Microeconomics Assignment: Questions and Answers

VerifiedAdded on 2023/06/12

|11

|2351

|110

AI Summary

This assignment covers topics such as tax revenue, dead-weight loss, price elasticity, budget constraint, and prisoners' dilemma. It also includes examples and diagrams to illustrate the concepts.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Running Head: MICROECONOMICS ASSIGNMENT

Microeconomics Assignment

Questions and Answers

Microeconomics Assignment

Questions and Answers

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

MICROECONOMICS ASSIGNMENT Page 1 of 11

Table of Contents

PART 1...................................................................................................................................................2

Question 1.........................................................................................................................................2

Question 2.........................................................................................................................................3

PART 2...................................................................................................................................................4

Question 1.........................................................................................................................................4

Question 2.........................................................................................................................................7

Question 3.........................................................................................................................................7

Question 4.........................................................................................................................................7

Question 5: Bonus Question..............................................................................................................8

Question 6: Another Bonus Question................................................................................................9

References...........................................................................................................................................10

Table of Contents

PART 1...................................................................................................................................................2

Question 1.........................................................................................................................................2

Question 2.........................................................................................................................................3

PART 2...................................................................................................................................................4

Question 1.........................................................................................................................................4

Question 2.........................................................................................................................................7

Question 3.........................................................................................................................................7

Question 4.........................................................................................................................................7

Question 5: Bonus Question..............................................................................................................8

Question 6: Another Bonus Question................................................................................................9

References...........................................................................................................................................10

MICROECONOMICS ASSIGNMENT Page 2 of 11

PART 1

Question 1

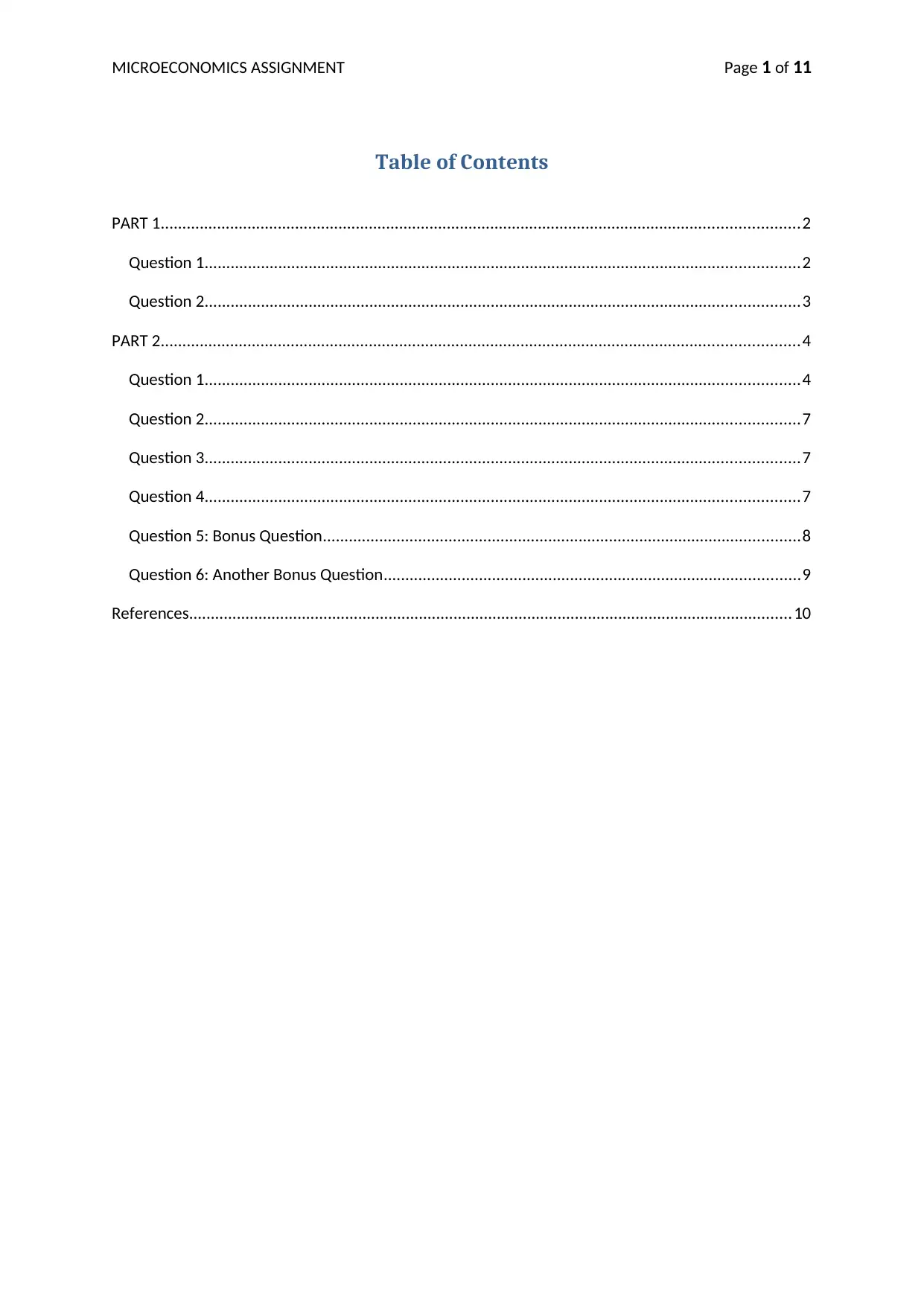

a. It is the difference between the reservation price or the price that he is willing and able to

pay and the amount he actually pays for the commodity or the prevailing market price

(Mankiw, 2017).

b. It is the price at which the supplier is willing to supply his produce over the amount he

actually receives for the commodity or the prevailing market price.

c. Tax revenue is the amount the government receives by imposing a tax in the economy. A

tax can be levied on income, commodities or the profits of a firm. It reduces both

consumer and producer surplus and creates dead-weight loss in the society. Dead-weight

loss neither goes to the consumer and producer, nor the government. It leads to

inefficiency in the market.

d. It refers to the inefficiency created by imposition of tax or grant of subsidy. It is the

amount the consumer has to pay in excess of the taxes (Aure, 2012). It can be describes as

the inefficiency arising out of allocation or the excess burden on the economy. It leads to

disequilibrium in the economy and wastage of resources.

Figure 1: Before tax imposition

Consumer

Surplus

Demand

Curve

Quantity

Price

E

Q

*

O

Supply

Curve

P* Producer

Surplus

PART 1

Question 1

a. It is the difference between the reservation price or the price that he is willing and able to

pay and the amount he actually pays for the commodity or the prevailing market price

(Mankiw, 2017).

b. It is the price at which the supplier is willing to supply his produce over the amount he

actually receives for the commodity or the prevailing market price.

c. Tax revenue is the amount the government receives by imposing a tax in the economy. A

tax can be levied on income, commodities or the profits of a firm. It reduces both

consumer and producer surplus and creates dead-weight loss in the society. Dead-weight

loss neither goes to the consumer and producer, nor the government. It leads to

inefficiency in the market.

d. It refers to the inefficiency created by imposition of tax or grant of subsidy. It is the

amount the consumer has to pay in excess of the taxes (Aure, 2012). It can be describes as

the inefficiency arising out of allocation or the excess burden on the economy. It leads to

disequilibrium in the economy and wastage of resources.

Figure 1: Before tax imposition

Consumer

Surplus

Demand

Curve

Quantity

Price

E

Q

*

O

Supply

Curve

P* Producer

Surplus

Consumer

Surplus

Producer

Surplus

Dead-weight

Loss

MICROECONOMICS ASSIGNMENT Page 3 of 11

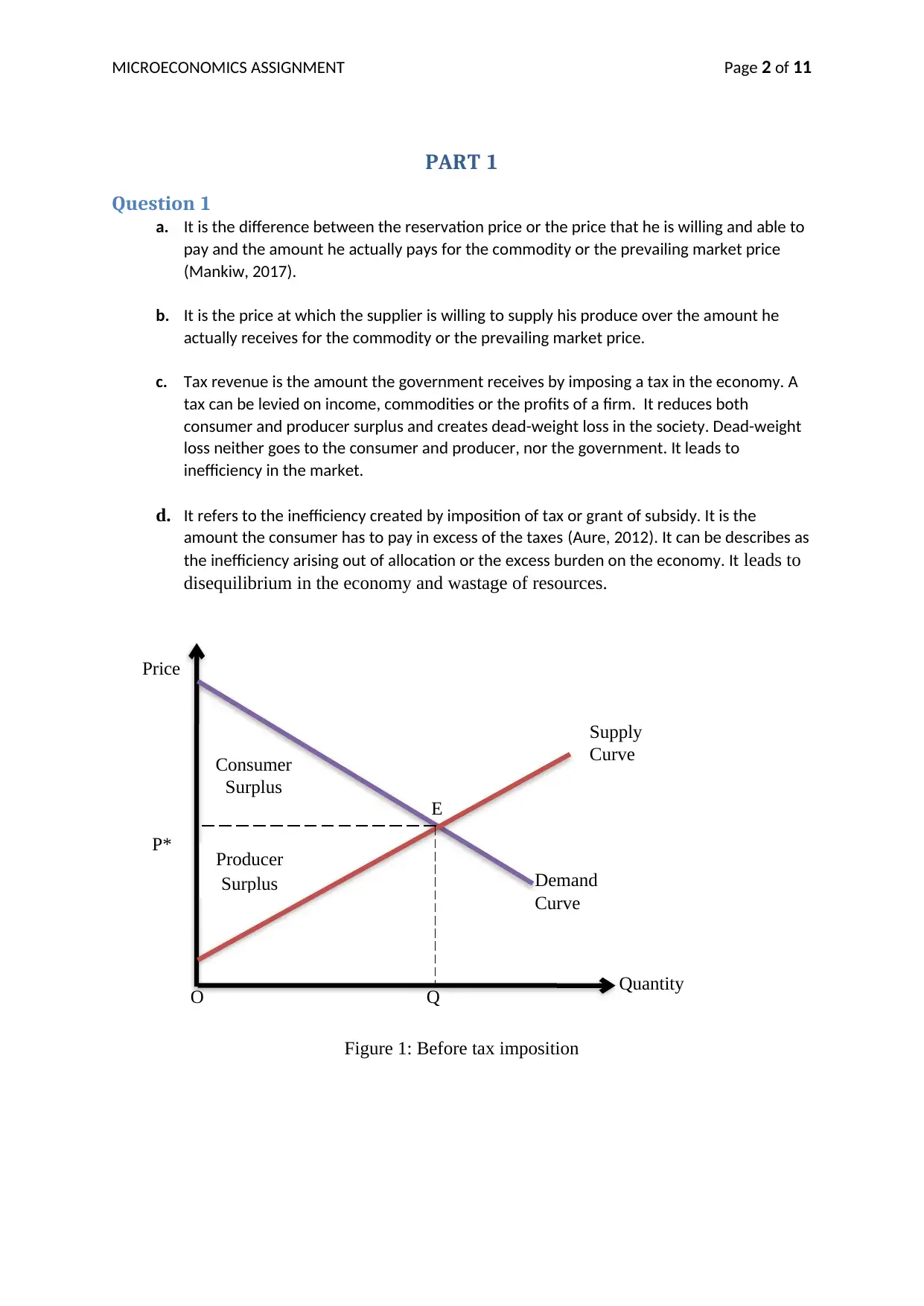

Figure 2: After tax imposition

Question 2

a. At equilibrium quantity demanded is equal to the quantity supplied.

All quantities are in 1000.

QD = QS

-P +23 = 2P -10

3P = 33

P* = $11 (equilibrium price)

Q* = 12 (equilibrium quantity)

b. On y-axis, demand curve intersects at:

QD = -P + 23

P = 23

Base = Q* = 12 (equilibrium quantity)

Height = 23 – P* = 23- 11 = 12

Consumer Surplus (before tax) = ½ *base*height

= ½ * 12 * 12

= 72 unit square

c. On y-axis, supply curve intersects at:

QS = 2P – 10

P = 5

Q*QO

Tax

Supply

Curve

Demand

Curve

E

PS

PB

Price

Quantity

Tax

Revenue

PC: Price paid by Buyer

PS: Price received by Seller

Surplus

Producer

Surplus

Dead-weight

Loss

MICROECONOMICS ASSIGNMENT Page 3 of 11

Figure 2: After tax imposition

Question 2

a. At equilibrium quantity demanded is equal to the quantity supplied.

All quantities are in 1000.

QD = QS

-P +23 = 2P -10

3P = 33

P* = $11 (equilibrium price)

Q* = 12 (equilibrium quantity)

b. On y-axis, demand curve intersects at:

QD = -P + 23

P = 23

Base = Q* = 12 (equilibrium quantity)

Height = 23 – P* = 23- 11 = 12

Consumer Surplus (before tax) = ½ *base*height

= ½ * 12 * 12

= 72 unit square

c. On y-axis, supply curve intersects at:

QS = 2P – 10

P = 5

Q*QO

Tax

Supply

Curve

Demand

Curve

E

PS

PB

Price

Quantity

Tax

Revenue

PC: Price paid by Buyer

PS: Price received by Seller

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

MICROECONOMICS ASSIGNMENT Page 4 of 11

Base = Q* = 12 (equilibrium quantity)

Height = P*- 5 = 11 - 5 = 6

Producer Surplus (before tax) = ½ *base*height

= ½ * 12 * 6

= 36 unit square

d. Net social benefit before tax = Consumer Surplus + Producer Surplus

= 72 + 36 = 108 unit square

e. Tax= Price paid by the buyer – Price received by the seller

T = PB - PS

PS = PB – T

QD = QS

-PB +23 = 2PS -10

-PB +23 = 2(PB – T) -10

-PB +23 = 2(PB – 1.50) -10

-PB +23 = 2PB – 3 – 10

3 PB = 36

PB = $12

PS = $10.50

Q1 = 11 (new quantity sold)

Change in quantity sold = Q* - Q1 = 12 – 11 = 1

f. Tax Revenue = T * Q1 = 1.50 * 11 = $16.50

g. Base = Q1 = 11

Height = 23 – 11 = 12

New consumer surplus = ½ * 11*12 =66 unit square

h. Base = Q1 = 11

Height = 10.50 – 5 = 5.50 unit square

i. Base = Q* - Q1 = 12 – 11 = 1

Height = 12 – 10.50 = 1.50

Dead-weight loss = ½ * 1 * 1.50 = 0.75 unit square

j. New net social benefit = New consumer surplus + New producer surplus

= 66 + 5.50 = 71.50 unit square

PART 2

Question 1

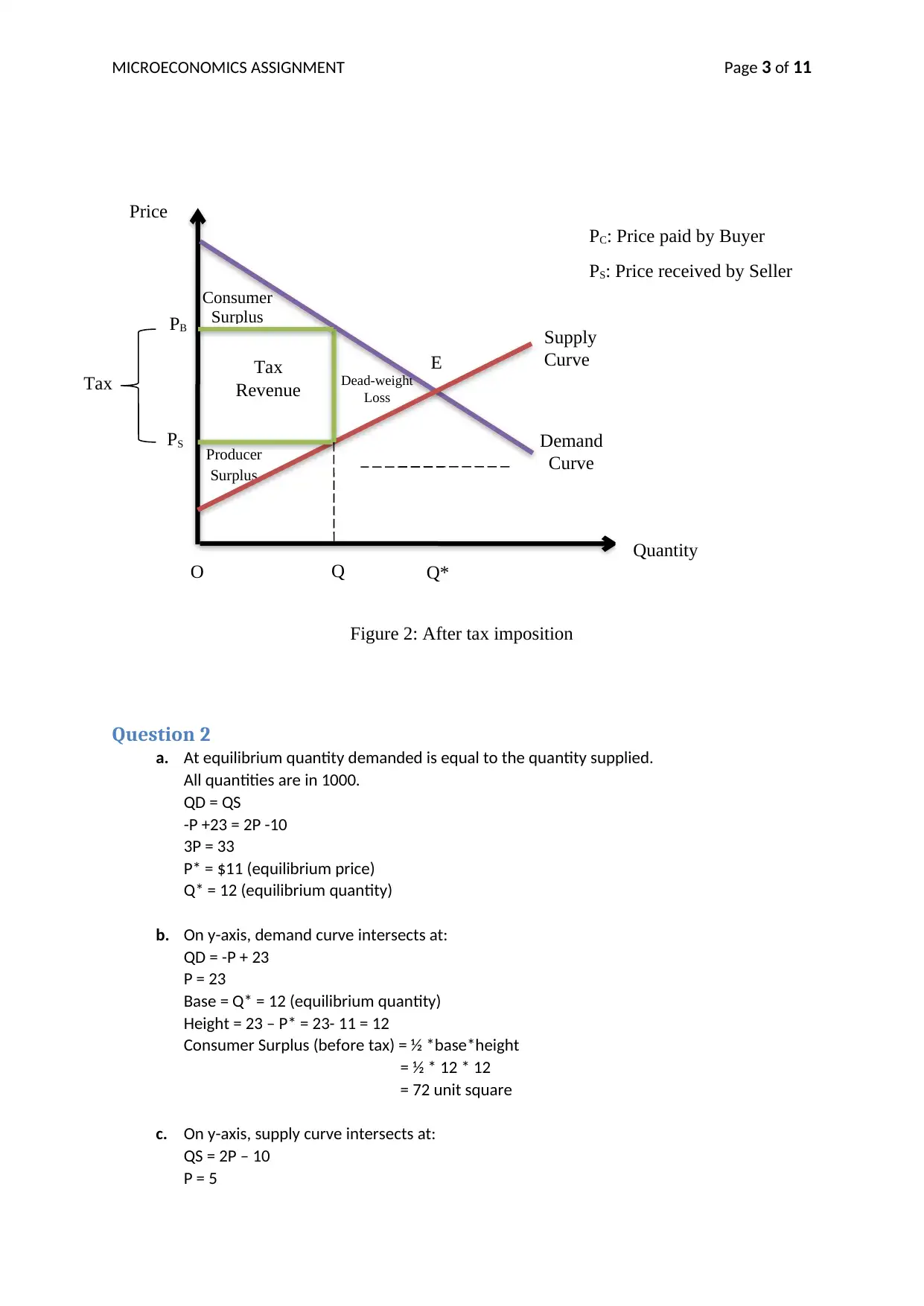

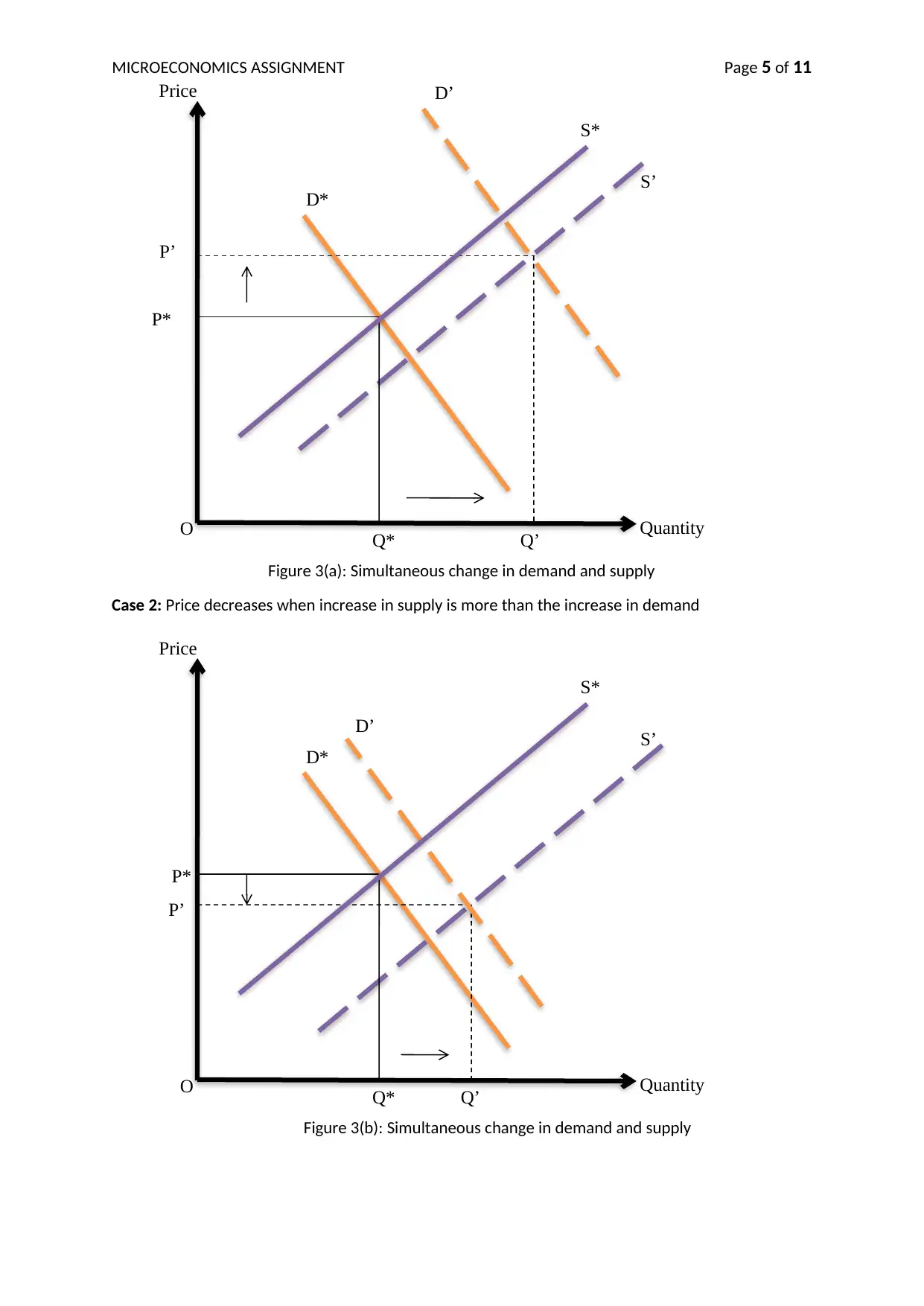

a. Simultaneous increase in demand and supply leads to increase in output while the effect

on equilibrium price can be ambiguous. This can be illustrated with the help of following

diagrams:

Case 1: Price increases when increase in supply is less than the increase in demand

Base = Q* = 12 (equilibrium quantity)

Height = P*- 5 = 11 - 5 = 6

Producer Surplus (before tax) = ½ *base*height

= ½ * 12 * 6

= 36 unit square

d. Net social benefit before tax = Consumer Surplus + Producer Surplus

= 72 + 36 = 108 unit square

e. Tax= Price paid by the buyer – Price received by the seller

T = PB - PS

PS = PB – T

QD = QS

-PB +23 = 2PS -10

-PB +23 = 2(PB – T) -10

-PB +23 = 2(PB – 1.50) -10

-PB +23 = 2PB – 3 – 10

3 PB = 36

PB = $12

PS = $10.50

Q1 = 11 (new quantity sold)

Change in quantity sold = Q* - Q1 = 12 – 11 = 1

f. Tax Revenue = T * Q1 = 1.50 * 11 = $16.50

g. Base = Q1 = 11

Height = 23 – 11 = 12

New consumer surplus = ½ * 11*12 =66 unit square

h. Base = Q1 = 11

Height = 10.50 – 5 = 5.50 unit square

i. Base = Q* - Q1 = 12 – 11 = 1

Height = 12 – 10.50 = 1.50

Dead-weight loss = ½ * 1 * 1.50 = 0.75 unit square

j. New net social benefit = New consumer surplus + New producer surplus

= 66 + 5.50 = 71.50 unit square

PART 2

Question 1

a. Simultaneous increase in demand and supply leads to increase in output while the effect

on equilibrium price can be ambiguous. This can be illustrated with the help of following

diagrams:

Case 1: Price increases when increase in supply is less than the increase in demand

MICROECONOMICS ASSIGNMENT Page 5 of 11

Figure 3(a): Simultaneous change in demand and supply

Case 2: Price decreases when increase in supply is more than the increase in demand

Figure 3(b): Simultaneous change in demand and supply

Q’

S’

S*

D’

D*

P’

O Q*

Price

P*

Quantity

Q’

S’

S*

D’

D*

P’

O Q*

Price

P*

Quantity

Figure 3(a): Simultaneous change in demand and supply

Case 2: Price decreases when increase in supply is more than the increase in demand

Figure 3(b): Simultaneous change in demand and supply

Q’

S’

S*

D’

D*

P’

O Q*

Price

P*

Quantity

Q’

S’

S*

D’

D*

P’

O Q*

Price

P*

Quantity

MICROECONOMICS ASSIGNMENT Page 6 of 11

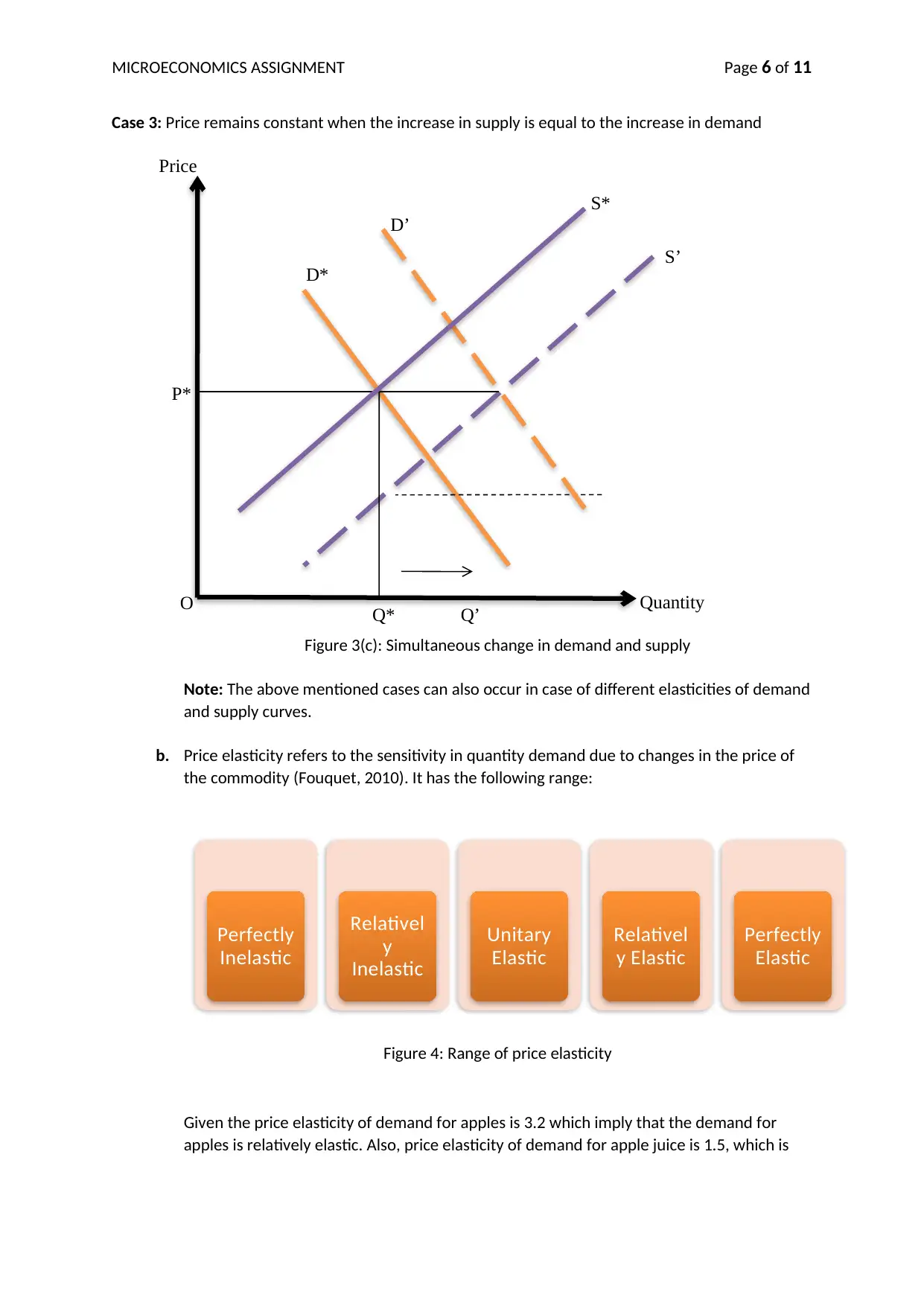

Case 3: Price remains constant when the increase in supply is equal to the increase in demand

Figure 3(c): Simultaneous change in demand and supply

Note: The above mentioned cases can also occur in case of different elasticities of demand

and supply curves.

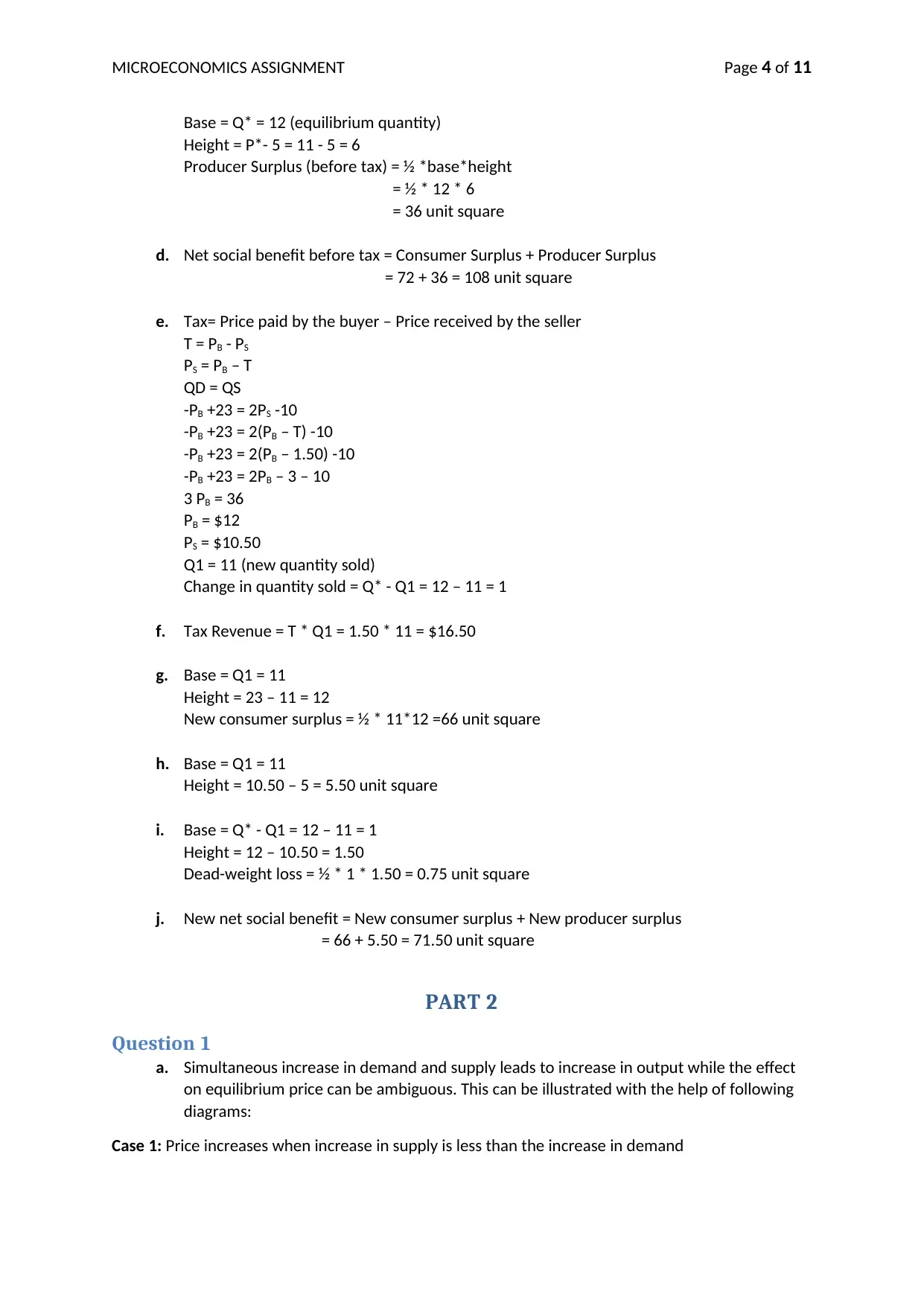

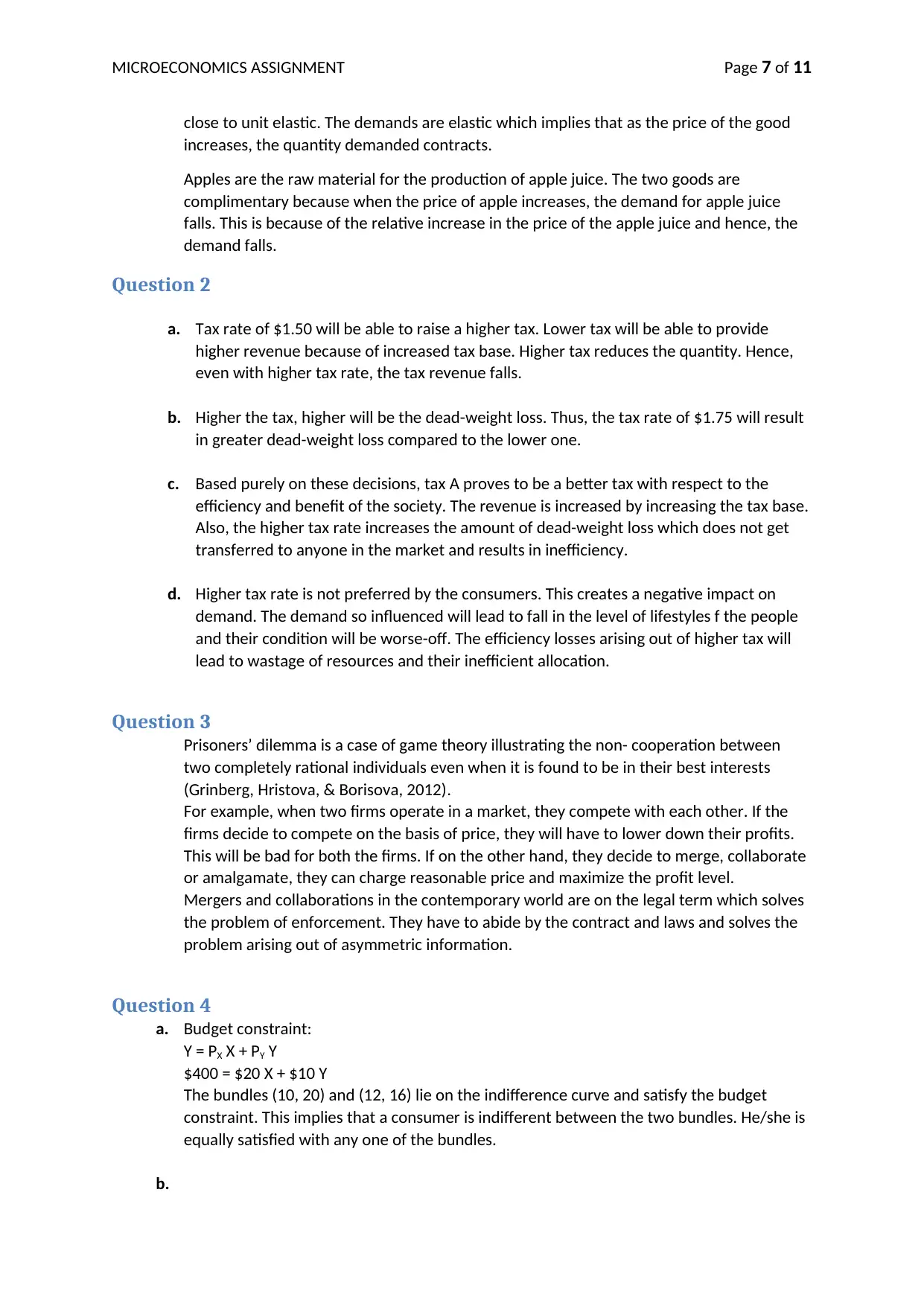

b. Price elasticity refers to the sensitivity in quantity demand due to changes in the price of

the commodity (Fouquet, 2010). It has the following range:

Figure 4: Range of price elasticity

Given the price elasticity of demand for apples is 3.2 which imply that the demand for

apples is relatively elastic. Also, price elasticity of demand for apple juice is 1.5, which is

ep = 0Perfectly

Inelastic

0 < ep < 1Relativel

y

Inelastic

ep = 1Unitary

Elastic

1 < ep <

∞Relativel

y Elastic

ep = ∞Perfectly

Elastic

Q’

S’

S*

D’

D*

O Q*

Price

P*

Quantity

Case 3: Price remains constant when the increase in supply is equal to the increase in demand

Figure 3(c): Simultaneous change in demand and supply

Note: The above mentioned cases can also occur in case of different elasticities of demand

and supply curves.

b. Price elasticity refers to the sensitivity in quantity demand due to changes in the price of

the commodity (Fouquet, 2010). It has the following range:

Figure 4: Range of price elasticity

Given the price elasticity of demand for apples is 3.2 which imply that the demand for

apples is relatively elastic. Also, price elasticity of demand for apple juice is 1.5, which is

ep = 0Perfectly

Inelastic

0 < ep < 1Relativel

y

Inelastic

ep = 1Unitary

Elastic

1 < ep <

∞Relativel

y Elastic

ep = ∞Perfectly

Elastic

Q’

S’

S*

D’

D*

O Q*

Price

P*

Quantity

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

MICROECONOMICS ASSIGNMENT Page 7 of 11

close to unit elastic. The demands are elastic which implies that as the price of the good

increases, the quantity demanded contracts.

Apples are the raw material for the production of apple juice. The two goods are

complimentary because when the price of apple increases, the demand for apple juice

falls. This is because of the relative increase in the price of the apple juice and hence, the

demand falls.

Question 2

a. Tax rate of $1.50 will be able to raise a higher tax. Lower tax will be able to provide

higher revenue because of increased tax base. Higher tax reduces the quantity. Hence,

even with higher tax rate, the tax revenue falls.

b. Higher the tax, higher will be the dead-weight loss. Thus, the tax rate of $1.75 will result

in greater dead-weight loss compared to the lower one.

c. Based purely on these decisions, tax A proves to be a better tax with respect to the

efficiency and benefit of the society. The revenue is increased by increasing the tax base.

Also, the higher tax rate increases the amount of dead-weight loss which does not get

transferred to anyone in the market and results in inefficiency.

d. Higher tax rate is not preferred by the consumers. This creates a negative impact on

demand. The demand so influenced will lead to fall in the level of lifestyles f the people

and their condition will be worse-off. The efficiency losses arising out of higher tax will

lead to wastage of resources and their inefficient allocation.

Question 3

Prisoners’ dilemma is a case of game theory illustrating the non- cooperation between

two completely rational individuals even when it is found to be in their best interests

(Grinberg, Hristova, & Borisova, 2012).

For example, when two firms operate in a market, they compete with each other. If the

firms decide to compete on the basis of price, they will have to lower down their profits.

This will be bad for both the firms. If on the other hand, they decide to merge, collaborate

or amalgamate, they can charge reasonable price and maximize the profit level.

Mergers and collaborations in the contemporary world are on the legal term which solves

the problem of enforcement. They have to abide by the contract and laws and solves the

problem arising out of asymmetric information.

Question 4

a. Budget constraint:

Y = PX X + PY Y

$400 = $20 X + $10 Y

The bundles (10, 20) and (12, 16) lie on the indifference curve and satisfy the budget

constraint. This implies that a consumer is indifferent between the two bundles. He/she is

equally satisfied with any one of the bundles.

b.

close to unit elastic. The demands are elastic which implies that as the price of the good

increases, the quantity demanded contracts.

Apples are the raw material for the production of apple juice. The two goods are

complimentary because when the price of apple increases, the demand for apple juice

falls. This is because of the relative increase in the price of the apple juice and hence, the

demand falls.

Question 2

a. Tax rate of $1.50 will be able to raise a higher tax. Lower tax will be able to provide

higher revenue because of increased tax base. Higher tax reduces the quantity. Hence,

even with higher tax rate, the tax revenue falls.

b. Higher the tax, higher will be the dead-weight loss. Thus, the tax rate of $1.75 will result

in greater dead-weight loss compared to the lower one.

c. Based purely on these decisions, tax A proves to be a better tax with respect to the

efficiency and benefit of the society. The revenue is increased by increasing the tax base.

Also, the higher tax rate increases the amount of dead-weight loss which does not get

transferred to anyone in the market and results in inefficiency.

d. Higher tax rate is not preferred by the consumers. This creates a negative impact on

demand. The demand so influenced will lead to fall in the level of lifestyles f the people

and their condition will be worse-off. The efficiency losses arising out of higher tax will

lead to wastage of resources and their inefficient allocation.

Question 3

Prisoners’ dilemma is a case of game theory illustrating the non- cooperation between

two completely rational individuals even when it is found to be in their best interests

(Grinberg, Hristova, & Borisova, 2012).

For example, when two firms operate in a market, they compete with each other. If the

firms decide to compete on the basis of price, they will have to lower down their profits.

This will be bad for both the firms. If on the other hand, they decide to merge, collaborate

or amalgamate, they can charge reasonable price and maximize the profit level.

Mergers and collaborations in the contemporary world are on the legal term which solves

the problem of enforcement. They have to abide by the contract and laws and solves the

problem arising out of asymmetric information.

Question 4

a. Budget constraint:

Y = PX X + PY Y

$400 = $20 X + $10 Y

The bundles (10, 20) and (12, 16) lie on the indifference curve and satisfy the budget

constraint. This implies that a consumer is indifferent between the two bundles. He/she is

equally satisfied with any one of the bundles.

b.

MICROECONOMICS ASSIGNMENT Page 8 of 11

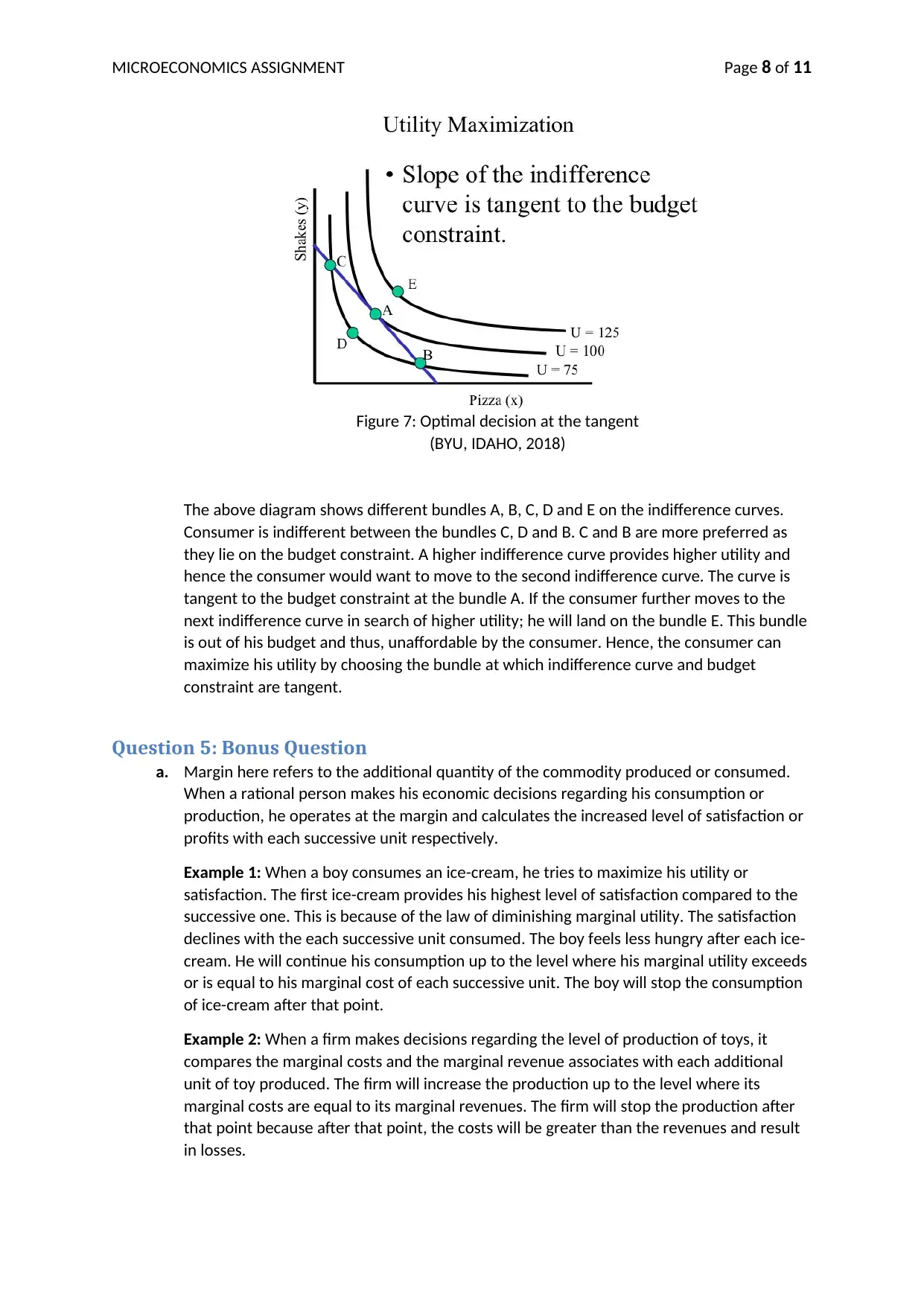

Figure 7: Optimal decision at the tangent

(BYU, IDAHO, 2018)

The above diagram shows different bundles A, B, C, D and E on the indifference curves.

Consumer is indifferent between the bundles C, D and B. C and B are more preferred as

they lie on the budget constraint. A higher indifference curve provides higher utility and

hence the consumer would want to move to the second indifference curve. The curve is

tangent to the budget constraint at the bundle A. If the consumer further moves to the

next indifference curve in search of higher utility; he will land on the bundle E. This bundle

is out of his budget and thus, unaffordable by the consumer. Hence, the consumer can

maximize his utility by choosing the bundle at which indifference curve and budget

constraint are tangent.

Question 5: Bonus Question

a. Margin here refers to the additional quantity of the commodity produced or consumed.

When a rational person makes his economic decisions regarding his consumption or

production, he operates at the margin and calculates the increased level of satisfaction or

profits with each successive unit respectively.

Example 1: When a boy consumes an ice-cream, he tries to maximize his utility or

satisfaction. The first ice-cream provides his highest level of satisfaction compared to the

successive one. This is because of the law of diminishing marginal utility. The satisfaction

declines with the each successive unit consumed. The boy feels less hungry after each ice-

cream. He will continue his consumption up to the level where his marginal utility exceeds

or is equal to his marginal cost of each successive unit. The boy will stop the consumption

of ice-cream after that point.

Example 2: When a firm makes decisions regarding the level of production of toys, it

compares the marginal costs and the marginal revenue associates with each additional

unit of toy produced. The firm will increase the production up to the level where its

marginal costs are equal to its marginal revenues. The firm will stop the production after

that point because after that point, the costs will be greater than the revenues and result

in losses.

Figure 7: Optimal decision at the tangent

(BYU, IDAHO, 2018)

The above diagram shows different bundles A, B, C, D and E on the indifference curves.

Consumer is indifferent between the bundles C, D and B. C and B are more preferred as

they lie on the budget constraint. A higher indifference curve provides higher utility and

hence the consumer would want to move to the second indifference curve. The curve is

tangent to the budget constraint at the bundle A. If the consumer further moves to the

next indifference curve in search of higher utility; he will land on the bundle E. This bundle

is out of his budget and thus, unaffordable by the consumer. Hence, the consumer can

maximize his utility by choosing the bundle at which indifference curve and budget

constraint are tangent.

Question 5: Bonus Question

a. Margin here refers to the additional quantity of the commodity produced or consumed.

When a rational person makes his economic decisions regarding his consumption or

production, he operates at the margin and calculates the increased level of satisfaction or

profits with each successive unit respectively.

Example 1: When a boy consumes an ice-cream, he tries to maximize his utility or

satisfaction. The first ice-cream provides his highest level of satisfaction compared to the

successive one. This is because of the law of diminishing marginal utility. The satisfaction

declines with the each successive unit consumed. The boy feels less hungry after each ice-

cream. He will continue his consumption up to the level where his marginal utility exceeds

or is equal to his marginal cost of each successive unit. The boy will stop the consumption

of ice-cream after that point.

Example 2: When a firm makes decisions regarding the level of production of toys, it

compares the marginal costs and the marginal revenue associates with each additional

unit of toy produced. The firm will increase the production up to the level where its

marginal costs are equal to its marginal revenues. The firm will stop the production after

that point because after that point, the costs will be greater than the revenues and result

in losses.

MICROECONOMICS ASSIGNMENT Page 9 of 11

Question 6: Another Bonus Question

a. Price elasticity of demand (η)¿ % change∈quantity demanded

% change∈ price

It can also be written as:

η=− ΔQ

ΔP × P

Q

η=−10,000

4 × 12

500,000

η=−0.06

b. The negative sign shows the inverse relationship between price and demand and hence,

can be ignored. The magnitude is close to 0. The elasticity in this case is 0.06 implies is it

inelastic. The quantity demanded is not affected by the changes in prices.

c. The product can be petrol because the change in the price does not affect the quantity

demanded much. The demand is inelastic because it is required for transportation, travel

and a wide range of products. Petrol can be considered a necessity for the growth and

development of an economy and hence the demand is inelastic.

Question 6: Another Bonus Question

a. Price elasticity of demand (η)¿ % change∈quantity demanded

% change∈ price

It can also be written as:

η=− ΔQ

ΔP × P

Q

η=−10,000

4 × 12

500,000

η=−0.06

b. The negative sign shows the inverse relationship between price and demand and hence,

can be ignored. The magnitude is close to 0. The elasticity in this case is 0.06 implies is it

inelastic. The quantity demanded is not affected by the changes in prices.

c. The product can be petrol because the change in the price does not affect the quantity

demanded much. The demand is inelastic because it is required for transportation, travel

and a wide range of products. Petrol can be considered a necessity for the growth and

development of an economy and hence the demand is inelastic.

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

MICROECONOMICS ASSIGNMENT Page 10 of 11

References

Aure, M. L. (2012). Deadweight Loss and Taxation. NTRC Tax Research Journal, 24(06), 1-26.

Retrieved April 26, 2018, from http://www.ntrc.gov.ph/images/journal/j20121112a.pdf

BYU, IDAHO. (2018). Economic Principles and Problems. Retrieved April 26, 2018, from BYU, IDAHO:

https://courses.byui.edu/econ_150/econ_150_old_site/lesson_05.htm

Fouquet, R. (2010). Trens in Income and Price Elasticities of Transport Demand (1850-2010). Energy

Policy, 50, 50-61. Retrieved April 26, 2018, from

https://www.sciencedirect.com/science/article/pii/S0301421512002066

Grinberg, M., Hristova, E., & Borisova, M. (2012). Cooperation in Prisoner’s Dilemma Game:Influence

of Social Relations. Proceedings of the Annual Meeting of the Cognitive Science Society,

34(34), 408-413. Retrieved April 26, 2018, from

http://mindmodeling.org/cogsci2012/papers/0082/paper0082.pdf

Mankiw, N. G. (2017). On welfare economics in the principles course. The Journal of Economic

Education, 48(01), 27-8. Retrieved April 26, 2018, from

https://scholar.harvard.edu/files/mankiw/files/on_welfare_economics.pdf

References

Aure, M. L. (2012). Deadweight Loss and Taxation. NTRC Tax Research Journal, 24(06), 1-26.

Retrieved April 26, 2018, from http://www.ntrc.gov.ph/images/journal/j20121112a.pdf

BYU, IDAHO. (2018). Economic Principles and Problems. Retrieved April 26, 2018, from BYU, IDAHO:

https://courses.byui.edu/econ_150/econ_150_old_site/lesson_05.htm

Fouquet, R. (2010). Trens in Income and Price Elasticities of Transport Demand (1850-2010). Energy

Policy, 50, 50-61. Retrieved April 26, 2018, from

https://www.sciencedirect.com/science/article/pii/S0301421512002066

Grinberg, M., Hristova, E., & Borisova, M. (2012). Cooperation in Prisoner’s Dilemma Game:Influence

of Social Relations. Proceedings of the Annual Meeting of the Cognitive Science Society,

34(34), 408-413. Retrieved April 26, 2018, from

http://mindmodeling.org/cogsci2012/papers/0082/paper0082.pdf

Mankiw, N. G. (2017). On welfare economics in the principles course. The Journal of Economic

Education, 48(01), 27-8. Retrieved April 26, 2018, from

https://scholar.harvard.edu/files/mankiw/files/on_welfare_economics.pdf

1 out of 11

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.