Random Motors Project

VerifiedAdded on 2023/01/13

|10

|1087

|32

AI Summary

This document provides solutions for a Random Motors Project. It includes hypothesis tests, regression equations, predicted sales, and overall predicted profit for Rocinante36 and Marengo32 models. It also discusses the impact of price increase on sales and the removal of insignificant regression variables. Course code: N/A, Course name: N/A, College/University: N/A

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Random Motors Project

Submission

Name – Neethu Nair

Submission

Name – Neethu Nair

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Q-1a) Formulate the null hypotheses to check whether the new models are

performing as per the desired design specifications.

For Rocinante36:

Mileage HO : Mean = 22 km/ltr

Top speed HO : Mean = 140 km/hr

For Marengo32:

Mileage HO : Mean = 15 km/ltr

Top speed HO : Mean = 210 km/hr

performing as per the desired design specifications.

For Rocinante36:

Mileage HO : Mean = 22 km/ltr

Top speed HO : Mean = 140 km/hr

For Marengo32:

Mileage HO : Mean = 15 km/ltr

Top speed HO : Mean = 210 km/hr

Q-1b) Formulate the alternate hypotheses to check whether the new models

are performing as per the desired design specifications.

For Rocinante36:

Mileage H1 : Mean ≠ 22 km/ltr

Top speed H1 : Mean ≠ 140 km/hr

For Marengo32:

Mileage H1 : Mean ≠ 15 km/ltr

Top speed H1 : Mean ≠ 210 km/hr

are performing as per the desired design specifications.

For Rocinante36:

Mileage H1 : Mean ≠ 22 km/ltr

Top speed H1 : Mean ≠ 140 km/hr

For Marengo32:

Mileage H1 : Mean ≠ 15 km/ltr

Top speed H1 : Mean ≠ 210 km/hr

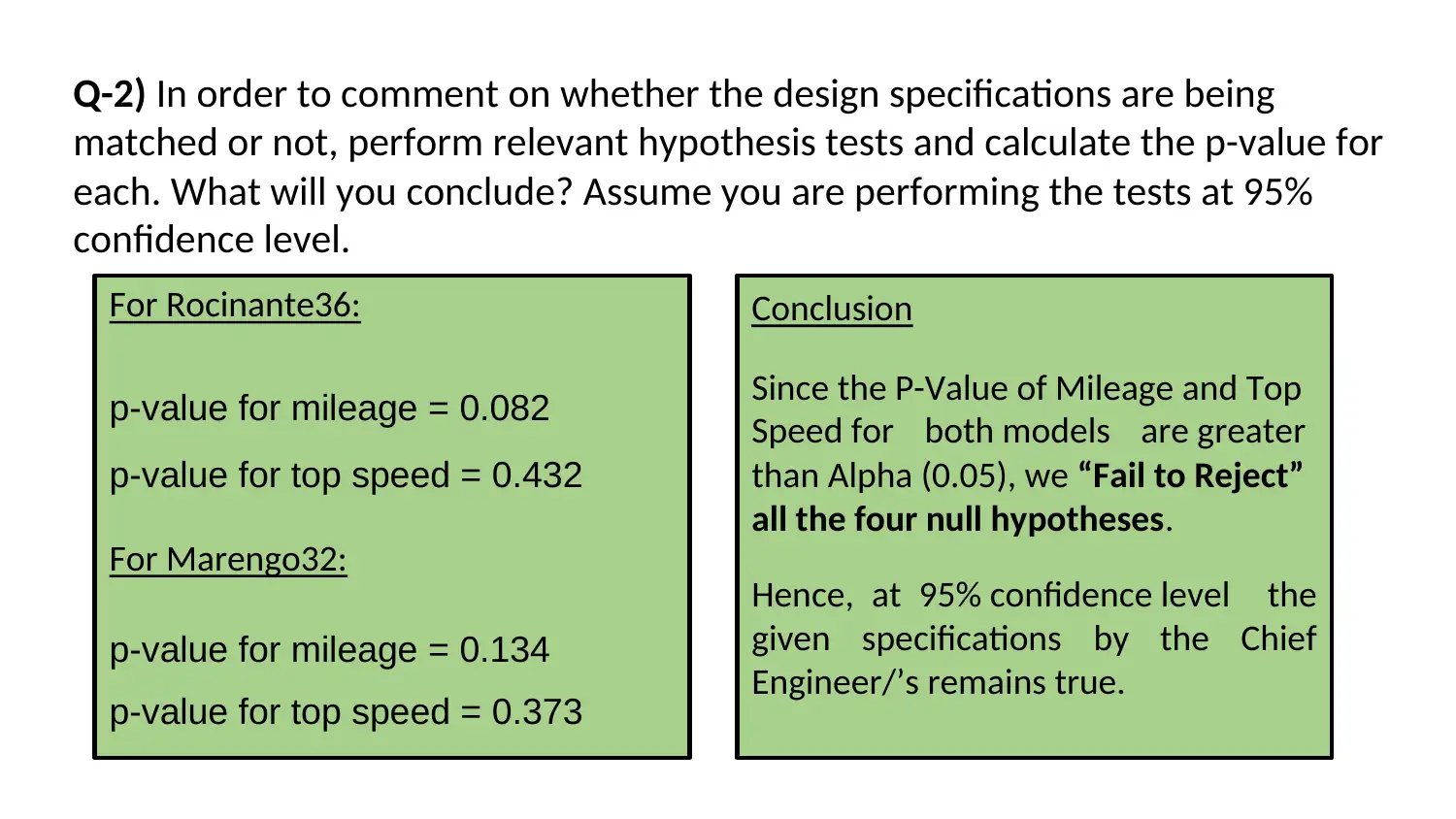

Q-2) In order to comment on whether the design specifications are being

matched or not, perform relevant hypothesis tests and calculate the p-value for

each. What will you conclude? Assume you are performing the tests at 95%

confidence level.

For Rocinante36:

p-value for mileage = 0.082

p-value for top speed = 0.432

For Marengo32:

p-value for mileage = 0.134

p-value for top speed = 0.373

Conclusion

Since the P-Value of Mileage and Top

Speed for both models are greater

than Alpha (0.05), we “Fail to Reject”

all the four null hypotheses.

Hence, at 95% confidence level the

given specifications by the Chief

Engineer/’s remains true.

matched or not, perform relevant hypothesis tests and calculate the p-value for

each. What will you conclude? Assume you are performing the tests at 95%

confidence level.

For Rocinante36:

p-value for mileage = 0.082

p-value for top speed = 0.432

For Marengo32:

p-value for mileage = 0.134

p-value for top speed = 0.373

Conclusion

Since the P-Value of Mileage and Top

Speed for both models are greater

than Alpha (0.05), we “Fail to Reject”

all the four null hypotheses.

Hence, at 95% confidence level the

given specifications by the Chief

Engineer/’s remains true.

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

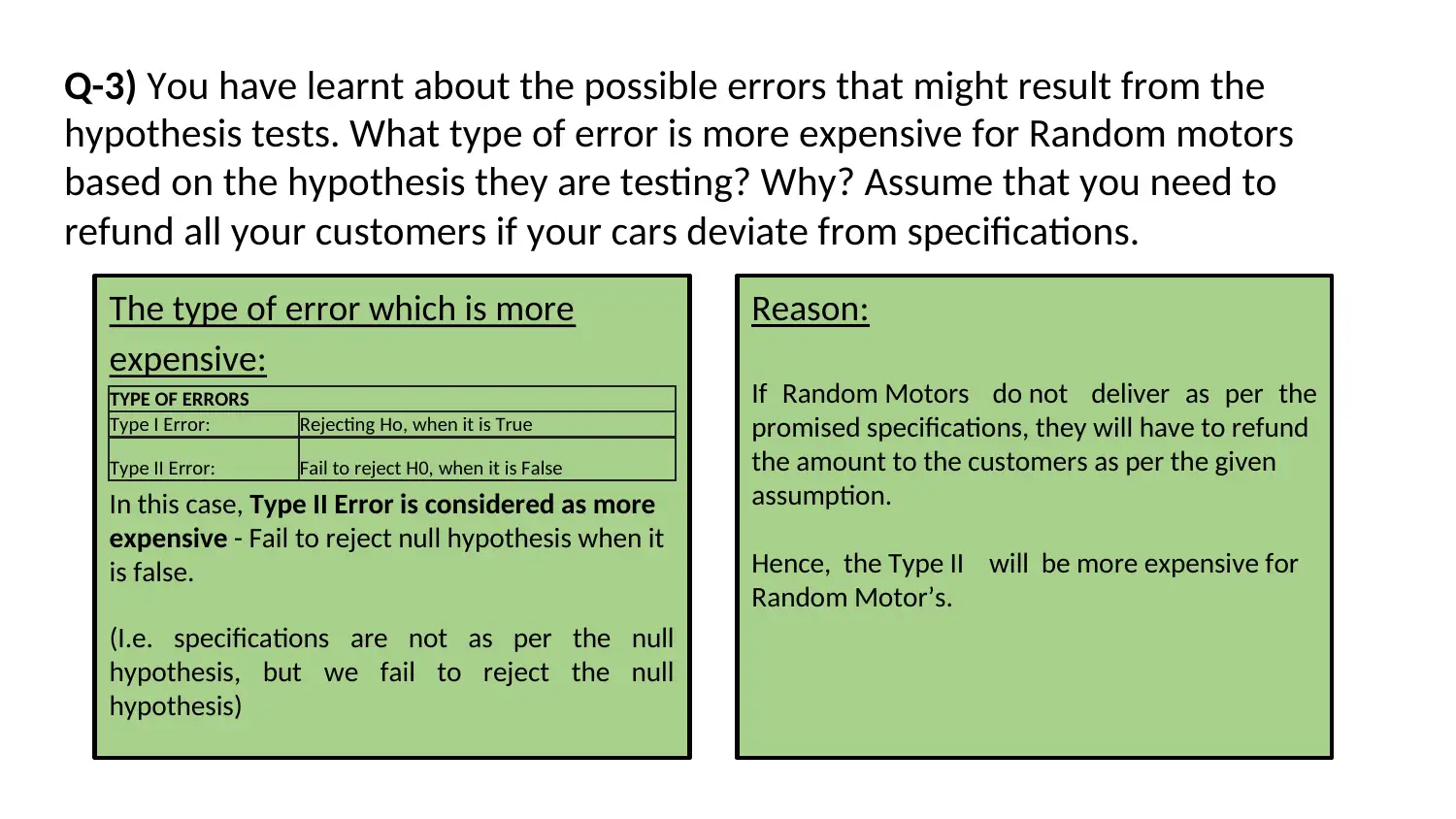

Q-3) You have learnt about the possible errors that might result from the

hypothesis tests. What type of error is more expensive for Random motors

based on the hypothesis they are testing? Why? Assume that you need to

refund all your customers if your cars deviate from specifications.

The type of error which is more

expensive:

In this case, Type II Error is considered as more

expensive - Fail to reject null hypothesis when it

is false.

(I.e. specifications are not as per the null

hypothesis, but we fail to reject the null

hypothesis)

Reason:

If Random Motors do not deliver as per the

promised specifications, they will have to refund

the amount to the customers as per the given

assumption.

Hence, the Type II will be more expensive for

Random Motor’s.

TYPE OF ERRORS

Type I Error: Rejecting Ho, when it is True

Type II Error: Fail to reject H0, when it is False

hypothesis tests. What type of error is more expensive for Random motors

based on the hypothesis they are testing? Why? Assume that you need to

refund all your customers if your cars deviate from specifications.

The type of error which is more

expensive:

In this case, Type II Error is considered as more

expensive - Fail to reject null hypothesis when it

is false.

(I.e. specifications are not as per the null

hypothesis, but we fail to reject the null

hypothesis)

Reason:

If Random Motors do not deliver as per the

promised specifications, they will have to refund

the amount to the customers as per the given

assumption.

Hence, the Type II will be more expensive for

Random Motor’s.

TYPE OF ERRORS

Type I Error: Rejecting Ho, when it is True

Type II Error: Fail to reject H0, when it is False

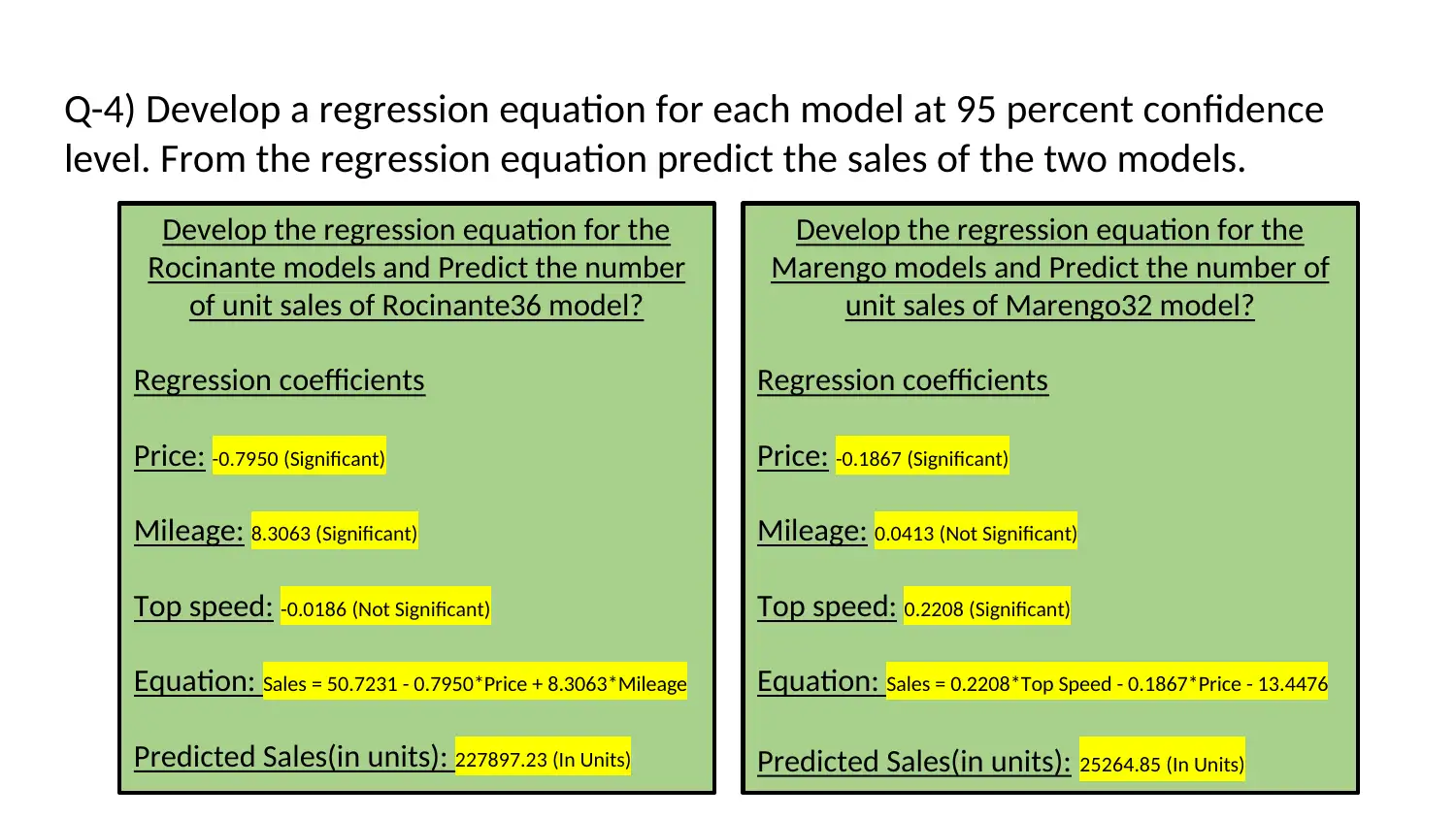

Q-4) Develop a regression equation for each model at 95 percent confidence

level. From the regression equation predict the sales of the two models.

Develop the regression equation for the

Rocinante models and Predict the number

of unit sales of Rocinante36 model?

Regression coefficients

Price: -0.7950 (Significant)

Mileage: 8.3063 (Significant)

Top speed: -0.0186 (Not Significant)

Equation: Sales = 50.7231 - 0.7950*Price + 8.3063*Mileage

Predicted Sales(in units): 227897.23 (In Units)

Develop the regression equation for the

Marengo models and Predict the number of

unit sales of Marengo32 model?

Regression coefficients

Price: -0.1867 (Significant)

Mileage: 0.0413 (Not Significant)

Top speed: 0.2208 (Significant)

Equation: Sales = 0.2208*Top Speed - 0.1867*Price - 13.4476

Predicted Sales(in units): 25264.85 (In Units)

level. From the regression equation predict the sales of the two models.

Develop the regression equation for the

Rocinante models and Predict the number

of unit sales of Rocinante36 model?

Regression coefficients

Price: -0.7950 (Significant)

Mileage: 8.3063 (Significant)

Top speed: -0.0186 (Not Significant)

Equation: Sales = 50.7231 - 0.7950*Price + 8.3063*Mileage

Predicted Sales(in units): 227897.23 (In Units)

Develop the regression equation for the

Marengo models and Predict the number of

unit sales of Marengo32 model?

Regression coefficients

Price: -0.1867 (Significant)

Mileage: 0.0413 (Not Significant)

Top speed: 0.2208 (Significant)

Equation: Sales = 0.2208*Top Speed - 0.1867*Price - 13.4476

Predicted Sales(in units): 25264.85 (In Units)

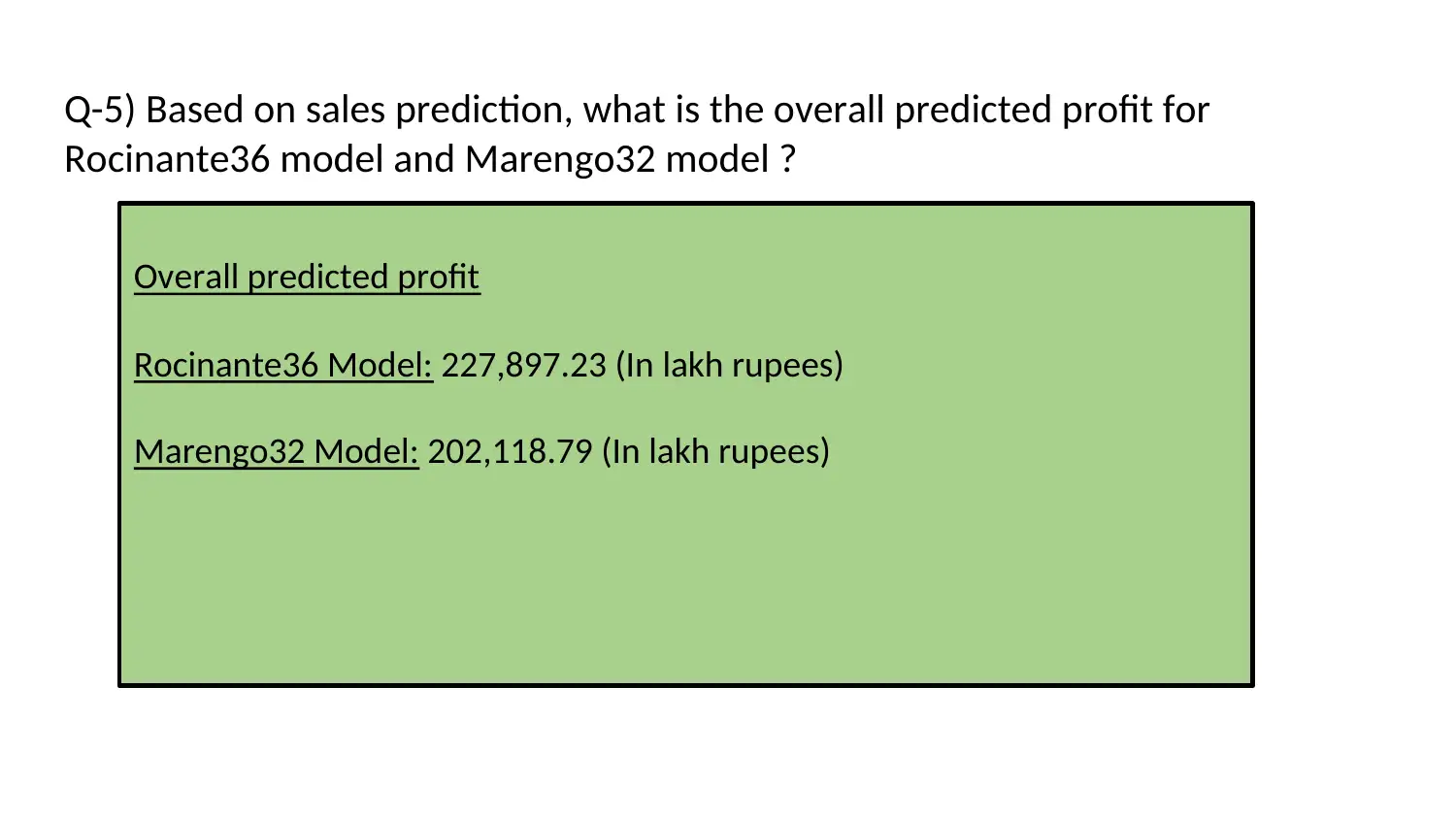

Q-5) Based on sales prediction, what is the overall predicted profit for

Rocinante36 model and Marengo32 model ?

Overall predicted profit

Rocinante36 Model: 227,897.23 (In lakh rupees)

Marengo32 Model: 202,118.79 (In lakh rupees)

Rocinante36 model and Marengo32 model ?

Overall predicted profit

Rocinante36 Model: 227,897.23 (In lakh rupees)

Marengo32 Model: 202,118.79 (In lakh rupees)

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

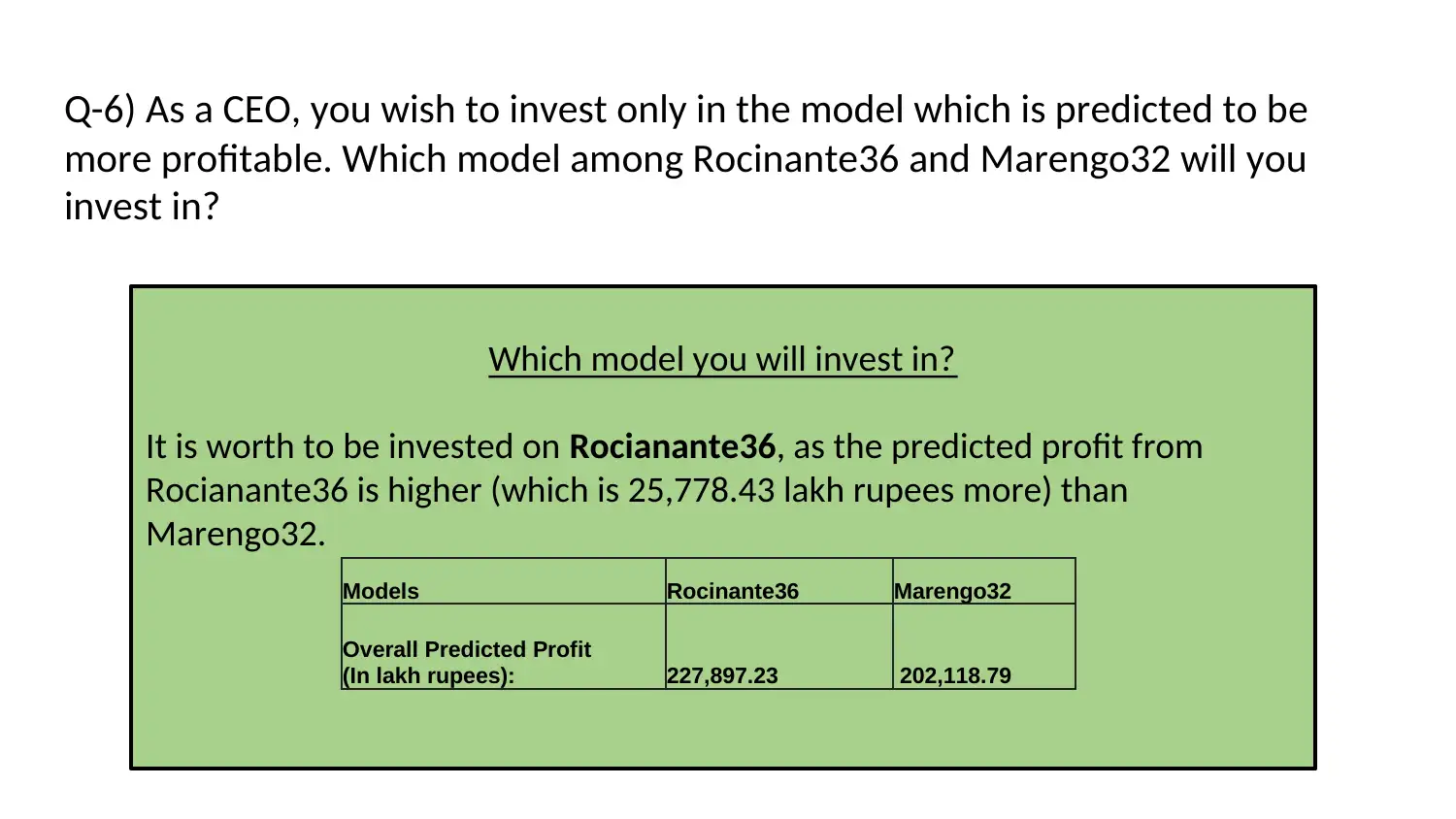

Q-6) As a CEO, you wish to invest only in the model which is predicted to be

more profitable. Which model among Rocinante36 and Marengo32 will you

invest in?

Which model you will invest in?

It is worth to be invested on Rocianante36, as the predicted profit from

Rocianante36 is higher (which is 25,778.43 lakh rupees more) than

Marengo32.

Models Rocinante36 Marengo32

Overall Predicted Profit

(In lakh rupees): 227,897.23 202,118.79

more profitable. Which model among Rocinante36 and Marengo32 will you

invest in?

Which model you will invest in?

It is worth to be invested on Rocianante36, as the predicted profit from

Rocianante36 is higher (which is 25,778.43 lakh rupees more) than

Marengo32.

Models Rocinante36 Marengo32

Overall Predicted Profit

(In lakh rupees): 227,897.23 202,118.79

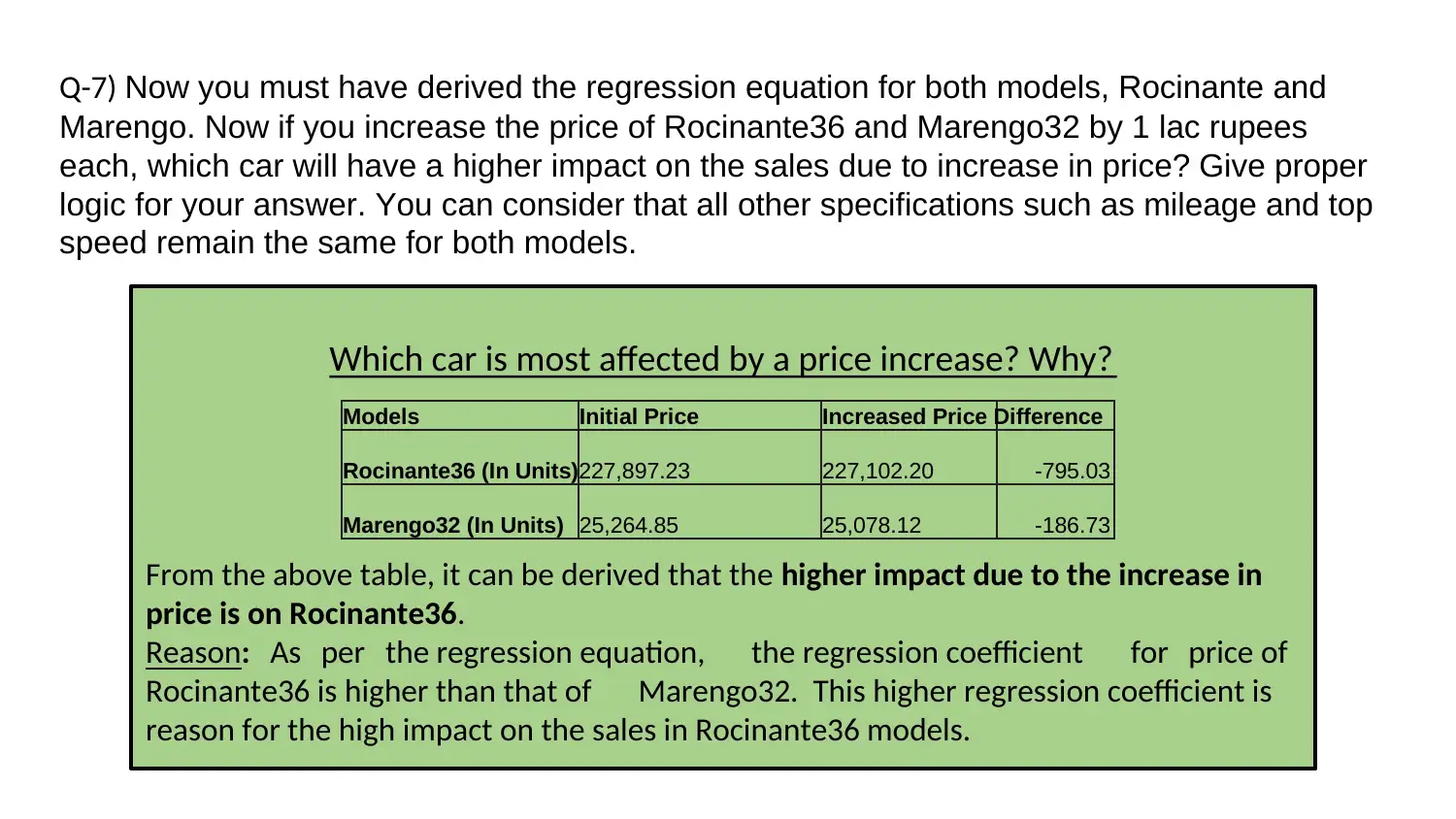

Q-7) Now you must have derived the regression equation for both models, Rocinante and

Marengo. Now if you increase the price of Rocinante36 and Marengo32 by 1 lac rupees

each, which car will have a higher impact on the sales due to increase in price? Give proper

logic for your answer. You can consider that all other specifications such as mileage and top

speed remain the same for both models.

Which car is most affected by a price increase? Why?

From the above table, it can be derived that the higher impact due to the increase in

price is on Rocinante36.

Reason: As per the regression equation, the regression coefficient for price of

Rocinante36 is higher than that of Marengo32. This higher regression coefficient is

reason for the high impact on the sales in Rocinante36 models.

Models Initial Price Increased Price Difference

Rocinante36 (In Units)227,897.23 227,102.20 -795.03

Marengo32 (In Units) 25,264.85 25,078.12 -186.73

Marengo. Now if you increase the price of Rocinante36 and Marengo32 by 1 lac rupees

each, which car will have a higher impact on the sales due to increase in price? Give proper

logic for your answer. You can consider that all other specifications such as mileage and top

speed remain the same for both models.

Which car is most affected by a price increase? Why?

From the above table, it can be derived that the higher impact due to the increase in

price is on Rocinante36.

Reason: As per the regression equation, the regression coefficient for price of

Rocinante36 is higher than that of Marengo32. This higher regression coefficient is

reason for the high impact on the sales in Rocinante36 models.

Models Initial Price Increased Price Difference

Rocinante36 (In Units)227,897.23 227,102.20 -795.03

Marengo32 (In Units) 25,264.85 25,078.12 -186.73

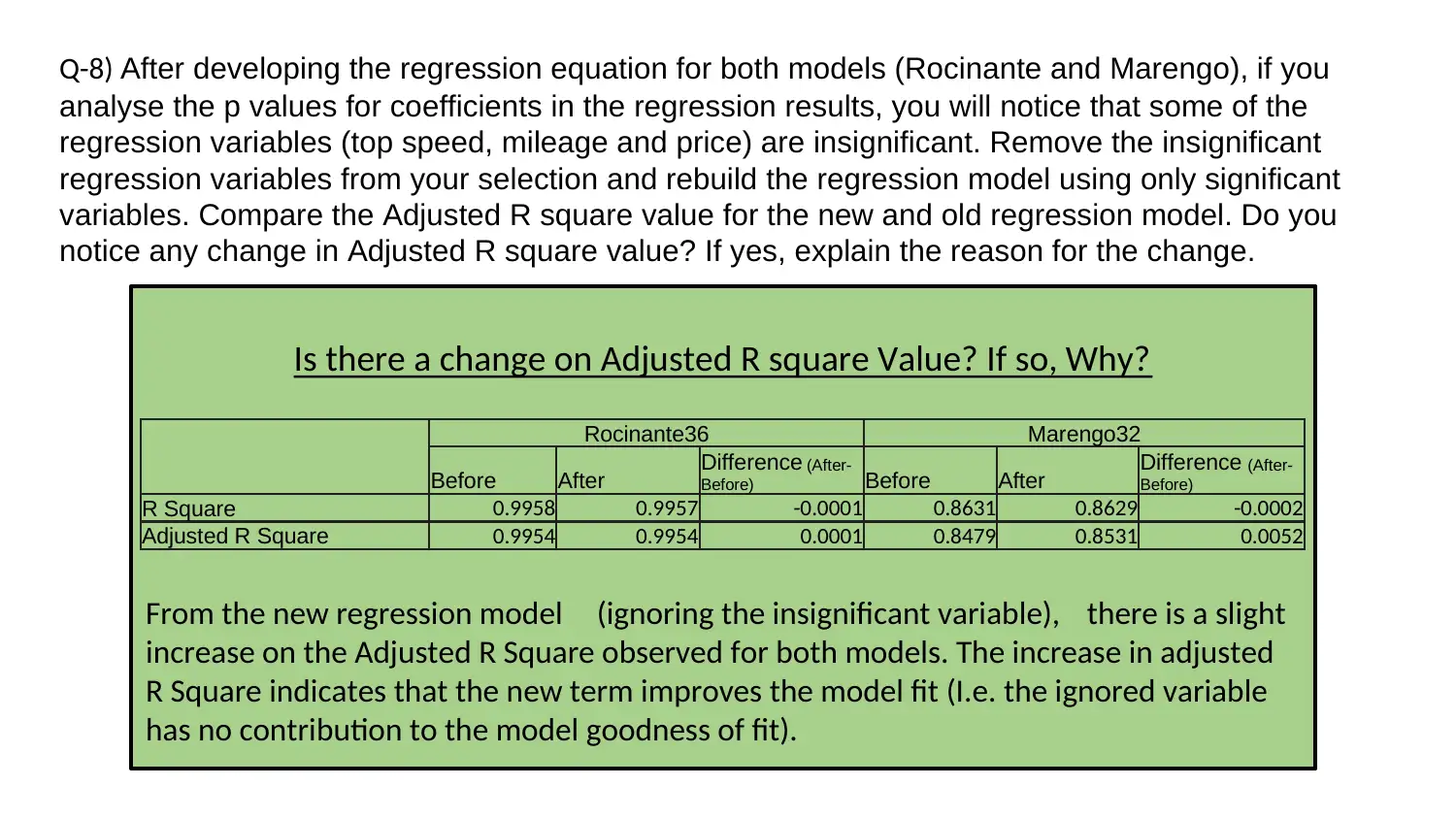

Q-8) After developing the regression equation for both models (Rocinante and Marengo), if you

analyse the p values for coefficients in the regression results, you will notice that some of the

regression variables (top speed, mileage and price) are insignificant. Remove the insignificant

regression variables from your selection and rebuild the regression model using only significant

variables. Compare the Adjusted R square value for the new and old regression model. Do you

notice any change in Adjusted R square value? If yes, explain the reason for the change.

Is there a change on Adjusted R square Value? If so, Why?

From the new regression model (ignoring the insignificant variable), there is a slight

increase on the Adjusted R Square observed for both models. The increase in adjusted

R Square indicates that the new term improves the model fit (I.e. the ignored variable

has no contribution to the model goodness of fit).

Rocinante36 Marengo32

Before After Difference (After-

Before) Before After Difference (After-

Before)

R Square 0.9958 0.9957 -0.0001 0.8631 0.8629 -0.0002

Adjusted R Square 0.9954 0.9954 0.0001 0.8479 0.8531 0.0052

analyse the p values for coefficients in the regression results, you will notice that some of the

regression variables (top speed, mileage and price) are insignificant. Remove the insignificant

regression variables from your selection and rebuild the regression model using only significant

variables. Compare the Adjusted R square value for the new and old regression model. Do you

notice any change in Adjusted R square value? If yes, explain the reason for the change.

Is there a change on Adjusted R square Value? If so, Why?

From the new regression model (ignoring the insignificant variable), there is a slight

increase on the Adjusted R Square observed for both models. The increase in adjusted

R Square indicates that the new term improves the model fit (I.e. the ignored variable

has no contribution to the model goodness of fit).

Rocinante36 Marengo32

Before After Difference (After-

Before) Before After Difference (After-

Before)

R Square 0.9958 0.9957 -0.0001 0.8631 0.8629 -0.0002

Adjusted R Square 0.9954 0.9954 0.0001 0.8479 0.8531 0.0052

1 out of 10

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.