Statistics Assignment: Regression Analysis and Interpretation of Data

VerifiedAdded on 2023/04/06

|13

|1581

|495

Homework Assignment

AI Summary

This document presents a complete solution to a statistics assignment focusing on regression analysis. The assignment covers two main problems. The first problem involves analyzing the relationship between house prices and various factors like house size, lot size, number of bedrooms and bathrooms, and age. It includes interpreting regression coefficients, performing hypothesis tests to assess the significance of each variable, calculating the adjusted R-squared, and forecasting house prices based on given input values. The second problem explores the factors affecting sales, including price, time trend, and seasonal and event-based dummy variables. The solution includes interpreting regression outputs, testing the significance of price and time, calculating confidence intervals for sales differences between seasons, performing hypothesis tests, and forecasting sales for different quarters, considering price and time variables.

STATISTICS

[Document subtitle]

[DATE]

[Document subtitle]

[DATE]

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Assignment III

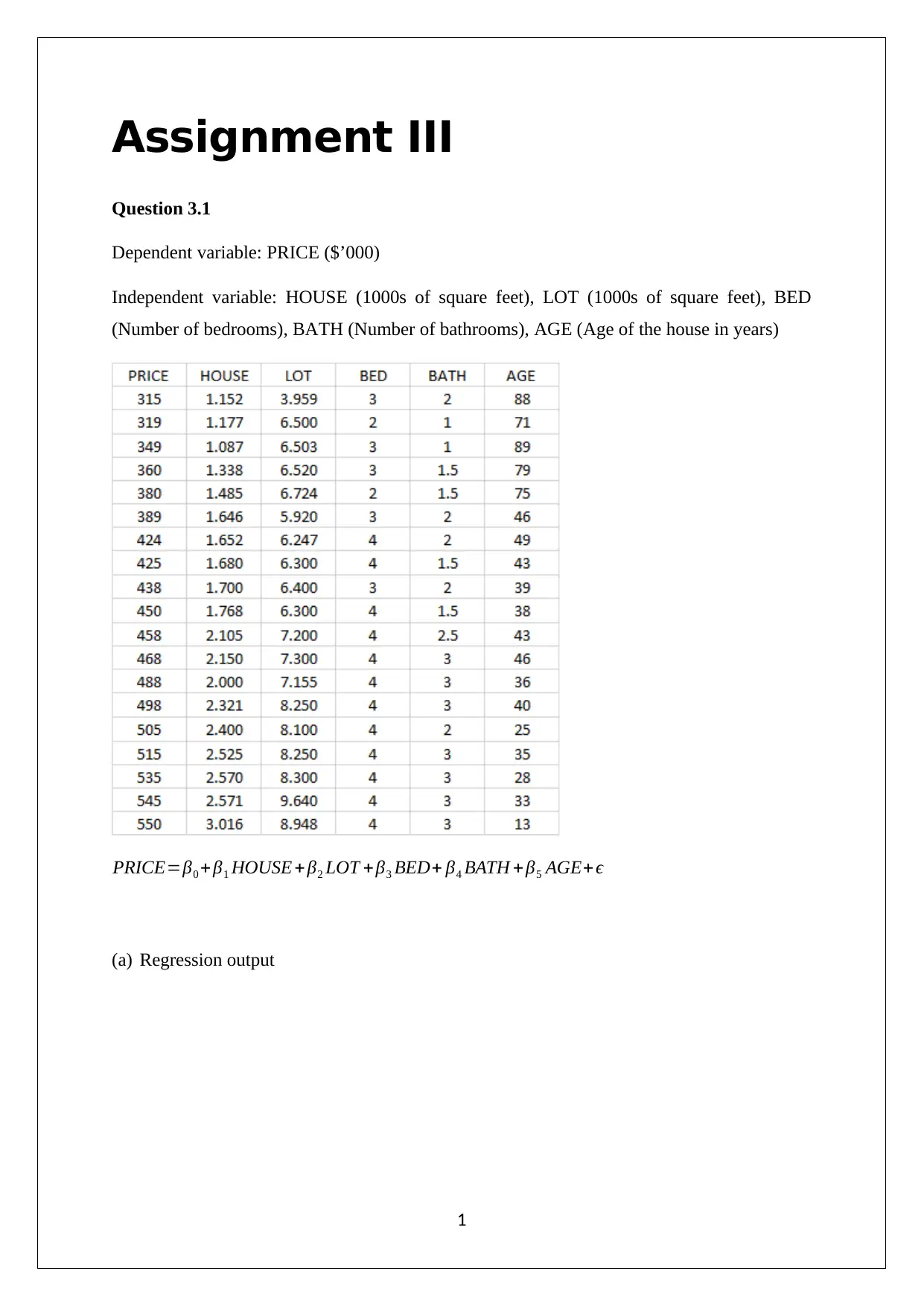

Question 3.1

Dependent variable: PRICE ($’000)

Independent variable: HOUSE (1000s of square feet), LOT (1000s of square feet), BED

(Number of bedrooms), BATH (Number of bathrooms), AGE (Age of the house in years)

PRICE=β0 + β1 HOUSE +β2 LOT +β3 BED+ β4 BATH + β5 AGE+ ϵ

(a) Regression output

1

Question 3.1

Dependent variable: PRICE ($’000)

Independent variable: HOUSE (1000s of square feet), LOT (1000s of square feet), BED

(Number of bedrooms), BATH (Number of bathrooms), AGE (Age of the house in years)

PRICE=β0 + β1 HOUSE +β2 LOT +β3 BED+ β4 BATH + β5 AGE+ ϵ

(a) Regression output

1

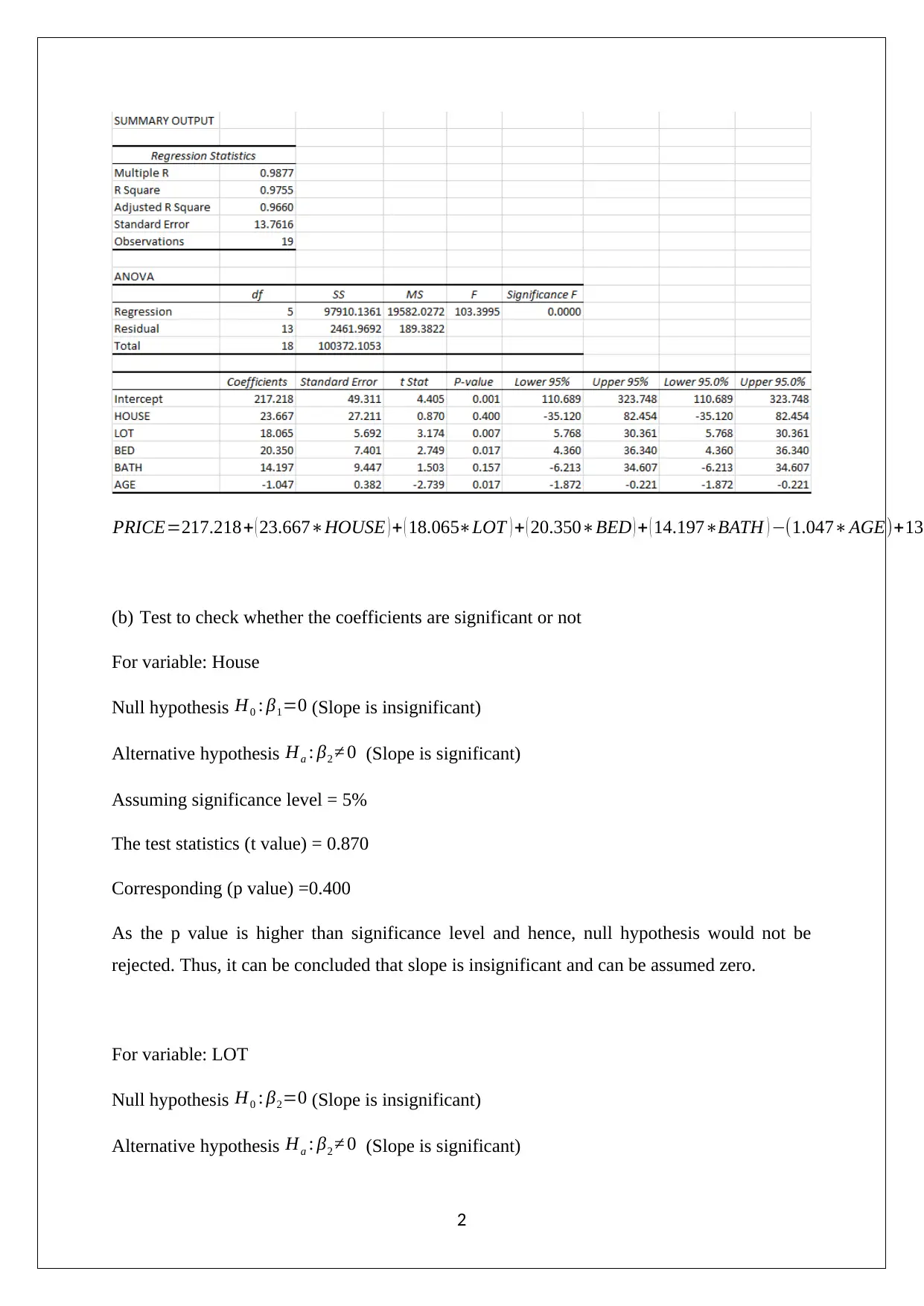

PRICE=217.218+ ( 23.667∗HOUSE ) + ( 18.065∗LOT ) + ( 20.350∗BED ) + ( 14.197∗BATH ) −(1.047∗AGE)+13

(b) Test to check whether the coefficients are significant or not

For variable: House

Null hypothesis H0 : β1=0 (Slope is insignificant)

Alternative hypothesis Ha : β2 ≠ 0 (Slope is significant)

Assuming significance level = 5%

The test statistics (t value) = 0.870

Corresponding (p value) =0.400

As the p value is higher than significance level and hence, null hypothesis would not be

rejected. Thus, it can be concluded that slope is insignificant and can be assumed zero.

For variable: LOT

Null hypothesis H0 : β2=0 (Slope is insignificant)

Alternative hypothesis Ha : β2 ≠ 0 (Slope is significant)

2

(b) Test to check whether the coefficients are significant or not

For variable: House

Null hypothesis H0 : β1=0 (Slope is insignificant)

Alternative hypothesis Ha : β2 ≠ 0 (Slope is significant)

Assuming significance level = 5%

The test statistics (t value) = 0.870

Corresponding (p value) =0.400

As the p value is higher than significance level and hence, null hypothesis would not be

rejected. Thus, it can be concluded that slope is insignificant and can be assumed zero.

For variable: LOT

Null hypothesis H0 : β2=0 (Slope is insignificant)

Alternative hypothesis Ha : β2 ≠ 0 (Slope is significant)

2

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

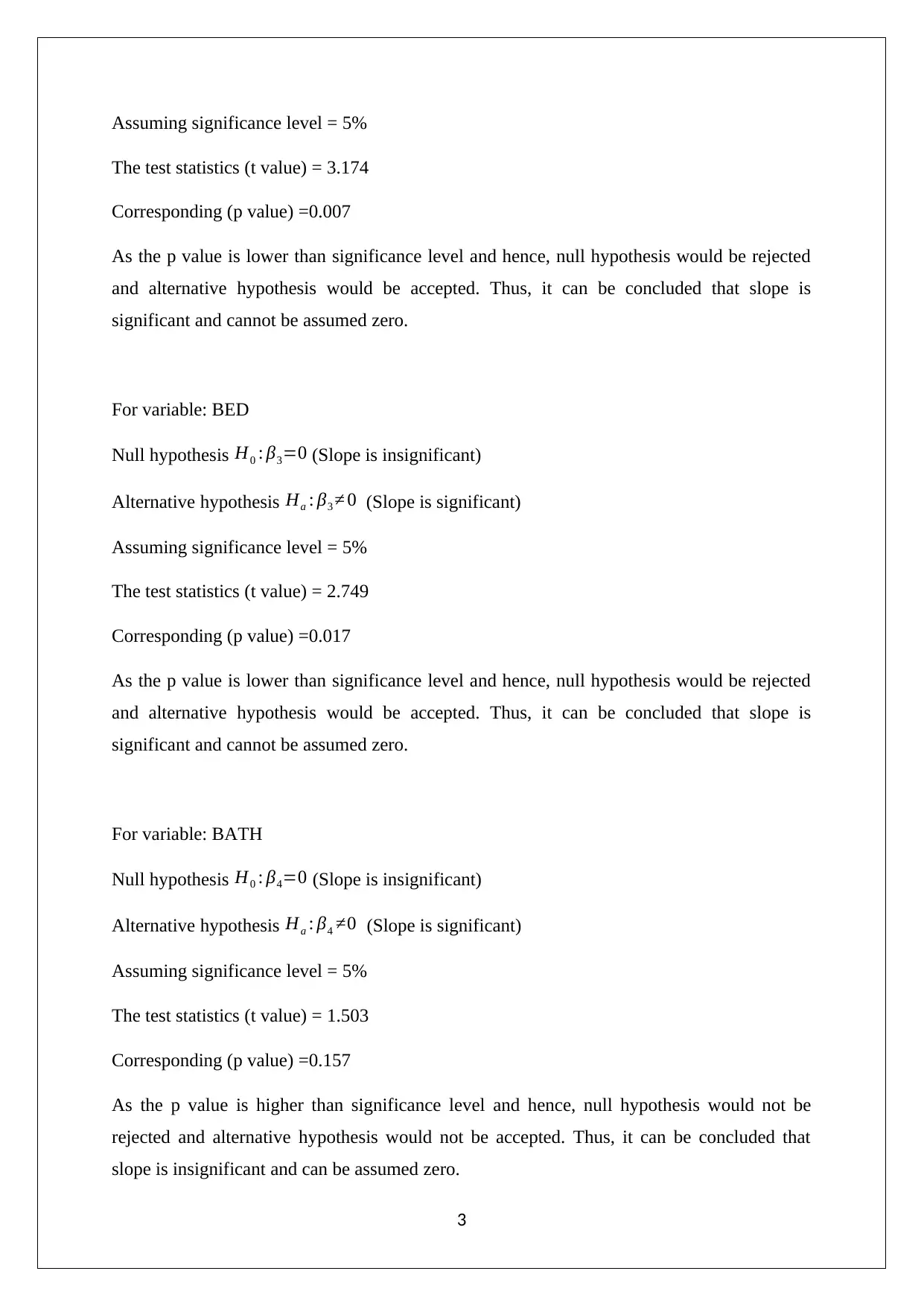

Assuming significance level = 5%

The test statistics (t value) = 3.174

Corresponding (p value) =0.007

As the p value is lower than significance level and hence, null hypothesis would be rejected

and alternative hypothesis would be accepted. Thus, it can be concluded that slope is

significant and cannot be assumed zero.

For variable: BED

Null hypothesis H0 : β3=0 (Slope is insignificant)

Alternative hypothesis Ha : β3 ≠ 0 (Slope is significant)

Assuming significance level = 5%

The test statistics (t value) = 2.749

Corresponding (p value) =0.017

As the p value is lower than significance level and hence, null hypothesis would be rejected

and alternative hypothesis would be accepted. Thus, it can be concluded that slope is

significant and cannot be assumed zero.

For variable: BATH

Null hypothesis H0 : β4=0 (Slope is insignificant)

Alternative hypothesis Ha : β4 ≠0 (Slope is significant)

Assuming significance level = 5%

The test statistics (t value) = 1.503

Corresponding (p value) =0.157

As the p value is higher than significance level and hence, null hypothesis would not be

rejected and alternative hypothesis would not be accepted. Thus, it can be concluded that

slope is insignificant and can be assumed zero.

3

The test statistics (t value) = 3.174

Corresponding (p value) =0.007

As the p value is lower than significance level and hence, null hypothesis would be rejected

and alternative hypothesis would be accepted. Thus, it can be concluded that slope is

significant and cannot be assumed zero.

For variable: BED

Null hypothesis H0 : β3=0 (Slope is insignificant)

Alternative hypothesis Ha : β3 ≠ 0 (Slope is significant)

Assuming significance level = 5%

The test statistics (t value) = 2.749

Corresponding (p value) =0.017

As the p value is lower than significance level and hence, null hypothesis would be rejected

and alternative hypothesis would be accepted. Thus, it can be concluded that slope is

significant and cannot be assumed zero.

For variable: BATH

Null hypothesis H0 : β4=0 (Slope is insignificant)

Alternative hypothesis Ha : β4 ≠0 (Slope is significant)

Assuming significance level = 5%

The test statistics (t value) = 1.503

Corresponding (p value) =0.157

As the p value is higher than significance level and hence, null hypothesis would not be

rejected and alternative hypothesis would not be accepted. Thus, it can be concluded that

slope is insignificant and can be assumed zero.

3

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Summary table

(c) Interpretation of Β3 Bed

The BED slope coefficient = 20.35

It implies that when there is an increase of one bedroom in the house, the house price would

increase by $20,350

(d) Hypothesis test to check the significance of variable ‘AGE’

Null hypothesis H0 : β5=0 (Slope is insignificant)

Alternative hypothesis Ha : β5 ≠ 0 (Slope is significant)

Assuming significance level = 0.01

The test statistics (t value) = -2.739

Corresponding (p value) =0.017

As the p value is higher than significance level and hence, null hypothesis would not be

rejected and alternative hypothesis would not be accepted. Thus, it can be concluded that for

0.01 significance level the slope is insignificant and can be assumed zero.

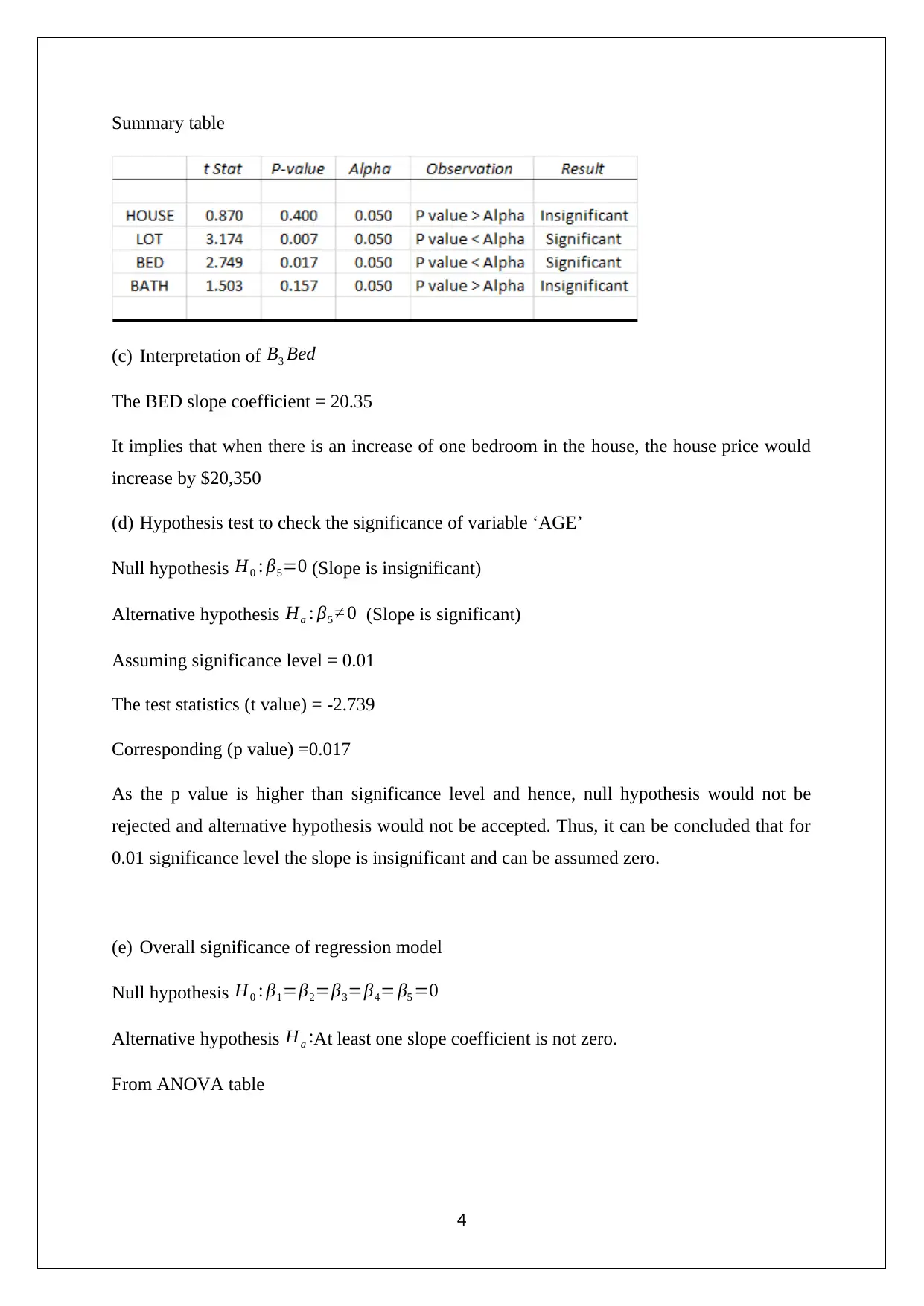

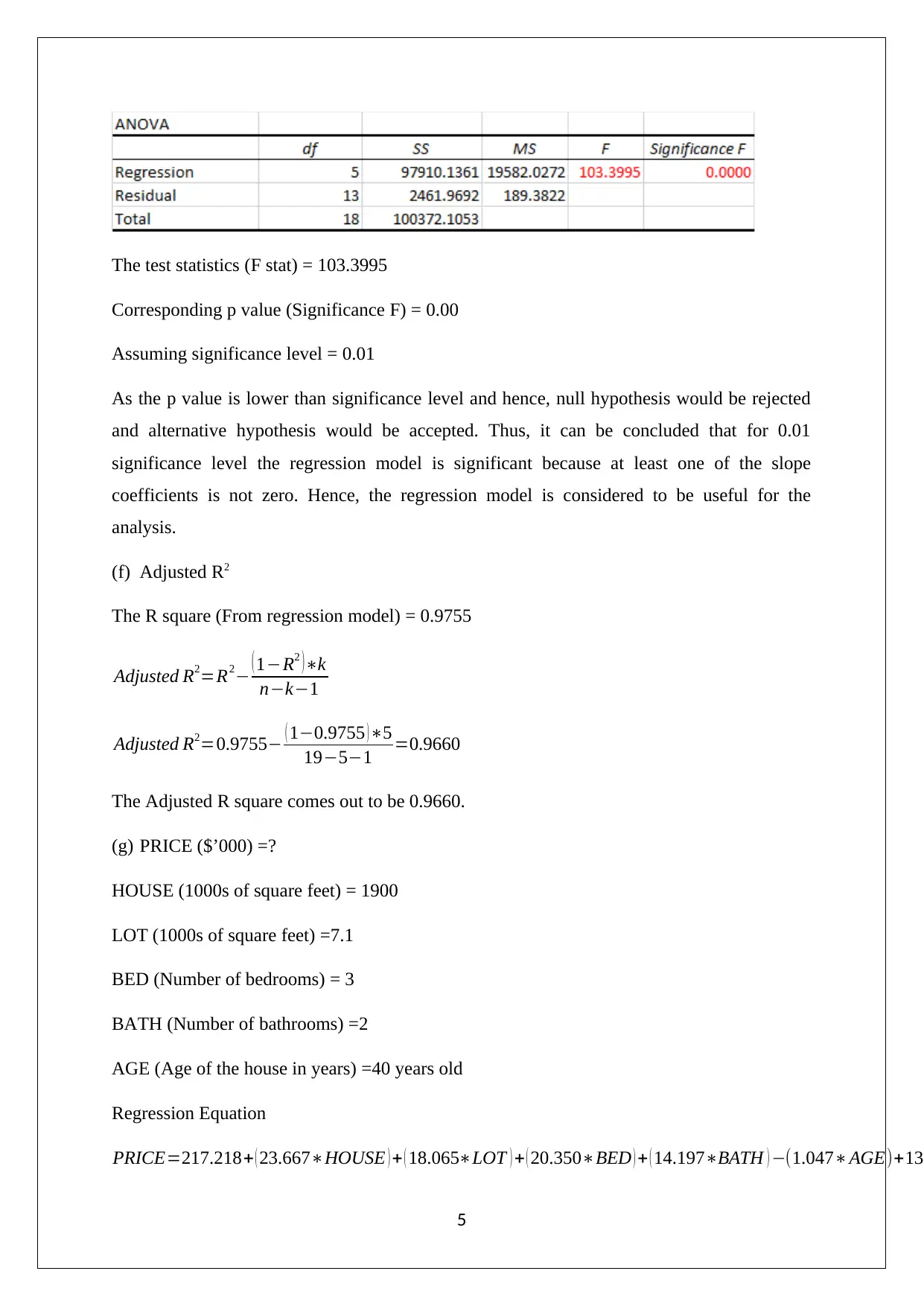

(e) Overall significance of regression model

Null hypothesis H0 : β1=β2=β3=β4= β5 =0

Alternative hypothesis Ha :At least one slope coefficient is not zero.

From ANOVA table

4

(c) Interpretation of Β3 Bed

The BED slope coefficient = 20.35

It implies that when there is an increase of one bedroom in the house, the house price would

increase by $20,350

(d) Hypothesis test to check the significance of variable ‘AGE’

Null hypothesis H0 : β5=0 (Slope is insignificant)

Alternative hypothesis Ha : β5 ≠ 0 (Slope is significant)

Assuming significance level = 0.01

The test statistics (t value) = -2.739

Corresponding (p value) =0.017

As the p value is higher than significance level and hence, null hypothesis would not be

rejected and alternative hypothesis would not be accepted. Thus, it can be concluded that for

0.01 significance level the slope is insignificant and can be assumed zero.

(e) Overall significance of regression model

Null hypothesis H0 : β1=β2=β3=β4= β5 =0

Alternative hypothesis Ha :At least one slope coefficient is not zero.

From ANOVA table

4

The test statistics (F stat) = 103.3995

Corresponding p value (Significance F) = 0.00

Assuming significance level = 0.01

As the p value is lower than significance level and hence, null hypothesis would be rejected

and alternative hypothesis would be accepted. Thus, it can be concluded that for 0.01

significance level the regression model is significant because at least one of the slope

coefficients is not zero. Hence, the regression model is considered to be useful for the

analysis.

(f) Adjusted R2

The R square (From regression model) = 0.9755

Adjusted R2=R2− ( 1−R2 ) ∗k

n−k−1

Adjusted R2=0.9755− ( 1−0.9755 ) ∗5

19−5−1 =0.9660

The Adjusted R square comes out to be 0.9660.

(g) PRICE ($’000) =?

HOUSE (1000s of square feet) = 1900

LOT (1000s of square feet) =7.1

BED (Number of bedrooms) = 3

BATH (Number of bathrooms) =2

AGE (Age of the house in years) =40 years old

Regression Equation

PRICE=217.218+ ( 23.667∗HOUSE ) + ( 18.065∗LOT ) + ( 20.350∗BED ) + ( 14.197∗BATH ) −(1.047∗AGE)+13

5

Corresponding p value (Significance F) = 0.00

Assuming significance level = 0.01

As the p value is lower than significance level and hence, null hypothesis would be rejected

and alternative hypothesis would be accepted. Thus, it can be concluded that for 0.01

significance level the regression model is significant because at least one of the slope

coefficients is not zero. Hence, the regression model is considered to be useful for the

analysis.

(f) Adjusted R2

The R square (From regression model) = 0.9755

Adjusted R2=R2− ( 1−R2 ) ∗k

n−k−1

Adjusted R2=0.9755− ( 1−0.9755 ) ∗5

19−5−1 =0.9660

The Adjusted R square comes out to be 0.9660.

(g) PRICE ($’000) =?

HOUSE (1000s of square feet) = 1900

LOT (1000s of square feet) =7.1

BED (Number of bedrooms) = 3

BATH (Number of bathrooms) =2

AGE (Age of the house in years) =40 years old

Regression Equation

PRICE=217.218+ ( 23.667∗HOUSE ) + ( 18.065∗LOT ) + ( 20.350∗BED ) + ( 14.197∗BATH ) −(1.047∗AGE)+13

5

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

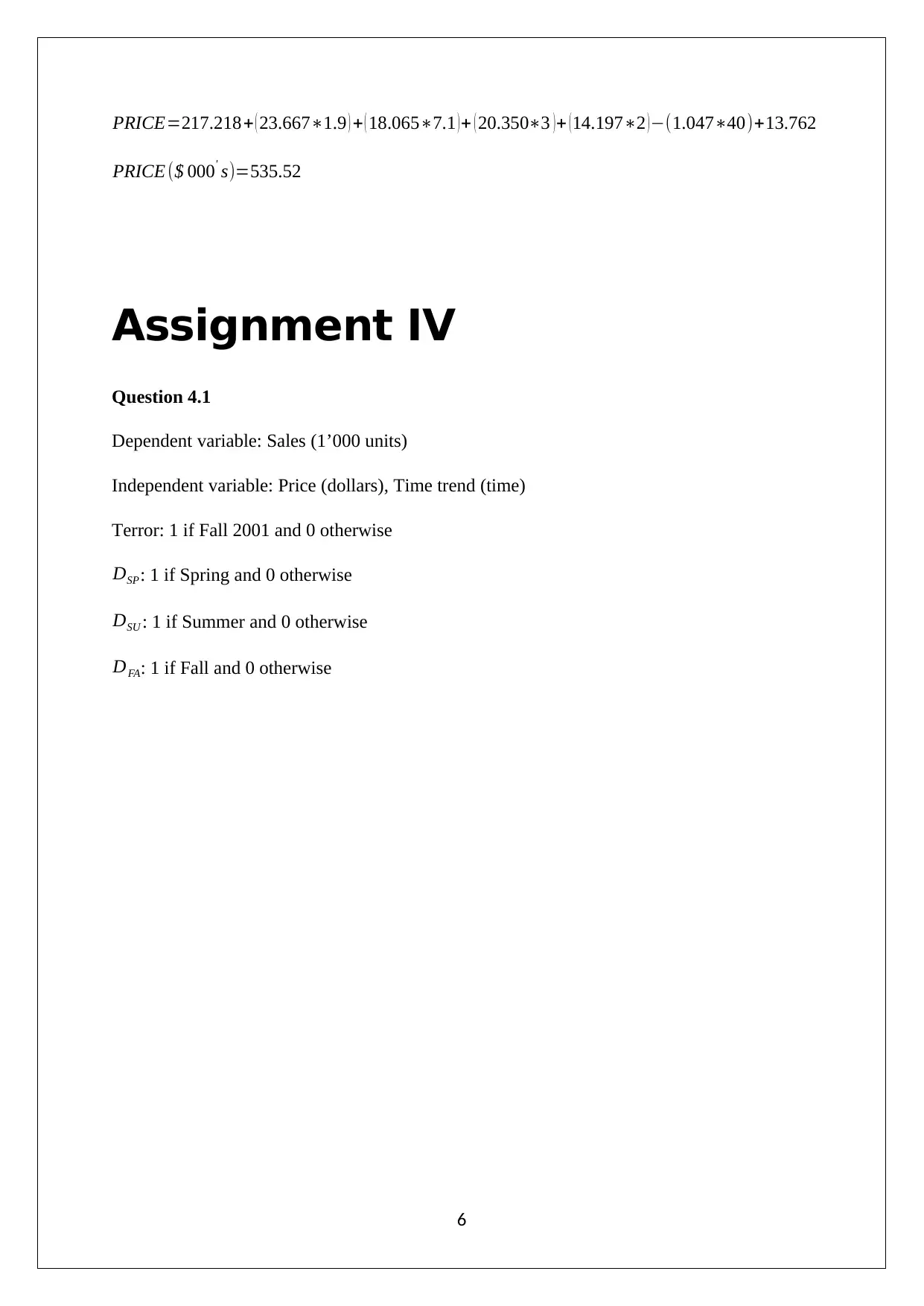

PRICE=217.218+ ( 23.667∗1.9 ) + ( 18.065∗7.1 ) + ( 20.350∗3 ) + ( 14.197∗2 ) −(1.047∗40)+13.762

PRICE ($ 000' s)=535.52

Assignment IV

Question 4.1

Dependent variable: Sales (1’000 units)

Independent variable: Price (dollars), Time trend (time)

Terror: 1 if Fall 2001 and 0 otherwise

DSP: 1 if Spring and 0 otherwise

DSU : 1 if Summer and 0 otherwise

DFA: 1 if Fall and 0 otherwise

6

PRICE ($ 000' s)=535.52

Assignment IV

Question 4.1

Dependent variable: Sales (1’000 units)

Independent variable: Price (dollars), Time trend (time)

Terror: 1 if Fall 2001 and 0 otherwise

DSP: 1 if Spring and 0 otherwise

DSU : 1 if Summer and 0 otherwise

DFA: 1 if Fall and 0 otherwise

6

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

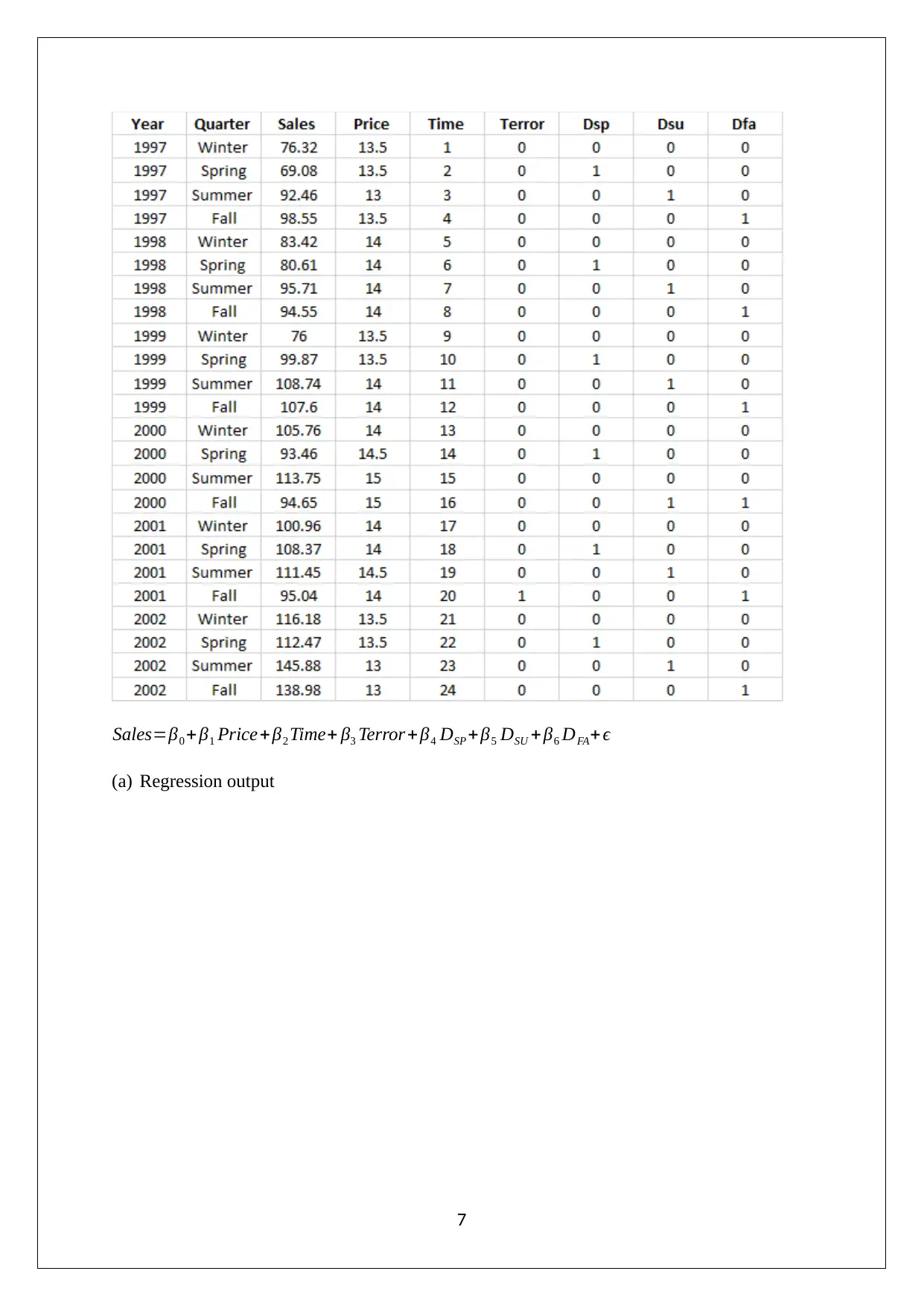

Sales=β0 + β1 Price+β2 Time+ β3 Terror + β4 DSP + β5 DSU +β6 DFA+ ϵ

(a) Regression output

7

(a) Regression output

7

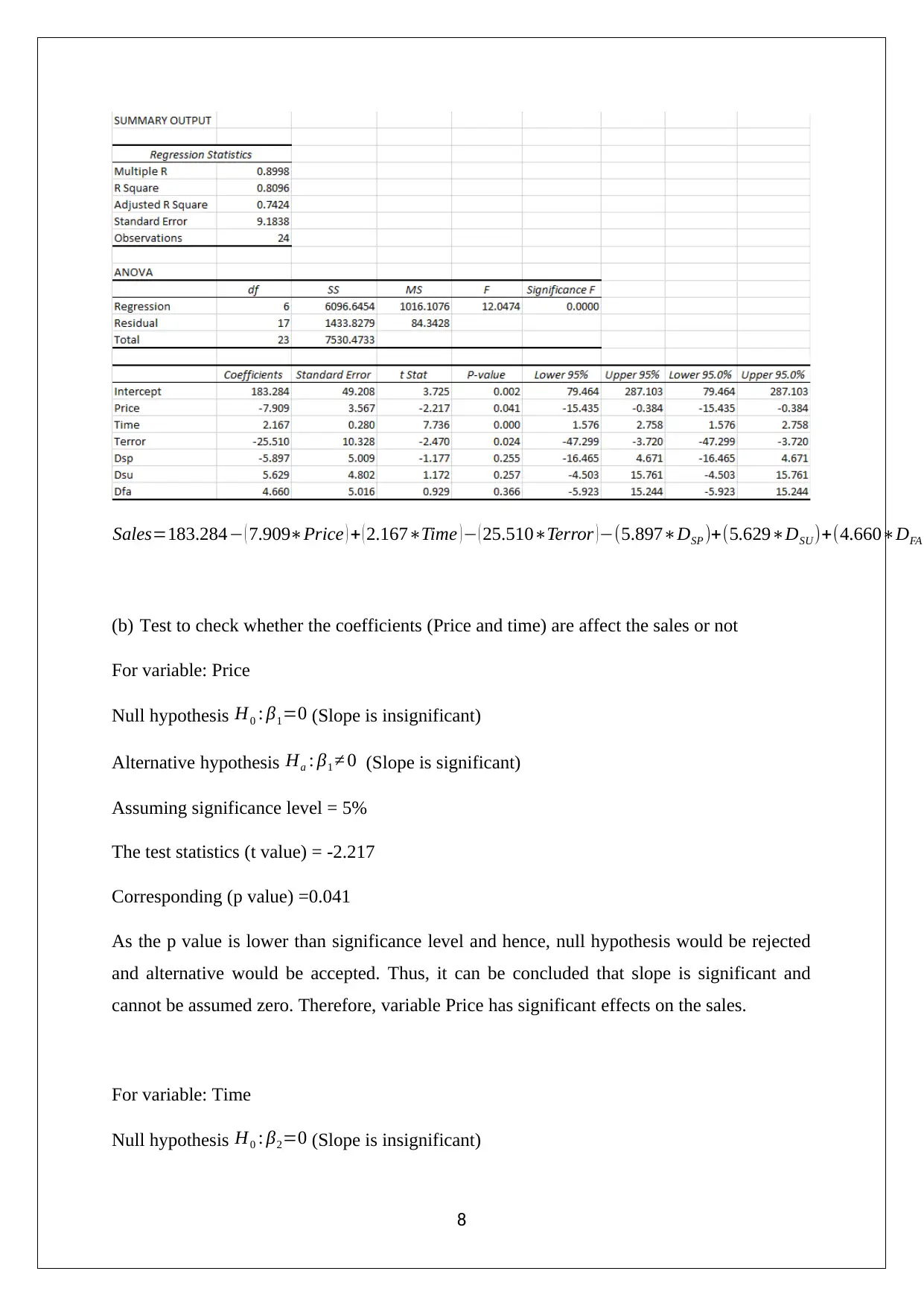

Sales=183.284− ( 7.909∗Price ) + ( 2.167∗Time ) − ( 25.510∗Terror ) −(5.897∗DSP )+(5.629∗DSU )+(4.660∗DFA

(b) Test to check whether the coefficients (Price and time) are affect the sales or not

For variable: Price

Null hypothesis H0 : β1=0 (Slope is insignificant)

Alternative hypothesis Ha : β1 ≠ 0 (Slope is significant)

Assuming significance level = 5%

The test statistics (t value) = -2.217

Corresponding (p value) =0.041

As the p value is lower than significance level and hence, null hypothesis would be rejected

and alternative would be accepted. Thus, it can be concluded that slope is significant and

cannot be assumed zero. Therefore, variable Price has significant effects on the sales.

For variable: Time

Null hypothesis H0 : β2=0 (Slope is insignificant)

8

(b) Test to check whether the coefficients (Price and time) are affect the sales or not

For variable: Price

Null hypothesis H0 : β1=0 (Slope is insignificant)

Alternative hypothesis Ha : β1 ≠ 0 (Slope is significant)

Assuming significance level = 5%

The test statistics (t value) = -2.217

Corresponding (p value) =0.041

As the p value is lower than significance level and hence, null hypothesis would be rejected

and alternative would be accepted. Thus, it can be concluded that slope is significant and

cannot be assumed zero. Therefore, variable Price has significant effects on the sales.

For variable: Time

Null hypothesis H0 : β2=0 (Slope is insignificant)

8

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

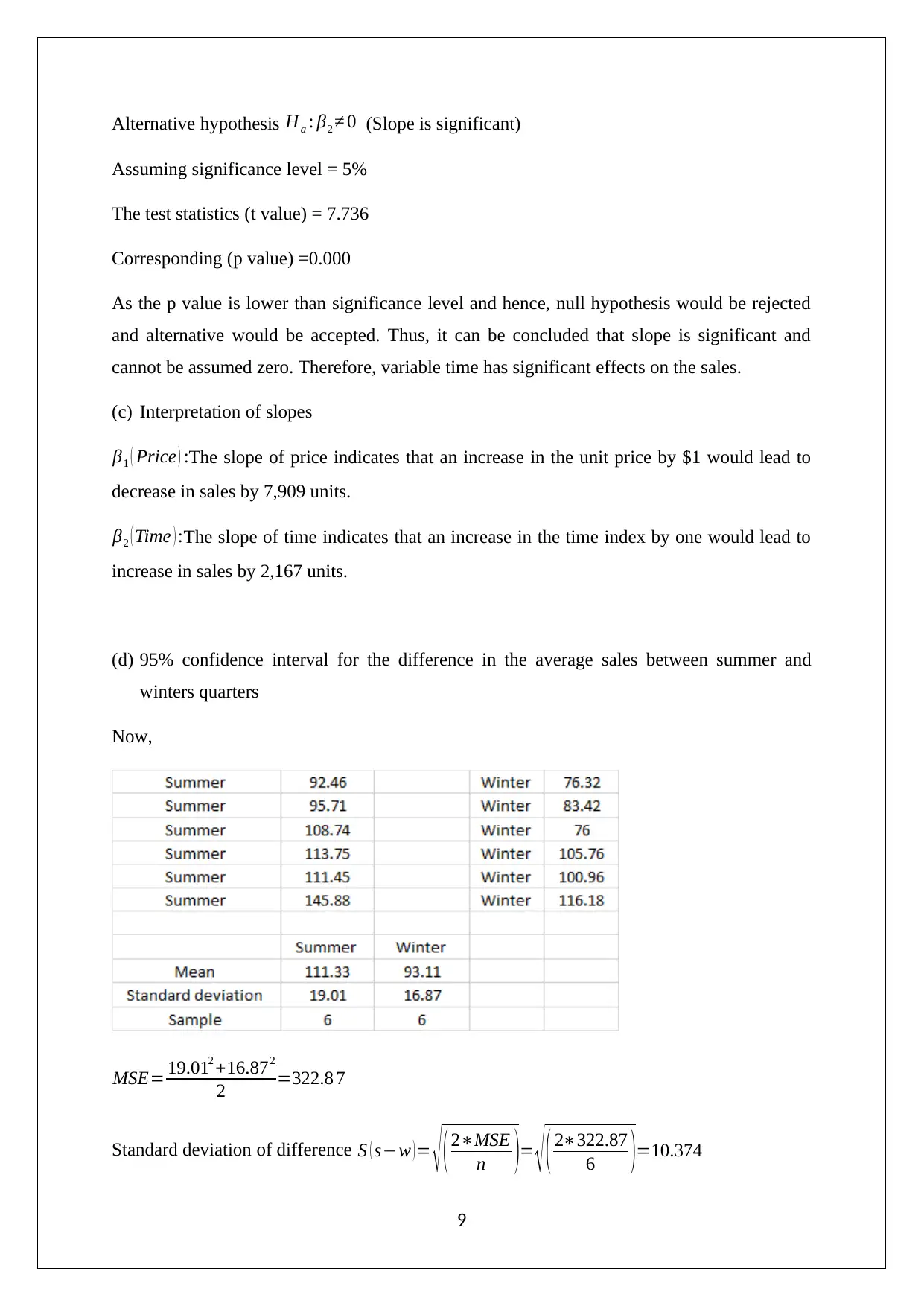

Alternative hypothesis Ha : β2 ≠ 0 (Slope is significant)

Assuming significance level = 5%

The test statistics (t value) = 7.736

Corresponding (p value) =0.000

As the p value is lower than significance level and hence, null hypothesis would be rejected

and alternative would be accepted. Thus, it can be concluded that slope is significant and

cannot be assumed zero. Therefore, variable time has significant effects on the sales.

(c) Interpretation of slopes

β1 ( Price ) :The slope of price indicates that an increase in the unit price by $1 would lead to

decrease in sales by 7,909 units.

β2 ( Time ) :The slope of time indicates that an increase in the time index by one would lead to

increase in sales by 2,167 units.

(d) 95% confidence interval for the difference in the average sales between summer and

winters quarters

Now,

MSE= 19.012 +16.872

2 =322.8 7

Standard deviation of difference S ( s−w )= √ (2∗MSE

n )= √ ( 2∗322.87

6 )=10.374

9

Assuming significance level = 5%

The test statistics (t value) = 7.736

Corresponding (p value) =0.000

As the p value is lower than significance level and hence, null hypothesis would be rejected

and alternative would be accepted. Thus, it can be concluded that slope is significant and

cannot be assumed zero. Therefore, variable time has significant effects on the sales.

(c) Interpretation of slopes

β1 ( Price ) :The slope of price indicates that an increase in the unit price by $1 would lead to

decrease in sales by 7,909 units.

β2 ( Time ) :The slope of time indicates that an increase in the time index by one would lead to

increase in sales by 2,167 units.

(d) 95% confidence interval for the difference in the average sales between summer and

winters quarters

Now,

MSE= 19.012 +16.872

2 =322.8 7

Standard deviation of difference S ( s−w )= √ (2∗MSE

n )= √ ( 2∗322.87

6 )=10.374

9

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

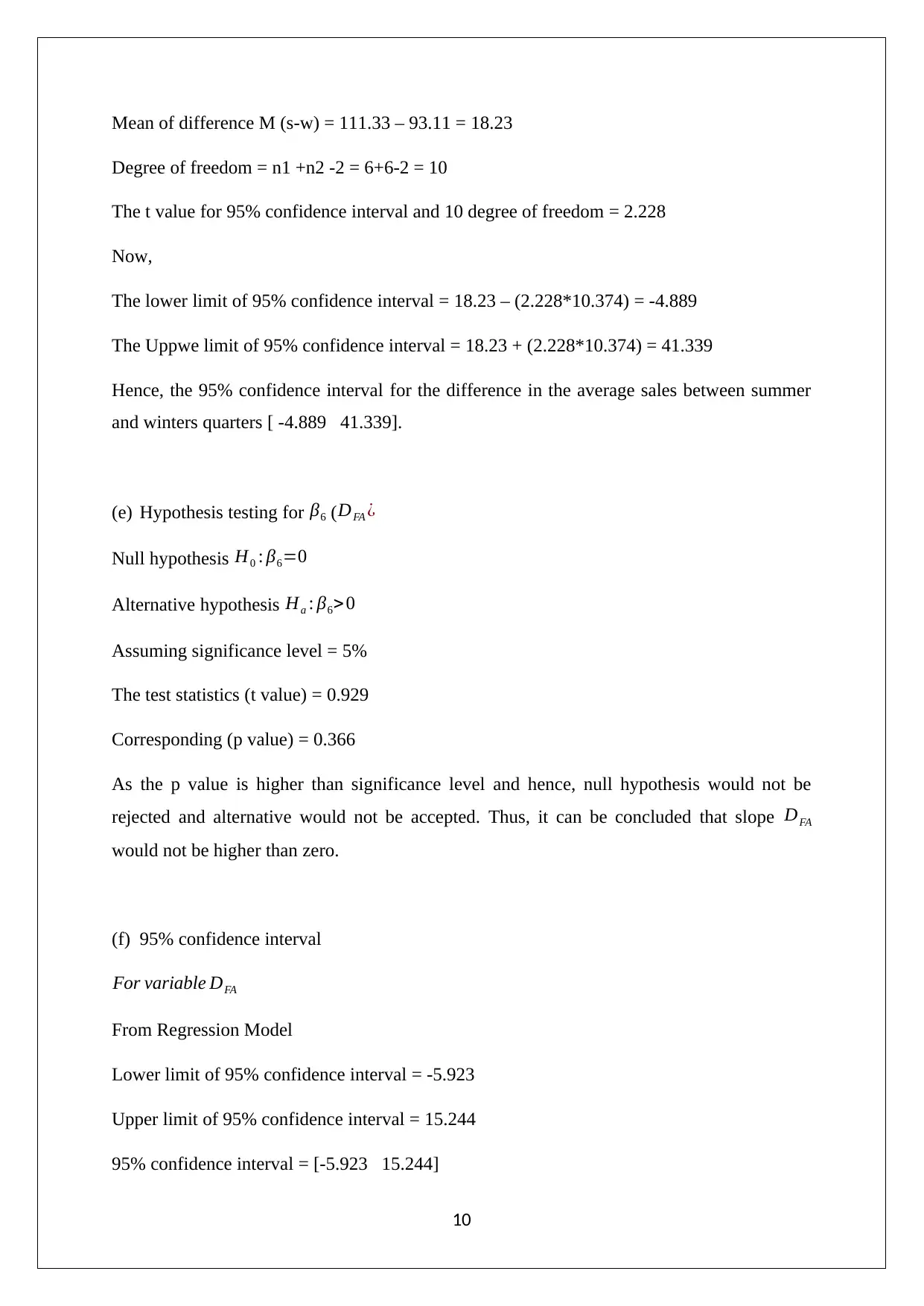

Mean of difference M (s-w) = 111.33 – 93.11 = 18.23

Degree of freedom = n1 +n2 -2 = 6+6-2 = 10

The t value for 95% confidence interval and 10 degree of freedom = 2.228

Now,

The lower limit of 95% confidence interval = 18.23 – (2.228*10.374) = -4.889

The Uppwe limit of 95% confidence interval = 18.23 + (2.228*10.374) = 41.339

Hence, the 95% confidence interval for the difference in the average sales between summer

and winters quarters [ -4.889 41.339].

(e) Hypothesis testing for β6 (DFA ¿

Null hypothesis H0 : β6=0

Alternative hypothesis Ha : β6>0

Assuming significance level = 5%

The test statistics (t value) = 0.929

Corresponding (p value) = 0.366

As the p value is higher than significance level and hence, null hypothesis would not be

rejected and alternative would not be accepted. Thus, it can be concluded that slope DFA

would not be higher than zero.

(f) 95% confidence interval

For variable DFA

From Regression Model

Lower limit of 95% confidence interval = -5.923

Upper limit of 95% confidence interval = 15.244

95% confidence interval = [-5.923 15.244]

10

Degree of freedom = n1 +n2 -2 = 6+6-2 = 10

The t value for 95% confidence interval and 10 degree of freedom = 2.228

Now,

The lower limit of 95% confidence interval = 18.23 – (2.228*10.374) = -4.889

The Uppwe limit of 95% confidence interval = 18.23 + (2.228*10.374) = 41.339

Hence, the 95% confidence interval for the difference in the average sales between summer

and winters quarters [ -4.889 41.339].

(e) Hypothesis testing for β6 (DFA ¿

Null hypothesis H0 : β6=0

Alternative hypothesis Ha : β6>0

Assuming significance level = 5%

The test statistics (t value) = 0.929

Corresponding (p value) = 0.366

As the p value is higher than significance level and hence, null hypothesis would not be

rejected and alternative would not be accepted. Thus, it can be concluded that slope DFA

would not be higher than zero.

(f) 95% confidence interval

For variable DFA

From Regression Model

Lower limit of 95% confidence interval = -5.923

Upper limit of 95% confidence interval = 15.244

95% confidence interval = [-5.923 15.244]

10

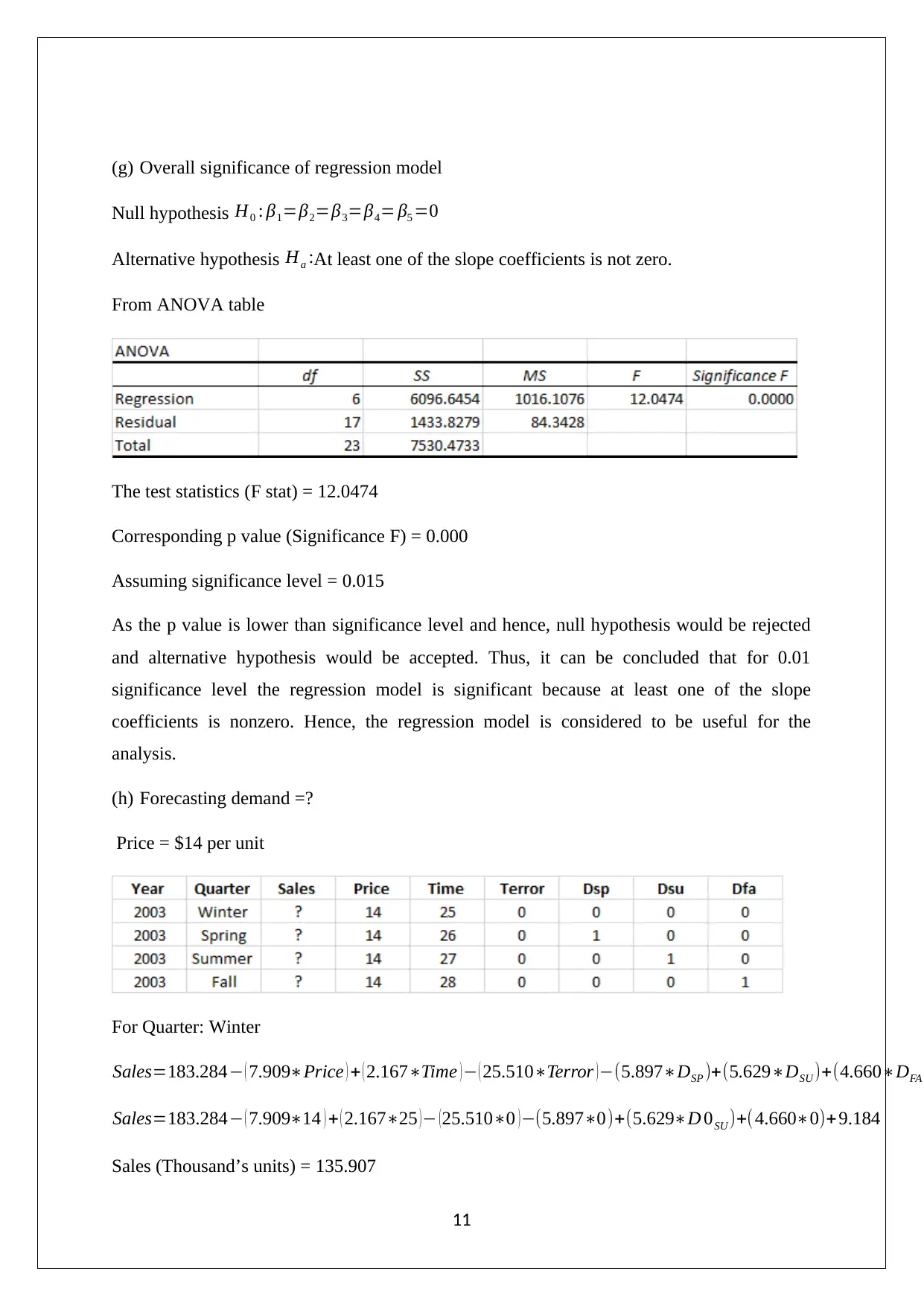

(g) Overall significance of regression model

Null hypothesis H0 : β1=β2=β3=β4= β5 =0

Alternative hypothesis Ha :At least one of the slope coefficients is not zero.

From ANOVA table

The test statistics (F stat) = 12.0474

Corresponding p value (Significance F) = 0.000

Assuming significance level = 0.015

As the p value is lower than significance level and hence, null hypothesis would be rejected

and alternative hypothesis would be accepted. Thus, it can be concluded that for 0.01

significance level the regression model is significant because at least one of the slope

coefficients is nonzero. Hence, the regression model is considered to be useful for the

analysis.

(h) Forecasting demand =?

Price = $14 per unit

For Quarter: Winter

Sales=183.284− ( 7.909∗Price ) + ( 2.167∗Time ) − ( 25.510∗Terror ) −(5.897∗DSP )+(5.629∗DSU )+(4.660∗DFA

Sales=183.284− ( 7.909∗14 ) + ( 2.167∗25 )− (25.510∗0 )−(5.897∗0)+(5.629∗D 0SU )+(4.660∗0)+ 9.184

Sales (Thousand’s units) = 135.907

11

Null hypothesis H0 : β1=β2=β3=β4= β5 =0

Alternative hypothesis Ha :At least one of the slope coefficients is not zero.

From ANOVA table

The test statistics (F stat) = 12.0474

Corresponding p value (Significance F) = 0.000

Assuming significance level = 0.015

As the p value is lower than significance level and hence, null hypothesis would be rejected

and alternative hypothesis would be accepted. Thus, it can be concluded that for 0.01

significance level the regression model is significant because at least one of the slope

coefficients is nonzero. Hence, the regression model is considered to be useful for the

analysis.

(h) Forecasting demand =?

Price = $14 per unit

For Quarter: Winter

Sales=183.284− ( 7.909∗Price ) + ( 2.167∗Time ) − ( 25.510∗Terror ) −(5.897∗DSP )+(5.629∗DSU )+(4.660∗DFA

Sales=183.284− ( 7.909∗14 ) + ( 2.167∗25 )− (25.510∗0 )−(5.897∗0)+(5.629∗D 0SU )+(4.660∗0)+ 9.184

Sales (Thousand’s units) = 135.907

11

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 13

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.