Taxation Law: Analysis and Advice on Brad Smith's Tax Return 2017/18

VerifiedAdded on 2020/05/28

|6

|1152

|86

Homework Assignment

AI Summary

This assignment presents a taxation law analysis in the form of a letter of advice to Brad Smith regarding his 2017/18 tax return. It details the calculation of assessable income, including gross salary, travel allowance, rental income, and capital gains from share sales and the sale of Russian dolls. The assignment identifies allowable deductions, such as interest on a loan and repairs to an investment property, while disallowing expenses on an air conditioning unit and legal fees for a neighbor dispute. The document meticulously calculates the total taxable income, tax payable, and tax withheld, providing a clear breakdown of the tax liability based on relevant sections of the ITAA 1997 and FBTAA 1986. The letter concludes with a summary of the tax position and references supporting legal frameworks.

Running head: TAXATION LAW

Taxation Law

Name of the Student

Name of the University

Authors Note

Course ID

Taxation Law

Name of the Student

Name of the University

Authors Note

Course ID

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1TAXATION LAW

Letter of Advice

To: Brad Smith

From: Tax Accountant

Subject: Tax Return 2017/18

Dear Brad

I would like to draw your kind attention towards the taxable information provided by

you has been acknowledged and based on this information we are providing you with

appropriate tax information from the transactions reported by you. As evident from your note

it is noted that you have reported gross salary of $99,920 and out of which $26,734 has been

withheld. According to the “section 6-5 of the ITAA 1997” your gross salary would be

considered to be assessable and would be included in your taxable return (Barkoczy 2016).

Additionally, it is found that you have undertook loan of $100,000 at the annual interest rate

of 2%. Therefore, the interest charged on the loan taken for purchasing the investment

property can be claimed by you for as the assessable income under “section 8-1 of the ITAA

1997”. You have reported that you incurred expenses on petrol and the expenses incurred by

you have been incurred for work purpose and the same can be claimed as deductions under

“FBTAA 1986” (Tan et al. 2016).

According to the “Taxation ruling of TR 97/23” an individual can claim deductions

for the expenses incurred on repairs. The ruling effectively provides the circumstances under

which the expenditure incurred by the taxpayer for repairs would be considered as the

allowable deductions under “section 25-10 of the ITAA 1997” (Snape and De Souza 2016).

As evident from the information provided it was found that you incurred expenses for repairs

on the investment property. In context of the “section 25-10” the expense of $30,000

Letter of Advice

To: Brad Smith

From: Tax Accountant

Subject: Tax Return 2017/18

Dear Brad

I would like to draw your kind attention towards the taxable information provided by

you has been acknowledged and based on this information we are providing you with

appropriate tax information from the transactions reported by you. As evident from your note

it is noted that you have reported gross salary of $99,920 and out of which $26,734 has been

withheld. According to the “section 6-5 of the ITAA 1997” your gross salary would be

considered to be assessable and would be included in your taxable return (Barkoczy 2016).

Additionally, it is found that you have undertook loan of $100,000 at the annual interest rate

of 2%. Therefore, the interest charged on the loan taken for purchasing the investment

property can be claimed by you for as the assessable income under “section 8-1 of the ITAA

1997”. You have reported that you incurred expenses on petrol and the expenses incurred by

you have been incurred for work purpose and the same can be claimed as deductions under

“FBTAA 1986” (Tan et al. 2016).

According to the “Taxation ruling of TR 97/23” an individual can claim deductions

for the expenses incurred on repairs. The ruling effectively provides the circumstances under

which the expenditure incurred by the taxpayer for repairs would be considered as the

allowable deductions under “section 25-10 of the ITAA 1997” (Snape and De Souza 2016).

As evident from the information provided it was found that you incurred expenses for repairs

on the investment property. In context of the “section 25-10” the expense of $30,000

2TAXATION LAW

reported by you satisfies the term “repairs” since it is related to the work done by you on the

premises. The work has been done you is in conjunction with the objective of remedying or

making the defects goods and preventing the property from being deteriorated. On the other

hand, it was noted that you bought air condition system which is not related to any repairs

and hence the expenses incurred on air conditions would not be allowed as allowable

deductions under “section 25-10 of the ITAA 1997” (Saad 2014).

In the later part it has been noted that you sold shares of Telstra that was bought by

you and in respect of the Australian taxation office gains made from the sale of shares give

rise to CGT events (Miller and Oats 2016). Similarly, it was noticed that you incurred a loss

from the sale of shares that held in Orica and the same can be set off against the gains made

from the sale of Telstra shares. As evident from the information the loss on sale of shares

from Circa can be offset from the gains made on sale of Telstra Shares.

The information provided by you also contained transaction on the sale of Russian

Babushka dolls. The doll was purchased by you for $1,000 and the same was sold for $4900.

As a result of this you made a capital gains and the same would be included in your

assessable income which would subjected to 50% CGT discount for the amount reported by

you.

According to “section 8-1 of the ITAA 1997” it provides that any form of loss or outgoings

reported by the taxpayer would be considered as allowable deductions given that legal

expenses has been incurred in generating the assessable income of the taxpayer (Bevacqua

2015). A deduction would not be available if the expenses incurred are of capital, private or

of domestic nature. The legal expenses that is incurred by you on neighbours for illegal fence

would not be considered for allowable deductions since these expenses carries the nature of

private or domestic expenses.

reported by you satisfies the term “repairs” since it is related to the work done by you on the

premises. The work has been done you is in conjunction with the objective of remedying or

making the defects goods and preventing the property from being deteriorated. On the other

hand, it was noted that you bought air condition system which is not related to any repairs

and hence the expenses incurred on air conditions would not be allowed as allowable

deductions under “section 25-10 of the ITAA 1997” (Saad 2014).

In the later part it has been noted that you sold shares of Telstra that was bought by

you and in respect of the Australian taxation office gains made from the sale of shares give

rise to CGT events (Miller and Oats 2016). Similarly, it was noticed that you incurred a loss

from the sale of shares that held in Orica and the same can be set off against the gains made

from the sale of Telstra shares. As evident from the information the loss on sale of shares

from Circa can be offset from the gains made on sale of Telstra Shares.

The information provided by you also contained transaction on the sale of Russian

Babushka dolls. The doll was purchased by you for $1,000 and the same was sold for $4900.

As a result of this you made a capital gains and the same would be included in your

assessable income which would subjected to 50% CGT discount for the amount reported by

you.

According to “section 8-1 of the ITAA 1997” it provides that any form of loss or outgoings

reported by the taxpayer would be considered as allowable deductions given that legal

expenses has been incurred in generating the assessable income of the taxpayer (Bevacqua

2015). A deduction would not be available if the expenses incurred are of capital, private or

of domestic nature. The legal expenses that is incurred by you on neighbours for illegal fence

would not be considered for allowable deductions since these expenses carries the nature of

private or domestic expenses.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3TAXATION LAW

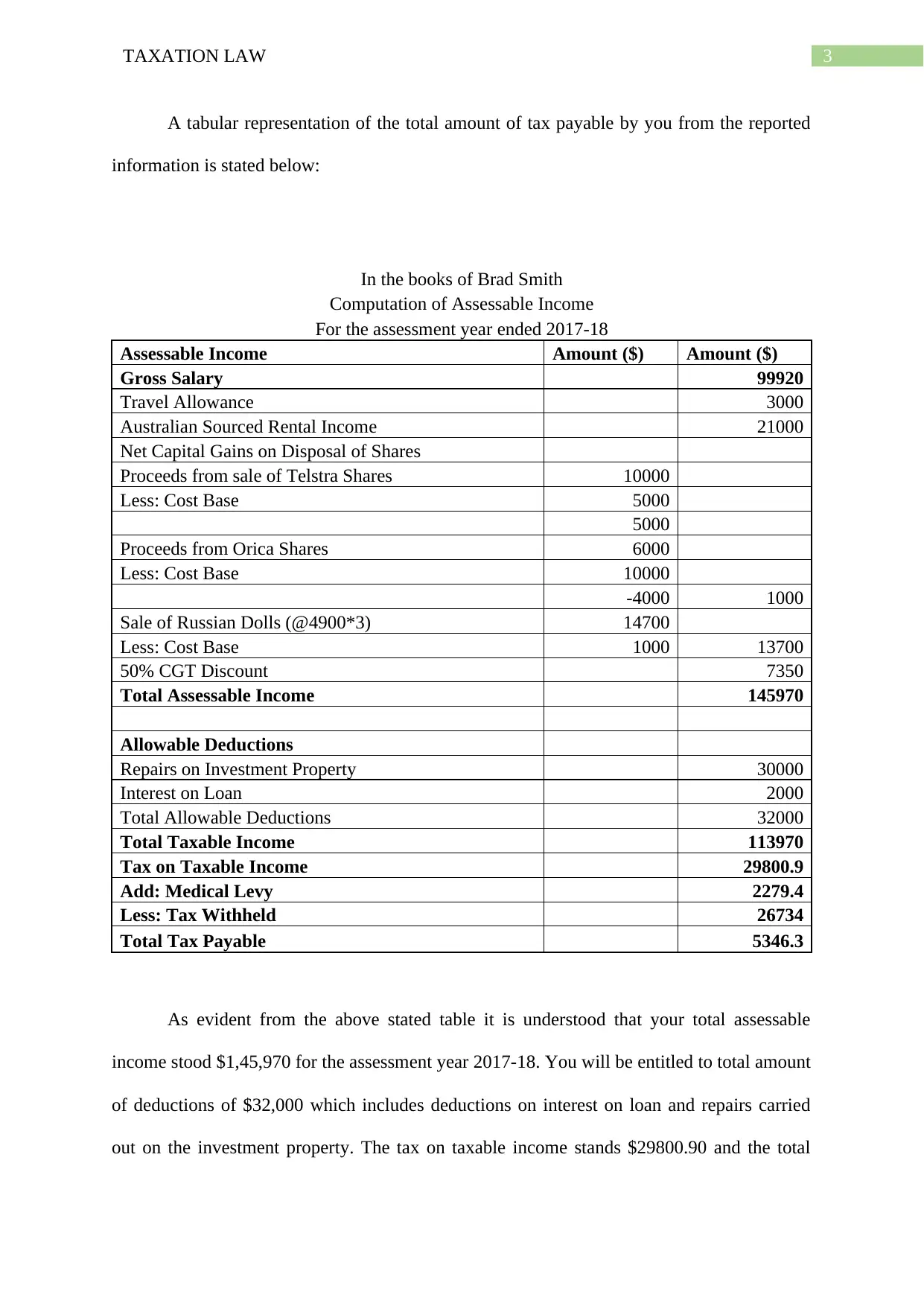

A tabular representation of the total amount of tax payable by you from the reported

information is stated below:

In the books of Brad Smith

Computation of Assessable Income

For the assessment year ended 2017-18

Assessable Income Amount ($) Amount ($)

Gross Salary 99920

Travel Allowance 3000

Australian Sourced Rental Income 21000

Net Capital Gains on Disposal of Shares

Proceeds from sale of Telstra Shares 10000

Less: Cost Base 5000

5000

Proceeds from Orica Shares 6000

Less: Cost Base 10000

-4000 1000

Sale of Russian Dolls (@4900*3) 14700

Less: Cost Base 1000 13700

50% CGT Discount 7350

Total Assessable Income 145970

Allowable Deductions

Repairs on Investment Property 30000

Interest on Loan 2000

Total Allowable Deductions 32000

Total Taxable Income 113970

Tax on Taxable Income 29800.9

Add: Medical Levy 2279.4

Less: Tax Withheld 26734

Total Tax Payable 5346.3

As evident from the above stated table it is understood that your total assessable

income stood $1,45,970 for the assessment year 2017-18. You will be entitled to total amount

of deductions of $32,000 which includes deductions on interest on loan and repairs carried

out on the investment property. The tax on taxable income stands $29800.90 and the total

A tabular representation of the total amount of tax payable by you from the reported

information is stated below:

In the books of Brad Smith

Computation of Assessable Income

For the assessment year ended 2017-18

Assessable Income Amount ($) Amount ($)

Gross Salary 99920

Travel Allowance 3000

Australian Sourced Rental Income 21000

Net Capital Gains on Disposal of Shares

Proceeds from sale of Telstra Shares 10000

Less: Cost Base 5000

5000

Proceeds from Orica Shares 6000

Less: Cost Base 10000

-4000 1000

Sale of Russian Dolls (@4900*3) 14700

Less: Cost Base 1000 13700

50% CGT Discount 7350

Total Assessable Income 145970

Allowable Deductions

Repairs on Investment Property 30000

Interest on Loan 2000

Total Allowable Deductions 32000

Total Taxable Income 113970

Tax on Taxable Income 29800.9

Add: Medical Levy 2279.4

Less: Tax Withheld 26734

Total Tax Payable 5346.3

As evident from the above stated table it is understood that your total assessable

income stood $1,45,970 for the assessment year 2017-18. You will be entitled to total amount

of deductions of $32,000 which includes deductions on interest on loan and repairs carried

out on the investment property. The tax on taxable income stands $29800.90 and the total

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4TAXATION LAW

amount of tax that is withheld from your gross salary has been deducted to reduce your tax

liability. Consequently, the total amount of tax payable by you is $5,346.30.

I hope that above stated advice is relevant to you as all the information provided by has been

duly complied with appropriate sections to support your tax status.

Thank You

_____________

amount of tax that is withheld from your gross salary has been deducted to reduce your tax

liability. Consequently, the total amount of tax payable by you is $5,346.30.

I hope that above stated advice is relevant to you as all the information provided by has been

duly complied with appropriate sections to support your tax status.

Thank You

_____________

5TAXATION LAW

Reference List:

Barkoczy, S., 2016. Foundations of Taxation Law 2016. OUP Catalogue.

Bevacqua, J., 2015. ATO accountability and taxpayer fairness: An assessment of the proposal

to split the Australian taxation office. UNSWLJ, 38, p.995.

Miller, A. and Oats, L., 2016. Principles of international taxation. Bloomsbury Publishing.

Saad, N., 2014. Tax knowledge, tax complexity and tax compliance: Taxpayers’

view. Procedia-Social and Behavioral Sciences, 109, pp.1069-1075.

Snape, J. and De Souza, J., 2016. Environmental taxation law: policy, contexts and practice.

Routledge.

Tan, L.M., Braithwaite, V. and Reinhart, M., 2016. Why do small business taxpayers stay

with their practitioners? Trust, competence and aggressive advice. International Small

Business Journal, 34(3), pp.329-344.

Reference List:

Barkoczy, S., 2016. Foundations of Taxation Law 2016. OUP Catalogue.

Bevacqua, J., 2015. ATO accountability and taxpayer fairness: An assessment of the proposal

to split the Australian taxation office. UNSWLJ, 38, p.995.

Miller, A. and Oats, L., 2016. Principles of international taxation. Bloomsbury Publishing.

Saad, N., 2014. Tax knowledge, tax complexity and tax compliance: Taxpayers’

view. Procedia-Social and Behavioral Sciences, 109, pp.1069-1075.

Snape, J. and De Souza, J., 2016. Environmental taxation law: policy, contexts and practice.

Routledge.

Tan, L.M., Braithwaite, V. and Reinhart, M., 2016. Why do small business taxpayers stay

with their practitioners? Trust, competence and aggressive advice. International Small

Business Journal, 34(3), pp.329-344.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 6

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.