Finance Assignment: Overhead Allocation and Activity Based Costing

VerifiedAdded on 2023/01/18

|6

|1357

|70

Homework Assignment

AI Summary

This assignment analyzes overhead allocation and activity-based costing (ABC) methods, focusing on Dwayne Manufacturing Ltd. Part A calculates departmental and plant-wide overhead rates using provided cost and operational data. It includes the allocation of indirect costs, the computation of overhead rates for machining and assembly departments, and a plan...

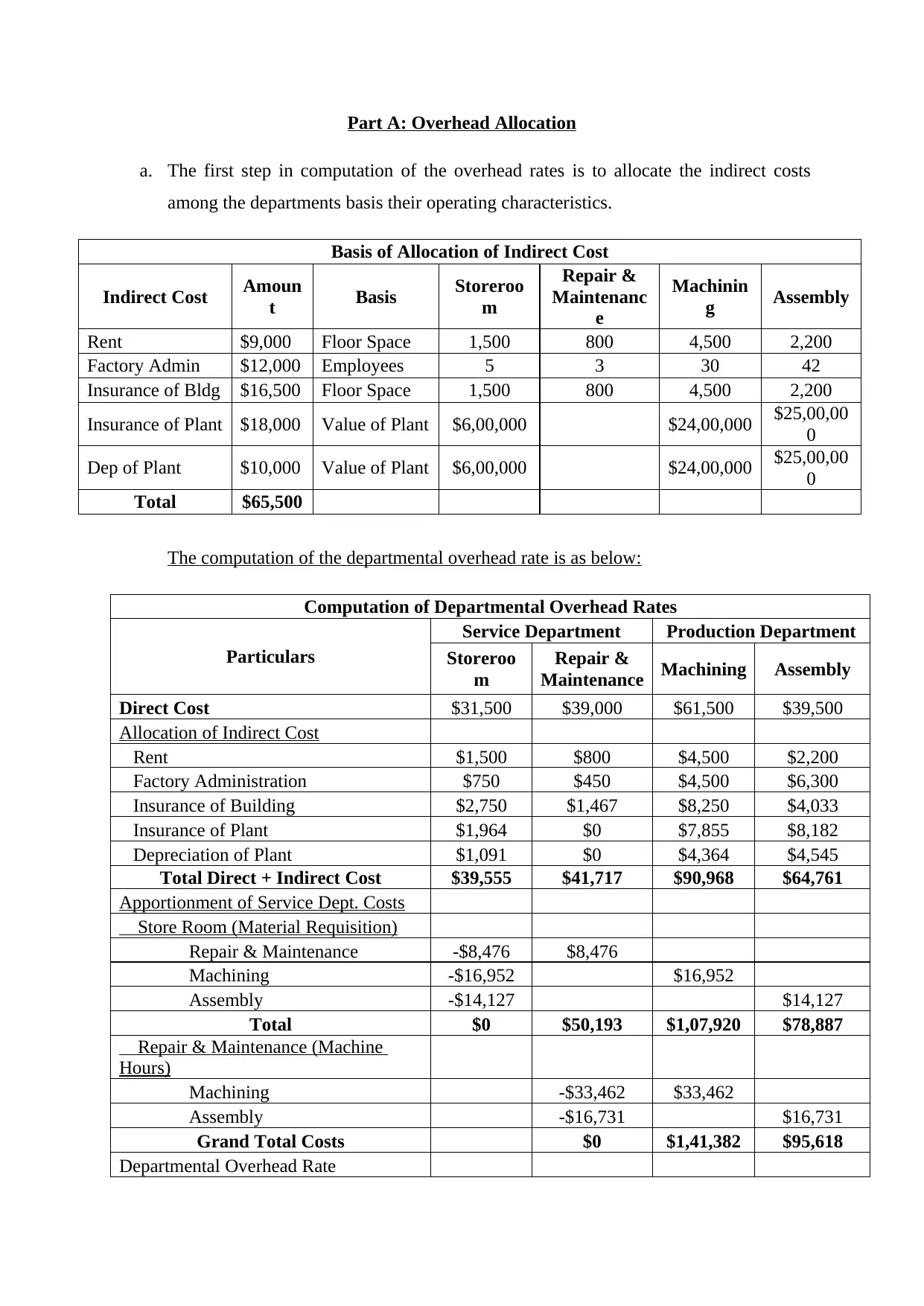

Part A: Overhead Allocation

a. The first step in computation of the overhead rates is to allocate the indirect costs

among the departments basis their operating characteristics.

Basis of Allocation of Indirect Cost

Indirect Cost Amoun

t Basis Storeroo

m

Repair &

Maintenanc

e

Machinin

g Assembly

Rent $9,000 Floor Space 1,500 800 4,500 2,200

Factory Admin $12,000 Employees 5 3 30 42

Insurance of Bldg $16,500 Floor Space 1,500 800 4,500 2,200

Insurance of Plant $18,000 Value of Plant $6,00,000 $24,00,000 $25,00,00

0

Dep of Plant $10,000 Value of Plant $6,00,000 $24,00,000 $25,00,00

0

Total $65,500

The computation of the departmental overhead rate is as below:

Computation of Departmental Overhead Rates

Particulars

Service Department Production Department

Storeroo

m

Repair &

Maintenance Machining Assembly

Direct Cost $31,500 $39,000 $61,500 $39,500

Allocation of Indirect Cost

Rent $1,500 $800 $4,500 $2,200

Factory Administration $750 $450 $4,500 $6,300

Insurance of Building $2,750 $1,467 $8,250 $4,033

Insurance of Plant $1,964 $0 $7,855 $8,182

Depreciation of Plant $1,091 $0 $4,364 $4,545

Total Direct + Indirect Cost $39,555 $41,717 $90,968 $64,761

Apportionment of Service Dept. Costs

Store Room (Material Requisition)

Repair & Maintenance -$8,476 $8,476

Machining -$16,952 $16,952

Assembly -$14,127 $14,127

Total $0 $50,193 $1,07,920 $78,887

Repair & Maintenance (Machine

Hours)

Machining -$33,462 $33,462

Assembly -$16,731 $16,731

Grand Total Costs $0 $1,41,382 $95,618

Departmental Overhead Rate

a. The first step in computation of the overhead rates is to allocate the indirect costs

among the departments basis their operating characteristics.

Basis of Allocation of Indirect Cost

Indirect Cost Amoun

t Basis Storeroo

m

Repair &

Maintenanc

e

Machinin

g Assembly

Rent $9,000 Floor Space 1,500 800 4,500 2,200

Factory Admin $12,000 Employees 5 3 30 42

Insurance of Bldg $16,500 Floor Space 1,500 800 4,500 2,200

Insurance of Plant $18,000 Value of Plant $6,00,000 $24,00,000 $25,00,00

0

Dep of Plant $10,000 Value of Plant $6,00,000 $24,00,000 $25,00,00

0

Total $65,500

The computation of the departmental overhead rate is as below:

Computation of Departmental Overhead Rates

Particulars

Service Department Production Department

Storeroo

m

Repair &

Maintenance Machining Assembly

Direct Cost $31,500 $39,000 $61,500 $39,500

Allocation of Indirect Cost

Rent $1,500 $800 $4,500 $2,200

Factory Administration $750 $450 $4,500 $6,300

Insurance of Building $2,750 $1,467 $8,250 $4,033

Insurance of Plant $1,964 $0 $7,855 $8,182

Depreciation of Plant $1,091 $0 $4,364 $4,545

Total Direct + Indirect Cost $39,555 $41,717 $90,968 $64,761

Apportionment of Service Dept. Costs

Store Room (Material Requisition)

Repair & Maintenance -$8,476 $8,476

Machining -$16,952 $16,952

Assembly -$14,127 $14,127

Total $0 $50,193 $1,07,920 $78,887

Repair & Maintenance (Machine

Hours)

Machining -$33,462 $33,462

Assembly -$16,731 $16,731

Grand Total Costs $0 $1,41,382 $95,618

Departmental Overhead Rate

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

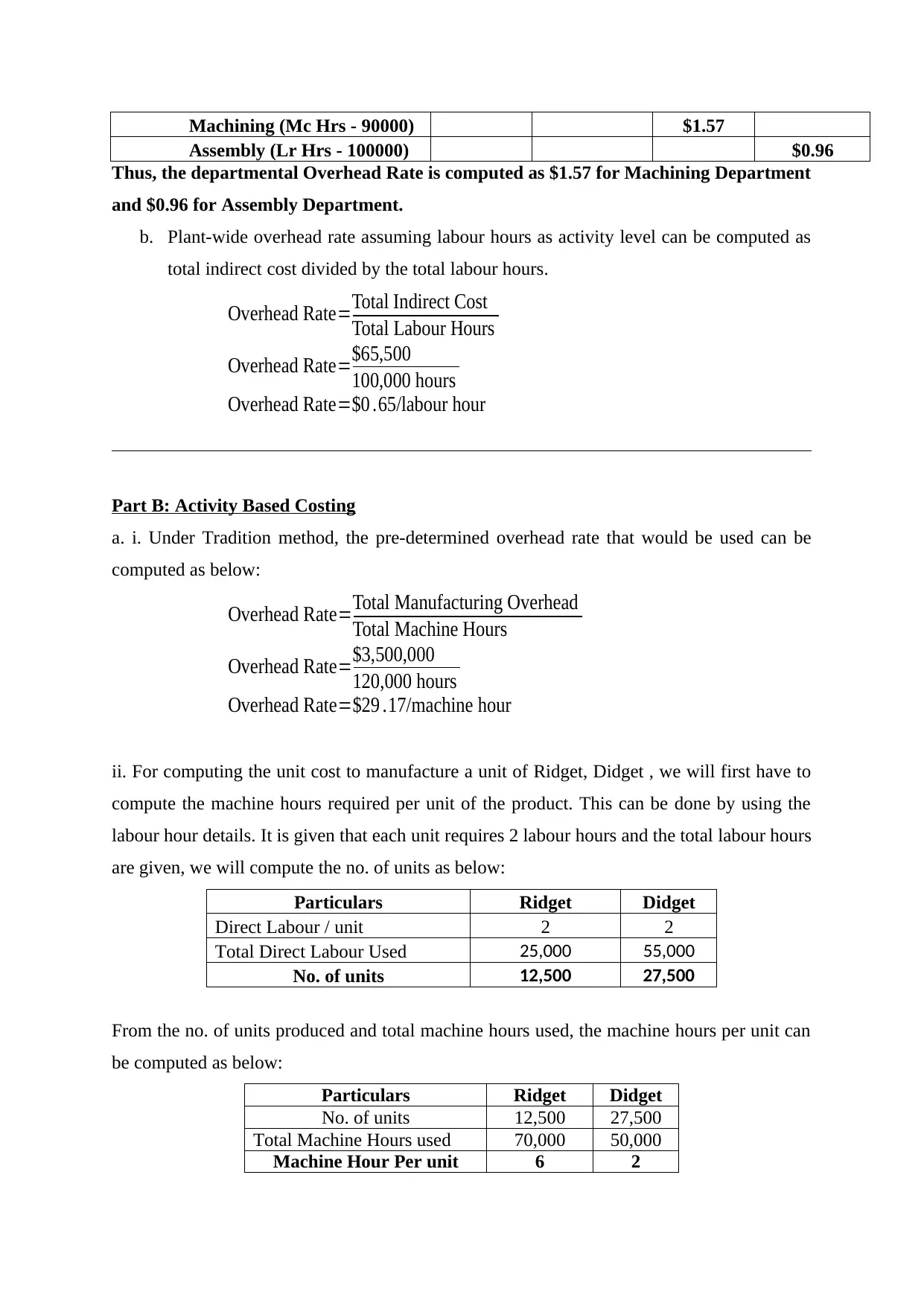

Machining (Mc Hrs - 90000) $1.57

Assembly (Lr Hrs - 100000) $0.96

Thus, the departmental Overhead Rate is computed as $1.57 for Machining Department

and $0.96 for Assembly Department.

b. Plant-wide overhead rate assuming labour hours as activity level can be computed as

total indirect cost divided by the total labour hours.

Overhead Rate=Total Indirect Cost

Total Labour Hours

Overhead Rate=$65,500

100,000 hours

Overhead Rate=$0 .65/labour hour

Part B: Activity Based Costing

a. i. Under Tradition method, the pre-determined overhead rate that would be used can be

computed as below:

Overhead Rate=Total Manufacturing Overhead

Total Machine Hours

Overhead Rate=$3,500,000

120,000 hours

Overhead Rate=$29 .17/machine hour

ii. For computing the unit cost to manufacture a unit of Ridget, Didget , we will first have to

compute the machine hours required per unit of the product. This can be done by using the

labour hour details. It is given that each unit requires 2 labour hours and the total labour hours

are given, we will compute the no. of units as below:

Particulars Ridget Didget

Direct Labour / unit 2 2

Total Direct Labour Used 25,000 55,000

No. of units 12,500 27,500

From the no. of units produced and total machine hours used, the machine hours per unit can

be computed as below:

Particulars Ridget Didget

No. of units 12,500 27,500

Total Machine Hours used 70,000 50,000

Machine Hour Per unit 6 2

Assembly (Lr Hrs - 100000) $0.96

Thus, the departmental Overhead Rate is computed as $1.57 for Machining Department

and $0.96 for Assembly Department.

b. Plant-wide overhead rate assuming labour hours as activity level can be computed as

total indirect cost divided by the total labour hours.

Overhead Rate=Total Indirect Cost

Total Labour Hours

Overhead Rate=$65,500

100,000 hours

Overhead Rate=$0 .65/labour hour

Part B: Activity Based Costing

a. i. Under Tradition method, the pre-determined overhead rate that would be used can be

computed as below:

Overhead Rate=Total Manufacturing Overhead

Total Machine Hours

Overhead Rate=$3,500,000

120,000 hours

Overhead Rate=$29 .17/machine hour

ii. For computing the unit cost to manufacture a unit of Ridget, Didget , we will first have to

compute the machine hours required per unit of the product. This can be done by using the

labour hour details. It is given that each unit requires 2 labour hours and the total labour hours

are given, we will compute the no. of units as below:

Particulars Ridget Didget

Direct Labour / unit 2 2

Total Direct Labour Used 25,000 55,000

No. of units 12,500 27,500

From the no. of units produced and total machine hours used, the machine hours per unit can

be computed as below:

Particulars Ridget Didget

No. of units 12,500 27,500

Total Machine Hours used 70,000 50,000

Machine Hour Per unit 6 2

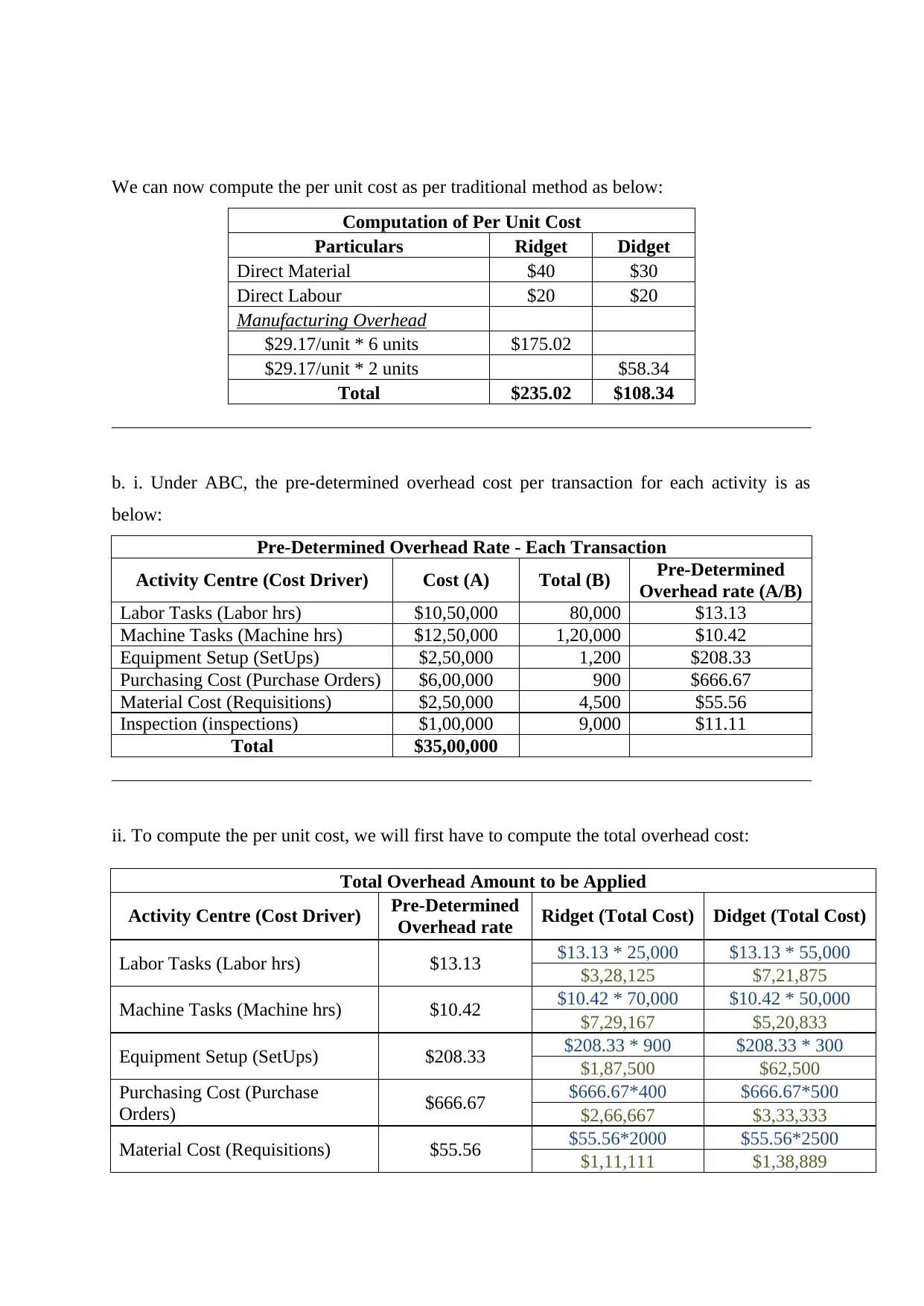

We can now compute the per unit cost as per traditional method as below:

Computation of Per Unit Cost

Particulars Ridget Didget

Direct Material $40 $30

Direct Labour $20 $20

Manufacturing Overhead

$29.17/unit * 6 units $175.02

$29.17/unit * 2 units $58.34

Total $235.02 $108.34

b. i. Under ABC, the pre-determined overhead cost per transaction for each activity is as

below:

Pre-Determined Overhead Rate - Each Transaction

Activity Centre (Cost Driver) Cost (A) Total (B) Pre-Determined

Overhead rate (A/B)

Labor Tasks (Labor hrs) $10,50,000 80,000 $13.13

Machine Tasks (Machine hrs) $12,50,000 1,20,000 $10.42

Equipment Setup (SetUps) $2,50,000 1,200 $208.33

Purchasing Cost (Purchase Orders) $6,00,000 900 $666.67

Material Cost (Requisitions) $2,50,000 4,500 $55.56

Inspection (inspections) $1,00,000 9,000 $11.11

Total $35,00,000

ii. To compute the per unit cost, we will first have to compute the total overhead cost:

Total Overhead Amount to be Applied

Activity Centre (Cost Driver) Pre-Determined

Overhead rate Ridget (Total Cost) Didget (Total Cost)

Labor Tasks (Labor hrs) $13.13 $13.13 * 25,000 $13.13 * 55,000

$3,28,125 $7,21,875

Machine Tasks (Machine hrs) $10.42 $10.42 * 70,000 $10.42 * 50,000

$7,29,167 $5,20,833

Equipment Setup (SetUps) $208.33 $208.33 * 900 $208.33 * 300

$1,87,500 $62,500

Purchasing Cost (Purchase

Orders) $666.67 $666.67*400 $666.67*500

$2,66,667 $3,33,333

Material Cost (Requisitions) $55.56 $55.56*2000 $55.56*2500

$1,11,111 $1,38,889

Computation of Per Unit Cost

Particulars Ridget Didget

Direct Material $40 $30

Direct Labour $20 $20

Manufacturing Overhead

$29.17/unit * 6 units $175.02

$29.17/unit * 2 units $58.34

Total $235.02 $108.34

b. i. Under ABC, the pre-determined overhead cost per transaction for each activity is as

below:

Pre-Determined Overhead Rate - Each Transaction

Activity Centre (Cost Driver) Cost (A) Total (B) Pre-Determined

Overhead rate (A/B)

Labor Tasks (Labor hrs) $10,50,000 80,000 $13.13

Machine Tasks (Machine hrs) $12,50,000 1,20,000 $10.42

Equipment Setup (SetUps) $2,50,000 1,200 $208.33

Purchasing Cost (Purchase Orders) $6,00,000 900 $666.67

Material Cost (Requisitions) $2,50,000 4,500 $55.56

Inspection (inspections) $1,00,000 9,000 $11.11

Total $35,00,000

ii. To compute the per unit cost, we will first have to compute the total overhead cost:

Total Overhead Amount to be Applied

Activity Centre (Cost Driver) Pre-Determined

Overhead rate Ridget (Total Cost) Didget (Total Cost)

Labor Tasks (Labor hrs) $13.13 $13.13 * 25,000 $13.13 * 55,000

$3,28,125 $7,21,875

Machine Tasks (Machine hrs) $10.42 $10.42 * 70,000 $10.42 * 50,000

$7,29,167 $5,20,833

Equipment Setup (SetUps) $208.33 $208.33 * 900 $208.33 * 300

$1,87,500 $62,500

Purchasing Cost (Purchase

Orders) $666.67 $666.67*400 $666.67*500

$2,66,667 $3,33,333

Material Cost (Requisitions) $55.56 $55.56*2000 $55.56*2500

$1,11,111 $1,38,889

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

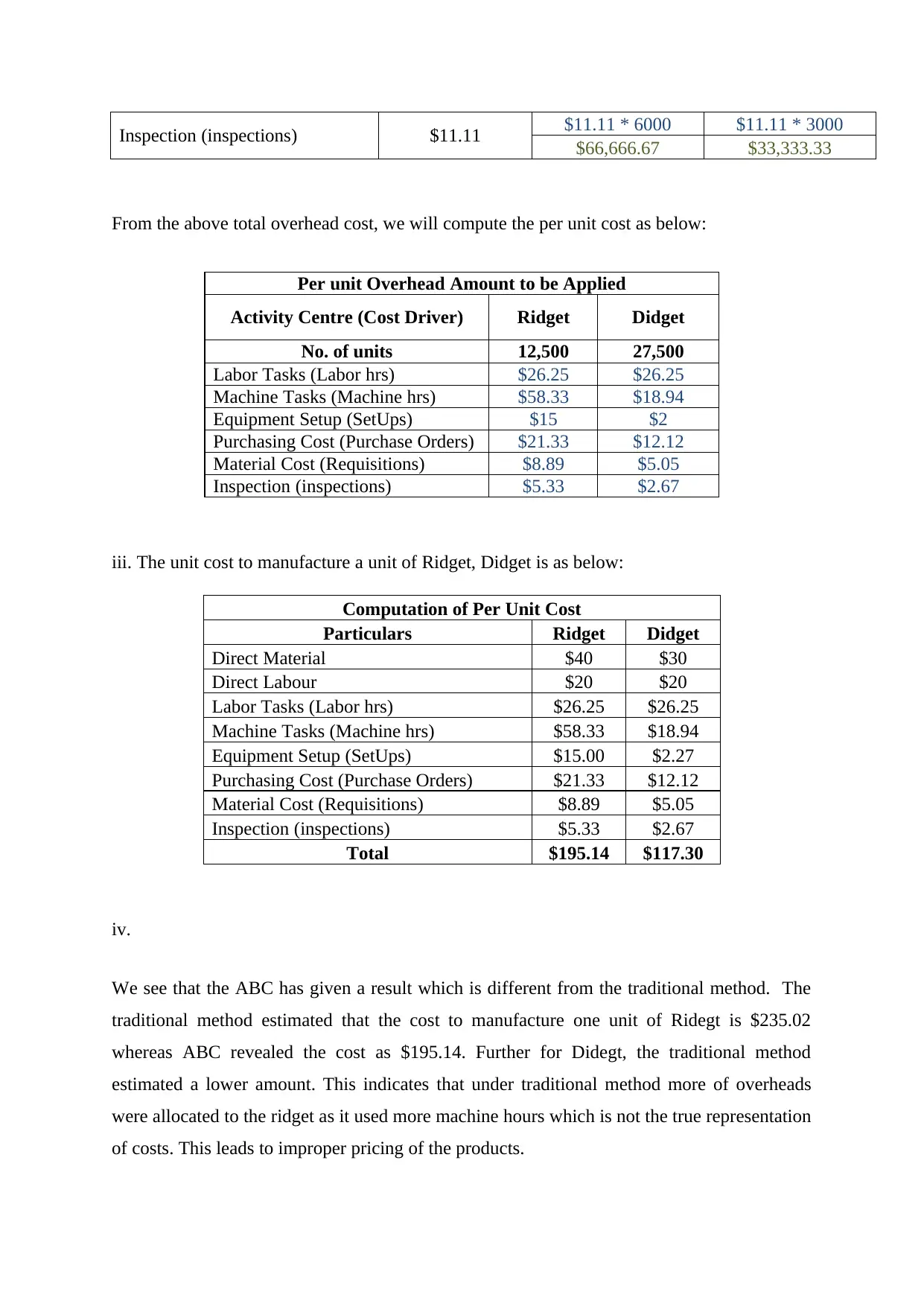

Inspection (inspections) $11.11 $11.11 * 6000 $11.11 * 3000

$66,666.67 $33,333.33

From the above total overhead cost, we will compute the per unit cost as below:

Per unit Overhead Amount to be Applied

Activity Centre (Cost Driver) Ridget Didget

No. of units 12,500 27,500

Labor Tasks (Labor hrs) $26.25 $26.25

Machine Tasks (Machine hrs) $58.33 $18.94

Equipment Setup (SetUps) $15 $2

Purchasing Cost (Purchase Orders) $21.33 $12.12

Material Cost (Requisitions) $8.89 $5.05

Inspection (inspections) $5.33 $2.67

iii. The unit cost to manufacture a unit of Ridget, Didget is as below:

Computation of Per Unit Cost

Particulars Ridget Didget

Direct Material $40 $30

Direct Labour $20 $20

Labor Tasks (Labor hrs) $26.25 $26.25

Machine Tasks (Machine hrs) $58.33 $18.94

Equipment Setup (SetUps) $15.00 $2.27

Purchasing Cost (Purchase Orders) $21.33 $12.12

Material Cost (Requisitions) $8.89 $5.05

Inspection (inspections) $5.33 $2.67

Total $195.14 $117.30

iv.

We see that the ABC has given a result which is different from the traditional method. The

traditional method estimated that the cost to manufacture one unit of Ridegt is $235.02

whereas ABC revealed the cost as $195.14. Further for Didegt, the traditional method

estimated a lower amount. This indicates that under traditional method more of overheads

were allocated to the ridget as it used more machine hours which is not the true representation

of costs. This leads to improper pricing of the products.

$66,666.67 $33,333.33

From the above total overhead cost, we will compute the per unit cost as below:

Per unit Overhead Amount to be Applied

Activity Centre (Cost Driver) Ridget Didget

No. of units 12,500 27,500

Labor Tasks (Labor hrs) $26.25 $26.25

Machine Tasks (Machine hrs) $58.33 $18.94

Equipment Setup (SetUps) $15 $2

Purchasing Cost (Purchase Orders) $21.33 $12.12

Material Cost (Requisitions) $8.89 $5.05

Inspection (inspections) $5.33 $2.67

iii. The unit cost to manufacture a unit of Ridget, Didget is as below:

Computation of Per Unit Cost

Particulars Ridget Didget

Direct Material $40 $30

Direct Labour $20 $20

Labor Tasks (Labor hrs) $26.25 $26.25

Machine Tasks (Machine hrs) $58.33 $18.94

Equipment Setup (SetUps) $15.00 $2.27

Purchasing Cost (Purchase Orders) $21.33 $12.12

Material Cost (Requisitions) $8.89 $5.05

Inspection (inspections) $5.33 $2.67

Total $195.14 $117.30

iv.

We see that the ABC has given a result which is different from the traditional method. The

traditional method estimated that the cost to manufacture one unit of Ridegt is $235.02

whereas ABC revealed the cost as $195.14. Further for Didegt, the traditional method

estimated a lower amount. This indicates that under traditional method more of overheads

were allocated to the ridget as it used more machine hours which is not the true representation

of costs. This leads to improper pricing of the products.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

ABC on the other hand, allocates the overheads on the basis of activities and their usage in

the departments.

The benefits of using ABC are as under:

a. It provides an accurate and reliable product costs by focusing on cause and effect

relationship (Agarwal, 2019).

b. It uses multiple cost drivers and allocates the cost basis the transactions per product

and not simply total volume. (Agarwal, 2019).

c. It is easy to understand and is helpful for institutions and companies in order to

identify activities and assign each cost for every activity thus giving accurate product

costs. (Ayres, 2019)

the departments.

The benefits of using ABC are as under:

a. It provides an accurate and reliable product costs by focusing on cause and effect

relationship (Agarwal, 2019).

b. It uses multiple cost drivers and allocates the cost basis the transactions per product

and not simply total volume. (Agarwal, 2019).

c. It is easy to understand and is helpful for institutions and companies in order to

identify activities and assign each cost for every activity thus giving accurate product

costs. (Ayres, 2019)

References

Agarwal, R. (2019). Advantages and Demerits of Activity Based Costing (ABC).

Your Article Library. Retrieved from

http://www.yourarticlelibrary.com/accounting/costing/advantages-and-

demerits-of-activity-based-costing-abc/52617 on 10 Apr. 2019.

Ayres, C. (2019). 8 Pros and Cons of Activity Based Costing. [Blog] Green

Garage. Retrieved from https://greengarageblog.org/8-pros-and-cons-of-

activity-based-costing on 10 Apr. 2019].

Agarwal, R. (2019). Advantages and Demerits of Activity Based Costing (ABC).

Your Article Library. Retrieved from

http://www.yourarticlelibrary.com/accounting/costing/advantages-and-

demerits-of-activity-based-costing-abc/52617 on 10 Apr. 2019.

Ayres, C. (2019). 8 Pros and Cons of Activity Based Costing. [Blog] Green

Garage. Retrieved from https://greengarageblog.org/8-pros-and-cons-of-

activity-based-costing on 10 Apr. 2019].

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 6

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.