Financial Accounting Analysis of Rolls-Royce

VerifiedAdded on 2023/06/12

|7

|1260

|164

AI Summary

This article provides a financial accounting analysis of Rolls-Royce, including its major operations, strategies, objectives, and performance measurement. It also includes a year-wise and company-wise comparison to measure the performance.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Running head: FINANCIAL ACCOUNTING

Financial Accounting

Name of the Student

Name of the University

Author Note

Financial Accounting

Name of the Student

Name of the University

Author Note

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

1FINANCIAL ACCOUNTING

Table of Contents

Brief overview of the company..................................................................................................2

Major operations of the company..............................................................................................2

The strategy and objectives of the company..............................................................................2

Performance measurement.........................................................................................................4

The year wise and company wise comparison to measure the performance.............................4

Performance and operation analysis and current position of the company................................4

References..................................................................................................................................6

Table of Contents

Brief overview of the company..................................................................................................2

Major operations of the company..............................................................................................2

The strategy and objectives of the company..............................................................................2

Performance measurement.........................................................................................................4

The year wise and company wise comparison to measure the performance.............................4

Performance and operation analysis and current position of the company................................4

References..................................................................................................................................6

2FINANCIAL ACCOUNTING

Brief overview of the company

The chosen company for the analysis has been taken Rolls-Royce which is a

multinational public company is Britain. The company was established in theyear1904 and

deals with aircraft manufacturing. The world’s second-largest maker of aircraft engines

Rolls-Royce has major businesses in the energy sectors and marine propulsion. All of its

shares are tradable on other markets and London Stock Exchange. The headquarters are in

London and is constituent of FTSE 100 index. Aerospace business Rolls-Royce makes

military gas turbine engines for military, commercial, civil, and corporate aircraft clients

globally.

Major operations of the company

The Rolls-Royce pioneers utilizes cutting edge technology for delivering the cleanest,

safest and the most competitive to meet the needs of the people. Aerospace business of Rolls-

Royce makes commercial and military gas turbine engines for military, civil, and corporate

aircraft customers globally and holds 90% market share (King & Fitzgerald, 2016). The

company also engages in regional and corporate jets, turboprop aircraft and helicopters,

and manufacturing. Rolls-Royce also installs and constructs power generation systems this

can be said to be the most interesting operating of the company. Another interesting

component of the company is that its core gas turbine technology has created one of the

broadest product ranges of aero-engines in the world, with 50,000 engines in service with 500

airlines, 2,400 corporate and utility operators and more than 100 armed forces, powering

both fixed- and rotary-wing aircraft. The subsidiary company of Rolls Royce manufactures

and tests nuclear reactors for making submarines named Rolls-Royce Marine Power

Operations Ltd.

Brief overview of the company

The chosen company for the analysis has been taken Rolls-Royce which is a

multinational public company is Britain. The company was established in theyear1904 and

deals with aircraft manufacturing. The world’s second-largest maker of aircraft engines

Rolls-Royce has major businesses in the energy sectors and marine propulsion. All of its

shares are tradable on other markets and London Stock Exchange. The headquarters are in

London and is constituent of FTSE 100 index. Aerospace business Rolls-Royce makes

military gas turbine engines for military, commercial, civil, and corporate aircraft clients

globally.

Major operations of the company

The Rolls-Royce pioneers utilizes cutting edge technology for delivering the cleanest,

safest and the most competitive to meet the needs of the people. Aerospace business of Rolls-

Royce makes commercial and military gas turbine engines for military, civil, and corporate

aircraft customers globally and holds 90% market share (King & Fitzgerald, 2016). The

company also engages in regional and corporate jets, turboprop aircraft and helicopters,

and manufacturing. Rolls-Royce also installs and constructs power generation systems this

can be said to be the most interesting operating of the company. Another interesting

component of the company is that its core gas turbine technology has created one of the

broadest product ranges of aero-engines in the world, with 50,000 engines in service with 500

airlines, 2,400 corporate and utility operators and more than 100 armed forces, powering

both fixed- and rotary-wing aircraft. The subsidiary company of Rolls Royce manufactures

and tests nuclear reactors for making submarines named Rolls-Royce Marine Power

Operations Ltd.

3FINANCIAL ACCOUNTING

The strategy and objectives of the company

The main strategies of the Rolls Royce Holding includes the following:

Business transformation: The Rolls Royce’s continuous strategy involves

development of the business for generating substantial value for the various

stakeholders. The company is improving and implementing the operating system of

the business with the help of digitalization. This would enable them to create entirely

new techniques of engineering, manufacturing and serving the clients worldwide

(Elliott, Fanning & Peecher, 2016).

Electrification: The Company invests in new power solutions for a success in long-

term. The use of the thermo-mechanical engineering to produce state-of-the-art

electro-mechanical and hybrid power systems helps to innovate and develop rapidly.

At present Rolls Royce combines the engines in hybrid systems for trains, micro-grids

and ships.

Balanced portfolio: The Company seeks the new products and markets that bring

new capabilities and technologies, and generate synergies and scale. They invests to

manage the transition towards electrification and digitalization (Tricker & Tricker,

2015). For the purpose of risk mitigation the company develops the activities where

electrification is relevant such as micro-grids

Digitalization: The primary strategy of Rolls Royce is to make the business process

digital in order to generate new insights, new solutions and new opportunities. The

company digital solutions for better care of the customers.

The objectives of the company are:

Ultimate consumer satisfaction by providing technologies that would deliver safest

and the most efficient products.

The strategy and objectives of the company

The main strategies of the Rolls Royce Holding includes the following:

Business transformation: The Rolls Royce’s continuous strategy involves

development of the business for generating substantial value for the various

stakeholders. The company is improving and implementing the operating system of

the business with the help of digitalization. This would enable them to create entirely

new techniques of engineering, manufacturing and serving the clients worldwide

(Elliott, Fanning & Peecher, 2016).

Electrification: The Company invests in new power solutions for a success in long-

term. The use of the thermo-mechanical engineering to produce state-of-the-art

electro-mechanical and hybrid power systems helps to innovate and develop rapidly.

At present Rolls Royce combines the engines in hybrid systems for trains, micro-grids

and ships.

Balanced portfolio: The Company seeks the new products and markets that bring

new capabilities and technologies, and generate synergies and scale. They invests to

manage the transition towards electrification and digitalization (Tricker & Tricker,

2015). For the purpose of risk mitigation the company develops the activities where

electrification is relevant such as micro-grids

Digitalization: The primary strategy of Rolls Royce is to make the business process

digital in order to generate new insights, new solutions and new opportunities. The

company digital solutions for better care of the customers.

The objectives of the company are:

Ultimate consumer satisfaction by providing technologies that would deliver safest

and the most efficient products.

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

4FINANCIAL ACCOUNTING

To provide solutions to meet the various vital power needs of the globe and steenthen

the functions.

To achieve the global market and improve the cash flow generation

Cost reduction and disciplined capital allocation

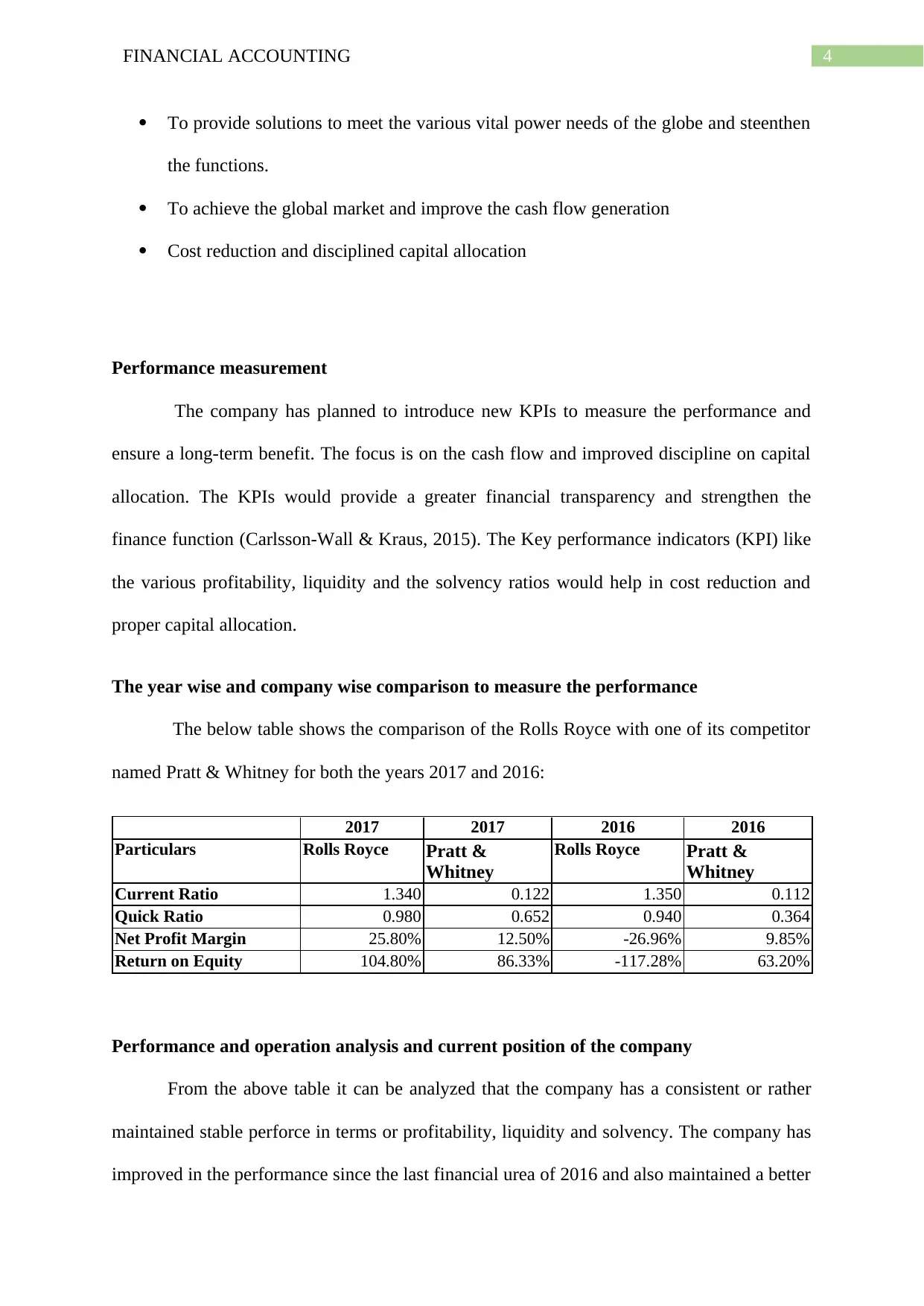

Performance measurement

The company has planned to introduce new KPIs to measure the performance and

ensure a long-term benefit. The focus is on the cash flow and improved discipline on capital

allocation. The KPIs would provide a greater financial transparency and strengthen the

finance function (Carlsson-Wall & Kraus, 2015). The Key performance indicators (KPI) like

the various profitability, liquidity and the solvency ratios would help in cost reduction and

proper capital allocation.

The year wise and company wise comparison to measure the performance

The below table shows the comparison of the Rolls Royce with one of its competitor

named Pratt & Whitney for both the years 2017 and 2016:

2017 2017 2016 2016

Particulars Rolls Royce Pratt &

Whitney

Rolls Royce Pratt &

Whitney

Current Ratio 1.340 0.122 1.350 0.112

Quick Ratio 0.980 0.652 0.940 0.364

Net Profit Margin 25.80% 12.50% -26.96% 9.85%

Return on Equity 104.80% 86.33% -117.28% 63.20%

Performance and operation analysis and current position of the company

From the above table it can be analyzed that the company has a consistent or rather

maintained stable perforce in terms or profitability, liquidity and solvency. The company has

improved in the performance since the last financial urea of 2016 and also maintained a better

To provide solutions to meet the various vital power needs of the globe and steenthen

the functions.

To achieve the global market and improve the cash flow generation

Cost reduction and disciplined capital allocation

Performance measurement

The company has planned to introduce new KPIs to measure the performance and

ensure a long-term benefit. The focus is on the cash flow and improved discipline on capital

allocation. The KPIs would provide a greater financial transparency and strengthen the

finance function (Carlsson-Wall & Kraus, 2015). The Key performance indicators (KPI) like

the various profitability, liquidity and the solvency ratios would help in cost reduction and

proper capital allocation.

The year wise and company wise comparison to measure the performance

The below table shows the comparison of the Rolls Royce with one of its competitor

named Pratt & Whitney for both the years 2017 and 2016:

2017 2017 2016 2016

Particulars Rolls Royce Pratt &

Whitney

Rolls Royce Pratt &

Whitney

Current Ratio 1.340 0.122 1.350 0.112

Quick Ratio 0.980 0.652 0.940 0.364

Net Profit Margin 25.80% 12.50% -26.96% 9.85%

Return on Equity 104.80% 86.33% -117.28% 63.20%

Performance and operation analysis and current position of the company

From the above table it can be analyzed that the company has a consistent or rather

maintained stable perforce in terms or profitability, liquidity and solvency. The company has

improved in the performance since the last financial urea of 2016 and also maintained a better

5FINANCIAL ACCOUNTING

performance than Pratt & Whitney. It can be said from the performance analysis that the

company has been able to meets its objectives of attaining a stable profitability and cash flow

generation (Reid, et. al., 2015). Rolls-Royce is the world’s second-largest maker of aircraft

engines and has major businesses in the energy sectors and marine propulsion (Ammar,

2017). The financial statement are formatted as per the requirement of GAAP by preparing

the Income statement, equity changes, balance sheet and statement of cash flow. The

company has been successful in meeting up the obligations and is developing continuously.

performance than Pratt & Whitney. It can be said from the performance analysis that the

company has been able to meets its objectives of attaining a stable profitability and cash flow

generation (Reid, et. al., 2015). Rolls-Royce is the world’s second-largest maker of aircraft

engines and has major businesses in the energy sectors and marine propulsion (Ammar,

2017). The financial statement are formatted as per the requirement of GAAP by preparing

the Income statement, equity changes, balance sheet and statement of cash flow. The

company has been successful in meeting up the obligations and is developing continuously.

6FINANCIAL ACCOUNTING

References

Ammar, S. (2017). Enterprise systems, business process management and UK-management

accounting practices: Cross-sectional case studies. Qualitative Research in

Accounting & Management, 14(3), 230-281.

Carlsson-Wall, M., & Kraus, K. (2015). Opening the black box of the role of accounting

practices in the fuzzy front-end of product innovation. Industrial Marketing

Management, 45, 184-194.

Elliott, W. B., Fanning, K., & Peecher, M. E. (2016). Do Investors Value Financial

Reporting Quality Beyond Estimated Fundamental Value? And, Can Better Audit

Reports Unlock This Value?. Working paper, University of Illinois at Urbana–

Champaign.

King, R., & Fitzgerald, L. (2016). 10. Challenges facing the accounting profession:

maintaining relevance in a changing environment. Perspectives on Contemporary

Professional Work: Challenges and Experiences, 187.

Reid, L. C., Carcello, J. V., Li, C., & Neal, T. L. (2015). Are auditor and audit committee

report changes useful to investors? Evidence from the United Kingdom.

Tricker, R. B., & Tricker, R. I. (2015). Corporate governance: Principles, policies, and

practices. Oxford University Press, USA.

References

Ammar, S. (2017). Enterprise systems, business process management and UK-management

accounting practices: Cross-sectional case studies. Qualitative Research in

Accounting & Management, 14(3), 230-281.

Carlsson-Wall, M., & Kraus, K. (2015). Opening the black box of the role of accounting

practices in the fuzzy front-end of product innovation. Industrial Marketing

Management, 45, 184-194.

Elliott, W. B., Fanning, K., & Peecher, M. E. (2016). Do Investors Value Financial

Reporting Quality Beyond Estimated Fundamental Value? And, Can Better Audit

Reports Unlock This Value?. Working paper, University of Illinois at Urbana–

Champaign.

King, R., & Fitzgerald, L. (2016). 10. Challenges facing the accounting profession:

maintaining relevance in a changing environment. Perspectives on Contemporary

Professional Work: Challenges and Experiences, 187.

Reid, L. C., Carcello, J. V., Li, C., & Neal, T. L. (2015). Are auditor and audit committee

report changes useful to investors? Evidence from the United Kingdom.

Tricker, R. B., & Tricker, R. I. (2015). Corporate governance: Principles, policies, and

practices. Oxford University Press, USA.

1 out of 7

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.