Taxation Law Assignment: Deductions, GST, Legal Expenses Analysis

VerifiedAdded on 2020/04/07

|15

|2018

|32

Homework Assignment

AI Summary

This document presents a comprehensive analysis of taxation law, addressing various aspects of deductions, GST, and legal expenses. The assignment delves into the eligibility of expenses such as machinery relocation costs, asset revaluation costs, legal expenses related to winding-up petitions, and solicitor fees, examining their deductibility under Section 8-1 of the ITAA 1997. Furthermore, the assignment investigates the determination of input tax credit for advertising expenditures under the GST Act 1999, referencing relevant rulings and case law, including GSTR 2006/3 and the Ronpibon Tin NL v. FC of T case. The document provides detailed explanations, legislation references, and conclusions for each scenario, offering a thorough understanding of taxation principles and their application in practical situations. The assignment includes a table of contents and a references section, ensuring a structured and well-supported analysis.

Running head: TAXATION LAW

Taxation Law

Name of the Student

Name of the University

Author Note

Taxation Law

Name of the Student

Name of the University

Author Note

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1TAXATION LAW

Table of Contents

Answer 1:.........................................................................................................................................2

Requirement 1:.............................................................................................................................2

Issue:........................................................................................................................................2

Legislation:..............................................................................................................................2

Application:.............................................................................................................................2

Conclusion:..............................................................................................................................3

Requirement 2:.............................................................................................................................3

Issue:........................................................................................................................................3

Legislation:..............................................................................................................................3

Application:.............................................................................................................................3

Conclusion:..............................................................................................................................4

Requirement 3:.............................................................................................................................4

Issue:........................................................................................................................................4

Legislation:..............................................................................................................................4

Application:.............................................................................................................................4

Conclusion:..............................................................................................................................5

Requirement 4:.............................................................................................................................5

Issue:........................................................................................................................................5

Legislation:..............................................................................................................................5

Table of Contents

Answer 1:.........................................................................................................................................2

Requirement 1:.............................................................................................................................2

Issue:........................................................................................................................................2

Legislation:..............................................................................................................................2

Application:.............................................................................................................................2

Conclusion:..............................................................................................................................3

Requirement 2:.............................................................................................................................3

Issue:........................................................................................................................................3

Legislation:..............................................................................................................................3

Application:.............................................................................................................................3

Conclusion:..............................................................................................................................4

Requirement 3:.............................................................................................................................4

Issue:........................................................................................................................................4

Legislation:..............................................................................................................................4

Application:.............................................................................................................................4

Conclusion:..............................................................................................................................5

Requirement 4:.............................................................................................................................5

Issue:........................................................................................................................................5

Legislation:..............................................................................................................................5

2TAXATION LAW

Application:.............................................................................................................................6

Conclusion:..............................................................................................................................6

Answer 2:.........................................................................................................................................7

Issue:............................................................................................................................................7

Legislation:..................................................................................................................................7

Application:.................................................................................................................................7

Conclusion:..................................................................................................................................9

Answer 3:.......................................................................................................................................10

Answer 4:.......................................................................................................................................12

References:....................................................................................................................................13

Application:.............................................................................................................................6

Conclusion:..............................................................................................................................6

Answer 2:.........................................................................................................................................7

Issue:............................................................................................................................................7

Legislation:..................................................................................................................................7

Application:.................................................................................................................................7

Conclusion:..................................................................................................................................9

Answer 3:.......................................................................................................................................10

Answer 4:.......................................................................................................................................12

References:....................................................................................................................................13

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3TAXATION LAW

Answer 1:

Requirement 1:

Issue:

In this issue it is to be seen whether the cost incurred to move a machinery from one site

to another new site shall be treated as eligible for deductions with respect to “section 8-1 of the

ITAA 1997”.

Legislation:

a. “Section 8-1 of the Income Tax Assessment Act 1997”

b. “British Insulated & Helsby Cables”

Application:

Under the “section 8-1 of the Income Tax Assessment Act 1997”, the cost incurred by a

firm in relocating its machinery to a new site falls under the nature of capital and therefore, is not

eligible to any deductions. If seen from the aspect of depreciation, movement of machinery to a

new site may increase the cost of asset. The cost of moving machinery falls under the domain of

the cost of small changes. It shall be allowed for deductions. The reason for considering it

eligible to deductions the cost is a part of the day-to-day business expenses1.

The “British Insulated & Helsby Cables” case verdict states that the cost of transferring

machinery leads to the benefit of the business premises due to the shifting of assets, which are

depreciable. As under “Taxation Ruling of TD 93/126”, in case of installing a machinery in new

premises, the cost of bringing it in operation will be seen as revenue and therefore, in this case,

1 Barkoczy, Stephen. "Foundations of Taxation Law 2016." OUP Catalogue(2016).

Answer 1:

Requirement 1:

Issue:

In this issue it is to be seen whether the cost incurred to move a machinery from one site

to another new site shall be treated as eligible for deductions with respect to “section 8-1 of the

ITAA 1997”.

Legislation:

a. “Section 8-1 of the Income Tax Assessment Act 1997”

b. “British Insulated & Helsby Cables”

Application:

Under the “section 8-1 of the Income Tax Assessment Act 1997”, the cost incurred by a

firm in relocating its machinery to a new site falls under the nature of capital and therefore, is not

eligible to any deductions. If seen from the aspect of depreciation, movement of machinery to a

new site may increase the cost of asset. The cost of moving machinery falls under the domain of

the cost of small changes. It shall be allowed for deductions. The reason for considering it

eligible to deductions the cost is a part of the day-to-day business expenses1.

The “British Insulated & Helsby Cables” case verdict states that the cost of transferring

machinery leads to the benefit of the business premises due to the shifting of assets, which are

depreciable. As under “Taxation Ruling of TD 93/126”, in case of installing a machinery in new

premises, the cost of bringing it in operation will be seen as revenue and therefore, in this case,

1 Barkoczy, Stephen. "Foundations of Taxation Law 2016." OUP Catalogue(2016).

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4TAXATION LAW

the cost of transporting the machine is representing a capital expenditure and therefore, will not

be allowed for deductions.

Conclusion:

The above cost being a form of capital expenditure will not be allowed for deductions

under “section 8-1 of the Income Tax Assessment Act 1997”.

Requirement 2:

Issue:

The issue deals with the eligibility of the cost of revaluing assets to effect insurance cover

for deduction under the “section 8-1 of the Income Tax Assessment Act 1997”.

Legislation:

a. “Section 8-1 of the Income Tax Assessment Act 1997”

Application:

The expenses in this scenario are associated with that of the fixed asset. Therefore, to see

their eligibility to deductions it is to be seen whether the expenditures are merely done to protect

the asset or they are done in order to increase the revenue. If the former situation occurs resulting

in temporary benefits and if expenses are repetitive in nature, then they will be permissible for

deductions, under “section 8-1 of the Income Tax Assessment Act 1997”. In this case, the

expenditures to revalue assets to effect cover of insurance are in all probability repetitive by

nature and therefore, they should be allowable for deductions2.

2 Saad, Natrah. "Tax Non-Compliance Behaviour: Taxpayers View." Procedia-Social and

Behavioral Sciences 65 (2012): 344-351.

the cost of transporting the machine is representing a capital expenditure and therefore, will not

be allowed for deductions.

Conclusion:

The above cost being a form of capital expenditure will not be allowed for deductions

under “section 8-1 of the Income Tax Assessment Act 1997”.

Requirement 2:

Issue:

The issue deals with the eligibility of the cost of revaluing assets to effect insurance cover

for deduction under the “section 8-1 of the Income Tax Assessment Act 1997”.

Legislation:

a. “Section 8-1 of the Income Tax Assessment Act 1997”

Application:

The expenses in this scenario are associated with that of the fixed asset. Therefore, to see

their eligibility to deductions it is to be seen whether the expenditures are merely done to protect

the asset or they are done in order to increase the revenue. If the former situation occurs resulting

in temporary benefits and if expenses are repetitive in nature, then they will be permissible for

deductions, under “section 8-1 of the Income Tax Assessment Act 1997”. In this case, the

expenditures to revalue assets to effect cover of insurance are in all probability repetitive by

nature and therefore, they should be allowable for deductions2.

2 Saad, Natrah. "Tax Non-Compliance Behaviour: Taxpayers View." Procedia-Social and

Behavioral Sciences 65 (2012): 344-351.

5TAXATION LAW

Conclusion:

The concerned expenditure, under “section 8-1 of the ITAA 1997”, will be permissible

for deductions because of their repetitive nature.

Requirement 3:

Issue:

In this scenario, the eligibility of the legal expenses of a company occurring to oppose the

winding up petition, as deductions is seen, with reference to the “section 8-1 of the ITAA 1997”.

Legislation:

a. “FC of T v Snowden and Wilson Pty Ltd (1958) 99 CLR 431)”

b. “Section 8-1 of the Income Tax Assessment Act 1997”

Application:

The “section 8-1 of the Income Tax Assessment Act 1997”, states that the cost of

winding up businesses falls in the category of business operational costs and are therefore, in

general are not permissible deductions. However, under the “taxation ruling of ID 2004/367”,

the legal costs are considered for the deductions if they occur for business operations, through

which the taxable proceeds are produced by the individuals.

With reference to “FC of T v Snowden and Ilson Pty Ltd (1958)”, the expenditures are

unusual and the taxpayer did not have to commence lawful actions in the earlier occasions as it

does not prevent expenses to be eligible as deductions under any circumstances.

Conclusion:

The concerned expenditure, under “section 8-1 of the ITAA 1997”, will be permissible

for deductions because of their repetitive nature.

Requirement 3:

Issue:

In this scenario, the eligibility of the legal expenses of a company occurring to oppose the

winding up petition, as deductions is seen, with reference to the “section 8-1 of the ITAA 1997”.

Legislation:

a. “FC of T v Snowden and Wilson Pty Ltd (1958) 99 CLR 431)”

b. “Section 8-1 of the Income Tax Assessment Act 1997”

Application:

The “section 8-1 of the Income Tax Assessment Act 1997”, states that the cost of

winding up businesses falls in the category of business operational costs and are therefore, in

general are not permissible deductions. However, under the “taxation ruling of ID 2004/367”,

the legal costs are considered for the deductions if they occur for business operations, through

which the taxable proceeds are produced by the individuals.

With reference to “FC of T v Snowden and Ilson Pty Ltd (1958)”, the expenditures are

unusual and the taxpayer did not have to commence lawful actions in the earlier occasions as it

does not prevent expenses to be eligible as deductions under any circumstances.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6TAXATION LAW

In this case, the legal expenditures for opposing the winding up petition shall not be

permissible as deductions as they are a type of capital expenditure occurring in association to

business operations3.

Conclusion:

As can be seen from the above discussion, the concerned expenses will not be treated as

permissible deductions under the “section 8-1 of the ITAA 1997”, as they are of the nature of

capital expenditures in relation to operations in business.

Requirement 4:

Issue:

In this scenario it is seen as to whether the legal expenses which occurs for availing the

services of a solicitor with regards to different types of operations of the clients should be treated

as allowable deductions under the “section 8-1 of the ITAA 1997”.

Legislation:

a. “Section 8-1 of the Income Tax Assessment Act 1997”

Application:

Taking reference from the “section 8-1 of the Income Tax Assessment Act 1997”, the

legal expenses taking place in relation to the business activities for generation of revenue, shall

be permissible as deductions. However, in the aspect of legal expenses, some exceptions exist

3 Oats, Lynne, ed. Taxation: A fieldwork research handbook. Routledge, 2012.

In this case, the legal expenditures for opposing the winding up petition shall not be

permissible as deductions as they are a type of capital expenditure occurring in association to

business operations3.

Conclusion:

As can be seen from the above discussion, the concerned expenses will not be treated as

permissible deductions under the “section 8-1 of the ITAA 1997”, as they are of the nature of

capital expenditures in relation to operations in business.

Requirement 4:

Issue:

In this scenario it is seen as to whether the legal expenses which occurs for availing the

services of a solicitor with regards to different types of operations of the clients should be treated

as allowable deductions under the “section 8-1 of the ITAA 1997”.

Legislation:

a. “Section 8-1 of the Income Tax Assessment Act 1997”

Application:

Taking reference from the “section 8-1 of the Income Tax Assessment Act 1997”, the

legal expenses taking place in relation to the business activities for generation of revenue, shall

be permissible as deductions. However, in the aspect of legal expenses, some exceptions exist

3 Oats, Lynne, ed. Taxation: A fieldwork research handbook. Routledge, 2012.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7TAXATION LAW

like those which are of private of capital expenditure types, especially if the expenditures are in

he are of producing exempt and the proceeds of non-chargeable and non-exempt types4.

Here, the legal fees incurred might not be allowable as deductions as the expenses have

no relation to generation of taxable income. In the present scenario, as the expenditures of the

individual are associated with chargeable income producing business activities, therefore, it will

be allowable as deductions5.

Conclusion:

The expenditures, in this scenario, should be eligible as allowable deductions under the

“section 8-1 of the ITAA 1997”, as it is related to the business activities involved in the

generation of taxable income.

Answer 2:

Issue:

In this issue, the situation of Big Bank is dealt with. It is concerned with the

determination of the input tax credit with respect to the advertisement expenditures, taking

reference of the “GST Act 1999”.

4 ROBIN, H. AUSTRALIAN TAXATION LAW 2017. OXFORD University Press, 2017.

5 Woellner, R. H., et al. Australian Taxation Law Select: Legislation and Commentary 2016.

Oxford University Press, 2016.

like those which are of private of capital expenditure types, especially if the expenditures are in

he are of producing exempt and the proceeds of non-chargeable and non-exempt types4.

Here, the legal fees incurred might not be allowable as deductions as the expenses have

no relation to generation of taxable income. In the present scenario, as the expenditures of the

individual are associated with chargeable income producing business activities, therefore, it will

be allowable as deductions5.

Conclusion:

The expenditures, in this scenario, should be eligible as allowable deductions under the

“section 8-1 of the ITAA 1997”, as it is related to the business activities involved in the

generation of taxable income.

Answer 2:

Issue:

In this issue, the situation of Big Bank is dealt with. It is concerned with the

determination of the input tax credit with respect to the advertisement expenditures, taking

reference of the “GST Act 1999”.

4 ROBIN, H. AUSTRALIAN TAXATION LAW 2017. OXFORD University Press, 2017.

5 Woellner, R. H., et al. Australian Taxation Law Select: Legislation and Commentary 2016.

Oxford University Press, 2016.

8TAXATION LAW

Legislation:

a. “GST Act 1999”

b. “subsections 15-25”

c. “Paragraphs 11-5 and 15-5”

d. “Goods and Service taxation ruling of GSTR 2006/3”

e. “Ronpibon Tin NL v. FC of T”

Application:

The “GSTR 2006/3” has the guidelines regarding the ways of determining input tax

credit with administrations for the changes, which the financial supplies use under that of the

“GST Act 1999”.

The application of the ruling with reference to the divisions 11 and 15 of GST Act and

the creditable purpose’s extent are also included here. The ruling, in a general framework, is

applied to the registered taxable units and to those who are mandatorily needed to be registered

for acquiring financial supplies which surpass the threshold of financial acquisition and those

who are eligible for that of input tax credit6.

In this situation, the Big Bank has an expenditure of $1,650,000 as GST which includes

the advertising expenditures in the previous year. Therefore, in this situation, the rulings of the

GSTR 2006/3 will be applicable for Big Bank as it is eligible for input tax credit or for lowered

input tax credit. Under this ruling, a registered unit or those, which need to get registration, shall

6 Mawuli, Agogo. "Goods and services tax: An appraisal." Paper presented at the PNG Taxation

Research and Review Symposium. Vol. 29. 2014.

Legislation:

a. “GST Act 1999”

b. “subsections 15-25”

c. “Paragraphs 11-5 and 15-5”

d. “Goods and Service taxation ruling of GSTR 2006/3”

e. “Ronpibon Tin NL v. FC of T”

Application:

The “GSTR 2006/3” has the guidelines regarding the ways of determining input tax

credit with administrations for the changes, which the financial supplies use under that of the

“GST Act 1999”.

The application of the ruling with reference to the divisions 11 and 15 of GST Act and

the creditable purpose’s extent are also included here. The ruling, in a general framework, is

applied to the registered taxable units and to those who are mandatorily needed to be registered

for acquiring financial supplies which surpass the threshold of financial acquisition and those

who are eligible for that of input tax credit6.

In this situation, the Big Bank has an expenditure of $1,650,000 as GST which includes

the advertising expenditures in the previous year. Therefore, in this situation, the rulings of the

GSTR 2006/3 will be applicable for Big Bank as it is eligible for input tax credit or for lowered

input tax credit. Under this ruling, a registered unit or those, which need to get registration, shall

6 Mawuli, Agogo. "Goods and services tax: An appraisal." Paper presented at the PNG Taxation

Research and Review Symposium. Vol. 29. 2014.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9TAXATION LAW

be included under the domain of GST in order to make taxable supplies. Under the GST

legislation, the unit can claim the input tax credit for the supplies, which are GST inclusive7.

Taking reference of the case “Ronpibon Tin NL v. FC of T”, the “extent” and “to the

extent” doctrine has been used to analyze the GST legislation. This is inclusive of the obligation

where the method adopted for apportion should be appropriate and practical in case of the

concerned enterprise. As under paragraph 11-5 and 15-5, an acquisition should be entirely

creditable or partially creditable to be eligible a s a creditable acquisition8.

Under the “paragraphs 11-5 and 15-5 (a)”, to be eligible as a creditable acquisition, an

acquisition should be for creditable purpose entirely. If it is partially for that purpose, then

degree of credible purpose should be mentioned. The subsection 15-25 states that an import, if is

partly for creditable purposes, will be regarded as eligible to be a creditable import. An

acquisition, section 11-15 or 15-10, qualifies as creditable if it supplies to claim the input tax

credit9.

7 McCouat, Philip. Australian Master GST Guide 2012. CCH Australia Limited, 2012.

8 "GSTD 2006/3 - Goods and services tax: are settlement adjustments taken into account to

determine the consideration for the supply or acquisition of real property? (As at 16 April

2008)". Law.ato.gov.au, 2017. Online. Internet. 14 Sep. 2017. . Available:

http://law.ato.gov.au/atolaw/view.htm?docid=GSD/GSTD20063/NAT/ATO/00001.

9 "Legal Database". Ato.gov.au, 2017. Online. Internet. 14 Sep. 2017. . Available:

https://www.ato.gov.au/law/view/document?docid=GST/GSTR20063/NAT/ATO/00001.

be included under the domain of GST in order to make taxable supplies. Under the GST

legislation, the unit can claim the input tax credit for the supplies, which are GST inclusive7.

Taking reference of the case “Ronpibon Tin NL v. FC of T”, the “extent” and “to the

extent” doctrine has been used to analyze the GST legislation. This is inclusive of the obligation

where the method adopted for apportion should be appropriate and practical in case of the

concerned enterprise. As under paragraph 11-5 and 15-5, an acquisition should be entirely

creditable or partially creditable to be eligible a s a creditable acquisition8.

Under the “paragraphs 11-5 and 15-5 (a)”, to be eligible as a creditable acquisition, an

acquisition should be for creditable purpose entirely. If it is partially for that purpose, then

degree of credible purpose should be mentioned. The subsection 15-25 states that an import, if is

partly for creditable purposes, will be regarded as eligible to be a creditable import. An

acquisition, section 11-15 or 15-10, qualifies as creditable if it supplies to claim the input tax

credit9.

7 McCouat, Philip. Australian Master GST Guide 2012. CCH Australia Limited, 2012.

8 "GSTD 2006/3 - Goods and services tax: are settlement adjustments taken into account to

determine the consideration for the supply or acquisition of real property? (As at 16 April

2008)". Law.ato.gov.au, 2017. Online. Internet. 14 Sep. 2017. . Available:

http://law.ato.gov.au/atolaw/view.htm?docid=GSD/GSTD20063/NAT/ATO/00001.

9 "Legal Database". Ato.gov.au, 2017. Online. Internet. 14 Sep. 2017. . Available:

https://www.ato.gov.au/law/view/document?docid=GST/GSTR20063/NAT/ATO/00001.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10TAXATION LAW

The expenditure for advertising, in case of the Big Bank, was for creditable acquisition

purpose. With reference to the “GSTR ruling of 2006/3”, the enterprise has surpassed the

threshold limit and the invoice of the Big Bank will be eligible for the input tax credit for the

GST inclusive supplies which has been made by the company10.

Conclusion:

From the above discussion, it can be concluded that the Big Bank is eligible for claiming

the input tax credit, for the advertisement expenditures incurred by the firm, for creditable

acquisition purposes, as can be seen with respect to the “GSTR 2006/13”.

10 "Legal Database". Ato.gov.au, 2017. Online. Internet. 14 Sep. 2017. . Available:

https://www.ato.gov.au/law/view/document?docid=PAC/19970038/8-1.

The expenditure for advertising, in case of the Big Bank, was for creditable acquisition

purpose. With reference to the “GSTR ruling of 2006/3”, the enterprise has surpassed the

threshold limit and the invoice of the Big Bank will be eligible for the input tax credit for the

GST inclusive supplies which has been made by the company10.

Conclusion:

From the above discussion, it can be concluded that the Big Bank is eligible for claiming

the input tax credit, for the advertisement expenditures incurred by the firm, for creditable

acquisition purposes, as can be seen with respect to the “GSTR 2006/13”.

10 "Legal Database". Ato.gov.au, 2017. Online. Internet. 14 Sep. 2017. . Available:

https://www.ato.gov.au/law/view/document?docid=PAC/19970038/8-1.

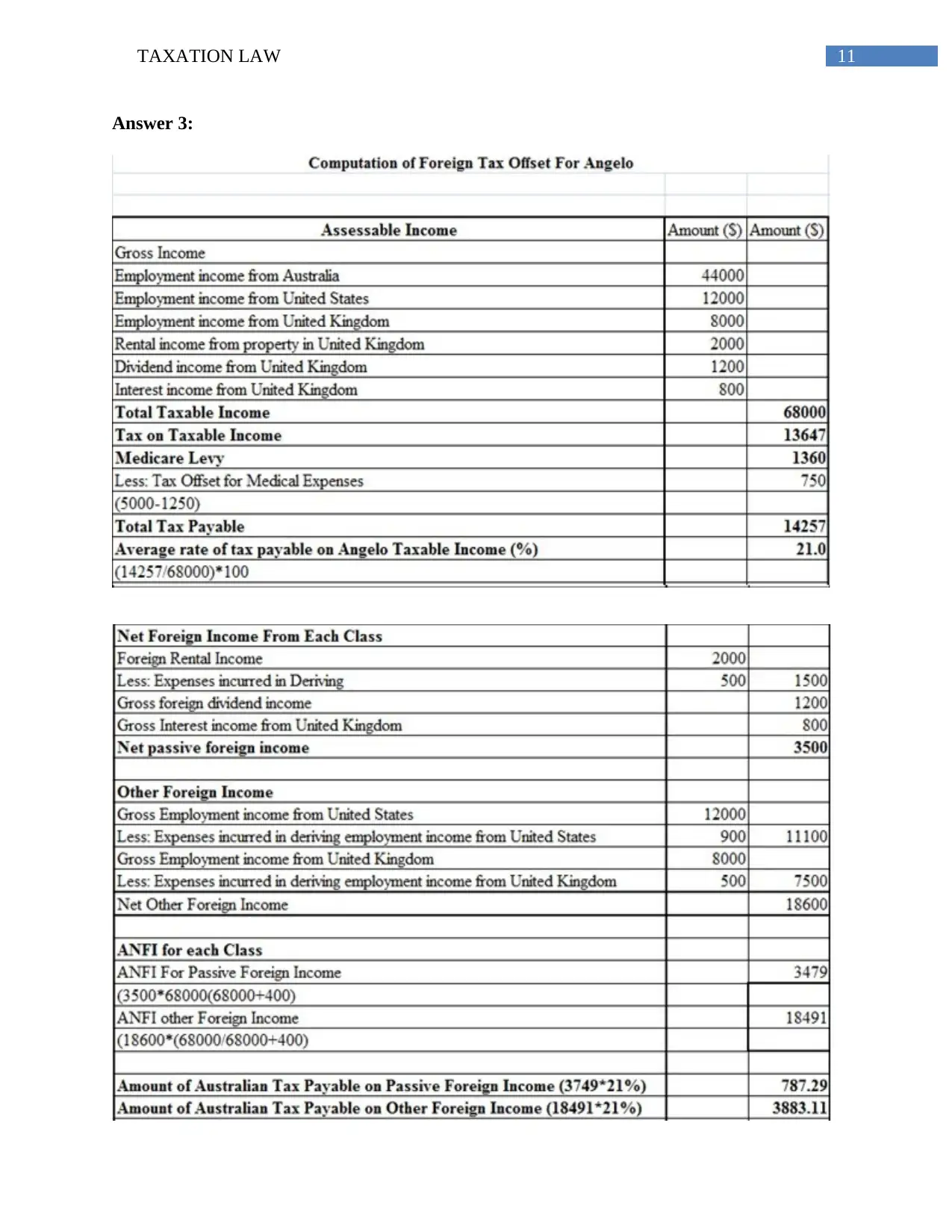

11TAXATION LAW

Answer 3:

Answer 3:

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 15

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.