Management Accounting Concepts and Practices

VerifiedAdded on 2020/02/03

|18

|5574

|119

Essay

AI Summary

This assignment delves into the core principles of management accounting, examining concepts such as marginal cost, budgetary control, and their significance in organizational decision-making. Students are required to demonstrate understanding of these concepts through referencing relevant academic sources and online materials.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Management Accounting

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Table of Contents

INTRODUCTION...........................................................................................................................3

P.1 Management accounting and its kinds:.................................................................................3

P.2 Various tools used for the management accounting:............................................................6

P.3 Computation costs via adequate techniques of cost analysis to frame an income statement

through marginal and absorption costs:......................................................................................7

P.4 Performance and disadvantages of various kinds of preparation methodological analysis

used for budget control:............................................................................................................11

P.5 Planning tools for accounting respond appropriately to solving fiscal problems to lead.. .14

CONCLUSION..............................................................................................................................14

REFERENCES..............................................................................................................................16

INTRODUCTION...........................................................................................................................3

P.1 Management accounting and its kinds:.................................................................................3

P.2 Various tools used for the management accounting:............................................................6

P.3 Computation costs via adequate techniques of cost analysis to frame an income statement

through marginal and absorption costs:......................................................................................7

P.4 Performance and disadvantages of various kinds of preparation methodological analysis

used for budget control:............................................................................................................11

P.5 Planning tools for accounting respond appropriately to solving fiscal problems to lead.. .14

CONCLUSION..............................................................................................................................14

REFERENCES..............................................................................................................................16

INTRODUCTION

Management accounting is the process which is used to manage the internal organisation

with an utmost level. Now, the company also wants to make perfect decision making techniques

which could help in making the company sustainable and viable. Along with that the

management accounting assist in sustainable development of the firm. At the cut throat

competition time, company need to emerge the business so viable so that the firm could sustain

for the long run and effectively achieve the set objectives of the firm(Contrafatto and Burns,

2013). However, there are so many management accounting practices which have been exercised

in the businesses for the development of the overall operations of Unilever plc. Now, every

company wants to reduce their cost at the time producing goods and for reduction purposes, each

organisations are using management accounting practices in the firm. There are so many

management accounting tools through which the uniliver plc is get to know their operational

pictures. Unilever plc is having their manufacturing operations so there is tremendous need to

make their operations so effective so that the cost of production can be decreased at an optimum

way. Now, there is cut throat competition in the market and each and every firm is trying the way

to minimize their cost and also make their operation so easy and smooth that could support the

company to have sustainable development over the competitors(Dillard and Roslender, 2011).

P.1 Management accounting and its kinds:

Management accounting is a system in which we use decision relevant fiscal and non fiscal

content to preserve and generate the value of organisation by sourcing, analysis and

communicating (Zimmerman and Yahya-Zadeh, 2011). It is a combination of finance,

accounting and management with the business skills and techniques. It is for add value in an

organisation. The accountants who are working management and they are eligible to work across

the advising managers on the fiscal implications of decision, not just in finance, work across the

business the monitoring risk and business strategy is more crunching than numbers. In this

mangers required information to make day to day decision. It is different from fiscal accounting

because in that we have to make annual reports for the stakeholders and the weekly report is

done by chief executive officer and department manager. In this report we can show the is

Management accounting is the process which is used to manage the internal organisation

with an utmost level. Now, the company also wants to make perfect decision making techniques

which could help in making the company sustainable and viable. Along with that the

management accounting assist in sustainable development of the firm. At the cut throat

competition time, company need to emerge the business so viable so that the firm could sustain

for the long run and effectively achieve the set objectives of the firm(Contrafatto and Burns,

2013). However, there are so many management accounting practices which have been exercised

in the businesses for the development of the overall operations of Unilever plc. Now, every

company wants to reduce their cost at the time producing goods and for reduction purposes, each

organisations are using management accounting practices in the firm. There are so many

management accounting tools through which the uniliver plc is get to know their operational

pictures. Unilever plc is having their manufacturing operations so there is tremendous need to

make their operations so effective so that the cost of production can be decreased at an optimum

way. Now, there is cut throat competition in the market and each and every firm is trying the way

to minimize their cost and also make their operation so easy and smooth that could support the

company to have sustainable development over the competitors(Dillard and Roslender, 2011).

P.1 Management accounting and its kinds:

Management accounting is a system in which we use decision relevant fiscal and non fiscal

content to preserve and generate the value of organisation by sourcing, analysis and

communicating (Zimmerman and Yahya-Zadeh, 2011). It is a combination of finance,

accounting and management with the business skills and techniques. It is for add value in an

organisation. The accountants who are working management and they are eligible to work across

the advising managers on the fiscal implications of decision, not just in finance, work across the

business the monitoring risk and business strategy is more crunching than numbers. In this

mangers required information to make day to day decision. It is different from fiscal accounting

because in that we have to make annual reports for the stakeholders and the weekly report is

done by chief executive officer and department manager. In this report we can show the is

available in cash and the revenue is generated, raw material, discrepancy analysis, outstanding

debts etc.

Management accounting systems vary from their uses. Each system is designed to give

Management varying information based on the needs of Management to aide in the decision

making.

The most basic types of Management Accounting Systems are:

Cost Accounting System

Inventory Management System

Job-Costing System

Price-Optimization System

Lean accounting

Lean accounting: it is very crucial fro the development and viability of the firm. As, this is

completely new from the traditional accounting system. As, this framework is mainly focused

on the cost reduction of the production process. And also help the administration of the Unilever

plc to make the methodology for the delivering the better profits with the minimum cost. As this

is the latest accounting technique. Lean accounting helps the organization to change the

accounting, administration methodology so that powerful production procedure should be

possible. Lean accounting system upgraded the cost as standard costing execute the labour and

overheads cost. There is just a single negative effect of lean accounting which linked the

standard costing in the manufacturing procedure.

In management accounting there are two types of users primary users and secondary

users. Primary users are internal users and secondary users are external users.

Management,employees and owners are the part of internal users. Management analyse the

performance of the Unilever and take measures to improve company results. Employees are the

part of company who are assigned to earn the profit and show in the books of accounting

(Baldvinsdottir Mitchell and Nørreklit, 2010). Owners is for analyse profitability of their

investment funds. These all are some primary users. Secondary users of accounting information

are creditors, tax authorities, investors, regulatory authorities and customers. Customers are the

part of accounting because if customer will purchase the product then it will be shown in

accounting. Tax authority shows the credibility of tax return on behalf of company.

debts etc.

Management accounting systems vary from their uses. Each system is designed to give

Management varying information based on the needs of Management to aide in the decision

making.

The most basic types of Management Accounting Systems are:

Cost Accounting System

Inventory Management System

Job-Costing System

Price-Optimization System

Lean accounting

Lean accounting: it is very crucial fro the development and viability of the firm. As, this is

completely new from the traditional accounting system. As, this framework is mainly focused

on the cost reduction of the production process. And also help the administration of the Unilever

plc to make the methodology for the delivering the better profits with the minimum cost. As this

is the latest accounting technique. Lean accounting helps the organization to change the

accounting, administration methodology so that powerful production procedure should be

possible. Lean accounting system upgraded the cost as standard costing execute the labour and

overheads cost. There is just a single negative effect of lean accounting which linked the

standard costing in the manufacturing procedure.

In management accounting there are two types of users primary users and secondary

users. Primary users are internal users and secondary users are external users.

Management,employees and owners are the part of internal users. Management analyse the

performance of the Unilever and take measures to improve company results. Employees are the

part of company who are assigned to earn the profit and show in the books of accounting

(Baldvinsdottir Mitchell and Nørreklit, 2010). Owners is for analyse profitability of their

investment funds. These all are some primary users. Secondary users of accounting information

are creditors, tax authorities, investors, regulatory authorities and customers. Customers are the

part of accounting because if customer will purchase the product then it will be shown in

accounting. Tax authority shows the credibility of tax return on behalf of company.

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Accountancy encompasses the transcription, categorization and succinct of transactions and

events in a manner that helps its users to assess the fiscal performance and position of the entity.

Management accounting can modify decision making in a company or in an organization.

Cost Accounting System: This is the framework which is utilized to evaluate the cost of

the item for the making the benefit examination, stock valuation and cost control.

Expectation of the correct cost of the item is such a great amount of basic for beneficial

practices. There is have to think about which items are gainful and which are not, and this

is conceivable just when it has determined the right cost of the item. An item costing

framework help with anticipating the end estimation of the material stock, work-in-

advance and completed items remembering ofr putting forth the monetary expressions.

Job costing framework: It is the costing strategy in which the cost of the whole item is

found out. Presently, it has been seen that this technique is utilized for doling out

assembling expenses to groups of the tasks. Under this strategy a specific costing

procedure is utilized as a part of request to evaluate the cost of a specific cost of work.

Batch costing system: It is a type of particular request costing. It resembles work costing

procedure. There are such a large number of amounts inside a group so there is have to

know the cost of that specific clump. This system is essentially utilized as a part of the

pharma area.

Inventory management framework: This is the most considered instrument in the

business association. As this is helpful for dealing with the stock of the business which is

most critical for any business. With the assistance of stock administration framework, the

organization would ready to actualize their assets in a superior way.

Four management accounting principles are:

Value involves analysing information with value generation path,focusing on

risk,cost and evaluating opportunity of organisation strategy model.

Influence in management accounting the good communication of critical

information to cut the facilities of integrated thinking. It begins and with

conversation the one area of business can be better understood,repaired and

accepted.

Trust balancing the short term interest against long run for stakeholder.

Investigation make the decision making process objective.

events in a manner that helps its users to assess the fiscal performance and position of the entity.

Management accounting can modify decision making in a company or in an organization.

Cost Accounting System: This is the framework which is utilized to evaluate the cost of

the item for the making the benefit examination, stock valuation and cost control.

Expectation of the correct cost of the item is such a great amount of basic for beneficial

practices. There is have to think about which items are gainful and which are not, and this

is conceivable just when it has determined the right cost of the item. An item costing

framework help with anticipating the end estimation of the material stock, work-in-

advance and completed items remembering ofr putting forth the monetary expressions.

Job costing framework: It is the costing strategy in which the cost of the whole item is

found out. Presently, it has been seen that this technique is utilized for doling out

assembling expenses to groups of the tasks. Under this strategy a specific costing

procedure is utilized as a part of request to evaluate the cost of a specific cost of work.

Batch costing system: It is a type of particular request costing. It resembles work costing

procedure. There are such a large number of amounts inside a group so there is have to

know the cost of that specific clump. This system is essentially utilized as a part of the

pharma area.

Inventory management framework: This is the most considered instrument in the

business association. As this is helpful for dealing with the stock of the business which is

most critical for any business. With the assistance of stock administration framework, the

organization would ready to actualize their assets in a superior way.

Four management accounting principles are:

Value involves analysing information with value generation path,focusing on

risk,cost and evaluating opportunity of organisation strategy model.

Influence in management accounting the good communication of critical

information to cut the facilities of integrated thinking. It begins and with

conversation the one area of business can be better understood,repaired and

accepted.

Trust balancing the short term interest against long run for stakeholder.

Investigation make the decision making process objective.

Relevance the information which we can used should be relevant. It scan the best

resources for information. Combine fiscal information with non fiscal information

data to paint a complete image of the business (Macintosh and Quattrone, 2010).

Managerial accounting is the process of distinguishing, mensuration, analysing, rendition and

human activity information for the pursuance of an social group goals. Social controller use

content relating to the costs of goods or services acquire by the companionship. Trend analysis

affect reassessment the trend line for definite costs and investigation unusual variant or pervert.

Appraisal Managerial accounting deals with crucial the actual costs of products or services.

Social controller figure and assign overhead charges to property evaluate the true cost related to

the human action of a trade good (Lukka and Modell, 2010). Management accounting is a

backbone of all system.

M1. Benefits of management accounting systems and their application

Reduce Expenses

Management accounting can assist companies lower their functional expenses. Enterprise

proprietor often use management accounting content to review the cost of economical resources

and other enterprise operations. This subject matter allows owners to improved understand how

much wealth it costs to run the business. Better Cash Flow Monetary fund are a major part of

management accounting. Business proprietor often use monetary fund so they have a fiscal road

map for upcoming business outlay. Management businessperson can prepare fiscal forecasting

relating to consumer demand, expected sales or the effects of consumer price alteration in the

economic market place Which is also beneficial for generating the money from the market

(Weißenbergerand Angelkort, 2011).

D.1 Management accounting systems and management accounting reporting can be integrated

for organisational processes.

Since it is focused on making coming conclusion with the help of past fiscal information, it is

progressive looking and therefore innovative in nature. It is meant for internal users like top

management and therefore it is not essential that it is made by following strict road map which is

the case with fiscal accounting (Cinquini and Tenucci, 2010). The accuracy of Unilever is also

dependent on how accurate that data is, therefore it is one of the boundary as far as its

serviceability is involvement.

resources for information. Combine fiscal information with non fiscal information

data to paint a complete image of the business (Macintosh and Quattrone, 2010).

Managerial accounting is the process of distinguishing, mensuration, analysing, rendition and

human activity information for the pursuance of an social group goals. Social controller use

content relating to the costs of goods or services acquire by the companionship. Trend analysis

affect reassessment the trend line for definite costs and investigation unusual variant or pervert.

Appraisal Managerial accounting deals with crucial the actual costs of products or services.

Social controller figure and assign overhead charges to property evaluate the true cost related to

the human action of a trade good (Lukka and Modell, 2010). Management accounting is a

backbone of all system.

M1. Benefits of management accounting systems and their application

Reduce Expenses

Management accounting can assist companies lower their functional expenses. Enterprise

proprietor often use management accounting content to review the cost of economical resources

and other enterprise operations. This subject matter allows owners to improved understand how

much wealth it costs to run the business. Better Cash Flow Monetary fund are a major part of

management accounting. Business proprietor often use monetary fund so they have a fiscal road

map for upcoming business outlay. Management businessperson can prepare fiscal forecasting

relating to consumer demand, expected sales or the effects of consumer price alteration in the

economic market place Which is also beneficial for generating the money from the market

(Weißenbergerand Angelkort, 2011).

D.1 Management accounting systems and management accounting reporting can be integrated

for organisational processes.

Since it is focused on making coming conclusion with the help of past fiscal information, it is

progressive looking and therefore innovative in nature. It is meant for internal users like top

management and therefore it is not essential that it is made by following strict road map which is

the case with fiscal accounting (Cinquini and Tenucci, 2010). The accuracy of Unilever is also

dependent on how accurate that data is, therefore it is one of the boundary as far as its

serviceability is involvement.

P.2 Various tools used for the management accounting:

There are so many tools used by the management accountant for reporting the money

related issues to the administration. As this is essential for Unilever plc for getting ready for

monetary components. The fundamental focus of any organisation is to earn profitability.

Through management accounting tools,company would able to make more profits by

diminishing cost and keeping up quality in their merchandise and administration. Financial

management is used in the firm for the attainment of their set objectives and long term goals.

Through different tools of management accounting, company would able to make the financial

statements and also interpret and assist the company for making the strategy that could also

support the company to take an effective decision.

Analysis of financial statement: financial statement of the Unilever plc is used to draw a

valid conclusion that could able to run the firm smoothly(Cinquini and Tenucci, 2010).

It is a requirement in the any firm that there is need of assessment of financial

information so that the finance manger in the company would able to analyse better for

the effectiveness of the operation and that will also assist the firm and outsiders for

knowing the genuine picture of the firm.

Cash flow analysis: through cash flow analysis, Unilever plc would able to analyse the

cash outflow and inflow of the firm . Cash flow analysis helps the company to know the

entire cash requirement of the firm and cash generated in the firm so that the firm could

make their operations effective.

Cost accounting: this is the technique by which firm would know the entire production

process and also assist the firm to eliminate the unwanted cost of the company. So that

the firm can able to sell their product with the lower cost and make the cost leadership

strategy in the marketplace (Fullerton, Kennedy and Widener, 2014). Now, lean

accounting tools has emerged which not only reduce the cost but also assist the firm for

making effective decision.

Fund flow analysis: with the help of analytical tool company is able to assess the

movement of funds during the certain period. Under this analysis, company compares

the previous data with the future estimated data and then find out the deviation and also

tries to remove such deviation for the smooth running of the firm.

There are so many tools used by the management accountant for reporting the money

related issues to the administration. As this is essential for Unilever plc for getting ready for

monetary components. The fundamental focus of any organisation is to earn profitability.

Through management accounting tools,company would able to make more profits by

diminishing cost and keeping up quality in their merchandise and administration. Financial

management is used in the firm for the attainment of their set objectives and long term goals.

Through different tools of management accounting, company would able to make the financial

statements and also interpret and assist the company for making the strategy that could also

support the company to take an effective decision.

Analysis of financial statement: financial statement of the Unilever plc is used to draw a

valid conclusion that could able to run the firm smoothly(Cinquini and Tenucci, 2010).

It is a requirement in the any firm that there is need of assessment of financial

information so that the finance manger in the company would able to analyse better for

the effectiveness of the operation and that will also assist the firm and outsiders for

knowing the genuine picture of the firm.

Cash flow analysis: through cash flow analysis, Unilever plc would able to analyse the

cash outflow and inflow of the firm . Cash flow analysis helps the company to know the

entire cash requirement of the firm and cash generated in the firm so that the firm could

make their operations effective.

Cost accounting: this is the technique by which firm would know the entire production

process and also assist the firm to eliminate the unwanted cost of the company. So that

the firm can able to sell their product with the lower cost and make the cost leadership

strategy in the marketplace (Fullerton, Kennedy and Widener, 2014). Now, lean

accounting tools has emerged which not only reduce the cost but also assist the firm for

making effective decision.

Fund flow analysis: with the help of analytical tool company is able to assess the

movement of funds during the certain period. Under this analysis, company compares

the previous data with the future estimated data and then find out the deviation and also

tries to remove such deviation for the smooth running of the firm.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Standard costing: It is that stream of costing which is a pre-determined cost. It renders a

strong base for evaluation and measurement of actual performance. Also, it can also be

said that theses tool also assists in finding reasons for deviations if any.

Marginal costing: It is another tool or technique of management accounting which is used

to set sale price, selection of optimum sales mix. In addition to this, it also involves best

possible use of all raw materials and resources, which helps to form decision or accept or

reject it. This method or technique is based on variable cost, fixed cost and contribution.

Budgetary control: In this method, it has been laid down that needs and requirements of

future aspects, are assessed and arranged in accordance to an orderly basis. Moreover, it

is also beneficial for having an effective control on financial performances of business

concern.

Management accounting system: It can be considered as a method in which free flow

communication within a premises of a company is necessary for conducting business

operations in an effective manner.

P.3 Computation costs via adequate techniques of cost analysis to frame an income statement

through marginal and absorption costs:

Basically, there are two methods and tools implemented for ascertaining the net income

of the firm. Absorption costing and marginal costing. These tools changes based on the manner

that fixed cost is used in the product cost(Christ and Burritt, 2013). This total product cost

covered in the cost of goods sold and stock. Only such cost could be covered in the stock.

Marginal cost is computed from the production cost of the firm for a short period of time.

This covers the output and total cost. Marginal cost is the change in the total cost of additional

unit produced. For instance, in many of the production company's, the marginal cost of

manufacturing declines as the volume of unit enhanced due to economies of scale. Cost of the

product will be lower as the company purchases raw material in bulk and also make optimum use

of machinery.

Income statement as per marginal costing :

Working 1: Calculate variable production cost £

Direct material 6

strong base for evaluation and measurement of actual performance. Also, it can also be

said that theses tool also assists in finding reasons for deviations if any.

Marginal costing: It is another tool or technique of management accounting which is used

to set sale price, selection of optimum sales mix. In addition to this, it also involves best

possible use of all raw materials and resources, which helps to form decision or accept or

reject it. This method or technique is based on variable cost, fixed cost and contribution.

Budgetary control: In this method, it has been laid down that needs and requirements of

future aspects, are assessed and arranged in accordance to an orderly basis. Moreover, it

is also beneficial for having an effective control on financial performances of business

concern.

Management accounting system: It can be considered as a method in which free flow

communication within a premises of a company is necessary for conducting business

operations in an effective manner.

P.3 Computation costs via adequate techniques of cost analysis to frame an income statement

through marginal and absorption costs:

Basically, there are two methods and tools implemented for ascertaining the net income

of the firm. Absorption costing and marginal costing. These tools changes based on the manner

that fixed cost is used in the product cost(Christ and Burritt, 2013). This total product cost

covered in the cost of goods sold and stock. Only such cost could be covered in the stock.

Marginal cost is computed from the production cost of the firm for a short period of time.

This covers the output and total cost. Marginal cost is the change in the total cost of additional

unit produced. For instance, in many of the production company's, the marginal cost of

manufacturing declines as the volume of unit enhanced due to economies of scale. Cost of the

product will be lower as the company purchases raw material in bulk and also make optimum use

of machinery.

Income statement as per marginal costing :

Working 1: Calculate variable production cost £

Direct material 6

Direct labour 5

Variable production o/h 3

Variable production cost 14

Working 2: Calculate value of inventory and production

Opening inventory Production Closing inventory

0 700*14 = 9800 100*14 = 1400

Absorption costing is the thing that firm presumably consider when you consider

product costing. Since the start of management accounting course, accountants have been

informed that product cost comprises of direct materials, direct labour, and overhead. Since

company have brought cost behaviour into the course, accountant realize that overhead can be

either variable or fixed(direct materials and direct work are variable cost).

Income Statement as per absorption costing :

Selling price £35

Unit costs

Direct materials £6

Direct Labour £5

Variable Production overhead £2

Variable sales overhead £1

Budgeted production for the period is 600 units

W1

Fixed Production overhead absorption rate (OAR)= £1,800/600 =

£3 per unit

W2

Calculation of cost of production:

Marginal Absorption

Direct material 6 6

Direct labour 5 5

Variable overhead 2 2

Fixed production overhead 0 3

Variable production o/h 3

Variable production cost 14

Working 2: Calculate value of inventory and production

Opening inventory Production Closing inventory

0 700*14 = 9800 100*14 = 1400

Absorption costing is the thing that firm presumably consider when you consider

product costing. Since the start of management accounting course, accountants have been

informed that product cost comprises of direct materials, direct labour, and overhead. Since

company have brought cost behaviour into the course, accountant realize that overhead can be

either variable or fixed(direct materials and direct work are variable cost).

Income Statement as per absorption costing :

Selling price £35

Unit costs

Direct materials £6

Direct Labour £5

Variable Production overhead £2

Variable sales overhead £1

Budgeted production for the period is 600 units

W1

Fixed Production overhead absorption rate (OAR)= £1,800/600 =

£3 per unit

W2

Calculation of cost of production:

Marginal Absorption

Direct material 6 6

Direct labour 5 5

Variable overhead 2 2

Fixed production overhead 0 3

Cost of production per unit 13 16

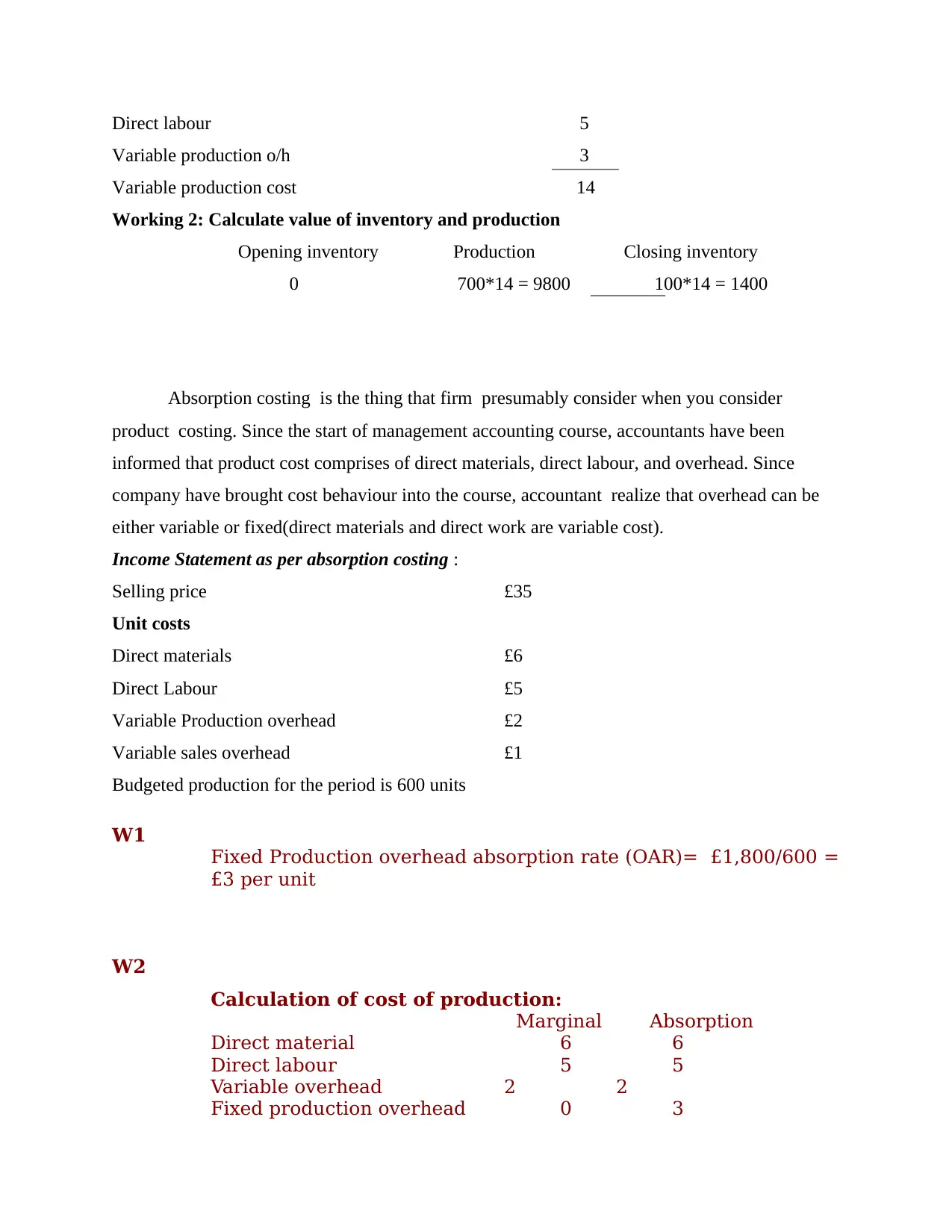

W3

Adjustment for over or under absorption of overheads

Actual production overhead £2,000

Absorbed production overhead (700 x 3) £2,100

£100

The following information are also given in the question

Selling price £35

Direct materials £6

Direct Labour £5

Variable Production overhead £ 2

Actual production for the month 700 units

Actual sales for the month 600 units

Closing stock for the month 100 units

Income statement using marginal costing

£ £

Sales 700 x 35 21,000

Cost of Production 13 (W2)x 700 9,100

Less: Closing stock 13(W2) x 100 (1,300)

Variable cost of sale 7,800

Contribution 13,200

Less: Variable sales overhead 1 x600 600

Less: Fixed Costs; Production overhead 2,000

Administration cost 700

Selling cost 600 3,900

Profit 9,300

W3

Adjustment for over or under absorption of overheads

Actual production overhead £2,000

Absorbed production overhead (700 x 3) £2,100

£100

The following information are also given in the question

Selling price £35

Direct materials £6

Direct Labour £5

Variable Production overhead £ 2

Actual production for the month 700 units

Actual sales for the month 600 units

Closing stock for the month 100 units

Income statement using marginal costing

£ £

Sales 700 x 35 21,000

Cost of Production 13 (W2)x 700 9,100

Less: Closing stock 13(W2) x 100 (1,300)

Variable cost of sale 7,800

Contribution 13,200

Less: Variable sales overhead 1 x600 600

Less: Fixed Costs; Production overhead 2,000

Administration cost 700

Selling cost 600 3,900

Profit 9,300

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

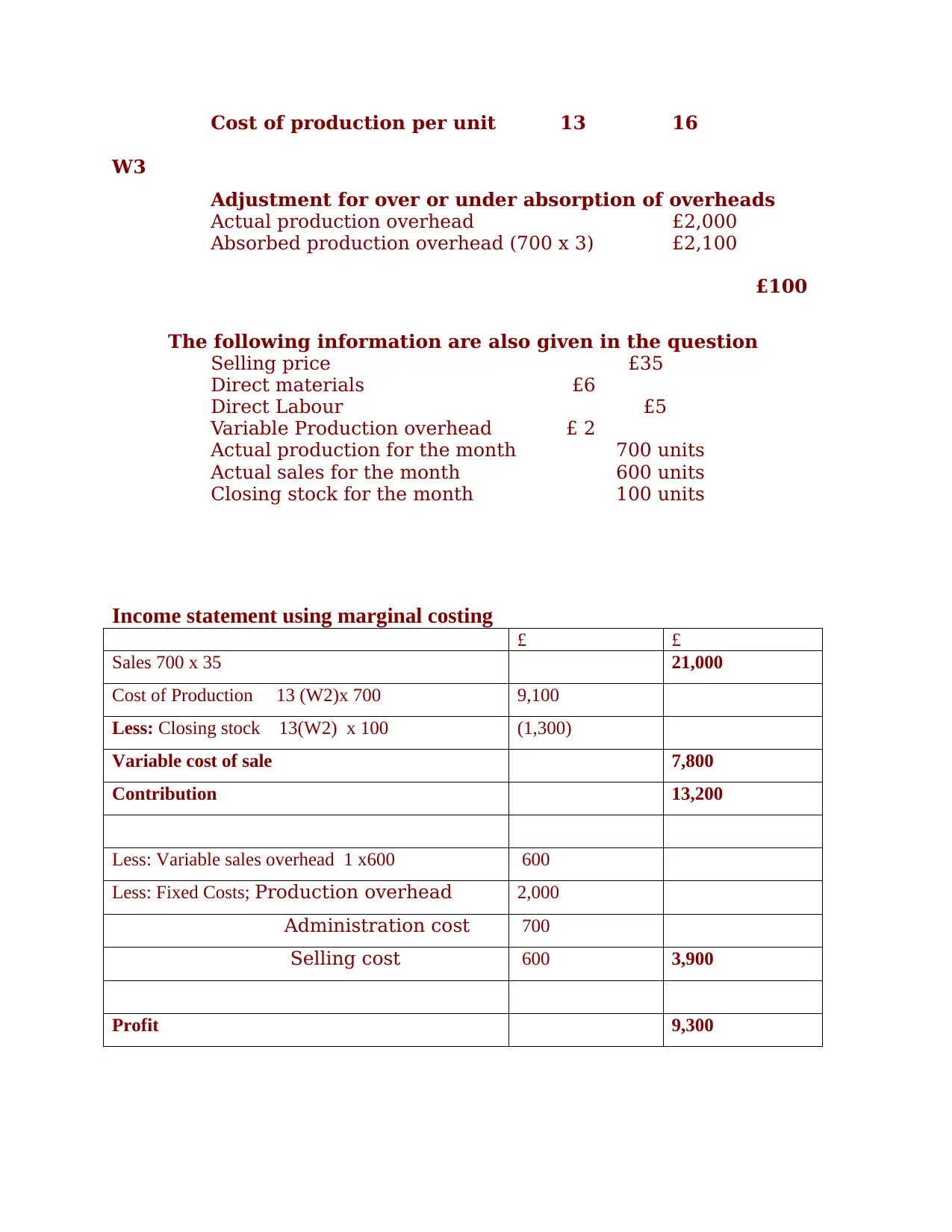

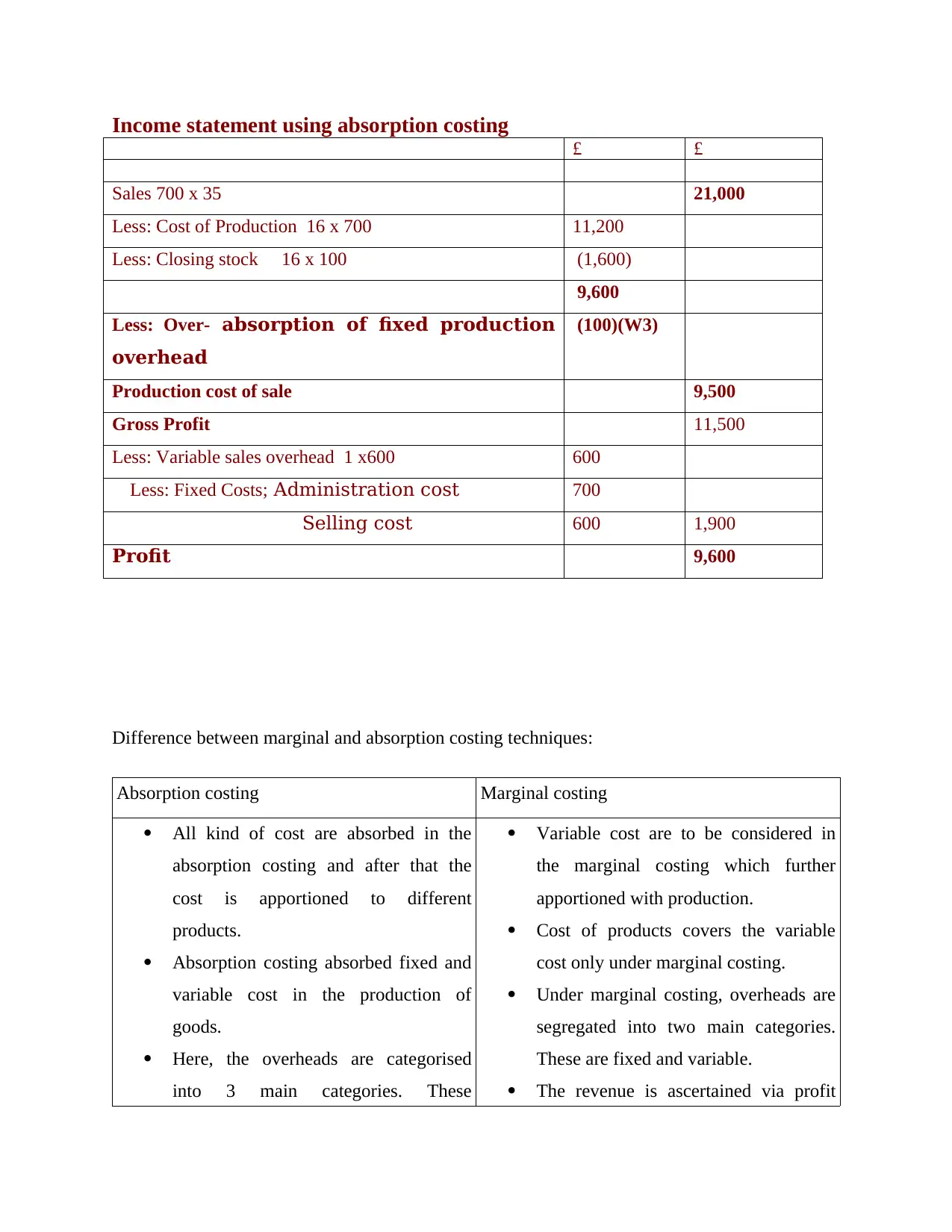

Income statement using absorption costing

£ £

Sales 700 x 35 21,000

Less: Cost of Production 16 x 700 11,200

Less: Closing stock 16 x 100 (1,600)

9,600

Less: Over- absorption of fixed production

overhead

(100)(W3)

Production cost of sale 9,500

Gross Profit 11,500

Less: Variable sales overhead 1 x600 600

Less: Fixed Costs; Administration cost 700

Selling cost 600 1,900

Profit 9,600

Difference between marginal and absorption costing techniques:

Absorption costing Marginal costing

All kind of cost are absorbed in the

absorption costing and after that the

cost is apportioned to different

products.

Absorption costing absorbed fixed and

variable cost in the production of

goods.

Here, the overheads are categorised

into 3 main categories. These

Variable cost are to be considered in

the marginal costing which further

apportioned with production.

Cost of products covers the variable

cost only under marginal costing.

Under marginal costing, overheads are

segregated into two main categories.

These are fixed and variable.

The revenue is ascertained via profit

£ £

Sales 700 x 35 21,000

Less: Cost of Production 16 x 700 11,200

Less: Closing stock 16 x 100 (1,600)

9,600

Less: Over- absorption of fixed production

overhead

(100)(W3)

Production cost of sale 9,500

Gross Profit 11,500

Less: Variable sales overhead 1 x600 600

Less: Fixed Costs; Administration cost 700

Selling cost 600 1,900

Profit 9,600

Difference between marginal and absorption costing techniques:

Absorption costing Marginal costing

All kind of cost are absorbed in the

absorption costing and after that the

cost is apportioned to different

products.

Absorption costing absorbed fixed and

variable cost in the production of

goods.

Here, the overheads are categorised

into 3 main categories. These

Variable cost are to be considered in

the marginal costing which further

apportioned with production.

Cost of products covers the variable

cost only under marginal costing.

Under marginal costing, overheads are

segregated into two main categories.

These are fixed and variable.

The revenue is ascertained via profit

categories are production,

administration and selling and

distribution overheads.

Under absorption costing, net income

of the firm is considered as a profit

under absorption costing.

volume ratio in the marginal costing.

Uses of management accounting procedures if there should arise an occurrence of Unilever plc :

Management accounting and its tools are exceptionally fundamental for effective running

and functional management. They co-ordinate with each other in helping administration of

Unilever plc in accomplishment of its long term objectives and goals. Administrative staffs needs

to track execution of firm so they can follow that association and its advancement is going in the

correct course and does it accomplishing craved goals(Busco and Scapens, 2011). However,

there are so many tools and techniques of management accounting system through which firm

could attain its objectives. There are some of the techniques which have been mentioned

hereunder:

Profit volume analysis: this is also known as PV ratio. This represents the contribution of

the firm in the production of goods. Profit volume ratio only consider the variable cost of

the product that very with the change in production of goods. Contribution of the

company is computed via subtracting variable cost from the sales. This does not consider

the fixed cost of the production process.

Absorption costing: Above mentioned income statement is prepared according to

absorption costing. The company's entire production cost per unit was £ 19 that covers

the prime cost including £ 6 for direct material, £ 5 for direct labour, £ 3 is for variable

cost and fixed cost of £ 5 represents apportioned on certain basis. In absorption costing

administration and selling and

distribution overheads.

Under absorption costing, net income

of the firm is considered as a profit

under absorption costing.

volume ratio in the marginal costing.

Uses of management accounting procedures if there should arise an occurrence of Unilever plc :

Management accounting and its tools are exceptionally fundamental for effective running

and functional management. They co-ordinate with each other in helping administration of

Unilever plc in accomplishment of its long term objectives and goals. Administrative staffs needs

to track execution of firm so they can follow that association and its advancement is going in the

correct course and does it accomplishing craved goals(Busco and Scapens, 2011). However,

there are so many tools and techniques of management accounting system through which firm

could attain its objectives. There are some of the techniques which have been mentioned

hereunder:

Profit volume analysis: this is also known as PV ratio. This represents the contribution of

the firm in the production of goods. Profit volume ratio only consider the variable cost of

the product that very with the change in production of goods. Contribution of the

company is computed via subtracting variable cost from the sales. This does not consider

the fixed cost of the production process.

Absorption costing: Above mentioned income statement is prepared according to

absorption costing. The company's entire production cost per unit was £ 19 that covers

the prime cost including £ 6 for direct material, £ 5 for direct labour, £ 3 is for variable

cost and fixed cost of £ 5 represents apportioned on certain basis. In absorption costing

unilever plc determine under and over absorbed production overheads so that better cost

management can be done by it.

P.4 Performance and disadvantages of various kinds of preparation methodological analysis used

for budget control:

Budget control is essential for the impressive operation of commercial enterprise and this could

help in making the organisation property. Now, there has been some pros and cons as well of for

budget control. budget control assist the Unilever organisation so that the organisation could

able to make the effective plan for the commercial enterprise, reinforced the efficiency as well,

improving the communication as well for the betterment of the firm, control the firm, co-

ordination the entire departments of the firm, motivation of the employees, increasing the

revenues of the firm, approximation the loan or fiscal support requirement of the firm and

activeness in making the uniform policies (Luft and Shields,2010). These advantages has been

described hereafter:

1. Formulation preparation: preparation is the basic need for any firm's improved. This is the tool

by which organisation would able to make the effective decision and strategy for the betterment

of the objectives. This is the primary stage which is needed before implementing the plan of the

firm. By this tool, organisation would able to know the in and out about the future projects on

which organisation need to work. like- cost of project, labour requirements, material

requirements and so many things have to know in advance. Unilever will also know the money

that organisation are going to spend on a certain project and organisation also know the

incoming of working capital which have been acceptable in future year.

2. Improve the productivity: productivity of the firm can be improved with the help of budget

control. This is the tool by which organisation would able to make their productivity better so

that the organisation would able to gain the better profits and that is why firm can make

sustainable development.

3. Adequate communication: With the help of proper communication among the each

departments of the firm, organisation could perform in a better way and also make their

operation so effective at render timely information.

4. Control: budget control assist the organisation to control the whole firm so that the firm could

eliminate the waste from each divisions and make the organisation so profitable. money makes

the firm to compare the actual outcomes with the expected outcomes and then strive hard to

management can be done by it.

P.4 Performance and disadvantages of various kinds of preparation methodological analysis used

for budget control:

Budget control is essential for the impressive operation of commercial enterprise and this could

help in making the organisation property. Now, there has been some pros and cons as well of for

budget control. budget control assist the Unilever organisation so that the organisation could

able to make the effective plan for the commercial enterprise, reinforced the efficiency as well,

improving the communication as well for the betterment of the firm, control the firm, co-

ordination the entire departments of the firm, motivation of the employees, increasing the

revenues of the firm, approximation the loan or fiscal support requirement of the firm and

activeness in making the uniform policies (Luft and Shields,2010). These advantages has been

described hereafter:

1. Formulation preparation: preparation is the basic need for any firm's improved. This is the tool

by which organisation would able to make the effective decision and strategy for the betterment

of the objectives. This is the primary stage which is needed before implementing the plan of the

firm. By this tool, organisation would able to know the in and out about the future projects on

which organisation need to work. like- cost of project, labour requirements, material

requirements and so many things have to know in advance. Unilever will also know the money

that organisation are going to spend on a certain project and organisation also know the

incoming of working capital which have been acceptable in future year.

2. Improve the productivity: productivity of the firm can be improved with the help of budget

control. This is the tool by which organisation would able to make their productivity better so

that the organisation would able to gain the better profits and that is why firm can make

sustainable development.

3. Adequate communication: With the help of proper communication among the each

departments of the firm, organisation could perform in a better way and also make their

operation so effective at render timely information.

4. Control: budget control assist the organisation to control the whole firm so that the firm could

eliminate the waste from each divisions and make the organisation so profitable. money makes

the firm to compare the actual outcomes with the expected outcomes and then strive hard to

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

eliminate the deviation between the two process(Bennett, Schaltegger and Zvezdov, 2013).

Also, organisation will take a decisions effectively via controlling.

5. Co-ordination: This will assist the organisation to co-ordinate each departments for the

effective utilization of human resources. money process encourage the co-ordination among

various department of the firm. It supports the centralised regulations of assorted operations.

The money committee perform as a co-ordinator of operations, sales and other divisions. The

significant quality of money preparation is that it organizes exercises across over other

departments.

6. Commission of authority: money appreciates the delegation of authority. It set the target

within which the delegated authority can be implemented. Lower level authority could act

initiatory and legal opinion within the budget limits.

7. Motivation: money assist the organisation to stimulate the performance of the firm and also

motivates the employees to do better with the organisation's operations. Motivation is the tool by

which employees feel associated to the firm and do work with more efficiency so that the firm

would able to make its operations more profitable.

8. Maximization of revenues: money helps the organisation to utilize firms human and other

resources effectively so that the maximum output can gain. This is the tool by which the firm

would able to boost their revenues and also think about their diversification.

9.Estimating fund requirement: Money is the technique which is used to make their operation

effective and also helps the finance managers to understand the need of the working working

capital for their existing operations or new one (Van Helden And et. al, 2010).

M.3 Different planning tools and their application for forecasting budget:

Forecasting process is to define the fundamental issues effect the forecast. The outcome of this

first step will provide insight into which forecasting methods are most proper and will help

create a common understanding among the forecasters as to the goals of the forecasting process.

Gathering information: To support the prediction process, use statistical data as well as

the assembled judgement and expertise of one-on-one inside and perhaps also outside the

organization. For instance, sector heads may have an insight into activities within their

own section. This step is designed to increase the forecaster expert knowledge about the

forces consequence revenues and expenditures.

Also, organisation will take a decisions effectively via controlling.

5. Co-ordination: This will assist the organisation to co-ordinate each departments for the

effective utilization of human resources. money process encourage the co-ordination among

various department of the firm. It supports the centralised regulations of assorted operations.

The money committee perform as a co-ordinator of operations, sales and other divisions. The

significant quality of money preparation is that it organizes exercises across over other

departments.

6. Commission of authority: money appreciates the delegation of authority. It set the target

within which the delegated authority can be implemented. Lower level authority could act

initiatory and legal opinion within the budget limits.

7. Motivation: money assist the organisation to stimulate the performance of the firm and also

motivates the employees to do better with the organisation's operations. Motivation is the tool by

which employees feel associated to the firm and do work with more efficiency so that the firm

would able to make its operations more profitable.

8. Maximization of revenues: money helps the organisation to utilize firms human and other

resources effectively so that the maximum output can gain. This is the tool by which the firm

would able to boost their revenues and also think about their diversification.

9.Estimating fund requirement: Money is the technique which is used to make their operation

effective and also helps the finance managers to understand the need of the working working

capital for their existing operations or new one (Van Helden And et. al, 2010).

M.3 Different planning tools and their application for forecasting budget:

Forecasting process is to define the fundamental issues effect the forecast. The outcome of this

first step will provide insight into which forecasting methods are most proper and will help

create a common understanding among the forecasters as to the goals of the forecasting process.

Gathering information: To support the prediction process, use statistical data as well as

the assembled judgement and expertise of one-on-one inside and perhaps also outside the

organization. For instance, sector heads may have an insight into activities within their

own section. This step is designed to increase the forecaster expert knowledge about the

forces consequence revenues and expenditures.

Preliminary and Exploratory analysis: In this analysis should consider an investigation of

historical data and relevant economic condition. By this we can improve the quality of

forecasting by giving the predictor improved when it was quantitative techniques might

be suitable and also is useful for postscript forecasting method.

Select method: Find out the quantitative or qualitative forecasting methods that will be

used. Keep in mind that the selected method for one system may differ for some other.

While analysable techniques may get more close answers in particular cases, simpler

method tend to execute just as well or amended on ordinary.

Implement method: Production the prediction and using calculate ranges are included

within the implementation methods(Baldvinsdottir, Mitchell and Nørreklit, 2010).

Making the calculate. Put into activity one or more of the foretelling methods described

above. Calculate ranges. It may be wise to develop a range of possible forecast outcomes,

with the use of different premise. Multiple prediction should be a part of a well-planned

and exhaustively discussed approach (Renz, 2016).

P.5 Planning tools for accounting respond appropriately to solving fiscal problems to lead.

Key performance indicator: They are an arrangement of quantifiable measures that an

organization uses to enhance its execution. These are utilized to decide an organization's

advance in accomplishing key and operational objectives. KPI is additionally alluded as

key achievement markers relying on the relevant criteria. The absolute most regular Key

execution pointers spin around income and overall revenues. The most fundamental

benefit meter is net benefit . The gross net revenue, which measures incomes in the wake

of representing costs specifically connected with the creation of merchandise available to

be purchased, is a benefit based KPI.

Budgetary targets: It is an arrangement of dealing with a business by applying a money

related an incentive to each estimate action. Real execution is contrasted and the

evaluations. A separated synopsis of expected pay and consumption of an organization is

over a predetermined period.

Benchmarking: It is contrasting one's business procedures and execution measures to

industry bests hones from different organizations. During the time spent benchmarking,

administration recognizes the best firms in their industry where comparable procedures

exist. Benchmark appraisals are short evaluations utilized by instructors at different

historical data and relevant economic condition. By this we can improve the quality of

forecasting by giving the predictor improved when it was quantitative techniques might

be suitable and also is useful for postscript forecasting method.

Select method: Find out the quantitative or qualitative forecasting methods that will be

used. Keep in mind that the selected method for one system may differ for some other.

While analysable techniques may get more close answers in particular cases, simpler

method tend to execute just as well or amended on ordinary.

Implement method: Production the prediction and using calculate ranges are included

within the implementation methods(Baldvinsdottir, Mitchell and Nørreklit, 2010).

Making the calculate. Put into activity one or more of the foretelling methods described

above. Calculate ranges. It may be wise to develop a range of possible forecast outcomes,

with the use of different premise. Multiple prediction should be a part of a well-planned

and exhaustively discussed approach (Renz, 2016).

P.5 Planning tools for accounting respond appropriately to solving fiscal problems to lead.

Key performance indicator: They are an arrangement of quantifiable measures that an

organization uses to enhance its execution. These are utilized to decide an organization's

advance in accomplishing key and operational objectives. KPI is additionally alluded as

key achievement markers relying on the relevant criteria. The absolute most regular Key

execution pointers spin around income and overall revenues. The most fundamental

benefit meter is net benefit . The gross net revenue, which measures incomes in the wake

of representing costs specifically connected with the creation of merchandise available to

be purchased, is a benefit based KPI.

Budgetary targets: It is an arrangement of dealing with a business by applying a money

related an incentive to each estimate action. Real execution is contrasted and the

evaluations. A separated synopsis of expected pay and consumption of an organization is

over a predetermined period.

Benchmarking: It is contrasting one's business procedures and execution measures to

industry bests hones from different organizations. During the time spent benchmarking,

administration recognizes the best firms in their industry where comparable procedures

exist. Benchmark appraisals are short evaluations utilized by instructors at different

circumstances all through the school year to screen understudy advance in some range of

the school educational modules. These are known as between time appraisals.

CONCLUSION

From the above written report, it has been observed that the Unilever plc need to make effective

decisions in order to attain their long term goals and objectives. There is also need to adopt the

management accounting practices in the firm for the betterment of the operational process as

these management accounting practices support the company for sustainability purposes.

Organization additionally accentuation on the administration devices for enhancing the money

related condition of the firm. It additionally bring up that the organization's financial feasibility

depends on the compelling utilization of management accounting practices in the firm.

REFERENCES

Books and Journals

Zimmerman, J.L. and Yahya-Zadeh, M., 2011. Accounting for decision making and control.

Issues in Accounting Education. 26(1). pp.258-259.

Baldvinsdottir, G., Mitchell, F. and Nørreklit, H., 2010. Issues in the relationship between theory

and practice in management accounting. Management Accounting Research. 21(2).

pp.79-82.

Ward, K., 2012. Strategic management accounting. Rout ledge.

Lukka, K. and Modell, S., 2010. Validation in interpretive management accounting research.

Accounting, Organizations and Society. 35(4). pp.462-477.

the school educational modules. These are known as between time appraisals.

CONCLUSION

From the above written report, it has been observed that the Unilever plc need to make effective

decisions in order to attain their long term goals and objectives. There is also need to adopt the

management accounting practices in the firm for the betterment of the operational process as

these management accounting practices support the company for sustainability purposes.

Organization additionally accentuation on the administration devices for enhancing the money

related condition of the firm. It additionally bring up that the organization's financial feasibility

depends on the compelling utilization of management accounting practices in the firm.

REFERENCES

Books and Journals

Zimmerman, J.L. and Yahya-Zadeh, M., 2011. Accounting for decision making and control.

Issues in Accounting Education. 26(1). pp.258-259.

Baldvinsdottir, G., Mitchell, F. and Nørreklit, H., 2010. Issues in the relationship between theory

and practice in management accounting. Management Accounting Research. 21(2).

pp.79-82.

Ward, K., 2012. Strategic management accounting. Rout ledge.

Lukka, K. and Modell, S., 2010. Validation in interpretive management accounting research.

Accounting, Organizations and Society. 35(4). pp.462-477.

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Garrison, R.H. and et. al., 2010. Managerial accounting. Issues in Accounting Education. 25(4).

pp.792-793.

Weißenberger, B.E. and Angelkort, H., 2011. Integration of financial and management

accounting systems: The mediating influence of a consistent financial language on

controller ship effectiveness. Management Accounting Research. 22(3). pp.160-180.

Cinquini, L. and Tenucci, A., 2010. Strategic management accounting and business strategy: a

loose coupling?. Journal of Accounting & organizational change. 6(2). pp.228-259.

Fullerton, R.R., Kennedy, F.A. and Widener, S.K., 2013. Management accounting and control

practices in a lean manufacturing environment. Accounting, Organizations and Society.

38(1). pp.50-71.

Luft, J. and Shields, M.D., 2010. Psychology models of management accounting. Foundations

and Trends® in Accounting. 4(3–4). pp.199-345.

Van Helden. And et. al., 2010. Knowledge creation for practice in public sector management

accounting by consultants and academics: Preliminary findings and directions for future

research. Management Accounting Research. 21(2). pp.83-94.

Renz, D.O., 2016. The Jossey-Bass handbook of non-profit leadership and management. John

Wiley & Sons.

Macintosh, N.B. and Quattrone, P., 2010. Management accounting and control systems: An

organizational and sociological approach. John Wiley & Sons.

Kaplan, R.S. and Atkinson, A.A., 2015. Advanced management accounting. PHI Learning.

Baldvinsdottir, G., Mitchell, F. and Nørreklit, H., 2010. Issues in the relationship between theory

and practice in management accounting. Management Accounting Research. 21(2).

pp.79-82.

Bennett, M.D., Schaltegger, S. and Zvezdov, D., 2013. Exploring corporate practices in

management accounting for sustainability. (pp. 1-56). London: ICAEW.

Busco, C. and Scapens, R.W., 2011. Management accounting systems and organisational culture:

Interpreting their linkages and processes of change. Qualitative Research in Accounting

& Management. 8(4). pp.320-357.

Christ, K.L. and Burritt, R.L., 2013. Environmental management accounting: the significance of

contingent variables for adoption. Journal of Cleaner Production. 41. pp.163-173.

Cinquini, L. and Tenucci, A., 2010. Strategic management accounting and business strategy: a

loose coupling?. Journal of Accounting & organizational change. 6(2). pp.228-259.

Contrafatto, M. and Burns, J., 2013. Social and environmental accounting, organisational change

and management accounting: A processual view. Management Accounting Research.

24(4). pp.349-365.

Dillard, J. and Roslender, R., 2011. Taking pluralism seriously: embedded moralities in

management accounting and control systems. Critical Perspectives on Accounting.

22(2). pp.135-147.

Fullerton, R. R., Kennedy, F. A. and Widener, S. K., 2014. Lean manufacturing and firm

performance: The incremental contribution of lean management accounting practices.

Journal of Operations Management. 32(7). pp.414-428.

Online

marginal cost. 2017. [online]. Available

through :<http://www.businessdictionary.com/definition/marginal-cost.html>.Accessed

on [18th April 2017]

pp.792-793.

Weißenberger, B.E. and Angelkort, H., 2011. Integration of financial and management

accounting systems: The mediating influence of a consistent financial language on

controller ship effectiveness. Management Accounting Research. 22(3). pp.160-180.

Cinquini, L. and Tenucci, A., 2010. Strategic management accounting and business strategy: a

loose coupling?. Journal of Accounting & organizational change. 6(2). pp.228-259.

Fullerton, R.R., Kennedy, F.A. and Widener, S.K., 2013. Management accounting and control

practices in a lean manufacturing environment. Accounting, Organizations and Society.

38(1). pp.50-71.

Luft, J. and Shields, M.D., 2010. Psychology models of management accounting. Foundations

and Trends® in Accounting. 4(3–4). pp.199-345.

Van Helden. And et. al., 2010. Knowledge creation for practice in public sector management

accounting by consultants and academics: Preliminary findings and directions for future

research. Management Accounting Research. 21(2). pp.83-94.

Renz, D.O., 2016. The Jossey-Bass handbook of non-profit leadership and management. John

Wiley & Sons.

Macintosh, N.B. and Quattrone, P., 2010. Management accounting and control systems: An

organizational and sociological approach. John Wiley & Sons.

Kaplan, R.S. and Atkinson, A.A., 2015. Advanced management accounting. PHI Learning.

Baldvinsdottir, G., Mitchell, F. and Nørreklit, H., 2010. Issues in the relationship between theory

and practice in management accounting. Management Accounting Research. 21(2).

pp.79-82.

Bennett, M.D., Schaltegger, S. and Zvezdov, D., 2013. Exploring corporate practices in

management accounting for sustainability. (pp. 1-56). London: ICAEW.

Busco, C. and Scapens, R.W., 2011. Management accounting systems and organisational culture:

Interpreting their linkages and processes of change. Qualitative Research in Accounting

& Management. 8(4). pp.320-357.

Christ, K.L. and Burritt, R.L., 2013. Environmental management accounting: the significance of

contingent variables for adoption. Journal of Cleaner Production. 41. pp.163-173.

Cinquini, L. and Tenucci, A., 2010. Strategic management accounting and business strategy: a

loose coupling?. Journal of Accounting & organizational change. 6(2). pp.228-259.

Contrafatto, M. and Burns, J., 2013. Social and environmental accounting, organisational change

and management accounting: A processual view. Management Accounting Research.

24(4). pp.349-365.

Dillard, J. and Roslender, R., 2011. Taking pluralism seriously: embedded moralities in

management accounting and control systems. Critical Perspectives on Accounting.

22(2). pp.135-147.

Fullerton, R. R., Kennedy, F. A. and Widener, S. K., 2014. Lean manufacturing and firm

performance: The incremental contribution of lean management accounting practices.

Journal of Operations Management. 32(7). pp.414-428.

Online

marginal cost. 2017. [online]. Available

through :<http://www.businessdictionary.com/definition/marginal-cost.html>.Accessed

on [18th April 2017]

What is Budgetary control?. 2017. [online]. Available through

:<http://accountlearning.com/budgetary-control-objectives-advantages-disadvantages/>.

Accessed on [18th April 2017]

:<http://accountlearning.com/budgetary-control-objectives-advantages-disadvantages/>.

Accessed on [18th April 2017]

1 out of 18

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.