MGT5STR: Inghams Enterprise Strategic Analysis in Agribusiness

VerifiedAdded on 2023/06/08

|13

|3340

|213

Report

AI Summary

This report provides a strategic analysis of Inghams Enterprise, an Australian agribusiness, focusing on its business activities, revenue streams, and market position. The analysis includes an examination of the external environment using PESTEL framework and Porter's Five Forces, assessing political, economic, social, technological, environmental, and legal factors impacting the company. An internal analysis using SWOT framework identifies Inghams' strengths, weaknesses, opportunities, and threats, along with its resources, capabilities, and core competencies. The report concludes with recommendations for the company's future strategic direction, highlighting areas for improvement and growth. Desklib offers similar solved assignments and past papers for students.

Running head: Strategic management

Strategic management

Strategic management

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Strategic management

Executive summary

External and internal environment play a fundamental role in each and every company to cope

up with rivalries internationally. The business units, outputs and revenue of Inghams enterprise

have been briefly explained in the task. The paper discusses that how the company analyzes and

identifies the micro and macro environment to capture the entire target audience. Along with

this, internal resources, capabilities, and core values also have been explained in the task. Further

detail of the task has been detailed below.

2

Executive summary

External and internal environment play a fundamental role in each and every company to cope

up with rivalries internationally. The business units, outputs and revenue of Inghams enterprise

have been briefly explained in the task. The paper discusses that how the company analyzes and

identifies the micro and macro environment to capture the entire target audience. Along with

this, internal resources, capabilities, and core values also have been explained in the task. Further

detail of the task has been detailed below.

2

Strategic management

Table of Contents

Executive summary.....................................................................................................................................2

Introduction.................................................................................................................................................4

Profile of Inghams enterprise.......................................................................................................................4

External analysis..........................................................................................................................................5

Pestel analysis.............................................................................................................................................6

Internal analysis of Inghams enterprise.......................................................................................................8

Resources, capabilities, core competencies and competitive benefits..........................................................9

Recommendations.....................................................................................................................................10

Conclusion.................................................................................................................................................11

References.................................................................................................................................................12

3

Table of Contents

Executive summary.....................................................................................................................................2

Introduction.................................................................................................................................................4

Profile of Inghams enterprise.......................................................................................................................4

External analysis..........................................................................................................................................5

Pestel analysis.............................................................................................................................................6

Internal analysis of Inghams enterprise.......................................................................................................8

Resources, capabilities, core competencies and competitive benefits..........................................................9

Recommendations.....................................................................................................................................10

Conclusion.................................................................................................................................................11

References.................................................................................................................................................12

3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Strategic management

Introduction

The main motive of this paper is to discuss about the business activities and operations of

Inghams enterprises limited that provides chicken products to the customers. The firm operates

and manages business operations as a poultry producer. Here is the brief discussion about the

revenue, profitability and business units of Ingham’s enterprise. A brief information about

external environment and internal organization have been explained in the task. The external and

internal analysis is done by the corporation to evaluate and analyze the challenges and issues of

the market. Along with this, the paper also provides brief information about resources,

capabilities, and core competencies of Inghams enterprise limited. The report outlines that how

the company takes competitive benefits by providing delicious products to the customers.

Profile of Inghams enterprise

Inghams enterprise is generally known as Inghams that is incorporated in 1918 in Australia. It is

Australian based corporation owned by TPG Capital and producer of fodder and poultry. It is one

of the biggest producers of turkey and chicken products in Australia. The firm has employed

approx 8,000 people in more than 100 locations in New Zealand and Australia (Inghams, 2018).

The organization is constantly improving and enhancing customer service and quality of the

products. Inghams is a biggest stockfeed producer who provides wide range of excellent quality

stockfeed products to the customers. Ingham is a poultry producer supplies to retail, retail and

foodservice customers. It processes 4 million birds every week. The company entered into

supply arrangements with the major retail restaurants in the 1960s. It enhanced it’s processing

capabilities to cater changing preference of the consumers towards enhanced poultry products. It

supplies a wide range of high-quality stock feed to the poultry, dairy,and industries. Ingham’s is

one of the largest poultry providers in Australia. The company supplies an inclusive range of

fresh and frozen chicken and turkey products to food service outlets. It also makes available

products like healthy chicken which have been approved by the schools. The company provides

free range chicken breast products. The business model of Ingham’s is vertically united and

includes 345 facilities and farms across Australia and New Zealand. Ingham’s has unmatched

service line of processing and distribution facilities across the country.

4

Introduction

The main motive of this paper is to discuss about the business activities and operations of

Inghams enterprises limited that provides chicken products to the customers. The firm operates

and manages business operations as a poultry producer. Here is the brief discussion about the

revenue, profitability and business units of Ingham’s enterprise. A brief information about

external environment and internal organization have been explained in the task. The external and

internal analysis is done by the corporation to evaluate and analyze the challenges and issues of

the market. Along with this, the paper also provides brief information about resources,

capabilities, and core competencies of Inghams enterprise limited. The report outlines that how

the company takes competitive benefits by providing delicious products to the customers.

Profile of Inghams enterprise

Inghams enterprise is generally known as Inghams that is incorporated in 1918 in Australia. It is

Australian based corporation owned by TPG Capital and producer of fodder and poultry. It is one

of the biggest producers of turkey and chicken products in Australia. The firm has employed

approx 8,000 people in more than 100 locations in New Zealand and Australia (Inghams, 2018).

The organization is constantly improving and enhancing customer service and quality of the

products. Inghams is a biggest stockfeed producer who provides wide range of excellent quality

stockfeed products to the customers. Ingham is a poultry producer supplies to retail, retail and

foodservice customers. It processes 4 million birds every week. The company entered into

supply arrangements with the major retail restaurants in the 1960s. It enhanced it’s processing

capabilities to cater changing preference of the consumers towards enhanced poultry products. It

supplies a wide range of high-quality stock feed to the poultry, dairy,and industries. Ingham’s is

one of the largest poultry providers in Australia. The company supplies an inclusive range of

fresh and frozen chicken and turkey products to food service outlets. It also makes available

products like healthy chicken which have been approved by the schools. The company provides

free range chicken breast products. The business model of Ingham’s is vertically united and

includes 345 facilities and farms across Australia and New Zealand. Ingham’s has unmatched

service line of processing and distribution facilities across the country.

4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Strategic management

Ingham’s is a foreign-owned public company originating revenue from production and sale of

chicken and turkey products. The company is listed on the ASX. The operations of Ingham

includes ten feedmills, breeder, broiler farms, hatcheries, seven primary processing plants, seven

additional processing plants and nine supply centres. The product range of the company includes:

Chicken: Fresh whole chicken, fresh chicken breast bone, boneless chicken, chicken

breast tenders and so on.

Turkey: Fresh turkey mince, fresh turkey wings, drumsticks and so on.

The company also produces stockfeed which is used internally and sells to the poultry and pig

industries. Ingham’s is having business units in Australia and New York. Ingham’s is a leading

poultry producer in New Zealand which reported 2.5% gain the earnings and trading also

improved in 2017 and the trend has continued in 2018. Ingham is having a leading market

position in Australia and is committed to the customer satisfaction (Nzherald.co.nz, 2017). The

business units of the company focus on the innovation and commitment to the food standards

and safety, employee’s health, and environment sustainability along with family welfare (Paulraj,

2011).

External analysis

The growth of Ingham’s depending on the external environment in the last 40 years. The five

force model is given below:

Bargaining power of suppliers: The service provided by the suppliers is quite satisfactory.

Ingham’s do not import chicken from any country. It is beneficial for the company as it gets a

discount from the domestic suppliers. The factors includes such as delivery on time, superior

quality of chicken helpthe company to win the trust of the customers (Zivanovic& Luck, 2016).

Competitor: There are various competitors for the company in the Australian market. The

competitors are Samex Australian meat company, Australian Meat Company, JBS Australia Pty

Limited and more. The company also faces competition from the companies outside Australia.

The companies have adopted the same product range and quality. In such a scenario, it has

become difficult to compete.

5

Ingham’s is a foreign-owned public company originating revenue from production and sale of

chicken and turkey products. The company is listed on the ASX. The operations of Ingham

includes ten feedmills, breeder, broiler farms, hatcheries, seven primary processing plants, seven

additional processing plants and nine supply centres. The product range of the company includes:

Chicken: Fresh whole chicken, fresh chicken breast bone, boneless chicken, chicken

breast tenders and so on.

Turkey: Fresh turkey mince, fresh turkey wings, drumsticks and so on.

The company also produces stockfeed which is used internally and sells to the poultry and pig

industries. Ingham’s is having business units in Australia and New York. Ingham’s is a leading

poultry producer in New Zealand which reported 2.5% gain the earnings and trading also

improved in 2017 and the trend has continued in 2018. Ingham is having a leading market

position in Australia and is committed to the customer satisfaction (Nzherald.co.nz, 2017). The

business units of the company focus on the innovation and commitment to the food standards

and safety, employee’s health, and environment sustainability along with family welfare (Paulraj,

2011).

External analysis

The growth of Ingham’s depending on the external environment in the last 40 years. The five

force model is given below:

Bargaining power of suppliers: The service provided by the suppliers is quite satisfactory.

Ingham’s do not import chicken from any country. It is beneficial for the company as it gets a

discount from the domestic suppliers. The factors includes such as delivery on time, superior

quality of chicken helpthe company to win the trust of the customers (Zivanovic& Luck, 2016).

Competitor: There are various competitors for the company in the Australian market. The

competitors are Samex Australian meat company, Australian Meat Company, JBS Australia Pty

Limited and more. The company also faces competition from the companies outside Australia.

The companies have adopted the same product range and quality. In such a scenario, it has

become difficult to compete.

5

Strategic management

The threat of new entrants: A good investment is required to take entry into the market. But there

are some companies like Ingham’s which are already established. In such a scenario, the threat of

new entrants is low in the Australia market. The switching cost is also low in the market (E.

Dobbs, 2014).

The threat of substitute products: It is not obligatory that customers will always prefer chicken as

a main source of food. The threat of substitute products is high for the company as people are

conscious about their health (Financial Review, 2017). So, they can like to consume vegetarian

food and can be selective for the non-veg.

Bargaining power of customers: The customers are well educated and like to attain all the

required information before getting delivery. The customers can communicate through helpline

and websites. The company prefers fixed pricing method. So, the bargaining power of the

customers is low.

Pestel analysis

Political factors: The political factors play important role in determining the factors which can

impact the long-term profitability of Ingham’s. There is political stability in Australia and the

company is supported by the local government. There are antitrust laws related to food (Bailey

&Inderberg, 2017).

Economic factors: The economy of Australia has experiencing uninterrupted economic growth.

Australia supports exports of agricultural products (Chuvieco, et. al. 2014). Ingham’s export to

New York and is provided support to expand operations in more parts of the country. The

inflation rate in the country was 1.9% in 2017 whereas the wage rate grew by 2.1%.

Social factors: Australia has a collection of diverse people living in the younger society

relatively. The younger generation is more health conscious and prefers to consume products of

Ingham’s. The company also makes available meals for every section of the society such as

children, youth and older. People are also highly educated and understand the value of healthy

food as a source of nutrition and protein.

Technological factors: The technology used by the Ingham’s helps to reduce costs and improve

quality. The company continuously makes efforts for the innovation. It benefits the organization

6

The threat of new entrants: A good investment is required to take entry into the market. But there

are some companies like Ingham’s which are already established. In such a scenario, the threat of

new entrants is low in the Australia market. The switching cost is also low in the market (E.

Dobbs, 2014).

The threat of substitute products: It is not obligatory that customers will always prefer chicken as

a main source of food. The threat of substitute products is high for the company as people are

conscious about their health (Financial Review, 2017). So, they can like to consume vegetarian

food and can be selective for the non-veg.

Bargaining power of customers: The customers are well educated and like to attain all the

required information before getting delivery. The customers can communicate through helpline

and websites. The company prefers fixed pricing method. So, the bargaining power of the

customers is low.

Pestel analysis

Political factors: The political factors play important role in determining the factors which can

impact the long-term profitability of Ingham’s. There is political stability in Australia and the

company is supported by the local government. There are antitrust laws related to food (Bailey

&Inderberg, 2017).

Economic factors: The economy of Australia has experiencing uninterrupted economic growth.

Australia supports exports of agricultural products (Chuvieco, et. al. 2014). Ingham’s export to

New York and is provided support to expand operations in more parts of the country. The

inflation rate in the country was 1.9% in 2017 whereas the wage rate grew by 2.1%.

Social factors: Australia has a collection of diverse people living in the younger society

relatively. The younger generation is more health conscious and prefers to consume products of

Ingham’s. The company also makes available meals for every section of the society such as

children, youth and older. People are also highly educated and understand the value of healthy

food as a source of nutrition and protein.

Technological factors: The technology used by the Ingham’s helps to reduce costs and improve

quality. The company continuously makes efforts for the innovation. It benefits the organization

6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

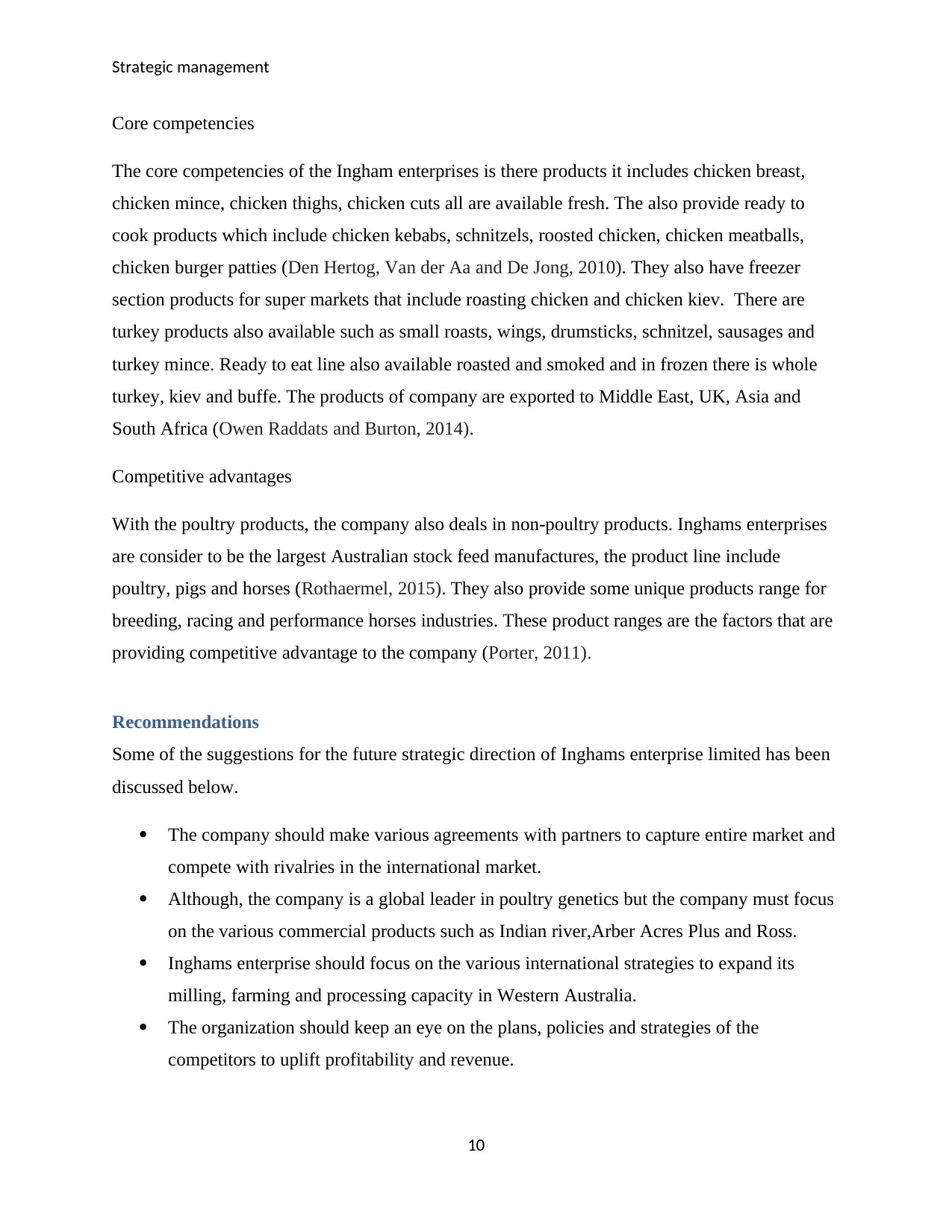

Strategic management

as well as employees. Australia also makes efforts for the technological advancements of the

companies like Ingham’s. The technology used by the company in preserving and packaging of

chicken.

Environmental factors: Australia is one of the most biologically diverse countries. The country

has animals in large number which increases the scope of business for Ingham’s. There are

suitable conditions for the animals. The norms and the environmental standards of Australia

impact the profitability of Ingham’s (Poultry World, 2017).

Legal factors: The legal framework is capable enough to protect the intellectual rights of the

company. Ingham’s is affected by the laws like the anti-trust law in food, discrimination law,

employment law and consumer protection. The legal changes such as new systems and

procedures affect the cost of the company.

7

as well as employees. Australia also makes efforts for the technological advancements of the

companies like Ingham’s. The technology used by the company in preserving and packaging of

chicken.

Environmental factors: Australia is one of the most biologically diverse countries. The country

has animals in large number which increases the scope of business for Ingham’s. There are

suitable conditions for the animals. The norms and the environmental standards of Australia

impact the profitability of Ingham’s (Poultry World, 2017).

Legal factors: The legal framework is capable enough to protect the intellectual rights of the

company. Ingham’s is affected by the laws like the anti-trust law in food, discrimination law,

employment law and consumer protection. The legal changes such as new systems and

procedures affect the cost of the company.

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Strategic management

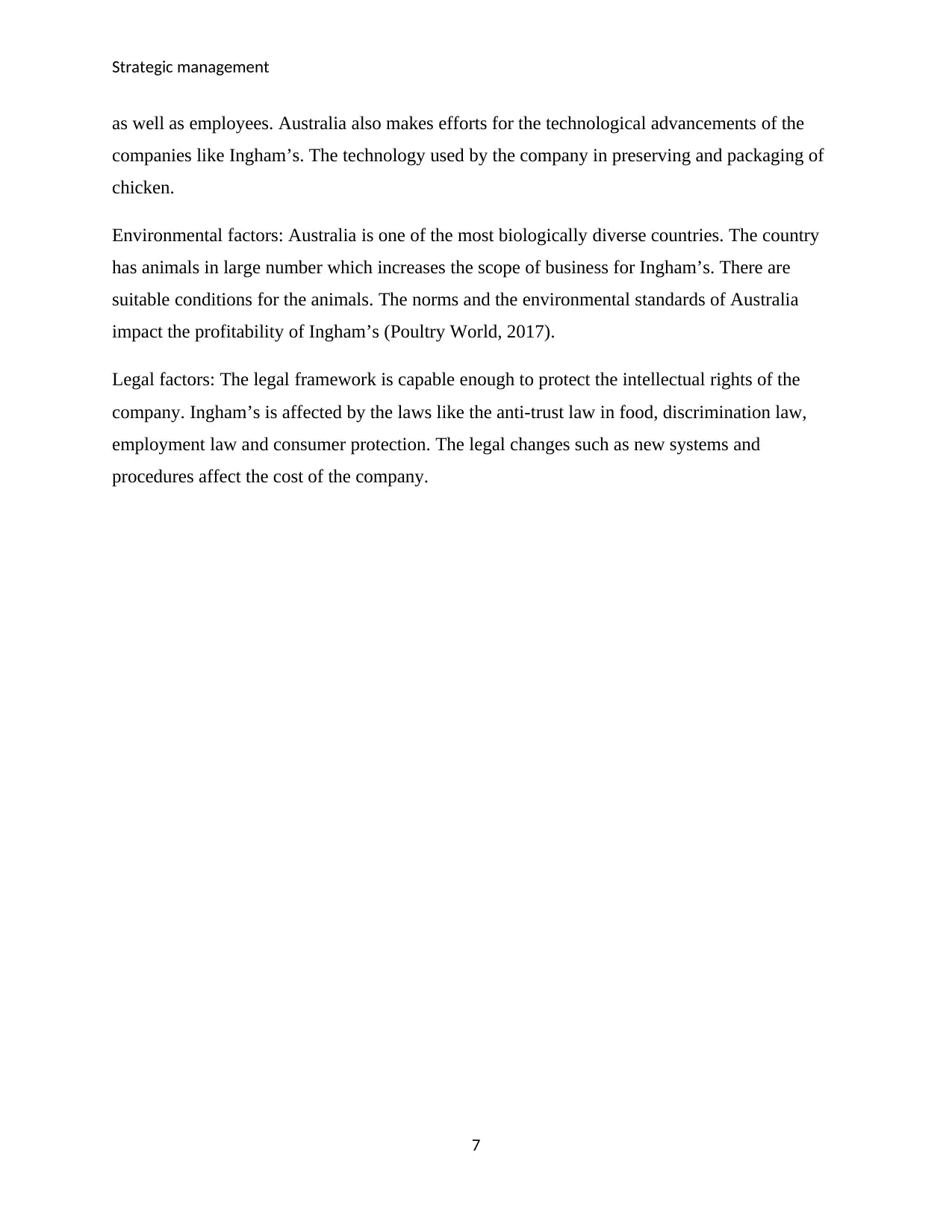

Internal analysis of Inghams enterprise

An internal analysis is an examination of company’s competency, competitive viability and cost

position in the global market (Lin and Wu, 2014). Internal environmental analysis provides

effective and unique information about the organization’s strengths, weaknesses, opportunities

and threats. SWOT analysis is done by Inghams enterprise to overcome the competitors in the

international market. The SWOT analysis for Inghams enterprise has been discussed below.

Strengths Weaknesses

The company provides high level of

customer satisfaction to the customers

across the world.

Inghams enterprise has strong and

unique management team and further it

uses dynamic supply chain

management.

The firm has strong and attractive free

cash flows that render resources in the

hand of the firm to expand and explore

into new projects.

Well known and effective brand name

with dynamic reputation and service.

The potential risk involved in core

revenue concentration.

Bad acquisitions and cost structure

system that affects the growth and

progress of the company adversely.

Work inefficiency is one of the vital

weaknesses for the firm.

Opportunities Threats

Inghams enterprise has invested huge

amount on online platform. This

investment helps the company to open

new sales channel in the international

market.

The purchasers may obtain better

monetary value and quality at Inghams

Changing consumer buying behavior

from ample of online channels could be

a biggest threat to the firm.

Shortage of skilled and talented labor

force in global market may also be a

biggest and serious threat for the

company (Helms and Nixon, 2010).

8

Internal analysis of Inghams enterprise

An internal analysis is an examination of company’s competency, competitive viability and cost

position in the global market (Lin and Wu, 2014). Internal environmental analysis provides

effective and unique information about the organization’s strengths, weaknesses, opportunities

and threats. SWOT analysis is done by Inghams enterprise to overcome the competitors in the

international market. The SWOT analysis for Inghams enterprise has been discussed below.

Strengths Weaknesses

The company provides high level of

customer satisfaction to the customers

across the world.

Inghams enterprise has strong and

unique management team and further it

uses dynamic supply chain

management.

The firm has strong and attractive free

cash flows that render resources in the

hand of the firm to expand and explore

into new projects.

Well known and effective brand name

with dynamic reputation and service.

The potential risk involved in core

revenue concentration.

Bad acquisitions and cost structure

system that affects the growth and

progress of the company adversely.

Work inefficiency is one of the vital

weaknesses for the firm.

Opportunities Threats

Inghams enterprise has invested huge

amount on online platform. This

investment helps the company to open

new sales channel in the international

market.

The purchasers may obtain better

monetary value and quality at Inghams

Changing consumer buying behavior

from ample of online channels could be

a biggest threat to the firm.

Shortage of skilled and talented labor

force in global market may also be a

biggest and serious threat for the

company (Helms and Nixon, 2010).

8

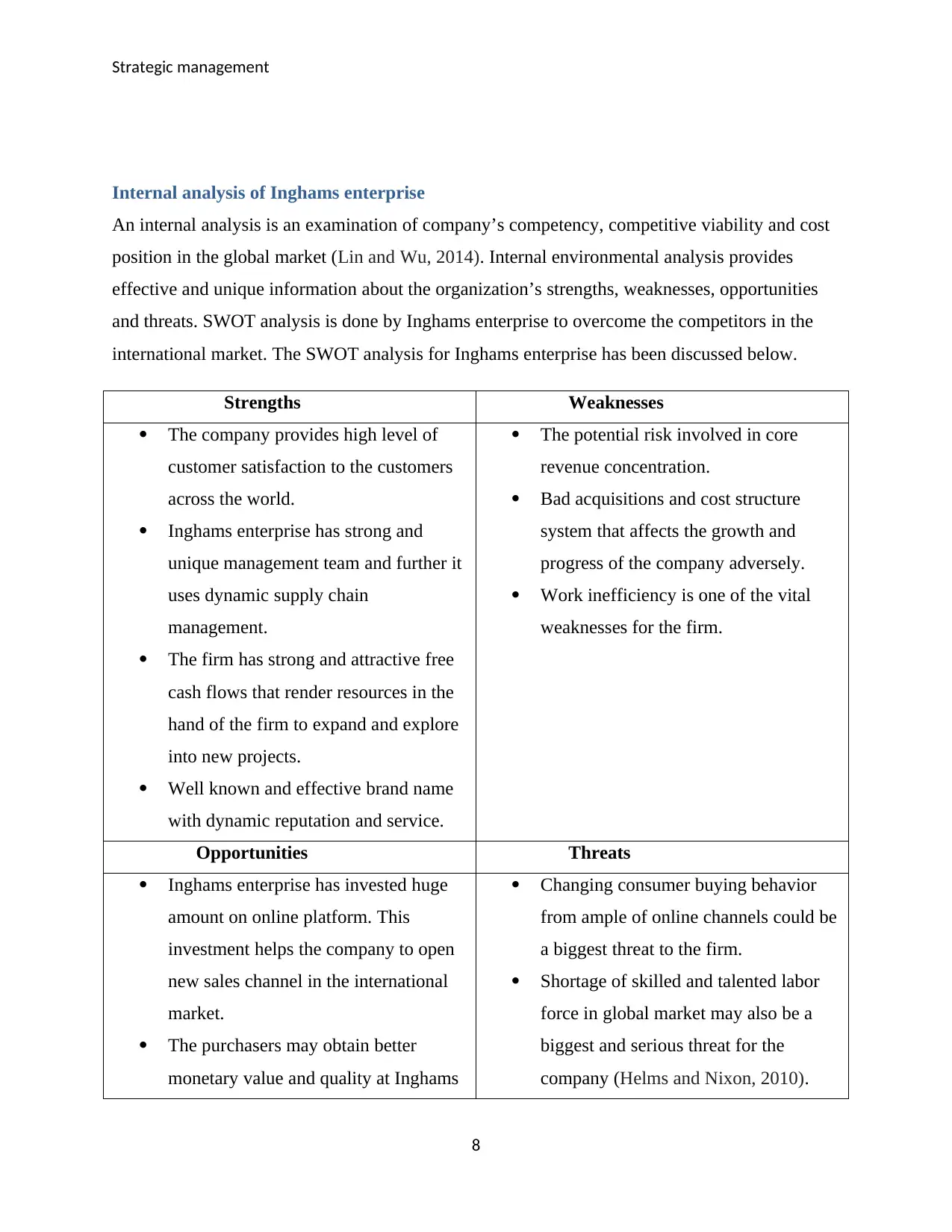

Strategic management

with the help of win-win state of

affairs.

The cost of transportation has been

decreased due to lower shipping costs

thus it helps in providing good

opportunity to boost and increase

profitability and outcomes.

Furthermore, new and innovative

technology also provides an

opportunity to the firm for exploring

and expanding the business activities

widely (Fernfortuniversity, 2018).

Low quality product is also a one of the

significant threats to the organization.

Resources, capabilities, core competencies and competitive benefits

Resources

Resources that help the company in doing their business effectively and efficiently are the best

breed of chicken those are available in market, they have a big farm where they keeps the

chicken and rise their own chicken, eggs and turkey products (Cameron and Quinn, 2011). They

have the most sophisticated machinery and the largest poultry processing plant of the country

(Pritchard and Tonts, 2011).

Capabilities

The fonder Walter Ingham had purchased a 42 acres area in 1918 and start a business with six

hens, and one cockerel (Inghams, 2018). In 2001, Inghams established a poultry processing plant

‘Murarrie’ that was a largest plant in the country (Barreto, 2010). In present, the business is

expanded to various part of world. The production and supply chain technologies provide

employment to approx. 1200 workers (Inghams, 2018). The company employed around 9000

people in more than 100 locations in New Zealand and Australia (Weerawardena and Mavondo,

2011).

9

with the help of win-win state of

affairs.

The cost of transportation has been

decreased due to lower shipping costs

thus it helps in providing good

opportunity to boost and increase

profitability and outcomes.

Furthermore, new and innovative

technology also provides an

opportunity to the firm for exploring

and expanding the business activities

widely (Fernfortuniversity, 2018).

Low quality product is also a one of the

significant threats to the organization.

Resources, capabilities, core competencies and competitive benefits

Resources

Resources that help the company in doing their business effectively and efficiently are the best

breed of chicken those are available in market, they have a big farm where they keeps the

chicken and rise their own chicken, eggs and turkey products (Cameron and Quinn, 2011). They

have the most sophisticated machinery and the largest poultry processing plant of the country

(Pritchard and Tonts, 2011).

Capabilities

The fonder Walter Ingham had purchased a 42 acres area in 1918 and start a business with six

hens, and one cockerel (Inghams, 2018). In 2001, Inghams established a poultry processing plant

‘Murarrie’ that was a largest plant in the country (Barreto, 2010). In present, the business is

expanded to various part of world. The production and supply chain technologies provide

employment to approx. 1200 workers (Inghams, 2018). The company employed around 9000

people in more than 100 locations in New Zealand and Australia (Weerawardena and Mavondo,

2011).

9

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Strategic management

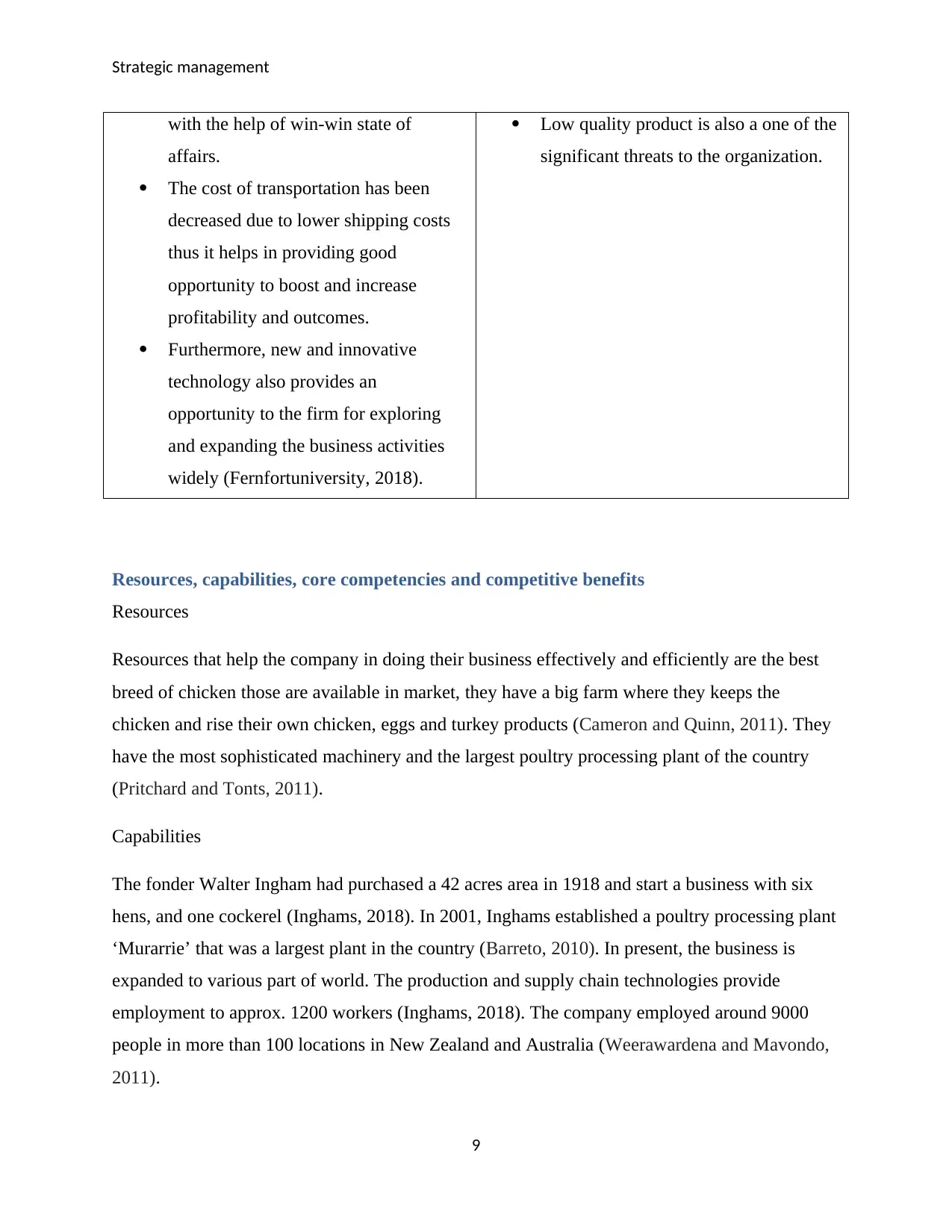

Core competencies

The core competencies of the Ingham enterprises is there products it includes chicken breast,

chicken mince, chicken thighs, chicken cuts all are available fresh. The also provide ready to

cook products which include chicken kebabs, schnitzels, roosted chicken, chicken meatballs,

chicken burger patties (Den Hertog, Van der Aa and De Jong, 2010). They also have freezer

section products for super markets that include roasting chicken and chicken kiev. There are

turkey products also available such as small roasts, wings, drumsticks, schnitzel, sausages and

turkey mince. Ready to eat line also available roasted and smoked and in frozen there is whole

turkey, kiev and buffe. The products of company are exported to Middle East, UK, Asia and

South Africa (Owen Raddats and Burton, 2014).

Competitive advantages

With the poultry products, the company also deals in non-poultry products. Inghams enterprises

are consider to be the largest Australian stock feed manufactures, the product line include

poultry, pigs and horses (Rothaermel, 2015). They also provide some unique products range for

breeding, racing and performance horses industries. These product ranges are the factors that are

providing competitive advantage to the company (Porter, 2011).

Recommendations

Some of the suggestions for the future strategic direction of Inghams enterprise limited has been

discussed below.

The company should make various agreements with partners to capture entire market and

compete with rivalries in the international market.

Although, the company is a global leader in poultry genetics but the company must focus

on the various commercial products such as Indian river,Arber Acres Plus and Ross.

Inghams enterprise should focus on the various international strategies to expand its

milling, farming and processing capacity in Western Australia.

The organization should keep an eye on the plans, policies and strategies of the

competitors to uplift profitability and revenue.

10

Core competencies

The core competencies of the Ingham enterprises is there products it includes chicken breast,

chicken mince, chicken thighs, chicken cuts all are available fresh. The also provide ready to

cook products which include chicken kebabs, schnitzels, roosted chicken, chicken meatballs,

chicken burger patties (Den Hertog, Van der Aa and De Jong, 2010). They also have freezer

section products for super markets that include roasting chicken and chicken kiev. There are

turkey products also available such as small roasts, wings, drumsticks, schnitzel, sausages and

turkey mince. Ready to eat line also available roasted and smoked and in frozen there is whole

turkey, kiev and buffe. The products of company are exported to Middle East, UK, Asia and

South Africa (Owen Raddats and Burton, 2014).

Competitive advantages

With the poultry products, the company also deals in non-poultry products. Inghams enterprises

are consider to be the largest Australian stock feed manufactures, the product line include

poultry, pigs and horses (Rothaermel, 2015). They also provide some unique products range for

breeding, racing and performance horses industries. These product ranges are the factors that are

providing competitive advantage to the company (Porter, 2011).

Recommendations

Some of the suggestions for the future strategic direction of Inghams enterprise limited has been

discussed below.

The company should make various agreements with partners to capture entire market and

compete with rivalries in the international market.

Although, the company is a global leader in poultry genetics but the company must focus

on the various commercial products such as Indian river,Arber Acres Plus and Ross.

Inghams enterprise should focus on the various international strategies to expand its

milling, farming and processing capacity in Western Australia.

The organization should keep an eye on the plans, policies and strategies of the

competitors to uplift profitability and revenue.

10

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Strategic management

Product differentiation strategy shall be used by the company to differentiate its products

from the competitors.

Furthermore, Inghams enterprise must focus on the leadership strategy and management

to attract the candidates and to eliminate resistance to change within the organization.

Effective training and development coaching shall be provided by the firm to the workers

to motivate and encourage them towards the attainment of long term goals and objectives.

Conclusion

On the above mentioned limelight event, it is concluded that Inghams enterprise limited is one of

the biggest players in agribusiness food sector in Australia. In today’s era, the company provides

chicken and turkey products to the customers across the world. The above analysis shows that

how the company analyze and evaluate the external environment to identify risks and challenges

of the market. Pestle and SWOT analysis are done by the company to gain competitive benefits

in the global market. The analysis shows that resources, core capabilities and core values play a

vital role to meet the long term requirements and wants of the business. At the end, some

recommendations have been given for future growth and progress of the firm.

11

Product differentiation strategy shall be used by the company to differentiate its products

from the competitors.

Furthermore, Inghams enterprise must focus on the leadership strategy and management

to attract the candidates and to eliminate resistance to change within the organization.

Effective training and development coaching shall be provided by the firm to the workers

to motivate and encourage them towards the attainment of long term goals and objectives.

Conclusion

On the above mentioned limelight event, it is concluded that Inghams enterprise limited is one of

the biggest players in agribusiness food sector in Australia. In today’s era, the company provides

chicken and turkey products to the customers across the world. The above analysis shows that

how the company analyze and evaluate the external environment to identify risks and challenges

of the market. Pestle and SWOT analysis are done by the company to gain competitive benefits

in the global market. The analysis shows that resources, core capabilities and core values play a

vital role to meet the long term requirements and wants of the business. At the end, some

recommendations have been given for future growth and progress of the firm.

11

Strategic management

References

Bailey, I. and Inderberg, T.H.J., 2017. Australia: domestic politics, diffusion and emissions

trading design as a technical and political project. In The Evolution of Carbon Markets (pp. 136-

156).Routledge.

Barreto, I., 2010. Dynamic capabilities: A review of past research and an agenda for the

future. Journal of management, 36(1), pp.256-280.

Cameron, K.S. and Quinn, R.E., 2011. Diagnosing and changing organizational culture: Based

on the competing values framework. John Wiley & Sons.

Chuvieco, E., Martínez, S., Román, M.V., Hantson, S. and Pettinari, M.L., 2014. Integration of

ecological and socio‐economic factors to assess global vulnerability to wildfire. Global Ecology

and Biogeography, 23(2), pp.245-258.

Den Hertog, P., Van der Aa, W. and De Jong, M.W., 2010. Capabilities for managing service

innovation: towards a conceptual framework. Journal of service Management, 21(4), pp.490-

514.

E. Dobbs, M., 2014. Guidelines for applying Porter's five forces framework: a set of industry

analysis templates. Competitiveness Review, 24(1), pp.32-45.

Fernfortuniversity.2018. Inghams group limited SWOT analysis/Matrix [Online]. Available from

http://fernfortuniversity.com/term-papers/swot/nyse/4845-inghams-group-limited.php [Accessed

as on 20th August 2018].

Financial Review, 2017. Feathers fly at chicken processor Ingham’s. [Online] Available at

https://www.afr.com/business/agriculture/feathers-fly-at-chicken-processor-inghams-20170905-

gyb6n4 [Accessed on 15 August, 2018].

Helms, M.M. and Nixon, J., 2010. Exploring SWOT analysis–where are we now? A review of

academic research from the last decade. Journal of strategy and management, 3(3), pp.215-251.

12

References

Bailey, I. and Inderberg, T.H.J., 2017. Australia: domestic politics, diffusion and emissions

trading design as a technical and political project. In The Evolution of Carbon Markets (pp. 136-

156).Routledge.

Barreto, I., 2010. Dynamic capabilities: A review of past research and an agenda for the

future. Journal of management, 36(1), pp.256-280.

Cameron, K.S. and Quinn, R.E., 2011. Diagnosing and changing organizational culture: Based

on the competing values framework. John Wiley & Sons.

Chuvieco, E., Martínez, S., Román, M.V., Hantson, S. and Pettinari, M.L., 2014. Integration of

ecological and socio‐economic factors to assess global vulnerability to wildfire. Global Ecology

and Biogeography, 23(2), pp.245-258.

Den Hertog, P., Van der Aa, W. and De Jong, M.W., 2010. Capabilities for managing service

innovation: towards a conceptual framework. Journal of service Management, 21(4), pp.490-

514.

E. Dobbs, M., 2014. Guidelines for applying Porter's five forces framework: a set of industry

analysis templates. Competitiveness Review, 24(1), pp.32-45.

Fernfortuniversity.2018. Inghams group limited SWOT analysis/Matrix [Online]. Available from

http://fernfortuniversity.com/term-papers/swot/nyse/4845-inghams-group-limited.php [Accessed

as on 20th August 2018].

Financial Review, 2017. Feathers fly at chicken processor Ingham’s. [Online] Available at

https://www.afr.com/business/agriculture/feathers-fly-at-chicken-processor-inghams-20170905-

gyb6n4 [Accessed on 15 August, 2018].

Helms, M.M. and Nixon, J., 2010. Exploring SWOT analysis–where are we now? A review of

academic research from the last decade. Journal of strategy and management, 3(3), pp.215-251.

12

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 13

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.