Managing International Business

VerifiedAdded on 2023/01/23

|69

|20400

|72

AI Summary

This literature review focuses on customer satisfaction and service quality in the context of the general insurance market. It explores the dimensions of service quality, such as tangibles, reliability, responsiveness, assurance, and empathy. The review also discusses the SERVQUAL model and its application in the insurance industry. Recommendations and limitations for further research are provided.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Running head: MANAGING INTERNATIONAL BUSINESS

Managing International Business

Managing International Business

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

MANAGING INTERNATIONAL BUSINESS 2

Table of Contents

Chapter 2 Literature review...................................................................................................................4

2.0 Introduction.................................................................................................................................4

2.1 Service Quality............................................................................................................................4

2.2 Perceived Value.........................................................................................................................13

2.3 Customer Satisfaction................................................................................................................19

2.4 Customer Loyalty......................................................................................................................21

Chapter 3 Research Methodology........................................................................................................24

3.1 Introduction of research methodology.......................................................................................24

3.2 Epistemology for methodology..................................................................................................25

3.3 Selected research methodology..................................................................................................28

3.4 Sampling approach....................................................................................................................28

3.5 Research methods......................................................................................................................29

3.6 Format of questionnaire (refer to appendixes)...........................................................................30

3.7 Data analysis..............................................................................................................................31

3.7.1 Data clean...............................................................................................................................31

3.7.2 Reliability test.........................................................................................................................31

3.7.3 Validity test............................................................................................................................32

3.7.4. Perform 4 assumptions of regression analysis........................................................................32

3.8 Research Ethics..........................................................................................................................33

3.9 Research limitations...................................................................................................................34

3.10 Chapter Summary....................................................................................................................35

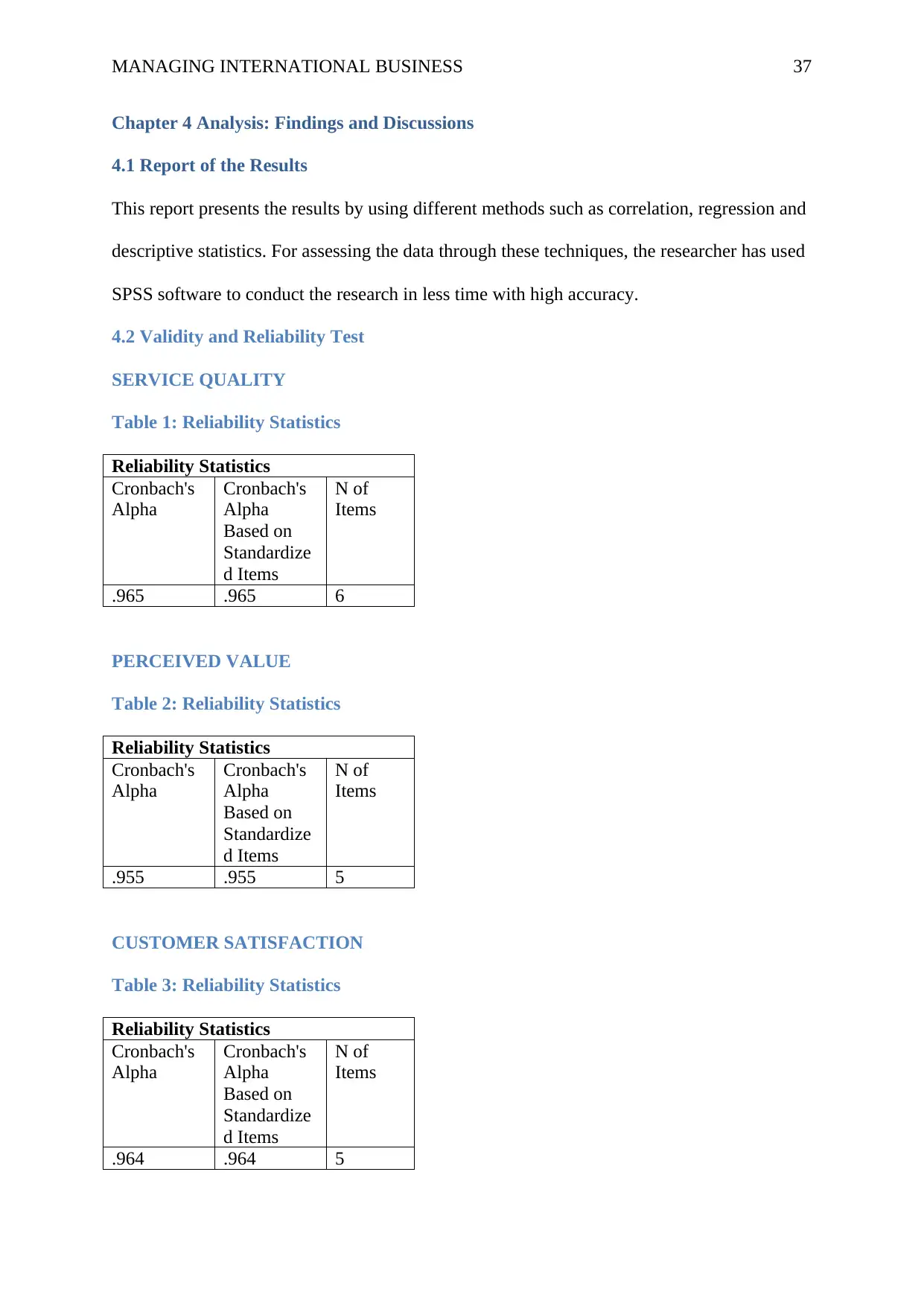

Chapter 4 Analysis: Findings and Discussions....................................................................................35

4.1 Report of the Results.....................................................................................................................35

4.2 Validity and Reliability Test......................................................................................................35

SERVICE QUALITY..................................................................................................................35

PERCEIVED VALUE.................................................................................................................35

CUSTOMER SATISFACTION..................................................................................................36

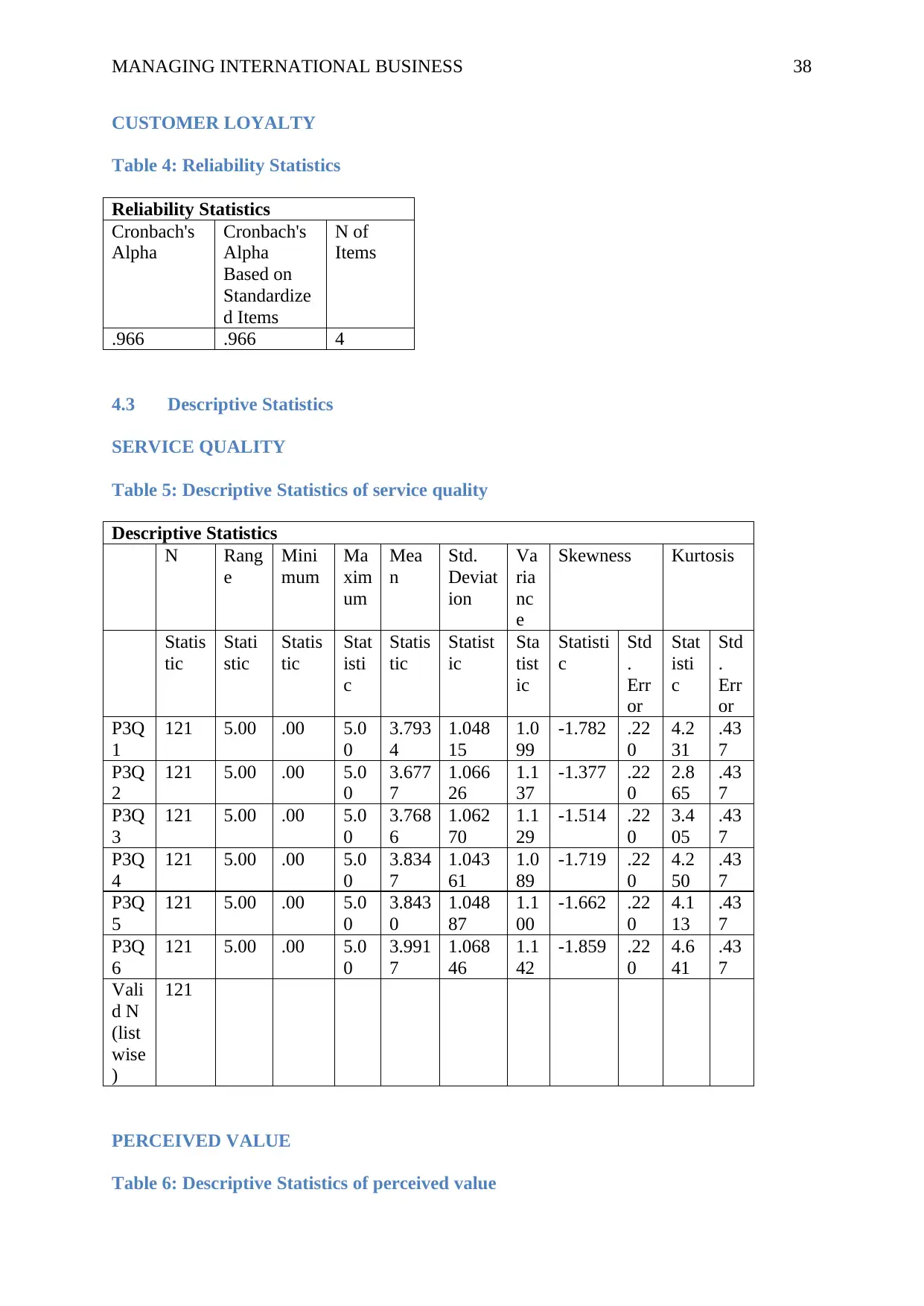

CUSTOMER LOYALTY............................................................................................................36

4.3 Descriptive Statistics............................................................................................................36

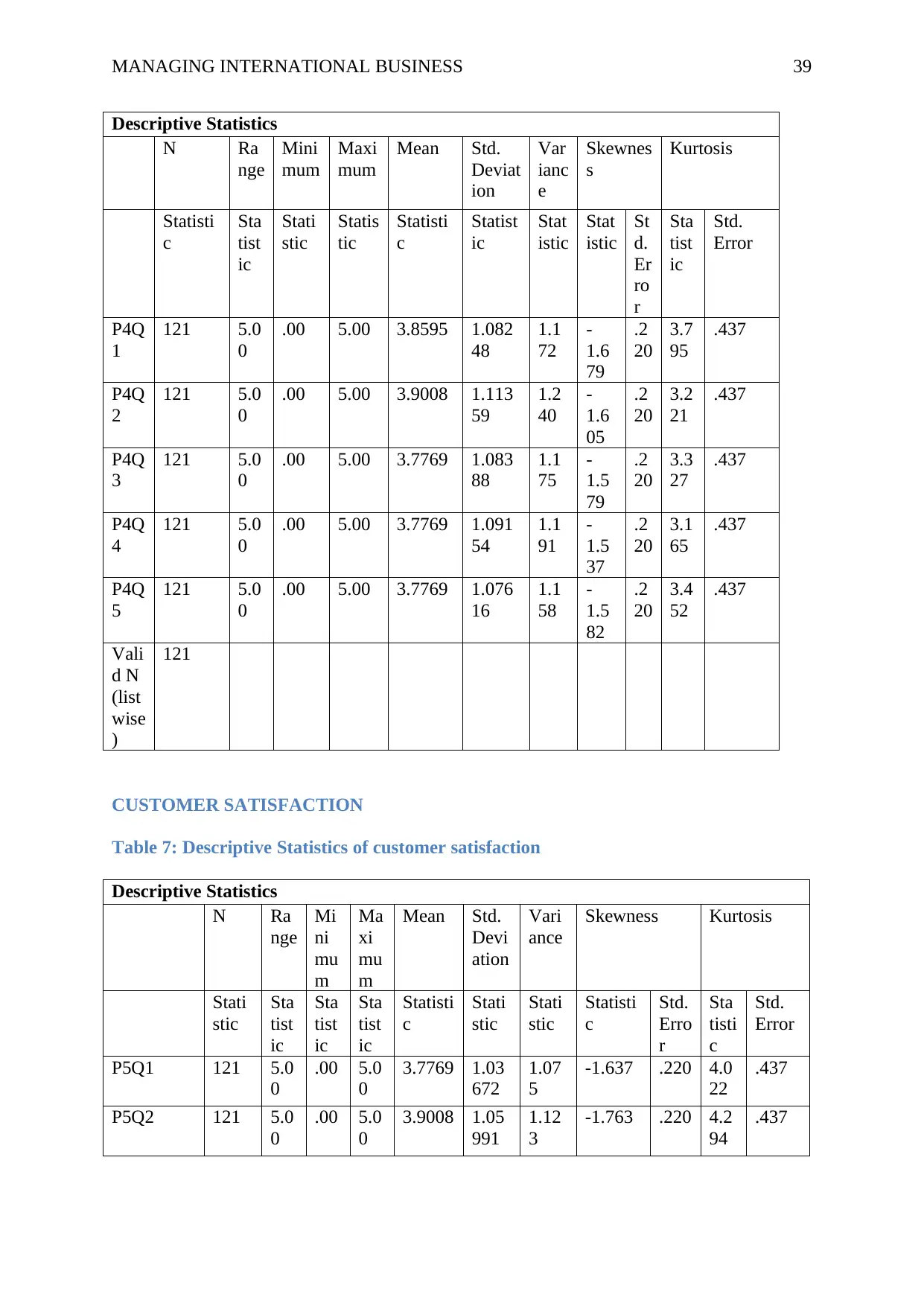

SERVICE QUALITY..................................................................................................................36

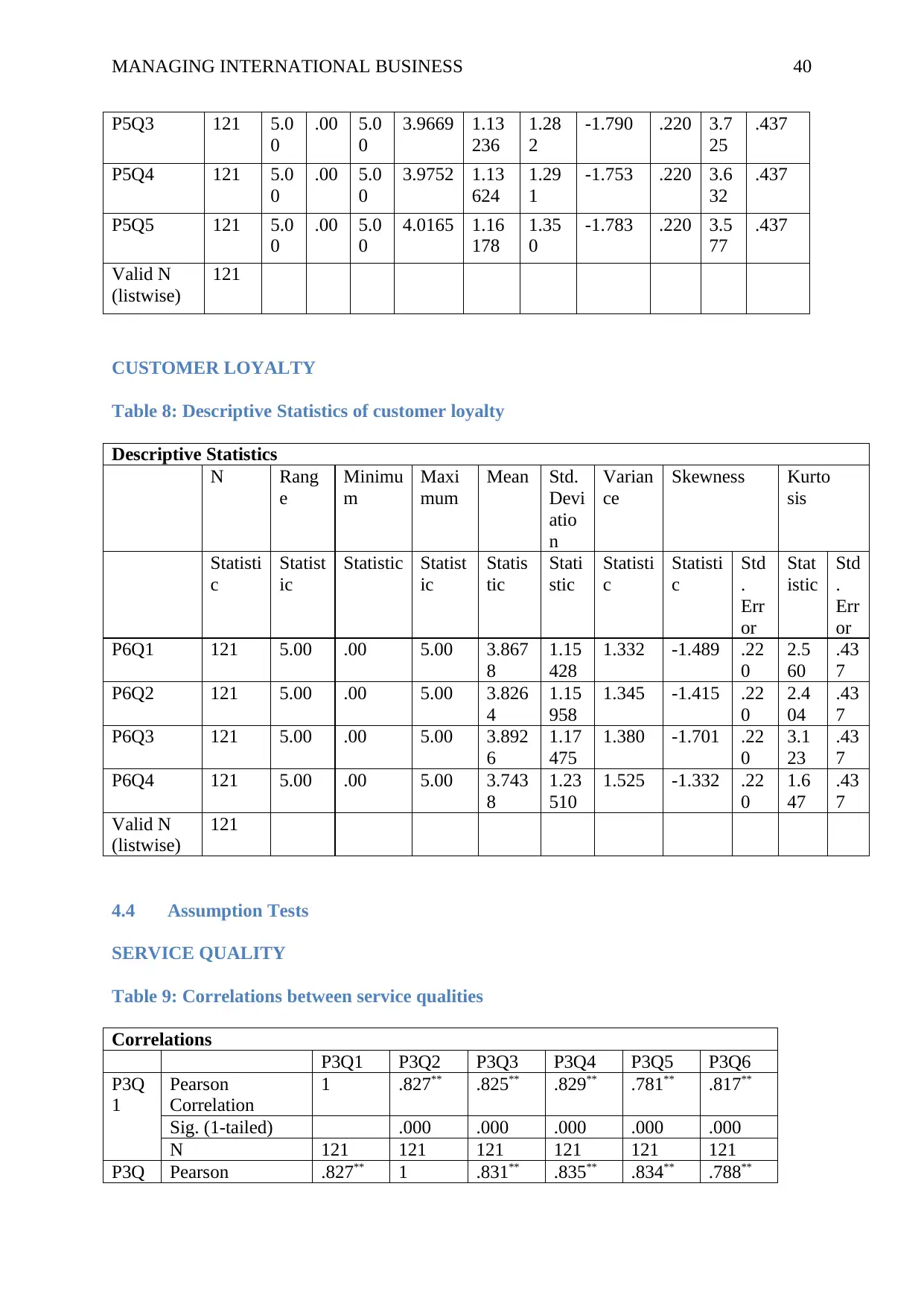

PERCEIVED VALUE.................................................................................................................37

CUSTOMER SATISFACTION..................................................................................................38

CUSTOMER LOYALTY............................................................................................................38

Table of Contents

Chapter 2 Literature review...................................................................................................................4

2.0 Introduction.................................................................................................................................4

2.1 Service Quality............................................................................................................................4

2.2 Perceived Value.........................................................................................................................13

2.3 Customer Satisfaction................................................................................................................19

2.4 Customer Loyalty......................................................................................................................21

Chapter 3 Research Methodology........................................................................................................24

3.1 Introduction of research methodology.......................................................................................24

3.2 Epistemology for methodology..................................................................................................25

3.3 Selected research methodology..................................................................................................28

3.4 Sampling approach....................................................................................................................28

3.5 Research methods......................................................................................................................29

3.6 Format of questionnaire (refer to appendixes)...........................................................................30

3.7 Data analysis..............................................................................................................................31

3.7.1 Data clean...............................................................................................................................31

3.7.2 Reliability test.........................................................................................................................31

3.7.3 Validity test............................................................................................................................32

3.7.4. Perform 4 assumptions of regression analysis........................................................................32

3.8 Research Ethics..........................................................................................................................33

3.9 Research limitations...................................................................................................................34

3.10 Chapter Summary....................................................................................................................35

Chapter 4 Analysis: Findings and Discussions....................................................................................35

4.1 Report of the Results.....................................................................................................................35

4.2 Validity and Reliability Test......................................................................................................35

SERVICE QUALITY..................................................................................................................35

PERCEIVED VALUE.................................................................................................................35

CUSTOMER SATISFACTION..................................................................................................36

CUSTOMER LOYALTY............................................................................................................36

4.3 Descriptive Statistics............................................................................................................36

SERVICE QUALITY..................................................................................................................36

PERCEIVED VALUE.................................................................................................................37

CUSTOMER SATISFACTION..................................................................................................38

CUSTOMER LOYALTY............................................................................................................38

MANAGING INTERNATIONAL BUSINESS 3

4.4 Assumption Tests.................................................................................................................39

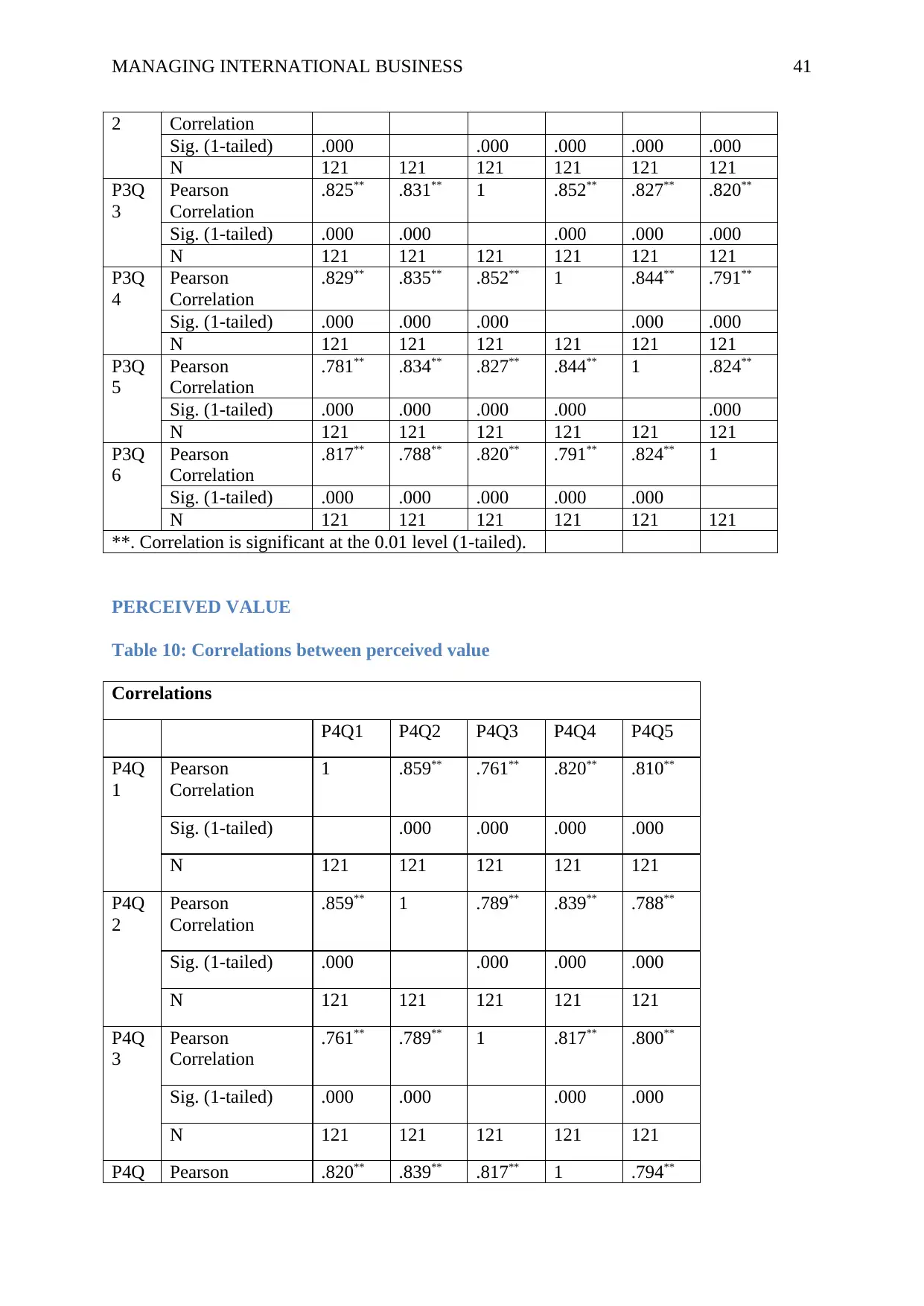

SERVICE QUALITY..................................................................................................................39

PERCEIVED VALUE.................................................................................................................39

CUSTOMER SATISFACTION..................................................................................................40

CUSTOMER LOYALTY............................................................................................................41

4.5 Regression Analysis.............................................................................................................41

SERVICE QUALITY......................................................................................................................41

PERCEIVED VALUE.................................................................................................................43

CUSTOMER SATISFACTION..................................................................................................44

CUSTOMER LOYALTY............................................................................................................45

4.6 Discussion of the Results...........................................................................................................47

Service quality.................................................................................................................................47

Perceived value................................................................................................................................47

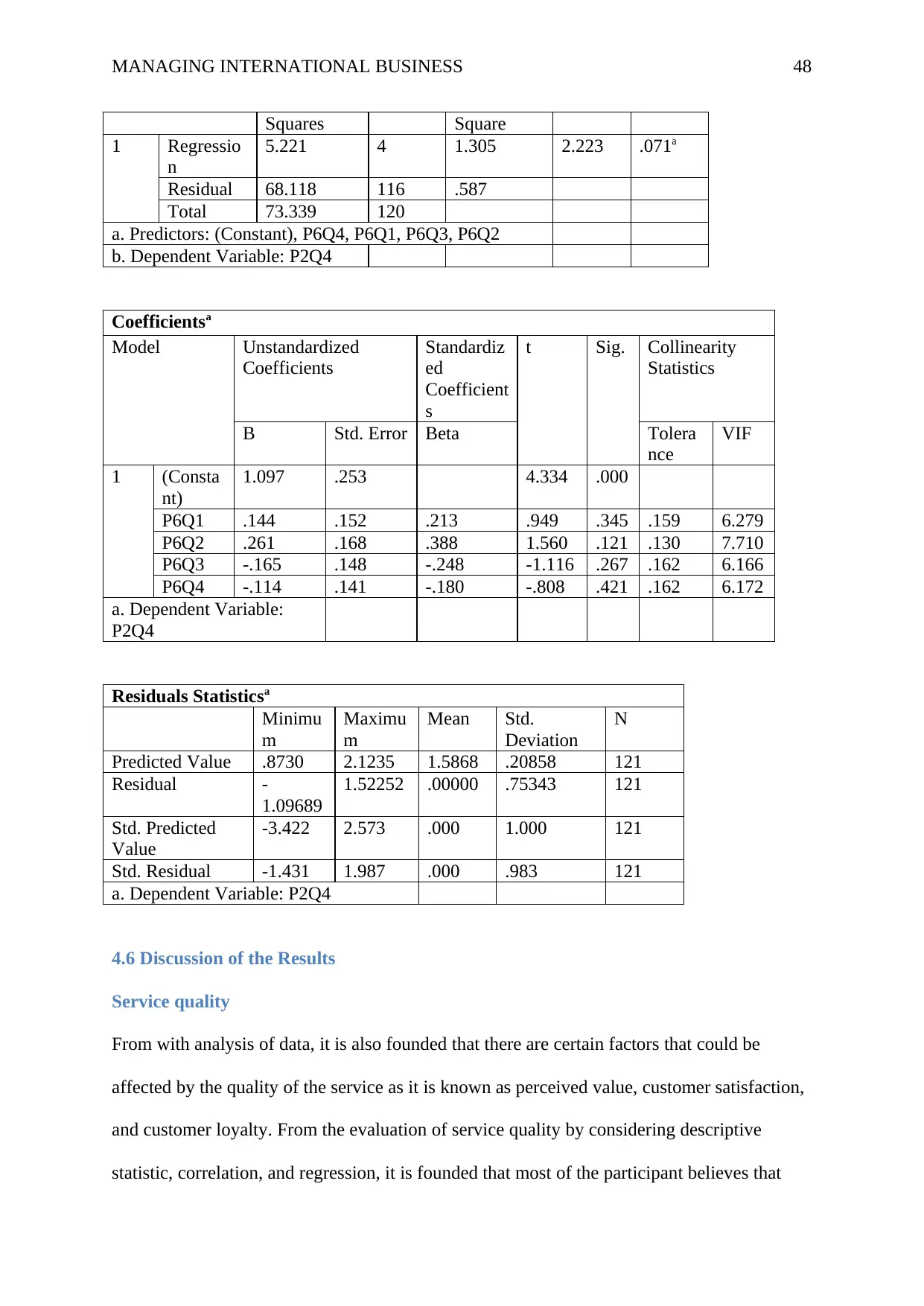

Customer satisfaction......................................................................................................................48

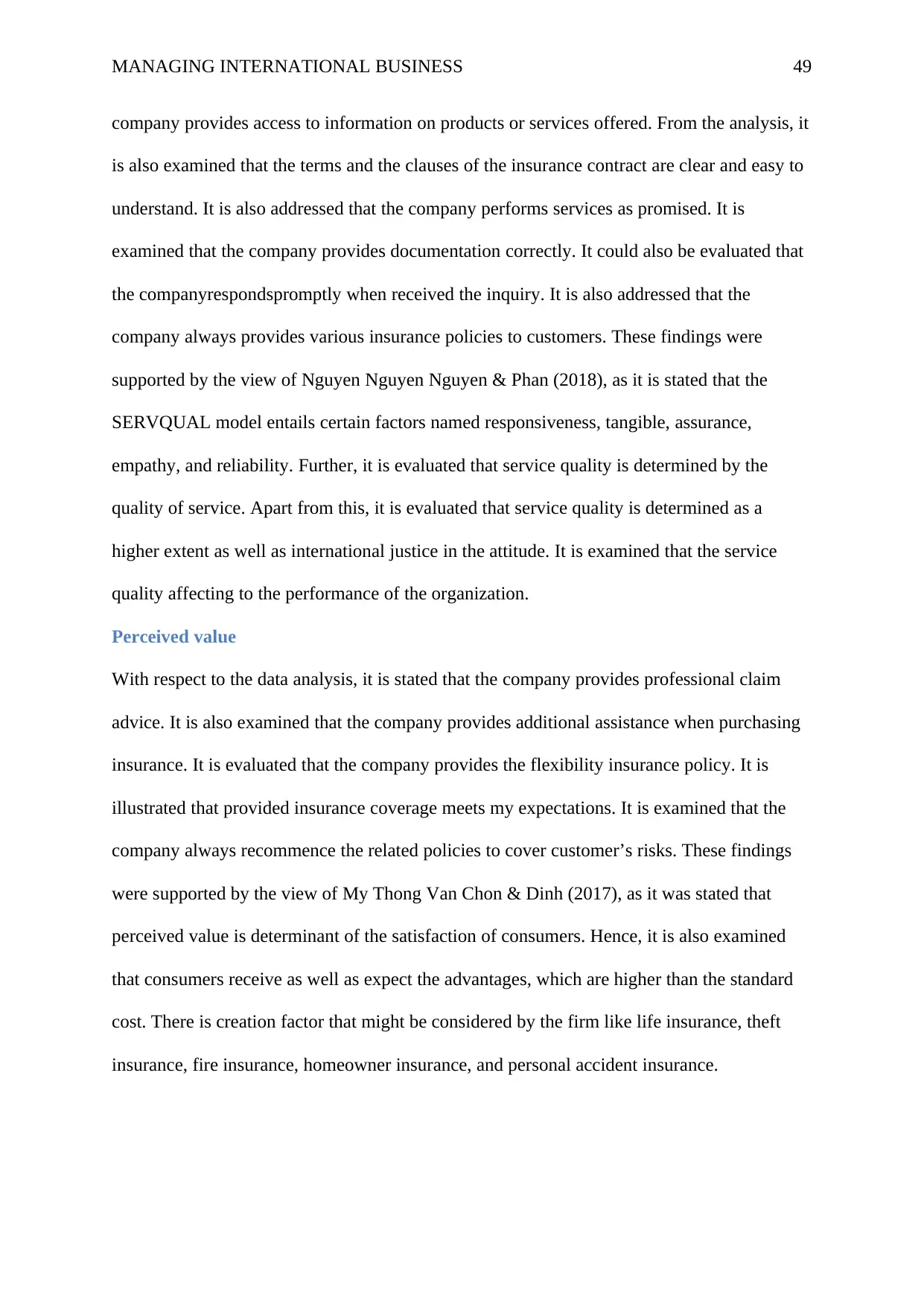

Customer loyalty.............................................................................................................................48

Chapter 5 Conclusions and Recommendations....................................................................................49

5.1 Comprehensive Summary..........................................................................................................49

5.2 Recommendations.....................................................................................................................50

5.3 Research Limitations and Suggestions for Further Research.....................................................52

References...........................................................................................................................................53

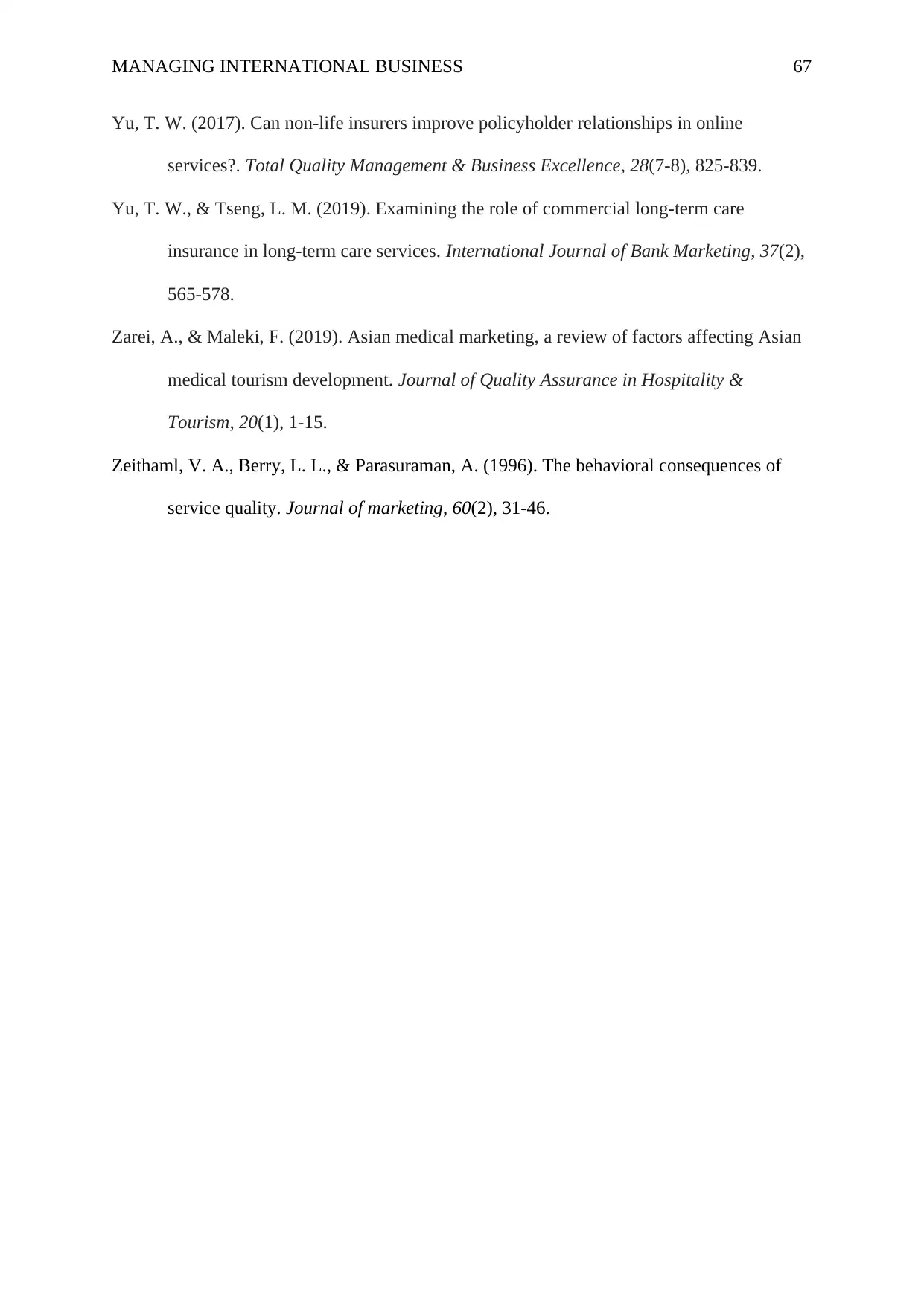

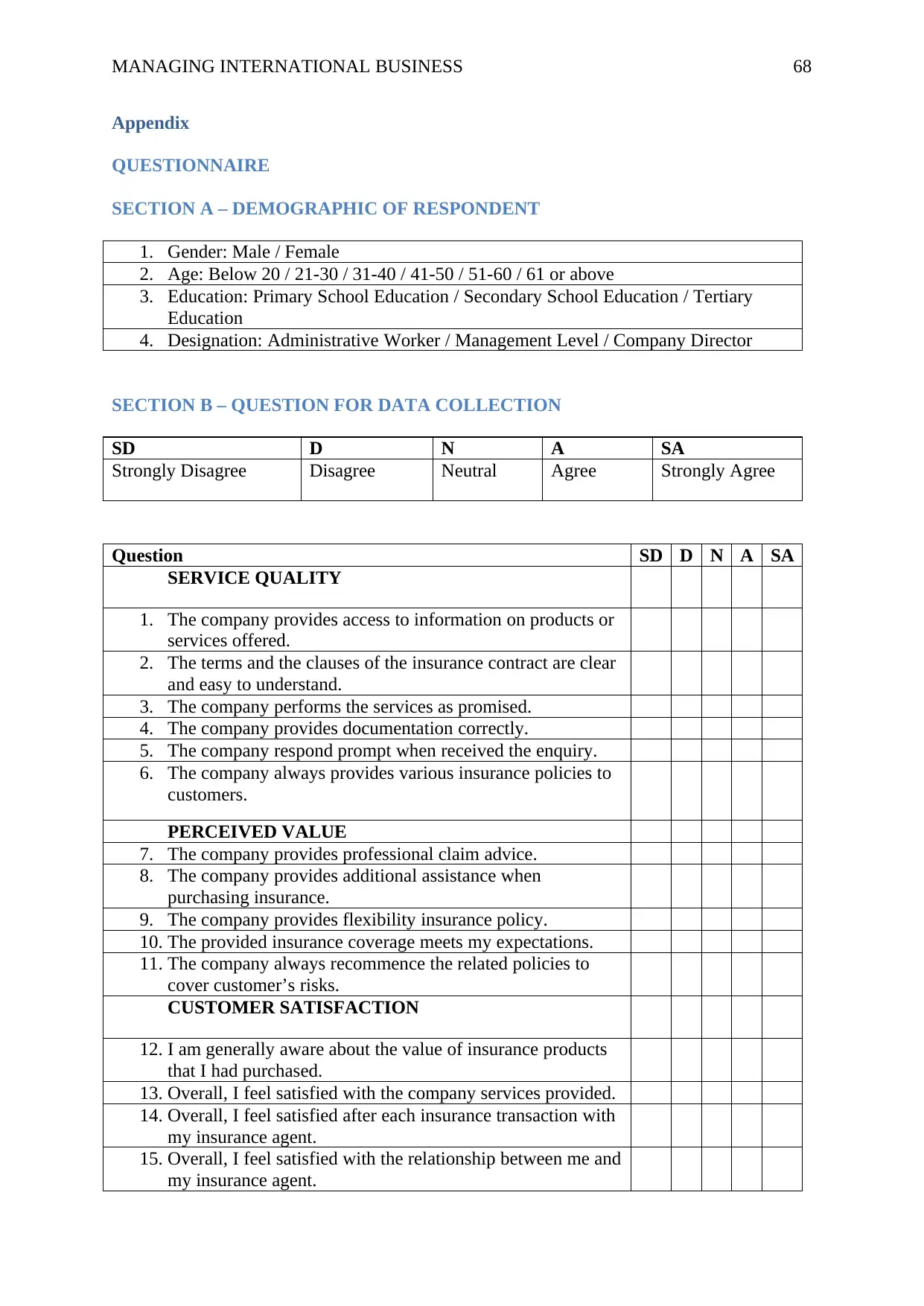

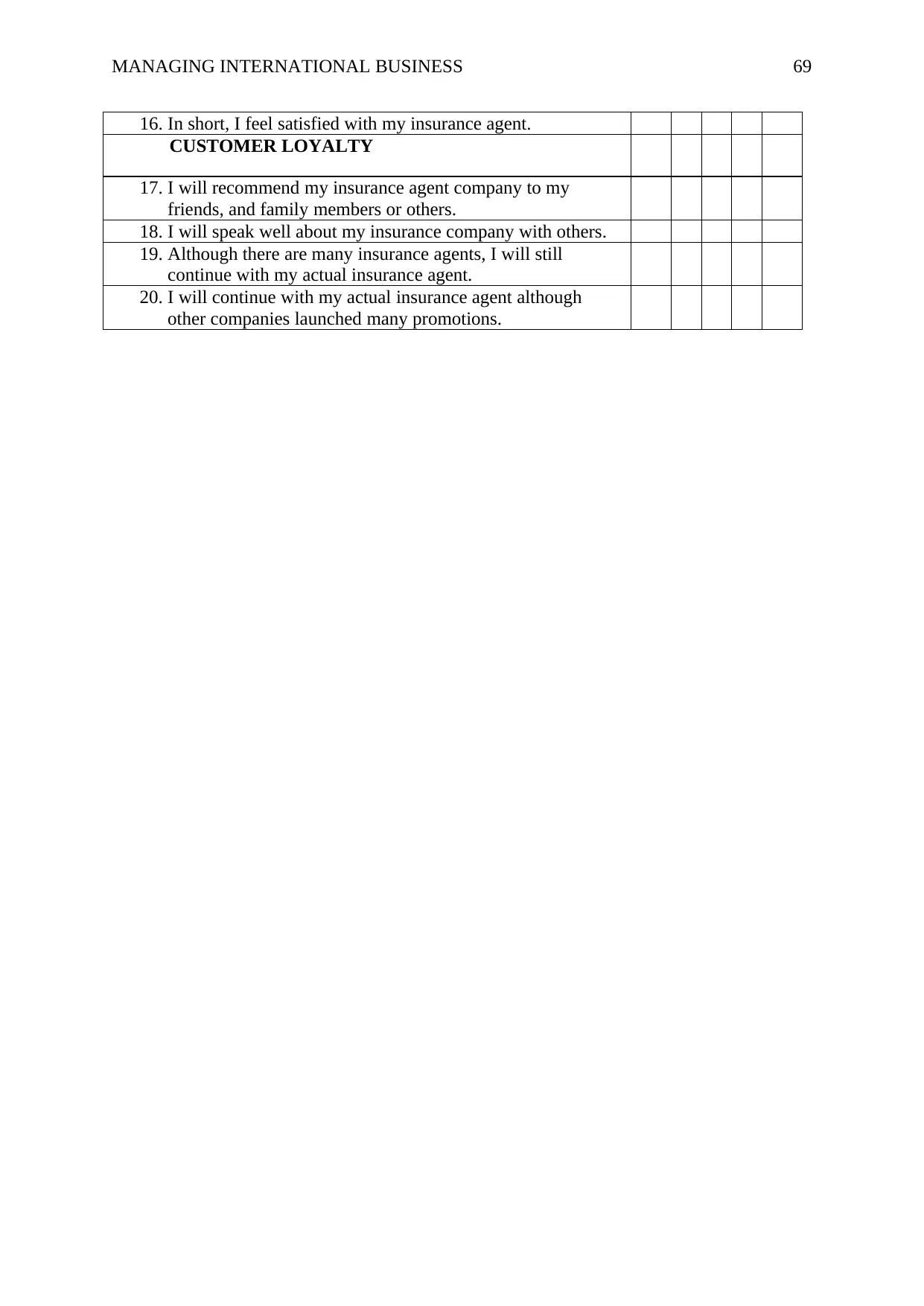

Appendix.............................................................................................................................................66

QUESTIONNAIRE.........................................................................................................................66

SECTION A – DEMOGRAPHIC OF RESPONDENT...............................................................66

SECTION B – QUESTION FOR DATA COLLECTION...........................................................66

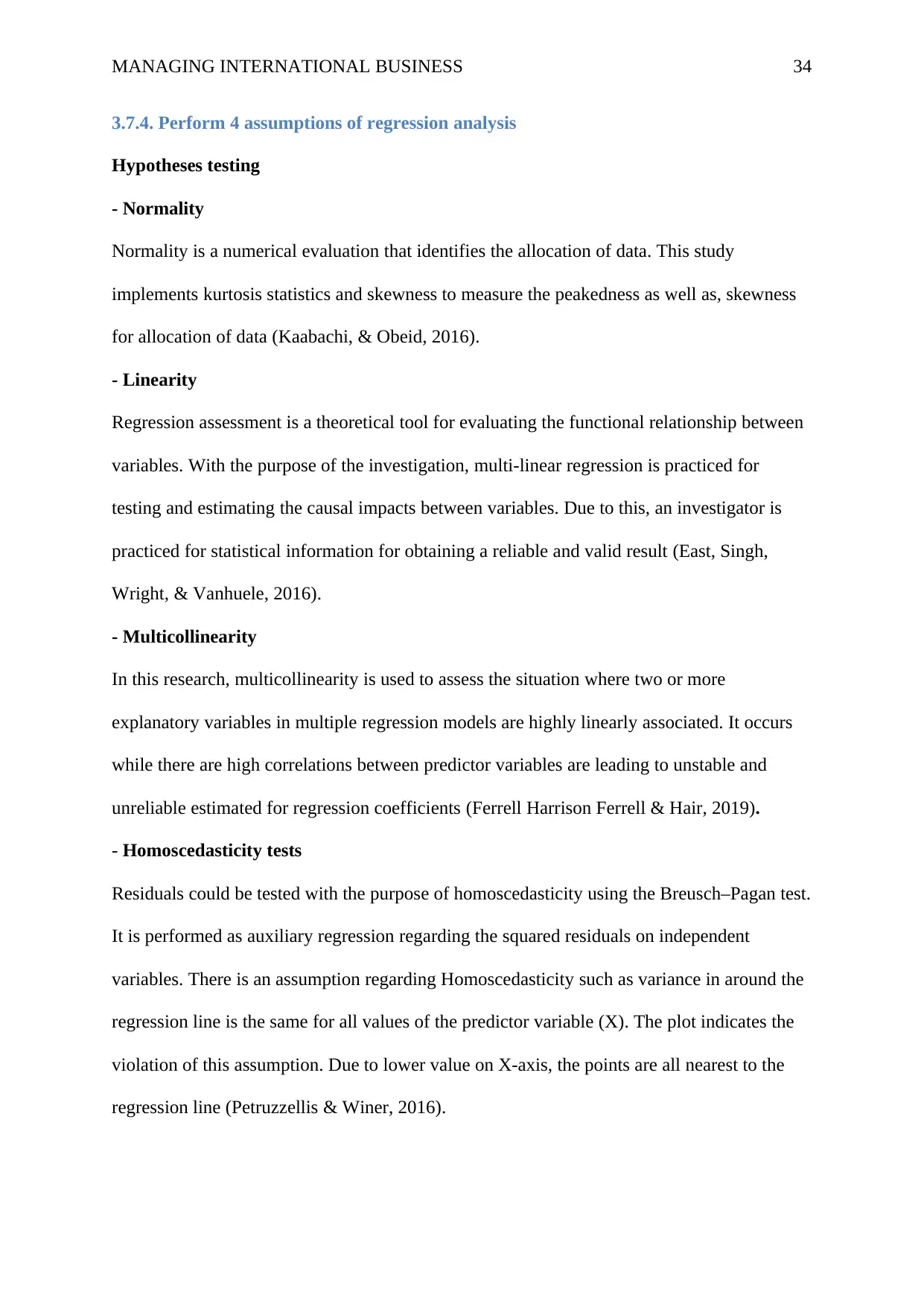

Table 1: Reliability Statistics...............................................................................................................36

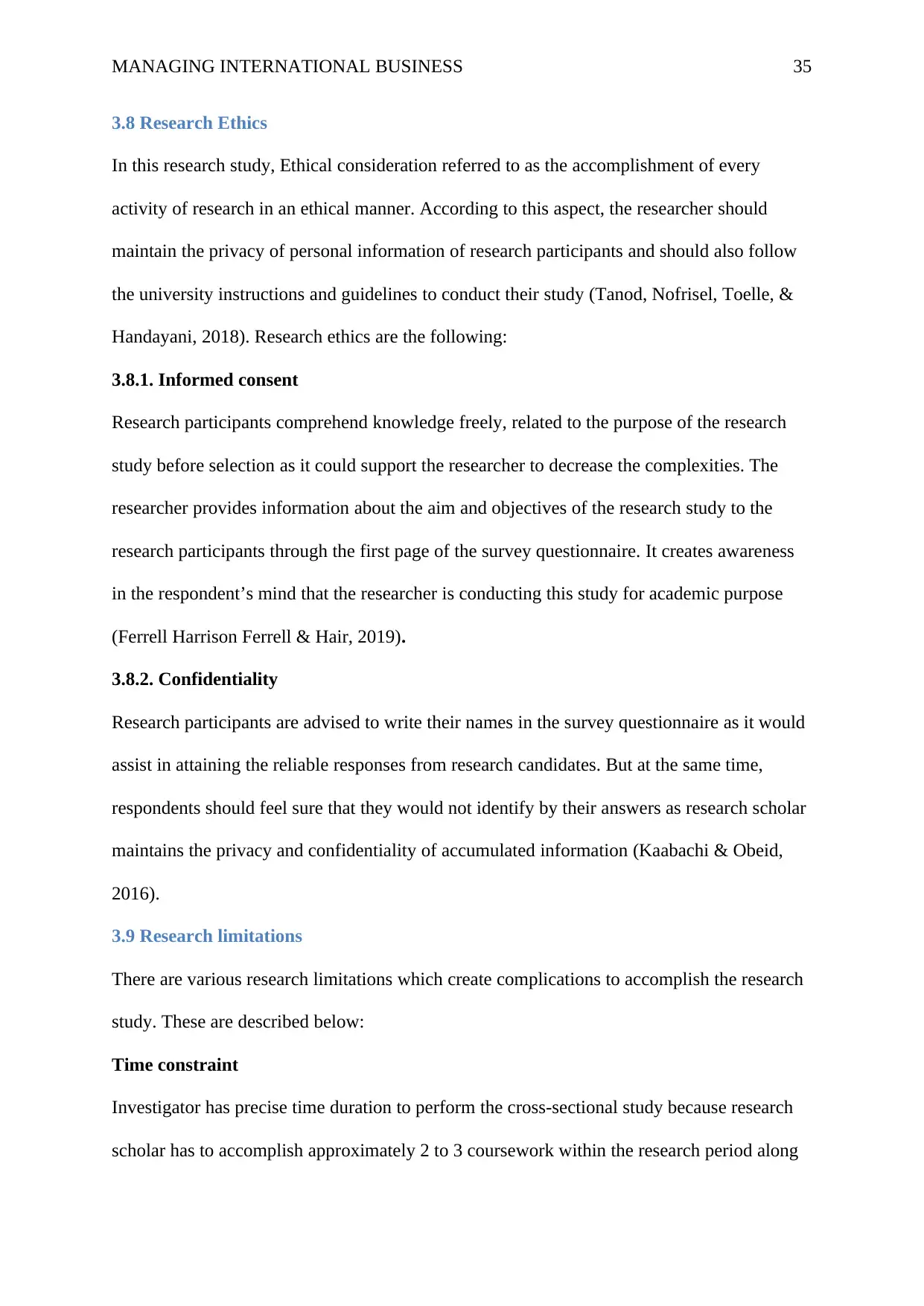

Table 2: Reliability Statistics...............................................................................................................36

Table 3: Reliability Statistics...............................................................................................................37

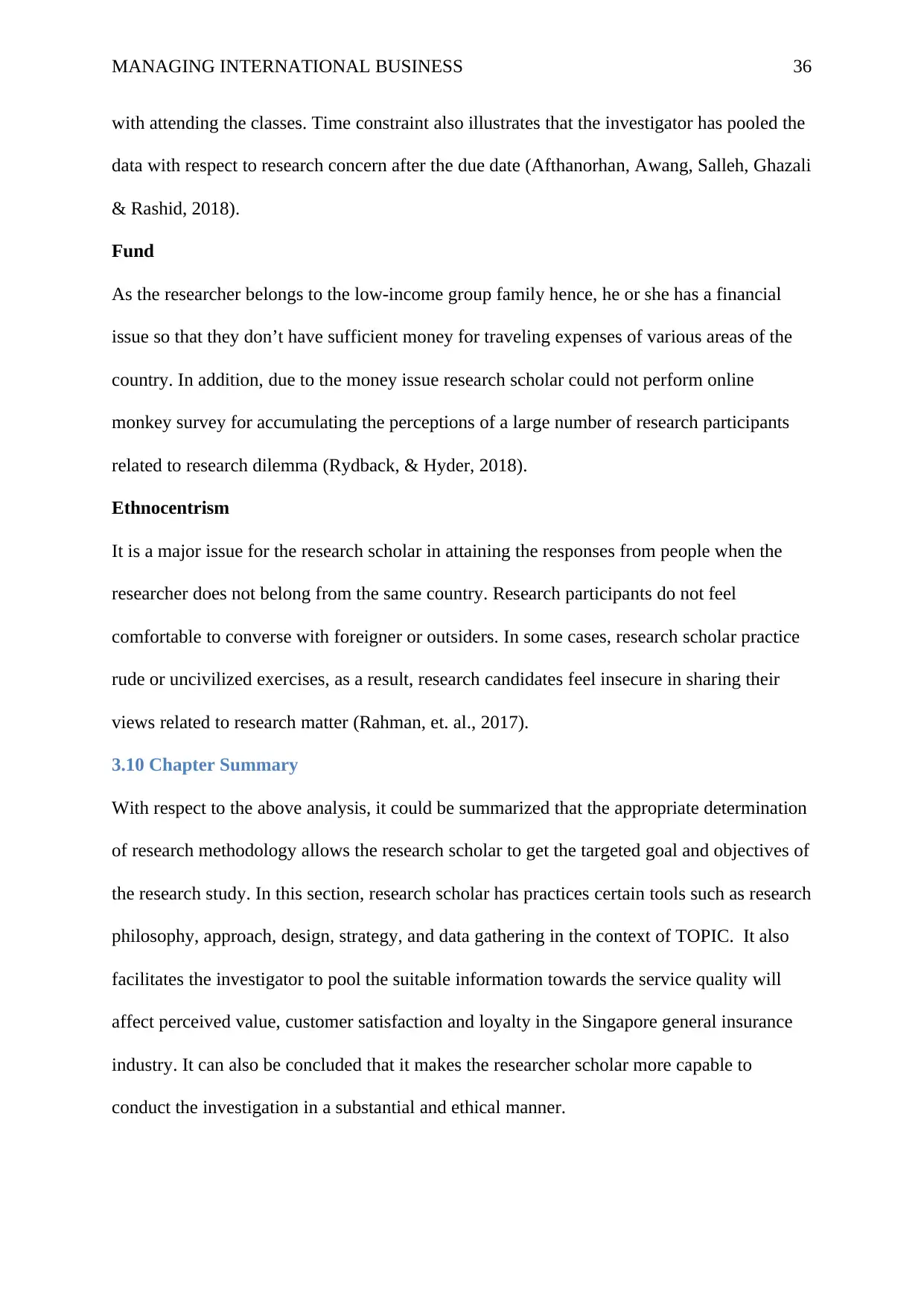

Table 4: Reliability Statistics...............................................................................................................37

Table 5: Descriptive Statistics of service quality.................................................................................37

Table 6: Descriptive Statistics of perceived value...............................................................................38

Table 7: Descriptive Statistics of customer satisfaction.......................................................................39

Table 8: Descriptive Statistics of customer loyalty..............................................................................39

Table 9: Correlations between service qualities...................................................................................40

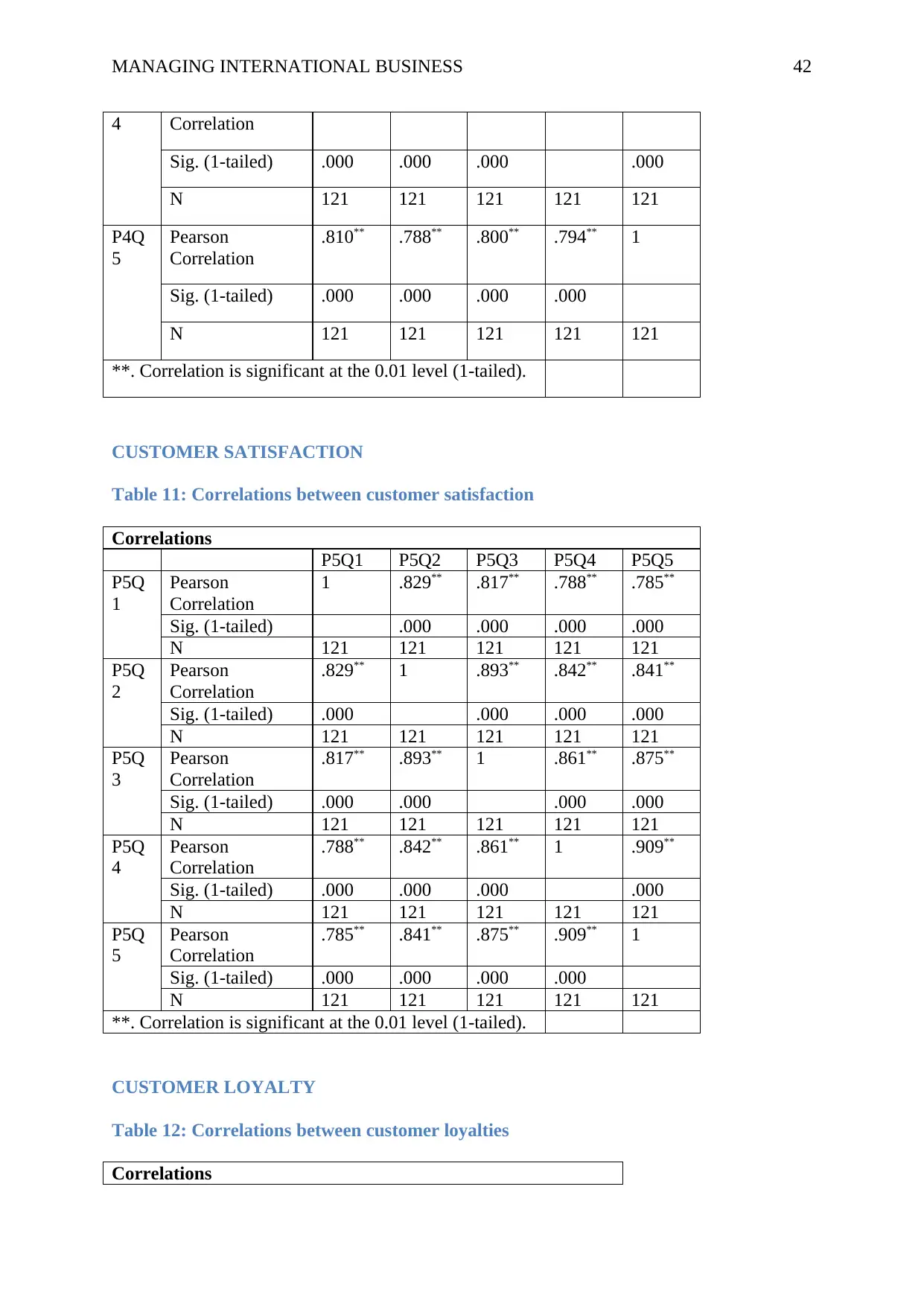

Table 10: Correlations between perceived value.................................................................................40

Table 11: Correlations between customer satisfactions.......................................................................41

4.4 Assumption Tests.................................................................................................................39

SERVICE QUALITY..................................................................................................................39

PERCEIVED VALUE.................................................................................................................39

CUSTOMER SATISFACTION..................................................................................................40

CUSTOMER LOYALTY............................................................................................................41

4.5 Regression Analysis.............................................................................................................41

SERVICE QUALITY......................................................................................................................41

PERCEIVED VALUE.................................................................................................................43

CUSTOMER SATISFACTION..................................................................................................44

CUSTOMER LOYALTY............................................................................................................45

4.6 Discussion of the Results...........................................................................................................47

Service quality.................................................................................................................................47

Perceived value................................................................................................................................47

Customer satisfaction......................................................................................................................48

Customer loyalty.............................................................................................................................48

Chapter 5 Conclusions and Recommendations....................................................................................49

5.1 Comprehensive Summary..........................................................................................................49

5.2 Recommendations.....................................................................................................................50

5.3 Research Limitations and Suggestions for Further Research.....................................................52

References...........................................................................................................................................53

Appendix.............................................................................................................................................66

QUESTIONNAIRE.........................................................................................................................66

SECTION A – DEMOGRAPHIC OF RESPONDENT...............................................................66

SECTION B – QUESTION FOR DATA COLLECTION...........................................................66

Table 1: Reliability Statistics...............................................................................................................36

Table 2: Reliability Statistics...............................................................................................................36

Table 3: Reliability Statistics...............................................................................................................37

Table 4: Reliability Statistics...............................................................................................................37

Table 5: Descriptive Statistics of service quality.................................................................................37

Table 6: Descriptive Statistics of perceived value...............................................................................38

Table 7: Descriptive Statistics of customer satisfaction.......................................................................39

Table 8: Descriptive Statistics of customer loyalty..............................................................................39

Table 9: Correlations between service qualities...................................................................................40

Table 10: Correlations between perceived value.................................................................................40

Table 11: Correlations between customer satisfactions.......................................................................41

MANAGING INTERNATIONAL BUSINESS 4

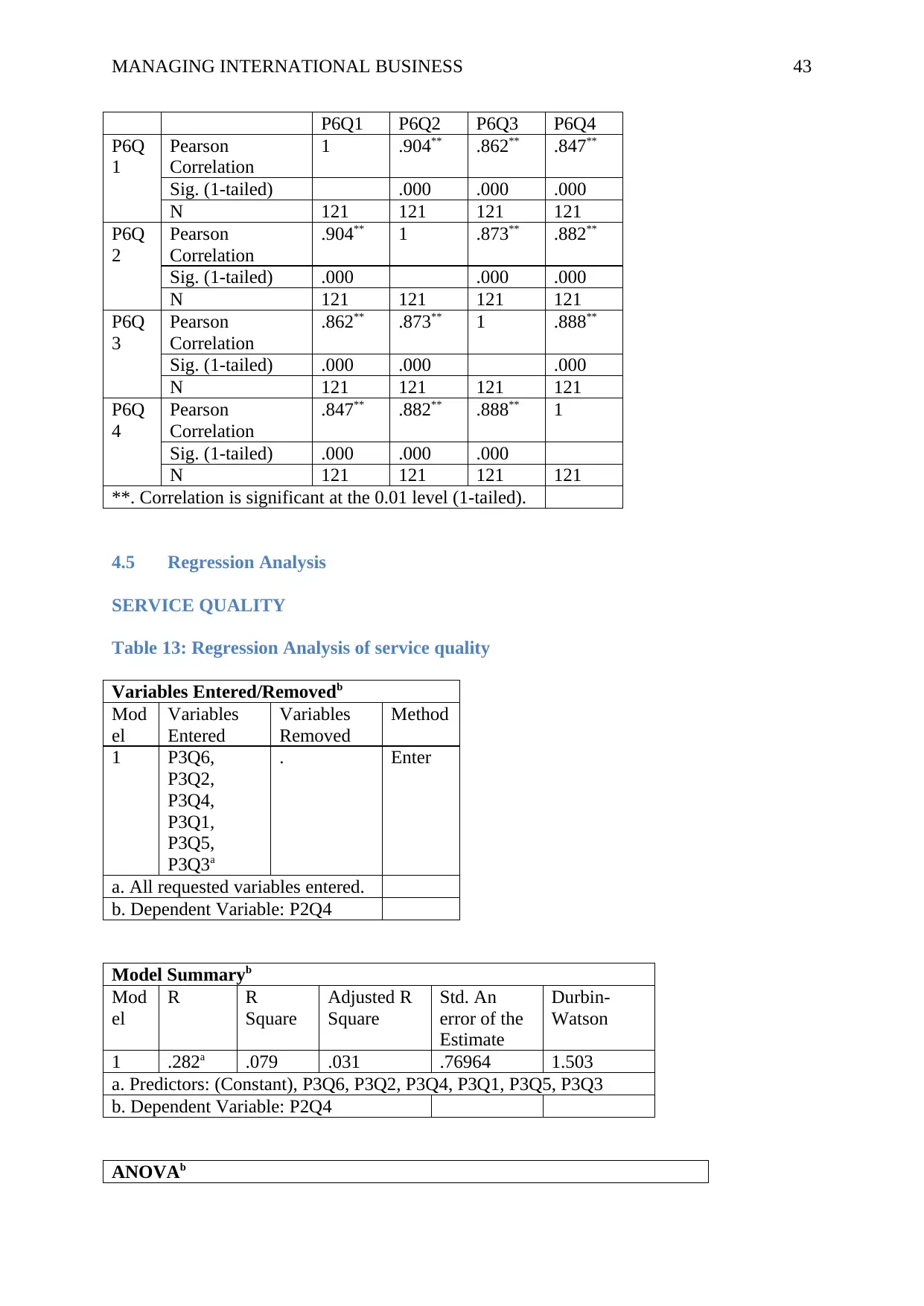

Table 12: Correlations between customer loyalties.............................................................................42

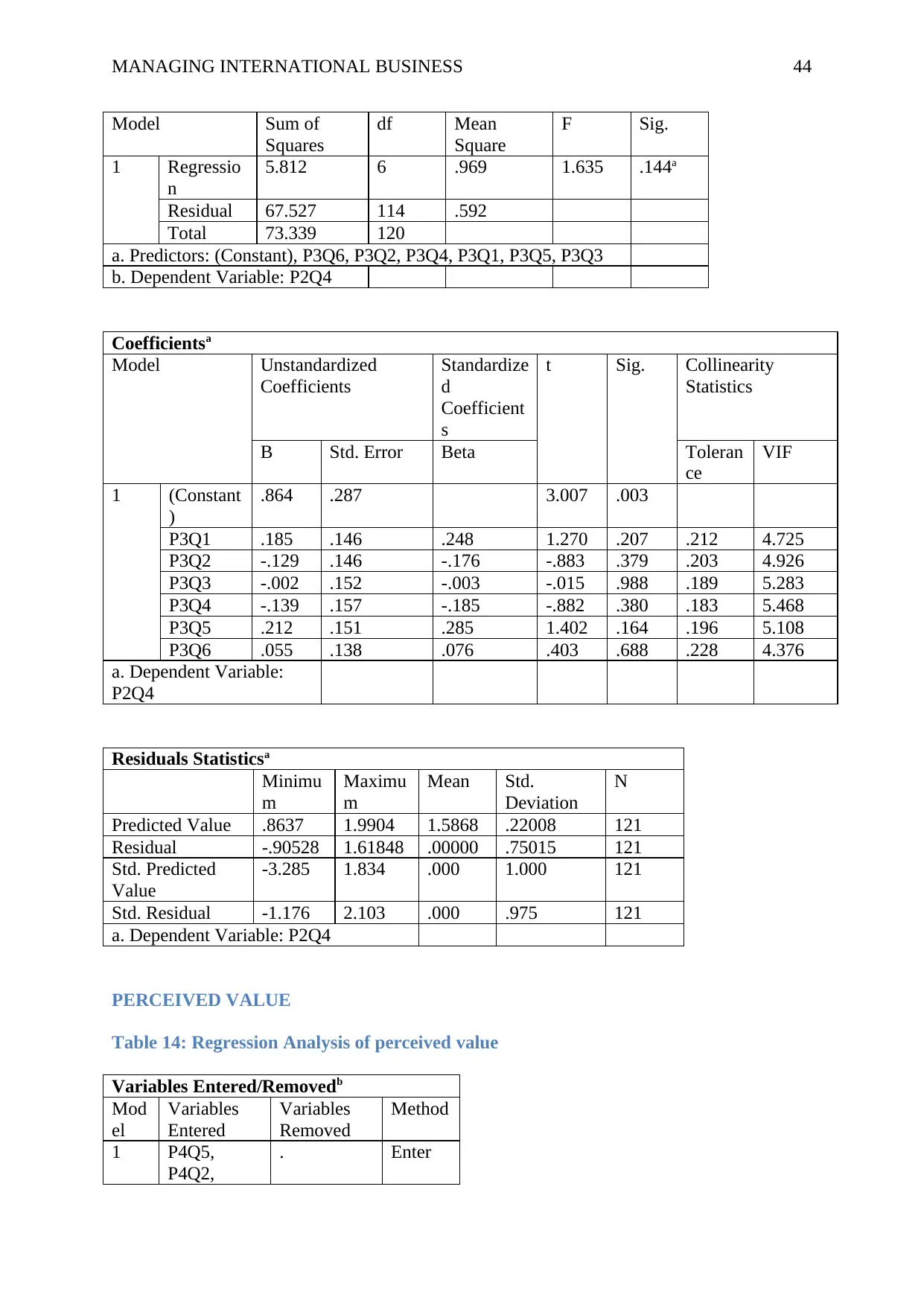

Table 13: Regression Analysis of service quality................................................................................42

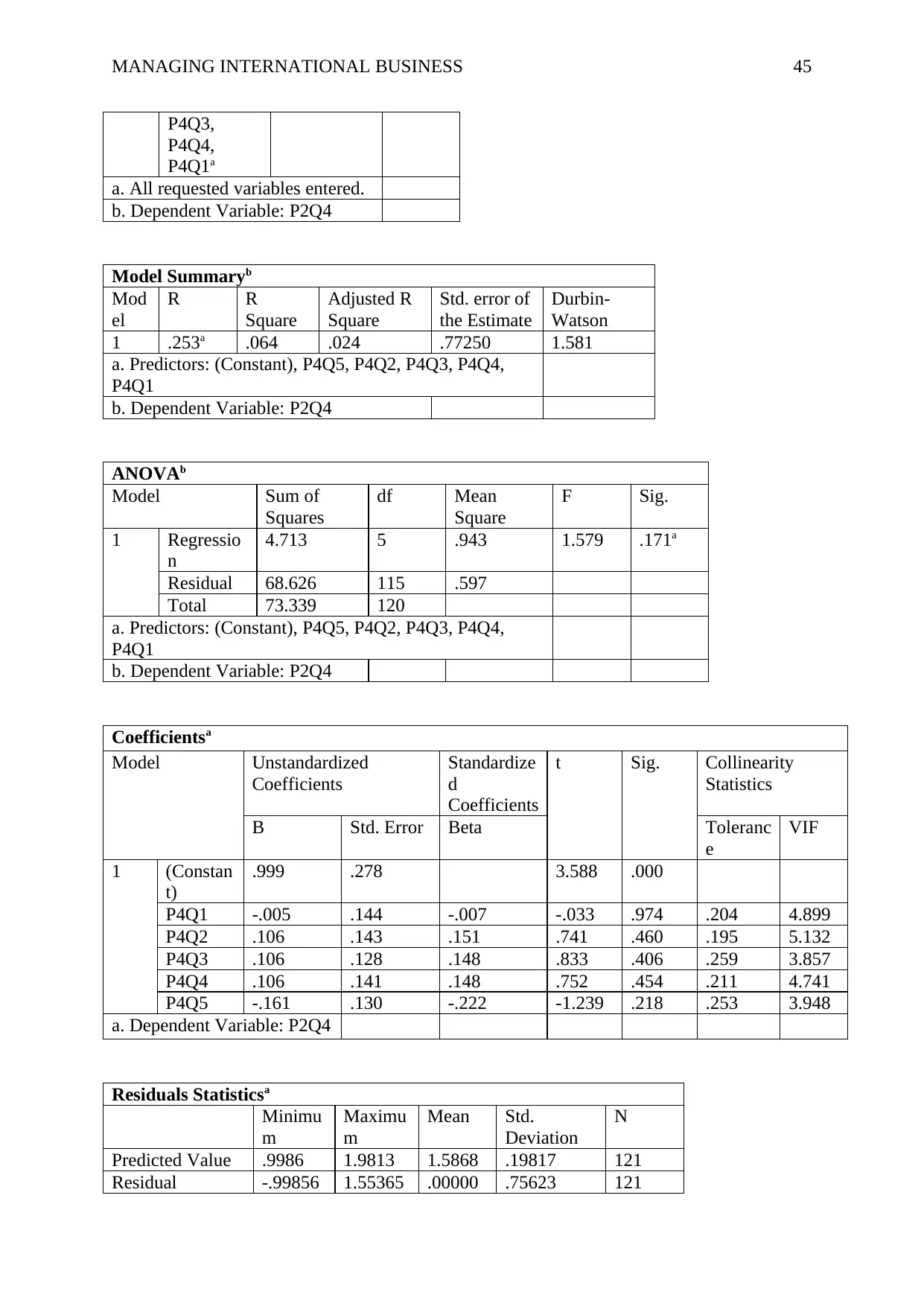

Table 14: Regression Analysis of perceived value..............................................................................44

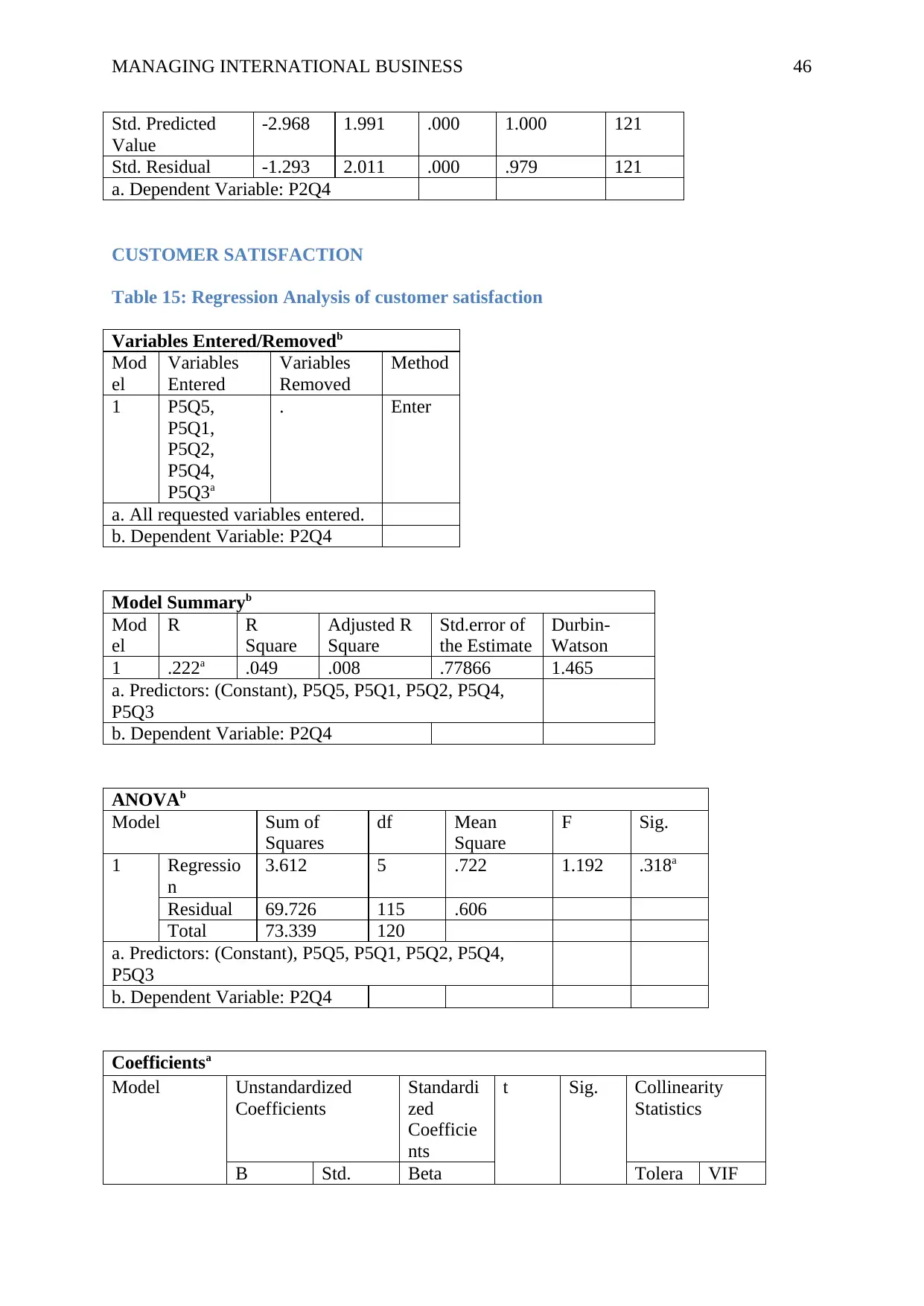

Table 15: Regression Analysis of customer satisfaction......................................................................45

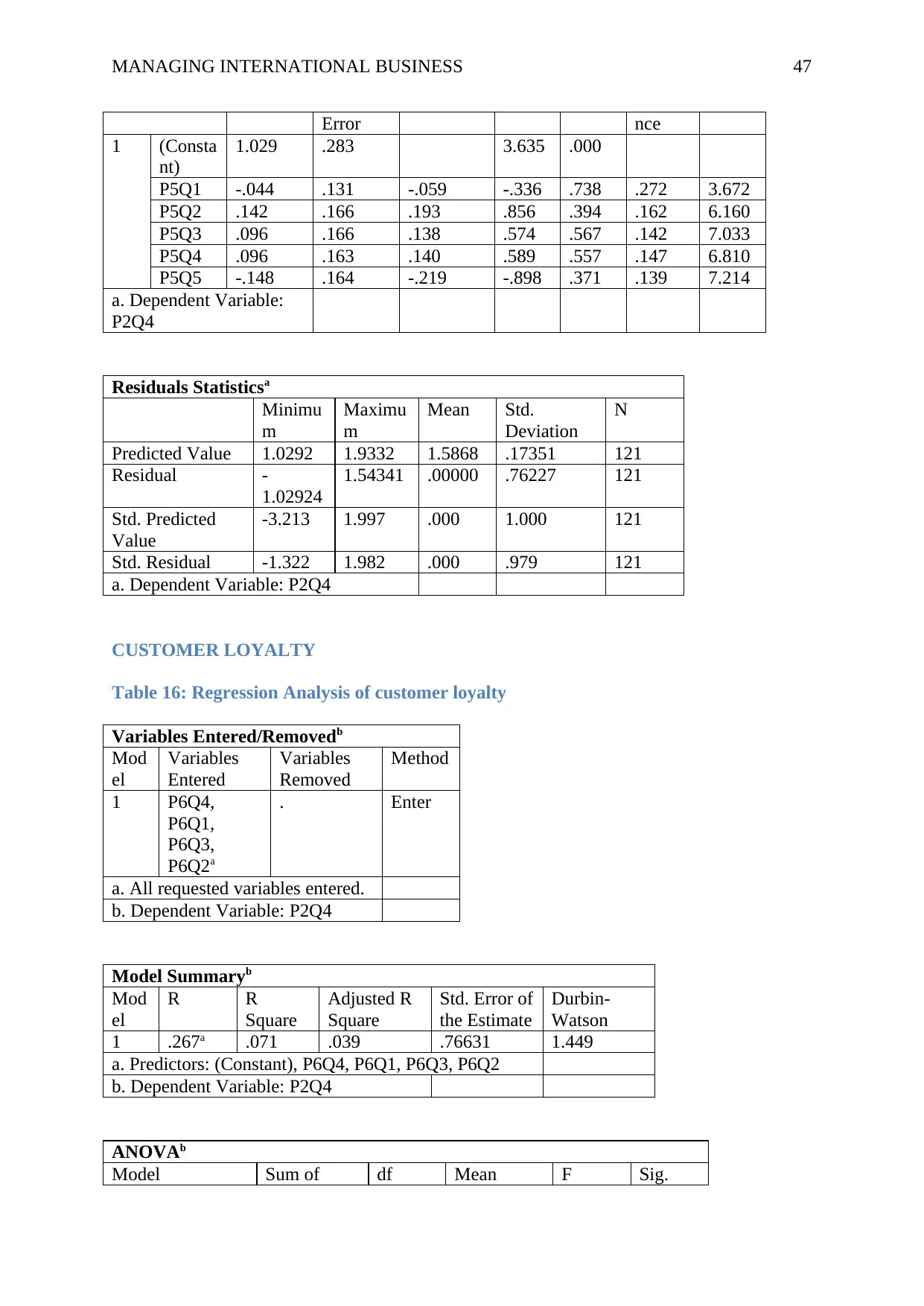

Table 16: Regression Analysis of customer loyalty.............................................................................46

Table 12: Correlations between customer loyalties.............................................................................42

Table 13: Regression Analysis of service quality................................................................................42

Table 14: Regression Analysis of perceived value..............................................................................44

Table 15: Regression Analysis of customer satisfaction......................................................................45

Table 16: Regression Analysis of customer loyalty.............................................................................46

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

MANAGING INTERNATIONAL BUSINESS 5

Chapter 2 Literature review

2.0 Introduction

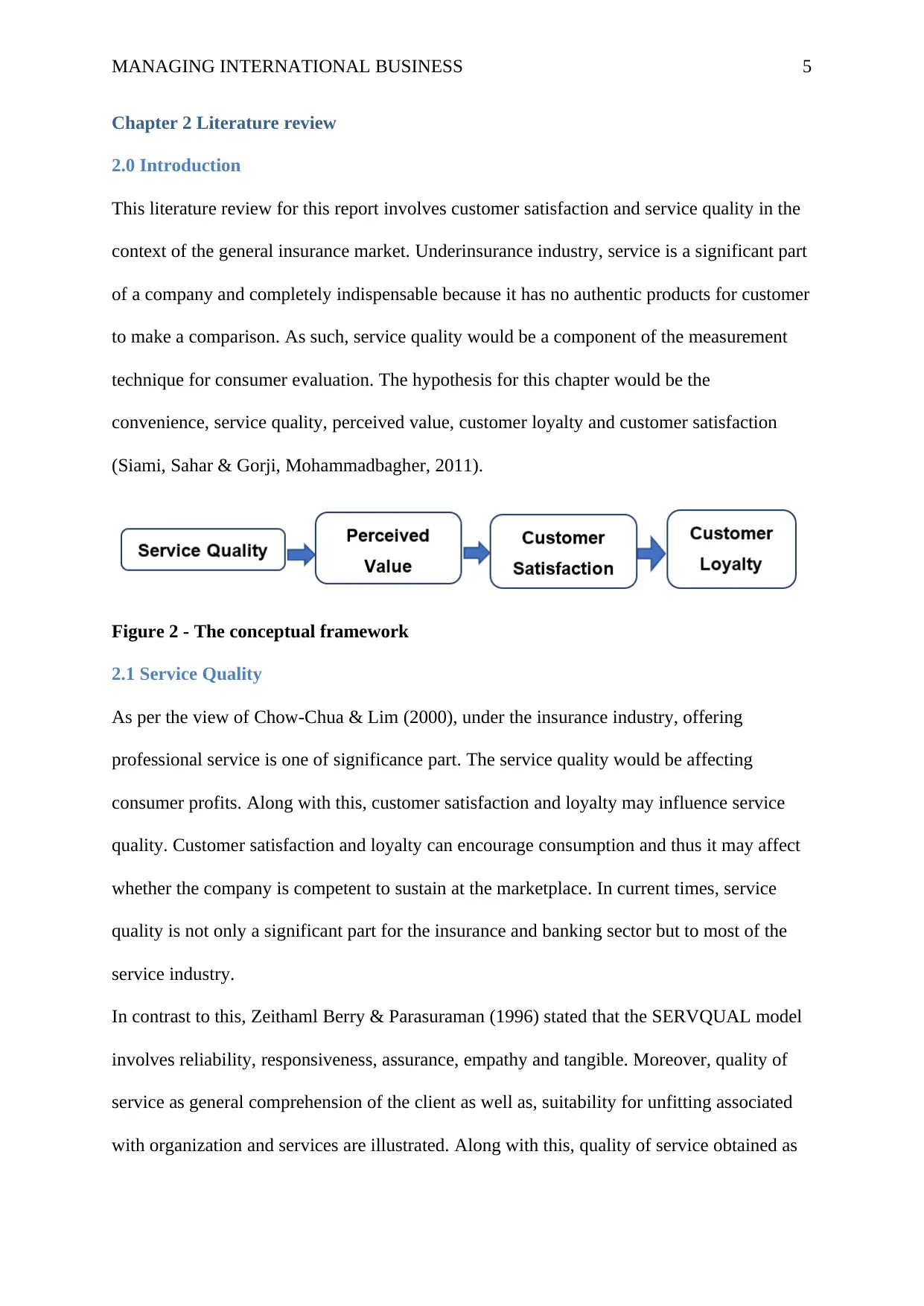

This literature review for this report involves customer satisfaction and service quality in the

context of the general insurance market. Underinsurance industry, service is a significant part

of a company and completely indispensable because it has no authentic products for customer

to make a comparison. As such, service quality would be a component of the measurement

technique for consumer evaluation. The hypothesis for this chapter would be the

convenience, service quality, perceived value, customer loyalty and customer satisfaction

(Siami, Sahar & Gorji, Mohammadbagher, 2011).

Figure 2 - The conceptual framework

2.1 Service Quality

As per the view of Chow-Chua & Lim (2000), under the insurance industry, offering

professional service is one of significance part. The service quality would be affecting

consumer profits. Along with this, customer satisfaction and loyalty may influence service

quality. Customer satisfaction and loyalty can encourage consumption and thus it may affect

whether the company is competent to sustain at the marketplace. In current times, service

quality is not only a significant part for the insurance and banking sector but to most of the

service industry.

In contrast to this, Zeithaml Berry & Parasuraman (1996) stated that the SERVQUAL model

involves reliability, responsiveness, assurance, empathy and tangible. Moreover, quality of

service as general comprehension of the client as well as, suitability for unfitting associated

with organization and services are illustrated. Along with this, quality of service obtained as

Chapter 2 Literature review

2.0 Introduction

This literature review for this report involves customer satisfaction and service quality in the

context of the general insurance market. Underinsurance industry, service is a significant part

of a company and completely indispensable because it has no authentic products for customer

to make a comparison. As such, service quality would be a component of the measurement

technique for consumer evaluation. The hypothesis for this chapter would be the

convenience, service quality, perceived value, customer loyalty and customer satisfaction

(Siami, Sahar & Gorji, Mohammadbagher, 2011).

Figure 2 - The conceptual framework

2.1 Service Quality

As per the view of Chow-Chua & Lim (2000), under the insurance industry, offering

professional service is one of significance part. The service quality would be affecting

consumer profits. Along with this, customer satisfaction and loyalty may influence service

quality. Customer satisfaction and loyalty can encourage consumption and thus it may affect

whether the company is competent to sustain at the marketplace. In current times, service

quality is not only a significant part for the insurance and banking sector but to most of the

service industry.

In contrast to this, Zeithaml Berry & Parasuraman (1996) stated that the SERVQUAL model

involves reliability, responsiveness, assurance, empathy and tangible. Moreover, quality of

service as general comprehension of the client as well as, suitability for unfitting associated

with organization and services are illustrated. Along with this, quality of service obtained as

MANAGING INTERNATIONAL BUSINESS 6

international justice and higher extent of attitude is depending on service offered are

illustrated and have observed that judge on quality service illustrates the difference among

route customer expectations and views. Cronin Jr & Taylor (1992) opined that quality is

generally illustrated as those product features and fitness for use that attain the requirement of

customers as well as, thereby offers the higher extent of customer satisfaction in Singapore

insurance industry. The tendency with respect to demonstrating services as well as, quality

has a significant component in the service industry like the insurance industry. Since, service

quality is significant to sustain and profit making of the company, then it may influence

customer satisfaction as well as, motivation after shopping favorably.

In opposed to this, Tsoukatos & Rand (2006) evaluated that customer satisfaction has

affected the tendency with respect to shopping favorably. Service quality and customer

satisfaction are considered as vital affairs in a high service industry nowadays. In addition,

quality of service as general comprehension of client and suitability of inappropriateness

relative to their company and services are illustrated.

Hsu & Petchsakulwong (2010) discussed that the quality of services are received as superior

attitudes and the international judge is relied on service offered. It is observed that the judge

on quality services exhibits the difference among order and route customer expectations and

views. But, while it is related to particular service attributes and dimension as a wide

category of model and structure presented and there is different research on service quality

measurement in different industry aspects. In specific, traditional aspects and measures of

customer satisfaction and service quality has been questioned in business to business

atmospheres.

On the other side, Eckardt (2007) stated that service quality can have a different meaning in a

diverse context. There are different scholars who have illustrated the service quality as per

several theoretical assumptions. For illustration, quality is illustrated as an overall impression

international justice and higher extent of attitude is depending on service offered are

illustrated and have observed that judge on quality service illustrates the difference among

route customer expectations and views. Cronin Jr & Taylor (1992) opined that quality is

generally illustrated as those product features and fitness for use that attain the requirement of

customers as well as, thereby offers the higher extent of customer satisfaction in Singapore

insurance industry. The tendency with respect to demonstrating services as well as, quality

has a significant component in the service industry like the insurance industry. Since, service

quality is significant to sustain and profit making of the company, then it may influence

customer satisfaction as well as, motivation after shopping favorably.

In opposed to this, Tsoukatos & Rand (2006) evaluated that customer satisfaction has

affected the tendency with respect to shopping favorably. Service quality and customer

satisfaction are considered as vital affairs in a high service industry nowadays. In addition,

quality of service as general comprehension of client and suitability of inappropriateness

relative to their company and services are illustrated.

Hsu & Petchsakulwong (2010) discussed that the quality of services are received as superior

attitudes and the international judge is relied on service offered. It is observed that the judge

on quality services exhibits the difference among order and route customer expectations and

views. But, while it is related to particular service attributes and dimension as a wide

category of model and structure presented and there is different research on service quality

measurement in different industry aspects. In specific, traditional aspects and measures of

customer satisfaction and service quality has been questioned in business to business

atmospheres.

On the other side, Eckardt (2007) stated that service quality can have a different meaning in a

diverse context. There are different scholars who have illustrated the service quality as per

several theoretical assumptions. For illustration, quality is illustrated as an overall impression

MANAGING INTERNATIONAL BUSINESS 7

of customers related to the superiority and inferiority of the company and its services. It is

assessed that perceived service quality is examined as the global judgment and attitude

associated to the superiority of service and observed that the judgment on service quality is a

demonstration of degree as well as, the direction of discrepancy among perceptions and

expectations of customers.

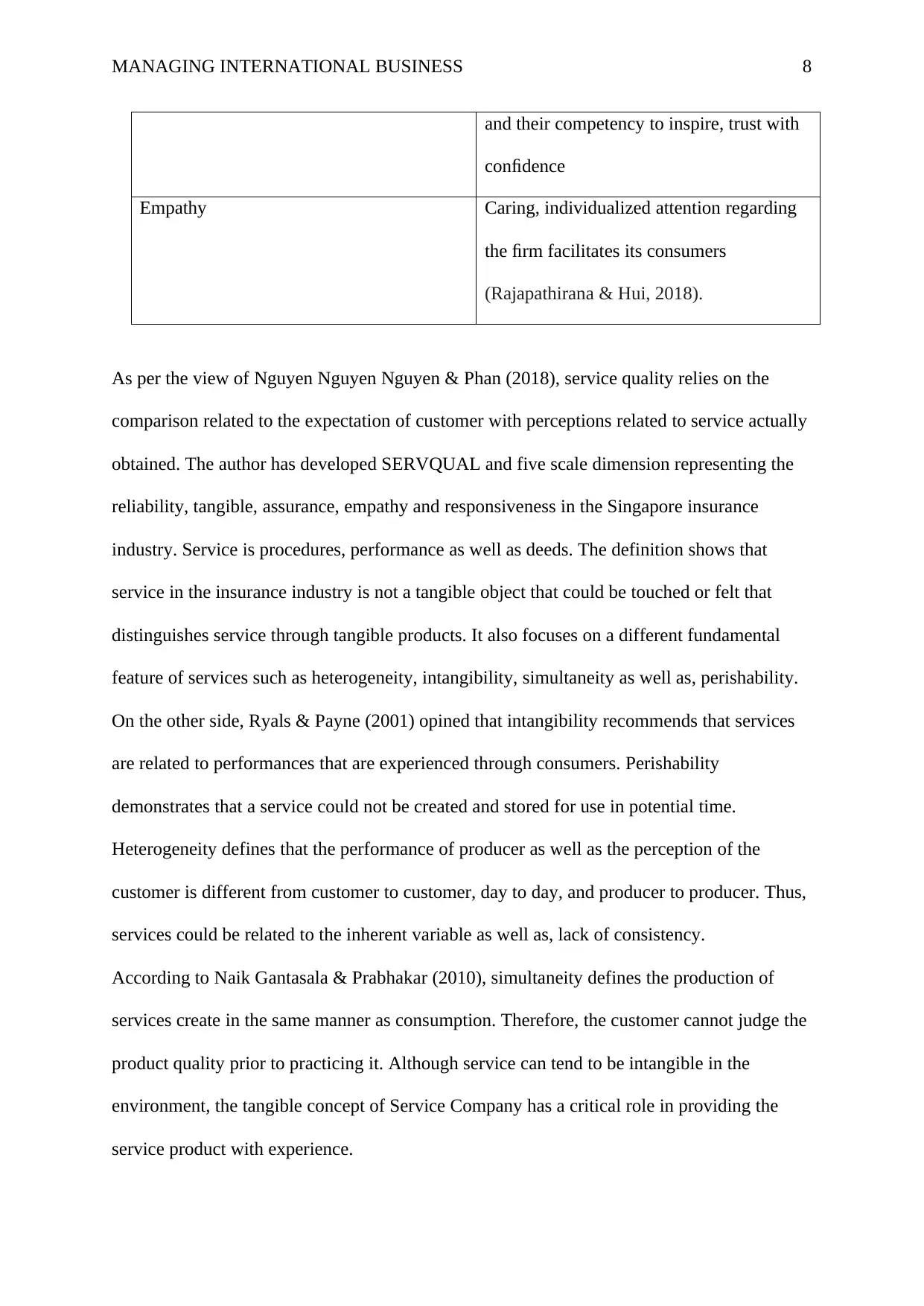

As per the view of Joseph Stone & Anderson (2003), there is five dimensions of service

quality scales such as reliability, empathy, response capabilities, feelings and ensures. It is

widely spread within a various organization has been practiced. Along with this, the

SERVQUAL model depicts the customer scale regarding sufficient quality and value

measure. This literature is highly rich with respect to model, definition, dimension and

measurement concerns in service quality that is supported by the several empirical studies

through different service-related application sectors. In opposed to this, Crosby & Stephens

(1987) examined that some of the contemporary definition regarding service quality from the

literature were provided in this research. The SERVQUAL scale is intended to assess the

service quality observed by participants from different service categories such as long-

distance telephone, insurance, security brokerage, maintenance firm, credit cards, and

appliance repair.

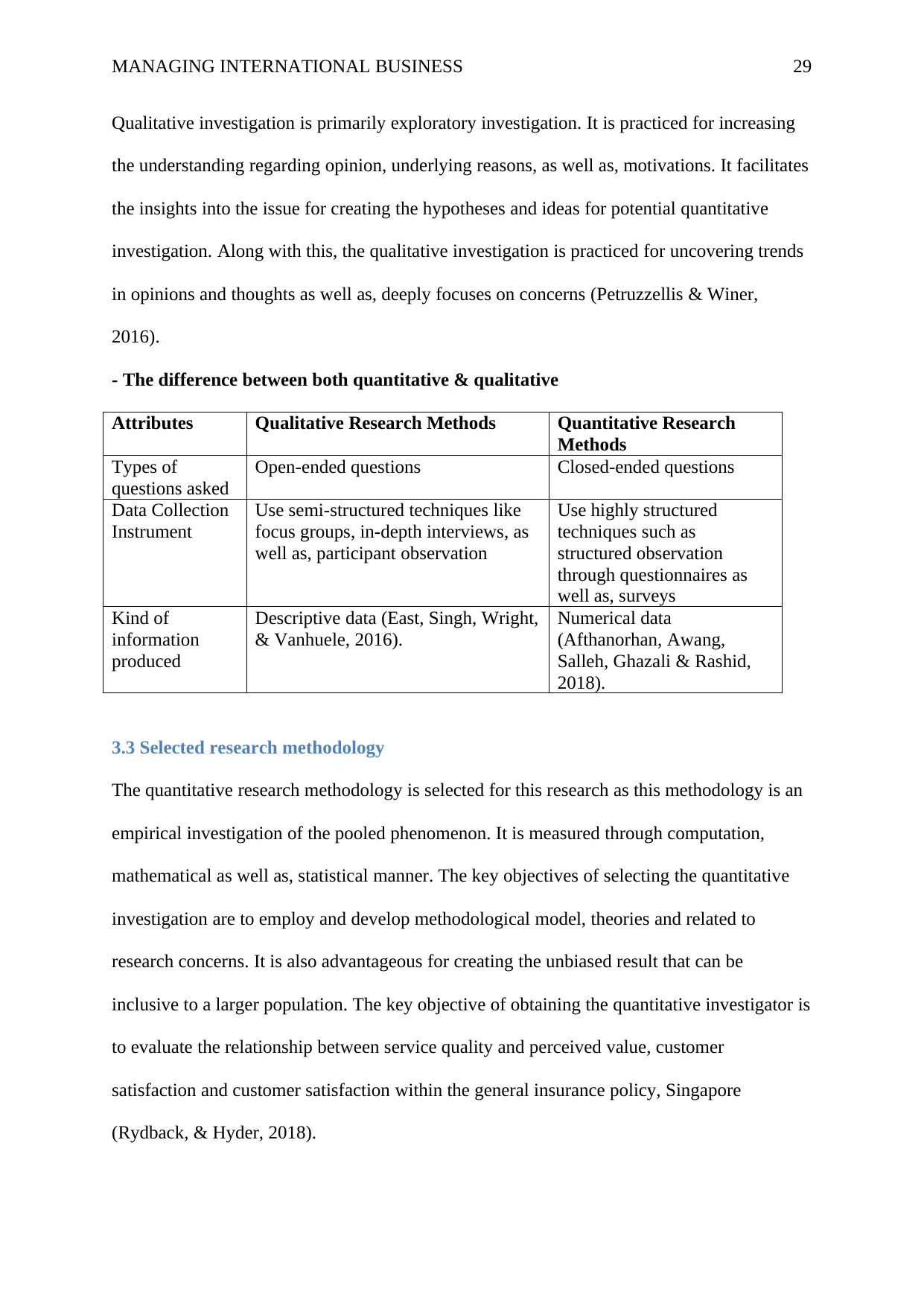

Dimension Explanation

Tangibles Equipment, Physical facilities, as well as,

appearance related to personnel

Reliability Competency to perform the promised

service reliably and correctly

Responsiveness Willingness to support the customers as

well as offer the prompt service.

Assurance Considerate and courtesy of workforces

of customers related to the superiority and inferiority of the company and its services. It is

assessed that perceived service quality is examined as the global judgment and attitude

associated to the superiority of service and observed that the judgment on service quality is a

demonstration of degree as well as, the direction of discrepancy among perceptions and

expectations of customers.

As per the view of Joseph Stone & Anderson (2003), there is five dimensions of service

quality scales such as reliability, empathy, response capabilities, feelings and ensures. It is

widely spread within a various organization has been practiced. Along with this, the

SERVQUAL model depicts the customer scale regarding sufficient quality and value

measure. This literature is highly rich with respect to model, definition, dimension and

measurement concerns in service quality that is supported by the several empirical studies

through different service-related application sectors. In opposed to this, Crosby & Stephens

(1987) examined that some of the contemporary definition regarding service quality from the

literature were provided in this research. The SERVQUAL scale is intended to assess the

service quality observed by participants from different service categories such as long-

distance telephone, insurance, security brokerage, maintenance firm, credit cards, and

appliance repair.

Dimension Explanation

Tangibles Equipment, Physical facilities, as well as,

appearance related to personnel

Reliability Competency to perform the promised

service reliably and correctly

Responsiveness Willingness to support the customers as

well as offer the prompt service.

Assurance Considerate and courtesy of workforces

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

MANAGING INTERNATIONAL BUSINESS 8

and their competency to inspire, trust with

confidence

Empathy Caring, individualized attention regarding

the firm facilitates its consumers

(Rajapathirana & Hui, 2018).

As per the view of Nguyen Nguyen Nguyen & Phan (2018), service quality relies on the

comparison related to the expectation of customer with perceptions related to service actually

obtained. The author has developed SERVQUAL and five scale dimension representing the

reliability, tangible, assurance, empathy and responsiveness in the Singapore insurance

industry. Service is procedures, performance as well as deeds. The definition shows that

service in the insurance industry is not a tangible object that could be touched or felt that

distinguishes service through tangible products. It also focuses on a different fundamental

feature of services such as heterogeneity, intangibility, simultaneity as well as, perishability.

On the other side, Ryals & Payne (2001) opined that intangibility recommends that services

are related to performances that are experienced through consumers. Perishability

demonstrates that a service could not be created and stored for use in potential time.

Heterogeneity defines that the performance of producer as well as the perception of the

customer is different from customer to customer, day to day, and producer to producer. Thus,

services could be related to the inherent variable as well as, lack of consistency.

According to Naik Gantasala & Prabhakar (2010), simultaneity defines the production of

services create in the same manner as consumption. Therefore, the customer cannot judge the

product quality prior to practicing it. Although service can tend to be intangible in the

environment, the tangible concept of Service Company has a critical role in providing the

service product with experience.

and their competency to inspire, trust with

confidence

Empathy Caring, individualized attention regarding

the firm facilitates its consumers

(Rajapathirana & Hui, 2018).

As per the view of Nguyen Nguyen Nguyen & Phan (2018), service quality relies on the

comparison related to the expectation of customer with perceptions related to service actually

obtained. The author has developed SERVQUAL and five scale dimension representing the

reliability, tangible, assurance, empathy and responsiveness in the Singapore insurance

industry. Service is procedures, performance as well as deeds. The definition shows that

service in the insurance industry is not a tangible object that could be touched or felt that

distinguishes service through tangible products. It also focuses on a different fundamental

feature of services such as heterogeneity, intangibility, simultaneity as well as, perishability.

On the other side, Ryals & Payne (2001) opined that intangibility recommends that services

are related to performances that are experienced through consumers. Perishability

demonstrates that a service could not be created and stored for use in potential time.

Heterogeneity defines that the performance of producer as well as the perception of the

customer is different from customer to customer, day to day, and producer to producer. Thus,

services could be related to the inherent variable as well as, lack of consistency.

According to Naik Gantasala & Prabhakar (2010), simultaneity defines the production of

services create in the same manner as consumption. Therefore, the customer cannot judge the

product quality prior to practicing it. Although service can tend to be intangible in the

environment, the tangible concept of Service Company has a critical role in providing the

service product with experience.

MANAGING INTERNATIONAL BUSINESS 9

In opposed to this, The straits times (2019) stated that when the core benefit source is higher

intangible as compared to tangible, it can be considered as a service. It has criticized

SERVQUAL and proposed the alternative scale such as SERVPERF. It involves all

SERVQUAL scale dimension, however, uses only service performance as a measure for

customer perceived service quality instead of the gap among expectation and perception

strategy of SEQUAL.

As per the view of Abu-Salim Onyia Harrison & Lindsay (2017), among different aspects

related to service quality, service quality gap model plays a significant role in the literature of

service management. Gap identifies the precious proposition related to how the notion

‘service quality’ may be comprehended and how the service quality origins across the service

company.

On the other hand, Ramamoorthy et al. (2018) stated that cognitive level of service quality is

assessed by distinguishing between the perception of after sale service and pre-sell service

expectation. Hence, the credit card, product maintenance, and banks, as well as the security

agent industry were processed by using the exploration investigation in order to further

develop the service quality model.

Lovelock & Patterson (2015) discussed the causes that the service quality of the service

industry cannot attain customer demand. It also considers that in terms of attaining the

customer demand, it is required to incorporate the five service quality gaps in the model.

These five gaps are considered as the difference between manager cognition and customer

expectation, the difference between service quality standard and manager cognition, the

difference between provided services as well as external communication, the difference

between expected services, and customer cognition services.

According to Kondasani & Panda (2015), in order to satisfy the consumers, the difference of

gap 5 should be shortened, hence, directly involving the customer expected service standard

In opposed to this, The straits times (2019) stated that when the core benefit source is higher

intangible as compared to tangible, it can be considered as a service. It has criticized

SERVQUAL and proposed the alternative scale such as SERVPERF. It involves all

SERVQUAL scale dimension, however, uses only service performance as a measure for

customer perceived service quality instead of the gap among expectation and perception

strategy of SEQUAL.

As per the view of Abu-Salim Onyia Harrison & Lindsay (2017), among different aspects

related to service quality, service quality gap model plays a significant role in the literature of

service management. Gap identifies the precious proposition related to how the notion

‘service quality’ may be comprehended and how the service quality origins across the service

company.

On the other hand, Ramamoorthy et al. (2018) stated that cognitive level of service quality is

assessed by distinguishing between the perception of after sale service and pre-sell service

expectation. Hence, the credit card, product maintenance, and banks, as well as the security

agent industry were processed by using the exploration investigation in order to further

develop the service quality model.

Lovelock & Patterson (2015) discussed the causes that the service quality of the service

industry cannot attain customer demand. It also considers that in terms of attaining the

customer demand, it is required to incorporate the five service quality gaps in the model.

These five gaps are considered as the difference between manager cognition and customer

expectation, the difference between service quality standard and manager cognition, the

difference between provided services as well as external communication, the difference

between expected services, and customer cognition services.

According to Kondasani & Panda (2015), in order to satisfy the consumers, the difference of

gap 5 should be shortened, hence, directly involving the customer expected service standard

MANAGING INTERNATIONAL BUSINESS 10

as well as, actual perception service standard would permit the assessment of overall service

quality result that is the value of Gap 5. It is also identified that 11 determining factor related

to service quality in the model developed through the difference among the cognition services

and expected customer services. These respectively are competence, courtesy,

responsiveness, access, security, credibility, access, communication as well as,

understanding.

In contrast to this, Yadav Rai & Srivastava (2016) stated that ten service dimension can be

considered as the foundation for creating the questions. This literature has adopted the

concept related to service quality can be originated through difference among customer

expected services as well as, cognitive service. In this literature, Q indicates the service

quality, P demonstrates the perception, and E shows the expectation in developing the

questionnaire. This method is used to assess the service quality scale with good validity as

well as reliability. This scale is developed through five dimensions such as reliability,

responsiveness, tangibles, empathy, and assurance.

According to Wu & Li (2017), the company should make efforts for understanding customer

displeasure with the services that have resulted in several studies related to service quality as

well as, satisfaction. It is addressed that there is direct and indirect associations between

repurchase intention, perceived value, customer satisfaction, and service quality. For

instance, service quality is a major antecedent to repurchase intention, customer satisfaction,

and perceived value. It is also addressed that perceived value had a strong and positive impact

on the perceived value that in turn, influenced repurchase behavior.

On the other side, Eid (2015) evaluated that service quality is significant component related

to sports facilities manager that aims for sustaining and gaining their customer base,

competitive benefits, and creates sustainable sales from their consumers. This notion keeps

as well as, actual perception service standard would permit the assessment of overall service

quality result that is the value of Gap 5. It is also identified that 11 determining factor related

to service quality in the model developed through the difference among the cognition services

and expected customer services. These respectively are competence, courtesy,

responsiveness, access, security, credibility, access, communication as well as,

understanding.

In contrast to this, Yadav Rai & Srivastava (2016) stated that ten service dimension can be

considered as the foundation for creating the questions. This literature has adopted the

concept related to service quality can be originated through difference among customer

expected services as well as, cognitive service. In this literature, Q indicates the service

quality, P demonstrates the perception, and E shows the expectation in developing the

questionnaire. This method is used to assess the service quality scale with good validity as

well as reliability. This scale is developed through five dimensions such as reliability,

responsiveness, tangibles, empathy, and assurance.

According to Wu & Li (2017), the company should make efforts for understanding customer

displeasure with the services that have resulted in several studies related to service quality as

well as, satisfaction. It is addressed that there is direct and indirect associations between

repurchase intention, perceived value, customer satisfaction, and service quality. For

instance, service quality is a major antecedent to repurchase intention, customer satisfaction,

and perceived value. It is also addressed that perceived value had a strong and positive impact

on the perceived value that in turn, influenced repurchase behavior.

On the other side, Eid (2015) evaluated that service quality is significant component related

to sports facilities manager that aims for sustaining and gaining their customer base,

competitive benefits, and creates sustainable sales from their consumers. This notion keeps

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

MANAGING INTERNATIONAL BUSINESS 11

the program targeted at the set of customer aged over 60. Along with this, service quality is a

decisive component in whether or not customers reconsider the sports services.

As per the view of Pansari & Kumar (2017), there is a critical issue in insurance marketing is

assessing the customer satisfaction, wants, expectations, transformations in preferences, and

needs so as to competently address contingent variable, which may associate to development

related to the strategic marketing plan. Service quality is illustrated as the ability of a

company for delivering the service in accordance with the level of expectation related to

customers.

In contrast to this, Moreira & Silva (2015) stated that the expectation is classified by the gap

among desires, and wants of customers, a post-purchase feeling of consumers as well as, the

offering of companies. This structure contains the twenty-two items that are originated

through the several focus groups with the consumers demonstrating different areas for the

service sector.

Díaz (2017) explained that the difference among service quality could be determined as the

extent of difference among expectation of customers with respect to service offered for each

quality dimension and items. Further investigation shows that there is a significant favorable

association among service quality and perceived value. Along with this, perceived value can

be illustrated as the evaluation of difference in perception among actual service performed

and the expectation of customers.

In contrast to this, Yu & Tseng (2019) stated that perceived service quality can be illustrated

as a judgment of the customer regarding the business overall dominance. Moreover, it is

defined as the evaluation of customer regarding received service performance along with,

how it is compared to the expectation. Another aspect examined that assessment is relied on

service attributes rather these relied on feelings and memory of customers. Therefore,

customers identify the service quality with respect to how the extent of satisfaction they have

the program targeted at the set of customer aged over 60. Along with this, service quality is a

decisive component in whether or not customers reconsider the sports services.

As per the view of Pansari & Kumar (2017), there is a critical issue in insurance marketing is

assessing the customer satisfaction, wants, expectations, transformations in preferences, and

needs so as to competently address contingent variable, which may associate to development

related to the strategic marketing plan. Service quality is illustrated as the ability of a

company for delivering the service in accordance with the level of expectation related to

customers.

In contrast to this, Moreira & Silva (2015) stated that the expectation is classified by the gap

among desires, and wants of customers, a post-purchase feeling of consumers as well as, the

offering of companies. This structure contains the twenty-two items that are originated

through the several focus groups with the consumers demonstrating different areas for the

service sector.

Díaz (2017) explained that the difference among service quality could be determined as the

extent of difference among expectation of customers with respect to service offered for each

quality dimension and items. Further investigation shows that there is a significant favorable

association among service quality and perceived value. Along with this, perceived value can

be illustrated as the evaluation of difference in perception among actual service performed

and the expectation of customers.

In contrast to this, Yu & Tseng (2019) stated that perceived service quality can be illustrated

as a judgment of the customer regarding the business overall dominance. Moreover, it is

defined as the evaluation of customer regarding received service performance along with,

how it is compared to the expectation. Another aspect examined that assessment is relied on

service attributes rather these relied on feelings and memory of customers. Therefore,

customers identify the service quality with respect to how the extent of satisfaction they have

MANAGING INTERNATIONAL BUSINESS 12

obtained through services. The role related to perceived service quality in customer

satisfaction is developed however the condition in a different dimension of impact will or will

not influence service quality evaluation, as well as customer satisfaction.

Ren Hyun & Park (2017) assessed that associations among service quality and customer

satisfaction are presented. However, perceived service quality could be managed through

treating the workforces in an appropriate way. The definition of service quality could be

provided on the basis of the outcome of Dinh (2017), who opined that perceived service

quality is demonstrated as the direction and degree related to discrepancy among perception

of customers as well as expectations.

As per the view of Narteh (2018), perceived quality is the actual customer experience related

to services. It is addressed that there is a favorable association between customer satisfaction

and service quality. It is stated that perceived quality has a positive and direct impact on the

extent of customer satisfaction. Prompt delivery of service will be perceived as a higher

extent of service quality whereas a sluggish delivery will be perceived as low service quality.

In contrast to this, Guo Barnes & Jia (2017) has categorized the function of expectations in

satisfaction into two parts such as the anticipation of satisfaction and another one is the role

of expectation as relative referents. While an individual explains the expectations as

anticipation then the customer thinks that the expectation may have a direct impact on

satisfaction level. Therefore, the aspect of expectation is related to standard against, which

result obtained through performance are measured.

In support of this, Oke Kamolshotiros Popoola Ajagbe & Olujobi (2016) stated that when the

actual outcome of consumers exceed expectation, then the customer would be called satisfied

and in the same manner, while the expectation exceeds the results, then the customer would

be dissatisfied. It is addressed that when comparing Japan and the US with respect to high

obtained through services. The role related to perceived service quality in customer

satisfaction is developed however the condition in a different dimension of impact will or will

not influence service quality evaluation, as well as customer satisfaction.

Ren Hyun & Park (2017) assessed that associations among service quality and customer

satisfaction are presented. However, perceived service quality could be managed through

treating the workforces in an appropriate way. The definition of service quality could be

provided on the basis of the outcome of Dinh (2017), who opined that perceived service

quality is demonstrated as the direction and degree related to discrepancy among perception

of customers as well as expectations.

As per the view of Narteh (2018), perceived quality is the actual customer experience related

to services. It is addressed that there is a favorable association between customer satisfaction

and service quality. It is stated that perceived quality has a positive and direct impact on the

extent of customer satisfaction. Prompt delivery of service will be perceived as a higher

extent of service quality whereas a sluggish delivery will be perceived as low service quality.

In contrast to this, Guo Barnes & Jia (2017) has categorized the function of expectations in

satisfaction into two parts such as the anticipation of satisfaction and another one is the role

of expectation as relative referents. While an individual explains the expectations as

anticipation then the customer thinks that the expectation may have a direct impact on

satisfaction level. Therefore, the aspect of expectation is related to standard against, which

result obtained through performance are measured.

In support of this, Oke Kamolshotiros Popoola Ajagbe & Olujobi (2016) stated that when the

actual outcome of consumers exceed expectation, then the customer would be called satisfied

and in the same manner, while the expectation exceeds the results, then the customer would

be dissatisfied. It is addressed that when comparing Japan and the US with respect to high

MANAGING INTERNATIONAL BUSINESS 13

performance then it would ultimately yield higher customer satisfaction and high perceived

service quality.

As per the view of Su Hsu & Swanson (2017), customer expectation is evaluated by asking

the consumer to recall the extent of quality they predicted on the basis of their understanding

regarding service or products as well as, actual experience with the goods and services.

Responses are collected on the basis of above questions such as overall expectation with

products and services, expectation associated with customization, and expectation about the

reliability. It is addressed that service performance is received through consumers should

exceed the expectation. The gap among perceived service quality and expectation is

associated with the customer’s satisfaction/dissatisfaction in B2B.

On the other side, Lee et al. (2018) evaluated that some managerial implication considers the

under-promising as well as, over-delivering. From this outcome, managers can focus on the

lesser expectation of customers in order to make sure they can go over that expectation.

However, another view is related to the gap in perception and expectation, perception

regarding service quality result under promising will outcome in lower quality perception,

high expectation related to service performance would be related to high perception about

service quality. Tseng (2019) viewed that managers who want to gain customer perceived

quality should decline the gap among expected quality as well as, actually received service by

the raising of expectation rather than, making efforts for increasing the gap between delivered

services along with, expectation. Moreover, the expectation could be considered as

corresponding to the perception of service quality before practicing the services. This

perception is made earlier the use of services as per the expectation as well as, perception

related to quality is made by using the services in the general insurance industry.

In opposed to this, Juhana Manik Farinella & Sidharta (2015) elaborated that there is some

limitation of low expectation such as when a customer observes low service; they would

performance then it would ultimately yield higher customer satisfaction and high perceived

service quality.

As per the view of Su Hsu & Swanson (2017), customer expectation is evaluated by asking

the consumer to recall the extent of quality they predicted on the basis of their understanding

regarding service or products as well as, actual experience with the goods and services.

Responses are collected on the basis of above questions such as overall expectation with

products and services, expectation associated with customization, and expectation about the

reliability. It is addressed that service performance is received through consumers should

exceed the expectation. The gap among perceived service quality and expectation is

associated with the customer’s satisfaction/dissatisfaction in B2B.

On the other side, Lee et al. (2018) evaluated that some managerial implication considers the

under-promising as well as, over-delivering. From this outcome, managers can focus on the

lesser expectation of customers in order to make sure they can go over that expectation.

However, another view is related to the gap in perception and expectation, perception

regarding service quality result under promising will outcome in lower quality perception,

high expectation related to service performance would be related to high perception about

service quality. Tseng (2019) viewed that managers who want to gain customer perceived

quality should decline the gap among expected quality as well as, actually received service by

the raising of expectation rather than, making efforts for increasing the gap between delivered

services along with, expectation. Moreover, the expectation could be considered as

corresponding to the perception of service quality before practicing the services. This

perception is made earlier the use of services as per the expectation as well as, perception

related to quality is made by using the services in the general insurance industry.

In opposed to this, Juhana Manik Farinella & Sidharta (2015) elaborated that there is some

limitation of low expectation such as when a customer observes low service; they would

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

MANAGING INTERNATIONAL BUSINESS 14

perceive the company as a comparatively low-quality service provider. When the service

companies exceed the expectations of the consumer then, they would be perceived as low-

quality providers of services. When the company went in under promising phenomenon as

compared to expectation cannot be reviewed up to extend that is advantageous for the

company. Therefore, under promising will outcome in a lower level of perceived service

quality. Hence, it is significant to recall that it is effective for attaining the high expectation as

compared to exceeding the low expectation.

As per the view of Sharma Kong & Kingshott (2016), the gap among perceived expectation

and performance can be taken as a measure for perceived service quality. The gap among

perceived as well as, expected quality could be effectively measured through SERVQUAL in

the insurance industry. Therefore, perceived service quality= service perception-service

expectation.

2.2 Perceived Value

As per the opinion of My Thong Van Chon & Dinh (2017), perceived value is entailed as the

overall evaluation of customer in the context of the value of products and services as per the

perception of what is received or given. Perceived value can be one significant measurement

in terms of developing competitive benefits. Perceived value is regarded as a determinant of

customer satisfaction. Therefore, most consumers receive and expect the benefits that are

higher as compared to costs. Hence, when they feel unexpected sentiments after buying, it

would impact their perceived value in the general insurance industry.

As per the view of Zarei & Maleki (2019), insurance is defined as the guaranteeing financial

security in against of several risks. There are several types of insurance to consider different

condition. There are different insurance products that are fire insurance, life insurance,

personal accident insurance, theft insurance, and homeowner insurance. It creates a favorable

perception regarding the customers.

perceive the company as a comparatively low-quality service provider. When the service

companies exceed the expectations of the consumer then, they would be perceived as low-

quality providers of services. When the company went in under promising phenomenon as

compared to expectation cannot be reviewed up to extend that is advantageous for the

company. Therefore, under promising will outcome in a lower level of perceived service

quality. Hence, it is significant to recall that it is effective for attaining the high expectation as

compared to exceeding the low expectation.

As per the view of Sharma Kong & Kingshott (2016), the gap among perceived expectation

and performance can be taken as a measure for perceived service quality. The gap among

perceived as well as, expected quality could be effectively measured through SERVQUAL in

the insurance industry. Therefore, perceived service quality= service perception-service

expectation.

2.2 Perceived Value

As per the opinion of My Thong Van Chon & Dinh (2017), perceived value is entailed as the

overall evaluation of customer in the context of the value of products and services as per the

perception of what is received or given. Perceived value can be one significant measurement

in terms of developing competitive benefits. Perceived value is regarded as a determinant of

customer satisfaction. Therefore, most consumers receive and expect the benefits that are

higher as compared to costs. Hence, when they feel unexpected sentiments after buying, it

would impact their perceived value in the general insurance industry.

As per the view of Zarei & Maleki (2019), insurance is defined as the guaranteeing financial

security in against of several risks. There are several types of insurance to consider different

condition. There are different insurance products that are fire insurance, life insurance,

personal accident insurance, theft insurance, and homeowner insurance. It creates a favorable

perception regarding the customers.

MANAGING INTERNATIONAL BUSINESS 15

On the other side, Rahman Abdel Fattah Zaman & Hassan (2018) identified that life

insurance is intended to keep against two distinct uncertainties such as premature death as

well as, superannuation. Life insurance is perceived by customers as a positive value because

it makes sure the continuous stream related to income to beneficiaries. In addition to this,

insurance companies are concerned regarding superannuating as an individual can endure

their income earning competency. It can serve as a technique for making sure the constant

stream for income.

In the view of Kumar & Reinartz (2016), life insurance is intended to indemnify the insured

related to lose of or damage to furniture, fixtures, buildings and other personal property as a

consequence of lighting, hail, and fire. This may create a favorable impact on the perceived

value of customer’s in the general insurance industry of Singapore. Moreover, Singapore

matches the trend of epidemic proportion in certain western nations in which, there has been

an enormous gain in incidence related to burning. The company should offer some protection

against the hazards of fire.

On the other side, Alharbi & Qassim (2017) evaluated that health insurance is the protection

system in against loss by disease or other uncertainties that are health associated. The loss can

be associated with loss in wages caused by sickness, hospital bills, and expenses for doctor’s

bills. Moreover, health insurance can be purchased as a single policy or as a kind of riders

attached to certain basic life insurance strategy.

Liao Lin Luo & Chea (2017) stated that each Singaporean includes a Medisave account

related to the central provident fund. Along with this, Singaporean involved the Medishield

that are a low-cost medical insurance plan that enables the policyholders and dependants

financial security against the high medical expenses created from the treatment of severe and

prolonged sicknesses. However, some are a bit more careful by obtaining a modest private

medical insurance policy. Each individual needs medical treatment for something later or

On the other side, Rahman Abdel Fattah Zaman & Hassan (2018) identified that life

insurance is intended to keep against two distinct uncertainties such as premature death as

well as, superannuation. Life insurance is perceived by customers as a positive value because

it makes sure the continuous stream related to income to beneficiaries. In addition to this,

insurance companies are concerned regarding superannuating as an individual can endure

their income earning competency. It can serve as a technique for making sure the constant

stream for income.

In the view of Kumar & Reinartz (2016), life insurance is intended to indemnify the insured

related to lose of or damage to furniture, fixtures, buildings and other personal property as a

consequence of lighting, hail, and fire. This may create a favorable impact on the perceived

value of customer’s in the general insurance industry of Singapore. Moreover, Singapore

matches the trend of epidemic proportion in certain western nations in which, there has been

an enormous gain in incidence related to burning. The company should offer some protection

against the hazards of fire.

On the other side, Alharbi & Qassim (2017) evaluated that health insurance is the protection

system in against loss by disease or other uncertainties that are health associated. The loss can

be associated with loss in wages caused by sickness, hospital bills, and expenses for doctor’s

bills. Moreover, health insurance can be purchased as a single policy or as a kind of riders

attached to certain basic life insurance strategy.

Liao Lin Luo & Chea (2017) stated that each Singaporean includes a Medisave account

related to the central provident fund. Along with this, Singaporean involved the Medishield

that are a low-cost medical insurance plan that enables the policyholders and dependants

financial security against the high medical expenses created from the treatment of severe and

prolonged sicknesses. However, some are a bit more careful by obtaining a modest private

medical insurance policy. Each individual needs medical treatment for something later or

MANAGING INTERNATIONAL BUSINESS 16

earlier and hence there is a requirement related to health insurance. Thus, this type of

insurance also favorably influences the perceived value of customers in Singapore insurance

industry.

On the contrary, Holloway (2017) stated that homeowner’s insurance is a type of insurance

policy related to the security of each thing that is inside the home. Furthermore, a home

content policy involves just about everything that a company will consider to move. It

discusses the furnishing household products, furniture, kitchen equipment, food and drink,

clothing, personal impacts and valuable products like jewelry as well as, cash is over the

targeted limits. Since, the definition is so uncertain and broad as well as, policies of

homeowner are varying in terms of coverage and amount. There are two kinds of coverage

presented such as indemnity and replacement as new.

As per the view of Eid & El-Gohary (2015), accidents are a major cause of death and injury.

Statistics indicate that about one in every 14 Singaporeans would seek the treatment at an

emergency as well as accident department. In addition, out of every 18 death would be the

consequence of an accident. The possibility of being entailed in an accident is high. There are

some kinds of life assurance that can help the injured for surviving financially in accidents.

In opposed to this, Sayani (2015) evaluated that some policies are related to meeting the

particular requirements like mortgage payments. There is a deficit in cash that an individual

would need to support them by the traumatic period as well as, the financial crisis that

promptly follows the accidents. Due to this, a high amount of individual purchase personal

accident insurance. By buying the personal accident insurance, the insured can actually

purchase the peace for mind that they would be competent to cope with the life’s accident.

As per the view of Jin Nicely Fan & Adler (2019), personal accident insurance compensates

the agreed amount of compensation when the insured individual is killed and injured within

an accident. It generally does not entail the consequences related to disease and illness.

earlier and hence there is a requirement related to health insurance. Thus, this type of

insurance also favorably influences the perceived value of customers in Singapore insurance

industry.

On the contrary, Holloway (2017) stated that homeowner’s insurance is a type of insurance

policy related to the security of each thing that is inside the home. Furthermore, a home

content policy involves just about everything that a company will consider to move. It

discusses the furnishing household products, furniture, kitchen equipment, food and drink,

clothing, personal impacts and valuable products like jewelry as well as, cash is over the

targeted limits. Since, the definition is so uncertain and broad as well as, policies of

homeowner are varying in terms of coverage and amount. There are two kinds of coverage

presented such as indemnity and replacement as new.

As per the view of Eid & El-Gohary (2015), accidents are a major cause of death and injury.

Statistics indicate that about one in every 14 Singaporeans would seek the treatment at an

emergency as well as accident department. In addition, out of every 18 death would be the

consequence of an accident. The possibility of being entailed in an accident is high. There are

some kinds of life assurance that can help the injured for surviving financially in accidents.

In opposed to this, Sayani (2015) evaluated that some policies are related to meeting the

particular requirements like mortgage payments. There is a deficit in cash that an individual

would need to support them by the traumatic period as well as, the financial crisis that

promptly follows the accidents. Due to this, a high amount of individual purchase personal

accident insurance. By buying the personal accident insurance, the insured can actually

purchase the peace for mind that they would be competent to cope with the life’s accident.

As per the view of Jin Nicely Fan & Adler (2019), personal accident insurance compensates

the agreed amount of compensation when the insured individual is killed and injured within

an accident. It generally does not entail the consequences related to disease and illness.

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

MANAGING INTERNATIONAL BUSINESS 17

Moreover, personal accident insurance is a significant consideration because the injured

individual is unlikely to be competent to work full time until they completely get better from

the accidents.

In opposed to this, Sayani (2015) evaluated that theft insurance protects in against the

damage of assets because of forced ownership by others like incidents associated with theft,

burglary, and robbery. In the nation of Singapore with the associatively low crime rate and

theft insurance policies are not frequently bought. Along with this, in Singapore, there are no

rules and regulation that states an individual cannot leave the nation unless they are insured.

There are many individuals who are willing to taking the risks.

As per the view of Ameryoun Najafi Nejati-Zarnaqi Khalilifar Ajam & Ansarimoghadam

(2017), there is less than 10 percent of holiday travelers out of Singapore that takes out

isolated insurance cover and also involves adequate security. But, there are a large number of

travel coverage under their medical insurance strategy that covers both overseas and

Singapore as well as, in their personal accident insurance policies that are extended to involve

overseas trip.

In contrast to this, Kilibarda Nikolicic & Andrejic (2016) stated that travel insurance would

likely to involve different areas such as personal accident, money indemnity, personal

luggage, medical expenses, personal liability, and cancellation. Other areas are delayed

baggage, and travel delay benefits are sometimes involved. Perceived value is becoming a

significant criterion in building the managerial strategies for generating, delivering value and

communicates to consumers.

Ong Nguyen & Syed Alwi (2017) illustrated that value is assessed by evaluating the spectrum

related to the experience of customers. It can be assessed by discrepancy among the

perceived benefit as well as, actual cost. It is also the finest modifier throughout the

consumption procedure of an individual in the insurance industry. It also plays a significant

Moreover, personal accident insurance is a significant consideration because the injured

individual is unlikely to be competent to work full time until they completely get better from

the accidents.

In opposed to this, Sayani (2015) evaluated that theft insurance protects in against the

damage of assets because of forced ownership by others like incidents associated with theft,

burglary, and robbery. In the nation of Singapore with the associatively low crime rate and

theft insurance policies are not frequently bought. Along with this, in Singapore, there are no

rules and regulation that states an individual cannot leave the nation unless they are insured.

There are many individuals who are willing to taking the risks.

As per the view of Ameryoun Najafi Nejati-Zarnaqi Khalilifar Ajam & Ansarimoghadam

(2017), there is less than 10 percent of holiday travelers out of Singapore that takes out

isolated insurance cover and also involves adequate security. But, there are a large number of

travel coverage under their medical insurance strategy that covers both overseas and

Singapore as well as, in their personal accident insurance policies that are extended to involve

overseas trip.

In contrast to this, Kilibarda Nikolicic & Andrejic (2016) stated that travel insurance would

likely to involve different areas such as personal accident, money indemnity, personal

luggage, medical expenses, personal liability, and cancellation. Other areas are delayed

baggage, and travel delay benefits are sometimes involved. Perceived value is becoming a

significant criterion in building the managerial strategies for generating, delivering value and

communicates to consumers.

Ong Nguyen & Syed Alwi (2017) illustrated that value is assessed by evaluating the spectrum

related to the experience of customers. It can be assessed by discrepancy among the

perceived benefit as well as, actual cost. It is also the finest modifier throughout the

consumption procedure of an individual in the insurance industry. It also plays a significant

MANAGING INTERNATIONAL BUSINESS 18

component in the evaluation of service quality, behavioral intention as well as, customer

satisfaction. This literature demonstrates that perceived value would have a favorable impact

on customer satisfaction as well as repurchase intention.

On the other hand, Ukil (2016) stated that value is considered as an overall evaluation

regarding benefits of some products as per the perception of the customer regarding what has

been given and received by the goods and services. Value can be entailed as experience

regarding interactive as well as relativistic preference regarding subject experience in doing

communication with some object. In terms of customer value, the subject is related to the

customer when the feasible object is products such as ideas, goods, services, people/private,

activity/event, and company.

Prajitmutita Perényi & Prentice (2016) viewed that service quality contains different

dimension such as reliability, tangible, responsiveness, assurance, and empathy and it helps to

increase customer loyalty towards the service suppliers. Loyalty is able to develop the quality

in each service. There is also a significant association between service quality and customer

loyalty. It is addressed that customer satisfaction is associated with customer loyalty as a

satisfied consumer always be loyal to the customer.

In opposed to this, Gowanit Thawesaengskulthai Sophatsathit & Chaiyawat (2016) addressed