Taxation Theory, Practice & Law Report: In-depth Case Analysis, Law

VerifiedAdded on 2020/07/23

|9

|2486

|40

Report

AI Summary

This report provides a comprehensive analysis of taxation theory, practice, and law, covering various aspects through case studies. The report begins with an introduction to capital gains tax, discussing how profits and losses from the sale of capital assets are assessed and taxed, using the case of Eric's antique items and shares as an example. The second section explores fringe benefits tax (FBT), detailing how benefits provided by employers are included in taxable income, using the example of an employer providing a loan at a reduced interest rate. The third section examines property rental income and associated tax implications, including deductions for maintenance costs and the impact of capital gains when selling the property. The fourth section discusses tax avoidance, referencing the IRC vs. Duke of Westminster case and the legal strategies employed to minimize tax liabilities. Finally, the report concludes by examining the taxation of timber sales, considering whether the income is classified as agricultural or revenue-generating, using the case of Bill's timber clearing activities as a basis for analysis. Each section includes critical analysis, supporting evidence, and conclusions, providing a detailed overview of the relevant tax laws and their practical applications.

Taxation Theory, Practice & Law

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

Question 1........................................................................................................................................1

Introduction.................................................................................................................................1

Critical Analysis..........................................................................................................................1

Supporting evidence....................................................................................................................1

Conclusion ..................................................................................................................................2

Question 2........................................................................................................................................2

Introduction.................................................................................................................................2

Critical analyses..........................................................................................................................2

Supportive evidence....................................................................................................................3

Conclusion...................................................................................................................................3

Question 3........................................................................................................................................3

Introduction.................................................................................................................................3

Critical Analysis..........................................................................................................................3

Supporting evidence....................................................................................................................4

Conclusion...................................................................................................................................4

Question 4........................................................................................................................................4

Introduction.................................................................................................................................4

Supporting evidence....................................................................................................................5

Conclusion...................................................................................................................................5

Question 5........................................................................................................................................5

Introduction.................................................................................................................................5

Critical analyses..........................................................................................................................5

Supporting evidence....................................................................................................................6

Conclusion...................................................................................................................................6

REFERENCES................................................................................................................................7

Question 1........................................................................................................................................1

Introduction.................................................................................................................................1

Critical Analysis..........................................................................................................................1

Supporting evidence....................................................................................................................1

Conclusion ..................................................................................................................................2

Question 2........................................................................................................................................2

Introduction.................................................................................................................................2

Critical analyses..........................................................................................................................2

Supportive evidence....................................................................................................................3

Conclusion...................................................................................................................................3

Question 3........................................................................................................................................3

Introduction.................................................................................................................................3

Critical Analysis..........................................................................................................................3

Supporting evidence....................................................................................................................4

Conclusion...................................................................................................................................4

Question 4........................................................................................................................................4

Introduction.................................................................................................................................4

Supporting evidence....................................................................................................................5

Conclusion...................................................................................................................................5

Question 5........................................................................................................................................5

Introduction.................................................................................................................................5

Critical analyses..........................................................................................................................5

Supporting evidence....................................................................................................................6

Conclusion...................................................................................................................................6

REFERENCES................................................................................................................................7

Question 1

Introduction

Capital profit or financial loss is assessed on scaling of capital assets. The amount

payable are taxed under legal procedures but the person who is paying tax can reduce the capital

loss from initial profits which were the felling of trees in a plantation or forest, even though the

taxpayer concerned did not plant or tend the trees achieved previously (Antwi-Agyei and et. al.,

2012). There is a case of Eric who have brought various antique things and also shares. He faced

loss by selling some items and for some profits.

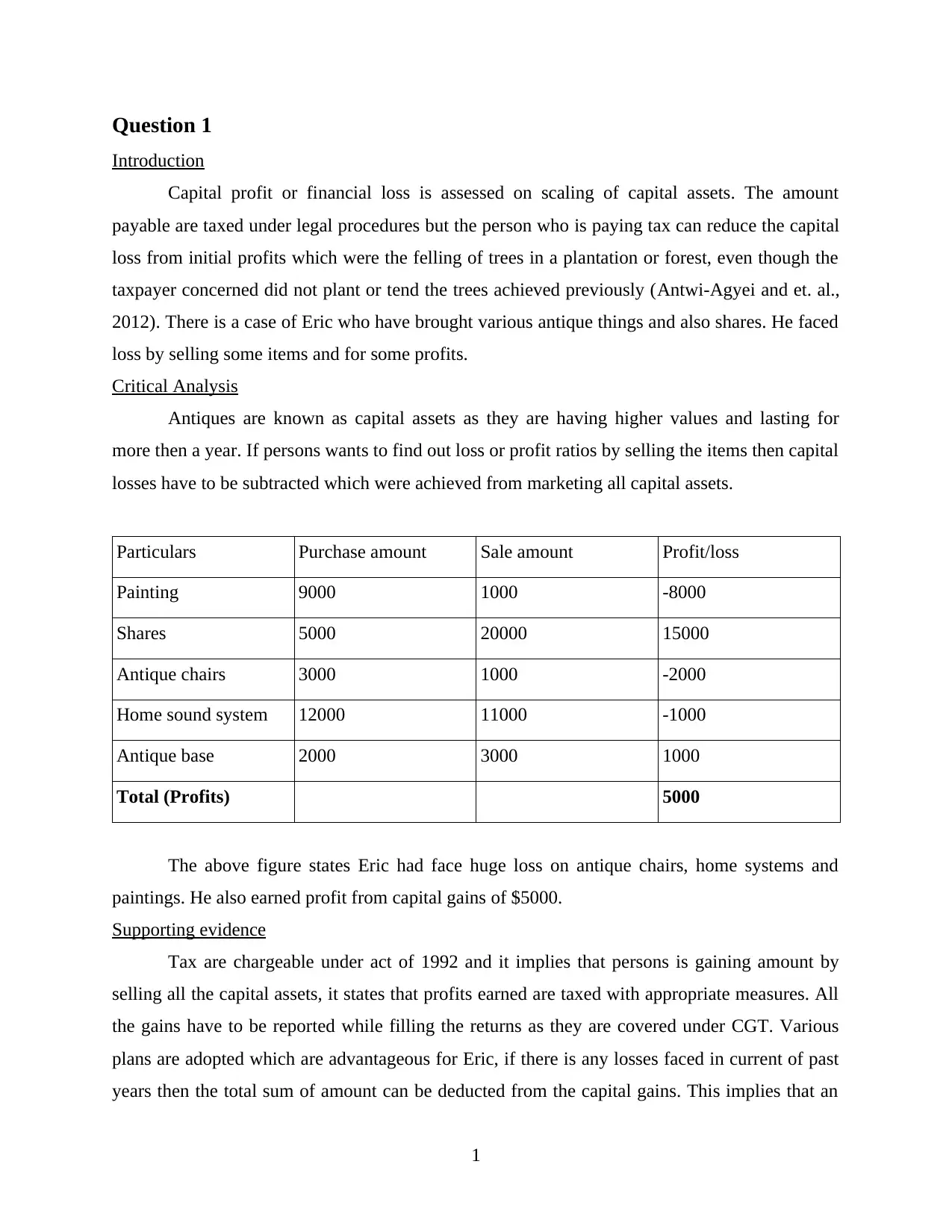

Critical Analysis

Antiques are known as capital assets as they are having higher values and lasting for

more then a year. If persons wants to find out loss or profit ratios by selling the items then capital

losses have to be subtracted which were achieved from marketing all capital assets.

Particulars Purchase amount Sale amount Profit/loss

Painting 9000 1000 -8000

Shares 5000 20000 15000

Antique chairs 3000 1000 -2000

Home sound system 12000 11000 -1000

Antique base 2000 3000 1000

Total (Profits) 5000

The above figure states Eric had face huge loss on antique chairs, home systems and

paintings. He also earned profit from capital gains of $5000.

Supporting evidence

Tax are chargeable under act of 1992 and it implies that persons is gaining amount by

selling all the capital assets, it states that profits earned are taxed with appropriate measures. All

the gains have to be reported while filling the returns as they are covered under CGT. Various

plans are adopted which are advantageous for Eric, if there is any losses faced in current of past

years then the total sum of amount can be deducted from the capital gains. This implies that an

1

Introduction

Capital profit or financial loss is assessed on scaling of capital assets. The amount

payable are taxed under legal procedures but the person who is paying tax can reduce the capital

loss from initial profits which were the felling of trees in a plantation or forest, even though the

taxpayer concerned did not plant or tend the trees achieved previously (Antwi-Agyei and et. al.,

2012). There is a case of Eric who have brought various antique things and also shares. He faced

loss by selling some items and for some profits.

Critical Analysis

Antiques are known as capital assets as they are having higher values and lasting for

more then a year. If persons wants to find out loss or profit ratios by selling the items then capital

losses have to be subtracted which were achieved from marketing all capital assets.

Particulars Purchase amount Sale amount Profit/loss

Painting 9000 1000 -8000

Shares 5000 20000 15000

Antique chairs 3000 1000 -2000

Home sound system 12000 11000 -1000

Antique base 2000 3000 1000

Total (Profits) 5000

The above figure states Eric had face huge loss on antique chairs, home systems and

paintings. He also earned profit from capital gains of $5000.

Supporting evidence

Tax are chargeable under act of 1992 and it implies that persons is gaining amount by

selling all the capital assets, it states that profits earned are taxed with appropriate measures. All

the gains have to be reported while filling the returns as they are covered under CGT. Various

plans are adopted which are advantageous for Eric, if there is any losses faced in current of past

years then the total sum of amount can be deducted from the capital gains. This implies that an

1

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

individual can easily subtract capital loss from the total profits earned by selling any type of

capital assets.

Conclusion

From the above task it can be stated that persons are liable to pay compulsory taxes on

any amount of capital gains earned. The amount to taxes can be reduced by subtracting all types

of capital earnings from total profit ratios.

Question 2

Introduction

An employer at work places are giving various benefits to their employees a part from

their normal salary which is offered to them. All the allowances and prerequisites are composed

in income at the times when tax amount had to be paid. In this case fringe benefits are given to

employees. Employer at Brain granted loan of $ 1 million at 1% per annum. He had acquire

some amount of monetary values in order to gain extra amount of money (Baldwin, Cave and

Lodge, 2012).

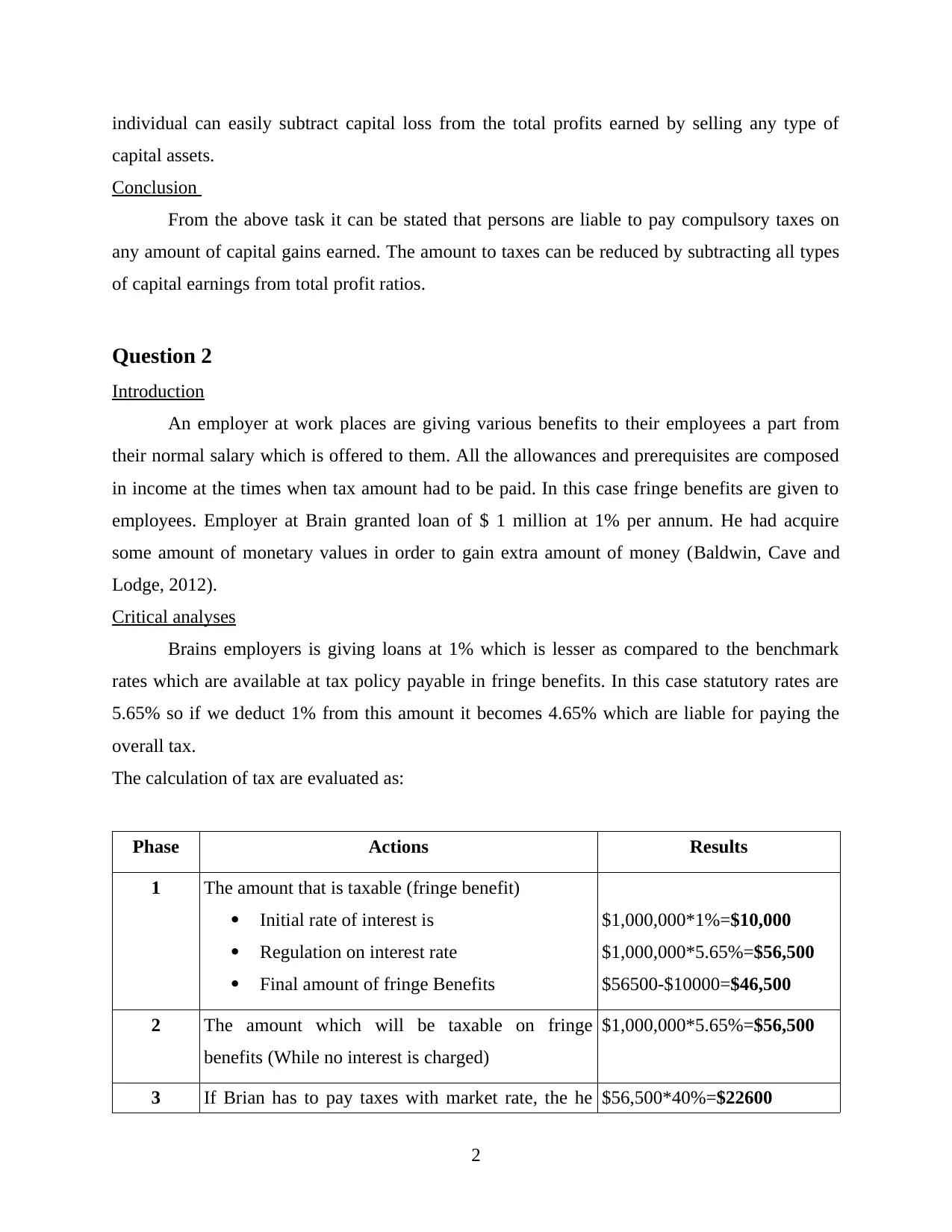

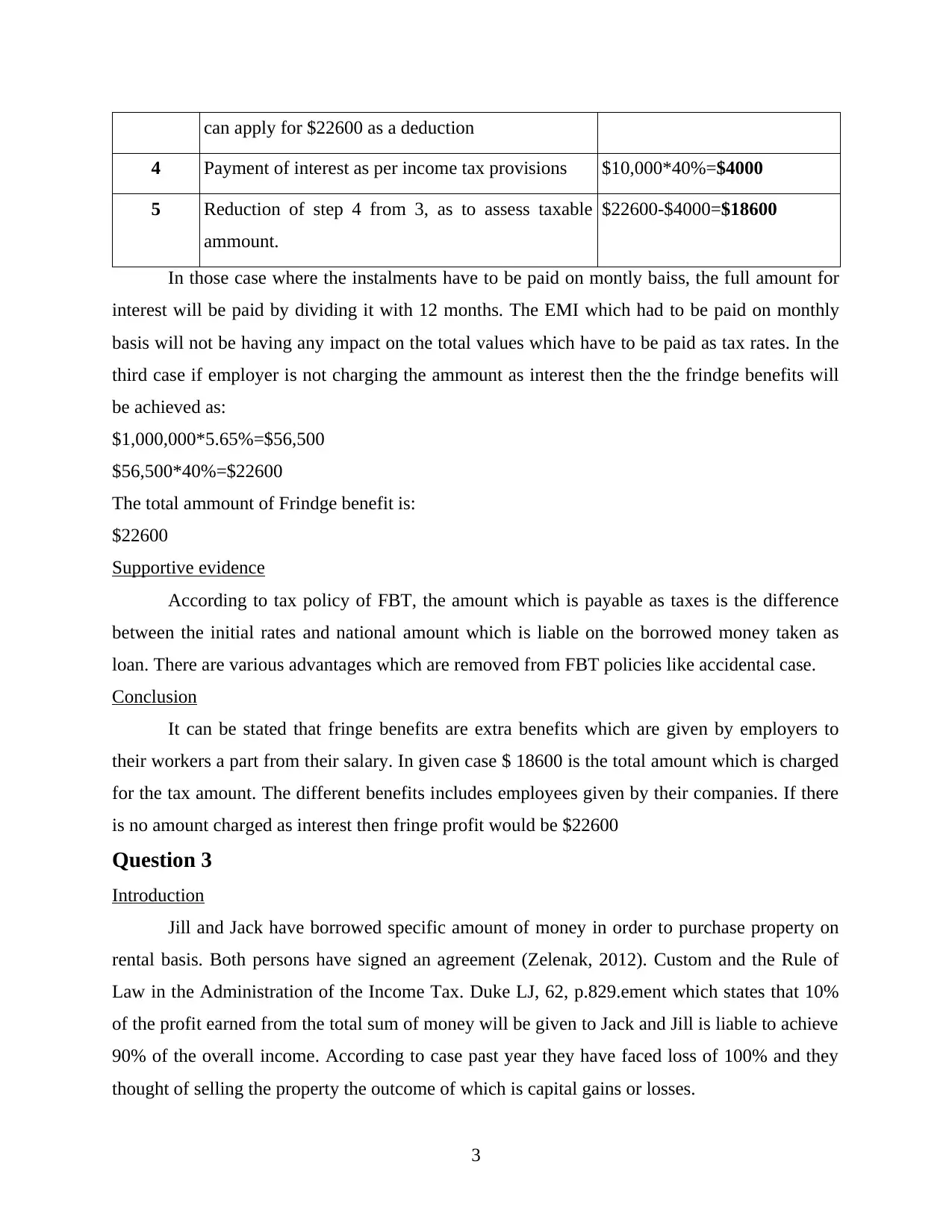

Critical analyses

Brains employers is giving loans at 1% which is lesser as compared to the benchmark

rates which are available at tax policy payable in fringe benefits. In this case statutory rates are

5.65% so if we deduct 1% from this amount it becomes 4.65% which are liable for paying the

overall tax.

The calculation of tax are evaluated as:

Phase Actions Results

1 The amount that is taxable (fringe benefit)

Initial rate of interest is

Regulation on interest rate

Final amount of fringe Benefits

$1,000,000*1%=$10,000

$1,000,000*5.65%=$56,500

$56500-$10000=$46,500

2 The amount which will be taxable on fringe

benefits (While no interest is charged)

$1,000,000*5.65%=$56,500

3 If Brian has to pay taxes with market rate, the he $56,500*40%=$22600

2

capital assets.

Conclusion

From the above task it can be stated that persons are liable to pay compulsory taxes on

any amount of capital gains earned. The amount to taxes can be reduced by subtracting all types

of capital earnings from total profit ratios.

Question 2

Introduction

An employer at work places are giving various benefits to their employees a part from

their normal salary which is offered to them. All the allowances and prerequisites are composed

in income at the times when tax amount had to be paid. In this case fringe benefits are given to

employees. Employer at Brain granted loan of $ 1 million at 1% per annum. He had acquire

some amount of monetary values in order to gain extra amount of money (Baldwin, Cave and

Lodge, 2012).

Critical analyses

Brains employers is giving loans at 1% which is lesser as compared to the benchmark

rates which are available at tax policy payable in fringe benefits. In this case statutory rates are

5.65% so if we deduct 1% from this amount it becomes 4.65% which are liable for paying the

overall tax.

The calculation of tax are evaluated as:

Phase Actions Results

1 The amount that is taxable (fringe benefit)

Initial rate of interest is

Regulation on interest rate

Final amount of fringe Benefits

$1,000,000*1%=$10,000

$1,000,000*5.65%=$56,500

$56500-$10000=$46,500

2 The amount which will be taxable on fringe

benefits (While no interest is charged)

$1,000,000*5.65%=$56,500

3 If Brian has to pay taxes with market rate, the he $56,500*40%=$22600

2

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

can apply for $22600 as a deduction

4 Payment of interest as per income tax provisions $10,000*40%=$4000

5 Reduction of step 4 from 3, as to assess taxable

ammount.

$22600-$4000=$18600

In those case where the instalments have to be paid on montly baiss, the full amount for

interest will be paid by dividing it with 12 months. The EMI which had to be paid on monthly

basis will not be having any impact on the total values which have to be paid as tax rates. In the

third case if employer is not charging the ammount as interest then the the frindge benefits will

be achieved as:

$1,000,000*5.65%=$56,500

$56,500*40%=$22600

The total ammount of Frindge benefit is:

$22600

Supportive evidence

According to tax policy of FBT, the amount which is payable as taxes is the difference

between the initial rates and national amount which is liable on the borrowed money taken as

loan. There are various advantages which are removed from FBT policies like accidental case.

Conclusion

It can be stated that fringe benefits are extra benefits which are given by employers to

their workers a part from their salary. In given case $ 18600 is the total amount which is charged

for the tax amount. The different benefits includes employees given by their companies. If there

is no amount charged as interest then fringe profit would be $22600

Question 3

Introduction

Jill and Jack have borrowed specific amount of money in order to purchase property on

rental basis. Both persons have signed an agreement (Zelenak, 2012). Custom and the Rule of

Law in the Administration of the Income Tax. Duke LJ, 62, p.829.ement which states that 10%

of the profit earned from the total sum of money will be given to Jack and Jill is liable to achieve

90% of the overall income. According to case past year they have faced loss of 100% and they

thought of selling the property the outcome of which is capital gains or losses.

3

4 Payment of interest as per income tax provisions $10,000*40%=$4000

5 Reduction of step 4 from 3, as to assess taxable

ammount.

$22600-$4000=$18600

In those case where the instalments have to be paid on montly baiss, the full amount for

interest will be paid by dividing it with 12 months. The EMI which had to be paid on monthly

basis will not be having any impact on the total values which have to be paid as tax rates. In the

third case if employer is not charging the ammount as interest then the the frindge benefits will

be achieved as:

$1,000,000*5.65%=$56,500

$56,500*40%=$22600

The total ammount of Frindge benefit is:

$22600

Supportive evidence

According to tax policy of FBT, the amount which is payable as taxes is the difference

between the initial rates and national amount which is liable on the borrowed money taken as

loan. There are various advantages which are removed from FBT policies like accidental case.

Conclusion

It can be stated that fringe benefits are extra benefits which are given by employers to

their workers a part from their salary. In given case $ 18600 is the total amount which is charged

for the tax amount. The different benefits includes employees given by their companies. If there

is no amount charged as interest then fringe profit would be $22600

Question 3

Introduction

Jill and Jack have borrowed specific amount of money in order to purchase property on

rental basis. Both persons have signed an agreement (Zelenak, 2012). Custom and the Rule of

Law in the Administration of the Income Tax. Duke LJ, 62, p.829.ement which states that 10%

of the profit earned from the total sum of money will be given to Jack and Jill is liable to achieve

90% of the overall income. According to case past year they have faced loss of 100% and they

thought of selling the property the outcome of which is capital gains or losses.

3

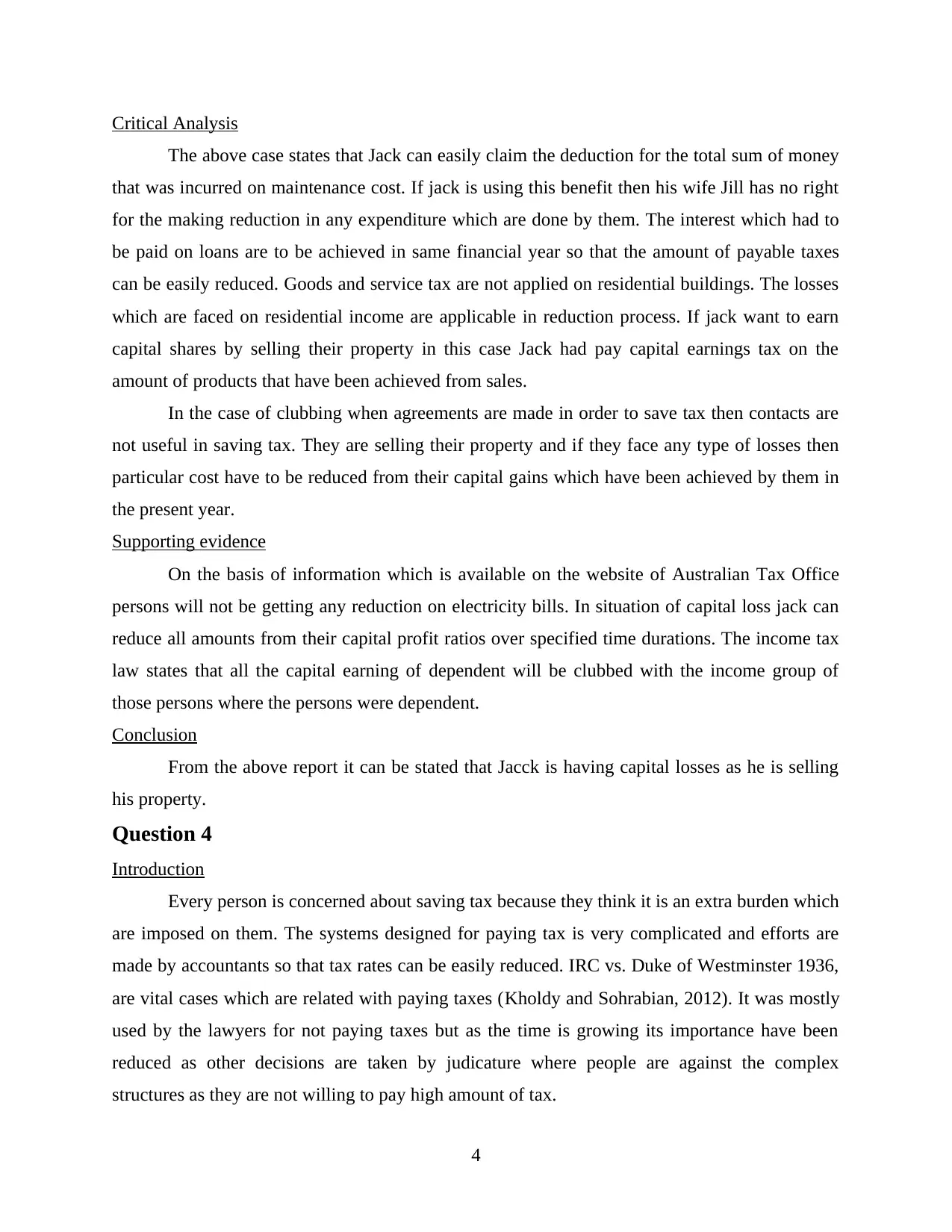

Critical Analysis

The above case states that Jack can easily claim the deduction for the total sum of money

that was incurred on maintenance cost. If jack is using this benefit then his wife Jill has no right

for the making reduction in any expenditure which are done by them. The interest which had to

be paid on loans are to be achieved in same financial year so that the amount of payable taxes

can be easily reduced. Goods and service tax are not applied on residential buildings. The losses

which are faced on residential income are applicable in reduction process. If jack want to earn

capital shares by selling their property in this case Jack had pay capital earnings tax on the

amount of products that have been achieved from sales.

In the case of clubbing when agreements are made in order to save tax then contacts are

not useful in saving tax. They are selling their property and if they face any type of losses then

particular cost have to be reduced from their capital gains which have been achieved by them in

the present year.

Supporting evidence

On the basis of information which is available on the website of Australian Tax Office

persons will not be getting any reduction on electricity bills. In situation of capital loss jack can

reduce all amounts from their capital profit ratios over specified time durations. The income tax

law states that all the capital earning of dependent will be clubbed with the income group of

those persons where the persons were dependent.

Conclusion

From the above report it can be stated that Jacck is having capital losses as he is selling

his property.

Question 4

Introduction

Every person is concerned about saving tax because they think it is an extra burden which

are imposed on them. The systems designed for paying tax is very complicated and efforts are

made by accountants so that tax rates can be easily reduced. IRC vs. Duke of Westminster 1936,

are vital cases which are related with paying taxes (Kholdy and Sohrabian, 2012). It was mostly

used by the lawyers for not paying taxes but as the time is growing its importance have been

reduced as other decisions are taken by judicature where people are against the complex

structures as they are not willing to pay high amount of tax.

4

The above case states that Jack can easily claim the deduction for the total sum of money

that was incurred on maintenance cost. If jack is using this benefit then his wife Jill has no right

for the making reduction in any expenditure which are done by them. The interest which had to

be paid on loans are to be achieved in same financial year so that the amount of payable taxes

can be easily reduced. Goods and service tax are not applied on residential buildings. The losses

which are faced on residential income are applicable in reduction process. If jack want to earn

capital shares by selling their property in this case Jack had pay capital earnings tax on the

amount of products that have been achieved from sales.

In the case of clubbing when agreements are made in order to save tax then contacts are

not useful in saving tax. They are selling their property and if they face any type of losses then

particular cost have to be reduced from their capital gains which have been achieved by them in

the present year.

Supporting evidence

On the basis of information which is available on the website of Australian Tax Office

persons will not be getting any reduction on electricity bills. In situation of capital loss jack can

reduce all amounts from their capital profit ratios over specified time durations. The income tax

law states that all the capital earning of dependent will be clubbed with the income group of

those persons where the persons were dependent.

Conclusion

From the above report it can be stated that Jacck is having capital losses as he is selling

his property.

Question 4

Introduction

Every person is concerned about saving tax because they think it is an extra burden which

are imposed on them. The systems designed for paying tax is very complicated and efforts are

made by accountants so that tax rates can be easily reduced. IRC vs. Duke of Westminster 1936,

are vital cases which are related with paying taxes (Kholdy and Sohrabian, 2012). It was mostly

used by the lawyers for not paying taxes but as the time is growing its importance have been

reduced as other decisions are taken by judicature where people are against the complex

structures as they are not willing to pay high amount of tax.

4

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Critical analyses

In case of IRC vs. Duke of Westminster [1936], Duke had elected a gardener for taking

care of his land where the plants were growing. Duke had signed an agreement with his worker

where he had agreed to pay him salary on monthly basis. He tried to find ways in order to reduce

the income tax so that his money could be saved. He was finding the structures of paying taxes

very complicated. Duke was not paying money to worker as he made an agreement rather he was

paying it on yearly basis in order to save tax. There was a case filed by IRC where they were

trying to say that Duke were finding ways in order to reduce their tax amount which is payable

by them. The judge gave his argument that if a person is finding ways in order to pay less tax

then IRC cannot force persons to pay higher tax (IRC vs. Duke of Westminster, 2017).

According to employment act of Australia Duke had top pay salary to his worker as was

stated in the agreement. At times avoiding taxes can also be a difficult task as persons are

misusing the laws.

Supporting evidence

The case implies the most important lawsuits while taxes are avoided. The judgement

given by Lord Tomlin were very much shocking for persons as they believe if persons are

finding ways to pay less tax then it is not against the law. According to principle of Ramsay if

persons are taking artificial steps which does not contains any purpose other then tax saving. In

this case person is libel to pay tax on whole transaction.

Conclusion

From the above report it can be concluded that if legal ways are adopted in order to

reduce taxes than it is not considered as a crime. In the present time saving taxes are most

difficult steps because different laws have been enacted by courts.

Question 5

Introduction

It is very difficult task to find out the amount which will be paid as tax while selling

timber. Most of the people were analysing it as income that is earned from agriculture while

other saw it as revenue generation activities. Bills of the owner of land which was covered with

palm trees. He want to clear the areas in order to graze his animals thus a company was

appointed who will take $1000 for clearing 100 meter

5

In case of IRC vs. Duke of Westminster [1936], Duke had elected a gardener for taking

care of his land where the plants were growing. Duke had signed an agreement with his worker

where he had agreed to pay him salary on monthly basis. He tried to find ways in order to reduce

the income tax so that his money could be saved. He was finding the structures of paying taxes

very complicated. Duke was not paying money to worker as he made an agreement rather he was

paying it on yearly basis in order to save tax. There was a case filed by IRC where they were

trying to say that Duke were finding ways in order to reduce their tax amount which is payable

by them. The judge gave his argument that if a person is finding ways in order to pay less tax

then IRC cannot force persons to pay higher tax (IRC vs. Duke of Westminster, 2017).

According to employment act of Australia Duke had top pay salary to his worker as was

stated in the agreement. At times avoiding taxes can also be a difficult task as persons are

misusing the laws.

Supporting evidence

The case implies the most important lawsuits while taxes are avoided. The judgement

given by Lord Tomlin were very much shocking for persons as they believe if persons are

finding ways to pay less tax then it is not against the law. According to principle of Ramsay if

persons are taking artificial steps which does not contains any purpose other then tax saving. In

this case person is libel to pay tax on whole transaction.

Conclusion

From the above report it can be concluded that if legal ways are adopted in order to

reduce taxes than it is not considered as a crime. In the present time saving taxes are most

difficult steps because different laws have been enacted by courts.

Question 5

Introduction

It is very difficult task to find out the amount which will be paid as tax while selling

timber. Most of the people were analysing it as income that is earned from agriculture while

other saw it as revenue generation activities. Bills of the owner of land which was covered with

palm trees. He want to clear the areas in order to graze his animals thus a company was

appointed who will take $1000 for clearing 100 meter

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Critical analyses

The income generated while selling timber trees will be counted as tax payable income.

Bill was paying amount to logging company for clearing the land. This is a profitable situation

for bill as his land would be cleared. He was doing business with company as he gave permission

to them to take timber with them. This will be counted under Loyalty as he is not cutting any

palm tree or selling it to another person. He had to pay lower taxes, thus achievement of capital

gains.

Supporting evidence

As stated under TR 95/6 if persons is allowing to cut trees and in return taking money

then it is counted in income of persons (Poore, 2013). The main focus of Bill was to clear land

and not to earn money so it is not counted as forest operations.

Conclusion

From the above it can be stated that if persons made a deal in order to clear land, then

income earned by selling trees are counted as forest operations.

6

The income generated while selling timber trees will be counted as tax payable income.

Bill was paying amount to logging company for clearing the land. This is a profitable situation

for bill as his land would be cleared. He was doing business with company as he gave permission

to them to take timber with them. This will be counted under Loyalty as he is not cutting any

palm tree or selling it to another person. He had to pay lower taxes, thus achievement of capital

gains.

Supporting evidence

As stated under TR 95/6 if persons is allowing to cut trees and in return taking money

then it is counted in income of persons (Poore, 2013). The main focus of Bill was to clear land

and not to earn money so it is not counted as forest operations.

Conclusion

From the above it can be stated that if persons made a deal in order to clear land, then

income earned by selling trees are counted as forest operations.

6

REFERENCES

Books and Journals

Antwi-Agyei, P. and et. al., 2012. Mapping the vulnerability of crop production to drought in

Ghana using rainfall, yield and socioeconomic data. Applied Geography. 32(2). pp.324-

334.

Baldwin, R., Cave, M. and Lodge, M., 2012. Understanding regulation: theory, strategy, and

practice. Oxford University Press on Demand

Bisong, A. and Rahman, M., 2011. An overview of the security concerns in enterprise cloud

computing. arXiv preprint arXiv:1101.5613.

Bodie, Z., 2013. Investments. McGraw-Hill.

Guenther, D.A., 2014. Measuring corporate tax avoidance: Effective tax rates and book-tax

differences.Browser Download This Paper.

Gutiérrez‐i‐Puigarnau, E. and Van Ommeren, J.N., 2011. Welfare Effects Of Distortionary

Fringe Benefits Taxation: The Case Of Employer‐Provided Cars. International

Economic Review. 52(4). pp.1105-1122.

Kholdy, S. and Sohrabian, A., 2011. Capital gain expectations and efficiency in the real estate

markets. Journal of Business & Economics Research (JBER). 6(4).

Poore, D., 2013. No timber without trees: sustainability in the tropical forest. Routledge.

Rana, N.A. and Haltiwanger, R.S., 2011. Fringe benefits: functional and structural impacts of O-

glycosylation on the extracellular domain of Notch receptors. Current opinion in

structural biology. 21(5). pp.583-589.

Zelenak, L., 2012. Custom and the Rule of Law in the Administration of the Income Tax. Duke

LJ. 62. p.829

Online

IRC vs. Duke of Westminster. 2017. [Online]. Available Through:

<https://www.taxinsider.co.uk/680What_is_The_Difference_Between_Tax_Avoidance_

and_Tax_Evasion.html>. [Accessed On 19th September 2017].

7

Books and Journals

Antwi-Agyei, P. and et. al., 2012. Mapping the vulnerability of crop production to drought in

Ghana using rainfall, yield and socioeconomic data. Applied Geography. 32(2). pp.324-

334.

Baldwin, R., Cave, M. and Lodge, M., 2012. Understanding regulation: theory, strategy, and

practice. Oxford University Press on Demand

Bisong, A. and Rahman, M., 2011. An overview of the security concerns in enterprise cloud

computing. arXiv preprint arXiv:1101.5613.

Bodie, Z., 2013. Investments. McGraw-Hill.

Guenther, D.A., 2014. Measuring corporate tax avoidance: Effective tax rates and book-tax

differences.Browser Download This Paper.

Gutiérrez‐i‐Puigarnau, E. and Van Ommeren, J.N., 2011. Welfare Effects Of Distortionary

Fringe Benefits Taxation: The Case Of Employer‐Provided Cars. International

Economic Review. 52(4). pp.1105-1122.

Kholdy, S. and Sohrabian, A., 2011. Capital gain expectations and efficiency in the real estate

markets. Journal of Business & Economics Research (JBER). 6(4).

Poore, D., 2013. No timber without trees: sustainability in the tropical forest. Routledge.

Rana, N.A. and Haltiwanger, R.S., 2011. Fringe benefits: functional and structural impacts of O-

glycosylation on the extracellular domain of Notch receptors. Current opinion in

structural biology. 21(5). pp.583-589.

Zelenak, L., 2012. Custom and the Rule of Law in the Administration of the Income Tax. Duke

LJ. 62. p.829

Online

IRC vs. Duke of Westminster. 2017. [Online]. Available Through:

<https://www.taxinsider.co.uk/680What_is_The_Difference_Between_Tax_Avoidance_

and_Tax_Evasion.html>. [Accessed On 19th September 2017].

7

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 9

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.