St George & Westpac Acquisition: Economic Rationale, Analysis, and Performance

VerifiedAdded on 2023/06/09

|17

|3971

|76

AI Summary

The case of St George & Westpac assists in highlighting the international corporate strategies together with the business models that facilitate stagnant growth. The major economic rationale behind the acquisition was that Westpac believed that the respective brands would be more capable in competing and flourishing by belonging to the same stronger and larger organization. The directors of St George believed that partnership with Westpac would fetch or create significant value for their shareholders by permitting them to benefit from a stronger base of resources whilst preserving their unique and unbreakable relationship with the customers across Australia. After the process of merger betwixt Westpac and St George, the merged company attained effective accounting performance.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

qwertyuiopasdfghjklzxcvbnmqw

ertyuiopasdfghjklzxcvbnmqwert

yuiopasdfghjklzxcvbnmqwertyu

iopasdfghjklzxcvbnmqwertyuio

pasdfghjklzxcvbnmqwertyuiopa

sdfghjklzxcvbnmqwertyuiopasd

fghjklzxcvbnmqwertyuiopasdfg

hjklzxcvbnmqwertyuiopasdfghj

klzxcvbnmqwertyuiopasdfghjklz

xcvbnmqwertyuiopasdfghjklzxc

vbnmqwertyuiopasdfghjklzxcvb

nmqwertyuiopasdfghjklzxcvbn

mqwertyuiopasdfghjklzxcvbnm

qwertyuiopasdfghjklzxcvbnmqw

ertyuiopasdfghjklzxcvbnmqwert

yuiopasdfghjklzxcvbnmqwertyu

iopasdfghjklzxcvbnmrtyuiopasd

fghjklzxcvbnmqwertyuiopasdfg

Corporate accounting

ertyuiopasdfghjklzxcvbnmqwert

yuiopasdfghjklzxcvbnmqwertyu

iopasdfghjklzxcvbnmqwertyuio

pasdfghjklzxcvbnmqwertyuiopa

sdfghjklzxcvbnmqwertyuiopasd

fghjklzxcvbnmqwertyuiopasdfg

hjklzxcvbnmqwertyuiopasdfghj

klzxcvbnmqwertyuiopasdfghjklz

xcvbnmqwertyuiopasdfghjklzxc

vbnmqwertyuiopasdfghjklzxcvb

nmqwertyuiopasdfghjklzxcvbn

mqwertyuiopasdfghjklzxcvbnm

qwertyuiopasdfghjklzxcvbnmqw

ertyuiopasdfghjklzxcvbnmqwert

yuiopasdfghjklzxcvbnmqwertyu

iopasdfghjklzxcvbnmrtyuiopasd

fghjklzxcvbnmqwertyuiopasdfg

Corporate accounting

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

St George & Westpac Acquisition

Executive summary

The case of St George & Westpac assists in highlighting the international corporate

strategies together with the business models that facilitates in stagnant growth. The main

reason of the acquisition lies in the fact that Westpac believed that the respective brands

would be more capable in competing and flourishing by belonging to the same stronger and

larger organization. Besides, the CSR measures adopted by the company ensure that there is a

friendly and fair environment for the society at large. In the previous years, the company’s

growth strategies in the form of technological measures, innovative products, etc allowed to

expand throughout the world. This means that both the organization were potent in their

approach and had a strong market capture that lead to powerful business. From the

acquisition it became crystal clear that the major objective is to strengthen the market further

and deliver a huge range of services to the customer and stakeholders.

2

Executive summary

The case of St George & Westpac assists in highlighting the international corporate

strategies together with the business models that facilitates in stagnant growth. The main

reason of the acquisition lies in the fact that Westpac believed that the respective brands

would be more capable in competing and flourishing by belonging to the same stronger and

larger organization. Besides, the CSR measures adopted by the company ensure that there is a

friendly and fair environment for the society at large. In the previous years, the company’s

growth strategies in the form of technological measures, innovative products, etc allowed to

expand throughout the world. This means that both the organization were potent in their

approach and had a strong market capture that lead to powerful business. From the

acquisition it became crystal clear that the major objective is to strengthen the market further

and deliver a huge range of services to the customer and stakeholders.

2

St George & Westpac Acquisition

Contents

Introduction...........................................................................................................................................3

Economic rationale behind the acquisition...........................................................................................4

Personal incentives to accept the offer.................................................................................................5

Acquisition method and analysis...........................................................................................................6

Post-acquisition accounting performance.............................................................................................8

Whether the deal was value enhancing for shareholders...................................................................11

Conclusion...........................................................................................................................................14

References...........................................................................................................................................15

3

Contents

Introduction...........................................................................................................................................3

Economic rationale behind the acquisition...........................................................................................4

Personal incentives to accept the offer.................................................................................................5

Acquisition method and analysis...........................................................................................................6

Post-acquisition accounting performance.............................................................................................8

Whether the deal was value enhancing for shareholders...................................................................11

Conclusion...........................................................................................................................................14

References...........................................................................................................................................15

3

St George & Westpac Acquisition

Introduction

In April 1817, Westpac began its trading as the primary bank of New South Wales. However,

in 1982, it got merged with the Commercial Bank of Australia and became Westpac Banking

Corporation. It has affiliates and branches throughout New Zealand and Australia,

contributed by mergers throughout prior years and the Pacific area, and significant financial

centres around the globe including Hongkong, Singapore, London, and New York. The bank

employs more than 29000 people around the world and pursues more than $402 billion assets

that allows it to create a huge base of customers. On the other hand, St George was a housing

based financial institution that was founded in 1937 and eventually it became the fifth largest

bank of Australia. It has business spanning of all segments of the financial industry that

includes institutional, retail banking, wealth management, and business banking. In business

culture, this bank focuses primarily on customer services (Alexandridis & Travlos, 2010). In

2008, Westpac acquired St George and both merged as a $66 billion group that became the

biggest home lending provider with a market share of twenty five percent and biggest wealth

platform provider having resources under administration of $108 billion. Overall, this merger

created Australia’s leading financial services company for the shareholders, customers, and

employees with an AA credit rating complimented by better fund accessibility and bigger

balance sheet (Alshwer et. al, 2011).

4

Introduction

In April 1817, Westpac began its trading as the primary bank of New South Wales. However,

in 1982, it got merged with the Commercial Bank of Australia and became Westpac Banking

Corporation. It has affiliates and branches throughout New Zealand and Australia,

contributed by mergers throughout prior years and the Pacific area, and significant financial

centres around the globe including Hongkong, Singapore, London, and New York. The bank

employs more than 29000 people around the world and pursues more than $402 billion assets

that allows it to create a huge base of customers. On the other hand, St George was a housing

based financial institution that was founded in 1937 and eventually it became the fifth largest

bank of Australia. It has business spanning of all segments of the financial industry that

includes institutional, retail banking, wealth management, and business banking. In business

culture, this bank focuses primarily on customer services (Alexandridis & Travlos, 2010). In

2008, Westpac acquired St George and both merged as a $66 billion group that became the

biggest home lending provider with a market share of twenty five percent and biggest wealth

platform provider having resources under administration of $108 billion. Overall, this merger

created Australia’s leading financial services company for the shareholders, customers, and

employees with an AA credit rating complimented by better fund accessibility and bigger

balance sheet (Alshwer et. al, 2011).

4

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

St George & Westpac Acquisition

Westpac St George merger

Economic rationale behind the acquisition

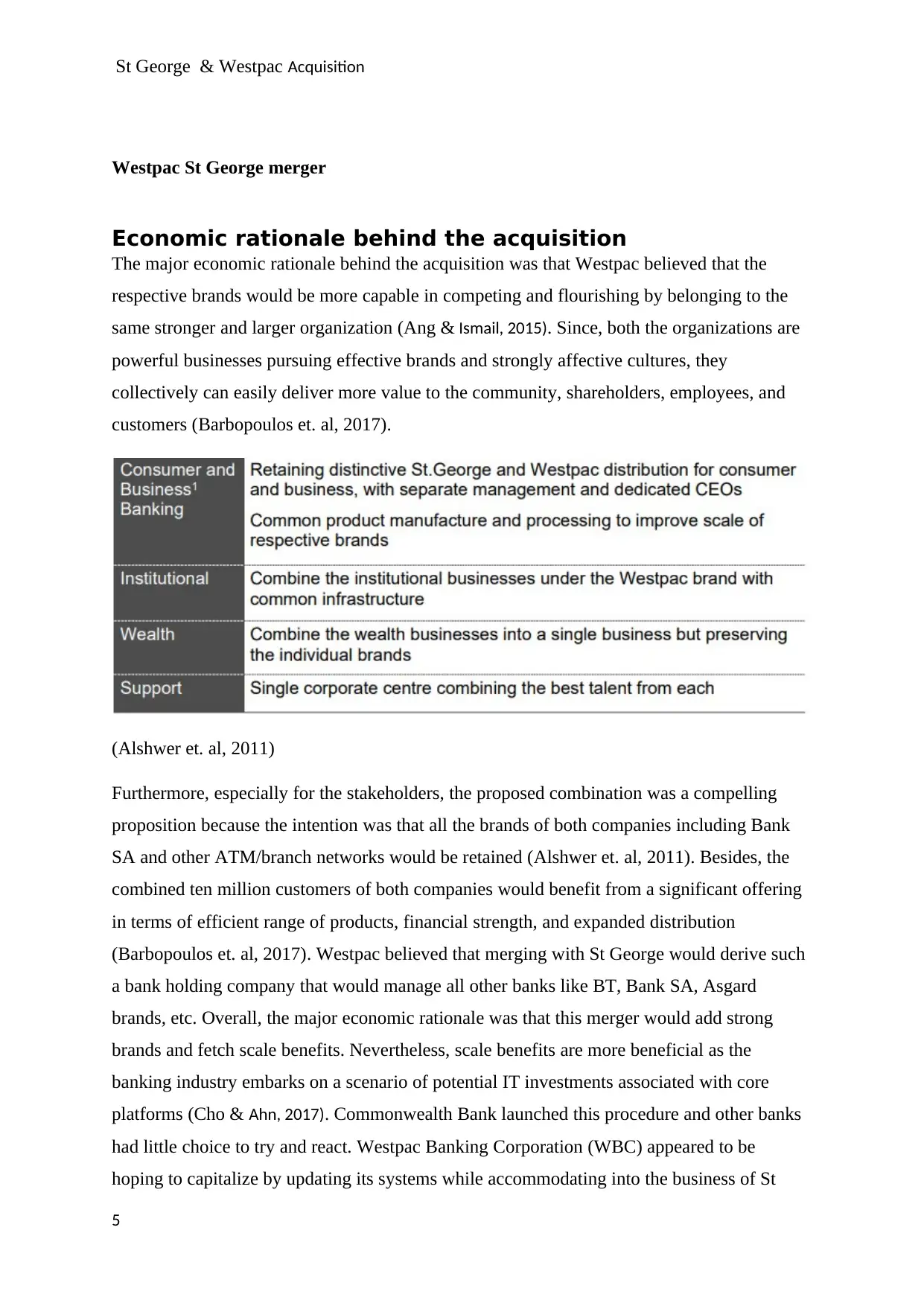

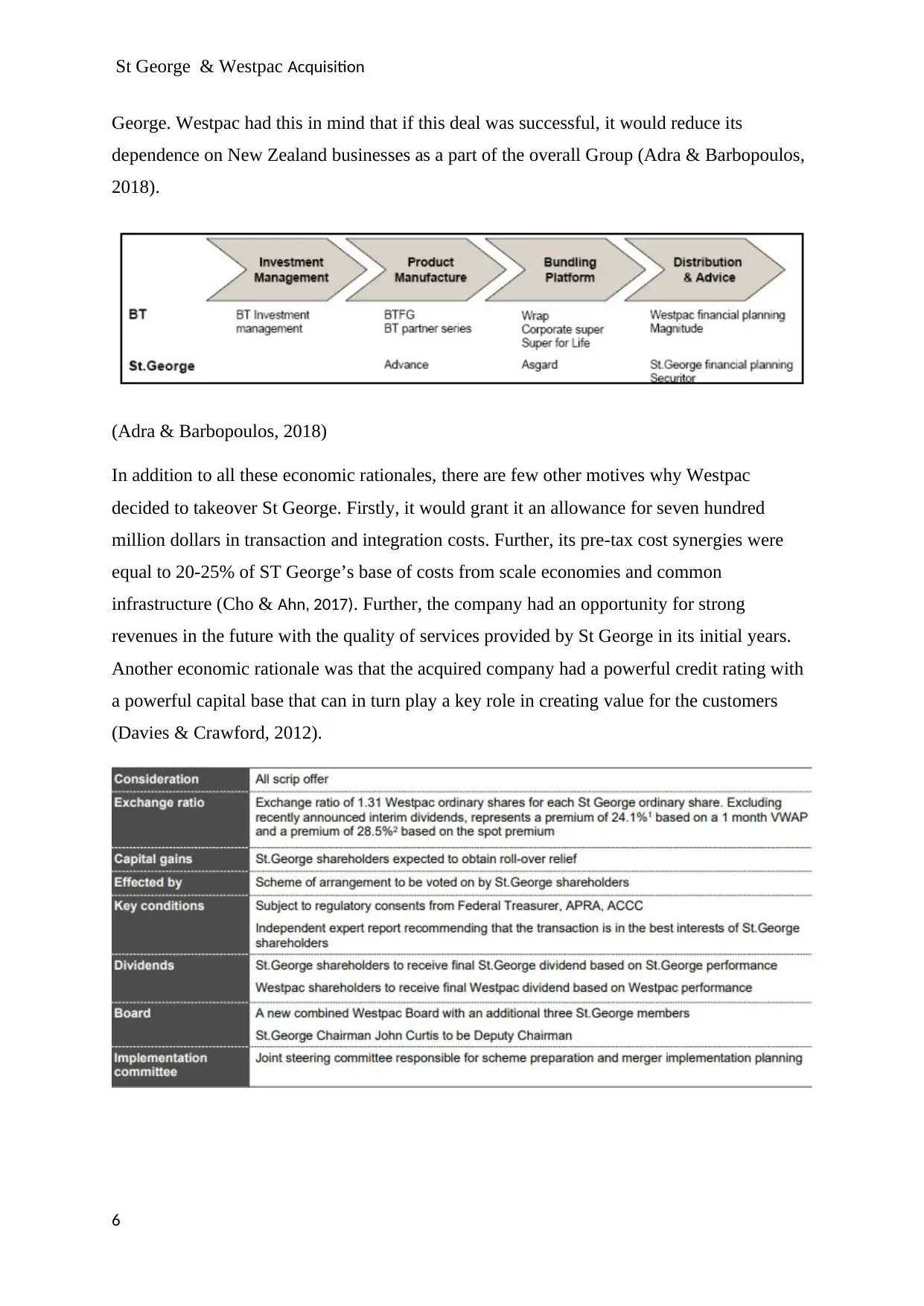

The major economic rationale behind the acquisition was that Westpac believed that the

respective brands would be more capable in competing and flourishing by belonging to the

same stronger and larger organization (Ang & Ismail, 2015). Since, both the organizations are

powerful businesses pursuing effective brands and strongly affective cultures, they

collectively can easily deliver more value to the community, shareholders, employees, and

customers (Barbopoulos et. al, 2017).

(Alshwer et. al, 2011)

Furthermore, especially for the stakeholders, the proposed combination was a compelling

proposition because the intention was that all the brands of both companies including Bank

SA and other ATM/branch networks would be retained (Alshwer et. al, 2011). Besides, the

combined ten million customers of both companies would benefit from a significant offering

in terms of efficient range of products, financial strength, and expanded distribution

(Barbopoulos et. al, 2017). Westpac believed that merging with St George would derive such

a bank holding company that would manage all other banks like BT, Bank SA, Asgard

brands, etc. Overall, the major economic rationale was that this merger would add strong

brands and fetch scale benefits. Nevertheless, scale benefits are more beneficial as the

banking industry embarks on a scenario of potential IT investments associated with core

platforms (Cho & Ahn, 2017). Commonwealth Bank launched this procedure and other banks

had little choice to try and react. Westpac Banking Corporation (WBC) appeared to be

hoping to capitalize by updating its systems while accommodating into the business of St

5

Westpac St George merger

Economic rationale behind the acquisition

The major economic rationale behind the acquisition was that Westpac believed that the

respective brands would be more capable in competing and flourishing by belonging to the

same stronger and larger organization (Ang & Ismail, 2015). Since, both the organizations are

powerful businesses pursuing effective brands and strongly affective cultures, they

collectively can easily deliver more value to the community, shareholders, employees, and

customers (Barbopoulos et. al, 2017).

(Alshwer et. al, 2011)

Furthermore, especially for the stakeholders, the proposed combination was a compelling

proposition because the intention was that all the brands of both companies including Bank

SA and other ATM/branch networks would be retained (Alshwer et. al, 2011). Besides, the

combined ten million customers of both companies would benefit from a significant offering

in terms of efficient range of products, financial strength, and expanded distribution

(Barbopoulos et. al, 2017). Westpac believed that merging with St George would derive such

a bank holding company that would manage all other banks like BT, Bank SA, Asgard

brands, etc. Overall, the major economic rationale was that this merger would add strong

brands and fetch scale benefits. Nevertheless, scale benefits are more beneficial as the

banking industry embarks on a scenario of potential IT investments associated with core

platforms (Cho & Ahn, 2017). Commonwealth Bank launched this procedure and other banks

had little choice to try and react. Westpac Banking Corporation (WBC) appeared to be

hoping to capitalize by updating its systems while accommodating into the business of St

5

St George & Westpac Acquisition

George. Westpac had this in mind that if this deal was successful, it would reduce its

dependence on New Zealand businesses as a part of the overall Group (Adra & Barbopoulos,

2018).

(Adra & Barbopoulos, 2018)

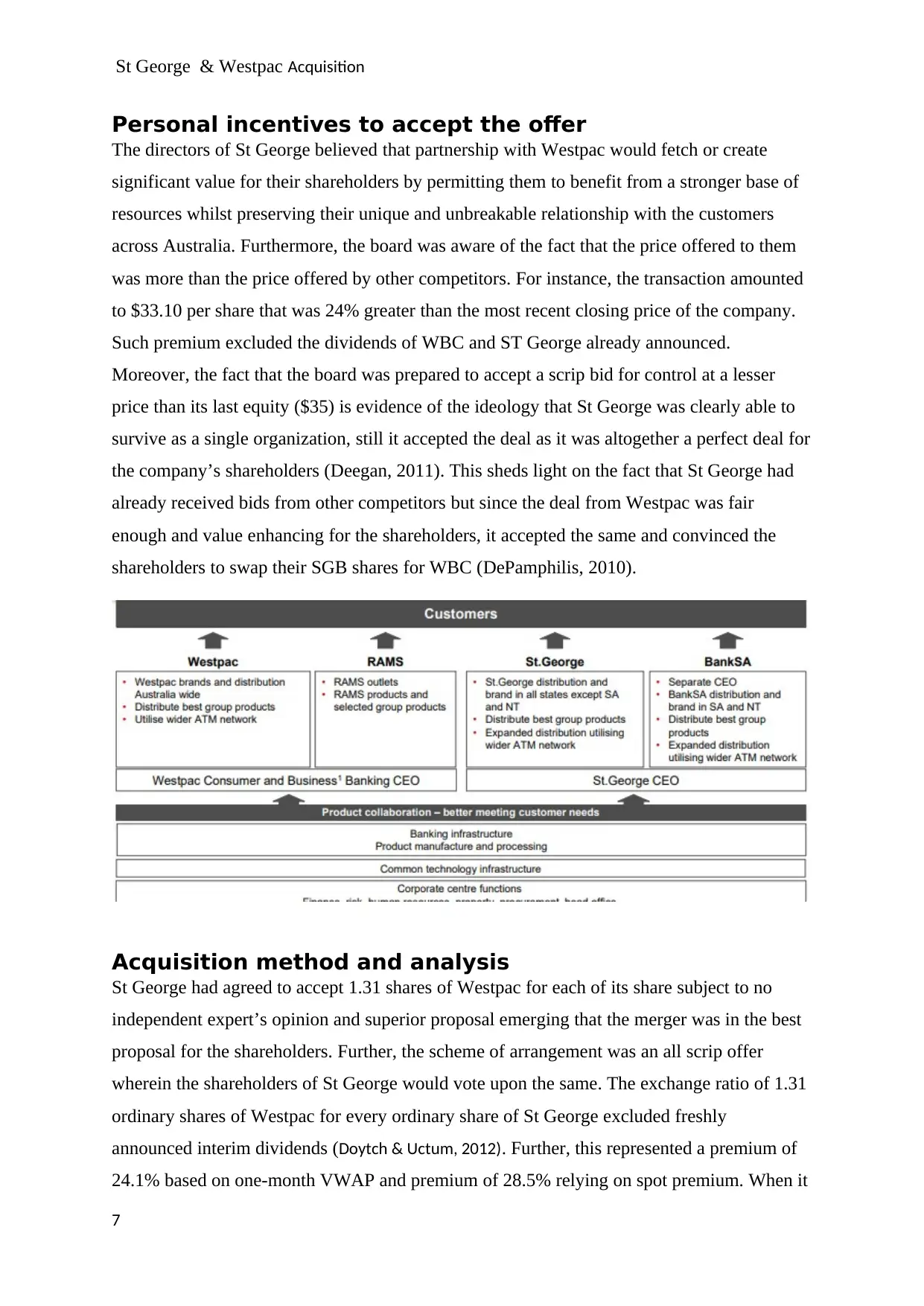

In addition to all these economic rationales, there are few other motives why Westpac

decided to takeover St George. Firstly, it would grant it an allowance for seven hundred

million dollars in transaction and integration costs. Further, its pre-tax cost synergies were

equal to 20-25% of ST George’s base of costs from scale economies and common

infrastructure (Cho & Ahn, 2017). Further, the company had an opportunity for strong

revenues in the future with the quality of services provided by St George in its initial years.

Another economic rationale was that the acquired company had a powerful credit rating with

a powerful capital base that can in turn play a key role in creating value for the customers

(Davies & Crawford, 2012).

6

George. Westpac had this in mind that if this deal was successful, it would reduce its

dependence on New Zealand businesses as a part of the overall Group (Adra & Barbopoulos,

2018).

(Adra & Barbopoulos, 2018)

In addition to all these economic rationales, there are few other motives why Westpac

decided to takeover St George. Firstly, it would grant it an allowance for seven hundred

million dollars in transaction and integration costs. Further, its pre-tax cost synergies were

equal to 20-25% of ST George’s base of costs from scale economies and common

infrastructure (Cho & Ahn, 2017). Further, the company had an opportunity for strong

revenues in the future with the quality of services provided by St George in its initial years.

Another economic rationale was that the acquired company had a powerful credit rating with

a powerful capital base that can in turn play a key role in creating value for the customers

(Davies & Crawford, 2012).

6

St George & Westpac Acquisition

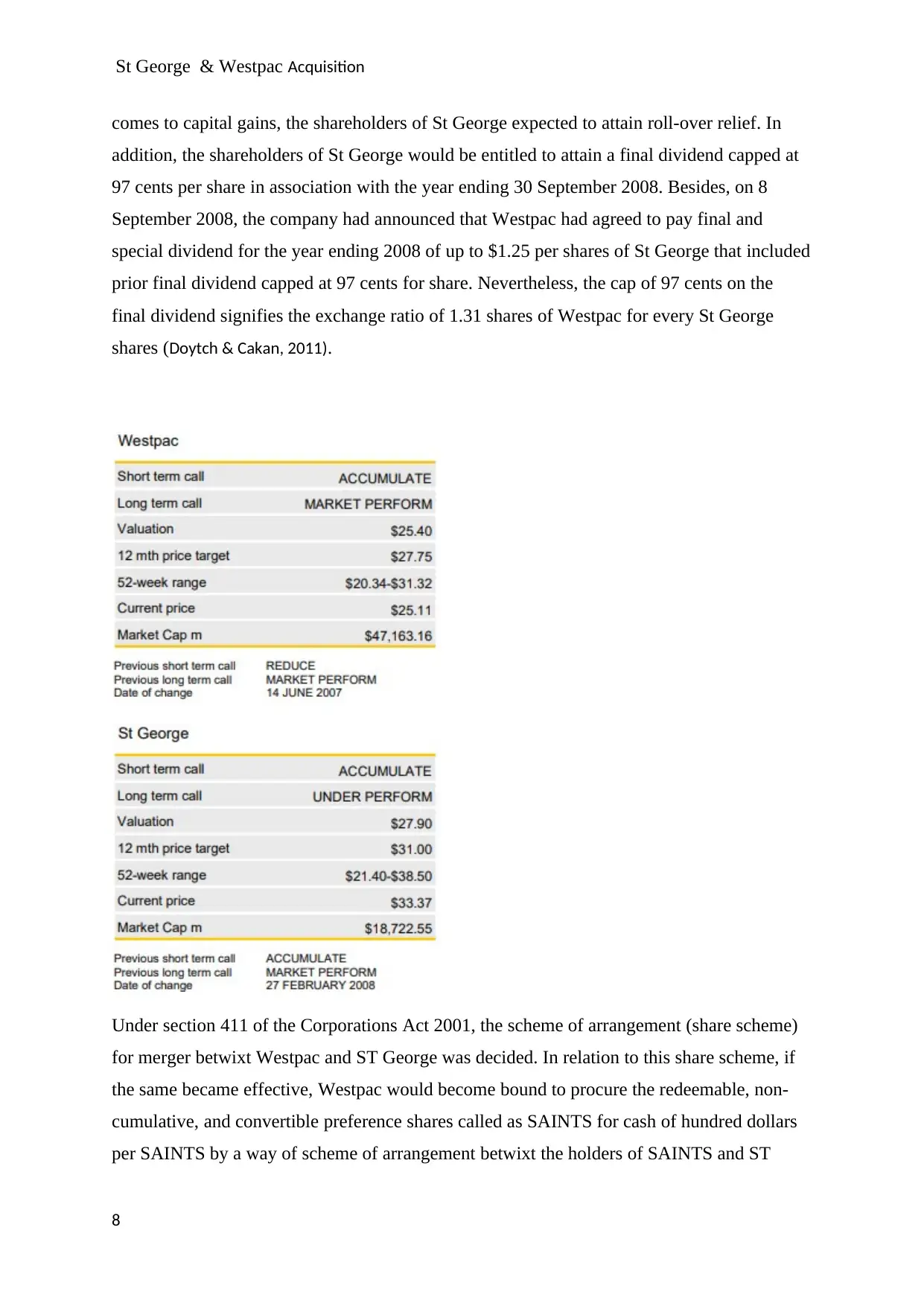

Personal incentives to accept the offer

The directors of St George believed that partnership with Westpac would fetch or create

significant value for their shareholders by permitting them to benefit from a stronger base of

resources whilst preserving their unique and unbreakable relationship with the customers

across Australia. Furthermore, the board was aware of the fact that the price offered to them

was more than the price offered by other competitors. For instance, the transaction amounted

to $33.10 per share that was 24% greater than the most recent closing price of the company.

Such premium excluded the dividends of WBC and ST George already announced.

Moreover, the fact that the board was prepared to accept a scrip bid for control at a lesser

price than its last equity ($35) is evidence of the ideology that St George was clearly able to

survive as a single organization, still it accepted the deal as it was altogether a perfect deal for

the company’s shareholders (Deegan, 2011). This sheds light on the fact that St George had

already received bids from other competitors but since the deal from Westpac was fair

enough and value enhancing for the shareholders, it accepted the same and convinced the

shareholders to swap their SGB shares for WBC (DePamphilis, 2010).

Acquisition method and analysis

St George had agreed to accept 1.31 shares of Westpac for each of its share subject to no

independent expert’s opinion and superior proposal emerging that the merger was in the best

proposal for the shareholders. Further, the scheme of arrangement was an all scrip offer

wherein the shareholders of St George would vote upon the same. The exchange ratio of 1.31

ordinary shares of Westpac for every ordinary share of St George excluded freshly

announced interim dividends (Doytch & Uctum, 2012). Further, this represented a premium of

24.1% based on one-month VWAP and premium of 28.5% relying on spot premium. When it

7

Personal incentives to accept the offer

The directors of St George believed that partnership with Westpac would fetch or create

significant value for their shareholders by permitting them to benefit from a stronger base of

resources whilst preserving their unique and unbreakable relationship with the customers

across Australia. Furthermore, the board was aware of the fact that the price offered to them

was more than the price offered by other competitors. For instance, the transaction amounted

to $33.10 per share that was 24% greater than the most recent closing price of the company.

Such premium excluded the dividends of WBC and ST George already announced.

Moreover, the fact that the board was prepared to accept a scrip bid for control at a lesser

price than its last equity ($35) is evidence of the ideology that St George was clearly able to

survive as a single organization, still it accepted the deal as it was altogether a perfect deal for

the company’s shareholders (Deegan, 2011). This sheds light on the fact that St George had

already received bids from other competitors but since the deal from Westpac was fair

enough and value enhancing for the shareholders, it accepted the same and convinced the

shareholders to swap their SGB shares for WBC (DePamphilis, 2010).

Acquisition method and analysis

St George had agreed to accept 1.31 shares of Westpac for each of its share subject to no

independent expert’s opinion and superior proposal emerging that the merger was in the best

proposal for the shareholders. Further, the scheme of arrangement was an all scrip offer

wherein the shareholders of St George would vote upon the same. The exchange ratio of 1.31

ordinary shares of Westpac for every ordinary share of St George excluded freshly

announced interim dividends (Doytch & Uctum, 2012). Further, this represented a premium of

24.1% based on one-month VWAP and premium of 28.5% relying on spot premium. When it

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

St George & Westpac Acquisition

comes to capital gains, the shareholders of St George expected to attain roll-over relief. In

addition, the shareholders of St George would be entitled to attain a final dividend capped at

97 cents per share in association with the year ending 30 September 2008. Besides, on 8

September 2008, the company had announced that Westpac had agreed to pay final and

special dividend for the year ending 2008 of up to $1.25 per shares of St George that included

prior final dividend capped at 97 cents for share. Nevertheless, the cap of 97 cents on the

final dividend signifies the exchange ratio of 1.31 shares of Westpac for every St George

shares (Doytch & Cakan, 2011).

Under section 411 of the Corporations Act 2001, the scheme of arrangement (share scheme)

for merger betwixt Westpac and ST George was decided. In relation to this share scheme, if

the same became effective, Westpac would become bound to procure the redeemable, non-

cumulative, and convertible preference shares called as SAINTS for cash of hundred dollars

per SAINTS by a way of scheme of arrangement betwixt the holders of SAINTS and ST

8

comes to capital gains, the shareholders of St George expected to attain roll-over relief. In

addition, the shareholders of St George would be entitled to attain a final dividend capped at

97 cents per share in association with the year ending 30 September 2008. Besides, on 8

September 2008, the company had announced that Westpac had agreed to pay final and

special dividend for the year ending 2008 of up to $1.25 per shares of St George that included

prior final dividend capped at 97 cents for share. Nevertheless, the cap of 97 cents on the

final dividend signifies the exchange ratio of 1.31 shares of Westpac for every St George

shares (Doytch & Cakan, 2011).

Under section 411 of the Corporations Act 2001, the scheme of arrangement (share scheme)

for merger betwixt Westpac and ST George was decided. In relation to this share scheme, if

the same became effective, Westpac would become bound to procure the redeemable, non-

cumulative, and convertible preference shares called as SAINTS for cash of hundred dollars

per SAINTS by a way of scheme of arrangement betwixt the holders of SAINTS and ST

8

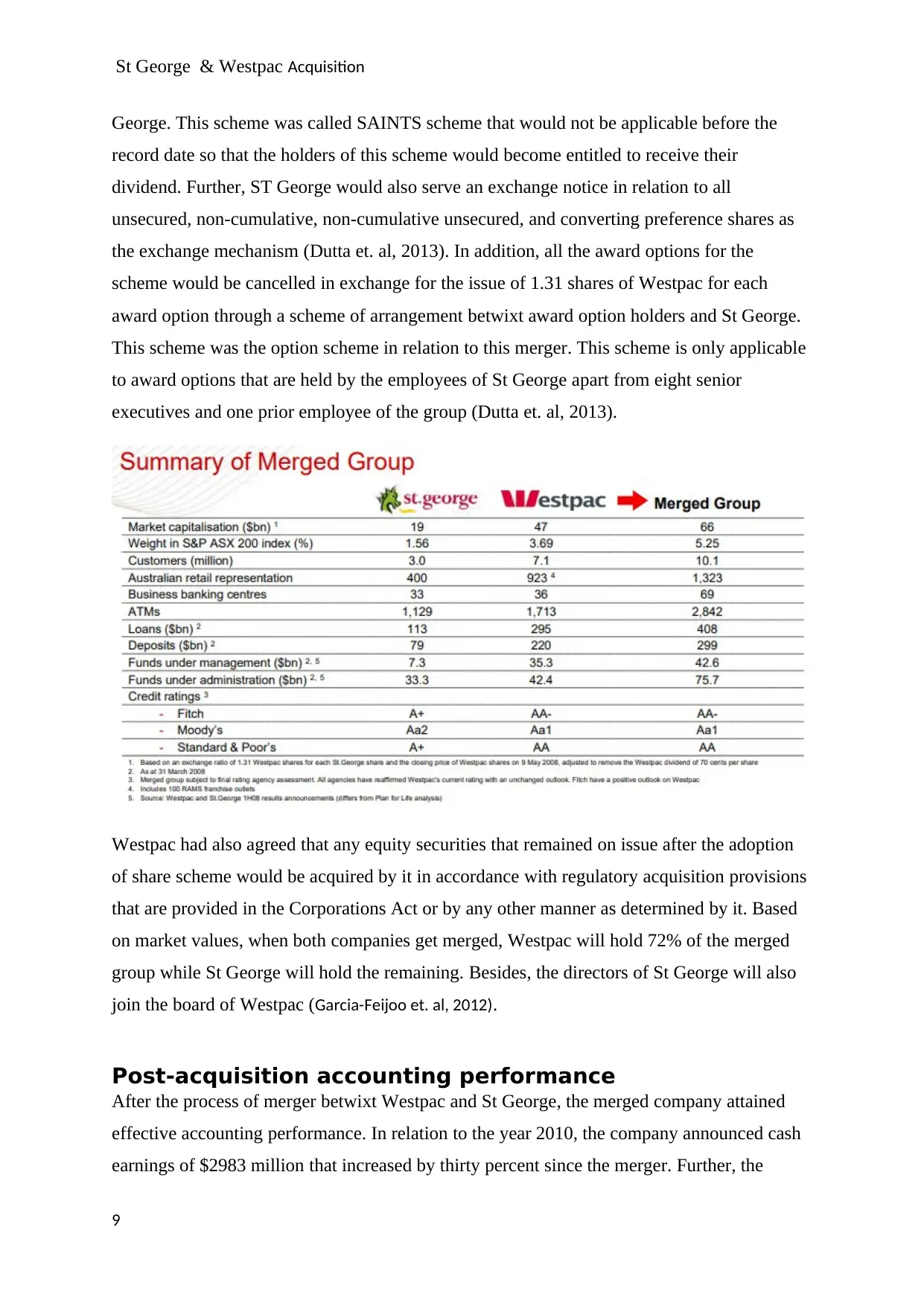

St George & Westpac Acquisition

George. This scheme was called SAINTS scheme that would not be applicable before the

record date so that the holders of this scheme would become entitled to receive their

dividend. Further, ST George would also serve an exchange notice in relation to all

unsecured, non-cumulative, non-cumulative unsecured, and converting preference shares as

the exchange mechanism (Dutta et. al, 2013). In addition, all the award options for the

scheme would be cancelled in exchange for the issue of 1.31 shares of Westpac for each

award option through a scheme of arrangement betwixt award option holders and St George.

This scheme was the option scheme in relation to this merger. This scheme is only applicable

to award options that are held by the employees of St George apart from eight senior

executives and one prior employee of the group (Dutta et. al, 2013).

Westpac had also agreed that any equity securities that remained on issue after the adoption

of share scheme would be acquired by it in accordance with regulatory acquisition provisions

that are provided in the Corporations Act or by any other manner as determined by it. Based

on market values, when both companies get merged, Westpac will hold 72% of the merged

group while St George will hold the remaining. Besides, the directors of St George will also

join the board of Westpac (Garcia-Feijoo et. al, 2012).

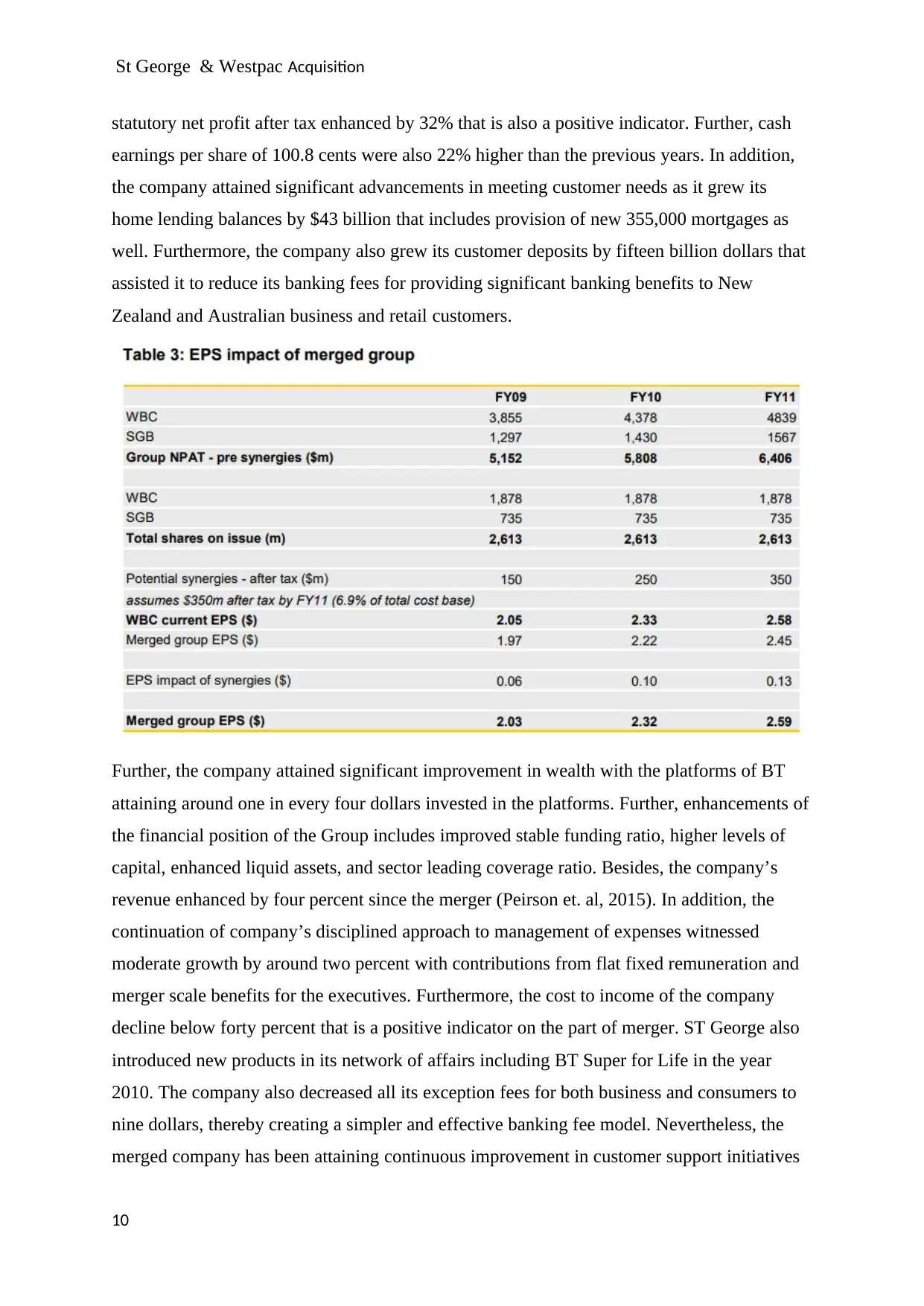

Post-acquisition accounting performance

After the process of merger betwixt Westpac and St George, the merged company attained

effective accounting performance. In relation to the year 2010, the company announced cash

earnings of $2983 million that increased by thirty percent since the merger. Further, the

9

George. This scheme was called SAINTS scheme that would not be applicable before the

record date so that the holders of this scheme would become entitled to receive their

dividend. Further, ST George would also serve an exchange notice in relation to all

unsecured, non-cumulative, non-cumulative unsecured, and converting preference shares as

the exchange mechanism (Dutta et. al, 2013). In addition, all the award options for the

scheme would be cancelled in exchange for the issue of 1.31 shares of Westpac for each

award option through a scheme of arrangement betwixt award option holders and St George.

This scheme was the option scheme in relation to this merger. This scheme is only applicable

to award options that are held by the employees of St George apart from eight senior

executives and one prior employee of the group (Dutta et. al, 2013).

Westpac had also agreed that any equity securities that remained on issue after the adoption

of share scheme would be acquired by it in accordance with regulatory acquisition provisions

that are provided in the Corporations Act or by any other manner as determined by it. Based

on market values, when both companies get merged, Westpac will hold 72% of the merged

group while St George will hold the remaining. Besides, the directors of St George will also

join the board of Westpac (Garcia-Feijoo et. al, 2012).

Post-acquisition accounting performance

After the process of merger betwixt Westpac and St George, the merged company attained

effective accounting performance. In relation to the year 2010, the company announced cash

earnings of $2983 million that increased by thirty percent since the merger. Further, the

9

St George & Westpac Acquisition

statutory net profit after tax enhanced by 32% that is also a positive indicator. Further, cash

earnings per share of 100.8 cents were also 22% higher than the previous years. In addition,

the company attained significant advancements in meeting customer needs as it grew its

home lending balances by $43 billion that includes provision of new 355,000 mortgages as

well. Furthermore, the company also grew its customer deposits by fifteen billion dollars that

assisted it to reduce its banking fees for providing significant banking benefits to New

Zealand and Australian business and retail customers.

Further, the company attained significant improvement in wealth with the platforms of BT

attaining around one in every four dollars invested in the platforms. Further, enhancements of

the financial position of the Group includes improved stable funding ratio, higher levels of

capital, enhanced liquid assets, and sector leading coverage ratio. Besides, the company’s

revenue enhanced by four percent since the merger (Peirson et. al, 2015). In addition, the

continuation of company’s disciplined approach to management of expenses witnessed

moderate growth by around two percent with contributions from flat fixed remuneration and

merger scale benefits for the executives. Furthermore, the cost to income of the company

decline below forty percent that is a positive indicator on the part of merger. ST George also

introduced new products in its network of affairs including BT Super for Life in the year

2010. The company also decreased all its exception fees for both business and consumers to

nine dollars, thereby creating a simpler and effective banking fee model. Nevertheless, the

merged company has been attaining continuous improvement in customer support initiatives

10

statutory net profit after tax enhanced by 32% that is also a positive indicator. Further, cash

earnings per share of 100.8 cents were also 22% higher than the previous years. In addition,

the company attained significant advancements in meeting customer needs as it grew its

home lending balances by $43 billion that includes provision of new 355,000 mortgages as

well. Furthermore, the company also grew its customer deposits by fifteen billion dollars that

assisted it to reduce its banking fees for providing significant banking benefits to New

Zealand and Australian business and retail customers.

Further, the company attained significant improvement in wealth with the platforms of BT

attaining around one in every four dollars invested in the platforms. Further, enhancements of

the financial position of the Group includes improved stable funding ratio, higher levels of

capital, enhanced liquid assets, and sector leading coverage ratio. Besides, the company’s

revenue enhanced by four percent since the merger (Peirson et. al, 2015). In addition, the

continuation of company’s disciplined approach to management of expenses witnessed

moderate growth by around two percent with contributions from flat fixed remuneration and

merger scale benefits for the executives. Furthermore, the cost to income of the company

decline below forty percent that is a positive indicator on the part of merger. ST George also

introduced new products in its network of affairs including BT Super for Life in the year

2010. The company also decreased all its exception fees for both business and consumers to

nine dollars, thereby creating a simpler and effective banking fee model. Nevertheless, the

merged company has been attaining continuous improvement in customer support initiatives

10

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

St George & Westpac Acquisition

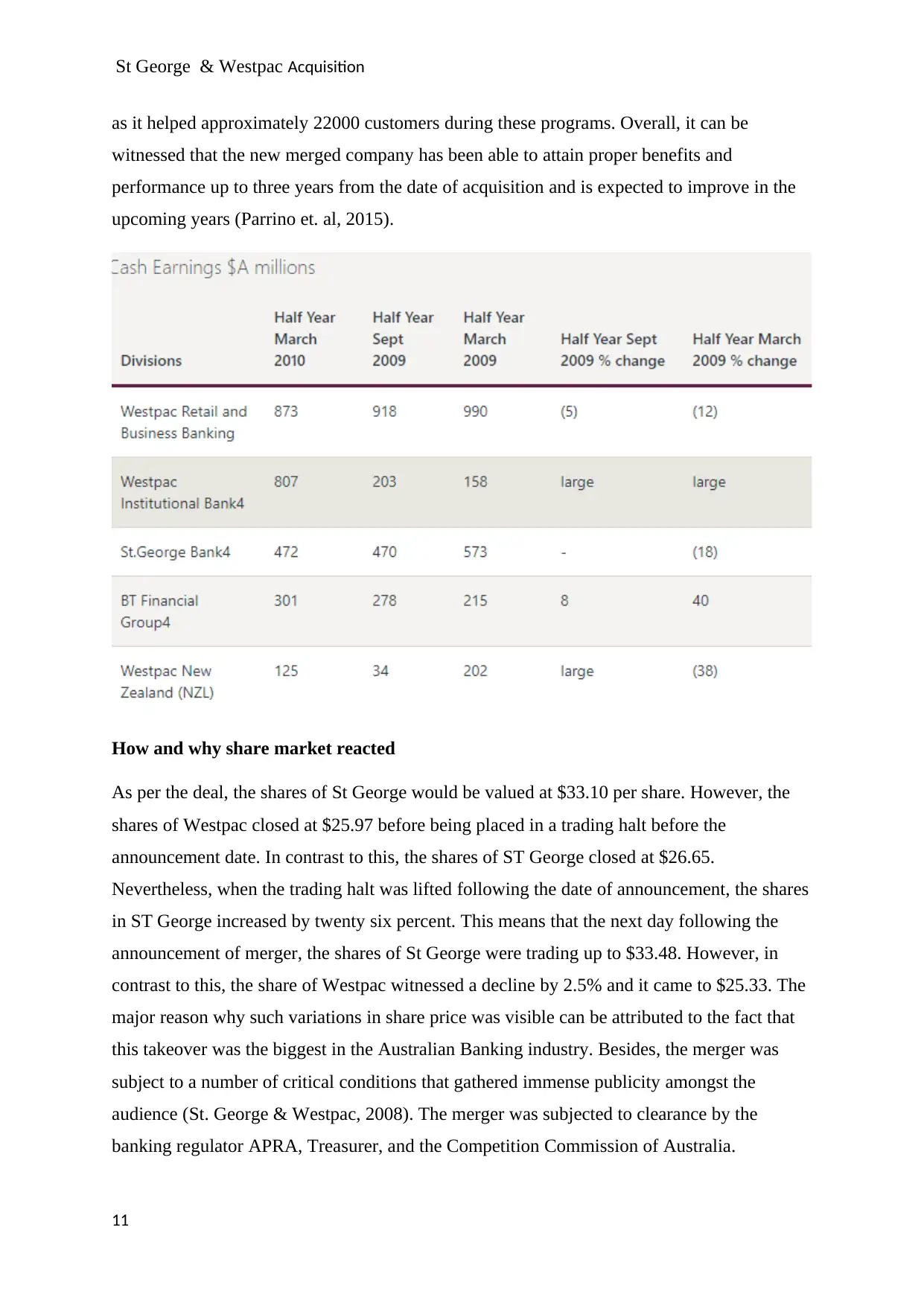

as it helped approximately 22000 customers during these programs. Overall, it can be

witnessed that the new merged company has been able to attain proper benefits and

performance up to three years from the date of acquisition and is expected to improve in the

upcoming years (Parrino et. al, 2015).

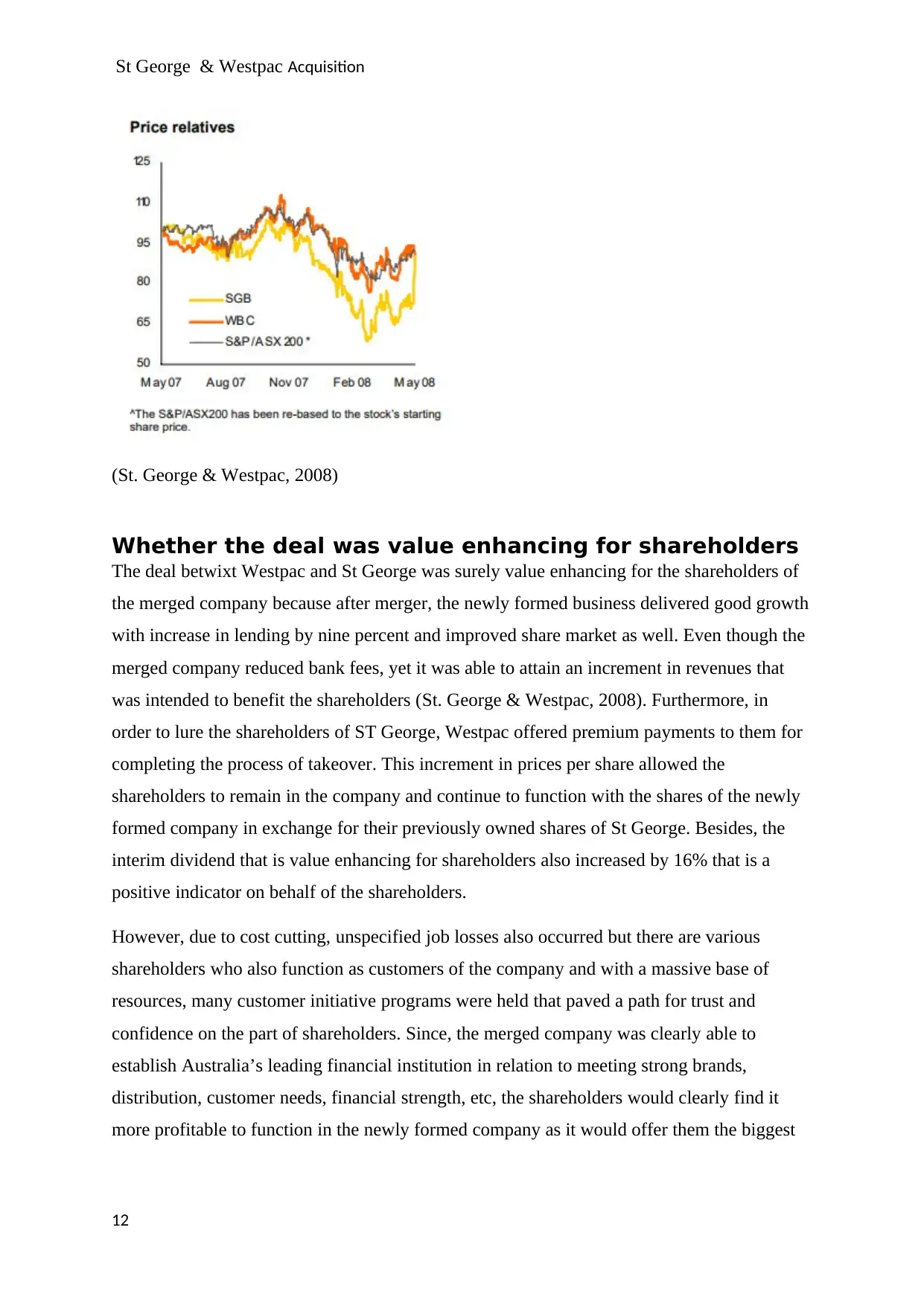

How and why share market reacted

As per the deal, the shares of St George would be valued at $33.10 per share. However, the

shares of Westpac closed at $25.97 before being placed in a trading halt before the

announcement date. In contrast to this, the shares of ST George closed at $26.65.

Nevertheless, when the trading halt was lifted following the date of announcement, the shares

in ST George increased by twenty six percent. This means that the next day following the

announcement of merger, the shares of St George were trading up to $33.48. However, in

contrast to this, the share of Westpac witnessed a decline by 2.5% and it came to $25.33. The

major reason why such variations in share price was visible can be attributed to the fact that

this takeover was the biggest in the Australian Banking industry. Besides, the merger was

subject to a number of critical conditions that gathered immense publicity amongst the

audience (St. George & Westpac, 2008). The merger was subjected to clearance by the

banking regulator APRA, Treasurer, and the Competition Commission of Australia.

11

as it helped approximately 22000 customers during these programs. Overall, it can be

witnessed that the new merged company has been able to attain proper benefits and

performance up to three years from the date of acquisition and is expected to improve in the

upcoming years (Parrino et. al, 2015).

How and why share market reacted

As per the deal, the shares of St George would be valued at $33.10 per share. However, the

shares of Westpac closed at $25.97 before being placed in a trading halt before the

announcement date. In contrast to this, the shares of ST George closed at $26.65.

Nevertheless, when the trading halt was lifted following the date of announcement, the shares

in ST George increased by twenty six percent. This means that the next day following the

announcement of merger, the shares of St George were trading up to $33.48. However, in

contrast to this, the share of Westpac witnessed a decline by 2.5% and it came to $25.33. The

major reason why such variations in share price was visible can be attributed to the fact that

this takeover was the biggest in the Australian Banking industry. Besides, the merger was

subject to a number of critical conditions that gathered immense publicity amongst the

audience (St. George & Westpac, 2008). The merger was subjected to clearance by the

banking regulator APRA, Treasurer, and the Competition Commission of Australia.

11

St George & Westpac Acquisition

(St. George & Westpac, 2008)

Whether the deal was value enhancing for shareholders

The deal betwixt Westpac and St George was surely value enhancing for the shareholders of

the merged company because after merger, the newly formed business delivered good growth

with increase in lending by nine percent and improved share market as well. Even though the

merged company reduced bank fees, yet it was able to attain an increment in revenues that

was intended to benefit the shareholders (St. George & Westpac, 2008). Furthermore, in

order to lure the shareholders of ST George, Westpac offered premium payments to them for

completing the process of takeover. This increment in prices per share allowed the

shareholders to remain in the company and continue to function with the shares of the newly

formed company in exchange for their previously owned shares of St George. Besides, the

interim dividend that is value enhancing for shareholders also increased by 16% that is a

positive indicator on behalf of the shareholders.

However, due to cost cutting, unspecified job losses also occurred but there are various

shareholders who also function as customers of the company and with a massive base of

resources, many customer initiative programs were held that paved a path for trust and

confidence on the part of shareholders. Since, the merged company was clearly able to

establish Australia’s leading financial institution in relation to meeting strong brands,

distribution, customer needs, financial strength, etc, the shareholders would clearly find it

more profitable to function in the newly formed company as it would offer them the biggest

12

(St. George & Westpac, 2008)

Whether the deal was value enhancing for shareholders

The deal betwixt Westpac and St George was surely value enhancing for the shareholders of

the merged company because after merger, the newly formed business delivered good growth

with increase in lending by nine percent and improved share market as well. Even though the

merged company reduced bank fees, yet it was able to attain an increment in revenues that

was intended to benefit the shareholders (St. George & Westpac, 2008). Furthermore, in

order to lure the shareholders of ST George, Westpac offered premium payments to them for

completing the process of takeover. This increment in prices per share allowed the

shareholders to remain in the company and continue to function with the shares of the newly

formed company in exchange for their previously owned shares of St George. Besides, the

interim dividend that is value enhancing for shareholders also increased by 16% that is a

positive indicator on behalf of the shareholders.

However, due to cost cutting, unspecified job losses also occurred but there are various

shareholders who also function as customers of the company and with a massive base of

resources, many customer initiative programs were held that paved a path for trust and

confidence on the part of shareholders. Since, the merged company was clearly able to

establish Australia’s leading financial institution in relation to meeting strong brands,

distribution, customer needs, financial strength, etc, the shareholders would clearly find it

more profitable to function in the newly formed company as it would offer them the biggest

12

St George & Westpac Acquisition

distribution network having over 1200 branches and more than 2700 ATM’s all around the

globe.

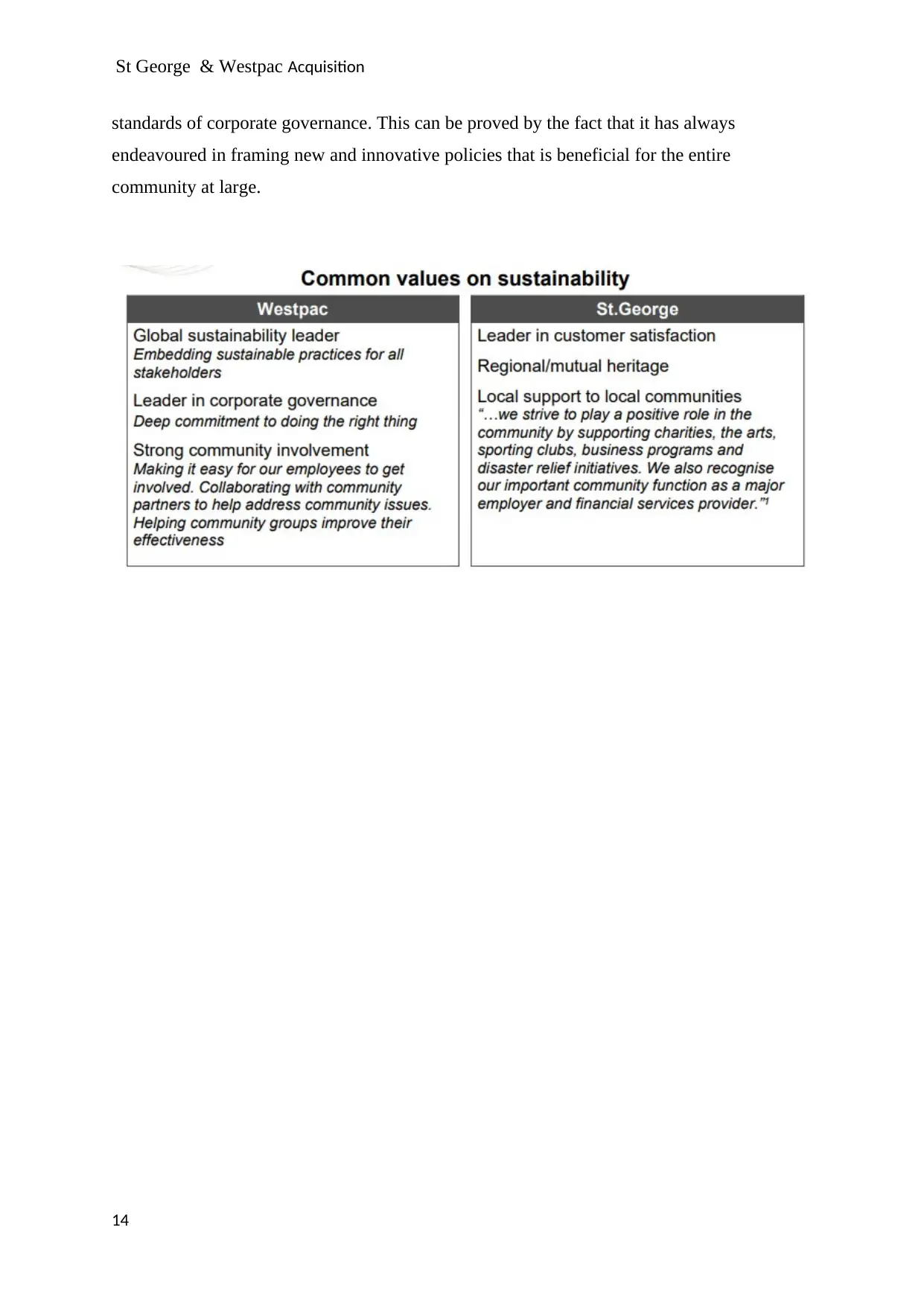

Furthermore, the merged company was capable in offering significant value to the

shareholders of both the companies. Besides, both companies had a powerful suite of brands

that was benefitted from enhanced scale. Nevertheless, since the company was a strategic fit

for the sector, it was able to align customer focus that can in turn create maximized wealth for

the shareholders of the company. In addition to these, the combined force of both the

companies were more than 1000 that played a key role in building wealth or superannuation

opportunities for the customers. Common values like sustainability was also attained by the

merged company that resulted in value enhancement for the entire group of shareholders. The

company’s plan on hiring new managers and regional managers for the betterment of

customers is also a noteworthy factor that can altogether play a role in creating value for the

shareholders. Even though the GFC that incurred in 2008-2009, the impacts could be seen in

Australia for some years, yet the company remained prudent in its efforts to encounter the

challenges in future. Since, every business must be obligated towards the society, adherence

to the CSR initiatives is essential in nature because new policies can be built and a balance

can be created betwixt the corporate world and the society on a whole. In relation to Tata

Group, the company has effectively catered to its responsibilities towards the society and

others as well. Besides, the methods adopted by the company in handling their CSR efforts

are beneficial in creating awareness all around the world. Furthermore, the adequately

considered its sustainable development and growth together with compliance with the

13

distribution network having over 1200 branches and more than 2700 ATM’s all around the

globe.

Furthermore, the merged company was capable in offering significant value to the

shareholders of both the companies. Besides, both companies had a powerful suite of brands

that was benefitted from enhanced scale. Nevertheless, since the company was a strategic fit

for the sector, it was able to align customer focus that can in turn create maximized wealth for

the shareholders of the company. In addition to these, the combined force of both the

companies were more than 1000 that played a key role in building wealth or superannuation

opportunities for the customers. Common values like sustainability was also attained by the

merged company that resulted in value enhancement for the entire group of shareholders. The

company’s plan on hiring new managers and regional managers for the betterment of

customers is also a noteworthy factor that can altogether play a role in creating value for the

shareholders. Even though the GFC that incurred in 2008-2009, the impacts could be seen in

Australia for some years, yet the company remained prudent in its efforts to encounter the

challenges in future. Since, every business must be obligated towards the society, adherence

to the CSR initiatives is essential in nature because new policies can be built and a balance

can be created betwixt the corporate world and the society on a whole. In relation to Tata

Group, the company has effectively catered to its responsibilities towards the society and

others as well. Besides, the methods adopted by the company in handling their CSR efforts

are beneficial in creating awareness all around the world. Furthermore, the adequately

considered its sustainable development and growth together with compliance with the

13

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

St George & Westpac Acquisition

standards of corporate governance. This can be proved by the fact that it has always

endeavoured in framing new and innovative policies that is beneficial for the entire

community at large.

14

standards of corporate governance. This can be proved by the fact that it has always

endeavoured in framing new and innovative policies that is beneficial for the entire

community at large.

14

St George & Westpac Acquisition

Conclusion

From the previously mentioned analysis, it is visible that the merger betwixt Westpac and St

George was apt in nature as it resulted into a number of efficacies both for the bank and other

stakeholders as well. Furthermore, both companies were in a strong position to perform alone

in the market, yet the decision to acquire one company was a bold move by Westpac Bank.

Moreover, other competitors like Commonwealth Bank also offered bids to takeover the

company but Westpac offered the highest of them all so that it can diversify throughout the

world and retain a maximum number of customers. From the merger betwixt these

companies, the share market also reacted in a positive note and the prices of St George started

rising gradually. Besides, the deal was also value enhancing for the shareholders of both the

company because it resulted in a maximum number of benefits like cost cutting, increase in

revenues, etc. This is the reason why global financial crisis could not affect the smooth

performance of the banks as they focused on supporting customers throughout the crisis by

investing massive resources in the front line. Overall, the merged company has been very

well positioned to further enhance services to customers and improve returns for the

shareholders.

15

Conclusion

From the previously mentioned analysis, it is visible that the merger betwixt Westpac and St

George was apt in nature as it resulted into a number of efficacies both for the bank and other

stakeholders as well. Furthermore, both companies were in a strong position to perform alone

in the market, yet the decision to acquire one company was a bold move by Westpac Bank.

Moreover, other competitors like Commonwealth Bank also offered bids to takeover the

company but Westpac offered the highest of them all so that it can diversify throughout the

world and retain a maximum number of customers. From the merger betwixt these

companies, the share market also reacted in a positive note and the prices of St George started

rising gradually. Besides, the deal was also value enhancing for the shareholders of both the

company because it resulted in a maximum number of benefits like cost cutting, increase in

revenues, etc. This is the reason why global financial crisis could not affect the smooth

performance of the banks as they focused on supporting customers throughout the crisis by

investing massive resources in the front line. Overall, the merged company has been very

well positioned to further enhance services to customers and improve returns for the

shareholders.

15

St George & Westpac Acquisition

References

Adra, S. and Barbopoulos, L.G. (2018) The valuation effects of investor attention in stock-

financed acquisitions. Journal of Empirical Finance. [online]. 45, 108-125. Doi:

https://doi.org/10.1016/j.jempfin.2017.10.001

Alexandridis, D.P. and Travlos, N. (2010) Gains from Mergers and Acquisitions Around the

World: New Evidence. Financial Management. [online]. 39(4), 1671-1695. Doi:

https://doi.org/10.1111/j.1755-053X.2010.01126.x

Alshwer, A.A., Sibilkov, V. and Zaiats, N. (2011) Financial Constraints and the Method of

Payment in Mergers and Acquisitions. Available at: https://doi.org/10.2139/ssrn.1364455

[Accessed 14 August 2018]

Ang, J.S. and Ismail, A.K. (2015) What Premiums Do Target Shareholders Expect?

Explaining Negative Returns upon Offer Announcements. Journal of Corporate Finance.

[online]. 30, 245-256. Doi: https://doi.org/10.1016/j.jcorpfin.2014.12.015

Barbopoulos, L.G., Paudyal, K. and Sudarsanam, S. (2017) Earnout deals: method of initial

payment and acquirers' gain. European Financial Management [online]. pp. 1-43. Doi:

https://doi.org/10.1111/eufm.12135

Cho, H. and Ahn, H.S. (2017) Stock payment and the effects of institutional and cultural

differences: A study of shareholder value creation in cross-border M&As. International

Business Review. [online]. 26(3), 461-475. Doi: https://doi.org/10.1016/j.ibusrev.2016.10.004

Davies, T. and Crawford, I. (2012) Financial accounting. Harlow, England: Pearson.

Deegan, C. M. (2011) In Financial accounting theory. North Ryde, N.S.W: McGraw-Hill

DePamphilis, D. (2010). Mergers and Acquisitions Basics Negotiation and Deal Structuring.

Academic Press.

Doytch, N. and Uctum, M. (2012) Sectoral Growth Effects of Cross-Border Mergers and

Acquisitions. Eastern Economic Journal. [online]. 38(3), 319-330. Doi:

https://doi.org/10.1057/eej.2011.16

Doytch, N., & Cakan, E. (2011). Growth Effects of Mergers and Acquisitions: A Sector-level

Study of OECD countries. Journal of Applied Economics and Business Research, 1(3), 120-

129.

16

References

Adra, S. and Barbopoulos, L.G. (2018) The valuation effects of investor attention in stock-

financed acquisitions. Journal of Empirical Finance. [online]. 45, 108-125. Doi:

https://doi.org/10.1016/j.jempfin.2017.10.001

Alexandridis, D.P. and Travlos, N. (2010) Gains from Mergers and Acquisitions Around the

World: New Evidence. Financial Management. [online]. 39(4), 1671-1695. Doi:

https://doi.org/10.1111/j.1755-053X.2010.01126.x

Alshwer, A.A., Sibilkov, V. and Zaiats, N. (2011) Financial Constraints and the Method of

Payment in Mergers and Acquisitions. Available at: https://doi.org/10.2139/ssrn.1364455

[Accessed 14 August 2018]

Ang, J.S. and Ismail, A.K. (2015) What Premiums Do Target Shareholders Expect?

Explaining Negative Returns upon Offer Announcements. Journal of Corporate Finance.

[online]. 30, 245-256. Doi: https://doi.org/10.1016/j.jcorpfin.2014.12.015

Barbopoulos, L.G., Paudyal, K. and Sudarsanam, S. (2017) Earnout deals: method of initial

payment and acquirers' gain. European Financial Management [online]. pp. 1-43. Doi:

https://doi.org/10.1111/eufm.12135

Cho, H. and Ahn, H.S. (2017) Stock payment and the effects of institutional and cultural

differences: A study of shareholder value creation in cross-border M&As. International

Business Review. [online]. 26(3), 461-475. Doi: https://doi.org/10.1016/j.ibusrev.2016.10.004

Davies, T. and Crawford, I. (2012) Financial accounting. Harlow, England: Pearson.

Deegan, C. M. (2011) In Financial accounting theory. North Ryde, N.S.W: McGraw-Hill

DePamphilis, D. (2010). Mergers and Acquisitions Basics Negotiation and Deal Structuring.

Academic Press.

Doytch, N. and Uctum, M. (2012) Sectoral Growth Effects of Cross-Border Mergers and

Acquisitions. Eastern Economic Journal. [online]. 38(3), 319-330. Doi:

https://doi.org/10.1057/eej.2011.16

Doytch, N., & Cakan, E. (2011). Growth Effects of Mergers and Acquisitions: A Sector-level

Study of OECD countries. Journal of Applied Economics and Business Research, 1(3), 120-

129.

16

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

St George & Westpac Acquisition

Dutta, S., Saadi, S. and Zhu, P. (2013) Does Payment Method Matter in Cross-Border

Acquisitions? International Review of Economics & Finance. [online]. 25, 91-107. Doi:

https://doi.org/10.1016/j.iref.2012.06.005

Garcia-Feijoo, L., Maduraa, J. and Ngo, T. (2012). Impact of Industry Characteristics on the

Method of Payment in Mergers. Journal of Economics and Business. [online]. 64(4), 261-

274. Doi: https://doi.org/10.1016/j.jeconbus.2012.03.003

Parrino, R, Kidwell, D. and Bates, T. (2012) Fundamentals of corporate finance. Hoboken,

NJ: Wiley

Peirson, G, Brown, R., Easton, S, Howard, P. and Pinder, S. (2015) Business Finance, 12th

ed. North Ryde: McGraw-Hill Australia.

St. George & Westpac. (2008). St. George & Westpac Merger. Available at:

https://www.westpac.com.au/docs/pdf/aw/ic/WBC_SGB_080526_Pres.pdf [Accessed 17

August 2018]

17

Dutta, S., Saadi, S. and Zhu, P. (2013) Does Payment Method Matter in Cross-Border

Acquisitions? International Review of Economics & Finance. [online]. 25, 91-107. Doi:

https://doi.org/10.1016/j.iref.2012.06.005

Garcia-Feijoo, L., Maduraa, J. and Ngo, T. (2012). Impact of Industry Characteristics on the

Method of Payment in Mergers. Journal of Economics and Business. [online]. 64(4), 261-

274. Doi: https://doi.org/10.1016/j.jeconbus.2012.03.003

Parrino, R, Kidwell, D. and Bates, T. (2012) Fundamentals of corporate finance. Hoboken,

NJ: Wiley

Peirson, G, Brown, R., Easton, S, Howard, P. and Pinder, S. (2015) Business Finance, 12th

ed. North Ryde: McGraw-Hill Australia.

St. George & Westpac. (2008). St. George & Westpac Merger. Available at:

https://www.westpac.com.au/docs/pdf/aw/ic/WBC_SGB_080526_Pres.pdf [Accessed 17

August 2018]

17

1 out of 17

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.