Accounting Report: Financial, Management Accounting and Analysis

VerifiedAdded on 2023/01/16

|14

|2710

|56

Report

AI Summary

This report provides a comprehensive overview of accounting, focusing on both financial and management accounting. It begins with an executive summary and an introduction to accounting, emphasizing its role in communicating business results. The report then delves into the distinctions between financial and management accounting, outlining their respective functions and the types of information they provide. Financial accounting is presented as a specialized branch that tracks financial transactions, prepares financial statements, and communicates results to external stakeholders. Management accounting, on the other hand, is described as providing financial information to internal managers for decision-making, cost control, and business development. The report includes detailed analysis of investment appraisal techniques, such as payback period, accounting rate of return, net present value, and internal rate of return, to evaluate the viability of three different projects. Finally, the report presents a financial analysis using ratio analysis to assess the company's profitability, liquidity, and efficiency, providing insights into the company's financial health and performance.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

EXECUTIVE SUMMARY

Report is about the accounting and the types of accounting. Report will include the

understanding of management accounting and financial accounting. Function of both the

accounting methods are also discussed in the report. This will also include the concepts and

techniques that are used in management and financial accounting.

Report is about the accounting and the types of accounting. Report will include the

understanding of management accounting and financial accounting. Function of both the

accounting methods are also discussed in the report. This will also include the concepts and

techniques that are used in management and financial accounting.

TABLE OF CONTENTS

EXECUTIVE SUMMARY.............................................................................................................2

INTRODUCTION...........................................................................................................................1

RESEARCH/ FINDINGS / ANALYSIS.........................................................................................1

Question 1....................................................................................................................................1

Question 2....................................................................................................................................3

Question 3....................................................................................................................................8

CONCLUSION..............................................................................................................................10

REFERENCES..............................................................................................................................11

EXECUTIVE SUMMARY.............................................................................................................2

INTRODUCTION...........................................................................................................................1

RESEARCH/ FINDINGS / ANALYSIS.........................................................................................1

Question 1....................................................................................................................................1

Question 2....................................................................................................................................3

Question 3....................................................................................................................................8

CONCLUSION..............................................................................................................................10

REFERENCES..............................................................................................................................11

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

INTRODUCTION

Accounting is medium for communicating the results of the business operations for

various parties that are interested or are associated with business. They are owners, investors,

creditors, bank and the financial institutions. This is known as the business language. Accounting

is not limited to business, but extends to everyone that is required to keep record of monetary

transactions. As per Smith and Ashburne Accounting refers to science of recording & classifying

the business events and transactions of financial character (Otley, 2016). It is also art of creating

significant summaries, analysing and interpreting the transactions and communicating results to

judgement and decision makers. The report will provide about the branches of accounting that

are management accounting and the financial accounting. It will also cover the numericals on

capital budgeting and analysis of financial statements using ratio analysis.

RESEARCH/ FINDINGS / ANALYSIS

Question 1

Financial accounting

Financial Accounting refers to specialized accounting branch keeping track of the

financial transactions of company. Companies using standards and guidelines record transaction,

summarize and present the information in financial statements or the financial reports. These

reports include profit or loss statements, balance sheet and cash flow statements.

Financial statement are to be issued by the companies on routine basis. Financial

statements are considered external to the as given outside people of the company. The motive of

financial accounting is not only of reporting value of company. Purpose is of providing

information for assessing value of company and its financial position (Mårtensson and et.al.,

2016). They are prepared mainly for the external users of the company. Use of financial

statements is for assessing financial health before the investments could be made.

Functions of Financial Accounting

Systematic Record

Main Function of financial accounting is of recording the financial transactions of

business. Systematic refers to recording using financial standards and national guidelines for

recording every transaction of business.

Analysing & Summarizing

1

Accounting is medium for communicating the results of the business operations for

various parties that are interested or are associated with business. They are owners, investors,

creditors, bank and the financial institutions. This is known as the business language. Accounting

is not limited to business, but extends to everyone that is required to keep record of monetary

transactions. As per Smith and Ashburne Accounting refers to science of recording & classifying

the business events and transactions of financial character (Otley, 2016). It is also art of creating

significant summaries, analysing and interpreting the transactions and communicating results to

judgement and decision makers. The report will provide about the branches of accounting that

are management accounting and the financial accounting. It will also cover the numericals on

capital budgeting and analysis of financial statements using ratio analysis.

RESEARCH/ FINDINGS / ANALYSIS

Question 1

Financial accounting

Financial Accounting refers to specialized accounting branch keeping track of the

financial transactions of company. Companies using standards and guidelines record transaction,

summarize and present the information in financial statements or the financial reports. These

reports include profit or loss statements, balance sheet and cash flow statements.

Financial statement are to be issued by the companies on routine basis. Financial

statements are considered external to the as given outside people of the company. The motive of

financial accounting is not only of reporting value of company. Purpose is of providing

information for assessing value of company and its financial position (Mårtensson and et.al.,

2016). They are prepared mainly for the external users of the company. Use of financial

statements is for assessing financial health before the investments could be made.

Functions of Financial Accounting

Systematic Record

Main Function of financial accounting is of recording the financial transactions of

business. Systematic refers to recording using financial standards and national guidelines for

recording every transaction of business.

Analysing & Summarizing

1

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

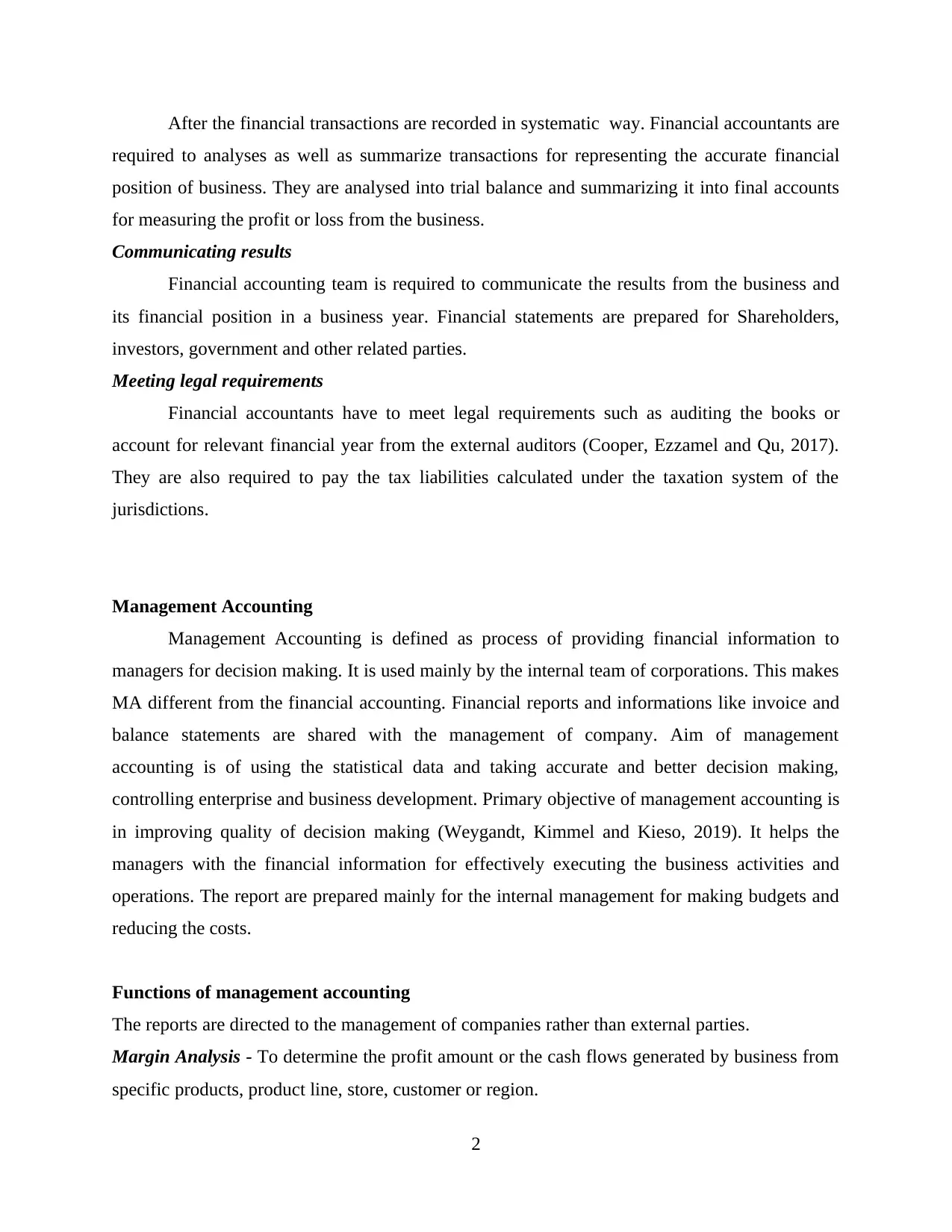

After the financial transactions are recorded in systematic way. Financial accountants are

required to analyses as well as summarize transactions for representing the accurate financial

position of business. They are analysed into trial balance and summarizing it into final accounts

for measuring the profit or loss from the business.

Communicating results

Financial accounting team is required to communicate the results from the business and

its financial position in a business year. Financial statements are prepared for Shareholders,

investors, government and other related parties.

Meeting legal requirements

Financial accountants have to meet legal requirements such as auditing the books or

account for relevant financial year from the external auditors (Cooper, Ezzamel and Qu, 2017).

They are also required to pay the tax liabilities calculated under the taxation system of the

jurisdictions.

Management Accounting

Management Accounting is defined as process of providing financial information to

managers for decision making. It is used mainly by the internal team of corporations. This makes

MA different from the financial accounting. Financial reports and informations like invoice and

balance statements are shared with the management of company. Aim of management

accounting is of using the statistical data and taking accurate and better decision making,

controlling enterprise and business development. Primary objective of management accounting is

in improving quality of decision making (Weygandt, Kimmel and Kieso, 2019). It helps the

managers with the financial information for effectively executing the business activities and

operations. The report are prepared mainly for the internal management for making budgets and

reducing the costs.

Functions of management accounting

The reports are directed to the management of companies rather than external parties.

Margin Analysis - To determine the profit amount or the cash flows generated by business from

specific products, product line, store, customer or region.

2

required to analyses as well as summarize transactions for representing the accurate financial

position of business. They are analysed into trial balance and summarizing it into final accounts

for measuring the profit or loss from the business.

Communicating results

Financial accounting team is required to communicate the results from the business and

its financial position in a business year. Financial statements are prepared for Shareholders,

investors, government and other related parties.

Meeting legal requirements

Financial accountants have to meet legal requirements such as auditing the books or

account for relevant financial year from the external auditors (Cooper, Ezzamel and Qu, 2017).

They are also required to pay the tax liabilities calculated under the taxation system of the

jurisdictions.

Management Accounting

Management Accounting is defined as process of providing financial information to

managers for decision making. It is used mainly by the internal team of corporations. This makes

MA different from the financial accounting. Financial reports and informations like invoice and

balance statements are shared with the management of company. Aim of management

accounting is of using the statistical data and taking accurate and better decision making,

controlling enterprise and business development. Primary objective of management accounting is

in improving quality of decision making (Weygandt, Kimmel and Kieso, 2019). It helps the

managers with the financial information for effectively executing the business activities and

operations. The report are prepared mainly for the internal management for making budgets and

reducing the costs.

Functions of management accounting

The reports are directed to the management of companies rather than external parties.

Margin Analysis - To determine the profit amount or the cash flows generated by business from

specific products, product line, store, customer or region.

2

Break-even analysis – To calculate unit volume and contribution margin mix where the business

breaks even exactly that is helpful in determining the prices of products & services.

Constraint analysis – To understand the main bottlenecks in company, and how their ability is

impacting the ability of business in earning profits and revenues.

Target Costing – To assist in designing the new products through accumulation of new design's

cost, comparing them with targeted cost levels & reporting these information to the management.

Inventory valuation – To determine direct costs associated with the cost of goods sold as well as

the inventory items and allocation of overhead cost to the items (Schaltegger and Burritt, 2017).

Trend Analysis – For reviewing trend line related to various costs incurred to identify if any

unusual variances are seen in the long term patterns.

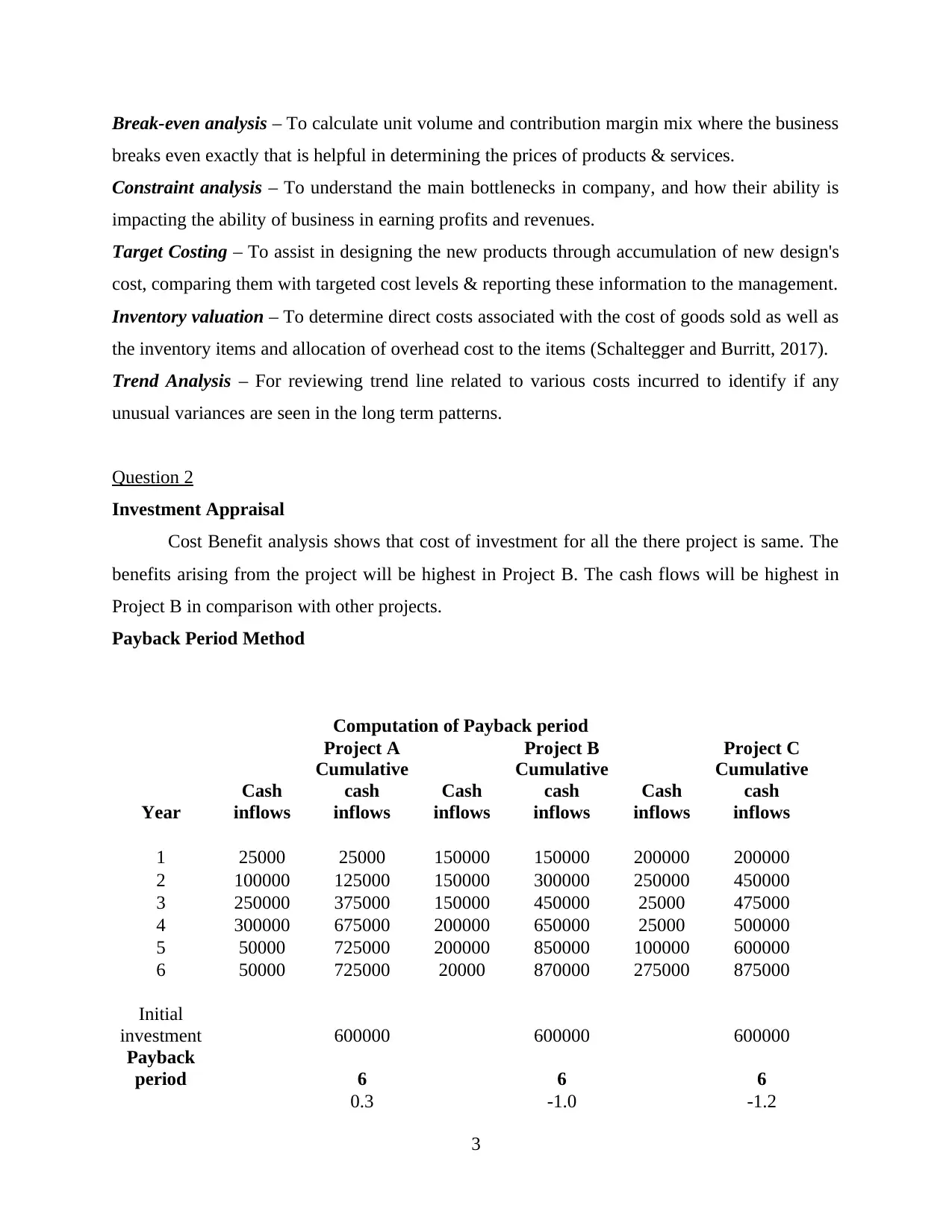

Question 2

Investment Appraisal

Cost Benefit analysis shows that cost of investment for all the there project is same. The

benefits arising from the project will be highest in Project B. The cash flows will be highest in

Project B in comparison with other projects.

Payback Period Method

Computation of Payback period

Project A Project B Project C

Year

Cash

inflows

Cumulative

cash

inflows

Cash

inflows

Cumulative

cash

inflows

Cash

inflows

Cumulative

cash

inflows

1 25000 25000 150000 150000 200000 200000

2 100000 125000 150000 300000 250000 450000

3 250000 375000 150000 450000 25000 475000

4 300000 675000 200000 650000 25000 500000

5 50000 725000 200000 850000 100000 600000

6 50000 725000 20000 870000 275000 875000

Initial

investment 600000 600000 600000

Payback

period 6 6 6

0.3 -1.0 -1.2

3

breaks even exactly that is helpful in determining the prices of products & services.

Constraint analysis – To understand the main bottlenecks in company, and how their ability is

impacting the ability of business in earning profits and revenues.

Target Costing – To assist in designing the new products through accumulation of new design's

cost, comparing them with targeted cost levels & reporting these information to the management.

Inventory valuation – To determine direct costs associated with the cost of goods sold as well as

the inventory items and allocation of overhead cost to the items (Schaltegger and Burritt, 2017).

Trend Analysis – For reviewing trend line related to various costs incurred to identify if any

unusual variances are seen in the long term patterns.

Question 2

Investment Appraisal

Cost Benefit analysis shows that cost of investment for all the there project is same. The

benefits arising from the project will be highest in Project B. The cash flows will be highest in

Project B in comparison with other projects.

Payback Period Method

Computation of Payback period

Project A Project B Project C

Year

Cash

inflows

Cumulative

cash

inflows

Cash

inflows

Cumulative

cash

inflows

Cash

inflows

Cumulative

cash

inflows

1 25000 25000 150000 150000 200000 200000

2 100000 125000 150000 300000 250000 450000

3 250000 375000 150000 450000 25000 475000

4 300000 675000 200000 650000 25000 500000

5 50000 725000 200000 850000 100000 600000

6 50000 725000 20000 870000 275000 875000

Initial

investment 600000 600000 600000

Payback

period 6 6 6

0.3 -1.0 -1.2

3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Payback

period

5 year and

3 months 5 years

4 years and

10 months

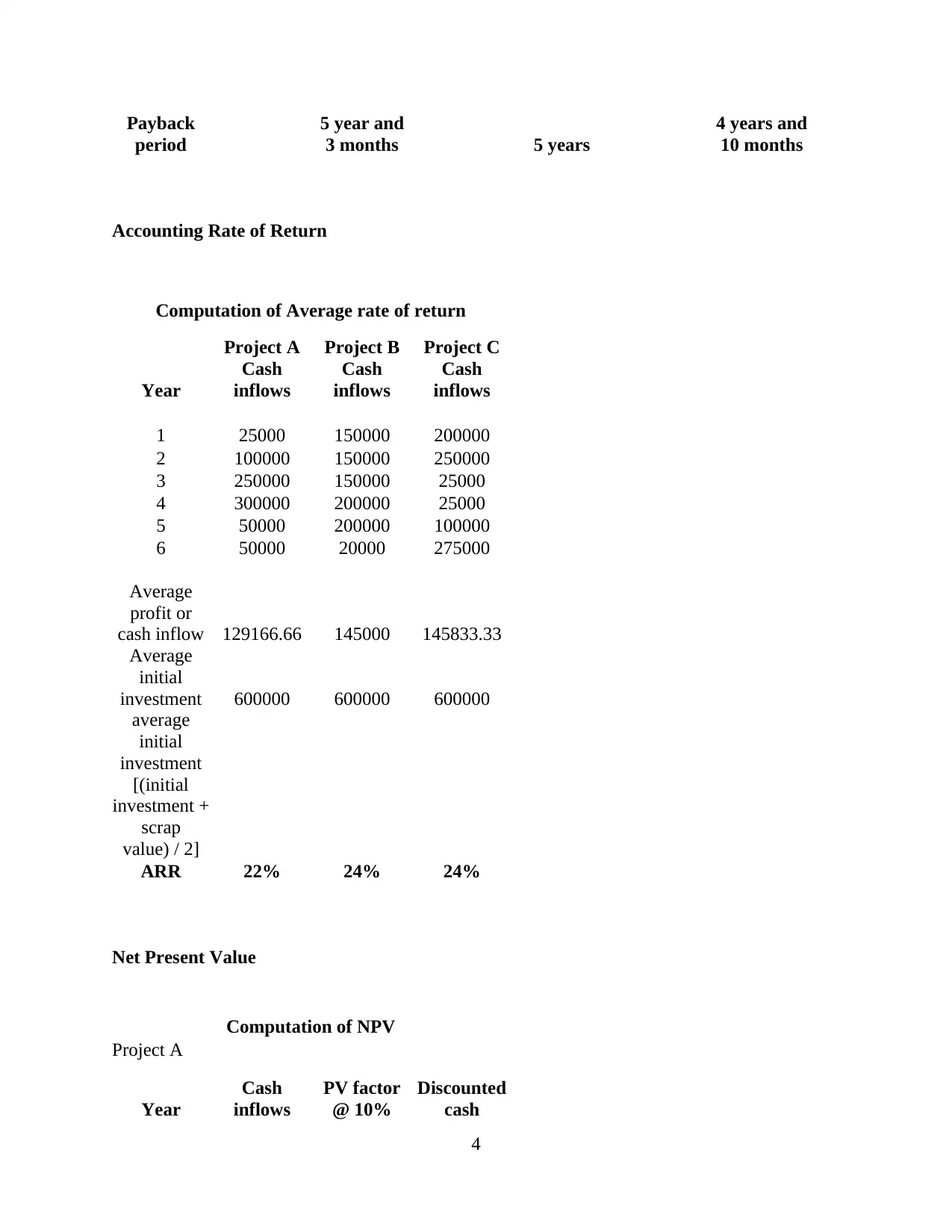

Accounting Rate of Return

Computation of Average rate of return

Project A Project B Project C

Year

Cash

inflows

Cash

inflows

Cash

inflows

1 25000 150000 200000

2 100000 150000 250000

3 250000 150000 25000

4 300000 200000 25000

5 50000 200000 100000

6 50000 20000 275000

Average

profit or

cash inflow 129166.66 145000 145833.33

Average

initial

investment 600000 600000 600000

average

initial

investment

[(initial

investment +

scrap

value) / 2]

ARR 22% 24% 24%

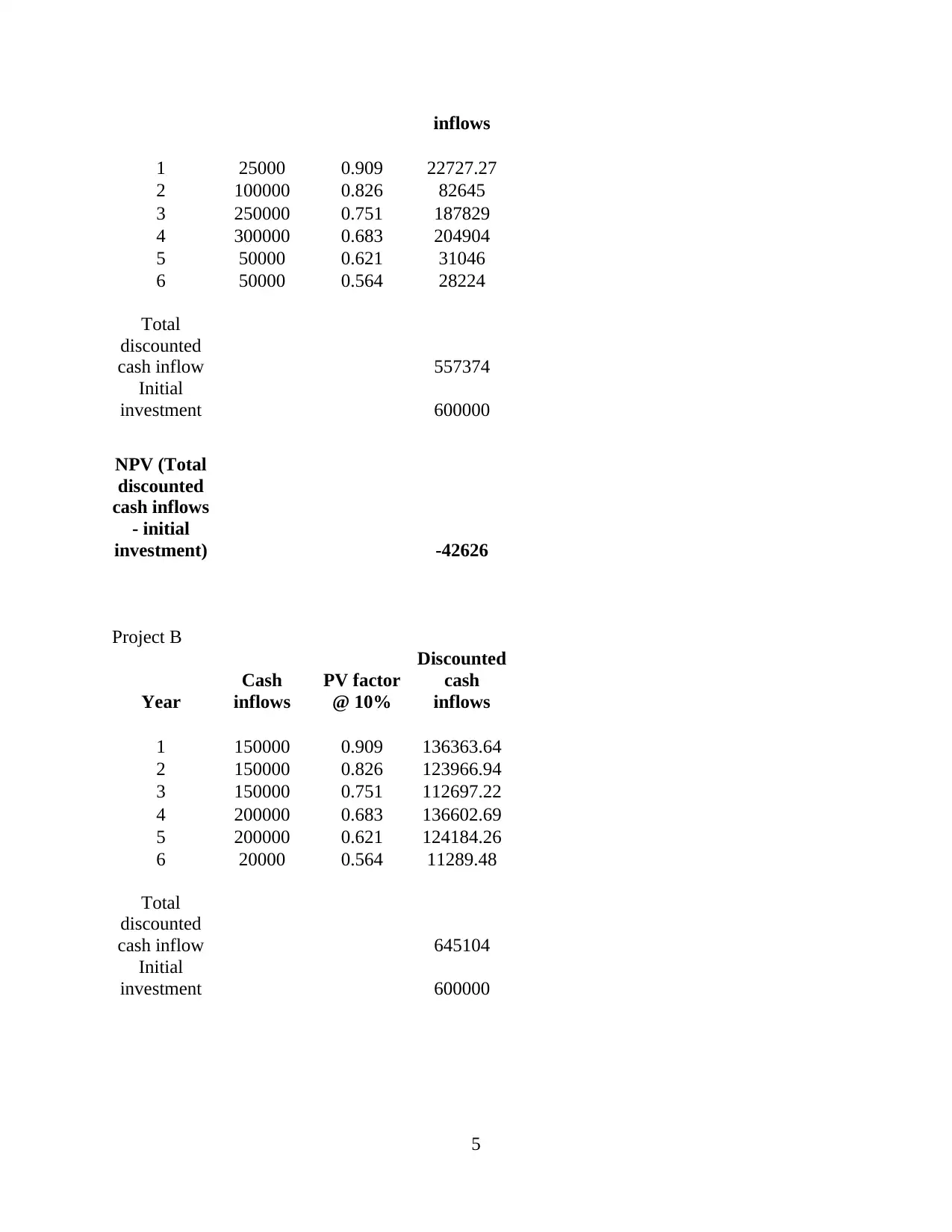

Net Present Value

Computation of NPV

Project A

Year

Cash

inflows

PV factor

@ 10%

Discounted

cash

4

period

5 year and

3 months 5 years

4 years and

10 months

Accounting Rate of Return

Computation of Average rate of return

Project A Project B Project C

Year

Cash

inflows

Cash

inflows

Cash

inflows

1 25000 150000 200000

2 100000 150000 250000

3 250000 150000 25000

4 300000 200000 25000

5 50000 200000 100000

6 50000 20000 275000

Average

profit or

cash inflow 129166.66 145000 145833.33

Average

initial

investment 600000 600000 600000

average

initial

investment

[(initial

investment +

scrap

value) / 2]

ARR 22% 24% 24%

Net Present Value

Computation of NPV

Project A

Year

Cash

inflows

PV factor

@ 10%

Discounted

cash

4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

inflows

1 25000 0.909 22727.27

2 100000 0.826 82645

3 250000 0.751 187829

4 300000 0.683 204904

5 50000 0.621 31046

6 50000 0.564 28224

Total

discounted

cash inflow 557374

Initial

investment 600000

NPV (Total

discounted

cash inflows

- initial

investment) -42626

Project B

Year

Cash

inflows

PV factor

@ 10%

Discounted

cash

inflows

1 150000 0.909 136363.64

2 150000 0.826 123966.94

3 150000 0.751 112697.22

4 200000 0.683 136602.69

5 200000 0.621 124184.26

6 20000 0.564 11289.48

Total

discounted

cash inflow 645104

Initial

investment 600000

5

1 25000 0.909 22727.27

2 100000 0.826 82645

3 250000 0.751 187829

4 300000 0.683 204904

5 50000 0.621 31046

6 50000 0.564 28224

Total

discounted

cash inflow 557374

Initial

investment 600000

NPV (Total

discounted

cash inflows

- initial

investment) -42626

Project B

Year

Cash

inflows

PV factor

@ 10%

Discounted

cash

inflows

1 150000 0.909 136363.64

2 150000 0.826 123966.94

3 150000 0.751 112697.22

4 200000 0.683 136602.69

5 200000 0.621 124184.26

6 20000 0.564 11289.48

Total

discounted

cash inflow 645104

Initial

investment 600000

5

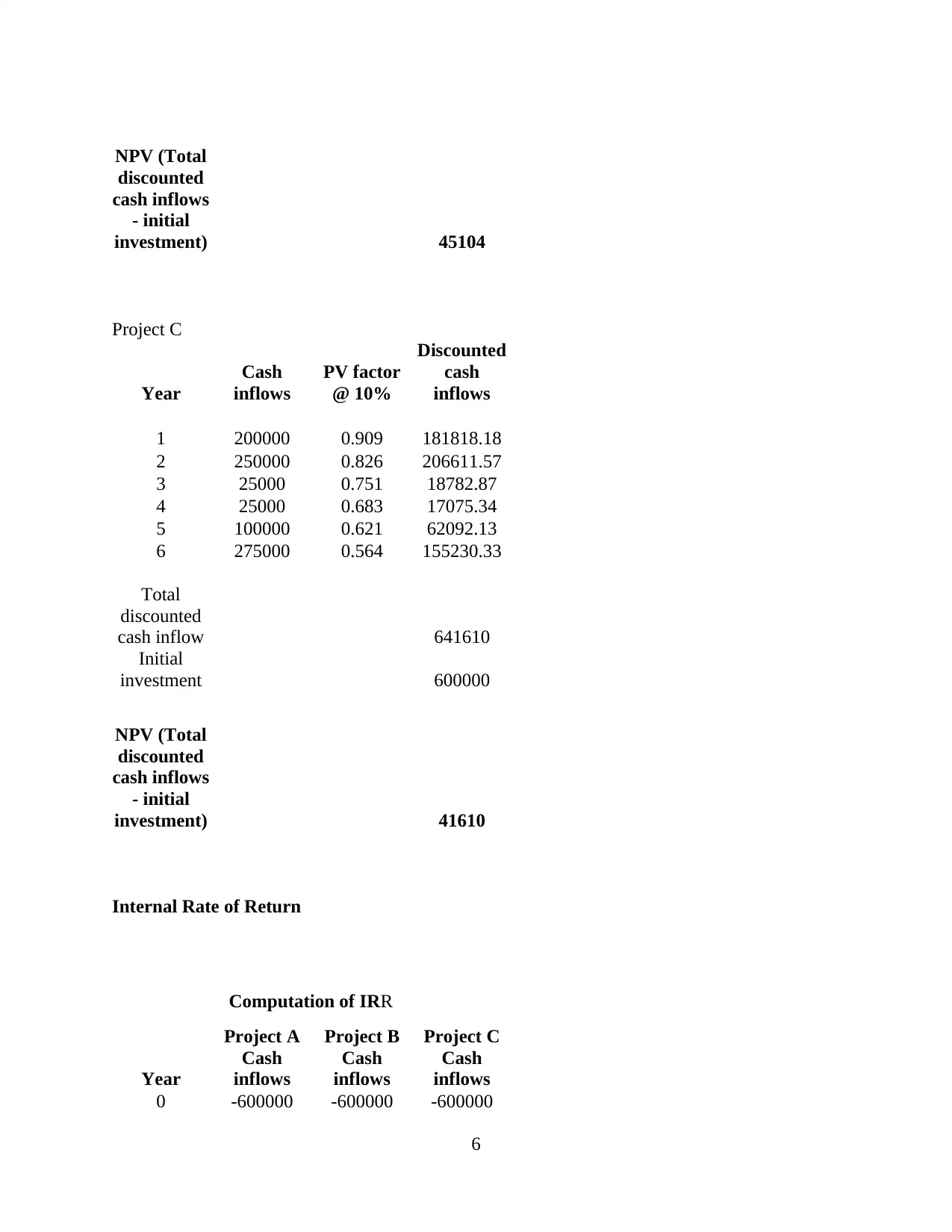

NPV (Total

discounted

cash inflows

- initial

investment) 45104

Project C

Year

Cash

inflows

PV factor

@ 10%

Discounted

cash

inflows

1 200000 0.909 181818.18

2 250000 0.826 206611.57

3 25000 0.751 18782.87

4 25000 0.683 17075.34

5 100000 0.621 62092.13

6 275000 0.564 155230.33

Total

discounted

cash inflow 641610

Initial

investment 600000

NPV (Total

discounted

cash inflows

- initial

investment) 41610

Internal Rate of Return

Computation of IRR

Project A Project B Project C

Year

Cash

inflows

Cash

inflows

Cash

inflows

0 -600000 -600000 -600000

6

discounted

cash inflows

- initial

investment) 45104

Project C

Year

Cash

inflows

PV factor

@ 10%

Discounted

cash

inflows

1 200000 0.909 181818.18

2 250000 0.826 206611.57

3 25000 0.751 18782.87

4 25000 0.683 17075.34

5 100000 0.621 62092.13

6 275000 0.564 155230.33

Total

discounted

cash inflow 641610

Initial

investment 600000

NPV (Total

discounted

cash inflows

- initial

investment) 41610

Internal Rate of Return

Computation of IRR

Project A Project B Project C

Year

Cash

inflows

Cash

inflows

Cash

inflows

0 -600000 -600000 -600000

6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 25000 150000 200000

2 100000 150000 250000

3 250000 150000 25000

4 300000 200000 25000

5 50000 200000 100000

6 50000 20000 275000

Internal

rate of

return

(IRR) 8% 13% 12%

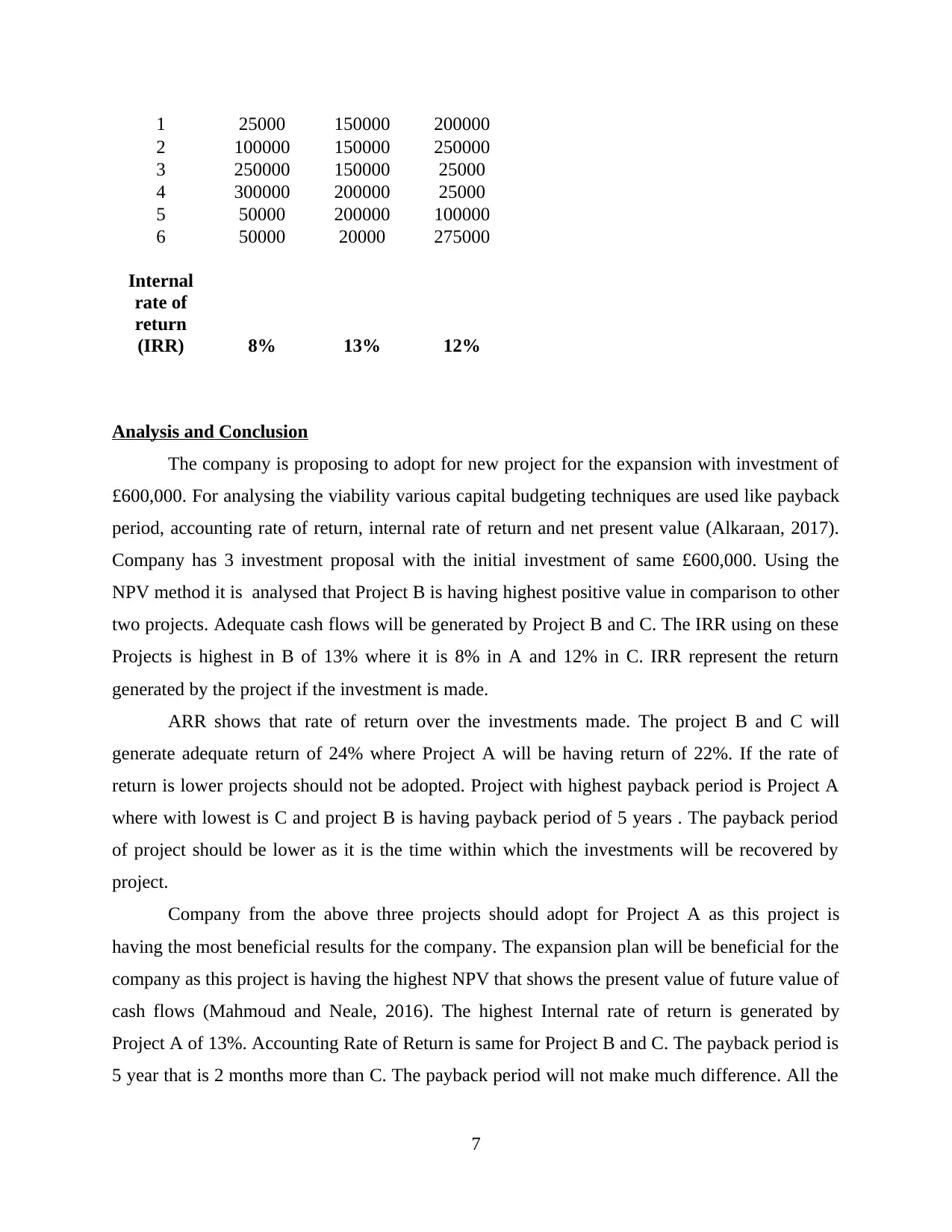

Analysis and Conclusion

The company is proposing to adopt for new project for the expansion with investment of

£600,000. For analysing the viability various capital budgeting techniques are used like payback

period, accounting rate of return, internal rate of return and net present value (Alkaraan, 2017).

Company has 3 investment proposal with the initial investment of same £600,000. Using the

NPV method it is analysed that Project B is having highest positive value in comparison to other

two projects. Adequate cash flows will be generated by Project B and C. The IRR using on these

Projects is highest in B of 13% where it is 8% in A and 12% in C. IRR represent the return

generated by the project if the investment is made.

ARR shows that rate of return over the investments made. The project B and C will

generate adequate return of 24% where Project A will be having return of 22%. If the rate of

return is lower projects should not be adopted. Project with highest payback period is Project A

where with lowest is C and project B is having payback period of 5 years . The payback period

of project should be lower as it is the time within which the investments will be recovered by

project.

Company from the above three projects should adopt for Project A as this project is

having the most beneficial results for the company. The expansion plan will be beneficial for the

company as this project is having the highest NPV that shows the present value of future value of

cash flows (Mahmoud and Neale, 2016). The highest Internal rate of return is generated by

Project A of 13%. Accounting Rate of Return is same for Project B and C. The payback period is

5 year that is 2 months more than C. The payback period will not make much difference. All the

7

2 100000 150000 250000

3 250000 150000 25000

4 300000 200000 25000

5 50000 200000 100000

6 50000 20000 275000

Internal

rate of

return

(IRR) 8% 13% 12%

Analysis and Conclusion

The company is proposing to adopt for new project for the expansion with investment of

£600,000. For analysing the viability various capital budgeting techniques are used like payback

period, accounting rate of return, internal rate of return and net present value (Alkaraan, 2017).

Company has 3 investment proposal with the initial investment of same £600,000. Using the

NPV method it is analysed that Project B is having highest positive value in comparison to other

two projects. Adequate cash flows will be generated by Project B and C. The IRR using on these

Projects is highest in B of 13% where it is 8% in A and 12% in C. IRR represent the return

generated by the project if the investment is made.

ARR shows that rate of return over the investments made. The project B and C will

generate adequate return of 24% where Project A will be having return of 22%. If the rate of

return is lower projects should not be adopted. Project with highest payback period is Project A

where with lowest is C and project B is having payback period of 5 years . The payback period

of project should be lower as it is the time within which the investments will be recovered by

project.

Company from the above three projects should adopt for Project A as this project is

having the most beneficial results for the company. The expansion plan will be beneficial for the

company as this project is having the highest NPV that shows the present value of future value of

cash flows (Mahmoud and Neale, 2016). The highest Internal rate of return is generated by

Project A of 13%. Accounting Rate of Return is same for Project B and C. The payback period is

5 year that is 2 months more than C. The payback period will not make much difference. All the

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

techniques of capital budgeting provides for the viability of project B and after that for C.

Project A should not be adopted by the company.

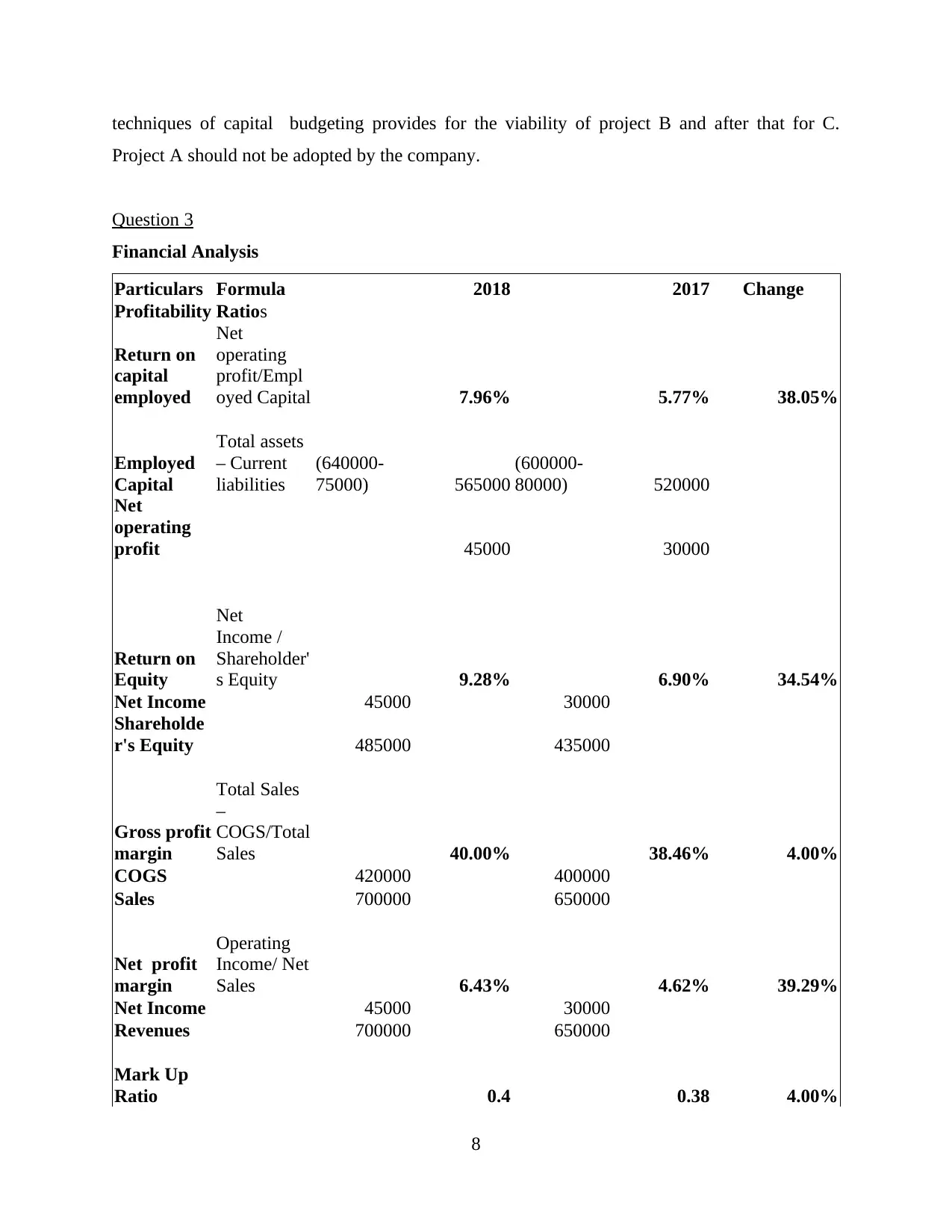

Question 3

Financial Analysis

Particulars Formula 2018 2017 Change

Profitability Ratios

Return on

capital

employed

Net

operating

profit/Empl

oyed Capital 7.96% 5.77% 38.05%

Employed

Capital

Total assets

– Current

liabilities

(640000-

75000) 565000

(600000-

80000) 520000

Net

operating

profit 45000 30000

Return on

Equity

Net

Income /

Shareholder'

s Equity 9.28% 6.90% 34.54%

Net Income 45000 30000

Shareholde

r's Equity 485000 435000

Gross profit

margin

Total Sales

–

COGS/Total

Sales 40.00% 38.46% 4.00%

COGS 420000 400000

Sales 700000 650000

Net profit

margin

Operating

Income/ Net

Sales 6.43% 4.62% 39.29%

Net Income 45000 30000

Revenues 700000 650000

Mark Up

Ratio 0.4 0.38 4.00%

8

Project A should not be adopted by the company.

Question 3

Financial Analysis

Particulars Formula 2018 2017 Change

Profitability Ratios

Return on

capital

employed

Net

operating

profit/Empl

oyed Capital 7.96% 5.77% 38.05%

Employed

Capital

Total assets

– Current

liabilities

(640000-

75000) 565000

(600000-

80000) 520000

Net

operating

profit 45000 30000

Return on

Equity

Net

Income /

Shareholder'

s Equity 9.28% 6.90% 34.54%

Net Income 45000 30000

Shareholde

r's Equity 485000 435000

Gross profit

margin

Total Sales

–

COGS/Total

Sales 40.00% 38.46% 4.00%

COGS 420000 400000

Sales 700000 650000

Net profit

margin

Operating

Income/ Net

Sales 6.43% 4.62% 39.29%

Net Income 45000 30000

Revenues 700000 650000

Mark Up

Ratio 0.4 0.38 4.00%

8

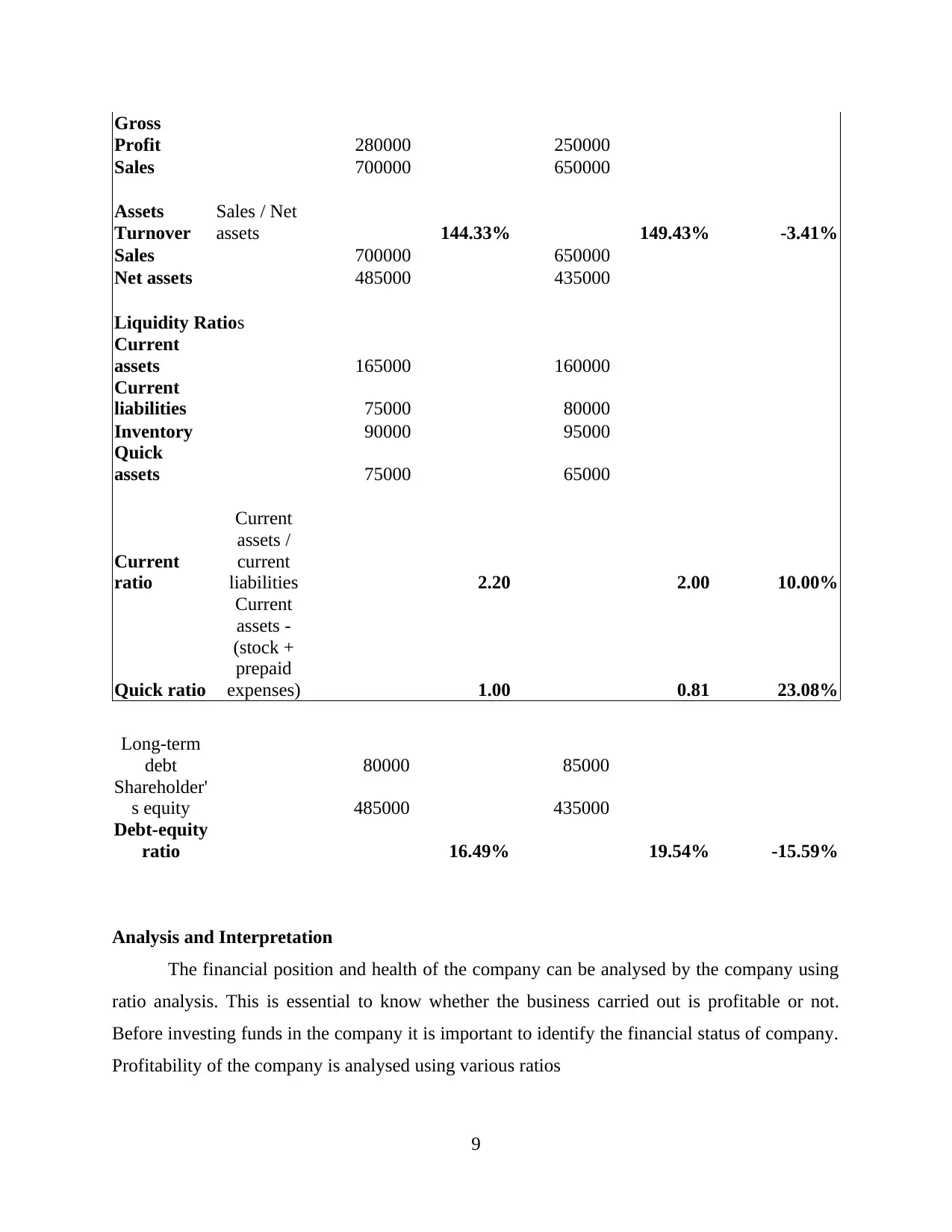

Gross

Profit 280000 250000

Sales 700000 650000

Assets

Turnover

Sales / Net

assets 144.33% 149.43% -3.41%

Sales 700000 650000

Net assets 485000 435000

Liquidity Ratios

Current

assets 165000 160000

Current

liabilities 75000 80000

Inventory 90000 95000

Quick

assets 75000 65000

Current

ratio

Current

assets /

current

liabilities 2.20 2.00 10.00%

Quick ratio

Current

assets -

(stock +

prepaid

expenses) 1.00 0.81 23.08%

Long-term

debt 80000 85000

Shareholder'

s equity 485000 435000

Debt-equity

ratio 16.49% 19.54% -15.59%

Analysis and Interpretation

The financial position and health of the company can be analysed by the company using

ratio analysis. This is essential to know whether the business carried out is profitable or not.

Before investing funds in the company it is important to identify the financial status of company.

Profitability of the company is analysed using various ratios

9

Profit 280000 250000

Sales 700000 650000

Assets

Turnover

Sales / Net

assets 144.33% 149.43% -3.41%

Sales 700000 650000

Net assets 485000 435000

Liquidity Ratios

Current

assets 165000 160000

Current

liabilities 75000 80000

Inventory 90000 95000

Quick

assets 75000 65000

Current

ratio

Current

assets /

current

liabilities 2.20 2.00 10.00%

Quick ratio

Current

assets -

(stock +

prepaid

expenses) 1.00 0.81 23.08%

Long-term

debt 80000 85000

Shareholder'

s equity 485000 435000

Debt-equity

ratio 16.49% 19.54% -15.59%

Analysis and Interpretation

The financial position and health of the company can be analysed by the company using

ratio analysis. This is essential to know whether the business carried out is profitable or not.

Before investing funds in the company it is important to identify the financial status of company.

Profitability of the company is analysed using various ratios

9

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 14

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.