Detailed Solution for Finance and Accounting Exam (Alpha Group)

VerifiedAdded on 2022/12/28

|13

|2076

|68

Homework Assignment

AI Summary

This document presents a comprehensive solution to a finance exam, addressing various accounting and financial reporting concepts. The solution includes detailed calculations and explanations for questions related to consolidation, cash flow statements, and accounting treatments under IFRS. The solution covers topics such as the calculation of goodwill, non-controlling interest, and consolidated retained earnings. It analyzes cash flow statements, identifies key issues, and explains the impact of operating activities on capital returns. Furthermore, it provides accounting treatments for contracts, commission rates, and depreciation, and offers guidance on currency selection and the accounting for specific transactions, including patent and land acquisitions, and revenue recognition. The document provides a complete guide to the accounting treatment of contracts and depreciation and addresses the selection of functional currency and accounting for specific transactions.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

ONLINE EXAM

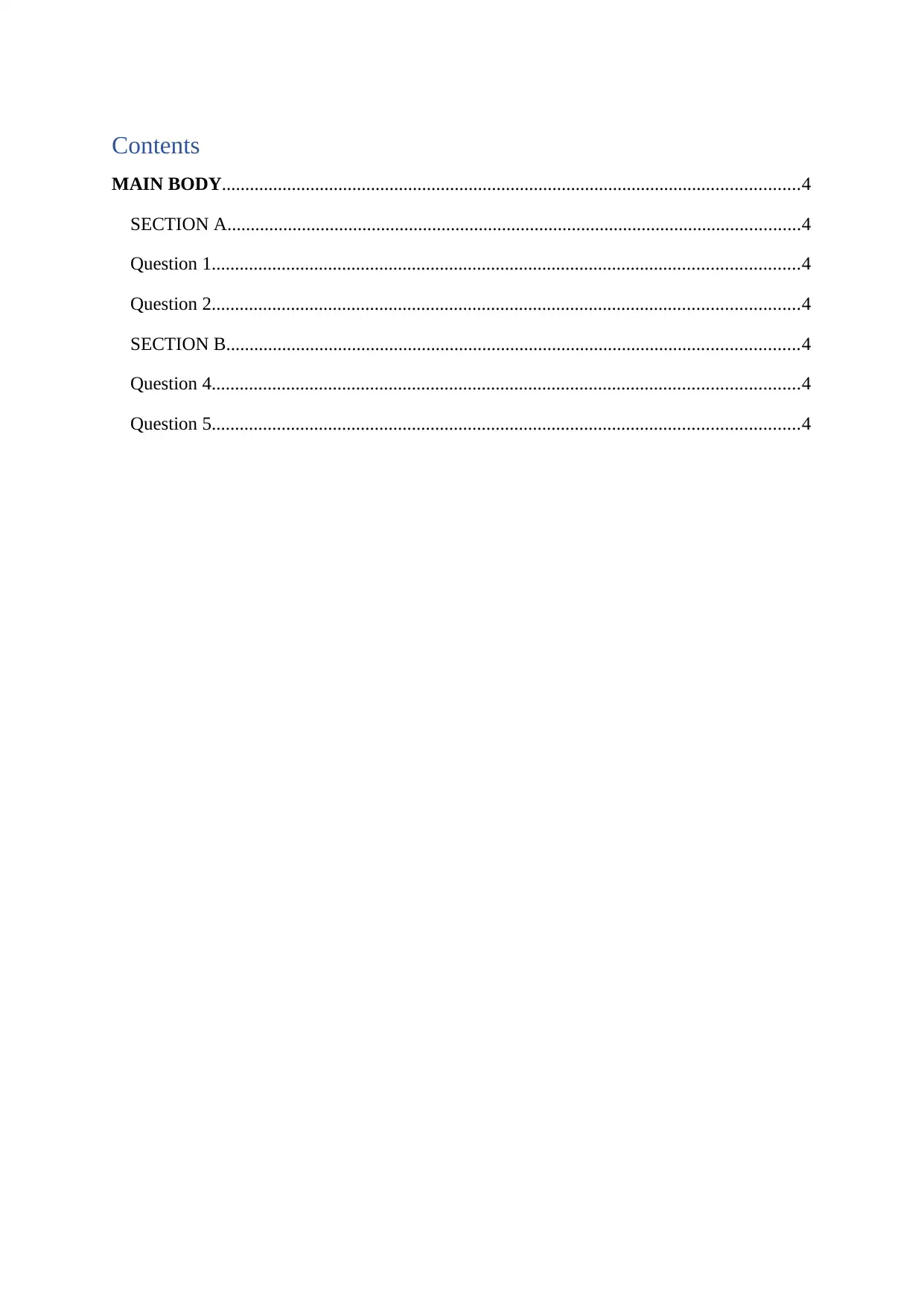

Contents

MAIN BODY............................................................................................................................4

SECTION A...........................................................................................................................4

Question 1..............................................................................................................................4

Question 2..............................................................................................................................4

SECTION B...........................................................................................................................4

Question 4..............................................................................................................................4

Question 5..............................................................................................................................4

MAIN BODY............................................................................................................................4

SECTION A...........................................................................................................................4

Question 1..............................................................................................................................4

Question 2..............................................................................................................................4

SECTION B...........................................................................................................................4

Question 4..............................................................................................................................4

Question 5..............................................................................................................................4

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

SECTION A

Question 1

A).

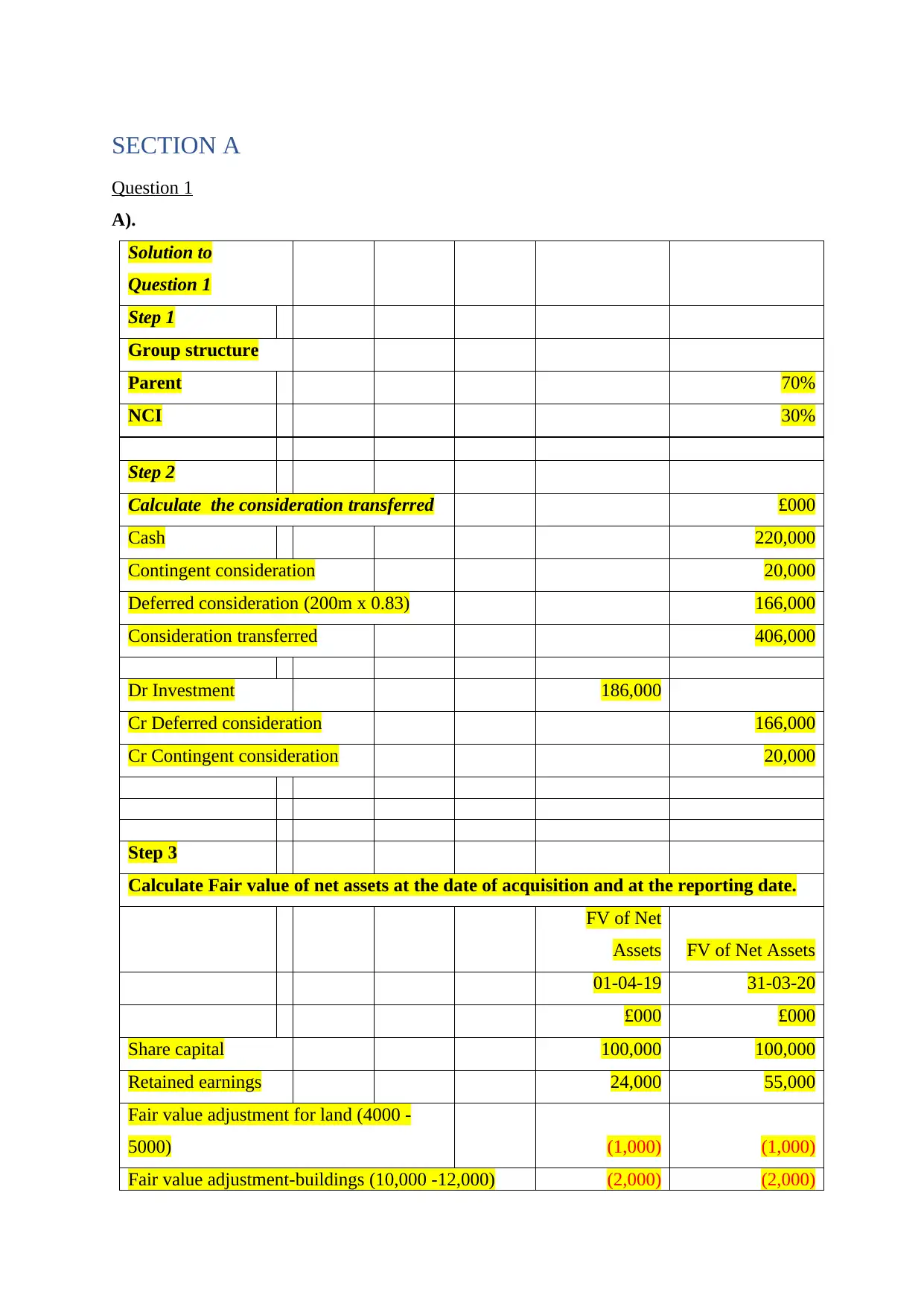

Solution to

Question 1

Step 1

Group structure

Parent 70%

NCI 30%

Step 2

Calculate the consideration transferred £000

Cash 220,000

Contingent consideration 20,000

Deferred consideration (200m x 0.83) 166,000

Consideration transferred 406,000

Dr Investment 186,000

Cr Deferred consideration 166,000

Cr Contingent consideration 20,000

Step 3

Calculate Fair value of net assets at the date of acquisition and at the reporting date.

FV of Net

Assets FV of Net Assets

01-04-19 31-03-20

£000 £000

Share capital 100,000 100,000

Retained earnings 24,000 55,000

Fair value adjustment for land (4000 -

5000) (1,000) (1,000)

Fair value adjustment-buildings (10,000 -12,000) (2,000) (2,000)

Question 1

A).

Solution to

Question 1

Step 1

Group structure

Parent 70%

NCI 30%

Step 2

Calculate the consideration transferred £000

Cash 220,000

Contingent consideration 20,000

Deferred consideration (200m x 0.83) 166,000

Consideration transferred 406,000

Dr Investment 186,000

Cr Deferred consideration 166,000

Cr Contingent consideration 20,000

Step 3

Calculate Fair value of net assets at the date of acquisition and at the reporting date.

FV of Net

Assets FV of Net Assets

01-04-19 31-03-20

£000 £000

Share capital 100,000 100,000

Retained earnings 24,000 55,000

Fair value adjustment for land (4000 -

5000) (1,000) (1,000)

Fair value adjustment-buildings (10,000 -12,000) (2,000) (2,000)

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

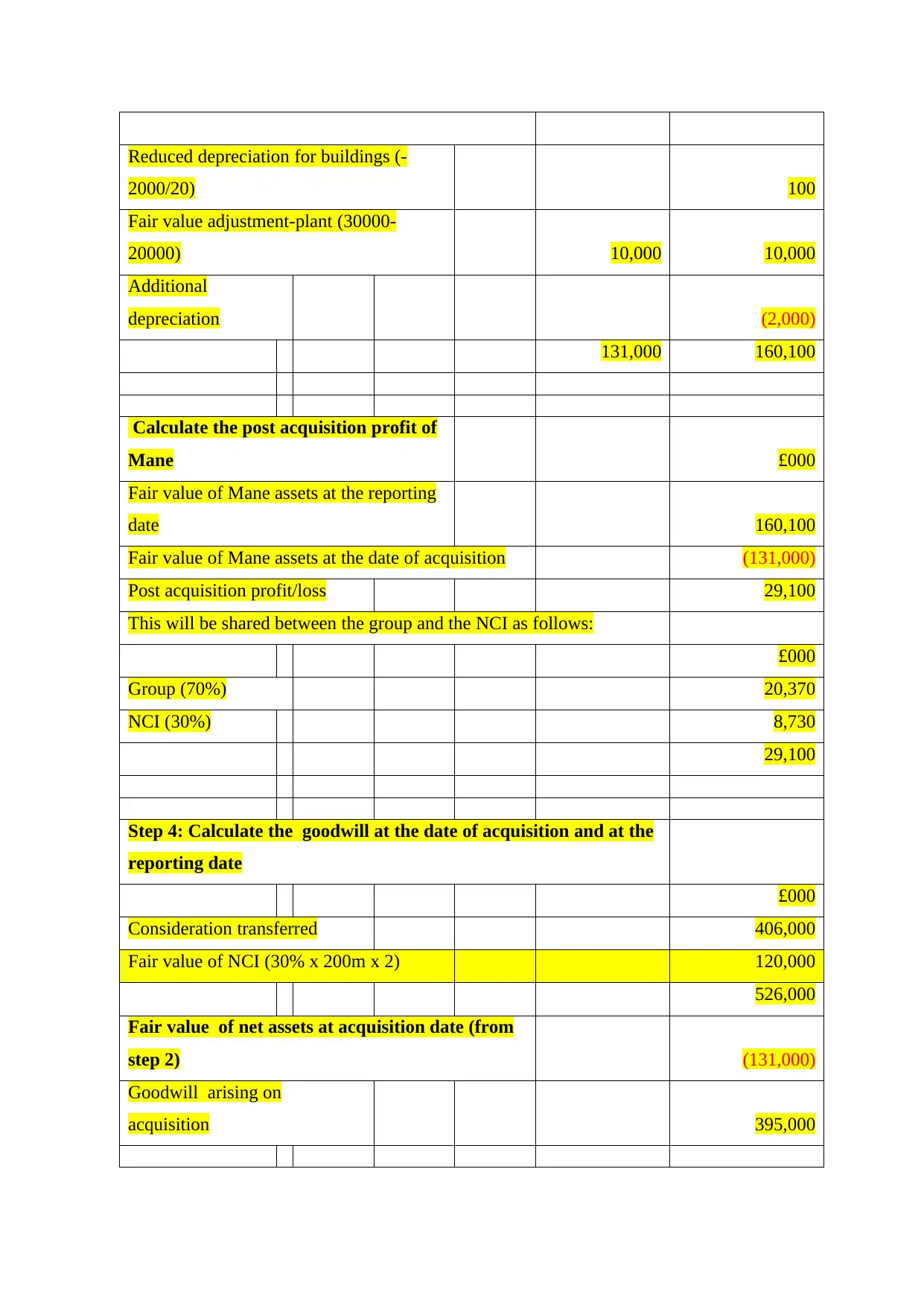

Reduced depreciation for buildings (-

2000/20) 100

Fair value adjustment-plant (30000-

20000) 10,000 10,000

Additional

depreciation (2,000)

131,000 160,100

Calculate the post acquisition profit of

Mane £000

Fair value of Mane assets at the reporting

date 160,100

Fair value of Mane assets at the date of acquisition (131,000)

Post acquisition profit/loss 29,100

This will be shared between the group and the NCI as follows:

£000

Group (70%) 20,370

NCI (30%) 8,730

29,100

Step 4: Calculate the goodwill at the date of acquisition and at the

reporting date

£000

Consideration transferred 406,000

Fair value of NCI (30% x 200m x 2) 120,000

526,000

Fair value of net assets at acquisition date (from

step 2) (131,000)

Goodwill arising on

acquisition 395,000

2000/20) 100

Fair value adjustment-plant (30000-

20000) 10,000 10,000

Additional

depreciation (2,000)

131,000 160,100

Calculate the post acquisition profit of

Mane £000

Fair value of Mane assets at the reporting

date 160,100

Fair value of Mane assets at the date of acquisition (131,000)

Post acquisition profit/loss 29,100

This will be shared between the group and the NCI as follows:

£000

Group (70%) 20,370

NCI (30%) 8,730

29,100

Step 4: Calculate the goodwill at the date of acquisition and at the

reporting date

£000

Consideration transferred 406,000

Fair value of NCI (30% x 200m x 2) 120,000

526,000

Fair value of net assets at acquisition date (from

step 2) (131,000)

Goodwill arising on

acquisition 395,000

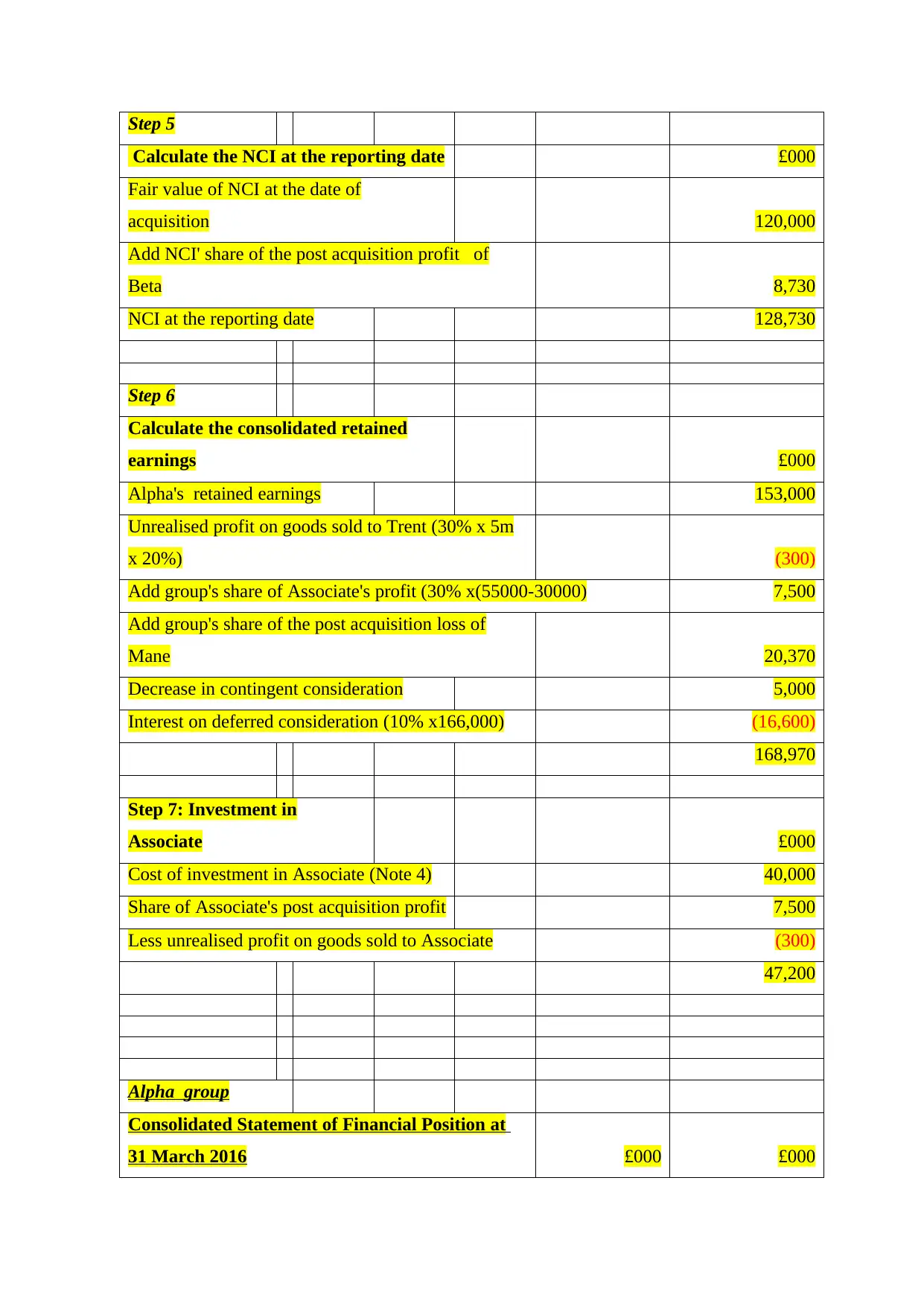

Step 5

Calculate the NCI at the reporting date £000

Fair value of NCI at the date of

acquisition 120,000

Add NCI' share of the post acquisition profit of

Beta 8,730

NCI at the reporting date 128,730

Step 6

Calculate the consolidated retained

earnings £000

Alpha's retained earnings 153,000

Unrealised profit on goods sold to Trent (30% x 5m

x 20%) (300)

Add group's share of Associate's profit (30% x(55000-30000) 7,500

Add group's share of the post acquisition loss of

Mane 20,370

Decrease in contingent consideration 5,000

Interest on deferred consideration (10% x166,000) (16,600)

168,970

Step 7: Investment in

Associate £000

Cost of investment in Associate (Note 4) 40,000

Share of Associate's post acquisition profit 7,500

Less unrealised profit on goods sold to Associate (300)

47,200

Alpha group

Consolidated Statement of Financial Position at

31 March 2016 £000 £000

Calculate the NCI at the reporting date £000

Fair value of NCI at the date of

acquisition 120,000

Add NCI' share of the post acquisition profit of

Beta 8,730

NCI at the reporting date 128,730

Step 6

Calculate the consolidated retained

earnings £000

Alpha's retained earnings 153,000

Unrealised profit on goods sold to Trent (30% x 5m

x 20%) (300)

Add group's share of Associate's profit (30% x(55000-30000) 7,500

Add group's share of the post acquisition loss of

Mane 20,370

Decrease in contingent consideration 5,000

Interest on deferred consideration (10% x166,000) (16,600)

168,970

Step 7: Investment in

Associate £000

Cost of investment in Associate (Note 4) 40,000

Share of Associate's post acquisition profit 7,500

Less unrealised profit on goods sold to Associate (300)

47,200

Alpha group

Consolidated Statement of Financial Position at

31 March 2016 £000 £000

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

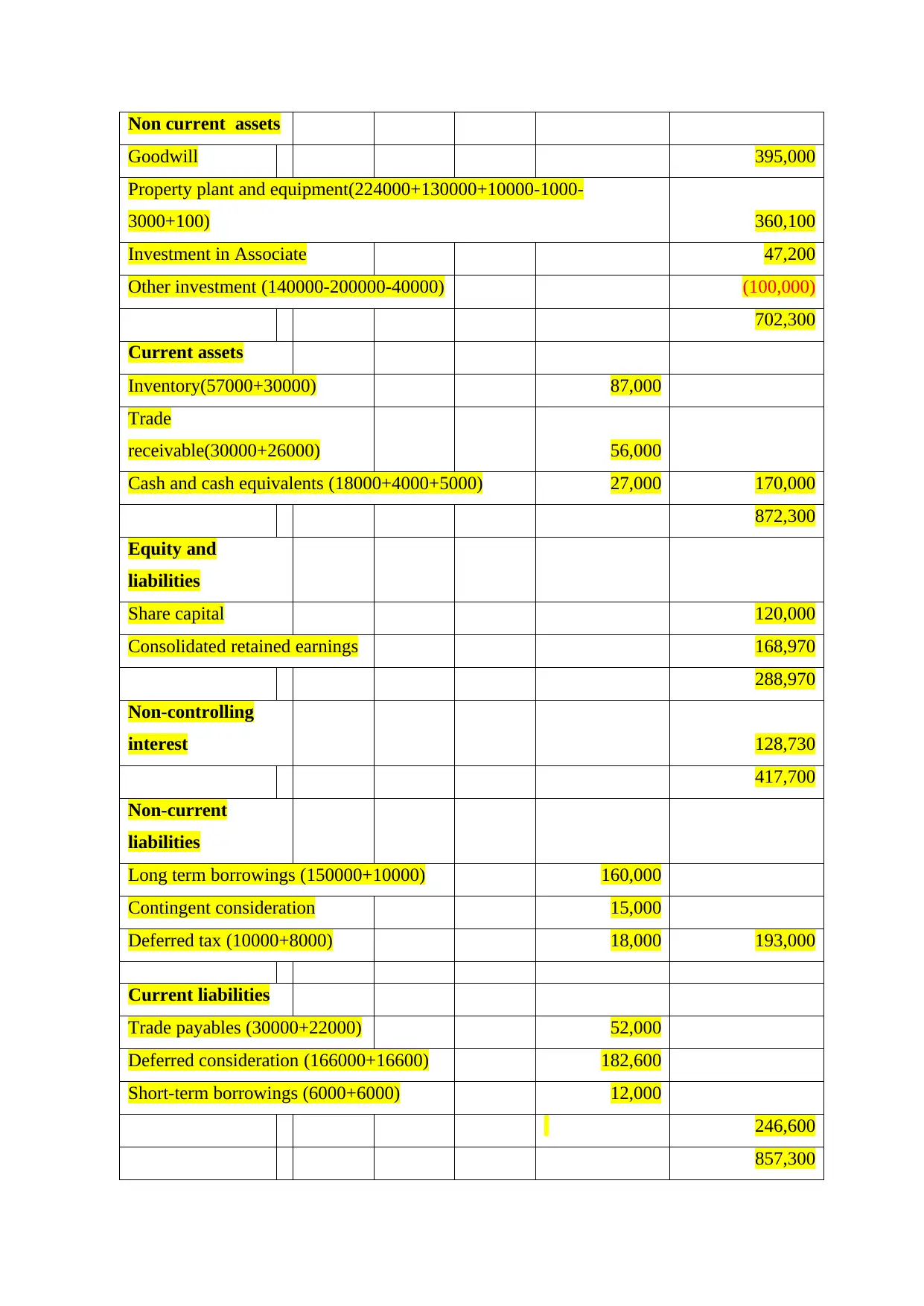

Non current assets

Goodwill 395,000

Property plant and equipment(224000+130000+10000-1000-

3000+100) 360,100

Investment in Associate 47,200

Other investment (140000-200000-40000) (100,000)

702,300

Current assets

Inventory(57000+30000) 87,000

Trade

receivable(30000+26000) 56,000

Cash and cash equivalents (18000+4000+5000) 27,000 170,000

872,300

Equity and

liabilities

Share capital 120,000

Consolidated retained earnings 168,970

288,970

Non-controlling

interest 128,730

417,700

Non-current

liabilities

Long term borrowings (150000+10000) 160,000

Contingent consideration 15,000

Deferred tax (10000+8000) 18,000 193,000

Current liabilities

Trade payables (30000+22000) 52,000

Deferred consideration (166000+16600) 182,600

Short-term borrowings (6000+6000) 12,000

246,600

857,300

Goodwill 395,000

Property plant and equipment(224000+130000+10000-1000-

3000+100) 360,100

Investment in Associate 47,200

Other investment (140000-200000-40000) (100,000)

702,300

Current assets

Inventory(57000+30000) 87,000

Trade

receivable(30000+26000) 56,000

Cash and cash equivalents (18000+4000+5000) 27,000 170,000

872,300

Equity and

liabilities

Share capital 120,000

Consolidated retained earnings 168,970

288,970

Non-controlling

interest 128,730

417,700

Non-current

liabilities

Long term borrowings (150000+10000) 160,000

Contingent consideration 15,000

Deferred tax (10000+8000) 18,000 193,000

Current liabilities

Trade payables (30000+22000) 52,000

Deferred consideration (166000+16600) 182,600

Short-term borrowings (6000+6000) 12,000

246,600

857,300

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

B).

At each of the three primary controls listed above, IFRS 10 makes reference to the

suggestions. This is a complete tutorial. The part guide separately may feel that every "link"

to other material requires a definite control evaluation. Bear in mind, though, that all five

modules are connected and all 3 should really be monitored.

Strength

IFRS 10 corroborates which rights are the root of power. The rights represent the force to

allow the financial specialist to arrange "unique experiments" in a specific way, as applicable

(see below). "maximum cost" throughout this situation may not need the opportunity to be

automatically exercised. Things considered, it is necessary to ensure that civil liberties can be

exerted before selecting proper exercises.

Dependent return participation or privileges

To be in charge of a financial specialist, in return for the operator, he should have closing or

discretionary rights. Component distributions are extensively characterized and go well

beyond profitability property investment profits.

Capacity to leverage control in order to manipulate returns

The chapter 3 of the examination is that a fund manager will affect his income (in some cases

referred to as a "link"). This relation depends on the capacity of the finance specialist to

organise the simulations (dynamic rights). It is up to a bigger portion of shareholdings to

attach a power to an impossible restoration to a regular parent-helper partnership. Similarly,

in these situations no subjective study is appropriate. In any situation, this third component of

the authority is necessary where, for particular, the management of the company or service

holds dynamic privileges as a result of a management arrangement or comparative strategy.

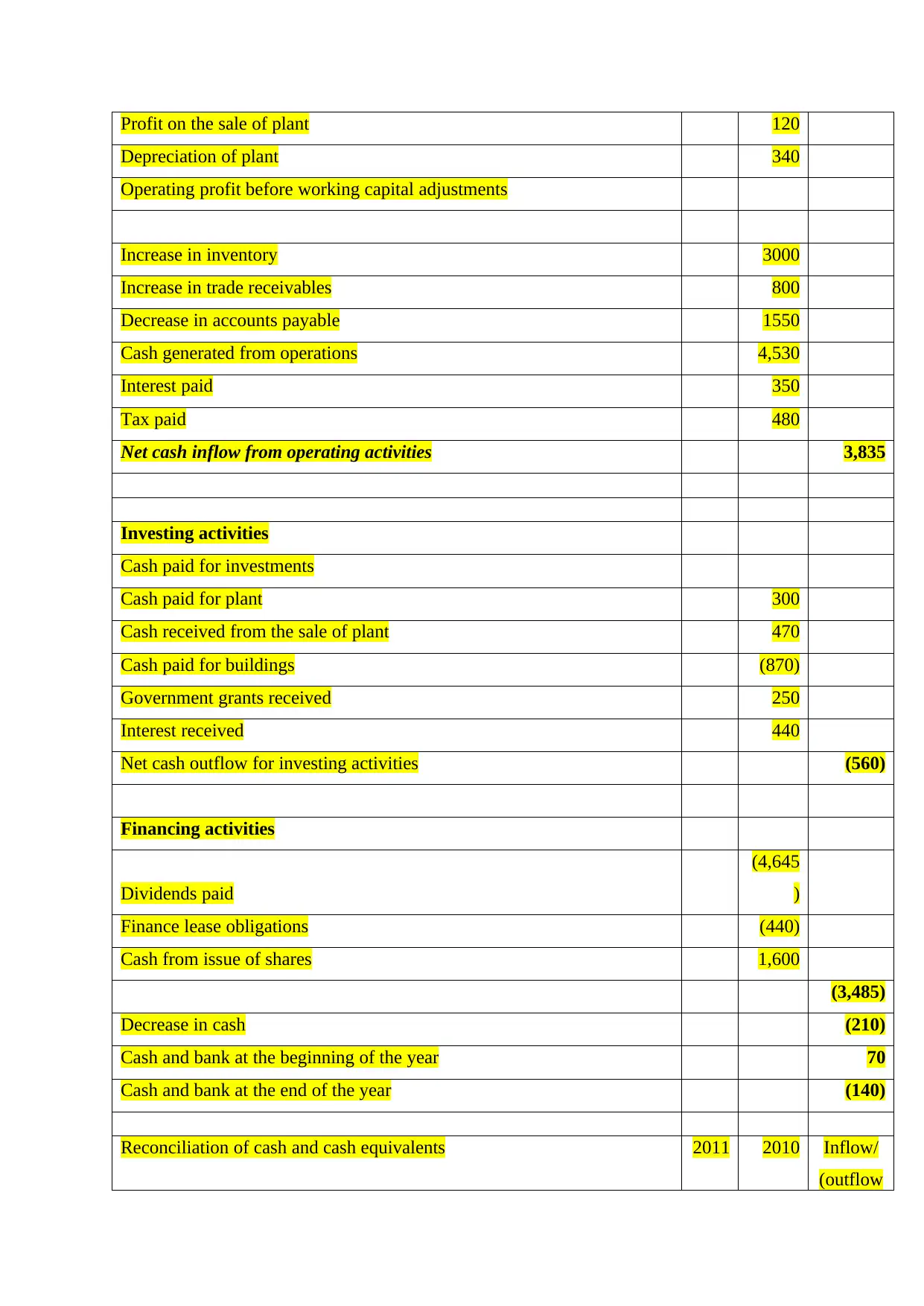

Question 2

A)

Profit before tax 2950

Interest payable (250)

Interest receivable 0

Amortization of government grants 0

Depreciation of buildings 150

At each of the three primary controls listed above, IFRS 10 makes reference to the

suggestions. This is a complete tutorial. The part guide separately may feel that every "link"

to other material requires a definite control evaluation. Bear in mind, though, that all five

modules are connected and all 3 should really be monitored.

Strength

IFRS 10 corroborates which rights are the root of power. The rights represent the force to

allow the financial specialist to arrange "unique experiments" in a specific way, as applicable

(see below). "maximum cost" throughout this situation may not need the opportunity to be

automatically exercised. Things considered, it is necessary to ensure that civil liberties can be

exerted before selecting proper exercises.

Dependent return participation or privileges

To be in charge of a financial specialist, in return for the operator, he should have closing or

discretionary rights. Component distributions are extensively characterized and go well

beyond profitability property investment profits.

Capacity to leverage control in order to manipulate returns

The chapter 3 of the examination is that a fund manager will affect his income (in some cases

referred to as a "link"). This relation depends on the capacity of the finance specialist to

organise the simulations (dynamic rights). It is up to a bigger portion of shareholdings to

attach a power to an impossible restoration to a regular parent-helper partnership. Similarly,

in these situations no subjective study is appropriate. In any situation, this third component of

the authority is necessary where, for particular, the management of the company or service

holds dynamic privileges as a result of a management arrangement or comparative strategy.

Question 2

A)

Profit before tax 2950

Interest payable (250)

Interest receivable 0

Amortization of government grants 0

Depreciation of buildings 150

Profit on the sale of plant 120

Depreciation of plant 340

Operating profit before working capital adjustments

Increase in inventory 3000

Increase in trade receivables 800

Decrease in accounts payable 1550

Cash generated from operations 4,530

Interest paid 350

Tax paid 480

Net cash inflow from operating activities 3,835

Investing activities

Cash paid for investments

Cash paid for plant 300

Cash received from the sale of plant 470

Cash paid for buildings (870)

Government grants received 250

Interest received 440

Net cash outflow for investing activities (560)

Financing activities

Dividends paid

(4,645

)

Finance lease obligations (440)

Cash from issue of shares 1,600

(3,485)

Decrease in cash (210)

Cash and bank at the beginning of the year 70

Cash and bank at the end of the year (140)

Reconciliation of cash and cash equivalents 2011 2010 Inflow/

(outflow

Depreciation of plant 340

Operating profit before working capital adjustments

Increase in inventory 3000

Increase in trade receivables 800

Decrease in accounts payable 1550

Cash generated from operations 4,530

Interest paid 350

Tax paid 480

Net cash inflow from operating activities 3,835

Investing activities

Cash paid for investments

Cash paid for plant 300

Cash received from the sale of plant 470

Cash paid for buildings (870)

Government grants received 250

Interest received 440

Net cash outflow for investing activities (560)

Financing activities

Dividends paid

(4,645

)

Finance lease obligations (440)

Cash from issue of shares 1,600

(3,485)

Decrease in cash (210)

Cash and bank at the beginning of the year 70

Cash and bank at the end of the year (140)

Reconciliation of cash and cash equivalents 2011 2010 Inflow/

(outflow

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

)

Bank 50 150 (100)

Overdraft

(190

) (80) (110)

(140

) 70 (210)

b)

The primary issues found in the cash flow statement by Firmino are the negative balance

between all spending and funding operations, which in total makes the three activities that

losing balance. These two operations are thus the key problems revealed by cash flow

statement. As these operations result in a capital outflow from the financial accounts of the

organisation which are reflected in the reduction in cash and cash equivalents.

c)

Operating benefit or cash inflows in operations are the key factors of returns on capital during

2020. The activities benefit has been taken into account in determining the return on the

employed money. Where employed investment is mixed into equity and debt. The only factor

contributing to the company's return is net profit before interest and tax.

SECTION B

Question 4

A) Price of contract = £600,000

Interest rate = 10%

The accounting treatment for the contract between king and customers is as follows:

01/01/2019 Cash a/c £600,000

01/01/2019 Contract Liability £600,000

31/12/2020 Contract liability £660,000

Bank 50 150 (100)

Overdraft

(190

) (80) (110)

(140

) 70 (210)

b)

The primary issues found in the cash flow statement by Firmino are the negative balance

between all spending and funding operations, which in total makes the three activities that

losing balance. These two operations are thus the key problems revealed by cash flow

statement. As these operations result in a capital outflow from the financial accounts of the

organisation which are reflected in the reduction in cash and cash equivalents.

c)

Operating benefit or cash inflows in operations are the key factors of returns on capital during

2020. The activities benefit has been taken into account in determining the return on the

employed money. Where employed investment is mixed into equity and debt. The only factor

contributing to the company's return is net profit before interest and tax.

SECTION B

Question 4

A) Price of contract = £600,000

Interest rate = 10%

The accounting treatment for the contract between king and customers is as follows:

01/01/2019 Cash a/c £600,000

01/01/2019 Contract Liability £600,000

31/12/2020 Contract liability £660,000

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

31/12/2020 Revenue to king £600,000

Interest received £60000

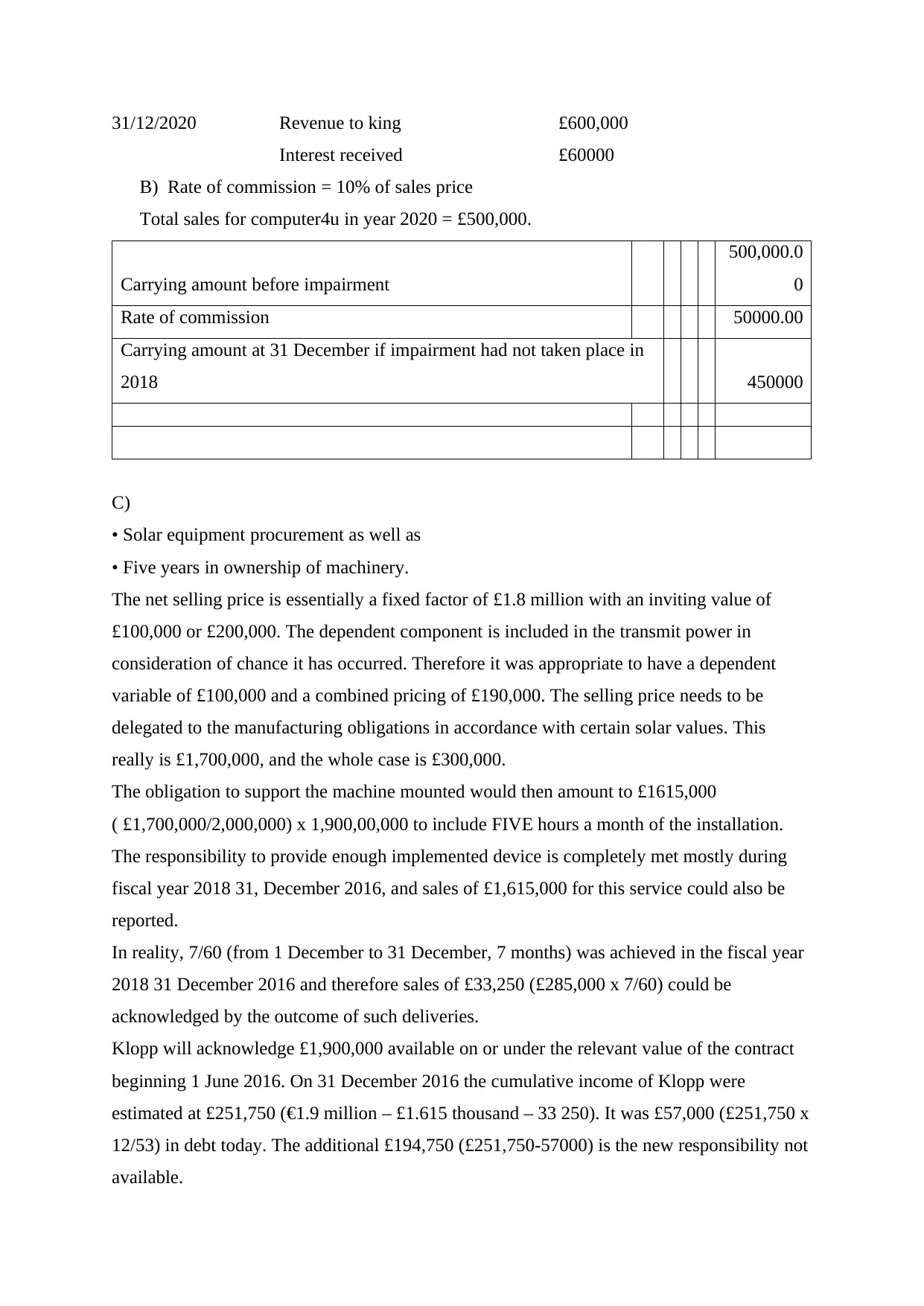

B) Rate of commission = 10% of sales price

Total sales for computer4u in year 2020 = £500,000.

Carrying amount before impairment

500,000.0

0

Rate of commission 50000.00

Carrying amount at 31 December if impairment had not taken place in

2018 450000

C)

• Solar equipment procurement as well as

• Five years in ownership of machinery.

The net selling price is essentially a fixed factor of £1.8 million with an inviting value of

£100,000 or £200,000. The dependent component is included in the transmit power in

consideration of chance it has occurred. Therefore it was appropriate to have a dependent

variable of £100,000 and a combined pricing of £190,000. The selling price needs to be

delegated to the manufacturing obligations in accordance with certain solar values. This

really is £1,700,000, and the whole case is £300,000.

The obligation to support the machine mounted would then amount to £1615,000

( £1,700,000/2,000,000) x 1,900,00,000 to include FIVE hours a month of the installation.

The responsibility to provide enough implemented device is completely met mostly during

fiscal year 2018 31, December 2016, and sales of £1,615,000 for this service could also be

reported.

In reality, 7/60 (from 1 December to 31 December, 7 months) was achieved in the fiscal year

2018 31 December 2016 and therefore sales of £33,250 (£285,000 x 7/60) could be

acknowledged by the outcome of such deliveries.

Klopp will acknowledge £1,900,000 available on or under the relevant value of the contract

beginning 1 June 2016. On 31 December 2016 the cumulative income of Klopp were

estimated at £251,750 (€1.9 million – £1.615 thousand – 33 250). It was £57,000 (£251,750 x

12/53) in debt today. The additional £194,750 (£251,750-57000) is the new responsibility not

available.

Interest received £60000

B) Rate of commission = 10% of sales price

Total sales for computer4u in year 2020 = £500,000.

Carrying amount before impairment

500,000.0

0

Rate of commission 50000.00

Carrying amount at 31 December if impairment had not taken place in

2018 450000

C)

• Solar equipment procurement as well as

• Five years in ownership of machinery.

The net selling price is essentially a fixed factor of £1.8 million with an inviting value of

£100,000 or £200,000. The dependent component is included in the transmit power in

consideration of chance it has occurred. Therefore it was appropriate to have a dependent

variable of £100,000 and a combined pricing of £190,000. The selling price needs to be

delegated to the manufacturing obligations in accordance with certain solar values. This

really is £1,700,000, and the whole case is £300,000.

The obligation to support the machine mounted would then amount to £1615,000

( £1,700,000/2,000,000) x 1,900,00,000 to include FIVE hours a month of the installation.

The responsibility to provide enough implemented device is completely met mostly during

fiscal year 2018 31, December 2016, and sales of £1,615,000 for this service could also be

reported.

In reality, 7/60 (from 1 December to 31 December, 7 months) was achieved in the fiscal year

2018 31 December 2016 and therefore sales of £33,250 (£285,000 x 7/60) could be

acknowledged by the outcome of such deliveries.

Klopp will acknowledge £1,900,000 available on or under the relevant value of the contract

beginning 1 June 2016. On 31 December 2016 the cumulative income of Klopp were

estimated at £251,750 (€1.9 million – £1.615 thousand – 33 250). It was £57,000 (£251,750 x

12/53) in debt today. The additional £194,750 (£251,750-57000) is the new responsibility not

available.

53= 60 months + 7 months (1 June 2016 to 31 December 2016 is a period of 7 months).

(b) The purchase rates relevant effects of particular goods that can be returned to the

customer.

Though this figure is specifically measured, revenues are forecast and total income is

projected at £4,320,000 (90 percent 800x £6,000). The bursary is called the £4,800,000 (800

x £6,000) for receivables.

The refund is 480,000 pounds (47,000 pounds - 43,000 pounds). This is called an existing

responsibility. Gross values for sold goods (800 x £3,500) amounted to £2,800,000. The

balance will equate to £2,520,000 (90% x 800x £3,500), which will be charged as sales costs.

The outstanding £280,000 is known to have the RIV Right (€2,800,000 -€2,520,000). Current

expenditure.

Question 5

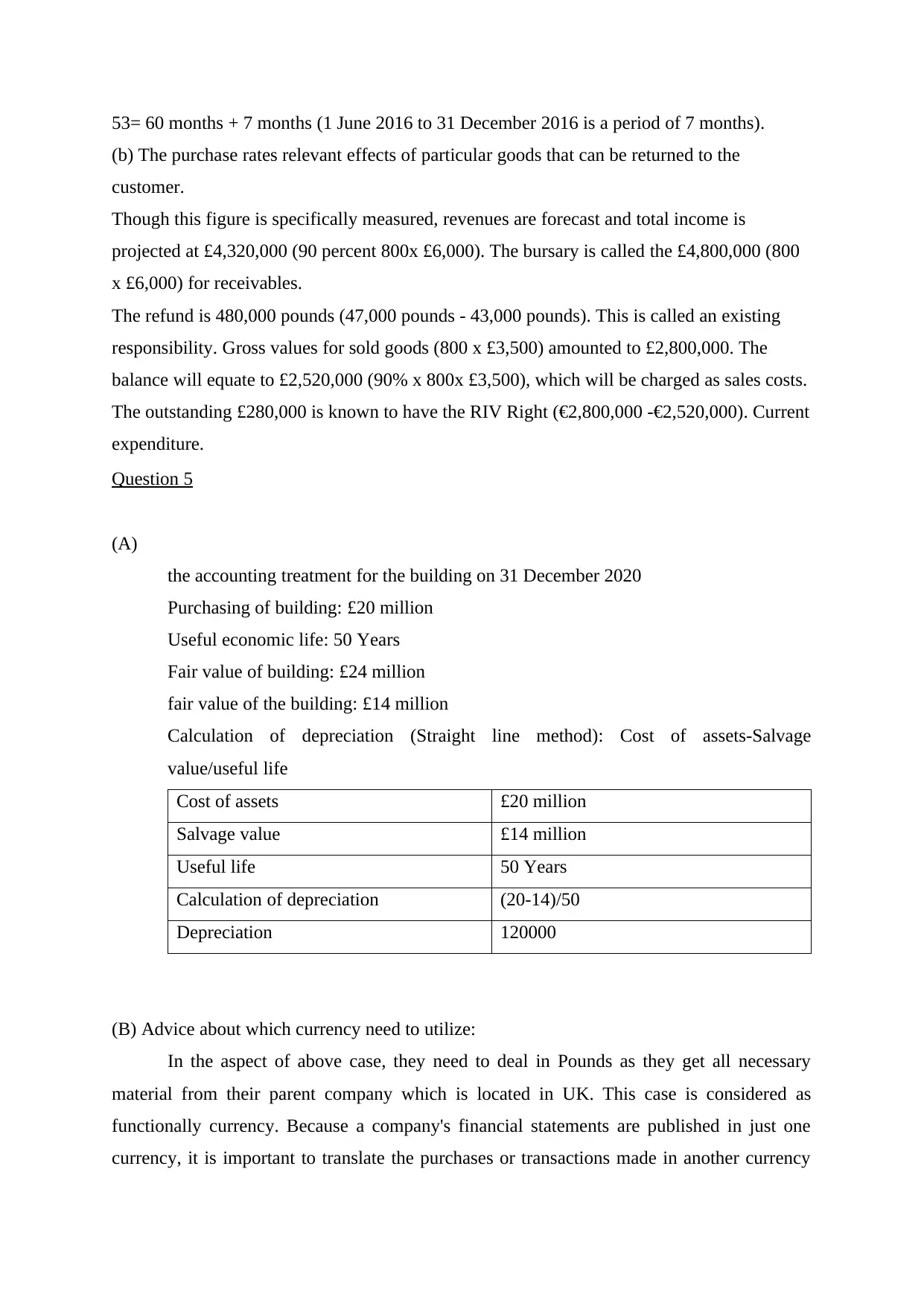

(A)

the accounting treatment for the building on 31 December 2020

Purchasing of building: £20 million

Useful economic life: 50 Years

Fair value of building: £24 million

fair value of the building: £14 million

Calculation of depreciation (Straight line method): Cost of assets-Salvage

value/useful life

Cost of assets £20 million

Salvage value £14 million

Useful life 50 Years

Calculation of depreciation (20-14)/50

Depreciation 120000

(B) Advice about which currency need to utilize:

In the aspect of above case, they need to deal in Pounds as they get all necessary

material from their parent company which is located in UK. This case is considered as

functionally currency. Because a company's financial statements are published in just one

currency, it is important to translate the purchases or transactions made in another currency

(b) The purchase rates relevant effects of particular goods that can be returned to the

customer.

Though this figure is specifically measured, revenues are forecast and total income is

projected at £4,320,000 (90 percent 800x £6,000). The bursary is called the £4,800,000 (800

x £6,000) for receivables.

The refund is 480,000 pounds (47,000 pounds - 43,000 pounds). This is called an existing

responsibility. Gross values for sold goods (800 x £3,500) amounted to £2,800,000. The

balance will equate to £2,520,000 (90% x 800x £3,500), which will be charged as sales costs.

The outstanding £280,000 is known to have the RIV Right (€2,800,000 -€2,520,000). Current

expenditure.

Question 5

(A)

the accounting treatment for the building on 31 December 2020

Purchasing of building: £20 million

Useful economic life: 50 Years

Fair value of building: £24 million

fair value of the building: £14 million

Calculation of depreciation (Straight line method): Cost of assets-Salvage

value/useful life

Cost of assets £20 million

Salvage value £14 million

Useful life 50 Years

Calculation of depreciation (20-14)/50

Depreciation 120000

(B) Advice about which currency need to utilize:

In the aspect of above case, they need to deal in Pounds as they get all necessary

material from their parent company which is located in UK. This case is considered as

functionally currency. Because a company's financial statements are published in just one

currency, it is important to translate the purchases or transactions made in another currency

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 13

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.