency (Griebeler, 2015)

i) Acquisition – it focuses on the ability of an organization to gain new customers,

thereby increasing the customer base. There are three challenges associated with

acquisition which include generating of opportunities. Opportunities can be

generated by ensuring more customer visits and customer traffic at a store or a

website which increases the chances of sales. Having a respected brand and being

highly visible makes the challenge easier. Another way of generating opportunity

is through increasing the brand equity. Brand equity build value for a corporate

and is influential in increasing sales, improving customer conversion rates and

increasing the sales per customer. Increase in market share also increases

opportunities as higher market share provides the companies with pricing power

and growth.

ii) Retention – it focuses on how a company can retain its customers by increasing

their life time value and avoiding switch over of brands. Retention can be

achieved by creating customer loyalty. A loyal customer will refrain from

switching brands. A company may undertake loyalty programs for such purpose.

Create advocates is another way of retention in which an advocate customer will

taxes are to be paid (College, 2013)

In the current scenario, the purchase price of inventory has been rising. As a result, the prices

under FIFO are lower as lower costs are assigned to goods sold and higher costs are assigned

to the ending inventory. Under LIFO method, the cost of goods sold is higher as higher costs

have been assigned to the goods sold first and lower cost to the ending inventory.

Question 5

a) Smart Looks has decided on the various performance measures. The indicators to be

used for determining the success of each measure is discussed below:

1) Customer experience

Customer experience is a very important measure of a company’s performance as a company

exists to serve the customers and in turn makes profits. Customer experience is a very

complex area and requires the right vision and execution to be successful. The customer

experience can be measured by three major areas which include acquisition, retention and

efficiency (Griebeler, 2015)

i) Acquisition – it focuses on the ability of an organization to gain new customers,

thereby increasing the customer base. There are three challenges associated with

acquisition which include generating of opportunities. Opportunities can be

generated by ensuring more customer visits and customer traffic at a store or a

website which increases the chances of sales. Having a respected brand and being

highly visible makes the challenge easier. Another way of generating opportunity

is through increasing the brand equity. Brand equity build value for a corporate

and is influential in increasing sales, improving customer conversion rates and

increasing the sales per customer. Increase in market share also increases

opportunities as higher market share provides the companies with pricing power

and growth.

ii) Retention – it focuses on how a company can retain its customers by increasing

their life time value and avoiding switch over of brands. Retention can be

achieved by creating customer loyalty. A loyal customer will refrain from

switching brands. A company may undertake loyalty programs for such purpose.

Create advocates is another way of retention in which an advocate customer will

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

influence his family or friends in doing business with the organization. Having as

many advocates measures the company’s success management. While increasing

the customer base, a company also focuses on increasing the size of the wallet per

customer in order to drive higher profits per customer.

2) Supplier and product quality

Supply chain performance indicators are important tools for monitoring and improving the

performance of supply chain in order to gain competitive advantage. Such indicators also

provide useful information for decision making. Three types of performance indicators

necessary for measurement of supply chain performance are flexibility, resource and output

(Ambe, 2014)

i) Percentage of defective parts per million – it measures the quantity of defective

parts out of the total units produced. This KPI measures the quality of the process

and the product before the product is shipped. The tracking of the defective parts

is done on a control chart with a lower and upper limit in most of the

organizations. The organization has to figure out the reason of the defective part

which can be due to the assemble of defective material or the wrong use of the

part making it defective. This helps in identifying whether the supplier of the

defective part is supplying wrong parts or is there any other issue. Based on the

above analysis, an organization can decide whether it would go for a more

expensive supplier to reduce the defective parts per million (Londe, 2016)

ii) Performance of the supplier – monitoring the supplier performance is crucial to

improved performance. The supplier performance can be measured by gathering

their performance information like lead times from order, compliance of pricing

and other things in the contract, meeting of quality standards. Also customer

experience in respect of response rates, services and attitude can be used to assess

the supplier performance. It is also important to assess the experience of the

supplier of working with the buying organization as the suppliers may be facing

difficulties in dealing with the people of the organization leading to poor

performance (Knowledge, 2013)

3) Operations Efficiency

It is essential for an organization to measures its productivity. Many companies are investing

a lot of money to track their operational efficiencies. People involved in designing such

many advocates measures the company’s success management. While increasing

the customer base, a company also focuses on increasing the size of the wallet per

customer in order to drive higher profits per customer.

2) Supplier and product quality

Supply chain performance indicators are important tools for monitoring and improving the

performance of supply chain in order to gain competitive advantage. Such indicators also

provide useful information for decision making. Three types of performance indicators

necessary for measurement of supply chain performance are flexibility, resource and output

(Ambe, 2014)

i) Percentage of defective parts per million – it measures the quantity of defective

parts out of the total units produced. This KPI measures the quality of the process

and the product before the product is shipped. The tracking of the defective parts

is done on a control chart with a lower and upper limit in most of the

organizations. The organization has to figure out the reason of the defective part

which can be due to the assemble of defective material or the wrong use of the

part making it defective. This helps in identifying whether the supplier of the

defective part is supplying wrong parts or is there any other issue. Based on the

above analysis, an organization can decide whether it would go for a more

expensive supplier to reduce the defective parts per million (Londe, 2016)

ii) Performance of the supplier – monitoring the supplier performance is crucial to

improved performance. The supplier performance can be measured by gathering

their performance information like lead times from order, compliance of pricing

and other things in the contract, meeting of quality standards. Also customer

experience in respect of response rates, services and attitude can be used to assess

the supplier performance. It is also important to assess the experience of the

supplier of working with the buying organization as the suppliers may be facing

difficulties in dealing with the people of the organization leading to poor

performance (Knowledge, 2013)

3) Operations Efficiency

It is essential for an organization to measures its productivity. Many companies are investing

a lot of money to track their operational efficiencies. People involved in designing such

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

measurement systems are cost accountants, economists and statistician (Chew, 1988). The

various indicators of operational efficiency include:

i) Budgets – organizations mostly set budgets for their operations. There is a master

budget followed by other operational budgets. The various operational budgets are

sales budget, production budget, material budget, labour budget, etc. A comparison of

the actual results with the above budgets helps in identifying the variances as to where

the results are not being achieved. On the basis of such variances, corrective action

can be taken.

ii) Customer performance – includes metrics for customer satisfaction, speed of

customer issue resolution, and accuracy of customer issue resolution and customer

retention rate (Hatch, 2008)

4) Reducing Maintenance Spending

The maintenance KPIs help in making the maintenance more effective and efficient.

Effective maintenance helps in reducing operational risks and increases equipment reliability.

Efficient maintenance brings equipment reliability and risk reduction with the least possible

resources (Sondalini)

i) Equipment reliability – it can be measured by two ways which are asset MTBF

(mean time between failure) and Production MTBF. The asset MTBF is the time

between unplanned outages of an asset and production MTBF is the time between

unplanned break down of equipment. The data on equipment reliability should be

accurately measured and reported.

ii) Maintenance costs – the various ways of measuring the maintenance costs include

maintenance cost component in the cost of production, difference in the actual and

budgeted maintenance cost, maintenance cost per asset, maintenance cost per

maintenance strategy.

5) Cost reduction and profitability increase

Profitability can be ensured by focusing on four important areas which are reducing costs,

increasing productivity and efficiency and increasing the revenue.

i) Profit margins – a measurement of the profit margins is an indicator of

increasing profitability. The various ratios that can be used include gross

profit margin, net profit margin, return on capital employed, and return on

various indicators of operational efficiency include:

i) Budgets – organizations mostly set budgets for their operations. There is a master

budget followed by other operational budgets. The various operational budgets are

sales budget, production budget, material budget, labour budget, etc. A comparison of

the actual results with the above budgets helps in identifying the variances as to where

the results are not being achieved. On the basis of such variances, corrective action

can be taken.

ii) Customer performance – includes metrics for customer satisfaction, speed of

customer issue resolution, and accuracy of customer issue resolution and customer

retention rate (Hatch, 2008)

4) Reducing Maintenance Spending

The maintenance KPIs help in making the maintenance more effective and efficient.

Effective maintenance helps in reducing operational risks and increases equipment reliability.

Efficient maintenance brings equipment reliability and risk reduction with the least possible

resources (Sondalini)

i) Equipment reliability – it can be measured by two ways which are asset MTBF

(mean time between failure) and Production MTBF. The asset MTBF is the time

between unplanned outages of an asset and production MTBF is the time between

unplanned break down of equipment. The data on equipment reliability should be

accurately measured and reported.

ii) Maintenance costs – the various ways of measuring the maintenance costs include

maintenance cost component in the cost of production, difference in the actual and

budgeted maintenance cost, maintenance cost per asset, maintenance cost per

maintenance strategy.

5) Cost reduction and profitability increase

Profitability can be ensured by focusing on four important areas which are reducing costs,

increasing productivity and efficiency and increasing the revenue.

i) Profit margins – a measurement of the profit margins is an indicator of

increasing profitability. The various ratios that can be used include gross

profit margin, net profit margin, return on capital employed, and return on

equity, EBITDA. An increase in the above ratio signifies increasing

profitability (Vrabel)

ii) Operating margin – a measurement of the operating margin is an indicator

of the increase or decrease in costs. An increase in the operating margin

means the costs have reduced and vice versa.

b) The metrics discussed above have been agreed upon for use as they will measure the

performance and in the process lead to reduction in costs and enhance the value and

quality.

1) The costs can be reduced by maintaining operational efficiency, reducing

maintenance spending and cost reduction measures. Operational efficiency will help

in reducing operation costs. Reduced maintenance spending will help in reducing

maintenance costs.

2) The value of the company can be enhanced through rich customer experience. A

satisfied customer will be loyal to the company and can also become the advocate foe

the company thus increasing its value. By ensuring supplier and product quality, the

company can ensure quality goods being supplied by the supplier which will in turn

improve product quality. Also cost efficient suppliers help in reducing costs. By

providing quality products, the company can increase its market value.

Task 2

Question 6

Budget is a short term financial plan where an estimation of the costs, revenues and resources

are made for a specific period and the same are reviewed over a period of time. Budget is a

planning document which comprises of financial and non-financial information of the future

activities to be undertaken by a company (Mirela-Oana Pintea)

Purpose of Budgets

Budgets are important for an effective management as they are a very good control system.

The advantages of budgets include:

a) Setting short term targets – setting targets are great means of implementing goals. The

set targets are objective and action oriented. The targets have a time dimension. Like

at a broader level, the target can be to earn $500000 in the first quarter of next year, at

a lower level it can be have maximum of 5 defective parts per thousand. Through

profitability (Vrabel)

ii) Operating margin – a measurement of the operating margin is an indicator

of the increase or decrease in costs. An increase in the operating margin

means the costs have reduced and vice versa.

b) The metrics discussed above have been agreed upon for use as they will measure the

performance and in the process lead to reduction in costs and enhance the value and

quality.

1) The costs can be reduced by maintaining operational efficiency, reducing

maintenance spending and cost reduction measures. Operational efficiency will help

in reducing operation costs. Reduced maintenance spending will help in reducing

maintenance costs.

2) The value of the company can be enhanced through rich customer experience. A

satisfied customer will be loyal to the company and can also become the advocate foe

the company thus increasing its value. By ensuring supplier and product quality, the

company can ensure quality goods being supplied by the supplier which will in turn

improve product quality. Also cost efficient suppliers help in reducing costs. By

providing quality products, the company can increase its market value.

Task 2

Question 6

Budget is a short term financial plan where an estimation of the costs, revenues and resources

are made for a specific period and the same are reviewed over a period of time. Budget is a

planning document which comprises of financial and non-financial information of the future

activities to be undertaken by a company (Mirela-Oana Pintea)

Purpose of Budgets

Budgets are important for an effective management as they are a very good control system.

The advantages of budgets include:

a) Setting short term targets – setting targets are great means of implementing goals. The

set targets are objective and action oriented. The targets have a time dimension. Like

at a broader level, the target can be to earn $500000 in the first quarter of next year, at

a lower level it can be have maximum of 5 defective parts per thousand. Through

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

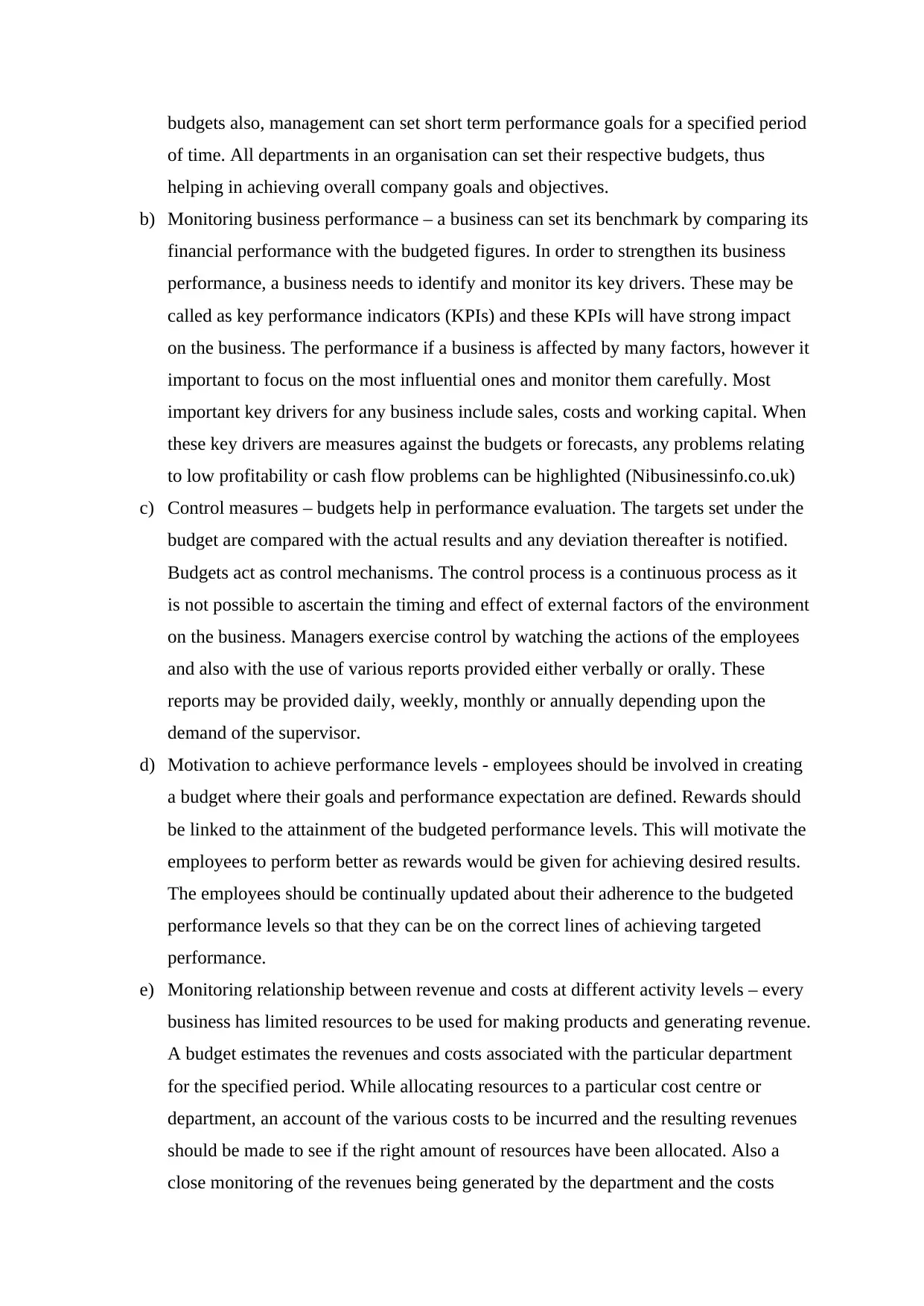

budgets also, management can set short term performance goals for a specified period

of time. All departments in an organisation can set their respective budgets, thus

helping in achieving overall company goals and objectives.

b) Monitoring business performance – a business can set its benchmark by comparing its

financial performance with the budgeted figures. In order to strengthen its business

performance, a business needs to identify and monitor its key drivers. These may be

called as key performance indicators (KPIs) and these KPIs will have strong impact

on the business. The performance if a business is affected by many factors, however it

important to focus on the most influential ones and monitor them carefully. Most

important key drivers for any business include sales, costs and working capital. When

these key drivers are measures against the budgets or forecasts, any problems relating

to low profitability or cash flow problems can be highlighted (Nibusinessinfo.co.uk)

c) Control measures – budgets help in performance evaluation. The targets set under the

budget are compared with the actual results and any deviation thereafter is notified.

Budgets act as control mechanisms. The control process is a continuous process as it

is not possible to ascertain the timing and effect of external factors of the environment

on the business. Managers exercise control by watching the actions of the employees

and also with the use of various reports provided either verbally or orally. These

reports may be provided daily, weekly, monthly or annually depending upon the

demand of the supervisor.

d) Motivation to achieve performance levels - employees should be involved in creating

a budget where their goals and performance expectation are defined. Rewards should

be linked to the attainment of the budgeted performance levels. This will motivate the

employees to perform better as rewards would be given for achieving desired results.

The employees should be continually updated about their adherence to the budgeted

performance levels so that they can be on the correct lines of achieving targeted

performance.

e) Monitoring relationship between revenue and costs at different activity levels – every

business has limited resources to be used for making products and generating revenue.

A budget estimates the revenues and costs associated with the particular department

for the specified period. While allocating resources to a particular cost centre or

department, an account of the various costs to be incurred and the resulting revenues

should be made to see if the right amount of resources have been allocated. Also a

close monitoring of the revenues being generated by the department and the costs

of time. All departments in an organisation can set their respective budgets, thus

helping in achieving overall company goals and objectives.

b) Monitoring business performance – a business can set its benchmark by comparing its

financial performance with the budgeted figures. In order to strengthen its business

performance, a business needs to identify and monitor its key drivers. These may be

called as key performance indicators (KPIs) and these KPIs will have strong impact

on the business. The performance if a business is affected by many factors, however it

important to focus on the most influential ones and monitor them carefully. Most

important key drivers for any business include sales, costs and working capital. When

these key drivers are measures against the budgets or forecasts, any problems relating

to low profitability or cash flow problems can be highlighted (Nibusinessinfo.co.uk)

c) Control measures – budgets help in performance evaluation. The targets set under the

budget are compared with the actual results and any deviation thereafter is notified.

Budgets act as control mechanisms. The control process is a continuous process as it

is not possible to ascertain the timing and effect of external factors of the environment

on the business. Managers exercise control by watching the actions of the employees

and also with the use of various reports provided either verbally or orally. These

reports may be provided daily, weekly, monthly or annually depending upon the

demand of the supervisor.

d) Motivation to achieve performance levels - employees should be involved in creating

a budget where their goals and performance expectation are defined. Rewards should

be linked to the attainment of the budgeted performance levels. This will motivate the

employees to perform better as rewards would be given for achieving desired results.

The employees should be continually updated about their adherence to the budgeted

performance levels so that they can be on the correct lines of achieving targeted

performance.

e) Monitoring relationship between revenue and costs at different activity levels – every

business has limited resources to be used for making products and generating revenue.

A budget estimates the revenues and costs associated with the particular department

for the specified period. While allocating resources to a particular cost centre or

department, an account of the various costs to be incurred and the resulting revenues

should be made to see if the right amount of resources have been allocated. Also a

close monitoring of the revenues being generated by the department and the costs

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

being incurred will help in identifying the profit making departments or products from

the non-profitable ones.

f) Aid to communication with the senior department – budgets act as formal channel of

communication between seniors and juniors. In the process of preparing a budget,

senior management takes the inputs from the employees also, thus facilitating

communication. Also once budgets are prepared, they are communicated to the whole

organisation.

There are various methods available for preparing budgets some of which are discussed

below:

a) Zero based budget – it is a method budgeting which starts from zero base. All the

expenses need to be justified every period as if they were being incurred for the first

time (Pidgeon, 2010). Zero based budgeting requires thorough knowledge of the

organisation and requires lot of time, effort and training. It puts a lot of pressure on

the manager to justify their spending from scratch (Portal, 2013)

b) Fixed budget – it is also called a static budget. It is based on the assumption that the

estimate of the sales and volume will not change over the specified period and on the

basis of the estimated sales and revenue, expenses and operations are planned.

However, this budget is not reliable as the estimation of sales is rarely accurate. Any

growth or decline in the industry is not taken into consideration and hence actual

performance cannot be compared to the budgeted ones. Though fixed budgets are not

reliable but they can be useful for companies with reliable annual trends.

c) Variable budget – also called flexible budget, is a financial plan of revenues and

expenses based on the current actual output. The budget takes into consideration the

effect on revenues and expenses of the change in volume. Under a flexible budget,

there are different budgeted costs for different levels of activity. Under the budget, all

expenses are classified into fixed, variable and semi variable (Lodha)

The most suitable budget for Smart Looks is flexible budget because the company has both

fixed and variable costs. The level of activity also may differ from time to time; hence it is

beneficial to use flexible budgeting.

Question 7

the non-profitable ones.

f) Aid to communication with the senior department – budgets act as formal channel of

communication between seniors and juniors. In the process of preparing a budget,

senior management takes the inputs from the employees also, thus facilitating

communication. Also once budgets are prepared, they are communicated to the whole

organisation.

There are various methods available for preparing budgets some of which are discussed

below:

a) Zero based budget – it is a method budgeting which starts from zero base. All the

expenses need to be justified every period as if they were being incurred for the first

time (Pidgeon, 2010). Zero based budgeting requires thorough knowledge of the

organisation and requires lot of time, effort and training. It puts a lot of pressure on

the manager to justify their spending from scratch (Portal, 2013)

b) Fixed budget – it is also called a static budget. It is based on the assumption that the

estimate of the sales and volume will not change over the specified period and on the

basis of the estimated sales and revenue, expenses and operations are planned.

However, this budget is not reliable as the estimation of sales is rarely accurate. Any

growth or decline in the industry is not taken into consideration and hence actual

performance cannot be compared to the budgeted ones. Though fixed budgets are not

reliable but they can be useful for companies with reliable annual trends.

c) Variable budget – also called flexible budget, is a financial plan of revenues and

expenses based on the current actual output. The budget takes into consideration the

effect on revenues and expenses of the change in volume. Under a flexible budget,

there are different budgeted costs for different levels of activity. Under the budget, all

expenses are classified into fixed, variable and semi variable (Lodha)

The most suitable budget for Smart Looks is flexible budget because the company has both

fixed and variable costs. The level of activity also may differ from time to time; hence it is

beneficial to use flexible budgeting.

Question 7

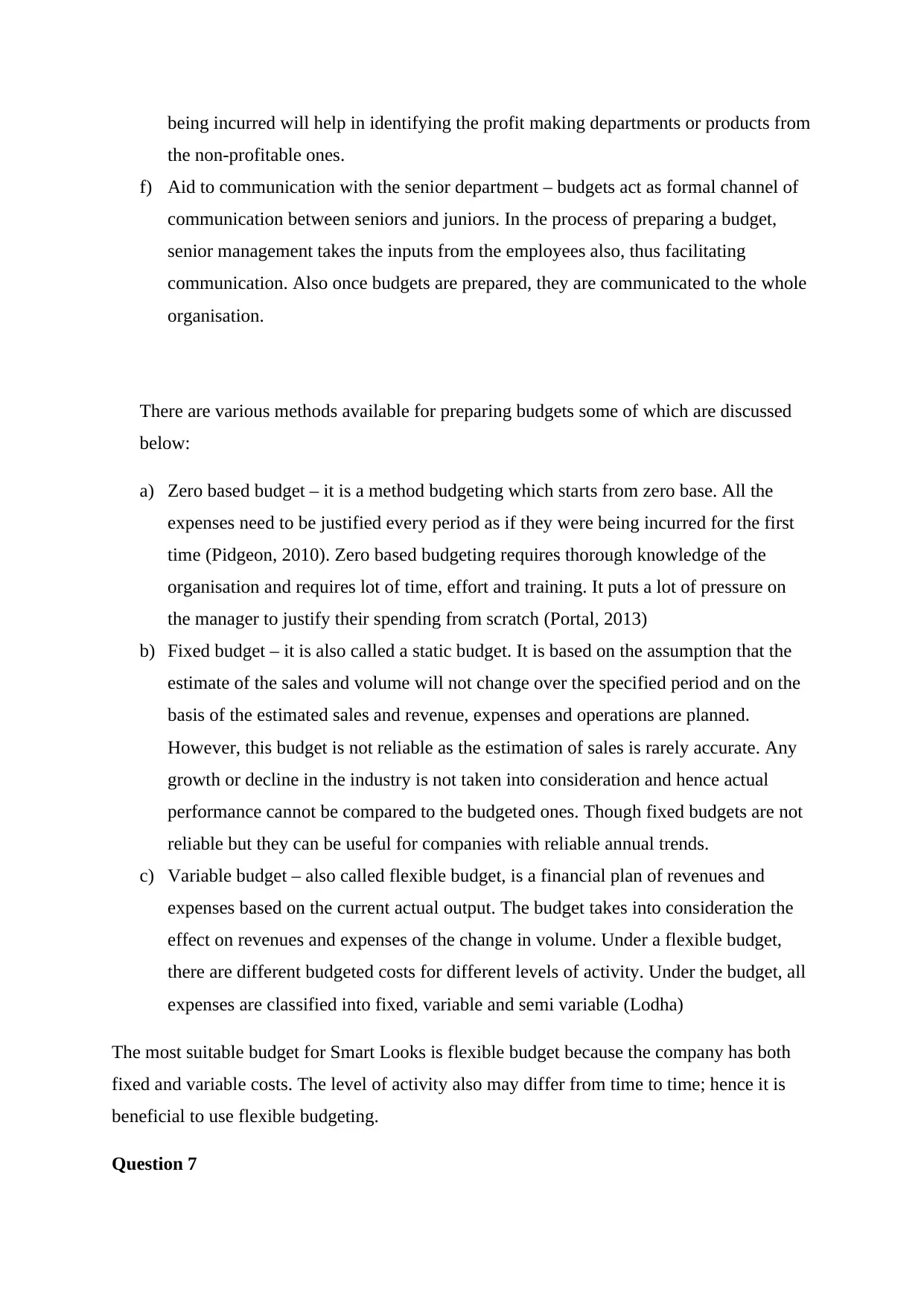

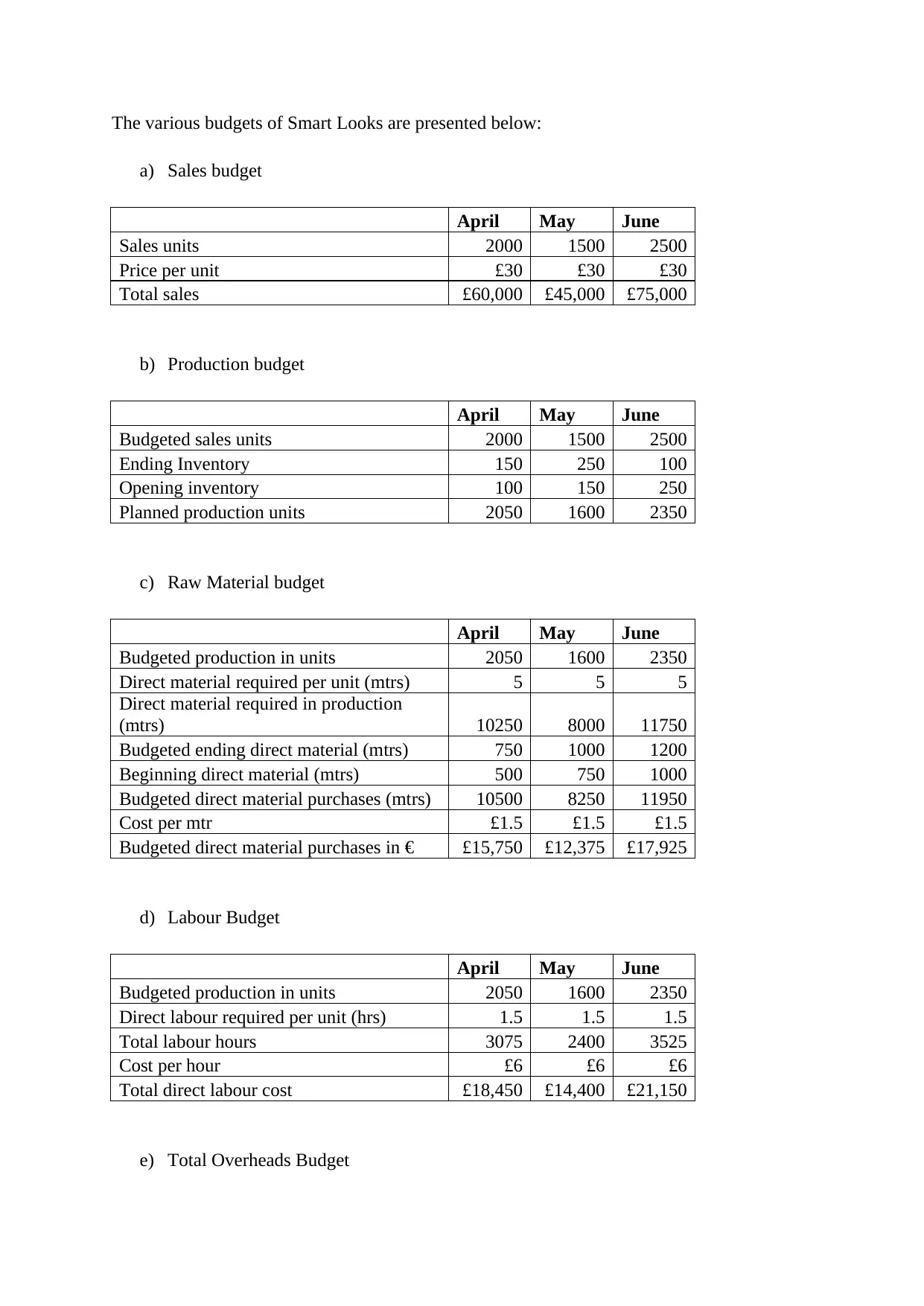

The various budgets of Smart Looks are presented below:

a) Sales budget

April May June

Sales units 2000 1500 2500

Price per unit £30 £30 £30

Total sales £60,000 £45,000 £75,000

b) Production budget

April May June

Budgeted sales units 2000 1500 2500

Ending Inventory 150 250 100

Opening inventory 100 150 250

Planned production units 2050 1600 2350

c) Raw Material budget

April May June

Budgeted production in units 2050 1600 2350

Direct material required per unit (mtrs) 5 5 5

Direct material required in production

(mtrs) 10250 8000 11750

Budgeted ending direct material (mtrs) 750 1000 1200

Beginning direct material (mtrs) 500 750 1000

Budgeted direct material purchases (mtrs) 10500 8250 11950

Cost per mtr £1.5 £1.5 £1.5

Budgeted direct material purchases in € £15,750 £12,375 £17,925

d) Labour Budget

April May June

Budgeted production in units 2050 1600 2350

Direct labour required per unit (hrs) 1.5 1.5 1.5

Total labour hours 3075 2400 3525

Cost per hour £6 £6 £6

Total direct labour cost £18,450 £14,400 £21,150

e) Total Overheads Budget

a) Sales budget

April May June

Sales units 2000 1500 2500

Price per unit £30 £30 £30

Total sales £60,000 £45,000 £75,000

b) Production budget

April May June

Budgeted sales units 2000 1500 2500

Ending Inventory 150 250 100

Opening inventory 100 150 250

Planned production units 2050 1600 2350

c) Raw Material budget

April May June

Budgeted production in units 2050 1600 2350

Direct material required per unit (mtrs) 5 5 5

Direct material required in production

(mtrs) 10250 8000 11750

Budgeted ending direct material (mtrs) 750 1000 1200

Beginning direct material (mtrs) 500 750 1000

Budgeted direct material purchases (mtrs) 10500 8250 11950

Cost per mtr £1.5 £1.5 £1.5

Budgeted direct material purchases in € £15,750 £12,375 £17,925

d) Labour Budget

April May June

Budgeted production in units 2050 1600 2350

Direct labour required per unit (hrs) 1.5 1.5 1.5

Total labour hours 3075 2400 3525

Cost per hour £6 £6 £6

Total direct labour cost £18,450 £14,400 £21,150

e) Total Overheads Budget

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 18

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.