Oil and Gas Management: Challenges, Strategies, and Planning

VerifiedAdded on 2020/01/28

|10

|2861

|36

Report

AI Summary

This report delves into the multifaceted challenges confronting the oil and gas sector. It begins by examining the cash crunch faced by companies due to sub-$50/bbl oil prices, impacting projects and dividends. The analysis explores the implications of this financial strain on operational activities and profitability, including strategies like cost reduction and project delays. The report then investigates the debate surrounding the abandonment of production-maximizing policies in light of environmental concerns and government regulations like the Climate Change Act 2008. Furthermore, it discusses the planning efforts of oil companies to promote a low-carbon global world, including investments in green technologies, carbon emission charges, and adherence to environmental policies. The study emphasizes the importance of adapting to changing market conditions, environmental regulations, and the need for sustainable practices within the oil and gas industry.

Oil and Gas Management

1

1

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TABLE OF CONTENTS

INTRODUCTION...........................................................................................................................3

Theme 1: Cash crunch of sub-$50/bbl oil on projects and dividends..........................................3

Theme 2: Whether to abandon production-maximising policies.................................................5

Theme 3: Planning by oil companies to promote low carbon global world................................7

CONCLUSION................................................................................................................................8

REFERENCES................................................................................................................................9

ILLUSTRATION INDEX

Illustration 1: Dividend and profit ratio...........................................................................................4

Illustration 2: Dividends at $100 a barrel .......................................................................................5

2

INTRODUCTION...........................................................................................................................3

Theme 1: Cash crunch of sub-$50/bbl oil on projects and dividends..........................................3

Theme 2: Whether to abandon production-maximising policies.................................................5

Theme 3: Planning by oil companies to promote low carbon global world................................7

CONCLUSION................................................................................................................................8

REFERENCES................................................................................................................................9

ILLUSTRATION INDEX

Illustration 1: Dividend and profit ratio...........................................................................................4

Illustration 2: Dividends at $100 a barrel .......................................................................................5

2

INTRODUCTION

Oil and gas sector plays a key role in economic development through performing various

activities in regard to oil production and sales. In addition to this, Big oil industry is considered

as critical factor because it holds membership of various big oil giants. Classification of big oil

and gas business firms can be as BP, Shell, Total, Nioc, Cnooc, Conoco, etc. It has been

identified that the working of such big oil and gas companies is related with the fossil fuels lobby

(Schroders, 2015). It also have direct influence on the economic development and political

aspects of the country. Price and demand changes plays a vital role in oil and gas industry.

However, the current learning is focused towards various challenges that big oil organisation

faces in international and domestic market. Furthermore, issues will be discussed under themes

of cash crunch, desertion of policies in context to production-maximization. It will also focus on

various factors of planning process that can reduce the carbon issue in the world.

Theme 1: Cash crunch of sub-$50/bbl oil on projects and dividends

As per the structured study, it has been identified that the cash crunch is considered as a

market circumstances where companies does not have sufficient funds to operate business. In

other aspect, it is referred as an issue in context to low liquidity which impacts the overall work

culture of the sector. Advancement in such kind of issues have direct influence on the operational

activities and profitability of the firms. For the same, the oil and gas industry also demands high

investment in order to perform production activities but due to lack of liquidity the companies

are facing issue of cash crunch (Kent, 2015). Big oil firms require funds to maintain equipments

and machineries, delivery of final product and salary of employees. Moreover, big oil and gas

business firms that are classified as BP, Shell, Total, Nioc, Cnooc, Conoco, etc. also demands the

same to operate business in sustainable manner. As per current statistical report, it has been

identified that in last one year, the Shell, Total and BP are facing issue regarding decrease in

pricing of their products and services (Anderson, 2012). It has also impacted the overall

development of oil and gas industry in global context. Perception of shareholders has also

affected due to such kind of negative changes in market. It has also increased the issue of low

liquidity in the global market and influenced operational activities.

Moreover, in order to overcome such issue the big oil companies has started focusing on

reduction in operational cost. In last six months due to lack of liquidity the internal and domestic

3

Oil and gas sector plays a key role in economic development through performing various

activities in regard to oil production and sales. In addition to this, Big oil industry is considered

as critical factor because it holds membership of various big oil giants. Classification of big oil

and gas business firms can be as BP, Shell, Total, Nioc, Cnooc, Conoco, etc. It has been

identified that the working of such big oil and gas companies is related with the fossil fuels lobby

(Schroders, 2015). It also have direct influence on the economic development and political

aspects of the country. Price and demand changes plays a vital role in oil and gas industry.

However, the current learning is focused towards various challenges that big oil organisation

faces in international and domestic market. Furthermore, issues will be discussed under themes

of cash crunch, desertion of policies in context to production-maximization. It will also focus on

various factors of planning process that can reduce the carbon issue in the world.

Theme 1: Cash crunch of sub-$50/bbl oil on projects and dividends

As per the structured study, it has been identified that the cash crunch is considered as a

market circumstances where companies does not have sufficient funds to operate business. In

other aspect, it is referred as an issue in context to low liquidity which impacts the overall work

culture of the sector. Advancement in such kind of issues have direct influence on the operational

activities and profitability of the firms. For the same, the oil and gas industry also demands high

investment in order to perform production activities but due to lack of liquidity the companies

are facing issue of cash crunch (Kent, 2015). Big oil firms require funds to maintain equipments

and machineries, delivery of final product and salary of employees. Moreover, big oil and gas

business firms that are classified as BP, Shell, Total, Nioc, Cnooc, Conoco, etc. also demands the

same to operate business in sustainable manner. As per current statistical report, it has been

identified that in last one year, the Shell, Total and BP are facing issue regarding decrease in

pricing of their products and services (Anderson, 2012). It has also impacted the overall

development of oil and gas industry in global context. Perception of shareholders has also

affected due to such kind of negative changes in market. It has also increased the issue of low

liquidity in the global market and influenced operational activities.

Moreover, in order to overcome such issue the big oil companies has started focusing on

reduction in operational cost. In last six months due to lack of liquidity the internal and domestic

3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

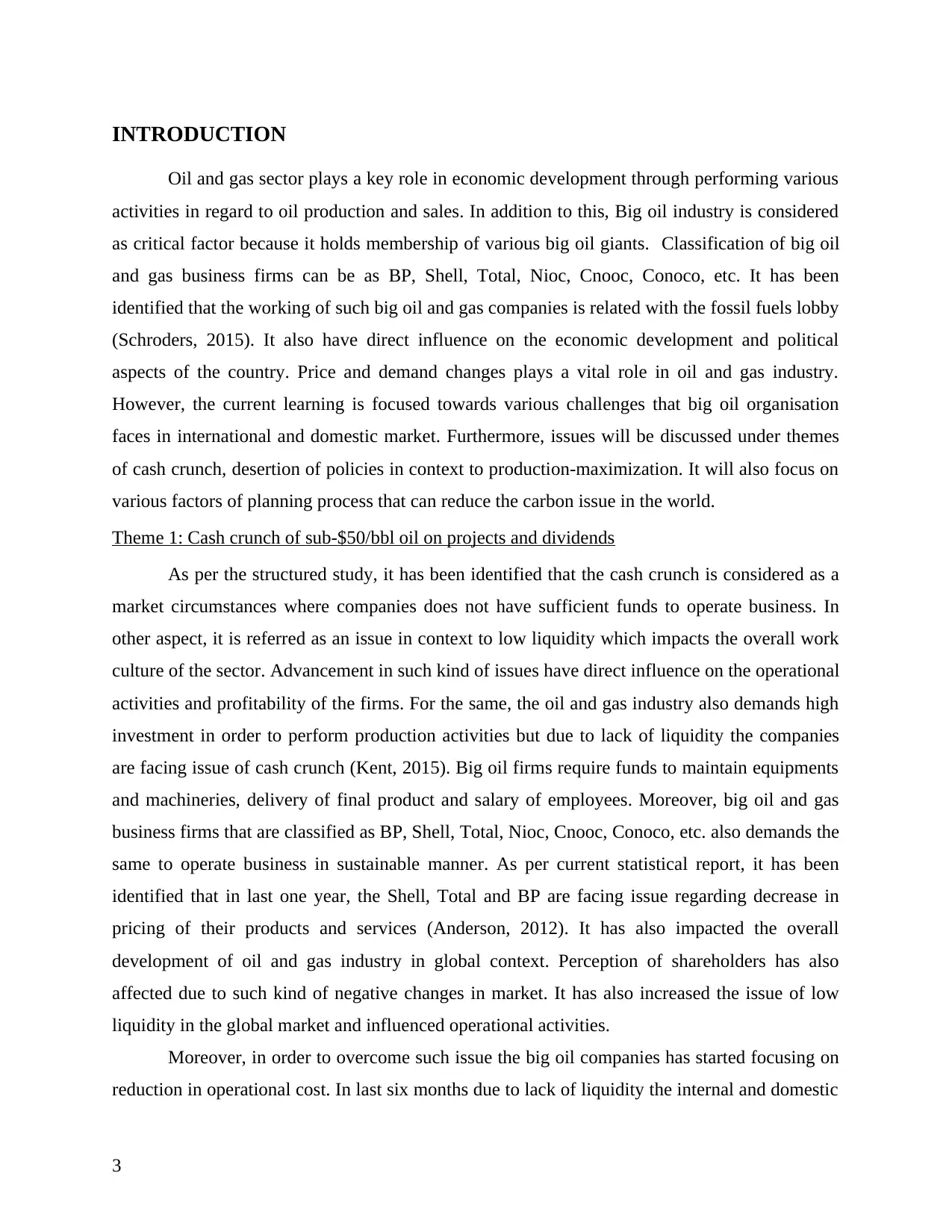

giants has decreased their expenses nearby $30 billion (Entrekin and et.al., 2011). In regard to

this big oil companies like BP, Shell, Total, Nioc, Cnooc, Conoco, etc. are ensuring that their

projects may get delayed so that their production units can have sustainable working and their

return on investment can be increased. Profit margin ratio of oil and gas firms has also decreased

in last one year due to cash crunch issue (Imam and Capareda, 2012). In starting of year 2015 the

organizations were facing cash crunch issue nearby $20 billion and it is increasing day by day. It

also higher their operational cost and providing less rate of return.

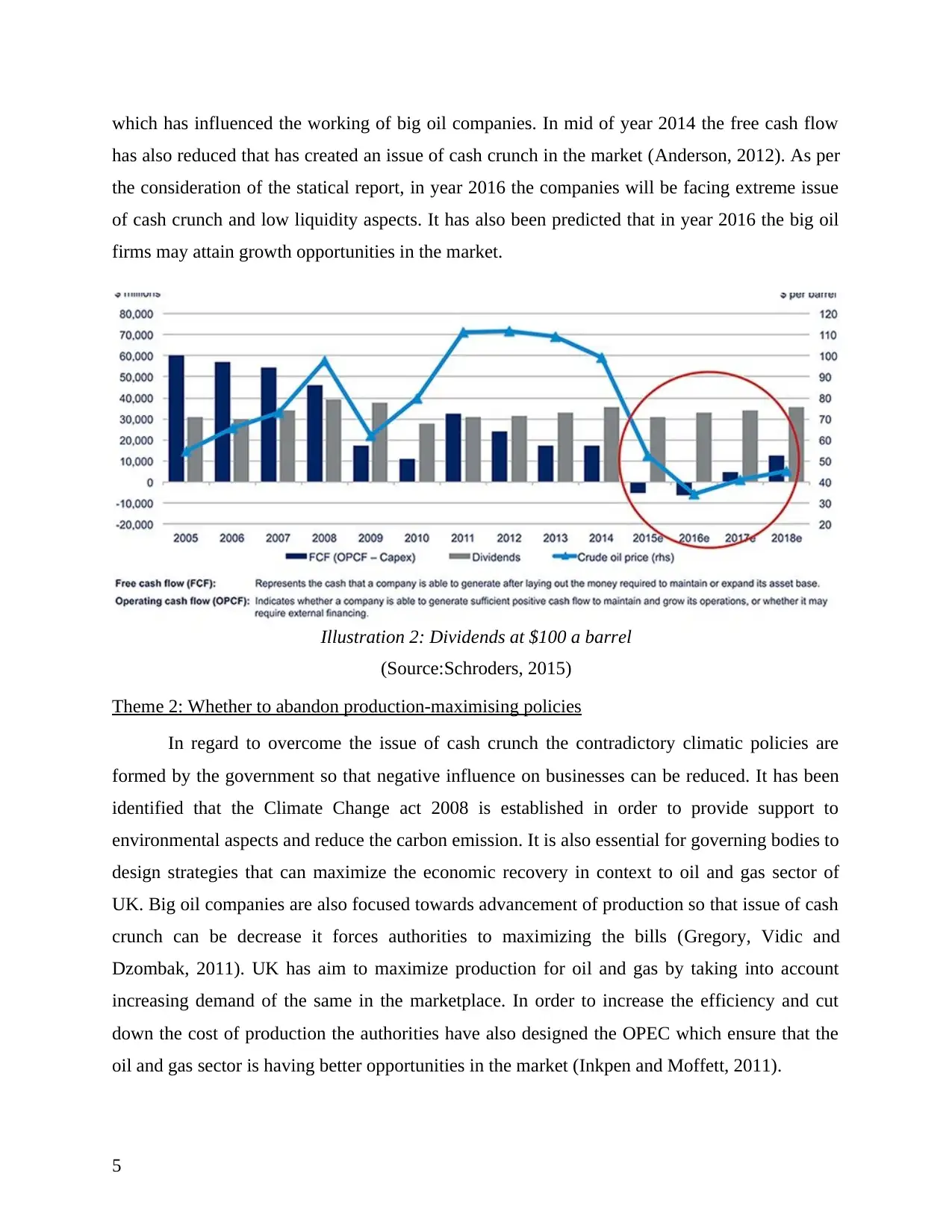

As per the above statical report, the cash dividend payment of big oil companies has

decreased but still considered as positive in regard to cash. It also indicates that in year 2014 the

net profit of BP, Chevron, Shell and Exxon Mobil has decreased which has impacted the overall

development of the sector. BP is facing loss of 3 billion in year 2014 that has impacted its

operational activities in the internal market (Osborn and et.al., 2011). It also indicates that the

Exxon Mobil is much stable in the market as compared to other competitors in the market. It is

due to optimistic strategy of sustainability, company is focusing on advancement of production

unit rather than decrease in cost of operation. However, the decreases in price of oil products also

impacts the rate of return and creates negative influence on the organisation. It is one of reason

that the organisations have started decreasing their cost of operation (Wilson and VanBriesen,

2012).

The following graph indicates that the dividend of international oil and gas sector is

having rapid changes. In the starting of year 2014 the prices of crude oil has started decrease

4

Illustration 1: Dividend and profit ratio

(Source:Kent, s., 2015)

this big oil companies like BP, Shell, Total, Nioc, Cnooc, Conoco, etc. are ensuring that their

projects may get delayed so that their production units can have sustainable working and their

return on investment can be increased. Profit margin ratio of oil and gas firms has also decreased

in last one year due to cash crunch issue (Imam and Capareda, 2012). In starting of year 2015 the

organizations were facing cash crunch issue nearby $20 billion and it is increasing day by day. It

also higher their operational cost and providing less rate of return.

As per the above statical report, the cash dividend payment of big oil companies has

decreased but still considered as positive in regard to cash. It also indicates that in year 2014 the

net profit of BP, Chevron, Shell and Exxon Mobil has decreased which has impacted the overall

development of the sector. BP is facing loss of 3 billion in year 2014 that has impacted its

operational activities in the internal market (Osborn and et.al., 2011). It also indicates that the

Exxon Mobil is much stable in the market as compared to other competitors in the market. It is

due to optimistic strategy of sustainability, company is focusing on advancement of production

unit rather than decrease in cost of operation. However, the decreases in price of oil products also

impacts the rate of return and creates negative influence on the organisation. It is one of reason

that the organisations have started decreasing their cost of operation (Wilson and VanBriesen,

2012).

The following graph indicates that the dividend of international oil and gas sector is

having rapid changes. In the starting of year 2014 the prices of crude oil has started decrease

4

Illustration 1: Dividend and profit ratio

(Source:Kent, s., 2015)

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

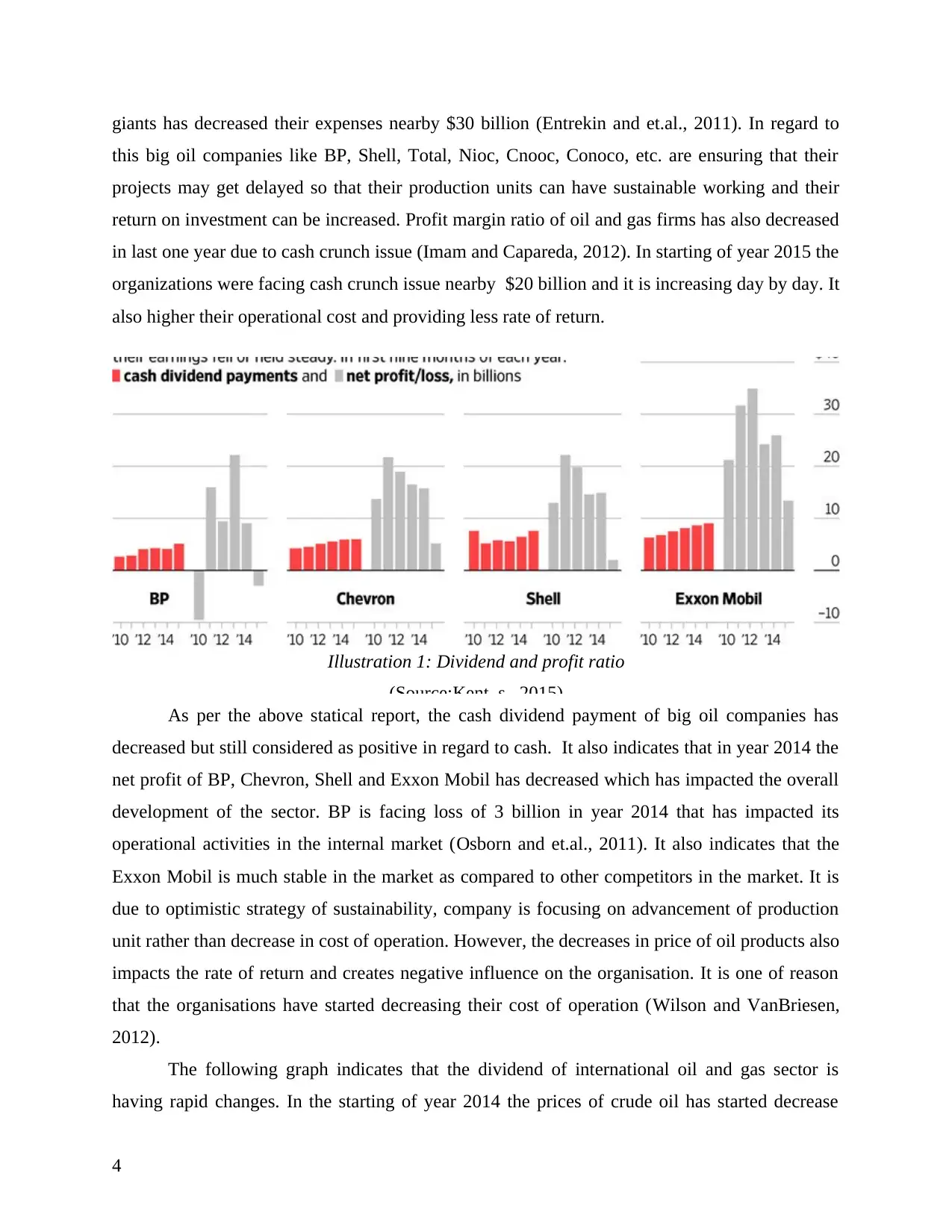

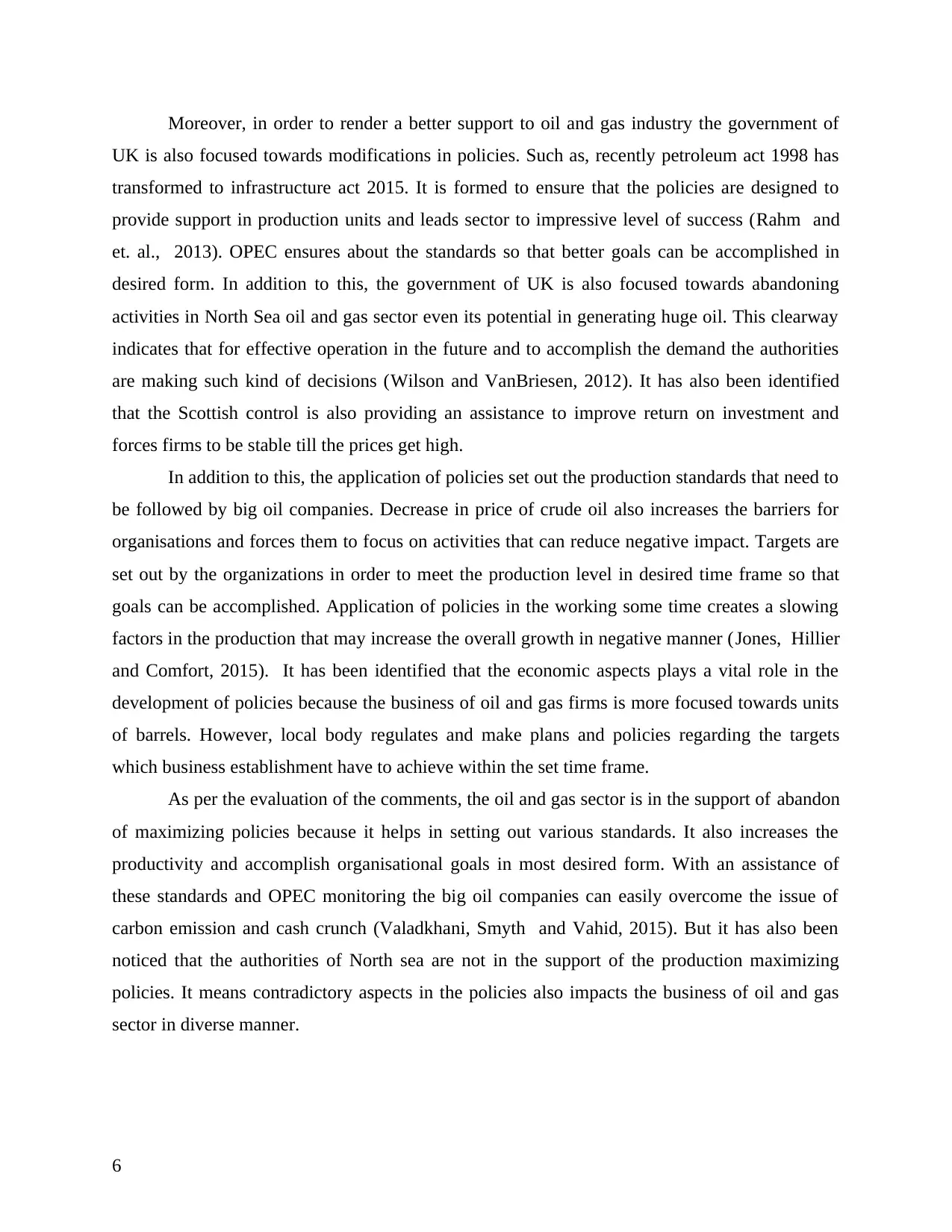

which has influenced the working of big oil companies. In mid of year 2014 the free cash flow

has also reduced that has created an issue of cash crunch in the market (Anderson, 2012). As per

the consideration of the statical report, in year 2016 the companies will be facing extreme issue

of cash crunch and low liquidity aspects. It has also been predicted that in year 2016 the big oil

firms may attain growth opportunities in the market.

Theme 2: Whether to abandon production-maximising policies

In regard to overcome the issue of cash crunch the contradictory climatic policies are

formed by the government so that negative influence on businesses can be reduced. It has been

identified that the Climate Change act 2008 is established in order to provide support to

environmental aspects and reduce the carbon emission. It is also essential for governing bodies to

design strategies that can maximize the economic recovery in context to oil and gas sector of

UK. Big oil companies are also focused towards advancement of production so that issue of cash

crunch can be decrease it forces authorities to maximizing the bills (Gregory, Vidic and

Dzombak, 2011). UK has aim to maximize production for oil and gas by taking into account

increasing demand of the same in the marketplace. In order to increase the efficiency and cut

down the cost of production the authorities have also designed the OPEC which ensure that the

oil and gas sector is having better opportunities in the market (Inkpen and Moffett, 2011).

5

Illustration 2: Dividends at $100 a barrel

(Source:Schroders, 2015)

has also reduced that has created an issue of cash crunch in the market (Anderson, 2012). As per

the consideration of the statical report, in year 2016 the companies will be facing extreme issue

of cash crunch and low liquidity aspects. It has also been predicted that in year 2016 the big oil

firms may attain growth opportunities in the market.

Theme 2: Whether to abandon production-maximising policies

In regard to overcome the issue of cash crunch the contradictory climatic policies are

formed by the government so that negative influence on businesses can be reduced. It has been

identified that the Climate Change act 2008 is established in order to provide support to

environmental aspects and reduce the carbon emission. It is also essential for governing bodies to

design strategies that can maximize the economic recovery in context to oil and gas sector of

UK. Big oil companies are also focused towards advancement of production so that issue of cash

crunch can be decrease it forces authorities to maximizing the bills (Gregory, Vidic and

Dzombak, 2011). UK has aim to maximize production for oil and gas by taking into account

increasing demand of the same in the marketplace. In order to increase the efficiency and cut

down the cost of production the authorities have also designed the OPEC which ensure that the

oil and gas sector is having better opportunities in the market (Inkpen and Moffett, 2011).

5

Illustration 2: Dividends at $100 a barrel

(Source:Schroders, 2015)

Moreover, in order to render a better support to oil and gas industry the government of

UK is also focused towards modifications in policies. Such as, recently petroleum act 1998 has

transformed to infrastructure act 2015. It is formed to ensure that the policies are designed to

provide support in production units and leads sector to impressive level of success (Rahm and

et. al., 2013). OPEC ensures about the standards so that better goals can be accomplished in

desired form. In addition to this, the government of UK is also focused towards abandoning

activities in North Sea oil and gas sector even its potential in generating huge oil. This clearway

indicates that for effective operation in the future and to accomplish the demand the authorities

are making such kind of decisions (Wilson and VanBriesen, 2012). It has also been identified

that the Scottish control is also providing an assistance to improve return on investment and

forces firms to be stable till the prices get high.

In addition to this, the application of policies set out the production standards that need to

be followed by big oil companies. Decrease in price of crude oil also increases the barriers for

organisations and forces them to focus on activities that can reduce negative impact. Targets are

set out by the organizations in order to meet the production level in desired time frame so that

goals can be accomplished. Application of policies in the working some time creates a slowing

factors in the production that may increase the overall growth in negative manner (Jones, Hillier

and Comfort, 2015). It has been identified that the economic aspects plays a vital role in the

development of policies because the business of oil and gas firms is more focused towards units

of barrels. However, local body regulates and make plans and policies regarding the targets

which business establishment have to achieve within the set time frame.

As per the evaluation of the comments, the oil and gas sector is in the support of abandon

of maximizing policies because it helps in setting out various standards. It also increases the

productivity and accomplish organisational goals in most desired form. With an assistance of

these standards and OPEC monitoring the big oil companies can easily overcome the issue of

carbon emission and cash crunch (Valadkhani, Smyth and Vahid, 2015). But it has also been

noticed that the authorities of North sea are not in the support of the production maximizing

policies. It means contradictory aspects in the policies also impacts the business of oil and gas

sector in diverse manner.

6

UK is also focused towards modifications in policies. Such as, recently petroleum act 1998 has

transformed to infrastructure act 2015. It is formed to ensure that the policies are designed to

provide support in production units and leads sector to impressive level of success (Rahm and

et. al., 2013). OPEC ensures about the standards so that better goals can be accomplished in

desired form. In addition to this, the government of UK is also focused towards abandoning

activities in North Sea oil and gas sector even its potential in generating huge oil. This clearway

indicates that for effective operation in the future and to accomplish the demand the authorities

are making such kind of decisions (Wilson and VanBriesen, 2012). It has also been identified

that the Scottish control is also providing an assistance to improve return on investment and

forces firms to be stable till the prices get high.

In addition to this, the application of policies set out the production standards that need to

be followed by big oil companies. Decrease in price of crude oil also increases the barriers for

organisations and forces them to focus on activities that can reduce negative impact. Targets are

set out by the organizations in order to meet the production level in desired time frame so that

goals can be accomplished. Application of policies in the working some time creates a slowing

factors in the production that may increase the overall growth in negative manner (Jones, Hillier

and Comfort, 2015). It has been identified that the economic aspects plays a vital role in the

development of policies because the business of oil and gas firms is more focused towards units

of barrels. However, local body regulates and make plans and policies regarding the targets

which business establishment have to achieve within the set time frame.

As per the evaluation of the comments, the oil and gas sector is in the support of abandon

of maximizing policies because it helps in setting out various standards. It also increases the

productivity and accomplish organisational goals in most desired form. With an assistance of

these standards and OPEC monitoring the big oil companies can easily overcome the issue of

carbon emission and cash crunch (Valadkhani, Smyth and Vahid, 2015). But it has also been

noticed that the authorities of North sea are not in the support of the production maximizing

policies. It means contradictory aspects in the policies also impacts the business of oil and gas

sector in diverse manner.

6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Theme 3: Planning by oil companies to promote low carbon global world

As per the structured study, carbon emission is one of critical issue that impacts the

environmental conditions as well as working of oil and gas sector in global context. It is essential

for big oil companies to design actions that can overcome carbon emission issue in appropriate

manner. In this regard, the big giants of oil and gas sector has started focus on promotion of low

carbon global world (Jones, Hillier and Comfort, 2015). Oil companies are planning activities

that cut down the negative impact of carbon emission. Government is also establishing various

policies that can boost economic development and reduce carbon emission. It will provide better

opportunities to the fast growing sector and lead businesses to better success. It has been

identified that in order to promote the environmental aspects the big oil companies have also

asked government authorities to pay charged on promotion carbon emission (Wilson and

VanBriesen, 2012). It has been noticed that the working of oil and gas sector is impacting global

warming aspects. In this respect, the management of oil and gas sector has decided to charge on

carbon emission. It also provides an assistance to economic development. For example, BP,

Shell and other authorities provide financial support in social development in respect of carbon

emission issues. Other than this, it has also been identified that the oil and gas sector big giants

are also following rules and regulations in appropriate manner so that global warming issue can

be overcome in effective manner (Inkpen and Moffett, 2011). Number of oil and gas

organisations are also increasing their investment on equipments and machineries development

so that carbon emission can be reduced in order to protect environmental aspects.

Moreover, the technological changes are also planned by the organisations in order to

ensure about environmental issues. 3D monitoring system and x-ray technology is being used to

have optimum use of raw materials and render a support to environmental conditions. It also

helps overcome various issues that impacts the image of the sector in negative manner. BP and

Shell has also decided to adopt green environment at their work place (Gregory, Vidic and

Dzombak, 2011). They are now investing more on plantation of trees their pumps and other

corporate infrastructure. It also provides a support to environmental conditions. Other than this,

in order to reduce the carbon emission the OPEC has also designed environmental policies that

need to be followed by big oil companies (Anderson, 2012). Various safeguarding policies are

designed and authorities are also planning to bring transformation in the rules and regulations so

that standards can be maintained in appropriate manner.

7

As per the structured study, carbon emission is one of critical issue that impacts the

environmental conditions as well as working of oil and gas sector in global context. It is essential

for big oil companies to design actions that can overcome carbon emission issue in appropriate

manner. In this regard, the big giants of oil and gas sector has started focus on promotion of low

carbon global world (Jones, Hillier and Comfort, 2015). Oil companies are planning activities

that cut down the negative impact of carbon emission. Government is also establishing various

policies that can boost economic development and reduce carbon emission. It will provide better

opportunities to the fast growing sector and lead businesses to better success. It has been

identified that in order to promote the environmental aspects the big oil companies have also

asked government authorities to pay charged on promotion carbon emission (Wilson and

VanBriesen, 2012). It has been noticed that the working of oil and gas sector is impacting global

warming aspects. In this respect, the management of oil and gas sector has decided to charge on

carbon emission. It also provides an assistance to economic development. For example, BP,

Shell and other authorities provide financial support in social development in respect of carbon

emission issues. Other than this, it has also been identified that the oil and gas sector big giants

are also following rules and regulations in appropriate manner so that global warming issue can

be overcome in effective manner (Inkpen and Moffett, 2011). Number of oil and gas

organisations are also increasing their investment on equipments and machineries development

so that carbon emission can be reduced in order to protect environmental aspects.

Moreover, the technological changes are also planned by the organisations in order to

ensure about environmental issues. 3D monitoring system and x-ray technology is being used to

have optimum use of raw materials and render a support to environmental conditions. It also

helps overcome various issues that impacts the image of the sector in negative manner. BP and

Shell has also decided to adopt green environment at their work place (Gregory, Vidic and

Dzombak, 2011). They are now investing more on plantation of trees their pumps and other

corporate infrastructure. It also provides a support to environmental conditions. Other than this,

in order to reduce the carbon emission the OPEC has also designed environmental policies that

need to be followed by big oil companies (Anderson, 2012). Various safeguarding policies are

designed and authorities are also planning to bring transformation in the rules and regulations so

that standards can be maintained in appropriate manner.

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Furthermore, oil companies are planning for their expansion where Shell proposed to

explore for oil in the Arctic whereas BP expended its operation in Gulf of Mexico. However, it

shows that the demand of oil and gas energy is increasing so management of big oil companies

are organizing campaigns that can reduce the demand of oil and gas products (Wilson and

VanBriesen, 2012). In addition to this, organisations are also focusing on implementation of

various corrective activities that can promote environmental aspects and reduce the issue of

carbon emission. Organisational frameworks are also designed according to carbon emission

policies. Technological tools are being used to promote renewable energy so that goals can be

accomplished in most appropriate manner.

CONCLUSION

As per the above study, it can be concluded that the oil and gas sector is facing various

challenges that can impact the overall development. Big oil companies are working in the

competitive market such as BP, Shell, Total, Nioc, Cnooc, Conoco, etc. It has been identified

that the cash crush is one of critical issue that impacts working of firms. Continuous decrease in

price of crude oil is key factor that increases low liquidity issue. Moreover, carbon emission

issue can be reduced by following work frameworks and technological updates in machineries.

8

explore for oil in the Arctic whereas BP expended its operation in Gulf of Mexico. However, it

shows that the demand of oil and gas energy is increasing so management of big oil companies

are organizing campaigns that can reduce the demand of oil and gas products (Wilson and

VanBriesen, 2012). In addition to this, organisations are also focusing on implementation of

various corrective activities that can promote environmental aspects and reduce the issue of

carbon emission. Organisational frameworks are also designed according to carbon emission

policies. Technological tools are being used to promote renewable energy so that goals can be

accomplished in most appropriate manner.

CONCLUSION

As per the above study, it can be concluded that the oil and gas sector is facing various

challenges that can impact the overall development. Big oil companies are working in the

competitive market such as BP, Shell, Total, Nioc, Cnooc, Conoco, etc. It has been identified

that the cash crush is one of critical issue that impacts working of firms. Continuous decrease in

price of crude oil is key factor that increases low liquidity issue. Moreover, carbon emission

issue can be reduced by following work frameworks and technological updates in machineries.

8

REFERENCES

Books and Journals

Anderson, G., 2012. Oil and gas in federal systems. Oxford University Press.

Entrekin, S. and et.al., 2011. Rapid expansion of natural gas development poses a threat to

surface waters. Frontiers in Ecology and the Environment. 9(9). pp.503-511.

Gregory, K. B., Vidic, R.D. and Dzombak, D. A., 2011. Water management challenges

associated with the production of shale gas by hydraulic fracturing. Elements. 7(3). pp.181-

186.

Imam, T. and Capareda, S., 2012. Characterization of bio-oil, syn-gas and bio-char from

switchgrass pyrolysis at various temperatures. Journal of Analytical and Applied Pyrolysis.

93, pp.170-177.

Inkpen, A.C. and Moffett, M.H., 2011. The Global Oil & Gas Industry: Management, Strategy

& Finance. PennWell Books.

Jones, P., Hillier, D. and Comfort, D., 2015. The contested future of fracking for shale gas in the

UK: risk, reputation and regulation. World Review of Entrepreneurship, Management and

Sustainable Development. 11(4). pp.377-390.

Osborn, S.G. and et.al., 2011. Methane contamination of drinking water accompanying gas-well

drilling and hydraulic fracturing. Proceedings of the National Academy of Sciences.

108(20). pp.8172-8176.

Rahm, B.G. and et. al., 2013. Wastewater management and Marcellus Shale gas development:

trends, drivers, and planning implications. Journal of environmental management. 120.

pp.105-113.

Valadkhani, A., Smyth, R. and Vahid, F., 2015. Asymmetric pricing of diesel at its source.

Energy Economics. 52. pp.183-194.

Wilson, J. M. and VanBriesen, J. M., 2012. Oil and gas produced water management and surface

drinking water sources in Pennsylvania. Environmental Practice. 14(04). pp.288-300.

Online

Kent, s., 2015. Oil Majors’ Dividends Survive Plunge in Oil Prices. [Online]. <Available

through: http://www.wsj.com/articles/oil-majors-dividends-survive-plunge-in-oil-prices-

1447634165>. [Accessed on: 13 April, 2016].

9

Books and Journals

Anderson, G., 2012. Oil and gas in federal systems. Oxford University Press.

Entrekin, S. and et.al., 2011. Rapid expansion of natural gas development poses a threat to

surface waters. Frontiers in Ecology and the Environment. 9(9). pp.503-511.

Gregory, K. B., Vidic, R.D. and Dzombak, D. A., 2011. Water management challenges

associated with the production of shale gas by hydraulic fracturing. Elements. 7(3). pp.181-

186.

Imam, T. and Capareda, S., 2012. Characterization of bio-oil, syn-gas and bio-char from

switchgrass pyrolysis at various temperatures. Journal of Analytical and Applied Pyrolysis.

93, pp.170-177.

Inkpen, A.C. and Moffett, M.H., 2011. The Global Oil & Gas Industry: Management, Strategy

& Finance. PennWell Books.

Jones, P., Hillier, D. and Comfort, D., 2015. The contested future of fracking for shale gas in the

UK: risk, reputation and regulation. World Review of Entrepreneurship, Management and

Sustainable Development. 11(4). pp.377-390.

Osborn, S.G. and et.al., 2011. Methane contamination of drinking water accompanying gas-well

drilling and hydraulic fracturing. Proceedings of the National Academy of Sciences.

108(20). pp.8172-8176.

Rahm, B.G. and et. al., 2013. Wastewater management and Marcellus Shale gas development:

trends, drivers, and planning implications. Journal of environmental management. 120.

pp.105-113.

Valadkhani, A., Smyth, R. and Vahid, F., 2015. Asymmetric pricing of diesel at its source.

Energy Economics. 52. pp.183-194.

Wilson, J. M. and VanBriesen, J. M., 2012. Oil and gas produced water management and surface

drinking water sources in Pennsylvania. Environmental Practice. 14(04). pp.288-300.

Online

Kent, s., 2015. Oil Majors’ Dividends Survive Plunge in Oil Prices. [Online]. <Available

through: http://www.wsj.com/articles/oil-majors-dividends-survive-plunge-in-oil-prices-

1447634165>. [Accessed on: 13 April, 2016].

9

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Schroders, 2015. What does the oil price fall mean for income investors. [Online]. <Available

through: http://www.schroders.com/nl/nl/institutioneel/nieuws-narktinformatie/markets/

what-does-the-oil-price-fall-mean-for-income-investors/>. [Accessed on: 13 April, 2016].

10

through: http://www.schroders.com/nl/nl/institutioneel/nieuws-narktinformatie/markets/

what-does-the-oil-price-fall-mean-for-income-investors/>. [Accessed on: 13 April, 2016].

10

1 out of 10

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.