Taxation Law Assignment: FBT and CGT Calculations and Analysis

VerifiedAdded on 2023/03/23

|10

|2252

|59

Homework Assignment

AI Summary

This assignment solution addresses a Taxation Law problem involving Fringe Benefit Tax (FBT) and Capital Gains Tax (CGT). The first part focuses on calculating FBT liability for a car fringe benefit, comparing the statutory and operating cost methods. It analyzes the provided data, including the car's base value, employee contributions, and various expenses, to determine the taxable value under each method and recommends the most advantageous approach for minimizing tax liability. The second part deals with CGT, analyzing several transactions to determine the net CGT gain or loss for an individual. It covers the sale of a painting, shares, and a yacht, and the sale of a house. The solution applies relevant CGT rules, including the treatment of main residences, collectibles, and shares, considering acquisition costs, sale proceeds, and associated expenses. It calculates the CGT gain or loss for each transaction and determines the overall net CGT liability, including the exclusion of the main residence from CGT calculations.

Running head: TAXATION LAW

Taxation Law

Name of the Student

Name of the University

Author Note

Taxation Law

Name of the Student

Name of the University

Author Note

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1TAXATION LAW

Answer 1

In the concerning circumstances, the issue is the determination of the FBT imposed

pertaining to Spiceco Pty Ltd with respect to the car that they have extended to Lucinda

during the FBT year 2018/19. The computation of the FBT liability through the various

methods of FBT computation and the suggestion of the most appropriate method that ensures

the minimisation of the FBT liability pertaining to Spiceco Pty Ltd.

U/s 136 of the FBTAA86, any value that has been extended by an employer to an

employee or any person related with the employee or any other third person who has been

extended with the value under any arrangement between the employer and the employee, in

the furtherance or by virtue of the employment in a particular income tax year is required to

be termed as the fringe benefit. The value that has been extended may be of several forms. It

can come in the form of a right or even an interest that has been extended pertaining to the

real or a personal property. It can also be extended in the form of a facility or a perquisite that

has been advanced towards the employer will also be included in this form of benefit.

However, when any such value extended by the employer the needs to be subjected to

taxation within the assessable income of the employer only. This imposes upon an employer

a fringe benefit tax for the fringe benefit that has been extended to the employee. The fringe

benefit may accrue with respect to any value that has been extended to the towards any past,

present as well as future employee (Barkoczy 2016).

A fringe benefit that has been accrued to an employer with respect to a car that he has

provided to the employee for being used by the employee in a private capacity is required to

be treated as a car fringe benefit u/s 7 of the FBTAA86. The car fringe benefit would likewise

be included in the tax liability of the taxpayer.

Answer 1

In the concerning circumstances, the issue is the determination of the FBT imposed

pertaining to Spiceco Pty Ltd with respect to the car that they have extended to Lucinda

during the FBT year 2018/19. The computation of the FBT liability through the various

methods of FBT computation and the suggestion of the most appropriate method that ensures

the minimisation of the FBT liability pertaining to Spiceco Pty Ltd.

U/s 136 of the FBTAA86, any value that has been extended by an employer to an

employee or any person related with the employee or any other third person who has been

extended with the value under any arrangement between the employer and the employee, in

the furtherance or by virtue of the employment in a particular income tax year is required to

be termed as the fringe benefit. The value that has been extended may be of several forms. It

can come in the form of a right or even an interest that has been extended pertaining to the

real or a personal property. It can also be extended in the form of a facility or a perquisite that

has been advanced towards the employer will also be included in this form of benefit.

However, when any such value extended by the employer the needs to be subjected to

taxation within the assessable income of the employer only. This imposes upon an employer

a fringe benefit tax for the fringe benefit that has been extended to the employee. The fringe

benefit may accrue with respect to any value that has been extended to the towards any past,

present as well as future employee (Barkoczy 2016).

A fringe benefit that has been accrued to an employer with respect to a car that he has

provided to the employee for being used by the employee in a private capacity is required to

be treated as a car fringe benefit u/s 7 of the FBTAA86. The car fringe benefit would likewise

be included in the tax liability of the taxpayer.

2TAXATION LAW

The FBTAA86 provides for two methods for the calculation of a car fringe benefit. U/s

9(1) of the FBTAA86, the statutory method for the computation of the car fringe benefit has

been provided. The formula is:

[0.2 * BV * (n/ tn)] - A

BV = Base value

n = no. of operating days

tn = no. of days in the year of income

C = contribution of the employee

U/s 10(2) of the FBTAA86, the operating cost method for the computation of the car

fringe benefit has been provided. The formula is:

[C * ( 100% - BP)] – R

C = operating cost during the period of holding, which includes maintenance, insurance,

registration and fuel.

BP = business percentage

C = contribution of the employee.

The FBT needs to be calculated in relation to the car fringe benefit by applying the FBT

rate to the taxable value calculated.

In the present situation, Spiceco Pty Ltd has provided a car towards Lucinda for the

purpose of being used for private purpose. This needs to be considered as a fringe benefit that

has been extended to Lucinda who has been employed with Spiceco Pty Ltd and the same

will be taxable in the hands of Spiceco Pty Ltd. This is because u/s 136 of the FBTAA86, any

value that has been extended by an employer to an employee or any person related with the

The FBTAA86 provides for two methods for the calculation of a car fringe benefit. U/s

9(1) of the FBTAA86, the statutory method for the computation of the car fringe benefit has

been provided. The formula is:

[0.2 * BV * (n/ tn)] - A

BV = Base value

n = no. of operating days

tn = no. of days in the year of income

C = contribution of the employee

U/s 10(2) of the FBTAA86, the operating cost method for the computation of the car

fringe benefit has been provided. The formula is:

[C * ( 100% - BP)] – R

C = operating cost during the period of holding, which includes maintenance, insurance,

registration and fuel.

BP = business percentage

C = contribution of the employee.

The FBT needs to be calculated in relation to the car fringe benefit by applying the FBT

rate to the taxable value calculated.

In the present situation, Spiceco Pty Ltd has provided a car towards Lucinda for the

purpose of being used for private purpose. This needs to be considered as a fringe benefit that

has been extended to Lucinda who has been employed with Spiceco Pty Ltd and the same

will be taxable in the hands of Spiceco Pty Ltd. This is because u/s 136 of the FBTAA86, any

value that has been extended by an employer to an employee or any person related with the

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3TAXATION LAW

employee or any other third person who has been extended with the value under any

arrangement between the employer and the employee, in the furtherance or by virtue of the

employment in a particular income tax year is required to be termed as the fringe benefit. The

benefit has been provided in form of a car and the same needs to be treated as car fringe

benefit. This is because a fringe benefit that has been accrued to an employer with respect to

a car that he has provided to the employee for being used by the employee in a private

capacity is required to be treated as a car fringe benefit u/s 7 of the FBTAA86.

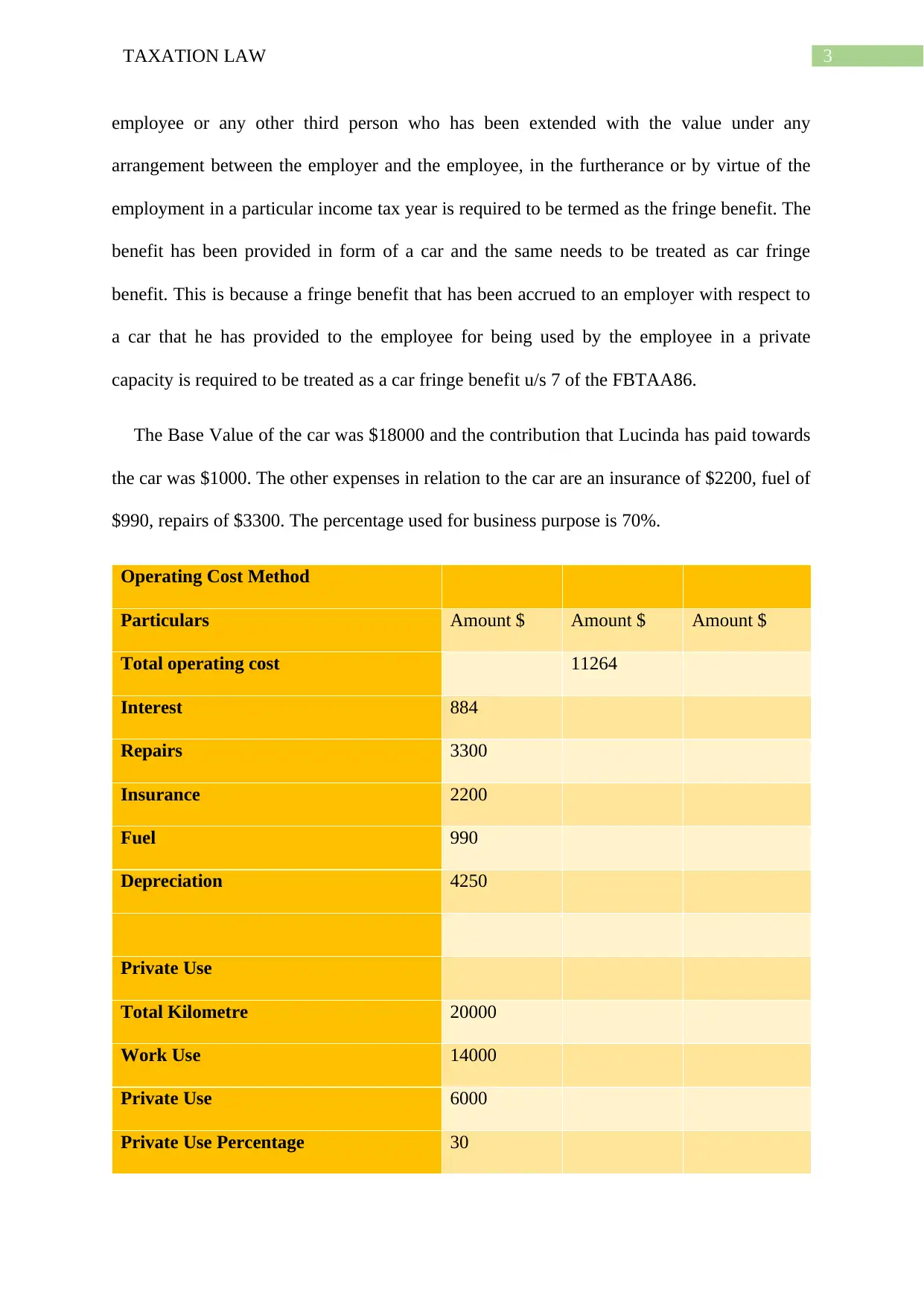

The Base Value of the car was $18000 and the contribution that Lucinda has paid towards

the car was $1000. The other expenses in relation to the car are an insurance of $2200, fuel of

$990, repairs of $3300. The percentage used for business purpose is 70%.

Operating Cost Method

Particulars Amount $ Amount $ Amount $

Total operating cost 11264

Interest 884

Repairs 3300

Insurance 2200

Fuel 990

Depreciation 4250

Private Use

Total Kilometre 20000

Work Use 14000

Private Use 6000

Private Use Percentage 30

employee or any other third person who has been extended with the value under any

arrangement between the employer and the employee, in the furtherance or by virtue of the

employment in a particular income tax year is required to be termed as the fringe benefit. The

benefit has been provided in form of a car and the same needs to be treated as car fringe

benefit. This is because a fringe benefit that has been accrued to an employer with respect to

a car that he has provided to the employee for being used by the employee in a private

capacity is required to be treated as a car fringe benefit u/s 7 of the FBTAA86.

The Base Value of the car was $18000 and the contribution that Lucinda has paid towards

the car was $1000. The other expenses in relation to the car are an insurance of $2200, fuel of

$990, repairs of $3300. The percentage used for business purpose is 70%.

Operating Cost Method

Particulars Amount $ Amount $ Amount $

Total operating cost 11264

Interest 884

Repairs 3300

Insurance 2200

Fuel 990

Depreciation 4250

Private Use

Total Kilometre 20000

Work Use 14000

Private Use 6000

Private Use Percentage 30

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4TAXATION LAW

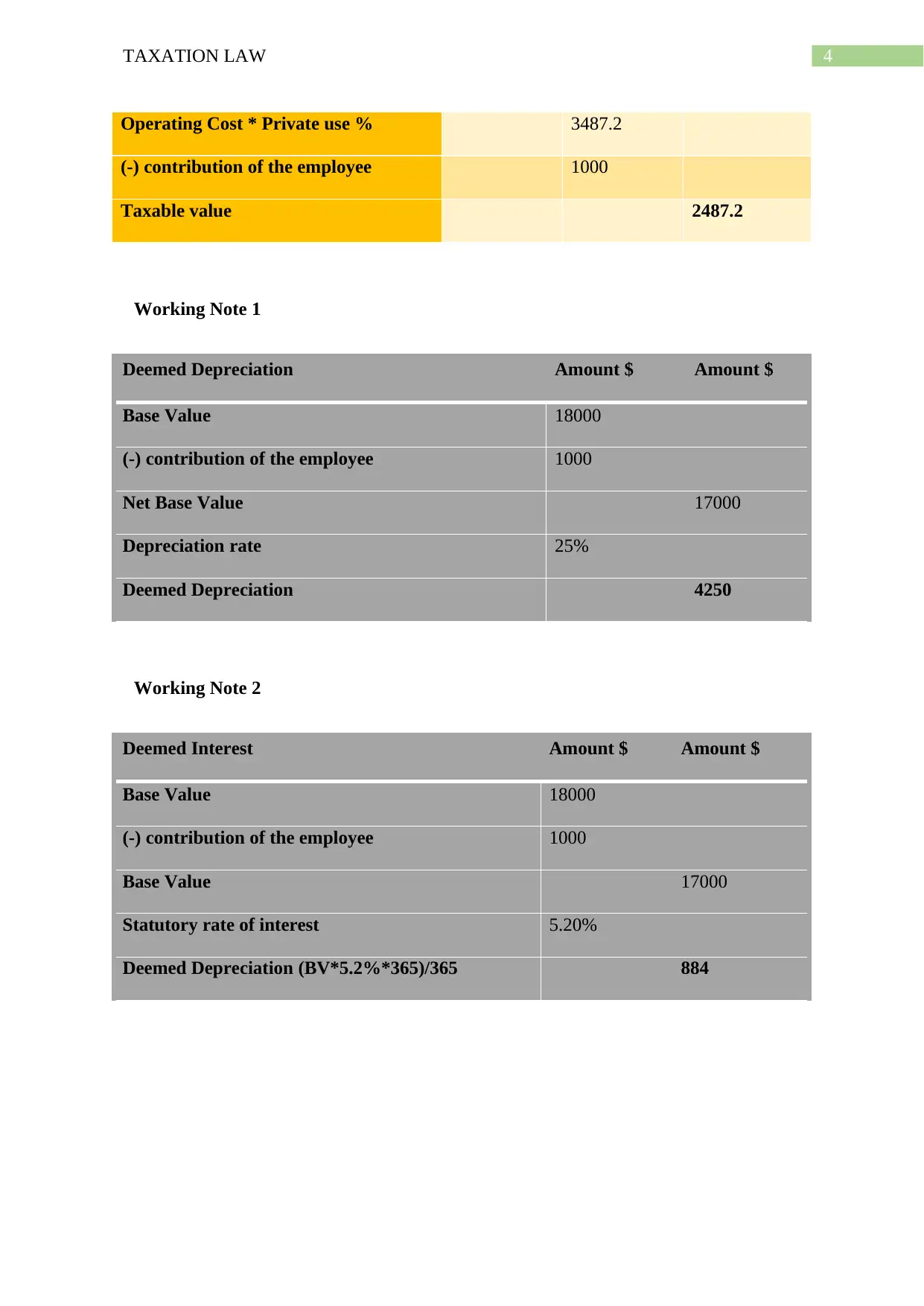

Operating Cost * Private use % 3487.2

(-) contribution of the employee 1000

Taxable value 2487.2

Working Note 1

Deemed Depreciation Amount $ Amount $

Base Value 18000

(-) contribution of the employee 1000

Net Base Value 17000

Depreciation rate 25%

Deemed Depreciation 4250

Working Note 2

Deemed Interest Amount $ Amount $

Base Value 18000

(-) contribution of the employee 1000

Base Value 17000

Statutory rate of interest 5.20%

Deemed Depreciation (BV*5.2%*365)/365 884

Operating Cost * Private use % 3487.2

(-) contribution of the employee 1000

Taxable value 2487.2

Working Note 1

Deemed Depreciation Amount $ Amount $

Base Value 18000

(-) contribution of the employee 1000

Net Base Value 17000

Depreciation rate 25%

Deemed Depreciation 4250

Working Note 2

Deemed Interest Amount $ Amount $

Base Value 18000

(-) contribution of the employee 1000

Base Value 17000

Statutory rate of interest 5.20%

Deemed Depreciation (BV*5.2%*365)/365 884

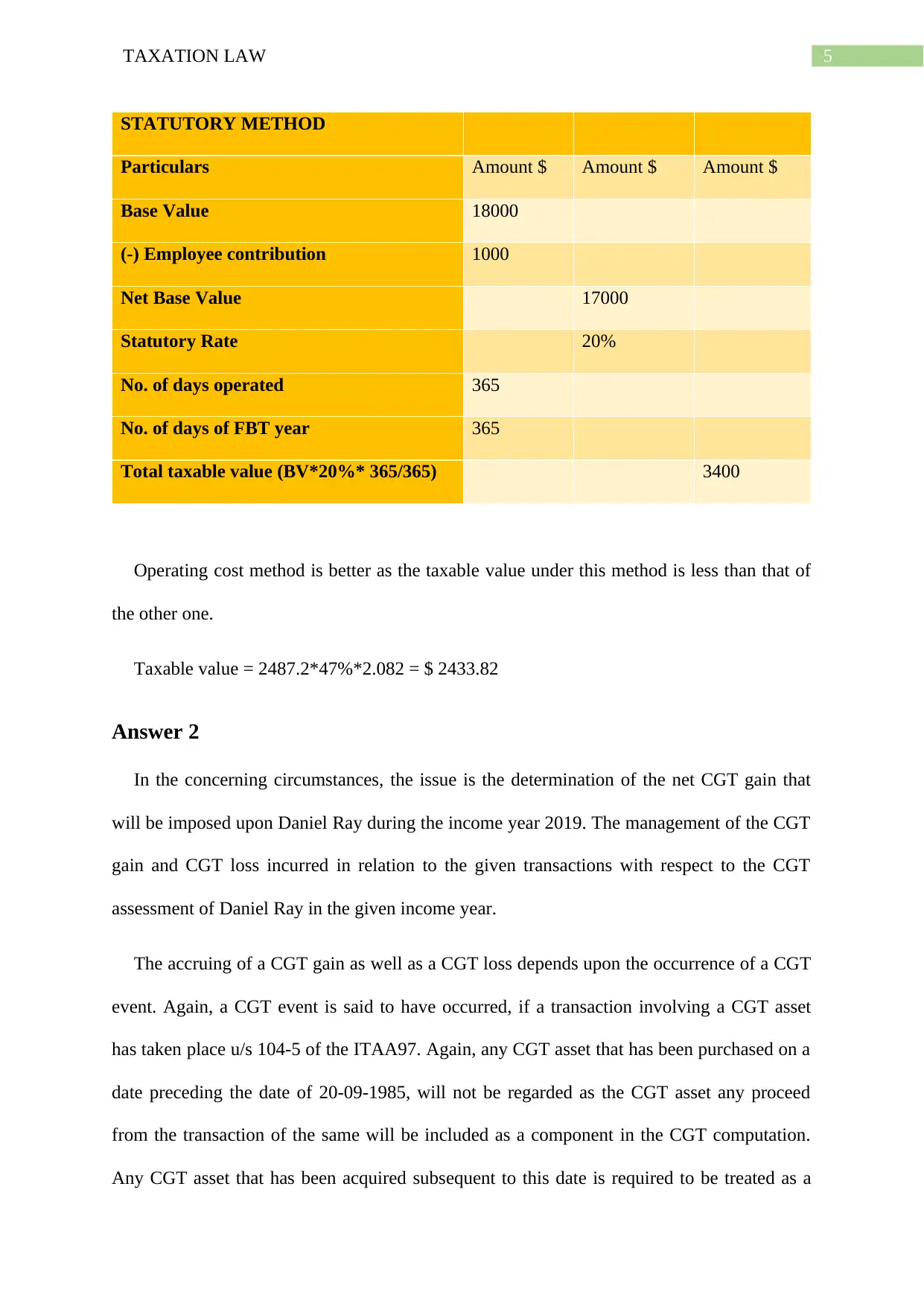

5TAXATION LAW

STATUTORY METHOD

Particulars Amount $ Amount $ Amount $

Base Value 18000

(-) Employee contribution 1000

Net Base Value 17000

Statutory Rate 20%

No. of days operated 365

No. of days of FBT year 365

Total taxable value (BV*20%* 365/365) 3400

Operating cost method is better as the taxable value under this method is less than that of

the other one.

Taxable value = 2487.2*47%*2.082 = $ 2433.82

Answer 2

In the concerning circumstances, the issue is the determination of the net CGT gain that

will be imposed upon Daniel Ray during the income year 2019. The management of the CGT

gain and CGT loss incurred in relation to the given transactions with respect to the CGT

assessment of Daniel Ray in the given income year.

The accruing of a CGT gain as well as a CGT loss depends upon the occurrence of a CGT

event. Again, a CGT event is said to have occurred, if a transaction involving a CGT asset

has taken place u/s 104-5 of the ITAA97. Again, any CGT asset that has been purchased on a

date preceding the date of 20-09-1985, will not be regarded as the CGT asset any proceed

from the transaction of the same will be included as a component in the CGT computation.

Any CGT asset that has been acquired subsequent to this date is required to be treated as a

STATUTORY METHOD

Particulars Amount $ Amount $ Amount $

Base Value 18000

(-) Employee contribution 1000

Net Base Value 17000

Statutory Rate 20%

No. of days operated 365

No. of days of FBT year 365

Total taxable value (BV*20%* 365/365) 3400

Operating cost method is better as the taxable value under this method is less than that of

the other one.

Taxable value = 2487.2*47%*2.082 = $ 2433.82

Answer 2

In the concerning circumstances, the issue is the determination of the net CGT gain that

will be imposed upon Daniel Ray during the income year 2019. The management of the CGT

gain and CGT loss incurred in relation to the given transactions with respect to the CGT

assessment of Daniel Ray in the given income year.

The accruing of a CGT gain as well as a CGT loss depends upon the occurrence of a CGT

event. Again, a CGT event is said to have occurred, if a transaction involving a CGT asset

has taken place u/s 104-5 of the ITAA97. Again, any CGT asset that has been purchased on a

date preceding the date of 20-09-1985, will not be regarded as the CGT asset any proceed

from the transaction of the same will be included as a component in the CGT computation.

Any CGT asset that has been acquired subsequent to this date is required to be treated as a

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6TAXATION LAW

CGT asset and the transaction of the is required to be treated as CGT event. There are two

instances that needs to be established to claim a gain or loss to be assessed as a CGT loss or a

CGT gain. The first instance in this respect is the presence of a transaction involving a CGT

asset. The second instance in this respect is the occurrence of a CGT event that has been

accrued the CGT loss or gain. Both the instances if present can render a situation to be have

incurred a CGT loss or a CGT gain.

The disposal of a CGT asset by way of sale is required to be treated as a CGT event and

the assessment of the same is required to be made u/s 104-10of the ITAA97. The CGT gain

or loss is required to be calculated by deducting the cost proceeds from the cost base or vice

versa depending upon the situation (the lower of the two needs to be deducted from the

other). However, the effect of CGT event is only assessable, when there is an actual transfer

of ownership or there is a contract being effected ensuring the ownership (Woellner et al.

2016).

The main residence when disposed of by the taxpayer earns a proceed that is required to

be treated as an exempt from the computation of CGT liability as per section 118-10 of the

ITAA97. The possession of the property by the taxpayer as a main residence is required to be

established and the giving it on rent will not suffice.

Collectible is permitted to be computed as a CGT liability when the value of same has

been above the threshold, which is $500. The value when fall below that limit needs to be

allowed as a deduction u/s110-10 of the ITAA97.

As per section 108-5 of the ITAA97, a CGT asset can be a right, which is legal as well as

equitable and it covers shares, options, lands, building, contractual rights, foreign currency

and debts that are recoverable. U/s 110.55 of the ITAA97, the transactions relating to shares

also can accrue CGT gain. When a loan has been availed for the purpose of acquiring shares

CGT asset and the transaction of the is required to be treated as CGT event. There are two

instances that needs to be established to claim a gain or loss to be assessed as a CGT loss or a

CGT gain. The first instance in this respect is the presence of a transaction involving a CGT

asset. The second instance in this respect is the occurrence of a CGT event that has been

accrued the CGT loss or gain. Both the instances if present can render a situation to be have

incurred a CGT loss or a CGT gain.

The disposal of a CGT asset by way of sale is required to be treated as a CGT event and

the assessment of the same is required to be made u/s 104-10of the ITAA97. The CGT gain

or loss is required to be calculated by deducting the cost proceeds from the cost base or vice

versa depending upon the situation (the lower of the two needs to be deducted from the

other). However, the effect of CGT event is only assessable, when there is an actual transfer

of ownership or there is a contract being effected ensuring the ownership (Woellner et al.

2016).

The main residence when disposed of by the taxpayer earns a proceed that is required to

be treated as an exempt from the computation of CGT liability as per section 118-10 of the

ITAA97. The possession of the property by the taxpayer as a main residence is required to be

established and the giving it on rent will not suffice.

Collectible is permitted to be computed as a CGT liability when the value of same has

been above the threshold, which is $500. The value when fall below that limit needs to be

allowed as a deduction u/s110-10 of the ITAA97.

As per section 108-5 of the ITAA97, a CGT asset can be a right, which is legal as well as

equitable and it covers shares, options, lands, building, contractual rights, foreign currency

and debts that are recoverable. U/s 110.55 of the ITAA97, the transactions relating to shares

also can accrue CGT gain. When a loan has been availed for the purpose of acquiring shares

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7TAXATION LAW

and an interest has been made payable with respect to the same, such an interest needs to be

excluded from the cost base of the shares so that the profit does not changes to loss even if

the transactiojn has been proved to be a gain.

The anticipated sale of the house that has been used by Daniel as a residence for thirty

years, has been projected to earn a proceed of $865000. However, such a house has been

acquired to by Daniel for a price of $70000. The payment to the real estate agent for an

amount of $15000 and a deposit of $85000 has also been made. However, after 14 days of

this the sale has been cancelled by the buyer. This needs to be extended from being

considered as a CGT component as the effect of CGT event is only assessable, when there is

an actual transfer of ownership or there is a contract being effected ensuring the ownership.

The sale of the painting by Daniel has been made for a price of $ 125000 and the

acquisition of the same has been made for a price of $15000 and in the date of 20.09.1985.

This will be treated as a CGT event and the proceed of the same needs to be computed as a

CGT gain or loss. As the cost base is lower than the cost proceed, the same needs to be

treated as a CGT gain.

The sale of the luxury yacht has been sold by Daniel for a price of $60000. The acquisition

cost of the same was $110000. As the cost proceed in this case is lower than the cost base, the

transaction has incurred a loss to the taxpayer.

The sale of the shares has been effected for a price of $80000 and the date of the same has

been January 2019. The acquisition of the share has been made for a price of $75000 and the

acquisition of the same has been made on June 2019. This will be computed as a CGT event

coming under the A1 category. But the discount of 50% will not be permitted as the shares

were not held by Daniel for period in excess of 12 months. Moreover, a loan availed for the

purchase of the share has accrued an interest to be payable. This will not be included in the

and an interest has been made payable with respect to the same, such an interest needs to be

excluded from the cost base of the shares so that the profit does not changes to loss even if

the transactiojn has been proved to be a gain.

The anticipated sale of the house that has been used by Daniel as a residence for thirty

years, has been projected to earn a proceed of $865000. However, such a house has been

acquired to by Daniel for a price of $70000. The payment to the real estate agent for an

amount of $15000 and a deposit of $85000 has also been made. However, after 14 days of

this the sale has been cancelled by the buyer. This needs to be extended from being

considered as a CGT component as the effect of CGT event is only assessable, when there is

an actual transfer of ownership or there is a contract being effected ensuring the ownership.

The sale of the painting by Daniel has been made for a price of $ 125000 and the

acquisition of the same has been made for a price of $15000 and in the date of 20.09.1985.

This will be treated as a CGT event and the proceed of the same needs to be computed as a

CGT gain or loss. As the cost base is lower than the cost proceed, the same needs to be

treated as a CGT gain.

The sale of the luxury yacht has been sold by Daniel for a price of $60000. The acquisition

cost of the same was $110000. As the cost proceed in this case is lower than the cost base, the

transaction has incurred a loss to the taxpayer.

The sale of the shares has been effected for a price of $80000 and the date of the same has

been January 2019. The acquisition of the share has been made for a price of $75000 and the

acquisition of the same has been made on June 2019. This will be computed as a CGT event

coming under the A1 category. But the discount of 50% will not be permitted as the shares

were not held by Daniel for period in excess of 12 months. Moreover, a loan availed for the

purchase of the share has accrued an interest to be payable. This will not be included in the

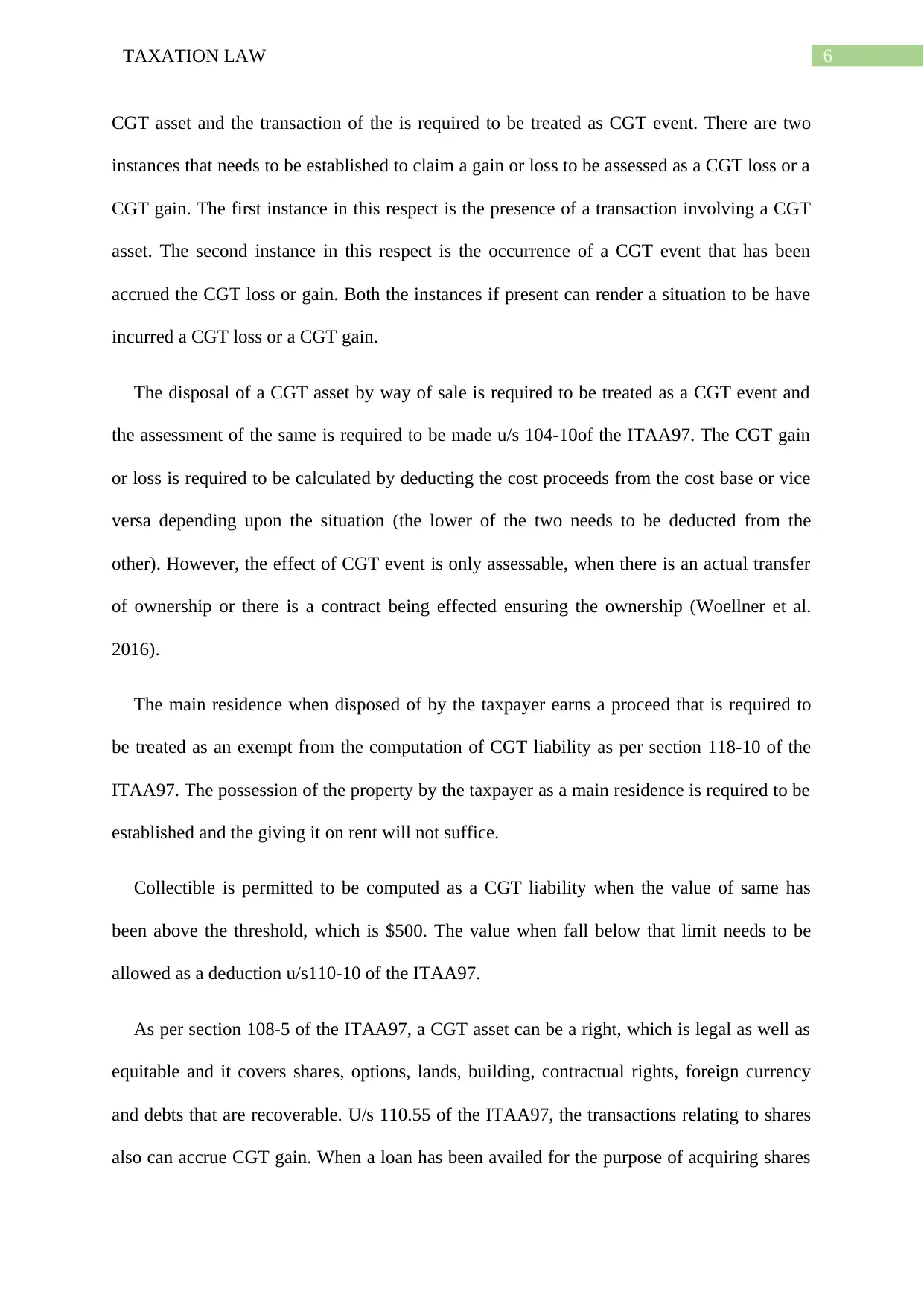

8TAXATION LAW

cost base. However, the stamp duty of $250 and the brokerage fee of $750 is required to be

included in the cost base. The computation of the Net CGT gain is as follows:

Particulars Amount $ Amount $

CGT gain from painting (1) 110000

Cost Proceed of painting 125000

(-) Cost Base of painting 15000

CGT gain from shares (2) 4000

Cost Proceed of shares 80000

(-) Reduced Cost Base of shares

(75000+750+250)

76000

CGT loss from yacht (3) 50000

Cost Base of Yacht 110000

(-)Cost proceed of Yacht 60000

Net CGT Liability (1) + (2) – (3) 64000

cost base. However, the stamp duty of $250 and the brokerage fee of $750 is required to be

included in the cost base. The computation of the Net CGT gain is as follows:

Particulars Amount $ Amount $

CGT gain from painting (1) 110000

Cost Proceed of painting 125000

(-) Cost Base of painting 15000

CGT gain from shares (2) 4000

Cost Proceed of shares 80000

(-) Reduced Cost Base of shares

(75000+750+250)

76000

CGT loss from yacht (3) 50000

Cost Base of Yacht 110000

(-)Cost proceed of Yacht 60000

Net CGT Liability (1) + (2) – (3) 64000

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9TAXATION LAW

Reference

Barkoczy, S., 2016. Foundations of taxation law 2016. OUP Catalogue.

The Fringe Benefits Tax Assessment Act 1986 (Cth)

The Income Tax Assessment Act 1997 (Cth)

Woellner, R., Barkoczy, S., Murphy, S., Evans, C. and Pinto, D., 2016. Australian Taxation

Law 2016. OUP Catalogue.

Reference

Barkoczy, S., 2016. Foundations of taxation law 2016. OUP Catalogue.

The Fringe Benefits Tax Assessment Act 1986 (Cth)

The Income Tax Assessment Act 1997 (Cth)

Woellner, R., Barkoczy, S., Murphy, S., Evans, C. and Pinto, D., 2016. Australian Taxation

Law 2016. OUP Catalogue.

1 out of 10

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.