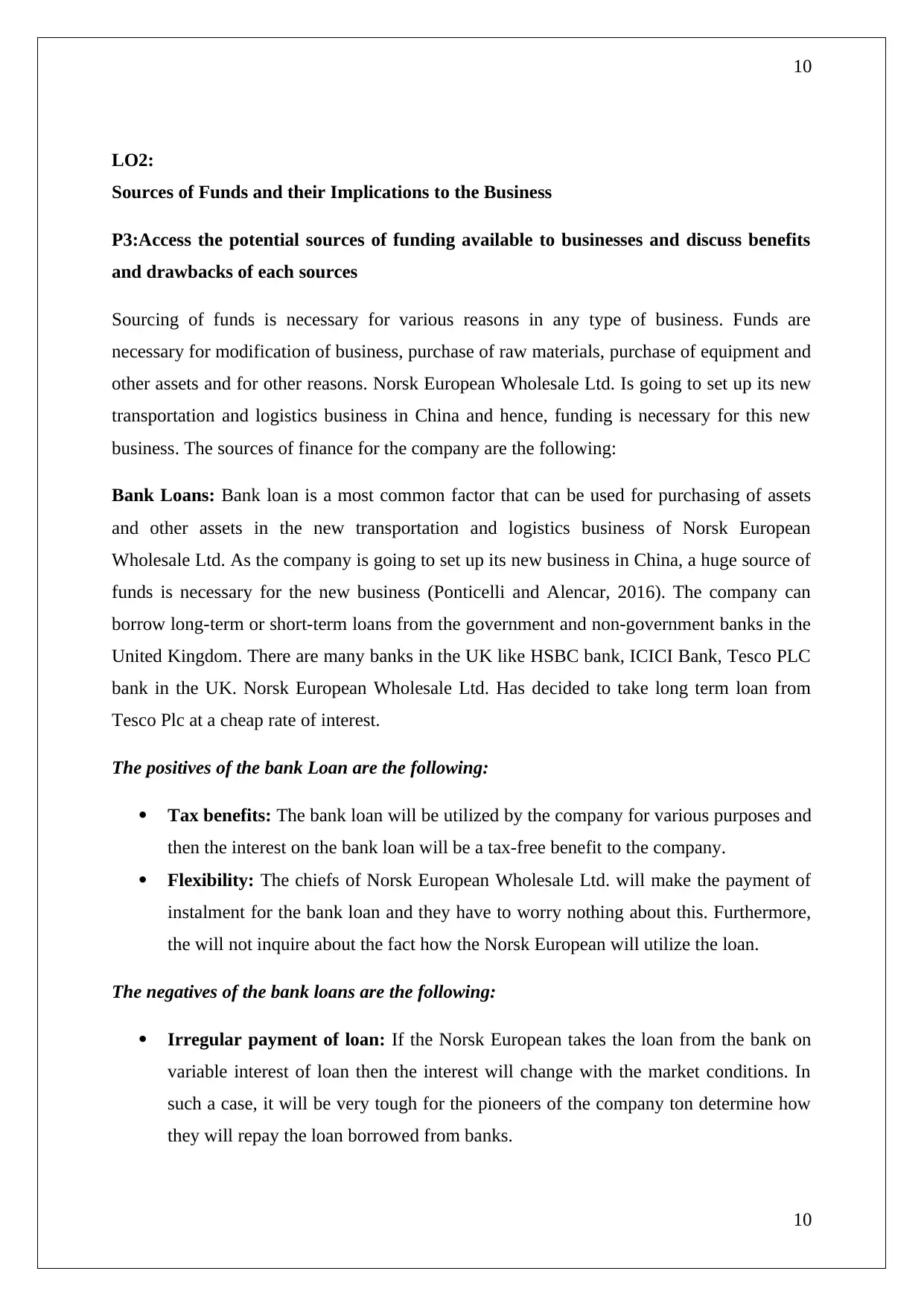

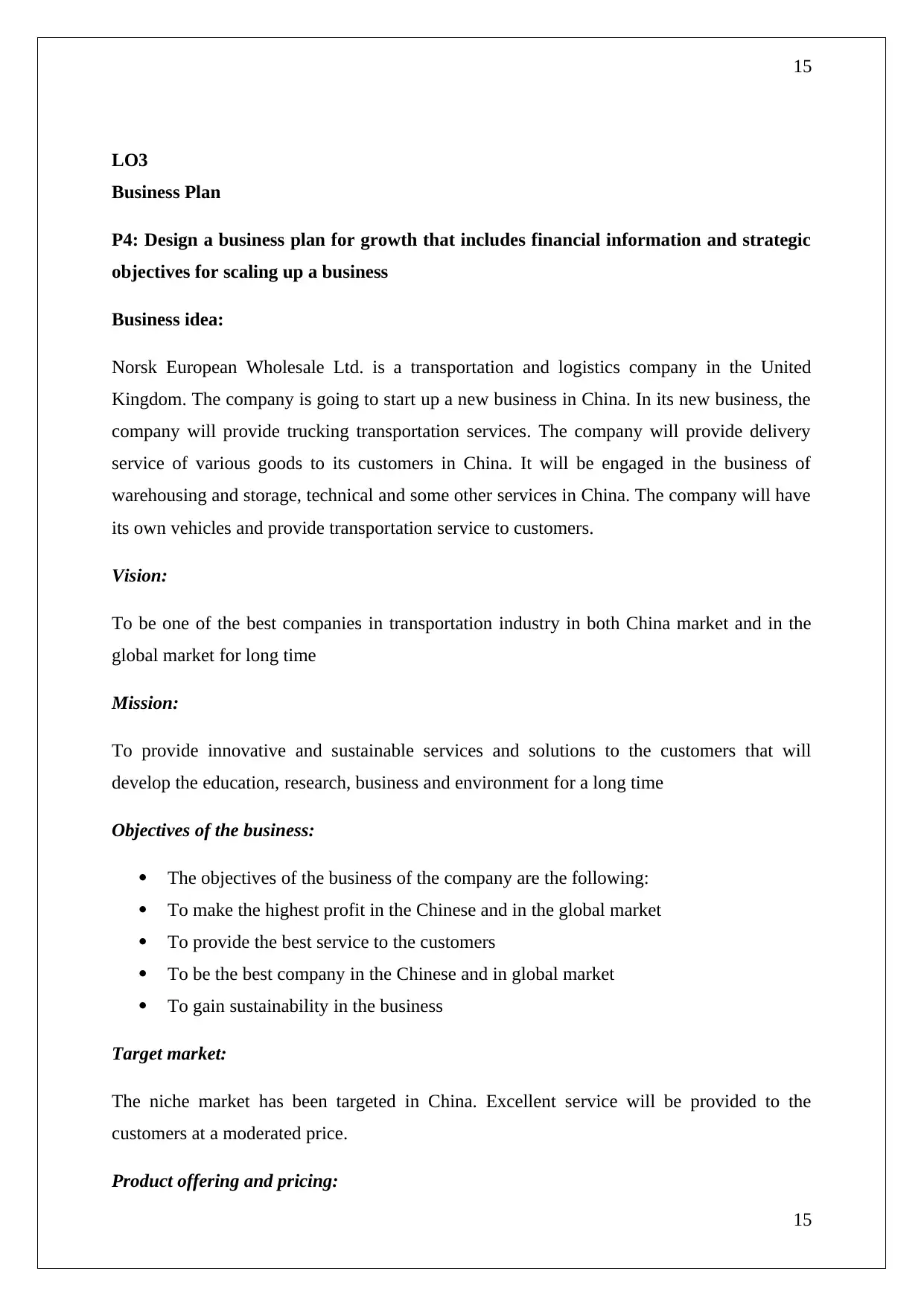

This project examines the growth planning strategies of Norsk European Wholesale Ltd., a UK-based company, as it expands its transportation and logistics business into the Chinese market. The analysis delves into key considerations for evaluating growth opportunities, utilizing Porter's Generic Strategies and PESTEL analysis. Ansoff's growth vector matrix is applied to evaluate potential growth options, and various sources of funding are discussed, including their benefits and drawbacks. A comprehensive business plan is designed, outlining financial information and strategic objectives for scaling up the business in China. Finally, the project explores exit and succession options for the company, highlighting the advantages and disadvantages of each approach. This case study provides valuable insights into the challenges and opportunities associated with international business expansion and the importance of strategic planning for sustainable growth.

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)