Netflix Report: Analysis of Netflix's Marketing and Business Model

VerifiedAdded on 2021/03/15

|13

|4125

|111

Report

AI Summary

This report provides a comprehensive analysis of Netflix, the leading online streaming service. It begins with an executive summary and an introduction, outlining the company's background, including its timeline, ownership, and micro and macro environments. A SWOT analysis is presented, detailing Netflix's strengths, weaknesses, opportunities, and threats. The report then delves into Netflix's business model and service portfolio, examining its financial performance and key recommendations for future success. The report covers various aspects of Netflix's operations, including its content strategy, market position, and competitive landscape. The analysis highlights the challenges and opportunities facing Netflix in the rapidly evolving media streaming industry, including the rise of competitors, content licensing, and technological innovation. The report concludes with recommendations for Netflix to maintain its market leadership and adapt to the changing demands of consumers. The report is designed for marketing professionals, providing valuable insights into the strategies and challenges of a leading digital media company.

Professional Development for Marketers

Netflix Report

For Ms. Zacharewicz Anna & Mr. Berry Richard

Anne-Sophie Kluwer w1748371

Justine Astoin w1737648

Anastasia Gushchina w1759536

Amado Morales w1741224

Kristine Alkhidze w1679912

Executive Summary

Netflix is the largest online streaming service founded by Reed Hastings – Netflix’s CEO to this day

- and Marc Randolf. In the 22 years since Netflix was established it has gained over 158 million

subscribers worldwide. As a leader of the industry the main threats for Netflix today is the rise of

the competitors, challenging it for content and price. However, the rising demand for on-demand

video streaming internationally, specifically in Asia-Pacific region provides new opportunities for

Netflix to gain new subscribers and compensate for possible revenue losses and higher costs

associated with obtaining content licenses and imposition of new regulations in other parts of the

world. Technological innovation and exclusive-to-the-platform content are the key competitive

factors for streaming services today. It is crucial for Netflix to be attuned to the demands of their

consumers in the upcoming years.

Table of contents

Introduction ………………………………………………………………………………………….... 3

Background of the Company - Timeline …………………………………………...…………….... 3

Netflix Report

For Ms. Zacharewicz Anna & Mr. Berry Richard

Anne-Sophie Kluwer w1748371

Justine Astoin w1737648

Anastasia Gushchina w1759536

Amado Morales w1741224

Kristine Alkhidze w1679912

Executive Summary

Netflix is the largest online streaming service founded by Reed Hastings – Netflix’s CEO to this day

- and Marc Randolf. In the 22 years since Netflix was established it has gained over 158 million

subscribers worldwide. As a leader of the industry the main threats for Netflix today is the rise of

the competitors, challenging it for content and price. However, the rising demand for on-demand

video streaming internationally, specifically in Asia-Pacific region provides new opportunities for

Netflix to gain new subscribers and compensate for possible revenue losses and higher costs

associated with obtaining content licenses and imposition of new regulations in other parts of the

world. Technological innovation and exclusive-to-the-platform content are the key competitive

factors for streaming services today. It is crucial for Netflix to be attuned to the demands of their

consumers in the upcoming years.

Table of contents

Introduction ………………………………………………………………………………………….... 3

Background of the Company - Timeline …………………………………………...…………….... 3

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Ownership - Behind the Brand ……….…………………………………………………………….. 4

Micro Environment …………………………………………………………………………………… 5

Macro environment ………………………………………………………………………………...

SWOT Analysis ……………………………………………………………………………………..

Netflix’s Business Model and Service Portfolio ………………………………………………..

Financial Performance …………………………………………………………………………….

Conclusion ………………………………………………………………………………………….

Key recommendations …………………………………………………………………………….

Introduction

Today traditional television still accounts for most TV time in the UK - 69% - however, it is

continuously falling at an accelerating rate, as Britain’s demand for streaming on demand videos

experiences rapid growth (Ofcom, 2019). Changes in the viewing habits are most prominent

among younger people, aged 16 to 24, who watch half as much traditional TV as their counterparts

in 2010 (Ofcom, 2019). This report was prepared for the Marketing Services Directors - Anna

Zacharewicz and Richard Berry in order to provide details on Netflix - one of the most popular

video streaming platforms in the UK and the largest streaming service globally (Moskowitz, 2019).

This report aims to provide insights into the company’s financial and market performance over the

past several years and, looking at the business model, investigate the main determinants of its

success.

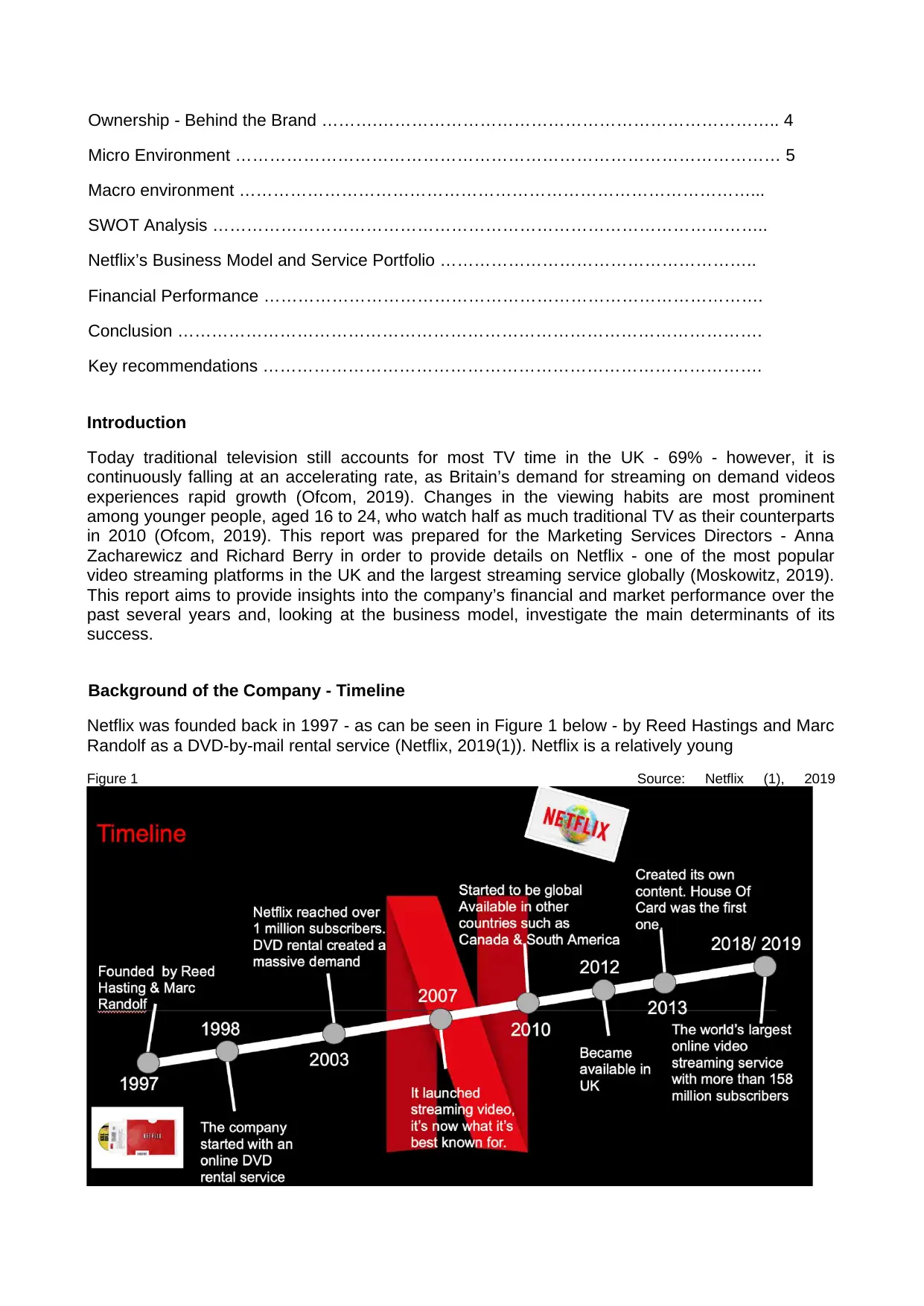

Background of the Company - Timeline

Netflix was founded back in 1997 - as can be seen in Figure 1 below - by Reed Hastings and Marc

Randolf as a DVD-by-mail rental service (Netflix, 2019(1)). Netflix is a relatively young

Figure 1 Source: Netflix (1), 2019

Micro Environment …………………………………………………………………………………… 5

Macro environment ………………………………………………………………………………...

SWOT Analysis ……………………………………………………………………………………..

Netflix’s Business Model and Service Portfolio ………………………………………………..

Financial Performance …………………………………………………………………………….

Conclusion ………………………………………………………………………………………….

Key recommendations …………………………………………………………………………….

Introduction

Today traditional television still accounts for most TV time in the UK - 69% - however, it is

continuously falling at an accelerating rate, as Britain’s demand for streaming on demand videos

experiences rapid growth (Ofcom, 2019). Changes in the viewing habits are most prominent

among younger people, aged 16 to 24, who watch half as much traditional TV as their counterparts

in 2010 (Ofcom, 2019). This report was prepared for the Marketing Services Directors - Anna

Zacharewicz and Richard Berry in order to provide details on Netflix - one of the most popular

video streaming platforms in the UK and the largest streaming service globally (Moskowitz, 2019).

This report aims to provide insights into the company’s financial and market performance over the

past several years and, looking at the business model, investigate the main determinants of its

success.

Background of the Company - Timeline

Netflix was founded back in 1997 - as can be seen in Figure 1 below - by Reed Hastings and Marc

Randolf as a DVD-by-mail rental service (Netflix, 2019(1)). Netflix is a relatively young

Figure 1 Source: Netflix (1), 2019

company when compared to the UK’s publicly owned broadcasting giant BBC, which is to celebrate

its 100th anniversary in 2022 (BBC, no date). Netflix started by providing a home delivery service

for its online rentals and success followed quickly as in 2003 (only 5 years after the launch) the

company had 1 million subscribers in the US (La Monica, 2003).

The critical point for the company happened in 2007 when it launched streaming video rvices,

which is what it is now best known for (BBC, 2018). Just 3 years later Netflix started to offer their

services outside of the US and became available in the UK in 2012 (BBC, 2018). Today it is

available in 190 countries, excluding China, North Korea and Syria (Netflix, 2019(2)).

In 2013, the company also started to offer original content and rapidly became a well-recognised

and respected trademark - Netflix Originals. Today company has over 158 million subscribers

(Moskowitz, 2019) and is considered the 5th largest media company worldwide (Shapiro, 2019).

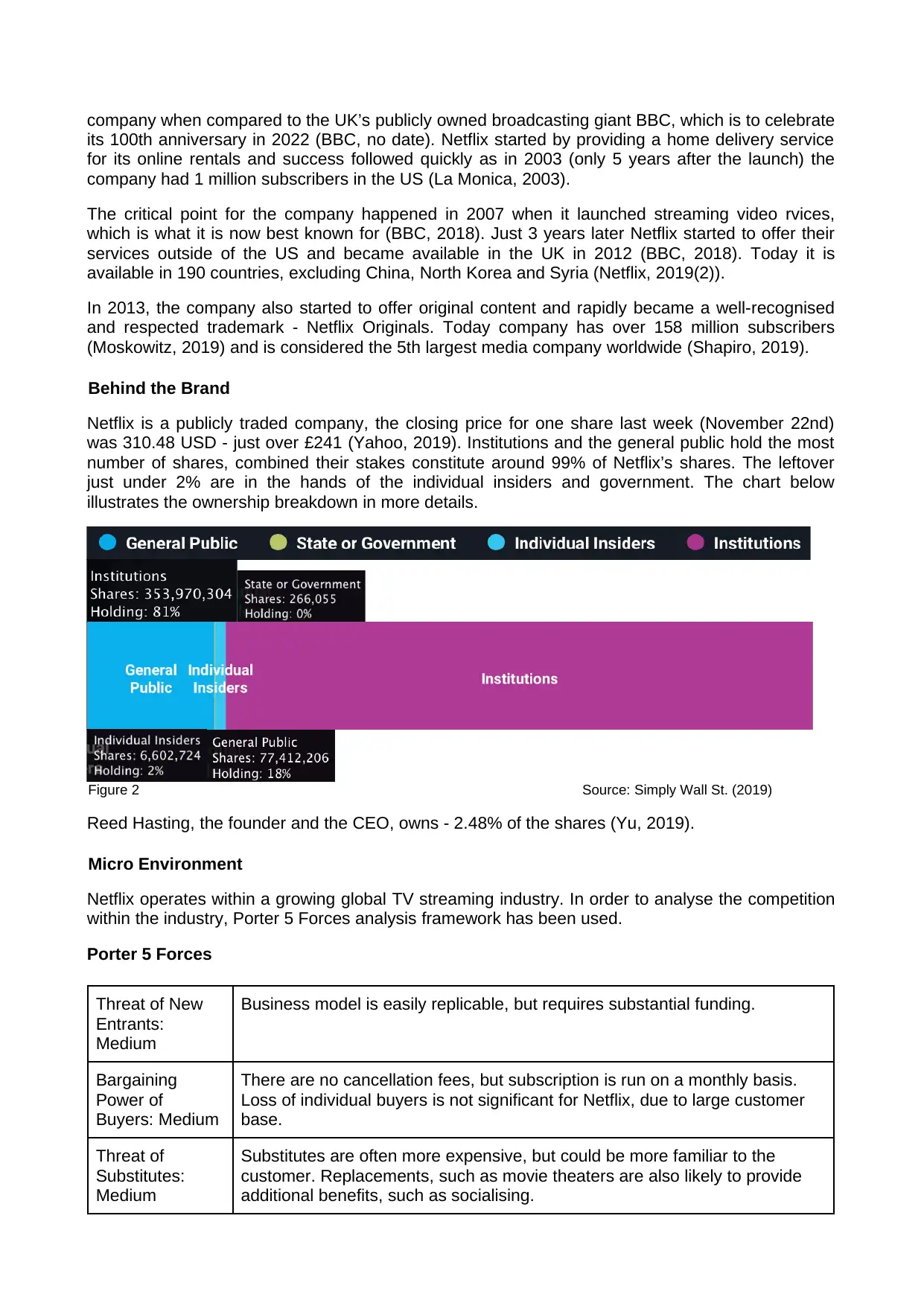

Behind the Brand

Netflix is a publicly traded company, the closing price for one share last week (November 22nd)

was 310.48 USD - just over £241 (Yahoo, 2019). Institutions and the general public hold the most

number of shares, combined their stakes constitute around 99% of Netflix’s shares. The leftover

just under 2% are in the hands of the individual insiders and government. The chart below

illustrates the ownership breakdown in more details.

Figure 2 Source: Simply Wall St. (2019)

Reed Hasting, the founder and the CEO, owns - 2.48% of the shares (Yu, 2019).

Micro Environment

Netflix operates within a growing global TV streaming industry. In order to analyse the competition

within the industry, Porter 5 Forces analysis framework has been used.

Porter 5 Forces

Threat of New

Entrants:

Medium

Business model is easily replicable, but requires substantial funding.

Bargaining

Power of

Buyers: Medium

There are no cancellation fees, but subscription is run on a monthly basis.

Loss of individual buyers is not significant for Netflix, due to large customer

base.

Threat of

Substitutes:

Medium

Substitutes are often more expensive, but could be more familiar to the

customer. Replacements, such as movie theaters are also likely to provide

additional benefits, such as socialising.

its 100th anniversary in 2022 (BBC, no date). Netflix started by providing a home delivery service

for its online rentals and success followed quickly as in 2003 (only 5 years after the launch) the

company had 1 million subscribers in the US (La Monica, 2003).

The critical point for the company happened in 2007 when it launched streaming video rvices,

which is what it is now best known for (BBC, 2018). Just 3 years later Netflix started to offer their

services outside of the US and became available in the UK in 2012 (BBC, 2018). Today it is

available in 190 countries, excluding China, North Korea and Syria (Netflix, 2019(2)).

In 2013, the company also started to offer original content and rapidly became a well-recognised

and respected trademark - Netflix Originals. Today company has over 158 million subscribers

(Moskowitz, 2019) and is considered the 5th largest media company worldwide (Shapiro, 2019).

Behind the Brand

Netflix is a publicly traded company, the closing price for one share last week (November 22nd)

was 310.48 USD - just over £241 (Yahoo, 2019). Institutions and the general public hold the most

number of shares, combined their stakes constitute around 99% of Netflix’s shares. The leftover

just under 2% are in the hands of the individual insiders and government. The chart below

illustrates the ownership breakdown in more details.

Figure 2 Source: Simply Wall St. (2019)

Reed Hasting, the founder and the CEO, owns - 2.48% of the shares (Yu, 2019).

Micro Environment

Netflix operates within a growing global TV streaming industry. In order to analyse the competition

within the industry, Porter 5 Forces analysis framework has been used.

Porter 5 Forces

Threat of New

Entrants:

Medium

Business model is easily replicable, but requires substantial funding.

Bargaining

Power of

Buyers: Medium

There are no cancellation fees, but subscription is run on a monthly basis.

Loss of individual buyers is not significant for Netflix, due to large customer

base.

Threat of

Substitutes:

Medium

Substitutes are often more expensive, but could be more familiar to the

customer. Replacements, such as movie theaters are also likely to provide

additional benefits, such as socialising.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Bargaining

Power of

Suppliers: High

Suppliers own over 90% of the content on the platform (Figure 5), which they

are able to relocate from the platform when license expires (typically within 1

year).

Competitive

Rivalry: Medium

Influx of new cash-rich entrants significantly increased the level of

competition within the industry, however, the content differences from one

platform to another are compelling, since licenses make content exclusive to

the platform. Netflix has another great advantage over the competition which

is a strong brand image.

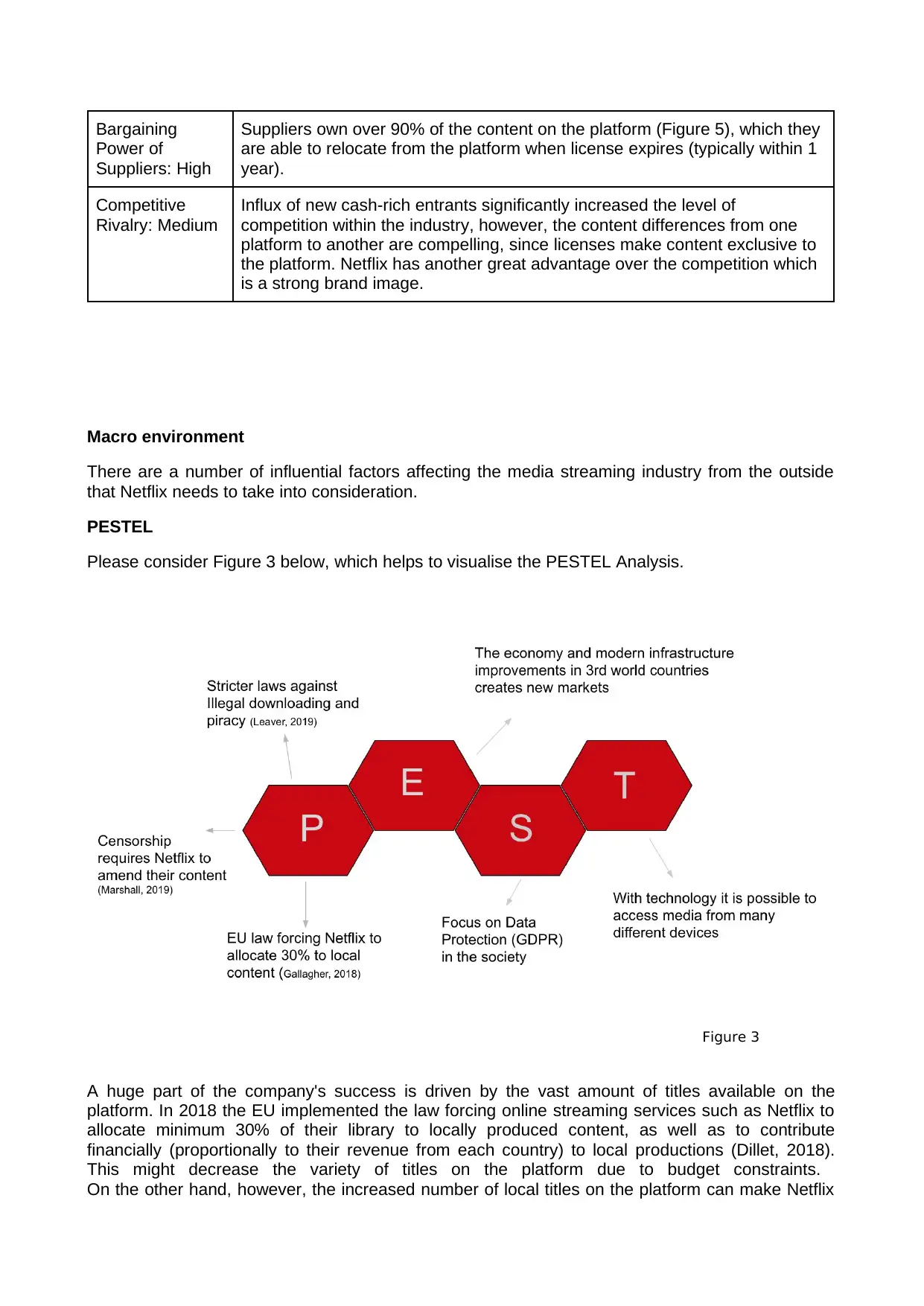

Macro environment

There are a number of influential factors affecting the media streaming industry from the outside

that Netflix needs to take into consideration.

PESTEL

Please consider Figure 3 below, which helps to visualise the PESTEL Analysis.

Figure 3

A huge part of the company's success is driven by the vast amount of titles available on the

platform. In 2018 the EU implemented the law forcing online streaming services such as Netflix to

allocate minimum 30% of their library to locally produced content, as well as to contribute

financially (proportionally to their revenue from each country) to local productions (Dillet, 2018).

This might decrease the variety of titles on the platform due to budget constraints.

On the other hand, however, the increased number of local titles on the platform can make Netflix

Power of

Suppliers: High

Suppliers own over 90% of the content on the platform (Figure 5), which they

are able to relocate from the platform when license expires (typically within 1

year).

Competitive

Rivalry: Medium

Influx of new cash-rich entrants significantly increased the level of

competition within the industry, however, the content differences from one

platform to another are compelling, since licenses make content exclusive to

the platform. Netflix has another great advantage over the competition which

is a strong brand image.

Macro environment

There are a number of influential factors affecting the media streaming industry from the outside

that Netflix needs to take into consideration.

PESTEL

Please consider Figure 3 below, which helps to visualise the PESTEL Analysis.

Figure 3

A huge part of the company's success is driven by the vast amount of titles available on the

platform. In 2018 the EU implemented the law forcing online streaming services such as Netflix to

allocate minimum 30% of their library to locally produced content, as well as to contribute

financially (proportionally to their revenue from each country) to local productions (Dillet, 2018).

This might decrease the variety of titles on the platform due to budget constraints.

On the other hand, however, the increased number of local titles on the platform can make Netflix

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

have greater appeal to the local customers (Bylund, 2019). The company can also benefit from

increased globalisation and economic growth in 3rd world countries which allow more people to

have access to an electronic device, use the internet, and be a part of Netflix.

Much of the platform’s success comes from the big data analytics that it collects and uses when

deciding on the content (Markman, 2019). Increased focus on data protection in society can

eventually challenge their way of tailoring content to the individual client. This is becoming

increasingly evident as large companies, such as Apple, YouTube and Netflix face accusations of

not complying with the EU’s General Data Protection Regulation (Meyer, 2019).

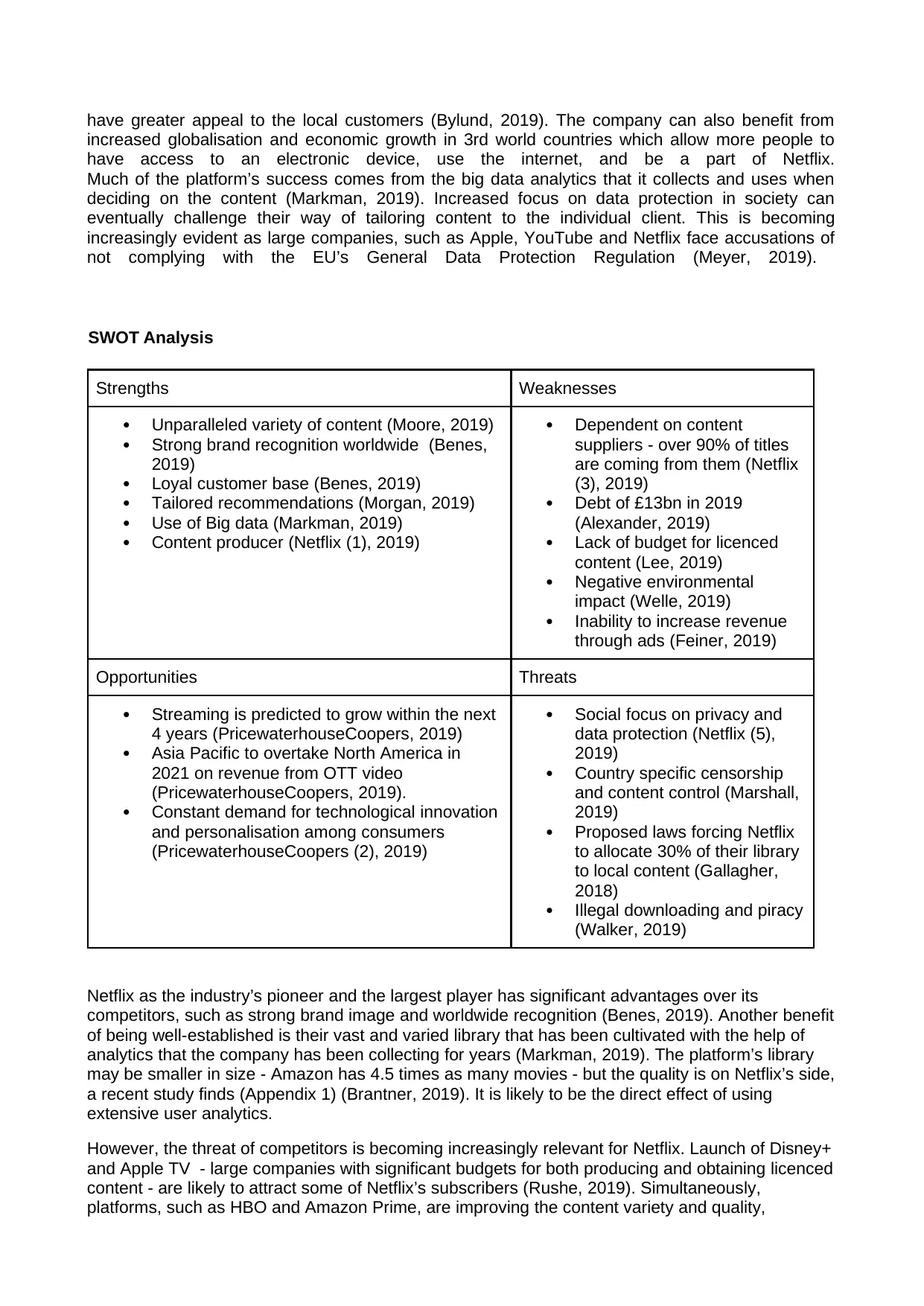

SWOT Analysis

Strengths Weaknesses

Unparalleled variety of content (Moore, 2019)

Strong brand recognition worldwide (Benes,

2019)

Loyal customer base (Benes, 2019)

Tailored recommendations (Morgan, 2019)

Use of Big data (Markman, 2019)

Content producer (Netflix (1), 2019)

Dependent on content

suppliers - over 90% of titles

are coming from them (Netflix

(3), 2019)

Debt of £13bn in 2019

(Alexander, 2019)

Lack of budget for licenced

content (Lee, 2019)

Negative environmental

impact (Welle, 2019)

Inability to increase revenue

through ads (Feiner, 2019)

Opportunities Threats

Streaming is predicted to grow within the next

4 years (PricewaterhouseCoopers, 2019)

Asia Pacific to overtake North America in

2021 on revenue from OTT video

(PricewaterhouseCoopers, 2019).

Constant demand for technological innovation

and personalisation among consumers

(PricewaterhouseCoopers (2), 2019)

Social focus on privacy and

data protection (Netflix (5),

2019)

Country specific censorship

and content control (Marshall,

2019)

Proposed laws forcing Netflix

to allocate 30% of their library

to local content (Gallagher,

2018)

Illegal downloading and piracy

(Walker, 2019)

Netflix as the industry’s pioneer and the largest player has significant advantages over its

competitors, such as strong brand image and worldwide recognition (Benes, 2019). Another benefit

of being well-established is their vast and varied library that has been cultivated with the help of

analytics that the company has been collecting for years (Markman, 2019). The platform’s library

may be smaller in size - Amazon has 4.5 times as many movies - but the quality is on Netflix’s side,

a recent study finds (Appendix 1) (Brantner, 2019). It is likely to be the direct effect of using

extensive user analytics.

However, the threat of competitors is becoming increasingly relevant for Netflix. Launch of Disney+

and Apple TV - large companies with significant budgets for both producing and obtaining licenced

content - are likely to attract some of Netflix’s subscribers (Rushe, 2019). Simultaneously,

platforms, such as HBO and Amazon Prime, are improving the content variety and quality,

increased globalisation and economic growth in 3rd world countries which allow more people to

have access to an electronic device, use the internet, and be a part of Netflix.

Much of the platform’s success comes from the big data analytics that it collects and uses when

deciding on the content (Markman, 2019). Increased focus on data protection in society can

eventually challenge their way of tailoring content to the individual client. This is becoming

increasingly evident as large companies, such as Apple, YouTube and Netflix face accusations of

not complying with the EU’s General Data Protection Regulation (Meyer, 2019).

SWOT Analysis

Strengths Weaknesses

Unparalleled variety of content (Moore, 2019)

Strong brand recognition worldwide (Benes,

2019)

Loyal customer base (Benes, 2019)

Tailored recommendations (Morgan, 2019)

Use of Big data (Markman, 2019)

Content producer (Netflix (1), 2019)

Dependent on content

suppliers - over 90% of titles

are coming from them (Netflix

(3), 2019)

Debt of £13bn in 2019

(Alexander, 2019)

Lack of budget for licenced

content (Lee, 2019)

Negative environmental

impact (Welle, 2019)

Inability to increase revenue

through ads (Feiner, 2019)

Opportunities Threats

Streaming is predicted to grow within the next

4 years (PricewaterhouseCoopers, 2019)

Asia Pacific to overtake North America in

2021 on revenue from OTT video

(PricewaterhouseCoopers, 2019).

Constant demand for technological innovation

and personalisation among consumers

(PricewaterhouseCoopers (2), 2019)

Social focus on privacy and

data protection (Netflix (5),

2019)

Country specific censorship

and content control (Marshall,

2019)

Proposed laws forcing Netflix

to allocate 30% of their library

to local content (Gallagher,

2018)

Illegal downloading and piracy

(Walker, 2019)

Netflix as the industry’s pioneer and the largest player has significant advantages over its

competitors, such as strong brand image and worldwide recognition (Benes, 2019). Another benefit

of being well-established is their vast and varied library that has been cultivated with the help of

analytics that the company has been collecting for years (Markman, 2019). The platform’s library

may be smaller in size - Amazon has 4.5 times as many movies - but the quality is on Netflix’s side,

a recent study finds (Appendix 1) (Brantner, 2019). It is likely to be the direct effect of using

extensive user analytics.

However, the threat of competitors is becoming increasingly relevant for Netflix. Launch of Disney+

and Apple TV - large companies with significant budgets for both producing and obtaining licenced

content - are likely to attract some of Netflix’s subscribers (Rushe, 2019). Simultaneously,

platforms, such as HBO and Amazon Prime, are improving the content variety and quality,

outbidding Netflix for popular shows, like Friends and The Office (US), offering cheaper

subscription prices (Lee, 2019). In fact, Netflix’s subscriber growth has already been affected by

the anticipation of Disney+ and Apple TV - 800,000 less it forecasted (Rushe, 2019).

Netflix has long been looking to enter the Chinese market (Netflix (2), 2019), but negotiations are

far from coming to a conclusion due to strict censorship and limited internet freedom in the country

(C, 2018). India - another huge potential customer base, although getting access to significantly

cheaper internet following the recent new entrant - Jio - breaking up the cartel and sharply driving

down the prices (Roy, 2019), has a very unique and particular tastes with large local media

companies saturation the entertainment market with content (Sharma, 2017). Therefore, despite

the increasing demand for streaming in Asia, Netflix is struggling to realise the opportunity to tap

into that market, as many customers in that region are hard to reach and satisfy.

Netflix’s negative environmental impact as company consumes large amounts of energy to keep

their servers running 24/7 all year round (Welle, 2019) might have a slight negative impact on sales

due to increasing social awareness and eco-consciousness. However, the issue can potentially

become a lot more prominent if the government increased taxation on CO2 emissions.

SWOT Summary

Overall, the key appeal of Netflix is the wide variety of quality content available on the platform.

However, as more and more competitors join the market and outbid Netflix for the popular titles,

this advantage is expected to diminish. The challenge for Netflix in the next few years would be to

stay appealing and relevant to the customers in the presence of strong competitors. However

before concluding on this, a closer look has to be taken at the company’s product and service

portfolio.

Netflix’s Business Model and Service Portfolio

As was touched upon earlier, Netflix has a variety of content on the platform, including movies of

different genres, documentaries, content for kids, reality shows and more. This makes their

customer profile very diverse. Company’s target market includes people of all genders, aged 17-

60, whose household income is above £23,300; which would suggest that psychographics are of

greater relevance to Netflix, than demographics (Pahwa, 2019). The service is also producing

original content, which is exclusive to the platform.

subscription prices (Lee, 2019). In fact, Netflix’s subscriber growth has already been affected by

the anticipation of Disney+ and Apple TV - 800,000 less it forecasted (Rushe, 2019).

Netflix has long been looking to enter the Chinese market (Netflix (2), 2019), but negotiations are

far from coming to a conclusion due to strict censorship and limited internet freedom in the country

(C, 2018). India - another huge potential customer base, although getting access to significantly

cheaper internet following the recent new entrant - Jio - breaking up the cartel and sharply driving

down the prices (Roy, 2019), has a very unique and particular tastes with large local media

companies saturation the entertainment market with content (Sharma, 2017). Therefore, despite

the increasing demand for streaming in Asia, Netflix is struggling to realise the opportunity to tap

into that market, as many customers in that region are hard to reach and satisfy.

Netflix’s negative environmental impact as company consumes large amounts of energy to keep

their servers running 24/7 all year round (Welle, 2019) might have a slight negative impact on sales

due to increasing social awareness and eco-consciousness. However, the issue can potentially

become a lot more prominent if the government increased taxation on CO2 emissions.

SWOT Summary

Overall, the key appeal of Netflix is the wide variety of quality content available on the platform.

However, as more and more competitors join the market and outbid Netflix for the popular titles,

this advantage is expected to diminish. The challenge for Netflix in the next few years would be to

stay appealing and relevant to the customers in the presence of strong competitors. However

before concluding on this, a closer look has to be taken at the company’s product and service

portfolio.

Netflix’s Business Model and Service Portfolio

As was touched upon earlier, Netflix has a variety of content on the platform, including movies of

different genres, documentaries, content for kids, reality shows and more. This makes their

customer profile very diverse. Company’s target market includes people of all genders, aged 17-

60, whose household income is above £23,300; which would suggest that psychographics are of

greater relevance to Netflix, than demographics (Pahwa, 2019). The service is also producing

original content, which is exclusive to the platform.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

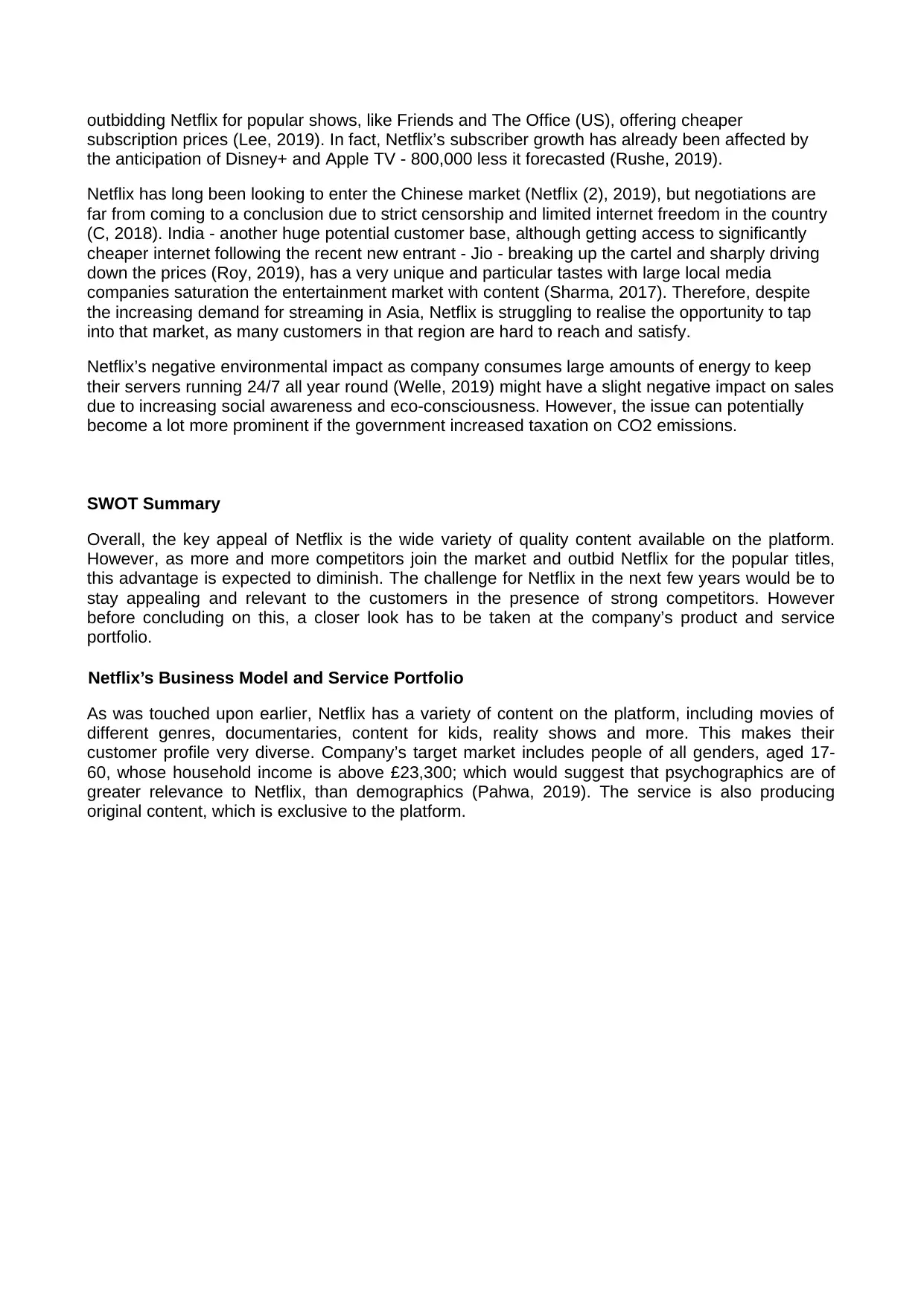

Figure 4 Source: Cook, 2018

Netflix’s library is different for each country, with many titles accessible worldwide, and local

differences (Rosenberg, 2019). Figure 4 illustrates the top 5 countries offering the largest number

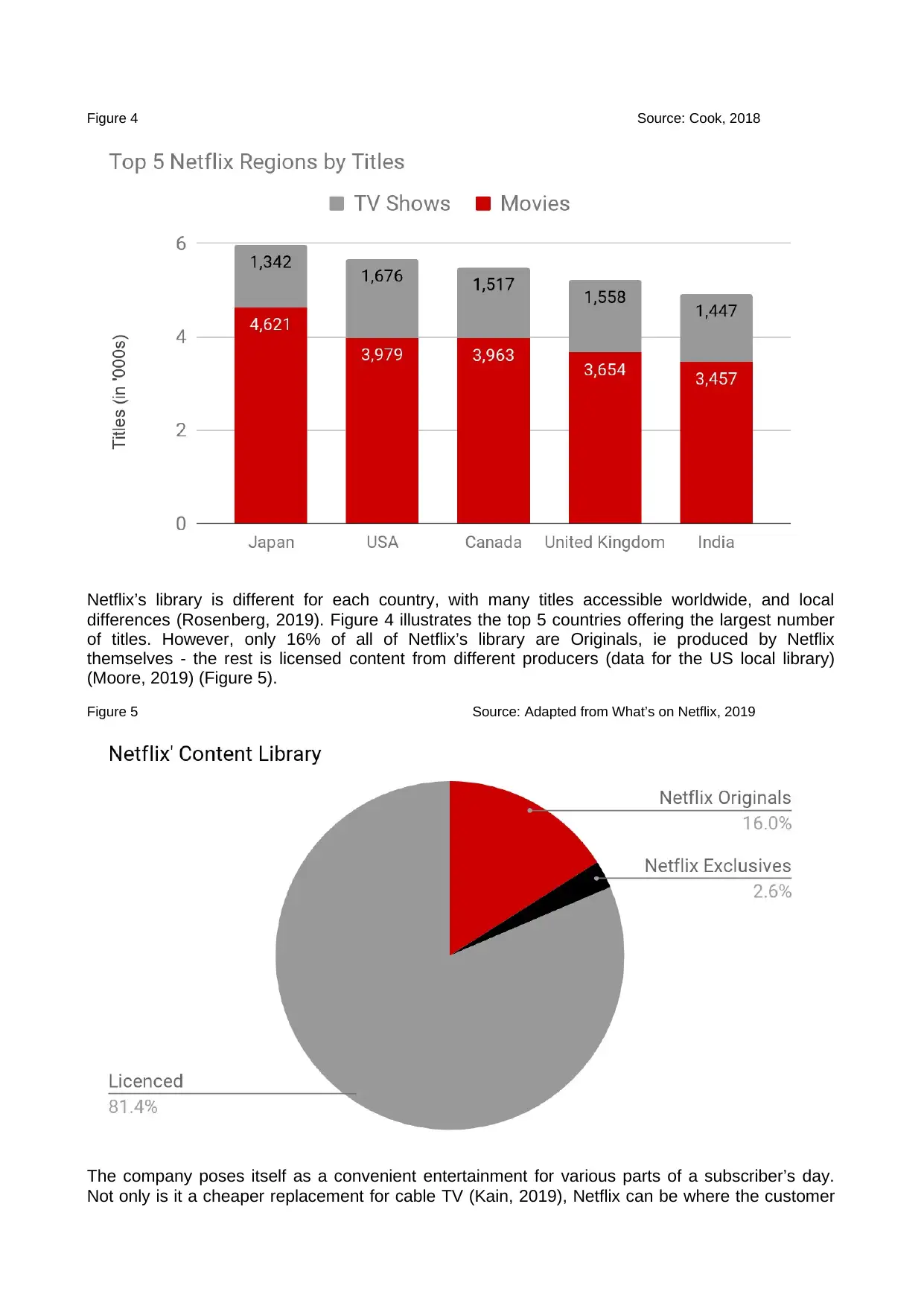

of titles. However, only 16% of all of Netflix’s library are Originals, ie produced by Netflix

themselves - the rest is licensed content from different producers (data for the US local library)

(Moore, 2019) (Figure 5).

Figure 5 Source: Adapted from What’s on Netflix, 2019

The company poses itself as a convenient entertainment for various parts of a subscriber’s day.

Not only is it a cheaper replacement for cable TV (Kain, 2019), Netflix can be where the customer

Netflix’s library is different for each country, with many titles accessible worldwide, and local

differences (Rosenberg, 2019). Figure 4 illustrates the top 5 countries offering the largest number

of titles. However, only 16% of all of Netflix’s library are Originals, ie produced by Netflix

themselves - the rest is licensed content from different producers (data for the US local library)

(Moore, 2019) (Figure 5).

Figure 5 Source: Adapted from What’s on Netflix, 2019

The company poses itself as a convenient entertainment for various parts of a subscriber’s day.

Not only is it a cheaper replacement for cable TV (Kain, 2019), Netflix can be where the customer

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

is, like while cooking or commuting to work. No TV, cables or Internet connection required - movies

can be downloaded onto any device - smart TVs, new generation consoles such as Playstation or

Xbox, tablets, mobiles phones and Blu-ray.

Netflix is highly reliant on subscription fees for its revenue. However, since 2017 Netflix has started

to look for other ways to bring in the revenue. Production of Originals allowed them to delve into

the merchandise market, as a line Stranger Things appeared in retailer Hot Topic during the spring

2017 (Huddlestone, 2017). The platform does not currently sell advertising.

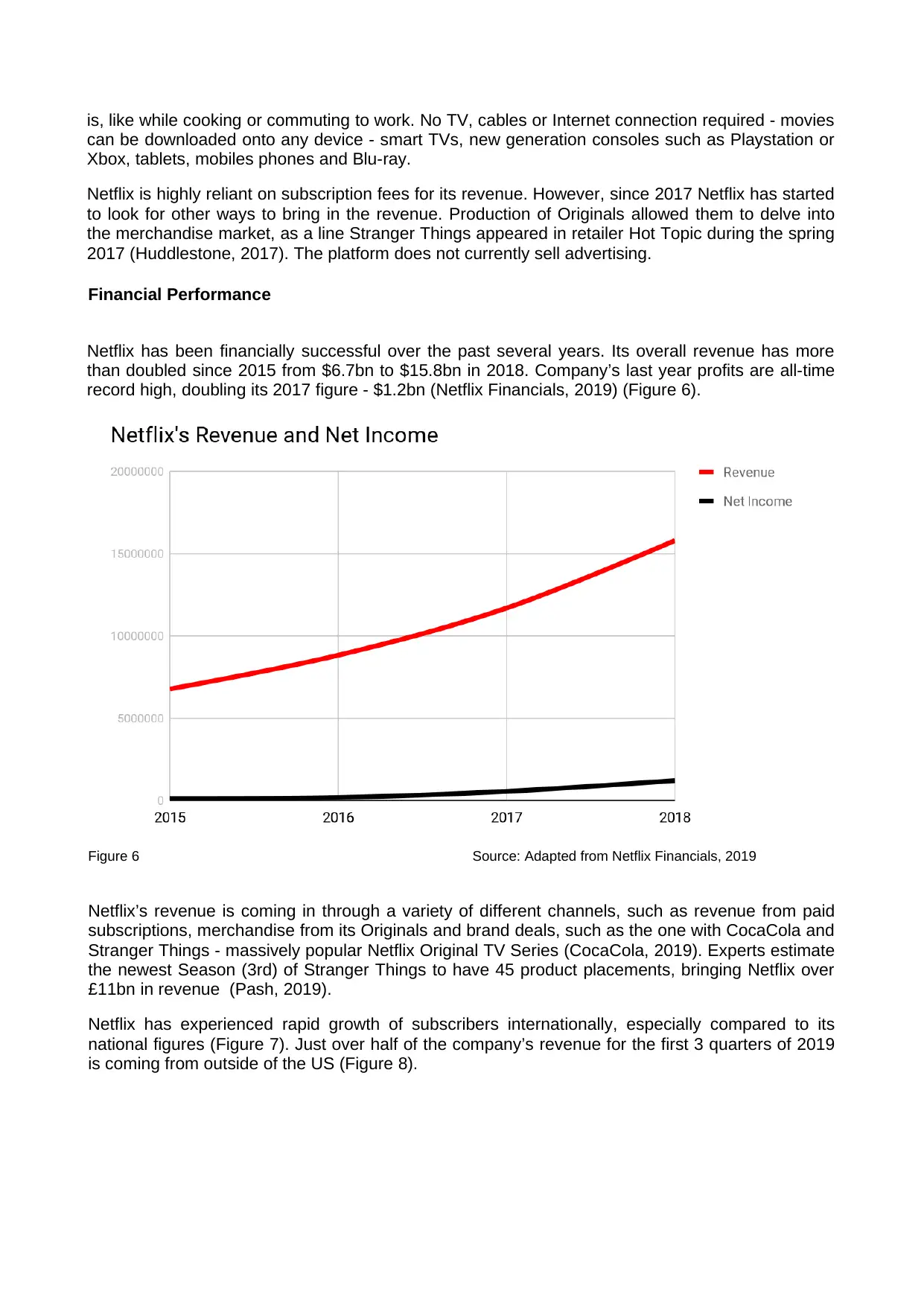

Financial Performance

Netflix has been financially successful over the past several years. Its overall revenue has more

than doubled since 2015 from $6.7bn to $15.8bn in 2018. Company’s last year profits are all-time

record high, doubling its 2017 figure - $1.2bn (Netflix Financials, 2019) (Figure 6).

Figure 6 Source: Adapted from Netflix Financials, 2019

Netflix’s revenue is coming in through a variety of different channels, such as revenue from paid

subscriptions, merchandise from its Originals and brand deals, such as the one with CocaCola and

Stranger Things - massively popular Netflix Original TV Series (CocaCola, 2019). Experts estimate

the newest Season (3rd) of Stranger Things to have 45 product placements, bringing Netflix over

£11bn in revenue (Pash, 2019).

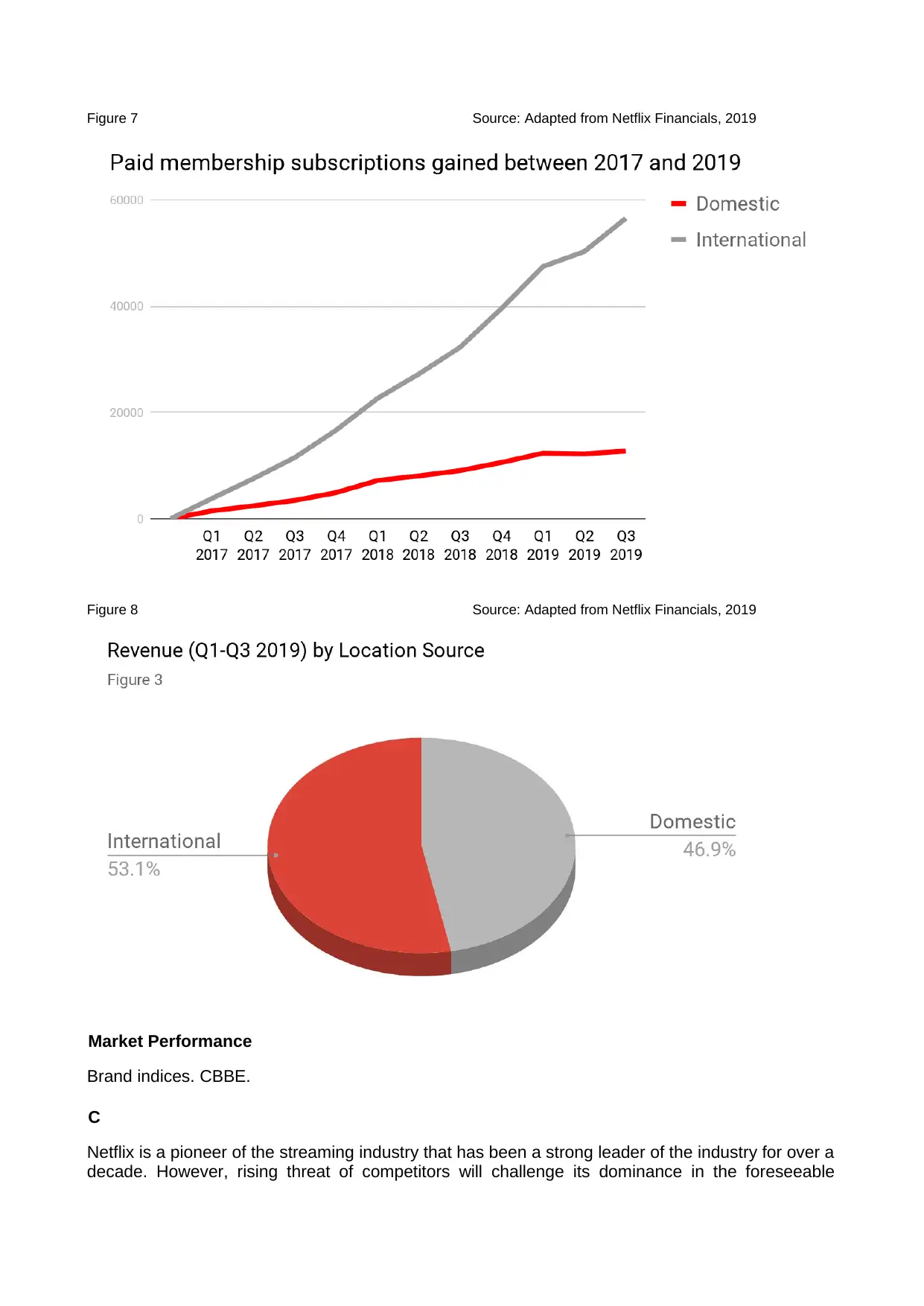

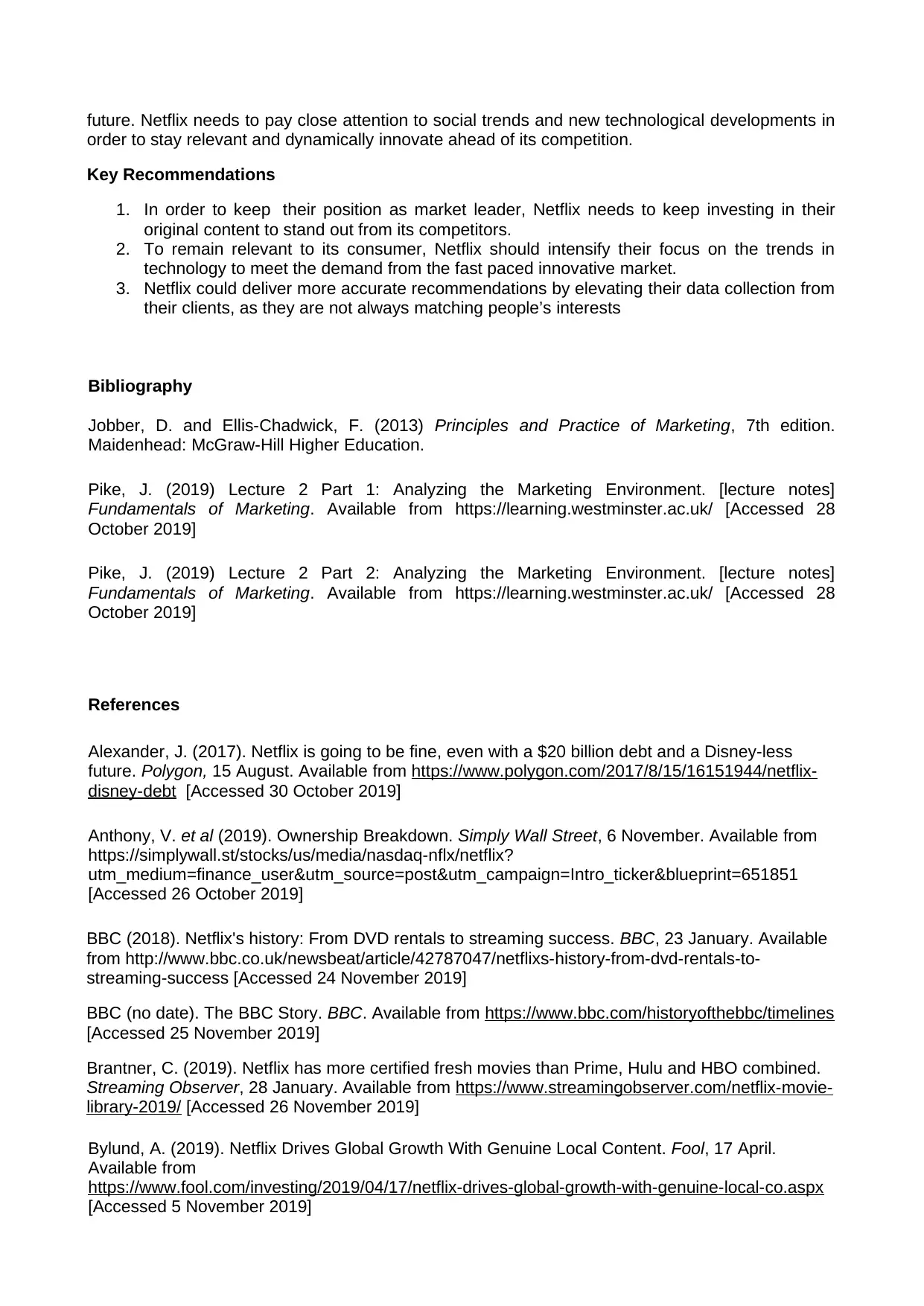

Netflix has experienced rapid growth of subscribers internationally, especially compared to its

national figures (Figure 7). Just over half of the company’s revenue for the first 3 quarters of 2019

is coming from outside of the US (Figure 8).

can be downloaded onto any device - smart TVs, new generation consoles such as Playstation or

Xbox, tablets, mobiles phones and Blu-ray.

Netflix is highly reliant on subscription fees for its revenue. However, since 2017 Netflix has started

to look for other ways to bring in the revenue. Production of Originals allowed them to delve into

the merchandise market, as a line Stranger Things appeared in retailer Hot Topic during the spring

2017 (Huddlestone, 2017). The platform does not currently sell advertising.

Financial Performance

Netflix has been financially successful over the past several years. Its overall revenue has more

than doubled since 2015 from $6.7bn to $15.8bn in 2018. Company’s last year profits are all-time

record high, doubling its 2017 figure - $1.2bn (Netflix Financials, 2019) (Figure 6).

Figure 6 Source: Adapted from Netflix Financials, 2019

Netflix’s revenue is coming in through a variety of different channels, such as revenue from paid

subscriptions, merchandise from its Originals and brand deals, such as the one with CocaCola and

Stranger Things - massively popular Netflix Original TV Series (CocaCola, 2019). Experts estimate

the newest Season (3rd) of Stranger Things to have 45 product placements, bringing Netflix over

£11bn in revenue (Pash, 2019).

Netflix has experienced rapid growth of subscribers internationally, especially compared to its

national figures (Figure 7). Just over half of the company’s revenue for the first 3 quarters of 2019

is coming from outside of the US (Figure 8).

Figure 7 Source: Adapted from Netflix Financials, 2019

Figure 8 Source: Adapted from Netflix Financials, 2019

Market Performance

Brand indices. CBBE.

C

Netflix is a pioneer of the streaming industry that has been a strong leader of the industry for over a

decade. However, rising threat of competitors will challenge its dominance in the foreseeable

Figure 8 Source: Adapted from Netflix Financials, 2019

Market Performance

Brand indices. CBBE.

C

Netflix is a pioneer of the streaming industry that has been a strong leader of the industry for over a

decade. However, rising threat of competitors will challenge its dominance in the foreseeable

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

future. Netflix needs to pay close attention to social trends and new technological developments in

order to stay relevant and dynamically innovate ahead of its competition.

Key Recommendations

1. In order to keep their position as market leader, Netflix needs to keep investing in their

original content to stand out from its competitors.

2. To remain relevant to its consumer, Netflix should intensify their focus on the trends in

technology to meet the demand from the fast paced innovative market.

3. Netflix could deliver more accurate recommendations by elevating their data collection from

their clients, as they are not always matching people’s interests

Bibliography

Jobber, D. and Ellis-Chadwick, F. (2013) Principles and Practice of Marketing, 7th edition.

Maidenhead: McGraw-Hill Higher Education.

Pike, J. (2019) Lecture 2 Part 1: Analyzing the Marketing Environment. [lecture notes]

Fundamentals of Marketing. Available from https://learning.westminster.ac.uk/ [Accessed 28

October 2019]

Pike, J. (2019) Lecture 2 Part 2: Analyzing the Marketing Environment. [lecture notes]

Fundamentals of Marketing. Available from https://learning.westminster.ac.uk/ [Accessed 28

October 2019]

References

Alexander, J. (2017). Netflix is going to be fine, even with a $20 billion debt and a Disney-less

future. Polygon, 15 August. Available from https://www.polygon.com/2017/8/15/16151944/netflix-

disney-debt [Accessed 30 October 2019]

Anthony, V. et al (2019). Ownership Breakdown. Simply Wall Street, 6 November. Available from

https://simplywall.st/stocks/us/media/nasdaq-nflx/netflix?

utm_medium=finance_user&utm_source=post&utm_campaign=Intro_ticker&blueprint=651851

[Accessed 26 October 2019]

BBC (2018). Netflix's history: From DVD rentals to streaming success. BBC, 23 January. Available

from http://www.bbc.co.uk/newsbeat/article/42787047/netflixs-history-from-dvd-rentals-to-

streaming-success [Accessed 24 November 2019]

BBC (no date). The BBC Story. BBC. Available from https://www.bbc.com/historyofthebbc/timelines

[Accessed 25 November 2019]

Brantner, C. (2019). Netflix has more certified fresh movies than Prime, Hulu and HBO combined.

Streaming Observer, 28 January. Available from https://www.streamingobserver.com/netflix-movie-

library-2019/ [Accessed 26 November 2019]

Bylund, A. (2019). Netflix Drives Global Growth With Genuine Local Content. Fool, 17 April.

Available from

https://www.fool.com/investing/2019/04/17/netflix-drives-global-growth-with-genuine-local-co.aspx

[Accessed 5 November 2019]

order to stay relevant and dynamically innovate ahead of its competition.

Key Recommendations

1. In order to keep their position as market leader, Netflix needs to keep investing in their

original content to stand out from its competitors.

2. To remain relevant to its consumer, Netflix should intensify their focus on the trends in

technology to meet the demand from the fast paced innovative market.

3. Netflix could deliver more accurate recommendations by elevating their data collection from

their clients, as they are not always matching people’s interests

Bibliography

Jobber, D. and Ellis-Chadwick, F. (2013) Principles and Practice of Marketing, 7th edition.

Maidenhead: McGraw-Hill Higher Education.

Pike, J. (2019) Lecture 2 Part 1: Analyzing the Marketing Environment. [lecture notes]

Fundamentals of Marketing. Available from https://learning.westminster.ac.uk/ [Accessed 28

October 2019]

Pike, J. (2019) Lecture 2 Part 2: Analyzing the Marketing Environment. [lecture notes]

Fundamentals of Marketing. Available from https://learning.westminster.ac.uk/ [Accessed 28

October 2019]

References

Alexander, J. (2017). Netflix is going to be fine, even with a $20 billion debt and a Disney-less

future. Polygon, 15 August. Available from https://www.polygon.com/2017/8/15/16151944/netflix-

disney-debt [Accessed 30 October 2019]

Anthony, V. et al (2019). Ownership Breakdown. Simply Wall Street, 6 November. Available from

https://simplywall.st/stocks/us/media/nasdaq-nflx/netflix?

utm_medium=finance_user&utm_source=post&utm_campaign=Intro_ticker&blueprint=651851

[Accessed 26 October 2019]

BBC (2018). Netflix's history: From DVD rentals to streaming success. BBC, 23 January. Available

from http://www.bbc.co.uk/newsbeat/article/42787047/netflixs-history-from-dvd-rentals-to-

streaming-success [Accessed 24 November 2019]

BBC (no date). The BBC Story. BBC. Available from https://www.bbc.com/historyofthebbc/timelines

[Accessed 25 November 2019]

Brantner, C. (2019). Netflix has more certified fresh movies than Prime, Hulu and HBO combined.

Streaming Observer, 28 January. Available from https://www.streamingobserver.com/netflix-movie-

library-2019/ [Accessed 26 November 2019]

Bylund, A. (2019). Netflix Drives Global Growth With Genuine Local Content. Fool, 17 April.

Available from

https://www.fool.com/investing/2019/04/17/netflix-drives-global-growth-with-genuine-local-co.aspx

[Accessed 5 November 2019]

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

C, E. (2018). The great firewall of China: Xi Jinping’s internet shutdown. The Guardian, 29 June.

Available from https://www.theguardian.com/news/2018/jun/29/the-great-firewall-of-china-xi-

jinpings-internet-shutdown [Accessed 25 November 2019]

CocaCola (2019) CocaCoca-Cola x Stranger Things: Find out what happened when we brought

the upside-down world to London. CocaCola, 15 July. Available from

https://www.coca-cola.co.uk/stories/coca-cola-x-strangerthings [Accessed 26 November]

Cook, S. (2018). Netflix Libraries Around the World: How Netflix Libraries Compare. Fixed, 24 July.

Available from https://flixed.io/netlfix-libraries-around-world/?fbclid=IwAR0ikj-

kK7ceL4MwZEe9Zpj27xjqcyIDd94yts0m-_keY4wIbuU6Lq8xx6Y [Accessed 20 November 2019]

Dillet, R. (2018). European Union approves content quota for streaming services. TechCrunch, 4

October. Available from https://techcrunch.com/2018/10/04/european-union-approves-content-

quota-for-streaming-services/ [Accessed 23 November 2019]

Gallagher, K. (2018). The EU is moving to regulate streaming libraries. Business Insider, 5

September. Available from https://www.businessinsider.com/netflix-amazon-prime-video-eu-law-

local-content-2018-9?r=US&IR=T [Accessed 14 November 2019]

GDPR Associates (no date). GDPR and Brexit. GDPR Associates. Available from

https://www.gdpr.associates/gdpr-brexit/ [Accessed 16 November 2019]

Huddlestone, T. (2017). Netflix Could Have a $1bn Merchandising Business. Fortune, 14 April.

Available from https://fortune.com/2017/04/14/netflix-merchandise/ [Accessed 25 November 2019]

Interbrand, 2019. 2019 Rankings | Netflix. Interbrand. Available from

https://www.interbrand.com/best-brands/best-global-brands/2019/ranking/netflix/ [Accessed 25

November 2019]

Kain, E. (2019). Is Netflix Doomed? Here's Why Disney+ Isn't A Netflix Killer Despite What You

Might Have Heard. Forbes, 10 July. Available from

https://www.google.co.uk/amp/s/www.forbes.com/sites/erikkain/2019/07/10/netflix-isnt-doomed-

disney-hbo-max-and-other-streaming-services-can-all-coexist/amp/ [Accessed 25 November 2019]

La Monica, P. (2003). I love Netflix (but not the stock). CNN Money, 18 April. Available from

https://money.cnn.com/2003/04/17/technology/techinvestor/lamonica/ [Accessed 24 November

2019]

Markman, J. (2019) Netflix Harnesses Big Data To Profit From Your Tastes. Forbes, 25 February.

Available from https://www.forbes.com/sites/jonmarkman/2019/02/25/netflix-harnesses-big-data-to-

profit-from-your-tastes/#3a8afec066fd [Accessed 24 November 2019]

Meyer, D. (2019) Apple, Netflix and YouTube among Streamers Flouting EU Privacy Law, Say

New Complaints. Fortune, 18 January. Available from

https://www.google.co.uk/amp/s/fortune.com/2019/01/18/apple-netflix-youtube-gdpr/amp/

[Accessed 20 November]

Moore, K. (2019). Netflix ID Bible - Every Category on Netflix in 2019. What’s On Netflix, 7 May.

Available fromhttps://www.whats-on-netflix.com/news/the-netflix-id-bible-every-category-on-netflix/

[Accessed 24 November 2019]

Moore, K. (2019) Only 16% of the Netflix Library is made up of Originals. What’s On Netflix, 1

January. Available from https://www.whats-on-netflix.com/news/only-16-percent-netflix-library-are-

originals/ [Accessed 16 November 2019]

Available from https://www.theguardian.com/news/2018/jun/29/the-great-firewall-of-china-xi-

jinpings-internet-shutdown [Accessed 25 November 2019]

CocaCola (2019) CocaCoca-Cola x Stranger Things: Find out what happened when we brought

the upside-down world to London. CocaCola, 15 July. Available from

https://www.coca-cola.co.uk/stories/coca-cola-x-strangerthings [Accessed 26 November]

Cook, S. (2018). Netflix Libraries Around the World: How Netflix Libraries Compare. Fixed, 24 July.

Available from https://flixed.io/netlfix-libraries-around-world/?fbclid=IwAR0ikj-

kK7ceL4MwZEe9Zpj27xjqcyIDd94yts0m-_keY4wIbuU6Lq8xx6Y [Accessed 20 November 2019]

Dillet, R. (2018). European Union approves content quota for streaming services. TechCrunch, 4

October. Available from https://techcrunch.com/2018/10/04/european-union-approves-content-

quota-for-streaming-services/ [Accessed 23 November 2019]

Gallagher, K. (2018). The EU is moving to regulate streaming libraries. Business Insider, 5

September. Available from https://www.businessinsider.com/netflix-amazon-prime-video-eu-law-

local-content-2018-9?r=US&IR=T [Accessed 14 November 2019]

GDPR Associates (no date). GDPR and Brexit. GDPR Associates. Available from

https://www.gdpr.associates/gdpr-brexit/ [Accessed 16 November 2019]

Huddlestone, T. (2017). Netflix Could Have a $1bn Merchandising Business. Fortune, 14 April.

Available from https://fortune.com/2017/04/14/netflix-merchandise/ [Accessed 25 November 2019]

Interbrand, 2019. 2019 Rankings | Netflix. Interbrand. Available from

https://www.interbrand.com/best-brands/best-global-brands/2019/ranking/netflix/ [Accessed 25

November 2019]

Kain, E. (2019). Is Netflix Doomed? Here's Why Disney+ Isn't A Netflix Killer Despite What You

Might Have Heard. Forbes, 10 July. Available from

https://www.google.co.uk/amp/s/www.forbes.com/sites/erikkain/2019/07/10/netflix-isnt-doomed-

disney-hbo-max-and-other-streaming-services-can-all-coexist/amp/ [Accessed 25 November 2019]

La Monica, P. (2003). I love Netflix (but not the stock). CNN Money, 18 April. Available from

https://money.cnn.com/2003/04/17/technology/techinvestor/lamonica/ [Accessed 24 November

2019]

Markman, J. (2019) Netflix Harnesses Big Data To Profit From Your Tastes. Forbes, 25 February.

Available from https://www.forbes.com/sites/jonmarkman/2019/02/25/netflix-harnesses-big-data-to-

profit-from-your-tastes/#3a8afec066fd [Accessed 24 November 2019]

Meyer, D. (2019) Apple, Netflix and YouTube among Streamers Flouting EU Privacy Law, Say

New Complaints. Fortune, 18 January. Available from

https://www.google.co.uk/amp/s/fortune.com/2019/01/18/apple-netflix-youtube-gdpr/amp/

[Accessed 20 November]

Moore, K. (2019). Netflix ID Bible - Every Category on Netflix in 2019. What’s On Netflix, 7 May.

Available fromhttps://www.whats-on-netflix.com/news/the-netflix-id-bible-every-category-on-netflix/

[Accessed 24 November 2019]

Moore, K. (2019) Only 16% of the Netflix Library is made up of Originals. What’s On Netflix, 1

January. Available from https://www.whats-on-netflix.com/news/only-16-percent-netflix-library-are-

originals/ [Accessed 16 November 2019]

Morgan, B. (2019). What Is The Netflix Effect? Forbes, 19 February. Available from

https://www.forbes.com/sites/blakemorgan/2019/02/19/what-is-the-netflix-effect/#565cbdf85640

[Accessed 2 November 2019]

Moskowitz, D. (2019) Who Are Netflix’s Main Competitors? (NFLX). Investopedia, 28 October.

Available from https://www.investopedia.com/articles/markets/051215/who-are-netflixs-main-

competitors-nflx.asp [Accessed 2 November 2019]

Netflix (2019) (1). About Netflix. Netflix. Available from https://media.netflix.com/en/about-netflix

[Accessed 24 November 2019]

Netflix (2019) (2). Where is Netflix available? Netflix. Available from

https://help.netflix.com/en/node/14164 [Accessed 24 November 2019]

Netflix (2019) (5). What is the General Data Protection Regulation?. Netflix. Available from

https://help.netflix.com/da/node/100629 [Accessed 3 November 2019]

Netflix (2019) (5). Annual Report Available from

https://s22.q4cdn.com/959853165/files/doc_financials/annual_reports/2018/Form-

10K_Q418_Filed.pdf [Accessed 18 November 2019].

Pahwa, A. (2019) Netflix Business Model | How does Netflix make money? Feedough, 7 August.

Available from https://www.feedough.com/how-does-netflix-make-money/ [Accessed 26 November

2019]

Pash, C. (2019) The stranger brands and advertising on Netflix. AdNews, 12 July. Available from

https://www.adnews.com.au/news/the-stranger-brands-and-advertising-on-netflix [Accessed 25

November 2019]

PricewaterhouseCoopers (2) (2019) Consumer demand for personalisation and tech advances

drives innovation in entertainment and media industry. PwC, 5 June. Available from

https://www.pwc.com/gx/en/news-room/press-releases/2019/consumer-personalisation-tmt.html

[Accessed 21 November 2019]

Rosenberg, E. Why Netflix Content Is Different Abroad. Invesopedia, 5 May. Available from

https://www.investopedia.com/articles/investing/050515/why-netflix-content-different-other-

countries.asp [Accessed 23 November 2019]

Roy, P. (2019). Mobile data: Why India has the world’s cheapest. BBC, 18 March. Available from

https://www.bbc.co.uk/news/world-asia-india-47537201 [Accessed 25 November 2019]

Rushe, D. Netflix’s growth slows as it braces for influx of competition. The Guardian, 16 October.

Available from https://www.google.co.uk/amp/s/amp.theguardian.com/media/2019/oct/16/netflixs-

growth-slows-as-it-braces-for-influx-of-competition [Accessed 24 November]

Shapiro, A. (2019). World's Biggest Media Companies 2019: Netflix Climbs The Ranks As

Streaming Transforms Industry. Forbes, 15 May. Avaliable from

https://www.forbes.com/sites/arielshapiro/2019/05/15/worlds-largest-media-companies-2019/

#44454662754b [Accessed 2 November 2019]

Sharma et al. (2017) Netflix in India: The Way Ahead. Harvard Business Publishing, 22 February.

Available from https://hbsp.harvard.edu/product/W17100-PDF-ENG?itemFindingMethod=Search

[Accessed 24 November 2019]

https://www.forbes.com/sites/blakemorgan/2019/02/19/what-is-the-netflix-effect/#565cbdf85640

[Accessed 2 November 2019]

Moskowitz, D. (2019) Who Are Netflix’s Main Competitors? (NFLX). Investopedia, 28 October.

Available from https://www.investopedia.com/articles/markets/051215/who-are-netflixs-main-

competitors-nflx.asp [Accessed 2 November 2019]

Netflix (2019) (1). About Netflix. Netflix. Available from https://media.netflix.com/en/about-netflix

[Accessed 24 November 2019]

Netflix (2019) (2). Where is Netflix available? Netflix. Available from

https://help.netflix.com/en/node/14164 [Accessed 24 November 2019]

Netflix (2019) (5). What is the General Data Protection Regulation?. Netflix. Available from

https://help.netflix.com/da/node/100629 [Accessed 3 November 2019]

Netflix (2019) (5). Annual Report Available from

https://s22.q4cdn.com/959853165/files/doc_financials/annual_reports/2018/Form-

10K_Q418_Filed.pdf [Accessed 18 November 2019].

Pahwa, A. (2019) Netflix Business Model | How does Netflix make money? Feedough, 7 August.

Available from https://www.feedough.com/how-does-netflix-make-money/ [Accessed 26 November

2019]

Pash, C. (2019) The stranger brands and advertising on Netflix. AdNews, 12 July. Available from

https://www.adnews.com.au/news/the-stranger-brands-and-advertising-on-netflix [Accessed 25

November 2019]

PricewaterhouseCoopers (2) (2019) Consumer demand for personalisation and tech advances

drives innovation in entertainment and media industry. PwC, 5 June. Available from

https://www.pwc.com/gx/en/news-room/press-releases/2019/consumer-personalisation-tmt.html

[Accessed 21 November 2019]

Rosenberg, E. Why Netflix Content Is Different Abroad. Invesopedia, 5 May. Available from

https://www.investopedia.com/articles/investing/050515/why-netflix-content-different-other-

countries.asp [Accessed 23 November 2019]

Roy, P. (2019). Mobile data: Why India has the world’s cheapest. BBC, 18 March. Available from

https://www.bbc.co.uk/news/world-asia-india-47537201 [Accessed 25 November 2019]

Rushe, D. Netflix’s growth slows as it braces for influx of competition. The Guardian, 16 October.

Available from https://www.google.co.uk/amp/s/amp.theguardian.com/media/2019/oct/16/netflixs-

growth-slows-as-it-braces-for-influx-of-competition [Accessed 24 November]

Shapiro, A. (2019). World's Biggest Media Companies 2019: Netflix Climbs The Ranks As

Streaming Transforms Industry. Forbes, 15 May. Avaliable from

https://www.forbes.com/sites/arielshapiro/2019/05/15/worlds-largest-media-companies-2019/

#44454662754b [Accessed 2 November 2019]

Sharma et al. (2017) Netflix in India: The Way Ahead. Harvard Business Publishing, 22 February.

Available from https://hbsp.harvard.edu/product/W17100-PDF-ENG?itemFindingMethod=Search

[Accessed 24 November 2019]

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 13

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.