PESTEL Analysis of TSB Bank PLC

VerifiedAdded on 2023/06/15

|15

|3859

|401

AI Summary

This report analyses the importance of PESTEL analysis for TSB Bank PLC and evaluates the external environmental forces of the firm. It conducts PESTEL analysis of TSB Bank PLC and discusses various political, environmental, technological, economic, political and social factors that positively or negatively affect its business.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Running head: BUSINESS ENVIRONMENT 0

Business Environment

TSB Bank PLC

Business Environment

TSB Bank PLC

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

BUSINESS ENVIRONMENT 1

Executive Summary

The aim of this report is to analyse the importance of PESTEL analysis which is a strategic

planning tool that assists marketers in analysing the external environment of an organisation.

The report analysed the history and organisational structure of TSB Bank PLC and examined

the relationship between Board of Director and employees, shareholders, and other members

of public who are affected by the actions of the firm. The report evaluated the purpose of

conducting PESTEL analysis for a business organisation which provided that it assist in

analysing the external factors that influence a firm’s business. The report conducted PESTEL

analysis of TSB Bank PLC and discussed various political, environmental, technological,

economic, political and social factors that positively or negatively affect its business.

Executive Summary

The aim of this report is to analyse the importance of PESTEL analysis which is a strategic

planning tool that assists marketers in analysing the external environment of an organisation.

The report analysed the history and organisational structure of TSB Bank PLC and examined

the relationship between Board of Director and employees, shareholders, and other members

of public who are affected by the actions of the firm. The report evaluated the purpose of

conducting PESTEL analysis for a business organisation which provided that it assist in

analysing the external factors that influence a firm’s business. The report conducted PESTEL

analysis of TSB Bank PLC and discussed various political, environmental, technological,

economic, political and social factors that positively or negatively affect its business.

BUSINESS ENVIRONMENT 2

Table of Contents

Introduction................................................................................................................................3

TSB Bank PLC...........................................................................................................................4

History....................................................................................................................................4

Organisational Structure.........................................................................................................4

How is the firm governed?.....................................................................................................5

Purpose of PESTEL Analysis....................................................................................................7

PESTEL of TSB Bank PLC.......................................................................................................8

Conclusion................................................................................................................................11

References................................................................................................................................12

Table of Contents

Introduction................................................................................................................................3

TSB Bank PLC...........................................................................................................................4

History....................................................................................................................................4

Organisational Structure.........................................................................................................4

How is the firm governed?.....................................................................................................5

Purpose of PESTEL Analysis....................................................................................................7

PESTEL of TSB Bank PLC.......................................................................................................8

Conclusion................................................................................................................................11

References................................................................................................................................12

BUSINESS ENVIRONMENT 3

Introduction

A PESTEL analysis is defined as a tool which is used by marketers in order to monitor and

evaluate macro-environment factors that influence a firm’s business. It is an analytical tool

which is used for strategic business planning by understanding different external factors that

influences a company’s business. PESTEL is an acronym for political, economic, social,

technological, environmental and legal environment that influence a firm’s business. This

report will analyse the corporate governance structure and management of TSB Bank PLC

and evaluate how it is governed. TSB Bank PLC was founded in 1985 as Trustee Savings

Bank PLC, and it is a subsidiary of Sabadell Group. The firm is a retailing and commercial

bank situated in the United Kingdom, and it operates a network of 550 branches across

different places of Scotland, Wales and England (TSB, 2018). This report will identify the

purpose of conducting PESTEL analysis for a business organisation. Further, the report will

examine the general external environmental forces of TSB Bank PLC by conducting PESTEL

analysis of the firm.

Introduction

A PESTEL analysis is defined as a tool which is used by marketers in order to monitor and

evaluate macro-environment factors that influence a firm’s business. It is an analytical tool

which is used for strategic business planning by understanding different external factors that

influences a company’s business. PESTEL is an acronym for political, economic, social,

technological, environmental and legal environment that influence a firm’s business. This

report will analyse the corporate governance structure and management of TSB Bank PLC

and evaluate how it is governed. TSB Bank PLC was founded in 1985 as Trustee Savings

Bank PLC, and it is a subsidiary of Sabadell Group. The firm is a retailing and commercial

bank situated in the United Kingdom, and it operates a network of 550 branches across

different places of Scotland, Wales and England (TSB, 2018). This report will identify the

purpose of conducting PESTEL analysis for a business organisation. Further, the report will

examine the general external environmental forces of TSB Bank PLC by conducting PESTEL

analysis of the firm.

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

BUSINESS ENVIRONMENT 4

TSB Bank PLC

The headquarters of TSB Bank PLC is situated in Edinburgh, Scotland, UK and it provides

its services across the UK through its 550 branches which are situated in different areas of

England, Wales and Scotland. The company operates in Territory sector, and it provides its

services to more than 4.5 million customers (TSB, 2014).

History

The firm was founded on 27th November 1985 as Trustee Savings Bank, and it merged with

Lloyds Bank in 1995 which formed Lloyds TSB in 1999. On 9th September 2013, the

enterprise reregistered itself under the name of ‘TSB Bank PLC’. In 2014, the parent

company called TSB Banking Group was registered in England and the same year it ended its

relationship with Lloyds Banking Group (Simon, 2013).

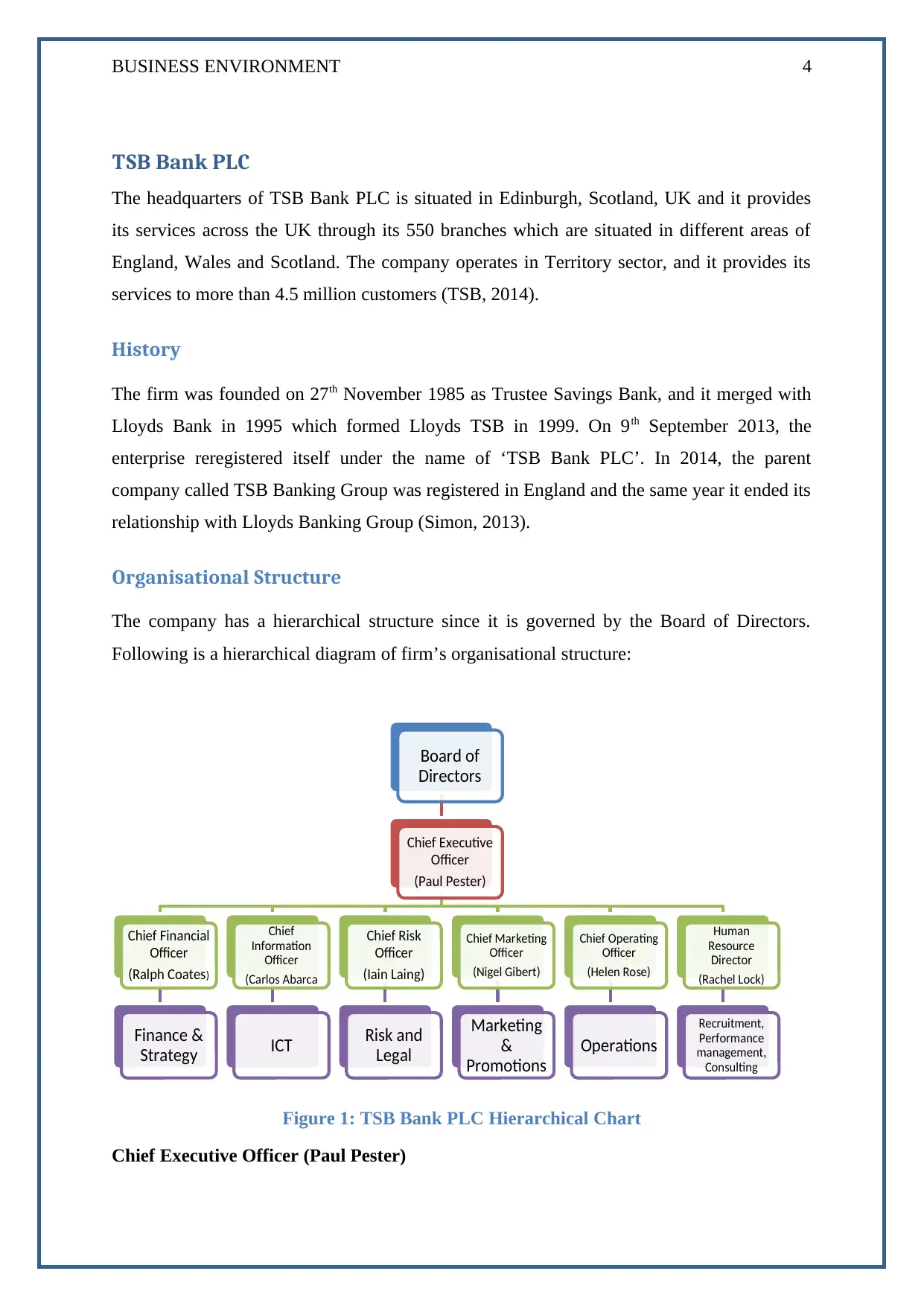

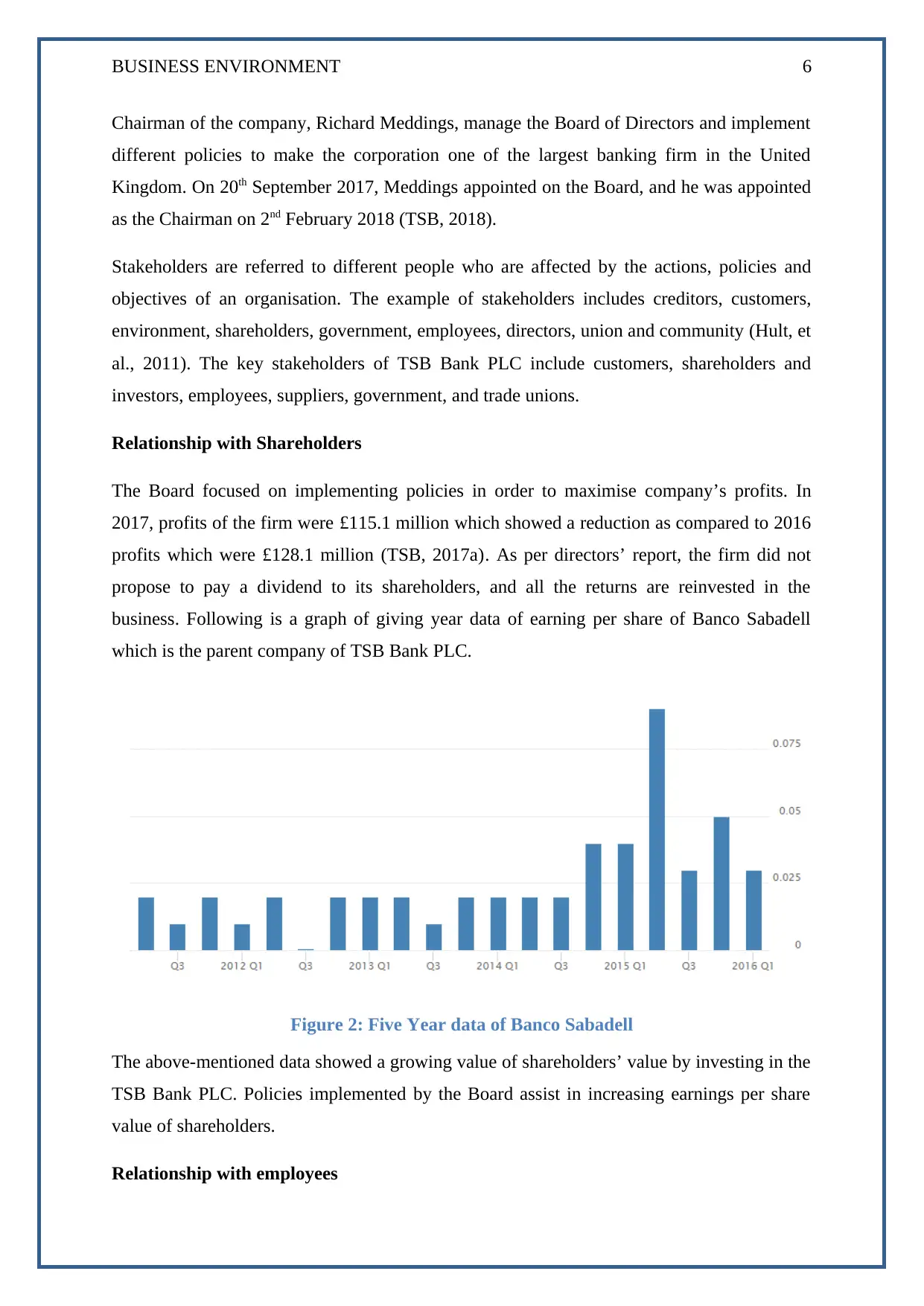

Organisational Structure

The company has a hierarchical structure since it is governed by the Board of Directors.

Following is a hierarchical diagram of firm’s organisational structure:

Figure 1: TSB Bank PLC Hierarchical Chart

Chief Executive Officer (Paul Pester)

Board of

Directors

Chief Executive

Officer

(Paul Pester)

Chief Financial

Officer

(Ralph Coates )

Finance &

Strategy

Chief

Information

Officer

(Carlos Abarca

ICT

Chief Risk

Officer

(Iain Laing)

Risk and

Legal

Chief Marketing

Officer

(Nigel Gibert)

Marketing

&

Promotions

Chief Operating

Officer

(Helen Rose)

Operations

Human

Resource

Director

(Rachel Lock)

Recruitment,

Performance

management,

Consulting

TSB Bank PLC

The headquarters of TSB Bank PLC is situated in Edinburgh, Scotland, UK and it provides

its services across the UK through its 550 branches which are situated in different areas of

England, Wales and Scotland. The company operates in Territory sector, and it provides its

services to more than 4.5 million customers (TSB, 2014).

History

The firm was founded on 27th November 1985 as Trustee Savings Bank, and it merged with

Lloyds Bank in 1995 which formed Lloyds TSB in 1999. On 9th September 2013, the

enterprise reregistered itself under the name of ‘TSB Bank PLC’. In 2014, the parent

company called TSB Banking Group was registered in England and the same year it ended its

relationship with Lloyds Banking Group (Simon, 2013).

Organisational Structure

The company has a hierarchical structure since it is governed by the Board of Directors.

Following is a hierarchical diagram of firm’s organisational structure:

Figure 1: TSB Bank PLC Hierarchical Chart

Chief Executive Officer (Paul Pester)

Board of

Directors

Chief Executive

Officer

(Paul Pester)

Chief Financial

Officer

(Ralph Coates )

Finance &

Strategy

Chief

Information

Officer

(Carlos Abarca

ICT

Chief Risk

Officer

(Iain Laing)

Risk and

Legal

Chief Marketing

Officer

(Nigel Gibert)

Marketing

&

Promotions

Chief Operating

Officer

(Helen Rose)

Operations

Human

Resource

Director

(Rachel Lock)

Recruitment,

Performance

management,

Consulting

BUSINESS ENVIRONMENT 5

On 31st January 2014, Pester was appointed as an Executive Director of the firm. Previously,

Pester had an experience of working with first Group CEO of Virgin Money, and he had also

worked in management consulting (TSB, 2018c). He is responsible for performing actions

related to corporate social responsibility, audit, risk management, business development and

others.

Chief Financial Officer (Ralph Coates)

Coates was appointed on 1st July 2016, and he previously worked with PwC or

PricewaterhouseCoopers as a Chartered Accountant. He is responsible for performing

controllership duties which makes him responsible for providing accurate and timely

financial information of the firm (TSB, 2018c).

Chief Information Officer (Carlos Abarca)

Abarca is responsible for performing managing information technology and computer system

in the firm in order to ensure that the data of the company and clients are safe.

Chief Marketing Officer (Nigel Gilbert)

Gilbert is responsible for overseeing and ensuring that the activities relating to planning,

development and implementation of the marketing strategy of the enterprise.

Chief Operating Officer (Helen Rose)

Rose handles daily operations of the company and provides routine reports to the CEO. She is

second in command at the corporation, and she ensures that daily operations are running

smoothly and the firm is focusing towards achieving its organisational goals.

Human Resource Director (Rachel Lock)

The HR director ensures that functions of human resource department are running smoothly,

and she supervises other operations regarding staffing compensation, budget, plans, benefits

and training and development.

How is the firm governed?

The corporation has a hierarchical organisational structure since it is governed by the Board

of Directors. There are nine members included in the Board of the firm in which six

independent non-executive directors, one group COO, one group CFO and a Chairman. The

On 31st January 2014, Pester was appointed as an Executive Director of the firm. Previously,

Pester had an experience of working with first Group CEO of Virgin Money, and he had also

worked in management consulting (TSB, 2018c). He is responsible for performing actions

related to corporate social responsibility, audit, risk management, business development and

others.

Chief Financial Officer (Ralph Coates)

Coates was appointed on 1st July 2016, and he previously worked with PwC or

PricewaterhouseCoopers as a Chartered Accountant. He is responsible for performing

controllership duties which makes him responsible for providing accurate and timely

financial information of the firm (TSB, 2018c).

Chief Information Officer (Carlos Abarca)

Abarca is responsible for performing managing information technology and computer system

in the firm in order to ensure that the data of the company and clients are safe.

Chief Marketing Officer (Nigel Gilbert)

Gilbert is responsible for overseeing and ensuring that the activities relating to planning,

development and implementation of the marketing strategy of the enterprise.

Chief Operating Officer (Helen Rose)

Rose handles daily operations of the company and provides routine reports to the CEO. She is

second in command at the corporation, and she ensures that daily operations are running

smoothly and the firm is focusing towards achieving its organisational goals.

Human Resource Director (Rachel Lock)

The HR director ensures that functions of human resource department are running smoothly,

and she supervises other operations regarding staffing compensation, budget, plans, benefits

and training and development.

How is the firm governed?

The corporation has a hierarchical organisational structure since it is governed by the Board

of Directors. There are nine members included in the Board of the firm in which six

independent non-executive directors, one group COO, one group CFO and a Chairman. The

BUSINESS ENVIRONMENT 6

Chairman of the company, Richard Meddings, manage the Board of Directors and implement

different policies to make the corporation one of the largest banking firm in the United

Kingdom. On 20th September 2017, Meddings appointed on the Board, and he was appointed

as the Chairman on 2nd February 2018 (TSB, 2018).

Stakeholders are referred to different people who are affected by the actions, policies and

objectives of an organisation. The example of stakeholders includes creditors, customers,

environment, shareholders, government, employees, directors, union and community (Hult, et

al., 2011). The key stakeholders of TSB Bank PLC include customers, shareholders and

investors, employees, suppliers, government, and trade unions.

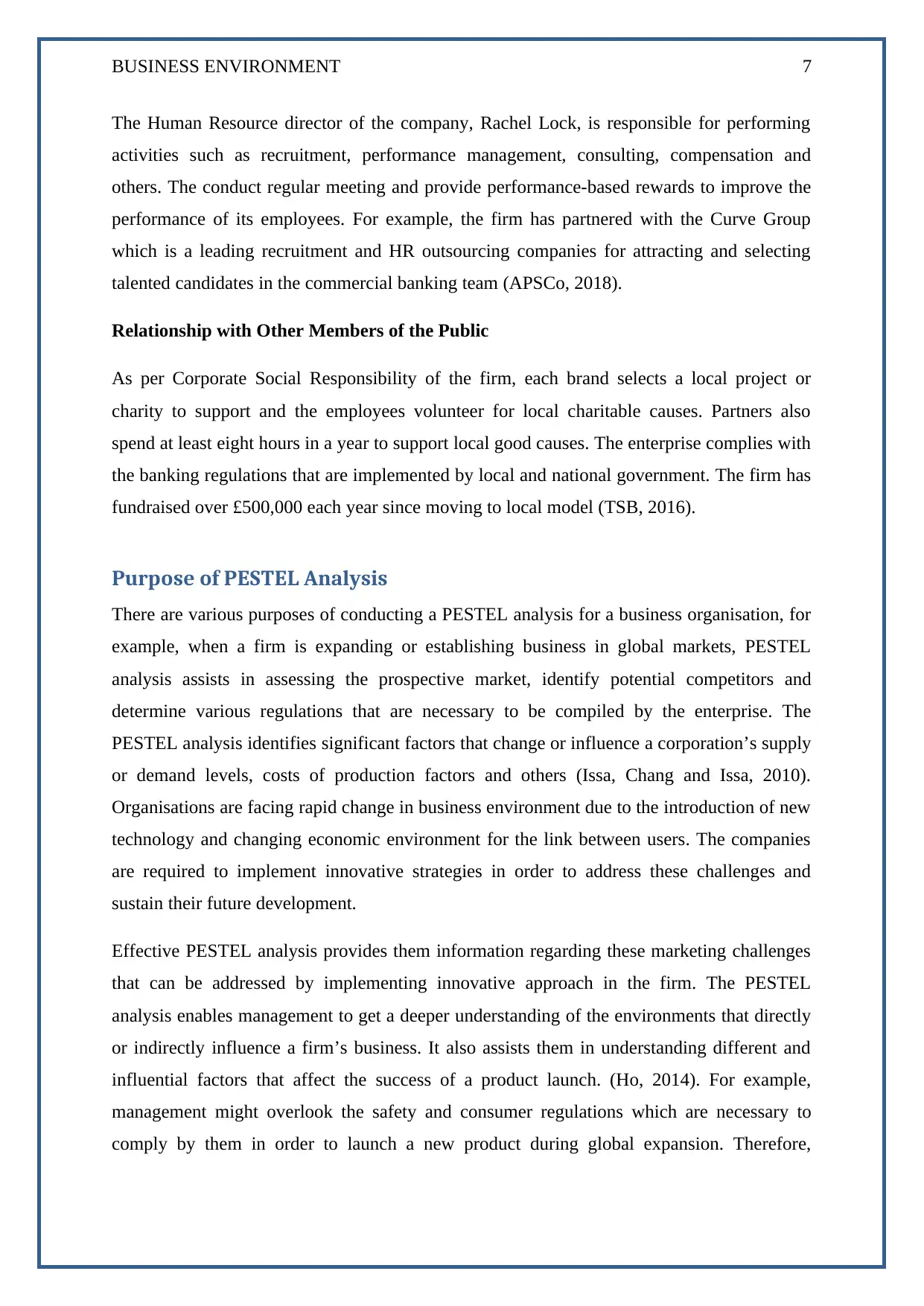

Relationship with Shareholders

The Board focused on implementing policies in order to maximise company’s profits. In

2017, profits of the firm were £115.1 million which showed a reduction as compared to 2016

profits which were £128.1 million (TSB, 2017a). As per directors’ report, the firm did not

propose to pay a dividend to its shareholders, and all the returns are reinvested in the

business. Following is a graph of giving year data of earning per share of Banco Sabadell

which is the parent company of TSB Bank PLC.

Figure 2: Five Year data of Banco Sabadell

The above-mentioned data showed a growing value of shareholders’ value by investing in the

TSB Bank PLC. Policies implemented by the Board assist in increasing earnings per share

value of shareholders.

Relationship with employees

Chairman of the company, Richard Meddings, manage the Board of Directors and implement

different policies to make the corporation one of the largest banking firm in the United

Kingdom. On 20th September 2017, Meddings appointed on the Board, and he was appointed

as the Chairman on 2nd February 2018 (TSB, 2018).

Stakeholders are referred to different people who are affected by the actions, policies and

objectives of an organisation. The example of stakeholders includes creditors, customers,

environment, shareholders, government, employees, directors, union and community (Hult, et

al., 2011). The key stakeholders of TSB Bank PLC include customers, shareholders and

investors, employees, suppliers, government, and trade unions.

Relationship with Shareholders

The Board focused on implementing policies in order to maximise company’s profits. In

2017, profits of the firm were £115.1 million which showed a reduction as compared to 2016

profits which were £128.1 million (TSB, 2017a). As per directors’ report, the firm did not

propose to pay a dividend to its shareholders, and all the returns are reinvested in the

business. Following is a graph of giving year data of earning per share of Banco Sabadell

which is the parent company of TSB Bank PLC.

Figure 2: Five Year data of Banco Sabadell

The above-mentioned data showed a growing value of shareholders’ value by investing in the

TSB Bank PLC. Policies implemented by the Board assist in increasing earnings per share

value of shareholders.

Relationship with employees

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

BUSINESS ENVIRONMENT 7

The Human Resource director of the company, Rachel Lock, is responsible for performing

activities such as recruitment, performance management, consulting, compensation and

others. The conduct regular meeting and provide performance-based rewards to improve the

performance of its employees. For example, the firm has partnered with the Curve Group

which is a leading recruitment and HR outsourcing companies for attracting and selecting

talented candidates in the commercial banking team (APSCo, 2018).

Relationship with Other Members of the Public

As per Corporate Social Responsibility of the firm, each brand selects a local project or

charity to support and the employees volunteer for local charitable causes. Partners also

spend at least eight hours in a year to support local good causes. The enterprise complies with

the banking regulations that are implemented by local and national government. The firm has

fundraised over £500,000 each year since moving to local model (TSB, 2016).

Purpose of PESTEL Analysis

There are various purposes of conducting a PESTEL analysis for a business organisation, for

example, when a firm is expanding or establishing business in global markets, PESTEL

analysis assists in assessing the prospective market, identify potential competitors and

determine various regulations that are necessary to be compiled by the enterprise. The

PESTEL analysis identifies significant factors that change or influence a corporation’s supply

or demand levels, costs of production factors and others (Issa, Chang and Issa, 2010).

Organisations are facing rapid change in business environment due to the introduction of new

technology and changing economic environment for the link between users. The companies

are required to implement innovative strategies in order to address these challenges and

sustain their future development.

Effective PESTEL analysis provides them information regarding these marketing challenges

that can be addressed by implementing innovative approach in the firm. The PESTEL

analysis enables management to get a deeper understanding of the environments that directly

or indirectly influence a firm’s business. It also assists them in understanding different and

influential factors that affect the success of a product launch. (Ho, 2014). For example,

management might overlook the safety and consumer regulations which are necessary to

comply by them in order to launch a new product during global expansion. Therefore,

The Human Resource director of the company, Rachel Lock, is responsible for performing

activities such as recruitment, performance management, consulting, compensation and

others. The conduct regular meeting and provide performance-based rewards to improve the

performance of its employees. For example, the firm has partnered with the Curve Group

which is a leading recruitment and HR outsourcing companies for attracting and selecting

talented candidates in the commercial banking team (APSCo, 2018).

Relationship with Other Members of the Public

As per Corporate Social Responsibility of the firm, each brand selects a local project or

charity to support and the employees volunteer for local charitable causes. Partners also

spend at least eight hours in a year to support local good causes. The enterprise complies with

the banking regulations that are implemented by local and national government. The firm has

fundraised over £500,000 each year since moving to local model (TSB, 2016).

Purpose of PESTEL Analysis

There are various purposes of conducting a PESTEL analysis for a business organisation, for

example, when a firm is expanding or establishing business in global markets, PESTEL

analysis assists in assessing the prospective market, identify potential competitors and

determine various regulations that are necessary to be compiled by the enterprise. The

PESTEL analysis identifies significant factors that change or influence a corporation’s supply

or demand levels, costs of production factors and others (Issa, Chang and Issa, 2010).

Organisations are facing rapid change in business environment due to the introduction of new

technology and changing economic environment for the link between users. The companies

are required to implement innovative strategies in order to address these challenges and

sustain their future development.

Effective PESTEL analysis provides them information regarding these marketing challenges

that can be addressed by implementing innovative approach in the firm. The PESTEL

analysis enables management to get a deeper understanding of the environments that directly

or indirectly influence a firm’s business. It also assists them in understanding different and

influential factors that affect the success of a product launch. (Ho, 2014). For example,

management might overlook the safety and consumer regulations which are necessary to

comply by them in order to launch a new product during global expansion. Therefore,

BUSINESS ENVIRONMENT 8

developing alertness in the business is another key purpose of conducting PESTEL analysis

for a business organisation.

PESTEL of TSB Bank PLC

Political Factors

TSB Bank PLC face a challenging political environment in the United Kingdom as its

business is characterised by new regulatory capital rules such as UK Banking reform Act and

EU Bank Recovery and Resolution. The new laws implemented by the state and national

government affects the business of TSB Bank PLC in the banking sector. For example, Brexit

has impacted TSB’s strategy and customers, and it has created various risks for the enterprise.

The firm faces difficulties if it wanted to expand its business in European markets due to

Brexit. The regulations implemented by the government have a substantial effect on the

business of TSB Bank PLC, and it focuses on forecasting the next governmental change. The

government changes regulations in the banking industry which are required to be followed by

the management of TSB. For example, the eight percent surcharge levied by the government

on the profits excess £25 million on banking corporations in the UK has a negative impact on

company’s profits (TSB, 2017).

Economic Factors

Due to Brexit, TSB Bank PLC face various economic risks relating to operations, regulations,

impact on clients, customers and employees, and negative consequences for capital. In the

short term, Brexit did not have a substantial impact on the financial position of TSB Bank

PLC, but in the long run, the firm might face difficulties due to high rate of inflation. The

decline in the exchange rate of pound can have a potentially negative impact on firm’s

capital. In 2016, the Bank of England has reduced the base rate for banking corporations from

0.5 percent to a record low of 0.25 percent (Partington, 2017). The bank changed the interest

rate due to the negative impact of Brexit. A low-interest rate negatively affects a banking

firm’s ability to generate profits, and it reduces its profitability. On the other hand, in the final

quarter of 2017, the UK economy grew just by 0.6 percent which was slowdown due to

Brexit (Partington and Elliott, 2018). High rate of inflation has a negative impact on banking

organisations as well. Inflation has a negative impact on currency and its value which

resulted in causing instability. Foreign investors did not prefer to invest in a country which

has a high currency value. The exchange rate of currency also affect banks situated in the UK

developing alertness in the business is another key purpose of conducting PESTEL analysis

for a business organisation.

PESTEL of TSB Bank PLC

Political Factors

TSB Bank PLC face a challenging political environment in the United Kingdom as its

business is characterised by new regulatory capital rules such as UK Banking reform Act and

EU Bank Recovery and Resolution. The new laws implemented by the state and national

government affects the business of TSB Bank PLC in the banking sector. For example, Brexit

has impacted TSB’s strategy and customers, and it has created various risks for the enterprise.

The firm faces difficulties if it wanted to expand its business in European markets due to

Brexit. The regulations implemented by the government have a substantial effect on the

business of TSB Bank PLC, and it focuses on forecasting the next governmental change. The

government changes regulations in the banking industry which are required to be followed by

the management of TSB. For example, the eight percent surcharge levied by the government

on the profits excess £25 million on banking corporations in the UK has a negative impact on

company’s profits (TSB, 2017).

Economic Factors

Due to Brexit, TSB Bank PLC face various economic risks relating to operations, regulations,

impact on clients, customers and employees, and negative consequences for capital. In the

short term, Brexit did not have a substantial impact on the financial position of TSB Bank

PLC, but in the long run, the firm might face difficulties due to high rate of inflation. The

decline in the exchange rate of pound can have a potentially negative impact on firm’s

capital. In 2016, the Bank of England has reduced the base rate for banking corporations from

0.5 percent to a record low of 0.25 percent (Partington, 2017). The bank changed the interest

rate due to the negative impact of Brexit. A low-interest rate negatively affects a banking

firm’s ability to generate profits, and it reduces its profitability. On the other hand, in the final

quarter of 2017, the UK economy grew just by 0.6 percent which was slowdown due to

Brexit (Partington and Elliott, 2018). High rate of inflation has a negative impact on banking

organisations as well. Inflation has a negative impact on currency and its value which

resulted in causing instability. Foreign investors did not prefer to invest in a country which

has a high currency value. The exchange rate of currency also affect banks situated in the UK

BUSINESS ENVIRONMENT 9

since currencies such as US dollar influence spending habits, inflation rates and currencies

value in the country.

Socio-cultural Factors

The way people live their lives has a substantial impact on the decision of banking firms. Any

change in lifestyle, social mobility, labour composition, fashion or other demographic trends

has a potential to influence banking companies. TSB Bank PLC requires implementing

innovative approach in order to address the issues faced by them due to rapidly changing

socio-cultural factors. For example, the population of the United Kingdom is ageing which

creates various potential business opportunities for TSB Bank PLC. Currently, the median

age in the UK is 40 years which has grown from 33.9 years in 1974 (Office of National

Statistics, 2016). Further, many studies have provided that the number of 55-64 years old

people will double by 2019 in the UK. The ageing population provide a significant business

opportunity to TSB Bank PLC as pension age of customers generate an earning and have a

higher disposable income. The firm is shifting its focus towards providing savings, wealth

management and investment facilities to its customers as their behaviour changes. Migration

is another crucial factor for TSB Bank PLC as more than half (55 percent) of the growth in

the UK population between 1991 and 2016 has resulted due to migration (Migration

Observatory, 2018). In order to find illegal immigrants, UK banks are required to check more

than 70 million accounts (Travis, 2017).

Technological Factors

The continuous and rapidly changing has a substantial impact on the business of TSB Bank

PLC. The firm faces several potential opportunities and threats due to the advancement of

technology. Most banks provide their services through the internet for convenience of their

customers, but, it increases the risk of cybersecurity attacks. TSB has to ensure that it

implements the latest cybersecurity programs in order to protect company’s and customers’

data from hacking which increase their overall costs. Innovation assists in providing

technological solutions of banking enterprises which resulted in improving their services and

security. Financial innovations such as FinTech companies are able to prove banking

facilities to their customers through modern ways (Dapp, et al., 2014). The traditional

methods of financial services have changed with the introduction of smartphones, mobile

banking, cryptocurrency and online investing services. These factors provide various

opportunities to banking organisation in order to expand their business and increase the

since currencies such as US dollar influence spending habits, inflation rates and currencies

value in the country.

Socio-cultural Factors

The way people live their lives has a substantial impact on the decision of banking firms. Any

change in lifestyle, social mobility, labour composition, fashion or other demographic trends

has a potential to influence banking companies. TSB Bank PLC requires implementing

innovative approach in order to address the issues faced by them due to rapidly changing

socio-cultural factors. For example, the population of the United Kingdom is ageing which

creates various potential business opportunities for TSB Bank PLC. Currently, the median

age in the UK is 40 years which has grown from 33.9 years in 1974 (Office of National

Statistics, 2016). Further, many studies have provided that the number of 55-64 years old

people will double by 2019 in the UK. The ageing population provide a significant business

opportunity to TSB Bank PLC as pension age of customers generate an earning and have a

higher disposable income. The firm is shifting its focus towards providing savings, wealth

management and investment facilities to its customers as their behaviour changes. Migration

is another crucial factor for TSB Bank PLC as more than half (55 percent) of the growth in

the UK population between 1991 and 2016 has resulted due to migration (Migration

Observatory, 2018). In order to find illegal immigrants, UK banks are required to check more

than 70 million accounts (Travis, 2017).

Technological Factors

The continuous and rapidly changing has a substantial impact on the business of TSB Bank

PLC. The firm faces several potential opportunities and threats due to the advancement of

technology. Most banks provide their services through the internet for convenience of their

customers, but, it increases the risk of cybersecurity attacks. TSB has to ensure that it

implements the latest cybersecurity programs in order to protect company’s and customers’

data from hacking which increase their overall costs. Innovation assists in providing

technological solutions of banking enterprises which resulted in improving their services and

security. Financial innovations such as FinTech companies are able to prove banking

facilities to their customers through modern ways (Dapp, et al., 2014). The traditional

methods of financial services have changed with the introduction of smartphones, mobile

banking, cryptocurrency and online investing services. These factors provide various

opportunities to banking organisation in order to expand their business and increase the

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

BUSINESS ENVIRONMENT 10

number of customers. The Security Operations Centre (SOC) of the firm focuses on

protecting the company’s data from cyber-attacks.

Environmental Factors

The awareness regarding environment protection is growing between modern companies, and

they focus on implementing innovative policies to reduce their carbon footprint and protect

environmental resources. TSB Bank PLC use innovative approach to establishing energy

efficient operations and using renewable energy in order to reduce their carbon footprint and

improve their overall operations. As per regulations implemented by the UK government,

GHG (Greenhouse Gas) and environmental reporting are mandatory for corporations situated

in the United Kingdom, including banking (CDSB, 2018). Therefore, TSB Bank PLC also

have to mandatory provided GHG and environmental reporting to the government which

require them to implement appropriate policies for reducing their carbon footprint.

Legal Factors

In recent years, there have been a number of significant changes in the legal environment in

the UK which affects TSB’s behaviour. For example, introduction of age and disability

discrimination require the corporation to improve their HR policies for the requirement for

avoiding discrimination. Legal changes also have an impact on company’s costs; for

example, they are required to implement new systems or procedures as per legal requirements

(Yuksel, 2012). Another example is while providing online financial services to customers;

the firm is required to comply with the provisions of Consumer law which protect customers

from any fraud or unfair trade practices. Similarly, TSB has to comply with Employment

Law in order to ensure that it complies with different regulations relating to dismissal,

redundancy, minimum wage and working hours. Any changes in law have a substantial

impact on company’s operations, for example, the Banking Regulations in the United

Kingdom changed after Brexit which influence the business of TSB.

number of customers. The Security Operations Centre (SOC) of the firm focuses on

protecting the company’s data from cyber-attacks.

Environmental Factors

The awareness regarding environment protection is growing between modern companies, and

they focus on implementing innovative policies to reduce their carbon footprint and protect

environmental resources. TSB Bank PLC use innovative approach to establishing energy

efficient operations and using renewable energy in order to reduce their carbon footprint and

improve their overall operations. As per regulations implemented by the UK government,

GHG (Greenhouse Gas) and environmental reporting are mandatory for corporations situated

in the United Kingdom, including banking (CDSB, 2018). Therefore, TSB Bank PLC also

have to mandatory provided GHG and environmental reporting to the government which

require them to implement appropriate policies for reducing their carbon footprint.

Legal Factors

In recent years, there have been a number of significant changes in the legal environment in

the UK which affects TSB’s behaviour. For example, introduction of age and disability

discrimination require the corporation to improve their HR policies for the requirement for

avoiding discrimination. Legal changes also have an impact on company’s costs; for

example, they are required to implement new systems or procedures as per legal requirements

(Yuksel, 2012). Another example is while providing online financial services to customers;

the firm is required to comply with the provisions of Consumer law which protect customers

from any fraud or unfair trade practices. Similarly, TSB has to comply with Employment

Law in order to ensure that it complies with different regulations relating to dismissal,

redundancy, minimum wage and working hours. Any changes in law have a substantial

impact on company’s operations, for example, the Banking Regulations in the United

Kingdom changed after Brexit which influence the business of TSB.

BUSINESS ENVIRONMENT 11

Conclusion

In conclusion, the PESTEL analysis is a strategic tool which is used by marketers in order to

evaluate and analyse the external factors which influence a firm’s business. The report

analysed the example of TSB Bank PLC to conduct a PESTEL analysis. The organisational

structure of TSB Bank PLC is hierarchical since it is governed by the Board of Directors. The

executive officers of TSB are responsible for managing and performing daily operations

whereas the directors implement policies for sustaining the future of the enterprise. The

Board maintained a relationship with different stakeholders by implementing different

policies such as establishing training and development program for employees, funding local

charities, complying with government regulations and others. The main purpose of PESTEL

analysis is that it provides necessary information to corporation regarding their external

environment which assists them in formulating appropriate policies to address such

challenges. PESTEL analysis of TSB Bank PLC is conducted above which provide different

challenges and opportunities faced by the enterprise such as cybersecurity risks, change in

government policies, ageing population, and others.

Conclusion

In conclusion, the PESTEL analysis is a strategic tool which is used by marketers in order to

evaluate and analyse the external factors which influence a firm’s business. The report

analysed the example of TSB Bank PLC to conduct a PESTEL analysis. The organisational

structure of TSB Bank PLC is hierarchical since it is governed by the Board of Directors. The

executive officers of TSB are responsible for managing and performing daily operations

whereas the directors implement policies for sustaining the future of the enterprise. The

Board maintained a relationship with different stakeholders by implementing different

policies such as establishing training and development program for employees, funding local

charities, complying with government regulations and others. The main purpose of PESTEL

analysis is that it provides necessary information to corporation regarding their external

environment which assists them in formulating appropriate policies to address such

challenges. PESTEL analysis of TSB Bank PLC is conducted above which provide different

challenges and opportunities faced by the enterprise such as cybersecurity risks, change in

government policies, ageing population, and others.

BUSINESS ENVIRONMENT 12

References

APSCo. (2018) TSB Bank Plc Appoints The Curve Group to Support the Build of TSB’s New

Commercial Banking Arm. [Online] APSCo. Available at: http://apsco.org/article/tsb-bank-

plc-appoints-the-curve-group-to-support-the-build-of-ts-3492.aspx [Accessed 28 February

2018].

CDSB. (2018) UK mandatory GHG and environmental reporting. [Online] CDSB. Available

at: https://www.cdsb.net/what-we-do/reporting-policy/uk-mandatory-ghg-reporting-qa

[Accessed 28 February 2018].

Dapp, T., Slomka, L., AG, D.B. and Hoffmann, R. (2014) Fintech–The digital (r) evolution in

the financial sector. Deutsche Bank Research”, Frankfurt am Main.

Global Legal Insights. (2017) Banking Regulation 2017. [Online] Global Legal Insights.

Available at: https://www.globallegalinsights.com/practice-areas/banking-and-finance/global-

legal-insights---banking-regulation-4th-ed./united-kingdom [Accessed 28 February 2018].

Ho, J.K.K. (2014) Formulation of a systemic PEST analysis for strategic analysis. European

academic research, 2(5), pp.6478-6492.

Hult, G.T.M., Mena, J.A., Ferrell, O.C. and Ferrell, L. (2011) Stakeholder marketing: a

definition and conceptual framework. AMS review, 1(1), pp.44-65.

Issa, T., Chang, V. and Issa, T. (2010) Sustainable business strategies and PESTEL

framework. GSTF International Journal on Computing, 1(1), pp.73-80.

Migration Observatory. (2018) The Impact of Migration on UK Population Growth. [Online]

Migration Observatory. Available at:

http://www.migrationobservatory.ox.ac.uk/resources/briefings/the-impact-of-migration-on-

uk-population-growth/ [Accessed 28 February 2018].

Office for National Statistics. (2016) Overview of the UK population: February 2016.

[Online] Office of National Statistics. Available at:

https://www.ons.gov.uk/peoplepopulationandcommunity/populationandmigration/

populationestimates/articles/overviewoftheukpopulation/february2016 [Accessed 28

February 2018].

References

APSCo. (2018) TSB Bank Plc Appoints The Curve Group to Support the Build of TSB’s New

Commercial Banking Arm. [Online] APSCo. Available at: http://apsco.org/article/tsb-bank-

plc-appoints-the-curve-group-to-support-the-build-of-ts-3492.aspx [Accessed 28 February

2018].

CDSB. (2018) UK mandatory GHG and environmental reporting. [Online] CDSB. Available

at: https://www.cdsb.net/what-we-do/reporting-policy/uk-mandatory-ghg-reporting-qa

[Accessed 28 February 2018].

Dapp, T., Slomka, L., AG, D.B. and Hoffmann, R. (2014) Fintech–The digital (r) evolution in

the financial sector. Deutsche Bank Research”, Frankfurt am Main.

Global Legal Insights. (2017) Banking Regulation 2017. [Online] Global Legal Insights.

Available at: https://www.globallegalinsights.com/practice-areas/banking-and-finance/global-

legal-insights---banking-regulation-4th-ed./united-kingdom [Accessed 28 February 2018].

Ho, J.K.K. (2014) Formulation of a systemic PEST analysis for strategic analysis. European

academic research, 2(5), pp.6478-6492.

Hult, G.T.M., Mena, J.A., Ferrell, O.C. and Ferrell, L. (2011) Stakeholder marketing: a

definition and conceptual framework. AMS review, 1(1), pp.44-65.

Issa, T., Chang, V. and Issa, T. (2010) Sustainable business strategies and PESTEL

framework. GSTF International Journal on Computing, 1(1), pp.73-80.

Migration Observatory. (2018) The Impact of Migration on UK Population Growth. [Online]

Migration Observatory. Available at:

http://www.migrationobservatory.ox.ac.uk/resources/briefings/the-impact-of-migration-on-

uk-population-growth/ [Accessed 28 February 2018].

Office for National Statistics. (2016) Overview of the UK population: February 2016.

[Online] Office of National Statistics. Available at:

https://www.ons.gov.uk/peoplepopulationandcommunity/populationandmigration/

populationestimates/articles/overviewoftheukpopulation/february2016 [Accessed 28

February 2018].

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

BUSINESS ENVIRONMENT 13

Partington, R. (2017) UK interest rates stay at 0.25% but Bank of England hints rise is

looming. [Online] The Guardian. Available at:

https://www.theguardian.com/business/2017/sep/14/uk-interest-rates-bank-of-england-mpc-

inflation [Accessed 28 February 2018].

Partington, R. and Elliott, L. (2018) UK economy grew by 0.6% in final quarter of 2017, says

thinktank. [Online] The Guardian. Available at:

https://www.theguardian.com/business/2018/jan/10/uk-manufacturing-output-rises-eighth-

month-in-row [Accessed 28 February 2018].

Simon, E. (2013) The TSB: the history of a new bank with an old name. [Online] The

Telegraph. Available at:

http://www.telegraph.co.uk/finance/personalfinance/bank-accounts/10015854/The-TSB-the-

history-of-a-new-bank-with-an-old-name.html [Accessed 28 February 2018].

Trading Economics. (2018) Banco Sabadell | EPS Earnings Per Share. [Online] Trading

Economics. Available at: https://tradingeconomics.com/sab:sm:eps [Accessed 28 February

2018].

TSB. (2014) News Releases. [Online] TSB. Available at: https://www.tsb.co.uk/news-

releases/tsb-launches-fix-and-flex-mortgage/ [Accessed 28 February 2018].

TSB. (2016) News Releases. [Online] TSB. Available at: https://www.tsb.co.uk/news-

releases/your-local-charity-is-struggling-to-get-its-voice-heard/ [Accessed 28 February

2018].

TSB. (2017a) Annual Report and Accounts 2017. [PDF] TSB. Available at:

https://www.tsb.co.uk/investors/results-reports/tsb-bank-annual-report-2017.pdf [Accessed

28 February 2018].

TSB. (2017b) During 2016 TSB continued to make great progress in its mission to bring

more competition to UK banking. [PDF] TSB. Available at:

https://www.tsb.co.uk/investors/results-reports/tsb-2016-results.pdf [Accessed 28 February

2018].

TSB. (2018a) Find a branch. [Online] TSB. Available at: https://www.tsb.co.uk/branch-

locator/ [Accessed 28 February 2018].

Partington, R. (2017) UK interest rates stay at 0.25% but Bank of England hints rise is

looming. [Online] The Guardian. Available at:

https://www.theguardian.com/business/2017/sep/14/uk-interest-rates-bank-of-england-mpc-

inflation [Accessed 28 February 2018].

Partington, R. and Elliott, L. (2018) UK economy grew by 0.6% in final quarter of 2017, says

thinktank. [Online] The Guardian. Available at:

https://www.theguardian.com/business/2018/jan/10/uk-manufacturing-output-rises-eighth-

month-in-row [Accessed 28 February 2018].

Simon, E. (2013) The TSB: the history of a new bank with an old name. [Online] The

Telegraph. Available at:

http://www.telegraph.co.uk/finance/personalfinance/bank-accounts/10015854/The-TSB-the-

history-of-a-new-bank-with-an-old-name.html [Accessed 28 February 2018].

Trading Economics. (2018) Banco Sabadell | EPS Earnings Per Share. [Online] Trading

Economics. Available at: https://tradingeconomics.com/sab:sm:eps [Accessed 28 February

2018].

TSB. (2014) News Releases. [Online] TSB. Available at: https://www.tsb.co.uk/news-

releases/tsb-launches-fix-and-flex-mortgage/ [Accessed 28 February 2018].

TSB. (2016) News Releases. [Online] TSB. Available at: https://www.tsb.co.uk/news-

releases/your-local-charity-is-struggling-to-get-its-voice-heard/ [Accessed 28 February

2018].

TSB. (2017a) Annual Report and Accounts 2017. [PDF] TSB. Available at:

https://www.tsb.co.uk/investors/results-reports/tsb-bank-annual-report-2017.pdf [Accessed

28 February 2018].

TSB. (2017b) During 2016 TSB continued to make great progress in its mission to bring

more competition to UK banking. [PDF] TSB. Available at:

https://www.tsb.co.uk/investors/results-reports/tsb-2016-results.pdf [Accessed 28 February

2018].

TSB. (2018a) Find a branch. [Online] TSB. Available at: https://www.tsb.co.uk/branch-

locator/ [Accessed 28 February 2018].

BUSINESS ENVIRONMENT 14

TSB. (2018b) News Releases. [Online] TSB. Available at: https://www.tsb.co.uk/news-

releases/richard-meddings-to-succeed-will-samuel-as-chairman-of-tsb/ [Accessed 28

February 2018].

TSB. (2018c) Our People. [Online] TSB. Available at:

https://www.tsb.co.uk/investors/people/ [Accessed 28 February 2018].

Yüksel, İ. (2012) Developing a multi-criteria decision making model for PESTEL

analysis. International Journal of Business and Management, 7(24), p.52.

TSB. (2018b) News Releases. [Online] TSB. Available at: https://www.tsb.co.uk/news-

releases/richard-meddings-to-succeed-will-samuel-as-chairman-of-tsb/ [Accessed 28

February 2018].

TSB. (2018c) Our People. [Online] TSB. Available at:

https://www.tsb.co.uk/investors/people/ [Accessed 28 February 2018].

Yüksel, İ. (2012) Developing a multi-criteria decision making model for PESTEL

analysis. International Journal of Business and Management, 7(24), p.52.

1 out of 15

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.