Taxation Law Assignment: Analysis of Income and Deductions (2019)

VerifiedAdded on 2023/01/18

|7

|1412

|75

Homework Assignment

AI Summary

This document provides a detailed solution to a taxation law assignment, addressing a problem-style question with two parts. The assignment analyzes various aspects of income tax law, including the determination of assessable income from employment and part-time lecturing, referencing sections from the ITAA 1936 and ITAA 1997. It examines the deductibility of travel expenses, distinguishing between work-related travel and expenses for pursuing further education or negotiating contracts. Furthermore, the solution explores the treatment of repair expenses versus capital improvements, citing relevant case law such as Sun Newspapers Ltd v FC of T (1938). Finally, it covers the implications of capital gains tax (CGT) events, particularly the disposal of a CGT asset and the calculation of cost base, providing a comprehensive understanding of taxation principles. The solution also includes a references section with the relevant sources.

Running head: TAXATION LAW

Taxation Law

Name of the Student

Name of the University

Authors Note

Course ID

Taxation Law

Name of the Student

Name of the University

Authors Note

Course ID

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1TAXATION LAW

Table of Contents

Answer to Part B........................................................................................................................2

Answer to Question A:...........................................................................................................2

References:.................................................................................................................................6

Table of Contents

Answer to Part B........................................................................................................................2

Answer to Question A:...........................................................................................................2

References:.................................................................................................................................6

2TAXATION LAW

Answer to Part B

Answer to Question A:

As stated under “section 6, ITAA 1936” when a taxpayer obtains income from

earnings, wages, salaries, commissions, wages, bonus etc. received in capacity of the

employee would be treated as earnings from private effort. Furthermore, under “section 6-5,

ITAA 1997” a larger portion of the income that is received by the taxpayer is treated as

ordinary income (Woellner et al., 2016). The law court in “Scott v FCT (1935)” stated that

earnings must not be viewed as art and requires the application of essential principles to treat

those receipts as income in agreement with ordinary conceptions and mankind usage.

As evident in case of Paul he is employed as a doctor at John James Hospital and

earns annual income of $175,000. He also works as the part-time lecturer at medical school in

Canberra and earns $65,000 per year. Referring to “section 6, ITAA 1936” the income

earned by Paul constitutes income from personal exertion (Blakelock & King, 2017).

Therefore, the salary from the employment at hospital and part-time lecturer would be

considered as assessable income under the ordinary meaning of “section 6-5, ITAA 1997”.

The court in “Lunney v FCT (1958)” travel amid the home and person’s place of

work is not allowed for deductions (Barkoczy, 2016). While “section 25-100, ITAA 1997”

allows the taxpayer to obtain deduction for the charges incurred in travelling amid the

workplaces. The travel must be related among the two workplaces where the profits

producing activities are performed by the taxpayer and neither of the place is the home of

taxpayer. The law court in “FCT v Wiener (1978)” permitted the taxpayer with the allowable

tax deduction for traveling expenses amid schools and also between home and travel between

home and the first and last school attended each day by the taxpayer (Sadiq, 2018).

Answer to Part B

Answer to Question A:

As stated under “section 6, ITAA 1936” when a taxpayer obtains income from

earnings, wages, salaries, commissions, wages, bonus etc. received in capacity of the

employee would be treated as earnings from private effort. Furthermore, under “section 6-5,

ITAA 1997” a larger portion of the income that is received by the taxpayer is treated as

ordinary income (Woellner et al., 2016). The law court in “Scott v FCT (1935)” stated that

earnings must not be viewed as art and requires the application of essential principles to treat

those receipts as income in agreement with ordinary conceptions and mankind usage.

As evident in case of Paul he is employed as a doctor at John James Hospital and

earns annual income of $175,000. He also works as the part-time lecturer at medical school in

Canberra and earns $65,000 per year. Referring to “section 6, ITAA 1936” the income

earned by Paul constitutes income from personal exertion (Blakelock & King, 2017).

Therefore, the salary from the employment at hospital and part-time lecturer would be

considered as assessable income under the ordinary meaning of “section 6-5, ITAA 1997”.

The court in “Lunney v FCT (1958)” travel amid the home and person’s place of

work is not allowed for deductions (Barkoczy, 2016). While “section 25-100, ITAA 1997”

allows the taxpayer to obtain deduction for the charges incurred in travelling amid the

workplaces. The travel must be related among the two workplaces where the profits

producing activities are performed by the taxpayer and neither of the place is the home of

taxpayer. The law court in “FCT v Wiener (1978)” permitted the taxpayer with the allowable

tax deduction for traveling expenses amid schools and also between home and travel between

home and the first and last school attended each day by the taxpayer (Sadiq, 2018).

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3TAXATION LAW

Similarly, in the case of John, under “section 25-100, ITAA 1997” he will be

permitted to claim deduction for travelling expenditures between two place of work. The

occupation of the taxpayer here is inherently travelling and he travelled in the performance of

his duty from the time when John leaves his home till the time he returns home.

Under the first limb, to obtain a new employment are not treated as in the course of

generating the taxable revenue. The court in “Maddalena v FCT (1971)” denied the football

player with the deduction for the travel expenses incurred in negotiating his contract (Morgan

& Castelyn, 2018). The Commissioner of Taxation held that the expenses were not allowed

for deductions as it occurred point too soon. Similarly, the travelling and accommodation

expenses occurred by Paul to attend a post-graduate course in USA so that he can apply for

the promotion is not tax deductible under the positive limbs of “section 8-1, ITAA 1997”.

The expenditures occurred at a point too soon. Furthermore, the expenditure incurred by Paul

does not holds sufficient nexus with the earnings generating activities of the taxpayer.

Under “section 25-10, ITAA 1997” work done on the premises to remedy the defect

or prevent any further deterioration is considered as repair (Morgan et al., 2018). If the work

done on the property goes further than the repair under “section 25-10, ITAA 1997” then any

such expenditure for work is not allowed as deductions. Expenses incurred on repair is not

permissible for deduction under “section 25-10, ITAA 1997”, if the outgoings that are

occurred is capital in nature (Robin, 2019). The law court in “Sun Newspapers Ltd v FC of

T (1938)” held that expenditure was occurred in establishing, replacing or expanding the

profit deriving structure instead of being working or operational expenditure.

In an another example of “Lindsay v FCT (1960)” the court of law held that

expenditures occurred for renewing the slipway was the renewal of the entirety and does not

constitute a deductible repair (Robin & Barkoczy, 2019). Renovating the asset to its previous

Similarly, in the case of John, under “section 25-100, ITAA 1997” he will be

permitted to claim deduction for travelling expenditures between two place of work. The

occupation of the taxpayer here is inherently travelling and he travelled in the performance of

his duty from the time when John leaves his home till the time he returns home.

Under the first limb, to obtain a new employment are not treated as in the course of

generating the taxable revenue. The court in “Maddalena v FCT (1971)” denied the football

player with the deduction for the travel expenses incurred in negotiating his contract (Morgan

& Castelyn, 2018). The Commissioner of Taxation held that the expenses were not allowed

for deductions as it occurred point too soon. Similarly, the travelling and accommodation

expenses occurred by Paul to attend a post-graduate course in USA so that he can apply for

the promotion is not tax deductible under the positive limbs of “section 8-1, ITAA 1997”.

The expenditures occurred at a point too soon. Furthermore, the expenditure incurred by Paul

does not holds sufficient nexus with the earnings generating activities of the taxpayer.

Under “section 25-10, ITAA 1997” work done on the premises to remedy the defect

or prevent any further deterioration is considered as repair (Morgan et al., 2018). If the work

done on the property goes further than the repair under “section 25-10, ITAA 1997” then any

such expenditure for work is not allowed as deductions. Expenses incurred on repair is not

permissible for deduction under “section 25-10, ITAA 1997”, if the outgoings that are

occurred is capital in nature (Robin, 2019). The law court in “Sun Newspapers Ltd v FC of

T (1938)” held that expenditure was occurred in establishing, replacing or expanding the

profit deriving structure instead of being working or operational expenditure.

In an another example of “Lindsay v FCT (1960)” the court of law held that

expenditures occurred for renewing the slipway was the renewal of the entirety and does not

constitute a deductible repair (Robin & Barkoczy, 2019). Renovating the asset to its previous

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4TAXATION LAW

conditions without causing any kind of change to its essential character or function

constitutes repairs. It may involve renewal or replacement of secondary parts as the whole but

not the rebuilding of the entirety. Similarly, the replacement of floor coverings with the new

wooden floorboards by Paul cannot be allowed for deductions because it amounted to

improvement under “section 25-10, ITAA 1997”.

On the other hand, Paul also incurred expenses on repainting and re-plastering the

wall of investment property that was damaged because of leak can be allowed as tax

deductible expenses because it amounts to repairs under “section 25-10, ITAA 1997”. The

repairs were undertaken by Paul to restore the assets to its previous state without causing any

kind of change in its functions (Blakelock & King, 2017). The aim was only to make the

deterioration good through the wear and tear.

A taxpayer usually makes the capital gains or capital loss if the CGT event happens

under “section 102-20 of the ITAA 1997”. A CGT event A1 happens under “section 104-10

(1), ITAA 1997” when the CGT assets is disposed (Morgan et al., 2018). To work out the

capital gains the cost base are regarded as the total costs that are related with the CGT asset.

Under “section 110-25”, the cost base of the property includes the incidental costs such as

acquisition or event. While the 3rd element of cost base items includes the non-capital costs of

ownerships such as capital repairs (Blakelock & King, 2017). The legal fees and stamp duty

paid on acquisition by Paul will be included in the cost base under the second element while

the legal fees and sales commission upon disposal would be excluded from the sales proceeds

of the investment property. The sale of investment property by Paul to his sister constitutes

the CGT event A1 under section “section 102-20 of the ITAA 1997”. The total taxable

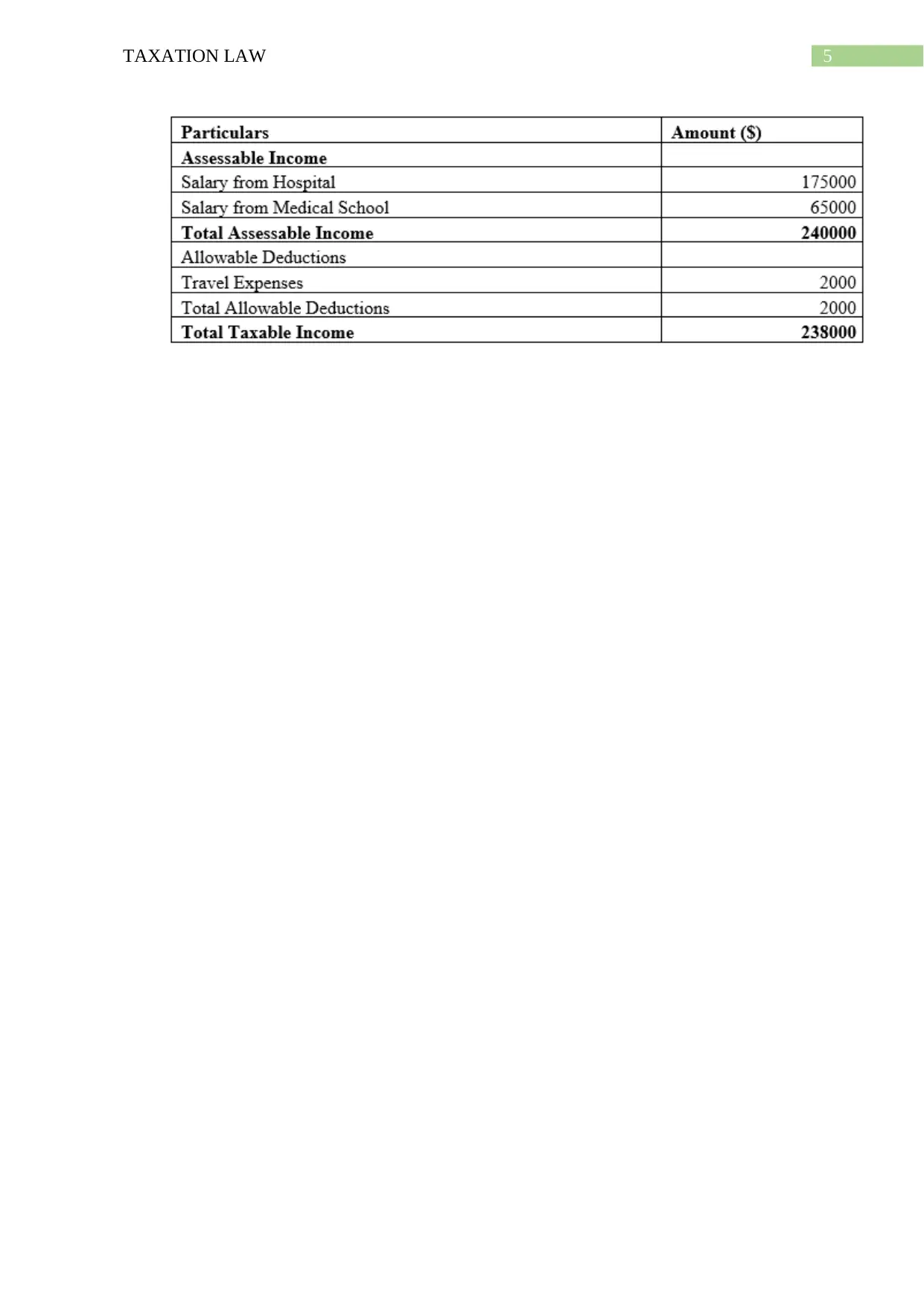

income derived by Paul and allowable deductions for the year has been stated below;

conditions without causing any kind of change to its essential character or function

constitutes repairs. It may involve renewal or replacement of secondary parts as the whole but

not the rebuilding of the entirety. Similarly, the replacement of floor coverings with the new

wooden floorboards by Paul cannot be allowed for deductions because it amounted to

improvement under “section 25-10, ITAA 1997”.

On the other hand, Paul also incurred expenses on repainting and re-plastering the

wall of investment property that was damaged because of leak can be allowed as tax

deductible expenses because it amounts to repairs under “section 25-10, ITAA 1997”. The

repairs were undertaken by Paul to restore the assets to its previous state without causing any

kind of change in its functions (Blakelock & King, 2017). The aim was only to make the

deterioration good through the wear and tear.

A taxpayer usually makes the capital gains or capital loss if the CGT event happens

under “section 102-20 of the ITAA 1997”. A CGT event A1 happens under “section 104-10

(1), ITAA 1997” when the CGT assets is disposed (Morgan et al., 2018). To work out the

capital gains the cost base are regarded as the total costs that are related with the CGT asset.

Under “section 110-25”, the cost base of the property includes the incidental costs such as

acquisition or event. While the 3rd element of cost base items includes the non-capital costs of

ownerships such as capital repairs (Blakelock & King, 2017). The legal fees and stamp duty

paid on acquisition by Paul will be included in the cost base under the second element while

the legal fees and sales commission upon disposal would be excluded from the sales proceeds

of the investment property. The sale of investment property by Paul to his sister constitutes

the CGT event A1 under section “section 102-20 of the ITAA 1997”. The total taxable

income derived by Paul and allowable deductions for the year has been stated below;

5TAXATION LAW

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6TAXATION LAW

References:

Barkoczy, S. (2016). Foundations of taxation law 2016. OUP Catalogue.

Blakelock, S., & King, P. (2017). Taxation law: The advance of ATO data

matching. Proctor, The, 37(6), 18.

Morgan, A., & Castelyn, D. (2018). Taxation Education in Secondary Schools. J.

Australasian Tax Tchrs. Ass'n, 13, 307.

Morgan, A., Mortimer, C., & Pinto, D. (2018). A practical introduction to Australian

taxation law 2018. Oxford University Press.

Robin & Barkoczy Woellner (Stephen & Murphy, Shirley Et Al.). (2019). Australian

Taxation Law Select 2019: Legislation And Commentary. Oxford University Press.

Robin, H. (2019). Australian Taxation Law 2019. Oxford University Press.

Sadiq, K. (2018). Australian Tax Law Cases 2018. Thomson Reuters.

Woellner, R., Barkoczy, S., Murphy, S., Evans, C., & Pinto, D. (2016). Australian Taxation

Law 2016. OUP Catalogue.

References:

Barkoczy, S. (2016). Foundations of taxation law 2016. OUP Catalogue.

Blakelock, S., & King, P. (2017). Taxation law: The advance of ATO data

matching. Proctor, The, 37(6), 18.

Morgan, A., & Castelyn, D. (2018). Taxation Education in Secondary Schools. J.

Australasian Tax Tchrs. Ass'n, 13, 307.

Morgan, A., Mortimer, C., & Pinto, D. (2018). A practical introduction to Australian

taxation law 2018. Oxford University Press.

Robin & Barkoczy Woellner (Stephen & Murphy, Shirley Et Al.). (2019). Australian

Taxation Law Select 2019: Legislation And Commentary. Oxford University Press.

Robin, H. (2019). Australian Taxation Law 2019. Oxford University Press.

Sadiq, K. (2018). Australian Tax Law Cases 2018. Thomson Reuters.

Woellner, R., Barkoczy, S., Murphy, S., Evans, C., & Pinto, D. (2016). Australian Taxation

Law 2016. OUP Catalogue.

1 out of 7

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.