Rio Tinto Executive Summery Rio Tinto

VerifiedAdded on 2020/03/16

|18

|4863

|182

AI Summary

Rio tinto Executive summery Rio Tinto is one of the largest mining companies in the world which is operating many countries of the world but has strong focus on the North America and Australia. The company offers copper, aluminium, gold, diamond, coal, iron and uranium as their main products to the exporting countries. Executive summery 2 Company background information 4 Industry background information 5 Porter five forces analysis 7 Threat from the new entrants in the market: 8 Suppliers Bargaining Power: 9 Buyers Bargaining Power: 10 Threat

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Rio tinto

1

1

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Executive summery

Rio Tinto is one of the largest mining companies in the world which is operating many

countries of the world but has strong focus on the North America and Australia. The

organisation is one of the blue chip companies in the ASX. The company offers copper,

aluminium, gold, diamond, coal, iron and uranium as their main products to the exporting

countries. The main focus of the company is on the iron ore sector. Australia is one of the

largest iron ore suppliers of the country. The slowdown of some of the emerging economy

especially China, has cause the price decrease in the commodity market. The current price

level of the commodity has improved from the down of 2016 but because of the sluggish

growth prospection of the exporting countries the mineral market sentiment in not up. The

strategic analyse shows that the threat of new entrant in the market is low as the industry is

highly capital intensive and the current economic scenario is not bright. Because of the large

size of Rio Tinto get a strong hold on the suppliers side but the buyer bargaining power is

moderate in the market as the company is focused on the specific buyers market and did not

diversified. The threat to substitution is low because of the basic requirements of the ores.

Because of the lower demand in the market the competition is very high in the market. Rio

Tinto now focusing on the 4 p strategy where it emphasises on the people, performance,

portfolio and partners. The organisation in the current situation can develop a new diversified

approach of Nickel mining as the main use of the product is in the stainless still and Rio Tinto

can export this to its current iron ore customer countries.

2

Rio Tinto is one of the largest mining companies in the world which is operating many

countries of the world but has strong focus on the North America and Australia. The

organisation is one of the blue chip companies in the ASX. The company offers copper,

aluminium, gold, diamond, coal, iron and uranium as their main products to the exporting

countries. The main focus of the company is on the iron ore sector. Australia is one of the

largest iron ore suppliers of the country. The slowdown of some of the emerging economy

especially China, has cause the price decrease in the commodity market. The current price

level of the commodity has improved from the down of 2016 but because of the sluggish

growth prospection of the exporting countries the mineral market sentiment in not up. The

strategic analyse shows that the threat of new entrant in the market is low as the industry is

highly capital intensive and the current economic scenario is not bright. Because of the large

size of Rio Tinto get a strong hold on the suppliers side but the buyer bargaining power is

moderate in the market as the company is focused on the specific buyers market and did not

diversified. The threat to substitution is low because of the basic requirements of the ores.

Because of the lower demand in the market the competition is very high in the market. Rio

Tinto now focusing on the 4 p strategy where it emphasises on the people, performance,

portfolio and partners. The organisation in the current situation can develop a new diversified

approach of Nickel mining as the main use of the product is in the stainless still and Rio Tinto

can export this to its current iron ore customer countries.

2

Table of Contents

Executive summery....................................................................................................................2

Company background information............................................................................................4

Industry background information...............................................................................................5

Porter five forces analysis......................................................................................................7

Threat from the new entrants in the market:..........................................................................8

Suppliers Bargaining Power:..................................................................................................9

Buyers Bargaining Power:...................................................................................................10

Threat of Alternative Products:............................................................................................11

Rivalry that exists among the different companies of the industry:.....................................12

Strategic history.......................................................................................................................12

Distinct features of business.................................................................................................12

Corporate strategy................................................................................................................13

Strategic future.........................................................................................................................15

Way to improve strategy making.........................................................................................15

New capability development for strategic advantage..........................................................15

References:...............................................................................................................................16

3

Executive summery....................................................................................................................2

Company background information............................................................................................4

Industry background information...............................................................................................5

Porter five forces analysis......................................................................................................7

Threat from the new entrants in the market:..........................................................................8

Suppliers Bargaining Power:..................................................................................................9

Buyers Bargaining Power:...................................................................................................10

Threat of Alternative Products:............................................................................................11

Rivalry that exists among the different companies of the industry:.....................................12

Strategic history.......................................................................................................................12

Distinct features of business.................................................................................................12

Corporate strategy................................................................................................................13

Strategic future.........................................................................................................................15

Way to improve strategy making.........................................................................................15

New capability development for strategic advantage..........................................................15

References:...............................................................................................................................16

3

Company background information

Rio Tinto is in the operation or last 150 years. The main approach that the business took in its

operation is continuous exploration, operation expansion and innovation. The business of Rio

Tinto is speared over many countries but main focus is on the North America and Australia.

In its total operation the organisation employs around 500000 employees (Riotinto, 2017).

The main products that are offered by the company are copper, aluminium, gold, diamond,

coal, iron and uranium.

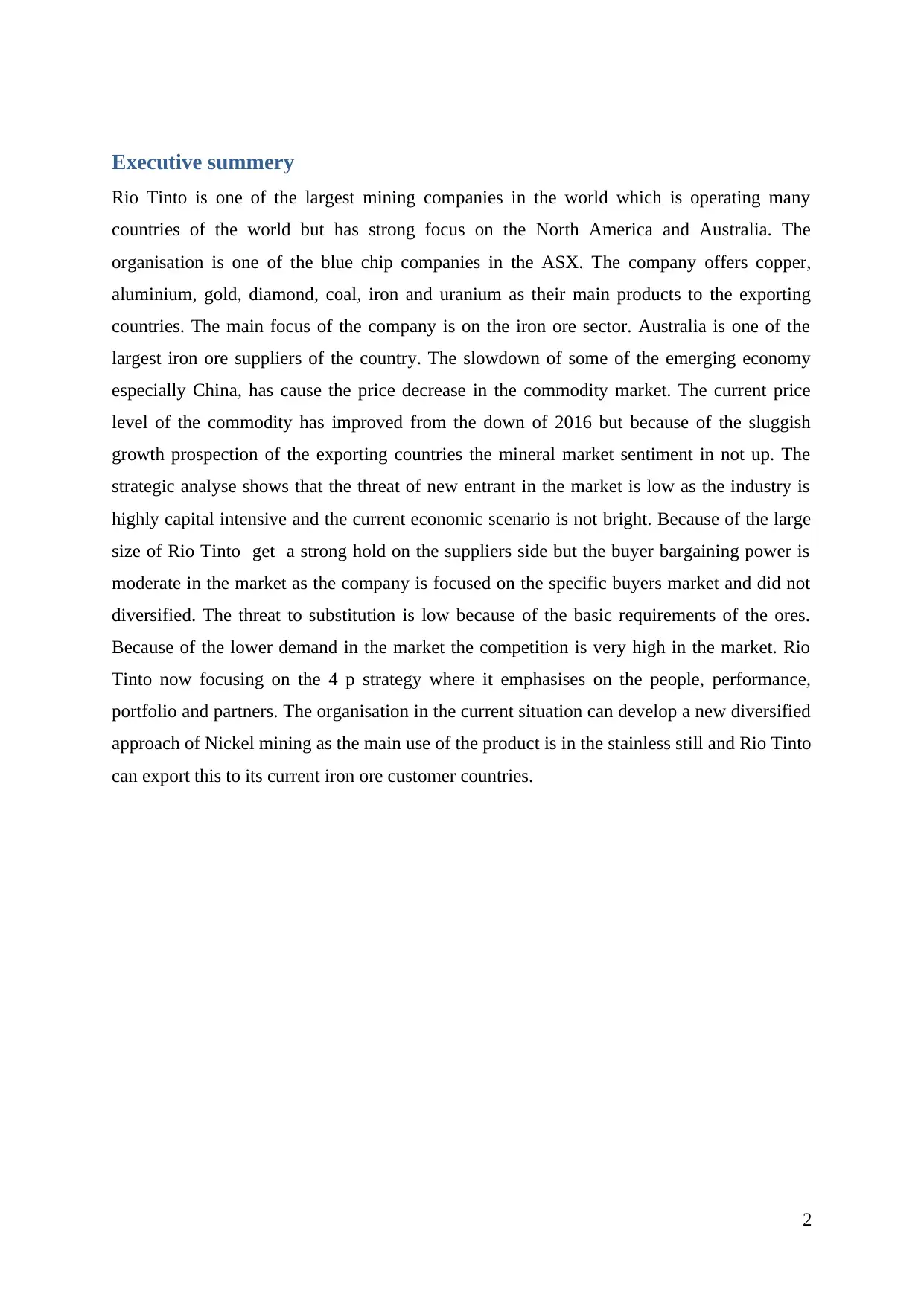

[Source: riotinto, 2016]

Main focus of the company from the above figures can be well understood in the Iron ore

section. Within this above portfolio the iron ore segment contributes around 41% of the

revenue. Second to that the main focus of the company is on the Aluminium segment of the

4

Rio Tinto is in the operation or last 150 years. The main approach that the business took in its

operation is continuous exploration, operation expansion and innovation. The business of Rio

Tinto is speared over many countries but main focus is on the North America and Australia.

In its total operation the organisation employs around 500000 employees (Riotinto, 2017).

The main products that are offered by the company are copper, aluminium, gold, diamond,

coal, iron and uranium.

[Source: riotinto, 2016]

Main focus of the company from the above figures can be well understood in the Iron ore

section. Within this above portfolio the iron ore segment contributes around 41% of the

revenue. Second to that the main focus of the company is on the Aluminium segment of the

4

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

mineral market (riotinto, 2016). The efficiency wise also the iron ore segment is most

profitable also for the company as shows by the EBITDA figures.

One of the main mottos of the company is to adopt the innovation process for the growth in

the business. For the better portfolio development of the business the innovation and growth

approach is applied. The innovation and new technology that are applied by the company was

awarded internationally. The ‘Mine Automation System (MAS) and RTVis’ that Rio Tinto

uses as mining technology in its operation got the gold medal from the Austmine (Riotinto,

2017). Austmine also recognised Rio Tinto as the industry leader in the ‘Miners Innovation

Award’.

Industry background information

The global mining industry has seen the worst year in the year 2015. The industry had seen

difficult situation in worldwide. The situation can be understood from the situation of top 40

mining company of the world. The report developed by PWC for the mining industry in the

year 2015 showed that for the first time these companies collectively shoed loss at the end of

the year. There were 37% reductions in the market capitalisation of these companies (PWC,

2016). The companies in this industry were debt ridden in that situation and because of that

they have to sales some of their assets. The economic situations were looking very

disappointing at that time and the companies were in cost cutting mood to reduce the loss

from the operation. The commodity price had seen a sharp 25% decline for YOY basis

(PWC, 2016). The drop in profitability had seen drop in price of the share of the companies.

Here the long term approach which is specially required for the mining companies were

missing at that time. But the strong focus of the companies on the cost cutting measures had

helped the companies to reduce the cost by around 17% on an average.

5

profitable also for the company as shows by the EBITDA figures.

One of the main mottos of the company is to adopt the innovation process for the growth in

the business. For the better portfolio development of the business the innovation and growth

approach is applied. The innovation and new technology that are applied by the company was

awarded internationally. The ‘Mine Automation System (MAS) and RTVis’ that Rio Tinto

uses as mining technology in its operation got the gold medal from the Austmine (Riotinto,

2017). Austmine also recognised Rio Tinto as the industry leader in the ‘Miners Innovation

Award’.

Industry background information

The global mining industry has seen the worst year in the year 2015. The industry had seen

difficult situation in worldwide. The situation can be understood from the situation of top 40

mining company of the world. The report developed by PWC for the mining industry in the

year 2015 showed that for the first time these companies collectively shoed loss at the end of

the year. There were 37% reductions in the market capitalisation of these companies (PWC,

2016). The companies in this industry were debt ridden in that situation and because of that

they have to sales some of their assets. The economic situations were looking very

disappointing at that time and the companies were in cost cutting mood to reduce the loss

from the operation. The commodity price had seen a sharp 25% decline for YOY basis

(PWC, 2016). The drop in profitability had seen drop in price of the share of the companies.

Here the long term approach which is specially required for the mining companies were

missing at that time. But the strong focus of the companies on the cost cutting measures had

helped the companies to reduce the cost by around 17% on an average.

5

[Source: Imf, 2017]

[Source: Tradingeconomics, 2017]

6

[Source: Tradingeconomics, 2017]

6

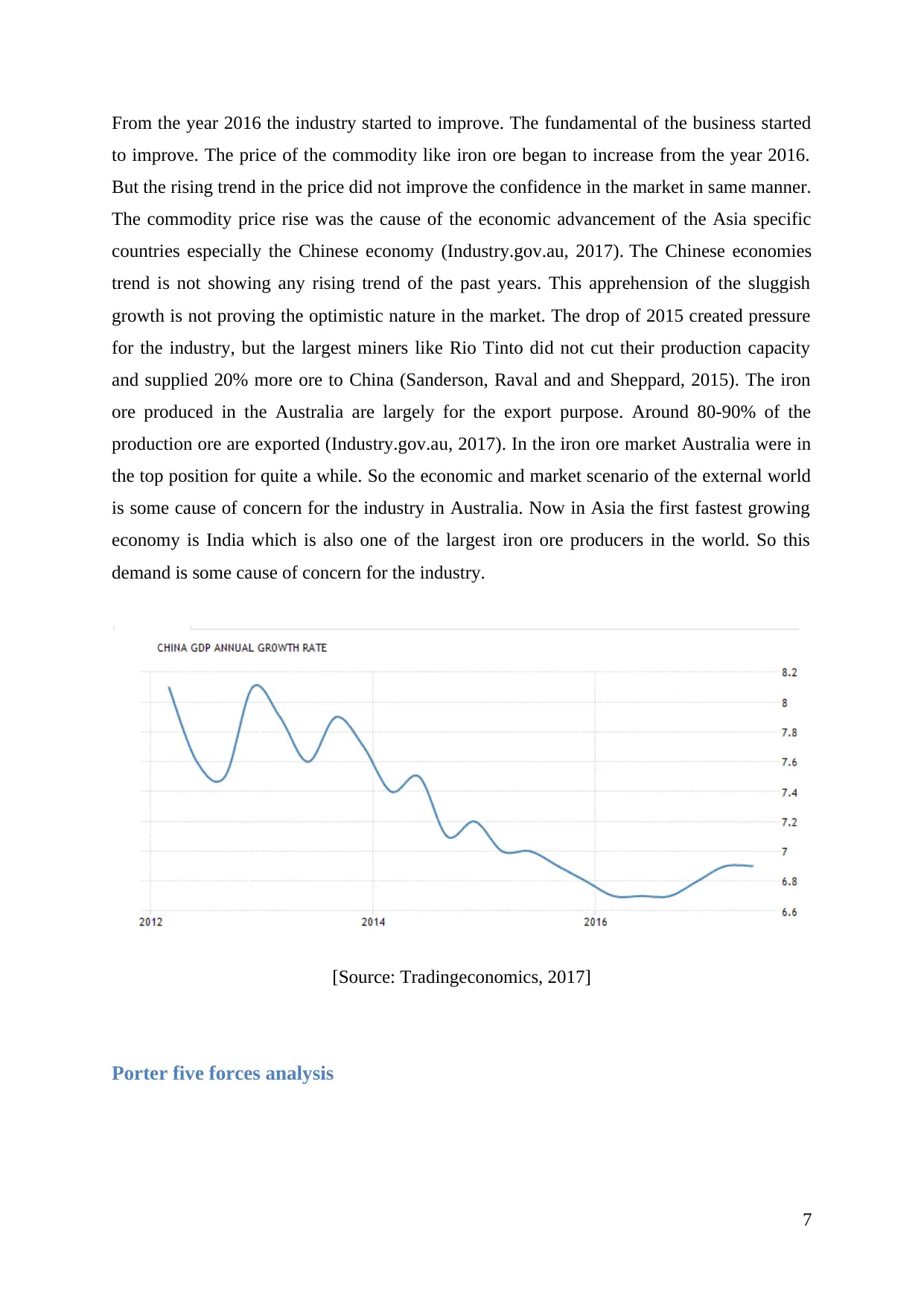

From the year 2016 the industry started to improve. The fundamental of the business started

to improve. The price of the commodity like iron ore began to increase from the year 2016.

But the rising trend in the price did not improve the confidence in the market in same manner.

The commodity price rise was the cause of the economic advancement of the Asia specific

countries especially the Chinese economy (Industry.gov.au, 2017). The Chinese economies

trend is not showing any rising trend of the past years. This apprehension of the sluggish

growth is not proving the optimistic nature in the market. The drop of 2015 created pressure

for the industry, but the largest miners like Rio Tinto did not cut their production capacity

and supplied 20% more ore to China (Sanderson, Raval and and Sheppard, 2015). The iron

ore produced in the Australia are largely for the export purpose. Around 80-90% of the

production ore are exported (Industry.gov.au, 2017). In the iron ore market Australia were in

the top position for quite a while. So the economic and market scenario of the external world

is some cause of concern for the industry in Australia. Now in Asia the first fastest growing

economy is India which is also one of the largest iron ore producers in the world. So this

demand is some cause of concern for the industry.

[Source: Tradingeconomics, 2017]

Porter five forces analysis

7

to improve. The price of the commodity like iron ore began to increase from the year 2016.

But the rising trend in the price did not improve the confidence in the market in same manner.

The commodity price rise was the cause of the economic advancement of the Asia specific

countries especially the Chinese economy (Industry.gov.au, 2017). The Chinese economies

trend is not showing any rising trend of the past years. This apprehension of the sluggish

growth is not proving the optimistic nature in the market. The drop of 2015 created pressure

for the industry, but the largest miners like Rio Tinto did not cut their production capacity

and supplied 20% more ore to China (Sanderson, Raval and and Sheppard, 2015). The iron

ore produced in the Australia are largely for the export purpose. Around 80-90% of the

production ore are exported (Industry.gov.au, 2017). In the iron ore market Australia were in

the top position for quite a while. So the economic and market scenario of the external world

is some cause of concern for the industry in Australia. Now in Asia the first fastest growing

economy is India which is also one of the largest iron ore producers in the world. So this

demand is some cause of concern for the industry.

[Source: Tradingeconomics, 2017]

Porter five forces analysis

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

With the help of the Porter’s five Forces, there are several factors that can be analyzed.

Porter’s five Forces help us to understand about the bargaining power of the supplies as well

as the customers. Additionally, it helps us to analyze whether there are any threats from the

substitute products or threat that can be faced from the new entrants in the industry (Eva, et

al., 2014). Lastly, five forces analysis helps to understand the rivalry that exists among the

companies that are there in the market.

Threat from the new entrants in the market:

The new entrants in the market are the ones who join the market recently or the business that

have been established in the same industry very recently (Fleisher et al., 2015). There are a

variety of challenges that can be faced by the companies form the new entrants as they can

take a part of the market share of the companies that are older in the market if they are

successful in establishing their business properly.

Rio Tinto faces a lot of challenges from the new entrants but as compared to the other factors,

the threats of new entrants in the market are very low for the company (PwC, 2017). As Rio

Tinto is in the business since a long time, it doesn’t face a survival challenge from the new

entrants, but there are a few challenges that the other recent mining companies bring in for

them. Some of the challenges faced by Rio Tinto are the pricing strategy that is followed by

the new entrants. Some of the new entrants like Iron Road Ltd., Ironbark Zinc, Fortescue

Metal Group, which were founded between the year 2002-2008, lowers the prices of their

products in the market and thus competes Rio Tinto and this can be viewed as a threat for

companies like Rio Tinto as the customers can shift their attention towards the lowered priced

items provided by new entrants (Ivanova, 2014). The pricing strategy that is followed by

these new entrants is competitive pricing with the help of which they provide the products to

the customers at a very low price and thus compete the companies like Rio Tinto and BHP

who are the leaders in the mining industry. The new entrants also bring in new schemes in

order to provide more value to the customers which can also be viewed as a threat for Rio

Tinto. When the customers are provided with more value by an organization, the satisfaction

level of them increases as well as the loyalty also increase which can pose a threat for Rio

Tinto.

There are some ways which Rio Tinto have taken in order to tackle the threat of new entrants

and some of them have been mentioned below:

Innovation:

8

Porter’s five Forces help us to understand about the bargaining power of the supplies as well

as the customers. Additionally, it helps us to analyze whether there are any threats from the

substitute products or threat that can be faced from the new entrants in the industry (Eva, et

al., 2014). Lastly, five forces analysis helps to understand the rivalry that exists among the

companies that are there in the market.

Threat from the new entrants in the market:

The new entrants in the market are the ones who join the market recently or the business that

have been established in the same industry very recently (Fleisher et al., 2015). There are a

variety of challenges that can be faced by the companies form the new entrants as they can

take a part of the market share of the companies that are older in the market if they are

successful in establishing their business properly.

Rio Tinto faces a lot of challenges from the new entrants but as compared to the other factors,

the threats of new entrants in the market are very low for the company (PwC, 2017). As Rio

Tinto is in the business since a long time, it doesn’t face a survival challenge from the new

entrants, but there are a few challenges that the other recent mining companies bring in for

them. Some of the challenges faced by Rio Tinto are the pricing strategy that is followed by

the new entrants. Some of the new entrants like Iron Road Ltd., Ironbark Zinc, Fortescue

Metal Group, which were founded between the year 2002-2008, lowers the prices of their

products in the market and thus competes Rio Tinto and this can be viewed as a threat for

companies like Rio Tinto as the customers can shift their attention towards the lowered priced

items provided by new entrants (Ivanova, 2014). The pricing strategy that is followed by

these new entrants is competitive pricing with the help of which they provide the products to

the customers at a very low price and thus compete the companies like Rio Tinto and BHP

who are the leaders in the mining industry. The new entrants also bring in new schemes in

order to provide more value to the customers which can also be viewed as a threat for Rio

Tinto. When the customers are provided with more value by an organization, the satisfaction

level of them increases as well as the loyalty also increase which can pose a threat for Rio

Tinto.

There are some ways which Rio Tinto have taken in order to tackle the threat of new entrants

and some of them have been mentioned below:

Innovation:

8

Innovation of the products is the factor with the help of which Rio Tinto brings in new

products for the customers and it helps the company to capture new customers in the market

and also provides a reason for the old customers to buy product from the company (Walsh,

2014). Silverglass is among the newest products of the company.

Lowering Fixed Cost:

With the help of building of economies of scale, Rio Tinto lowers the fixed cost of the

products per unit in the market which helps them to provide the customers with the products

that are less in price and thus keeping the customers satisfied.

Research and Development:

With the help of research and development, Rio Tinto is entering into an industry which is

more dynamic in nature where the new entrants might think twice before entering. With the

help of research and development investment, there is no super profit that Rio Tinto earns

from the business and thus the new entrants are discouraged to make an entry into the mining

industry (Walsh, 2014).

Suppliers Bargaining Power:

The suppliers bargaining power is the factor with the help of which the suppliers that supplies

raw materials to the firms can bargain with the business (Hamilton et al., 2015). There are a

number of suppliers that supplies their raw materials to Rio Tinto and as the suppliers are in a

good market position in the market they can demand a higher amount fees from Rio Tinto in

order to supply raw materials which can decrease the level of profit of the company. The

suppliers that supply raw materials to Rio Tinto are powerful in the market and among the top

three suppliers (Bellis, 2016). Thus they demand a higher price from the company in order to

supply raw material to them which lowers the rate of revenue of Rio Tinto.

Some steps that are taken by Rio Tinto in order to curb down the high bargaining power of

the suppliers have been cited below:

Multiple Suppliers:

In order to curb down the bargaining power of the suppliers, there is an efficient supply chain

that have been created by Rio Tinto where there are many suppliers. This helps them to take

the products from another supplier when one supplier demands high rate of the raw materials.

9

products for the customers and it helps the company to capture new customers in the market

and also provides a reason for the old customers to buy product from the company (Walsh,

2014). Silverglass is among the newest products of the company.

Lowering Fixed Cost:

With the help of building of economies of scale, Rio Tinto lowers the fixed cost of the

products per unit in the market which helps them to provide the customers with the products

that are less in price and thus keeping the customers satisfied.

Research and Development:

With the help of research and development, Rio Tinto is entering into an industry which is

more dynamic in nature where the new entrants might think twice before entering. With the

help of research and development investment, there is no super profit that Rio Tinto earns

from the business and thus the new entrants are discouraged to make an entry into the mining

industry (Walsh, 2014).

Suppliers Bargaining Power:

The suppliers bargaining power is the factor with the help of which the suppliers that supplies

raw materials to the firms can bargain with the business (Hamilton et al., 2015). There are a

number of suppliers that supplies their raw materials to Rio Tinto and as the suppliers are in a

good market position in the market they can demand a higher amount fees from Rio Tinto in

order to supply raw materials which can decrease the level of profit of the company. The

suppliers that supply raw materials to Rio Tinto are powerful in the market and among the top

three suppliers (Bellis, 2016). Thus they demand a higher price from the company in order to

supply raw material to them which lowers the rate of revenue of Rio Tinto.

Some steps that are taken by Rio Tinto in order to curb down the high bargaining power of

the suppliers have been cited below:

Multiple Suppliers:

In order to curb down the bargaining power of the suppliers, there is an efficient supply chain

that have been created by Rio Tinto where there are many suppliers. This helps them to take

the products from another supplier when one supplier demands high rate of the raw materials.

9

Experimenting:

With the help of experimentation, Rio Tinto lowers the price of their production and thus also

keeps their suppliers in control. When the price of one raw material is high in the market,

then Rio Tinto create experimental products with the help of using other raw materials which

is low in price (Ellem, 2014).

Development of dedicated suppliers:

Rio Tinto also focuses upon creating a supply chain that contains of trusted suppliers and

they charge reasonable amount of money from Rio Tinto. This is due to the fact that the

business of those suppliers depends upon Rio Tinto. Also Rio Tinto can follow the strategy of

Nike and Wal-Mart who use third party producers in order to run their business and it

provides them an edge over the competitors as there is no bargaining that is required.

Buyers Bargaining Power:

The bargaining power of the buyers is the factor with the help of which the buyers are able to

bargain for better quality of products form the business with least amount of money payable

for the products. The buyers of raw materials are the ones who demand a lot from Rio Tinto

and in terms of quality of the product and also wants to buy the products at a lower price. In

long run, these things put pressure upon Rio Tinto (Bailey et al., 2017). As the customer base

of Rio Tinto is huge in the market the bargaining power of the customers is very low. This is

due to the fact that when the customers bargain for discount or lower prices, the business

does not sale their products to those customers as there is a huge customers base and the

company is sure that some customers will buy the products at the price fixed by Rio Tinto.

Some measures taken by Rio Tinto to control the bargaining power of the customers are

mentioned below:

Building up of a huge customer base:

In order to control the bargaining power of the customers in the market, Rio Tinto has created

a huge base of customers in the market which helps them to keep the bargaining power of the

customers at the lowest level.

Innovation:

10

With the help of experimentation, Rio Tinto lowers the price of their production and thus also

keeps their suppliers in control. When the price of one raw material is high in the market,

then Rio Tinto create experimental products with the help of using other raw materials which

is low in price (Ellem, 2014).

Development of dedicated suppliers:

Rio Tinto also focuses upon creating a supply chain that contains of trusted suppliers and

they charge reasonable amount of money from Rio Tinto. This is due to the fact that the

business of those suppliers depends upon Rio Tinto. Also Rio Tinto can follow the strategy of

Nike and Wal-Mart who use third party producers in order to run their business and it

provides them an edge over the competitors as there is no bargaining that is required.

Buyers Bargaining Power:

The bargaining power of the buyers is the factor with the help of which the buyers are able to

bargain for better quality of products form the business with least amount of money payable

for the products. The buyers of raw materials are the ones who demand a lot from Rio Tinto

and in terms of quality of the product and also wants to buy the products at a lower price. In

long run, these things put pressure upon Rio Tinto (Bailey et al., 2017). As the customer base

of Rio Tinto is huge in the market the bargaining power of the customers is very low. This is

due to the fact that when the customers bargain for discount or lower prices, the business

does not sale their products to those customers as there is a huge customers base and the

company is sure that some customers will buy the products at the price fixed by Rio Tinto.

Some measures taken by Rio Tinto to control the bargaining power of the customers are

mentioned below:

Building up of a huge customer base:

In order to control the bargaining power of the customers in the market, Rio Tinto has created

a huge base of customers in the market which helps them to keep the bargaining power of the

customers at the lowest level.

Innovation:

10

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Also innovation of the new products in the market can also keep the bargaining power of the

buyers at minimum due to the fact that the customer also understands that the company will

not be providing the new products at a discounted rate (Floris et al., 2013).

Defection of customers:

When the company comes up with new products it can also reduce the rate of customers

shifting towards the other businesses products and thus it can also lower the price of

bargaining of the customers.

Threat of Alternative Products:

The threat of alternative products is the factor when there are alternative products launched in

the market which can perform the functions of the previous products and have the ability to

replace the product. The profitability of the whole industry also suffers when there is a launch

of new product in the market which can replace the demand for the mining products

(Debaere, 2016). The threat of alternative products are low in the market as iron ore is

product which is unique in mining industry but steel and iron can be used with the help of

recycling of the products.

There are some steps that have been taken by Rio Tinto in order to diminish the threat of

alternative products in the market and it includes:

Service Orientation:

Rio Tinto has diversified their business from being only product oriented business to also

shifting the focus upon service industry and thus they have minimized the risk of alternative

products.

Increase cost of switching:

Increasing the cost of switching from one product to another alternative product can also

minimize the alternative product risks of Rio Tinto (Walsh, 2014).

Understanding:

Rio Tinto can also focus upon understanding the main requirements of the customers than

focusing upon the products than the customers are buying.

11

buyers at minimum due to the fact that the customer also understands that the company will

not be providing the new products at a discounted rate (Floris et al., 2013).

Defection of customers:

When the company comes up with new products it can also reduce the rate of customers

shifting towards the other businesses products and thus it can also lower the price of

bargaining of the customers.

Threat of Alternative Products:

The threat of alternative products is the factor when there are alternative products launched in

the market which can perform the functions of the previous products and have the ability to

replace the product. The profitability of the whole industry also suffers when there is a launch

of new product in the market which can replace the demand for the mining products

(Debaere, 2016). The threat of alternative products are low in the market as iron ore is

product which is unique in mining industry but steel and iron can be used with the help of

recycling of the products.

There are some steps that have been taken by Rio Tinto in order to diminish the threat of

alternative products in the market and it includes:

Service Orientation:

Rio Tinto has diversified their business from being only product oriented business to also

shifting the focus upon service industry and thus they have minimized the risk of alternative

products.

Increase cost of switching:

Increasing the cost of switching from one product to another alternative product can also

minimize the alternative product risks of Rio Tinto (Walsh, 2014).

Understanding:

Rio Tinto can also focus upon understanding the main requirements of the customers than

focusing upon the products than the customers are buying.

11

Rivalry that exists among the different companies of the industry:

The competitive rivalry is the factor which has the potential to drive down the prices of the

products and services of an industry, when there is fierce rivalry among the competitors of a

same industry, the companies’ tries to bring down the prices of their products in order to beat

the competitors and gain more customers from the industry. The mining industry companies

of Australia compete among each other in the Australian market and lower the prices of the

products in order to attract more customers (Brooks, 2015). But being ones of the oldest

players in the market, it is regardless to say that Rio Tinto enjoys a favourable position in

spite of their moderate prices of the products. That is the reason, the competition in the

market do not affect much the profitability of Rio Tinto.

There are some ways with the help of which Rio Tinto controls tackles the rivalry that exists

between the different mining firms in the market and they have been quoted below:

Sustainable Differentiation:

With the help of creation of sustainable differentiation of their products from that of the

competitors in the market, Rio Tinto have differenced themselves form that of the

competitors (Fonseca et al., 2014). For instance, the iron ore and wrought iron that is

extracted by Rio Tinto and sold in the market is of very high quality than that of their

competitors of the same industry.

Collaboration:

Rio Tinto also follows the strategy to collaborate with the competitors and tries to gain a huge

market share in the Australian market and they do not focus upon fighting with the

competitors to gain a small amount of market share.

Strategic history

Distinct features of business

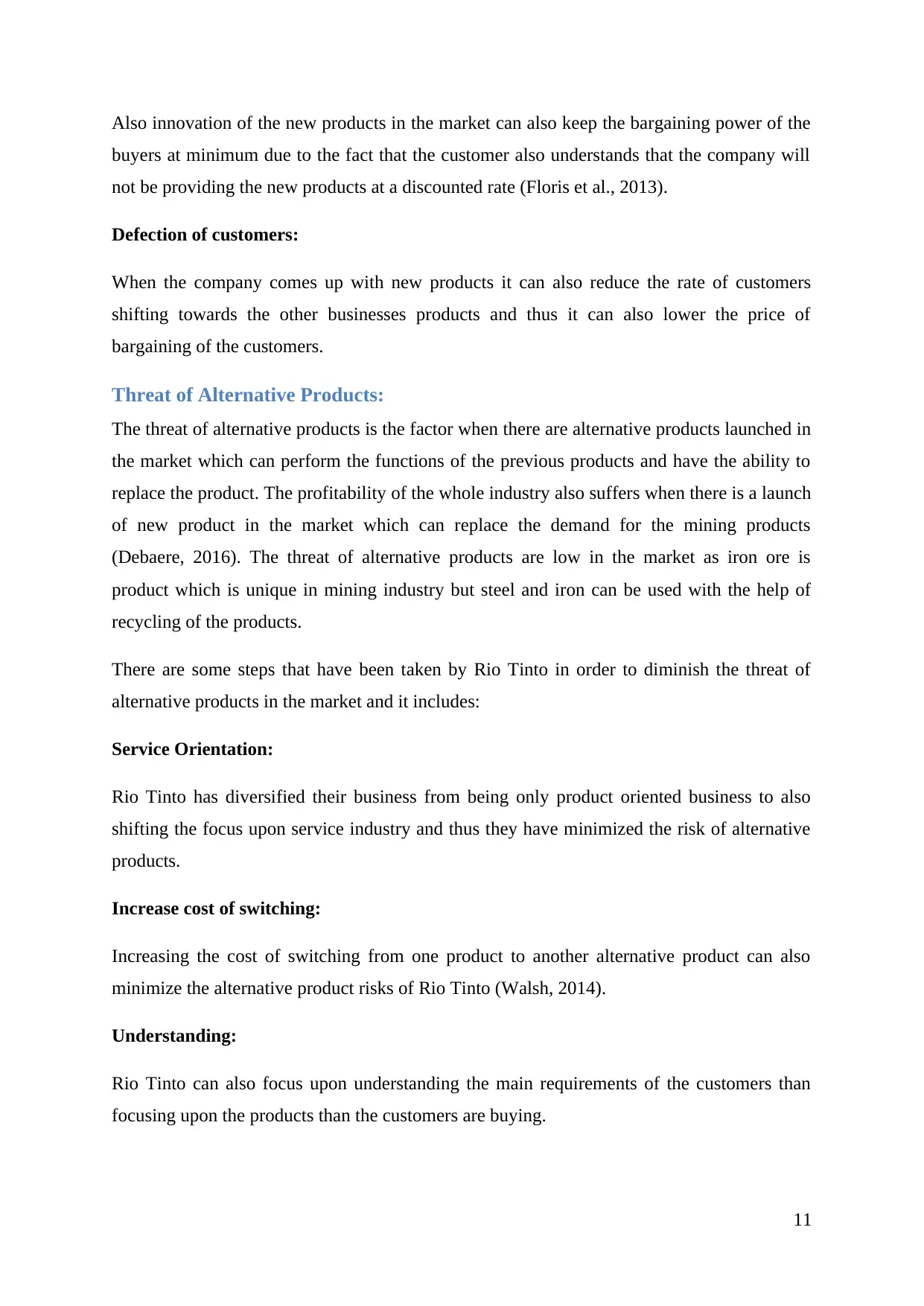

The main feature of the business is the value creation. The value creation approach in the

business is over and above the volume of the business. The company have some high class

assets around the world. In 2016 the business was able to cut cost in the operation of these

assets by around US$1.6 billion. This approach of greater value creation over the just volume

of production is one of the distinct features of the business of Rio Tinto. The business was

12

The competitive rivalry is the factor which has the potential to drive down the prices of the

products and services of an industry, when there is fierce rivalry among the competitors of a

same industry, the companies’ tries to bring down the prices of their products in order to beat

the competitors and gain more customers from the industry. The mining industry companies

of Australia compete among each other in the Australian market and lower the prices of the

products in order to attract more customers (Brooks, 2015). But being ones of the oldest

players in the market, it is regardless to say that Rio Tinto enjoys a favourable position in

spite of their moderate prices of the products. That is the reason, the competition in the

market do not affect much the profitability of Rio Tinto.

There are some ways with the help of which Rio Tinto controls tackles the rivalry that exists

between the different mining firms in the market and they have been quoted below:

Sustainable Differentiation:

With the help of creation of sustainable differentiation of their products from that of the

competitors in the market, Rio Tinto have differenced themselves form that of the

competitors (Fonseca et al., 2014). For instance, the iron ore and wrought iron that is

extracted by Rio Tinto and sold in the market is of very high quality than that of their

competitors of the same industry.

Collaboration:

Rio Tinto also follows the strategy to collaborate with the competitors and tries to gain a huge

market share in the Australian market and they do not focus upon fighting with the

competitors to gain a small amount of market share.

Strategic history

Distinct features of business

The main feature of the business is the value creation. The value creation approach in the

business is over and above the volume of the business. The company have some high class

assets around the world. In 2016 the business was able to cut cost in the operation of these

assets by around US$1.6 billion. This approach of greater value creation over the just volume

of production is one of the distinct features of the business of Rio Tinto. The business was

12

also been able to reduce its debt position in the year 2016 by US$4.2 billion to create more

value for the shareholders (riotinto, 2016). At the time of value delivery the company do not

focus only on the shareholder but also other stake holders like customers, employees,

communities, suppliers and the govt. In their operation the business uses their highest

capability to achieve operating excellence by properly utilising the quality asset that business

has been to acquire over the years. The capital allocation follows the cost cutting and the

productivity betterment approach to produce better profitability and growth for the

shareholders. Rio Tinto is in a capital intensive industry (Turban et al., 2008). Considering

that the balance sheet of the company is improved through reducing the debt level of the

business. The organisation currently has short and long term projects in the pipelines. The

business continuously revaluates the projects and maintains the capital discipline to promote

growth in the business.

[Source: riotinto, 2016]

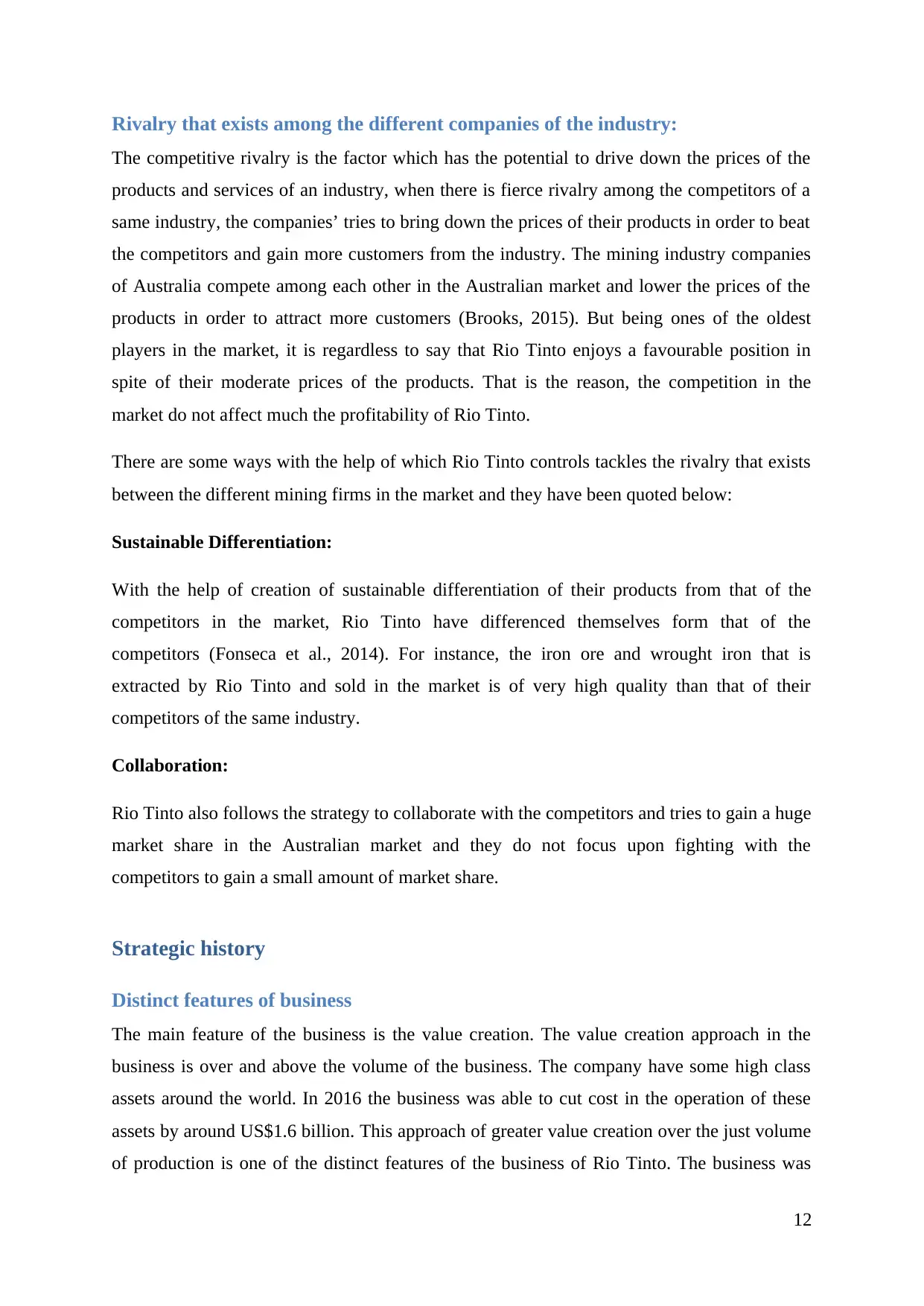

Corporate strategy

The organisation considers the current scenario of the international market and makes

strategy for the survival and expansion of the business. The main strategic approach of the

business to increase strength through strong balance sheet, asset quality worth world class

standard, and improvement in the operating excellence (Peng et al., 2008). The organisation

13

value for the shareholders (riotinto, 2016). At the time of value delivery the company do not

focus only on the shareholder but also other stake holders like customers, employees,

communities, suppliers and the govt. In their operation the business uses their highest

capability to achieve operating excellence by properly utilising the quality asset that business

has been to acquire over the years. The capital allocation follows the cost cutting and the

productivity betterment approach to produce better profitability and growth for the

shareholders. Rio Tinto is in a capital intensive industry (Turban et al., 2008). Considering

that the balance sheet of the company is improved through reducing the debt level of the

business. The organisation currently has short and long term projects in the pipelines. The

business continuously revaluates the projects and maintains the capital discipline to promote

growth in the business.

[Source: riotinto, 2016]

Corporate strategy

The organisation considers the current scenario of the international market and makes

strategy for the survival and expansion of the business. The main strategic approach of the

business to increase strength through strong balance sheet, asset quality worth world class

standard, and improvement in the operating excellence (Peng et al., 2008). The organisation

13

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

wants to maintain the discipline in the capital expenditure to produce greater cash flow into

the business. For the specific strategy the business has focused on their 4 ps in the business

operation.

Portfolio- in this first ‘P’ the business maintains world class quality of asset.

Performance- in this second ‘P’ oriented strategy of the business better performance of the

business is targeted through two different approaches (Riotinto, 2017). In one hand the

business wants to increase operating excellence and on the other hand the operational safety

is also given priority.

Partners- for the operating licence and smooth operation of the business, the organisation

wants to build long tern effective partnership with different stakeholder of the business.

People- for the better performance delivery the organisation recognise their employee’s

critical role ad that is why they give value to the capability increment of their people (Teece,

2010).

[Source: Riotinto, 2017]

14

the business. For the specific strategy the business has focused on their 4 ps in the business

operation.

Portfolio- in this first ‘P’ the business maintains world class quality of asset.

Performance- in this second ‘P’ oriented strategy of the business better performance of the

business is targeted through two different approaches (Riotinto, 2017). In one hand the

business wants to increase operating excellence and on the other hand the operational safety

is also given priority.

Partners- for the operating licence and smooth operation of the business, the organisation

wants to build long tern effective partnership with different stakeholder of the business.

People- for the better performance delivery the organisation recognise their employee’s

critical role ad that is why they give value to the capability increment of their people (Teece,

2010).

[Source: Riotinto, 2017]

14

Strategic future

Way to improve strategy making

Rio Tinto does the external market situation analysis along with the different internal

business variable analysis to come up with better strategy for the business. For long time this

approach has produces good result for the business. But in recent time the situation in the

world commodity market had shown some different picture. The demand of the mineral

especially the iron ore has come down because of the economic slowdown in the major iron

ore supplying market like China. So the business needs to meticulously evaluate the previous

success factor of the business and find hedging process at the time of crisis (Teece, 2010).

New capability development for strategic advantage

The above approach of strategic improvement implicates that the business has to improve the

process of diversification in the business. Currently the business is focused mainly on the iron

ore and somewhat of the Aluminium products. A well diversified products portfolio would

help the company to focus on different market for their revenue generation (Nath et al.,

2010). So when one market slows down the other market would help the company to

maintain the growth process. One of the diversified capabilities would be to go for the

production of Nickel. In the stainless steel production around 65% of the Nickel is consumed

(Hoatson et al., 2006). So the business could supply Nickel to the existing client of iron ore

of the company. Australia has good Nickel resource and would be beneficiation for the

company to develop this capability.

15

Way to improve strategy making

Rio Tinto does the external market situation analysis along with the different internal

business variable analysis to come up with better strategy for the business. For long time this

approach has produces good result for the business. But in recent time the situation in the

world commodity market had shown some different picture. The demand of the mineral

especially the iron ore has come down because of the economic slowdown in the major iron

ore supplying market like China. So the business needs to meticulously evaluate the previous

success factor of the business and find hedging process at the time of crisis (Teece, 2010).

New capability development for strategic advantage

The above approach of strategic improvement implicates that the business has to improve the

process of diversification in the business. Currently the business is focused mainly on the iron

ore and somewhat of the Aluminium products. A well diversified products portfolio would

help the company to focus on different market for their revenue generation (Nath et al.,

2010). So when one market slows down the other market would help the company to

maintain the growth process. One of the diversified capabilities would be to go for the

production of Nickel. In the stainless steel production around 65% of the Nickel is consumed

(Hoatson et al., 2006). So the business could supply Nickel to the existing client of iron ore

of the company. Australia has good Nickel resource and would be beneficiation for the

company to develop this capability.

15

References:

Bailey, J. and Jones, R., 2017. Rio Tinto Iron Ore-strategic channel optimisation and

management. Australasian Coasts & Ports 2017: Working with Nature, p.26.

Bellis, J.F., 2016. The iron ore production joint venture between Rio Tinto and BHP Billiton:

The European angle of a multinational antitrust review. In Emerging Issues in Sustainable

Development (pp. 221-243). Springer Japan.

Brooks, A., 2015. Strategic Analysis of an Electricity Deficit in British Columbia.

Debaere, P.M., 2016. Rio Tinto's Ore Mining: Making Hay from Water.

Ellem, B., 2014. A battle between titans? Rio Tinto and union recognition in Australia’s iron

ore industry. Economic and Industrial Democracy, 35(1), pp.185-200.

Eva, M., Hindle, K., Paul, D., Rollaston, C. and Tudor, D., 2014. Business analysis. BCS.

Fleisher, C.S. and Bensoussan, B.E., 2015. Business and competitive analysis: effective

application of new and classic methods. FT Press.

Floris, M., Grant, D. and Cutcher, L., 2013. Mining the discourse: Strategizing during BHP

Billiton's attempted acquisition of Rio Tinto. Journal of Management Studies, 50(7), pp.1185-

1215.

Fonseca, A., McAllister, M.L. and Fitzpatrick, P., 2014. Sustainability reporting among

mining corporations: a constructive critique of the GRI approach. Journal of Cleaner

Production, 84, pp.70-83.

Hamilton, L. and Webster, P., 2015. The international business environment. Oxford

University Press, USA.

Hoatson, D. M., Jaireth, S., and Jaques, A. L. (2006). Nickel sulfide deposits in Australia:

Characteristics, resources, and potential. Ore Geology Reviews, 29(3), 177-241.

Imf. (2017). IMF Primary Commodity Prices. [online] Available at:

http://www.imf.org/external/np/res/commod/images/chart_lg.jpg [Accessed 6 Oct. 2017].

Industry.gov.au. (2017). Iron Ore. [online] Available at:

https://www.industry.gov.au/resource/Mining/AustralianMineralCommodities/Pages/

IronOre.aspx [Accessed 6 Oct. 2017].

16

Bailey, J. and Jones, R., 2017. Rio Tinto Iron Ore-strategic channel optimisation and

management. Australasian Coasts & Ports 2017: Working with Nature, p.26.

Bellis, J.F., 2016. The iron ore production joint venture between Rio Tinto and BHP Billiton:

The European angle of a multinational antitrust review. In Emerging Issues in Sustainable

Development (pp. 221-243). Springer Japan.

Brooks, A., 2015. Strategic Analysis of an Electricity Deficit in British Columbia.

Debaere, P.M., 2016. Rio Tinto's Ore Mining: Making Hay from Water.

Ellem, B., 2014. A battle between titans? Rio Tinto and union recognition in Australia’s iron

ore industry. Economic and Industrial Democracy, 35(1), pp.185-200.

Eva, M., Hindle, K., Paul, D., Rollaston, C. and Tudor, D., 2014. Business analysis. BCS.

Fleisher, C.S. and Bensoussan, B.E., 2015. Business and competitive analysis: effective

application of new and classic methods. FT Press.

Floris, M., Grant, D. and Cutcher, L., 2013. Mining the discourse: Strategizing during BHP

Billiton's attempted acquisition of Rio Tinto. Journal of Management Studies, 50(7), pp.1185-

1215.

Fonseca, A., McAllister, M.L. and Fitzpatrick, P., 2014. Sustainability reporting among

mining corporations: a constructive critique of the GRI approach. Journal of Cleaner

Production, 84, pp.70-83.

Hamilton, L. and Webster, P., 2015. The international business environment. Oxford

University Press, USA.

Hoatson, D. M., Jaireth, S., and Jaques, A. L. (2006). Nickel sulfide deposits in Australia:

Characteristics, resources, and potential. Ore Geology Reviews, 29(3), 177-241.

Imf. (2017). IMF Primary Commodity Prices. [online] Available at:

http://www.imf.org/external/np/res/commod/images/chart_lg.jpg [Accessed 6 Oct. 2017].

Industry.gov.au. (2017). Iron Ore. [online] Available at:

https://www.industry.gov.au/resource/Mining/AustralianMineralCommodities/Pages/

IronOre.aspx [Accessed 6 Oct. 2017].

16

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Ivanova, G., 2014. The mining industry in Queensland, Australia: Some regional

development issues. Resources Policy, 39, pp.101-114.

Kogel, J.E., Trivedi, N. and Herpfer, M.A., 2014. Measuring sustainable development in

industrial minerals mining. International Journal of Mining and Mineral Engineering, 5(1),

pp.4-18.

Nath, P., Nachiappan, S., and Ramanathan, R. (2010). The impact of marketing capability,

operations capability and diversification strategy on performance: A resource-based

view. Industrial Marketing Management, 39(2), 317-329.

Peng, M. W., Wang, D. Y., and Jiang, Y. (2008). An institution-based view of international

business strategy: A focus on emerging economies. Journal of international business

studies, 39(5), 920-936.

PWC. (2016). Mine 2016: Slower, lower, weaker...but not defeated. [online] Available at:

https://www.pwc.com.au/publicationtop 40 s/mine-2016.html [Accessed 6 Oct. 2017].

riotinto. (2016). 2016 Annual report. [online] Available at:

http://www.riotinto.com/documents/RT_2016_Annual_report.pdf [Accessed 6 Oct. 2017].

Riotinto. (2017). A strategy to survive and thrive. [online] Available at:

http://www.riotinto.com/ourcommitment/spotlight-18130_20512.aspx [Accessed 6 Oct.

2017].

Riotinto. (2017). Our business. [online] Available at: http://www.riotinto.com/our-business-

75.aspx [Accessed 6 Oct. 2017].

Riotinto. (2017). Rio Tinto wins ‘gold medal’ at awards for innovative mine technologies.

[online] Available at: http://www.riotinto.com/media/media-releases-237_22401.aspx

[Accessed 6 Oct. 2017].

Sanderson, H., Raval and, A. and Sheppard, D. (2015). Explainer: Why commodities have

crashed. [online] Ft. Available at: https://www.ft.com/content/459ef70a-4a43-11e5-b558-

8a9722977189 [Accessed 6 Oct. 2017].

Teece, D. J. (2010). Business models, business strategy and innovation. Long range

planning, 43(2), 172-194.

17

development issues. Resources Policy, 39, pp.101-114.

Kogel, J.E., Trivedi, N. and Herpfer, M.A., 2014. Measuring sustainable development in

industrial minerals mining. International Journal of Mining and Mineral Engineering, 5(1),

pp.4-18.

Nath, P., Nachiappan, S., and Ramanathan, R. (2010). The impact of marketing capability,

operations capability and diversification strategy on performance: A resource-based

view. Industrial Marketing Management, 39(2), 317-329.

Peng, M. W., Wang, D. Y., and Jiang, Y. (2008). An institution-based view of international

business strategy: A focus on emerging economies. Journal of international business

studies, 39(5), 920-936.

PWC. (2016). Mine 2016: Slower, lower, weaker...but not defeated. [online] Available at:

https://www.pwc.com.au/publicationtop 40 s/mine-2016.html [Accessed 6 Oct. 2017].

riotinto. (2016). 2016 Annual report. [online] Available at:

http://www.riotinto.com/documents/RT_2016_Annual_report.pdf [Accessed 6 Oct. 2017].

Riotinto. (2017). A strategy to survive and thrive. [online] Available at:

http://www.riotinto.com/ourcommitment/spotlight-18130_20512.aspx [Accessed 6 Oct.

2017].

Riotinto. (2017). Our business. [online] Available at: http://www.riotinto.com/our-business-

75.aspx [Accessed 6 Oct. 2017].

Riotinto. (2017). Rio Tinto wins ‘gold medal’ at awards for innovative mine technologies.

[online] Available at: http://www.riotinto.com/media/media-releases-237_22401.aspx

[Accessed 6 Oct. 2017].

Sanderson, H., Raval and, A. and Sheppard, D. (2015). Explainer: Why commodities have

crashed. [online] Ft. Available at: https://www.ft.com/content/459ef70a-4a43-11e5-b558-

8a9722977189 [Accessed 6 Oct. 2017].

Teece, D. J. (2010). Business models, business strategy and innovation. Long range

planning, 43(2), 172-194.

17

Tradingeconomics. (2017). China GDP annual growth rate. [online] Available at:

https://tradingeconomics.com/china/gdp-growth-annual [Accessed 6 Oct. 2017].

Tradingeconomics. (2017). Iron Ore | 2008-2017 | Data | Chart | Calendar | Forecast |

News. [online] Available at: https://tradingeconomics.com/commodity/iron-ore [Accessed 6

Oct. 2017].

Turban, E., Sharda, R., Aronson, J. E., and King, D. (2008). Business intelligence: A

managerial approach (pp. 58-59). Upper Saddle River, NJ: Pearson Prentice Hall.

Walsh, S., 2014. Leading Rio Tinto's focus on value delivery. AusIMM Bulletin, (2), p.30.

Walsh, S., 2014. Leading Rio Tinto's focus on value delivery. AusIMM Bulletin, (2), p.30.

18

https://tradingeconomics.com/china/gdp-growth-annual [Accessed 6 Oct. 2017].

Tradingeconomics. (2017). Iron Ore | 2008-2017 | Data | Chart | Calendar | Forecast |

News. [online] Available at: https://tradingeconomics.com/commodity/iron-ore [Accessed 6

Oct. 2017].

Turban, E., Sharda, R., Aronson, J. E., and King, D. (2008). Business intelligence: A

managerial approach (pp. 58-59). Upper Saddle River, NJ: Pearson Prentice Hall.

Walsh, S., 2014. Leading Rio Tinto's focus on value delivery. AusIMM Bulletin, (2), p.30.

Walsh, S., 2014. Leading Rio Tinto's focus on value delivery. AusIMM Bulletin, (2), p.30.

18

1 out of 18

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.