LAWS20060: Individual Taxation Law Assignment - Term 2, 2019

VerifiedAdded on 2022/12/29

|13

|2596

|48

Homework Assignment

AI Summary

This document presents a comprehensive solution to a taxation law assignment, addressing several key questions. The assignment analyzes various scenarios related to taxation, including the deductibility of self-education expenses such as HECS-HELP payments, travel costs, books, and childcare expenses. It also delves into the taxation implications of repairing assets, clothing expenses, and legal expenses incurred in employment contracts. Furthermore, the assignment explores capital gains tax (CGT) events, including the lease of land and the offset of capital losses against capital gains, as well as main residence exemptions. The document also examines the cost base of CGT assets and the definition of assessable income, covering topics like interest, winnings, and income from personal exertion. The solution utilizes relevant sections of the Income Tax Assessment Act 1997 (ITAA 1997), case law, and taxation rulings to provide detailed and well-supported answers to each question.

Running head: TAXATION LAW

Taxation Law

Name of the Student

Name of the University

Authors Note

Course ID

Taxation Law

Name of the Student

Name of the University

Authors Note

Course ID

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1TAXATION LAW

Table of Contents

Answer to question 3:.................................................................................................................2

Answer to question 4:.................................................................................................................6

Answer to question 5:.................................................................................................................9

References:...............................................................................................................................12

Table of Contents

Answer to question 3:.................................................................................................................2

Answer to question 4:.................................................................................................................6

Answer to question 5:.................................................................................................................9

References:...............................................................................................................................12

2TAXATION LAW

Answer to question 3:

HECS-HELP 850:

As stated under the “s26-20, ITAA 1997” a taxpayer is not permissible to claim

certain types of self-education payments. This includes the contribution that is made towards

the HECS-HELP loan repayments1. The trainee accountant here incurs HECS-HELP payment

for $850. With respect to the guidelines given under “s26-20, ITAA 1997” no deduction is

allowable for that expenses.

Travel – work to university $110:

Self-education expenses that are happened by the taxpayer are usually held as

deductible where it is occurred in preserving or augmenting the skills of the taxpayer in the

current occupation in which they are presently employed. This mainly includes the expenses

that are occurred in improving the future income producing chances. Accordingly, travel

costs incurred by the taxpayer from work to education institution are treated as allowable

deduction2.

Likewise, the trainee accountant here occurs self-education travel expenses from work

place to the university. These are allowable for deduction under “s8-1, ITAA 1997”.

Books $200:

1 Section 26-20, Income Tax Assessment Act 1997 (Cth).

2 Section 8-1, Income Tax Assessment Act 1997 (Cth).

Answer to question 3:

HECS-HELP 850:

As stated under the “s26-20, ITAA 1997” a taxpayer is not permissible to claim

certain types of self-education payments. This includes the contribution that is made towards

the HECS-HELP loan repayments1. The trainee accountant here incurs HECS-HELP payment

for $850. With respect to the guidelines given under “s26-20, ITAA 1997” no deduction is

allowable for that expenses.

Travel – work to university $110:

Self-education expenses that are happened by the taxpayer are usually held as

deductible where it is occurred in preserving or augmenting the skills of the taxpayer in the

current occupation in which they are presently employed. This mainly includes the expenses

that are occurred in improving the future income producing chances. Accordingly, travel

costs incurred by the taxpayer from work to education institution are treated as allowable

deduction2.

Likewise, the trainee accountant here occurs self-education travel expenses from work

place to the university. These are allowable for deduction under “s8-1, ITAA 1997”.

Books $200:

1 Section 26-20, Income Tax Assessment Act 1997 (Cth).

2 Section 8-1, Income Tax Assessment Act 1997 (Cth).

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3TAXATION LAW

Denoting “taxation ruling of TR 98/9” cost associated to the study-related materials

are acceptable as deductions. For example, cost incurred for textbooks, calculators,

stationaries are acceptable as deductions under “sec 8-1, ITAA 1997”3. The decision of the

court was noted in “FCT v Studert (1982) ATC 4463” where it allowed the taxpayer to claim

allowable deduction for the expenses occurred for the course fees, accommodation and travel

associated to the self-education.

Citing “Taxation Ruling of TR 98/9” the trainee accountant will be allowed to claim

deduction for the outlays incurred for books under “sec 8-1, ITAA 1997”. Mentioning the

judgement made in “FCT v Studert (1982) ATC 4463” the expenditures were incurred

mainly by the taxpayer in maintaining or increasing his knowledge and ability in the current

profession.

Childcare during her evening classes $80:

As explained in the second negative limb of “s8-1(2)(b), ITAA 1997” an expenses or

loss which holds the character of personal in type might not be allowed for deduction if the

expenditures fails to fulfil the positive limbs4. The court in “Lodge v FCT (1972)” disallowed

the taxpayer from claiming the childcare payments incurred for having her child minded

when she attends her work. The judgement ruled that these costs were not relevant in the

attainment an assessable earnings.

The childcare expenses incurred during her evening classes holds the character of

private or domestic in type and will not be allowed for deduction under the second negative

3 Taxation Ruling of TR 98/9

4 Woellner, Robin H., et al. Australian taxation law. CCH Australia, 2016.

Denoting “taxation ruling of TR 98/9” cost associated to the study-related materials

are acceptable as deductions. For example, cost incurred for textbooks, calculators,

stationaries are acceptable as deductions under “sec 8-1, ITAA 1997”3. The decision of the

court was noted in “FCT v Studert (1982) ATC 4463” where it allowed the taxpayer to claim

allowable deduction for the expenses occurred for the course fees, accommodation and travel

associated to the self-education.

Citing “Taxation Ruling of TR 98/9” the trainee accountant will be allowed to claim

deduction for the outlays incurred for books under “sec 8-1, ITAA 1997”. Mentioning the

judgement made in “FCT v Studert (1982) ATC 4463” the expenditures were incurred

mainly by the taxpayer in maintaining or increasing his knowledge and ability in the current

profession.

Childcare during her evening classes $80:

As explained in the second negative limb of “s8-1(2)(b), ITAA 1997” an expenses or

loss which holds the character of personal in type might not be allowed for deduction if the

expenditures fails to fulfil the positive limbs4. The court in “Lodge v FCT (1972)” disallowed

the taxpayer from claiming the childcare payments incurred for having her child minded

when she attends her work. The judgement ruled that these costs were not relevant in the

attainment an assessable earnings.

The childcare expenses incurred during her evening classes holds the character of

private or domestic in type and will not be allowed for deduction under the second negative

3 Taxation Ruling of TR 98/9

4 Woellner, Robin H., et al. Australian taxation law. CCH Australia, 2016.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4TAXATION LAW

limb of “s8-1(2)(b), ITAA 1997” since the outgoings fails to fulfil the positive limbs5. Stating

the judgement in “FCT v Lodge (1972)” the payment is not pertinent in the attainment of her

assessable earnings.

Repair to her fridge at home $250:

Accordingly, under the “s25-10, ITAA 1997” a person is permissible to deduct the

expenditures that is incurred by them for repairing to the denigrating asset which is

exclusively held by them for attainment of taxable earnings. The taxpayers must denote that

no deduction of private or domestic type is allowed under this legislation.

The expenses incurred for repairs to fridge at home is entirely a private or domestic in

type. This is because the fridge at home is not used for producing any assessable income6.

With reference to “sec 25-10, ITAA 1997” no deduction for the repairs to fridge can be

allowed to claim in this context.

Black trousers and shirt to be worn at office $145:

According to the “sec 8-1, ITAA 1997” cost that are incurred for the clothing such as

suits are viewed as ordinary clothing items and usually no deduction is permitted to the

taxpayer under this purview7. The law court in “FCT v Mansfield (1996) ATC 4001”

explained that usually expenses occurred for the ordinary items of attire is non-deductible

5 Lodge v Federal Commissioner of Taxation (1972) HCA 49

6 Section 25-10, Income Tax Assessment Act 1997 (Cth).

7 Coleman, Geoffrey Lehmann Cynthia. "Taxation law in Australia." 2015.

limb of “s8-1(2)(b), ITAA 1997” since the outgoings fails to fulfil the positive limbs5. Stating

the judgement in “FCT v Lodge (1972)” the payment is not pertinent in the attainment of her

assessable earnings.

Repair to her fridge at home $250:

Accordingly, under the “s25-10, ITAA 1997” a person is permissible to deduct the

expenditures that is incurred by them for repairing to the denigrating asset which is

exclusively held by them for attainment of taxable earnings. The taxpayers must denote that

no deduction of private or domestic type is allowed under this legislation.

The expenses incurred for repairs to fridge at home is entirely a private or domestic in

type. This is because the fridge at home is not used for producing any assessable income6.

With reference to “sec 25-10, ITAA 1997” no deduction for the repairs to fridge can be

allowed to claim in this context.

Black trousers and shirt to be worn at office $145:

According to the “sec 8-1, ITAA 1997” cost that are incurred for the clothing such as

suits are viewed as ordinary clothing items and usually no deduction is permitted to the

taxpayer under this purview7. The law court in “FCT v Mansfield (1996) ATC 4001”

explained that usually expenses occurred for the ordinary items of attire is non-deductible

5 Lodge v Federal Commissioner of Taxation (1972) HCA 49

6 Section 25-10, Income Tax Assessment Act 1997 (Cth).

7 Coleman, Geoffrey Lehmann Cynthia. "Taxation law in Australia." 2015.

5TAXATION LAW

nonetheless that those expenses are happened by the taxpayer to make sure that appropriate

appearance is maintained at the workplace.

Similarly, the expenses incurred for the black trousers and shirts to be worn at office

amounts ordinary clothing items and usually no deduction is permitted to the taxpayer under

this purview8. Denoting the law court judgement in “Mansfield v FCT (1996) ATC 4001”

expenses occurred for the black trousers and shirts are ordinary items of attire which is not

permitted for deduction under “sec 8-1, ITAA 1997” irrespective that those payments are

occurred by the trainee to make sure that appropriate appearance is maintained at the

workplace.

Legal expenses incurred in writing up new employment contract with new employer

$300:

Citing “sec 8-1, ITAA 1997” expenses that are occurred for getting the new service

does not fall as deductible expenses under the 1st positive limbs. The verdict passed in “FCT

v Maddalena (1971)” stated that the taxpayer incurred traveling expenses to new football

club for negotiating a new employment contract. The judge held that these expenses occurred

at point very soon9.

Likewise, the legal expenses occurred for writing up new employment contract to new

employer is non-deductible in 1st positive limbs of “s8-1, ITAA 1997”10. Denoting the

8 Mansfield v FCT (1996) ATC 4001

9 Sadiq, Kerrie. Australian Taxation Law Cases 2019. Thomson Reuters, 2019.

10 Maddalena v FCT (1971) ATC 4161

nonetheless that those expenses are happened by the taxpayer to make sure that appropriate

appearance is maintained at the workplace.

Similarly, the expenses incurred for the black trousers and shirts to be worn at office

amounts ordinary clothing items and usually no deduction is permitted to the taxpayer under

this purview8. Denoting the law court judgement in “Mansfield v FCT (1996) ATC 4001”

expenses occurred for the black trousers and shirts are ordinary items of attire which is not

permitted for deduction under “sec 8-1, ITAA 1997” irrespective that those payments are

occurred by the trainee to make sure that appropriate appearance is maintained at the

workplace.

Legal expenses incurred in writing up new employment contract with new employer

$300:

Citing “sec 8-1, ITAA 1997” expenses that are occurred for getting the new service

does not fall as deductible expenses under the 1st positive limbs. The verdict passed in “FCT

v Maddalena (1971)” stated that the taxpayer incurred traveling expenses to new football

club for negotiating a new employment contract. The judge held that these expenses occurred

at point very soon9.

Likewise, the legal expenses occurred for writing up new employment contract to new

employer is non-deductible in 1st positive limbs of “s8-1, ITAA 1997”10. Denoting the

8 Mansfield v FCT (1996) ATC 4001

9 Sadiq, Kerrie. Australian Taxation Law Cases 2019. Thomson Reuters, 2019.

10 Maddalena v FCT (1971) ATC 4161

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6TAXATION LAW

judgement of law court in “Maddalena v FCT (1971)” the expenses occurred at point very

soon.

Answer to question 4:

Answer A:

Numerous types of CGT events are applicable on the lease of land. One of them is the

CGT event F1 which is applied when the land is leased for a premium by the owner or they

decide to extend the lease which was held by them earlier11. The taxpayer should note that no

CGT discount is allowed for the premium received in case of CGT event F1.

John here leases the land to David for a period of seven years at a lease of $7,000. The

granting of lease to David by John has resulted in CGT event F1. As a result, any capital

gains derived from the differences in lease premium by John will not be allowed for CGT

discount in this context.

Answer B:

Issues:

Is the taxpayer allowed to claim tax offset from the loss of CGT assets under “sec 102-22”?

Rule:

The broad definition of the CGT asset given under “sec 108-5 (1)” also includes the

shares held by the taxpayer in the company or unit in the trust. Accordingly, “sec 102-5,

ITAA 1997” necessitates the taxpayer to take in their chargeable earnings as the net sum of

capital gains. A CGT event A1 happens in “sec 104-10 (1)” when a taxpayer sells any CGT

11 Evans, Chris, John Minas, and Youngdeok Lim. "Taxing personal capital gains in

Australia: An alternative way forward." Austl. Tax F. 30 (2015): 735.

judgement of law court in “Maddalena v FCT (1971)” the expenses occurred at point very

soon.

Answer to question 4:

Answer A:

Numerous types of CGT events are applicable on the lease of land. One of them is the

CGT event F1 which is applied when the land is leased for a premium by the owner or they

decide to extend the lease which was held by them earlier11. The taxpayer should note that no

CGT discount is allowed for the premium received in case of CGT event F1.

John here leases the land to David for a period of seven years at a lease of $7,000. The

granting of lease to David by John has resulted in CGT event F1. As a result, any capital

gains derived from the differences in lease premium by John will not be allowed for CGT

discount in this context.

Answer B:

Issues:

Is the taxpayer allowed to claim tax offset from the loss of CGT assets under “sec 102-22”?

Rule:

The broad definition of the CGT asset given under “sec 108-5 (1)” also includes the

shares held by the taxpayer in the company or unit in the trust. Accordingly, “sec 102-5,

ITAA 1997” necessitates the taxpayer to take in their chargeable earnings as the net sum of

capital gains. A CGT event A1 happens in “sec 104-10 (1)” when a taxpayer sells any CGT

11 Evans, Chris, John Minas, and Youngdeok Lim. "Taxing personal capital gains in

Australia: An alternative way forward." Austl. Tax F. 30 (2015): 735.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7TAXATION LAW

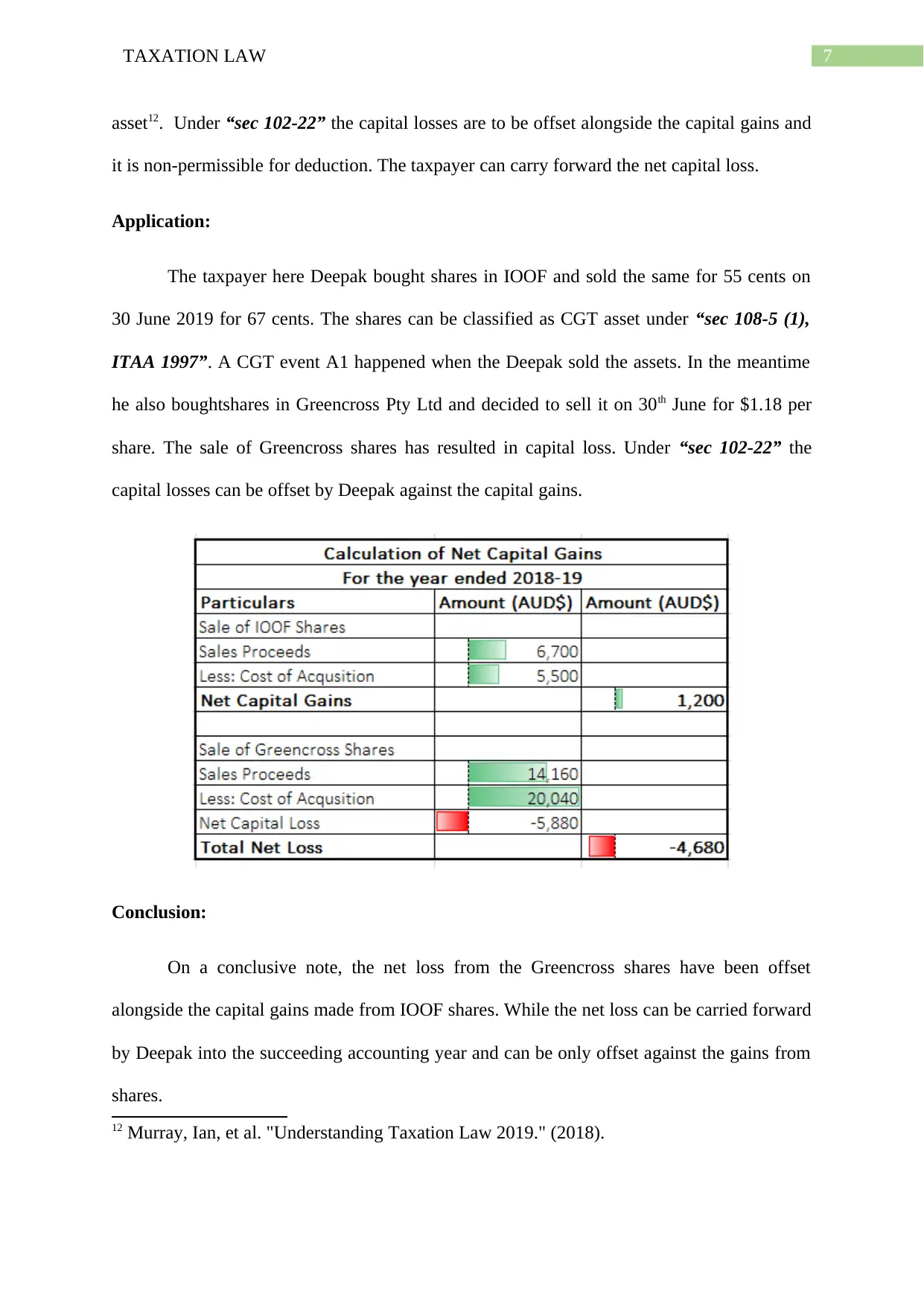

asset12. Under “sec 102-22” the capital losses are to be offset alongside the capital gains and

it is non-permissible for deduction. The taxpayer can carry forward the net capital loss.

Application:

The taxpayer here Deepak bought shares in IOOF and sold the same for 55 cents on

30 June 2019 for 67 cents. The shares can be classified as CGT asset under “sec 108-5 (1),

ITAA 1997”. A CGT event A1 happened when the Deepak sold the assets. In the meantime

he also boughtshares in Greencross Pty Ltd and decided to sell it on 30th June for $1.18 per

share. The sale of Greencross shares has resulted in capital loss. Under “sec 102-22” the

capital losses can be offset by Deepak against the capital gains.

Conclusion:

On a conclusive note, the net loss from the Greencross shares have been offset

alongside the capital gains made from IOOF shares. While the net loss can be carried forward

by Deepak into the succeeding accounting year and can be only offset against the gains from

shares.

12 Murray, Ian, et al. "Understanding Taxation Law 2019." (2018).

asset12. Under “sec 102-22” the capital losses are to be offset alongside the capital gains and

it is non-permissible for deduction. The taxpayer can carry forward the net capital loss.

Application:

The taxpayer here Deepak bought shares in IOOF and sold the same for 55 cents on

30 June 2019 for 67 cents. The shares can be classified as CGT asset under “sec 108-5 (1),

ITAA 1997”. A CGT event A1 happened when the Deepak sold the assets. In the meantime

he also boughtshares in Greencross Pty Ltd and decided to sell it on 30th June for $1.18 per

share. The sale of Greencross shares has resulted in capital loss. Under “sec 102-22” the

capital losses can be offset by Deepak against the capital gains.

Conclusion:

On a conclusive note, the net loss from the Greencross shares have been offset

alongside the capital gains made from IOOF shares. While the net loss can be carried forward

by Deepak into the succeeding accounting year and can be only offset against the gains from

shares.

12 Murray, Ian, et al. "Understanding Taxation Law 2019." (2018).

8TAXATION LAW

Answer C:

Issues:

Is the taxpayer permitted to obtain full main residence exemption?

Rule:

The main residence of the taxpayer is excluded from CGT provisions. However, a

partial main residence exception is permissible to taxpayer where a part of the house is used

separately by the taxpayer for business purpose.

Application:

The case facts obtained suggest that Li bought a house in March for 200,000 and used

a part of her house for physiotherapy business. The house was eventually sold by Li in 2019

for $700,000. As understood Li would not be allowed to claim full main residence exemption

however she can get partial main residence exemption.

Assessable portion = Capital gain x Percentage of floor area

= $700,000 – $400,000

= $300,000 (net capital gain)

= 300,000 x 20%

= $60,000 (Taxable Portion)

Conclusion:

Li here is assumed to have held the asset for a minimum of 12 months. She also meets

the rule of “home first home for producing income” since she soon started her business when

the property was purchased. Li can obtain a CGT discount from sale of her house since the

house was held for more than 12 months.

Answer C:

Issues:

Is the taxpayer permitted to obtain full main residence exemption?

Rule:

The main residence of the taxpayer is excluded from CGT provisions. However, a

partial main residence exception is permissible to taxpayer where a part of the house is used

separately by the taxpayer for business purpose.

Application:

The case facts obtained suggest that Li bought a house in March for 200,000 and used

a part of her house for physiotherapy business. The house was eventually sold by Li in 2019

for $700,000. As understood Li would not be allowed to claim full main residence exemption

however she can get partial main residence exemption.

Assessable portion = Capital gain x Percentage of floor area

= $700,000 – $400,000

= $300,000 (net capital gain)

= 300,000 x 20%

= $60,000 (Taxable Portion)

Conclusion:

Li here is assumed to have held the asset for a minimum of 12 months. She also meets

the rule of “home first home for producing income” since she soon started her business when

the property was purchased. Li can obtain a CGT discount from sale of her house since the

house was held for more than 12 months.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9TAXATION LAW

Answer D:

A CGT assets cost base includes the purchase price which the taxpayer pays for

purchasing the asset. The cost base comprises of few other costs as well. Notably, the price

paid in acquiring the asset, price paid for holding and sale of asset as well forms the part of

cost base13. The reduced cost base denotes that when the CGT event occurs and no capital

gains made by taxpayer. Under the reduce cost base, the taxpayer on the contrary are only

allowed to use the reduce cost base of the asset to reduce any form of capital loss and cannot

be used for reducing other types of capital loss.

Answer to question 5:

Answer A:

An article that has the features of earnings is usually considered to have derived by a

person when it “come-home” to the taxpayer. Any such existence of illegality and immorality

such as drug-dealing, theft or insider trading is not effected in treating the income as taxable

earnings. The law court in “Lindsay v IRC (1993)” held that the presence of illegality and

immorality is irrelevant in treating the sum as taxable earnings.

Answer B:

Interest received by tax payer is viewed as having the characteristic of income stream

because it involves the periodical receipts. The amount of $500 received from savings

13 Chardon, Toni, Brett Freudenberg, and Mark Brimble. "Tax literacy in Australia: not

knowing your deduction from your offset." Austl. Tax F. 31 (2016): 321.

Answer D:

A CGT assets cost base includes the purchase price which the taxpayer pays for

purchasing the asset. The cost base comprises of few other costs as well. Notably, the price

paid in acquiring the asset, price paid for holding and sale of asset as well forms the part of

cost base13. The reduced cost base denotes that when the CGT event occurs and no capital

gains made by taxpayer. Under the reduce cost base, the taxpayer on the contrary are only

allowed to use the reduce cost base of the asset to reduce any form of capital loss and cannot

be used for reducing other types of capital loss.

Answer to question 5:

Answer A:

An article that has the features of earnings is usually considered to have derived by a

person when it “come-home” to the taxpayer. Any such existence of illegality and immorality

such as drug-dealing, theft or insider trading is not effected in treating the income as taxable

earnings. The law court in “Lindsay v IRC (1993)” held that the presence of illegality and

immorality is irrelevant in treating the sum as taxable earnings.

Answer B:

Interest received by tax payer is viewed as having the characteristic of income stream

because it involves the periodical receipts. The amount of $500 received from savings

13 Chardon, Toni, Brett Freudenberg, and Mark Brimble. "Tax literacy in Australia: not

knowing your deduction from your offset." Austl. Tax F. 31 (2016): 321.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10TAXATION LAW

account as interest will be measured assessable as ordinary earnings under “s6-5, ITAA

1997”. The winnings from crown casino of $10,000 is a windfall gain and not taxable as

income. While the rent received of $2,000 is an income from the regular flow concept14. The

rent will be chargeable as ordinary earnings under “s6-5, ITAA 1997”.

Answer C:

As per “sec 6, ITAA 1936” income from personal exertion denotes receipts that are

obtained by taxpayer from providing personal services in capacity of employee. The

examples of receipts includes salaries, wages, allowances, gratuities and bonus received in

capacity of employee. Likewise, in “FCT v Dean (1997)” remuneration received by taxpayer

from employment was treated as taxable income under ordinary sense of “s6-5, ITAA 1997”.

The sum of $500 received as allowance by the taxpayer is personal exertion income

under “sec 6, ITAA 1936”15. Referring the decision made in “FCT v Dean (1997)” the

allowance of $500 will be treated as assessable pay under ordinary perception of “sec 6-5,

ITAA 1997”.

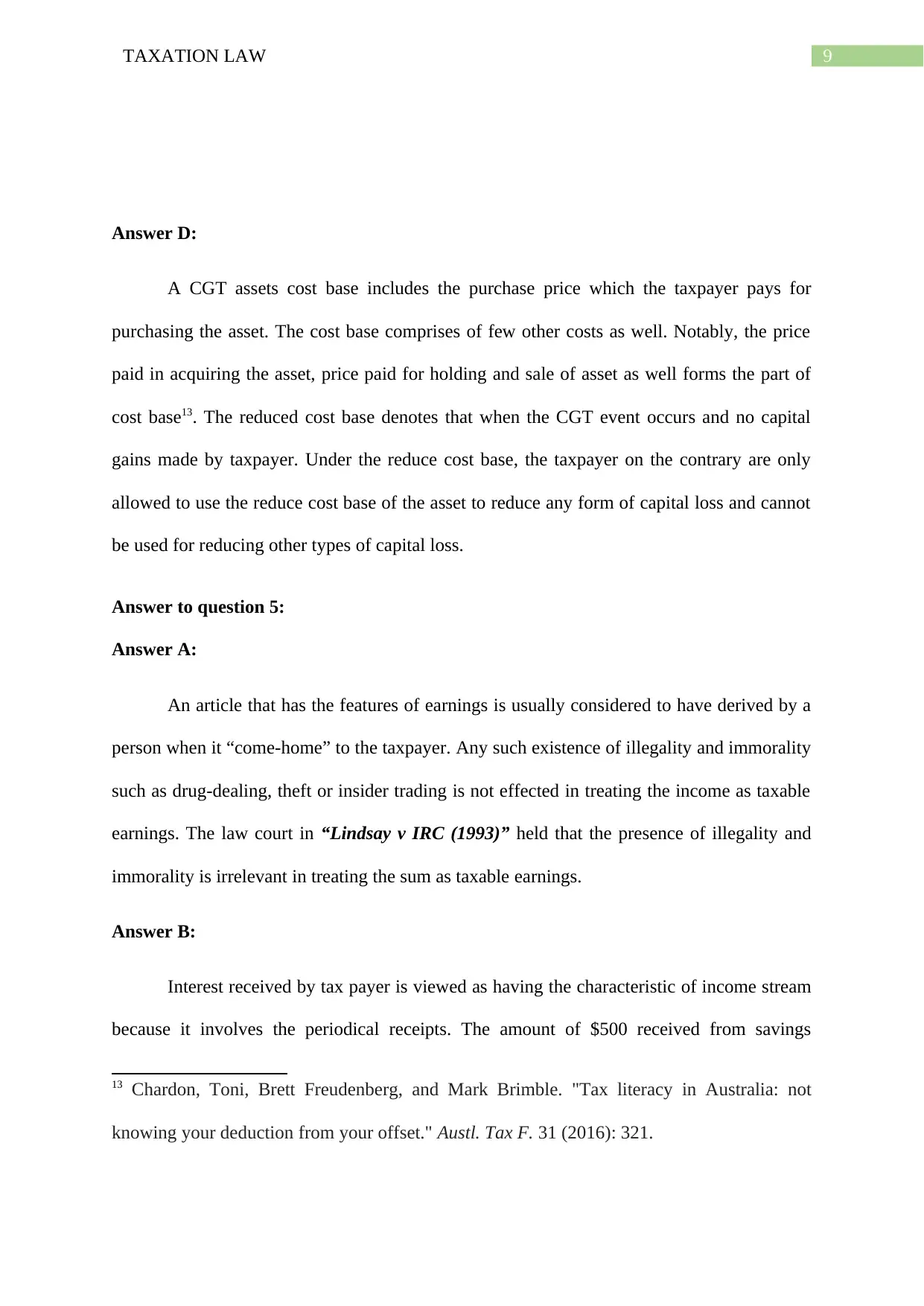

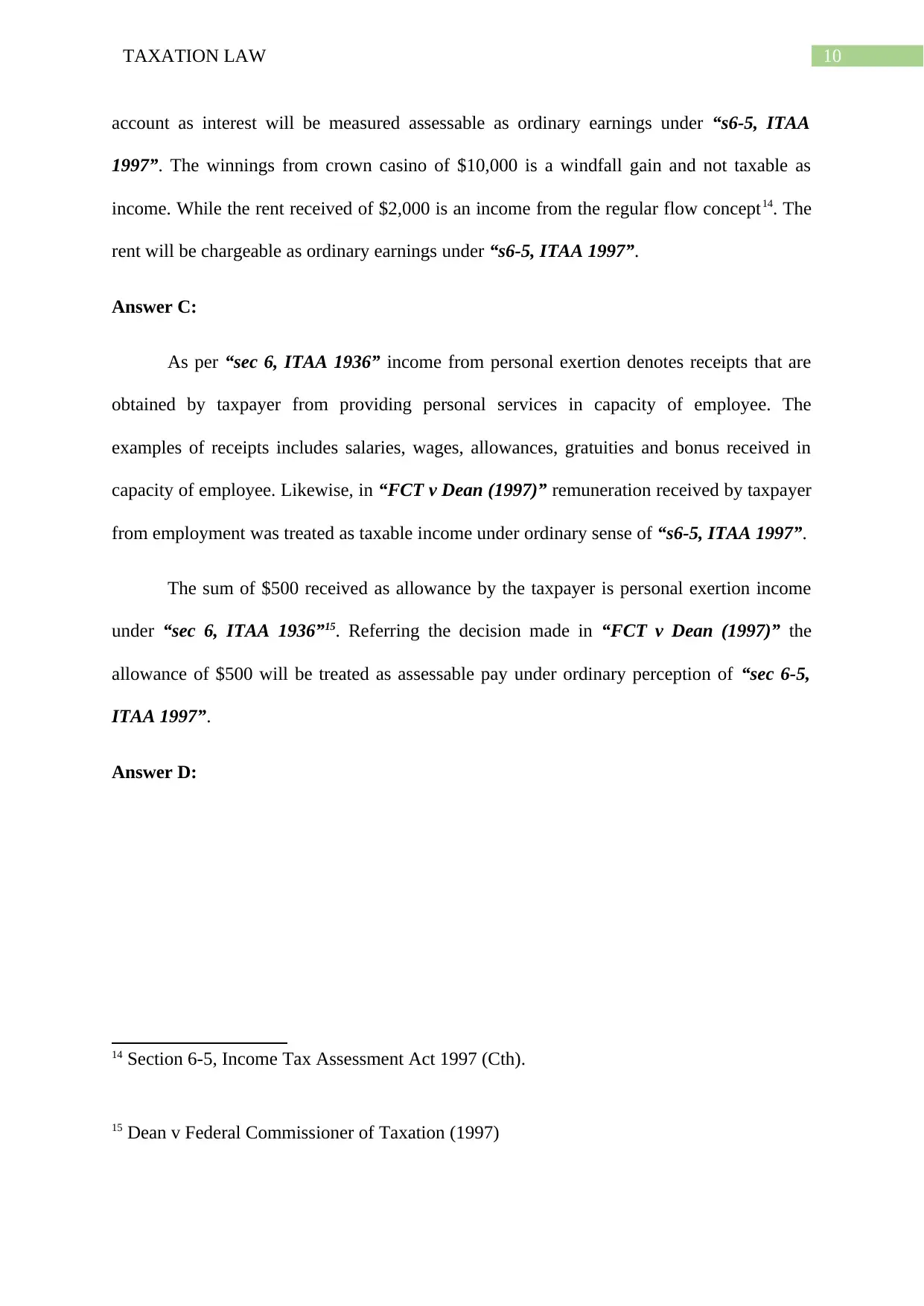

Answer D:

14 Section 6-5, Income Tax Assessment Act 1997 (Cth).

15 Dean v Federal Commissioner of Taxation (1997)

account as interest will be measured assessable as ordinary earnings under “s6-5, ITAA

1997”. The winnings from crown casino of $10,000 is a windfall gain and not taxable as

income. While the rent received of $2,000 is an income from the regular flow concept14. The

rent will be chargeable as ordinary earnings under “s6-5, ITAA 1997”.

Answer C:

As per “sec 6, ITAA 1936” income from personal exertion denotes receipts that are

obtained by taxpayer from providing personal services in capacity of employee. The

examples of receipts includes salaries, wages, allowances, gratuities and bonus received in

capacity of employee. Likewise, in “FCT v Dean (1997)” remuneration received by taxpayer

from employment was treated as taxable income under ordinary sense of “s6-5, ITAA 1997”.

The sum of $500 received as allowance by the taxpayer is personal exertion income

under “sec 6, ITAA 1936”15. Referring the decision made in “FCT v Dean (1997)” the

allowance of $500 will be treated as assessable pay under ordinary perception of “sec 6-5,

ITAA 1997”.

Answer D:

14 Section 6-5, Income Tax Assessment Act 1997 (Cth).

15 Dean v Federal Commissioner of Taxation (1997)

11TAXATION LAW

Answer E:

Answer E:

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 13

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.