Besto Company Case Study: Financial Analysis of Costing Systems

VerifiedAdded on 2022/11/25

|6

|1868

|199

Case Study

AI Summary

This case study analyzes Besto Company, a cheese manufacturer, and its costing methods. The company currently uses a traditional plantwide costing system, which allocates overhead based on the number of units produced. The analysis compares this to activity-based costing (ABC), a more modern approach that allocates costs based on the activities consuming resources. The study reveals that the traditional method misrepresents the true costs of different cheese varieties, leading to inaccurate pricing and declining profits. Using ABC, the study calculates per-unit costs for Cheddar and Mascarpone, highlighting the significant differences between the two costing methods. The analysis concludes with a recommendation for Besto Company to adopt ABC for more accurate, realistic, and reliable cost information, which is crucial for informed decision-making regarding pricing, cost control, and overall profitability. The annexures provide detailed calculations of per-unit costs under both costing methods, supporting the analysis and recommendations.

Name: Student ID:

Case Study Analysis – Besto Company

Background of the Case:

Besto Company is a manufacturer of cheese which currently manufactured a wide variety of

chees including Cheddar, Edam, Gouda, Feta, Mascarpone, and Queso Blanco. While the company

was producing the Cheddar, Edam, Gouda cheese range for over 20 years now, it has recently started

with wide range of low-volume speciality lines of chees which includes Feta, Mascarpone, and Queso

Blanco. The new lines are complex to produce but require very short runs and the company currently

have figures that indicate these lines as the most profitable for the company.

Conventional or Current Costing System:

The company currently employs a system of costing that allocates the overhead of the company using

a single plantwide rate. This current plantwide rate in use is computed using the total overheads and

the estimated annual number of units produced by the company. This method is also known as the

traditional or job costing method.

Job costing or the traditional costing apportions the total cost of the company to the products

manufactured on the basis of the single allocation factor be it the total machine hours, total labour

hours, total number of products, total labour cost or any other such single factor.

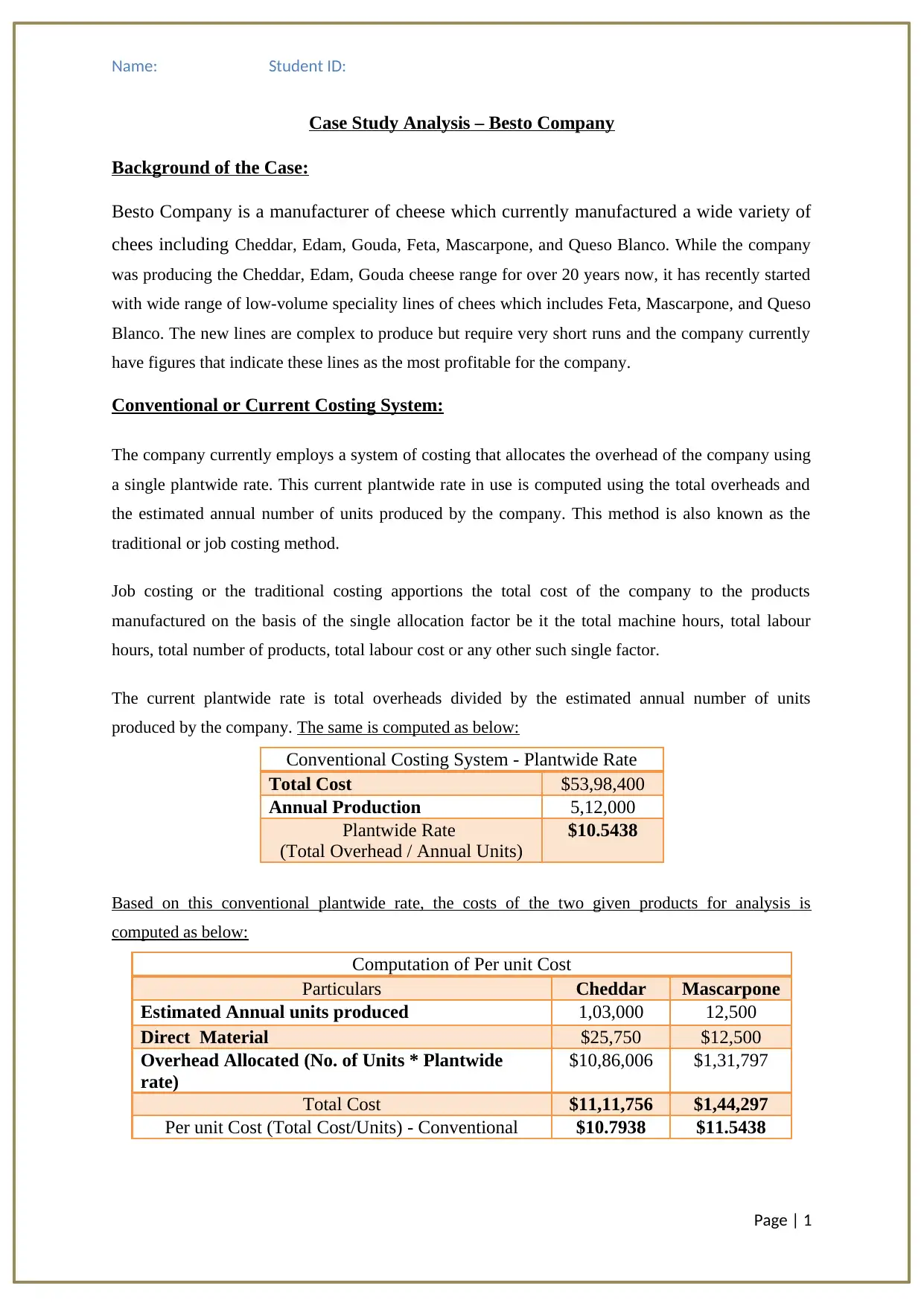

The current plantwide rate is total overheads divided by the estimated annual number of units

produced by the company. The same is computed as below:

Conventional Costing System - Plantwide Rate

Total Cost $53,98,400

Annual Production 5,12,000

Plantwide Rate

(Total Overhead / Annual Units)

$10.5438

Based on this conventional plantwide rate, the costs of the two given products for analysis is

computed as below:

Computation of Per unit Cost

Particulars Cheddar Mascarpone

Estimated Annual units produced 1,03,000 12,500

Direct Material $25,750 $12,500

Overhead Allocated (No. of Units * Plantwide

rate)

$10,86,006 $1,31,797

Total Cost $11,11,756 $1,44,297

Per unit Cost (Total Cost/Units) - Conventional $10.7938 $11.5438

Page | 1

Case Study Analysis – Besto Company

Background of the Case:

Besto Company is a manufacturer of cheese which currently manufactured a wide variety of

chees including Cheddar, Edam, Gouda, Feta, Mascarpone, and Queso Blanco. While the company

was producing the Cheddar, Edam, Gouda cheese range for over 20 years now, it has recently started

with wide range of low-volume speciality lines of chees which includes Feta, Mascarpone, and Queso

Blanco. The new lines are complex to produce but require very short runs and the company currently

have figures that indicate these lines as the most profitable for the company.

Conventional or Current Costing System:

The company currently employs a system of costing that allocates the overhead of the company using

a single plantwide rate. This current plantwide rate in use is computed using the total overheads and

the estimated annual number of units produced by the company. This method is also known as the

traditional or job costing method.

Job costing or the traditional costing apportions the total cost of the company to the products

manufactured on the basis of the single allocation factor be it the total machine hours, total labour

hours, total number of products, total labour cost or any other such single factor.

The current plantwide rate is total overheads divided by the estimated annual number of units

produced by the company. The same is computed as below:

Conventional Costing System - Plantwide Rate

Total Cost $53,98,400

Annual Production 5,12,000

Plantwide Rate

(Total Overhead / Annual Units)

$10.5438

Based on this conventional plantwide rate, the costs of the two given products for analysis is

computed as below:

Computation of Per unit Cost

Particulars Cheddar Mascarpone

Estimated Annual units produced 1,03,000 12,500

Direct Material $25,750 $12,500

Overhead Allocated (No. of Units * Plantwide

rate)

$10,86,006 $1,31,797

Total Cost $11,11,756 $1,44,297

Per unit Cost (Total Cost/Units) - Conventional $10.7938 $11.5438

Page | 1

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Name: Student ID:

Using the current costing system the cost of the two variety of cheese comes out to be approximately

the same. This is misguiding as we know that the efforts required to manufacture these two varieties

are varied and thus their costs should also be different.

The company currently uses this cost for their pricing decision and sets a selling price of $9 per unit

of Cheddar and $12 per unit of Mascarpone. This pricing and cost makes them believe that the

product is profitable and giving huge profit margins. But in reality, the overall profits of the

company are declining and that is a matter of concern.

We will now see the costs of the product using methods and ways of Activity based Costing.

Activity Costing System:

The activity based costing is a modern approach in costing wherein the product costs of the

organization is computed on the basis of the costs of each activity that is being consumed by

the product till it reaches a the delivery point for the consumers. ABC starts with

identification of the underlying activities or resources of the organisation and then allocates

the resource costs to the products and/or services based on the usage of these resources. This

is a more robust approach of allocating overhead costs to the products of an organization.

ABC Costing and Traditional Costing Methods:

Both Conventional and ABC costing method allocates the cost of the company to the product

sold. The major point of difference between the two is the allocation base that they use to

allocate the costs to the company to the products.

While, ABC costing starts with accumulation of overhead costs for each of the resource

activities of an organization, and then assignment of these costs to various activity drivers

based on their usage of the resource activity, the conventional costing method uses a single

plantwide rate for overhead allocation, which here is based on the estimated annual no. of

units produced by Besto Company.

Further, a company that has only one product line is indifferent between the two approaches,

but companies with more than 1 product line should definitely use ABC for accurate level of

costs of the product.

Page | 2

Using the current costing system the cost of the two variety of cheese comes out to be approximately

the same. This is misguiding as we know that the efforts required to manufacture these two varieties

are varied and thus their costs should also be different.

The company currently uses this cost for their pricing decision and sets a selling price of $9 per unit

of Cheddar and $12 per unit of Mascarpone. This pricing and cost makes them believe that the

product is profitable and giving huge profit margins. But in reality, the overall profits of the

company are declining and that is a matter of concern.

We will now see the costs of the product using methods and ways of Activity based Costing.

Activity Costing System:

The activity based costing is a modern approach in costing wherein the product costs of the

organization is computed on the basis of the costs of each activity that is being consumed by

the product till it reaches a the delivery point for the consumers. ABC starts with

identification of the underlying activities or resources of the organisation and then allocates

the resource costs to the products and/or services based on the usage of these resources. This

is a more robust approach of allocating overhead costs to the products of an organization.

ABC Costing and Traditional Costing Methods:

Both Conventional and ABC costing method allocates the cost of the company to the product

sold. The major point of difference between the two is the allocation base that they use to

allocate the costs to the company to the products.

While, ABC costing starts with accumulation of overhead costs for each of the resource

activities of an organization, and then assignment of these costs to various activity drivers

based on their usage of the resource activity, the conventional costing method uses a single

plantwide rate for overhead allocation, which here is based on the estimated annual no. of

units produced by Besto Company.

Further, a company that has only one product line is indifferent between the two approaches,

but companies with more than 1 product line should definitely use ABC for accurate level of

costs of the product.

Page | 2

Name: Student ID:

Benefits, Costs and Limitation of ABC Method:

ABC do not use a flat rate to allocate the overhead and instead use usage based

approach to compute the accurate allocation based on usage of activity. Thus, it is

more accurate evaluation of product cost.

This accurate cost is pivotal to any organization for their decision making on product

pricing and gives them an edge while negotiating with the clients.

The accurate costs help the company in better decision making by controlling and

monitoring costs.

The cost of implementing the ABC is substantial but the benefits ensure that the NPV of

implementing ABC is positive. The limitation of the approach is that the process takes

substantial time and cost at the initial phase.

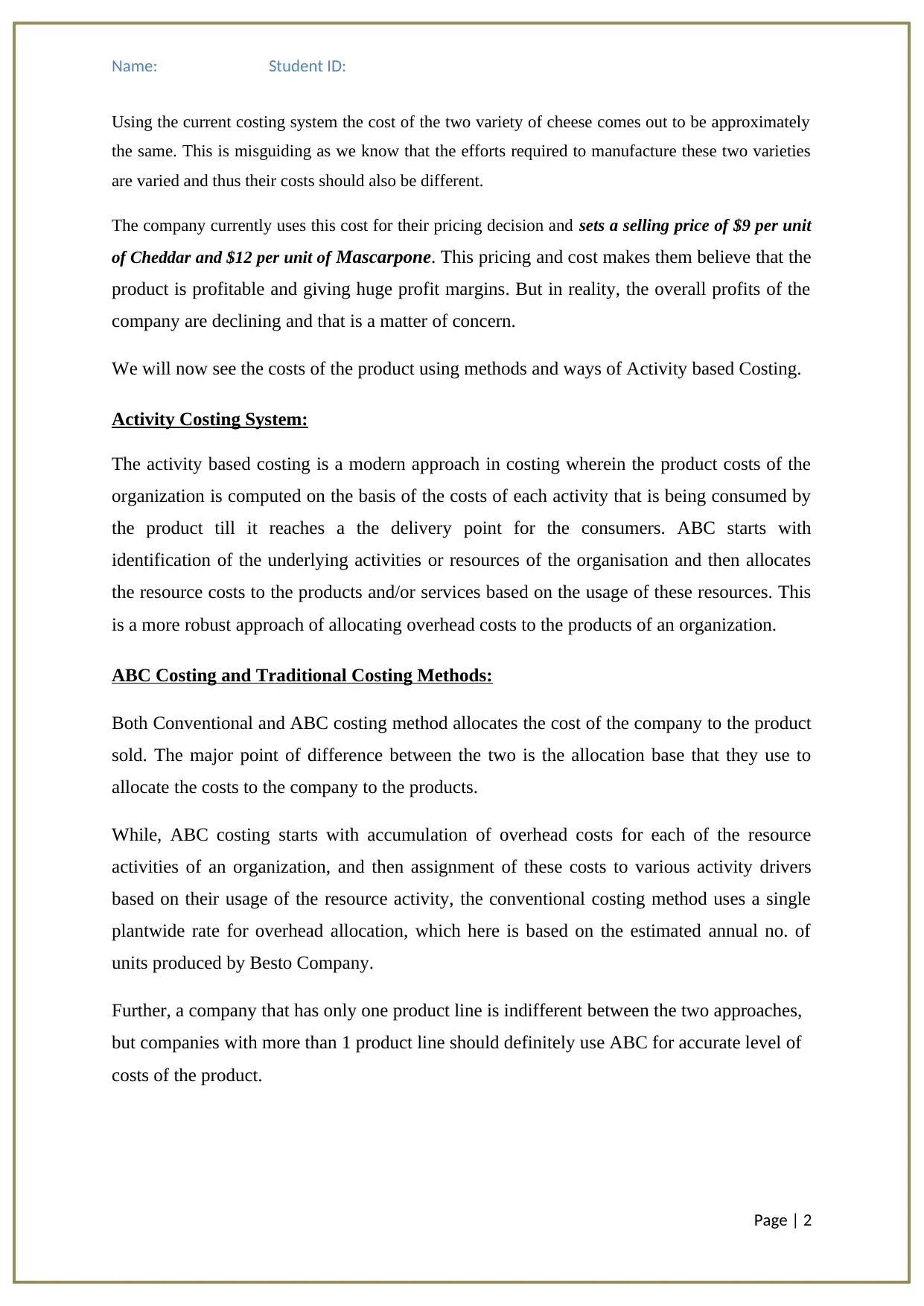

ABC and Traditional Method for Besto Company

In the given case, ABC or the activity based costing provides more accurate data on the cost

incurred to produce the two varieties of cheese. The comparison of costs under both these

methods is as below:

Particulars Cheddar Mascarpone

Per unit Cost - Conventional $10.7938 $11.5438

Per unit Cost - ABC $10.1037 $26.1838

Selling Price per unit $9.0000 $12.0000

Profit per unit - ABC -$1.1037 -$14.1838

Profit per unit - Conventional -$1.7938 $0.4563

(Please refer Annexure 1 and 2 for per unit costs of the product under ABC)

We see that the ABC has given a result which is different from the conventional method that

the company has been following. The conventional method estimated that the cost to

manufacture one unit of Mascarpone is $11.5438 whereas ABC revealed the true cost as

$26.1838. Further for cheddar, the conventional method estimated a higher amount. This is

indicative of the fact that under conventional method more of overheads were allocated to the

cheddar as the no. of units produced are more which not the true representation of costs is.

This leads to inaccurate pricing of the products.

Recommendation for Besto Company

Page | 3

Benefits, Costs and Limitation of ABC Method:

ABC do not use a flat rate to allocate the overhead and instead use usage based

approach to compute the accurate allocation based on usage of activity. Thus, it is

more accurate evaluation of product cost.

This accurate cost is pivotal to any organization for their decision making on product

pricing and gives them an edge while negotiating with the clients.

The accurate costs help the company in better decision making by controlling and

monitoring costs.

The cost of implementing the ABC is substantial but the benefits ensure that the NPV of

implementing ABC is positive. The limitation of the approach is that the process takes

substantial time and cost at the initial phase.

ABC and Traditional Method for Besto Company

In the given case, ABC or the activity based costing provides more accurate data on the cost

incurred to produce the two varieties of cheese. The comparison of costs under both these

methods is as below:

Particulars Cheddar Mascarpone

Per unit Cost - Conventional $10.7938 $11.5438

Per unit Cost - ABC $10.1037 $26.1838

Selling Price per unit $9.0000 $12.0000

Profit per unit - ABC -$1.1037 -$14.1838

Profit per unit - Conventional -$1.7938 $0.4563

(Please refer Annexure 1 and 2 for per unit costs of the product under ABC)

We see that the ABC has given a result which is different from the conventional method that

the company has been following. The conventional method estimated that the cost to

manufacture one unit of Mascarpone is $11.5438 whereas ABC revealed the true cost as

$26.1838. Further for cheddar, the conventional method estimated a higher amount. This is

indicative of the fact that under conventional method more of overheads were allocated to the

cheddar as the no. of units produced are more which not the true representation of costs is.

This leads to inaccurate pricing of the products.

Recommendation for Besto Company

Page | 3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Name: Student ID:

The major point of distinction between using plantwide rate and activity rates is the allocation

of the overhead to the production. The activity rates method apportions the overhead to the

production based on usage and thus is an accurate measure of costs.

My recommendation to the company is to adopt the Activity Based Costing method as it

gives costs that are more accurate, realistic and reliable.

Page | 4

The major point of distinction between using plantwide rate and activity rates is the allocation

of the overhead to the production. The activity rates method apportions the overhead to the

production based on usage and thus is an accurate measure of costs.

My recommendation to the company is to adopt the Activity Based Costing method as it

gives costs that are more accurate, realistic and reliable.

Page | 4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Name: Student ID:

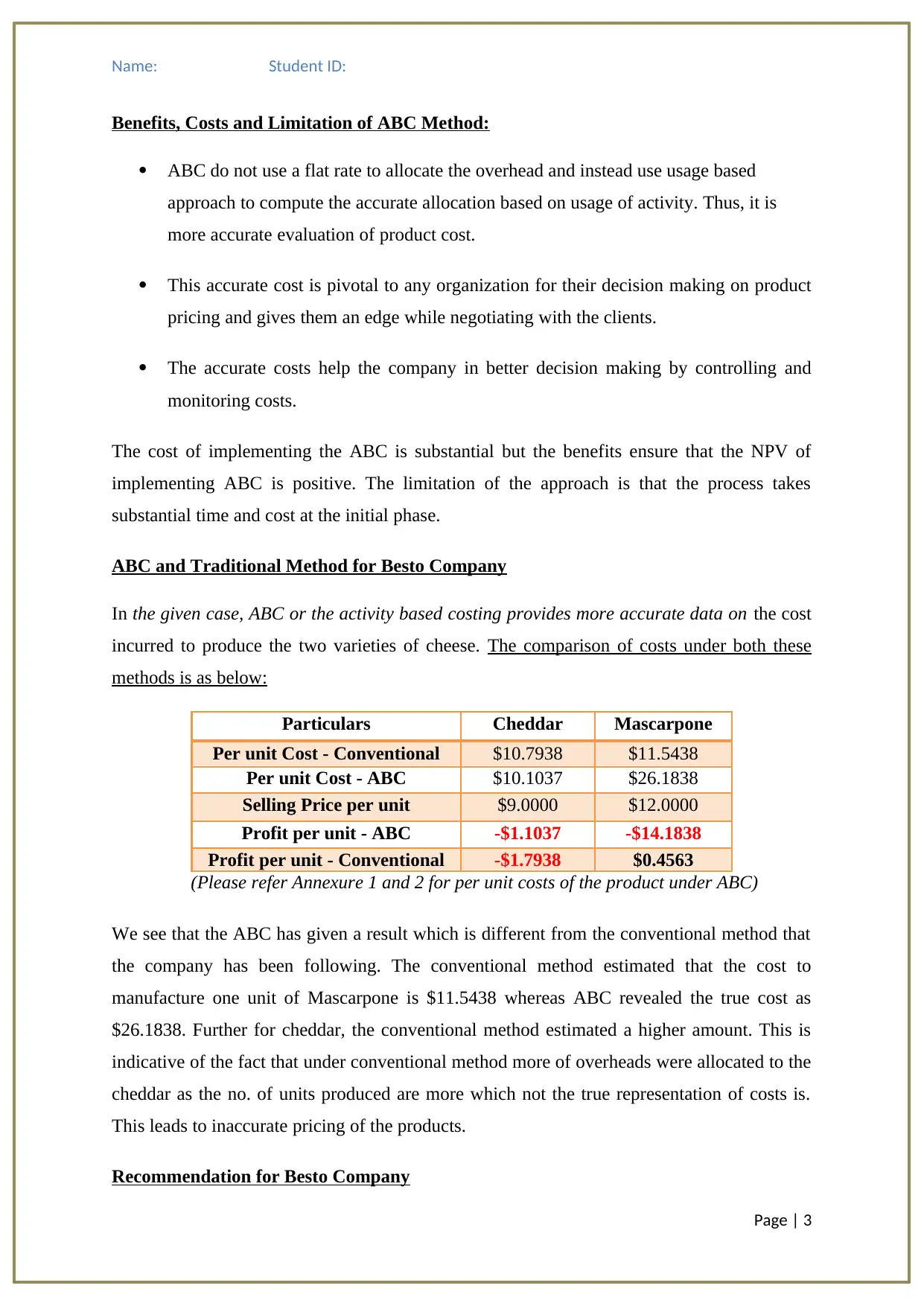

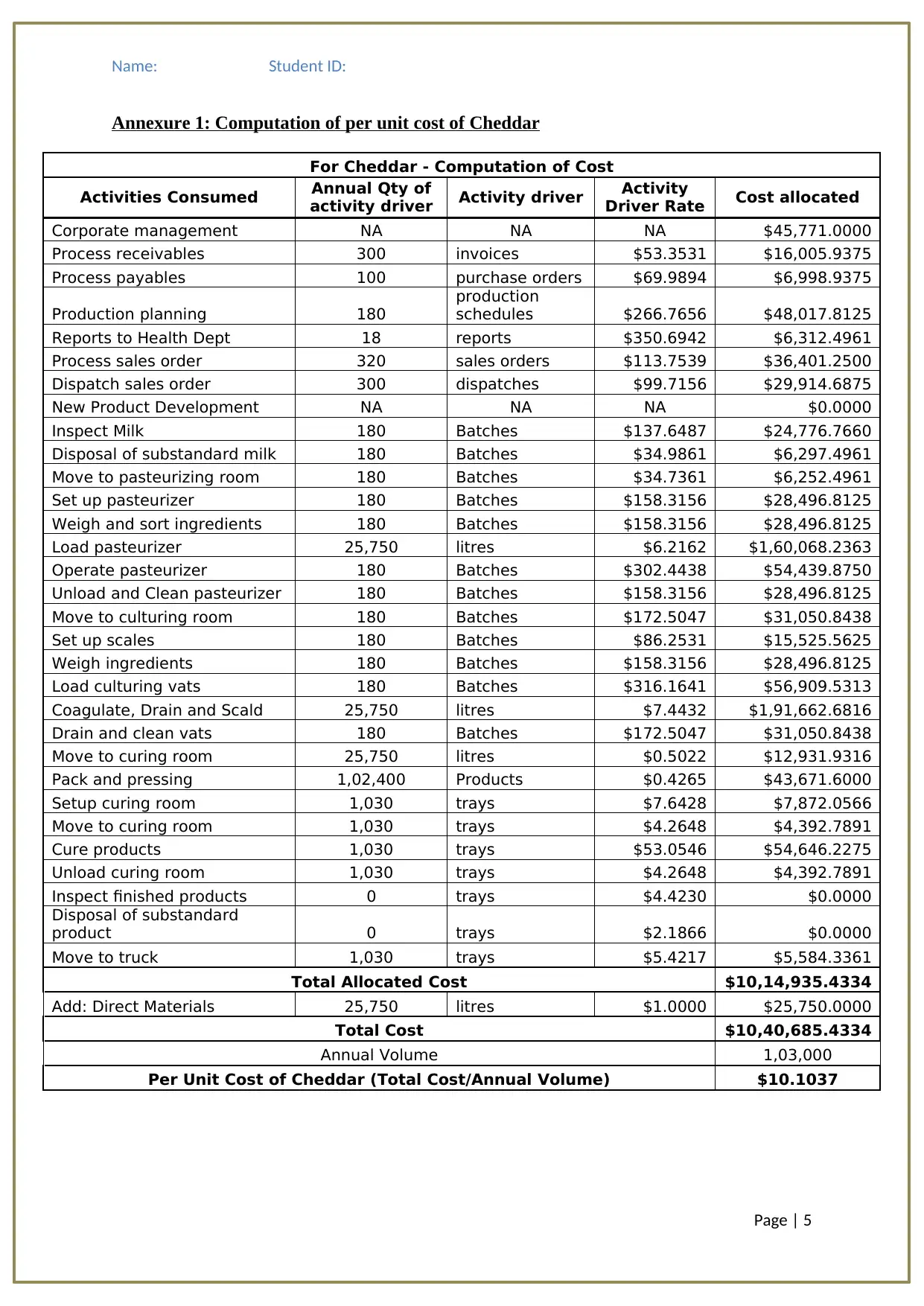

Annexure 1: Computation of per unit cost of Cheddar

For Cheddar - Computation of Cost

Activities Consumed Annual Qty of

activity driver Activity driver Activity

Driver Rate Cost allocated

Corporate management NA NA NA $45,771.0000

Process receivables 300 invoices $53.3531 $16,005.9375

Process payables 100 purchase orders $69.9894 $6,998.9375

Production planning 180

production

schedules $266.7656 $48,017.8125

Reports to Health Dept 18 reports $350.6942 $6,312.4961

Process sales order 320 sales orders $113.7539 $36,401.2500

Dispatch sales order 300 dispatches $99.7156 $29,914.6875

New Product Development NA NA NA $0.0000

Inspect Milk 180 Batches $137.6487 $24,776.7660

Disposal of substandard milk 180 Batches $34.9861 $6,297.4961

Move to pasteurizing room 180 Batches $34.7361 $6,252.4961

Set up pasteurizer 180 Batches $158.3156 $28,496.8125

Weigh and sort ingredients 180 Batches $158.3156 $28,496.8125

Load pasteurizer 25,750 litres $6.2162 $1,60,068.2363

Operate pasteurizer 180 Batches $302.4438 $54,439.8750

Unload and Clean pasteurizer 180 Batches $158.3156 $28,496.8125

Move to culturing room 180 Batches $172.5047 $31,050.8438

Set up scales 180 Batches $86.2531 $15,525.5625

Weigh ingredients 180 Batches $158.3156 $28,496.8125

Load culturing vats 180 Batches $316.1641 $56,909.5313

Coagulate, Drain and Scald 25,750 litres $7.4432 $1,91,662.6816

Drain and clean vats 180 Batches $172.5047 $31,050.8438

Move to curing room 25,750 litres $0.5022 $12,931.9316

Pack and pressing 1,02,400 Products $0.4265 $43,671.6000

Setup curing room 1,030 trays $7.6428 $7,872.0566

Move to curing room 1,030 trays $4.2648 $4,392.7891

Cure products 1,030 trays $53.0546 $54,646.2275

Unload curing room 1,030 trays $4.2648 $4,392.7891

Inspect finished products 0 trays $4.4230 $0.0000

Disposal of substandard

product 0 trays $2.1866 $0.0000

Move to truck 1,030 trays $5.4217 $5,584.3361

Total Allocated Cost $10,14,935.4334

Add: Direct Materials 25,750 litres $1.0000 $25,750.0000

Total Cost $10,40,685.4334

Annual Volume 1,03,000

Per Unit Cost of Cheddar (Total Cost/Annual Volume) $10.1037

Page | 5

Annexure 1: Computation of per unit cost of Cheddar

For Cheddar - Computation of Cost

Activities Consumed Annual Qty of

activity driver Activity driver Activity

Driver Rate Cost allocated

Corporate management NA NA NA $45,771.0000

Process receivables 300 invoices $53.3531 $16,005.9375

Process payables 100 purchase orders $69.9894 $6,998.9375

Production planning 180

production

schedules $266.7656 $48,017.8125

Reports to Health Dept 18 reports $350.6942 $6,312.4961

Process sales order 320 sales orders $113.7539 $36,401.2500

Dispatch sales order 300 dispatches $99.7156 $29,914.6875

New Product Development NA NA NA $0.0000

Inspect Milk 180 Batches $137.6487 $24,776.7660

Disposal of substandard milk 180 Batches $34.9861 $6,297.4961

Move to pasteurizing room 180 Batches $34.7361 $6,252.4961

Set up pasteurizer 180 Batches $158.3156 $28,496.8125

Weigh and sort ingredients 180 Batches $158.3156 $28,496.8125

Load pasteurizer 25,750 litres $6.2162 $1,60,068.2363

Operate pasteurizer 180 Batches $302.4438 $54,439.8750

Unload and Clean pasteurizer 180 Batches $158.3156 $28,496.8125

Move to culturing room 180 Batches $172.5047 $31,050.8438

Set up scales 180 Batches $86.2531 $15,525.5625

Weigh ingredients 180 Batches $158.3156 $28,496.8125

Load culturing vats 180 Batches $316.1641 $56,909.5313

Coagulate, Drain and Scald 25,750 litres $7.4432 $1,91,662.6816

Drain and clean vats 180 Batches $172.5047 $31,050.8438

Move to curing room 25,750 litres $0.5022 $12,931.9316

Pack and pressing 1,02,400 Products $0.4265 $43,671.6000

Setup curing room 1,030 trays $7.6428 $7,872.0566

Move to curing room 1,030 trays $4.2648 $4,392.7891

Cure products 1,030 trays $53.0546 $54,646.2275

Unload curing room 1,030 trays $4.2648 $4,392.7891

Inspect finished products 0 trays $4.4230 $0.0000

Disposal of substandard

product 0 trays $2.1866 $0.0000

Move to truck 1,030 trays $5.4217 $5,584.3361

Total Allocated Cost $10,14,935.4334

Add: Direct Materials 25,750 litres $1.0000 $25,750.0000

Total Cost $10,40,685.4334

Annual Volume 1,03,000

Per Unit Cost of Cheddar (Total Cost/Annual Volume) $10.1037

Page | 5

Name: Student ID:

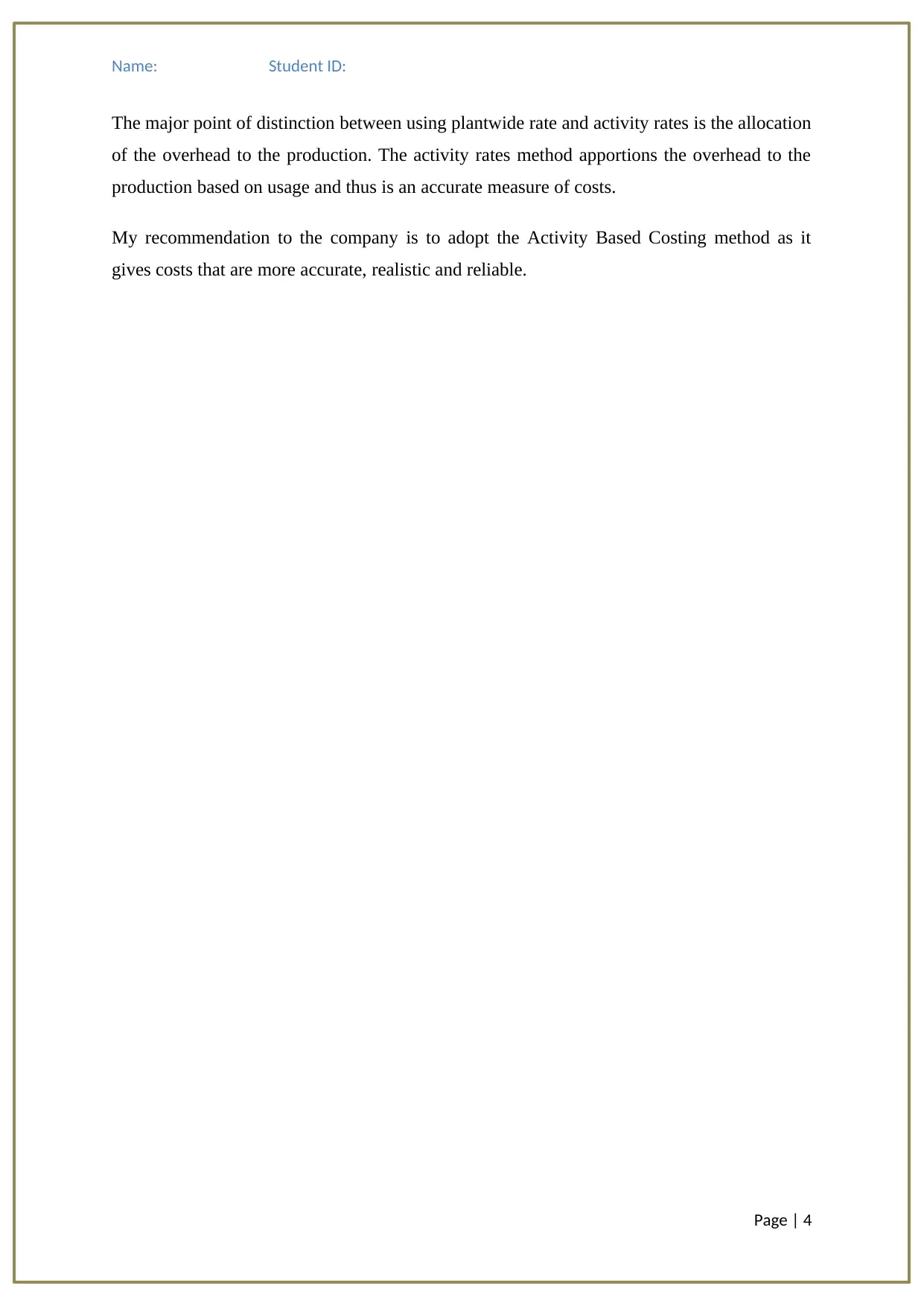

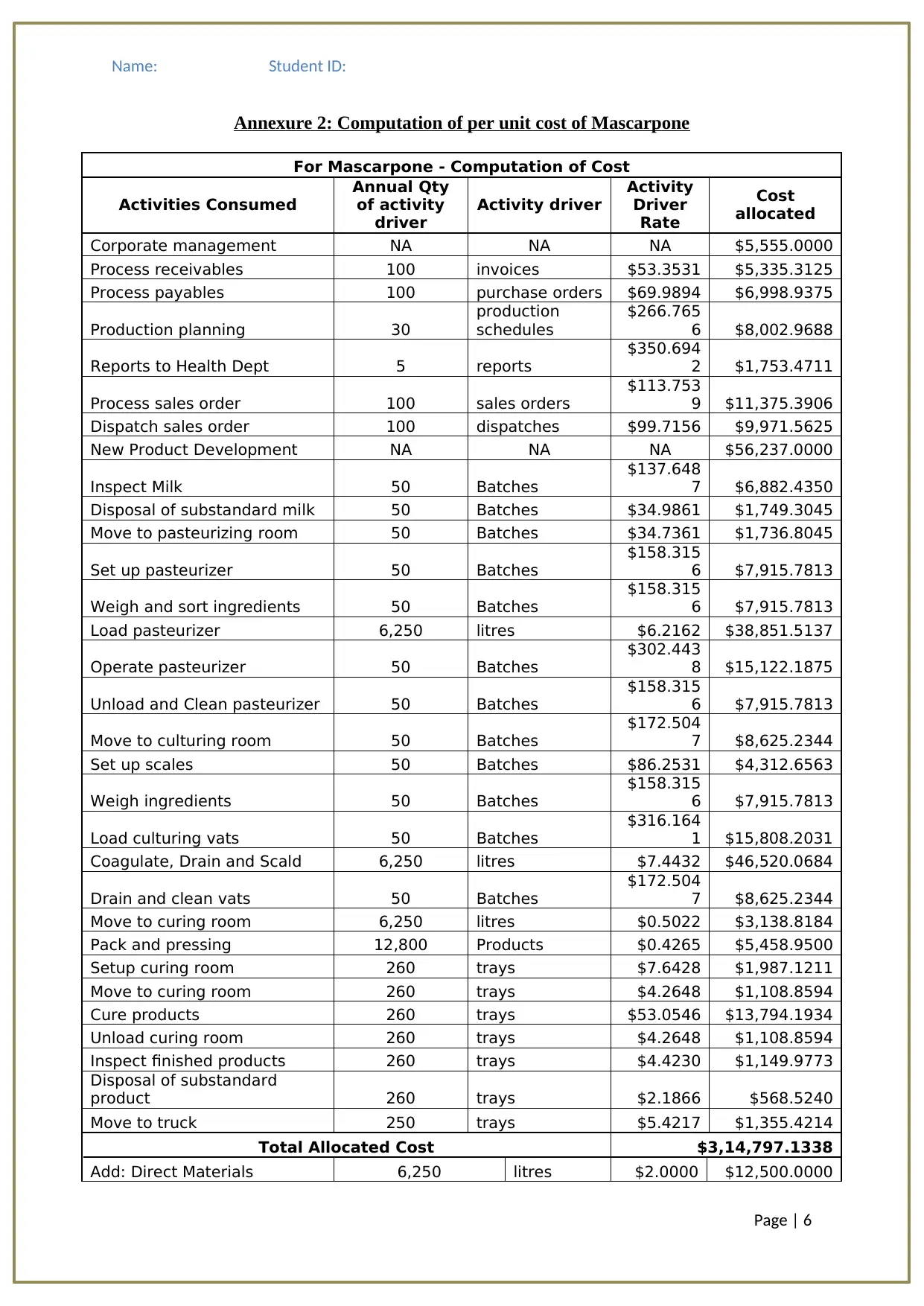

Annexure 2: Computation of per unit cost of Mascarpone

For Mascarpone - Computation of Cost

Activities Consumed

Annual Qty

of activity

driver

Activity driver

Activity

Driver

Rate

Cost

allocated

Corporate management NA NA NA $5,555.0000

Process receivables 100 invoices $53.3531 $5,335.3125

Process payables 100 purchase orders $69.9894 $6,998.9375

Production planning 30

production

schedules

$266.765

6 $8,002.9688

Reports to Health Dept 5 reports

$350.694

2 $1,753.4711

Process sales order 100 sales orders

$113.753

9 $11,375.3906

Dispatch sales order 100 dispatches $99.7156 $9,971.5625

New Product Development NA NA NA $56,237.0000

Inspect Milk 50 Batches

$137.648

7 $6,882.4350

Disposal of substandard milk 50 Batches $34.9861 $1,749.3045

Move to pasteurizing room 50 Batches $34.7361 $1,736.8045

Set up pasteurizer 50 Batches

$158.315

6 $7,915.7813

Weigh and sort ingredients 50 Batches

$158.315

6 $7,915.7813

Load pasteurizer 6,250 litres $6.2162 $38,851.5137

Operate pasteurizer 50 Batches

$302.443

8 $15,122.1875

Unload and Clean pasteurizer 50 Batches

$158.315

6 $7,915.7813

Move to culturing room 50 Batches

$172.504

7 $8,625.2344

Set up scales 50 Batches $86.2531 $4,312.6563

Weigh ingredients 50 Batches

$158.315

6 $7,915.7813

Load culturing vats 50 Batches

$316.164

1 $15,808.2031

Coagulate, Drain and Scald 6,250 litres $7.4432 $46,520.0684

Drain and clean vats 50 Batches

$172.504

7 $8,625.2344

Move to curing room 6,250 litres $0.5022 $3,138.8184

Pack and pressing 12,800 Products $0.4265 $5,458.9500

Setup curing room 260 trays $7.6428 $1,987.1211

Move to curing room 260 trays $4.2648 $1,108.8594

Cure products 260 trays $53.0546 $13,794.1934

Unload curing room 260 trays $4.2648 $1,108.8594

Inspect finished products 260 trays $4.4230 $1,149.9773

Disposal of substandard

product 260 trays $2.1866 $568.5240

Move to truck 250 trays $5.4217 $1,355.4214

Total Allocated Cost $3,14,797.1338

Add: Direct Materials 6,250 litres $2.0000 $12,500.0000

Page | 6

Annexure 2: Computation of per unit cost of Mascarpone

For Mascarpone - Computation of Cost

Activities Consumed

Annual Qty

of activity

driver

Activity driver

Activity

Driver

Rate

Cost

allocated

Corporate management NA NA NA $5,555.0000

Process receivables 100 invoices $53.3531 $5,335.3125

Process payables 100 purchase orders $69.9894 $6,998.9375

Production planning 30

production

schedules

$266.765

6 $8,002.9688

Reports to Health Dept 5 reports

$350.694

2 $1,753.4711

Process sales order 100 sales orders

$113.753

9 $11,375.3906

Dispatch sales order 100 dispatches $99.7156 $9,971.5625

New Product Development NA NA NA $56,237.0000

Inspect Milk 50 Batches

$137.648

7 $6,882.4350

Disposal of substandard milk 50 Batches $34.9861 $1,749.3045

Move to pasteurizing room 50 Batches $34.7361 $1,736.8045

Set up pasteurizer 50 Batches

$158.315

6 $7,915.7813

Weigh and sort ingredients 50 Batches

$158.315

6 $7,915.7813

Load pasteurizer 6,250 litres $6.2162 $38,851.5137

Operate pasteurizer 50 Batches

$302.443

8 $15,122.1875

Unload and Clean pasteurizer 50 Batches

$158.315

6 $7,915.7813

Move to culturing room 50 Batches

$172.504

7 $8,625.2344

Set up scales 50 Batches $86.2531 $4,312.6563

Weigh ingredients 50 Batches

$158.315

6 $7,915.7813

Load culturing vats 50 Batches

$316.164

1 $15,808.2031

Coagulate, Drain and Scald 6,250 litres $7.4432 $46,520.0684

Drain and clean vats 50 Batches

$172.504

7 $8,625.2344

Move to curing room 6,250 litres $0.5022 $3,138.8184

Pack and pressing 12,800 Products $0.4265 $5,458.9500

Setup curing room 260 trays $7.6428 $1,987.1211

Move to curing room 260 trays $4.2648 $1,108.8594

Cure products 260 trays $53.0546 $13,794.1934

Unload curing room 260 trays $4.2648 $1,108.8594

Inspect finished products 260 trays $4.4230 $1,149.9773

Disposal of substandard

product 260 trays $2.1866 $568.5240

Move to truck 250 trays $5.4217 $1,355.4214

Total Allocated Cost $3,14,797.1338

Add: Direct Materials 6,250 litres $2.0000 $12,500.0000

Page | 6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 6

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.

![Management Accounting: Costing Analysis of Office Desks - [Company]](/_next/image/?url=https%3A%2F%2Fdesklib.com%2Fmedia%2Fimages%2Fjv%2Fc197923795a34b81bdce50f667d18d4c.jpg&w=256&q=75)