Strategic Management: Opportunities and Threats to BP

VerifiedAdded on 2023/03/20

|11

|2667

|84

AI Summary

This report discusses the opportunities and threats faced by BP in the oil and gas industry through PESTLE analysis. It also analyzes the attractiveness of the steel industry using Porter's five forces model. Additionally, it examines the growth and market share of Apple Inc using the BCG matrix.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

STRATEGIC

MANAGEMENT

MANAGEMENT

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Table of Contents

INTRODUCTION...........................................................................................................................1

TASK 1............................................................................................................................................1

PESTLE Analysis to offer important opportunities and threats to BP.......................................1

TASK 2............................................................................................................................................3

Five Forces analysis that make steel industry attractive.............................................................3

TASK 3............................................................................................................................................4

a) Analyse growth/market share using BCG matrix ..................................................................4

B) Potential problems with the BCG matrix...............................................................................4

CONCLUSION................................................................................................................................4

REFERENCES................................................................................................................................4

INTRODUCTION...........................................................................................................................1

TASK 1............................................................................................................................................1

PESTLE Analysis to offer important opportunities and threats to BP.......................................1

TASK 2............................................................................................................................................3

Five Forces analysis that make steel industry attractive.............................................................3

TASK 3............................................................................................................................................4

a) Analyse growth/market share using BCG matrix ..................................................................4

B) Potential problems with the BCG matrix...............................................................................4

CONCLUSION................................................................................................................................4

REFERENCES................................................................................................................................4

INTRODUCTION

Strategic management is the important process adopted by business organisation in which

they frame important plans and steps that has to be followed effectively. This assignment involve

case of BP, which is one of the world's largest oil and gas company. Other case highlights the

importance of steel industry and roles played by it in number of places over nation. The report

focuses upon PESTEL analysis that underlines the opportunity and threats that is offered to BP.

Apart from it, it also highlight the five force analysis that make steel industry attractive.

TASK 1

PESTLE Analysis to offer important opportunities and threats to BP

BP utilises PESTLE analysis which is consider one of the tool to analyse the impact of

elements that are present in external environment and consider it while taking decisions. Thus, in

order to examine various factors that may effect their functioning to find out several

opportunities and threats are discussed below:

Opportunities: There are several opportunities that are experienced by Oil business in

Russia was aligned with in partnership with Rosneft, in which BP contains 18% of the shares.

According to the prediction of Forbes magazine, it was presented that economic growth of BP

will be 7% per annum for china, 2% for united States and 1% for Europe. This shows sustainable

increase in growth at market place. Another favourable condition of this company is that oil

prices is at peak in 2008, that is about $120. Apart from it, BP have to introduce new laws and

regulations related to workers safety, who are working in industry.

There are several technological opportunities that include 'Fire ice' and 'Fracking'.

Adopting 'Fracking' technology will lead to increase in supply of natural gas worldwide by 2020.

New and innovative technology results into fall of natural gas price to 30% between 2011 and

2013. Moreover company have to follow all the rules and regulations that are framed by UK

government so that all transactions that are related to oil and gas could be carried out in effective

manner. It is essential for them to Comply all rules and regulations that are formulated will allow

them to work smoothly without any problem.

Threats: There are several external and internal threats that are faced by this company

one involve the tragedy that took place in 2010, BP's deep water Horizon oil rig explosion that

lead to occurrence of 11 deaths, and for this US government charged $4bn for their disaster.

1

Strategic management is the important process adopted by business organisation in which

they frame important plans and steps that has to be followed effectively. This assignment involve

case of BP, which is one of the world's largest oil and gas company. Other case highlights the

importance of steel industry and roles played by it in number of places over nation. The report

focuses upon PESTEL analysis that underlines the opportunity and threats that is offered to BP.

Apart from it, it also highlight the five force analysis that make steel industry attractive.

TASK 1

PESTLE Analysis to offer important opportunities and threats to BP

BP utilises PESTLE analysis which is consider one of the tool to analyse the impact of

elements that are present in external environment and consider it while taking decisions. Thus, in

order to examine various factors that may effect their functioning to find out several

opportunities and threats are discussed below:

Opportunities: There are several opportunities that are experienced by Oil business in

Russia was aligned with in partnership with Rosneft, in which BP contains 18% of the shares.

According to the prediction of Forbes magazine, it was presented that economic growth of BP

will be 7% per annum for china, 2% for united States and 1% for Europe. This shows sustainable

increase in growth at market place. Another favourable condition of this company is that oil

prices is at peak in 2008, that is about $120. Apart from it, BP have to introduce new laws and

regulations related to workers safety, who are working in industry.

There are several technological opportunities that include 'Fire ice' and 'Fracking'.

Adopting 'Fracking' technology will lead to increase in supply of natural gas worldwide by 2020.

New and innovative technology results into fall of natural gas price to 30% between 2011 and

2013. Moreover company have to follow all the rules and regulations that are framed by UK

government so that all transactions that are related to oil and gas could be carried out in effective

manner. It is essential for them to Comply all rules and regulations that are formulated will allow

them to work smoothly without any problem.

Threats: There are several external and internal threats that are faced by this company

one involve the tragedy that took place in 2010, BP's deep water Horizon oil rig explosion that

lead to occurrence of 11 deaths, and for this US government charged $4bn for their disaster.

1

There are number of court cases that is still pending. The major threat also involve recession that

took place in 2009 and thus oil prices drop down to $30 from $120. Another factor involve

exchange rates that have to be consider by the company of different nations. Use of cars has been

declined in European countries and have shifted to motor vehicles, train. Technological aspects

of the company include 'Fracking' technology system results into pollution of local water bodies

and also lead to generation of small earthquakes. It also contributes in global warming as gas

which is produced in fracking process is directly released into the atmosphere. Major

threat faced this company was the oil rig explosion that took place in 2010, that results in 11

deaths. Apart from it, introduction of new technology that involve 'fracking' in which extraction

of gas took place from underground rock resulting in polluting water bodies and small

earthquakes. It also causes global warming that lead to pollution of environment. Different

nation have distinct legal rules and regulations, thus BP have to follow it in correct manner.

Major challenges faced by this company is to formulate policies related to health and safety of

workers that are working in that industry which should be in accordance to guidelines framed by

the government body. Company should frame tax rate related to their products that they sell to

various places. The deep water horizon disaster that took place in creation of safety rules that has

to be imposed into the system.

Conclusion: From the above discussion about PESTLE analysis that affect the BP

company in several ways. Each factors of PESTLE analysis offer some opportunities and threats

that may hinder and foster the performance of BP.

TASK 2

Five Forces analysis that make steel industry attractive

Porter's five forces model is an essential technique that help every business to evaluate

competition that is present in outside environment. The steel industry is a important component

and is static for longer period of time. Thus, it have to be analysed using porter's five forces

model which is described below:

2

took place in 2009 and thus oil prices drop down to $30 from $120. Another factor involve

exchange rates that have to be consider by the company of different nations. Use of cars has been

declined in European countries and have shifted to motor vehicles, train. Technological aspects

of the company include 'Fracking' technology system results into pollution of local water bodies

and also lead to generation of small earthquakes. It also contributes in global warming as gas

which is produced in fracking process is directly released into the atmosphere. Major

threat faced this company was the oil rig explosion that took place in 2010, that results in 11

deaths. Apart from it, introduction of new technology that involve 'fracking' in which extraction

of gas took place from underground rock resulting in polluting water bodies and small

earthquakes. It also causes global warming that lead to pollution of environment. Different

nation have distinct legal rules and regulations, thus BP have to follow it in correct manner.

Major challenges faced by this company is to formulate policies related to health and safety of

workers that are working in that industry which should be in accordance to guidelines framed by

the government body. Company should frame tax rate related to their products that they sell to

various places. The deep water horizon disaster that took place in creation of safety rules that has

to be imposed into the system.

Conclusion: From the above discussion about PESTLE analysis that affect the BP

company in several ways. Each factors of PESTLE analysis offer some opportunities and threats

that may hinder and foster the performance of BP.

TASK 2

Five Forces analysis that make steel industry attractive

Porter's five forces model is an essential technique that help every business to evaluate

competition that is present in outside environment. The steel industry is a important component

and is static for longer period of time. Thus, it have to be analysed using porter's five forces

model which is described below:

2

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

(Source:Five Forces Model,2018)

Competitive Rivalry: According to the case study, China is a major player in world steel

industry and have increase their capacity seven times. This may pose a rise of rivalry for Mittal

and TATA. China producers have fear that decrease in domestic demand would lead to surge

into international market.

Threat of new Entrant: China poses a huge threat in front of many steel companies and

is among the largest steel industry in the world. There are new companies coming into the

market including European steel Arcelor. There are presences of Anglo-Dutch company. There is

situation of over capacity in European steel industry and they have decided to close it down, but

the French government threatened to nationalise it.

Threat of Substitutes: Substitutes are the products and goods which can be used in place

of other basic commodity. If there are number of substitutes available than there is situation of

increase in competition. According to case study, there are three ore producers Vale, Rio and

Tinto which may lead to increase in competition amongst them. Consumers can shift their

3

Illustration 1: Five Forces Model, 2018

Competitive Rivalry: According to the case study, China is a major player in world steel

industry and have increase their capacity seven times. This may pose a rise of rivalry for Mittal

and TATA. China producers have fear that decrease in domestic demand would lead to surge

into international market.

Threat of new Entrant: China poses a huge threat in front of many steel companies and

is among the largest steel industry in the world. There are new companies coming into the

market including European steel Arcelor. There are presences of Anglo-Dutch company. There is

situation of over capacity in European steel industry and they have decided to close it down, but

the French government threatened to nationalise it.

Threat of Substitutes: Substitutes are the products and goods which can be used in place

of other basic commodity. If there are number of substitutes available than there is situation of

increase in competition. According to case study, there are three ore producers Vale, Rio and

Tinto which may lead to increase in competition amongst them. Consumers can shift their

3

Illustration 1: Five Forces Model, 2018

decision from one company to another. Similarly in cars steel material can be substituted with

plastic and aluminium metal that can be utilised for packaging.

Bargaining power of Buyer: It has been observed that major customers of steel are car

manufacturers and packaging industry. In North America if there is decline in any one of the

major three companies that include Ford, Chrysler and General Motors, this result into shifting to

other organisations that are Nissan, Honda, Toyota and BMW. This enable them to develop

opportunities for these companies to establish production plants.

Bargaining Power of the Supplier: According to the given case study, the suppliers of

Iron Ore include three major producers that are Rio Tinto, Vale and BHP Billiton. They

comprise of around 75% of market share to transfer their materials in international market.

Market Line Report: Initially, steel industry was seen as a most static and unpredictable

one. These are nationally, state based and are not earning huge profits. In early 2000, there were

50 steel producers that went to bankruptcy. This is a negative aspect and they, again earn

confidence in 2006, in which Mittal steel come into lime light and they had acquire European

Steel and contributed in among the largest steel industry. In last two decades China come into

existence and increased their capacity for seven times. In 2000 and 2008, steel production

increases about 50%.

Conclusion: This case study highlight the case of steel industries that are operating in the

business environment. There are number of rivalries that are present thus, they have to apply this

model to study all these elements. It is beneficial in modern time to open the steel industry as it is

achieving high growth in current market place.

TASK 3

a) Analyse growth/market share using BCG matrix

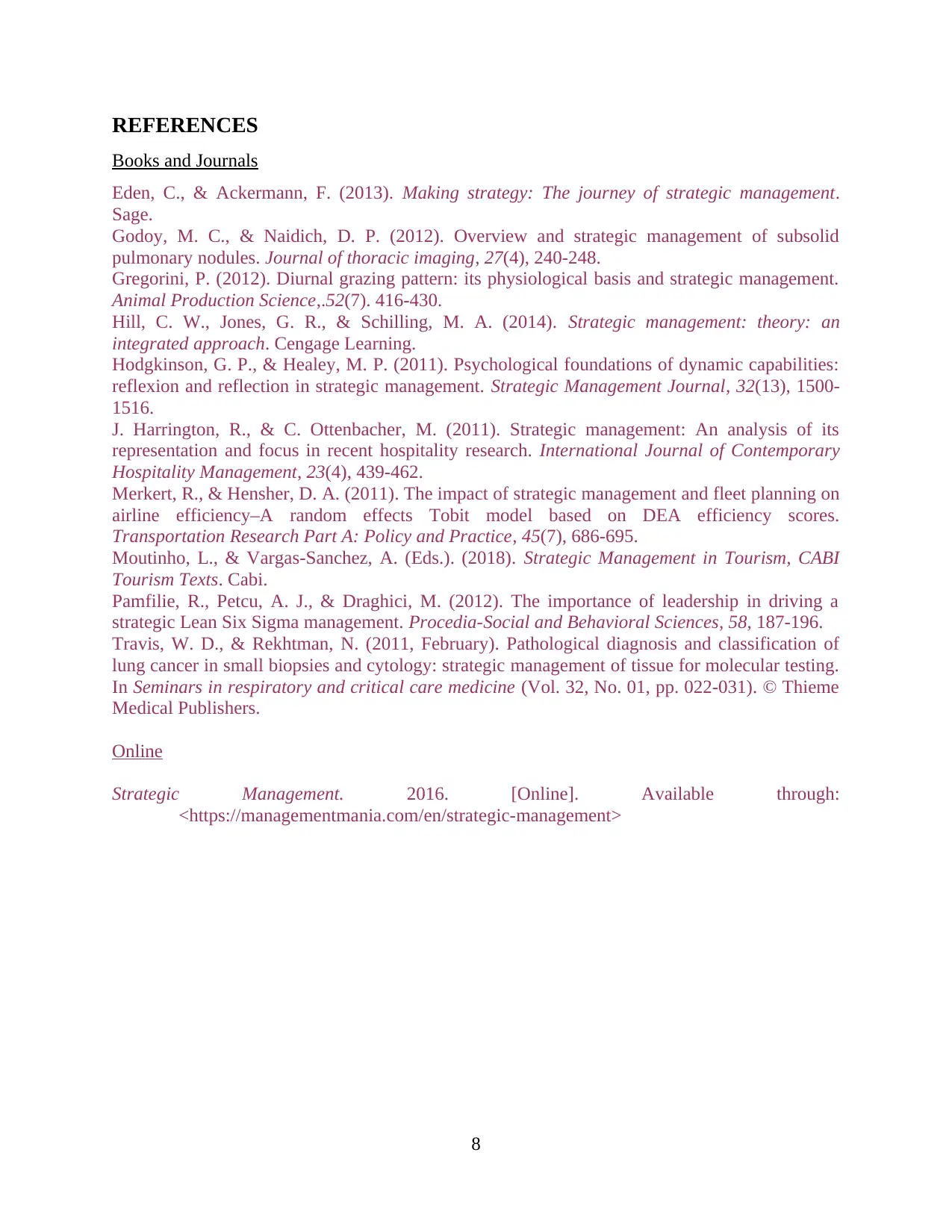

BCG matrix is devised by Bruce Henderson of the Boston Consultancy Group. It is

divided into four sections that involve interrelation of market share and growth. Apple Inc is one

of the well established technology company that is famous for their innovation, design and

number of advanced products to their potential customers. The elements of BCG matrix are:

4

plastic and aluminium metal that can be utilised for packaging.

Bargaining power of Buyer: It has been observed that major customers of steel are car

manufacturers and packaging industry. In North America if there is decline in any one of the

major three companies that include Ford, Chrysler and General Motors, this result into shifting to

other organisations that are Nissan, Honda, Toyota and BMW. This enable them to develop

opportunities for these companies to establish production plants.

Bargaining Power of the Supplier: According to the given case study, the suppliers of

Iron Ore include three major producers that are Rio Tinto, Vale and BHP Billiton. They

comprise of around 75% of market share to transfer their materials in international market.

Market Line Report: Initially, steel industry was seen as a most static and unpredictable

one. These are nationally, state based and are not earning huge profits. In early 2000, there were

50 steel producers that went to bankruptcy. This is a negative aspect and they, again earn

confidence in 2006, in which Mittal steel come into lime light and they had acquire European

Steel and contributed in among the largest steel industry. In last two decades China come into

existence and increased their capacity for seven times. In 2000 and 2008, steel production

increases about 50%.

Conclusion: This case study highlight the case of steel industries that are operating in the

business environment. There are number of rivalries that are present thus, they have to apply this

model to study all these elements. It is beneficial in modern time to open the steel industry as it is

achieving high growth in current market place.

TASK 3

a) Analyse growth/market share using BCG matrix

BCG matrix is devised by Bruce Henderson of the Boston Consultancy Group. It is

divided into four sections that involve interrelation of market share and growth. Apple Inc is one

of the well established technology company that is famous for their innovation, design and

number of advanced products to their potential customers. The elements of BCG matrix are:

4

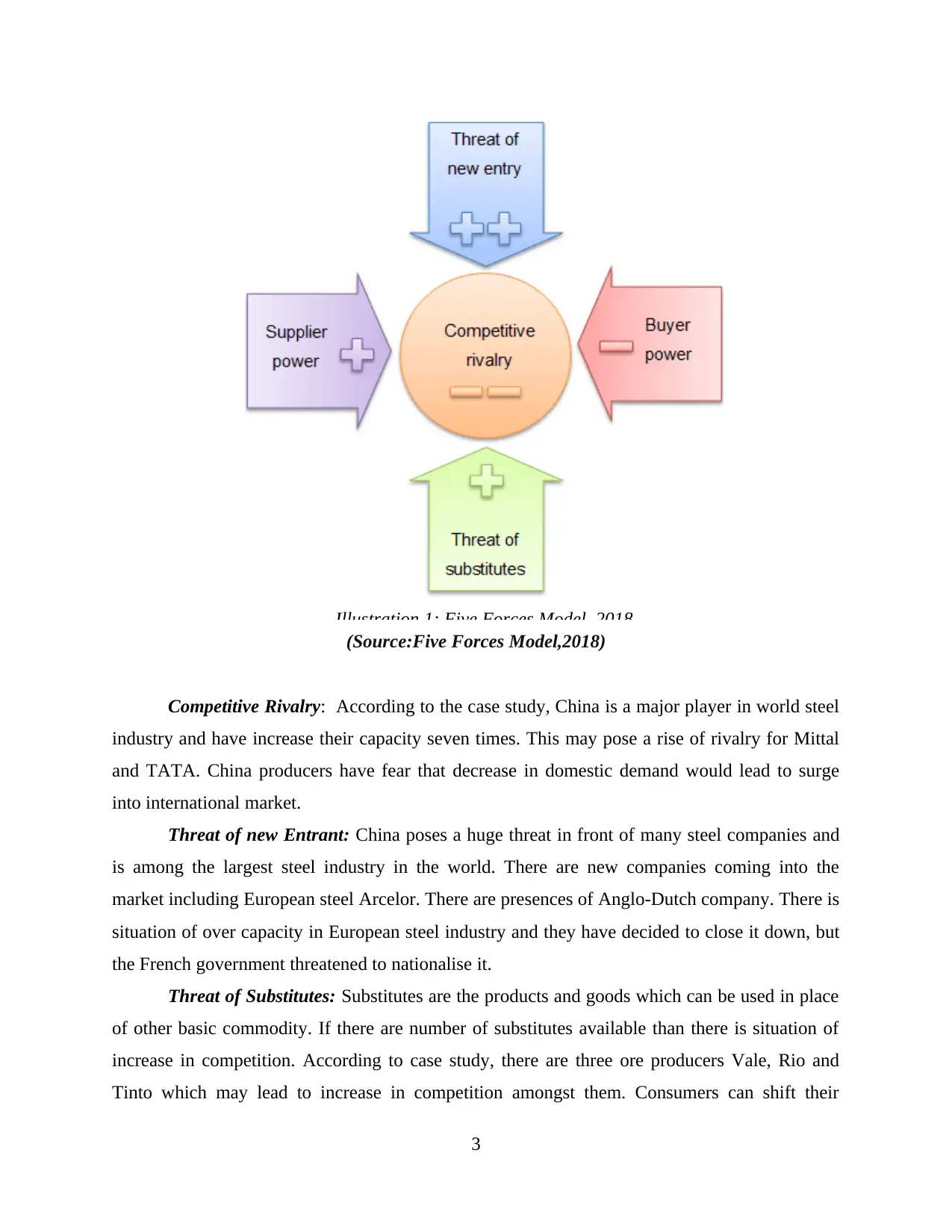

(Source: BCG Matrix of Apple Inc, 2017)

Stars (High market share and growth): This section highlights the powerful market share

but, it underlines the high amount of expenditures. Apple Inc have most innovative product that

is I phones, its growth rate is 27% and it is amongst the most demanded and famous product for

the company. This result in bringing high revenues to the company. If organisation are working

in this category they are successful and have well established goodwill in the current market

place.

Cash Cows(High market share and low growth rate): Mac Books can be located under

this section as it is contributing significantly in gaining high financial gains but it is lacking

significant growth. The main reason behind this loosing is that customers are preferring mobile

over other gadgets. Therefore, product already doing well but due to various reasons its growth

rate in very low.

Dogs(Low market share and Growth): product of apple Inc which can be classified into

this category is iPods. It growth rate is in negative that is -5%, which is a threat to the company.

5

Illustration 2: BCG Matrix of Apple Inc, 2017

Stars (High market share and growth): This section highlights the powerful market share

but, it underlines the high amount of expenditures. Apple Inc have most innovative product that

is I phones, its growth rate is 27% and it is amongst the most demanded and famous product for

the company. This result in bringing high revenues to the company. If organisation are working

in this category they are successful and have well established goodwill in the current market

place.

Cash Cows(High market share and low growth rate): Mac Books can be located under

this section as it is contributing significantly in gaining high financial gains but it is lacking

significant growth. The main reason behind this loosing is that customers are preferring mobile

over other gadgets. Therefore, product already doing well but due to various reasons its growth

rate in very low.

Dogs(Low market share and Growth): product of apple Inc which can be classified into

this category is iPods. It growth rate is in negative that is -5%, which is a threat to the company.

5

Illustration 2: BCG Matrix of Apple Inc, 2017

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

It is not bringing profit and revenue to the company. There are no consumers who are demanding

this product. Hence, company have to make decisions while considering this factor. Company

should formulate proper strategies to growth their shares and growth to sustainable level.

Question Mark(Low market share and High growth): The product chosen for this

category is Apple TV. It is growing but has not reached to maximum and significant level. Its

market share is 1.05 which is relatively low as compared to other products of Apple Inc.

company have the potential and make efforts to convert this into cash cows and star.

B) Potential problems with the BCG matrix

BCG matrix have some limitations(Disadvantages) that has to be evaluated in order to

find out areas that require some improvements and corrections. This matrix highlight the

performance and productivity level of company. It consist of two dimensions, market share and

growth rate. There are some problems associated with this matrix which is described below:

From the above discussion about BCG matrix of Apple Inc, it can be concluded that after

examining from, it has been observed that some products have high market growth and share

whereas some have low share. For instance, iPods is not beneficial for the company as it is

bringing negative growth and share which is not effective for their goodwill. Cash Cows segment

of this company involve Mac Books as it is showing significant growth but have diminishing

share. Thus all these information is collected while performing BCG matrix.

Several Advantages of BCG matrix are as follows:

This matrix allow positioning of each product on respective four categories so that

company can make effective decision regarding it. Apple Inc can categorise their products in

these segments and they are able to make out any improvements and modifications that are

required in particular products.

BCG Matrix is very much useful for those organisations that focus on managing their

product portfolio system in order to maintain balance between them.

Conclusion: From the above discussion, BCG Matrix is a important tool that is adopted

by various companies to identify several factors that affect market growth and share. It helps in

finding out several advantages and disadvantages that may be removed to foster their overall

performance.

6

this product. Hence, company have to make decisions while considering this factor. Company

should formulate proper strategies to growth their shares and growth to sustainable level.

Question Mark(Low market share and High growth): The product chosen for this

category is Apple TV. It is growing but has not reached to maximum and significant level. Its

market share is 1.05 which is relatively low as compared to other products of Apple Inc.

company have the potential and make efforts to convert this into cash cows and star.

B) Potential problems with the BCG matrix

BCG matrix have some limitations(Disadvantages) that has to be evaluated in order to

find out areas that require some improvements and corrections. This matrix highlight the

performance and productivity level of company. It consist of two dimensions, market share and

growth rate. There are some problems associated with this matrix which is described below:

From the above discussion about BCG matrix of Apple Inc, it can be concluded that after

examining from, it has been observed that some products have high market growth and share

whereas some have low share. For instance, iPods is not beneficial for the company as it is

bringing negative growth and share which is not effective for their goodwill. Cash Cows segment

of this company involve Mac Books as it is showing significant growth but have diminishing

share. Thus all these information is collected while performing BCG matrix.

Several Advantages of BCG matrix are as follows:

This matrix allow positioning of each product on respective four categories so that

company can make effective decision regarding it. Apple Inc can categorise their products in

these segments and they are able to make out any improvements and modifications that are

required in particular products.

BCG Matrix is very much useful for those organisations that focus on managing their

product portfolio system in order to maintain balance between them.

Conclusion: From the above discussion, BCG Matrix is a important tool that is adopted

by various companies to identify several factors that affect market growth and share. It helps in

finding out several advantages and disadvantages that may be removed to foster their overall

performance.

6

CONCLUSION

From the above prepared report it has been concluded that strategic management is a

important procedure that allow very company to formulate plan of actions that has to be followed

by them in order to reach ultimate goals and purposes in set time period. This report highlights

case of BP which is a leading gas and oil company and other section defines that condition of

steel industry. Therefore, in order to determine the effect of various factors that are present in

business environment company perform PESTLE and porter's five force model. Company also

uses BCG matrix to analyse the growth and market share of it.

7

From the above prepared report it has been concluded that strategic management is a

important procedure that allow very company to formulate plan of actions that has to be followed

by them in order to reach ultimate goals and purposes in set time period. This report highlights

case of BP which is a leading gas and oil company and other section defines that condition of

steel industry. Therefore, in order to determine the effect of various factors that are present in

business environment company perform PESTLE and porter's five force model. Company also

uses BCG matrix to analyse the growth and market share of it.

7

REFERENCES

Books and Journals

Eden, C., & Ackermann, F. (2013). Making strategy: The journey of strategic management.

Sage.

Godoy, M. C., & Naidich, D. P. (2012). Overview and strategic management of subsolid

pulmonary nodules. Journal of thoracic imaging, 27(4), 240-248.

Gregorini, P. (2012). Diurnal grazing pattern: its physiological basis and strategic management.

Animal Production Science,.52(7). 416-430.

Hill, C. W., Jones, G. R., & Schilling, M. A. (2014). Strategic management: theory: an

integrated approach. Cengage Learning.

Hodgkinson, G. P., & Healey, M. P. (2011). Psychological foundations of dynamic capabilities:

reflexion and reflection in strategic management. Strategic Management Journal, 32(13), 1500-

1516.

J. Harrington, R., & C. Ottenbacher, M. (2011). Strategic management: An analysis of its

representation and focus in recent hospitality research. International Journal of Contemporary

Hospitality Management, 23(4), 439-462.

Merkert, R., & Hensher, D. A. (2011). The impact of strategic management and fleet planning on

airline efficiency–A random effects Tobit model based on DEA efficiency scores.

Transportation Research Part A: Policy and Practice, 45(7), 686-695.

Moutinho, L., & Vargas-Sanchez, A. (Eds.). (2018). Strategic Management in Tourism, CABI

Tourism Texts. Cabi.

Pamfilie, R., Petcu, A. J., & Draghici, M. (2012). The importance of leadership in driving a

strategic Lean Six Sigma management. Procedia-Social and Behavioral Sciences, 58, 187-196.

Travis, W. D., & Rekhtman, N. (2011, February). Pathological diagnosis and classification of

lung cancer in small biopsies and cytology: strategic management of tissue for molecular testing.

In Seminars in respiratory and critical care medicine (Vol. 32, No. 01, pp. 022-031). © Thieme

Medical Publishers.

Online

Strategic Management. 2016. [Online]. Available through:

<https://managementmania.com/en/strategic-management>

8

Books and Journals

Eden, C., & Ackermann, F. (2013). Making strategy: The journey of strategic management.

Sage.

Godoy, M. C., & Naidich, D. P. (2012). Overview and strategic management of subsolid

pulmonary nodules. Journal of thoracic imaging, 27(4), 240-248.

Gregorini, P. (2012). Diurnal grazing pattern: its physiological basis and strategic management.

Animal Production Science,.52(7). 416-430.

Hill, C. W., Jones, G. R., & Schilling, M. A. (2014). Strategic management: theory: an

integrated approach. Cengage Learning.

Hodgkinson, G. P., & Healey, M. P. (2011). Psychological foundations of dynamic capabilities:

reflexion and reflection in strategic management. Strategic Management Journal, 32(13), 1500-

1516.

J. Harrington, R., & C. Ottenbacher, M. (2011). Strategic management: An analysis of its

representation and focus in recent hospitality research. International Journal of Contemporary

Hospitality Management, 23(4), 439-462.

Merkert, R., & Hensher, D. A. (2011). The impact of strategic management and fleet planning on

airline efficiency–A random effects Tobit model based on DEA efficiency scores.

Transportation Research Part A: Policy and Practice, 45(7), 686-695.

Moutinho, L., & Vargas-Sanchez, A. (Eds.). (2018). Strategic Management in Tourism, CABI

Tourism Texts. Cabi.

Pamfilie, R., Petcu, A. J., & Draghici, M. (2012). The importance of leadership in driving a

strategic Lean Six Sigma management. Procedia-Social and Behavioral Sciences, 58, 187-196.

Travis, W. D., & Rekhtman, N. (2011, February). Pathological diagnosis and classification of

lung cancer in small biopsies and cytology: strategic management of tissue for molecular testing.

In Seminars in respiratory and critical care medicine (Vol. 32, No. 01, pp. 022-031). © Thieme

Medical Publishers.

Online

Strategic Management. 2016. [Online]. Available through:

<https://managementmania.com/en/strategic-management>

8

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

9

1 out of 11

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.