HI6028 Taxation Law T3 2018: Partnership Tax Return and FBT Analysis

VerifiedAdded on 2023/04/22

|11

|2162

|359

Case Study

AI Summary

This case study provides a detailed analysis of taxation law, focusing on partnership tax returns and fringe benefit tax (FBT). It addresses the assessable income of a partnership, permissible deductions, and the calculation of taxable income according to ITAA 1936 and ITAA 1997. The study also examines the calculation of fringe benefit tax concerning employee benefits such as schooling costs and housing, referencing FBTAA 1986. It includes working papers demonstrating the computation of partnership income and FBT liabilities, providing a comprehensive overview of the legal and financial considerations involved. Desklib offers a wealth of similar solved assignments and resources for students.

Running head: TAXATION LAW

Taxation Law

Name of the Student

Name of the University

Authors Note

Course ID

Taxation Law

Name of the Student

Name of the University

Authors Note

Course ID

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1TAXATION LAW

Answer 1:

Issues:

Will Daniel and Olivia operating the business under partnership and producing

assessable income is liable for assessment as per the “section 90, ITAA 1936”?

Rule:

As held in “section 995-1, ITAA 1997”, “section 995-1, ITAA 1997” the

classification of partnership can be stated that two persons apart from the company are

making profit and that profit is considered as ordinary income or chargeable proceeds during

the course of the income year. This partnership continues the objective of profit making.

(Mumford 2017) There is an important explanation made under the provision of “S-90, ITA

Act 1997” for calculating the ordinary income. After making the necessary deduction from

the income derived the taxable income is computed.

It has been explained that the income is liable for assessment while the income tax is

levied based on the taxable income (Hope, Ma and Thomas 2013). The interpretation made

under “S 6-5, ITA Act 1997” defines that ordinary income is defined based on the ordinary

concepts. The legislative response is given under the case of “CT v Scott (1935)” for

interpreting the income upon the ordinary concepts and mankind usage.

The provision of general deductions is explained in terms of the deductions provided

to the taxpayer in reference to their expenditures (Batrancea, Nichita and Batrancea 2013). As

per “section 8-1, ITAA 1997” it has its impact on every potential taxpayer. Rendering to the

provision of deduction the taxpayer is allowed to get the deductions if these all the

expenditures took place for producing the ordinary income under “section 8-1, ITAA 1997”.

Hence, rendering to the “section 8-1, ITAA 1997” the taxpayer is entitled in getting the

Answer 1:

Issues:

Will Daniel and Olivia operating the business under partnership and producing

assessable income is liable for assessment as per the “section 90, ITAA 1936”?

Rule:

As held in “section 995-1, ITAA 1997”, “section 995-1, ITAA 1997” the

classification of partnership can be stated that two persons apart from the company are

making profit and that profit is considered as ordinary income or chargeable proceeds during

the course of the income year. This partnership continues the objective of profit making.

(Mumford 2017) There is an important explanation made under the provision of “S-90, ITA

Act 1997” for calculating the ordinary income. After making the necessary deduction from

the income derived the taxable income is computed.

It has been explained that the income is liable for assessment while the income tax is

levied based on the taxable income (Hope, Ma and Thomas 2013). The interpretation made

under “S 6-5, ITA Act 1997” defines that ordinary income is defined based on the ordinary

concepts. The legislative response is given under the case of “CT v Scott (1935)” for

interpreting the income upon the ordinary concepts and mankind usage.

The provision of general deductions is explained in terms of the deductions provided

to the taxpayer in reference to their expenditures (Batrancea, Nichita and Batrancea 2013). As

per “section 8-1, ITAA 1997” it has its impact on every potential taxpayer. Rendering to the

provision of deduction the taxpayer is allowed to get the deductions if these all the

expenditures took place for producing the ordinary income under “section 8-1, ITAA 1997”.

Hence, rendering to the “section 8-1, ITAA 1997” the taxpayer is entitled in getting the

2TAXATION LAW

deductions from their assessable incomes if the outgoing expenditures are incurred because of

maintaining their objective of producing the taxable incomes (Goldin and Listokin 2013).

Consequently, this is important to be mentioned that the deductions will not be allowed for

the expenditures under the general deduction concepts if the expenditures are generated for

the negative limbs of “section 8-1, ITAA 1997”. No kind of personal or capital outgoings are

permitted for income tax deduction under “S 8-1(2), ITAA 1997”.

The taxpayers are allowed for deductions in their assessable incomes while paying tax

if the repairs incurred for the assets which are producing assessable income under the

“section 25-10”. According to “section 25-10” the units those are repaired should be

producing the assessable incomes throughout the assessable income year (Chyz 2013). This

means that the taxpayer is indulging the repair aspect for investing property and also for

maintaining the business objective of earning profits.

There are few improvements made on the assets which are considered as repairs such

as paintings of business premises etc. according to the “section 25-10” the permanent

replacement of the assets which will be increasing the assessable income that will be allowed

as the deductions from the tax payable (Rose 2017). However, the replacement of asset

should be like if the part of any asset or the whole is worn out and the new one is same as in

design along with this the change in the asset is indulging some increment in productivity

then only the taxpayers will be allowed for the deductions.

According to the ATO the taxpayers are eligible to get the deductions if they are

spending lesser amount than $20,000 for the outgoing expenses to maintain their business

objectives.

Applications:

deductions from their assessable incomes if the outgoing expenditures are incurred because of

maintaining their objective of producing the taxable incomes (Goldin and Listokin 2013).

Consequently, this is important to be mentioned that the deductions will not be allowed for

the expenditures under the general deduction concepts if the expenditures are generated for

the negative limbs of “section 8-1, ITAA 1997”. No kind of personal or capital outgoings are

permitted for income tax deduction under “S 8-1(2), ITAA 1997”.

The taxpayers are allowed for deductions in their assessable incomes while paying tax

if the repairs incurred for the assets which are producing assessable income under the

“section 25-10”. According to “section 25-10” the units those are repaired should be

producing the assessable incomes throughout the assessable income year (Chyz 2013). This

means that the taxpayer is indulging the repair aspect for investing property and also for

maintaining the business objective of earning profits.

There are few improvements made on the assets which are considered as repairs such

as paintings of business premises etc. according to the “section 25-10” the permanent

replacement of the assets which will be increasing the assessable income that will be allowed

as the deductions from the tax payable (Rose 2017). However, the replacement of asset

should be like if the part of any asset or the whole is worn out and the new one is same as in

design along with this the change in the asset is indulging some increment in productivity

then only the taxpayers will be allowed for the deductions.

According to the ATO the taxpayers are eligible to get the deductions if they are

spending lesser amount than $20,000 for the outgoing expenses to maintain their business

objectives.

Applications:

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3TAXATION LAW

As detained in the “section 995-1, ITAA 1997” Olivia and Daniel is continuing their

partnership in a business where their gains and receipts are considered as the ordinary

assessable income throughout the income year. The net income is calculated in reference to

the “section 90, ITAA 1997”.

Daniel and Olivia have gained their income form the receipts along with the debtor’s

payment they collected from their business. The legislative response has been considered

relating to “Scott v CT” in calculating the partnership income in relation to the ordinary

meaning of “S 6-5, ITAA 1997” (Jaimovich and Rebelo 2017). For that reason, the cash sales

and the sum that is received from the debtors is the part of taxable income under “S 6-5,

ITAA 1997” because it is earnings for the partnership based on the ordinary concepts.

At the time of conducting their day-to-day business activities Daniel and Olivia has

also reported outgoings made during the year (Chenxi 2013). The outgoings are in the form

of bills for the electricity, rates that are paid to council, expenses for the car, bills related to

mobile. All these outgoings have been occurred as the part of day-to-day business course.

Therefore, they are permitted for general income tax deduction under the section 8-1, ITA

Act 1997.

In this part a discussion about the drawing those are made by Daniel and Olivia. The

partnership has drawn $6000 from the business. Apart from this, $3,200 was drawn for the

bottle shop items. These expenditures are not supported as these are made for the private

purpose of the partnership and also these falling under the negative limbs of “section 8-1

(2)”.

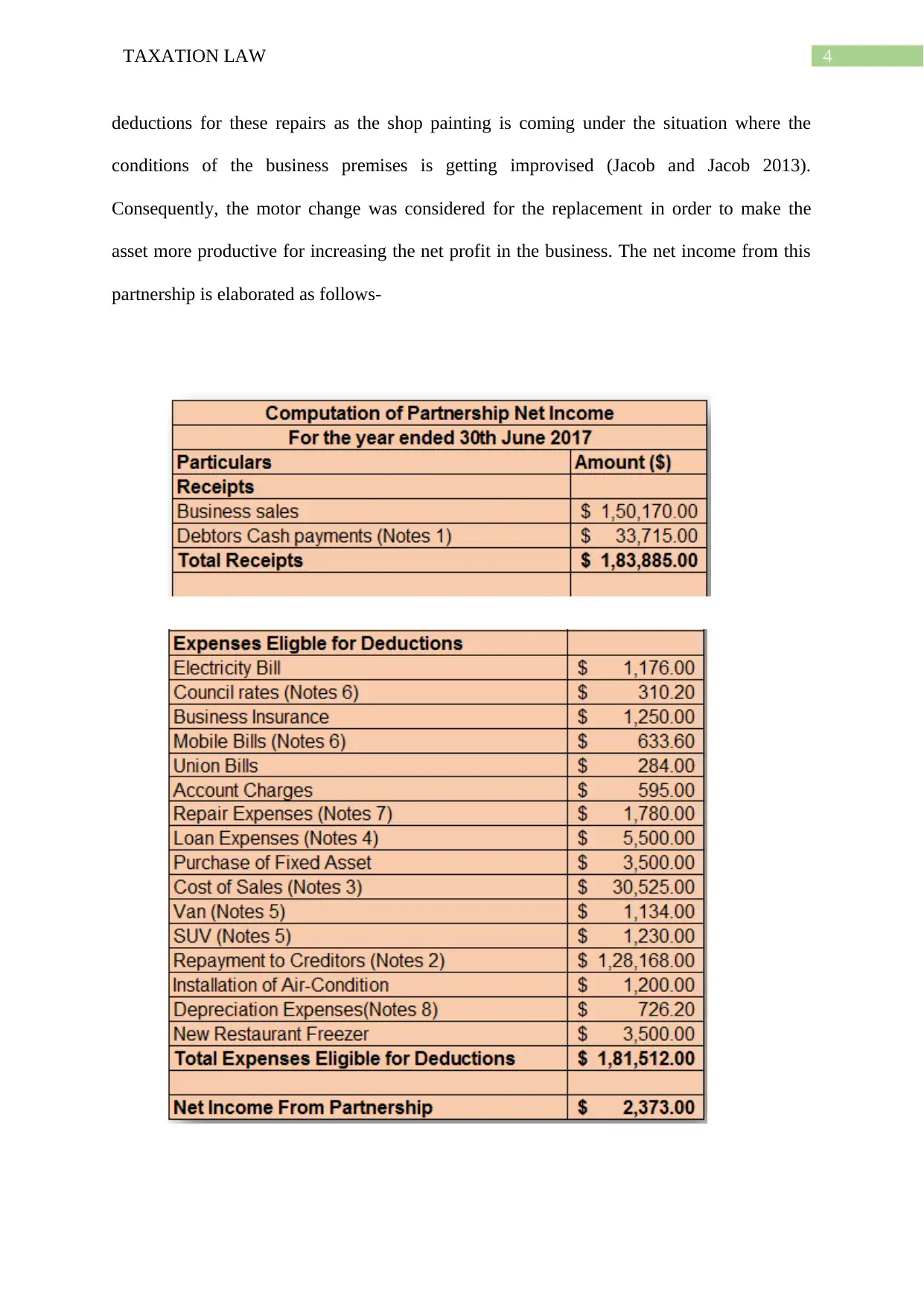

Repairs and maintenance of the shop have been taken into consideration in this

partnership as the shop painting and the replacement of the refrigerator motor has been done

by Olivia and Daniel. As held in “section 25-10” the partnership is allowed to get the

As detained in the “section 995-1, ITAA 1997” Olivia and Daniel is continuing their

partnership in a business where their gains and receipts are considered as the ordinary

assessable income throughout the income year. The net income is calculated in reference to

the “section 90, ITAA 1997”.

Daniel and Olivia have gained their income form the receipts along with the debtor’s

payment they collected from their business. The legislative response has been considered

relating to “Scott v CT” in calculating the partnership income in relation to the ordinary

meaning of “S 6-5, ITAA 1997” (Jaimovich and Rebelo 2017). For that reason, the cash sales

and the sum that is received from the debtors is the part of taxable income under “S 6-5,

ITAA 1997” because it is earnings for the partnership based on the ordinary concepts.

At the time of conducting their day-to-day business activities Daniel and Olivia has

also reported outgoings made during the year (Chenxi 2013). The outgoings are in the form

of bills for the electricity, rates that are paid to council, expenses for the car, bills related to

mobile. All these outgoings have been occurred as the part of day-to-day business course.

Therefore, they are permitted for general income tax deduction under the section 8-1, ITA

Act 1997.

In this part a discussion about the drawing those are made by Daniel and Olivia. The

partnership has drawn $6000 from the business. Apart from this, $3,200 was drawn for the

bottle shop items. These expenditures are not supported as these are made for the private

purpose of the partnership and also these falling under the negative limbs of “section 8-1

(2)”.

Repairs and maintenance of the shop have been taken into consideration in this

partnership as the shop painting and the replacement of the refrigerator motor has been done

by Olivia and Daniel. As held in “section 25-10” the partnership is allowed to get the

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4TAXATION LAW

deductions for these repairs as the shop painting is coming under the situation where the

conditions of the business premises is getting improvised (Jacob and Jacob 2013).

Consequently, the motor change was considered for the replacement in order to make the

asset more productive for increasing the net profit in the business. The net income from this

partnership is elaborated as follows-

deductions for these repairs as the shop painting is coming under the situation where the

conditions of the business premises is getting improvised (Jacob and Jacob 2013).

Consequently, the motor change was considered for the replacement in order to make the

asset more productive for increasing the net profit in the business. The net income from this

partnership is elaborated as follows-

5TAXATION LAW

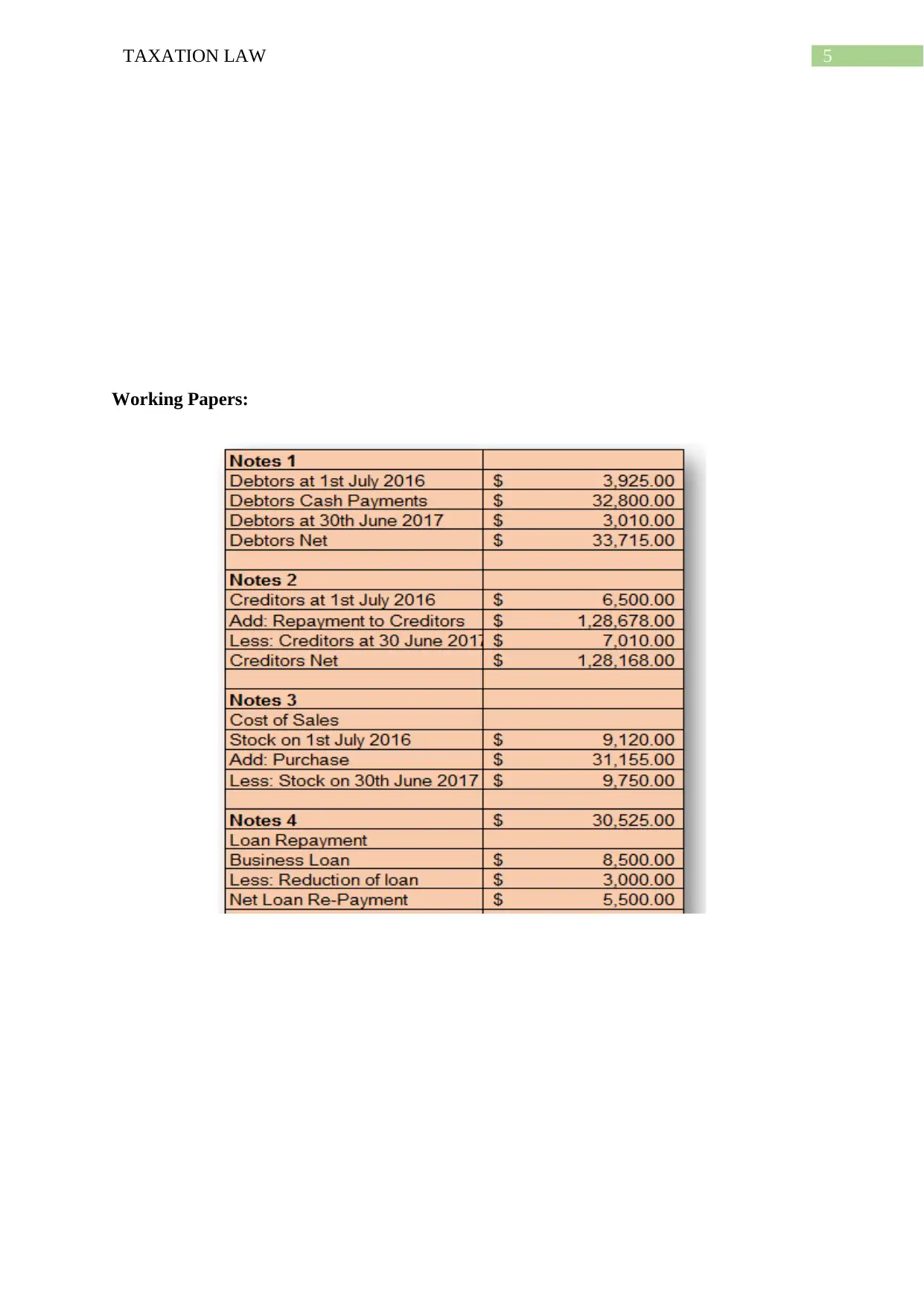

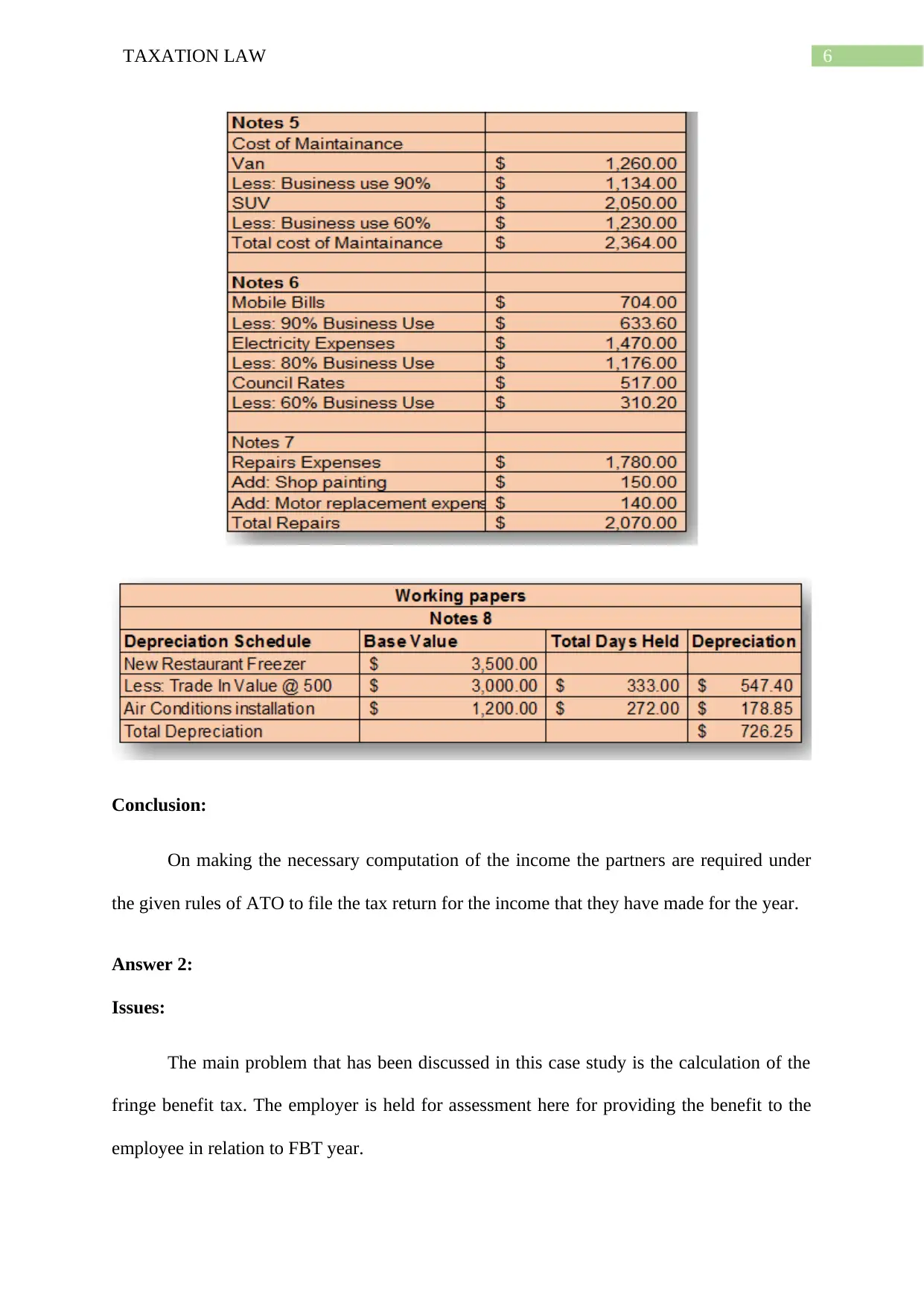

Working Papers:

Working Papers:

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6TAXATION LAW

Conclusion:

On making the necessary computation of the income the partners are required under

the given rules of ATO to file the tax return for the income that they have made for the year.

Answer 2:

Issues:

The main problem that has been discussed in this case study is the calculation of the

fringe benefit tax. The employer is held for assessment here for providing the benefit to the

employee in relation to FBT year.

Conclusion:

On making the necessary computation of the income the partners are required under

the given rules of ATO to file the tax return for the income that they have made for the year.

Answer 2:

Issues:

The main problem that has been discussed in this case study is the calculation of the

fringe benefit tax. The employer is held for assessment here for providing the benefit to the

employee in relation to FBT year.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7TAXATION LAW

Rule:

The employees get paid for their expenses apart from their salary and wages, this is

called fringe benefit provided by their employer. It should be noted that the fringe benefit

here given to the employee is for their employment with a company. If any kind of benefit is

given by the employer to the employee, then a tax is imposed for the total value of the

benefit.

Rendering to “S-20, FBTAA 1986” the expenditure takes place where the employer is

paying certain amount to their employee for these expenditures as they are paying these

amounts to some third party for the sake of gaining some relevant skills and benefits

(Frecknall-Hughes 2014). This is should be noted that the tax is paid by the employer under

the legislation of S-23, FBTA Act 1986 on the basis of expenses that are paid on behalf of the

employer.

It should be noted when the employee is given the house for living as the normal

place of residence then in this circumstances the employer is liable for the housing fringe

benefit. The housing fringe benefit tax is applied on the employer upon the current market

value of the house.

The housing fringe benefit is also provided by the employer to their employees as

they use it for their permanent residence. According to “Sect 27, FBTAA 1986” the market

value of this property decides the actual value for the part of the apartment or house. Here the

employer is responsible to pay the full or partial payments to their employer in accordance

with the value decided for the rent of that particular property (Ernst, Richter and Riedel

2014). Consequently, the taxable values for this housing fringe benefit are also taken from the

employees in terms of combination of rental values.

Application:

Rule:

The employees get paid for their expenses apart from their salary and wages, this is

called fringe benefit provided by their employer. It should be noted that the fringe benefit

here given to the employee is for their employment with a company. If any kind of benefit is

given by the employer to the employee, then a tax is imposed for the total value of the

benefit.

Rendering to “S-20, FBTAA 1986” the expenditure takes place where the employer is

paying certain amount to their employee for these expenditures as they are paying these

amounts to some third party for the sake of gaining some relevant skills and benefits

(Frecknall-Hughes 2014). This is should be noted that the tax is paid by the employer under

the legislation of S-23, FBTA Act 1986 on the basis of expenses that are paid on behalf of the

employer.

It should be noted when the employee is given the house for living as the normal

place of residence then in this circumstances the employer is liable for the housing fringe

benefit. The housing fringe benefit tax is applied on the employer upon the current market

value of the house.

The housing fringe benefit is also provided by the employer to their employees as

they use it for their permanent residence. According to “Sect 27, FBTAA 1986” the market

value of this property decides the actual value for the part of the apartment or house. Here the

employer is responsible to pay the full or partial payments to their employer in accordance

with the value decided for the rent of that particular property (Ernst, Richter and Riedel

2014). Consequently, the taxable values for this housing fringe benefit are also taken from the

employees in terms of combination of rental values.

Application:

8TAXATION LAW

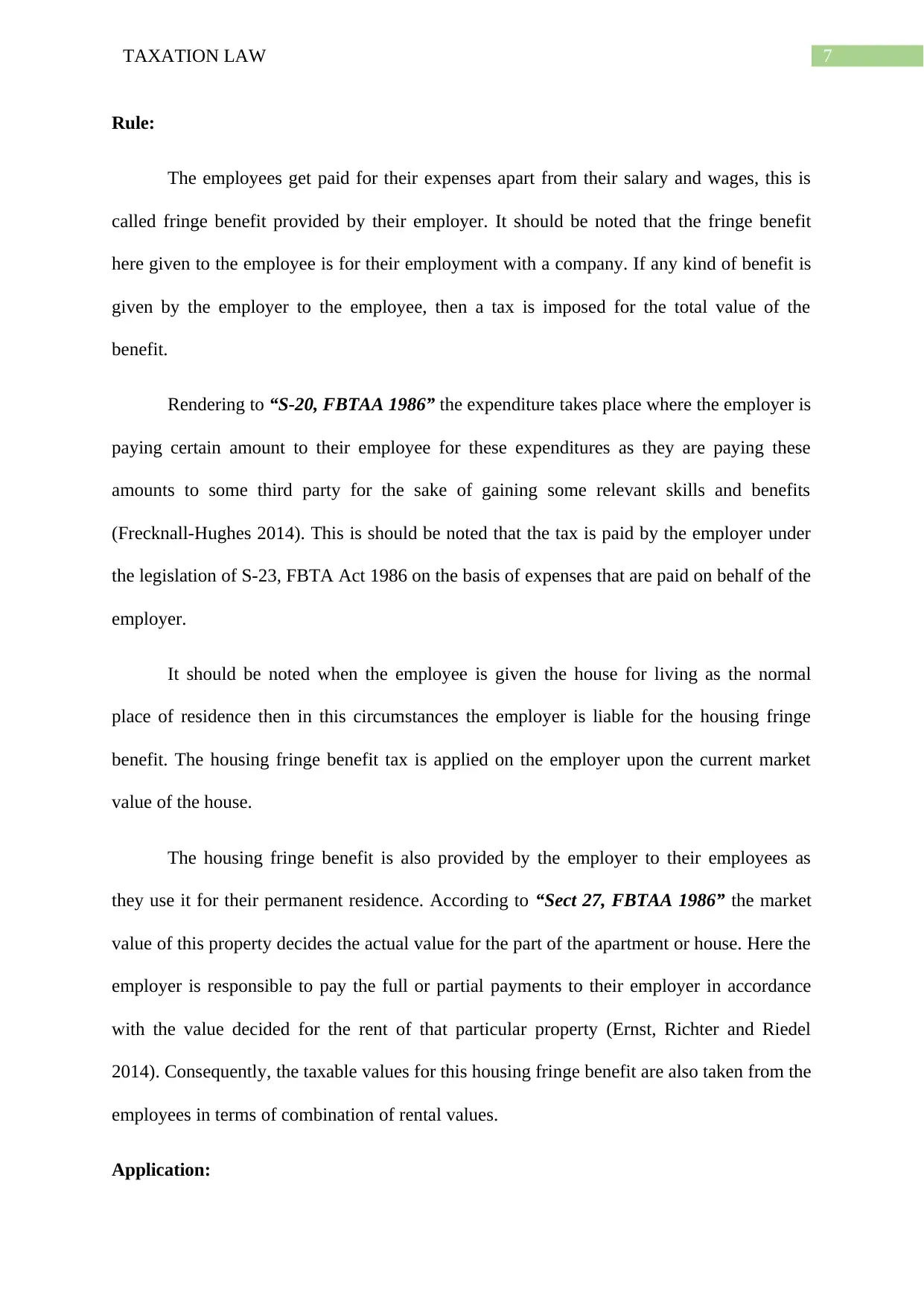

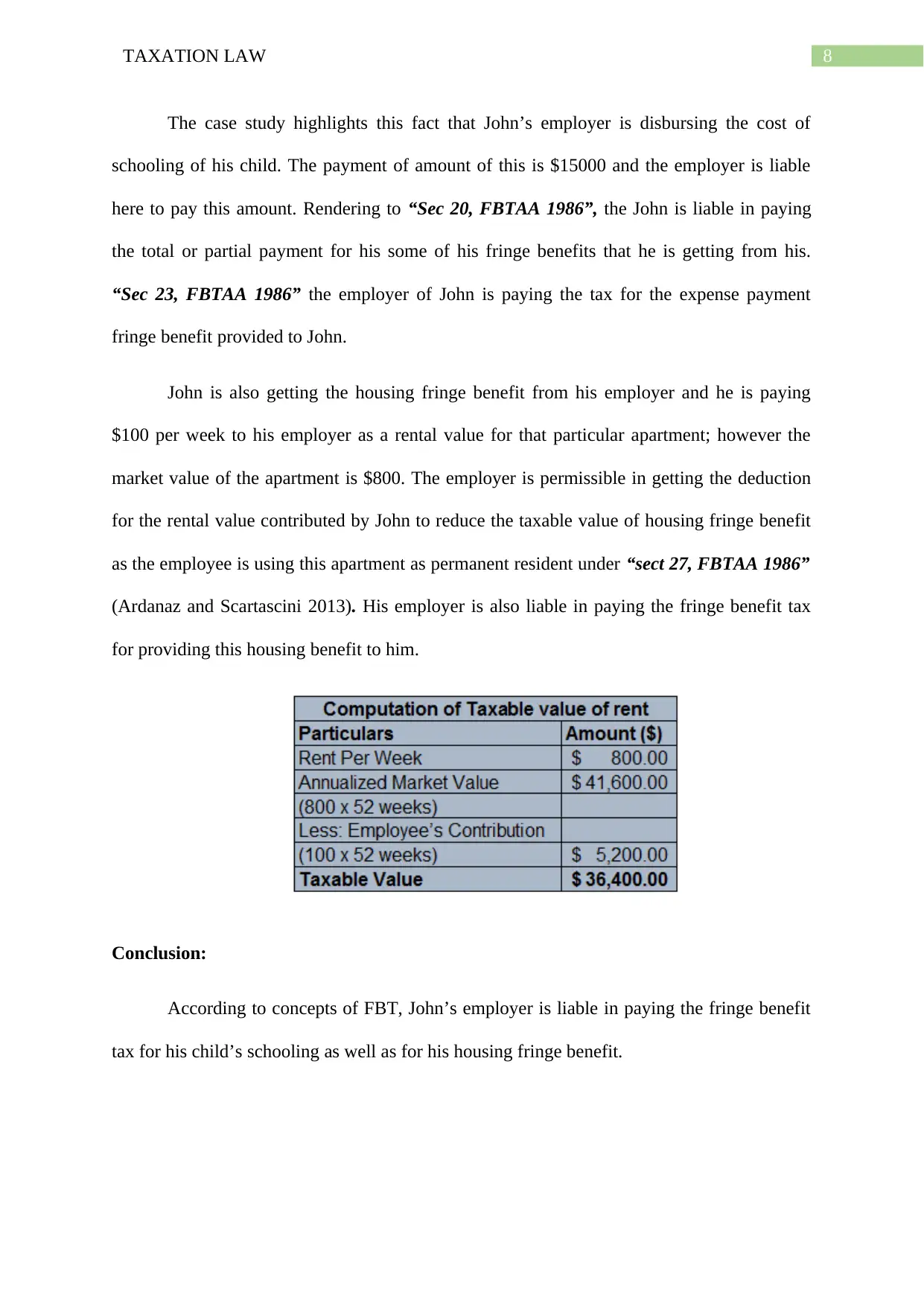

The case study highlights this fact that John’s employer is disbursing the cost of

schooling of his child. The payment of amount of this is $15000 and the employer is liable

here to pay this amount. Rendering to “Sec 20, FBTAA 1986”, the John is liable in paying

the total or partial payment for his some of his fringe benefits that he is getting from his.

“Sec 23, FBTAA 1986” the employer of John is paying the tax for the expense payment

fringe benefit provided to John.

John is also getting the housing fringe benefit from his employer and he is paying

$100 per week to his employer as a rental value for that particular apartment; however the

market value of the apartment is $800. The employer is permissible in getting the deduction

for the rental value contributed by John to reduce the taxable value of housing fringe benefit

as the employee is using this apartment as permanent resident under “sect 27, FBTAA 1986”

(Ardanaz and Scartascini 2013). His employer is also liable in paying the fringe benefit tax

for providing this housing benefit to him.

Conclusion:

According to concepts of FBT, John’s employer is liable in paying the fringe benefit

tax for his child’s schooling as well as for his housing fringe benefit.

The case study highlights this fact that John’s employer is disbursing the cost of

schooling of his child. The payment of amount of this is $15000 and the employer is liable

here to pay this amount. Rendering to “Sec 20, FBTAA 1986”, the John is liable in paying

the total or partial payment for his some of his fringe benefits that he is getting from his.

“Sec 23, FBTAA 1986” the employer of John is paying the tax for the expense payment

fringe benefit provided to John.

John is also getting the housing fringe benefit from his employer and he is paying

$100 per week to his employer as a rental value for that particular apartment; however the

market value of the apartment is $800. The employer is permissible in getting the deduction

for the rental value contributed by John to reduce the taxable value of housing fringe benefit

as the employee is using this apartment as permanent resident under “sect 27, FBTAA 1986”

(Ardanaz and Scartascini 2013). His employer is also liable in paying the fringe benefit tax

for providing this housing benefit to him.

Conclusion:

According to concepts of FBT, John’s employer is liable in paying the fringe benefit

tax for his child’s schooling as well as for his housing fringe benefit.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9TAXATION LAW

References:

Ardanaz, M. and Scartascini, C., 2013. Inequality and personal income taxation: The origins

and effects of legislative malapportionment. Comparative Political Studies, 46(12), pp.1636-

1663.

Batrancea, L.M., Nichita, R.A. and Batrancea, I., 2013. Understanding the determinants of

tax compliance behavior as a prerequisite for increasing public levies. The USV Annals of

Economics and Public Administration, 12(1 (15)), pp.201-210.

Chenxi, A., 2013. On The Absence of China's Statutory Taxation and Its Realization

[J]. Public Administration & Law, 3, p.021.

Chyz, J.A., 2013. Personally tax aggressive executives and corporate tax sheltering. Journal

of Accounting and Economics, 56(2-3), pp.311-328.

Ernst, C., Richter, K. and Riedel, N., 2014. Corporate taxation and the quality of research and

development. International Tax and Public Finance, 21(4), pp.694-719.

Frecknall-Hughes, J., 2014. The Theory, Principles and Management of Taxation: An

Introduction. Routledge.

Goldin, J. and Listokin, Y., 2013. Tax expenditure salience. American law and economics

review, 16(1), pp.144-176.

Hope, O.K., Ma, M.S. and Thomas, W.B., 2013. Tax avoidance and geographic earnings

disclosure. Journal of Accounting and Economics, 56(2-3), pp.170-189.

Jacob, M. and Jacob, M., 2013. Taxation, dividends, and share repurchases: Taking evidence

global. Journal of Financial and Quantitative Analysis, 48(4), pp.1241-1269.

References:

Ardanaz, M. and Scartascini, C., 2013. Inequality and personal income taxation: The origins

and effects of legislative malapportionment. Comparative Political Studies, 46(12), pp.1636-

1663.

Batrancea, L.M., Nichita, R.A. and Batrancea, I., 2013. Understanding the determinants of

tax compliance behavior as a prerequisite for increasing public levies. The USV Annals of

Economics and Public Administration, 12(1 (15)), pp.201-210.

Chenxi, A., 2013. On The Absence of China's Statutory Taxation and Its Realization

[J]. Public Administration & Law, 3, p.021.

Chyz, J.A., 2013. Personally tax aggressive executives and corporate tax sheltering. Journal

of Accounting and Economics, 56(2-3), pp.311-328.

Ernst, C., Richter, K. and Riedel, N., 2014. Corporate taxation and the quality of research and

development. International Tax and Public Finance, 21(4), pp.694-719.

Frecknall-Hughes, J., 2014. The Theory, Principles and Management of Taxation: An

Introduction. Routledge.

Goldin, J. and Listokin, Y., 2013. Tax expenditure salience. American law and economics

review, 16(1), pp.144-176.

Hope, O.K., Ma, M.S. and Thomas, W.B., 2013. Tax avoidance and geographic earnings

disclosure. Journal of Accounting and Economics, 56(2-3), pp.170-189.

Jacob, M. and Jacob, M., 2013. Taxation, dividends, and share repurchases: Taking evidence

global. Journal of Financial and Quantitative Analysis, 48(4), pp.1241-1269.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10TAXATION LAW

Jaimovich, N. and Rebelo, S., 2017. Nonlinear effects of taxation on growth. Journal of

Political Economy, 125(1), pp.265-291.

Mumford, A., 2017. Taxing culture: towards a theory of tax collection law. Routledge.

Rose, N., 2017. Beyond the public/private division: law, power and the family. In Law and

Families (pp. 33-48). Routledge.

Jaimovich, N. and Rebelo, S., 2017. Nonlinear effects of taxation on growth. Journal of

Political Economy, 125(1), pp.265-291.

Mumford, A., 2017. Taxing culture: towards a theory of tax collection law. Routledge.

Rose, N., 2017. Beyond the public/private division: law, power and the family. In Law and

Families (pp. 33-48). Routledge.

1 out of 11

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.