Graphical Techniques for Representing Australian Exports and Frequency Distributions

VerifiedAdded on 2023/03/17

|11

|1323

|75

AI Summary

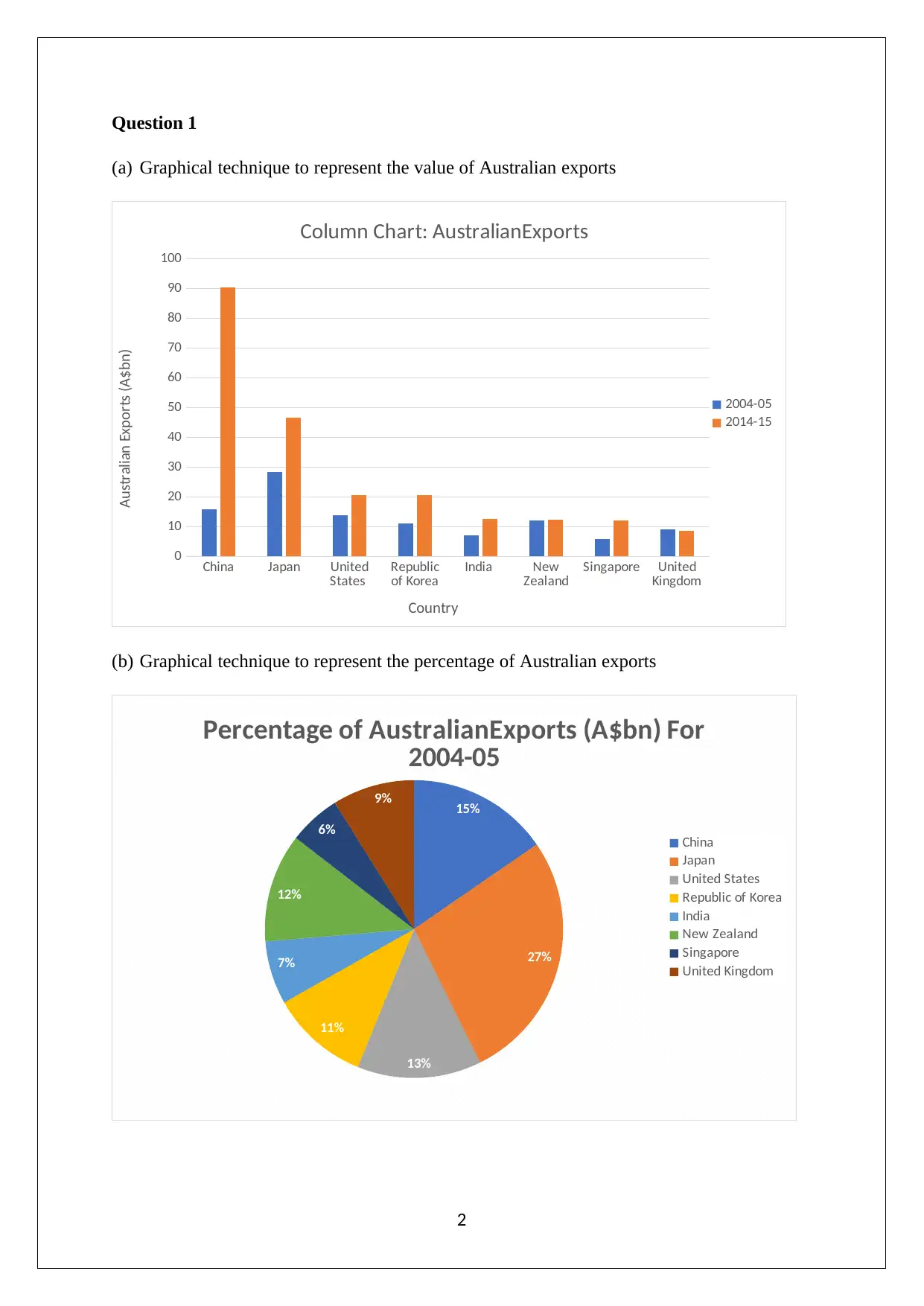

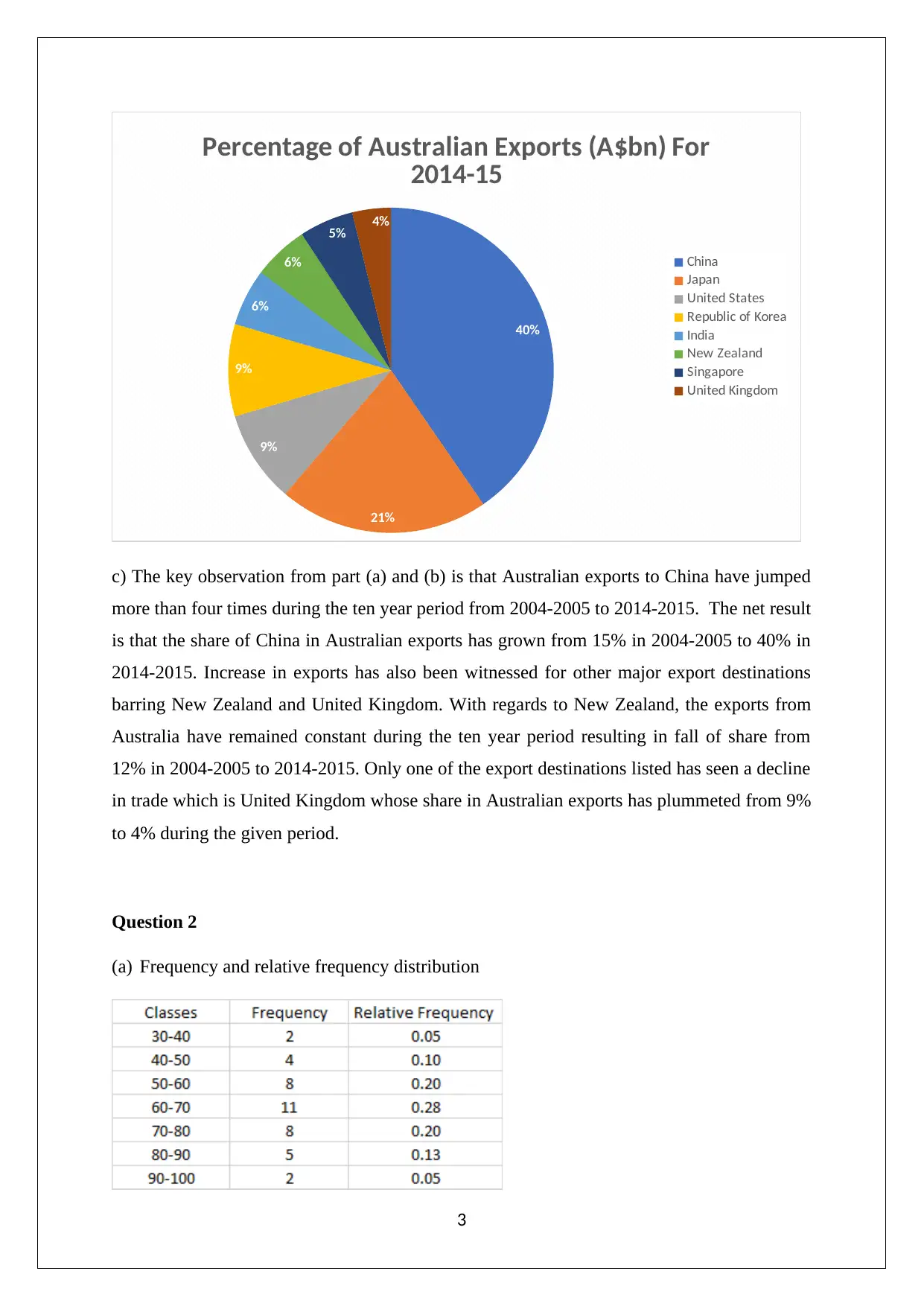

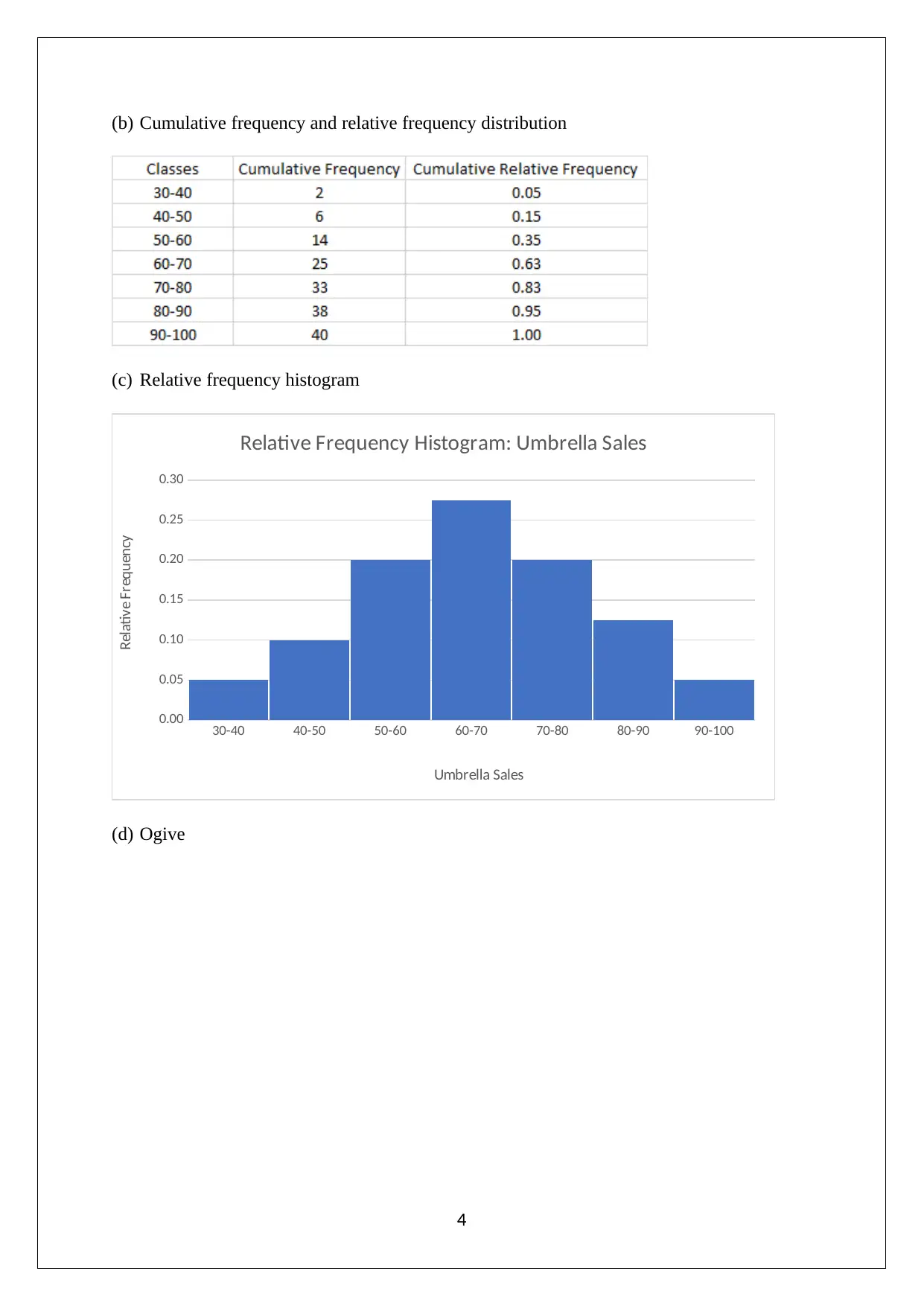

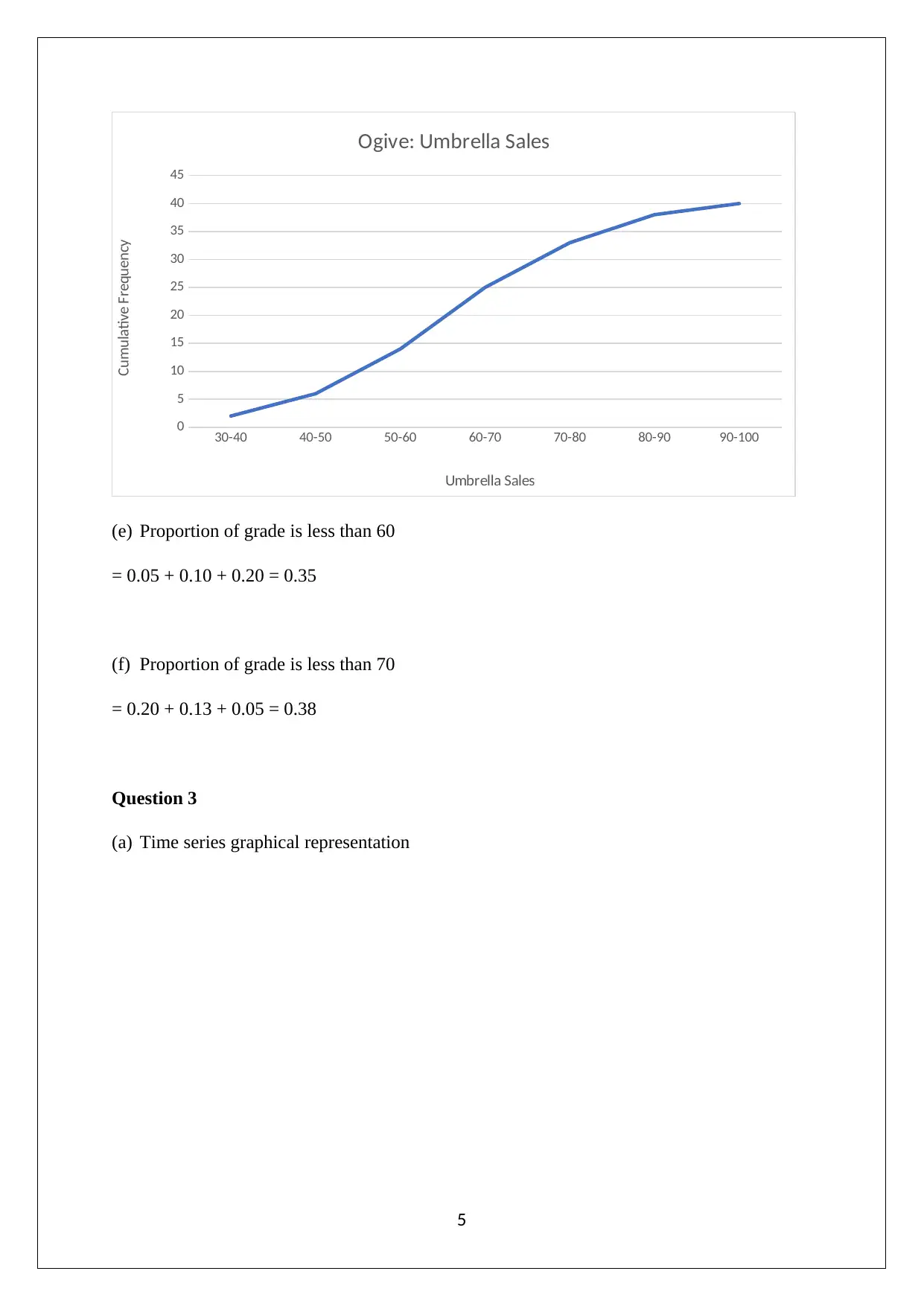

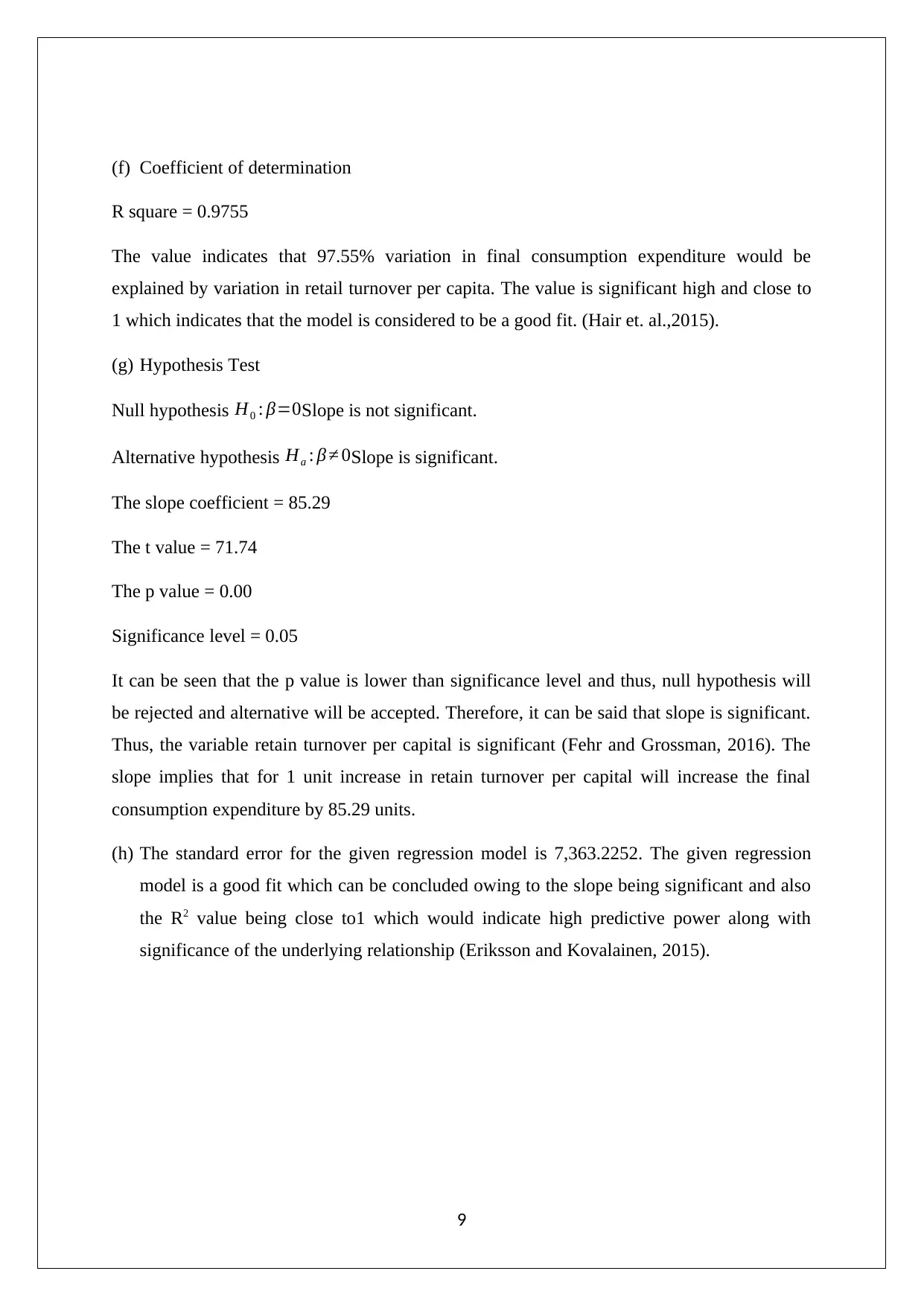

This document provides an overview of various graphical techniques used to represent Australian exports and frequency distributions. It covers the value and percentage of Australian exports, as well as frequency and relative frequency distributions. The document also discusses key observations and trends in Australian exports, time series graphical representation, scatter plots, numerical summaries, correlation coefficients, regression outputs, and hypothesis tests. It is a comprehensive resource for understanding and analyzing statistical data related to business and economics.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

1 out of 11

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)