Preparation of Financials Assignment

VerifiedAdded on 2021/06/14

|16

|2929

|57

AI Summary

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Solution-1

Part-A

(i) Yes, the trial balance is an important report since it provides the bird’s eye view of

entire transactions posted in the books. In the accounting, all the transactions are

posted in the general journal and from there it is posted to the ledgers. From the

ledgers, the trial balance is prepared which is basically a summarized report of the

transactions. With the help of trial balance, the financial statements are prepared,

without trial balance, the preparation of financials is almost impossible.

(ii) No, it will be incorrect to assume that if the trial balance matches, then the books are

correct. This is because the trial balance may contain the compensating errors or

errors of omission. For example, any transaction omitted from the books to record or

the transaction is recorded with the wrong amount on both the sides, and transaction

wrongly posted in wrong vendors account, say instead of Ram’s account to Shyam’s

account. All these transactions will not reflect in the trial balance making the trial

balance incorrect.

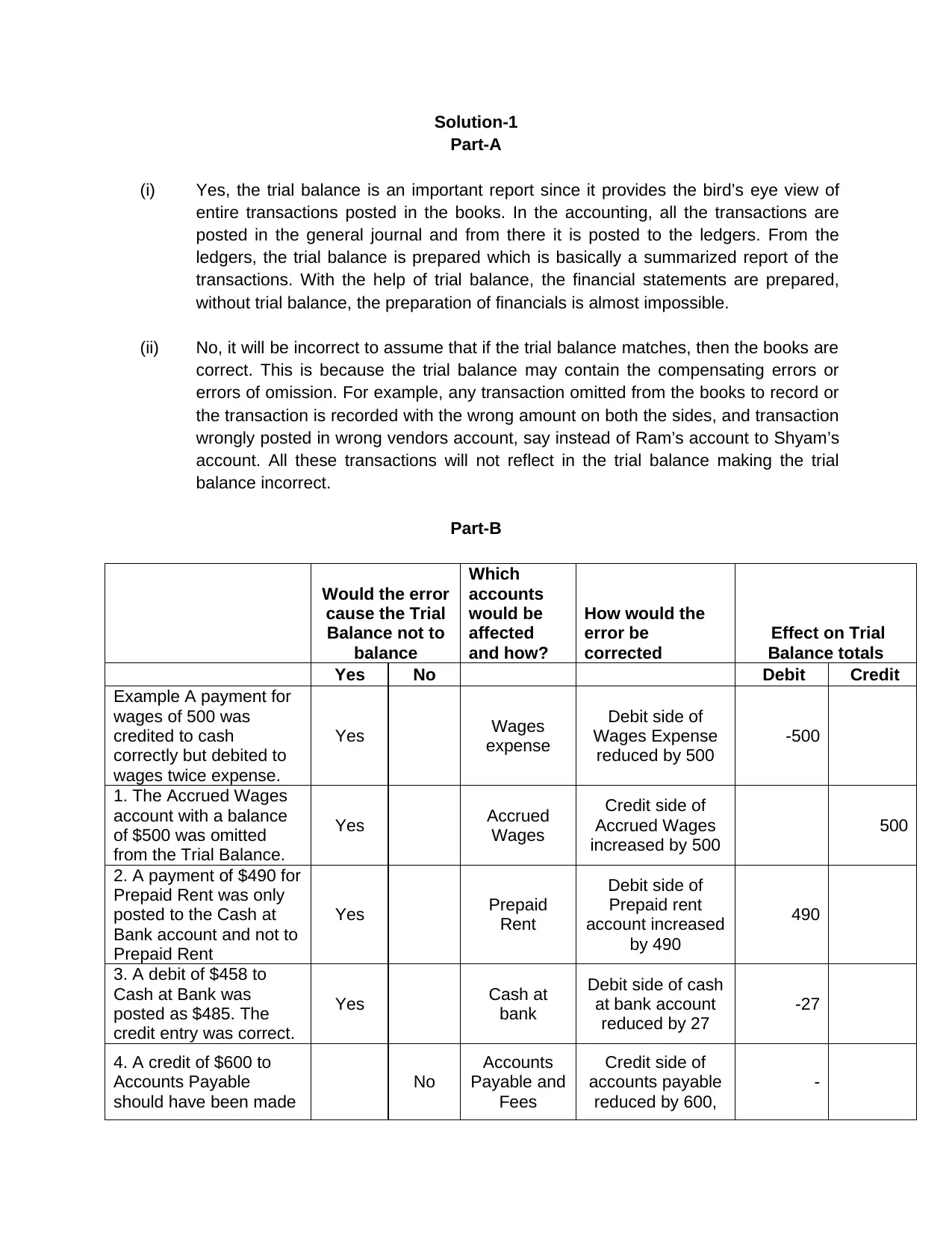

Part-B

Would the error

cause the Trial

Balance not to

balance

Which

accounts

would be

affected

and how?

How would the

error be

corrected

Effect on Trial

Balance totals

Yes No Debit Credit

Example A payment for

wages of 500 was

credited to cash

correctly but debited to

wages twice expense.

Yes Wages

expense

Debit side of

Wages Expense

reduced by 500

-500

1. The Accrued Wages

account with a balance

of $500 was omitted

from the Trial Balance.

Yes Accrued

Wages

Credit side of

Accrued Wages

increased by 500

500

2. A payment of $490 for

Prepaid Rent was only

posted to the Cash at

Bank account and not to

Prepaid Rent

Yes Prepaid

Rent

Debit side of

Prepaid rent

account increased

by 490

490

3. A debit of $458 to

Cash at Bank was

posted as $485. The

credit entry was correct.

Yes Cash at

bank

Debit side of cash

at bank account

reduced by 27

-27

4. A credit of $600 to

Accounts Payable

should have been made

No

Accounts

Payable and

Fees

Credit side of

accounts payable

reduced by 600,

-

Part-A

(i) Yes, the trial balance is an important report since it provides the bird’s eye view of

entire transactions posted in the books. In the accounting, all the transactions are

posted in the general journal and from there it is posted to the ledgers. From the

ledgers, the trial balance is prepared which is basically a summarized report of the

transactions. With the help of trial balance, the financial statements are prepared,

without trial balance, the preparation of financials is almost impossible.

(ii) No, it will be incorrect to assume that if the trial balance matches, then the books are

correct. This is because the trial balance may contain the compensating errors or

errors of omission. For example, any transaction omitted from the books to record or

the transaction is recorded with the wrong amount on both the sides, and transaction

wrongly posted in wrong vendors account, say instead of Ram’s account to Shyam’s

account. All these transactions will not reflect in the trial balance making the trial

balance incorrect.

Part-B

Would the error

cause the Trial

Balance not to

balance

Which

accounts

would be

affected

and how?

How would the

error be

corrected

Effect on Trial

Balance totals

Yes No Debit Credit

Example A payment for

wages of 500 was

credited to cash

correctly but debited to

wages twice expense.

Yes Wages

expense

Debit side of

Wages Expense

reduced by 500

-500

1. The Accrued Wages

account with a balance

of $500 was omitted

from the Trial Balance.

Yes Accrued

Wages

Credit side of

Accrued Wages

increased by 500

500

2. A payment of $490 for

Prepaid Rent was only

posted to the Cash at

Bank account and not to

Prepaid Rent

Yes Prepaid

Rent

Debit side of

Prepaid rent

account increased

by 490

490

3. A debit of $458 to

Cash at Bank was

posted as $485. The

credit entry was correct.

Yes Cash at

bank

Debit side of cash

at bank account

reduced by 27

-27

4. A credit of $600 to

Accounts Payable

should have been made

No

Accounts

Payable and

Fees

Credit side of

accounts payable

reduced by 600,

-

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

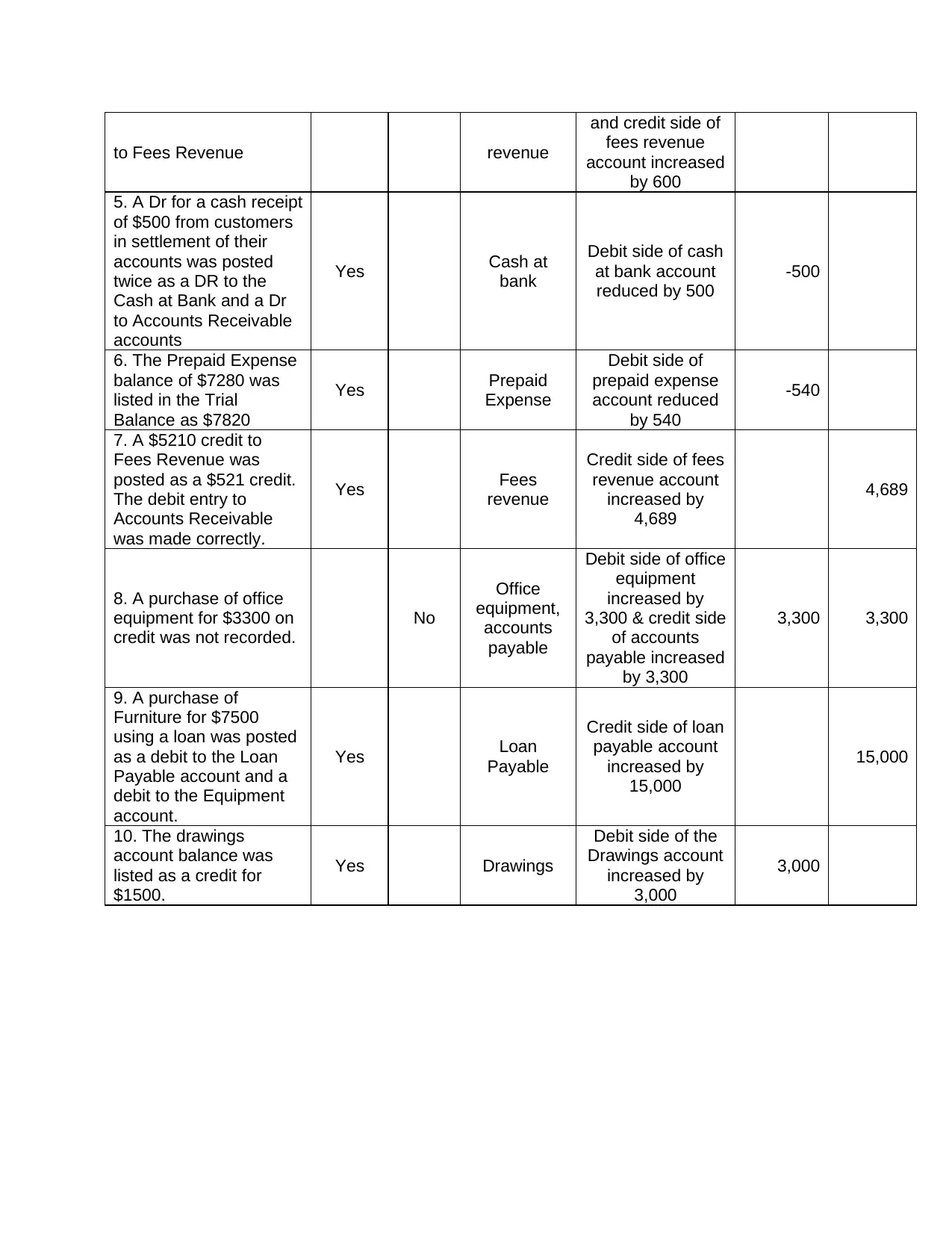

to Fees Revenue revenue

and credit side of

fees revenue

account increased

by 600

5. A Dr for a cash receipt

of $500 from customers

in settlement of their

accounts was posted

twice as a DR to the

Cash at Bank and a Dr

to Accounts Receivable

accounts

Yes Cash at

bank

Debit side of cash

at bank account

reduced by 500

-500

6. The Prepaid Expense

balance of $7280 was

listed in the Trial

Balance as $7820

Yes Prepaid

Expense

Debit side of

prepaid expense

account reduced

by 540

-540

7. A $5210 credit to

Fees Revenue was

posted as a $521 credit.

The debit entry to

Accounts Receivable

was made correctly.

Yes Fees

revenue

Credit side of fees

revenue account

increased by

4,689

4,689

8. A purchase of office

equipment for $3300 on

credit was not recorded.

No

Office

equipment,

accounts

payable

Debit side of office

equipment

increased by

3,300 & credit side

of accounts

payable increased

by 3,300

3,300 3,300

9. A purchase of

Furniture for $7500

using a loan was posted

as a debit to the Loan

Payable account and a

debit to the Equipment

account.

Yes Loan

Payable

Credit side of loan

payable account

increased by

15,000

15,000

10. The drawings

account balance was

listed as a credit for

$1500.

Yes Drawings

Debit side of the

Drawings account

increased by

3,000

3,000

and credit side of

fees revenue

account increased

by 600

5. A Dr for a cash receipt

of $500 from customers

in settlement of their

accounts was posted

twice as a DR to the

Cash at Bank and a Dr

to Accounts Receivable

accounts

Yes Cash at

bank

Debit side of cash

at bank account

reduced by 500

-500

6. The Prepaid Expense

balance of $7280 was

listed in the Trial

Balance as $7820

Yes Prepaid

Expense

Debit side of

prepaid expense

account reduced

by 540

-540

7. A $5210 credit to

Fees Revenue was

posted as a $521 credit.

The debit entry to

Accounts Receivable

was made correctly.

Yes Fees

revenue

Credit side of fees

revenue account

increased by

4,689

4,689

8. A purchase of office

equipment for $3300 on

credit was not recorded.

No

Office

equipment,

accounts

payable

Debit side of office

equipment

increased by

3,300 & credit side

of accounts

payable increased

by 3,300

3,300 3,300

9. A purchase of

Furniture for $7500

using a loan was posted

as a debit to the Loan

Payable account and a

debit to the Equipment

account.

Yes Loan

Payable

Credit side of loan

payable account

increased by

15,000

15,000

10. The drawings

account balance was

listed as a credit for

$1500.

Yes Drawings

Debit side of the

Drawings account

increased by

3,000

3,000

Solution-2

Part-A

Matching principle states that the expenses should be accounted for in the period in which

revenue is recognized. Means the expenses relating to a particulars income should be booked

in the same period. The matching principle suits with the accrual basis of accounting as the

accrual basis of accounting also requires booking of expenses related to the particular income

in the same period which the cash basis of accounting requires to book the expenses and

incomes in the period in which they are earned or expended in cash.

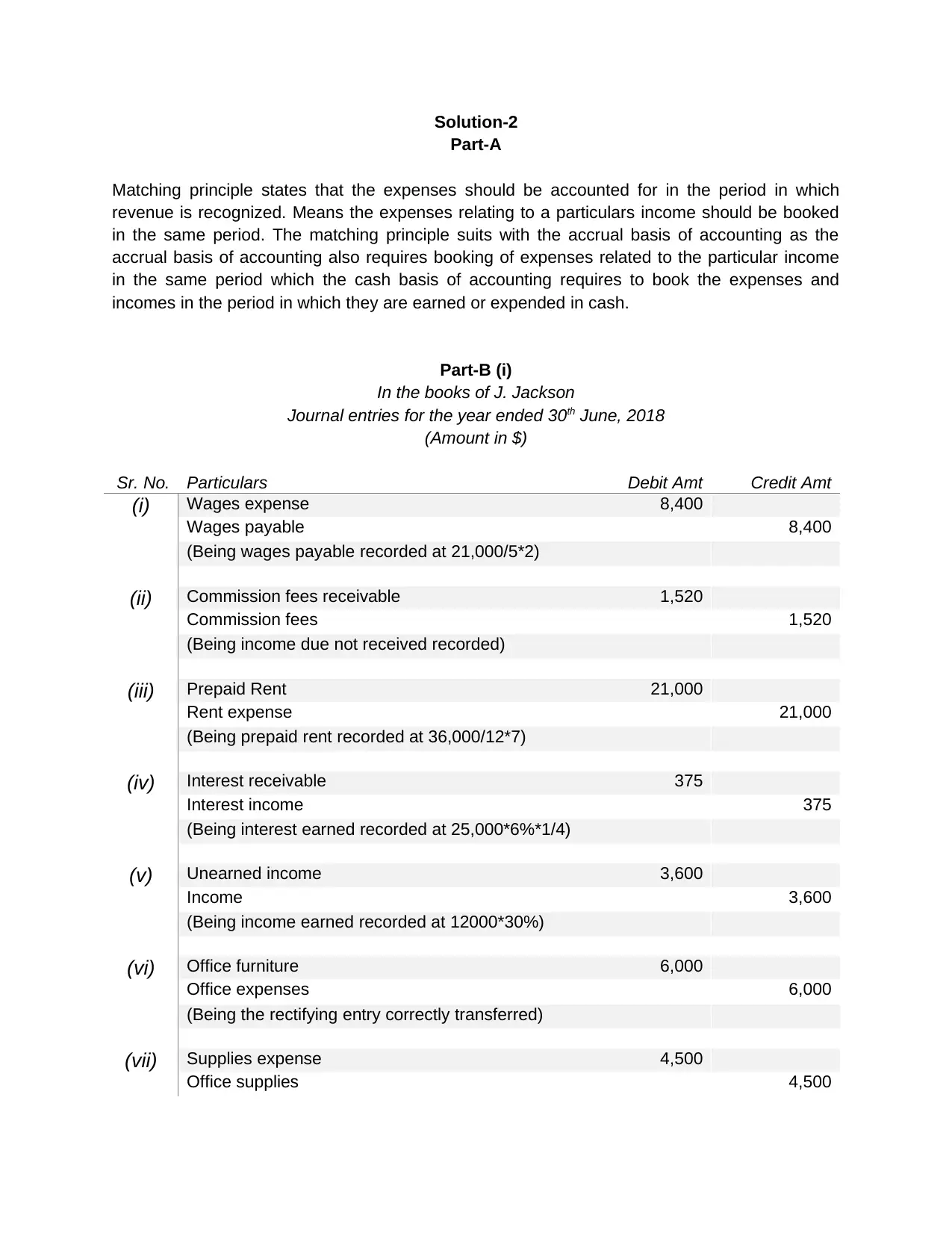

Part-B (i)

In the books of J. Jackson

Journal entries for the year ended 30th June, 2018

(Amount in $)

Sr. No. Particulars Debit Amt Credit Amt

(i) Wages expense 8,400

Wages payable 8,400

(Being wages payable recorded at 21,000/5*2)

(ii) Commission fees receivable 1,520

Commission fees 1,520

(Being income due not received recorded)

(iii) Prepaid Rent 21,000

Rent expense 21,000

(Being prepaid rent recorded at 36,000/12*7)

(iv) Interest receivable 375

Interest income 375

(Being interest earned recorded at 25,000*6%*1/4)

(v) Unearned income 3,600

Income 3,600

(Being income earned recorded at 12000*30%)

(vi) Office furniture 6,000

Office expenses 6,000

(Being the rectifying entry correctly transferred)

(vii) Supplies expense 4,500

Office supplies 4,500

Part-A

Matching principle states that the expenses should be accounted for in the period in which

revenue is recognized. Means the expenses relating to a particulars income should be booked

in the same period. The matching principle suits with the accrual basis of accounting as the

accrual basis of accounting also requires booking of expenses related to the particular income

in the same period which the cash basis of accounting requires to book the expenses and

incomes in the period in which they are earned or expended in cash.

Part-B (i)

In the books of J. Jackson

Journal entries for the year ended 30th June, 2018

(Amount in $)

Sr. No. Particulars Debit Amt Credit Amt

(i) Wages expense 8,400

Wages payable 8,400

(Being wages payable recorded at 21,000/5*2)

(ii) Commission fees receivable 1,520

Commission fees 1,520

(Being income due not received recorded)

(iii) Prepaid Rent 21,000

Rent expense 21,000

(Being prepaid rent recorded at 36,000/12*7)

(iv) Interest receivable 375

Interest income 375

(Being interest earned recorded at 25,000*6%*1/4)

(v) Unearned income 3,600

Income 3,600

(Being income earned recorded at 12000*30%)

(vi) Office furniture 6,000

Office expenses 6,000

(Being the rectifying entry correctly transferred)

(vii) Supplies expense 4,500

Office supplies 4,500

(Being consumption of office supplies recorded)

(viii) GST Collected 7,960

GST Paid 7,960

(Being net amount of GST recorded)

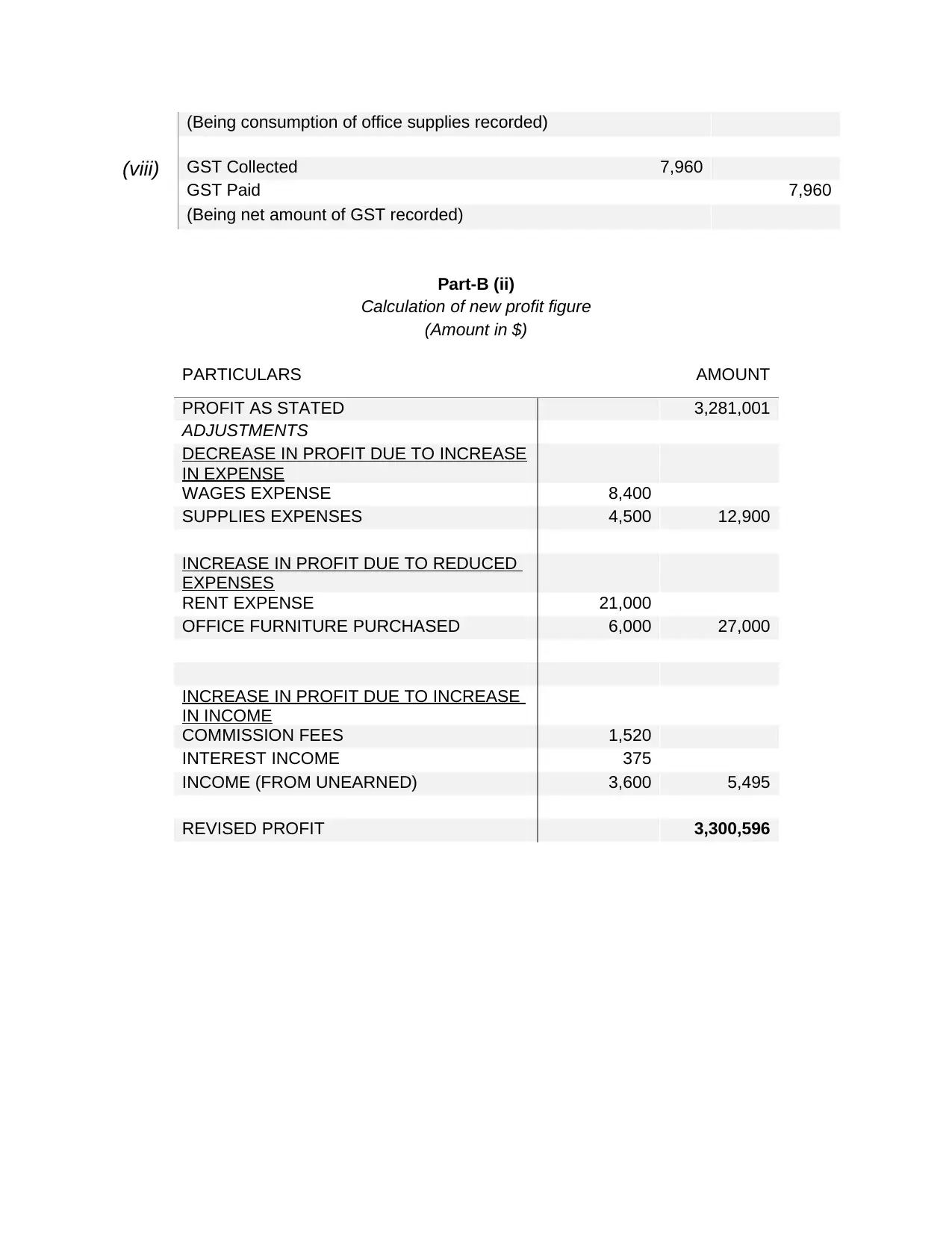

Part-B (ii)

Calculation of new profit figure

(Amount in $)

PARTICULARS AMOUNT

PROFIT AS STATED 3,281,001

ADJUSTMENTS

DECREASE IN PROFIT DUE TO INCREASE

IN EXPENSE

WAGES EXPENSE 8,400

SUPPLIES EXPENSES 4,500 12,900

INCREASE IN PROFIT DUE TO REDUCED

EXPENSES

RENT EXPENSE 21,000

OFFICE FURNITURE PURCHASED 6,000 27,000

INCREASE IN PROFIT DUE TO INCREASE

IN INCOME

COMMISSION FEES 1,520

INTEREST INCOME 375

INCOME (FROM UNEARNED) 3,600 5,495

REVISED PROFIT 3,300,596

(viii) GST Collected 7,960

GST Paid 7,960

(Being net amount of GST recorded)

Part-B (ii)

Calculation of new profit figure

(Amount in $)

PARTICULARS AMOUNT

PROFIT AS STATED 3,281,001

ADJUSTMENTS

DECREASE IN PROFIT DUE TO INCREASE

IN EXPENSE

WAGES EXPENSE 8,400

SUPPLIES EXPENSES 4,500 12,900

INCREASE IN PROFIT DUE TO REDUCED

EXPENSES

RENT EXPENSE 21,000

OFFICE FURNITURE PURCHASED 6,000 27,000

INCREASE IN PROFIT DUE TO INCREASE

IN INCOME

COMMISSION FEES 1,520

INTEREST INCOME 375

INCOME (FROM UNEARNED) 3,600 5,495

REVISED PROFIT 3,300,596

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Solution-3

Part-A

The four qualitative characteristics that enhance the usefulness of information are as below:

(a) Relevance – The presented information should be relevant and to the point.

(b) Understandability – The information presented in report should be simple and

understandable and should be prepared from the layman point’s of view.

(c) Reliability – The presented information should be free from errors and mis-

representations so that the information can be relied.

(d) Comparability – The information should be in the prescribed format and as per defined

criteria’s so that it can be compared easily.

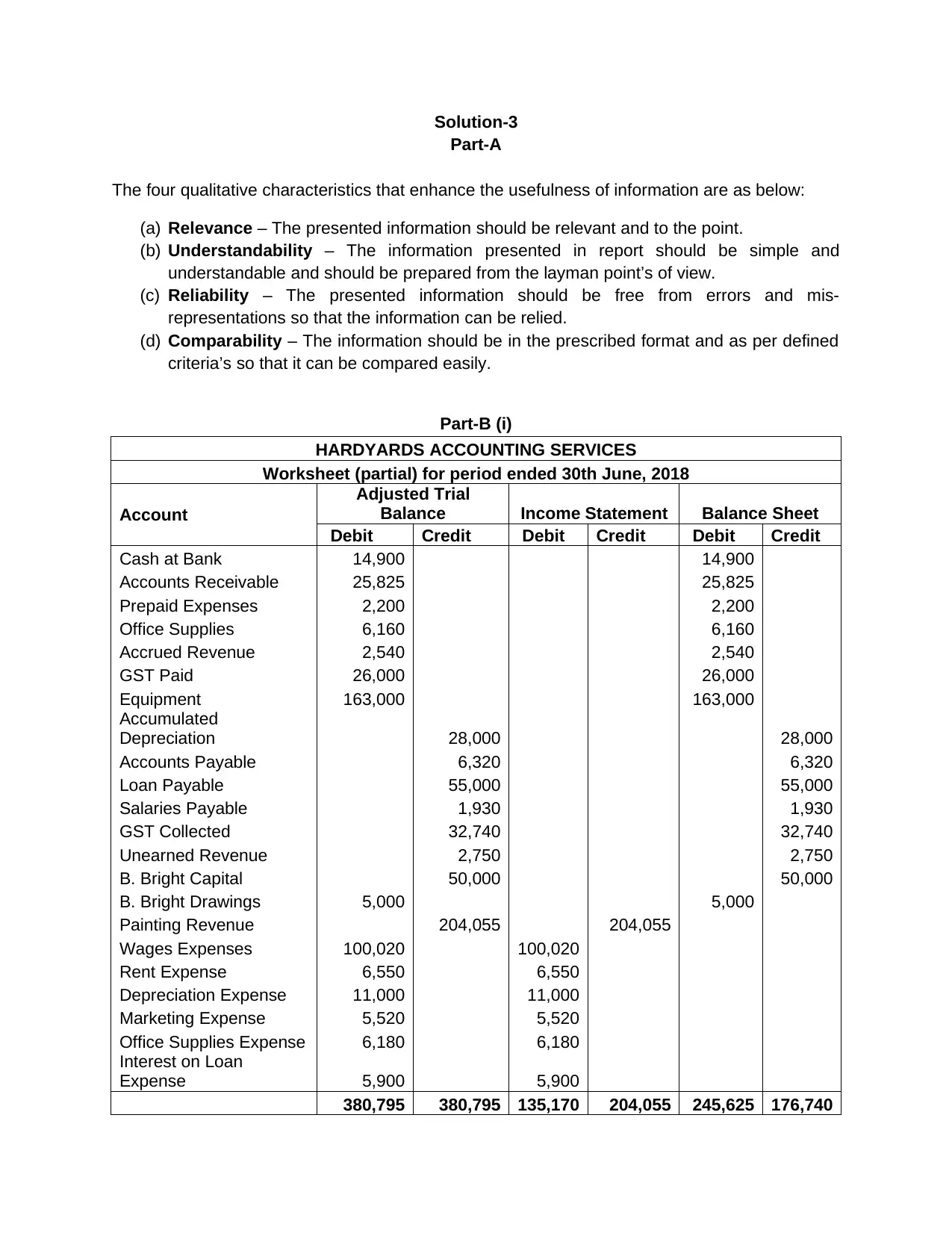

Part-B (i)

HARDYARDS ACCOUNTING SERVICES

Worksheet (partial) for period ended 30th June, 2018

Account

Adjusted Trial

Balance Income Statement Balance Sheet

Debit Credit Debit Credit Debit Credit

Cash at Bank 14,900 14,900

Accounts Receivable 25,825 25,825

Prepaid Expenses 2,200 2,200

Office Supplies 6,160 6,160

Accrued Revenue 2,540 2,540

GST Paid 26,000 26,000

Equipment 163,000 163,000

Accumulated

Depreciation 28,000 28,000

Accounts Payable 6,320 6,320

Loan Payable 55,000 55,000

Salaries Payable 1,930 1,930

GST Collected 32,740 32,740

Unearned Revenue 2,750 2,750

B. Bright Capital 50,000 50,000

B. Bright Drawings 5,000 5,000

Painting Revenue 204,055 204,055

Wages Expenses 100,020 100,020

Rent Expense 6,550 6,550

Depreciation Expense 11,000 11,000

Marketing Expense 5,520 5,520

Office Supplies Expense 6,180 6,180

Interest on Loan

Expense 5,900 5,900

380,795 380,795 135,170 204,055 245,625 176,740

Part-A

The four qualitative characteristics that enhance the usefulness of information are as below:

(a) Relevance – The presented information should be relevant and to the point.

(b) Understandability – The information presented in report should be simple and

understandable and should be prepared from the layman point’s of view.

(c) Reliability – The presented information should be free from errors and mis-

representations so that the information can be relied.

(d) Comparability – The information should be in the prescribed format and as per defined

criteria’s so that it can be compared easily.

Part-B (i)

HARDYARDS ACCOUNTING SERVICES

Worksheet (partial) for period ended 30th June, 2018

Account

Adjusted Trial

Balance Income Statement Balance Sheet

Debit Credit Debit Credit Debit Credit

Cash at Bank 14,900 14,900

Accounts Receivable 25,825 25,825

Prepaid Expenses 2,200 2,200

Office Supplies 6,160 6,160

Accrued Revenue 2,540 2,540

GST Paid 26,000 26,000

Equipment 163,000 163,000

Accumulated

Depreciation 28,000 28,000

Accounts Payable 6,320 6,320

Loan Payable 55,000 55,000

Salaries Payable 1,930 1,930

GST Collected 32,740 32,740

Unearned Revenue 2,750 2,750

B. Bright Capital 50,000 50,000

B. Bright Drawings 5,000 5,000

Painting Revenue 204,055 204,055

Wages Expenses 100,020 100,020

Rent Expense 6,550 6,550

Depreciation Expense 11,000 11,000

Marketing Expense 5,520 5,520

Office Supplies Expense 6,180 6,180

Interest on Loan

Expense 5,900 5,900

380,795 380,795 135,170 204,055 245,625 176,740

Profit 68,885

245,625 245,625

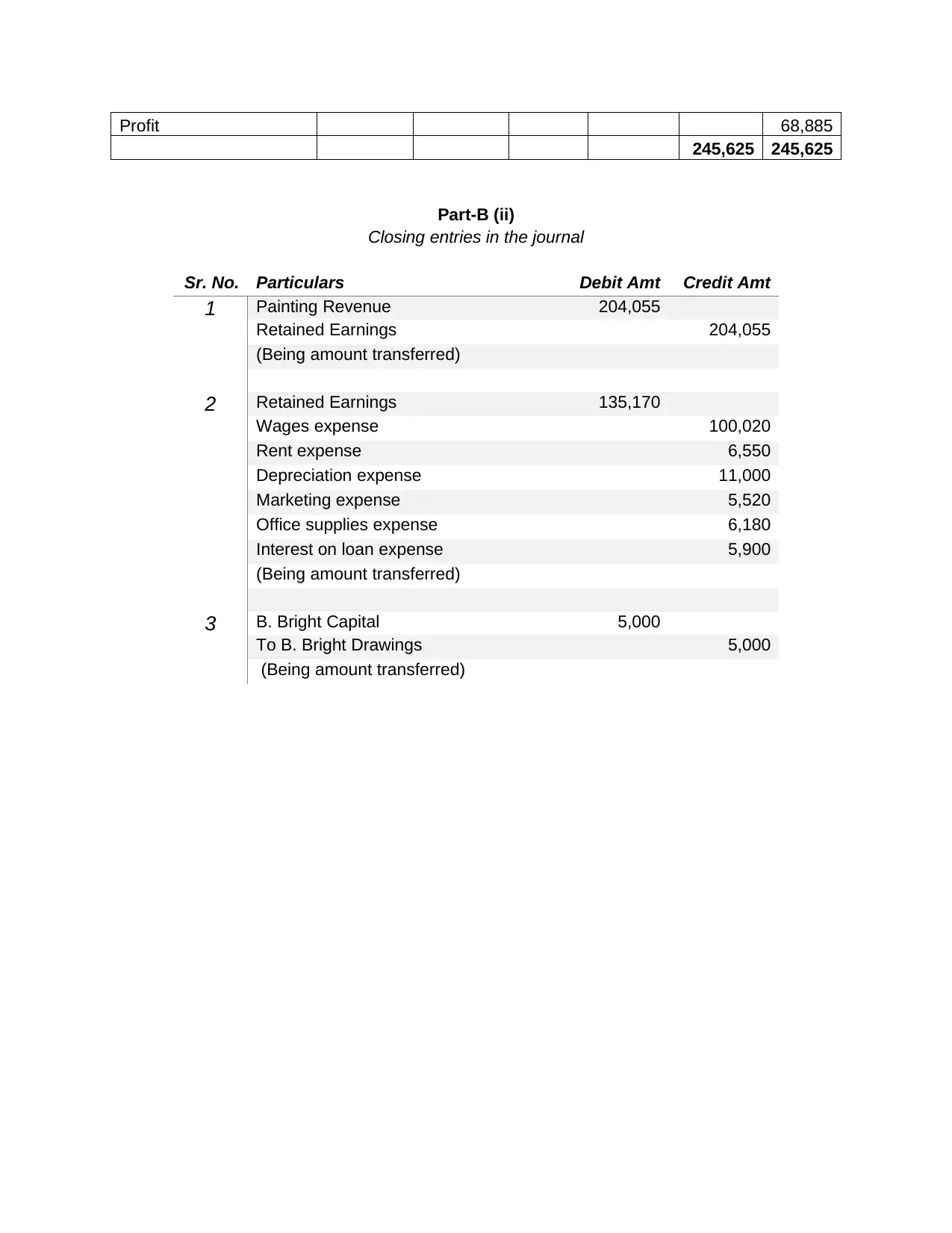

Part-B (ii)

Closing entries in the journal

Sr. No. Particulars Debit Amt Credit Amt

1 Painting Revenue 204,055

Retained Earnings 204,055

(Being amount transferred)

2 Retained Earnings 135,170

Wages expense 100,020

Rent expense 6,550

Depreciation expense 11,000

Marketing expense 5,520

Office supplies expense 6,180

Interest on loan expense 5,900

(Being amount transferred)

3 B. Bright Capital 5,000

To B. Bright Drawings 5,000

(Being amount transferred)

245,625 245,625

Part-B (ii)

Closing entries in the journal

Sr. No. Particulars Debit Amt Credit Amt

1 Painting Revenue 204,055

Retained Earnings 204,055

(Being amount transferred)

2 Retained Earnings 135,170

Wages expense 100,020

Rent expense 6,550

Depreciation expense 11,000

Marketing expense 5,520

Office supplies expense 6,180

Interest on loan expense 5,900

(Being amount transferred)

3 B. Bright Capital 5,000

To B. Bright Drawings 5,000

(Being amount transferred)

Solution-4

Part-A

(a) The way of offering credits by the business will not change as the sale terms and

conditions will remain same, what will change is the process of collections. Earlier the

business used to collect money on their own, now they have hired the factors or third

parties, who will collect the payment on their behalf. This will increase the collection

costs of the businesses which they now need to pay to these factors.

(b) Now, the firms will not have to monitor their receivables as for these factors are

responsible.

Factoring means to outsource the debts collection.

(c) If bad and doubtful debts are not allowed then it will increase the profit of the firm or will

overstate the profit while lowering the provisioning of bad debts.

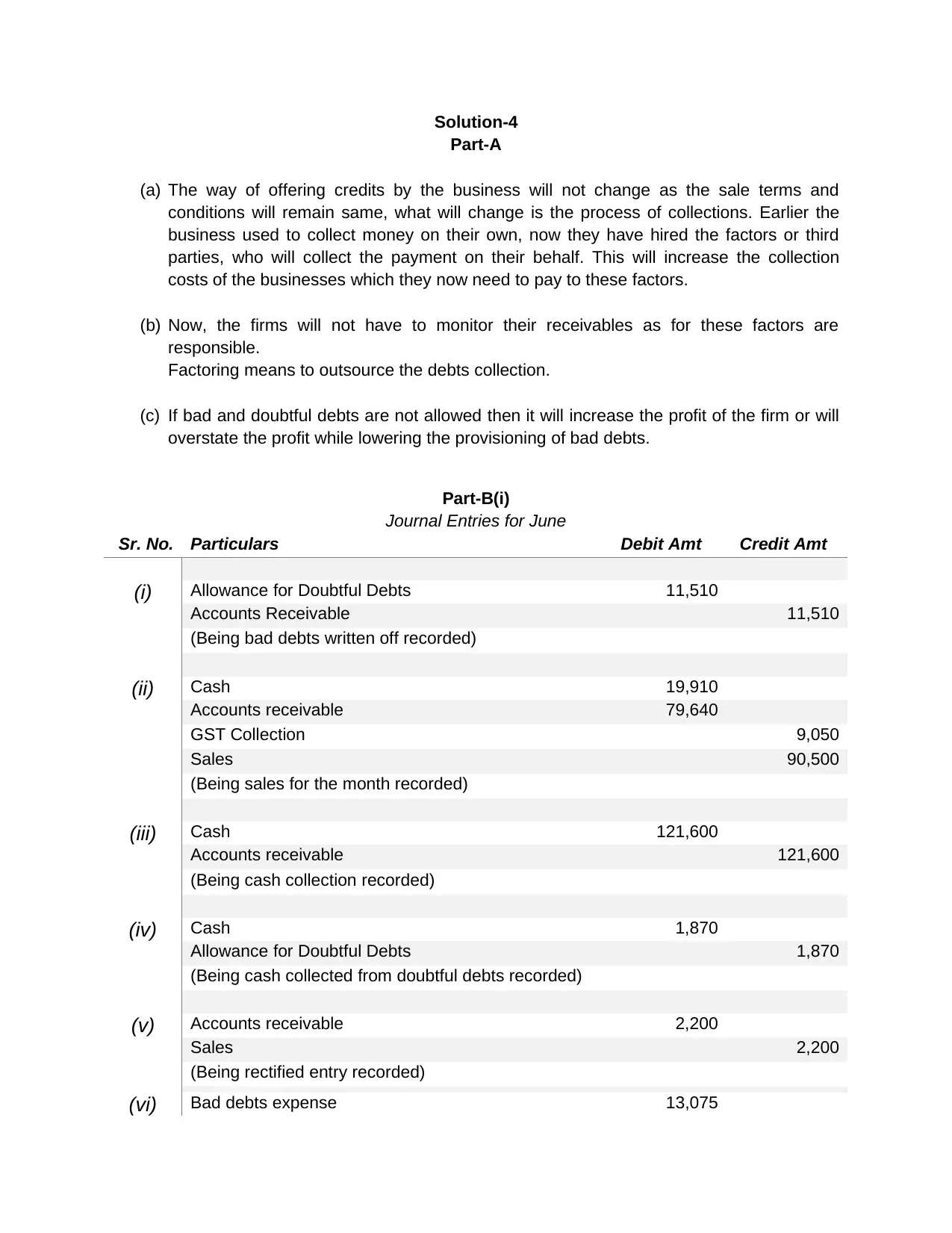

Part-B(i)

Journal Entries for June

Sr. No. Particulars Debit Amt Credit Amt

(i) Allowance for Doubtful Debts 11,510

Accounts Receivable 11,510

(Being bad debts written off recorded)

(ii) Cash 19,910

Accounts receivable 79,640

GST Collection 9,050

Sales 90,500

(Being sales for the month recorded)

(iii) Cash 121,600

Accounts receivable 121,600

(Being cash collection recorded)

(iv) Cash 1,870

Allowance for Doubtful Debts 1,870

(Being cash collected from doubtful debts recorded)

(v) Accounts receivable 2,200

Sales 2,200

(Being rectified entry recorded)

(vi) Bad debts expense 13,075

Part-A

(a) The way of offering credits by the business will not change as the sale terms and

conditions will remain same, what will change is the process of collections. Earlier the

business used to collect money on their own, now they have hired the factors or third

parties, who will collect the payment on their behalf. This will increase the collection

costs of the businesses which they now need to pay to these factors.

(b) Now, the firms will not have to monitor their receivables as for these factors are

responsible.

Factoring means to outsource the debts collection.

(c) If bad and doubtful debts are not allowed then it will increase the profit of the firm or will

overstate the profit while lowering the provisioning of bad debts.

Part-B(i)

Journal Entries for June

Sr. No. Particulars Debit Amt Credit Amt

(i) Allowance for Doubtful Debts 11,510

Accounts Receivable 11,510

(Being bad debts written off recorded)

(ii) Cash 19,910

Accounts receivable 79,640

GST Collection 9,050

Sales 90,500

(Being sales for the month recorded)

(iii) Cash 121,600

Accounts receivable 121,600

(Being cash collection recorded)

(iv) Cash 1,870

Allowance for Doubtful Debts 1,870

(Being cash collected from doubtful debts recorded)

(v) Accounts receivable 2,200

Sales 2,200

(Being rectified entry recorded)

(vi) Bad debts expense 13,075

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Allowance for Doubtful Debts 13,075

(Being record bad debts recorded)

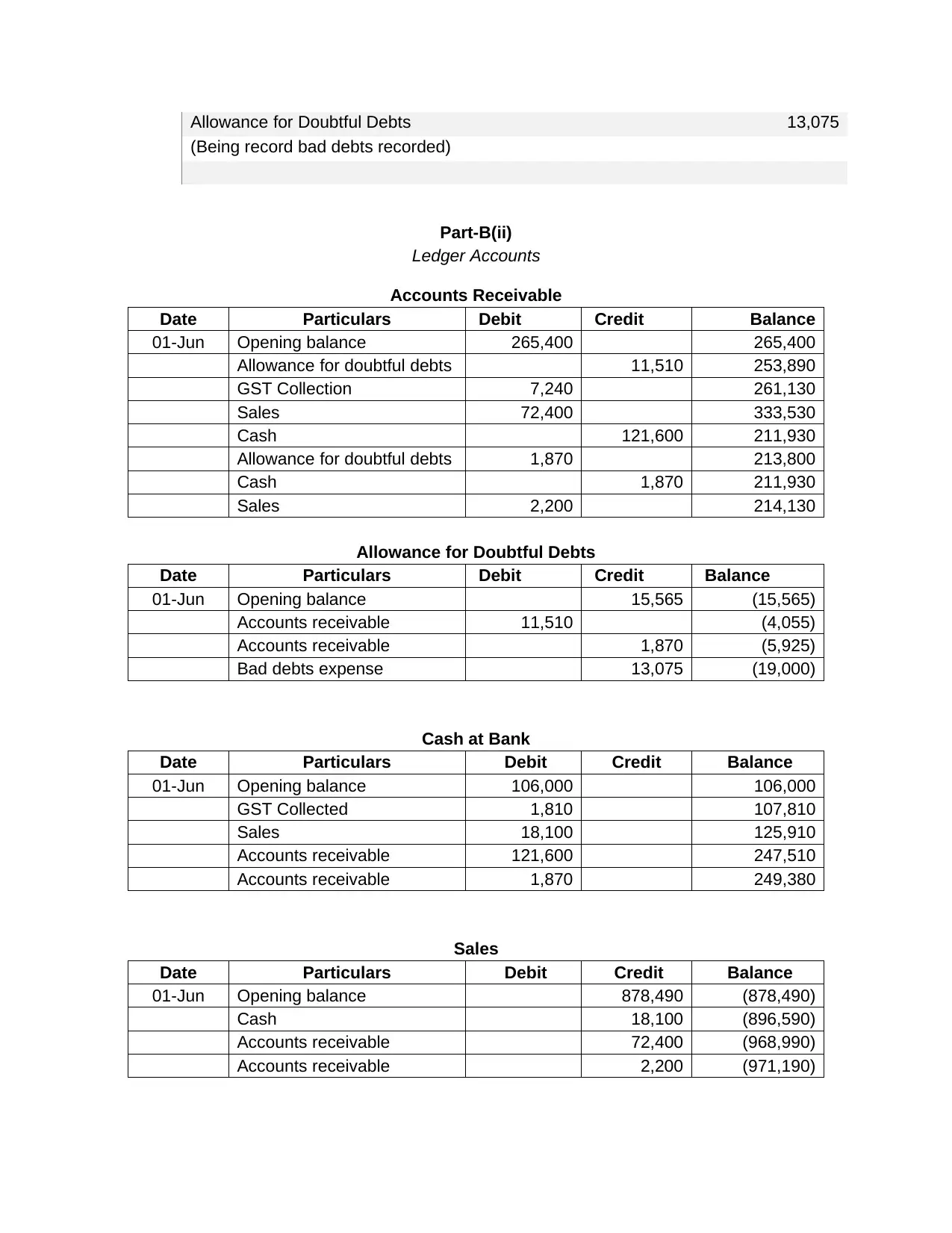

Part-B(ii)

Ledger Accounts

Accounts Receivable

Date Particulars Debit Credit Balance

01-Jun Opening balance 265,400 265,400

Allowance for doubtful debts 11,510 253,890

GST Collection 7,240 261,130

Sales 72,400 333,530

Cash 121,600 211,930

Allowance for doubtful debts 1,870 213,800

Cash 1,870 211,930

Sales 2,200 214,130

Allowance for Doubtful Debts

Date Particulars Debit Credit Balance

01-Jun Opening balance 15,565 (15,565)

Accounts receivable 11,510 (4,055)

Accounts receivable 1,870 (5,925)

Bad debts expense 13,075 (19,000)

Cash at Bank

Date Particulars Debit Credit Balance

01-Jun Opening balance 106,000 106,000

GST Collected 1,810 107,810

Sales 18,100 125,910

Accounts receivable 121,600 247,510

Accounts receivable 1,870 249,380

Sales

Date Particulars Debit Credit Balance

01-Jun Opening balance 878,490 (878,490)

Cash 18,100 (896,590)

Accounts receivable 72,400 (968,990)

Accounts receivable 2,200 (971,190)

(Being record bad debts recorded)

Part-B(ii)

Ledger Accounts

Accounts Receivable

Date Particulars Debit Credit Balance

01-Jun Opening balance 265,400 265,400

Allowance for doubtful debts 11,510 253,890

GST Collection 7,240 261,130

Sales 72,400 333,530

Cash 121,600 211,930

Allowance for doubtful debts 1,870 213,800

Cash 1,870 211,930

Sales 2,200 214,130

Allowance for Doubtful Debts

Date Particulars Debit Credit Balance

01-Jun Opening balance 15,565 (15,565)

Accounts receivable 11,510 (4,055)

Accounts receivable 1,870 (5,925)

Bad debts expense 13,075 (19,000)

Cash at Bank

Date Particulars Debit Credit Balance

01-Jun Opening balance 106,000 106,000

GST Collected 1,810 107,810

Sales 18,100 125,910

Accounts receivable 121,600 247,510

Accounts receivable 1,870 249,380

Sales

Date Particulars Debit Credit Balance

01-Jun Opening balance 878,490 (878,490)

Cash 18,100 (896,590)

Accounts receivable 72,400 (968,990)

Accounts receivable 2,200 (971,190)

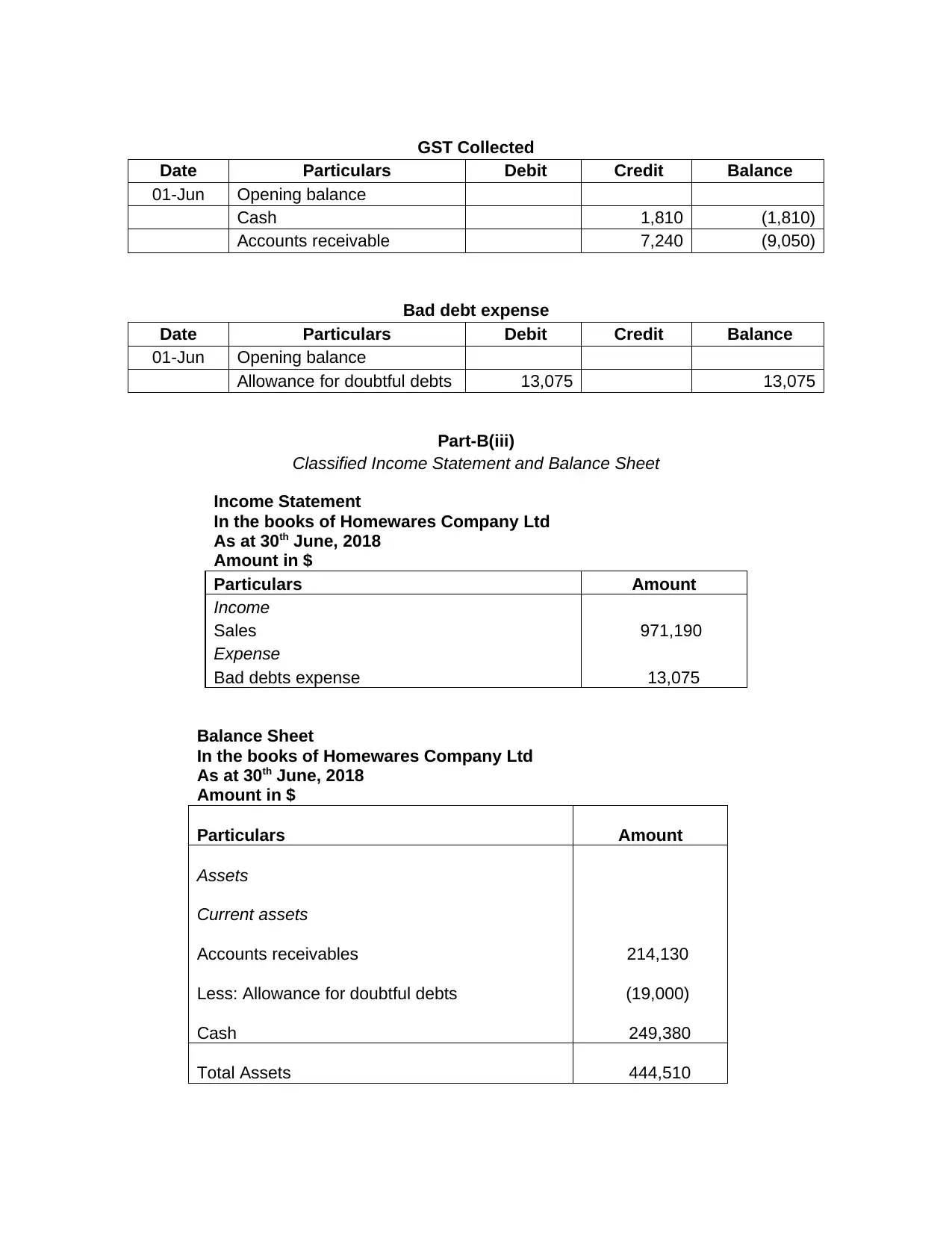

GST Collected

Date Particulars Debit Credit Balance

01-Jun Opening balance

Cash 1,810 (1,810)

Accounts receivable 7,240 (9,050)

Bad debt expense

Date Particulars Debit Credit Balance

01-Jun Opening balance

Allowance for doubtful debts 13,075 13,075

Part-B(iii)

Classified Income Statement and Balance Sheet

Income Statement

In the books of Homewares Company Ltd

As at 30th June, 2018

Amount in $

Particulars Amount

Income

Sales 971,190

Expense

Bad debts expense 13,075

Balance Sheet

In the books of Homewares Company Ltd

As at 30th June, 2018

Amount in $

Particulars Amount

Assets

Current assets

Accounts receivables 214,130

Less: Allowance for doubtful debts (19,000)

Cash 249,380

Total Assets 444,510

Date Particulars Debit Credit Balance

01-Jun Opening balance

Cash 1,810 (1,810)

Accounts receivable 7,240 (9,050)

Bad debt expense

Date Particulars Debit Credit Balance

01-Jun Opening balance

Allowance for doubtful debts 13,075 13,075

Part-B(iii)

Classified Income Statement and Balance Sheet

Income Statement

In the books of Homewares Company Ltd

As at 30th June, 2018

Amount in $

Particulars Amount

Income

Sales 971,190

Expense

Bad debts expense 13,075

Balance Sheet

In the books of Homewares Company Ltd

As at 30th June, 2018

Amount in $

Particulars Amount

Assets

Current assets

Accounts receivables 214,130

Less: Allowance for doubtful debts (19,000)

Cash 249,380

Total Assets 444,510

Liabilities

Current liabilities

GST Collected 9,050

Total Liabilities 9,050

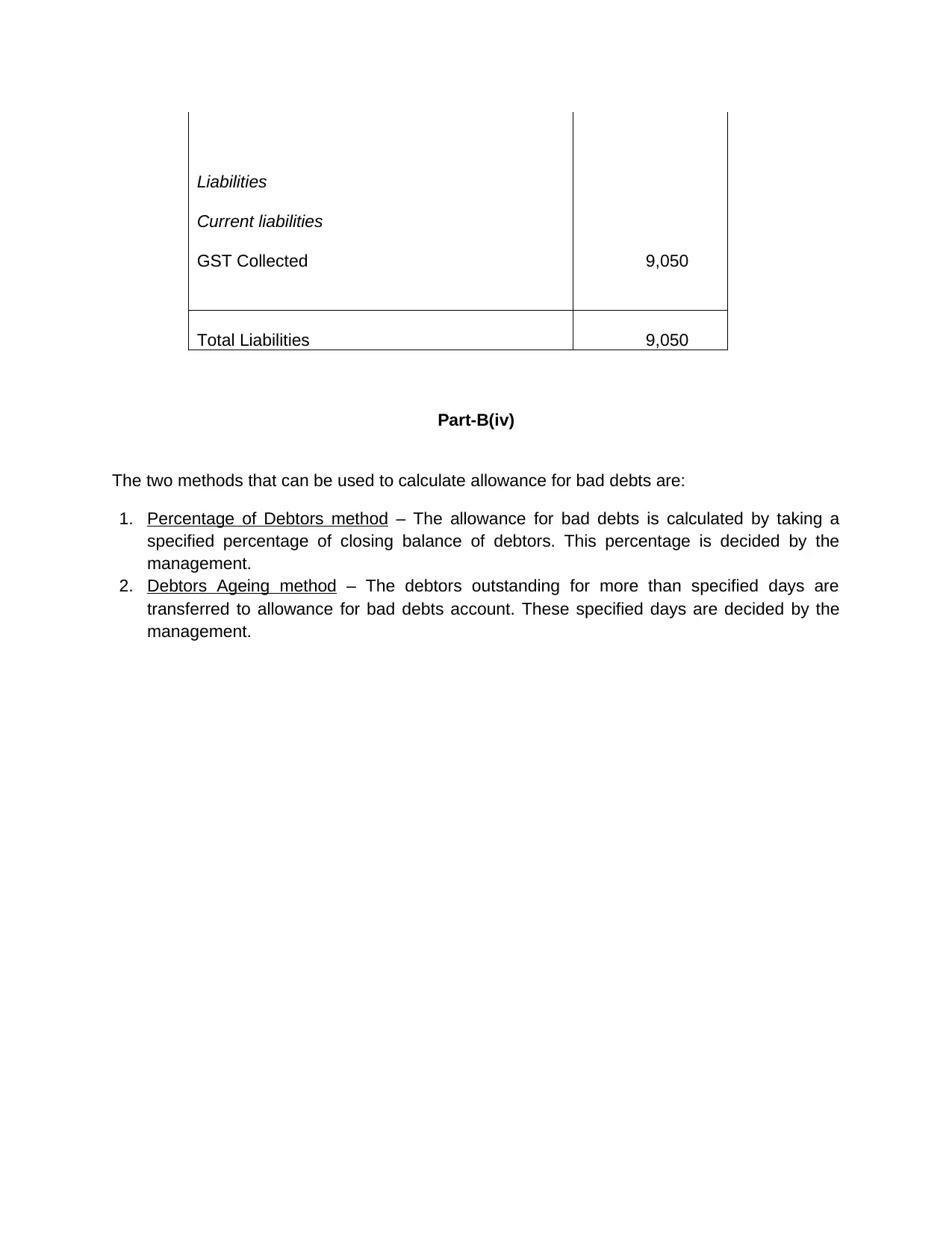

Part-B(iv)

The two methods that can be used to calculate allowance for bad debts are:

1. Percentage of Debtors method – The allowance for bad debts is calculated by taking a

specified percentage of closing balance of debtors. This percentage is decided by the

management.

2. Debtors Ageing method – The debtors outstanding for more than specified days are

transferred to allowance for bad debts account. These specified days are decided by the

management.

Current liabilities

GST Collected 9,050

Total Liabilities 9,050

Part-B(iv)

The two methods that can be used to calculate allowance for bad debts are:

1. Percentage of Debtors method – The allowance for bad debts is calculated by taking a

specified percentage of closing balance of debtors. This percentage is decided by the

management.

2. Debtors Ageing method – The debtors outstanding for more than specified days are

transferred to allowance for bad debts account. These specified days are decided by the

management.

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

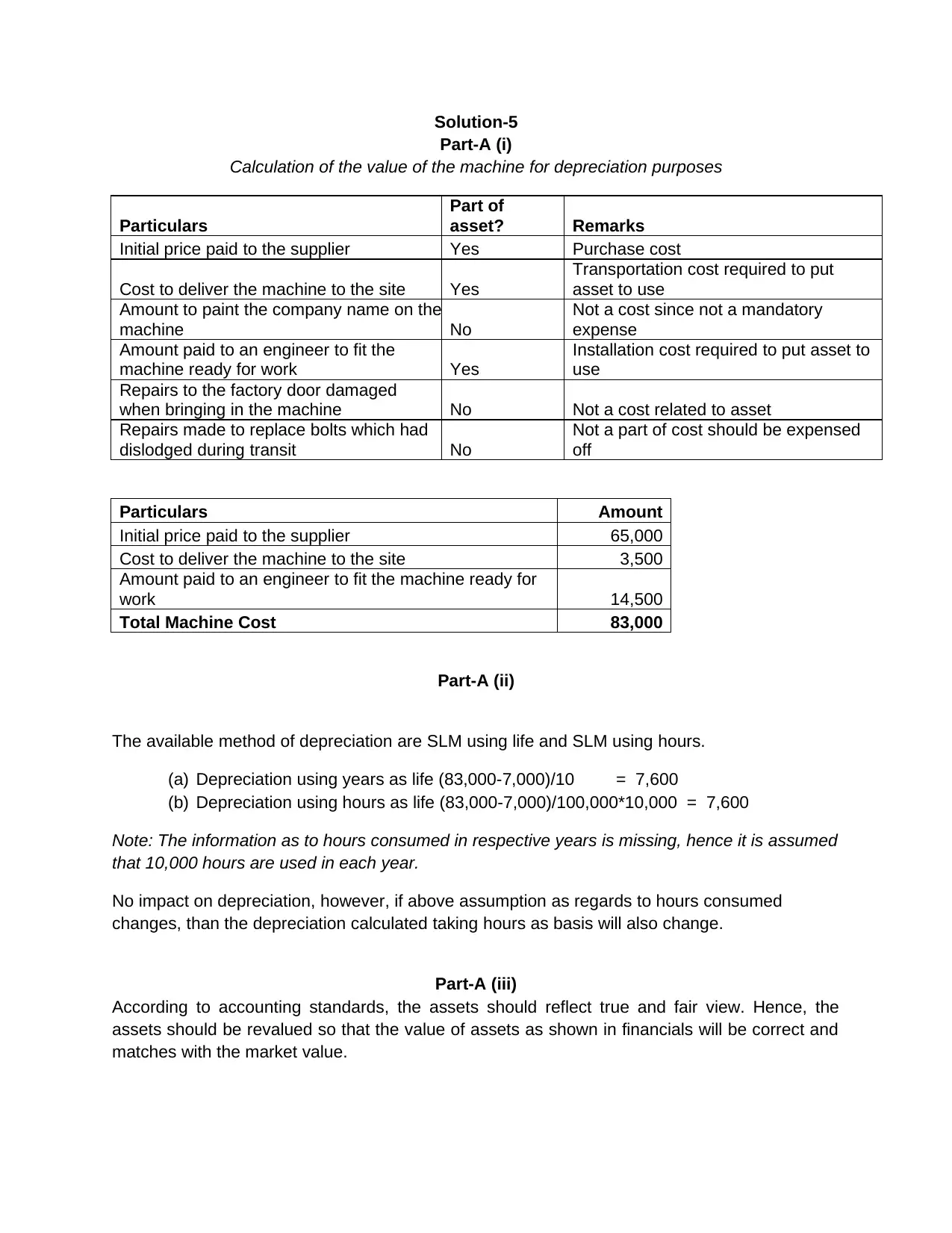

Solution-5

Part-A (i)

Calculation of the value of the machine for depreciation purposes

Particulars

Part of

asset? Remarks

Initial price paid to the supplier Yes Purchase cost

Cost to deliver the machine to the site Yes

Transportation cost required to put

asset to use

Amount to paint the company name on the

machine No

Not a cost since not a mandatory

expense

Amount paid to an engineer to fit the

machine ready for work Yes

Installation cost required to put asset to

use

Repairs to the factory door damaged

when bringing in the machine No Not a cost related to asset

Repairs made to replace bolts which had

dislodged during transit No

Not a part of cost should be expensed

off

Particulars Amount

Initial price paid to the supplier 65,000

Cost to deliver the machine to the site 3,500

Amount paid to an engineer to fit the machine ready for

work 14,500

Total Machine Cost 83,000

Part-A (ii)

The available method of depreciation are SLM using life and SLM using hours.

(a) Depreciation using years as life (83,000-7,000)/10 = 7,600

(b) Depreciation using hours as life (83,000-7,000)/100,000*10,000 = 7,600

Note: The information as to hours consumed in respective years is missing, hence it is assumed

that 10,000 hours are used in each year.

No impact on depreciation, however, if above assumption as regards to hours consumed

changes, than the depreciation calculated taking hours as basis will also change.

Part-A (iii)

According to accounting standards, the assets should reflect true and fair view. Hence, the

assets should be revalued so that the value of assets as shown in financials will be correct and

matches with the market value.

Part-A (i)

Calculation of the value of the machine for depreciation purposes

Particulars

Part of

asset? Remarks

Initial price paid to the supplier Yes Purchase cost

Cost to deliver the machine to the site Yes

Transportation cost required to put

asset to use

Amount to paint the company name on the

machine No

Not a cost since not a mandatory

expense

Amount paid to an engineer to fit the

machine ready for work Yes

Installation cost required to put asset to

use

Repairs to the factory door damaged

when bringing in the machine No Not a cost related to asset

Repairs made to replace bolts which had

dislodged during transit No

Not a part of cost should be expensed

off

Particulars Amount

Initial price paid to the supplier 65,000

Cost to deliver the machine to the site 3,500

Amount paid to an engineer to fit the machine ready for

work 14,500

Total Machine Cost 83,000

Part-A (ii)

The available method of depreciation are SLM using life and SLM using hours.

(a) Depreciation using years as life (83,000-7,000)/10 = 7,600

(b) Depreciation using hours as life (83,000-7,000)/100,000*10,000 = 7,600

Note: The information as to hours consumed in respective years is missing, hence it is assumed

that 10,000 hours are used in each year.

No impact on depreciation, however, if above assumption as regards to hours consumed

changes, than the depreciation calculated taking hours as basis will also change.

Part-A (iii)

According to accounting standards, the assets should reflect true and fair view. Hence, the

assets should be revalued so that the value of assets as shown in financials will be correct and

matches with the market value.

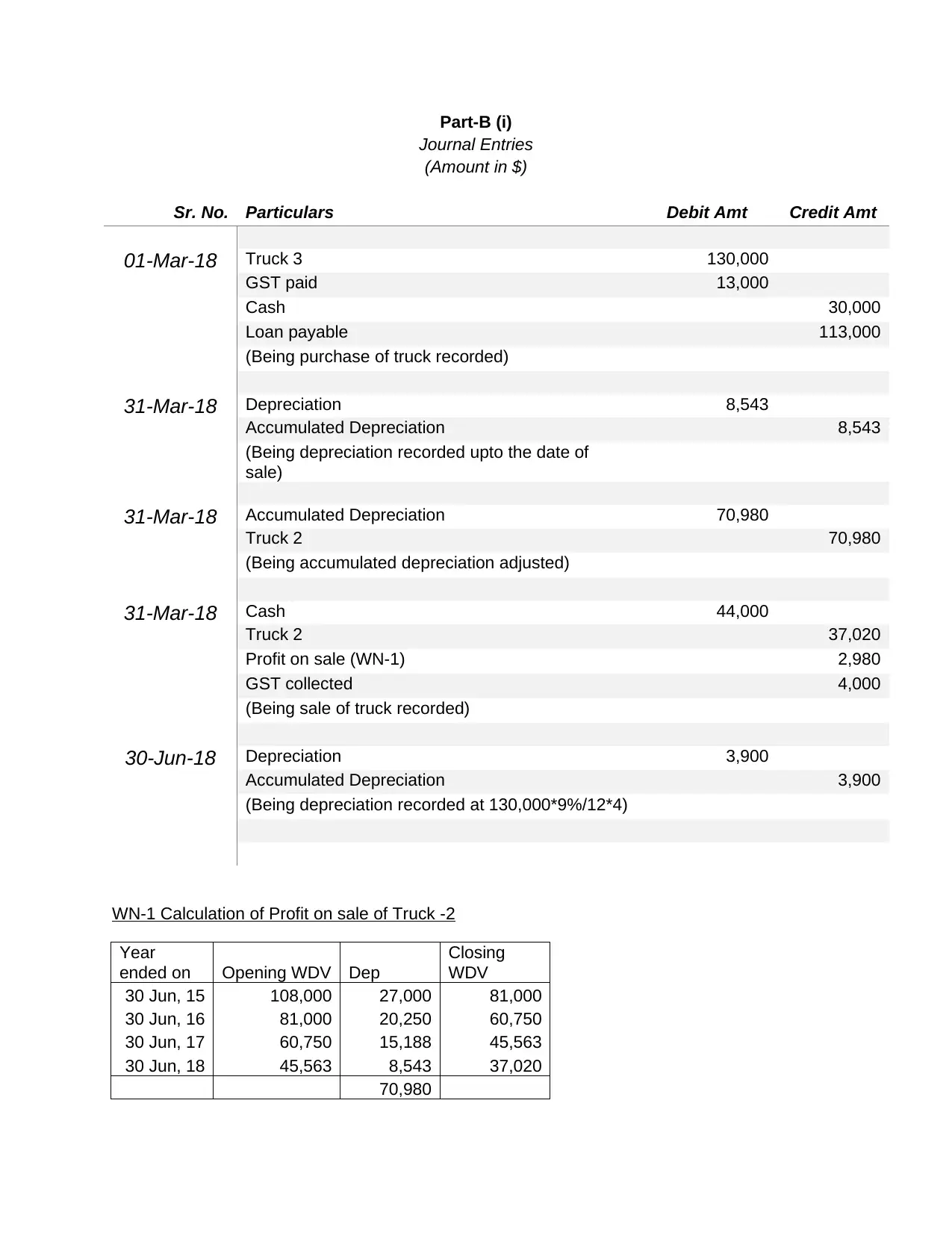

Part-B (i)

Journal Entries

(Amount in $)

Sr. No. Particulars Debit Amt Credit Amt

01-Mar-18 Truck 3 130,000

GST paid 13,000

Cash 30,000

Loan payable 113,000

(Being purchase of truck recorded)

31-Mar-18 Depreciation 8,543

Accumulated Depreciation 8,543

(Being depreciation recorded upto the date of

sale)

31-Mar-18 Accumulated Depreciation 70,980

Truck 2 70,980

(Being accumulated depreciation adjusted)

31-Mar-18 Cash 44,000

Truck 2 37,020

Profit on sale (WN-1) 2,980

GST collected 4,000

(Being sale of truck recorded)

30-Jun-18 Depreciation 3,900

Accumulated Depreciation 3,900

(Being depreciation recorded at 130,000*9%/12*4)

WN-1 Calculation of Profit on sale of Truck -2

Year

ended on Opening WDV Dep

Closing

WDV

30 Jun, 15 108,000 27,000 81,000

30 Jun, 16 81,000 20,250 60,750

30 Jun, 17 60,750 15,188 45,563

30 Jun, 18 45,563 8,543 37,020

70,980

Journal Entries

(Amount in $)

Sr. No. Particulars Debit Amt Credit Amt

01-Mar-18 Truck 3 130,000

GST paid 13,000

Cash 30,000

Loan payable 113,000

(Being purchase of truck recorded)

31-Mar-18 Depreciation 8,543

Accumulated Depreciation 8,543

(Being depreciation recorded upto the date of

sale)

31-Mar-18 Accumulated Depreciation 70,980

Truck 2 70,980

(Being accumulated depreciation adjusted)

31-Mar-18 Cash 44,000

Truck 2 37,020

Profit on sale (WN-1) 2,980

GST collected 4,000

(Being sale of truck recorded)

30-Jun-18 Depreciation 3,900

Accumulated Depreciation 3,900

(Being depreciation recorded at 130,000*9%/12*4)

WN-1 Calculation of Profit on sale of Truck -2

Year

ended on Opening WDV Dep

Closing

WDV

30 Jun, 15 108,000 27,000 81,000

30 Jun, 16 81,000 20,250 60,750

30 Jun, 17 60,750 15,188 45,563

30 Jun, 18 45,563 8,543 37,020

70,980

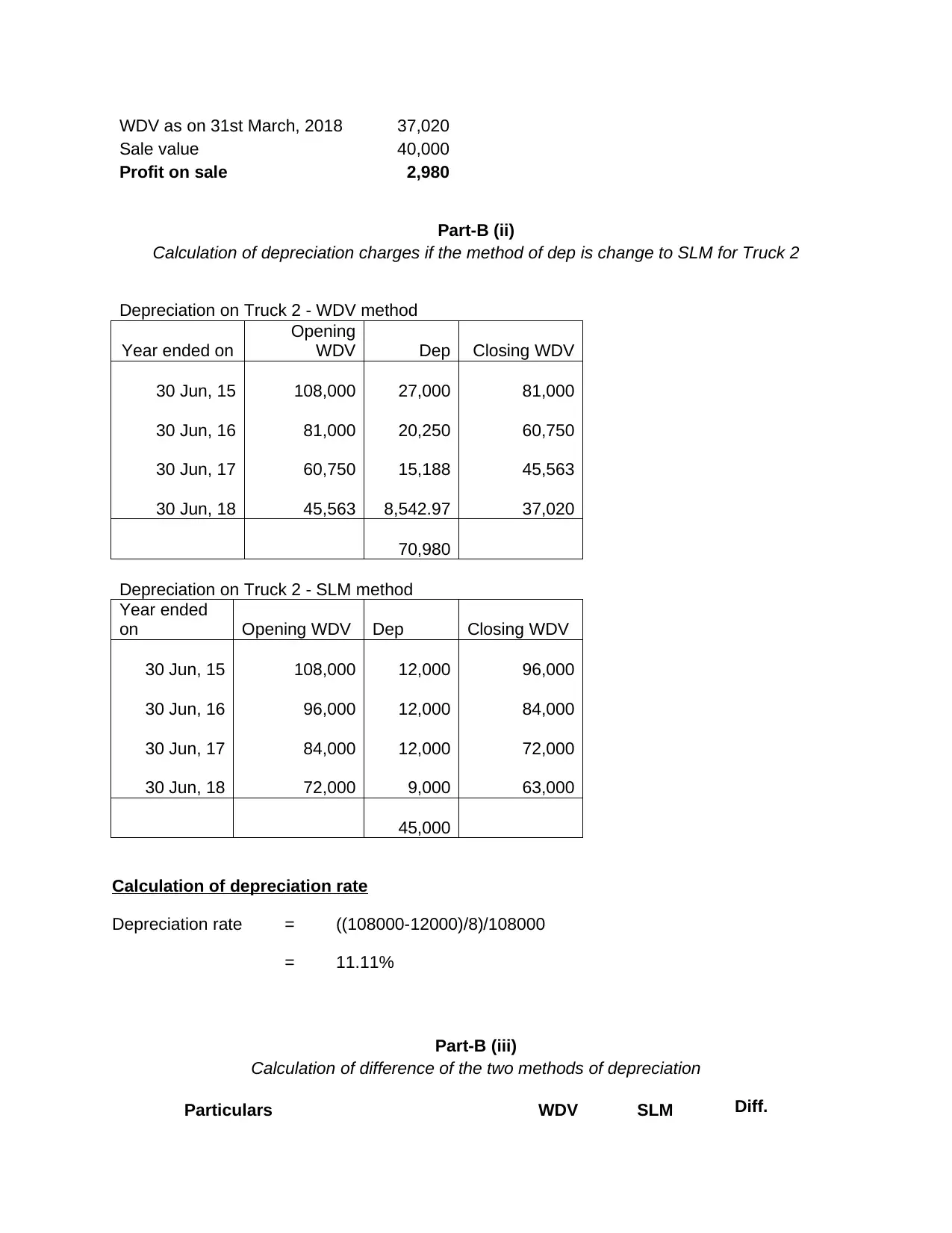

WDV as on 31st March, 2018 37,020

Sale value 40,000

Profit on sale 2,980

Part-B (ii)

Calculation of depreciation charges if the method of dep is change to SLM for Truck 2

Depreciation on Truck 2 - WDV method

Year ended on

Opening

WDV Dep Closing WDV

30 Jun, 15 108,000 27,000 81,000

30 Jun, 16 81,000 20,250 60,750

30 Jun, 17 60,750 15,188 45,563

30 Jun, 18 45,563 8,542.97 37,020

70,980

Depreciation on Truck 2 - SLM method

Year ended

on Opening WDV Dep Closing WDV

30 Jun, 15 108,000 12,000 96,000

30 Jun, 16 96,000 12,000 84,000

30 Jun, 17 84,000 12,000 72,000

30 Jun, 18 72,000 9,000 63,000

45,000

Calculation of depreciation rate

Depreciation rate = ((108000-12000)/8)/108000

= 11.11%

Part-B (iii)

Calculation of difference of the two methods of depreciation

Particulars WDV SLM Diff.

Sale value 40,000

Profit on sale 2,980

Part-B (ii)

Calculation of depreciation charges if the method of dep is change to SLM for Truck 2

Depreciation on Truck 2 - WDV method

Year ended on

Opening

WDV Dep Closing WDV

30 Jun, 15 108,000 27,000 81,000

30 Jun, 16 81,000 20,250 60,750

30 Jun, 17 60,750 15,188 45,563

30 Jun, 18 45,563 8,542.97 37,020

70,980

Depreciation on Truck 2 - SLM method

Year ended

on Opening WDV Dep Closing WDV

30 Jun, 15 108,000 12,000 96,000

30 Jun, 16 96,000 12,000 84,000

30 Jun, 17 84,000 12,000 72,000

30 Jun, 18 72,000 9,000 63,000

45,000

Calculation of depreciation rate

Depreciation rate = ((108000-12000)/8)/108000

= 11.11%

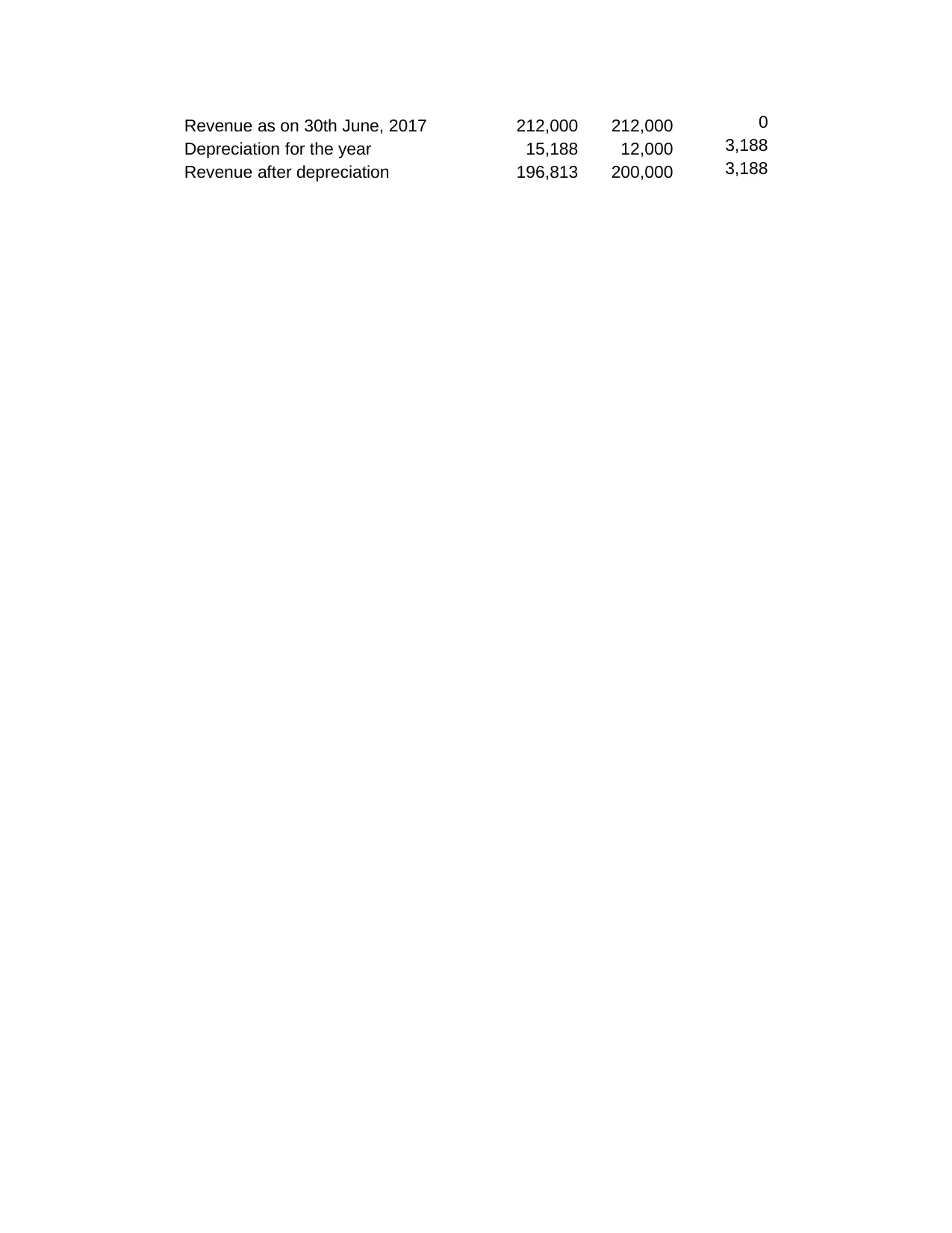

Part-B (iii)

Calculation of difference of the two methods of depreciation

Particulars WDV SLM Diff.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Revenue as on 30th June, 2017 212,000 212,000 0

Depreciation for the year 15,188 12,000 3,188

Revenue after depreciation 196,813 200,000 3,188

Depreciation for the year 15,188 12,000 3,188

Revenue after depreciation 196,813 200,000 3,188

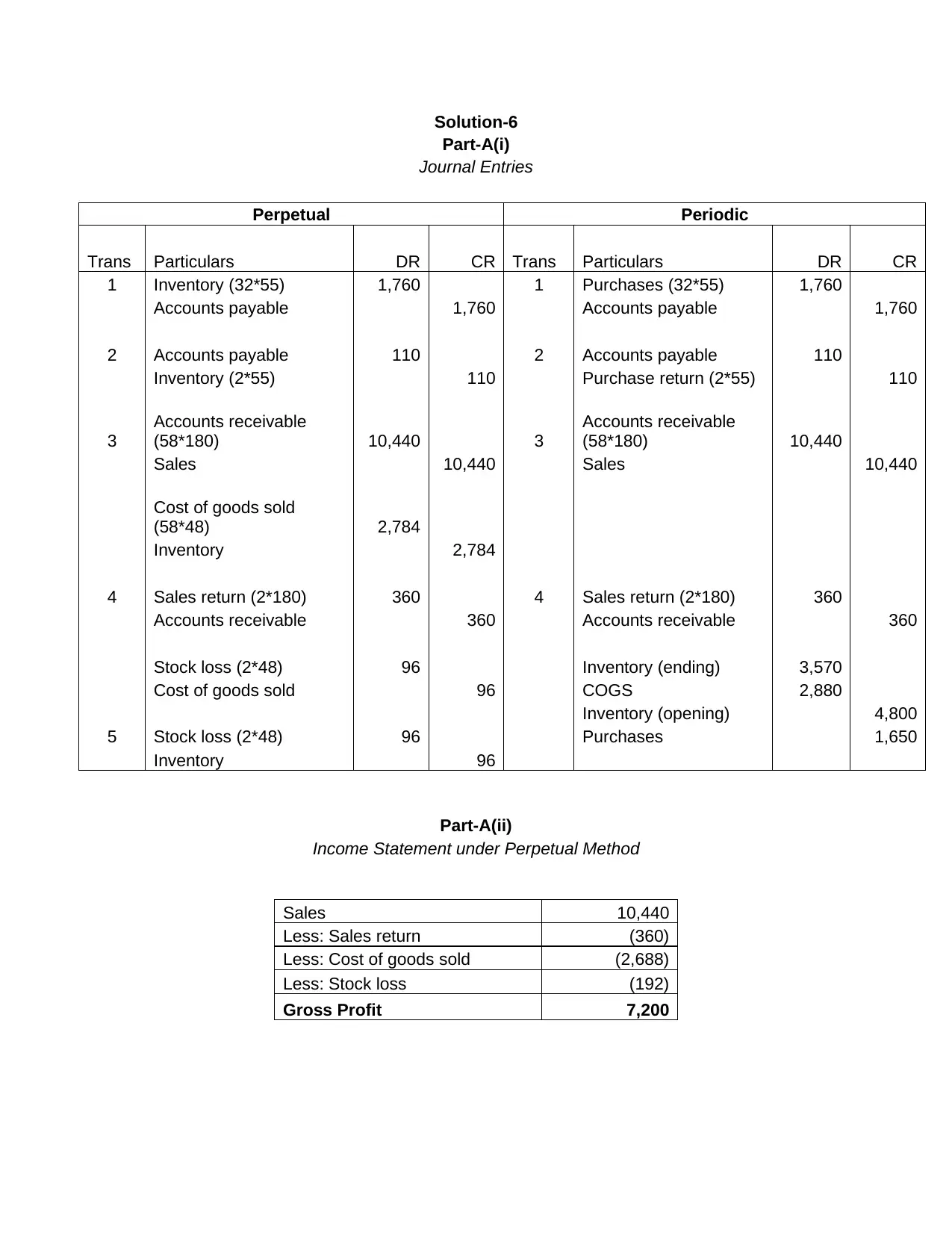

Solution-6

Part-A(i)

Journal Entries

Perpetual Periodic

Trans Particulars DR CR Trans Particulars DR CR

1 Inventory (32*55) 1,760 1 Purchases (32*55) 1,760

Accounts payable 1,760 Accounts payable 1,760

2 Accounts payable 110 2 Accounts payable 110

Inventory (2*55) 110 Purchase return (2*55) 110

3

Accounts receivable

(58*180) 10,440 3

Accounts receivable

(58*180) 10,440

Sales 10,440 Sales 10,440

Cost of goods sold

(58*48) 2,784

Inventory 2,784

4 Sales return (2*180) 360 4 Sales return (2*180) 360

Accounts receivable 360 Accounts receivable 360

Stock loss (2*48) 96 Inventory (ending) 3,570

Cost of goods sold 96 COGS 2,880

Inventory (opening) 4,800

5 Stock loss (2*48) 96 Purchases 1,650

Inventory 96

Part-A(ii)

Income Statement under Perpetual Method

Sales 10,440

Less: Sales return (360)

Less: Cost of goods sold (2,688)

Less: Stock loss (192)

Gross Profit 7,200

Part-A(i)

Journal Entries

Perpetual Periodic

Trans Particulars DR CR Trans Particulars DR CR

1 Inventory (32*55) 1,760 1 Purchases (32*55) 1,760

Accounts payable 1,760 Accounts payable 1,760

2 Accounts payable 110 2 Accounts payable 110

Inventory (2*55) 110 Purchase return (2*55) 110

3

Accounts receivable

(58*180) 10,440 3

Accounts receivable

(58*180) 10,440

Sales 10,440 Sales 10,440

Cost of goods sold

(58*48) 2,784

Inventory 2,784

4 Sales return (2*180) 360 4 Sales return (2*180) 360

Accounts receivable 360 Accounts receivable 360

Stock loss (2*48) 96 Inventory (ending) 3,570

Cost of goods sold 96 COGS 2,880

Inventory (opening) 4,800

5 Stock loss (2*48) 96 Purchases 1,650

Inventory 96

Part-A(ii)

Income Statement under Perpetual Method

Sales 10,440

Less: Sales return (360)

Less: Cost of goods sold (2,688)

Less: Stock loss (192)

Gross Profit 7,200

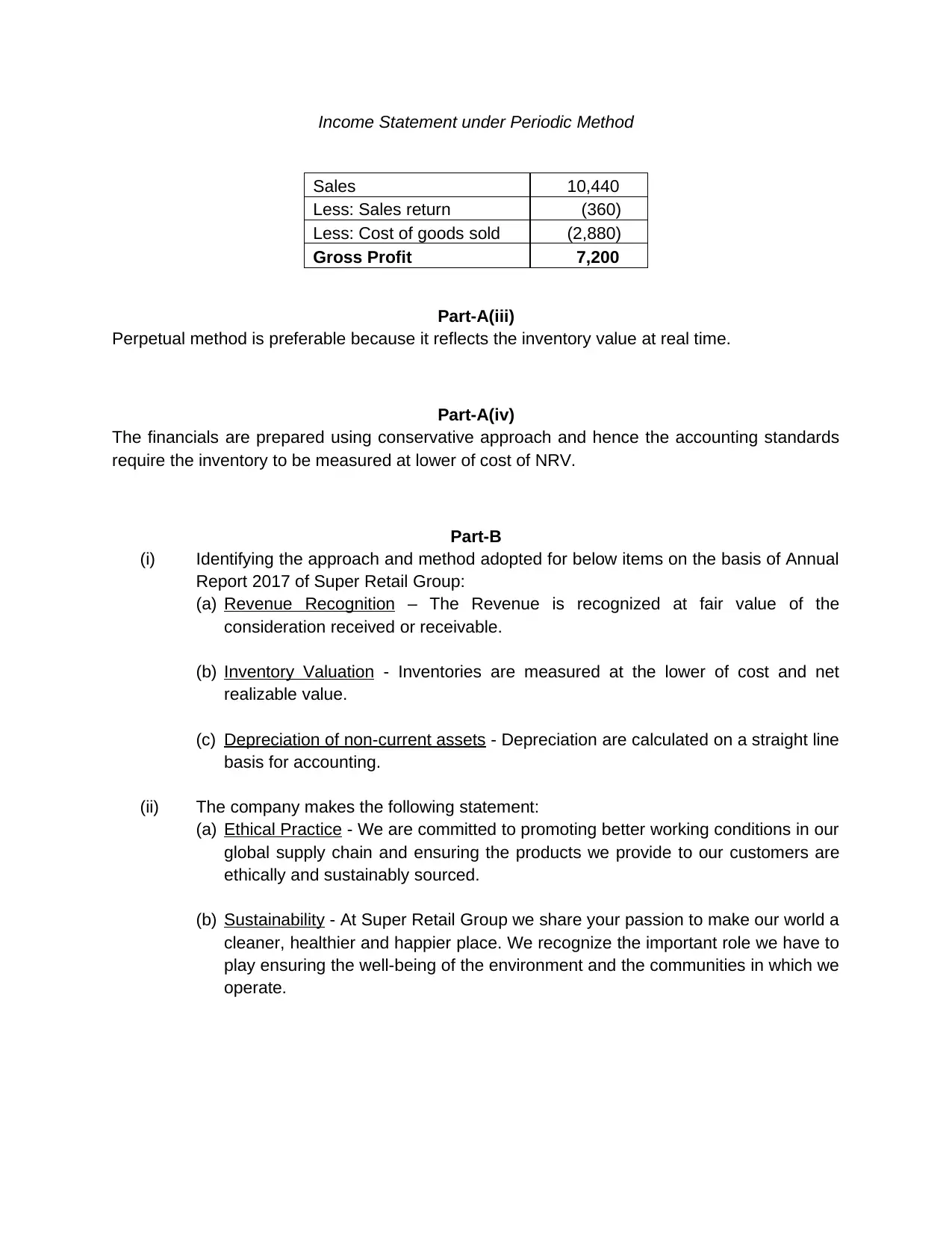

Income Statement under Periodic Method

Sales 10,440

Less: Sales return (360)

Less: Cost of goods sold (2,880)

Gross Profit 7,200

Part-A(iii)

Perpetual method is preferable because it reflects the inventory value at real time.

Part-A(iv)

The financials are prepared using conservative approach and hence the accounting standards

require the inventory to be measured at lower of cost of NRV.

Part-B

(i) Identifying the approach and method adopted for below items on the basis of Annual

Report 2017 of Super Retail Group:

(a) Revenue Recognition – The Revenue is recognized at fair value of the

consideration received or receivable.

(b) Inventory Valuation - Inventories are measured at the lower of cost and net

realizable value.

(c) Depreciation of non-current assets - Depreciation are calculated on a straight line

basis for accounting.

(ii) The company makes the following statement:

(a) Ethical Practice - We are committed to promoting better working conditions in our

global supply chain and ensuring the products we provide to our customers are

ethically and sustainably sourced.

(b) Sustainability - At Super Retail Group we share your passion to make our world a

cleaner, healthier and happier place. We recognize the important role we have to

play ensuring the well-being of the environment and the communities in which we

operate.

Sales 10,440

Less: Sales return (360)

Less: Cost of goods sold (2,880)

Gross Profit 7,200

Part-A(iii)

Perpetual method is preferable because it reflects the inventory value at real time.

Part-A(iv)

The financials are prepared using conservative approach and hence the accounting standards

require the inventory to be measured at lower of cost of NRV.

Part-B

(i) Identifying the approach and method adopted for below items on the basis of Annual

Report 2017 of Super Retail Group:

(a) Revenue Recognition – The Revenue is recognized at fair value of the

consideration received or receivable.

(b) Inventory Valuation - Inventories are measured at the lower of cost and net

realizable value.

(c) Depreciation of non-current assets - Depreciation are calculated on a straight line

basis for accounting.

(ii) The company makes the following statement:

(a) Ethical Practice - We are committed to promoting better working conditions in our

global supply chain and ensuring the products we provide to our customers are

ethically and sustainably sourced.

(b) Sustainability - At Super Retail Group we share your passion to make our world a

cleaner, healthier and happier place. We recognize the important role we have to

play ensuring the well-being of the environment and the communities in which we

operate.

1 out of 16

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.