BUS106 Report: Financial Ratio Analysis of Woolworths Company Limited

VerifiedAdded on 2023/03/21

|10

|1957

|43

Report

AI Summary

This report provides a detailed financial ratio analysis of Woolworths Company Limited. It begins with an executive summary outlining the company's operations and key financial parameters. The introduction gives an overview of Woolworths Group Limited, including its various segments such as Australian Food, New Zealand Food, and Endeavour Drinks. The analysis section examines crucial financial ratios, including Gross Profit Margin, Current Ratio, Liquid Ratio, Debt Ratio, and Operating Cash Flow Margin, comparing the years 2017 and 2018. The report highlights Woolworths' strong profit margins but points out weaknesses in its liquidity position. Recommendations are provided, such as reforming trading hours and improving liquidity ratios. A comparative ratio analysis is included, comparing Woolworths to About Life Pty Limited in terms of Return on Equity (ROE). The conclusion summarizes the findings, emphasizing the company's strong profitability and the need to address its liquidity concerns. The report incorporates references to relevant sources, demonstrating a thorough understanding of financial analysis principles.

RATIO ANALYSIS OF

WOOLWORTHS

COMPANY LIMITED

WOOLWORTHS

COMPANY LIMITED

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

EXECUTIVE SUMMARY

Company Woolworths Limited in engaged in various retail sector operation and the main business is

procuring the products from the outside market and reselling the same to various customers.The

financial parameters of the company in terms of gross profit and net profit ratio is strong but the

financial parameters in terms of liquidity position is weak which needs to be focussed on in order to

gain long term growth and sustainability.

Company Woolworths Limited in engaged in various retail sector operation and the main business is

procuring the products from the outside market and reselling the same to various customers.The

financial parameters of the company in terms of gross profit and net profit ratio is strong but the

financial parameters in terms of liquidity position is weak which needs to be focussed on in order to

gain long term growth and sustainability.

Contents

EXECUTIVE SUMMARY...........................................................................................................................2

INTRODUCTION AND OVERVIEW OF COMPANY....................................................................................4

ANALYSIS OF WOOLWORTHS GROUP LIMITED......................................................................................4

RECOMMENDATIONS............................................................................................................................6

COMPARATIVE RATIO ANALYSIS............................................................................................................6

CONCLUSION.........................................................................................................................................7

References.............................................................................................................................................8

EXECUTIVE SUMMARY...........................................................................................................................2

INTRODUCTION AND OVERVIEW OF COMPANY....................................................................................4

ANALYSIS OF WOOLWORTHS GROUP LIMITED......................................................................................4

RECOMMENDATIONS............................................................................................................................6

COMPARATIVE RATIO ANALYSIS............................................................................................................6

CONCLUSION.........................................................................................................................................7

References.............................................................................................................................................8

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

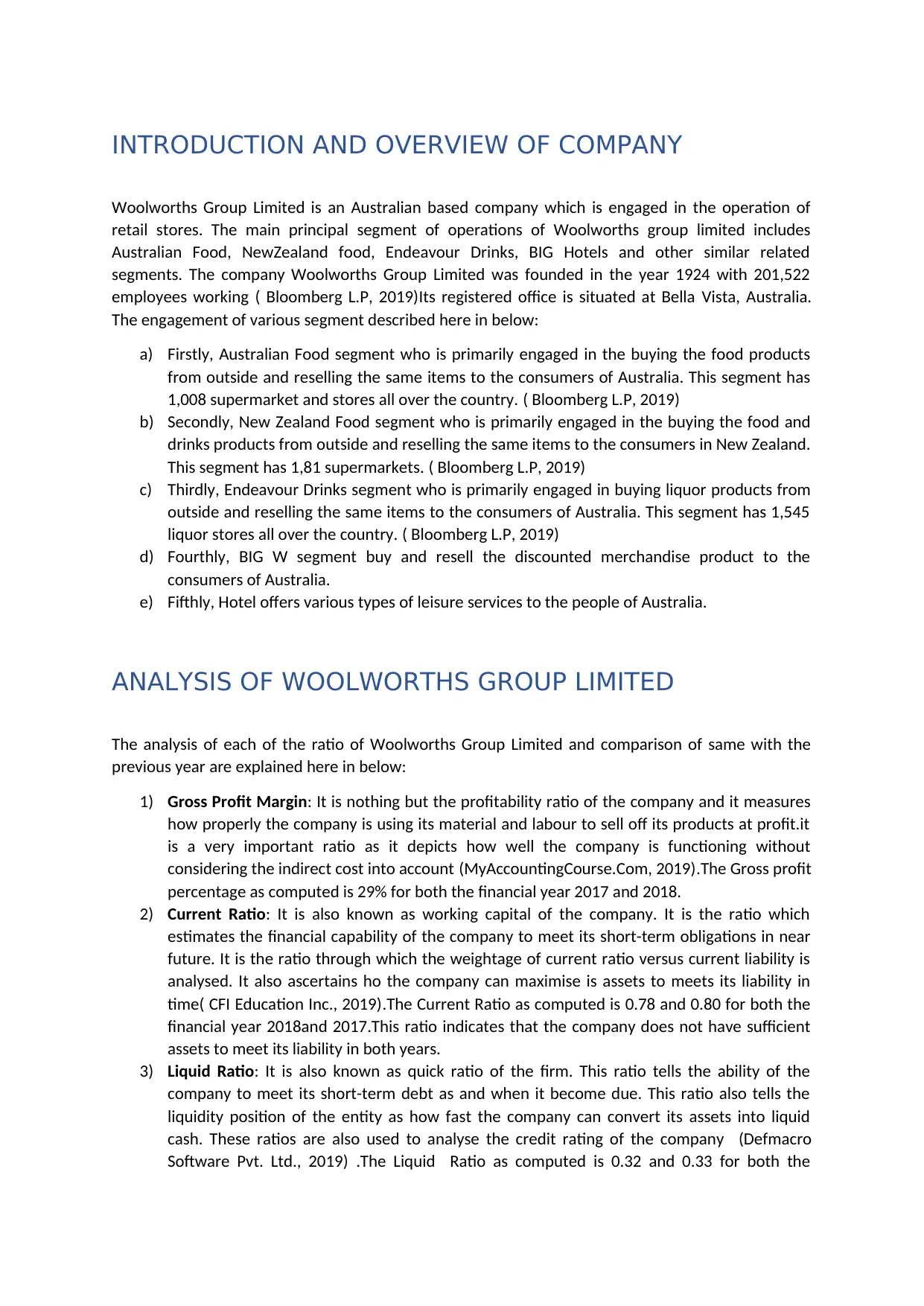

INTRODUCTION AND OVERVIEW OF COMPANY

Woolworths Group Limited is an Australian based company which is engaged in the operation of

retail stores. The main principal segment of operations of Woolworths group limited includes

Australian Food, NewZealand food, Endeavour Drinks, BIG Hotels and other similar related

segments. The company Woolworths Group Limited was founded in the year 1924 with 201,522

employees working ( Bloomberg L.P, 2019)Its registered office is situated at Bella Vista, Australia.

The engagement of various segment described here in below:

a) Firstly, Australian Food segment who is primarily engaged in the buying the food products

from outside and reselling the same items to the consumers of Australia. This segment has

1,008 supermarket and stores all over the country. ( Bloomberg L.P, 2019)

b) Secondly, New Zealand Food segment who is primarily engaged in the buying the food and

drinks products from outside and reselling the same items to the consumers in New Zealand.

This segment has 1,81 supermarkets. ( Bloomberg L.P, 2019)

c) Thirdly, Endeavour Drinks segment who is primarily engaged in buying liquor products from

outside and reselling the same items to the consumers of Australia. This segment has 1,545

liquor stores all over the country. ( Bloomberg L.P, 2019)

d) Fourthly, BIG W segment buy and resell the discounted merchandise product to the

consumers of Australia.

e) Fifthly, Hotel offers various types of leisure services to the people of Australia.

ANALYSIS OF WOOLWORTHS GROUP LIMITED

The analysis of each of the ratio of Woolworths Group Limited and comparison of same with the

previous year are explained here in below:

1) Gross Profit Margin: It is nothing but the profitability ratio of the company and it measures

how properly the company is using its material and labour to sell off its products at profit.it

is a very important ratio as it depicts how well the company is functioning without

considering the indirect cost into account (MyAccountingCourse.Com, 2019).The Gross profit

percentage as computed is 29% for both the financial year 2017 and 2018.

2) Current Ratio: It is also known as working capital of the company. It is the ratio which

estimates the financial capability of the company to meet its short-term obligations in near

future. It is the ratio through which the weightage of current ratio versus current liability is

analysed. It also ascertains ho the company can maximise is assets to meets its liability in

time( CFI Education Inc., 2019).The Current Ratio as computed is 0.78 and 0.80 for both the

financial year 2018and 2017.This ratio indicates that the company does not have sufficient

assets to meet its liability in both years.

3) Liquid Ratio: It is also known as quick ratio of the firm. This ratio tells the ability of the

company to meet its short-term debt as and when it become due. This ratio also tells the

liquidity position of the entity as how fast the company can convert its assets into liquid

cash. These ratios are also used to analyse the credit rating of the company (Defmacro

Software Pvt. Ltd., 2019) .The Liquid Ratio as computed is 0.32 and 0.33 for both the

Woolworths Group Limited is an Australian based company which is engaged in the operation of

retail stores. The main principal segment of operations of Woolworths group limited includes

Australian Food, NewZealand food, Endeavour Drinks, BIG Hotels and other similar related

segments. The company Woolworths Group Limited was founded in the year 1924 with 201,522

employees working ( Bloomberg L.P, 2019)Its registered office is situated at Bella Vista, Australia.

The engagement of various segment described here in below:

a) Firstly, Australian Food segment who is primarily engaged in the buying the food products

from outside and reselling the same items to the consumers of Australia. This segment has

1,008 supermarket and stores all over the country. ( Bloomberg L.P, 2019)

b) Secondly, New Zealand Food segment who is primarily engaged in the buying the food and

drinks products from outside and reselling the same items to the consumers in New Zealand.

This segment has 1,81 supermarkets. ( Bloomberg L.P, 2019)

c) Thirdly, Endeavour Drinks segment who is primarily engaged in buying liquor products from

outside and reselling the same items to the consumers of Australia. This segment has 1,545

liquor stores all over the country. ( Bloomberg L.P, 2019)

d) Fourthly, BIG W segment buy and resell the discounted merchandise product to the

consumers of Australia.

e) Fifthly, Hotel offers various types of leisure services to the people of Australia.

ANALYSIS OF WOOLWORTHS GROUP LIMITED

The analysis of each of the ratio of Woolworths Group Limited and comparison of same with the

previous year are explained here in below:

1) Gross Profit Margin: It is nothing but the profitability ratio of the company and it measures

how properly the company is using its material and labour to sell off its products at profit.it

is a very important ratio as it depicts how well the company is functioning without

considering the indirect cost into account (MyAccountingCourse.Com, 2019).The Gross profit

percentage as computed is 29% for both the financial year 2017 and 2018.

2) Current Ratio: It is also known as working capital of the company. It is the ratio which

estimates the financial capability of the company to meet its short-term obligations in near

future. It is the ratio through which the weightage of current ratio versus current liability is

analysed. It also ascertains ho the company can maximise is assets to meets its liability in

time( CFI Education Inc., 2019).The Current Ratio as computed is 0.78 and 0.80 for both the

financial year 2018and 2017.This ratio indicates that the company does not have sufficient

assets to meet its liability in both years.

3) Liquid Ratio: It is also known as quick ratio of the firm. This ratio tells the ability of the

company to meet its short-term debt as and when it become due. This ratio also tells the

liquidity position of the entity as how fast the company can convert its assets into liquid

cash. These ratios are also used to analyse the credit rating of the company (Defmacro

Software Pvt. Ltd., 2019) .The Liquid Ratio as computed is 0.32 and 0.33 for both the

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

financial year 2018and 2017.This ratio is not an ideal ratio as the company is not highly liquid

and the ideal ratio is generally considered to be 1:1.

4) Debt Ratio: It is generally a solvency ratio that analyse the firm’s total liabilities as a

percentage of total assets. This ratio analyses the company ability meets its liability with the

available total assets of the firm. In gene earl words we can say that how much assets that

the company needs to sell off in order to pay off its liability. This ratio also indicates the

financial leverage of the company. The company which have high level of liabilities as

compared to its total assets of the firm are considered to be highly risky and highly

leveraged firm and riskier for lenders (MyAccountingCourse.com, 2019). The Debt Ratio as

computed is 1.21 and 1.38 for both the financial year 2018and 2017.This ratio is not an ideal

ratio as the company as excess liability in comparison to assets of the company.

5) Operating Cash flow Margin: The most commonly used profitability by the company is the

operating cash flow ratio which is also known to be profitability ratio of the firm. It also

depicts how much revenue the company is generating from per dollar sales the company is

bringing in. In another way we can say that how much efficient the company is in

transforming the operations of the company into cash. There is very simple formula in order

to arrive at the figure i. e Operating Cash Flow Margin=Cash Flow from Operations/Net Sales

of the entity. As a general rule higher is the operating ratio the better is the performance of

the company. If the same ratio increases over time it indicates that the company is

performing well over time and converting its sales into actual cash flow (Clarke, 2019) .The

Operating Cash flow percentage as computed is 5.14% and 5.67% for both the financial year

2018and 2017.This percentage of the operating margin is good for the company growth.

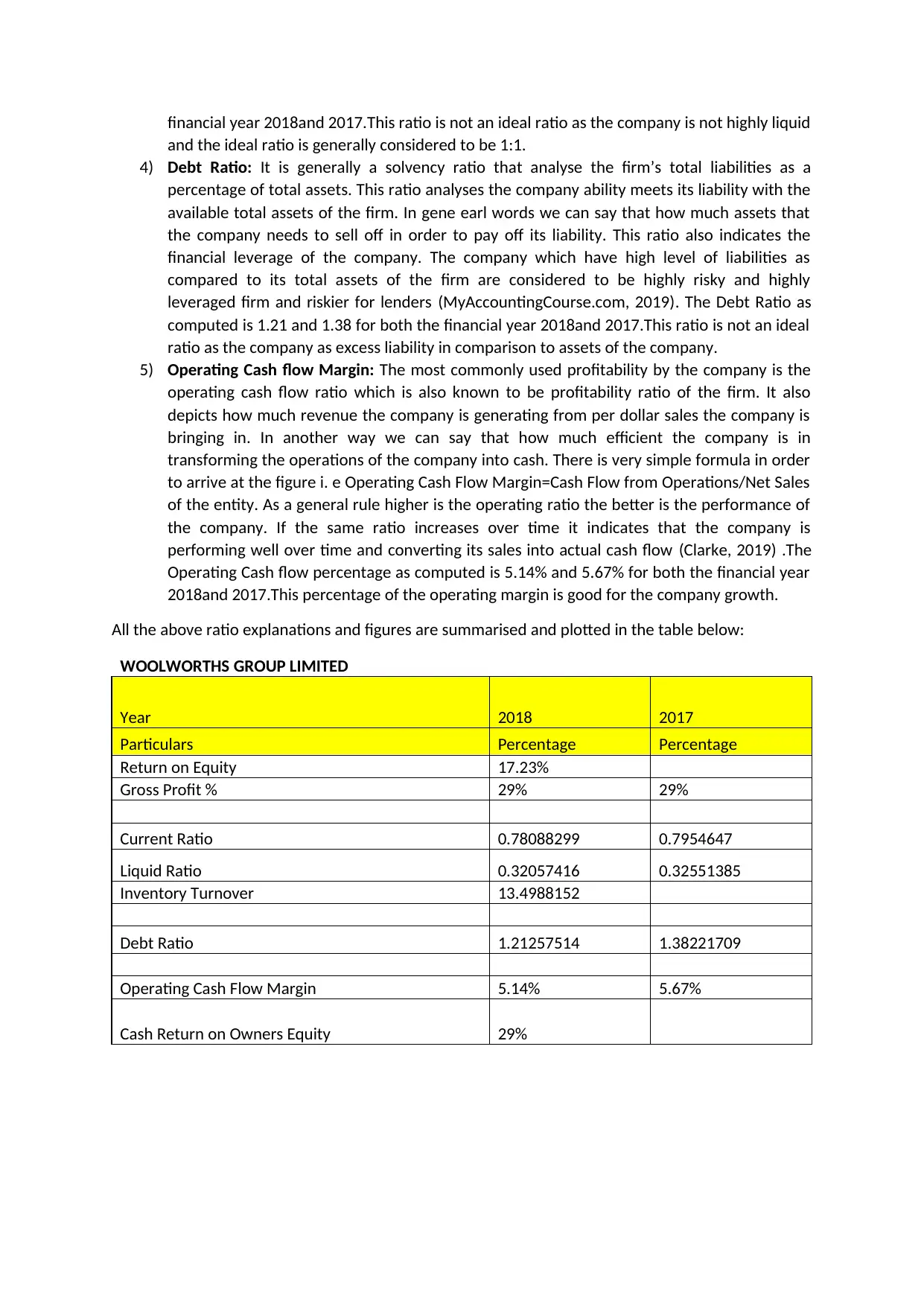

All the above ratio explanations and figures are summarised and plotted in the table below:

WOOLWORTHS GROUP LIMITED

Year 2018 2017

Particulars Percentage Percentage

Return on Equity 17.23%

Gross Profit % 29% 29%

Current Ratio 0.78088299 0.7954647

Liquid Ratio 0.32057416 0.32551385

Inventory Turnover 13.4988152

Debt Ratio 1.21257514 1.38221709

Operating Cash Flow Margin 5.14% 5.67%

Cash Return on Owners Equity 29%

and the ideal ratio is generally considered to be 1:1.

4) Debt Ratio: It is generally a solvency ratio that analyse the firm’s total liabilities as a

percentage of total assets. This ratio analyses the company ability meets its liability with the

available total assets of the firm. In gene earl words we can say that how much assets that

the company needs to sell off in order to pay off its liability. This ratio also indicates the

financial leverage of the company. The company which have high level of liabilities as

compared to its total assets of the firm are considered to be highly risky and highly

leveraged firm and riskier for lenders (MyAccountingCourse.com, 2019). The Debt Ratio as

computed is 1.21 and 1.38 for both the financial year 2018and 2017.This ratio is not an ideal

ratio as the company as excess liability in comparison to assets of the company.

5) Operating Cash flow Margin: The most commonly used profitability by the company is the

operating cash flow ratio which is also known to be profitability ratio of the firm. It also

depicts how much revenue the company is generating from per dollar sales the company is

bringing in. In another way we can say that how much efficient the company is in

transforming the operations of the company into cash. There is very simple formula in order

to arrive at the figure i. e Operating Cash Flow Margin=Cash Flow from Operations/Net Sales

of the entity. As a general rule higher is the operating ratio the better is the performance of

the company. If the same ratio increases over time it indicates that the company is

performing well over time and converting its sales into actual cash flow (Clarke, 2019) .The

Operating Cash flow percentage as computed is 5.14% and 5.67% for both the financial year

2018and 2017.This percentage of the operating margin is good for the company growth.

All the above ratio explanations and figures are summarised and plotted in the table below:

WOOLWORTHS GROUP LIMITED

Year 2018 2017

Particulars Percentage Percentage

Return on Equity 17.23%

Gross Profit % 29% 29%

Current Ratio 0.78088299 0.7954647

Liquid Ratio 0.32057416 0.32551385

Inventory Turnover 13.4988152

Debt Ratio 1.21257514 1.38221709

Operating Cash Flow Margin 5.14% 5.67%

Cash Return on Owners Equity 29%

RECOMMENDATIONS

Few recommendations which could help to increase the financial performance of the Woolworths

company limited are depicted here in below:

a) Reform in the trading hours which is the urgent requirement to do across Australia

according to the demand of customers and suite the lifestyle of the people around them.

This is very much necessary for the company as the company is mainly engaged in retail

sector and restrictions to operate the store should be very much limited so that the

customers can easily shop 24 hours a day without any restriction and can do a hassle free

shopping .therefore removing the trading hour criteria would relax the shopping of the

people in Australia and would increase the sales leading to growth in earning and profit. The

company should also increase the liquidity position of the company as when the demand

arises regarding the payment of liability the entity should be in a position to set off its

liability as when the situation demands.

b) The entity should improve its current ratio and quick ratio which is the working capital of the

company. As it indicates how much liquid the company is and how much within short span

the company can meet all its available liability with the assets available. To improve the

financial performance the company should also improve its debt ratio which is very bad at

the present moment for both the financial year 2018 and 2017.The debt ratio indicates how

much assets company is required to sell in order to meet its liability. The company has

greater liability comparison to assets of the company. These are the parameters which the

company should improve in order to improve the financial performance of the company.

COMPARATIVE RATIO ANALYSIS

Comparison of Woolworths Company Limited with About Life Pty Limited which belongs to the same

industry. The chosen ratio for both the company is return on equity. This return on equity measures

the profitability of the company and measures the ability of the company to generate profit from the

shareholders investment. It is the profitability ratio of the company. In general terms it means how

much profit each dollar of common equity shareholders generates. This is a very important ratio as

through the financial statement of the company the investors analyse how much there investment is

bringing them back the profit and how the money is utilised by the company in order to generate

the income (MyAccountingCourse.com, 2019)

It is also an indicator how efficiently the company is using the equity financing to fund the principal

operations of the company and working for the growth of the company. From investors point of

view they always want a high return on their investment and wants to higher ROE .Higher ROE are

always better compared to lower ROE (MyAccountingCourse.com, 2019).As every industry has

different types of investors and income level so ROE cannot be used to compare different types of

industry but it can be used to do comparison within the same industry as done in case of

Woolworths company limited and About Life Pty Limited .The ROE for Woolworths Company limited

for the financial year 2018 as computed is 17.23% and for the similar nature company is 15.67%.It

means Woolworth is performing well in the eyes of investors in terms of comparison of ROE.

Few recommendations which could help to increase the financial performance of the Woolworths

company limited are depicted here in below:

a) Reform in the trading hours which is the urgent requirement to do across Australia

according to the demand of customers and suite the lifestyle of the people around them.

This is very much necessary for the company as the company is mainly engaged in retail

sector and restrictions to operate the store should be very much limited so that the

customers can easily shop 24 hours a day without any restriction and can do a hassle free

shopping .therefore removing the trading hour criteria would relax the shopping of the

people in Australia and would increase the sales leading to growth in earning and profit. The

company should also increase the liquidity position of the company as when the demand

arises regarding the payment of liability the entity should be in a position to set off its

liability as when the situation demands.

b) The entity should improve its current ratio and quick ratio which is the working capital of the

company. As it indicates how much liquid the company is and how much within short span

the company can meet all its available liability with the assets available. To improve the

financial performance the company should also improve its debt ratio which is very bad at

the present moment for both the financial year 2018 and 2017.The debt ratio indicates how

much assets company is required to sell in order to meet its liability. The company has

greater liability comparison to assets of the company. These are the parameters which the

company should improve in order to improve the financial performance of the company.

COMPARATIVE RATIO ANALYSIS

Comparison of Woolworths Company Limited with About Life Pty Limited which belongs to the same

industry. The chosen ratio for both the company is return on equity. This return on equity measures

the profitability of the company and measures the ability of the company to generate profit from the

shareholders investment. It is the profitability ratio of the company. In general terms it means how

much profit each dollar of common equity shareholders generates. This is a very important ratio as

through the financial statement of the company the investors analyse how much there investment is

bringing them back the profit and how the money is utilised by the company in order to generate

the income (MyAccountingCourse.com, 2019)

It is also an indicator how efficiently the company is using the equity financing to fund the principal

operations of the company and working for the growth of the company. From investors point of

view they always want a high return on their investment and wants to higher ROE .Higher ROE are

always better compared to lower ROE (MyAccountingCourse.com, 2019).As every industry has

different types of investors and income level so ROE cannot be used to compare different types of

industry but it can be used to do comparison within the same industry as done in case of

Woolworths company limited and About Life Pty Limited .The ROE for Woolworths Company limited

for the financial year 2018 as computed is 17.23% and for the similar nature company is 15.67%.It

means Woolworth is performing well in the eyes of investors in terms of comparison of ROE.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

CONCLUSION

Accordingly, we can conclude that the financial parameters in terms of profit is strong in comparison

to other similar industry. When compared to liquidity position with other similar industry the

parameters of the company are quite weak and needs to be focussed on.

Accordingly, we can conclude that the financial parameters in terms of profit is strong in comparison

to other similar industry. When compared to liquidity position with other similar industry the

parameters of the company are quite weak and needs to be focussed on.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

References

Bloomberg L.P, 2019. Company Overview of Woolworths Group Limited. [Online]

Available at: https://www.bloomberg.com/research/stocks/private/snapshot.asp?privcapId=874687

[Accessed 15 May 2019].

CFI Education Inc., 2019. What is the Current Ratio?. [Online]

Available at: https://corporatefinanceinstitute.com/resources/knowledge/finance/current-ratio-

formula/

[Accessed 15 May 2019].

Clarke, D., 2019. What is Operating Cash Flow Margin and Why is it Important?. [Online]

Available at: https://kashoo.com/blog/what-is-operating-cash-flow-margin-and-why-is-it-important

[Accessed 15 May 2019].

Defmacro Software Pvt. Ltd., 2019. Liquidity Ratio, Formula With Examples. [Online]

Available at: https://cleartax.in/s/liquidity-ratio

[Accessed 15 May 2019].

MyAccountingCourse.com, 2019. Debt Ratio. [Online]

Available at: https://www.myaccountingcourse.com/financial-ratios/debt-ratio

[Accessed 15 May 2019].

MyAccountingCourse.Com, 2019. Gross Profit Margin. [Online]

Available at: https://www.myaccountingcourse.com/financial-ratios/gross-profit-margin

[Accessed 15 May 2019].

MyAccountingCourse.com, 2019. Return on Equity (ROE) Ratio. [Online]

Available at: https://www.myaccountingcourse.com/financial-ratios/return-on-equity

[Accessed 15 May 2019].

Bloomberg L.P, 2019. Company Overview of Woolworths Group Limited. [Online]

Available at: https://www.bloomberg.com/research/stocks/private/snapshot.asp?privcapId=874687

[Accessed 15 May 2019].

CFI Education Inc., 2019. What is the Current Ratio?. [Online]

Available at: https://corporatefinanceinstitute.com/resources/knowledge/finance/current-ratio-

formula/

[Accessed 15 May 2019].

Clarke, D., 2019. What is Operating Cash Flow Margin and Why is it Important?. [Online]

Available at: https://kashoo.com/blog/what-is-operating-cash-flow-margin-and-why-is-it-important

[Accessed 15 May 2019].

Defmacro Software Pvt. Ltd., 2019. Liquidity Ratio, Formula With Examples. [Online]

Available at: https://cleartax.in/s/liquidity-ratio

[Accessed 15 May 2019].

MyAccountingCourse.com, 2019. Debt Ratio. [Online]

Available at: https://www.myaccountingcourse.com/financial-ratios/debt-ratio

[Accessed 15 May 2019].

MyAccountingCourse.Com, 2019. Gross Profit Margin. [Online]

Available at: https://www.myaccountingcourse.com/financial-ratios/gross-profit-margin

[Accessed 15 May 2019].

MyAccountingCourse.com, 2019. Return on Equity (ROE) Ratio. [Online]

Available at: https://www.myaccountingcourse.com/financial-ratios/return-on-equity

[Accessed 15 May 2019].

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 10

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.