Management Accounting Report: XYZ Ltd, Budgeting, and Costing Analysis

VerifiedAdded on 2023/02/02

|16

|3624

|49

Report

AI Summary

This report provides a comprehensive analysis of management accounting principles, focusing on XYZ Ltd., a chair manufacturing company. It begins with an introduction to management accounting and its importance in business decision-making. The report then delves into the practical application of marginal and absorption costing methods, presenting income statements for three years using both approaches. Detailed calculations and interpretations are provided, highlighting the differences in profit figures generated by each costing method. Furthermore, the report examines the advantages and disadvantages of various budgeting control techniques, such as fixed budgets. The analysis provides insights into how these techniques can be used to manage and control business activities. The report concludes with a discussion on the differences between marginal and absorption costing and the implications of these differences in business decision-making.

Management accounting

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TABLE OF CONTENTS

INTRODUCTION...........................................................................................................................1

TASK...............................................................................................................................................1

P3. Advantages and disadvantages of budgeting control techniques.....................................1

P4. income statement for 3 years using marginal and absorption cost approach...................3

CONCLUSION..............................................................................................................................10

REFERENCES..............................................................................................................................11

INTRODUCTION...........................................................................................................................1

TASK...............................................................................................................................................1

P3. Advantages and disadvantages of budgeting control techniques.....................................1

P4. income statement for 3 years using marginal and absorption cost approach...................3

CONCLUSION..............................................................................................................................10

REFERENCES..............................................................................................................................11

INTRODUCTION

Management accounting is the process of assessing the business activities of the internal

management so that better decision making can be done. Management and accounting reports are

prepared so that company could analyse its profits and can compare it with past year's data.

Present study is based on XYZ ltd., a chair manufacturing company and will explain the

advantage and disadvantage of budgeting control tools. Furthermore, it will calculate net profit

by using marginal and absorption costing approach for 3 years’ business of XYZ ltd.

TASK

P3. Income statement for 3 years using marginal and absorption cost approach

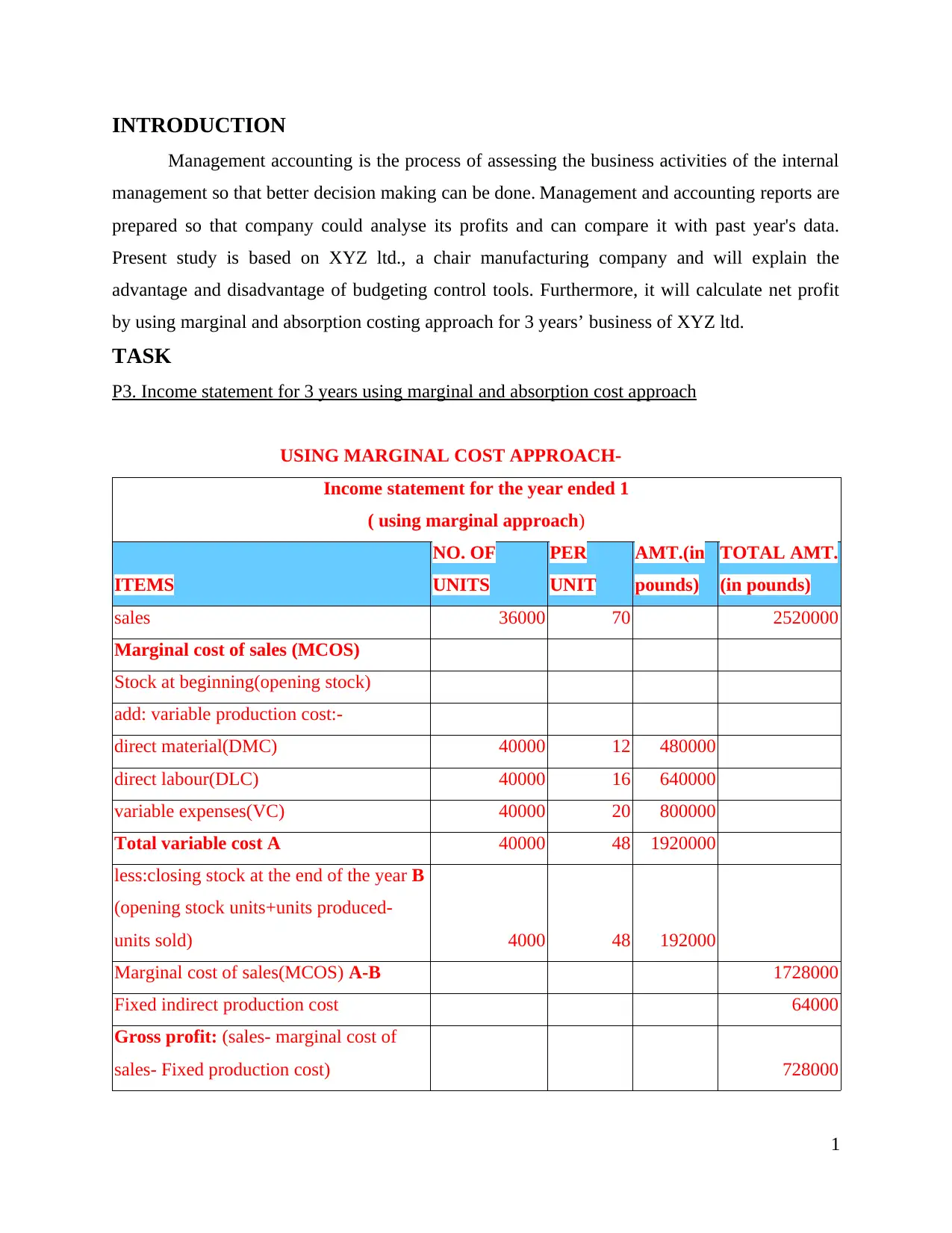

USING MARGINAL COST APPROACH-

Income statement for the year ended 1

( using marginal approach)

ITEMS

NO. OF

UNITS

PER

UNIT

AMT.(in

pounds)

TOTAL AMT.

(in pounds)

sales 36000 70 2520000

Marginal cost of sales (MCOS)

Stock at beginning(opening stock)

add: variable production cost:-

direct material(DMC) 40000 12 480000

direct labour(DLC) 40000 16 640000

variable expenses(VC) 40000 20 800000

Total variable cost A 40000 48 1920000

less:closing stock at the end of the year B

(opening stock units+units produced-

units sold) 4000 48 192000

Marginal cost of sales(MCOS) A-B 1728000

Fixed indirect production cost 64000

Gross profit: (sales- marginal cost of

sales- Fixed production cost) 728000

1

Management accounting is the process of assessing the business activities of the internal

management so that better decision making can be done. Management and accounting reports are

prepared so that company could analyse its profits and can compare it with past year's data.

Present study is based on XYZ ltd., a chair manufacturing company and will explain the

advantage and disadvantage of budgeting control tools. Furthermore, it will calculate net profit

by using marginal and absorption costing approach for 3 years’ business of XYZ ltd.

TASK

P3. Income statement for 3 years using marginal and absorption cost approach

USING MARGINAL COST APPROACH-

Income statement for the year ended 1

( using marginal approach)

ITEMS

NO. OF

UNITS

PER

UNIT

AMT.(in

pounds)

TOTAL AMT.

(in pounds)

sales 36000 70 2520000

Marginal cost of sales (MCOS)

Stock at beginning(opening stock)

add: variable production cost:-

direct material(DMC) 40000 12 480000

direct labour(DLC) 40000 16 640000

variable expenses(VC) 40000 20 800000

Total variable cost A 40000 48 1920000

less:closing stock at the end of the year B

(opening stock units+units produced-

units sold) 4000 48 192000

Marginal cost of sales(MCOS) A-B 1728000

Fixed indirect production cost 64000

Gross profit: (sales- marginal cost of

sales- Fixed production cost) 728000

1

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

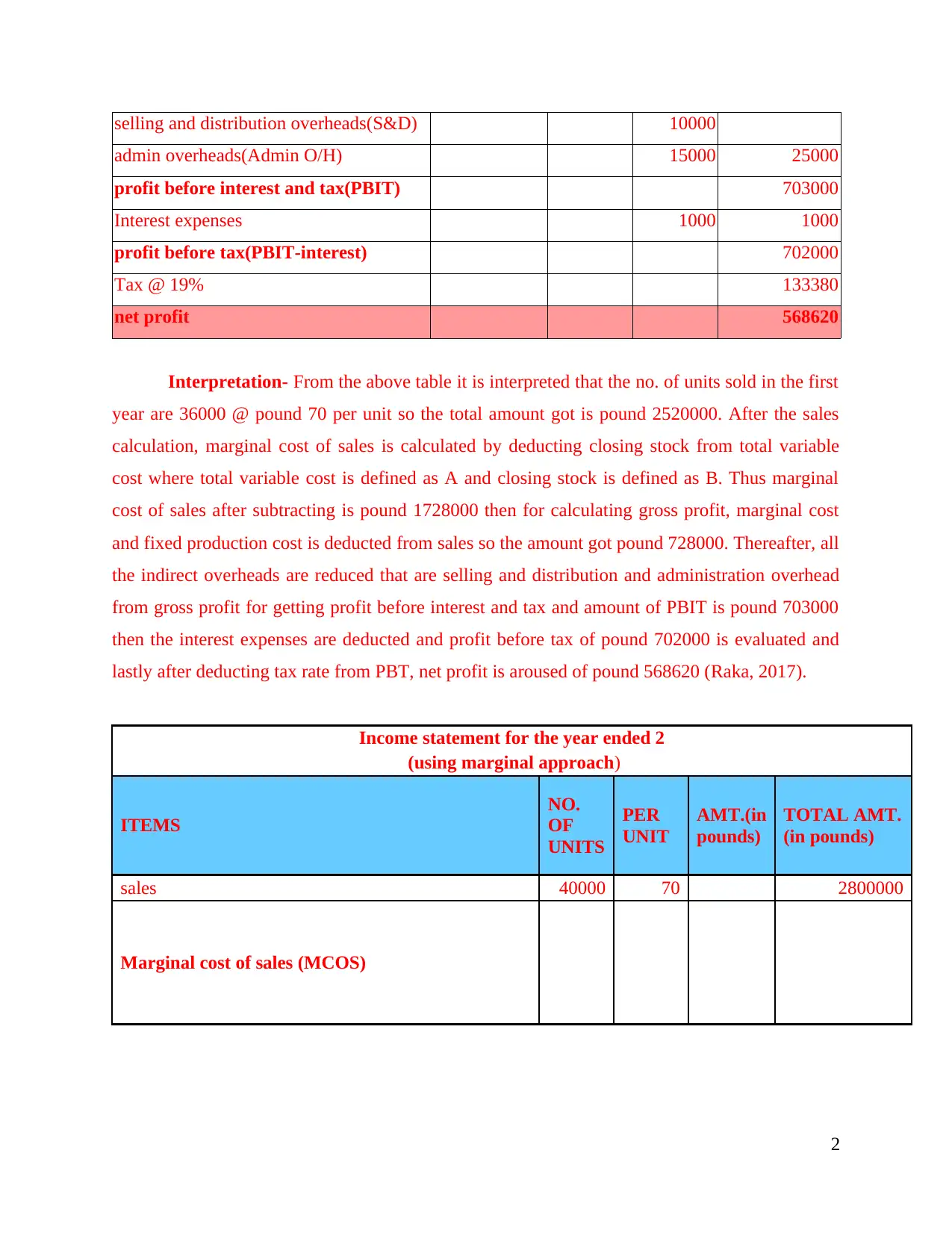

selling and distribution overheads(S&D) 10000

admin overheads(Admin O/H) 15000 25000

profit before interest and tax(PBIT) 703000

Interest expenses 1000 1000

profit before tax(PBIT-interest) 702000

Tax @ 19% 133380

net profit 568620

Interpretation- From the above table it is interpreted that the no. of units sold in the first

year are 36000 @ pound 70 per unit so the total amount got is pound 2520000. After the sales

calculation, marginal cost of sales is calculated by deducting closing stock from total variable

cost where total variable cost is defined as A and closing stock is defined as B. Thus marginal

cost of sales after subtracting is pound 1728000 then for calculating gross profit, marginal cost

and fixed production cost is deducted from sales so the amount got pound 728000. Thereafter, all

the indirect overheads are reduced that are selling and distribution and administration overhead

from gross profit for getting profit before interest and tax and amount of PBIT is pound 703000

then the interest expenses are deducted and profit before tax of pound 702000 is evaluated and

lastly after deducting tax rate from PBT, net profit is aroused of pound 568620 (Raka, 2017).

Income statement for the year ended 2

(using marginal approach)

ITEMS

NO.

OF

UNITS

PER

UNIT

AMT.(in

pounds)

TOTAL AMT.

(in pounds)

sales 40000 70 2800000

Marginal cost of sales (MCOS)

2

admin overheads(Admin O/H) 15000 25000

profit before interest and tax(PBIT) 703000

Interest expenses 1000 1000

profit before tax(PBIT-interest) 702000

Tax @ 19% 133380

net profit 568620

Interpretation- From the above table it is interpreted that the no. of units sold in the first

year are 36000 @ pound 70 per unit so the total amount got is pound 2520000. After the sales

calculation, marginal cost of sales is calculated by deducting closing stock from total variable

cost where total variable cost is defined as A and closing stock is defined as B. Thus marginal

cost of sales after subtracting is pound 1728000 then for calculating gross profit, marginal cost

and fixed production cost is deducted from sales so the amount got pound 728000. Thereafter, all

the indirect overheads are reduced that are selling and distribution and administration overhead

from gross profit for getting profit before interest and tax and amount of PBIT is pound 703000

then the interest expenses are deducted and profit before tax of pound 702000 is evaluated and

lastly after deducting tax rate from PBT, net profit is aroused of pound 568620 (Raka, 2017).

Income statement for the year ended 2

(using marginal approach)

ITEMS

NO.

OF

UNITS

PER

UNIT

AMT.(in

pounds)

TOTAL AMT.

(in pounds)

sales 40000 70 2800000

Marginal cost of sales (MCOS)

2

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

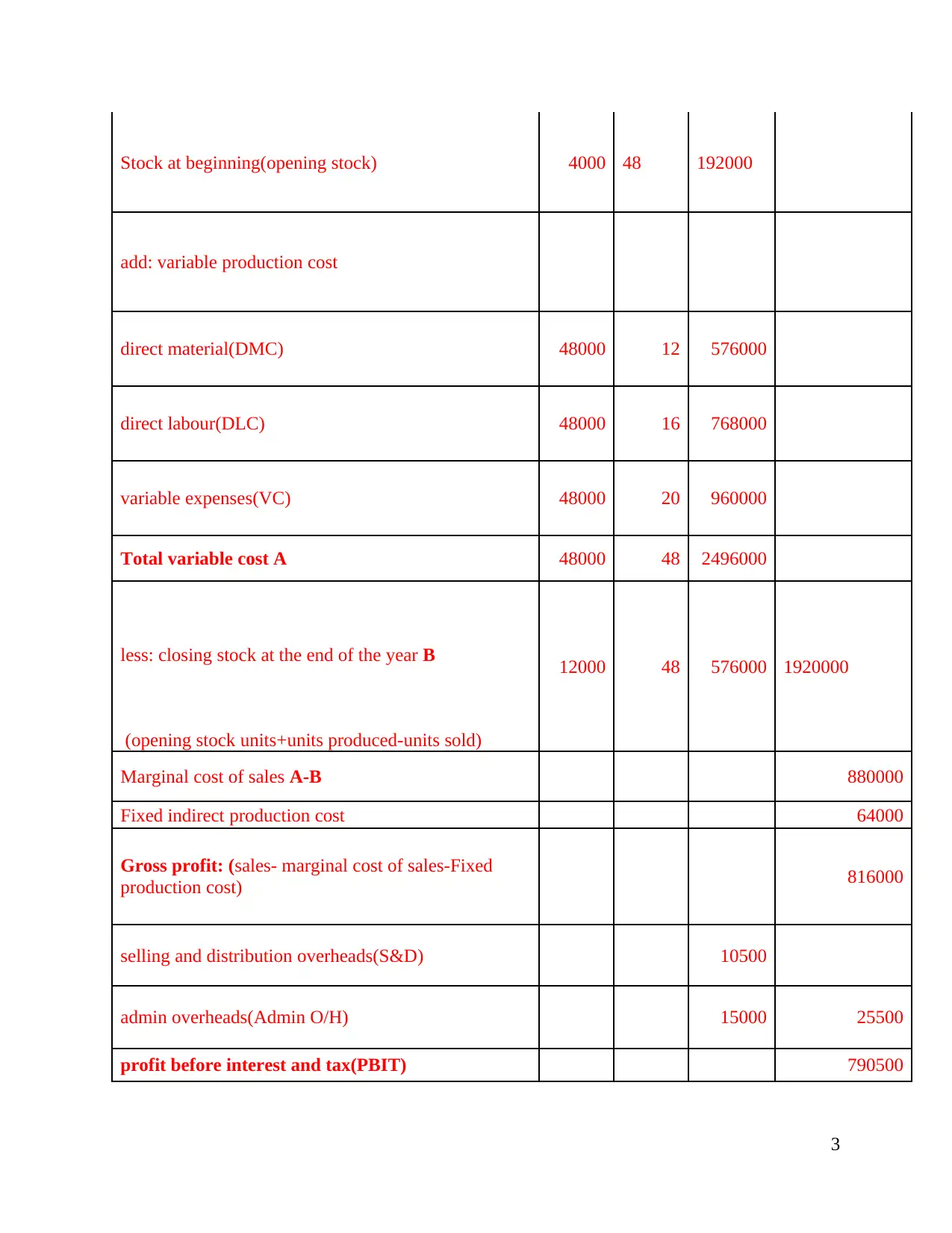

Stock at beginning(opening stock) 4000 48 192000

add: variable production cost

direct material(DMC) 48000 12 576000

direct labour(DLC) 48000 16 768000

variable expenses(VC) 48000 20 960000

Total variable cost A 48000 48 2496000

less: closing stock at the end of the year B 12000 48 576000 1920000

(opening stock units+units produced-units sold)

Marginal cost of sales A-B 880000

Fixed indirect production cost 64000

Gross profit: (sales- marginal cost of sales-Fixed

production cost) 816000

selling and distribution overheads(S&D) 10500

admin overheads(Admin O/H) 15000 25500

profit before interest and tax(PBIT) 790500

3

add: variable production cost

direct material(DMC) 48000 12 576000

direct labour(DLC) 48000 16 768000

variable expenses(VC) 48000 20 960000

Total variable cost A 48000 48 2496000

less: closing stock at the end of the year B 12000 48 576000 1920000

(opening stock units+units produced-units sold)

Marginal cost of sales A-B 880000

Fixed indirect production cost 64000

Gross profit: (sales- marginal cost of sales-Fixed

production cost) 816000

selling and distribution overheads(S&D) 10500

admin overheads(Admin O/H) 15000 25500

profit before interest and tax(PBIT) 790500

3

interest expenses 1250 1250

profit before tax(PBIT-interest) 789250

Tax @ 19% 149957.5

net profit 639292.5

Interpretation- In the second year table the sales given for the no. of units was pound

40000 @ 70 per unit so the total amount of sales realised is pound 2800000 then by subtracting

the closing stock that is B from the total variable cost that is A, marginal cost of sales is

ascertained of pound 1728000. After evaluation of MCOS, gross profit is calculated by reducing

fixed production cost and MCOS from sales that is equal to pound 1008000 then for evaluating

profit before interest and tax all the indirect cost that is overheads are deducted from gross profit

and the PBIT realised is of pound 982500 then interest expenses are subtracted and profit before

tax resulted as pound 981250 (Chi and Ho, 2017). Thus, profit before tax less tax rate the net

profit of pound 639292.5 was resulted.

Income statement for the year ended 3

(using marginal cost approach)

ITEMS

NO.

OF

UNITS

PER

UNIT

AMT.(in

pounds)

AMT.(in

pounds)

sales 60000 70 4200000

Marginal cost of sales (MCOS)

Stock at beginning(opening stock) 12000 48 576000

add: variable production cost

direct material(DMC) 51000 12 612000

direct labour(DLC) 51000 16 816000

variable expenses(VC) 51000 20 1020000

Total variable cost A 51000 48 3024000

4

profit before tax(PBIT-interest) 789250

Tax @ 19% 149957.5

net profit 639292.5

Interpretation- In the second year table the sales given for the no. of units was pound

40000 @ 70 per unit so the total amount of sales realised is pound 2800000 then by subtracting

the closing stock that is B from the total variable cost that is A, marginal cost of sales is

ascertained of pound 1728000. After evaluation of MCOS, gross profit is calculated by reducing

fixed production cost and MCOS from sales that is equal to pound 1008000 then for evaluating

profit before interest and tax all the indirect cost that is overheads are deducted from gross profit

and the PBIT realised is of pound 982500 then interest expenses are subtracted and profit before

tax resulted as pound 981250 (Chi and Ho, 2017). Thus, profit before tax less tax rate the net

profit of pound 639292.5 was resulted.

Income statement for the year ended 3

(using marginal cost approach)

ITEMS

NO.

OF

UNITS

PER

UNIT

AMT.(in

pounds)

AMT.(in

pounds)

sales 60000 70 4200000

Marginal cost of sales (MCOS)

Stock at beginning(opening stock) 12000 48 576000

add: variable production cost

direct material(DMC) 51000 12 612000

direct labour(DLC) 51000 16 816000

variable expenses(VC) 51000 20 1020000

Total variable cost A 51000 48 3024000

4

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

less: closing stock at the end of the year B

3000 48 144000 2880000

(opening stock units+ units produced-units

sold)

Marginal cost of sales A-B 1320000

Fixed indirect production cost 64000

Gross profit: (sales- marginal cost of sales-

Fixed production cost) 1256000

selling and distribution overheads(S&D) 11000

admin overheads(Admin O/H) 15000 26000

profit before interest and tax(PBIT) 1230000

interest expenses 1500 1500

profit before tax(PBIT-interest) 1228500

Tax @ 19% 233415

net profit 995085

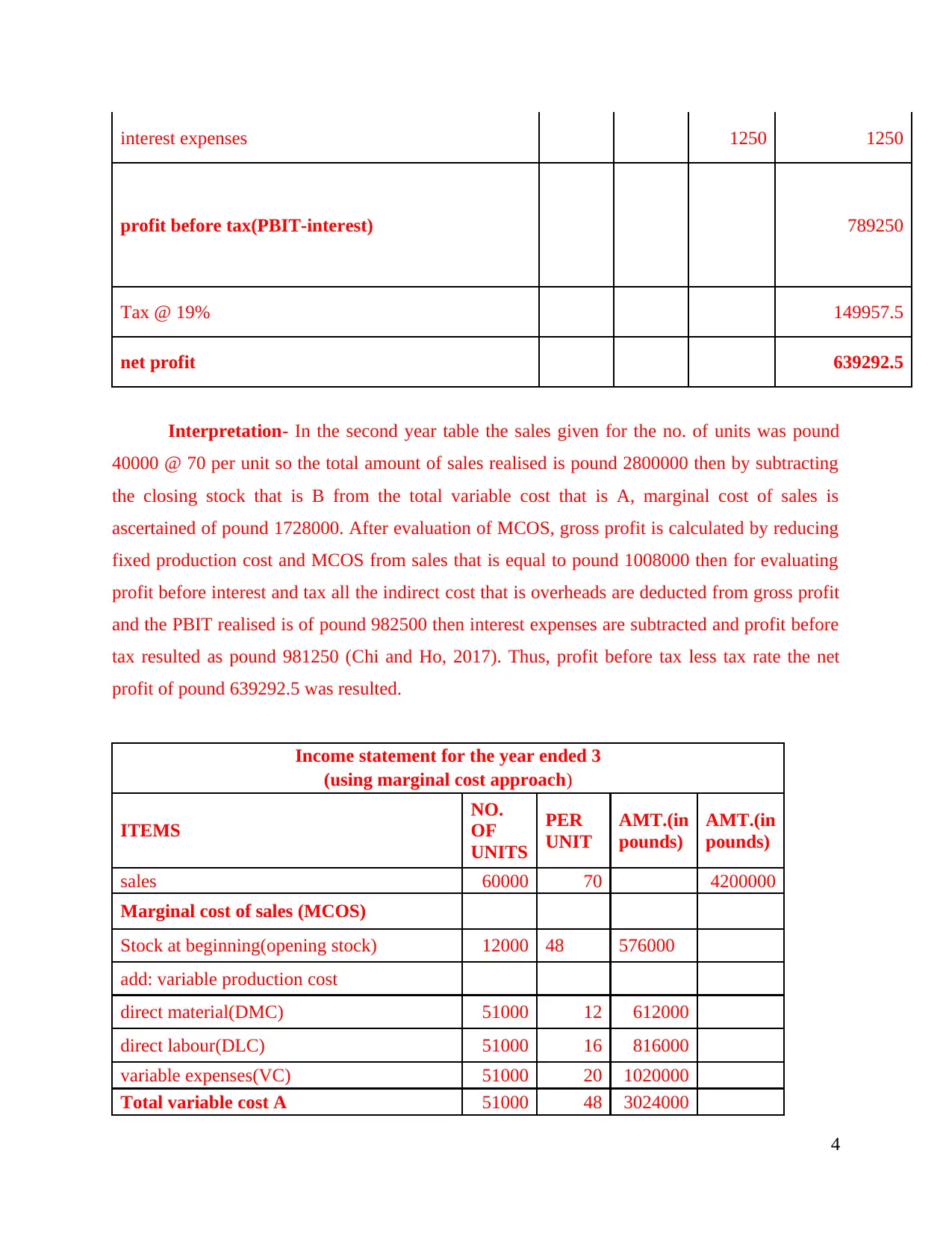

Interpretation- In the above table the sales given as pound 60000 @ 70 per unit and by

multiplying per unit with the no. of units’ total amount of sales realised as pound 4200000. after

calculating sales, marginal cost of sales is evaluated by reducing closing stock from total variable

cost which is equal to pound 3024000 then fixed indirect production cost and MCOS was

subtracted from the sales so that gross profit was ascertained of pound £1256000. Gross profit

less all the overheads, profit before interest and tax is realised of pound £1228500 and by

reducing the interest expenses from PBIT, Profit before tax is resulted of pound £1228500. Thus

PBT less tax rate @ 19% net profit was evaluated of pound £995085.

USING ABSORPTION COST APPROACH-

5

3000 48 144000 2880000

(opening stock units+ units produced-units

sold)

Marginal cost of sales A-B 1320000

Fixed indirect production cost 64000

Gross profit: (sales- marginal cost of sales-

Fixed production cost) 1256000

selling and distribution overheads(S&D) 11000

admin overheads(Admin O/H) 15000 26000

profit before interest and tax(PBIT) 1230000

interest expenses 1500 1500

profit before tax(PBIT-interest) 1228500

Tax @ 19% 233415

net profit 995085

Interpretation- In the above table the sales given as pound 60000 @ 70 per unit and by

multiplying per unit with the no. of units’ total amount of sales realised as pound 4200000. after

calculating sales, marginal cost of sales is evaluated by reducing closing stock from total variable

cost which is equal to pound 3024000 then fixed indirect production cost and MCOS was

subtracted from the sales so that gross profit was ascertained of pound £1256000. Gross profit

less all the overheads, profit before interest and tax is realised of pound £1228500 and by

reducing the interest expenses from PBIT, Profit before tax is resulted of pound £1228500. Thus

PBT less tax rate @ 19% net profit was evaluated of pound £995085.

USING ABSORPTION COST APPROACH-

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Income statement for Year 1

Using Absorption Costing Approach

ITEM

Number

of units

£

P.U.

AMOUNT

£

AMOUNT

£

SALES 36,000 70 2,520,000

MARGINAL COST OF SALES .…….. ………. ………..

OPENING STOCK 0 0

ADD: VARIABLE PRODUCTION

COST: ………… ……… ………..

Direct Material 40000 12 480000

Direct Labour 40000 16 640000

Variable Expenses 40000 20 800000

Fixed indirect production cost 64000 64000

Total Production Cost A 1984000

Less: Closing stock - end of year 1.

B. [Opening stock units+units

produced - units sold] use formula to

calculate amount

4000 198400

Cost of SALES : A-B: 1,785,600

Gross Profit: Sales - Cost of Sales : 734,400

Selling and Distribution Overheads 10000

Admin Overheads 15000 25000

Profit from operations Before

Interest & Tax (PBIT) 709,400

Interest Expenses 1000 1000

Probit Before Tax [PBIT-interest] 708,400

Tax @19% 134596

Net Profit 573,804

6

Using Absorption Costing Approach

ITEM

Number

of units

£

P.U.

AMOUNT

£

AMOUNT

£

SALES 36,000 70 2,520,000

MARGINAL COST OF SALES .…….. ………. ………..

OPENING STOCK 0 0

ADD: VARIABLE PRODUCTION

COST: ………… ……… ………..

Direct Material 40000 12 480000

Direct Labour 40000 16 640000

Variable Expenses 40000 20 800000

Fixed indirect production cost 64000 64000

Total Production Cost A 1984000

Less: Closing stock - end of year 1.

B. [Opening stock units+units

produced - units sold] use formula to

calculate amount

4000 198400

Cost of SALES : A-B: 1,785,600

Gross Profit: Sales - Cost of Sales : 734,400

Selling and Distribution Overheads 10000

Admin Overheads 15000 25000

Profit from operations Before

Interest & Tax (PBIT) 709,400

Interest Expenses 1000 1000

Probit Before Tax [PBIT-interest] 708,400

Tax @19% 134596

Net Profit 573,804

6

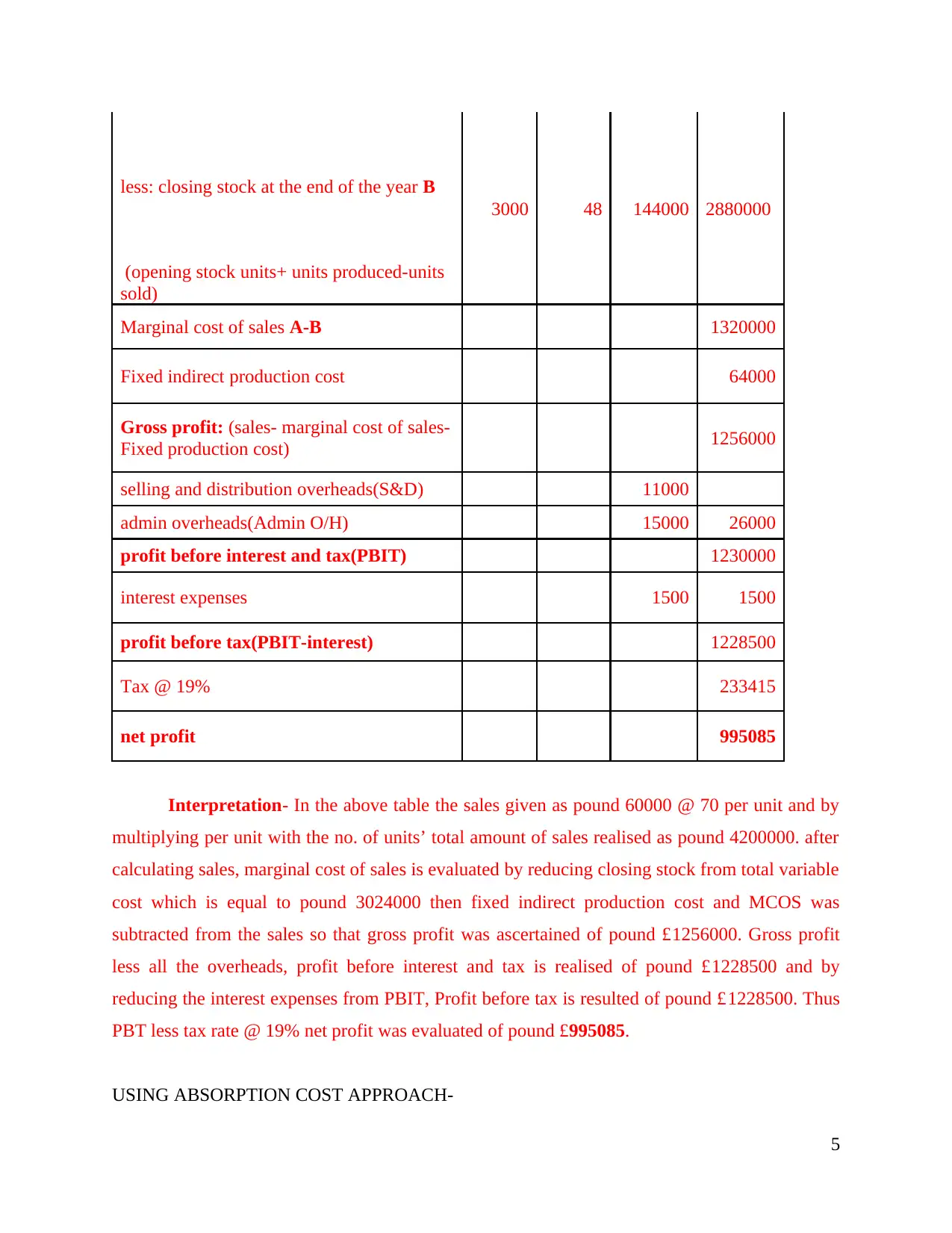

Interpretation- From the above table by using absorption costing approach the number

of units of sales was given of pound 36000 @ 70 per unit so the amount by multiplication is

resulted of pound 2520000 and by deducting cost of goods sold of pound 1984000 from the

sales, gross profit was realised of pound 734400. For evaluation of net operating income or net

profit all the operating expenses that are selling, administration and interest are subtracted from

the gross profit which was equal to pound 26000. Thus, the net profit was resulted of pound

573804.

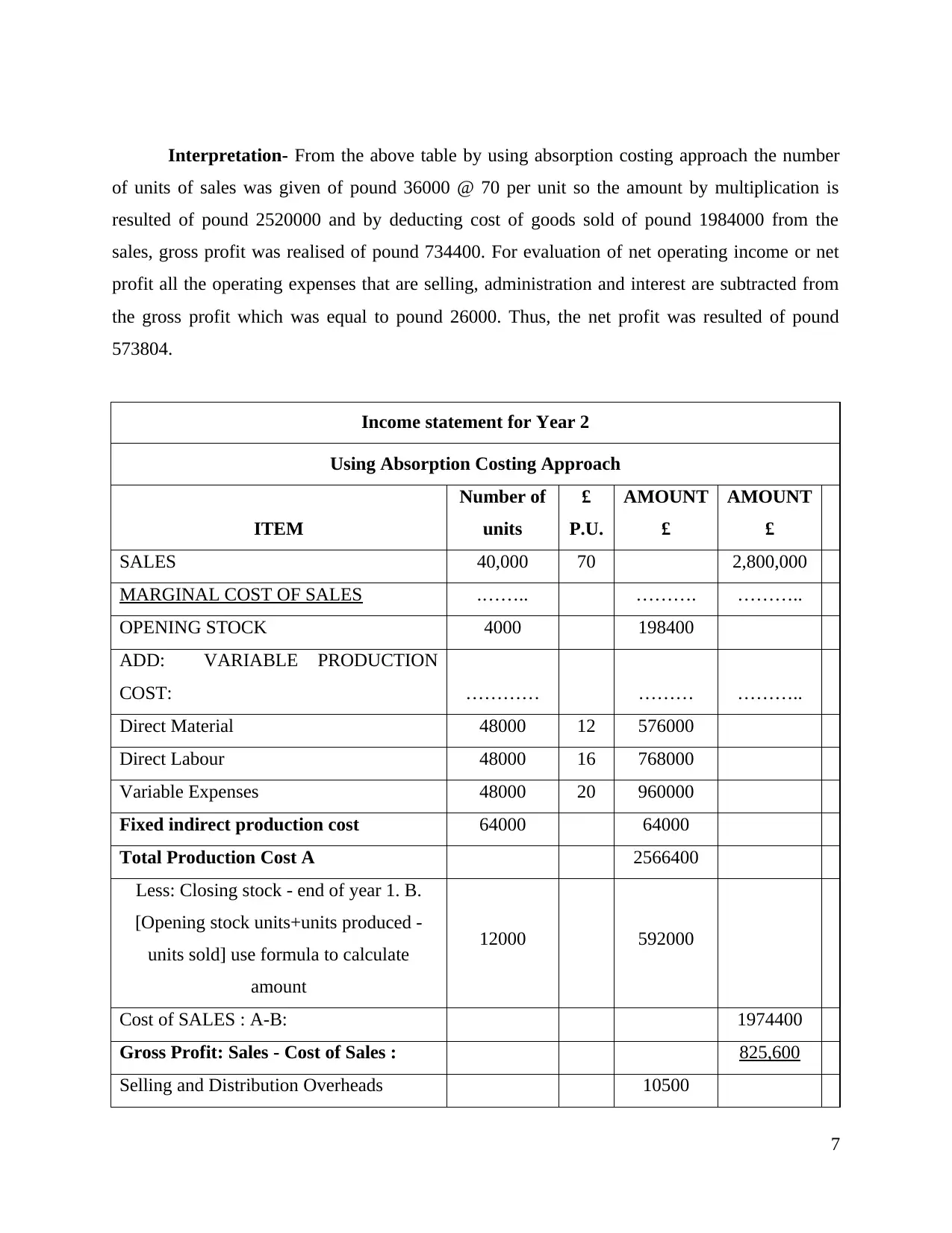

Income statement for Year 2

Using Absorption Costing Approach

ITEM

Number of

units

£

P.U.

AMOUNT

£

AMOUNT

£

SALES 40,000 70 2,800,000

MARGINAL COST OF SALES .…….. ………. ………..

OPENING STOCK 4000 198400

ADD: VARIABLE PRODUCTION

COST: ………… ……… ………..

Direct Material 48000 12 576000

Direct Labour 48000 16 768000

Variable Expenses 48000 20 960000

Fixed indirect production cost 64000 64000

Total Production Cost A 2566400

Less: Closing stock - end of year 1. B.

[Opening stock units+units produced -

units sold] use formula to calculate

amount

12000 592000

Cost of SALES : A-B: 1974400

Gross Profit: Sales - Cost of Sales : 825,600

Selling and Distribution Overheads 10500

7

of units of sales was given of pound 36000 @ 70 per unit so the amount by multiplication is

resulted of pound 2520000 and by deducting cost of goods sold of pound 1984000 from the

sales, gross profit was realised of pound 734400. For evaluation of net operating income or net

profit all the operating expenses that are selling, administration and interest are subtracted from

the gross profit which was equal to pound 26000. Thus, the net profit was resulted of pound

573804.

Income statement for Year 2

Using Absorption Costing Approach

ITEM

Number of

units

£

P.U.

AMOUNT

£

AMOUNT

£

SALES 40,000 70 2,800,000

MARGINAL COST OF SALES .…….. ………. ………..

OPENING STOCK 4000 198400

ADD: VARIABLE PRODUCTION

COST: ………… ……… ………..

Direct Material 48000 12 576000

Direct Labour 48000 16 768000

Variable Expenses 48000 20 960000

Fixed indirect production cost 64000 64000

Total Production Cost A 2566400

Less: Closing stock - end of year 1. B.

[Opening stock units+units produced -

units sold] use formula to calculate

amount

12000 592000

Cost of SALES : A-B: 1974400

Gross Profit: Sales - Cost of Sales : 825,600

Selling and Distribution Overheads 10500

7

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

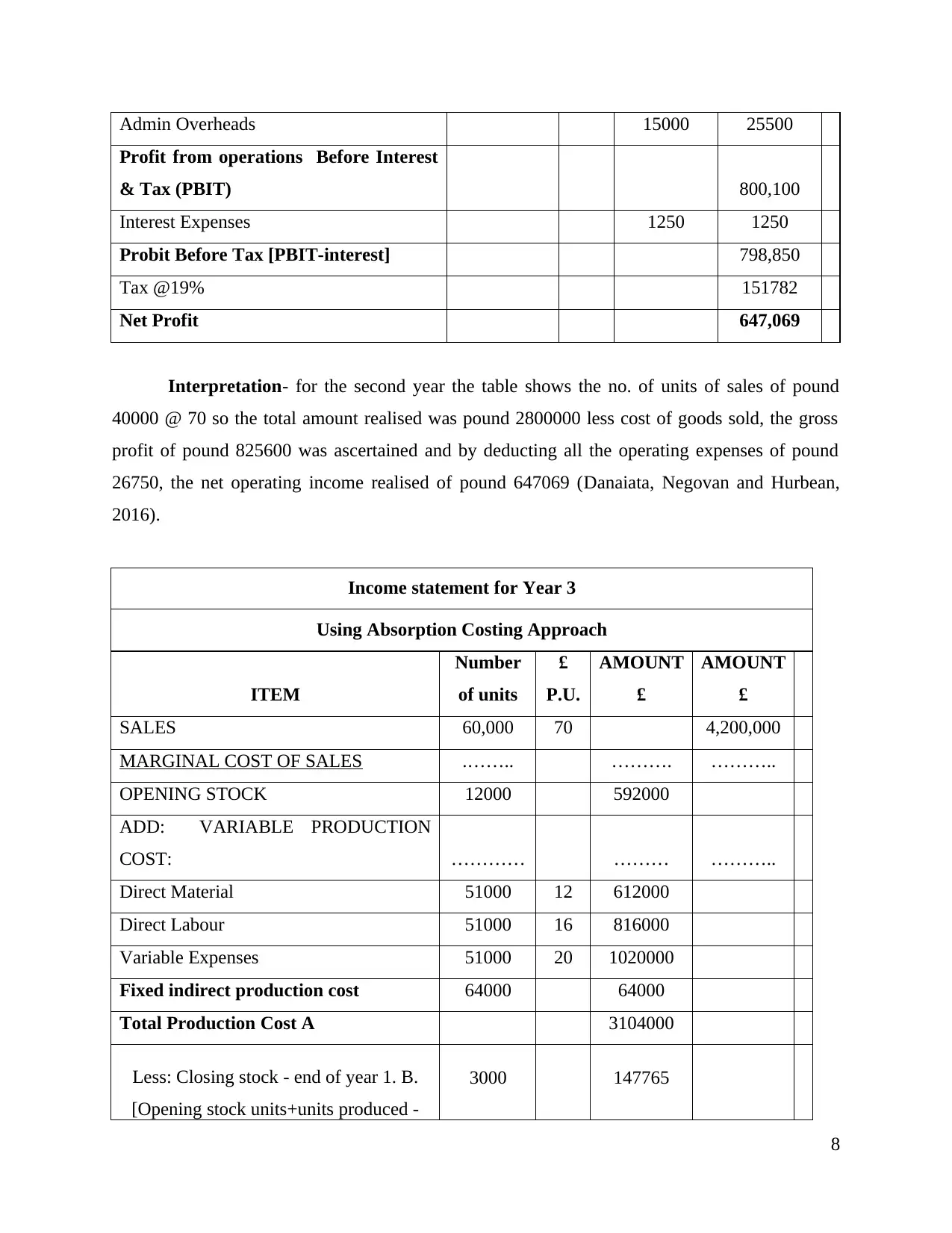

Admin Overheads 15000 25500

Profit from operations Before Interest

& Tax (PBIT) 800,100

Interest Expenses 1250 1250

Probit Before Tax [PBIT-interest] 798,850

Tax @19% 151782

Net Profit 647,069

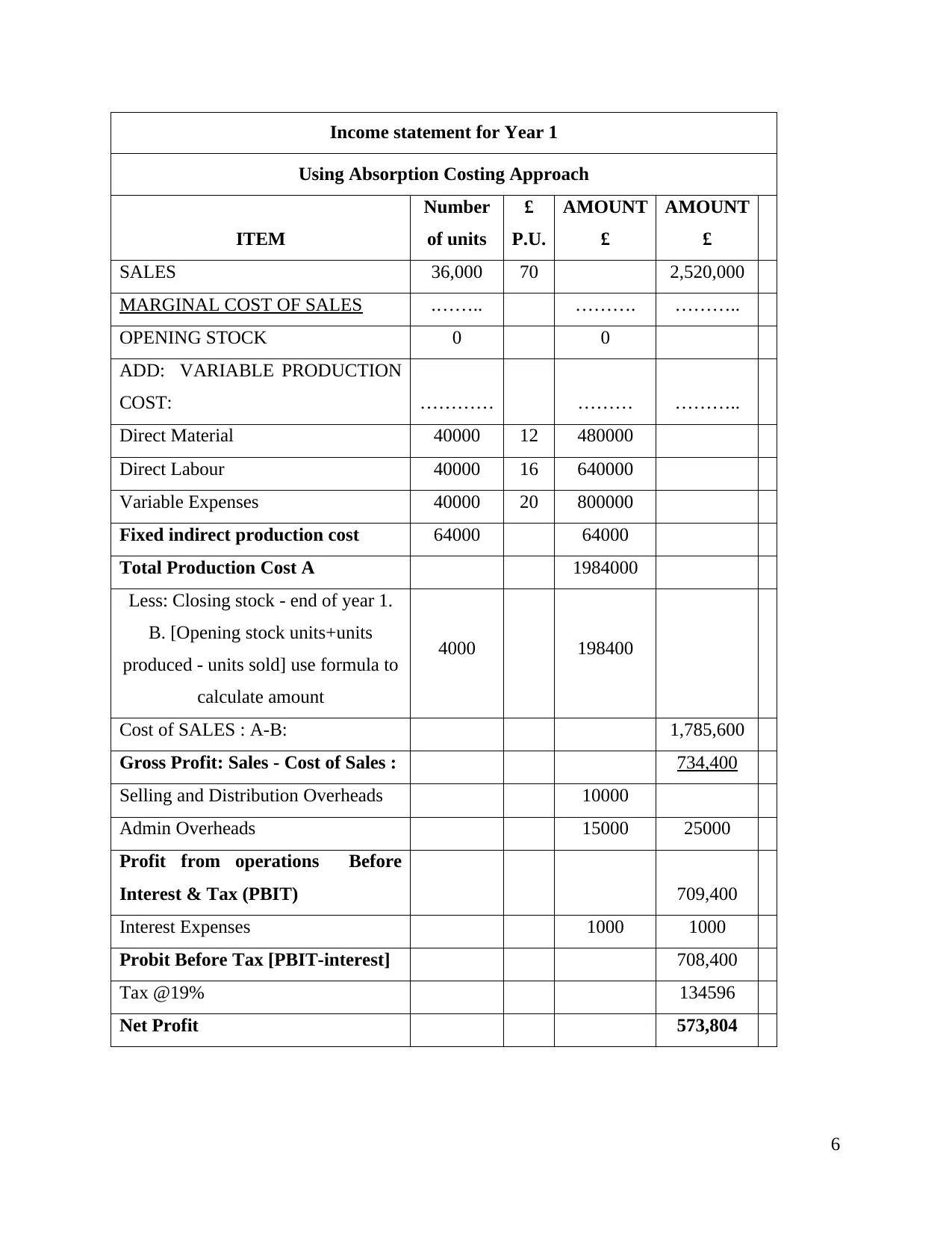

Interpretation- for the second year the table shows the no. of units of sales of pound

40000 @ 70 so the total amount realised was pound 2800000 less cost of goods sold, the gross

profit of pound 825600 was ascertained and by deducting all the operating expenses of pound

26750, the net operating income realised of pound 647069 (Danaiata, Negovan and Hurbean,

2016).

Income statement for Year 3

Using Absorption Costing Approach

ITEM

Number

of units

£

P.U.

AMOUNT

£

AMOUNT

£

SALES 60,000 70 4,200,000

MARGINAL COST OF SALES .…….. ………. ………..

OPENING STOCK 12000 592000

ADD: VARIABLE PRODUCTION

COST: ………… ……… ………..

Direct Material 51000 12 612000

Direct Labour 51000 16 816000

Variable Expenses 51000 20 1020000

Fixed indirect production cost 64000 64000

Total Production Cost A 3104000

Less: Closing stock - end of year 1. B.

[Opening stock units+units produced -

3000 147765

8

Profit from operations Before Interest

& Tax (PBIT) 800,100

Interest Expenses 1250 1250

Probit Before Tax [PBIT-interest] 798,850

Tax @19% 151782

Net Profit 647,069

Interpretation- for the second year the table shows the no. of units of sales of pound

40000 @ 70 so the total amount realised was pound 2800000 less cost of goods sold, the gross

profit of pound 825600 was ascertained and by deducting all the operating expenses of pound

26750, the net operating income realised of pound 647069 (Danaiata, Negovan and Hurbean,

2016).

Income statement for Year 3

Using Absorption Costing Approach

ITEM

Number

of units

£

P.U.

AMOUNT

£

AMOUNT

£

SALES 60,000 70 4,200,000

MARGINAL COST OF SALES .…….. ………. ………..

OPENING STOCK 12000 592000

ADD: VARIABLE PRODUCTION

COST: ………… ……… ………..

Direct Material 51000 12 612000

Direct Labour 51000 16 816000

Variable Expenses 51000 20 1020000

Fixed indirect production cost 64000 64000

Total Production Cost A 3104000

Less: Closing stock - end of year 1. B.

[Opening stock units+units produced -

3000 147765

8

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

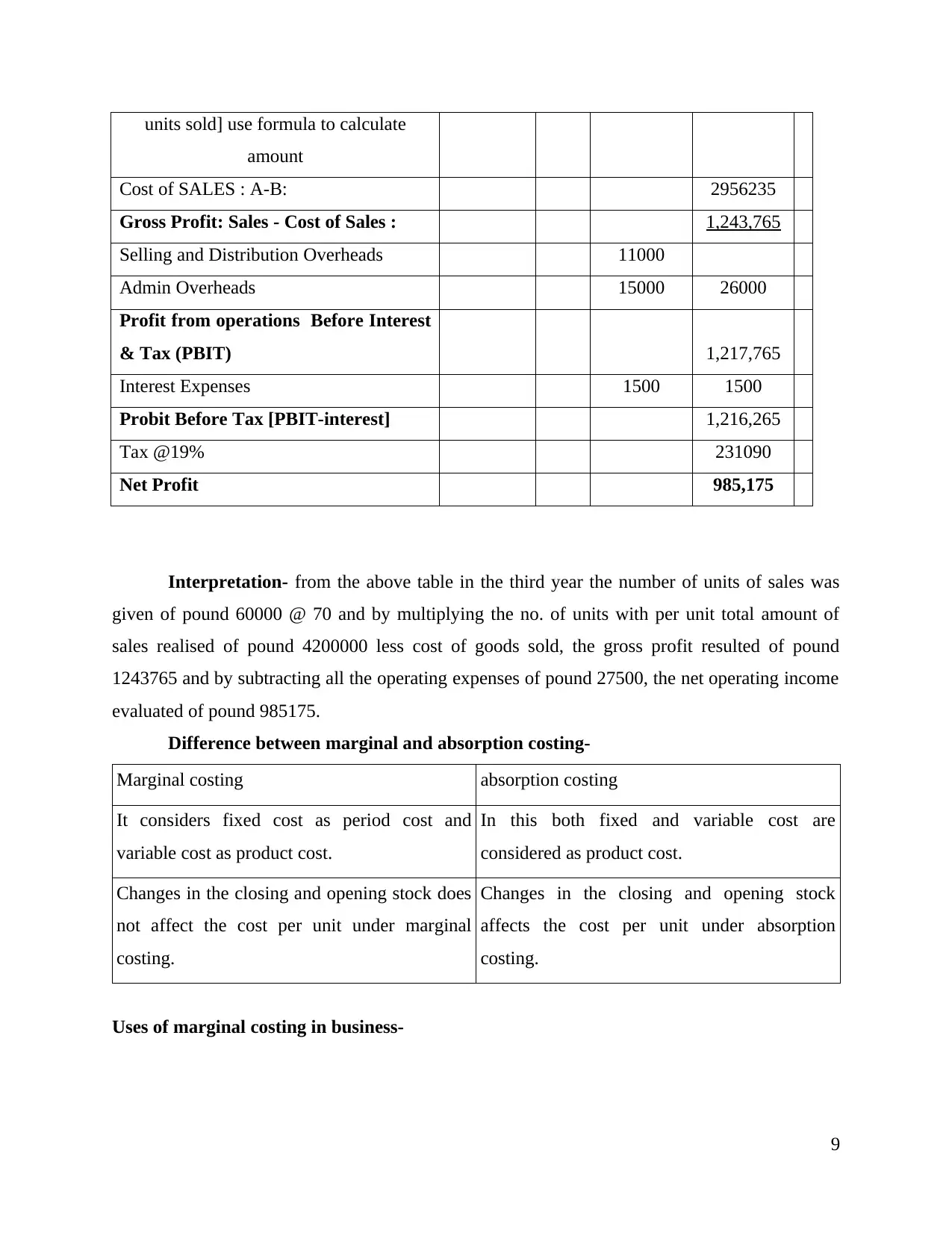

units sold] use formula to calculate

amount

Cost of SALES : A-B: 2956235

Gross Profit: Sales - Cost of Sales : 1,243,765

Selling and Distribution Overheads 11000

Admin Overheads 15000 26000

Profit from operations Before Interest

& Tax (PBIT) 1,217,765

Interest Expenses 1500 1500

Probit Before Tax [PBIT-interest] 1,216,265

Tax @19% 231090

Net Profit 985,175

Interpretation- from the above table in the third year the number of units of sales was

given of pound 60000 @ 70 and by multiplying the no. of units with per unit total amount of

sales realised of pound 4200000 less cost of goods sold, the gross profit resulted of pound

1243765 and by subtracting all the operating expenses of pound 27500, the net operating income

evaluated of pound 985175.

Difference between marginal and absorption costing-

Marginal costing absorption costing

It considers fixed cost as period cost and

variable cost as product cost.

In this both fixed and variable cost are

considered as product cost.

Changes in the closing and opening stock does

not affect the cost per unit under marginal

costing.

Changes in the closing and opening stock

affects the cost per unit under absorption

costing.

Uses of marginal costing in business-

9

amount

Cost of SALES : A-B: 2956235

Gross Profit: Sales - Cost of Sales : 1,243,765

Selling and Distribution Overheads 11000

Admin Overheads 15000 26000

Profit from operations Before Interest

& Tax (PBIT) 1,217,765

Interest Expenses 1500 1500

Probit Before Tax [PBIT-interest] 1,216,265

Tax @19% 231090

Net Profit 985,175

Interpretation- from the above table in the third year the number of units of sales was

given of pound 60000 @ 70 and by multiplying the no. of units with per unit total amount of

sales realised of pound 4200000 less cost of goods sold, the gross profit resulted of pound

1243765 and by subtracting all the operating expenses of pound 27500, the net operating income

evaluated of pound 985175.

Difference between marginal and absorption costing-

Marginal costing absorption costing

It considers fixed cost as period cost and

variable cost as product cost.

In this both fixed and variable cost are

considered as product cost.

Changes in the closing and opening stock does

not affect the cost per unit under marginal

costing.

Changes in the closing and opening stock

affects the cost per unit under absorption

costing.

Uses of marginal costing in business-

9

It enables the business in decision making and facilitates the profit volume ratio so that

XYZ ltd can compare the 3 years’ profit and can analyse the reasons of changes in the profits

each year.

Reason for difference in the profit by using different approach is-

As absorption costing consider fixed cost and variable both as the product cost so the net

profits get reduced in comparison with the marginal cost because marginal cost considers fixed

cost as period cost.

P4. Advantages and disadvantages of budgeting control techniques

Budgeting means preparation of a plan for a future period in numerical values. XYZ ltd.

adopts different techniques for preparation of budget like flexible budget, cash budget, fixed

budget, sales budget and zero based budgeting (Saha, 2017). It facilitates comparison and

performance measurement across different levels in the enterprise from year to year.

BUDGETARY TOOLS ARE-

Fixed budget-

Fixed budget is a plan that remains fixed and static means it does not change in respect of

any change in the other variables like sales, income etc of XYZ ltd. It is also called as a static

budget.

Advantages of fixed budget-

1) Remains static- The main advantage is that it remains same and does not change with the

change in other variable activities so that the valuation becomes easy and saves the time and

money of the XYZ ltd.

2)Best for fixed income people- It is best suited for fixed income people as the person having

fixed income can plan their expenditure for the whole year and could match and balance out with

each month's salary (Abdallah, 2017).

3)Easy reviewing- reviewing the budget is the most hectic task so fixed budget makes it easy as

the amount will not be varying from one month to another and the reviewing becomes simple for

the manager.

Disadvantages of fixed budget-

10

XYZ ltd can compare the 3 years’ profit and can analyse the reasons of changes in the profits

each year.

Reason for difference in the profit by using different approach is-

As absorption costing consider fixed cost and variable both as the product cost so the net

profits get reduced in comparison with the marginal cost because marginal cost considers fixed

cost as period cost.

P4. Advantages and disadvantages of budgeting control techniques

Budgeting means preparation of a plan for a future period in numerical values. XYZ ltd.

adopts different techniques for preparation of budget like flexible budget, cash budget, fixed

budget, sales budget and zero based budgeting (Saha, 2017). It facilitates comparison and

performance measurement across different levels in the enterprise from year to year.

BUDGETARY TOOLS ARE-

Fixed budget-

Fixed budget is a plan that remains fixed and static means it does not change in respect of

any change in the other variables like sales, income etc of XYZ ltd. It is also called as a static

budget.

Advantages of fixed budget-

1) Remains static- The main advantage is that it remains same and does not change with the

change in other variable activities so that the valuation becomes easy and saves the time and

money of the XYZ ltd.

2)Best for fixed income people- It is best suited for fixed income people as the person having

fixed income can plan their expenditure for the whole year and could match and balance out with

each month's salary (Abdallah, 2017).

3)Easy reviewing- reviewing the budget is the most hectic task so fixed budget makes it easy as

the amount will not be varying from one month to another and the reviewing becomes simple for

the manager.

Disadvantages of fixed budget-

10

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 16

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.