Cost Analysis and Budgeting: Management Accounting Report

VerifiedAdded on 2020/01/28

|23

|5884

|67

Report

AI Summary

This report presents a comprehensive analysis of management accounting principles applied to a case study of Jeffrey and Son's, a manufacturing company producing the 'Exquisite' brand. The report begins by classifying different types of costs, calculating unit and total job costs using job costing, and determining the cost of 'Exquisite' using absorption costing. It includes detailed calculations and allocations of costs across various departments and activities. The report then analyzes a cost report for September, calculating variances and identifying areas for potential improvement using performance indicators. The report also explores budgeting processes, including the preparation of production, material purchase, material usage, and cash budgets. Finally, the report calculates variances, prepares a reconciliation operating statement, and offers findings to management based on identified responsibility centers. The report utilizes tables and working notes to support its findings and concludes with recommendations for cost reduction and performance enhancement within the organization.

Management Accounting

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TABLE OF CONTENTS

INTRODUCTION...........................................................................................................................3

TASK 1............................................................................................................................................3

1.1 Different types of cost classification......................................................................................3

1.2 Calculating unit cost and total job cost by using job costing.................................................3

1.3 Calculating cost of Exquisite using absorption costing technique.........................................4

1.4 Analyzing cost of Exquisite...................................................................................................8

TASK 2............................................................................................................................................8

2.1 Preparing and analyzing cost report for the month of September.........................................8

2.2 Using performance indicators to identify areas for potential improvement........................10

2.3 Ways to reduce cost and enhance value, quality..................................................................10

TASK 3..........................................................................................................................................11

3.1 Purpose and nature of budgeting process.............................................................................11

3.2 Selecting appropriate budgeting methods for organization.................................................11

3.3 Preparation of different types of budget..............................................................................12

3.4 Preparing cash budget..........................................................................................................13

TASK 4..........................................................................................................................................16

4.1 Calculating variances...........................................................................................................16

4.2 Preparing reconciliation operating statement.......................................................................18

4.3 Findings to management in accordance with identified responsibility centers...................19

CONCLUSION..............................................................................................................................19

REFERENCES..............................................................................................................................21

2

INTRODUCTION...........................................................................................................................3

TASK 1............................................................................................................................................3

1.1 Different types of cost classification......................................................................................3

1.2 Calculating unit cost and total job cost by using job costing.................................................3

1.3 Calculating cost of Exquisite using absorption costing technique.........................................4

1.4 Analyzing cost of Exquisite...................................................................................................8

TASK 2............................................................................................................................................8

2.1 Preparing and analyzing cost report for the month of September.........................................8

2.2 Using performance indicators to identify areas for potential improvement........................10

2.3 Ways to reduce cost and enhance value, quality..................................................................10

TASK 3..........................................................................................................................................11

3.1 Purpose and nature of budgeting process.............................................................................11

3.2 Selecting appropriate budgeting methods for organization.................................................11

3.3 Preparation of different types of budget..............................................................................12

3.4 Preparing cash budget..........................................................................................................13

TASK 4..........................................................................................................................................16

4.1 Calculating variances...........................................................................................................16

4.2 Preparing reconciliation operating statement.......................................................................18

4.3 Findings to management in accordance with identified responsibility centers...................19

CONCLUSION..............................................................................................................................19

REFERENCES..............................................................................................................................21

2

Index of Tables

Table 1: Working note.....................................................................................................................6

Table 2: Table 3: Allocation of cost on the basis of machine hours...............................................8

Table 3: Allocating of criteria of cost..............................................................................................8

Table 4: Units to be produced..........................................................................................................8

Table 5: Overhead absorption rate ..................................................................................................8

Table 6: Absorption rate of Exquisite..............................................................................................8

Table 7: Calculating of absorption rate on the basis of labor hours................................................9

Table 8: Cost of Exquisite................................................................................................................9

Table 9: Cost report for September month......................................................................................9

Table 10: Calculating of standard budget at 1900 units................................................................10

Table 11: Production budget..........................................................................................................13

Table 12: Material purchase budget...............................................................................................13

Table 13: Material purchase budget .............................................................................................14

Table 14: Material usage budget....................................................................................................14

Table 15: Cash budget...................................................................................................................14

Table 16: Receivable from debtors................................................................................................14

Table 17: Overhead payment.........................................................................................................15

Table 18: Production cost..............................................................................................................15

Table 19: Sales budget...................................................................................................................15

Table 20: Cash budget...................................................................................................................15

Table 21: Variable overhead..........................................................................................................16

Table 22: P & L..............................................................................................................................17

Table 23: Operating profit statement for month of May................................................................19

3

Table 1: Working note.....................................................................................................................6

Table 2: Table 3: Allocation of cost on the basis of machine hours...............................................8

Table 3: Allocating of criteria of cost..............................................................................................8

Table 4: Units to be produced..........................................................................................................8

Table 5: Overhead absorption rate ..................................................................................................8

Table 6: Absorption rate of Exquisite..............................................................................................8

Table 7: Calculating of absorption rate on the basis of labor hours................................................9

Table 8: Cost of Exquisite................................................................................................................9

Table 9: Cost report for September month......................................................................................9

Table 10: Calculating of standard budget at 1900 units................................................................10

Table 11: Production budget..........................................................................................................13

Table 12: Material purchase budget...............................................................................................13

Table 13: Material purchase budget .............................................................................................14

Table 14: Material usage budget....................................................................................................14

Table 15: Cash budget...................................................................................................................14

Table 16: Receivable from debtors................................................................................................14

Table 17: Overhead payment.........................................................................................................15

Table 18: Production cost..............................................................................................................15

Table 19: Sales budget...................................................................................................................15

Table 20: Cash budget...................................................................................................................15

Table 21: Variable overhead..........................................................................................................16

Table 22: P & L..............................................................................................................................17

Table 23: Operating profit statement for month of May................................................................19

3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

INTRODUCTION

Management accounting refers to profession which involve in management decision,

planning and performance management system. It provides assistance in financial report and

control of organizational activities. The management accounting consists of three main aspects

such as strategic management, performance and risk (Griffith, Stephenson and Watson, 2014).

Present report is based on case of Jeffrey and Son's that manufacture popular brand product

called Exquisite. This organization has basically two departments such as service and production.

Further, different types of cost classification has been done. In addition to this, cost of Exquisite

has been calculated by using absorption costing technique. Apart from this, various performance

indicator are explained in order to assess organizational performance in the marketplace.

TASK 1

1.1 Different types of cost classification

Classification of cost has been done as follows- Element-According to element cost is divided into direct and indirect segment. In this

regard, it can be said that the direct and indirect elements are associated with prodction

activities (Backer, 2004). It also covers various kinds of direct and indirect cost that

relates with the production. Function- Number of functions are present that need to be consider for effective

accomplishment of goals (Arroyo, 2012). Classification of key functions can be as

production, finance, sales and marketing. It assist in better flow of production within

market. Nature- It is also classified in diverse factors such as labour, overhead expense and

material.

Behaviour- According to behavior cost is mainly divided into three parts such fixed, semi

fixed and variables (Chapman, 2008).

1.2 Calculating unit cost and total job cost by using job costing

Total and unit cost of project has been calculated as follows which in turn company can

effective decision for the growth and prospective.

4

Management accounting refers to profession which involve in management decision,

planning and performance management system. It provides assistance in financial report and

control of organizational activities. The management accounting consists of three main aspects

such as strategic management, performance and risk (Griffith, Stephenson and Watson, 2014).

Present report is based on case of Jeffrey and Son's that manufacture popular brand product

called Exquisite. This organization has basically two departments such as service and production.

Further, different types of cost classification has been done. In addition to this, cost of Exquisite

has been calculated by using absorption costing technique. Apart from this, various performance

indicator are explained in order to assess organizational performance in the marketplace.

TASK 1

1.1 Different types of cost classification

Classification of cost has been done as follows- Element-According to element cost is divided into direct and indirect segment. In this

regard, it can be said that the direct and indirect elements are associated with prodction

activities (Backer, 2004). It also covers various kinds of direct and indirect cost that

relates with the production. Function- Number of functions are present that need to be consider for effective

accomplishment of goals (Arroyo, 2012). Classification of key functions can be as

production, finance, sales and marketing. It assist in better flow of production within

market. Nature- It is also classified in diverse factors such as labour, overhead expense and

material.

Behaviour- According to behavior cost is mainly divided into three parts such fixed, semi

fixed and variables (Chapman, 2008).

1.2 Calculating unit cost and total job cost by using job costing

Total and unit cost of project has been calculated as follows which in turn company can

effective decision for the growth and prospective.

4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

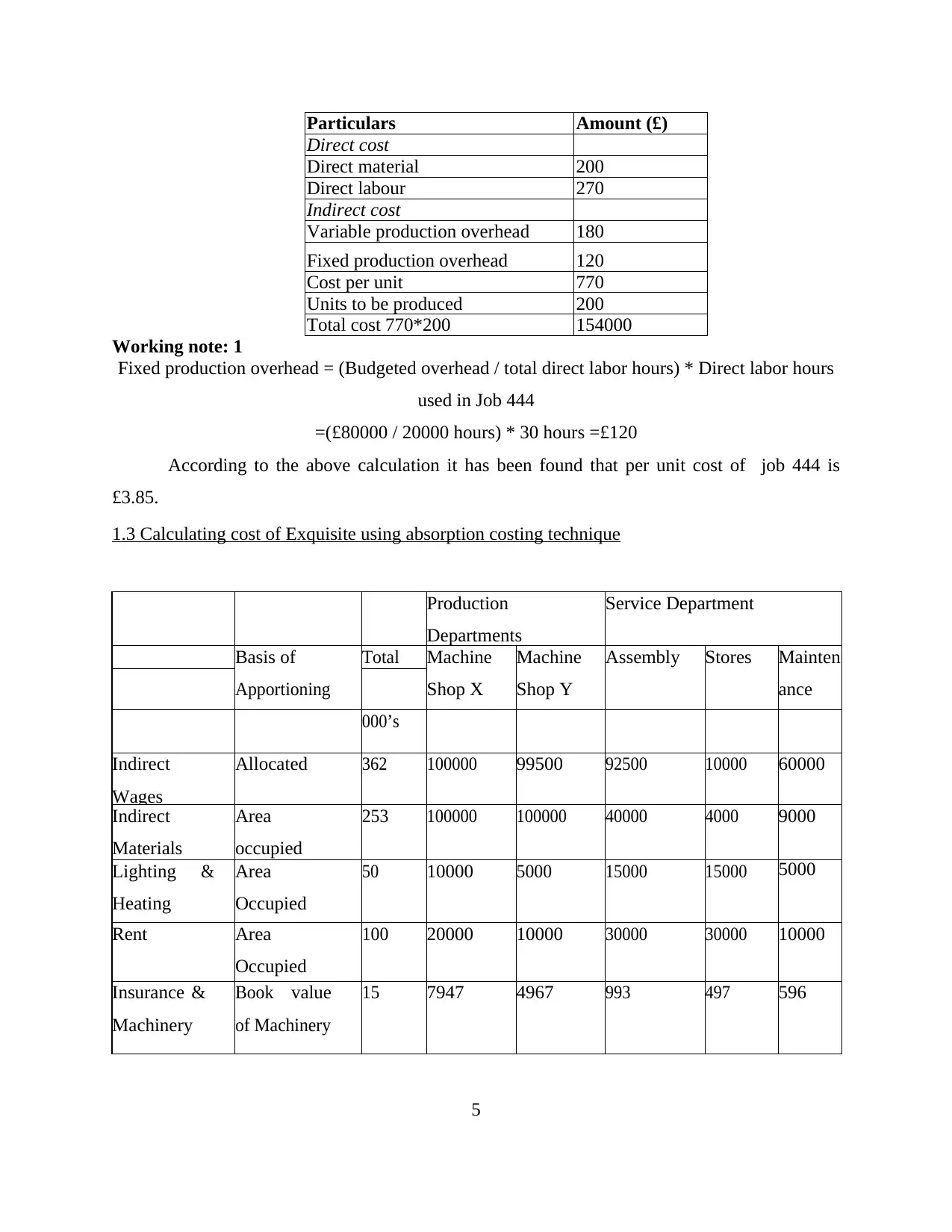

Particulars Amount (£)

Direct cost

Direct material 200

Direct labour 270

Indirect cost

Variable production overhead 180

Fixed production overhead 120

Cost per unit 770

Units to be produced 200

Total cost 770*200 154000

Working note: 1

Fixed production overhead = (Budgeted overhead / total direct labor hours) * Direct labor hours

used in Job 444

=(£80000 / 20000 hours) * 30 hours =£120

According to the above calculation it has been found that per unit cost of job 444 is

£3.85.

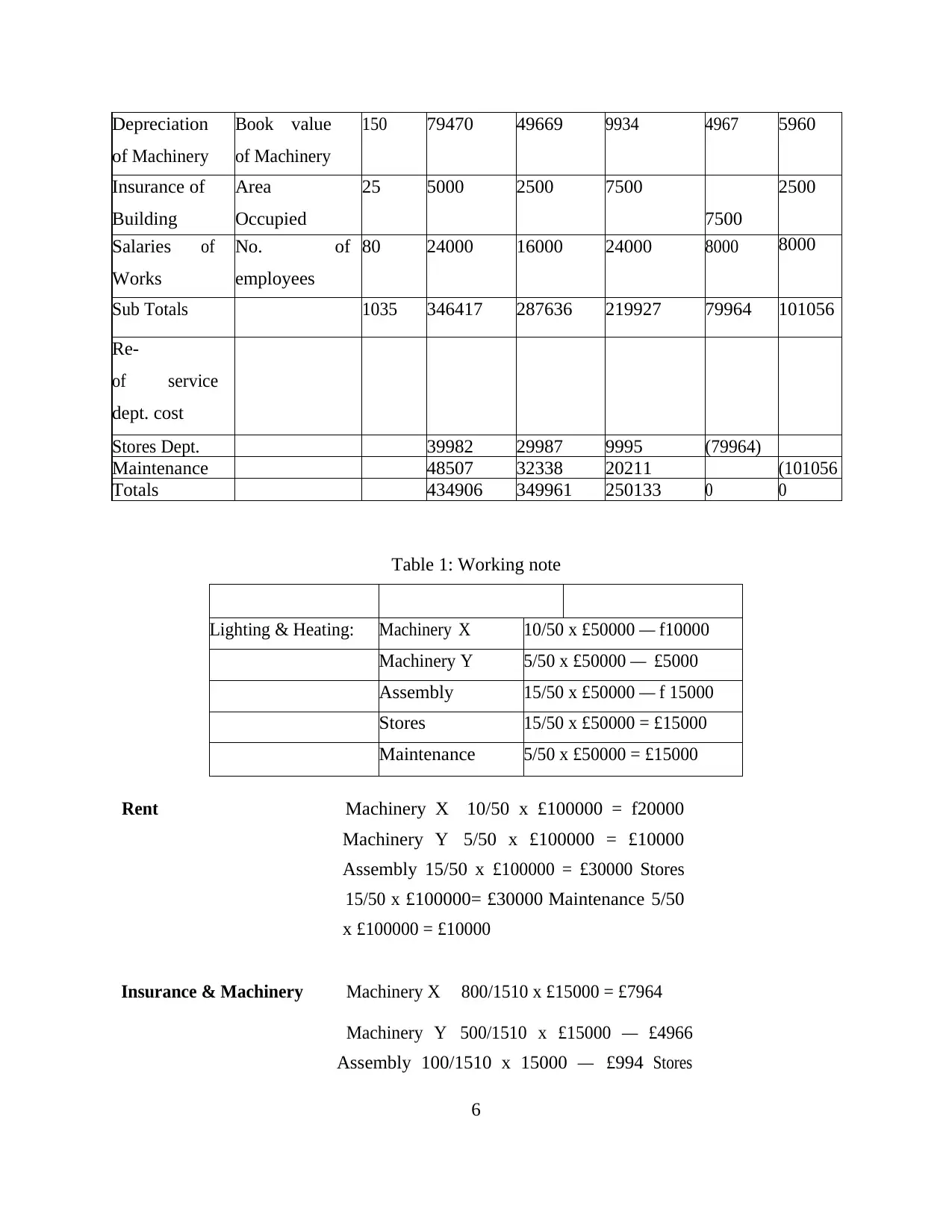

1.3 Calculating cost of Exquisite using absorption costing technique

Production

Departments

Service Department

Basis of

Apportioning

Total Machine

Shop X

Machine

Shop Y

Assembly Stores Mainten

ance

000’s

Indirect

Wages

Allocated 362 100000 99500 92500 10000 60000

Indirect

Materials

Area

occupied

253 100000 100000 40000 4000 9000

Lighting

Heating

& Area

Occupied

50 10000 5000 15000 15000 5000

Rent Area

Occupied

100 20000 10000 30000 30000 10000

Insurance &

Machinery

Book value

of Machinery

15 7947 4967 993 497 596

5

Direct cost

Direct material 200

Direct labour 270

Indirect cost

Variable production overhead 180

Fixed production overhead 120

Cost per unit 770

Units to be produced 200

Total cost 770*200 154000

Working note: 1

Fixed production overhead = (Budgeted overhead / total direct labor hours) * Direct labor hours

used in Job 444

=(£80000 / 20000 hours) * 30 hours =£120

According to the above calculation it has been found that per unit cost of job 444 is

£3.85.

1.3 Calculating cost of Exquisite using absorption costing technique

Production

Departments

Service Department

Basis of

Apportioning

Total Machine

Shop X

Machine

Shop Y

Assembly Stores Mainten

ance

000’s

Indirect

Wages

Allocated 362 100000 99500 92500 10000 60000

Indirect

Materials

Area

occupied

253 100000 100000 40000 4000 9000

Lighting

Heating

& Area

Occupied

50 10000 5000 15000 15000 5000

Rent Area

Occupied

100 20000 10000 30000 30000 10000

Insurance &

Machinery

Book value

of Machinery

15 7947 4967 993 497 596

5

Depreciation

of Machinery

Book value

of Machinery

150 79470 49669 9934 4967 5960

Insurance of

Building

Area

Occupied

25 5000 2500 7500

7500

2500

Salaries

Works

of No.

employees

of 80 24000 16000 24000 8000 8000

Sub Totals 1035 346417 287636 219927 79964 101056

Re-

of service

dept. cost

Stores Dept. 39982 29987 9995 (79964)

Maintenance 48507 32338 20211 (101056

Totals 434906 349961 250133 0 0

Table 1: Working note

Lighting & Heating: Machinery X 10/50 x £50000 — f10000

Machinery Y 5/50 x £50000 — £5000

Assembly 15/50 x £50000 — f 15000

Stores 15/50 x £50000 = £15000

Maintenance 5/50 x £50000 = £15000

Rent Machinery X 10/50 x £100000 = f20000

Machinery Y 5/50 x £100000 = £10000

Assembly 15/50 x £100000 = £30000 Stores

15/50 x £100000= £30000 Maintenance 5/50

x £100000 = £10000

Insurance & Machinery Machinery X 800/1510 x £15000 = £7964

Machinery Y 500/1510 x £15000 — £4966

Assembly 100/1510 x 15000 — £994 Stores

6

of Machinery

Book value

of Machinery

150 79470 49669 9934 4967 5960

Insurance of

Building

Area

Occupied

25 5000 2500 7500

7500

2500

Salaries

Works

of No.

employees

of 80 24000 16000 24000 8000 8000

Sub Totals 1035 346417 287636 219927 79964 101056

Re-

of service

dept. cost

Stores Dept. 39982 29987 9995 (79964)

Maintenance 48507 32338 20211 (101056

Totals 434906 349961 250133 0 0

Table 1: Working note

Lighting & Heating: Machinery X 10/50 x £50000 — f10000

Machinery Y 5/50 x £50000 — £5000

Assembly 15/50 x £50000 — f 15000

Stores 15/50 x £50000 = £15000

Maintenance 5/50 x £50000 = £15000

Rent Machinery X 10/50 x £100000 = f20000

Machinery Y 5/50 x £100000 = £10000

Assembly 15/50 x £100000 = £30000 Stores

15/50 x £100000= £30000 Maintenance 5/50

x £100000 = £10000

Insurance & Machinery Machinery X 800/1510 x £15000 = £7964

Machinery Y 500/1510 x £15000 — £4966

Assembly 100/1510 x 15000 — £994 Stores

6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

50/1510 x £15000= f 497

Maintenance 5/1510 x £15000= £596

Depreciation of Machinery Machinery X 800/1510 x £150000 = £79470

Machinery Y 500/1510 x £150000 = £49669

Assembly 100/1510 x £150000 = £9934

Stores 50/1510 x £150000 = £497

Maintenance 60/1510 x £150000 = £596

Insurance of Buildings Machinery X 15/50 x £25000 — £5000

Machinery Y 5/50 x £25000 = £2500

Assembly 15/50 x £25000 = f7500 Stores

15/50 x £25000 — £7500

Maintenance 5/50 x £25000 = £2500

Salaries of works mgmt. Machinery X 3/10 x £80000 = £24000

Machinery Y 2/10 x :E80000 = £16000

Assembly 3/10 x £80000 = £24000

Stores 1/10 x £80000 — £8000

Maintenance 1/10 x £80000 = £8000

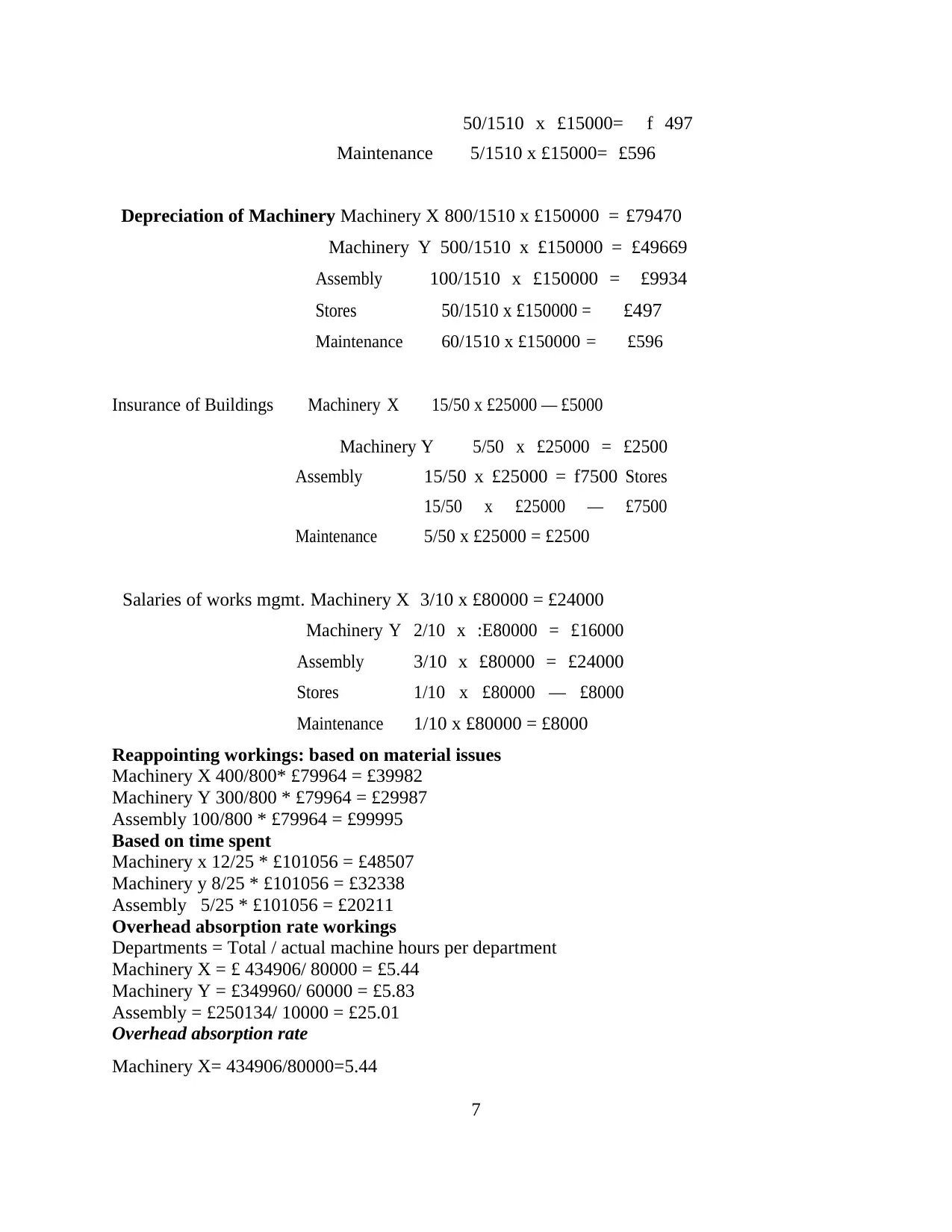

Reappointing workings: based on material issues

Machinery X 400/800* £79964 = £39982

Machinery Y 300/800 * £79964 = £29987

Assembly 100/800 * £79964 = £99995

Based on time spent

Machinery x 12/25 * £101056 = £48507

Machinery y 8/25 * £101056 = £32338

Assembly 5/25 * £101056 = £20211

Overhead absorption rate workings

Departments = Total / actual machine hours per department

Machinery X = £ 434906/ 80000 = £5.44

Machinery Y = £349960/ 60000 = £5.83

Assembly = £250134/ 10000 = £25.01

Overhead absorption rate

Machinery X= 434906/80000=5.44

7

Maintenance 5/1510 x £15000= £596

Depreciation of Machinery Machinery X 800/1510 x £150000 = £79470

Machinery Y 500/1510 x £150000 = £49669

Assembly 100/1510 x £150000 = £9934

Stores 50/1510 x £150000 = £497

Maintenance 60/1510 x £150000 = £596

Insurance of Buildings Machinery X 15/50 x £25000 — £5000

Machinery Y 5/50 x £25000 = £2500

Assembly 15/50 x £25000 = f7500 Stores

15/50 x £25000 — £7500

Maintenance 5/50 x £25000 = £2500

Salaries of works mgmt. Machinery X 3/10 x £80000 = £24000

Machinery Y 2/10 x :E80000 = £16000

Assembly 3/10 x £80000 = £24000

Stores 1/10 x £80000 — £8000

Maintenance 1/10 x £80000 = £8000

Reappointing workings: based on material issues

Machinery X 400/800* £79964 = £39982

Machinery Y 300/800 * £79964 = £29987

Assembly 100/800 * £79964 = £99995

Based on time spent

Machinery x 12/25 * £101056 = £48507

Machinery y 8/25 * £101056 = £32338

Assembly 5/25 * £101056 = £20211

Overhead absorption rate workings

Departments = Total / actual machine hours per department

Machinery X = £ 434906/ 80000 = £5.44

Machinery Y = £349960/ 60000 = £5.83

Assembly = £250134/ 10000 = £25.01

Overhead absorption rate

Machinery X= 434906/80000=5.44

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

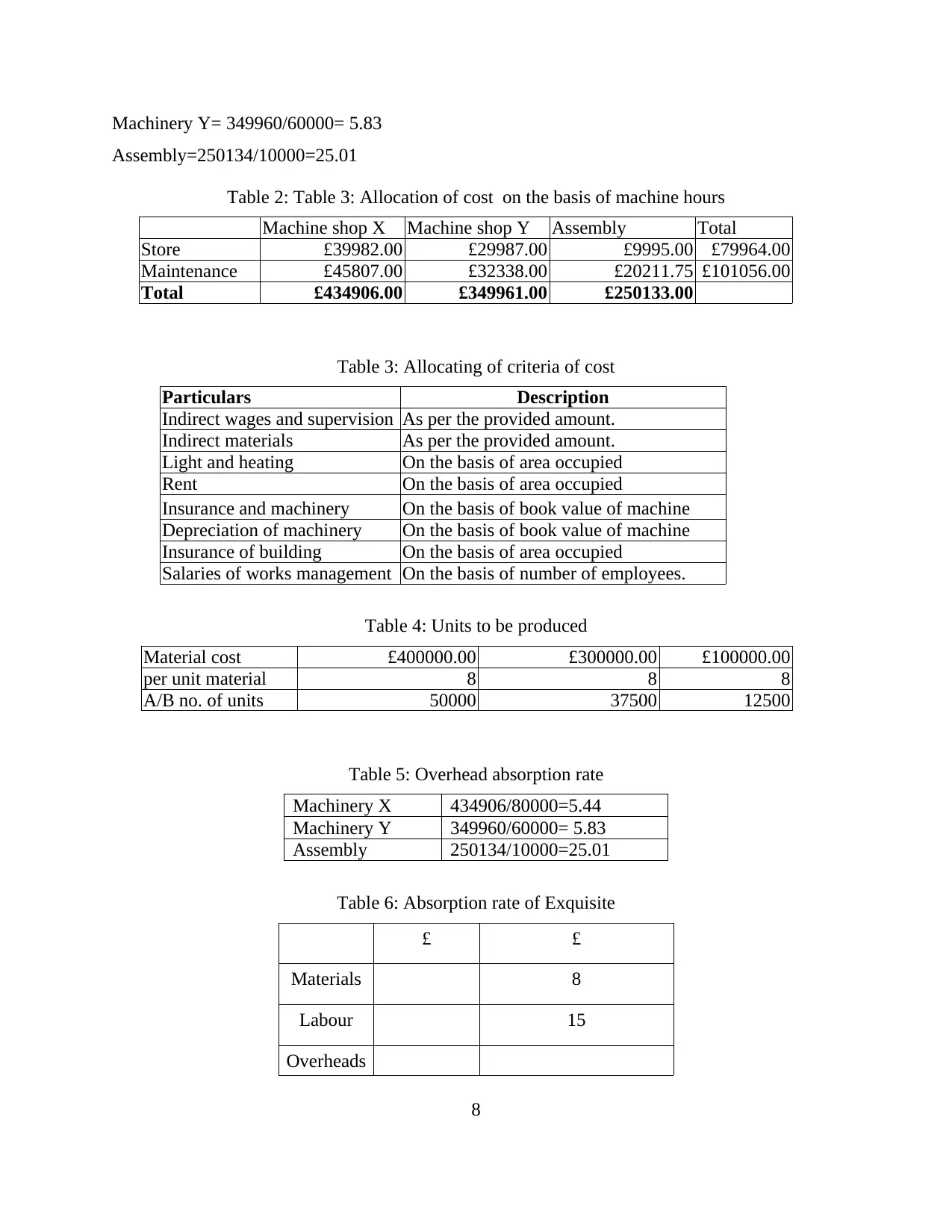

Machinery Y= 349960/60000= 5.83

Assembly=250134/10000=25.01

Table 2: Table 3: Allocation of cost on the basis of machine hours

Machine shop X Machine shop Y Assembly Total

Store £39982.00 £29987.00 £9995.00 £79964.00

Maintenance £45807.00 £32338.00 £20211.75 £101056.00

Total £434906.00 £349961.00 £250133.00

Table 3: Allocating of criteria of cost

Particulars Description

Indirect wages and supervision As per the provided amount.

Indirect materials As per the provided amount.

Light and heating On the basis of area occupied

Rent On the basis of area occupied

Insurance and machinery On the basis of book value of machine

Depreciation of machinery On the basis of book value of machine

Insurance of building On the basis of area occupied

Salaries of works management On the basis of number of employees.

Table 4: Units to be produced

Material cost £400000.00 £300000.00 £100000.00

per unit material 8 8 8

A/B no. of units 50000 37500 12500

Table 5: Overhead absorption rate

Machinery X 434906/80000=5.44

Machinery Y 349960/60000= 5.83

Assembly 250134/10000=25.01

Table 6: Absorption rate of Exquisite

£ £

Materials 8

Labour 15

Overheads

8

Assembly=250134/10000=25.01

Table 2: Table 3: Allocation of cost on the basis of machine hours

Machine shop X Machine shop Y Assembly Total

Store £39982.00 £29987.00 £9995.00 £79964.00

Maintenance £45807.00 £32338.00 £20211.75 £101056.00

Total £434906.00 £349961.00 £250133.00

Table 3: Allocating of criteria of cost

Particulars Description

Indirect wages and supervision As per the provided amount.

Indirect materials As per the provided amount.

Light and heating On the basis of area occupied

Rent On the basis of area occupied

Insurance and machinery On the basis of book value of machine

Depreciation of machinery On the basis of book value of machine

Insurance of building On the basis of area occupied

Salaries of works management On the basis of number of employees.

Table 4: Units to be produced

Material cost £400000.00 £300000.00 £100000.00

per unit material 8 8 8

A/B no. of units 50000 37500 12500

Table 5: Overhead absorption rate

Machinery X 434906/80000=5.44

Machinery Y 349960/60000= 5.83

Assembly 250134/10000=25.01

Table 6: Absorption rate of Exquisite

£ £

Materials 8

Labour 15

Overheads

8

X (0.8*5.44) 4.34

Y (.6*5.83) 3.5

Assembly (.1*25.01) 2.5

Total cost 33.35

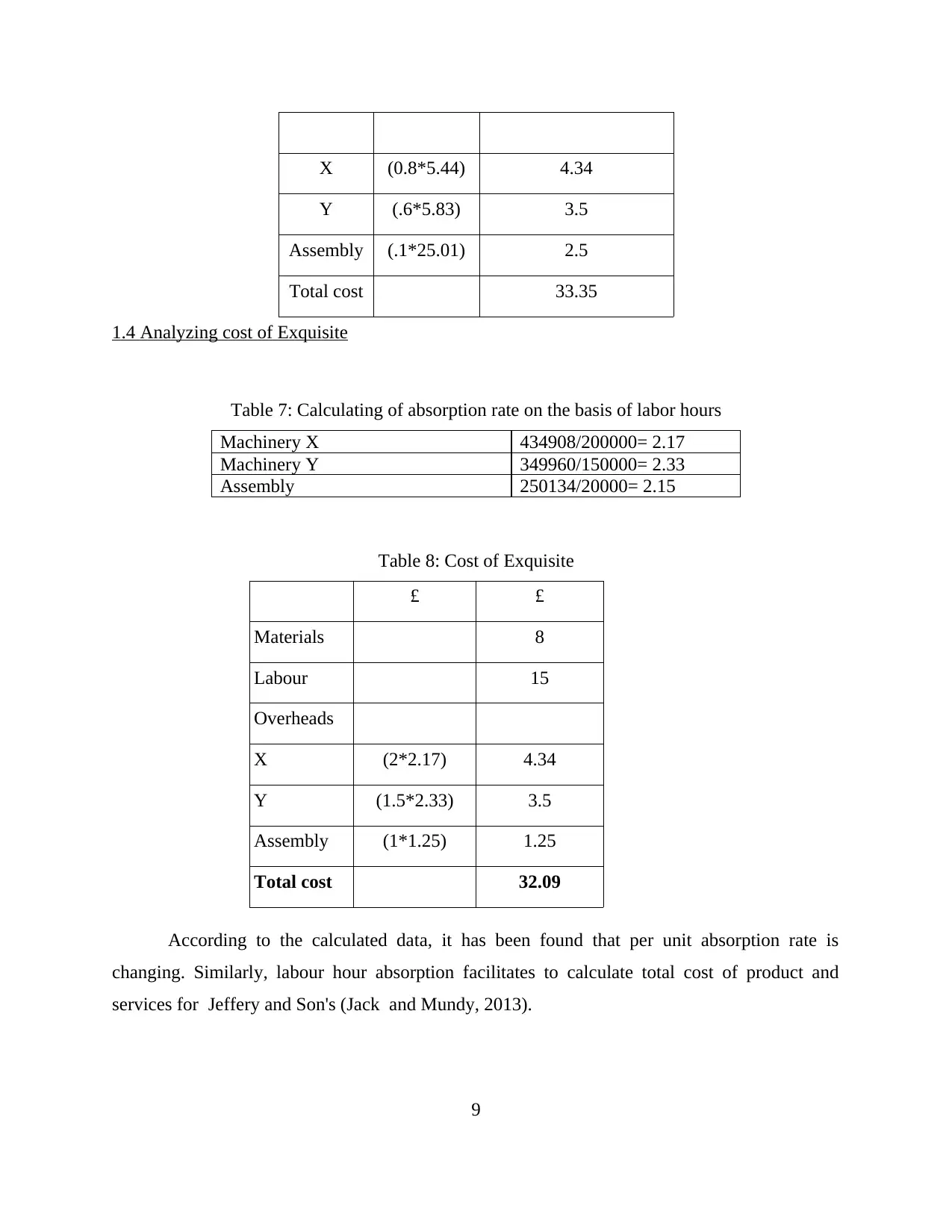

1.4 Analyzing cost of Exquisite

Table 7: Calculating of absorption rate on the basis of labor hours

Machinery X 434908/200000= 2.17

Machinery Y 349960/150000= 2.33

Assembly 250134/20000= 2.15

Table 8: Cost of Exquisite

£ £

Materials 8

Labour 15

Overheads

X (2*2.17) 4.34

Y (1.5*2.33) 3.5

Assembly (1*1.25) 1.25

Total cost 32.09

According to the calculated data, it has been found that per unit absorption rate is

changing. Similarly, labour hour absorption facilitates to calculate total cost of product and

services for Jeffery and Son's (Jack and Mundy, 2013).

9

Y (.6*5.83) 3.5

Assembly (.1*25.01) 2.5

Total cost 33.35

1.4 Analyzing cost of Exquisite

Table 7: Calculating of absorption rate on the basis of labor hours

Machinery X 434908/200000= 2.17

Machinery Y 349960/150000= 2.33

Assembly 250134/20000= 2.15

Table 8: Cost of Exquisite

£ £

Materials 8

Labour 15

Overheads

X (2*2.17) 4.34

Y (1.5*2.33) 3.5

Assembly (1*1.25) 1.25

Total cost 32.09

According to the calculated data, it has been found that per unit absorption rate is

changing. Similarly, labour hour absorption facilitates to calculate total cost of product and

services for Jeffery and Son's (Jack and Mundy, 2013).

9

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

TASK 2

2.1 Preparing and analyzing cost report for the month of September

Table 9: Cost report for September month

Budgeted cost Actual cost Variances

Particulars

Units 2000 units 1900 units 100 units

Material cost 24000 22800 -1200

Labor cost 18000 19000 1000

Fixed overhead 15000 15000 -

Electricity 8000 7625 375

Maintenance 5000 3000 2000

Total 70000 67425

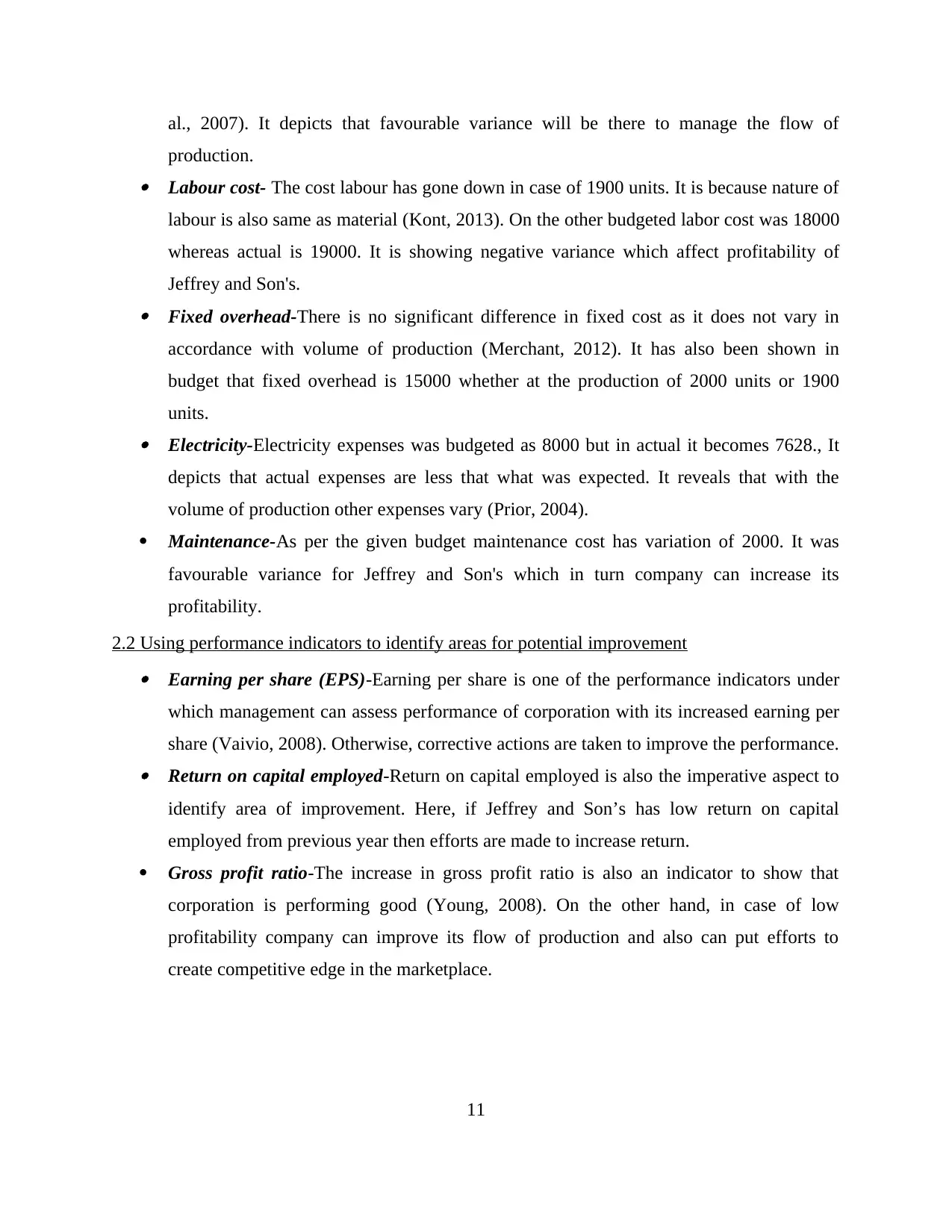

Table 10: Calculating of standard budget at 1900 units

Budgeted cost Budgeted cost

Particulars

Units 2000 units 1900 units

Material cost 24000 22800

Labor cost 18000 17100

Fixed overhead 15000 15000

Prime cost 57000 54900

Electricity

Fixed portion 500 500

Variable portion 7500 7125

Maintenance 5000 5000

Total production cost 70000 67525

Calculating of variable cost=Variation of total cost / change in no. of units to be produced

= (8000-5000) /(2000-1200)= £3.75.

According to evaluation of above budget it can be said that due to increase or decrease in

100 units. There will be no any impact on cost. It depicts that maintenance cost will not be

changes due to increase in decrease in 100 units.

Variance analysis of budget Material cost- Material cost is the most important portion of total cost which directly

related to production process. The above is showing that in case of production of 2000

units cost of material was 24000 but it has reduced in case of 1900 units (Kattan and et.

10

2.1 Preparing and analyzing cost report for the month of September

Table 9: Cost report for September month

Budgeted cost Actual cost Variances

Particulars

Units 2000 units 1900 units 100 units

Material cost 24000 22800 -1200

Labor cost 18000 19000 1000

Fixed overhead 15000 15000 -

Electricity 8000 7625 375

Maintenance 5000 3000 2000

Total 70000 67425

Table 10: Calculating of standard budget at 1900 units

Budgeted cost Budgeted cost

Particulars

Units 2000 units 1900 units

Material cost 24000 22800

Labor cost 18000 17100

Fixed overhead 15000 15000

Prime cost 57000 54900

Electricity

Fixed portion 500 500

Variable portion 7500 7125

Maintenance 5000 5000

Total production cost 70000 67525

Calculating of variable cost=Variation of total cost / change in no. of units to be produced

= (8000-5000) /(2000-1200)= £3.75.

According to evaluation of above budget it can be said that due to increase or decrease in

100 units. There will be no any impact on cost. It depicts that maintenance cost will not be

changes due to increase in decrease in 100 units.

Variance analysis of budget Material cost- Material cost is the most important portion of total cost which directly

related to production process. The above is showing that in case of production of 2000

units cost of material was 24000 but it has reduced in case of 1900 units (Kattan and et.

10

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

al., 2007). It depicts that favourable variance will be there to manage the flow of

production. Labour cost- The cost labour has gone down in case of 1900 units. It is because nature of

labour is also same as material (Kont, 2013). On the other budgeted labor cost was 18000

whereas actual is 19000. It is showing negative variance which affect profitability of

Jeffrey and Son's. Fixed overhead-There is no significant difference in fixed cost as it does not vary in

accordance with volume of production (Merchant, 2012). It has also been shown in

budget that fixed overhead is 15000 whether at the production of 2000 units or 1900

units. Electricity-Electricity expenses was budgeted as 8000 but in actual it becomes 7628., It

depicts that actual expenses are less that what was expected. It reveals that with the

volume of production other expenses vary (Prior, 2004).

Maintenance-As per the given budget maintenance cost has variation of 2000. It was

favourable variance for Jeffrey and Son's which in turn company can increase its

profitability.

2.2 Using performance indicators to identify areas for potential improvement Earning per share (EPS)-Earning per share is one of the performance indicators under

which management can assess performance of corporation with its increased earning per

share (Vaivio, 2008). Otherwise, corrective actions are taken to improve the performance. Return on capital employed-Return on capital employed is also the imperative aspect to

identify area of improvement. Here, if Jeffrey and Son’s has low return on capital

employed from previous year then efforts are made to increase return.

Gross profit ratio-The increase in gross profit ratio is also an indicator to show that

corporation is performing good (Young, 2008). On the other hand, in case of low

profitability company can improve its flow of production and also can put efforts to

create competitive edge in the marketplace.

11

production. Labour cost- The cost labour has gone down in case of 1900 units. It is because nature of

labour is also same as material (Kont, 2013). On the other budgeted labor cost was 18000

whereas actual is 19000. It is showing negative variance which affect profitability of

Jeffrey and Son's. Fixed overhead-There is no significant difference in fixed cost as it does not vary in

accordance with volume of production (Merchant, 2012). It has also been shown in

budget that fixed overhead is 15000 whether at the production of 2000 units or 1900

units. Electricity-Electricity expenses was budgeted as 8000 but in actual it becomes 7628., It

depicts that actual expenses are less that what was expected. It reveals that with the

volume of production other expenses vary (Prior, 2004).

Maintenance-As per the given budget maintenance cost has variation of 2000. It was

favourable variance for Jeffrey and Son's which in turn company can increase its

profitability.

2.2 Using performance indicators to identify areas for potential improvement Earning per share (EPS)-Earning per share is one of the performance indicators under

which management can assess performance of corporation with its increased earning per

share (Vaivio, 2008). Otherwise, corrective actions are taken to improve the performance. Return on capital employed-Return on capital employed is also the imperative aspect to

identify area of improvement. Here, if Jeffrey and Son’s has low return on capital

employed from previous year then efforts are made to increase return.

Gross profit ratio-The increase in gross profit ratio is also an indicator to show that

corporation is performing good (Young, 2008). On the other hand, in case of low

profitability company can improve its flow of production and also can put efforts to

create competitive edge in the marketplace.

11

2.3 Ways to reduce cost and enhance value, quality

Jeffrey and Son’s can adopt several ways to reduce cost and enhance value as well as

qualities. Here, approach of total quality management can be used so that flow of production can

be increased. It assists Jeffrey and Son’s to improve quality of products and services as well as

provide rich experience to consumers. Furthermore, recycling as the best option to reduce waste

material. This in turn company can effectively reduce cost of production and increase overall rate

of return (Vaivio, 2008). It leads to deliver good quality of services to large number of buyers in

affordable prices. In addition to this, employees should be provided training to work with

integration and in turn it will improve service quality and enhances value. Not only this, but

management of Jeffrey and Son’s can revise pricing strategies to attract more buyers and

recover cost of production effectively (Prior, 2004).

TASK 3

3.1 Purpose and nature of budgeting process

Budget is financial plan imposed by department of finance to allocate financial resources

for all business activities. The main purpose of budgeting process is to assess expenses to be

incurred in future and also the income to be derived from the same. Also, budget makes it

possible for management to compare performance of company and accordingly take right action

on right time.

Nature of budgeting process

The nature of budgeting process is to estimate financial environment of corporation on

the basis of budget of previous year. It aids to reduce uncertainty and increase earning of

business. Also, estimated amount of cash which will be generated in specified time is also

forecasted (Merchant, 2012). Furthermore, proportion of different expenditure like raw material,

production overheads and labour are also defined in advance. Likewise, expected amount of

expenditure is subtracted from the revenue so as to assess the future position of business. At last,

final budget is submitted after proper review.

12

Jeffrey and Son’s can adopt several ways to reduce cost and enhance value as well as

qualities. Here, approach of total quality management can be used so that flow of production can

be increased. It assists Jeffrey and Son’s to improve quality of products and services as well as

provide rich experience to consumers. Furthermore, recycling as the best option to reduce waste

material. This in turn company can effectively reduce cost of production and increase overall rate

of return (Vaivio, 2008). It leads to deliver good quality of services to large number of buyers in

affordable prices. In addition to this, employees should be provided training to work with

integration and in turn it will improve service quality and enhances value. Not only this, but

management of Jeffrey and Son’s can revise pricing strategies to attract more buyers and

recover cost of production effectively (Prior, 2004).

TASK 3

3.1 Purpose and nature of budgeting process

Budget is financial plan imposed by department of finance to allocate financial resources

for all business activities. The main purpose of budgeting process is to assess expenses to be

incurred in future and also the income to be derived from the same. Also, budget makes it

possible for management to compare performance of company and accordingly take right action

on right time.

Nature of budgeting process

The nature of budgeting process is to estimate financial environment of corporation on

the basis of budget of previous year. It aids to reduce uncertainty and increase earning of

business. Also, estimated amount of cash which will be generated in specified time is also

forecasted (Merchant, 2012). Furthermore, proportion of different expenditure like raw material,

production overheads and labour are also defined in advance. Likewise, expected amount of

expenditure is subtracted from the revenue so as to assess the future position of business. At last,

final budget is submitted after proper review.

12

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 23

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.