TAXATION LAW 1 - Deductions, Asset Revaluation, and Legal Expenses

VerifiedAdded on 2020/04/07

|12

|1822

|50

Homework Assignment

AI Summary

This taxation law assignment provides detailed answers to several key issues. It analyzes whether the cost of moving machinery to a new site is an allowable deduction under section 8-1 of the ITAA 1997, concluding it's a capital expenditure and not deductible. The assignment also examines asset revaluation, legal expenditures related to winding up a business, and legal expenses for client services, determining their deductibility under the same section. Furthermore, the assignment addresses input tax credit determination for advertising expenses under the GST Act 1999, specifically considering the Big Bank's situation and the application of the GSTR 2006/3 ruling. The assignment uses case law and legislation to support its conclusions.

Running head: TAXATION LAW

Taxation Law

Name of Student:

Name of University:

Author’s Note:

Taxation Law

Name of Student:

Name of University:

Author’s Note:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1TAXATION LAW

Answer 1:

Answer to requirement 1:

Issue:

In compliance with the section 8-1 of the ITAA 1997, the present issue considers whether

the cost suffered in the movement of the machinery to a new site is to be considered as allowable

deductions or not.

Legislations:

a. Section 8-1 of the Income Tax Assessment Act 1997

b. British Insulated & Helsby Cables

Applications:

The major reason for thinking about the expenditure for the allowable deductions is due

to the fact that the cost is considered as a part of the business expenses. No sort of deductions are

allowed in case of the cost that is incurred in transportation of machinery to the new site. This

follows from the 1 of the Income Tax Assessment Act 1997. According to the section 8-1 of the

Income Tax Assessment Act 1997, the obtained cost in the movement of machinery is

representative of a price which is incurred from minor changes and can be thought of as

allowable deductions (Barkoczy et al., 2016).

Based on the of British Insulated & Helsby Cables case verdict, the involved

transportation cost shows a continuous benefit on the business related matters after the shift of

Answer 1:

Answer to requirement 1:

Issue:

In compliance with the section 8-1 of the ITAA 1997, the present issue considers whether

the cost suffered in the movement of the machinery to a new site is to be considered as allowable

deductions or not.

Legislations:

a. Section 8-1 of the Income Tax Assessment Act 1997

b. British Insulated & Helsby Cables

Applications:

The major reason for thinking about the expenditure for the allowable deductions is due

to the fact that the cost is considered as a part of the business expenses. No sort of deductions are

allowed in case of the cost that is incurred in transportation of machinery to the new site. This

follows from the 1 of the Income Tax Assessment Act 1997. According to the section 8-1 of the

Income Tax Assessment Act 1997, the obtained cost in the movement of machinery is

representative of a price which is incurred from minor changes and can be thought of as

allowable deductions (Barkoczy et al., 2016).

Based on the of British Insulated & Helsby Cables case verdict, the involved

transportation cost shows a continuous benefit on the business related matters after the shift of

2TAXATION LAW

the assets which are deprecating. The cost of occurrence in bringing the machine to a state of

through operation will be considered as revenue according to the Taxation Ruling of TD 93/126

on the installation of the machinery. Based on the present scenario, it is learnt that the cost of

occurrence in the location of the machine to the new site is representative of the cost of capital.

This will be considered as non-permissible deductions.

Conclusion:

The incurred cost in the movement of the machine to a new site represents the

movement of an asset from one place to another. This falls under the category of capital

expenditure. In concern with this, no allowable deductions will be allowed under section 8-1 of

the Income Tax Assessment Act 1997.

Answer to requirement 2:

Issue:

The present situation introduces whether the revaluation of assets can be thought of as

allowable deductions under section 8-1 of the Income Tax Assessment Act 1997.

Legislation:

a. Section 8-1 of the Income Tax Assessment Act 1997

Application:

Proper study on the present situation indicates that expenses and the fixed assets are

related. Thus the determination of the deductions is crucial for the determination of whether such

the assets which are deprecating. The cost of occurrence in bringing the machine to a state of

through operation will be considered as revenue according to the Taxation Ruling of TD 93/126

on the installation of the machinery. Based on the present scenario, it is learnt that the cost of

occurrence in the location of the machine to the new site is representative of the cost of capital.

This will be considered as non-permissible deductions.

Conclusion:

The incurred cost in the movement of the machine to a new site represents the

movement of an asset from one place to another. This falls under the category of capital

expenditure. In concern with this, no allowable deductions will be allowed under section 8-1 of

the Income Tax Assessment Act 1997.

Answer to requirement 2:

Issue:

The present situation introduces whether the revaluation of assets can be thought of as

allowable deductions under section 8-1 of the Income Tax Assessment Act 1997.

Legislation:

a. Section 8-1 of the Income Tax Assessment Act 1997

Application:

Proper study on the present situation indicates that expenses and the fixed assets are

related. Thus the determination of the deductions is crucial for the determination of whether such

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3TAXATION LAW

expenses have occurred in revaluation (Nechaev, 2014). Either it is merely obtained in the

protection of the asset or obtained for increasing the revenue producing capability. In case the

former results in a sort of benefit to the temporary character, in case the expenses are repetitive,

then under the section 8-1 of the Income Tax Assessment Act 1997, it will be treated as

permissible deductions. Proper understanding of the present situation clearly indicates that the

cost incurred in asset revaluation will be considered as allowable deductions as there are

repetitive in nature. This is in compliance with the section 8-1.

Conclusion:

It can be concluded that, according to the section 8-1 of the ITAA 1997, the price leading

to the insurance cover is treated as allowable deductions. This is because the nature of the cost is

recurrent (Woellner et al., 2016).

Answer to requirement 3:

Issue:

The situation brings to the fore, the issue regarding the fact that if the legal expenditures

the company incurred would be treated for deductions based on the section 8-1 of the ITAA

1997.

Legislation:

a. Section 8-1 of the Income Tax Assessment Act 1997

b. FC of T v Snowden and Wilson Pty Ltd (1958) 99 CLR 431)

expenses have occurred in revaluation (Nechaev, 2014). Either it is merely obtained in the

protection of the asset or obtained for increasing the revenue producing capability. In case the

former results in a sort of benefit to the temporary character, in case the expenses are repetitive,

then under the section 8-1 of the Income Tax Assessment Act 1997, it will be treated as

permissible deductions. Proper understanding of the present situation clearly indicates that the

cost incurred in asset revaluation will be considered as allowable deductions as there are

repetitive in nature. This is in compliance with the section 8-1.

Conclusion:

It can be concluded that, according to the section 8-1 of the ITAA 1997, the price leading

to the insurance cover is treated as allowable deductions. This is because the nature of the cost is

recurrent (Woellner et al., 2016).

Answer to requirement 3:

Issue:

The situation brings to the fore, the issue regarding the fact that if the legal expenditures

the company incurred would be treated for deductions based on the section 8-1 of the ITAA

1997.

Legislation:

a. Section 8-1 of the Income Tax Assessment Act 1997

b. FC of T v Snowden and Wilson Pty Ltd (1958) 99 CLR 431)

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4TAXATION LAW

Application:

The legal expenditure for differences in the winding up of the petition cannot be allowed

as deductions. This is due to the fact that they represent the nature of the capital and these are

related to the business operations (Lang, 2014).

Based on the section 8-1 of the Income Tax Assessment Act 1997, the costs for the

winding up of the business are not considered as allowable deductions. These are incurred in the

business operations. The taxation ruling of ID 2004/367 represents clearly that legal cost can be

thought for the purpose of deductions in case the cost for carrying out the business operation by

which a person responsible for the business operation moves forward (Becker, Reimer & Rust,

2015).

In situations where the expenses are unusual and it is necessary for the taxpayer to start

the lawful actions it is required to understand that it prevents the expense to qualify as deductable

(Braithwaite, 2017).

Conclusion:

Based on the situation, the cost incurred in opposing the winding up plea, will be

treated as deductions of non-permissible nature in compliance with the section 8-1 of the ITAA

1997.

Application:

The legal expenditure for differences in the winding up of the petition cannot be allowed

as deductions. This is due to the fact that they represent the nature of the capital and these are

related to the business operations (Lang, 2014).

Based on the section 8-1 of the Income Tax Assessment Act 1997, the costs for the

winding up of the business are not considered as allowable deductions. These are incurred in the

business operations. The taxation ruling of ID 2004/367 represents clearly that legal cost can be

thought for the purpose of deductions in case the cost for carrying out the business operation by

which a person responsible for the business operation moves forward (Becker, Reimer & Rust,

2015).

In situations where the expenses are unusual and it is necessary for the taxpayer to start

the lawful actions it is required to understand that it prevents the expense to qualify as deductable

(Braithwaite, 2017).

Conclusion:

Based on the situation, the cost incurred in opposing the winding up plea, will be

treated as deductions of non-permissible nature in compliance with the section 8-1 of the ITAA

1997.

5TAXATION LAW

Answer to requirement 4:

Issue:

The situation at hand helps to ascertain whether, the legal expense for the purpose of the

solicitor services connected to several businesses of the clients will be considered as permissible

deductions under section 8-1 of the ITAA 1997.

Legislation:

a. section 8-1 of the Income Tax Assessment Act 1997

Application:

In case a legal expense occurs in place of the business functions for the

production of revenue, it will be considered as allowable deductions based on the section 8-1 of

the Income Tax Assessment Act 1997. Some exceptions are there in case of legal expenses that

are related to capital, domestic and private categories. This is when the price is incurred in case

the exempt is produced and the non-chargeable non-exempt proceeds (Barkoczy, 2016).

Based on the discussion, in situations where there is no relation in the generation of the

taxable income, the persons incurring legal fees may not be treated as allowable deductions. The

legal expense incurred by the taxpayer, shows that it has association with the business in

production of the chargeable deductions. It will be considered as allowable deductions according

to the section 8-1 of the ITAA 1997.

Answer to requirement 4:

Issue:

The situation at hand helps to ascertain whether, the legal expense for the purpose of the

solicitor services connected to several businesses of the clients will be considered as permissible

deductions under section 8-1 of the ITAA 1997.

Legislation:

a. section 8-1 of the Income Tax Assessment Act 1997

Application:

In case a legal expense occurs in place of the business functions for the

production of revenue, it will be considered as allowable deductions based on the section 8-1 of

the Income Tax Assessment Act 1997. Some exceptions are there in case of legal expenses that

are related to capital, domestic and private categories. This is when the price is incurred in case

the exempt is produced and the non-chargeable non-exempt proceeds (Barkoczy, 2016).

Based on the discussion, in situations where there is no relation in the generation of the

taxable income, the persons incurring legal fees may not be treated as allowable deductions. The

legal expense incurred by the taxpayer, shows that it has association with the business in

production of the chargeable deductions. It will be considered as allowable deductions according

to the section 8-1 of the ITAA 1997.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6TAXATION LAW

Conclusion:

Based on the above case, it can be said that the legal expense occurring with respect to

the business operations to produce taxable income will be treated as allowable deductions in

compliance with section 8-1 of the ITAA 1997.

Answer to question 2:

Issue:

The present scenario for the Big Bank is concerned with the input tax credit

determination with respect to the advertising expenditure based on GSTR Act 1999.

Legislation:

a. GST Act 1999

b. paragraphs 11-5 and 15-5

c. subsection 15-25

d. Goods and Service taxation ruling of GSTR 2006/3

e. Ronpibon Tin NL v. FC of T

Application:

Guidance on the implemented policies related to the determination of the input tax credit

as also the administration for change is mentioned in the taxation ruling of Goods and Service

of GSTR 2006/3. The extent to the creditable purpose and actual application of the ruling under

division 11,15 and 129 of the GST Act is also mentioned. The ruling is applicable for taxable

Conclusion:

Based on the above case, it can be said that the legal expense occurring with respect to

the business operations to produce taxable income will be treated as allowable deductions in

compliance with section 8-1 of the ITAA 1997.

Answer to question 2:

Issue:

The present scenario for the Big Bank is concerned with the input tax credit

determination with respect to the advertising expenditure based on GSTR Act 1999.

Legislation:

a. GST Act 1999

b. paragraphs 11-5 and 15-5

c. subsection 15-25

d. Goods and Service taxation ruling of GSTR 2006/3

e. Ronpibon Tin NL v. FC of T

Application:

Guidance on the implemented policies related to the determination of the input tax credit

as also the administration for change is mentioned in the taxation ruling of Goods and Service

of GSTR 2006/3. The extent to the creditable purpose and actual application of the ruling under

division 11,15 and 129 of the GST Act is also mentioned. The ruling is applicable for taxable

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7TAXATION LAW

entities registered or in the process of it, in order to obtain economic supplies past the limit of

fiscal acquisition (Barat).

Present scenario of the Big Bank shows that it has expense of $1,650,000 as GST

inclusive of the advertisement previously. It is eligible for the input tax credit or lowered input

tax credit and the taxation ruling of Goods and Service taxation ruling of GSTR 2006/3 applies.

The legislation of the GST relates to the claim of the input tax credit for the GST inclusive

supplies.

In the scenario of Ronpibon Tin NL v. FC of T the doctrine of “extent” and “to the

extent” is applied in analysing the legislation of GST. This involves the obligation in which the

method of apportion adopted must be just. Based on the paragraph 11-5 and 15-5 to qualify an

acquisition as the creditable acquisition it must be either partially or entirely creditable.

Another requirements of paragraphs 11-5 and 15-5 (a) for an acquisition to qualify as

creditable or creditable importation respectively, the acquisition must be entirely for creditable

purpose. In respect of the subsection 15-25 an import shall be viewed as creditable if it is partly

for creditable purpose. In regard to section 11-15 or 15-10 an acquisition qualifies to be

creditable if an entity makes the supplies for the purpose of claiming input tax credit. In respect

of the GSTR ruling of 2006/3 Big Bank Ltd has gone past the financial acquisition threshold

limit and the invoice that is issued to Big Bank Ltd will be entitled for input tax credit for the

GST supplies made.

entities registered or in the process of it, in order to obtain economic supplies past the limit of

fiscal acquisition (Barat).

Present scenario of the Big Bank shows that it has expense of $1,650,000 as GST

inclusive of the advertisement previously. It is eligible for the input tax credit or lowered input

tax credit and the taxation ruling of Goods and Service taxation ruling of GSTR 2006/3 applies.

The legislation of the GST relates to the claim of the input tax credit for the GST inclusive

supplies.

In the scenario of Ronpibon Tin NL v. FC of T the doctrine of “extent” and “to the

extent” is applied in analysing the legislation of GST. This involves the obligation in which the

method of apportion adopted must be just. Based on the paragraph 11-5 and 15-5 to qualify an

acquisition as the creditable acquisition it must be either partially or entirely creditable.

Another requirements of paragraphs 11-5 and 15-5 (a) for an acquisition to qualify as

creditable or creditable importation respectively, the acquisition must be entirely for creditable

purpose. In respect of the subsection 15-25 an import shall be viewed as creditable if it is partly

for creditable purpose. In regard to section 11-15 or 15-10 an acquisition qualifies to be

creditable if an entity makes the supplies for the purpose of claiming input tax credit. In respect

of the GSTR ruling of 2006/3 Big Bank Ltd has gone past the financial acquisition threshold

limit and the invoice that is issued to Big Bank Ltd will be entitled for input tax credit for the

GST supplies made.

8TAXATION LAW

Conclusion:

It can thus be concluded that Big Bank can claim the input tax credit in compliance with

the GSTR 2006/13 for the price incurred on the expense for advertising. This is for the creditable

acquisition.

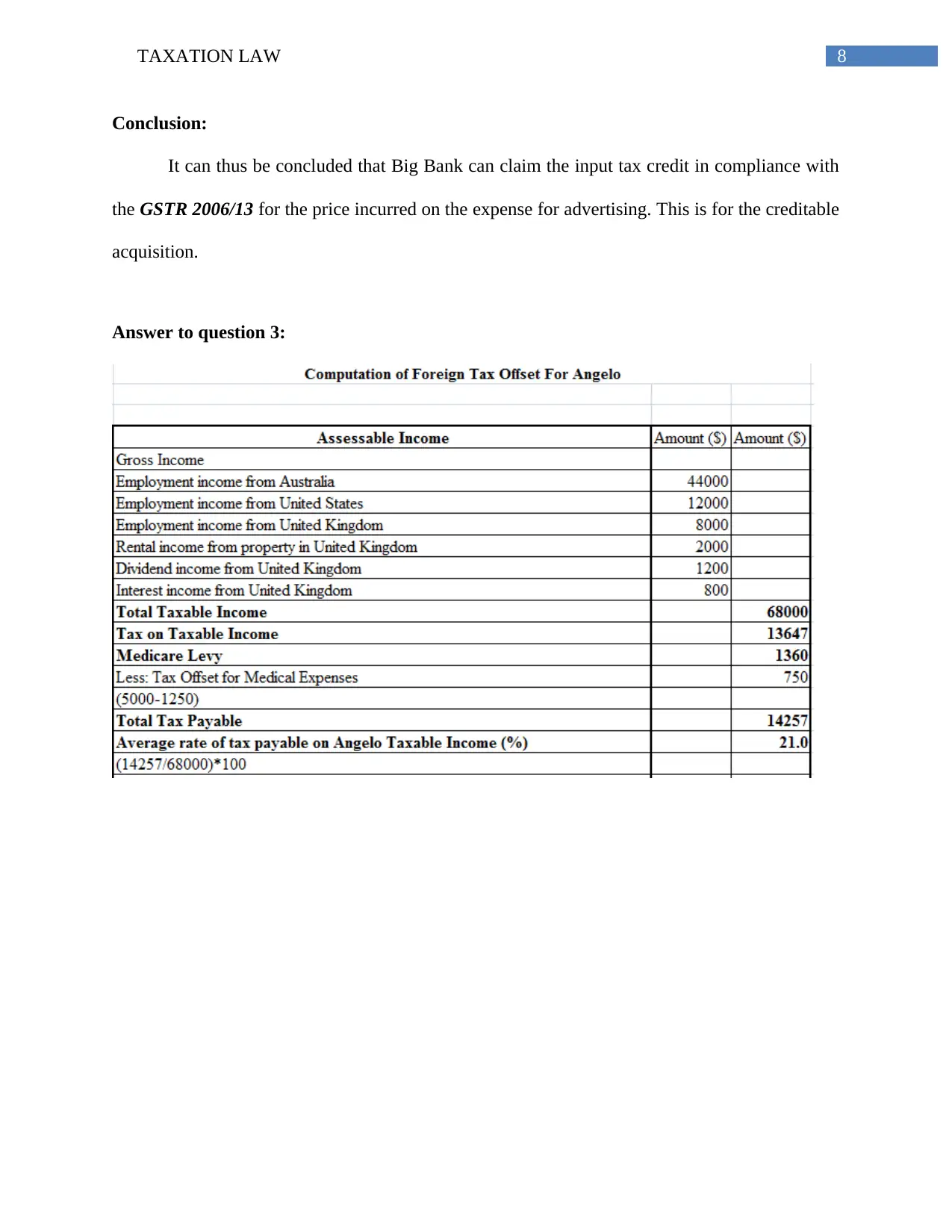

Answer to question 3:

Conclusion:

It can thus be concluded that Big Bank can claim the input tax credit in compliance with

the GSTR 2006/13 for the price incurred on the expense for advertising. This is for the creditable

acquisition.

Answer to question 3:

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

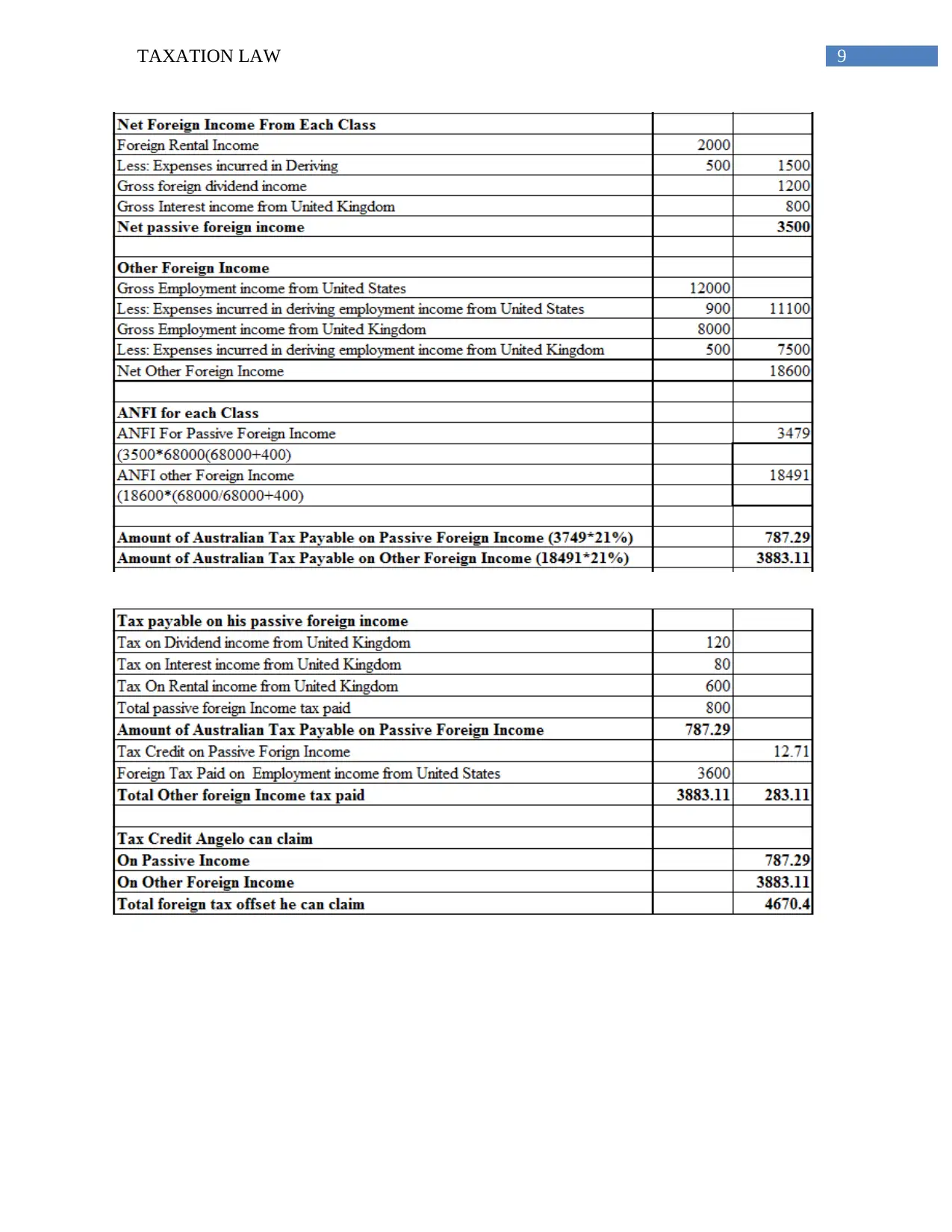

9TAXATION LAW

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10TAXATION LAW

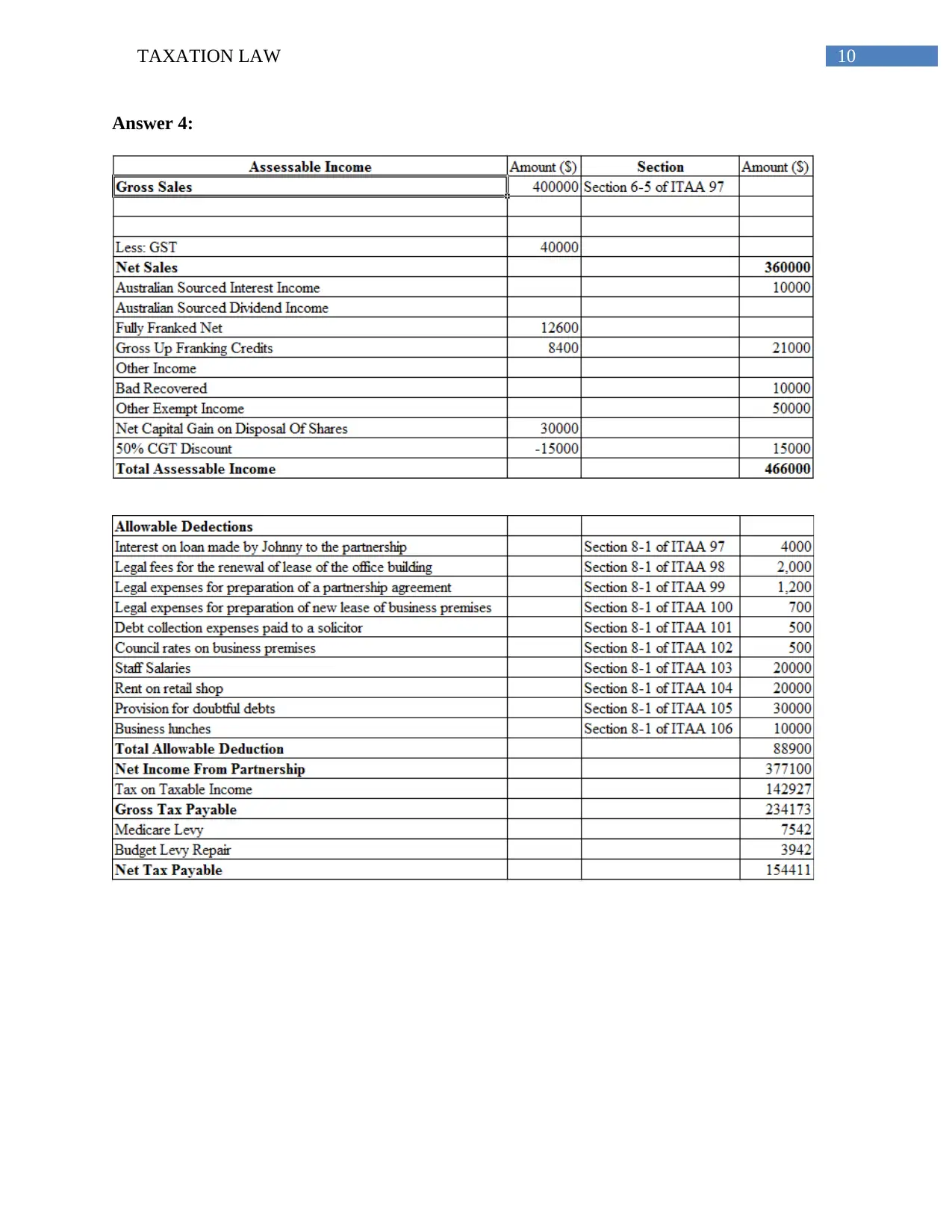

Answer 4:

Answer 4:

11TAXATION LAW

References:

Barat, J. U. B. A STUDY ON THE DETERMINANTS OF TAXPAYER’S INTENTION TOWARDS MANUAL

TAX SYSTEM, CASE STUDY IN KLANG VALLEY.

Barkoczy, S. (2016). Foundations of Taxation Law 2016. OUP Catalogue.

Barkoczy, S., Nethercott, L., Devos, K., & Richardson, G. (2016). Foundations Student Tax

Pack 3 2016. Oxford University Press Australia & New Zealand.

Becker, J., Reimer, E., & Rust, A. (2015). Klaus Vogel on Double Taxation Conventions. Kluwer

Law International.

Braithwaite, V. (Ed.). (2017). Taxing democracy: Understanding tax avoidance and evasion.

Routledge.

Lang, M. (2014). Introduction to the law of double taxation conventions. Linde Verlag GmbH.

Nechaev, A. (2014). Taxation as an instrument of stimulation of innovation-active business

entities. arXiv preprint arXiv:1412.2746.

Woellner, R. H., Barkoczy, S., Murphy, S., Evans, C., & Pinto, D. (2016). Australian Taxation

Law Select: Legislation and Commentary 2016. Oxford University Press.

References:

Barat, J. U. B. A STUDY ON THE DETERMINANTS OF TAXPAYER’S INTENTION TOWARDS MANUAL

TAX SYSTEM, CASE STUDY IN KLANG VALLEY.

Barkoczy, S. (2016). Foundations of Taxation Law 2016. OUP Catalogue.

Barkoczy, S., Nethercott, L., Devos, K., & Richardson, G. (2016). Foundations Student Tax

Pack 3 2016. Oxford University Press Australia & New Zealand.

Becker, J., Reimer, E., & Rust, A. (2015). Klaus Vogel on Double Taxation Conventions. Kluwer

Law International.

Braithwaite, V. (Ed.). (2017). Taxing democracy: Understanding tax avoidance and evasion.

Routledge.

Lang, M. (2014). Introduction to the law of double taxation conventions. Linde Verlag GmbH.

Nechaev, A. (2014). Taxation as an instrument of stimulation of innovation-active business

entities. arXiv preprint arXiv:1412.2746.

Woellner, R. H., Barkoczy, S., Murphy, S., Evans, C., & Pinto, D. (2016). Australian Taxation

Law Select: Legislation and Commentary 2016. Oxford University Press.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 12

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.