Management Accounting: Cost Analysis and Activity Drivers

VerifiedAdded on 2022/11/11

|25

|2530

|370

AI Summary

This document provides a detailed analysis of cost and activity drivers for various activities involved in the production of meat products. It covers topics such as activity centers, relevant costs, and annual quantity of activity drivers.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Running head: MANAGEMENT ACCOUNTING

Management Accounting

Name of the Student:

Name of the University:

Authors Note:

Management Accounting

Name of the Student:

Name of the University:

Authors Note:

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

1

MANAGEMENT ACCOUNTING

MANAGEMENT ACCOUNTING

2

MANAGEMENT ACCOUNTING

Contents

Requirement 1:.................................................................................................................................3

Requirement 2:.................................................................................................................................5

Requirement 3:.................................................................................................................................5

Requirement 4:.................................................................................................................................9

Requirement 5:...............................................................................................................................17

Requirement 6:...............................................................................................................................17

Requirement 7:...............................................................................................................................17

Requirement 8 and 9:.....................................................................................................................18

Introduction:..............................................................................................................................18

Discussion and analysis:............................................................................................................18

Conclusion:................................................................................................................................21

References:....................................................................................................................................22

MANAGEMENT ACCOUNTING

Contents

Requirement 1:.................................................................................................................................3

Requirement 2:.................................................................................................................................5

Requirement 3:.................................................................................................................................5

Requirement 4:.................................................................................................................................9

Requirement 5:...............................................................................................................................17

Requirement 6:...............................................................................................................................17

Requirement 7:...............................................................................................................................17

Requirement 8 and 9:.....................................................................................................................18

Introduction:..............................................................................................................................18

Discussion and analysis:............................................................................................................18

Conclusion:................................................................................................................................21

References:....................................................................................................................................22

3

MANAGEMENT ACCOUNTING

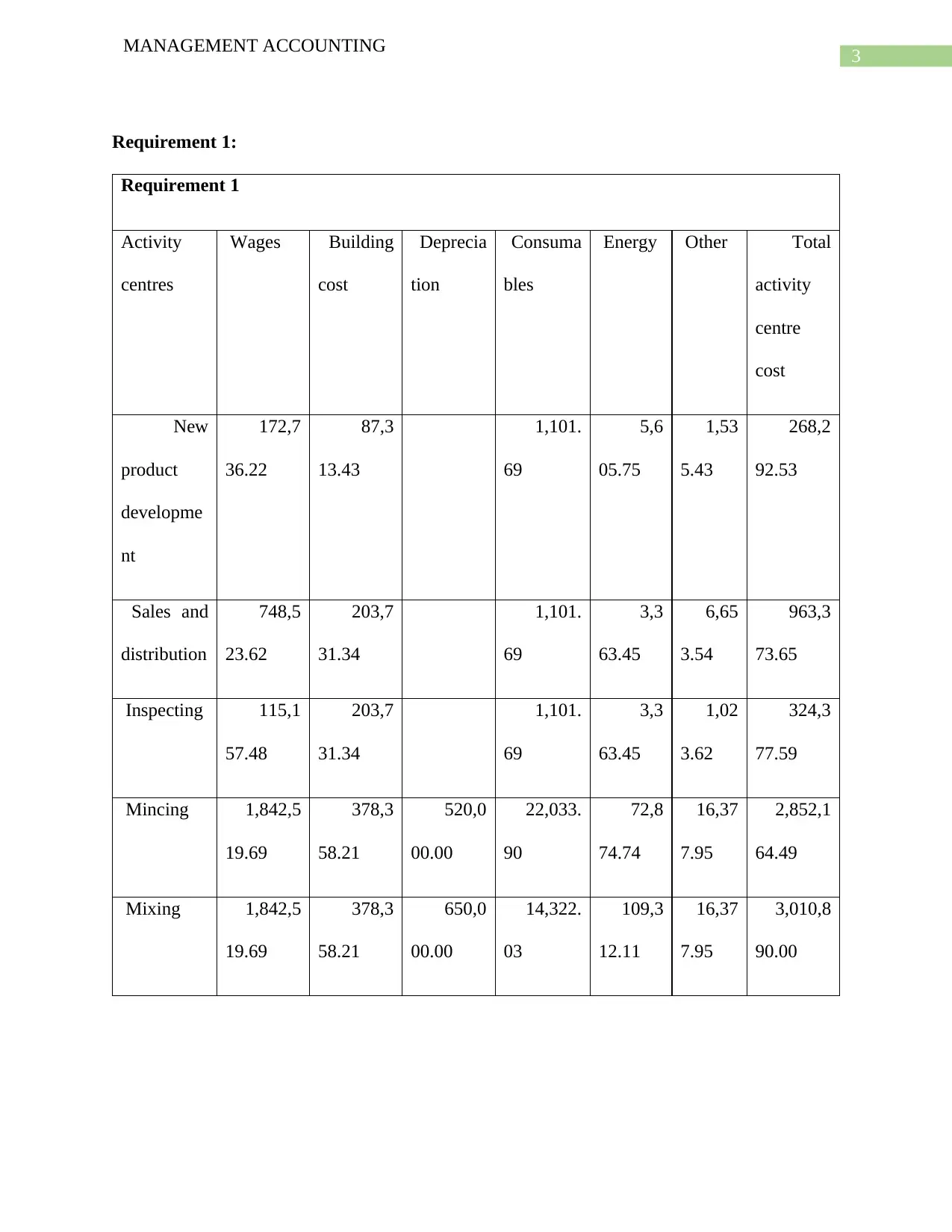

Requirement 1:

Requirement 1

Activity

centres

Wages Building

cost

Deprecia

tion

Consuma

bles

Energy Other Total

activity

centre

cost

New

product

developme

nt

172,7

36.22

87,3

13.43

1,101.

69

5,6

05.75

1,53

5.43

268,2

92.53

Sales and

distribution

748,5

23.62

203,7

31.34

1,101.

69

3,3

63.45

6,65

3.54

963,3

73.65

Inspecting 115,1

57.48

203,7

31.34

1,101.

69

3,3

63.45

1,02

3.62

324,3

77.59

Mincing 1,842,5

19.69

378,3

58.21

520,0

00.00

22,033.

90

72,8

74.74

16,37

7.95

2,852,1

64.49

Mixing 1,842,5

19.69

378,3

58.21

650,0

00.00

14,322.

03

109,3

12.11

16,37

7.95

3,010,8

90.00

MANAGEMENT ACCOUNTING

Requirement 1:

Requirement 1

Activity

centres

Wages Building

cost

Deprecia

tion

Consuma

bles

Energy Other Total

activity

centre

cost

New

product

developme

nt

172,7

36.22

87,3

13.43

1,101.

69

5,6

05.75

1,53

5.43

268,2

92.53

Sales and

distribution

748,5

23.62

203,7

31.34

1,101.

69

3,3

63.45

6,65

3.54

963,3

73.65

Inspecting 115,1

57.48

203,7

31.34

1,101.

69

3,3

63.45

1,02

3.62

324,3

77.59

Mincing 1,842,5

19.69

378,3

58.21

520,0

00.00

22,033.

90

72,8

74.74

16,37

7.95

2,852,1

64.49

Mixing 1,842,5

19.69

378,3

58.21

650,0

00.00

14,322.

03

109,3

12.11

16,37

7.95

3,010,8

90.00

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

4

MANAGEMENT ACCOUNTING

Smoking

and

packing

1,497,0

47.24

378,3

58.21

130,0

00.00

22,033.

90

72,8

74.74

13,30

7.09

2,113,6

21.18

Administr

ation

748,5

23.62

203,7

31.34

2,203.

39

2,8

02.87

6,65

3.54

963,9

14.77

Corporate

manageme

nt

345,4

72.44

116,4

17.91

1,101.

69

2,8

02.87

3,07

0.87

468,8

65.79

7,312,5

00.00

1,950,0

00.00

1,300,0

00.00

65,000.

00

273,0

00.00

65,00

0.00

Image view:

Requirement 1

acvtivity centres Wages Building cost Depreciation ConsumablesEnergy Other Total

New product development 172,736.22 87,313.43 1,101.69 5,605.75 1,535.43 268,292.53

Sales and distribution 748,523.62 203,731.34 1,101.69 3,363.45 6,653.54 963,373.65

Inspecting 115,157.48 203,731.34 1,101.69 3,363.45 1,023.62 324,377.59

Mincing 1,842,519.69 378,358.21 520,000.00 22,033.90 72,874.74 16,377.95 2,852,164.49

Mixing 1,842,519.69 378,358.21 650,000.00 14,322.03 109,312.11 16,377.95 3,010,890.00

Smoking and packing 1,497,047.24 378,358.21 130,000.00 22,033.90 72,874.74 13,307.09 2,113,621.18

Administration 748,523.62 203,731.34 2,203.39 2,802.87 6,653.54 963,914.77

Corporate management 345,472.44 116,417.91 1,101.69 2,802.87 3,070.87 468,865.79

7,312,500.00 1,950,000.00 1,300,000.00 65,000.00 273,000.00 65,000.00

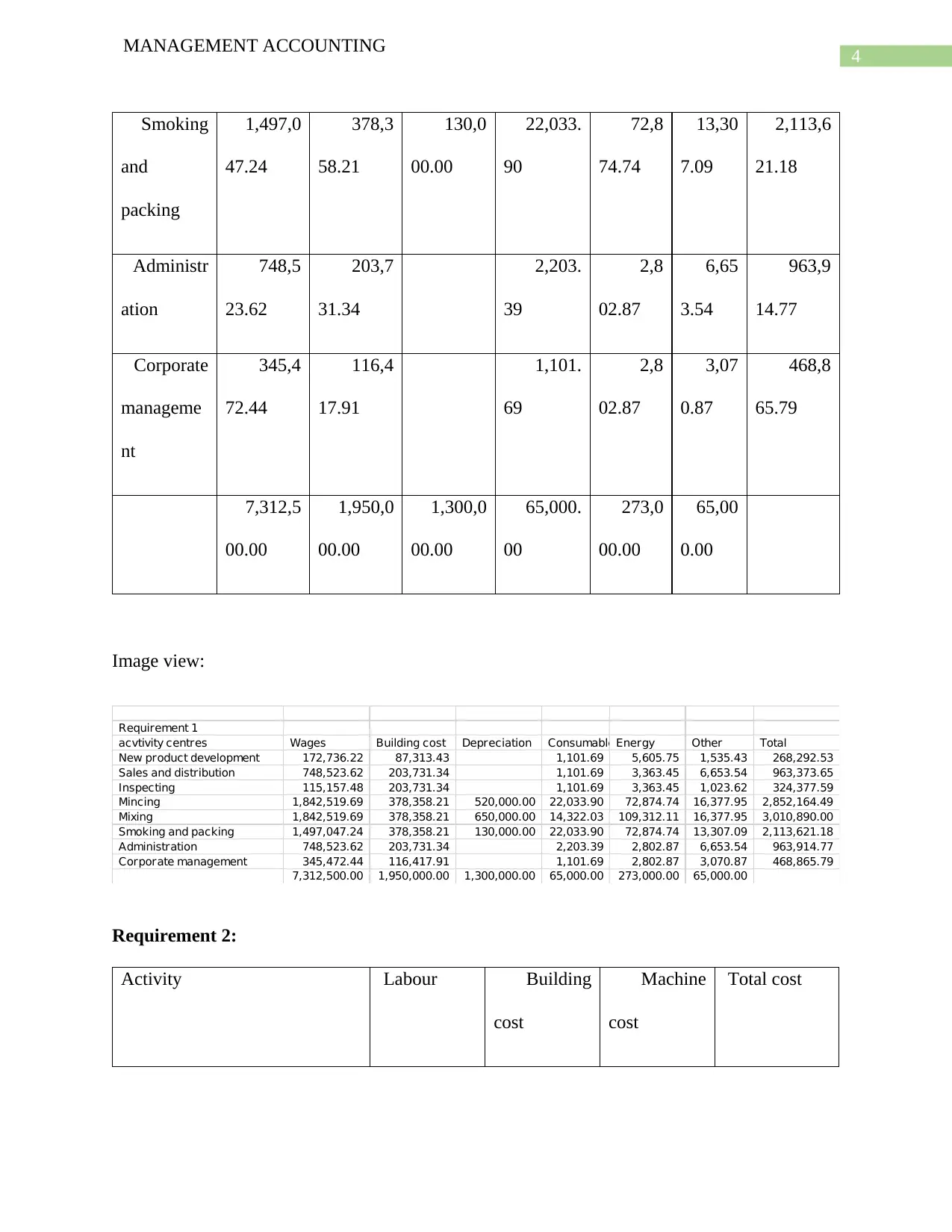

Requirement 2:

Activity Labour Building

cost

Machine

cost

Total cost

MANAGEMENT ACCOUNTING

Smoking

and

packing

1,497,0

47.24

378,3

58.21

130,0

00.00

22,033.

90

72,8

74.74

13,30

7.09

2,113,6

21.18

Administr

ation

748,5

23.62

203,7

31.34

2,203.

39

2,8

02.87

6,65

3.54

963,9

14.77

Corporate

manageme

nt

345,4

72.44

116,4

17.91

1,101.

69

2,8

02.87

3,07

0.87

468,8

65.79

7,312,5

00.00

1,950,0

00.00

1,300,0

00.00

65,000.

00

273,0

00.00

65,00

0.00

Image view:

Requirement 1

acvtivity centres Wages Building cost Depreciation ConsumablesEnergy Other Total

New product development 172,736.22 87,313.43 1,101.69 5,605.75 1,535.43 268,292.53

Sales and distribution 748,523.62 203,731.34 1,101.69 3,363.45 6,653.54 963,373.65

Inspecting 115,157.48 203,731.34 1,101.69 3,363.45 1,023.62 324,377.59

Mincing 1,842,519.69 378,358.21 520,000.00 22,033.90 72,874.74 16,377.95 2,852,164.49

Mixing 1,842,519.69 378,358.21 650,000.00 14,322.03 109,312.11 16,377.95 3,010,890.00

Smoking and packing 1,497,047.24 378,358.21 130,000.00 22,033.90 72,874.74 13,307.09 2,113,621.18

Administration 748,523.62 203,731.34 2,203.39 2,802.87 6,653.54 963,914.77

Corporate management 345,472.44 116,417.91 1,101.69 2,802.87 3,070.87 468,865.79

7,312,500.00 1,950,000.00 1,300,000.00 65,000.00 273,000.00 65,000.00

Requirement 2:

Activity Labour Building

cost

Machine

cost

Total cost

5

MANAGEMENT ACCOUNTING

Set up scales 365,625.

00

97,500.

00

463,125.

00

Weigh ingredients 731,250.

00

97,500.

00

828,750.

00

Load mixers 1,462,500.

00

195,000.

00

1,657,500.0

0

Operate mixers 3,656,250.

00

1,170,000.

00

1,300,000.

00

6,126,250.0

0

Clean mixers 731,250.

00

195,000.

00

926,250.

00

Move mixture to smoke house 365,625.

00

195,000.

00

560,625.

00

Total 7,312,500.

00

1,950,000.

00

1,300,000.

00

10,562,500.0

0

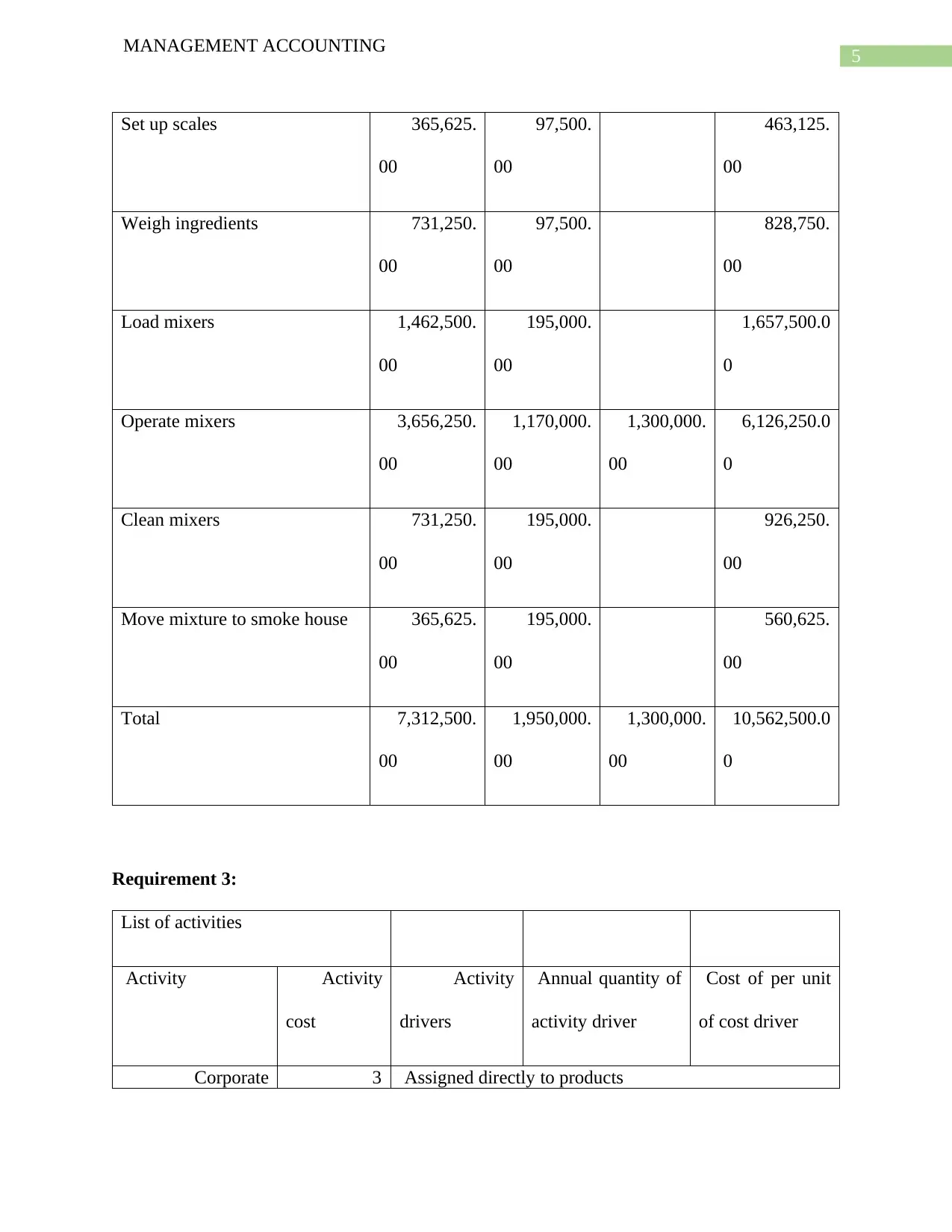

Requirement 3:

List of activities

Activity Activity

cost

Activity

drivers

Annual quantity of

activity driver

Cost of per unit

of cost driver

Corporate 3 Assigned directly to products

MANAGEMENT ACCOUNTING

Set up scales 365,625.

00

97,500.

00

463,125.

00

Weigh ingredients 731,250.

00

97,500.

00

828,750.

00

Load mixers 1,462,500.

00

195,000.

00

1,657,500.0

0

Operate mixers 3,656,250.

00

1,170,000.

00

1,300,000.

00

6,126,250.0

0

Clean mixers 731,250.

00

195,000.

00

926,250.

00

Move mixture to smoke house 365,625.

00

195,000.

00

560,625.

00

Total 7,312,500.

00

1,950,000.

00

1,300,000.

00

10,562,500.0

0

Requirement 3:

List of activities

Activity Activity

cost

Activity

drivers

Annual quantity of

activity driver

Cost of per unit

of cost driver

Corporate 3 Assigned directly to products

6

MANAGEMENT ACCOUNTING

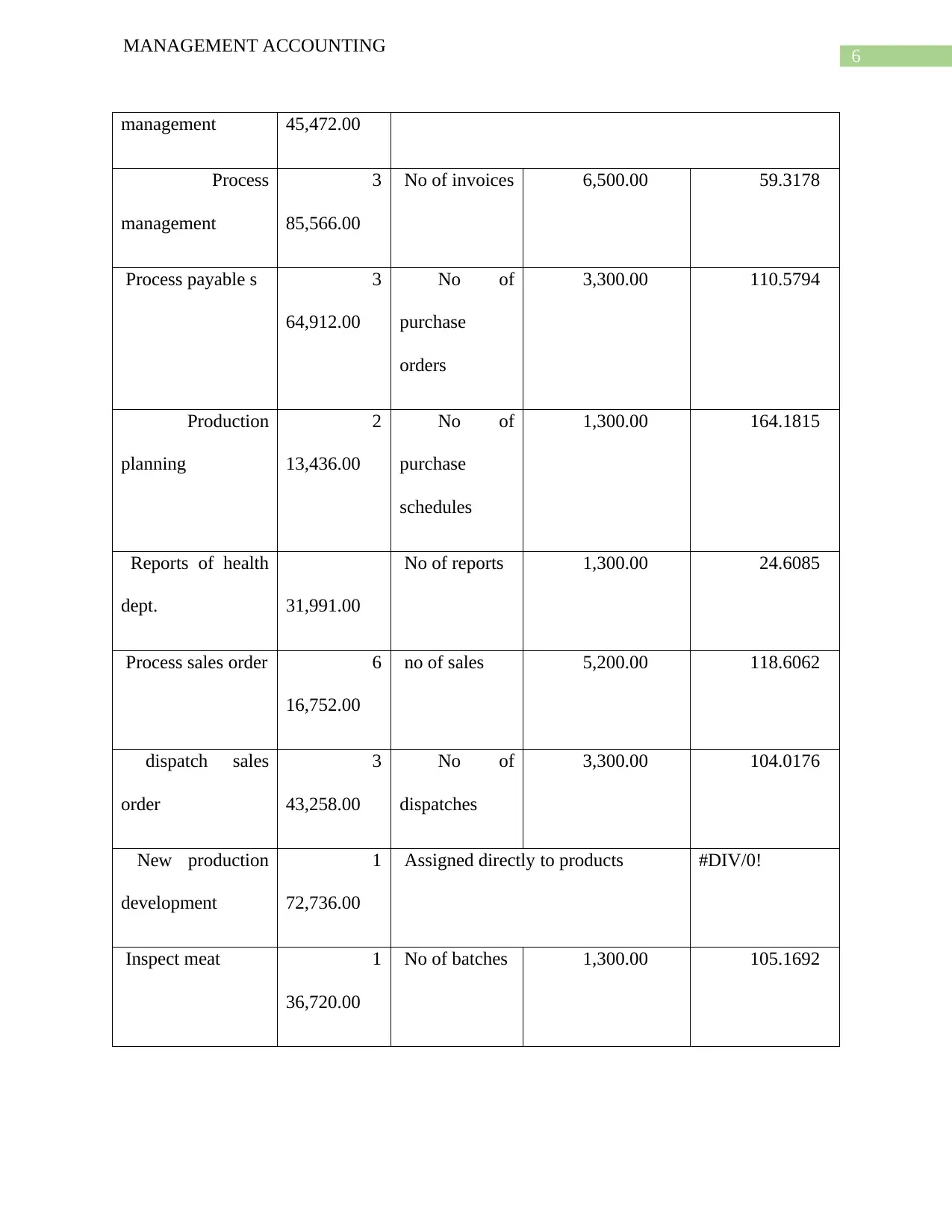

management 45,472.00

Process

management

3

85,566.00

No of invoices 6,500.00 59.3178

Process payable s 3

64,912.00

No of

purchase

orders

3,300.00 110.5794

Production

planning

2

13,436.00

No of

purchase

schedules

1,300.00 164.1815

Reports of health

dept. 31,991.00

No of reports 1,300.00 24.6085

Process sales order 6

16,752.00

no of sales 5,200.00 118.6062

dispatch sales

order

3

43,258.00

No of

dispatches

3,300.00 104.0176

New production

development

1

72,736.00

Assigned directly to products #DIV/0!

Inspect meat 1

36,720.00

No of batches 1,300.00 105.1692

MANAGEMENT ACCOUNTING

management 45,472.00

Process

management

3

85,566.00

No of invoices 6,500.00 59.3178

Process payable s 3

64,912.00

No of

purchase

orders

3,300.00 110.5794

Production

planning

2

13,436.00

No of

purchase

schedules

1,300.00 164.1815

Reports of health

dept. 31,991.00

No of reports 1,300.00 24.6085

Process sales order 6

16,752.00

no of sales 5,200.00 118.6062

dispatch sales

order

3

43,258.00

No of

dispatches

3,300.00 104.0176

New production

development

1

72,736.00

Assigned directly to products #DIV/0!

Inspect meat 1

36,720.00

No of batches 1,300.00 105.1692

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7

MANAGEMENT ACCOUNTING

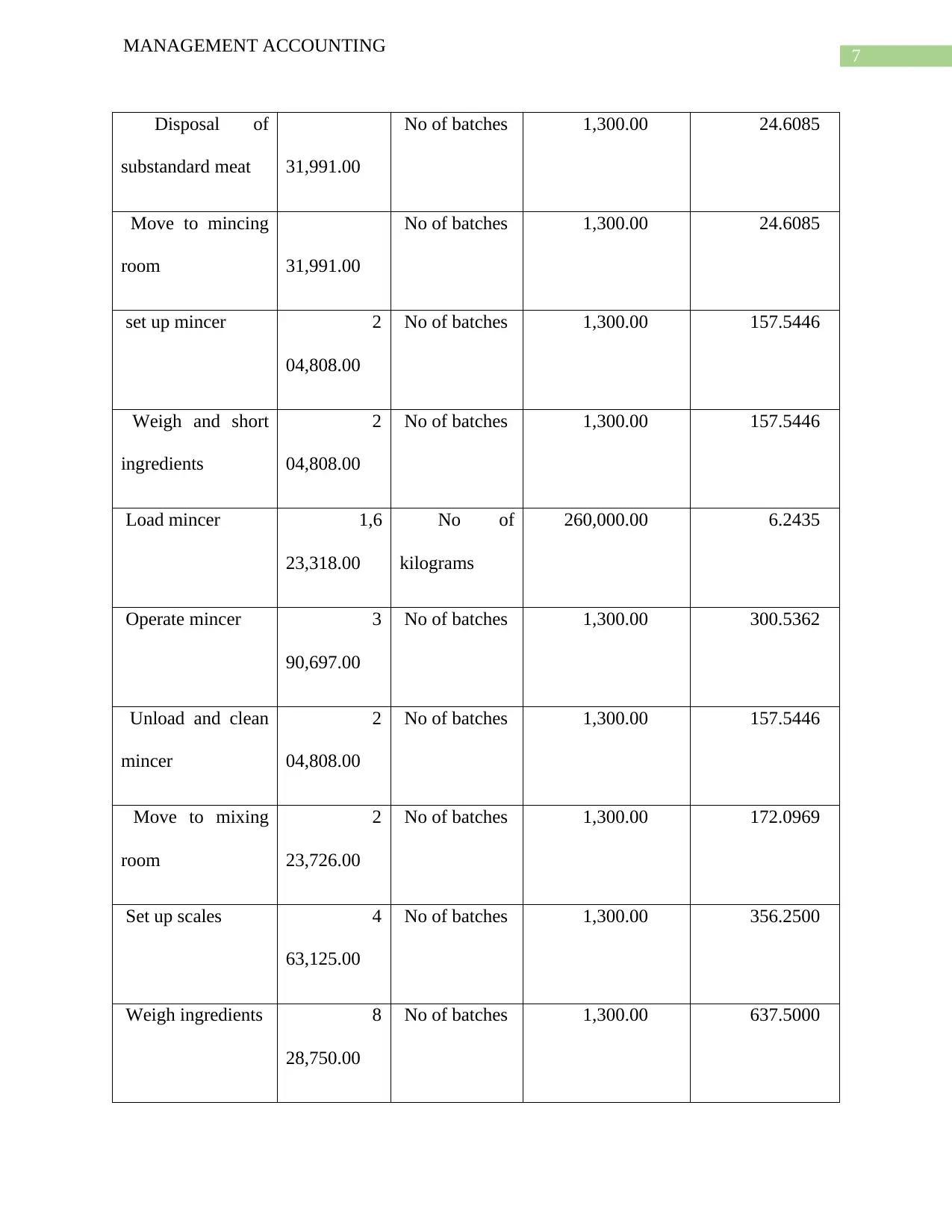

Disposal of

substandard meat 31,991.00

No of batches 1,300.00 24.6085

Move to mincing

room 31,991.00

No of batches 1,300.00 24.6085

set up mincer 2

04,808.00

No of batches 1,300.00 157.5446

Weigh and short

ingredients

2

04,808.00

No of batches 1,300.00 157.5446

Load mincer 1,6

23,318.00

No of

kilograms

260,000.00 6.2435

Operate mincer 3

90,697.00

No of batches 1,300.00 300.5362

Unload and clean

mincer

2

04,808.00

No of batches 1,300.00 157.5446

Move to mixing

room

2

23,726.00

No of batches 1,300.00 172.0969

Set up scales 4

63,125.00

No of batches 1,300.00 356.2500

Weigh ingredients 8

28,750.00

No of batches 1,300.00 637.5000

MANAGEMENT ACCOUNTING

Disposal of

substandard meat 31,991.00

No of batches 1,300.00 24.6085

Move to mincing

room 31,991.00

No of batches 1,300.00 24.6085

set up mincer 2

04,808.00

No of batches 1,300.00 157.5446

Weigh and short

ingredients

2

04,808.00

No of batches 1,300.00 157.5446

Load mincer 1,6

23,318.00

No of

kilograms

260,000.00 6.2435

Operate mincer 3

90,697.00

No of batches 1,300.00 300.5362

Unload and clean

mincer

2

04,808.00

No of batches 1,300.00 157.5446

Move to mixing

room

2

23,726.00

No of batches 1,300.00 172.0969

Set up scales 4

63,125.00

No of batches 1,300.00 356.2500

Weigh ingredients 8

28,750.00

No of batches 1,300.00 637.5000

8

MANAGEMENT ACCOUNTING

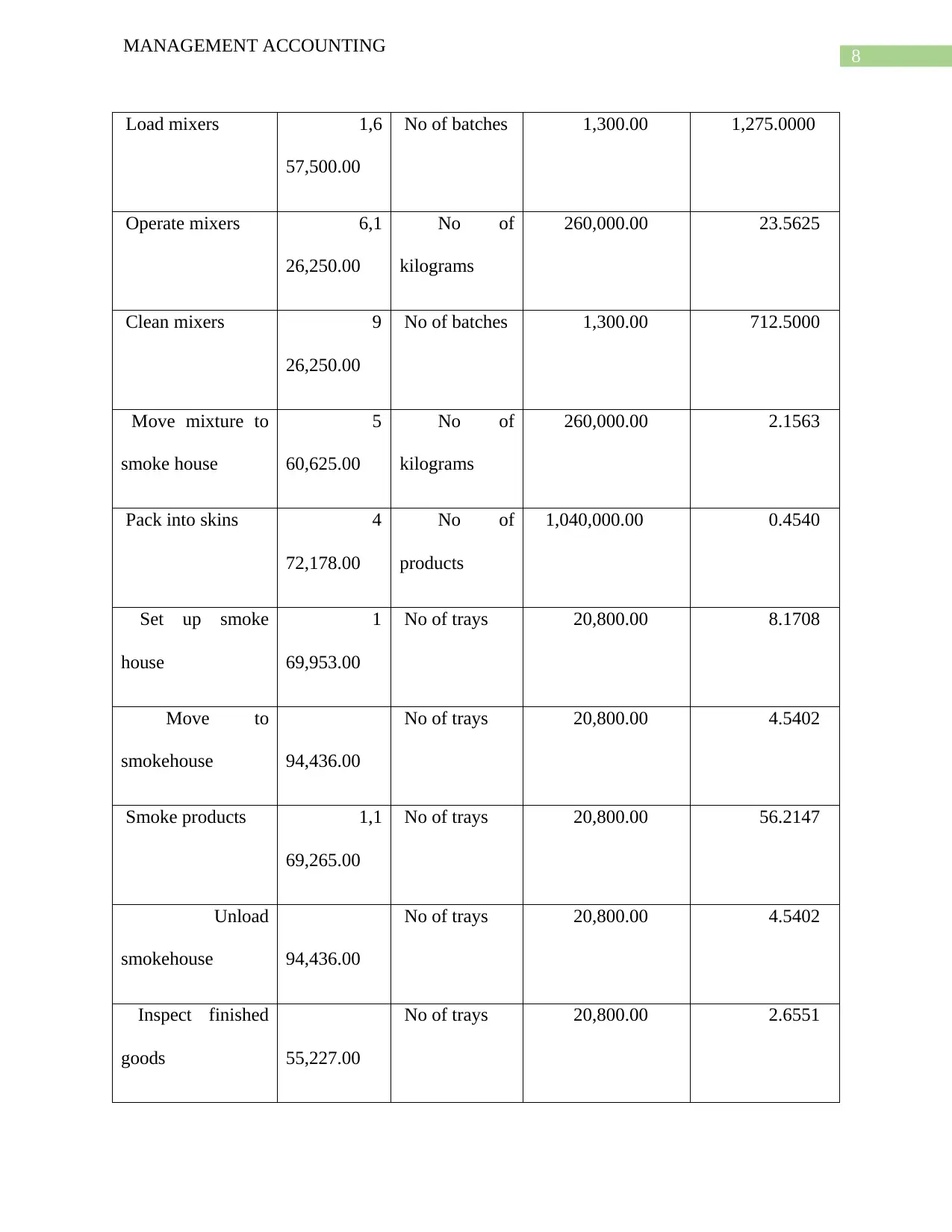

Load mixers 1,6

57,500.00

No of batches 1,300.00 1,275.0000

Operate mixers 6,1

26,250.00

No of

kilograms

260,000.00 23.5625

Clean mixers 9

26,250.00

No of batches 1,300.00 712.5000

Move mixture to

smoke house

5

60,625.00

No of

kilograms

260,000.00 2.1563

Pack into skins 4

72,178.00

No of

products

1,040,000.00 0.4540

Set up smoke

house

1

69,953.00

No of trays 20,800.00 8.1708

Move to

smokehouse 94,436.00

No of trays 20,800.00 4.5402

Smoke products 1,1

69,265.00

No of trays 20,800.00 56.2147

Unload

smokehouse 94,436.00

No of trays 20,800.00 4.5402

Inspect finished

goods 55,227.00

No of trays 20,800.00 2.6551

MANAGEMENT ACCOUNTING

Load mixers 1,6

57,500.00

No of batches 1,300.00 1,275.0000

Operate mixers 6,1

26,250.00

No of

kilograms

260,000.00 23.5625

Clean mixers 9

26,250.00

No of batches 1,300.00 712.5000

Move mixture to

smoke house

5

60,625.00

No of

kilograms

260,000.00 2.1563

Pack into skins 4

72,178.00

No of

products

1,040,000.00 0.4540

Set up smoke

house

1

69,953.00

No of trays 20,800.00 8.1708

Move to

smokehouse 94,436.00

No of trays 20,800.00 4.5402

Smoke products 1,1

69,265.00

No of trays 20,800.00 56.2147

Unload

smokehouse 94,436.00

No of trays 20,800.00 4.5402

Inspect finished

goods 55,227.00

No of trays 20,800.00 2.6551

9

MANAGEMENT ACCOUNTING

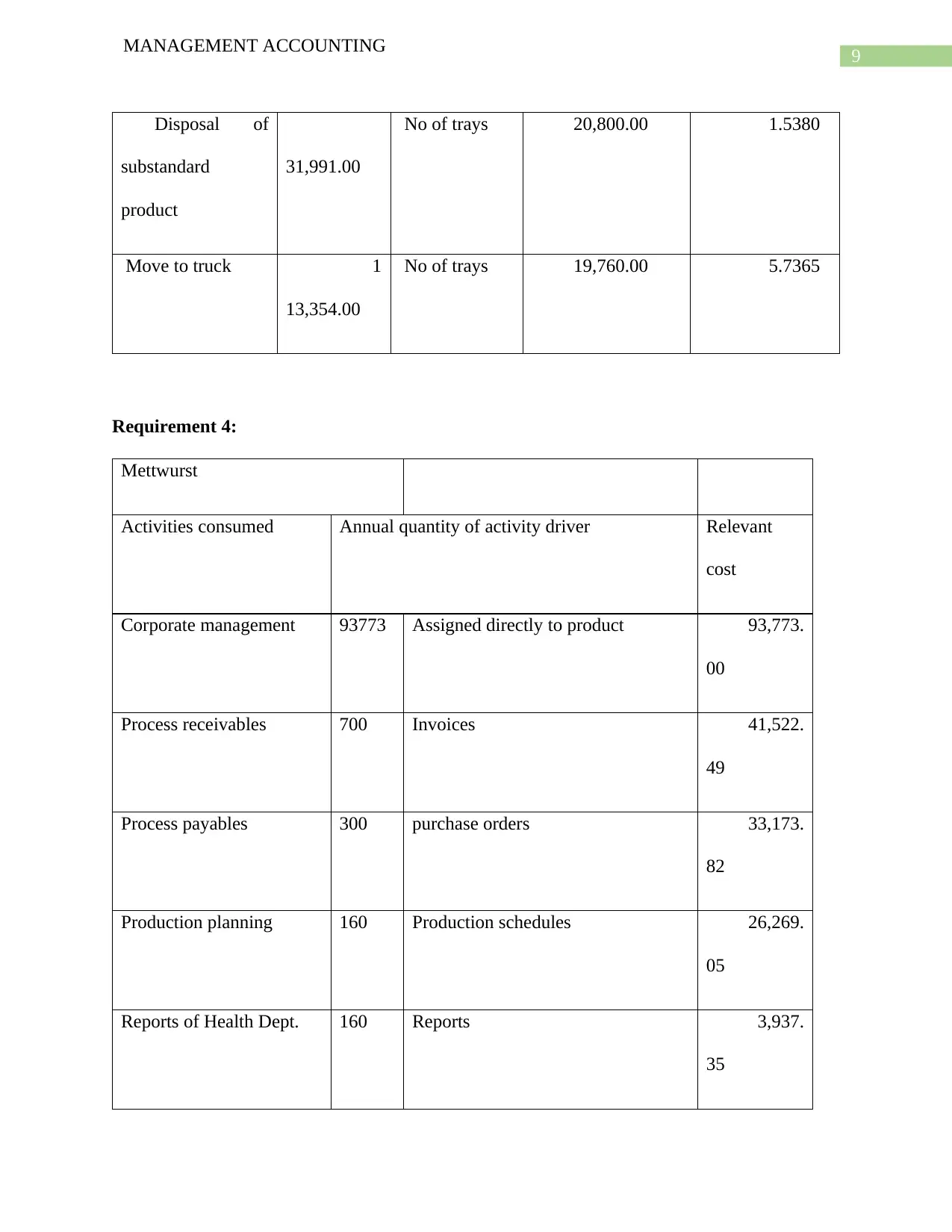

Disposal of

substandard

product

31,991.00

No of trays 20,800.00 1.5380

Move to truck 1

13,354.00

No of trays 19,760.00 5.7365

Requirement 4:

Mettwurst

Activities consumed Annual quantity of activity driver Relevant

cost

Corporate management 93773 Assigned directly to product 93,773.

00

Process receivables 700 Invoices 41,522.

49

Process payables 300 purchase orders 33,173.

82

Production planning 160 Production schedules 26,269.

05

Reports of Health Dept. 160 Reports 3,937.

35

MANAGEMENT ACCOUNTING

Disposal of

substandard

product

31,991.00

No of trays 20,800.00 1.5380

Move to truck 1

13,354.00

No of trays 19,760.00 5.7365

Requirement 4:

Mettwurst

Activities consumed Annual quantity of activity driver Relevant

cost

Corporate management 93773 Assigned directly to product 93,773.

00

Process receivables 700 Invoices 41,522.

49

Process payables 300 purchase orders 33,173.

82

Production planning 160 Production schedules 26,269.

05

Reports of Health Dept. 160 Reports 3,937.

35

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

10

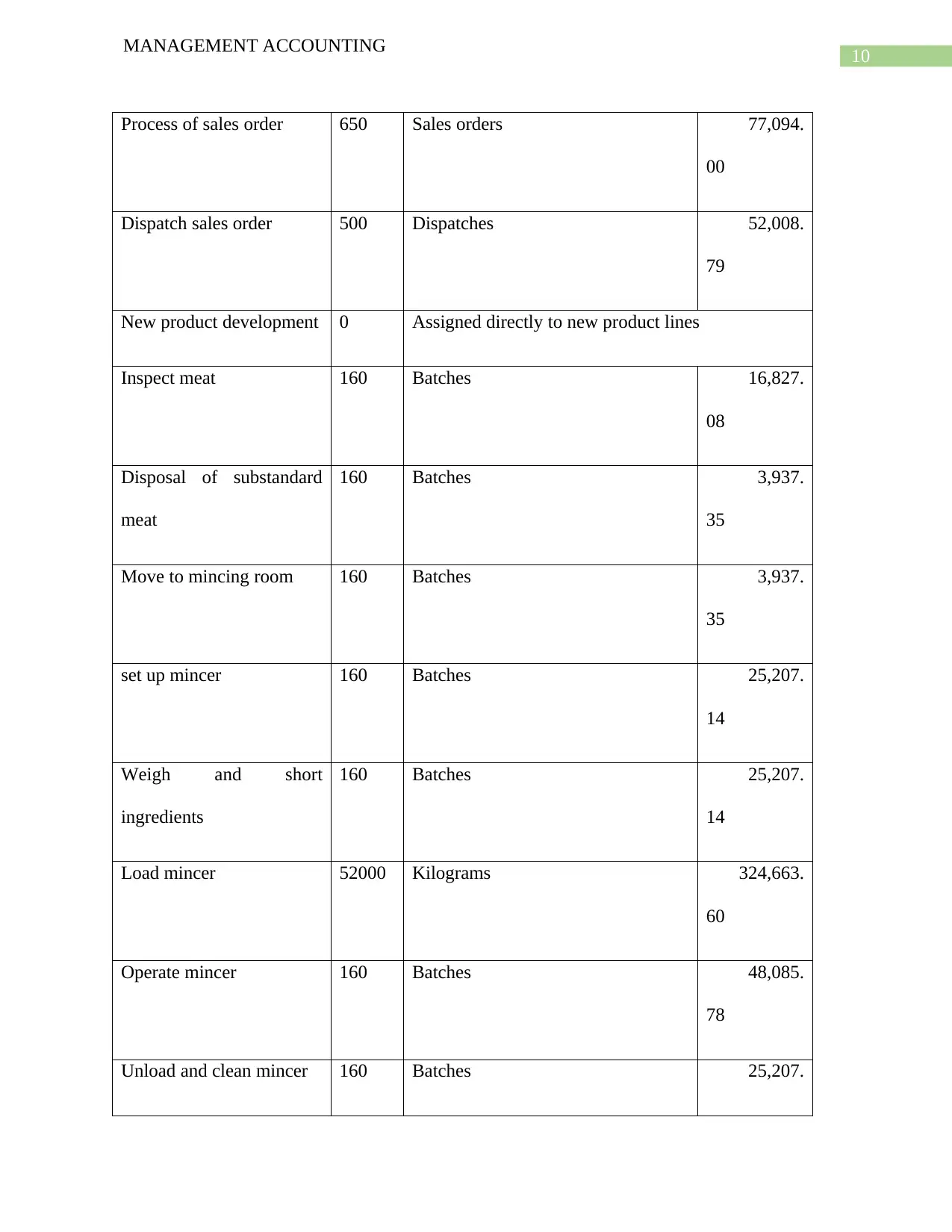

MANAGEMENT ACCOUNTING

Process of sales order 650 Sales orders 77,094.

00

Dispatch sales order 500 Dispatches 52,008.

79

New product development 0 Assigned directly to new product lines

Inspect meat 160 Batches 16,827.

08

Disposal of substandard

meat

160 Batches 3,937.

35

Move to mincing room 160 Batches 3,937.

35

set up mincer 160 Batches 25,207.

14

Weigh and short

ingredients

160 Batches 25,207.

14

Load mincer 52000 Kilograms 324,663.

60

Operate mincer 160 Batches 48,085.

78

Unload and clean mincer 160 Batches 25,207.

MANAGEMENT ACCOUNTING

Process of sales order 650 Sales orders 77,094.

00

Dispatch sales order 500 Dispatches 52,008.

79

New product development 0 Assigned directly to new product lines

Inspect meat 160 Batches 16,827.

08

Disposal of substandard

meat

160 Batches 3,937.

35

Move to mincing room 160 Batches 3,937.

35

set up mincer 160 Batches 25,207.

14

Weigh and short

ingredients

160 Batches 25,207.

14

Load mincer 52000 Kilograms 324,663.

60

Operate mincer 160 Batches 48,085.

78

Unload and clean mincer 160 Batches 25,207.

11

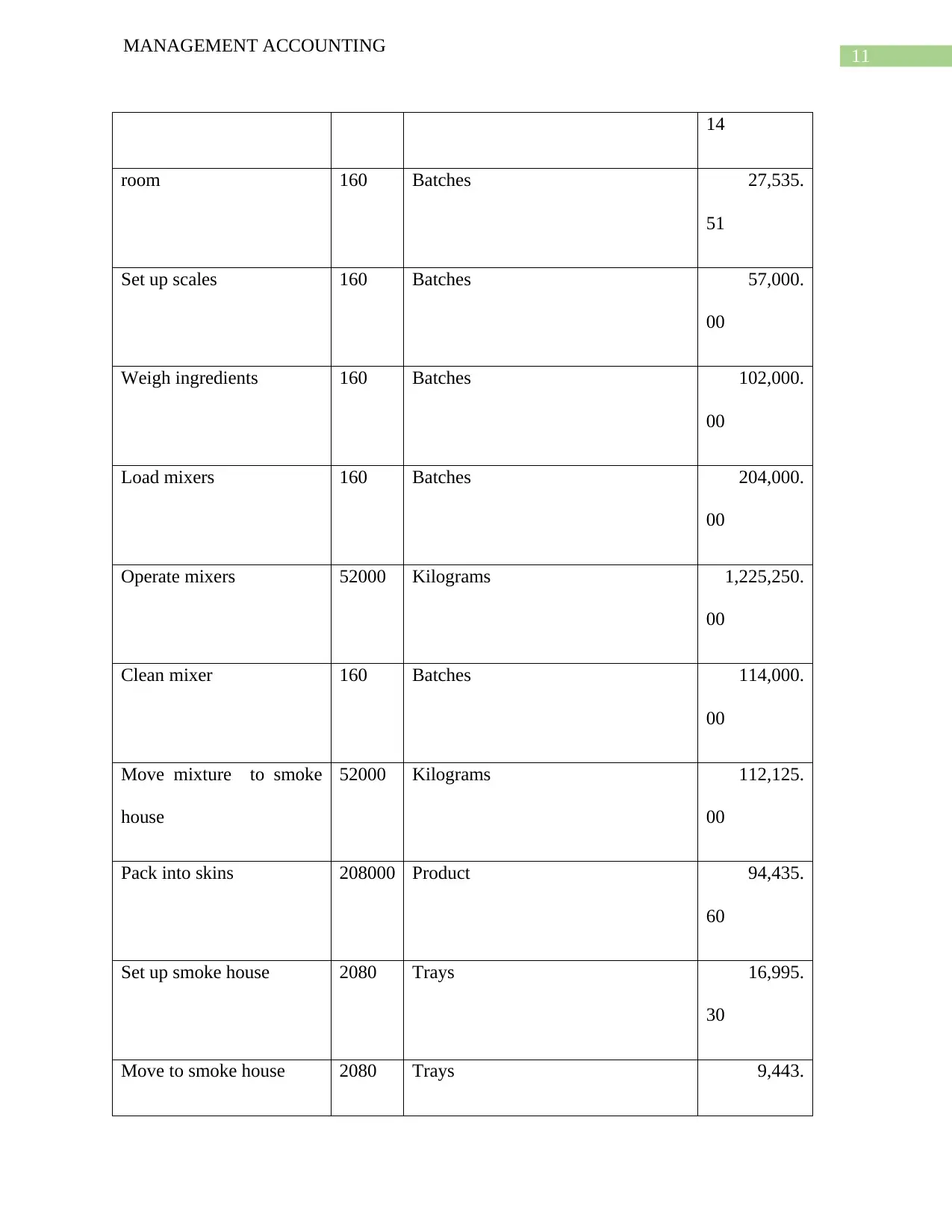

MANAGEMENT ACCOUNTING

14

room 160 Batches 27,535.

51

Set up scales 160 Batches 57,000.

00

Weigh ingredients 160 Batches 102,000.

00

Load mixers 160 Batches 204,000.

00

Operate mixers 52000 Kilograms 1,225,250.

00

Clean mixer 160 Batches 114,000.

00

Move mixture to smoke

house

52000 Kilograms 112,125.

00

Pack into skins 208000 Product 94,435.

60

Set up smoke house 2080 Trays 16,995.

30

Move to smoke house 2080 Trays 9,443.

MANAGEMENT ACCOUNTING

14

room 160 Batches 27,535.

51

Set up scales 160 Batches 57,000.

00

Weigh ingredients 160 Batches 102,000.

00

Load mixers 160 Batches 204,000.

00

Operate mixers 52000 Kilograms 1,225,250.

00

Clean mixer 160 Batches 114,000.

00

Move mixture to smoke

house

52000 Kilograms 112,125.

00

Pack into skins 208000 Product 94,435.

60

Set up smoke house 2080 Trays 16,995.

30

Move to smoke house 2080 Trays 9,443.

12

MANAGEMENT ACCOUNTING

60

Smoke products 2080 Trays 116,926.

50

Unload smokehouse 2080 Trays 9,443.

60

Inspect finished goods Trays

-

Disposal of substandard product Trays

-

Move to truck 2080 Finished trays 11,932.

00

Direct materials 3 Per kilogram assigned directly to

products

156,000.

00

Total cost 3,057,938.

19

Annual volume is 208000 units hence, per unit cost of above product is (3057938.19 / 208000) =

$14.70 per unit.

MANAGEMENT ACCOUNTING

60

Smoke products 2080 Trays 116,926.

50

Unload smokehouse 2080 Trays 9,443.

60

Inspect finished goods Trays

-

Disposal of substandard product Trays

-

Move to truck 2080 Finished trays 11,932.

00

Direct materials 3 Per kilogram assigned directly to

products

156,000.

00

Total cost 3,057,938.

19

Annual volume is 208000 units hence, per unit cost of above product is (3057938.19 / 208000) =

$14.70 per unit.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

13

MANAGEMENT ACCOUNTING

csabai

MANAGEMENT ACCOUNTING

csabai

14

MANAGEMENT ACCOUNTING

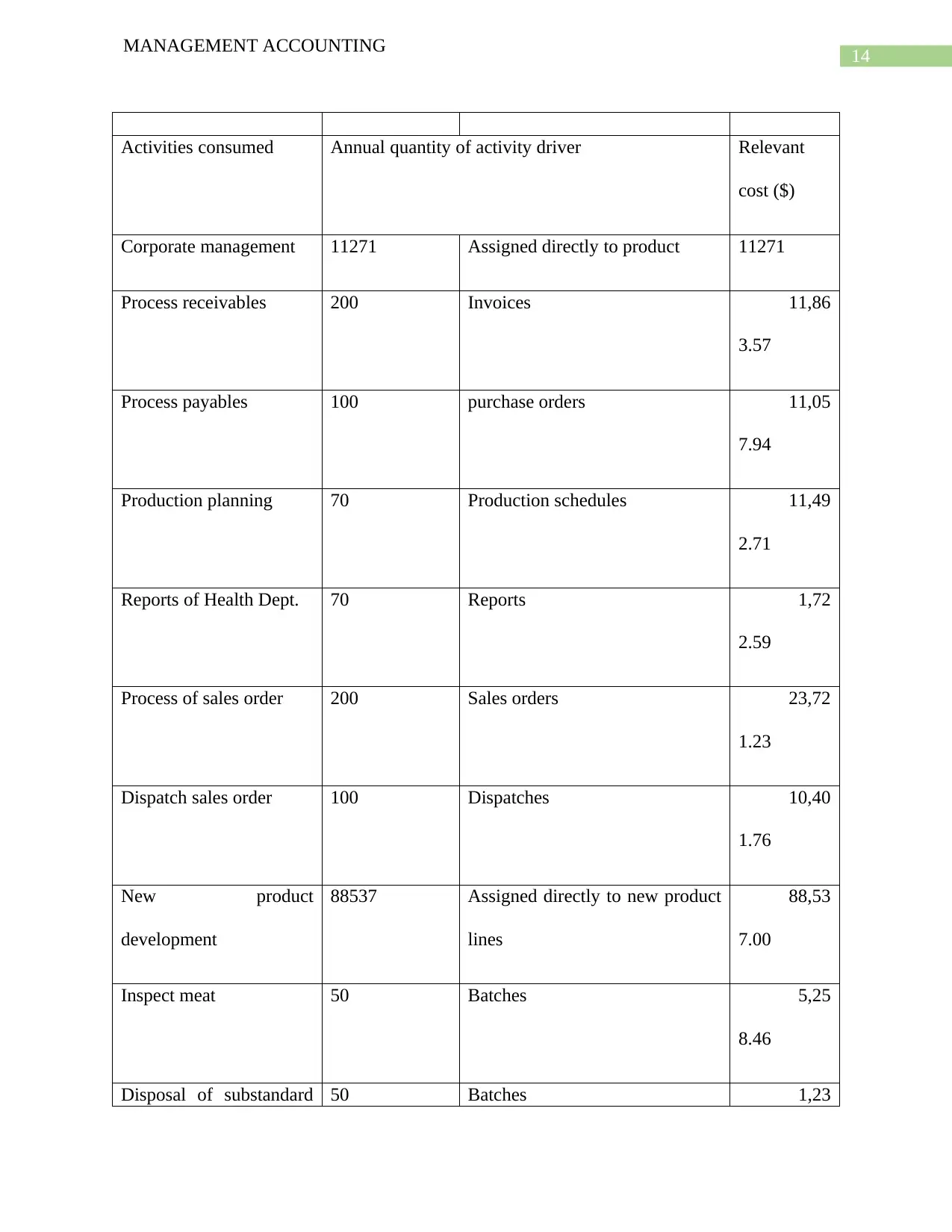

Activities consumed Annual quantity of activity driver Relevant

cost ($)

Corporate management 11271 Assigned directly to product 11271

Process receivables 200 Invoices 11,86

3.57

Process payables 100 purchase orders 11,05

7.94

Production planning 70 Production schedules 11,49

2.71

Reports of Health Dept. 70 Reports 1,72

2.59

Process of sales order 200 Sales orders 23,72

1.23

Dispatch sales order 100 Dispatches 10,40

1.76

New product

development

88537 Assigned directly to new product

lines

88,53

7.00

Inspect meat 50 Batches 5,25

8.46

Disposal of substandard 50 Batches 1,23

MANAGEMENT ACCOUNTING

Activities consumed Annual quantity of activity driver Relevant

cost ($)

Corporate management 11271 Assigned directly to product 11271

Process receivables 200 Invoices 11,86

3.57

Process payables 100 purchase orders 11,05

7.94

Production planning 70 Production schedules 11,49

2.71

Reports of Health Dept. 70 Reports 1,72

2.59

Process of sales order 200 Sales orders 23,72

1.23

Dispatch sales order 100 Dispatches 10,40

1.76

New product

development

88537 Assigned directly to new product

lines

88,53

7.00

Inspect meat 50 Batches 5,25

8.46

Disposal of substandard 50 Batches 1,23

15

MANAGEMENT ACCOUNTING

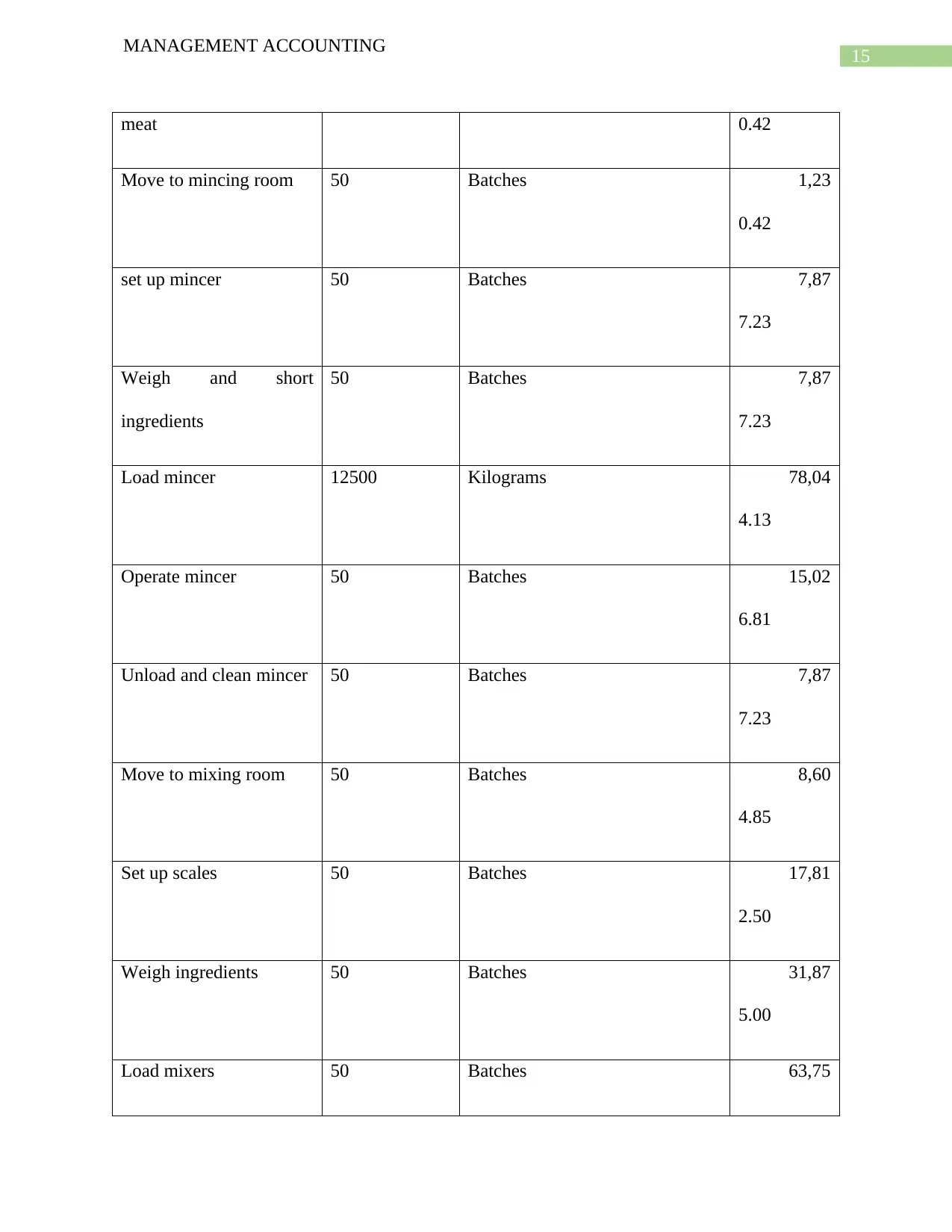

meat 0.42

Move to mincing room 50 Batches 1,23

0.42

set up mincer 50 Batches 7,87

7.23

Weigh and short

ingredients

50 Batches 7,87

7.23

Load mincer 12500 Kilograms 78,04

4.13

Operate mincer 50 Batches 15,02

6.81

Unload and clean mincer 50 Batches 7,87

7.23

Move to mixing room 50 Batches 8,60

4.85

Set up scales 50 Batches 17,81

2.50

Weigh ingredients 50 Batches 31,87

5.00

Load mixers 50 Batches 63,75

MANAGEMENT ACCOUNTING

meat 0.42

Move to mincing room 50 Batches 1,23

0.42

set up mincer 50 Batches 7,87

7.23

Weigh and short

ingredients

50 Batches 7,87

7.23

Load mincer 12500 Kilograms 78,04

4.13

Operate mincer 50 Batches 15,02

6.81

Unload and clean mincer 50 Batches 7,87

7.23

Move to mixing room 50 Batches 8,60

4.85

Set up scales 50 Batches 17,81

2.50

Weigh ingredients 50 Batches 31,87

5.00

Load mixers 50 Batches 63,75

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

16

MANAGEMENT ACCOUNTING

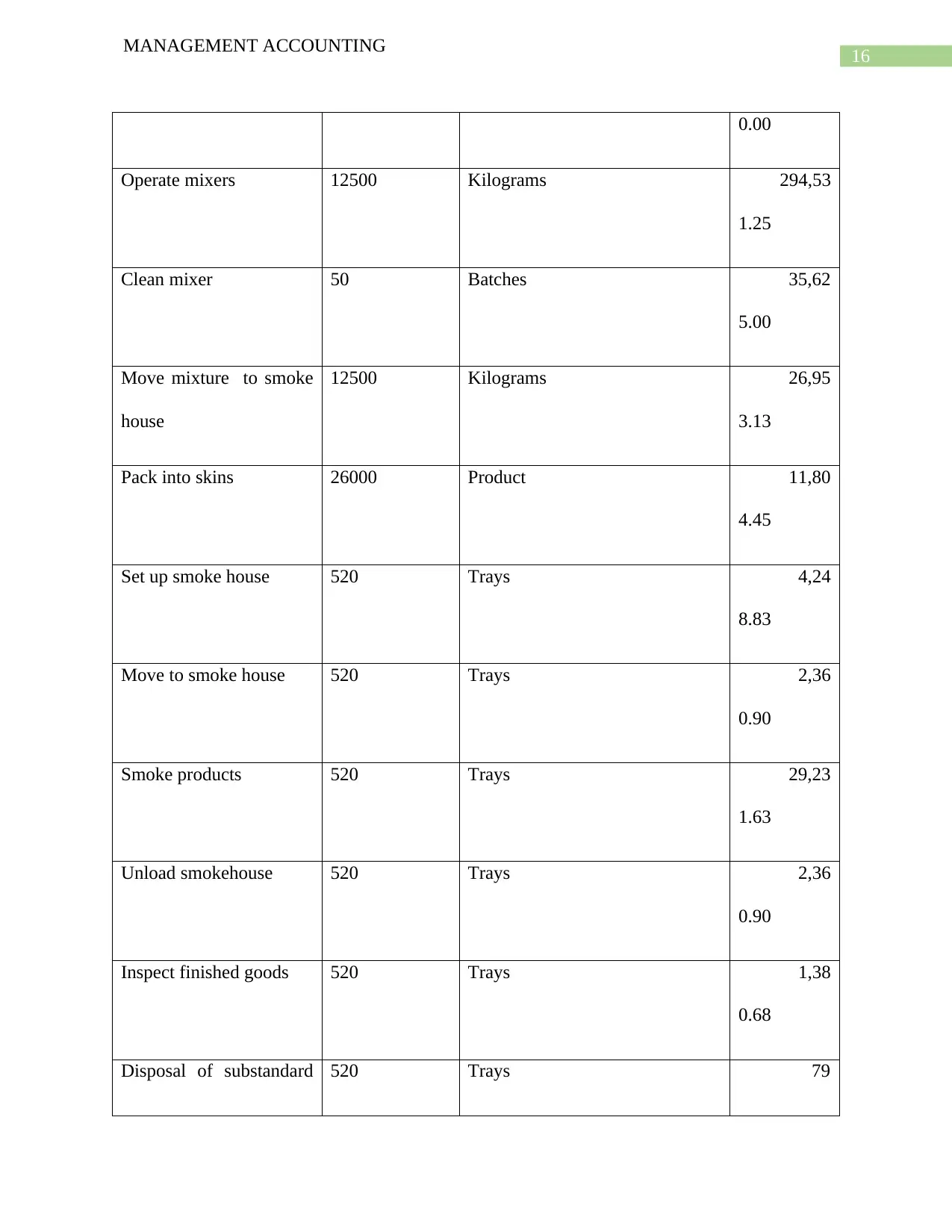

0.00

Operate mixers 12500 Kilograms 294,53

1.25

Clean mixer 50 Batches 35,62

5.00

Move mixture to smoke

house

12500 Kilograms 26,95

3.13

Pack into skins 26000 Product 11,80

4.45

Set up smoke house 520 Trays 4,24

8.83

Move to smoke house 520 Trays 2,36

0.90

Smoke products 520 Trays 29,23

1.63

Unload smokehouse 520 Trays 2,36

0.90

Inspect finished goods 520 Trays 1,38

0.68

Disposal of substandard 520 Trays 79

MANAGEMENT ACCOUNTING

0.00

Operate mixers 12500 Kilograms 294,53

1.25

Clean mixer 50 Batches 35,62

5.00

Move mixture to smoke

house

12500 Kilograms 26,95

3.13

Pack into skins 26000 Product 11,80

4.45

Set up smoke house 520 Trays 4,24

8.83

Move to smoke house 520 Trays 2,36

0.90

Smoke products 520 Trays 29,23

1.63

Unload smokehouse 520 Trays 2,36

0.90

Inspect finished goods 520 Trays 1,38

0.68

Disposal of substandard 520 Trays 79

17

MANAGEMENT ACCOUNTING

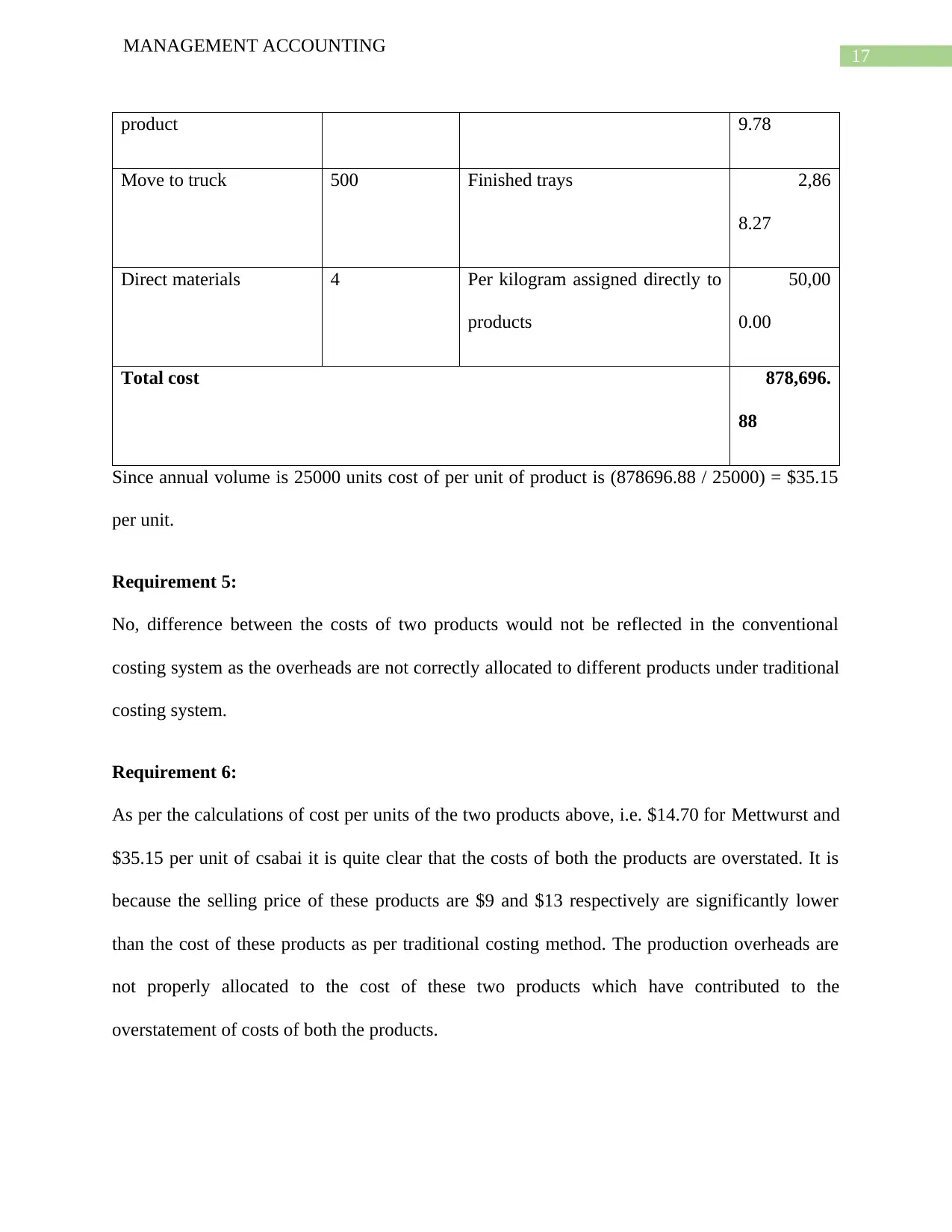

product 9.78

Move to truck 500 Finished trays 2,86

8.27

Direct materials 4 Per kilogram assigned directly to

products

50,00

0.00

Total cost 878,696.

88

Since annual volume is 25000 units cost of per unit of product is (878696.88 / 25000) = $35.15

per unit.

Requirement 5:

No, difference between the costs of two products would not be reflected in the conventional

costing system as the overheads are not correctly allocated to different products under traditional

costing system.

Requirement 6:

As per the calculations of cost per units of the two products above, i.e. $14.70 for Mettwurst and

$35.15 per unit of csabai it is quite clear that the costs of both the products are overstated. It is

because the selling price of these products are $9 and $13 respectively are significantly lower

than the cost of these products as per traditional costing method. The production overheads are

not properly allocated to the cost of these two products which have contributed to the

overstatement of costs of both the products.

MANAGEMENT ACCOUNTING

product 9.78

Move to truck 500 Finished trays 2,86

8.27

Direct materials 4 Per kilogram assigned directly to

products

50,00

0.00

Total cost 878,696.

88

Since annual volume is 25000 units cost of per unit of product is (878696.88 / 25000) = $35.15

per unit.

Requirement 5:

No, difference between the costs of two products would not be reflected in the conventional

costing system as the overheads are not correctly allocated to different products under traditional

costing system.

Requirement 6:

As per the calculations of cost per units of the two products above, i.e. $14.70 for Mettwurst and

$35.15 per unit of csabai it is quite clear that the costs of both the products are overstated. It is

because the selling price of these products are $9 and $13 respectively are significantly lower

than the cost of these products as per traditional costing method. The production overheads are

not properly allocated to the cost of these two products which have contributed to the

overstatement of costs of both the products.

18

MANAGEMENT ACCOUNTING

Requirement 7:

A company which is new takes time to understand the various costs and their nature thus, in the

initial years the costs cannot be properly segregated by correctly understanding the nature and

characteristics of different costs. With passage of time however, the management is very much

certain about different types of costs incurred by the organization and nature of these costs. Thus,

it becomes easier for the management to correctly allocate different costs in different products to

ascertain the cost of production. Also with passing of number of years in business operations the

fixed costs of an organization started to increase and the variable costs are started to decrease.

Thus, allocation of overheads and fixed costs in production is become much more crucial as the

costs pools increasingly comprise of fixed costs once an organization reach its maturity level.

The changes in cost structure of the company in this case for the company after passing of 15 to

20 years would also include more fixed costs as compared to variable costs. Thus, the

proportionate fixed costs to the overall costs would increase significantly within the cost

structure of the company with passing of 15 to 20 years conducting business operations. The

reasons for the change in cost structure are mainly as following:

I. Experienced management would be able to correctly ascertain the nature and

characteristics of different costs.

II. With longer duration of business operations the expenditures are more or less become

fixed except few thus, the cost structure includes more fixed costs.

Requirement 8 and 9:

Introduction:

Costing system is very essential to an organization as it is used by the organization ascertain the

cost of production and per unit cost of finished goods properly. Often the selection of costing

MANAGEMENT ACCOUNTING

Requirement 7:

A company which is new takes time to understand the various costs and their nature thus, in the

initial years the costs cannot be properly segregated by correctly understanding the nature and

characteristics of different costs. With passage of time however, the management is very much

certain about different types of costs incurred by the organization and nature of these costs. Thus,

it becomes easier for the management to correctly allocate different costs in different products to

ascertain the cost of production. Also with passing of number of years in business operations the

fixed costs of an organization started to increase and the variable costs are started to decrease.

Thus, allocation of overheads and fixed costs in production is become much more crucial as the

costs pools increasingly comprise of fixed costs once an organization reach its maturity level.

The changes in cost structure of the company in this case for the company after passing of 15 to

20 years would also include more fixed costs as compared to variable costs. Thus, the

proportionate fixed costs to the overall costs would increase significantly within the cost

structure of the company with passing of 15 to 20 years conducting business operations. The

reasons for the change in cost structure are mainly as following:

I. Experienced management would be able to correctly ascertain the nature and

characteristics of different costs.

II. With longer duration of business operations the expenditures are more or less become

fixed except few thus, the cost structure includes more fixed costs.

Requirement 8 and 9:

Introduction:

Costing system is very essential to an organization as it is used by the organization ascertain the

cost of production and per unit cost of finished goods properly. Often the selection of costing

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

19

MANAGEMENT ACCOUNTING

system to large extent influences the cost of each unit of finished goods to be determined for an

organization. Thus the importance of selecting an appropriate costing system to ensure that the

costs are correctly identified and determined is important to the correct disclosure of cost of each

unit of finished goods.

Discussion and analysis:

The existing costing system as per the calculation of cost of each unit of the two products clearly

showed that the costs of both the products were highly overstated. Overstatement of cost tales

place in an organization only when the organization has costing system with full of limitations.

Thus the existing costing system within the company has number of inherent limitations. Few are

discussed here (Öker and Özyapici, 2013).

Production of large volume of products:

Production of large volume of products have huge amount of variable costs thus, the importance

is to be given to the variable and direct costs however, and in costing the products the same

method has not been followed (Popesko and Novák, 2014).

Number of items are produced:

Different and large number of different products are manufactured by the company however, the

company has failed to correctly identify the cost drivers to correctly allocate the production

overheads in the cost of different products.

No standard costing system has been followed for allocation of production overheads:

MANAGEMENT ACCOUNTING

system to large extent influences the cost of each unit of finished goods to be determined for an

organization. Thus the importance of selecting an appropriate costing system to ensure that the

costs are correctly identified and determined is important to the correct disclosure of cost of each

unit of finished goods.

Discussion and analysis:

The existing costing system as per the calculation of cost of each unit of the two products clearly

showed that the costs of both the products were highly overstated. Overstatement of cost tales

place in an organization only when the organization has costing system with full of limitations.

Thus the existing costing system within the company has number of inherent limitations. Few are

discussed here (Öker and Özyapici, 2013).

Production of large volume of products:

Production of large volume of products have huge amount of variable costs thus, the importance

is to be given to the variable and direct costs however, and in costing the products the same

method has not been followed (Popesko and Novák, 2014).

Number of items are produced:

Different and large number of different products are manufactured by the company however, the

company has failed to correctly identify the cost drivers to correctly allocate the production

overheads in the cost of different products.

No standard costing system has been followed for allocation of production overheads:

20

MANAGEMENT ACCOUNTING

Allocation of production overheads to the cost of products is important however, the company

has no standard costing system to allocate the production overheads in the cost of manufacturing

and finished goods.

The cost drivers as well as cost pools are not properly identified:

The company has failed to correctly identify the cost drivers as well as cost pools resulting in

improper segregation of costs inn different products (Joao Major, 2014).

Neither fully rational nor fully activity based costing system is used:

The company neither uses fully traditional costing system to ascertain the cost of product nor

does it uses activity based costing to calculate the cost of products manufactured by the

company. Hence, there is no proper method followed by the company to calculate the cost of

each unit of finished goods of the company.

Improper method of allocation of production overheads: The Company has no standard costing

system in place to correctly allocate the production overhead costs. Hence, the cost calculated

using the existing method will not reflect the actual cost of goods manufactured by the company

(Hoozée and Hansen, 2018).

Using activity based costing will be helpful in overcoming the inherent limitations identified:

The inherent limitations which mainly include improper way of identification of cost drivers and

costs pools of the company. ABC will be helpful in correctly identifying the proper cost drives

driving different cost pools. Hence, ABC method shall be used to correctly calculate the cost of

MANAGEMENT ACCOUNTING

Allocation of production overheads to the cost of products is important however, the company

has no standard costing system to allocate the production overheads in the cost of manufacturing

and finished goods.

The cost drivers as well as cost pools are not properly identified:

The company has failed to correctly identify the cost drivers as well as cost pools resulting in

improper segregation of costs inn different products (Joao Major, 2014).

Neither fully rational nor fully activity based costing system is used:

The company neither uses fully traditional costing system to ascertain the cost of product nor

does it uses activity based costing to calculate the cost of products manufactured by the

company. Hence, there is no proper method followed by the company to calculate the cost of

each unit of finished goods of the company.

Improper method of allocation of production overheads: The Company has no standard costing

system in place to correctly allocate the production overhead costs. Hence, the cost calculated

using the existing method will not reflect the actual cost of goods manufactured by the company

(Hoozée and Hansen, 2018).

Using activity based costing will be helpful in overcoming the inherent limitations identified:

The inherent limitations which mainly include improper way of identification of cost drivers and

costs pools of the company. ABC will be helpful in correctly identifying the proper cost drives

driving different cost pools. Hence, ABC method shall be used to correctly calculate the cost of

21

MANAGEMENT ACCOUNTING

products manufactured by an organization. This will help to make optimum allocation of

production overheads in cost of manufacturing and result cost of each unit of finished goods.

In determining whether to use ABC method with both manufacturing overheads and non-

manufacturing overheads the company must consider the extent of manufacturing overheads and

non-manufacturing overheads incurred by the company. Apart from that the ability of the

management to correctly identify the cost drivers it is equally important consider the different

costs pools to correctly ascertain the cost of production and each unit of cost of finished goods

(Fei and Isa, 2010).

Benefits, costs and limitations of ABC method:

Benefits of ABC method include the following:

I. Correct and proper allocation of indirect production costs in calculation of cost of

goods manufactured.

II. Possible to correctly ascertain the cost of goods manufactured and cost of each unit of

finished goods.

III. Determination of proper price of the goods with better information at the disposal of

the management (Carli and Canavari, 2013).

Limitations and costs:

I. Difficult to maintain ABC method correctly as it requires expertise knowledge.

II. Cost of implementation of ABC method is significantly higher.

III. Wrong identification of cost drivers could result in wrong calculation of cost of each

unit of finished goods.

MANAGEMENT ACCOUNTING

products manufactured by an organization. This will help to make optimum allocation of

production overheads in cost of manufacturing and result cost of each unit of finished goods.

In determining whether to use ABC method with both manufacturing overheads and non-

manufacturing overheads the company must consider the extent of manufacturing overheads and

non-manufacturing overheads incurred by the company. Apart from that the ability of the

management to correctly identify the cost drivers it is equally important consider the different

costs pools to correctly ascertain the cost of production and each unit of cost of finished goods

(Fei and Isa, 2010).

Benefits, costs and limitations of ABC method:

Benefits of ABC method include the following:

I. Correct and proper allocation of indirect production costs in calculation of cost of

goods manufactured.

II. Possible to correctly ascertain the cost of goods manufactured and cost of each unit of

finished goods.

III. Determination of proper price of the goods with better information at the disposal of

the management (Carli and Canavari, 2013).

Limitations and costs:

I. Difficult to maintain ABC method correctly as it requires expertise knowledge.

II. Cost of implementation of ABC method is significantly higher.

III. Wrong identification of cost drivers could result in wrong calculation of cost of each

unit of finished goods.

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

22

MANAGEMENT ACCOUNTING

Conclusion:

It is clear from this discussion that the costing method and system in an organization is extremely

important to the functioning of the organization as it will help the organization to correctly

calculate the cost of each unit of product. In this case the company does not have a proper system

of costing to correctly ascertain the cost of product. Thus, the company should immediately

change its costing system to correctly calculate the cost of product.

MANAGEMENT ACCOUNTING

Conclusion:

It is clear from this discussion that the costing method and system in an organization is extremely

important to the functioning of the organization as it will help the organization to correctly

calculate the cost of each unit of product. In this case the company does not have a proper system

of costing to correctly ascertain the cost of product. Thus, the company should immediately

change its costing system to correctly calculate the cost of product.

23

MANAGEMENT ACCOUNTING

References:

Carli, G. and Canavari, M. (2013). Introducing Direct Costing and Activity based Costing in a

Farm Management System: A Conceptual Model. Procedia Technology, 8(12), pp.397-405.

Fei, Z. and Isa, C. (2010). Factors Influencing Activity-Based Costing Success: A Research

Framework. International Journal of Trade, Economics and Finance, 1(2), pp.144-150.

Hoozée, S. and Hansen, S. (2018). A Comparison of Activity-Based Costing and Time-Driven

Activity-Based Costing. Journal of Management Accounting Research, 30(1), pp.143-167.

Joao Major, M. (2014). Implementing Activity-Based Costing in the Telecommunications

Sector: A Case Study. Journal of Telecommunications System & Management, 03(01), pp.7-16.

Joao Major, M. (2014). Implementing Activity-Based Costing in the Telecommunications

Sector: A Case Study. Journal of Telecommunications System & Management, 03(01), p.12.

Öker, F. and Özyapici, H. (2013). A New Costing Model in Hospital Management. The Health

Care Manager, 32(1), pp.23-36.

Popesko, B. and Novák, P. (2014). Implementation of the Process-Oriented Costing System in a

Hospital Department. International Journal of Trade, Economics and Finance, 12(14), pp.82-87.

MANAGEMENT ACCOUNTING

References:

Carli, G. and Canavari, M. (2013). Introducing Direct Costing and Activity based Costing in a

Farm Management System: A Conceptual Model. Procedia Technology, 8(12), pp.397-405.

Fei, Z. and Isa, C. (2010). Factors Influencing Activity-Based Costing Success: A Research

Framework. International Journal of Trade, Economics and Finance, 1(2), pp.144-150.

Hoozée, S. and Hansen, S. (2018). A Comparison of Activity-Based Costing and Time-Driven

Activity-Based Costing. Journal of Management Accounting Research, 30(1), pp.143-167.

Joao Major, M. (2014). Implementing Activity-Based Costing in the Telecommunications

Sector: A Case Study. Journal of Telecommunications System & Management, 03(01), pp.7-16.

Joao Major, M. (2014). Implementing Activity-Based Costing in the Telecommunications

Sector: A Case Study. Journal of Telecommunications System & Management, 03(01), p.12.

Öker, F. and Özyapici, H. (2013). A New Costing Model in Hospital Management. The Health

Care Manager, 32(1), pp.23-36.

Popesko, B. and Novák, P. (2014). Implementation of the Process-Oriented Costing System in a

Hospital Department. International Journal of Trade, Economics and Finance, 12(14), pp.82-87.

24

MANAGEMENT ACCOUNTING

MANAGEMENT ACCOUNTING

1 out of 25

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.