Analyzing the Impact of Financial Management on Manufacturing Industry

VerifiedAdded on 2020/07/23

|17

|4325

|52

AI Summary

The assignment provided is a detailed analysis of the financial management practices in the manufacturing industry. It includes a review of various academic sources, such as journal articles and books, that discuss the importance of sound budgeting and financial management practices at the decentralised level of public administration. The assignment also examines the role of financial and non-financial evaluation measures in the process of management control over foreign subsidiaries. Additionally, it analyzes the financial statements of two Australian companies, Asaleo Care Ltd. and Brickworks Ltd., to assess their profitability, liquidity, efficiency, and debt ratios. The assignment concludes by discussing the major economic factors that affect businesses drastically.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

PRINCIPLE FINANCIAL

MANAGEMENT

MANAGEMENT

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

EXECUTIVE SUMMARY

Financial market is a place in which list of securities, commodities, stock, derivatives etc.

are exchanged among seller and buyer. Stock comprises with equity, debentures, bonds and

preference shares whereas commodities include precious metal, stones and agricultural products.

Purpose of people behind involving in this kind of market is gaining huge income with the low

costs. In order to conduct the present study about financial management, manufacturing industry

of Australia is taken as base. Further, Brickworks Limited (BKW) and Asaleo Care Limited

(AHY) are considered which are listed in ASX market (Australian Stock Exchange). In this

project, economic fundamentals are explained along with ways that how these influence to the

business performance and price of shares. Such factors are like interest rate, economic growth,

value of currency, exchange, recession, inflation rate etc. Apart from this, position of Brickworks

and Asaleo is analysed in the study in terms of financials within manufacturing sector. For this,

financial ratios computed and interpreted which involve profitability, solvency, liquidity,

efficiency and dividend payout. Once comparison among selected firms done then compared

with the industry average of relevant ratios. On the basis of this, performance in market or

overall sector is also easily pertained of the cited organisations.

Financial market is a place in which list of securities, commodities, stock, derivatives etc.

are exchanged among seller and buyer. Stock comprises with equity, debentures, bonds and

preference shares whereas commodities include precious metal, stones and agricultural products.

Purpose of people behind involving in this kind of market is gaining huge income with the low

costs. In order to conduct the present study about financial management, manufacturing industry

of Australia is taken as base. Further, Brickworks Limited (BKW) and Asaleo Care Limited

(AHY) are considered which are listed in ASX market (Australian Stock Exchange). In this

project, economic fundamentals are explained along with ways that how these influence to the

business performance and price of shares. Such factors are like interest rate, economic growth,

value of currency, exchange, recession, inflation rate etc. Apart from this, position of Brickworks

and Asaleo is analysed in the study in terms of financials within manufacturing sector. For this,

financial ratios computed and interpreted which involve profitability, solvency, liquidity,

efficiency and dividend payout. Once comparison among selected firms done then compared

with the industry average of relevant ratios. On the basis of this, performance in market or

overall sector is also easily pertained of the cited organisations.

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

INTRODUCTION

Introduction of manufacturing industry of Australia

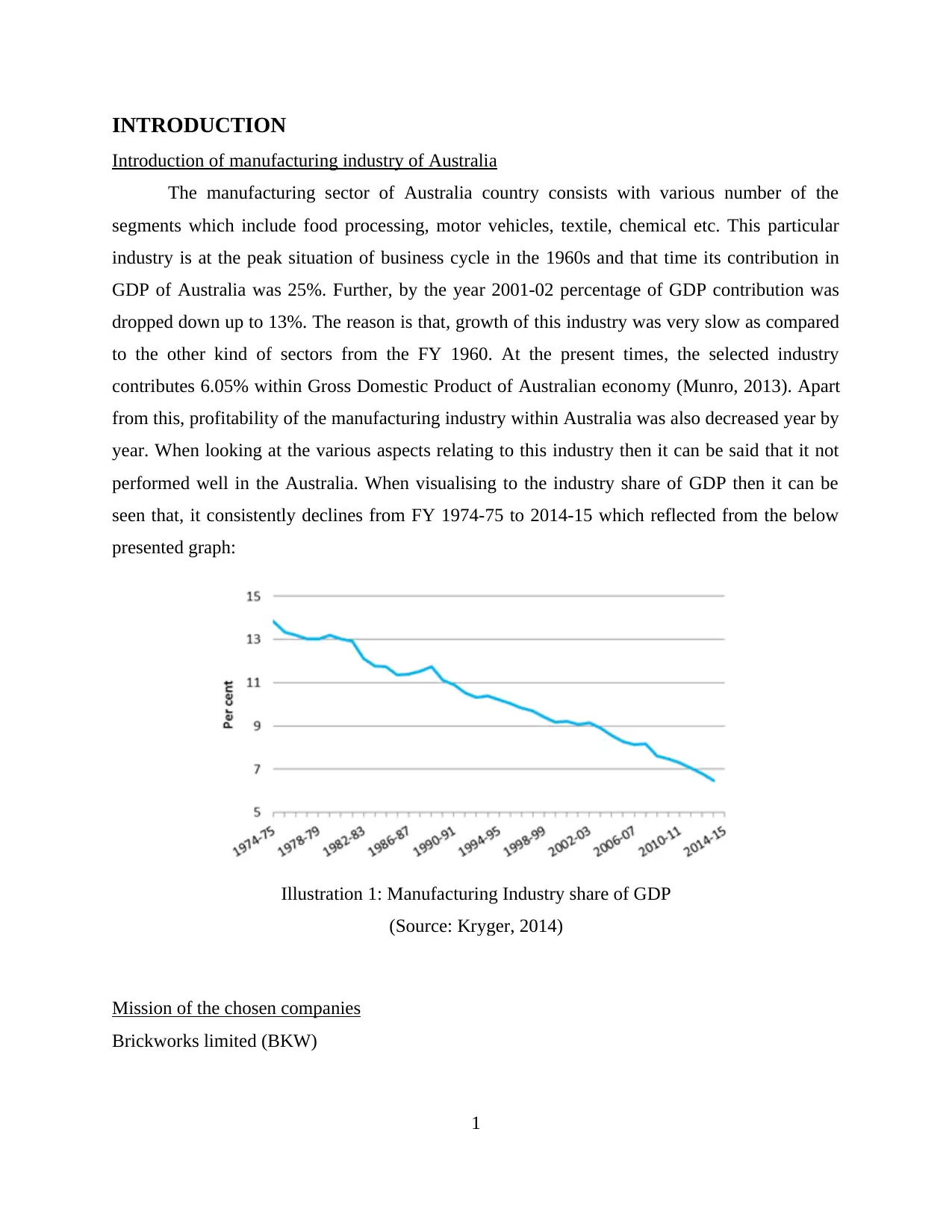

The manufacturing sector of Australia country consists with various number of the

segments which include food processing, motor vehicles, textile, chemical etc. This particular

industry is at the peak situation of business cycle in the 1960s and that time its contribution in

GDP of Australia was 25%. Further, by the year 2001-02 percentage of GDP contribution was

dropped down up to 13%. The reason is that, growth of this industry was very slow as compared

to the other kind of sectors from the FY 1960. At the present times, the selected industry

contributes 6.05% within Gross Domestic Product of Australian economy (Munro, 2013). Apart

from this, profitability of the manufacturing industry within Australia was also decreased year by

year. When looking at the various aspects relating to this industry then it can be said that it not

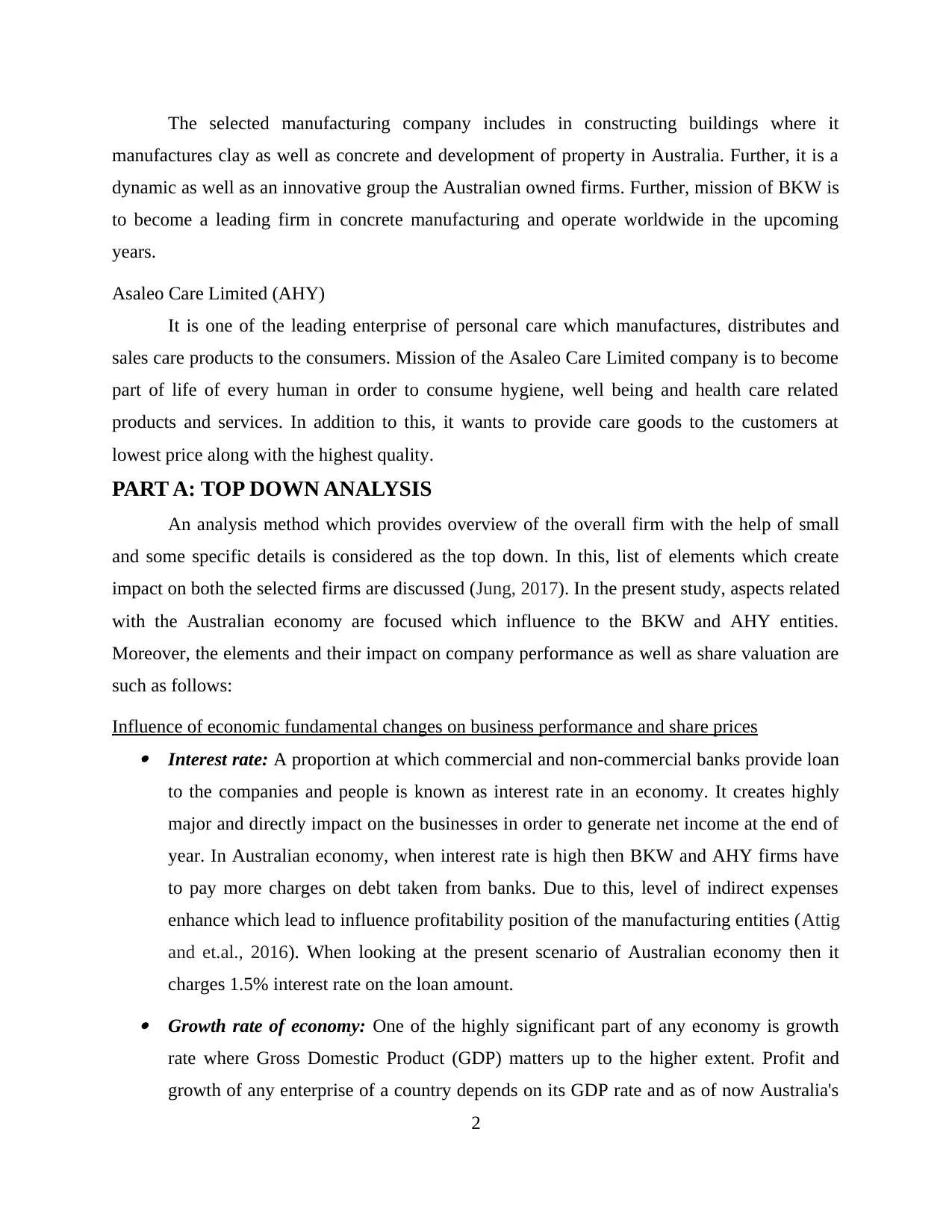

performed well in the Australia. When visualising to the industry share of GDP then it can be

seen that, it consistently declines from FY 1974-75 to 2014-15 which reflected from the below

presented graph:

Illustration 1: Manufacturing Industry share of GDP

(Source: Kryger, 2014)

Mission of the chosen companies

Brickworks limited (BKW)

1

Introduction of manufacturing industry of Australia

The manufacturing sector of Australia country consists with various number of the

segments which include food processing, motor vehicles, textile, chemical etc. This particular

industry is at the peak situation of business cycle in the 1960s and that time its contribution in

GDP of Australia was 25%. Further, by the year 2001-02 percentage of GDP contribution was

dropped down up to 13%. The reason is that, growth of this industry was very slow as compared

to the other kind of sectors from the FY 1960. At the present times, the selected industry

contributes 6.05% within Gross Domestic Product of Australian economy (Munro, 2013). Apart

from this, profitability of the manufacturing industry within Australia was also decreased year by

year. When looking at the various aspects relating to this industry then it can be said that it not

performed well in the Australia. When visualising to the industry share of GDP then it can be

seen that, it consistently declines from FY 1974-75 to 2014-15 which reflected from the below

presented graph:

Illustration 1: Manufacturing Industry share of GDP

(Source: Kryger, 2014)

Mission of the chosen companies

Brickworks limited (BKW)

1

The selected manufacturing company includes in constructing buildings where it

manufactures clay as well as concrete and development of property in Australia. Further, it is a

dynamic as well as an innovative group the Australian owned firms. Further, mission of BKW is

to become a leading firm in concrete manufacturing and operate worldwide in the upcoming

years.

Asaleo Care Limited (AHY)

It is one of the leading enterprise of personal care which manufactures, distributes and

sales care products to the consumers. Mission of the Asaleo Care Limited company is to become

part of life of every human in order to consume hygiene, well being and health care related

products and services. In addition to this, it wants to provide care goods to the customers at

lowest price along with the highest quality.

PART A: TOP DOWN ANALYSIS

An analysis method which provides overview of the overall firm with the help of small

and some specific details is considered as the top down. In this, list of elements which create

impact on both the selected firms are discussed (Jung, 2017). In the present study, aspects related

with the Australian economy are focused which influence to the BKW and AHY entities.

Moreover, the elements and their impact on company performance as well as share valuation are

such as follows:

Influence of economic fundamental changes on business performance and share prices Interest rate: A proportion at which commercial and non-commercial banks provide loan

to the companies and people is known as interest rate in an economy. It creates highly

major and directly impact on the businesses in order to generate net income at the end of

year. In Australian economy, when interest rate is high then BKW and AHY firms have

to pay more charges on debt taken from banks. Due to this, level of indirect expenses

enhance which lead to influence profitability position of the manufacturing entities (Attig

and et.al., 2016). When looking at the present scenario of Australian economy then it

charges 1.5% interest rate on the loan amount. Growth rate of economy: One of the highly significant part of any economy is growth

rate where Gross Domestic Product (GDP) matters up to the higher extent. Profit and

growth of any enterprise of a country depends on its GDP rate and as of now Australia's

2

manufactures clay as well as concrete and development of property in Australia. Further, it is a

dynamic as well as an innovative group the Australian owned firms. Further, mission of BKW is

to become a leading firm in concrete manufacturing and operate worldwide in the upcoming

years.

Asaleo Care Limited (AHY)

It is one of the leading enterprise of personal care which manufactures, distributes and

sales care products to the consumers. Mission of the Asaleo Care Limited company is to become

part of life of every human in order to consume hygiene, well being and health care related

products and services. In addition to this, it wants to provide care goods to the customers at

lowest price along with the highest quality.

PART A: TOP DOWN ANALYSIS

An analysis method which provides overview of the overall firm with the help of small

and some specific details is considered as the top down. In this, list of elements which create

impact on both the selected firms are discussed (Jung, 2017). In the present study, aspects related

with the Australian economy are focused which influence to the BKW and AHY entities.

Moreover, the elements and their impact on company performance as well as share valuation are

such as follows:

Influence of economic fundamental changes on business performance and share prices Interest rate: A proportion at which commercial and non-commercial banks provide loan

to the companies and people is known as interest rate in an economy. It creates highly

major and directly impact on the businesses in order to generate net income at the end of

year. In Australian economy, when interest rate is high then BKW and AHY firms have

to pay more charges on debt taken from banks. Due to this, level of indirect expenses

enhance which lead to influence profitability position of the manufacturing entities (Attig

and et.al., 2016). When looking at the present scenario of Australian economy then it

charges 1.5% interest rate on the loan amount. Growth rate of economy: One of the highly significant part of any economy is growth

rate where Gross Domestic Product (GDP) matters up to the higher extent. Profit and

growth of any enterprise of a country depends on its GDP rate and as of now Australia's

2

GDP is worth of 1204.62 billion US dollars. When this particular rate of Australia is

higher, then buying power of local community increases (The Major Economic Factors

Affecting Business Drastically, 2016). Therefore, Brickworks and Asaleo companies will

become more capable in order to generate more sales or profit and vice-versa. Currency valuation: When the company exchanges products and services from

international market then value of currency is big matter of concern. The reason is that,

by considering base to this aspect deal in terms of amount is completed among two firms.

Value of 1 Australian Dollars equal to 0.80 US Dollar in the present economic condition.

As value declines then shareholders and customers will not like to purchase shares and

products of the firm (Brigham and Houston, 2012). When purchasing of manufactured

items from BKW and AHY by consumers reduce then directly affects to the total

revenue. Moreover, profitability and business performance both influenced up to the

greater extent in an adverse direction. Recession: A situation of an economy in which product prices decline, flow of wealth in

the market reduces and value of money enhances is known as the recession (Bir, 2016).

In the market, in case this kind of condition comes into consideration then BKW and

AHY entities have to provide their services on low prices. Due to this, they will not able

to recover cost of production and selling from consumers. Therefore, Brickworks and

Asaleo cannot meet the break-even point which is sign of reducing profit at the fiscal

year ending.

Inflation rate: It is opposite condition of recession in the economy where prices of

products and flow of money increases and value of wealth affects negatively. As the

inflation takes place in any economy then purchasing power of people enhance but along

with this, prices boost up. As per the market research in July 2017, rate of inflation within

Australian economy is 1.9% which is at the moderate situation (Inflation rate of

Australia, 2017). Further, higher the inflation in the market create negative impact on

BKW and AHY firms which lead to reduce their performance in manufacturing industry.

When considering to the prices of stock then it directly affected from profitability and

performance of the company. If the firm not able to generate higher amount of profit at the end

of year then value in the market also influence adversely. The above described economic

3

higher, then buying power of local community increases (The Major Economic Factors

Affecting Business Drastically, 2016). Therefore, Brickworks and Asaleo companies will

become more capable in order to generate more sales or profit and vice-versa. Currency valuation: When the company exchanges products and services from

international market then value of currency is big matter of concern. The reason is that,

by considering base to this aspect deal in terms of amount is completed among two firms.

Value of 1 Australian Dollars equal to 0.80 US Dollar in the present economic condition.

As value declines then shareholders and customers will not like to purchase shares and

products of the firm (Brigham and Houston, 2012). When purchasing of manufactured

items from BKW and AHY by consumers reduce then directly affects to the total

revenue. Moreover, profitability and business performance both influenced up to the

greater extent in an adverse direction. Recession: A situation of an economy in which product prices decline, flow of wealth in

the market reduces and value of money enhances is known as the recession (Bir, 2016).

In the market, in case this kind of condition comes into consideration then BKW and

AHY entities have to provide their services on low prices. Due to this, they will not able

to recover cost of production and selling from consumers. Therefore, Brickworks and

Asaleo cannot meet the break-even point which is sign of reducing profit at the fiscal

year ending.

Inflation rate: It is opposite condition of recession in the economy where prices of

products and flow of money increases and value of wealth affects negatively. As the

inflation takes place in any economy then purchasing power of people enhance but along

with this, prices boost up. As per the market research in July 2017, rate of inflation within

Australian economy is 1.9% which is at the moderate situation (Inflation rate of

Australia, 2017). Further, higher the inflation in the market create negative impact on

BKW and AHY firms which lead to reduce their performance in manufacturing industry.

When considering to the prices of stock then it directly affected from profitability and

performance of the company. If the firm not able to generate higher amount of profit at the end

of year then value in the market also influence adversely. The above described economic

3

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

fundamentals having high level of impact on the sales and profit of Brickworks and Asaleo

companies. In general, as profit reduces then business valuation as well in the manufacturing

market of Australia. Therefore, share prices affects directly in the stock market i.e. Australian

Stock Exchange (Duncombe, 2016). Along with this, when such firms generate lower profit, then

unable to provide dividend to their shareholders. Hence, it can be said from the analysis that

economic factors influence performance and stock price of brickworks and Asaleo care limited

up to the higher level.

PART B: BOTTOM UP ANALYSIS

The tool for assessing company's performance under which only internal factors of an

organisation are undertaken is known as the bottom up analysis. There are several kinds of

methods used or applied in the business environment and one of the best is financial ratios.

Henceforth, profitability, efficiency, solvency, liquidity etc. ratios are calculated in the present

report with respect to Brickworks and Asaleo care limited companies. Apart from this, the ratios

are compared with manufacturing industry average as well. The reason is that, external financial

performance is also reflected of the entity within relevant sector.

Financial situations of selected manufacturing firms considering financial ratios

Some ratios regarding to the financials of BKW and AHY manufacturing enterprises are

such as follows:

Profitability ratios

The ratio through which profit situation of a company is measured and analysed at the

end of an accounting period is known as profitability ratios. It generally consists three ways like

gross, operating and net income. Moreover, base taken to perform this ratio is net sales (Frankel,

2016). With reference to Brickworks and Asaleo firm profitability ratios are stated below:

Brickworks Limited Asaleo Care Limited

Profitability ratios Formula 2015 2016 2015 2016

Net sales or

revenue 705 751 623 607

Gross income 191 232 266 242

4

companies. In general, as profit reduces then business valuation as well in the manufacturing

market of Australia. Therefore, share prices affects directly in the stock market i.e. Australian

Stock Exchange (Duncombe, 2016). Along with this, when such firms generate lower profit, then

unable to provide dividend to their shareholders. Hence, it can be said from the analysis that

economic factors influence performance and stock price of brickworks and Asaleo care limited

up to the higher level.

PART B: BOTTOM UP ANALYSIS

The tool for assessing company's performance under which only internal factors of an

organisation are undertaken is known as the bottom up analysis. There are several kinds of

methods used or applied in the business environment and one of the best is financial ratios.

Henceforth, profitability, efficiency, solvency, liquidity etc. ratios are calculated in the present

report with respect to Brickworks and Asaleo care limited companies. Apart from this, the ratios

are compared with manufacturing industry average as well. The reason is that, external financial

performance is also reflected of the entity within relevant sector.

Financial situations of selected manufacturing firms considering financial ratios

Some ratios regarding to the financials of BKW and AHY manufacturing enterprises are

such as follows:

Profitability ratios

The ratio through which profit situation of a company is measured and analysed at the

end of an accounting period is known as profitability ratios. It generally consists three ways like

gross, operating and net income. Moreover, base taken to perform this ratio is net sales (Frankel,

2016). With reference to Brickworks and Asaleo firm profitability ratios are stated below:

Brickworks Limited Asaleo Care Limited

Profitability ratios Formula 2015 2016 2015 2016

Net sales or

revenue 705 751 623 607

Gross income 191 232 266 242

4

Operating income 97 108 116 94

Net income 78 78 76 59

Gross profit ratio

Gross income / net sales

*100 27.09% 30.89% 42.70% 39.87%

Operating profit

ratio

Operating income / net sales

*100 13.76% 14.38% 18.62% 15.49%

Net profit ratio Net income / net sales *100 11.06% 10.39% 12.20% 9.72%

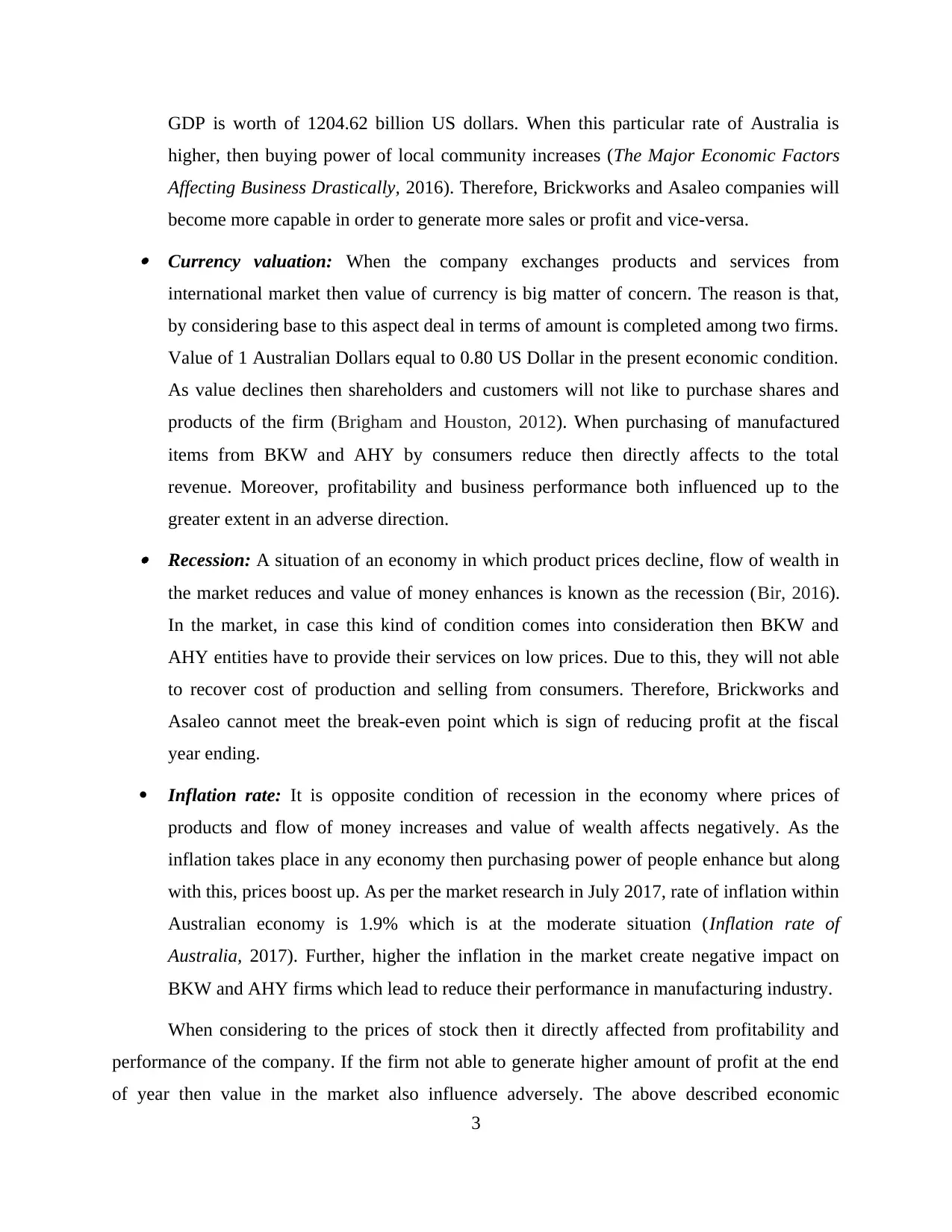

Illustration 2: Profitability ratios

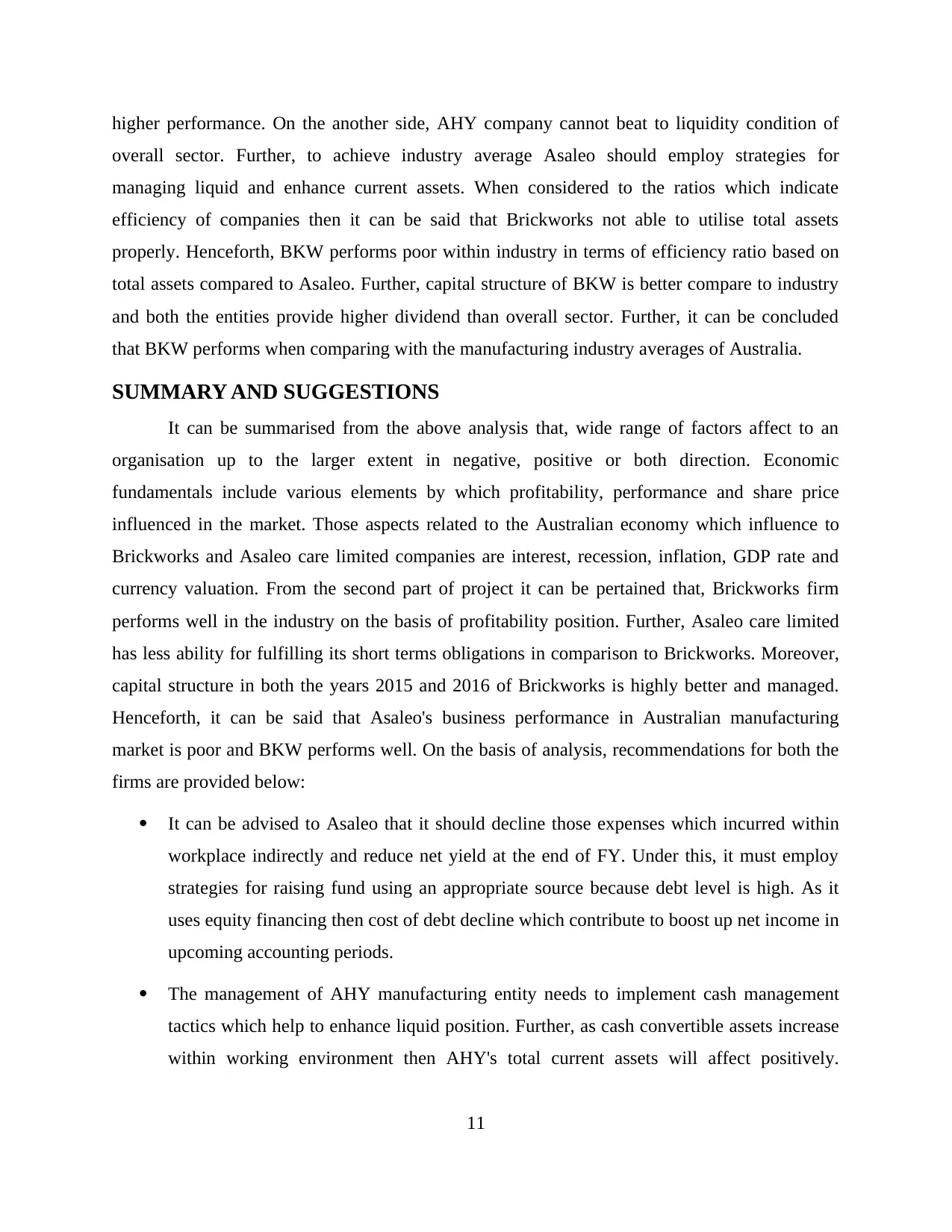

Interpretation: It can be found from the above calculation made that, operating and net

profit both the ratios declining of Brickworks and Asaleo company from 2015 to 2016. OP of

BKW and AHY at the year ending 2016 are 14.38% and 15.49% respectively in which ratio of

Brickworks declined. Apart from this, NP ratio was 11.06% and 12.20% of BKW and AHY in

the year 2015 which also reduces in upcoming period. In the FY 2016, NP ratio comes at 10.39%

and 9.72% which indicates that indirect costs increases consistently (Financials of Asaleo Care

Ltd., 2016). In addition to this, declining growth rate of overall manufacturing industry in

Australia is also a cause of reducing NP ratio (Zaman, 2017). In this, both manufacturing

enterprises should take corrective actions and boost up their revenue in upcoming year.

5

Net income 78 78 76 59

Gross profit ratio

Gross income / net sales

*100 27.09% 30.89% 42.70% 39.87%

Operating profit

ratio

Operating income / net sales

*100 13.76% 14.38% 18.62% 15.49%

Net profit ratio Net income / net sales *100 11.06% 10.39% 12.20% 9.72%

Illustration 2: Profitability ratios

Interpretation: It can be found from the above calculation made that, operating and net

profit both the ratios declining of Brickworks and Asaleo company from 2015 to 2016. OP of

BKW and AHY at the year ending 2016 are 14.38% and 15.49% respectively in which ratio of

Brickworks declined. Apart from this, NP ratio was 11.06% and 12.20% of BKW and AHY in

the year 2015 which also reduces in upcoming period. In the FY 2016, NP ratio comes at 10.39%

and 9.72% which indicates that indirect costs increases consistently (Financials of Asaleo Care

Ltd., 2016). In addition to this, declining growth rate of overall manufacturing industry in

Australia is also a cause of reducing NP ratio (Zaman, 2017). In this, both manufacturing

enterprises should take corrective actions and boost up their revenue in upcoming year.

5

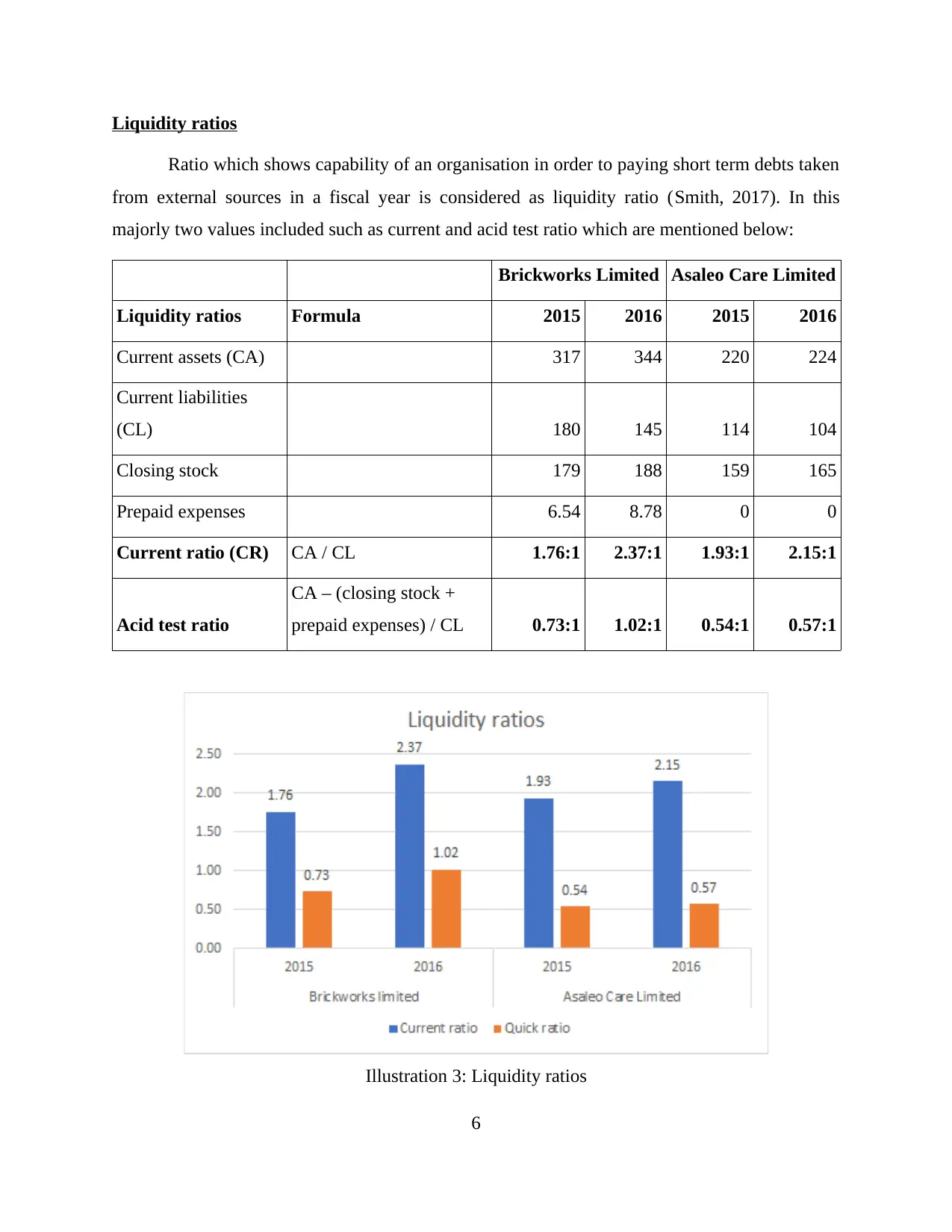

Liquidity ratios

Ratio which shows capability of an organisation in order to paying short term debts taken

from external sources in a fiscal year is considered as liquidity ratio (Smith, 2017). In this

majorly two values included such as current and acid test ratio which are mentioned below:

Brickworks Limited Asaleo Care Limited

Liquidity ratios Formula 2015 2016 2015 2016

Current assets (CA) 317 344 220 224

Current liabilities

(CL) 180 145 114 104

Closing stock 179 188 159 165

Prepaid expenses 6.54 8.78 0 0

Current ratio (CR) CA / CL 1.76:1 2.37:1 1.93:1 2.15:1

Acid test ratio

CA – (closing stock +

prepaid expenses) / CL 0.73:1 1.02:1 0.54:1 0.57:1

Illustration 3: Liquidity ratios

6

Ratio which shows capability of an organisation in order to paying short term debts taken

from external sources in a fiscal year is considered as liquidity ratio (Smith, 2017). In this

majorly two values included such as current and acid test ratio which are mentioned below:

Brickworks Limited Asaleo Care Limited

Liquidity ratios Formula 2015 2016 2015 2016

Current assets (CA) 317 344 220 224

Current liabilities

(CL) 180 145 114 104

Closing stock 179 188 159 165

Prepaid expenses 6.54 8.78 0 0

Current ratio (CR) CA / CL 1.76:1 2.37:1 1.93:1 2.15:1

Acid test ratio

CA – (closing stock +

prepaid expenses) / CL 0.73:1 1.02:1 0.54:1 0.57:1

Illustration 3: Liquidity ratios

6

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

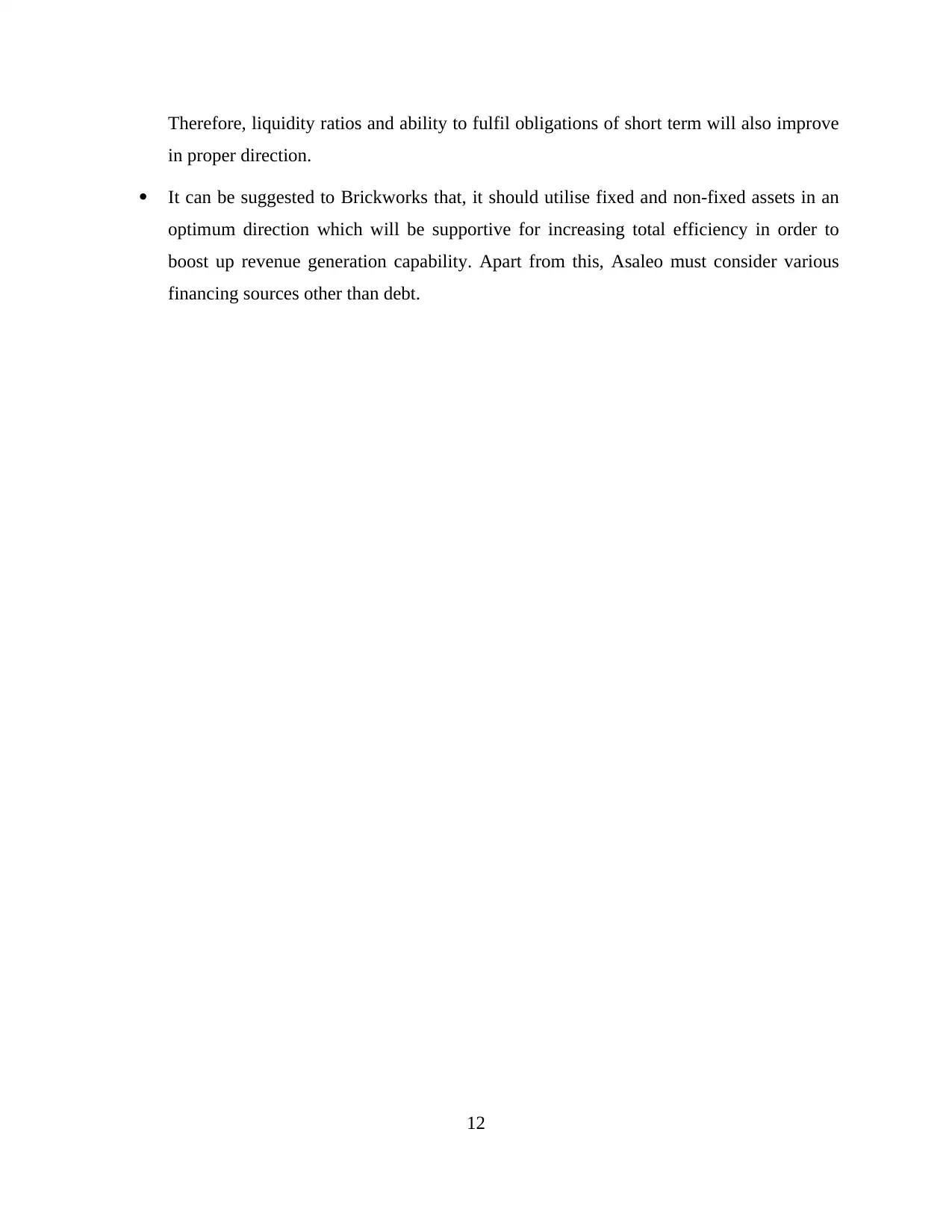

Interpretation: It can be pertained from the above graph of liquidity ratios that, current

and acid test both the ratios are increased in Brickworks and Asaleo firms in FY 2016. Increasing

CR from 1.76:1 to 2.37:1 and 1.93:1 to 2.15:1 in BKW and AHY manufacturing firms

respectively reflect that these have more capability to pay debt amount. As per ideal CR ratio i.e.

2:1 also companies perform very well in the market at the next year. By considering such values

of ratios it can be said that, entities have higher amount of current assets as compared to the

current liabilities which is better for them. Apart from this, acid test ratio also enhanced in both

firms but AHY not able to meet its standard proportion i.e. 1:1. Therefore, it can be said that

liquid position and performance of Brickworks limited is well at the end of 2016 within

Australian manufacturing sector.

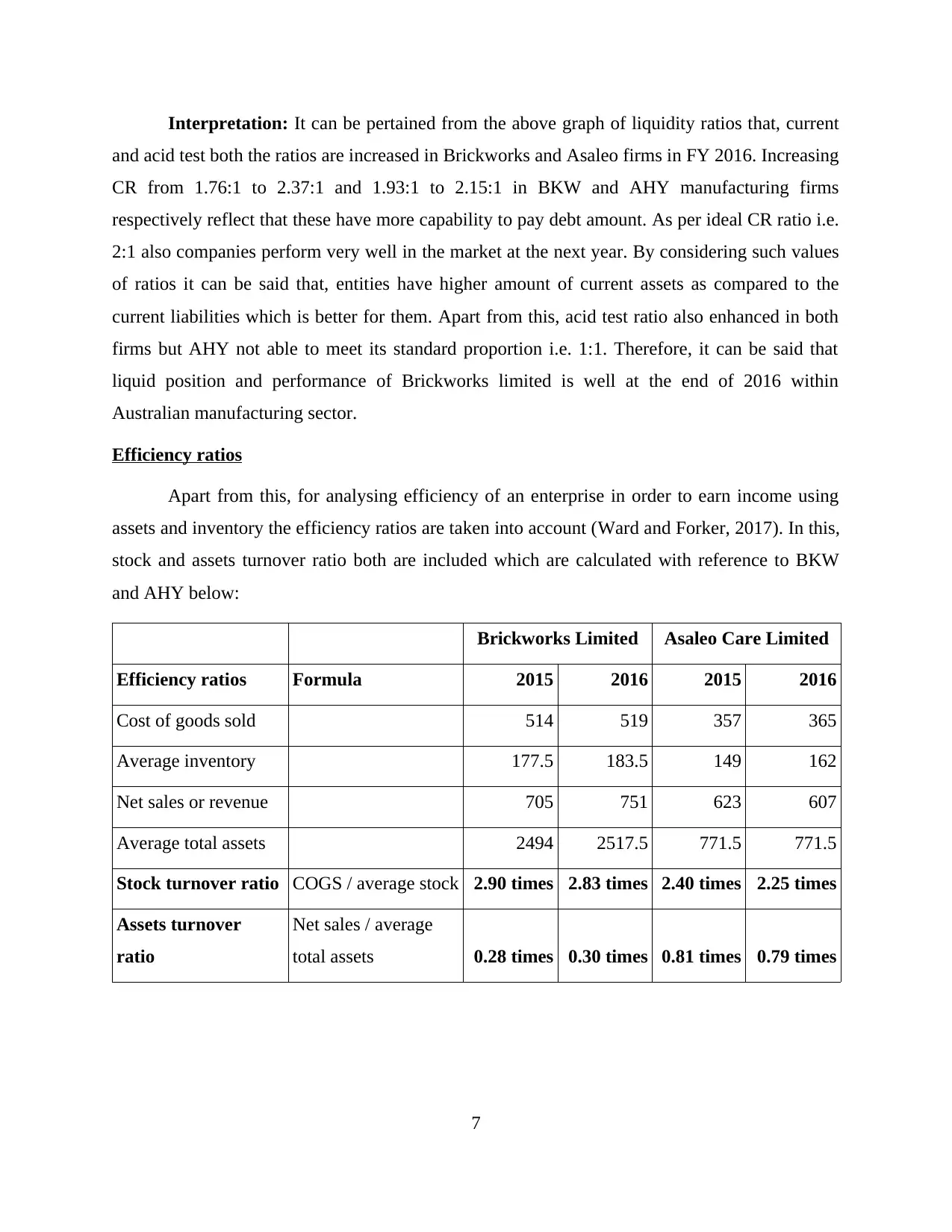

Efficiency ratios

Apart from this, for analysing efficiency of an enterprise in order to earn income using

assets and inventory the efficiency ratios are taken into account (Ward and Forker, 2017). In this,

stock and assets turnover ratio both are included which are calculated with reference to BKW

and AHY below:

Brickworks Limited Asaleo Care Limited

Efficiency ratios Formula 2015 2016 2015 2016

Cost of goods sold 514 519 357 365

Average inventory 177.5 183.5 149 162

Net sales or revenue 705 751 623 607

Average total assets 2494 2517.5 771.5 771.5

Stock turnover ratio COGS / average stock 2.90 times 2.83 times 2.40 times 2.25 times

Assets turnover

ratio

Net sales / average

total assets 0.28 times 0.30 times 0.81 times 0.79 times

7

and acid test both the ratios are increased in Brickworks and Asaleo firms in FY 2016. Increasing

CR from 1.76:1 to 2.37:1 and 1.93:1 to 2.15:1 in BKW and AHY manufacturing firms

respectively reflect that these have more capability to pay debt amount. As per ideal CR ratio i.e.

2:1 also companies perform very well in the market at the next year. By considering such values

of ratios it can be said that, entities have higher amount of current assets as compared to the

current liabilities which is better for them. Apart from this, acid test ratio also enhanced in both

firms but AHY not able to meet its standard proportion i.e. 1:1. Therefore, it can be said that

liquid position and performance of Brickworks limited is well at the end of 2016 within

Australian manufacturing sector.

Efficiency ratios

Apart from this, for analysing efficiency of an enterprise in order to earn income using

assets and inventory the efficiency ratios are taken into account (Ward and Forker, 2017). In this,

stock and assets turnover ratio both are included which are calculated with reference to BKW

and AHY below:

Brickworks Limited Asaleo Care Limited

Efficiency ratios Formula 2015 2016 2015 2016

Cost of goods sold 514 519 357 365

Average inventory 177.5 183.5 149 162

Net sales or revenue 705 751 623 607

Average total assets 2494 2517.5 771.5 771.5

Stock turnover ratio COGS / average stock 2.90 times 2.83 times 2.40 times 2.25 times

Assets turnover

ratio

Net sales / average

total assets 0.28 times 0.30 times 0.81 times 0.79 times

7

Illustration 4: Efficiency ratios

Interpretation: When looking at the efficiency to earn revenue using inventory then it

can be analysed that, Brickworks firm performs well. The reason is that stock turnover ratio was

2.90 times and 2.40 times within BKW and AHY firms at the end of 2015. Further, it enhances

and reach up to 2.83 times and 2.25 times in Brickworks and Asaleo respectively in FY 2016. It

can be said after considering this ratio that, first entity utilise inventory in highly optimum way

whereas another organisation not. When looking at the asset turnover ratio then it has been

obtained that, BKW had 0.28 times and AHY had 0.81 times at the fiscal period ending 2015. In

the next year ratio of asset turnover enhances and reduces i.e. 0.30 and 0.79 times respectively in

BKW and AHY (Financials of Brickworks Ltd., 2016). On the basis of this, Asaleo performs

well in previous year but become less efficient for utilising assets in the further accounting

period.

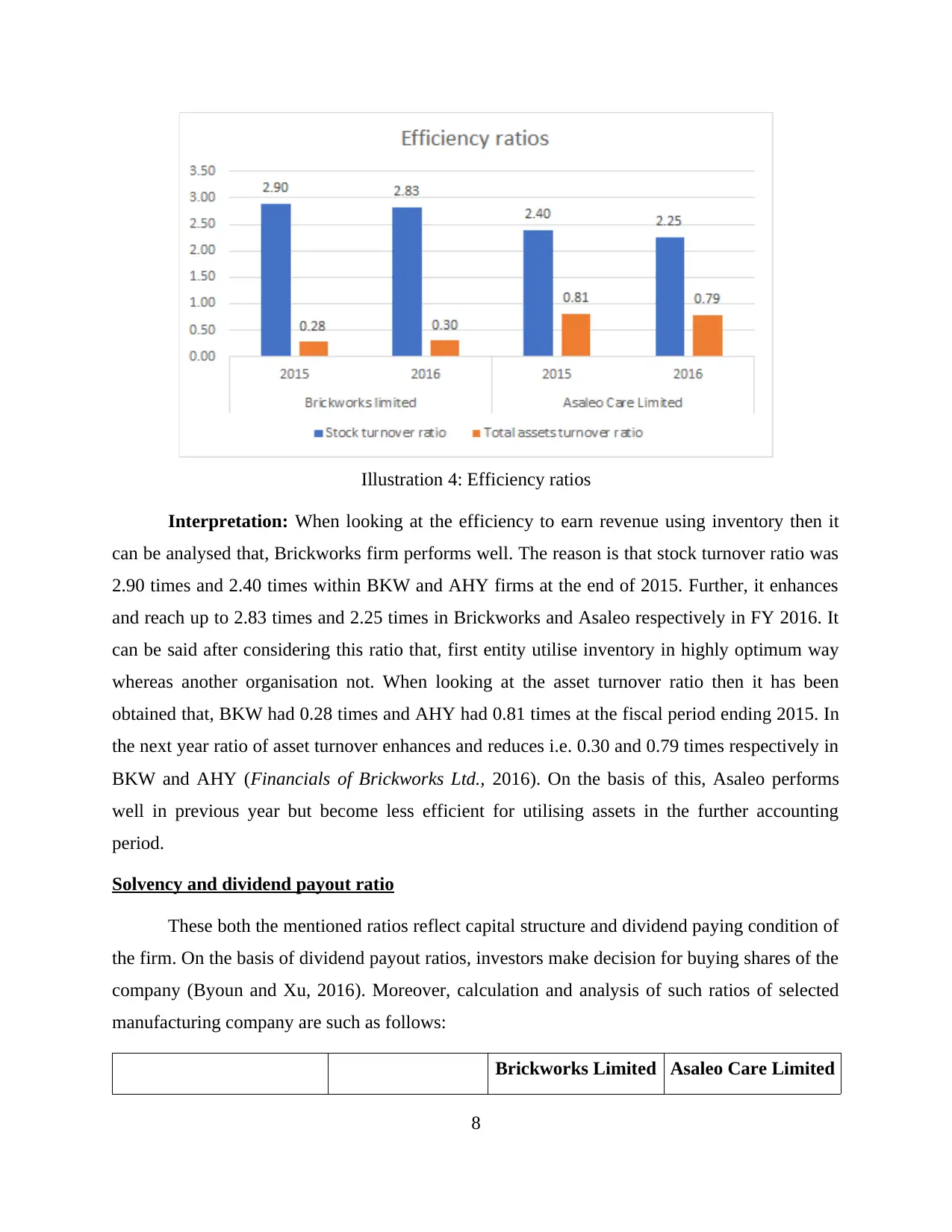

Solvency and dividend payout ratio

These both the mentioned ratios reflect capital structure and dividend paying condition of

the firm. On the basis of dividend payout ratios, investors make decision for buying shares of the

company (Byoun and Xu, 2016). Moreover, calculation and analysis of such ratios of selected

manufacturing company are such as follows:

Brickworks Limited Asaleo Care Limited

8

Interpretation: When looking at the efficiency to earn revenue using inventory then it

can be analysed that, Brickworks firm performs well. The reason is that stock turnover ratio was

2.90 times and 2.40 times within BKW and AHY firms at the end of 2015. Further, it enhances

and reach up to 2.83 times and 2.25 times in Brickworks and Asaleo respectively in FY 2016. It

can be said after considering this ratio that, first entity utilise inventory in highly optimum way

whereas another organisation not. When looking at the asset turnover ratio then it has been

obtained that, BKW had 0.28 times and AHY had 0.81 times at the fiscal period ending 2015. In

the next year ratio of asset turnover enhances and reduces i.e. 0.30 and 0.79 times respectively in

BKW and AHY (Financials of Brickworks Ltd., 2016). On the basis of this, Asaleo performs

well in previous year but become less efficient for utilising assets in the further accounting

period.

Solvency and dividend payout ratio

These both the mentioned ratios reflect capital structure and dividend paying condition of

the firm. On the basis of dividend payout ratios, investors make decision for buying shares of the

company (Byoun and Xu, 2016). Moreover, calculation and analysis of such ratios of selected

manufacturing company are such as follows:

Brickworks Limited Asaleo Care Limited

8

Solvency ratio Formula 2015 2016 2015 2016

Debt 324 299 295 324

Equity 1824 1838 333 307

Debt to equity (D/E) ratio Debt / Equity 0.18:1 0.16:1 0.89:1 1.06:1

Total dividends 67 72 58 55

Net profit 78 78 76 59

Dividend Payout (D/P)

Ratio

Total dividends /

net income 85.90% 92.31% 76.32% 93.22%

Illustration 5: D/E and D/P ratios

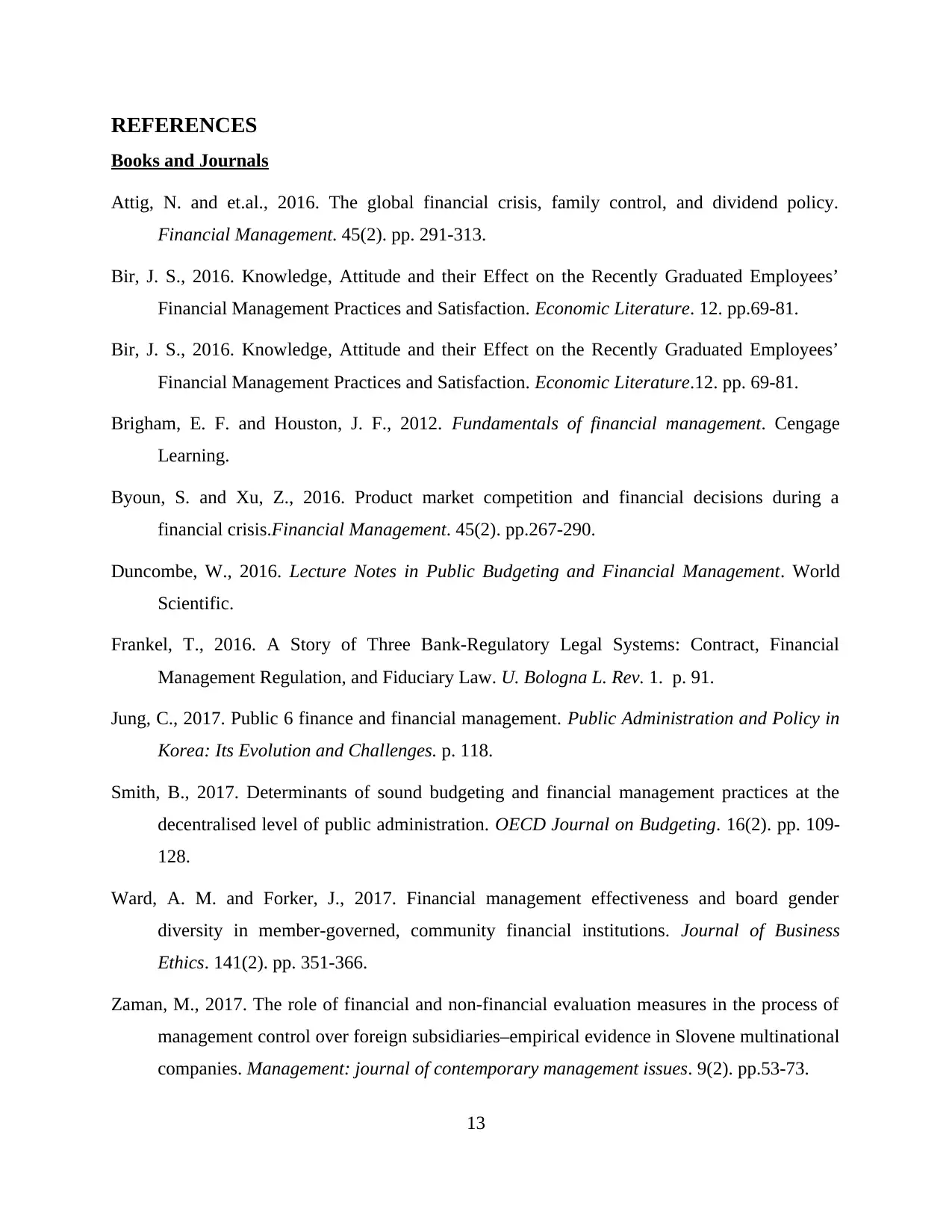

Interpretation: Decreasing debt to equity ratio in Brickworks from 0.18:1 to 0.16:1

shows that, capital structure of it is well managed and it considers equity financing source in

higher proportion than debentures. Moreover, in second firm D/E ratio was 0.89:1 in previous

which enhanced up to 1.06:1 in the year ending 2016. According to this, another firm raises fund

using debt along with generating lower net profit than Brickworks limited. Further D/P ratio

indicates that both firms provide very high amount of dividend to its shareholders. At the end of

9

Debt 324 299 295 324

Equity 1824 1838 333 307

Debt to equity (D/E) ratio Debt / Equity 0.18:1 0.16:1 0.89:1 1.06:1

Total dividends 67 72 58 55

Net profit 78 78 76 59

Dividend Payout (D/P)

Ratio

Total dividends /

net income 85.90% 92.31% 76.32% 93.22%

Illustration 5: D/E and D/P ratios

Interpretation: Decreasing debt to equity ratio in Brickworks from 0.18:1 to 0.16:1

shows that, capital structure of it is well managed and it considers equity financing source in

higher proportion than debentures. Moreover, in second firm D/E ratio was 0.89:1 in previous

which enhanced up to 1.06:1 in the year ending 2016. According to this, another firm raises fund

using debt along with generating lower net profit than Brickworks limited. Further D/P ratio

indicates that both firms provide very high amount of dividend to its shareholders. At the end of

9

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

accounting year 2016, BKW and AHY has 92.31% and 93.22% dividend payout ratio. In clearly

indicates that both entities allow their stockholders in order to give better dividend amount.

Therefore, easily able to attract more shareholders towards it. In this Asaleo must employ those

tactics which support to decline D/E ratio in upcoming years.

After considering overall financial ratios of both the manufacturing enterprises it can be

concluded that, Brickworks limited has better and increasing performance within market. In

opposite to this, Asaleo performs poor when compared with the BKW in the mentioned industry

of Australian economy.

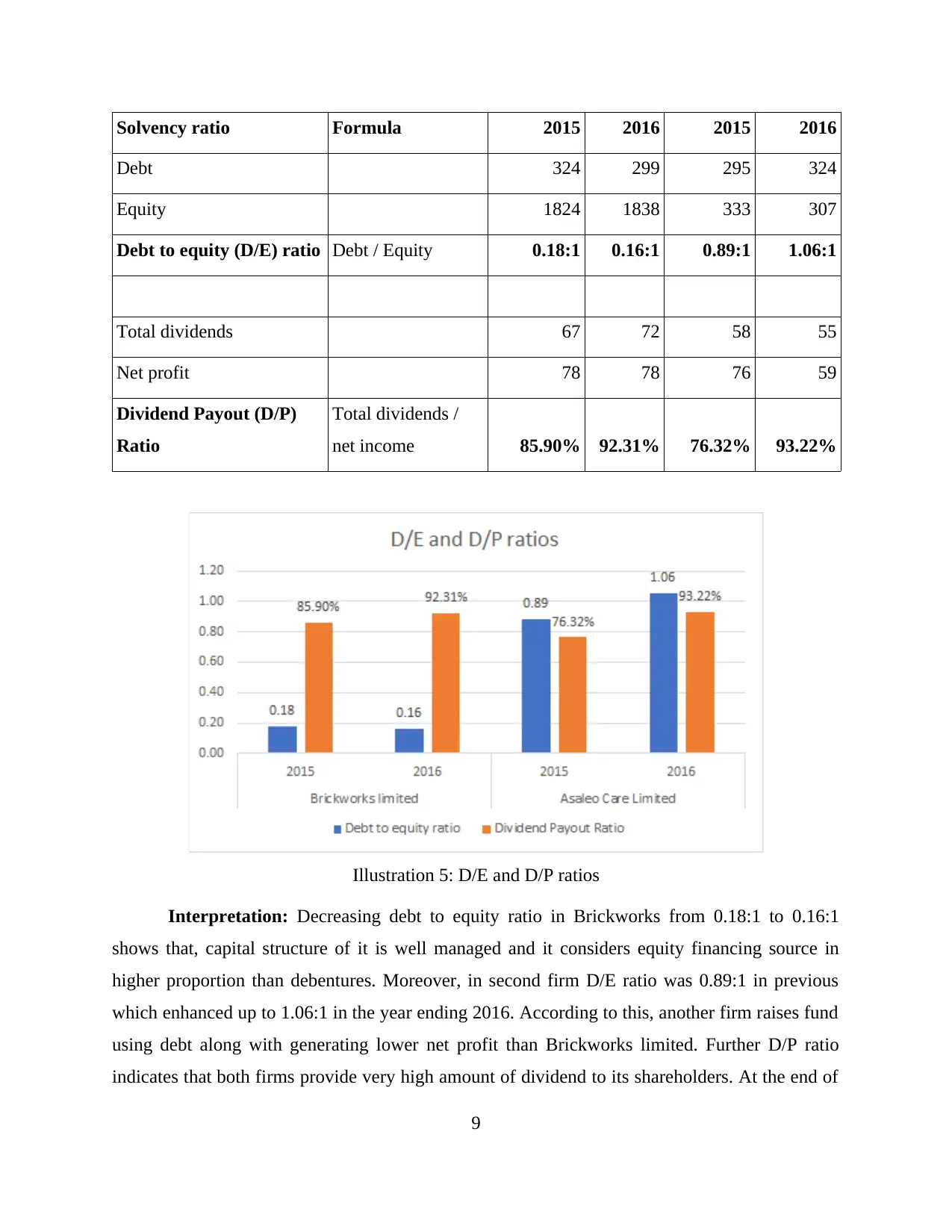

Industry comparison of the companies

Apart from comparing with companies, industry comparison is also one of the significant

part in order to assess performance of an entity (Bir, 2016). Due to this, industry average of

manufacturing market is considered for comparing with BKW and Asaleo firms which stated

below:

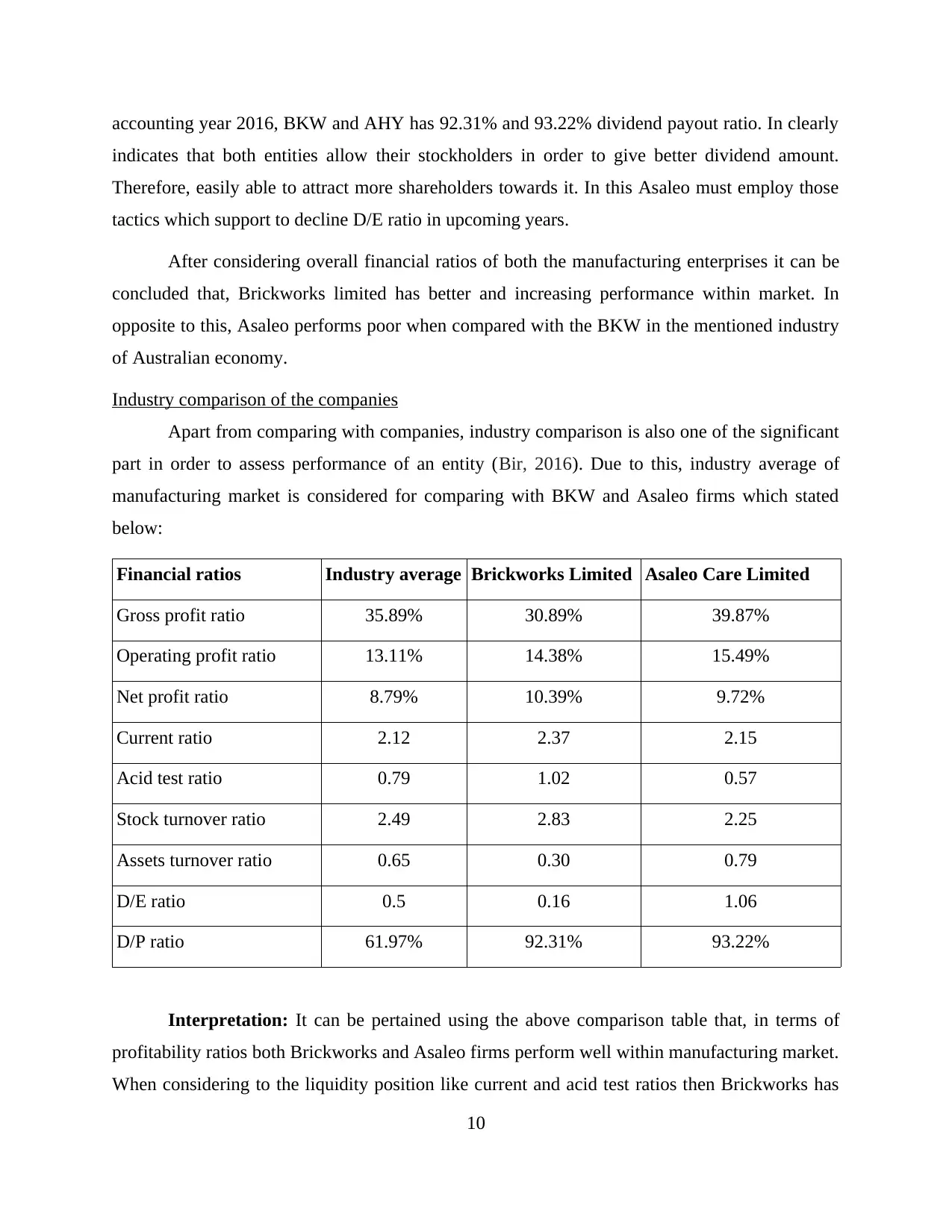

Financial ratios Industry average Brickworks Limited Asaleo Care Limited

Gross profit ratio 35.89% 30.89% 39.87%

Operating profit ratio 13.11% 14.38% 15.49%

Net profit ratio 8.79% 10.39% 9.72%

Current ratio 2.12 2.37 2.15

Acid test ratio 0.79 1.02 0.57

Stock turnover ratio 2.49 2.83 2.25

Assets turnover ratio 0.65 0.30 0.79

D/E ratio 0.5 0.16 1.06

D/P ratio 61.97% 92.31% 93.22%

Interpretation: It can be pertained using the above comparison table that, in terms of

profitability ratios both Brickworks and Asaleo firms perform well within manufacturing market.

When considering to the liquidity position like current and acid test ratios then Brickworks has

10

indicates that both entities allow their stockholders in order to give better dividend amount.

Therefore, easily able to attract more shareholders towards it. In this Asaleo must employ those

tactics which support to decline D/E ratio in upcoming years.

After considering overall financial ratios of both the manufacturing enterprises it can be

concluded that, Brickworks limited has better and increasing performance within market. In

opposite to this, Asaleo performs poor when compared with the BKW in the mentioned industry

of Australian economy.

Industry comparison of the companies

Apart from comparing with companies, industry comparison is also one of the significant

part in order to assess performance of an entity (Bir, 2016). Due to this, industry average of

manufacturing market is considered for comparing with BKW and Asaleo firms which stated

below:

Financial ratios Industry average Brickworks Limited Asaleo Care Limited

Gross profit ratio 35.89% 30.89% 39.87%

Operating profit ratio 13.11% 14.38% 15.49%

Net profit ratio 8.79% 10.39% 9.72%

Current ratio 2.12 2.37 2.15

Acid test ratio 0.79 1.02 0.57

Stock turnover ratio 2.49 2.83 2.25

Assets turnover ratio 0.65 0.30 0.79

D/E ratio 0.5 0.16 1.06

D/P ratio 61.97% 92.31% 93.22%

Interpretation: It can be pertained using the above comparison table that, in terms of

profitability ratios both Brickworks and Asaleo firms perform well within manufacturing market.

When considering to the liquidity position like current and acid test ratios then Brickworks has

10

higher performance. On the another side, AHY company cannot beat to liquidity condition of

overall sector. Further, to achieve industry average Asaleo should employ strategies for

managing liquid and enhance current assets. When considered to the ratios which indicate

efficiency of companies then it can be said that Brickworks not able to utilise total assets

properly. Henceforth, BKW performs poor within industry in terms of efficiency ratio based on

total assets compared to Asaleo. Further, capital structure of BKW is better compare to industry

and both the entities provide higher dividend than overall sector. Further, it can be concluded

that BKW performs when comparing with the manufacturing industry averages of Australia.

SUMMARY AND SUGGESTIONS

It can be summarised from the above analysis that, wide range of factors affect to an

organisation up to the larger extent in negative, positive or both direction. Economic

fundamentals include various elements by which profitability, performance and share price

influenced in the market. Those aspects related to the Australian economy which influence to

Brickworks and Asaleo care limited companies are interest, recession, inflation, GDP rate and

currency valuation. From the second part of project it can be pertained that, Brickworks firm

performs well in the industry on the basis of profitability position. Further, Asaleo care limited

has less ability for fulfilling its short terms obligations in comparison to Brickworks. Moreover,

capital structure in both the years 2015 and 2016 of Brickworks is highly better and managed.

Henceforth, it can be said that Asaleo's business performance in Australian manufacturing

market is poor and BKW performs well. On the basis of analysis, recommendations for both the

firms are provided below:

It can be advised to Asaleo that it should decline those expenses which incurred within

workplace indirectly and reduce net yield at the end of FY. Under this, it must employ

strategies for raising fund using an appropriate source because debt level is high. As it

uses equity financing then cost of debt decline which contribute to boost up net income in

upcoming accounting periods.

The management of AHY manufacturing entity needs to implement cash management

tactics which help to enhance liquid position. Further, as cash convertible assets increase

within working environment then AHY's total current assets will affect positively.

11

overall sector. Further, to achieve industry average Asaleo should employ strategies for

managing liquid and enhance current assets. When considered to the ratios which indicate

efficiency of companies then it can be said that Brickworks not able to utilise total assets

properly. Henceforth, BKW performs poor within industry in terms of efficiency ratio based on

total assets compared to Asaleo. Further, capital structure of BKW is better compare to industry

and both the entities provide higher dividend than overall sector. Further, it can be concluded

that BKW performs when comparing with the manufacturing industry averages of Australia.

SUMMARY AND SUGGESTIONS

It can be summarised from the above analysis that, wide range of factors affect to an

organisation up to the larger extent in negative, positive or both direction. Economic

fundamentals include various elements by which profitability, performance and share price

influenced in the market. Those aspects related to the Australian economy which influence to

Brickworks and Asaleo care limited companies are interest, recession, inflation, GDP rate and

currency valuation. From the second part of project it can be pertained that, Brickworks firm

performs well in the industry on the basis of profitability position. Further, Asaleo care limited

has less ability for fulfilling its short terms obligations in comparison to Brickworks. Moreover,

capital structure in both the years 2015 and 2016 of Brickworks is highly better and managed.

Henceforth, it can be said that Asaleo's business performance in Australian manufacturing

market is poor and BKW performs well. On the basis of analysis, recommendations for both the

firms are provided below:

It can be advised to Asaleo that it should decline those expenses which incurred within

workplace indirectly and reduce net yield at the end of FY. Under this, it must employ

strategies for raising fund using an appropriate source because debt level is high. As it

uses equity financing then cost of debt decline which contribute to boost up net income in

upcoming accounting periods.

The management of AHY manufacturing entity needs to implement cash management

tactics which help to enhance liquid position. Further, as cash convertible assets increase

within working environment then AHY's total current assets will affect positively.

11

Therefore, liquidity ratios and ability to fulfil obligations of short term will also improve

in proper direction.

It can be suggested to Brickworks that, it should utilise fixed and non-fixed assets in an

optimum direction which will be supportive for increasing total efficiency in order to

boost up revenue generation capability. Apart from this, Asaleo must consider various

financing sources other than debt.

12

in proper direction.

It can be suggested to Brickworks that, it should utilise fixed and non-fixed assets in an

optimum direction which will be supportive for increasing total efficiency in order to

boost up revenue generation capability. Apart from this, Asaleo must consider various

financing sources other than debt.

12

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

REFERENCES

Books and Journals

Attig, N. and et.al., 2016. The global financial crisis, family control, and dividend policy.

Financial Management. 45(2). pp. 291-313.

Bir, J. S., 2016. Knowledge, Attitude and their Effect on the Recently Graduated Employees’

Financial Management Practices and Satisfaction. Economic Literature. 12. pp.69-81.

Bir, J. S., 2016. Knowledge, Attitude and their Effect on the Recently Graduated Employees’

Financial Management Practices and Satisfaction. Economic Literature.12. pp. 69-81.

Brigham, E. F. and Houston, J. F., 2012. Fundamentals of financial management. Cengage

Learning.

Byoun, S. and Xu, Z., 2016. Product market competition and financial decisions during a

financial crisis.Financial Management. 45(2). pp.267-290.

Duncombe, W., 2016. Lecture Notes in Public Budgeting and Financial Management. World

Scientific.

Frankel, T., 2016. A Story of Three Bank-Regulatory Legal Systems: Contract, Financial

Management Regulation, and Fiduciary Law. U. Bologna L. Rev. 1. p. 91.

Jung, C., 2017. Public 6 finance and financial management. Public Administration and Policy in

Korea: Its Evolution and Challenges. p. 118.

Smith, B., 2017. Determinants of sound budgeting and financial management practices at the

decentralised level of public administration. OECD Journal on Budgeting. 16(2). pp. 109-

128.

Ward, A. M. and Forker, J., 2017. Financial management effectiveness and board gender

diversity in member-governed, community financial institutions. Journal of Business

Ethics. 141(2). pp. 351-366.

Zaman, M., 2017. The role of financial and non-financial evaluation measures in the process of

management control over foreign subsidiaries–empirical evidence in Slovene multinational

companies. Management: journal of contemporary management issues. 9(2). pp.53-73.

13

Books and Journals

Attig, N. and et.al., 2016. The global financial crisis, family control, and dividend policy.

Financial Management. 45(2). pp. 291-313.

Bir, J. S., 2016. Knowledge, Attitude and their Effect on the Recently Graduated Employees’

Financial Management Practices and Satisfaction. Economic Literature. 12. pp.69-81.

Bir, J. S., 2016. Knowledge, Attitude and their Effect on the Recently Graduated Employees’

Financial Management Practices and Satisfaction. Economic Literature.12. pp. 69-81.

Brigham, E. F. and Houston, J. F., 2012. Fundamentals of financial management. Cengage

Learning.

Byoun, S. and Xu, Z., 2016. Product market competition and financial decisions during a

financial crisis.Financial Management. 45(2). pp.267-290.

Duncombe, W., 2016. Lecture Notes in Public Budgeting and Financial Management. World

Scientific.

Frankel, T., 2016. A Story of Three Bank-Regulatory Legal Systems: Contract, Financial

Management Regulation, and Fiduciary Law. U. Bologna L. Rev. 1. p. 91.

Jung, C., 2017. Public 6 finance and financial management. Public Administration and Policy in

Korea: Its Evolution and Challenges. p. 118.

Smith, B., 2017. Determinants of sound budgeting and financial management practices at the

decentralised level of public administration. OECD Journal on Budgeting. 16(2). pp. 109-

128.

Ward, A. M. and Forker, J., 2017. Financial management effectiveness and board gender

diversity in member-governed, community financial institutions. Journal of Business

Ethics. 141(2). pp. 351-366.

Zaman, M., 2017. The role of financial and non-financial evaluation measures in the process of

management control over foreign subsidiaries–empirical evidence in Slovene multinational

companies. Management: journal of contemporary management issues. 9(2). pp.53-73.

13

1 out of 17

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.