Management Accounting Report: Financial Analysis of JB Hi-Fi Company

VerifiedAdded on 2023/06/03

|12

|2972

|301

Report

AI Summary

This management accounting report provides a detailed financial analysis of JB Hi-Fi, evaluating its performance based on the Australian Accounting Standards and IFRS. The report examines depreciation methods applied to the company's plant and machinery, including straight-line depreciation, and assesses the useful life of assets like leasehold improvements and plant and equipment. It calculates the minimum average annual net cash flow and analyzes the payback period and accounting rate of return. Furthermore, the report evaluates the Return on Investment (ROI) methodology and its influence on the company's financial performance, alongside a discussion of supply chain management and its impact on working capital and cash flow, including the importance of inventory management and warehouse optimization. The report concludes with a critical examination of costing models and the annual budgeting process to suggest improvements in JB Hi-Fi’s financial strategies.

Running head: MANAGEMENT ACCOUNTING

Management Accounting

Name of the Student:

Name of the University:

Author’s Note:

Management Accounting

Name of the Student:

Name of the University:

Author’s Note:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1MANAGEMENT ACCOUNTING

Table of Contents

Introduction................................................................................................................................2

Discussion..................................................................................................................................2

Depreciation Methods............................................................................................................2

Useful life of the Assets.........................................................................................................2

Minimum Average Annual Net Cash Flow...........................................................................3

Payback Period.......................................................................................................................4

Accounting Rate of Return.....................................................................................................5

Comparison of Average Payback Period...............................................................................5

Supply Chain Management Consultant..................................................................................6

Evaluating the Return on Investment (ROI) methodology and the influence of the same....6

Objective of the Study............................................................................................................6

Critical Examination of the Costing Model...........................................................................8

Methodology and Structure of the Annual Budgeting Process..............................................8

Conclusion..................................................................................................................................9

Reference..................................................................................................................................10

Table of Contents

Introduction................................................................................................................................2

Discussion..................................................................................................................................2

Depreciation Methods............................................................................................................2

Useful life of the Assets.........................................................................................................2

Minimum Average Annual Net Cash Flow...........................................................................3

Payback Period.......................................................................................................................4

Accounting Rate of Return.....................................................................................................5

Comparison of Average Payback Period...............................................................................5

Supply Chain Management Consultant..................................................................................6

Evaluating the Return on Investment (ROI) methodology and the influence of the same....6

Objective of the Study............................................................................................................6

Critical Examination of the Costing Model...........................................................................8

Methodology and Structure of the Annual Budgeting Process..............................................8

Conclusion..................................................................................................................................9

Reference..................................................................................................................................10

2MANAGEMENT ACCOUNTING

Introduction

Accounting Policies used by the JB HI-Fi Company is in accordance with the

Australian Accounting Standards and the principles and guidelines laid down by the same

were taken into view and account. The interpretation for the accounting policies were used in

accordance with the Corporations Act 2001. The financial report for the company was

prepared in accordance to the IFRS and the compliance with the same was taken into account.

Discussion

Depreciation Methods

The depreciation methods taken into account for the JB HI-Fi Company’s Plant and

Machinery was for the year 2016. The Depreciation provided on the plant and equipment and

the leasehold improvements were noted I the financial statements of the company at the

historical cost less any accumulated. The depreciation on all the non-current assets of the

company was provided. The method for depreciation is provided on a straight line basis

where the cost of each assets or the value of the assets is distributed among the useful life of

the asset and the following depreciation per year was calculated by the company. The

company reviews and overviews the different factors of the assets such as the useful or total

life of the asset or the market value and the suitable depreciation method. If the management

of the company felt regarding changes that needs to be done on the factors than the changes

are made. The oversight and annual review of the non-current assets of the company once

annually which will help a company helps them in better forecasting and maintaining better

operational efficiency in the business (Qian et al. 2016).

Useful life of the Assets.

The useful life of the assets was one in order to review and study the assets of the company in

brief. The estimated life selected and evaluated for the non-current assets of the company

Introduction

Accounting Policies used by the JB HI-Fi Company is in accordance with the

Australian Accounting Standards and the principles and guidelines laid down by the same

were taken into view and account. The interpretation for the accounting policies were used in

accordance with the Corporations Act 2001. The financial report for the company was

prepared in accordance to the IFRS and the compliance with the same was taken into account.

Discussion

Depreciation Methods

The depreciation methods taken into account for the JB HI-Fi Company’s Plant and

Machinery was for the year 2016. The Depreciation provided on the plant and equipment and

the leasehold improvements were noted I the financial statements of the company at the

historical cost less any accumulated. The depreciation on all the non-current assets of the

company was provided. The method for depreciation is provided on a straight line basis

where the cost of each assets or the value of the assets is distributed among the useful life of

the asset and the following depreciation per year was calculated by the company. The

company reviews and overviews the different factors of the assets such as the useful or total

life of the asset or the market value and the suitable depreciation method. If the management

of the company felt regarding changes that needs to be done on the factors than the changes

are made. The oversight and annual review of the non-current assets of the company once

annually which will help a company helps them in better forecasting and maintaining better

operational efficiency in the business (Qian et al. 2016).

Useful life of the Assets.

The useful life of the assets was one in order to review and study the assets of the company in

brief. The estimated life selected and evaluated for the non-current assets of the company

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3MANAGEMENT ACCOUNTING

were defining two key assets of the company (Kawasmi, Brown & Shell, 2018). The

leasehold improvements of the company was taken ad the useful life of the asset was

considered to be around 1-15 years of total time frame. The plant and equipment on the other

hand useful life for the asset was considered to be around 1.5years of time frame to 15 years

of time frame. The intangible assets of the company comprises the intangible assets like the

goodwill. The intangible assets of the company that have an indefinite useful life is are

carried and reported down at cost of acquisition less if any accumulated impairment charges

arising from the same. The viability of non-current assets of the company is generated with

the help of annual testing of impairment of assets for the company. The plant and equipment

of the company is charged with the impairment charges if the company observes that the

book value or the carrying value of the assets is greater than the fair market value of the

assets and the same assets amount is not expected to be recoverable then the company

charges the impairment charges on the following is charged to shows the economic viability

of the assets.

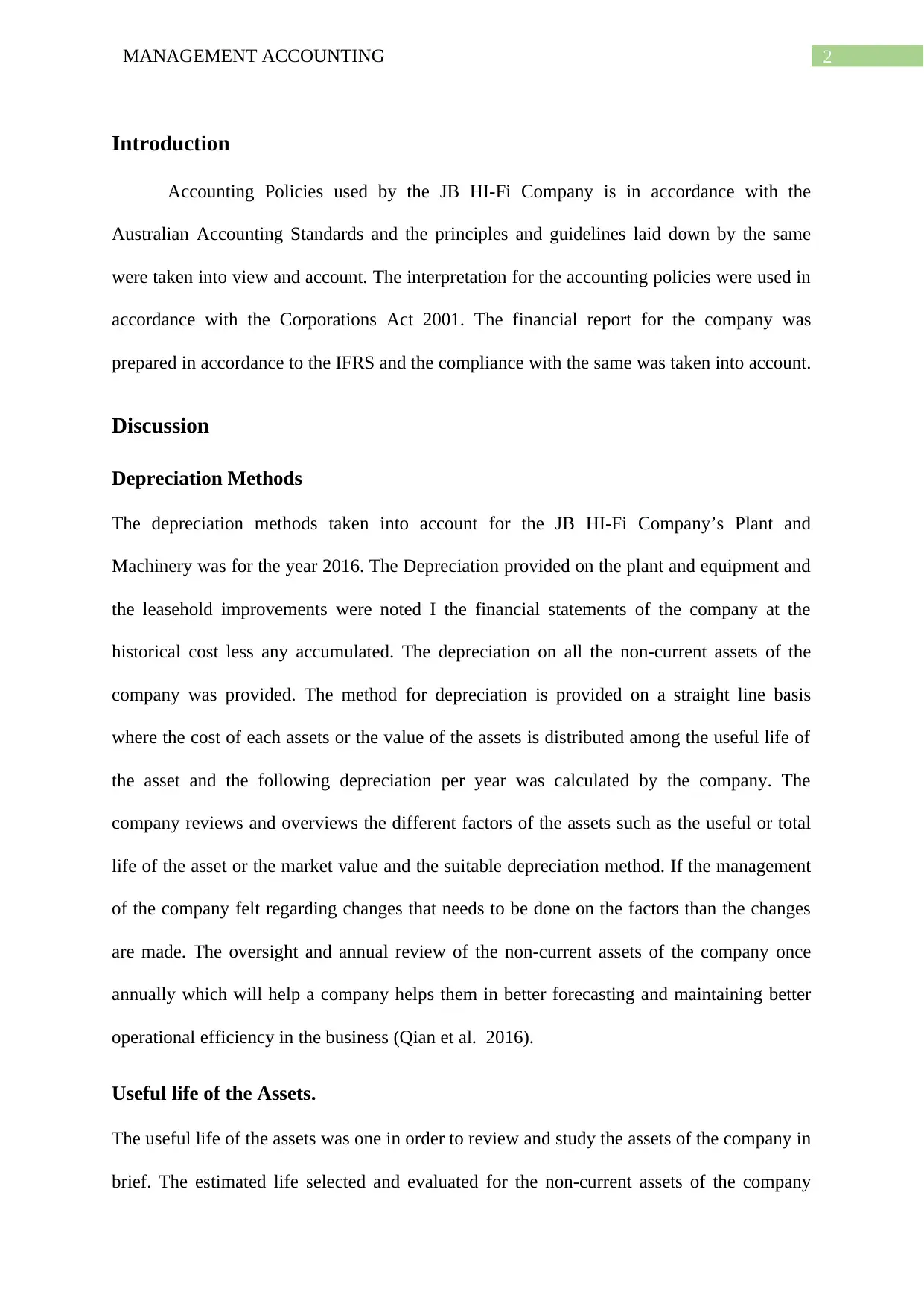

Payment Spend/incurred on Purchase of Plant and Machinery Evaluation and the r

Particulars Year 0 Year 1 Year 2 Year 3 Year 4 Year 5 Year 6

Cash Flows 52343

19404.7085

2

19404.70

9

19404.7085

2

19404.70

9

19404.7

1 19404.

Return on

Investment

14.00

%

Asset Useful

Life 10 Years

Maturity Amount of

Amount. Invested

194047.

1

{Equals:

52343*(1.14)^1

}

Minimum Average Annual Net Cash Flow

were defining two key assets of the company (Kawasmi, Brown & Shell, 2018). The

leasehold improvements of the company was taken ad the useful life of the asset was

considered to be around 1-15 years of total time frame. The plant and equipment on the other

hand useful life for the asset was considered to be around 1.5years of time frame to 15 years

of time frame. The intangible assets of the company comprises the intangible assets like the

goodwill. The intangible assets of the company that have an indefinite useful life is are

carried and reported down at cost of acquisition less if any accumulated impairment charges

arising from the same. The viability of non-current assets of the company is generated with

the help of annual testing of impairment of assets for the company. The plant and equipment

of the company is charged with the impairment charges if the company observes that the

book value or the carrying value of the assets is greater than the fair market value of the

assets and the same assets amount is not expected to be recoverable then the company

charges the impairment charges on the following is charged to shows the economic viability

of the assets.

Payment Spend/incurred on Purchase of Plant and Machinery Evaluation and the r

Particulars Year 0 Year 1 Year 2 Year 3 Year 4 Year 5 Year 6

Cash Flows 52343

19404.7085

2

19404.70

9

19404.7085

2

19404.70

9

19404.7

1 19404.

Return on

Investment

14.00

%

Asset Useful

Life 10 Years

Maturity Amount of

Amount. Invested

194047.

1

{Equals:

52343*(1.14)^1

}

Minimum Average Annual Net Cash Flow

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4MANAGEMENT ACCOUNTING

Year 0 Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Year 7 Year 8 Year 9 Year 10

0

10000

20000

30000

40000

50000

60000

Cash Flows

The average net annual cash flow is calculated with the help of the amount invested in the

assets of the company multiplied by the required rate of return for the company. The required

amount of investment was derived by the company in the form of the assets invested and the

return required in the due course of the time. The approximate cash flows was then estimated

using the maturity amount divided by the useful life of the assets.

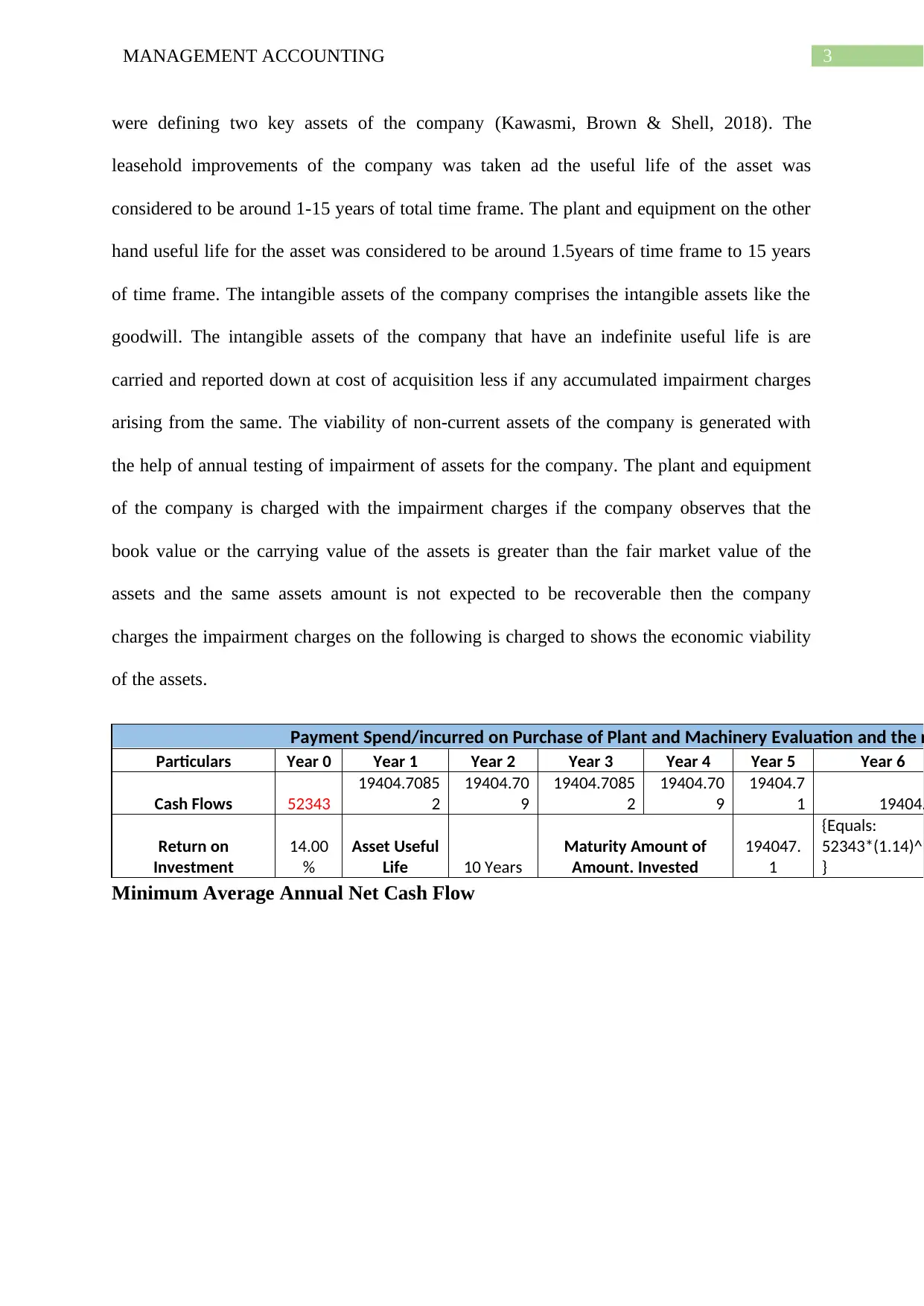

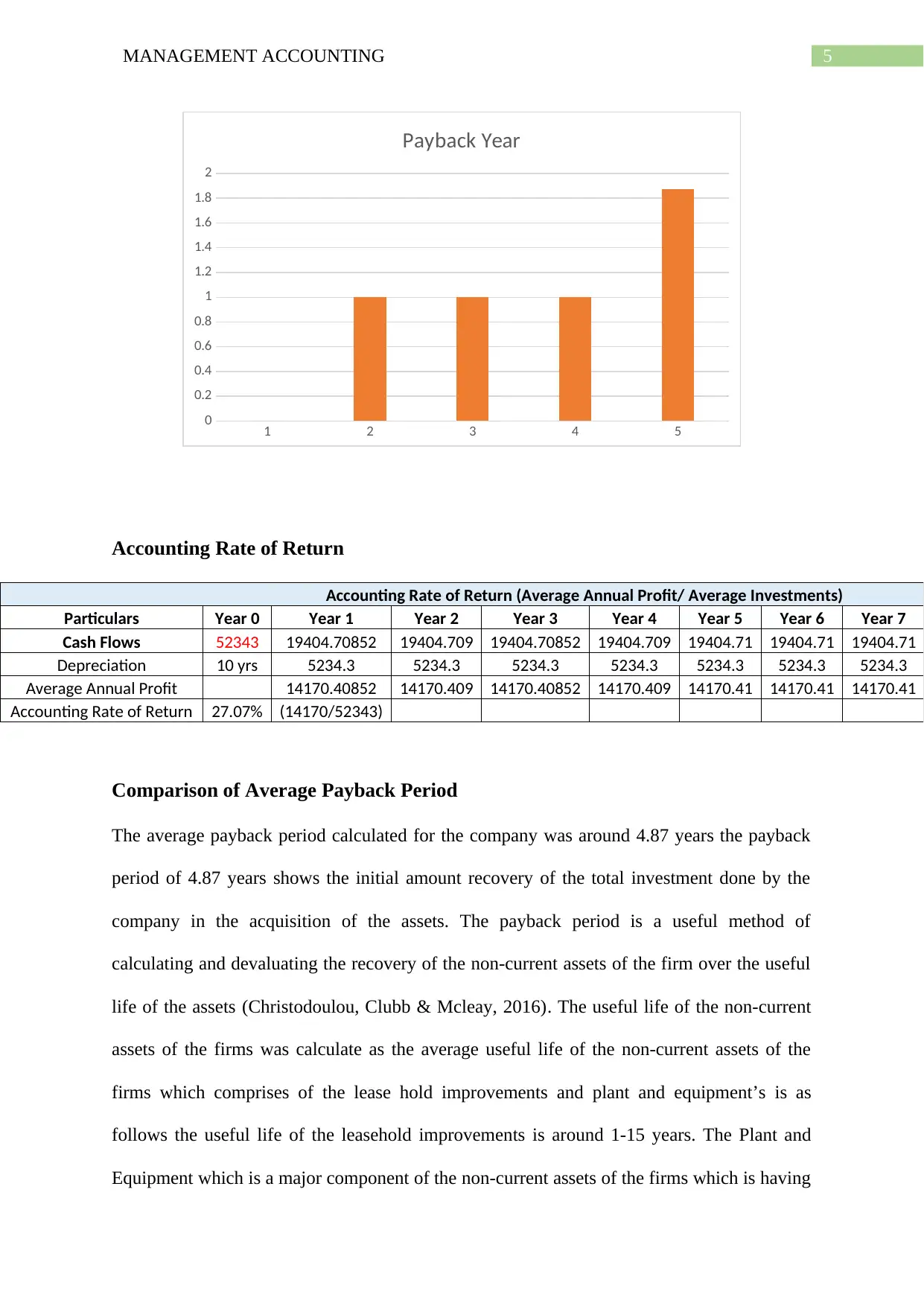

Payback Period

The payback period was calculated as the recovery of the initial amount invested into the

assets and the time in which the amount was invested. The key factor to notice in this cases is

that the payback period ignores the time value of money (Lin, Chang & Chung, 2015).

Payback Period Calculations

Particulars

Year

0 Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Yea

Cash Flows 52343 19404.70852 19404.709 19404.70852

19404.70

9 19404.71 19404.71 1940

Recoverable Amt.

-

52343 1904.7085 21309.417 40714.12555

60118.83

4 79523.54 98928.25 118

Payback Year 0 1 1 1 1.87 1 1

Payback Period 0 1 2 3 4.87

Year 0 Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Year 7 Year 8 Year 9 Year 10

0

10000

20000

30000

40000

50000

60000

Cash Flows

The average net annual cash flow is calculated with the help of the amount invested in the

assets of the company multiplied by the required rate of return for the company. The required

amount of investment was derived by the company in the form of the assets invested and the

return required in the due course of the time. The approximate cash flows was then estimated

using the maturity amount divided by the useful life of the assets.

Payback Period

The payback period was calculated as the recovery of the initial amount invested into the

assets and the time in which the amount was invested. The key factor to notice in this cases is

that the payback period ignores the time value of money (Lin, Chang & Chung, 2015).

Payback Period Calculations

Particulars

Year

0 Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Yea

Cash Flows 52343 19404.70852 19404.709 19404.70852

19404.70

9 19404.71 19404.71 1940

Recoverable Amt.

-

52343 1904.7085 21309.417 40714.12555

60118.83

4 79523.54 98928.25 118

Payback Year 0 1 1 1 1.87 1 1

Payback Period 0 1 2 3 4.87

5MANAGEMENT ACCOUNTING

1 2 3 4 5

0

0.2

0.4

0.6

0.8

1

1.2

1.4

1.6

1.8

2

Payback Year

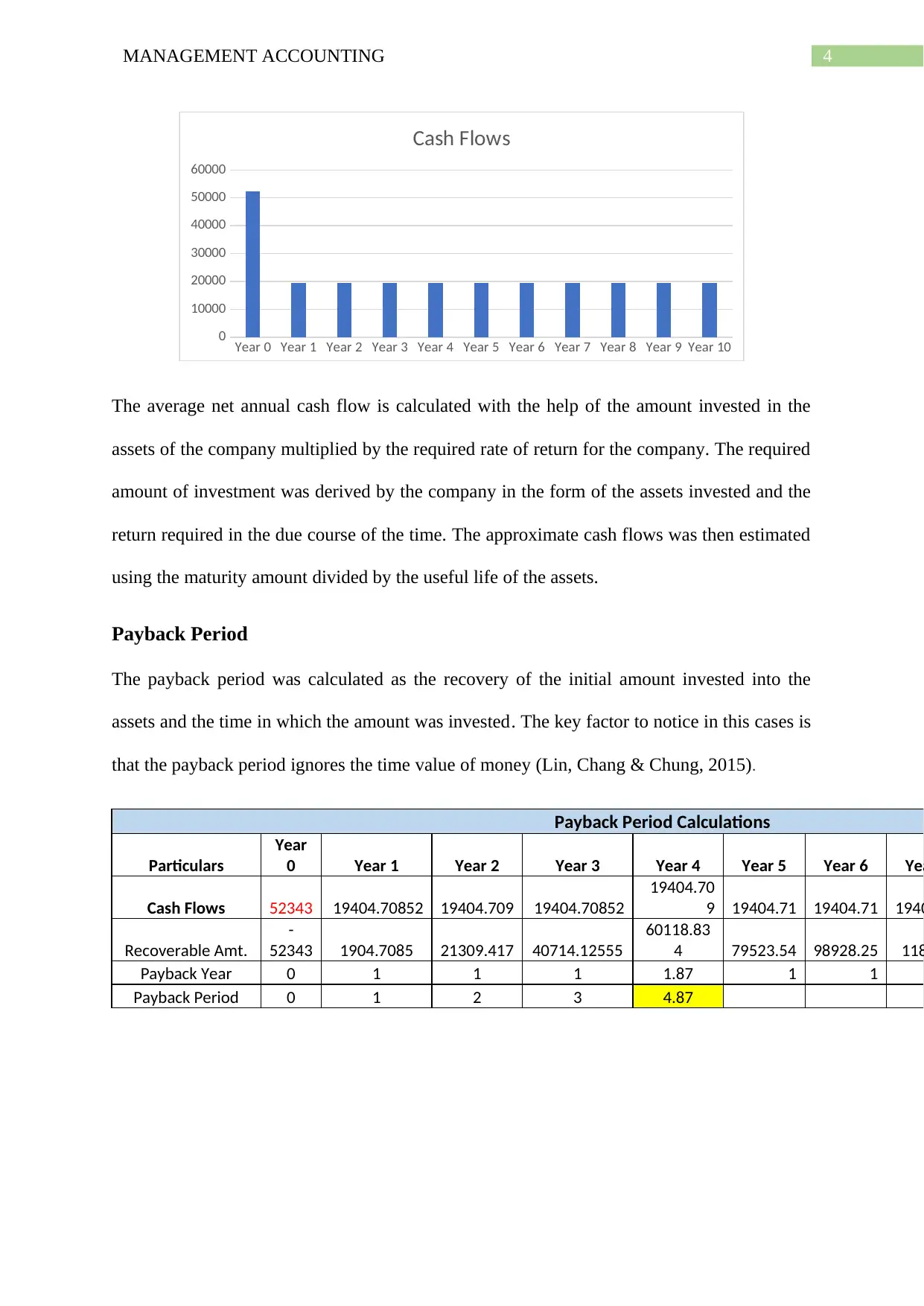

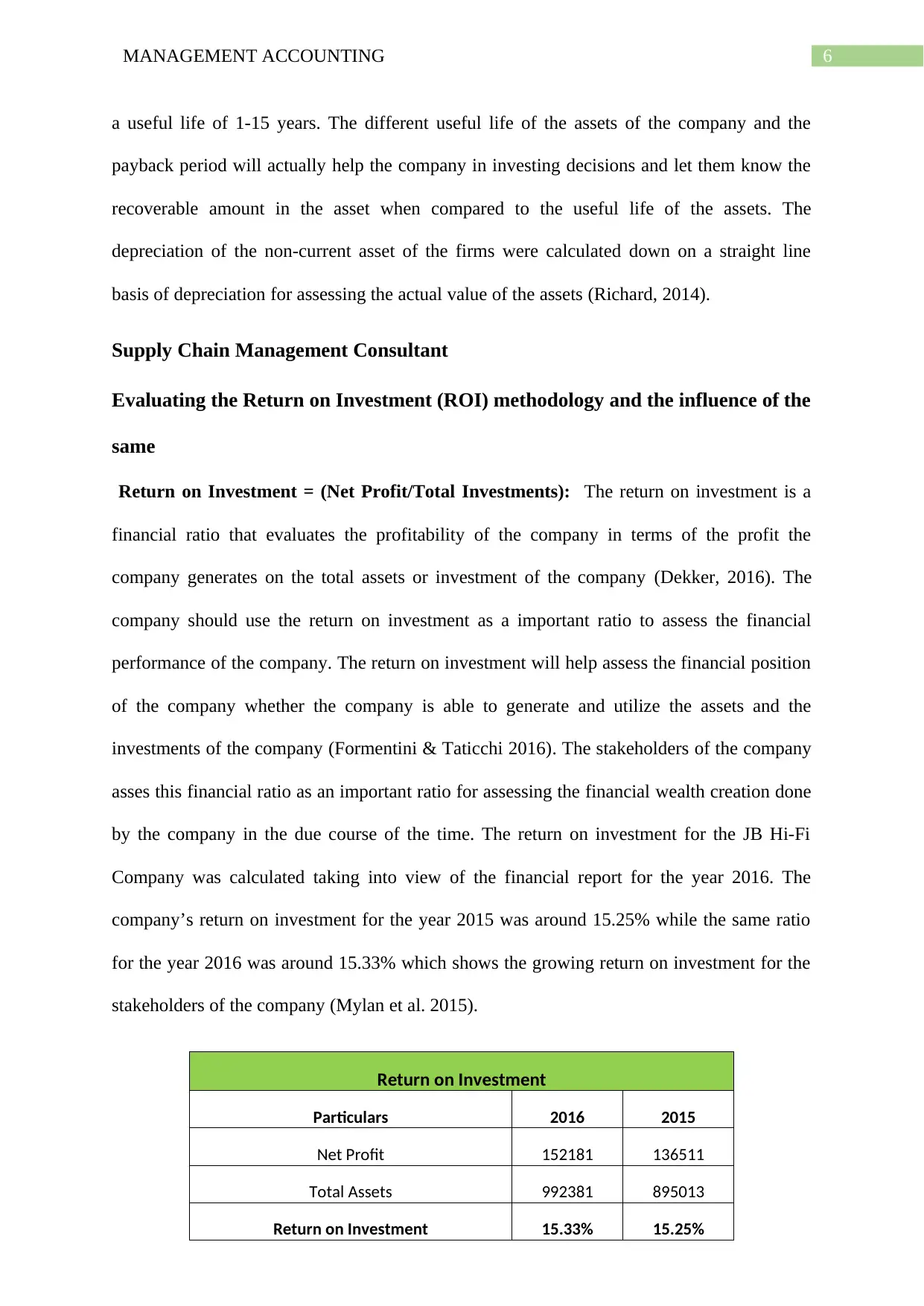

Accounting Rate of Return

Accounting Rate of Return (Average Annual Profit/ Average Investments)

Particulars Year 0 Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Year 7

Cash Flows 52343 19404.70852 19404.709 19404.70852 19404.709 19404.71 19404.71 19404.71

Depreciation 10 yrs 5234.3 5234.3 5234.3 5234.3 5234.3 5234.3 5234.3

Average Annual Profit 14170.40852 14170.409 14170.40852 14170.409 14170.41 14170.41 14170.41

Accounting Rate of Return 27.07% (14170/52343)

Comparison of Average Payback Period

The average payback period calculated for the company was around 4.87 years the payback

period of 4.87 years shows the initial amount recovery of the total investment done by the

company in the acquisition of the assets. The payback period is a useful method of

calculating and devaluating the recovery of the non-current assets of the firm over the useful

life of the assets (Christodoulou, Clubb & Mcleay, 2016). The useful life of the non-current

assets of the firms was calculate as the average useful life of the non-current assets of the

firms which comprises of the lease hold improvements and plant and equipment’s is as

follows the useful life of the leasehold improvements is around 1-15 years. The Plant and

Equipment which is a major component of the non-current assets of the firms which is having

1 2 3 4 5

0

0.2

0.4

0.6

0.8

1

1.2

1.4

1.6

1.8

2

Payback Year

Accounting Rate of Return

Accounting Rate of Return (Average Annual Profit/ Average Investments)

Particulars Year 0 Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Year 7

Cash Flows 52343 19404.70852 19404.709 19404.70852 19404.709 19404.71 19404.71 19404.71

Depreciation 10 yrs 5234.3 5234.3 5234.3 5234.3 5234.3 5234.3 5234.3

Average Annual Profit 14170.40852 14170.409 14170.40852 14170.409 14170.41 14170.41 14170.41

Accounting Rate of Return 27.07% (14170/52343)

Comparison of Average Payback Period

The average payback period calculated for the company was around 4.87 years the payback

period of 4.87 years shows the initial amount recovery of the total investment done by the

company in the acquisition of the assets. The payback period is a useful method of

calculating and devaluating the recovery of the non-current assets of the firm over the useful

life of the assets (Christodoulou, Clubb & Mcleay, 2016). The useful life of the non-current

assets of the firms was calculate as the average useful life of the non-current assets of the

firms which comprises of the lease hold improvements and plant and equipment’s is as

follows the useful life of the leasehold improvements is around 1-15 years. The Plant and

Equipment which is a major component of the non-current assets of the firms which is having

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6MANAGEMENT ACCOUNTING

a useful life of 1-15 years. The different useful life of the assets of the company and the

payback period will actually help the company in investing decisions and let them know the

recoverable amount in the asset when compared to the useful life of the assets. The

depreciation of the non-current asset of the firms were calculated down on a straight line

basis of depreciation for assessing the actual value of the assets (Richard, 2014).

Supply Chain Management Consultant

Evaluating the Return on Investment (ROI) methodology and the influence of the

same

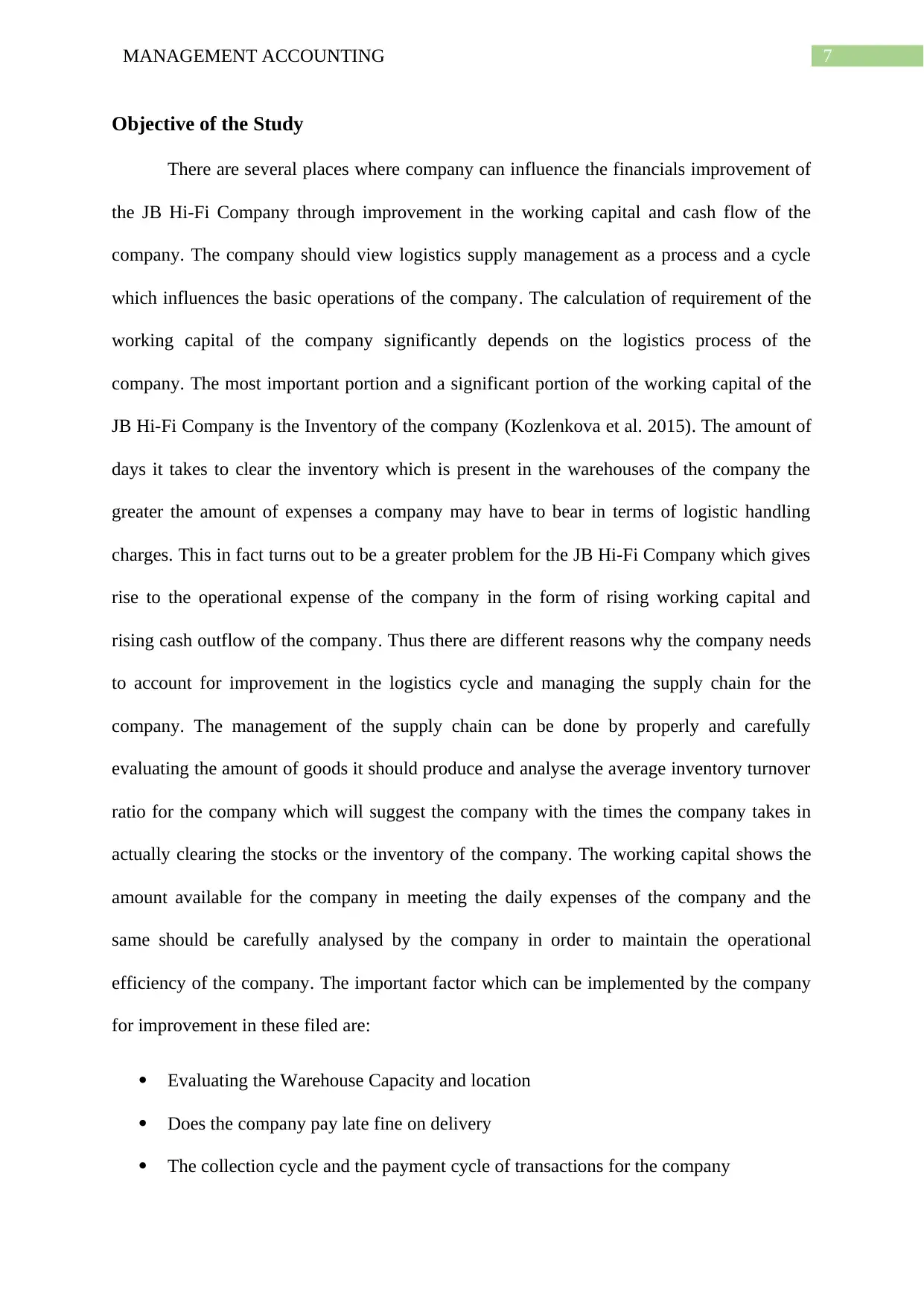

Return on Investment = (Net Profit/Total Investments): The return on investment is a

financial ratio that evaluates the profitability of the company in terms of the profit the

company generates on the total assets or investment of the company (Dekker, 2016). The

company should use the return on investment as a important ratio to assess the financial

performance of the company. The return on investment will help assess the financial position

of the company whether the company is able to generate and utilize the assets and the

investments of the company (Formentini & Taticchi 2016). The stakeholders of the company

asses this financial ratio as an important ratio for assessing the financial wealth creation done

by the company in the due course of the time. The return on investment for the JB Hi-Fi

Company was calculated taking into view of the financial report for the year 2016. The

company’s return on investment for the year 2015 was around 15.25% while the same ratio

for the year 2016 was around 15.33% which shows the growing return on investment for the

stakeholders of the company (Mylan et al. 2015).

Return on Investment

Particulars 2016 2015

Net Profit 152181 136511

Total Assets 992381 895013

Return on Investment 15.33% 15.25%

a useful life of 1-15 years. The different useful life of the assets of the company and the

payback period will actually help the company in investing decisions and let them know the

recoverable amount in the asset when compared to the useful life of the assets. The

depreciation of the non-current asset of the firms were calculated down on a straight line

basis of depreciation for assessing the actual value of the assets (Richard, 2014).

Supply Chain Management Consultant

Evaluating the Return on Investment (ROI) methodology and the influence of the

same

Return on Investment = (Net Profit/Total Investments): The return on investment is a

financial ratio that evaluates the profitability of the company in terms of the profit the

company generates on the total assets or investment of the company (Dekker, 2016). The

company should use the return on investment as a important ratio to assess the financial

performance of the company. The return on investment will help assess the financial position

of the company whether the company is able to generate and utilize the assets and the

investments of the company (Formentini & Taticchi 2016). The stakeholders of the company

asses this financial ratio as an important ratio for assessing the financial wealth creation done

by the company in the due course of the time. The return on investment for the JB Hi-Fi

Company was calculated taking into view of the financial report for the year 2016. The

company’s return on investment for the year 2015 was around 15.25% while the same ratio

for the year 2016 was around 15.33% which shows the growing return on investment for the

stakeholders of the company (Mylan et al. 2015).

Return on Investment

Particulars 2016 2015

Net Profit 152181 136511

Total Assets 992381 895013

Return on Investment 15.33% 15.25%

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7MANAGEMENT ACCOUNTING

Objective of the Study

There are several places where company can influence the financials improvement of

the JB Hi-Fi Company through improvement in the working capital and cash flow of the

company. The company should view logistics supply management as a process and a cycle

which influences the basic operations of the company. The calculation of requirement of the

working capital of the company significantly depends on the logistics process of the

company. The most important portion and a significant portion of the working capital of the

JB Hi-Fi Company is the Inventory of the company (Kozlenkova et al. 2015). The amount of

days it takes to clear the inventory which is present in the warehouses of the company the

greater the amount of expenses a company may have to bear in terms of logistic handling

charges. This in fact turns out to be a greater problem for the JB Hi-Fi Company which gives

rise to the operational expense of the company in the form of rising working capital and

rising cash outflow of the company. Thus there are different reasons why the company needs

to account for improvement in the logistics cycle and managing the supply chain for the

company. The management of the supply chain can be done by properly and carefully

evaluating the amount of goods it should produce and analyse the average inventory turnover

ratio for the company which will suggest the company with the times the company takes in

actually clearing the stocks or the inventory of the company. The working capital shows the

amount available for the company in meeting the daily expenses of the company and the

same should be carefully analysed by the company in order to maintain the operational

efficiency of the company. The important factor which can be implemented by the company

for improvement in these filed are:

Evaluating the Warehouse Capacity and location

Does the company pay late fine on delivery

The collection cycle and the payment cycle of transactions for the company

Objective of the Study

There are several places where company can influence the financials improvement of

the JB Hi-Fi Company through improvement in the working capital and cash flow of the

company. The company should view logistics supply management as a process and a cycle

which influences the basic operations of the company. The calculation of requirement of the

working capital of the company significantly depends on the logistics process of the

company. The most important portion and a significant portion of the working capital of the

JB Hi-Fi Company is the Inventory of the company (Kozlenkova et al. 2015). The amount of

days it takes to clear the inventory which is present in the warehouses of the company the

greater the amount of expenses a company may have to bear in terms of logistic handling

charges. This in fact turns out to be a greater problem for the JB Hi-Fi Company which gives

rise to the operational expense of the company in the form of rising working capital and

rising cash outflow of the company. Thus there are different reasons why the company needs

to account for improvement in the logistics cycle and managing the supply chain for the

company. The management of the supply chain can be done by properly and carefully

evaluating the amount of goods it should produce and analyse the average inventory turnover

ratio for the company which will suggest the company with the times the company takes in

actually clearing the stocks or the inventory of the company. The working capital shows the

amount available for the company in meeting the daily expenses of the company and the

same should be carefully analysed by the company in order to maintain the operational

efficiency of the company. The important factor which can be implemented by the company

for improvement in these filed are:

Evaluating the Warehouse Capacity and location

Does the company pay late fine on delivery

The collection cycle and the payment cycle of transactions for the company

8MANAGEMENT ACCOUNTING

The velocity of the inventory

Treatment of stagnant inventory ad taking action on the same.

These are the key steps for the JB Hi-Fi Company to evaluate and the steps which could

provide an improvement in the financials of the company.

Critical Examination of the Costing Model

The designing of an optimal and an efficient supply chain by utilizing or

implementing the supply chain costing model could be useful for the company. The

utilization and implementation of the model could improve supply chains and logistics

management at JB Hi-Fi Company. The key features and the challenge of such an model

would be that the model ability and the utilization should be such that is able to adapt and

capture the movement of the supply chain and the network or the process which supports it

and the infrastructure, changing customers and other developments in the field of economic

and technological field. The supply chain model developed could help the management of the

company in implementation of important managerial decisions via executing or deploying a

communication model which would bring out financially efficiency in the optimization of the

company’s services and products and the supply chain of the company. Whereas it is crucial

to note that the traditional costing model does not incorporate the several factors which are

included in the modern supply chain costing model. The traditional models just used to treat

costs under variable and fixed heads and the recommendations and the distributions and the

ways for reducing the fixed and variable expenses of the company were stated that gave a

minimum exposure in proving and interacting with the business environment for the

company. The benefits of using and implementation of the supply chain costing model

would be that it would depict a clear and a much transparent costing structure of the company

and the sensitivities of the different components involved in the same. Maximizing of the net

The velocity of the inventory

Treatment of stagnant inventory ad taking action on the same.

These are the key steps for the JB Hi-Fi Company to evaluate and the steps which could

provide an improvement in the financials of the company.

Critical Examination of the Costing Model

The designing of an optimal and an efficient supply chain by utilizing or

implementing the supply chain costing model could be useful for the company. The

utilization and implementation of the model could improve supply chains and logistics

management at JB Hi-Fi Company. The key features and the challenge of such an model

would be that the model ability and the utilization should be such that is able to adapt and

capture the movement of the supply chain and the network or the process which supports it

and the infrastructure, changing customers and other developments in the field of economic

and technological field. The supply chain model developed could help the management of the

company in implementation of important managerial decisions via executing or deploying a

communication model which would bring out financially efficiency in the optimization of the

company’s services and products and the supply chain of the company. Whereas it is crucial

to note that the traditional costing model does not incorporate the several factors which are

included in the modern supply chain costing model. The traditional models just used to treat

costs under variable and fixed heads and the recommendations and the distributions and the

ways for reducing the fixed and variable expenses of the company were stated that gave a

minimum exposure in proving and interacting with the business environment for the

company. The benefits of using and implementation of the supply chain costing model

would be that it would depict a clear and a much transparent costing structure of the company

and the sensitivities of the different components involved in the same. Maximizing of the net

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9MANAGEMENT ACCOUNTING

profits for the company by reducing the operational expenses of the company are some of the

key factors and benefits of the supply chain costing model.

Methodology and Structure of the Annual Budgeting Process

The JB Hi-Fi Company needs to use an annual budgeting process the annual budget

for the company will help the company determine and evaluate the financial goals of the

company relating to operating and investing activities of the company. In creation of values

or value creation for both the suppliers and the customers of the company it will be the role of

logistics and the management of the same. Time and place will be expressed as the functions

and key factors of the budgeting (Grossi, Reichard & Ruggiero, 2016).

The annual budgeting process or the continuous budgeting process will help the JB

Hi-Fi Company evaluate the costing nature of the company. The use of continuous budgeting

will help the company in easy forecasting of sales, financial and operational expenses

quarterly or month instead of the annual process. The key benefits for the company in the

implementation of the same will be the proper financial planning and evaluation of the

company’s operational and financial goals of the company.

Conclusion

A high quality budgeting system would provide a direction to the company for meeting the

operational work of the company. The short term forecasts and targets could be easily and

planned with the help of the continuous budgeting for the products and services given by he

JB Hi- Fi Company. The key pitfalls for implementation of such a model will be the excess

time and resources spent in the planning and implementation of the same.

profits for the company by reducing the operational expenses of the company are some of the

key factors and benefits of the supply chain costing model.

Methodology and Structure of the Annual Budgeting Process

The JB Hi-Fi Company needs to use an annual budgeting process the annual budget

for the company will help the company determine and evaluate the financial goals of the

company relating to operating and investing activities of the company. In creation of values

or value creation for both the suppliers and the customers of the company it will be the role of

logistics and the management of the same. Time and place will be expressed as the functions

and key factors of the budgeting (Grossi, Reichard & Ruggiero, 2016).

The annual budgeting process or the continuous budgeting process will help the JB

Hi-Fi Company evaluate the costing nature of the company. The use of continuous budgeting

will help the company in easy forecasting of sales, financial and operational expenses

quarterly or month instead of the annual process. The key benefits for the company in the

implementation of the same will be the proper financial planning and evaluation of the

company’s operational and financial goals of the company.

Conclusion

A high quality budgeting system would provide a direction to the company for meeting the

operational work of the company. The short term forecasts and targets could be easily and

planned with the help of the continuous budgeting for the products and services given by he

JB Hi- Fi Company. The key pitfalls for implementation of such a model will be the excess

time and resources spent in the planning and implementation of the same.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10MANAGEMENT ACCOUNTING

Reference

Dekker, H. C. (2016). On the boundaries between intrafirm and interfirm management

accounting research. Management Accounting Research, 31, 86-99.

Formentini, M., & Taticchi, P. (2016). Corporate sustainability approaches and governance

mechanisms in sustainable supply chain management. Journal of Cleaner

Production, 112, 1920-1933.

Mylan, J., Geels, F. W., Gee, S., McMeekin, A., & Foster, C. (2015). Eco-innovation and

retailers in milk, beef and bread chains: enriching environmental supply chain

management with insights from innovation studies. Journal of Cleaner

Production, 107, 20-30.

Kozlenkova, I. V., Hult, G. T. M., Lund, D. J., Mena, J. A., & Kekec, P. (2015). The role of

marketing channels in supply chain management. Journal of Retailing, 91(4), 586-

609.

Qian, C., Fan, X. J., Fan, J. J., Yuan, C. A., & Zhang, G. Q. (2016). An accelerated test

method of luminous flux depreciation for LED luminaires and lamps. Reliability

Engineering & System Safety, 147, 84-92.

Grossi, G., Reichard, C., & Ruggiero, P. (2016). Appropriateness and use of performance

information in the budgeting process: Some experiences from German and Italian

municipalities. Public Performance & Management Review, 39(3), 581-606.

Kawasmi, M., Brown, J., & Shell, M. (2018). Wastewater System Selfies: Utilizing

Remaining Useful Life for Asset Management of Critical Wastewater

Assets. Proceedings of the Water Environment Federation, 2018(1), 257-262.

Reference

Dekker, H. C. (2016). On the boundaries between intrafirm and interfirm management

accounting research. Management Accounting Research, 31, 86-99.

Formentini, M., & Taticchi, P. (2016). Corporate sustainability approaches and governance

mechanisms in sustainable supply chain management. Journal of Cleaner

Production, 112, 1920-1933.

Mylan, J., Geels, F. W., Gee, S., McMeekin, A., & Foster, C. (2015). Eco-innovation and

retailers in milk, beef and bread chains: enriching environmental supply chain

management with insights from innovation studies. Journal of Cleaner

Production, 107, 20-30.

Kozlenkova, I. V., Hult, G. T. M., Lund, D. J., Mena, J. A., & Kekec, P. (2015). The role of

marketing channels in supply chain management. Journal of Retailing, 91(4), 586-

609.

Qian, C., Fan, X. J., Fan, J. J., Yuan, C. A., & Zhang, G. Q. (2016). An accelerated test

method of luminous flux depreciation for LED luminaires and lamps. Reliability

Engineering & System Safety, 147, 84-92.

Grossi, G., Reichard, C., & Ruggiero, P. (2016). Appropriateness and use of performance

information in the budgeting process: Some experiences from German and Italian

municipalities. Public Performance & Management Review, 39(3), 581-606.

Kawasmi, M., Brown, J., & Shell, M. (2018). Wastewater System Selfies: Utilizing

Remaining Useful Life for Asset Management of Critical Wastewater

Assets. Proceedings of the Water Environment Federation, 2018(1), 257-262.

11MANAGEMENT ACCOUNTING

Lin, W. M., Chang, K. C., & Chung, K. M. (2015). Payback period for residential solar water

heaters in Taiwan. Renewable and Sustainable Energy Reviews, 41, 901-906.

Christodoulou, D., Clubb, C., & Mcleay, S. (2016). A structural accounting framework for

estimating the expected rate of return on equity. Abacus, 52(1), 176-210.

Richard, P. (2014). The Role of the Accounting Rate of Return in Financial Statement

Analysis. The Continuing Debate Over Depreciation, Capital and Income (RLE

Accounting), 67(2), 235.

Lin, W. M., Chang, K. C., & Chung, K. M. (2015). Payback period for residential solar water

heaters in Taiwan. Renewable and Sustainable Energy Reviews, 41, 901-906.

Christodoulou, D., Clubb, C., & Mcleay, S. (2016). A structural accounting framework for

estimating the expected rate of return on equity. Abacus, 52(1), 176-210.

Richard, P. (2014). The Role of the Accounting Rate of Return in Financial Statement

Analysis. The Continuing Debate Over Depreciation, Capital and Income (RLE

Accounting), 67(2), 235.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 12

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.