Managerial Accounting

VerifiedAdded on 2022/12/27

|22

|5649

|1

AI Summary

This report discusses various concepts of managerial accounting such as ratio analysis, budgetary control, variance analysis, variable costing, and absorption costing.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Running Head: Managerial Accounting

1

Project Report: Managerial Accounting

1

Project Report: Managerial Accounting

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Managerial Accounting

2

Contents

Part 1.................................................................................................................................3

Introduction...................................................................................................................3

Ratio analysis................................................................................................................3

Budgetary control.........................................................................................................5

Variance analysis..........................................................................................................6

Variable costing............................................................................................................8

Absorption costing......................................................................................................10

Conclusion..................................................................................................................11

Part 2...............................................................................................................................12

2.1...............................................................................................................................12

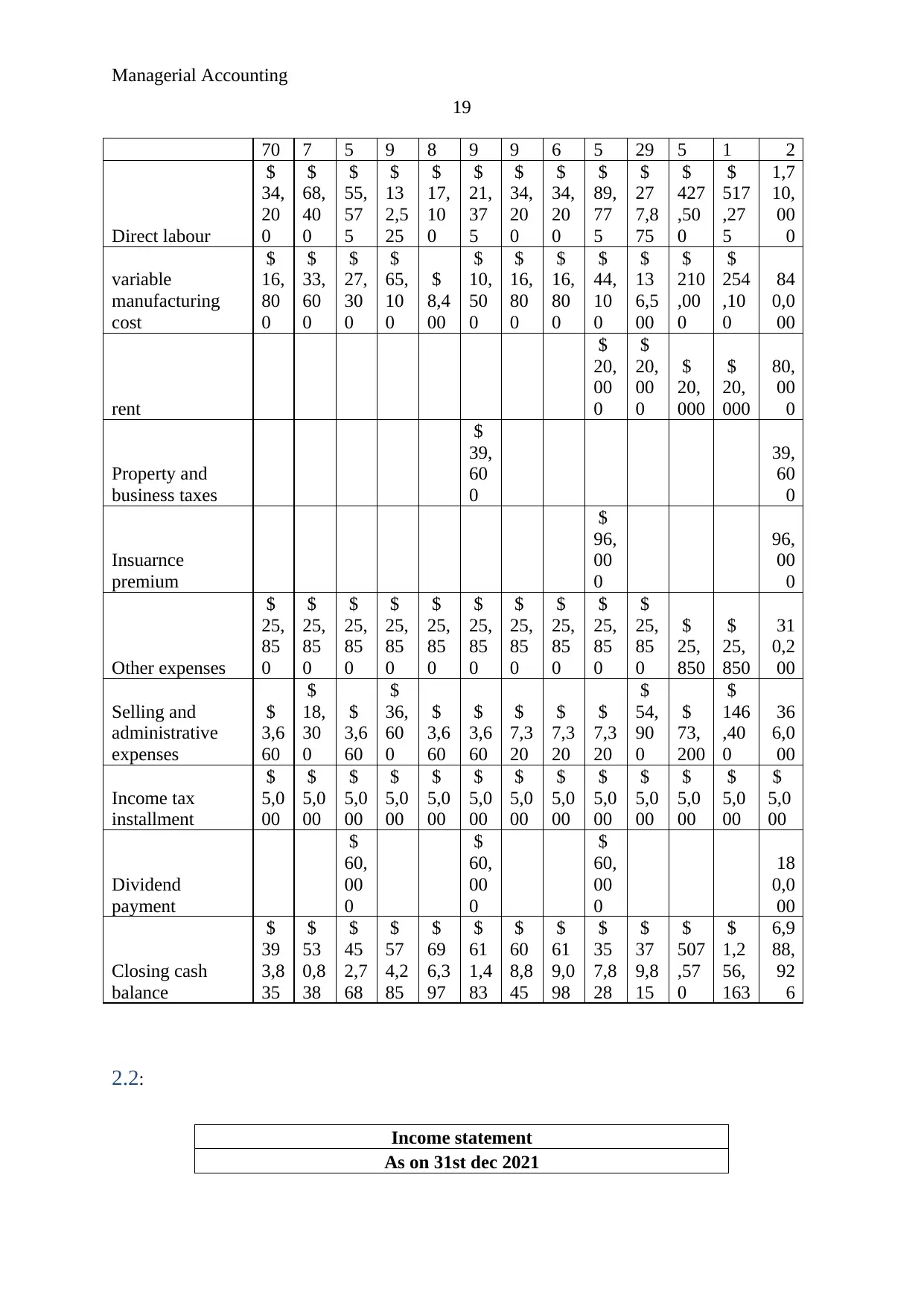

2.2...............................................................................................................................18

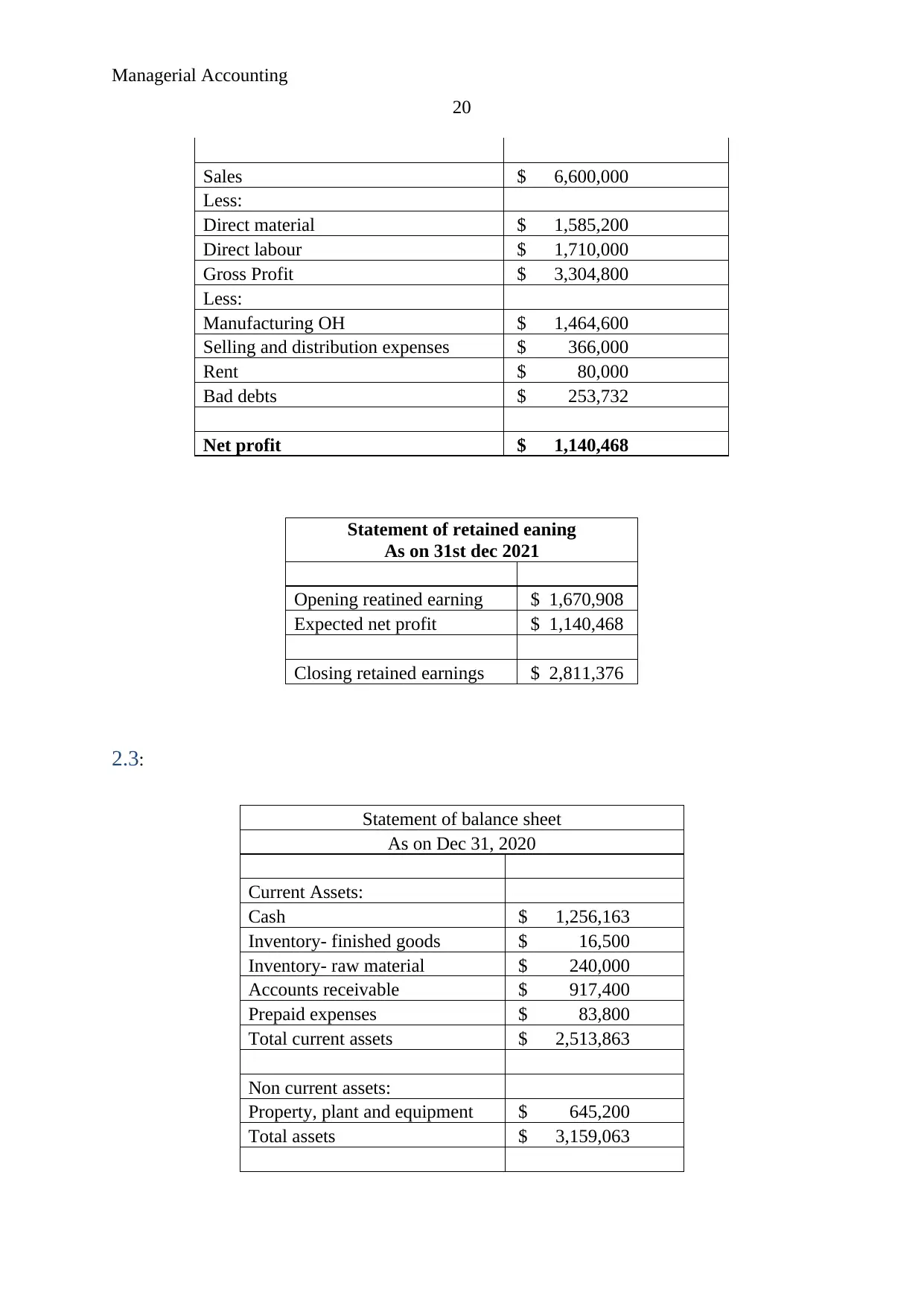

2.3...............................................................................................................................19

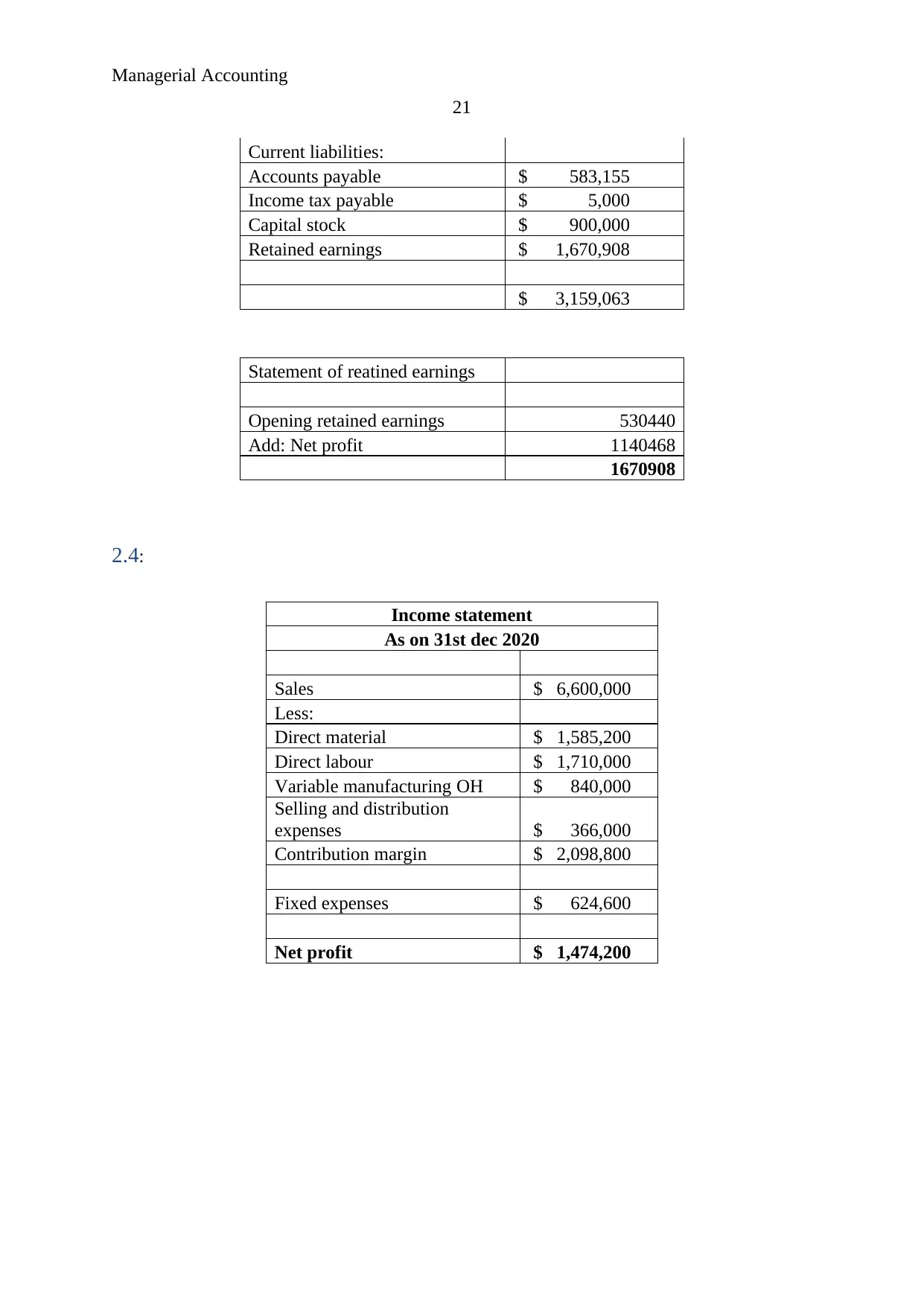

2.4...............................................................................................................................19

References.......................................................................................................................21

2

Contents

Part 1.................................................................................................................................3

Introduction...................................................................................................................3

Ratio analysis................................................................................................................3

Budgetary control.........................................................................................................5

Variance analysis..........................................................................................................6

Variable costing............................................................................................................8

Absorption costing......................................................................................................10

Conclusion..................................................................................................................11

Part 2...............................................................................................................................12

2.1...............................................................................................................................12

2.2...............................................................................................................................18

2.3...............................................................................................................................19

2.4...............................................................................................................................19

References.......................................................................................................................21

Managerial Accounting

3

Part 1:

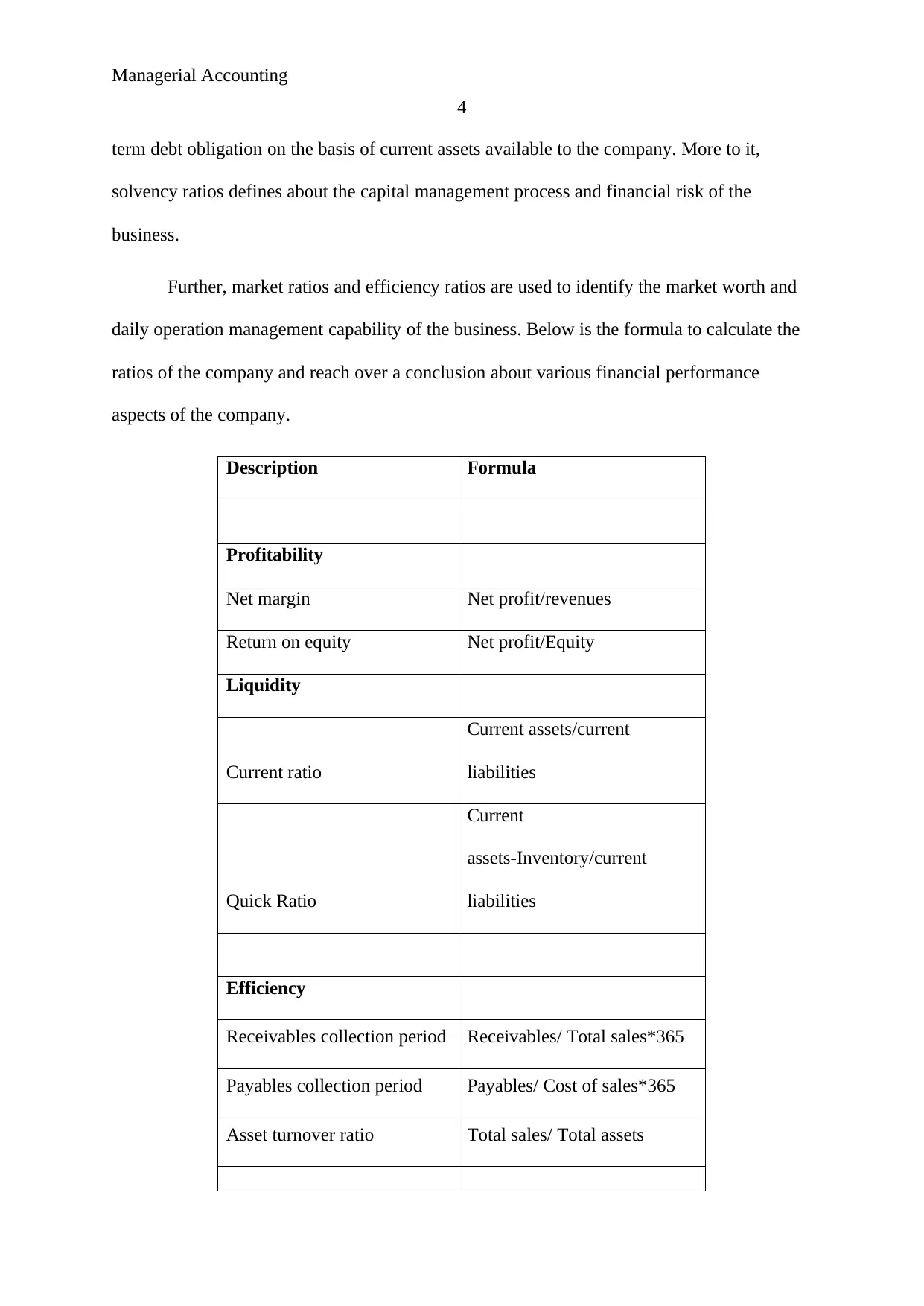

Introduction:

Managerial accounting is a broad concept which covers various applications and

method to apply over an organization in order to maintain the performance of the business

and reach over a decision. It is important for a business entity to look over these methods and

identify, evaluate and record all the financial contract into the company’s books to keep a

track over the performance of the company. The main accounting methods are ratio analysis,

budget analysis, variance analysis, variable costing and absorption costing. In the report,

these methods have been studied and applied over the professional life to measure their

impact.

Ratio analysis:

Ratio analysis is an accounting method which is applied over the financial statement

of the business to measure the financial performance of the business. The main aim of ratio

analysis is to summarize the financial statement of the organization and brief about the key

financial aspect of the company. It offers a quick indication about the financial performance

of the company through gathering the data from the financial statement of the company. In

accounting, ratios are categorized into various forms such as liquidity ratios, profitability

ratios, solvency ratios, debt management ratios, market value ratios etc. (Kaplan & Atkinson,

2015).

All of these ratios define about the different financial aspect of the company. Such as

profitability ratios are used in the organization to calculate the overall profitability

performance of the company against the total sales, equity, assets etc of the company.

Further, liquidity ratios are calculated to identify whether the company is able to pay the short

3

Part 1:

Introduction:

Managerial accounting is a broad concept which covers various applications and

method to apply over an organization in order to maintain the performance of the business

and reach over a decision. It is important for a business entity to look over these methods and

identify, evaluate and record all the financial contract into the company’s books to keep a

track over the performance of the company. The main accounting methods are ratio analysis,

budget analysis, variance analysis, variable costing and absorption costing. In the report,

these methods have been studied and applied over the professional life to measure their

impact.

Ratio analysis:

Ratio analysis is an accounting method which is applied over the financial statement

of the business to measure the financial performance of the business. The main aim of ratio

analysis is to summarize the financial statement of the organization and brief about the key

financial aspect of the company. It offers a quick indication about the financial performance

of the company through gathering the data from the financial statement of the company. In

accounting, ratios are categorized into various forms such as liquidity ratios, profitability

ratios, solvency ratios, debt management ratios, market value ratios etc. (Kaplan & Atkinson,

2015).

All of these ratios define about the different financial aspect of the company. Such as

profitability ratios are used in the organization to calculate the overall profitability

performance of the company against the total sales, equity, assets etc of the company.

Further, liquidity ratios are calculated to identify whether the company is able to pay the short

Managerial Accounting

4

term debt obligation on the basis of current assets available to the company. More to it,

solvency ratios defines about the capital management process and financial risk of the

business.

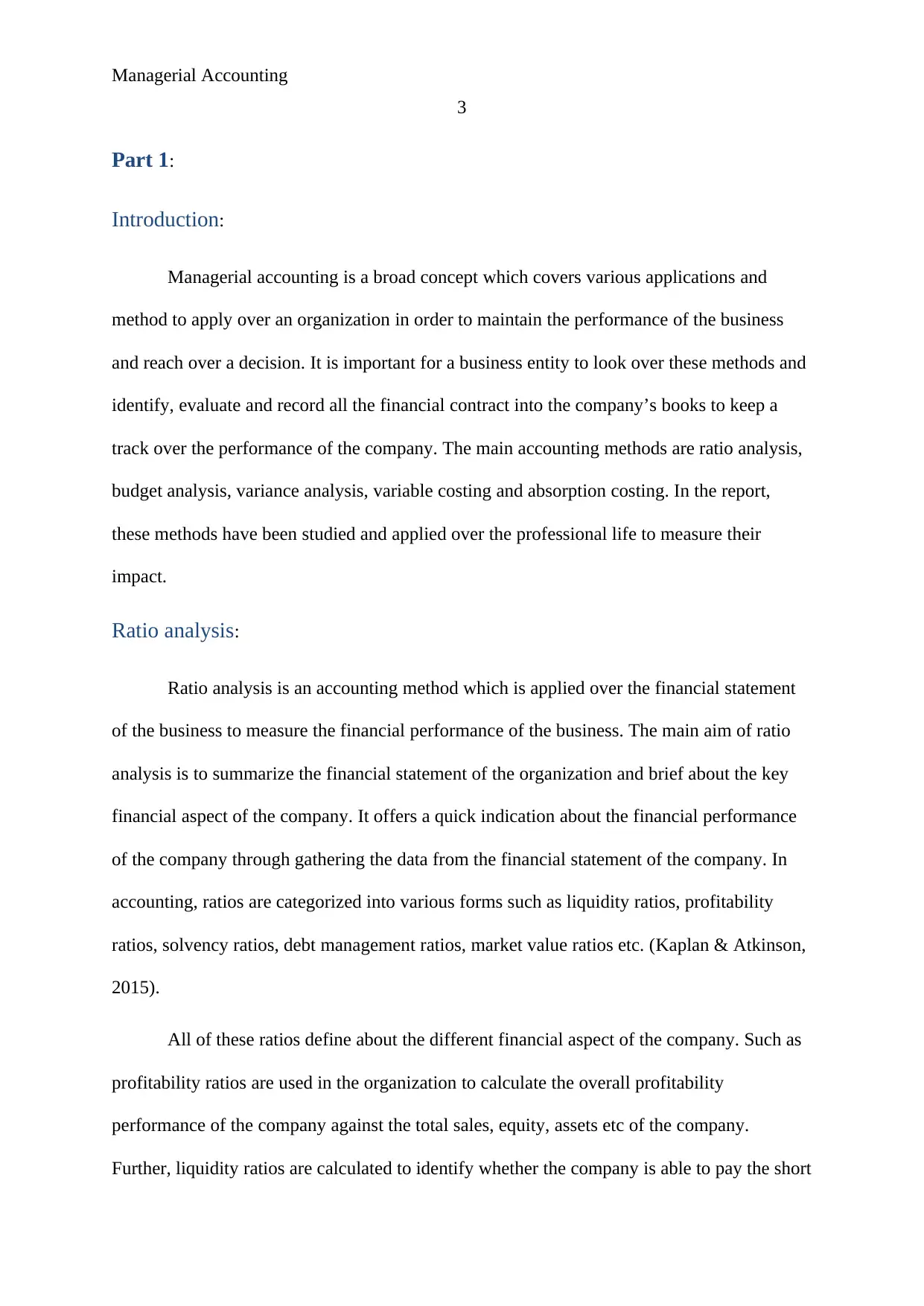

Further, market ratios and efficiency ratios are used to identify the market worth and

daily operation management capability of the business. Below is the formula to calculate the

ratios of the company and reach over a conclusion about various financial performance

aspects of the company.

Description Formula

Profitability

Net margin Net profit/revenues

Return on equity Net profit/Equity

Liquidity

Current ratio

Current assets/current

liabilities

Quick Ratio

Current

assets-Inventory/current

liabilities

Efficiency

Receivables collection period Receivables/ Total sales*365

Payables collection period Payables/ Cost of sales*365

Asset turnover ratio Total sales/ Total assets

4

term debt obligation on the basis of current assets available to the company. More to it,

solvency ratios defines about the capital management process and financial risk of the

business.

Further, market ratios and efficiency ratios are used to identify the market worth and

daily operation management capability of the business. Below is the formula to calculate the

ratios of the company and reach over a conclusion about various financial performance

aspects of the company.

Description Formula

Profitability

Net margin Net profit/revenues

Return on equity Net profit/Equity

Liquidity

Current ratio

Current assets/current

liabilities

Quick Ratio

Current

assets-Inventory/current

liabilities

Efficiency

Receivables collection period Receivables/ Total sales*365

Payables collection period Payables/ Cost of sales*365

Asset turnover ratio Total sales/ Total assets

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Managerial Accounting

5

Solvency

Debt to Equity Ratio Debt/ Equity

Debt to assets Debt/ Total assets

(Kaplan & Atkinson, 2015)

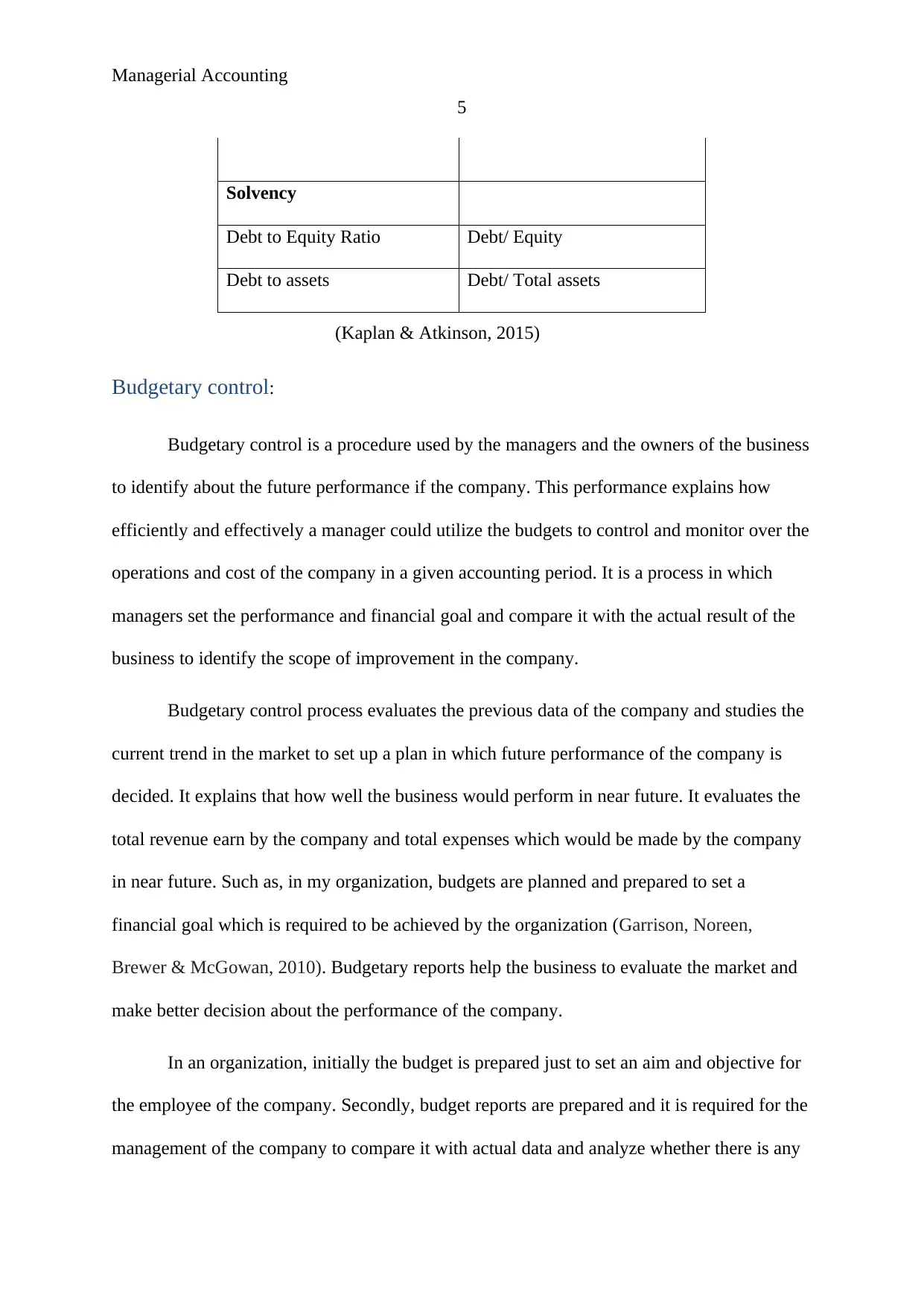

Budgetary control:

Budgetary control is a procedure used by the managers and the owners of the business

to identify about the future performance if the company. This performance explains how

efficiently and effectively a manager could utilize the budgets to control and monitor over the

operations and cost of the company in a given accounting period. It is a process in which

managers set the performance and financial goal and compare it with the actual result of the

business to identify the scope of improvement in the company.

Budgetary control process evaluates the previous data of the company and studies the

current trend in the market to set up a plan in which future performance of the company is

decided. It explains that how well the business would perform in near future. It evaluates the

total revenue earn by the company and total expenses which would be made by the company

in near future. Such as, in my organization, budgets are planned and prepared to set a

financial goal which is required to be achieved by the organization (Garrison, Noreen,

Brewer & McGowan, 2010). Budgetary reports help the business to evaluate the market and

make better decision about the performance of the company.

In an organization, initially the budget is prepared just to set an aim and objective for

the employee of the company. Secondly, budget reports are prepared and it is required for the

management of the company to compare it with actual data and analyze whether there is any

5

Solvency

Debt to Equity Ratio Debt/ Equity

Debt to assets Debt/ Total assets

(Kaplan & Atkinson, 2015)

Budgetary control:

Budgetary control is a procedure used by the managers and the owners of the business

to identify about the future performance if the company. This performance explains how

efficiently and effectively a manager could utilize the budgets to control and monitor over the

operations and cost of the company in a given accounting period. It is a process in which

managers set the performance and financial goal and compare it with the actual result of the

business to identify the scope of improvement in the company.

Budgetary control process evaluates the previous data of the company and studies the

current trend in the market to set up a plan in which future performance of the company is

decided. It explains that how well the business would perform in near future. It evaluates the

total revenue earn by the company and total expenses which would be made by the company

in near future. Such as, in my organization, budgets are planned and prepared to set a

financial goal which is required to be achieved by the organization (Garrison, Noreen,

Brewer & McGowan, 2010). Budgetary reports help the business to evaluate the market and

make better decision about the performance of the company.

In an organization, initially the budget is prepared just to set an aim and objective for

the employee of the company. Secondly, budget reports are prepared and it is required for the

management of the company to compare it with actual data and analyze whether there is any

Managerial Accounting

6

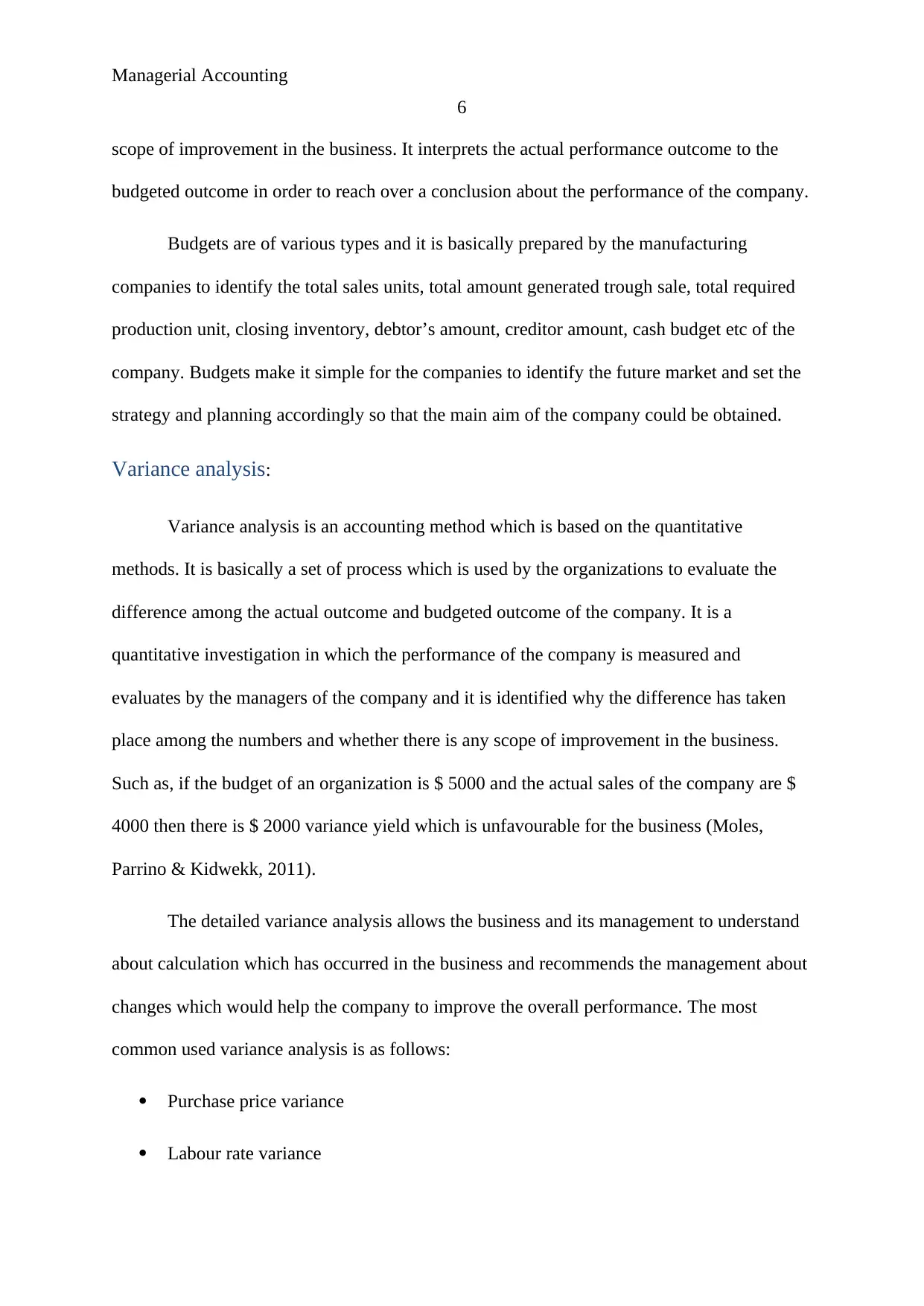

scope of improvement in the business. It interprets the actual performance outcome to the

budgeted outcome in order to reach over a conclusion about the performance of the company.

Budgets are of various types and it is basically prepared by the manufacturing

companies to identify the total sales units, total amount generated trough sale, total required

production unit, closing inventory, debtor’s amount, creditor amount, cash budget etc of the

company. Budgets make it simple for the companies to identify the future market and set the

strategy and planning accordingly so that the main aim of the company could be obtained.

Variance analysis:

Variance analysis is an accounting method which is based on the quantitative

methods. It is basically a set of process which is used by the organizations to evaluate the

difference among the actual outcome and budgeted outcome of the company. It is a

quantitative investigation in which the performance of the company is measured and

evaluates by the managers of the company and it is identified why the difference has taken

place among the numbers and whether there is any scope of improvement in the business.

Such as, if the budget of an organization is $ 5000 and the actual sales of the company are $

4000 then there is $ 2000 variance yield which is unfavourable for the business (Moles,

Parrino & Kidwekk, 2011).

The detailed variance analysis allows the business and its management to understand

about calculation which has occurred in the business and recommends the management about

changes which would help the company to improve the overall performance. The most

common used variance analysis is as follows:

Purchase price variance

Labour rate variance

6

scope of improvement in the business. It interprets the actual performance outcome to the

budgeted outcome in order to reach over a conclusion about the performance of the company.

Budgets are of various types and it is basically prepared by the manufacturing

companies to identify the total sales units, total amount generated trough sale, total required

production unit, closing inventory, debtor’s amount, creditor amount, cash budget etc of the

company. Budgets make it simple for the companies to identify the future market and set the

strategy and planning accordingly so that the main aim of the company could be obtained.

Variance analysis:

Variance analysis is an accounting method which is based on the quantitative

methods. It is basically a set of process which is used by the organizations to evaluate the

difference among the actual outcome and budgeted outcome of the company. It is a

quantitative investigation in which the performance of the company is measured and

evaluates by the managers of the company and it is identified why the difference has taken

place among the numbers and whether there is any scope of improvement in the business.

Such as, if the budget of an organization is $ 5000 and the actual sales of the company are $

4000 then there is $ 2000 variance yield which is unfavourable for the business (Moles,

Parrino & Kidwekk, 2011).

The detailed variance analysis allows the business and its management to understand

about calculation which has occurred in the business and recommends the management about

changes which would help the company to improve the overall performance. The most

common used variance analysis is as follows:

Purchase price variance

Labour rate variance

Managerial Accounting

7

Variable overhead spending variance

Fixed overhead spending variance

Selling price variance

Material yield variance

Labour efficiency variance

Variable overhead efficiency variance (Horngren, 2009)

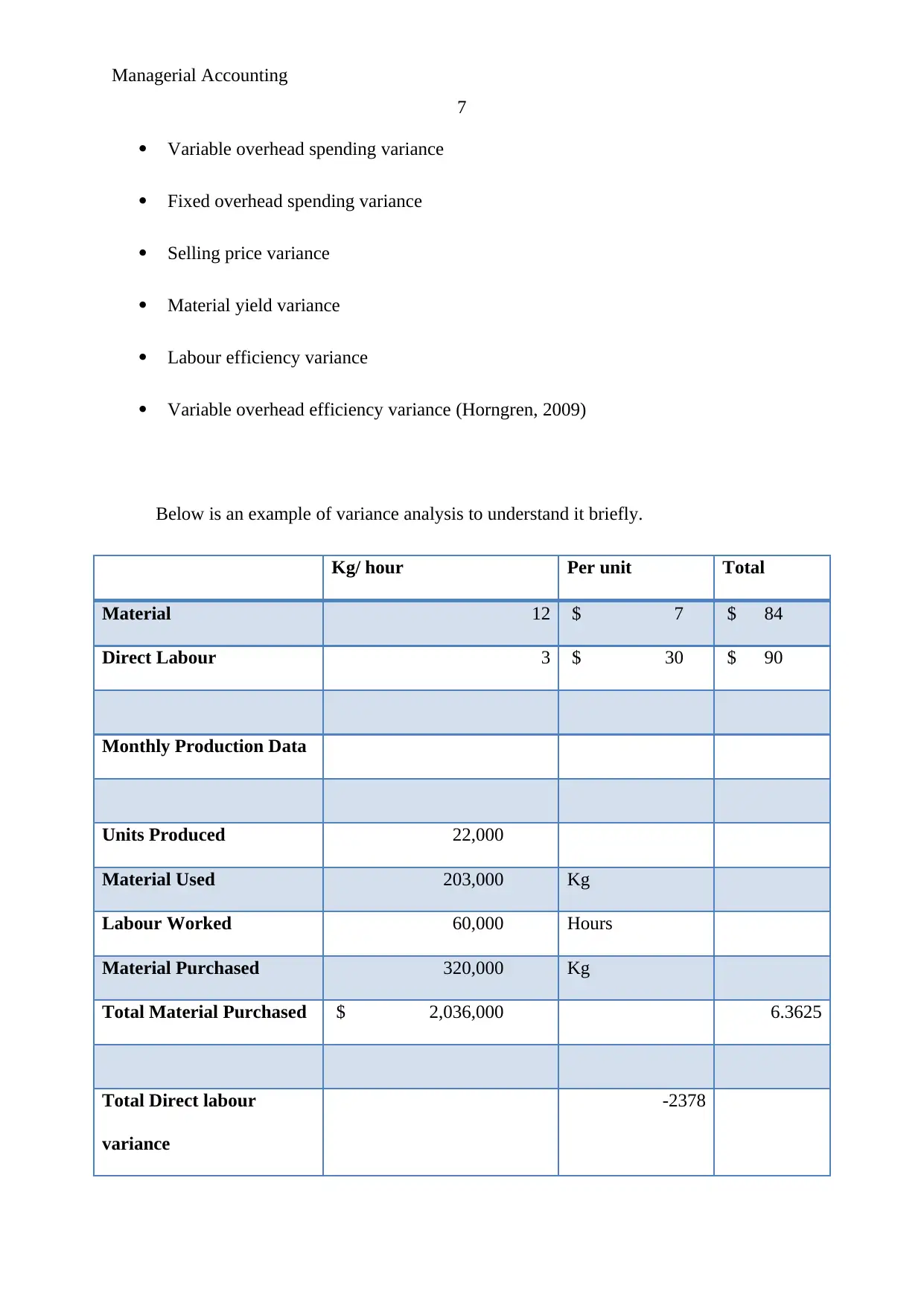

Below is an example of variance analysis to understand it briefly.

Kg/ hour Per unit Total

Material 12 $ 7 $ 84

Direct Labour 3 $ 30 $ 90

Monthly Production Data

Units Produced 22,000

Material Used 203,000 Kg

Labour Worked 60,000 Hours

Material Purchased 320,000 Kg

Total Material Purchased $ 2,036,000 6.3625

Total Direct labour

variance

-2378

7

Variable overhead spending variance

Fixed overhead spending variance

Selling price variance

Material yield variance

Labour efficiency variance

Variable overhead efficiency variance (Horngren, 2009)

Below is an example of variance analysis to understand it briefly.

Kg/ hour Per unit Total

Material 12 $ 7 $ 84

Direct Labour 3 $ 30 $ 90

Monthly Production Data

Units Produced 22,000

Material Used 203,000 Kg

Labour Worked 60,000 Hours

Material Purchased 320,000 Kg

Total Material Purchased $ 2,036,000 6.3625

Total Direct labour

variance

-2378

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Managerial Accounting

8

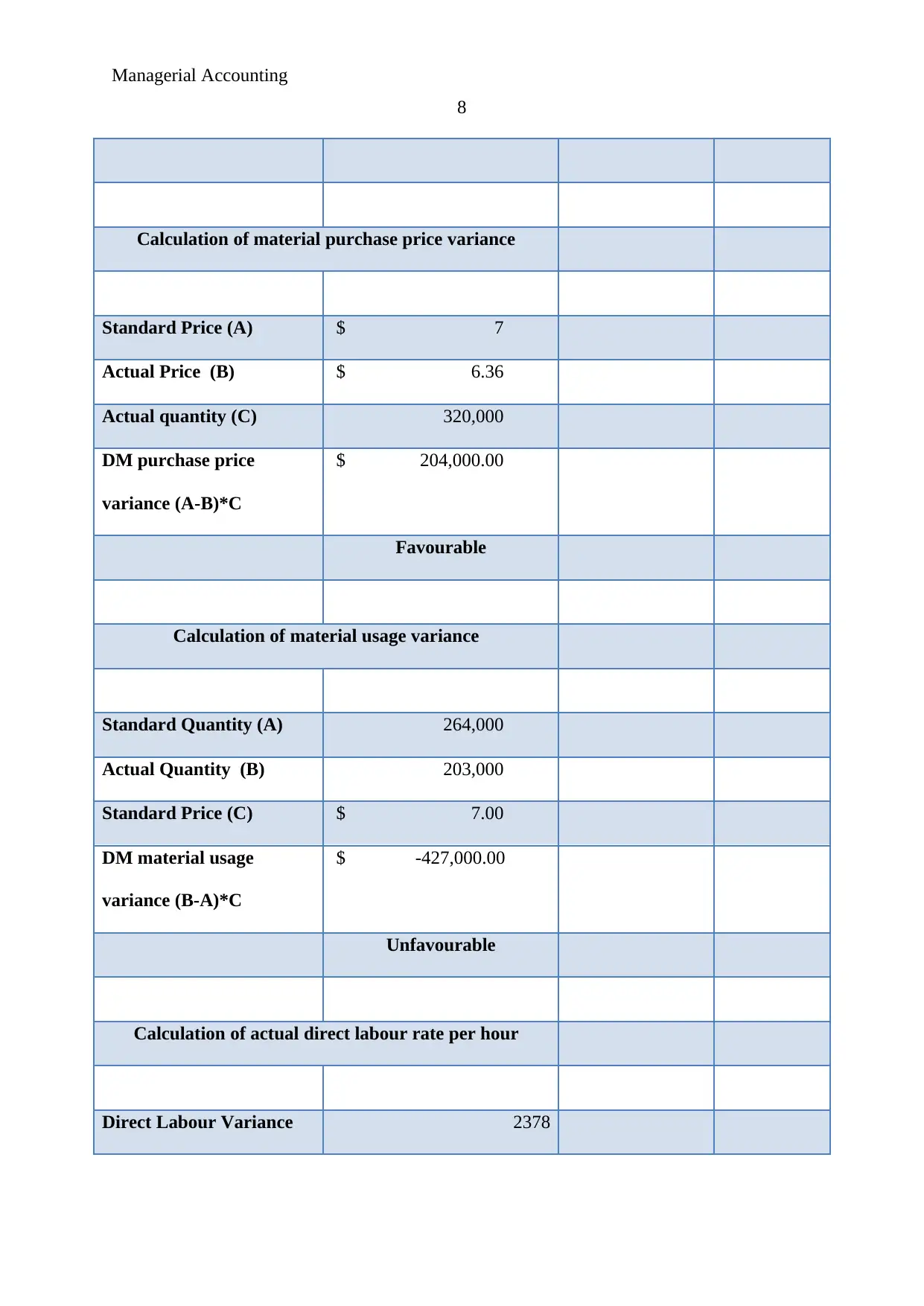

Calculation of material purchase price variance

Standard Price (A) $ 7

Actual Price (B) $ 6.36

Actual quantity (C) 320,000

DM purchase price

variance (A-B)*C

$ 204,000.00

Favourable

Calculation of material usage variance

Standard Quantity (A) 264,000

Actual Quantity (B) 203,000

Standard Price (C) $ 7.00

DM material usage

variance (B-A)*C

$ -427,000.00

Unfavourable

Calculation of actual direct labour rate per hour

Direct Labour Variance 2378

8

Calculation of material purchase price variance

Standard Price (A) $ 7

Actual Price (B) $ 6.36

Actual quantity (C) 320,000

DM purchase price

variance (A-B)*C

$ 204,000.00

Favourable

Calculation of material usage variance

Standard Quantity (A) 264,000

Actual Quantity (B) 203,000

Standard Price (C) $ 7.00

DM material usage

variance (B-A)*C

$ -427,000.00

Unfavourable

Calculation of actual direct labour rate per hour

Direct Labour Variance 2378

Managerial Accounting

9

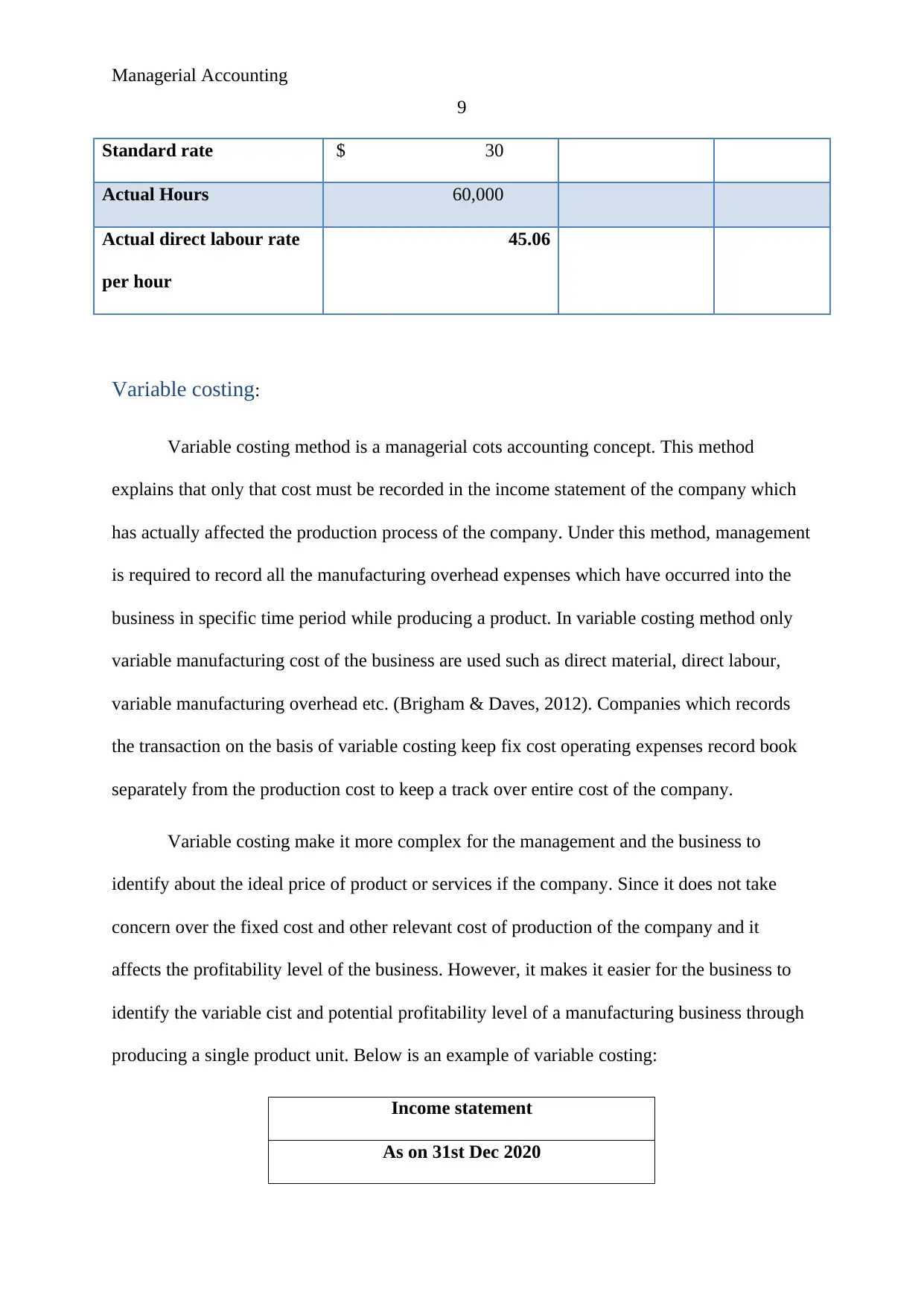

Standard rate $ 30

Actual Hours 60,000

Actual direct labour rate

per hour

45.06

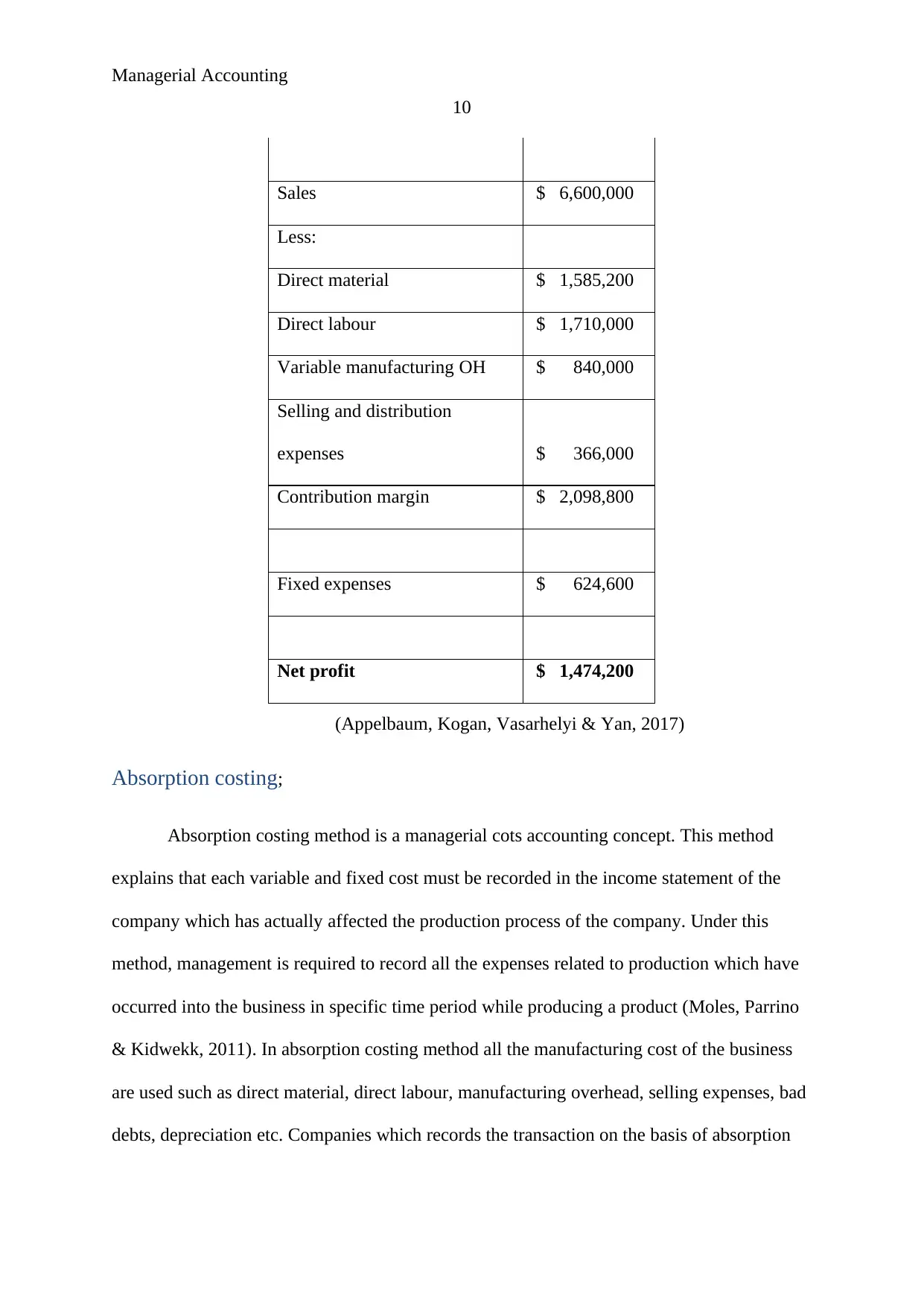

Variable costing:

Variable costing method is a managerial cots accounting concept. This method

explains that only that cost must be recorded in the income statement of the company which

has actually affected the production process of the company. Under this method, management

is required to record all the manufacturing overhead expenses which have occurred into the

business in specific time period while producing a product. In variable costing method only

variable manufacturing cost of the business are used such as direct material, direct labour,

variable manufacturing overhead etc. (Brigham & Daves, 2012). Companies which records

the transaction on the basis of variable costing keep fix cost operating expenses record book

separately from the production cost to keep a track over entire cost of the company.

Variable costing make it more complex for the management and the business to

identify about the ideal price of product or services if the company. Since it does not take

concern over the fixed cost and other relevant cost of production of the company and it

affects the profitability level of the business. However, it makes it easier for the business to

identify the variable cist and potential profitability level of a manufacturing business through

producing a single product unit. Below is an example of variable costing:

Income statement

As on 31st Dec 2020

9

Standard rate $ 30

Actual Hours 60,000

Actual direct labour rate

per hour

45.06

Variable costing:

Variable costing method is a managerial cots accounting concept. This method

explains that only that cost must be recorded in the income statement of the company which

has actually affected the production process of the company. Under this method, management

is required to record all the manufacturing overhead expenses which have occurred into the

business in specific time period while producing a product. In variable costing method only

variable manufacturing cost of the business are used such as direct material, direct labour,

variable manufacturing overhead etc. (Brigham & Daves, 2012). Companies which records

the transaction on the basis of variable costing keep fix cost operating expenses record book

separately from the production cost to keep a track over entire cost of the company.

Variable costing make it more complex for the management and the business to

identify about the ideal price of product or services if the company. Since it does not take

concern over the fixed cost and other relevant cost of production of the company and it

affects the profitability level of the business. However, it makes it easier for the business to

identify the variable cist and potential profitability level of a manufacturing business through

producing a single product unit. Below is an example of variable costing:

Income statement

As on 31st Dec 2020

Managerial Accounting

10

Sales $ 6,600,000

Less:

Direct material $ 1,585,200

Direct labour $ 1,710,000

Variable manufacturing OH $ 840,000

Selling and distribution

expenses $ 366,000

Contribution margin $ 2,098,800

Fixed expenses $ 624,600

Net profit $ 1,474,200

(Appelbaum, Kogan, Vasarhelyi & Yan, 2017)

Absorption costing;

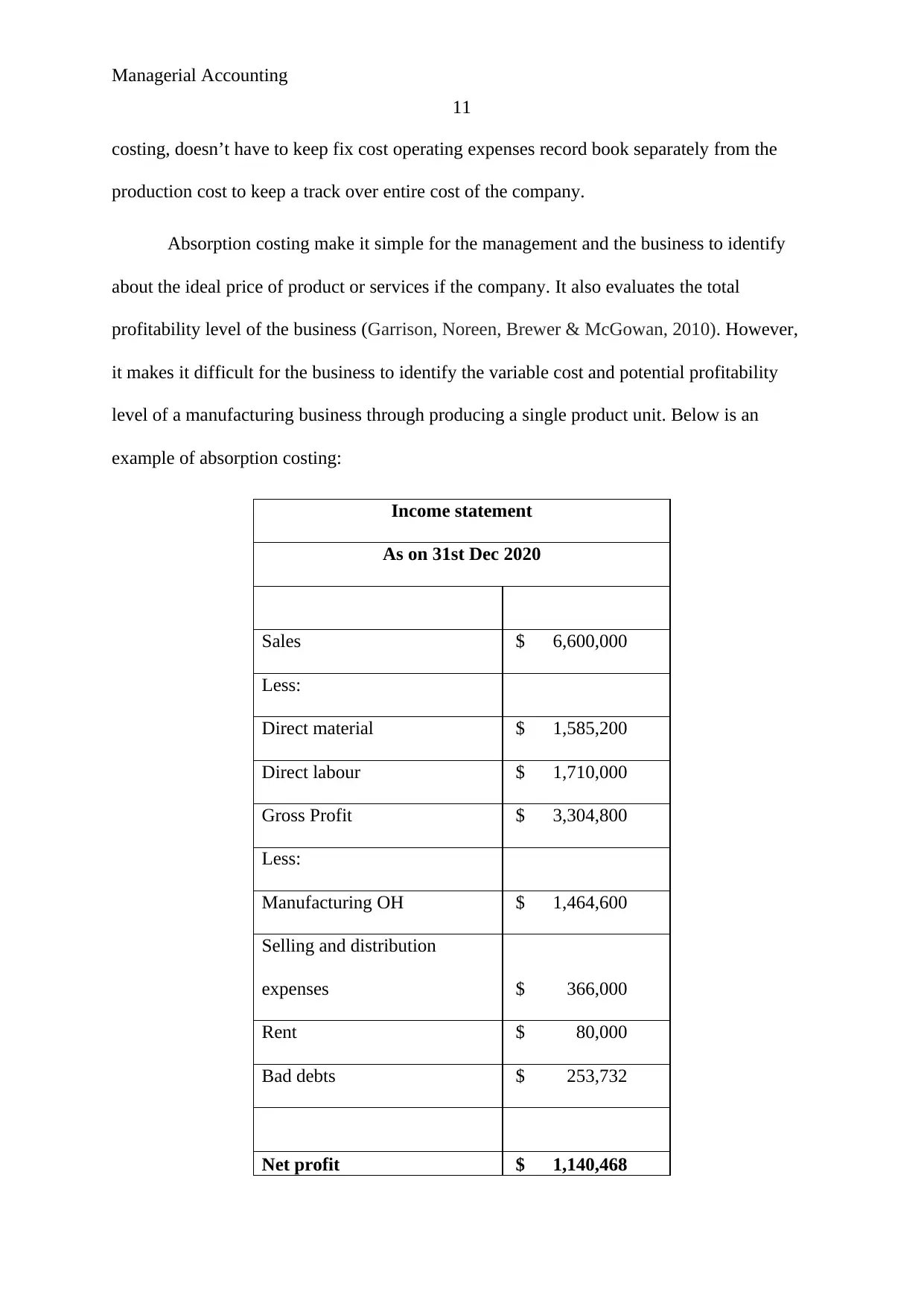

Absorption costing method is a managerial cots accounting concept. This method

explains that each variable and fixed cost must be recorded in the income statement of the

company which has actually affected the production process of the company. Under this

method, management is required to record all the expenses related to production which have

occurred into the business in specific time period while producing a product (Moles, Parrino

& Kidwekk, 2011). In absorption costing method all the manufacturing cost of the business

are used such as direct material, direct labour, manufacturing overhead, selling expenses, bad

debts, depreciation etc. Companies which records the transaction on the basis of absorption

10

Sales $ 6,600,000

Less:

Direct material $ 1,585,200

Direct labour $ 1,710,000

Variable manufacturing OH $ 840,000

Selling and distribution

expenses $ 366,000

Contribution margin $ 2,098,800

Fixed expenses $ 624,600

Net profit $ 1,474,200

(Appelbaum, Kogan, Vasarhelyi & Yan, 2017)

Absorption costing;

Absorption costing method is a managerial cots accounting concept. This method

explains that each variable and fixed cost must be recorded in the income statement of the

company which has actually affected the production process of the company. Under this

method, management is required to record all the expenses related to production which have

occurred into the business in specific time period while producing a product (Moles, Parrino

& Kidwekk, 2011). In absorption costing method all the manufacturing cost of the business

are used such as direct material, direct labour, manufacturing overhead, selling expenses, bad

debts, depreciation etc. Companies which records the transaction on the basis of absorption

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Managerial Accounting

11

costing, doesn’t have to keep fix cost operating expenses record book separately from the

production cost to keep a track over entire cost of the company.

Absorption costing make it simple for the management and the business to identify

about the ideal price of product or services if the company. It also evaluates the total

profitability level of the business (Garrison, Noreen, Brewer & McGowan, 2010). However,

it makes it difficult for the business to identify the variable cost and potential profitability

level of a manufacturing business through producing a single product unit. Below is an

example of absorption costing:

Income statement

As on 31st Dec 2020

Sales $ 6,600,000

Less:

Direct material $ 1,585,200

Direct labour $ 1,710,000

Gross Profit $ 3,304,800

Less:

Manufacturing OH $ 1,464,600

Selling and distribution

expenses $ 366,000

Rent $ 80,000

Bad debts $ 253,732

Net profit $ 1,140,468

11

costing, doesn’t have to keep fix cost operating expenses record book separately from the

production cost to keep a track over entire cost of the company.

Absorption costing make it simple for the management and the business to identify

about the ideal price of product or services if the company. It also evaluates the total

profitability level of the business (Garrison, Noreen, Brewer & McGowan, 2010). However,

it makes it difficult for the business to identify the variable cost and potential profitability

level of a manufacturing business through producing a single product unit. Below is an

example of absorption costing:

Income statement

As on 31st Dec 2020

Sales $ 6,600,000

Less:

Direct material $ 1,585,200

Direct labour $ 1,710,000

Gross Profit $ 3,304,800

Less:

Manufacturing OH $ 1,464,600

Selling and distribution

expenses $ 366,000

Rent $ 80,000

Bad debts $ 253,732

Net profit $ 1,140,468

Managerial Accounting

12

Conclusion:

To conclude, managerial accounting concept makes to easier for the management to

make various financial decision easily, It assist the management at every step to make better

decision and prepared better strategies for the company to meet the common goal and

objectives of the business.

12

Conclusion:

To conclude, managerial accounting concept makes to easier for the management to

make various financial decision easily, It assist the management at every step to make better

decision and prepared better strategies for the company to meet the common goal and

objectives of the business.

Managerial Accounting

13

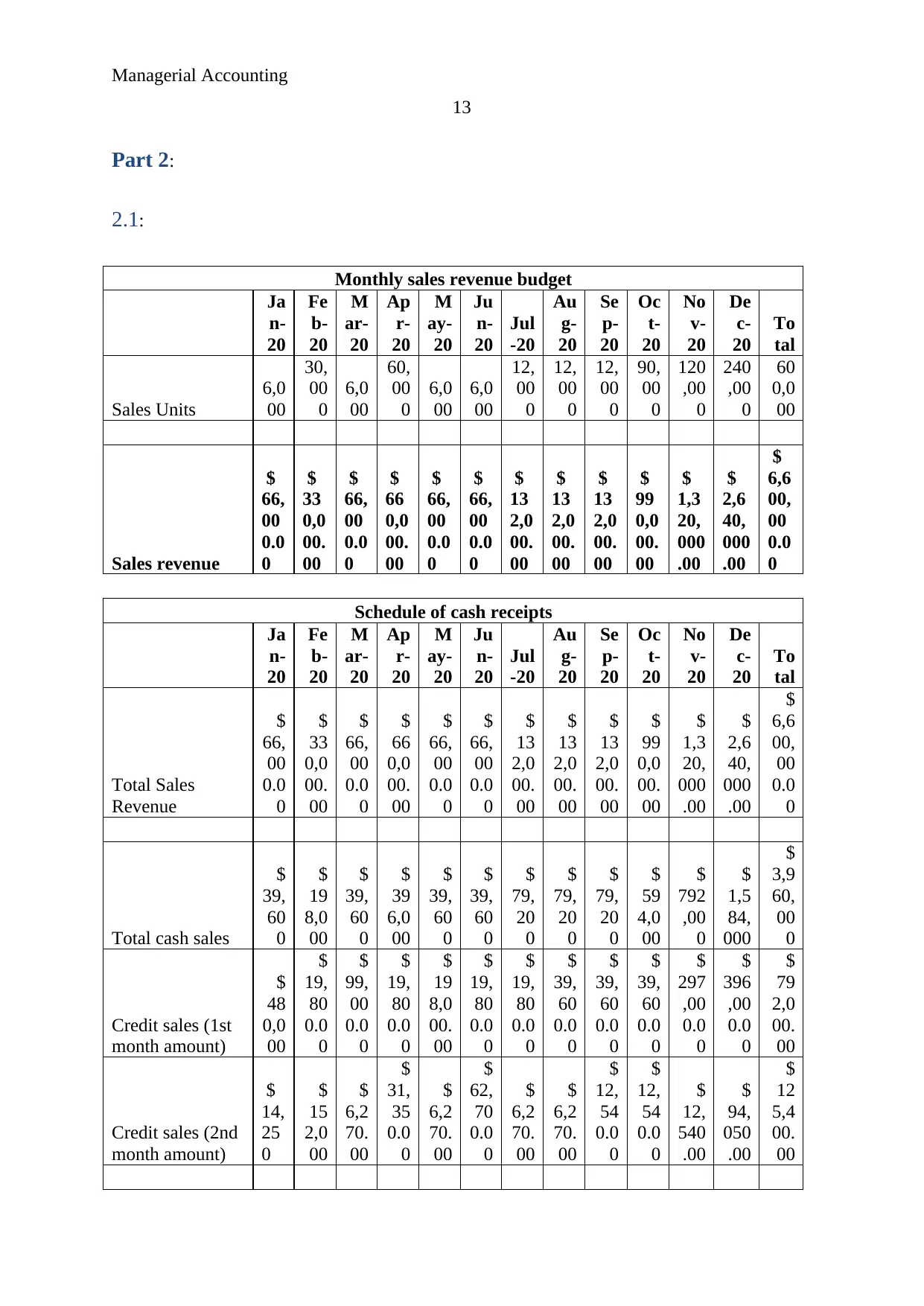

Part 2:

2.1:

Monthly sales revenue budget

Ja

n-

20

Fe

b-

20

M

ar-

20

Ap

r-

20

M

ay-

20

Ju

n-

20

Jul

-20

Au

g-

20

Se

p-

20

Oc

t-

20

No

v-

20

De

c-

20

To

tal

Sales Units

6,0

00

30,

00

0

6,0

00

60,

00

0

6,0

00

6,0

00

12,

00

0

12,

00

0

12,

00

0

90,

00

0

120

,00

0

240

,00

0

60

0,0

00

Sales revenue

$

66,

00

0.0

0

$

33

0,0

00.

00

$

66,

00

0.0

0

$

66

0,0

00.

00

$

66,

00

0.0

0

$

66,

00

0.0

0

$

13

2,0

00.

00

$

13

2,0

00.

00

$

13

2,0

00.

00

$

99

0,0

00.

00

$

1,3

20,

000

.00

$

2,6

40,

000

.00

$

6,6

00,

00

0.0

0

Schedule of cash receipts

Ja

n-

20

Fe

b-

20

M

ar-

20

Ap

r-

20

M

ay-

20

Ju

n-

20

Jul

-20

Au

g-

20

Se

p-

20

Oc

t-

20

No

v-

20

De

c-

20

To

tal

Total Sales

Revenue

$

66,

00

0.0

0

$

33

0,0

00.

00

$

66,

00

0.0

0

$

66

0,0

00.

00

$

66,

00

0.0

0

$

66,

00

0.0

0

$

13

2,0

00.

00

$

13

2,0

00.

00

$

13

2,0

00.

00

$

99

0,0

00.

00

$

1,3

20,

000

.00

$

2,6

40,

000

.00

$

6,6

00,

00

0.0

0

Total cash sales

$

39,

60

0

$

19

8,0

00

$

39,

60

0

$

39

6,0

00

$

39,

60

0

$

39,

60

0

$

79,

20

0

$

79,

20

0

$

79,

20

0

$

59

4,0

00

$

792

,00

0

$

1,5

84,

000

$

3,9

60,

00

0

Credit sales (1st

month amount)

$

48

0,0

00

$

19,

80

0.0

0

$

99,

00

0.0

0

$

19,

80

0.0

0

$

19

8,0

00.

00

$

19,

80

0.0

0

$

19,

80

0.0

0

$

39,

60

0.0

0

$

39,

60

0.0

0

$

39,

60

0.0

0

$

297

,00

0.0

0

$

396

,00

0.0

0

$

79

2,0

00.

00

Credit sales (2nd

month amount)

$

14,

25

0

$

15

2,0

00

$

6,2

70.

00

$

31,

35

0.0

0

$

6,2

70.

00

$

62,

70

0.0

0

$

6,2

70.

00

$

6,2

70.

00

$

12,

54

0.0

0

$

12,

54

0.0

0

$

12,

540

.00

$

94,

050

.00

$

12

5,4

00.

00

13

Part 2:

2.1:

Monthly sales revenue budget

Ja

n-

20

Fe

b-

20

M

ar-

20

Ap

r-

20

M

ay-

20

Ju

n-

20

Jul

-20

Au

g-

20

Se

p-

20

Oc

t-

20

No

v-

20

De

c-

20

To

tal

Sales Units

6,0

00

30,

00

0

6,0

00

60,

00

0

6,0

00

6,0

00

12,

00

0

12,

00

0

12,

00

0

90,

00

0

120

,00

0

240

,00

0

60

0,0

00

Sales revenue

$

66,

00

0.0

0

$

33

0,0

00.

00

$

66,

00

0.0

0

$

66

0,0

00.

00

$

66,

00

0.0

0

$

66,

00

0.0

0

$

13

2,0

00.

00

$

13

2,0

00.

00

$

13

2,0

00.

00

$

99

0,0

00.

00

$

1,3

20,

000

.00

$

2,6

40,

000

.00

$

6,6

00,

00

0.0

0

Schedule of cash receipts

Ja

n-

20

Fe

b-

20

M

ar-

20

Ap

r-

20

M

ay-

20

Ju

n-

20

Jul

-20

Au

g-

20

Se

p-

20

Oc

t-

20

No

v-

20

De

c-

20

To

tal

Total Sales

Revenue

$

66,

00

0.0

0

$

33

0,0

00.

00

$

66,

00

0.0

0

$

66

0,0

00.

00

$

66,

00

0.0

0

$

66,

00

0.0

0

$

13

2,0

00.

00

$

13

2,0

00.

00

$

13

2,0

00.

00

$

99

0,0

00.

00

$

1,3

20,

000

.00

$

2,6

40,

000

.00

$

6,6

00,

00

0.0

0

Total cash sales

$

39,

60

0

$

19

8,0

00

$

39,

60

0

$

39

6,0

00

$

39,

60

0

$

39,

60

0

$

79,

20

0

$

79,

20

0

$

79,

20

0

$

59

4,0

00

$

792

,00

0

$

1,5

84,

000

$

3,9

60,

00

0

Credit sales (1st

month amount)

$

48

0,0

00

$

19,

80

0.0

0

$

99,

00

0.0

0

$

19,

80

0.0

0

$

19

8,0

00.

00

$

19,

80

0.0

0

$

19,

80

0.0

0

$

39,

60

0.0

0

$

39,

60

0.0

0

$

39,

60

0.0

0

$

297

,00

0.0

0

$

396

,00

0.0

0

$

79

2,0

00.

00

Credit sales (2nd

month amount)

$

14,

25

0

$

15

2,0

00

$

6,2

70.

00

$

31,

35

0.0

0

$

6,2

70.

00

$

62,

70

0.0

0

$

6,2

70.

00

$

6,2

70.

00

$

12,

54

0.0

0

$

12,

54

0.0

0

$

12,

540

.00

$

94,

050

.00

$

12

5,4

00.

00

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Managerial Accounting

14

Total Cash

collection

$

53

3,8

50

$

36

9,8

00

$

14

4,8

70

$

44

7,1

50

$

24

3,8

70

$

12

2,1

00

$

10

5,2

70

$

12

5,0

70

$

13

1,3

40

$

64

6,1

40

$

1,1

01,

540

$

2,0

74,

050

$

4,8

77,

40

0

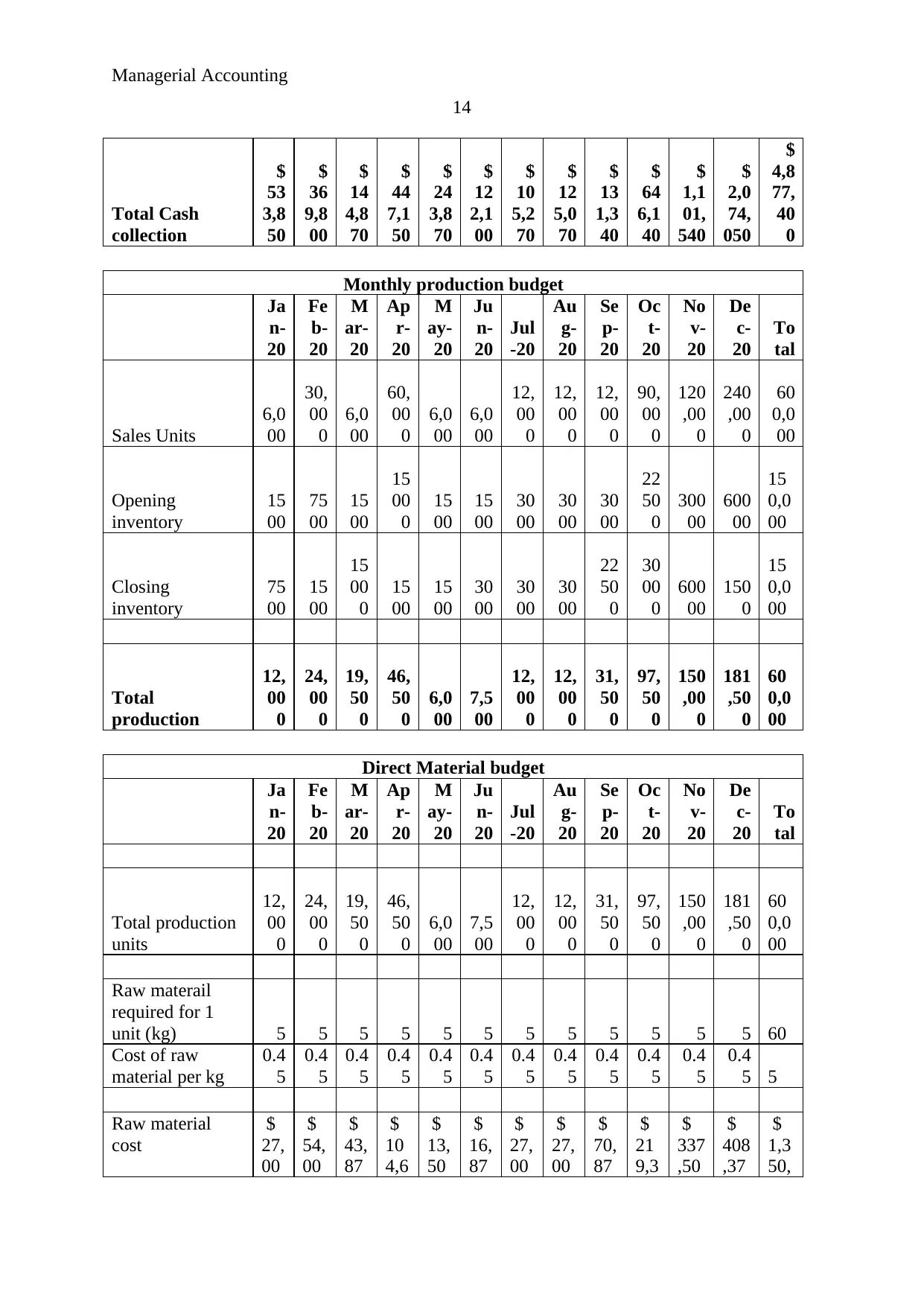

Monthly production budget

Ja

n-

20

Fe

b-

20

M

ar-

20

Ap

r-

20

M

ay-

20

Ju

n-

20

Jul

-20

Au

g-

20

Se

p-

20

Oc

t-

20

No

v-

20

De

c-

20

To

tal

Sales Units

6,0

00

30,

00

0

6,0

00

60,

00

0

6,0

00

6,0

00

12,

00

0

12,

00

0

12,

00

0

90,

00

0

120

,00

0

240

,00

0

60

0,0

00

Opening

inventory

15

00

75

00

15

00

15

00

0

15

00

15

00

30

00

30

00

30

00

22

50

0

300

00

600

00

15

0,0

00

Closing

inventory

75

00

15

00

15

00

0

15

00

15

00

30

00

30

00

30

00

22

50

0

30

00

0

600

00

150

0

15

0,0

00

Total

production

12,

00

0

24,

00

0

19,

50

0

46,

50

0

6,0

00

7,5

00

12,

00

0

12,

00

0

31,

50

0

97,

50

0

150

,00

0

181

,50

0

60

0,0

00

Direct Material budget

Ja

n-

20

Fe

b-

20

M

ar-

20

Ap

r-

20

M

ay-

20

Ju

n-

20

Jul

-20

Au

g-

20

Se

p-

20

Oc

t-

20

No

v-

20

De

c-

20

To

tal

Total production

units

12,

00

0

24,

00

0

19,

50

0

46,

50

0

6,0

00

7,5

00

12,

00

0

12,

00

0

31,

50

0

97,

50

0

150

,00

0

181

,50

0

60

0,0

00

Raw materail

required for 1

unit (kg) 5 5 5 5 5 5 5 5 5 5 5 5 60

Cost of raw

material per kg

0.4

5

0.4

5

0.4

5

0.4

5

0.4

5

0.4

5

0.4

5

0.4

5

0.4

5

0.4

5

0.4

5

0.4

5 5

Raw material

cost

$

27,

00

$

54,

00

$

43,

87

$

10

4,6

$

13,

50

$

16,

87

$

27,

00

$

27,

00

$

70,

87

$

21

9,3

$

337

,50

$

408

,37

$

1,3

50,

14

Total Cash

collection

$

53

3,8

50

$

36

9,8

00

$

14

4,8

70

$

44

7,1

50

$

24

3,8

70

$

12

2,1

00

$

10

5,2

70

$

12

5,0

70

$

13

1,3

40

$

64

6,1

40

$

1,1

01,

540

$

2,0

74,

050

$

4,8

77,

40

0

Monthly production budget

Ja

n-

20

Fe

b-

20

M

ar-

20

Ap

r-

20

M

ay-

20

Ju

n-

20

Jul

-20

Au

g-

20

Se

p-

20

Oc

t-

20

No

v-

20

De

c-

20

To

tal

Sales Units

6,0

00

30,

00

0

6,0

00

60,

00

0

6,0

00

6,0

00

12,

00

0

12,

00

0

12,

00

0

90,

00

0

120

,00

0

240

,00

0

60

0,0

00

Opening

inventory

15

00

75

00

15

00

15

00

0

15

00

15

00

30

00

30

00

30

00

22

50

0

300

00

600

00

15

0,0

00

Closing

inventory

75

00

15

00

15

00

0

15

00

15

00

30

00

30

00

30

00

22

50

0

30

00

0

600

00

150

0

15

0,0

00

Total

production

12,

00

0

24,

00

0

19,

50

0

46,

50

0

6,0

00

7,5

00

12,

00

0

12,

00

0

31,

50

0

97,

50

0

150

,00

0

181

,50

0

60

0,0

00

Direct Material budget

Ja

n-

20

Fe

b-

20

M

ar-

20

Ap

r-

20

M

ay-

20

Ju

n-

20

Jul

-20

Au

g-

20

Se

p-

20

Oc

t-

20

No

v-

20

De

c-

20

To

tal

Total production

units

12,

00

0

24,

00

0

19,

50

0

46,

50

0

6,0

00

7,5

00

12,

00

0

12,

00

0

31,

50

0

97,

50

0

150

,00

0

181

,50

0

60

0,0

00

Raw materail

required for 1

unit (kg) 5 5 5 5 5 5 5 5 5 5 5 5 60

Cost of raw

material per kg

0.4

5

0.4

5

0.4

5

0.4

5

0.4

5

0.4

5

0.4

5

0.4

5

0.4

5

0.4

5

0.4

5

0.4

5 5

Raw material

cost

$

27,

00

$

54,

00

$

43,

87

$

10

4,6

$

13,

50

$

16,

87

$

27,

00

$

27,

00

$

70,

87

$

21

9,3

$

337

,50

$

408

,37

$

1,3

50,

Managerial Accounting

15

0 0 5 25 0 5 0 0 5 75 0 5

00

0

Opening raw

material

$

4,8

00

$

9,6

00

$

7,8

00

$

18,

60

0

$

2,4

00

$

3,0

00

$

4,8

00

$

4,8

00

$

12,

60

0

$

39,

00

0

$

60,

000

$

72,

600

$

24

0,0

00

Closing raw

material

$

9,6

00

$

7,8

00

$

18,

60

0

$

2,4

00

$

3,0

00

$

4,8

00

$

4,8

00

$

12,

60

0

$

39,

00

0

$

60,

00

0

$

72,

600

$

240

,00

0

$

47

5,2

00

Total direct

material

$

31,

80

0

$

52,

20

0

$

54,

67

5

$

88,

42

5

$

14,

10

0

$

18,

67

5

$

27,

00

0

$

34,

80

0

$

97,

27

5

$

24

0,3

75

$

350

,10

0

$

575

,77

5

$

1,5

85,

20

0

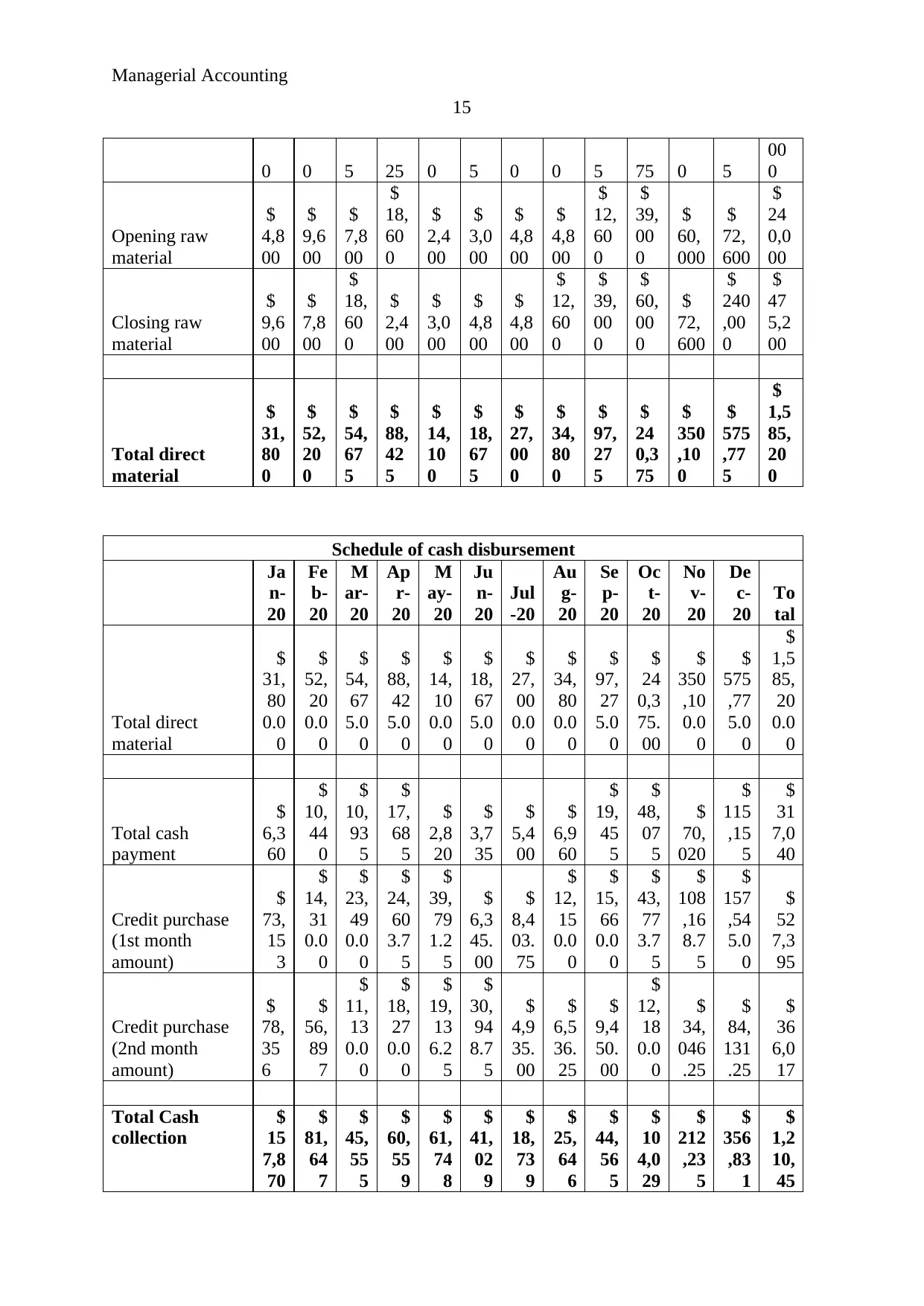

Schedule of cash disbursement

Ja

n-

20

Fe

b-

20

M

ar-

20

Ap

r-

20

M

ay-

20

Ju

n-

20

Jul

-20

Au

g-

20

Se

p-

20

Oc

t-

20

No

v-

20

De

c-

20

To

tal

Total direct

material

$

31,

80

0.0

0

$

52,

20

0.0

0

$

54,

67

5.0

0

$

88,

42

5.0

0

$

14,

10

0.0

0

$

18,

67

5.0

0

$

27,

00

0.0

0

$

34,

80

0.0

0

$

97,

27

5.0

0

$

24

0,3

75.

00

$

350

,10

0.0

0

$

575

,77

5.0

0

$

1,5

85,

20

0.0

0

Total cash

payment

$

6,3

60

$

10,

44

0

$

10,

93

5

$

17,

68

5

$

2,8

20

$

3,7

35

$

5,4

00

$

6,9

60

$

19,

45

5

$

48,

07

5

$

70,

020

$

115

,15

5

$

31

7,0

40

Credit purchase

(1st month

amount)

$

73,

15

3

$

14,

31

0.0

0

$

23,

49

0.0

0

$

24,

60

3.7

5

$

39,

79

1.2

5

$

6,3

45.

00

$

8,4

03.

75

$

12,

15

0.0

0

$

15,

66

0.0

0

$

43,

77

3.7

5

$

108

,16

8.7

5

$

157

,54

5.0

0

$

52

7,3

95

Credit purchase

(2nd month

amount)

$

78,

35

6

$

56,

89

7

$

11,

13

0.0

0

$

18,

27

0.0

0

$

19,

13

6.2

5

$

30,

94

8.7

5

$

4,9

35.

00

$

6,5

36.

25

$

9,4

50.

00

$

12,

18

0.0

0

$

34,

046

.25

$

84,

131

.25

$

36

6,0

17

Total Cash

collection

$

15

7,8

70

$

81,

64

7

$

45,

55

5

$

60,

55

9

$

61,

74

8

$

41,

02

9

$

18,

73

9

$

25,

64

6

$

44,

56

5

$

10

4,0

29

$

212

,23

5

$

356

,83

1

$

1,2

10,

45

15

0 0 5 25 0 5 0 0 5 75 0 5

00

0

Opening raw

material

$

4,8

00

$

9,6

00

$

7,8

00

$

18,

60

0

$

2,4

00

$

3,0

00

$

4,8

00

$

4,8

00

$

12,

60

0

$

39,

00

0

$

60,

000

$

72,

600

$

24

0,0

00

Closing raw

material

$

9,6

00

$

7,8

00

$

18,

60

0

$

2,4

00

$

3,0

00

$

4,8

00

$

4,8

00

$

12,

60

0

$

39,

00

0

$

60,

00

0

$

72,

600

$

240

,00

0

$

47

5,2

00

Total direct

material

$

31,

80

0

$

52,

20

0

$

54,

67

5

$

88,

42

5

$

14,

10

0

$

18,

67

5

$

27,

00

0

$

34,

80

0

$

97,

27

5

$

24

0,3

75

$

350

,10

0

$

575

,77

5

$

1,5

85,

20

0

Schedule of cash disbursement

Ja

n-

20

Fe

b-

20

M

ar-

20

Ap

r-

20

M

ay-

20

Ju

n-

20

Jul

-20

Au

g-

20

Se

p-

20

Oc

t-

20

No

v-

20

De

c-

20

To

tal

Total direct

material

$

31,

80

0.0

0

$

52,

20

0.0

0

$

54,

67

5.0

0

$

88,

42

5.0

0

$

14,

10

0.0

0

$

18,

67

5.0

0

$

27,

00

0.0

0

$

34,

80

0.0

0

$

97,

27

5.0

0

$

24

0,3

75.

00

$

350

,10

0.0

0

$

575

,77

5.0

0

$

1,5

85,

20

0.0

0

Total cash

payment

$

6,3

60

$

10,

44

0

$

10,

93

5

$

17,

68

5

$

2,8

20

$

3,7

35

$

5,4

00

$

6,9

60

$

19,

45

5

$

48,

07

5

$

70,

020

$

115

,15

5

$

31

7,0

40

Credit purchase

(1st month

amount)

$

73,

15

3

$

14,

31

0.0

0

$

23,

49

0.0

0

$

24,

60

3.7

5

$

39,

79

1.2

5

$

6,3

45.

00

$

8,4

03.

75

$

12,

15

0.0

0

$

15,

66

0.0

0

$

43,

77

3.7

5

$

108

,16

8.7

5

$

157

,54

5.0

0

$

52

7,3

95

Credit purchase

(2nd month

amount)

$

78,

35

6

$

56,

89

7

$

11,

13

0.0

0

$

18,

27

0.0

0

$

19,

13

6.2

5

$

30,

94

8.7

5

$

4,9

35.

00

$

6,5

36.

25

$

9,4

50.

00

$

12,

18

0.0

0

$

34,

046

.25

$

84,

131

.25

$

36

6,0

17

Total Cash

collection

$

15

7,8

70

$

81,

64

7

$

45,

55

5

$

60,

55

9

$

61,

74

8

$

41,

02

9

$

18,

73

9

$

25,

64

6

$

44,

56

5

$

10

4,0

29

$

212

,23

5

$

356

,83

1

$

1,2

10,

45

Managerial Accounting

16

2

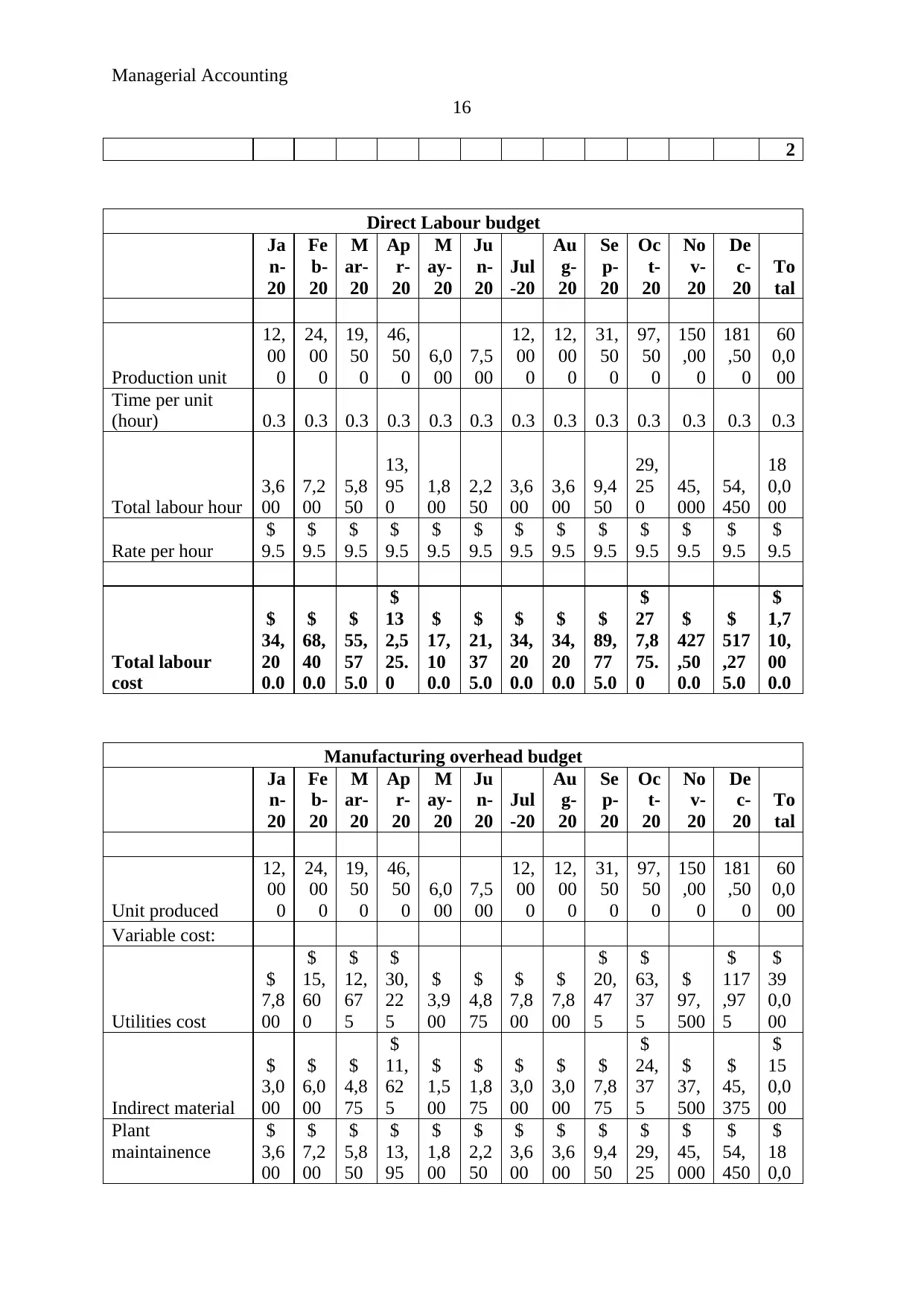

Direct Labour budget

Ja

n-

20

Fe

b-

20

M

ar-

20

Ap

r-

20

M

ay-

20

Ju

n-

20

Jul

-20

Au

g-

20

Se

p-

20

Oc

t-

20

No

v-

20

De

c-

20

To

tal

Production unit

12,

00

0

24,

00

0

19,

50

0

46,

50

0

6,0

00

7,5

00

12,

00

0

12,

00

0

31,

50

0

97,

50

0

150

,00

0

181

,50

0

60

0,0

00

Time per unit

(hour) 0.3 0.3 0.3 0.3 0.3 0.3 0.3 0.3 0.3 0.3 0.3 0.3 0.3

Total labour hour

3,6

00

7,2

00

5,8

50

13,

95

0

1,8

00

2,2

50

3,6

00

3,6

00

9,4

50

29,

25

0

45,

000

54,

450

18

0,0

00

Rate per hour

$

9.5

$

9.5

$

9.5

$

9.5

$

9.5

$

9.5

$

9.5

$

9.5

$

9.5

$

9.5

$

9.5

$

9.5

$

9.5

Total labour

cost

$

34,

20

0.0

$

68,

40

0.0

$

55,

57

5.0

$

13

2,5

25.

0

$

17,

10

0.0

$

21,

37

5.0

$

34,

20

0.0

$

34,

20

0.0

$

89,

77

5.0

$

27

7,8

75.

0

$

427

,50

0.0

$

517

,27

5.0

$

1,7

10,

00

0.0

Manufacturing overhead budget

Ja

n-

20

Fe

b-

20

M

ar-

20

Ap

r-

20

M

ay-

20

Ju

n-

20

Jul

-20

Au

g-

20

Se

p-

20

Oc

t-

20

No

v-

20

De

c-

20

To

tal

Unit produced

12,

00

0

24,

00

0

19,

50

0

46,

50

0

6,0

00

7,5

00

12,

00

0

12,

00

0

31,

50

0

97,

50

0

150

,00

0

181

,50

0

60

0,0

00

Variable cost:

Utilities cost

$

7,8

00

$

15,

60

0

$

12,

67

5

$

30,

22

5

$

3,9

00

$

4,8

75

$

7,8

00

$

7,8

00

$

20,

47

5

$

63,

37

5

$

97,

500

$

117

,97

5

$

39

0,0

00

Indirect material

$

3,0

00

$

6,0

00

$

4,8

75

$

11,

62

5

$

1,5

00

$

1,8

75

$

3,0

00

$

3,0

00

$

7,8

75

$

24,

37

5

$

37,

500

$

45,

375

$

15

0,0

00

Plant

maintainence

$

3,6

00

$

7,2

00

$

5,8

50

$

13,

95

$

1,8

00

$

2,2

50

$

3,6

00

$

3,6

00

$

9,4

50

$

29,

25

$

45,

000

$

54,

450

$

18

0,0

16

2

Direct Labour budget

Ja

n-

20

Fe

b-

20

M

ar-

20

Ap

r-

20

M

ay-

20

Ju

n-

20

Jul

-20

Au

g-

20

Se

p-

20

Oc

t-

20

No

v-

20

De

c-

20

To

tal

Production unit

12,

00

0

24,

00

0

19,

50

0

46,

50

0

6,0

00

7,5

00

12,

00

0

12,

00

0

31,

50

0

97,

50

0

150

,00

0

181

,50

0

60

0,0

00

Time per unit

(hour) 0.3 0.3 0.3 0.3 0.3 0.3 0.3 0.3 0.3 0.3 0.3 0.3 0.3

Total labour hour

3,6

00

7,2

00

5,8

50

13,

95

0

1,8

00

2,2

50

3,6

00

3,6

00

9,4

50

29,

25

0

45,

000

54,

450

18

0,0

00

Rate per hour

$

9.5

$

9.5

$

9.5

$

9.5

$

9.5

$

9.5

$

9.5

$

9.5

$

9.5

$

9.5

$

9.5

$

9.5

$

9.5

Total labour

cost

$

34,

20

0.0

$

68,

40

0.0

$

55,

57

5.0

$

13

2,5

25.

0

$

17,

10

0.0

$

21,

37

5.0

$

34,

20

0.0

$

34,

20

0.0

$

89,

77

5.0

$

27

7,8

75.

0

$

427

,50

0.0

$

517

,27

5.0

$

1,7

10,

00

0.0

Manufacturing overhead budget

Ja

n-

20

Fe

b-

20

M

ar-

20

Ap

r-

20

M

ay-

20

Ju

n-

20

Jul

-20

Au

g-

20

Se

p-

20

Oc

t-

20

No

v-

20

De

c-

20

To

tal

Unit produced

12,

00

0

24,

00

0

19,

50

0

46,

50

0

6,0

00

7,5

00

12,

00

0

12,

00

0

31,

50

0

97,

50

0

150

,00

0

181

,50

0

60

0,0

00

Variable cost:

Utilities cost

$

7,8

00

$

15,

60

0

$

12,

67

5

$

30,

22

5

$

3,9

00

$

4,8

75

$

7,8

00

$

7,8

00

$

20,

47

5

$

63,

37

5

$

97,

500

$

117

,97

5

$

39

0,0

00

Indirect material

$

3,0

00

$

6,0

00

$

4,8

75

$

11,

62

5

$

1,5

00

$

1,8

75

$

3,0

00

$

3,0

00

$

7,8

75

$

24,

37

5

$

37,

500

$

45,

375

$

15

0,0

00

Plant

maintainence

$

3,6

00

$

7,2

00

$

5,8

50

$

13,

95

$

1,8

00

$

2,2

50

$

3,6

00

$

3,6

00

$

9,4

50

$

29,

25

$

45,

000

$

54,

450

$

18

0,0

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Managerial Accounting

17

0 0 00

Environmental

fee

$

1,6

80

$

3,3

60

$

2,7

30

$

6,5

10

$

84

0

$

1,0

50

$

1,6

80

$

1,6

80

$

4,4

10

$

13,

65

0

$

21,

000

$

25,

410

$

84,

00

0

Others

$

72

0

$

1,4

40

$

1,1

70

$

2,7

90

$

36

0

$

45

0

$

72

0

$

72

0

$

1,8

90

$

5,8

50

$

9,0

00

$

10,

890

$

36,

00

0

Fixed cost:

Training and

devlopment

$

3,6

00

$

3,6

00

$

3,6

00

$

3,6

00

$

3,6

00

$

3,6

00

$

3,6

00

$

3,6

00

$

3,6

00

$

3,6

00

$

3,6

00

$

3,6

00

$

43,

20

0

Property and

business taxes

$

3,3

00

$

3,3

00

$

3,3

00

$

3,3

00

$

3,3

00

$

3,3

00

$

3,3

00

$

3,3

00

$

3,3

00

$

3,3

00

$

3,3

00

$

3,3

00

$

39,

60

0

Supervisor's

salary

$

12,

45

0

$

12,

45

0

$

12,

45

0

$

12,

45

0

$

12,

45

0

$

12,

45

0

$

12,

45

0

$

12,

45

0

$

12,

45

0

$

12,

45

0

$

12,

450

$

12,

450

$

14

9,4

00

Amortization on

equipment

$

14,

90

0

$

14,

90

0

$

14,

90

0

$

14,

90

0

$

14,

90

0

$

14,

90

0

$

14,

90

0

$

14,

90

0

$

14,

90

0

$

14,

90

0

$

14,

900

$

14,

900

$

17

8,8

00

Insuarnce

$

8,0

00

$

8,0

00

$

8,0

00

$

8,0

00

$

8,0

00

$

8,0

00

$

8,0

00

$

8,0

00

$

8,0

00

$

8,0

00

$

8,0

00

$

8,0

00

$

96,

00

0

Others

$

9,8

00

$

9,8

00

$

9,8

00

$

9,8

00

$

9,8

00

$

9,8

00

$

9,8

00

$

9,8

00

$

9,8

00

$

9,8

00

$

9,8

00

$

9,8

00

$

11

7,6

00

Total

manufacturing

cost

$

68,

85

0

$

85,

65

0

$

79,

35

0

$

11

7,1

50

$

60,

45

0

$

62,

55

0

$

68,

85

0

$

68,

85

0

$

96,

15

0

$

18

8,5

50

$

262

,05

0

$

306

,15

0

$

1,4

64,

60

0

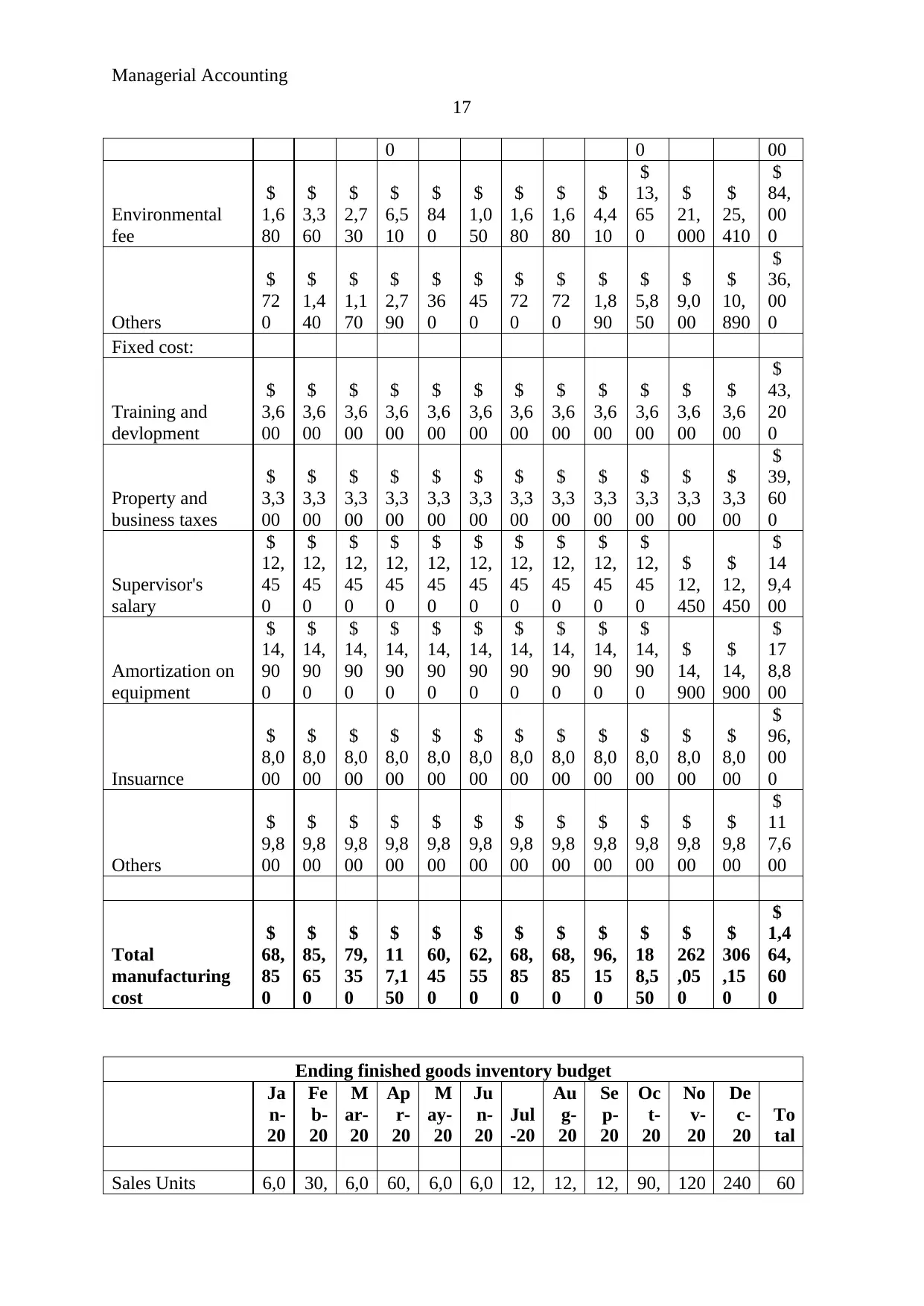

Ending finished goods inventory budget

Ja

n-

20

Fe

b-

20

M

ar-

20

Ap

r-

20

M

ay-

20

Ju

n-

20

Jul

-20

Au

g-

20

Se

p-

20

Oc

t-

20

No

v-

20

De

c-

20

To

tal

Sales Units 6,0 30, 6,0 60, 6,0 6,0 12, 12, 12, 90, 120 240 60

17

0 0 00

Environmental

fee

$

1,6

80

$

3,3

60

$

2,7

30

$

6,5

10

$

84

0

$

1,0

50

$

1,6

80

$

1,6

80

$

4,4

10

$

13,

65

0

$

21,

000

$

25,

410

$

84,

00

0

Others

$

72

0

$

1,4

40

$

1,1

70

$

2,7

90

$

36

0

$

45

0

$

72

0

$

72

0

$

1,8

90

$

5,8

50

$

9,0

00

$

10,

890

$

36,

00

0

Fixed cost:

Training and

devlopment

$

3,6

00

$

3,6

00

$

3,6

00

$

3,6

00

$

3,6

00

$

3,6

00

$

3,6

00

$

3,6

00

$

3,6

00

$

3,6

00

$

3,6

00

$

3,6

00

$

43,

20

0

Property and

business taxes

$

3,3

00

$

3,3

00

$

3,3

00

$

3,3

00

$

3,3

00

$

3,3

00

$

3,3

00

$

3,3

00

$

3,3

00

$

3,3

00

$

3,3

00

$

3,3

00

$

39,

60

0

Supervisor's

salary

$

12,

45

0

$

12,

45

0

$

12,

45

0

$

12,

45

0

$

12,

45

0

$

12,

45

0

$

12,

45

0

$

12,

45

0

$

12,

45

0

$

12,

45

0

$

12,

450

$

12,

450

$

14

9,4

00

Amortization on

equipment

$

14,

90

0

$

14,

90

0

$

14,

90

0

$

14,

90

0

$

14,

90

0

$

14,

90

0

$

14,

90

0

$

14,

90

0

$

14,

90

0

$

14,

90

0

$

14,

900

$

14,

900

$

17

8,8

00

Insuarnce

$

8,0

00

$

8,0

00

$

8,0

00

$

8,0

00

$

8,0

00

$

8,0

00

$

8,0

00

$

8,0

00

$

8,0

00

$

8,0

00

$

8,0

00

$

8,0

00

$

96,

00

0

Others

$

9,8

00

$

9,8

00

$

9,8

00

$

9,8

00

$

9,8

00

$

9,8

00

$

9,8

00

$

9,8

00

$

9,8

00

$

9,8

00

$

9,8

00

$

9,8

00

$

11

7,6

00

Total

manufacturing

cost

$

68,

85

0

$

85,

65

0

$

79,

35

0

$

11

7,1

50

$

60,

45

0

$

62,

55

0

$

68,

85

0

$

68,

85

0

$

96,

15

0

$

18

8,5

50

$

262

,05

0

$

306

,15

0

$

1,4

64,

60

0

Ending finished goods inventory budget

Ja

n-

20

Fe

b-

20

M

ar-

20

Ap

r-

20

M

ay-

20

Ju

n-

20

Jul

-20

Au

g-

20

Se

p-

20

Oc

t-

20

No

v-

20

De

c-

20

To

tal

Sales Units 6,0 30, 6,0 60, 6,0 6,0 12, 12, 12, 90, 120 240 60

Managerial Accounting

18

00

00

0 00

00

0 00 00

00

0

00

0

00

0

00

0

,00

0

,00

0

0,0

00

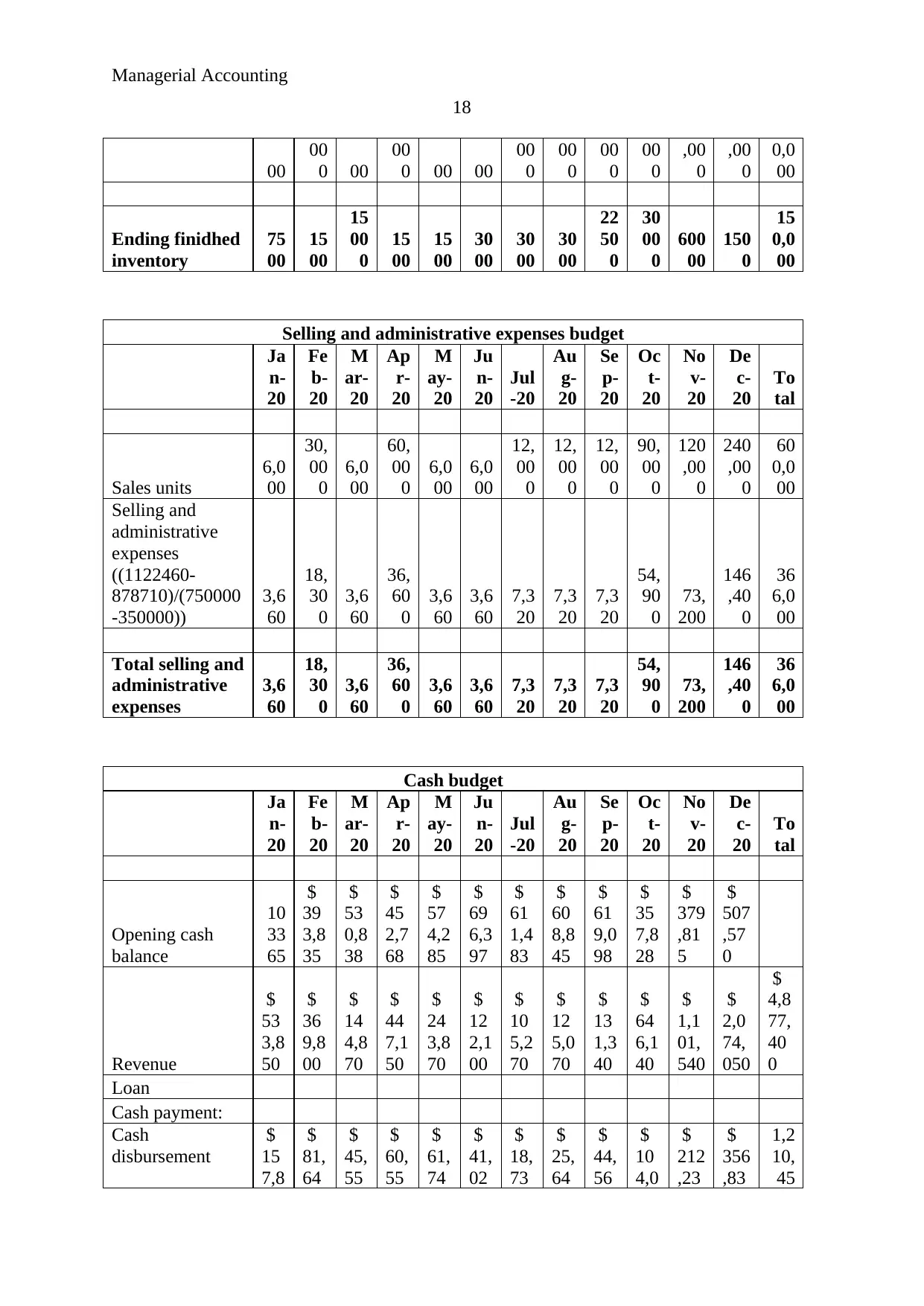

Ending finidhed

inventory

75

00

15

00

15

00

0

15

00

15

00

30

00

30

00

30

00

22

50

0

30

00

0

600

00

150

0

15

0,0

00

Selling and administrative expenses budget

Ja

n-

20

Fe

b-

20

M

ar-

20

Ap

r-

20

M

ay-

20

Ju

n-

20

Jul

-20

Au

g-

20

Se

p-

20

Oc

t-

20

No

v-

20

De

c-

20

To

tal

Sales units

6,0

00

30,

00

0

6,0

00

60,

00

0

6,0

00

6,0

00

12,

00

0

12,

00

0

12,

00

0

90,

00

0

120

,00

0

240

,00

0

60

0,0

00

Selling and

administrative

expenses

((1122460-

878710)/(750000

-350000))

3,6

60

18,

30

0

3,6

60

36,

60

0

3,6

60

3,6

60

7,3

20

7,3

20

7,3

20

54,

90

0

73,

200

146

,40

0

36

6,0

00

Total selling and

administrative

expenses

3,6

60

18,

30

0

3,6

60

36,

60

0

3,6

60

3,6

60

7,3

20

7,3

20

7,3

20

54,

90

0

73,

200

146

,40

0

36

6,0

00

Cash budget

Ja

n-

20

Fe

b-

20

M

ar-

20

Ap

r-

20

M

ay-

20

Ju

n-

20

Jul

-20

Au

g-

20

Se

p-

20

Oc

t-

20

No

v-

20

De

c-

20

To

tal

Opening cash

balance

10

33

65

$

39

3,8

35

$

53

0,8

38

$

45

2,7

68

$

57

4,2

85

$

69

6,3

97

$

61

1,4

83

$

60

8,8

45

$

61

9,0

98

$

35

7,8

28

$

379

,81

5

$

507

,57

0

Revenue

$

53

3,8

50

$

36

9,8

00

$

14

4,8

70

$

44

7,1

50

$

24

3,8

70

$

12

2,1

00

$

10

5,2

70

$

12

5,0

70

$

13

1,3

40

$

64

6,1

40

$

1,1

01,

540

$

2,0

74,

050

$

4,8

77,

40

0

Loan

Cash payment:

Cash

disbursement

$

15

7,8

$

81,

64

$

45,

55

$

60,

55

$

61,

74

$

41,

02

$

18,

73

$

25,

64

$

44,

56

$

10

4,0

$

212

,23

$

356

,83

1,2

10,

45

18

00

00

0 00

00

0 00 00

00

0

00

0

00

0

00

0

,00

0

,00

0

0,0

00

Ending finidhed

inventory

75

00

15

00

15

00

0

15

00

15

00

30

00

30

00

30

00

22

50

0

30

00

0

600

00

150

0

15

0,0

00

Selling and administrative expenses budget

Ja

n-

20

Fe

b-

20

M

ar-

20

Ap

r-

20

M

ay-

20

Ju

n-

20

Jul

-20

Au

g-

20

Se

p-

20

Oc

t-

20

No

v-

20

De

c-

20

To

tal

Sales units

6,0

00

30,

00

0

6,0

00

60,

00

0

6,0

00

6,0

00

12,

00

0

12,

00

0

12,

00

0

90,

00

0

120

,00

0

240

,00

0

60

0,0

00

Selling and

administrative

expenses

((1122460-

878710)/(750000

-350000))

3,6

60

18,

30

0

3,6

60

36,

60

0

3,6

60

3,6

60

7,3

20

7,3

20

7,3

20

54,

90

0

73,

200

146

,40

0

36

6,0

00

Total selling and

administrative

expenses

3,6

60

18,

30

0

3,6

60

36,

60

0

3,6

60

3,6

60

7,3

20

7,3

20

7,3

20

54,

90

0

73,

200

146

,40

0

36

6,0

00

Cash budget

Ja

n-

20

Fe

b-

20

M

ar-

20