Taxation Theory Practice and Law: Client Tax Analysis Report

VerifiedAdded on 2021/01/02

|16

|3313

|128

Report

AI Summary

This report provides a detailed analysis of taxation theory, specifically focusing on Capital Gains Tax (CGT) and Fringe Benefit Tax (FBT) in the Australian context. The report begins by defining CGT and its application to capital gains from the disposal of assets, including the indexation and discount methods. It analyzes the tax consequences of various assets, such as vacant land, an antique bed, a painting, shares, and a violin, calculating capital gains or losses for each. The report then addresses Fringe Benefit Tax (FBT) with examples like a car provided to an employee and FBT charged on goods sold at low cost. The analysis includes calculations of taxable amounts and suggestions for claiming exemptions to reduce tax liabilities. The report uses tables and interpretations to illustrate the tax implications of different scenarios. The report concludes with a comprehensive overview of the client's tax position, summarizing capital gains and losses and the resulting net taxable gains.

Taxation Theory

Practice and Law

Practice and Law

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TABLE OF CONTENTS

INTRODUCTION...........................................................................................................................1

QUESTION 1...................................................................................................................................1

Analysing net capital gain and losses of client as on 30th June 2017..........................................1

QUESTION 2.................................................................................................................................10

Car provided to employee.........................................................................................................10

Fringe Benefit as Loan..............................................................................................................11

FBT charged on goods sold to Jasmine at low cost..................................................................12

CONCLUSION..............................................................................................................................13

REFERENCES..............................................................................................................................14

INTRODUCTION...........................................................................................................................1

QUESTION 1...................................................................................................................................1

Analysing net capital gain and losses of client as on 30th June 2017..........................................1

QUESTION 2.................................................................................................................................10

Car provided to employee.........................................................................................................10

Fringe Benefit as Loan..............................................................................................................11

FBT charged on goods sold to Jasmine at low cost..................................................................12

CONCLUSION..............................................................................................................................13

REFERENCES..............................................................................................................................14

INTRODUCTION

Taxation in an economy plays main role for the growth, development and bringing capital

stability in global market. Thus, it is necessary that one country must have a well-managed and

governed taxation office. In the present report, there will be discussion based on various tax

consequences such as Capital Gains Tax (CGT) and Fringe benefit Tax (FBT) which were being

analysed for determining the income tax. Thus, it has been imposed by federal government on

the taxable income from organisation or citizens in Australia. Moreover, after analysing taxable

determination, there will be suggestions and advices will be presented to clients for claiming

exemptions and reducing the taxable liabilities.

QUESTION 1

Analysing net capital gain and losses of client as on 30th June 2017

Capital Gain Tax:

Capital Gains Tax (CGT) is generally applied to capital gain which is prepared for asset's

disposal in context of specific exemptions. It has been operated through treating capital gains as

income which is taxable in tax year where asset is disposed of or sold. The losses could be easily

offset but not in favour of capital gains (Edmonds, 2015). The net capital losses in specific tax

year could not be offset against income (normal) but might be carried forward.

Moreover, this is a gain which has been obtained by an individual with respect to

acquisition and disposing of any asset. Thus, the costs of purchasing an asset as well as make

them sell on different amount will bring the gain or losses through such transaction. Thus, it can

be analysed and levied on various assets such as real estate property, personal and capital assets,

etc. There have been various provisions and norms which were being awarded by Australian

Taxation office which have reflected the positive outcomes (Burkhauser, 2015). In addition,

these gains will be charged and payable by an individual as these are the part of income tax.

Moreover, CGT in Australia will be comprised of 3 methods such as:

Indexation Method:

This provision was made on 21st September 1999 that reflects if an asset which was being

purchased after this date and will be disposed-off after completing period of 12 months than it

will be charged on indexation basis. It will be by increasing the cost base as applicable in the

indexation factor that has been based on consumer price index till September, 1999.

1

Taxation in an economy plays main role for the growth, development and bringing capital

stability in global market. Thus, it is necessary that one country must have a well-managed and

governed taxation office. In the present report, there will be discussion based on various tax

consequences such as Capital Gains Tax (CGT) and Fringe benefit Tax (FBT) which were being

analysed for determining the income tax. Thus, it has been imposed by federal government on

the taxable income from organisation or citizens in Australia. Moreover, after analysing taxable

determination, there will be suggestions and advices will be presented to clients for claiming

exemptions and reducing the taxable liabilities.

QUESTION 1

Analysing net capital gain and losses of client as on 30th June 2017

Capital Gain Tax:

Capital Gains Tax (CGT) is generally applied to capital gain which is prepared for asset's

disposal in context of specific exemptions. It has been operated through treating capital gains as

income which is taxable in tax year where asset is disposed of or sold. The losses could be easily

offset but not in favour of capital gains (Edmonds, 2015). The net capital losses in specific tax

year could not be offset against income (normal) but might be carried forward.

Moreover, this is a gain which has been obtained by an individual with respect to

acquisition and disposing of any asset. Thus, the costs of purchasing an asset as well as make

them sell on different amount will bring the gain or losses through such transaction. Thus, it can

be analysed and levied on various assets such as real estate property, personal and capital assets,

etc. There have been various provisions and norms which were being awarded by Australian

Taxation office which have reflected the positive outcomes (Burkhauser, 2015). In addition,

these gains will be charged and payable by an individual as these are the part of income tax.

Moreover, CGT in Australia will be comprised of 3 methods such as:

Indexation Method:

This provision was made on 21st September 1999 that reflects if an asset which was being

purchased after this date and will be disposed-off after completing period of 12 months than it

will be charged on indexation basis. It will be by increasing the cost base as applicable in the

indexation factor that has been based on consumer price index till September, 1999.

1

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Discount Method:

This method will be applicable on assets which were being hold by an owner more than

the period of 12 months (Evans, 2015). In this, the gain of losses derived after disposing off an

asset will be 50% discounted. Therefore, on this, an individual has to make payments of 33.33%

of taxable liabilities.

Other method:

Calculation has been levied on the assets which were hold by an owner for less than 12

months of period as this took cost base away from the sale price (tax, 2018).

With reference to sell real estate, shares and properties where capital losses and gains are

directly listed on return of income tax are identified. All taxes were identified and beneficial for

appropriate administration of losses and gains. The provision of 20th September 1985 has

influenced for insisting about not levying any charges on personal asset. Hence, there are various

exemptions such as home, car and furniture for personal application. It will not be providing any

allowances on the basis of asset's depreciation along with fittings and furniture associated with

rental property. In the same context, items are listed below and different analysis of CGT tax are

identified with different assets such as bed, violin, shares and land.

(a) Block of Vacant Land

2

This method will be applicable on assets which were being hold by an owner more than

the period of 12 months (Evans, 2015). In this, the gain of losses derived after disposing off an

asset will be 50% discounted. Therefore, on this, an individual has to make payments of 33.33%

of taxable liabilities.

Other method:

Calculation has been levied on the assets which were hold by an owner for less than 12

months of period as this took cost base away from the sale price (tax, 2018).

With reference to sell real estate, shares and properties where capital losses and gains are

directly listed on return of income tax are identified. All taxes were identified and beneficial for

appropriate administration of losses and gains. The provision of 20th September 1985 has

influenced for insisting about not levying any charges on personal asset. Hence, there are various

exemptions such as home, car and furniture for personal application. It will not be providing any

allowances on the basis of asset's depreciation along with fittings and furniture associated with

rental property. In the same context, items are listed below and different analysis of CGT tax are

identified with different assets such as bed, violin, shares and land.

(a) Block of Vacant Land

2

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

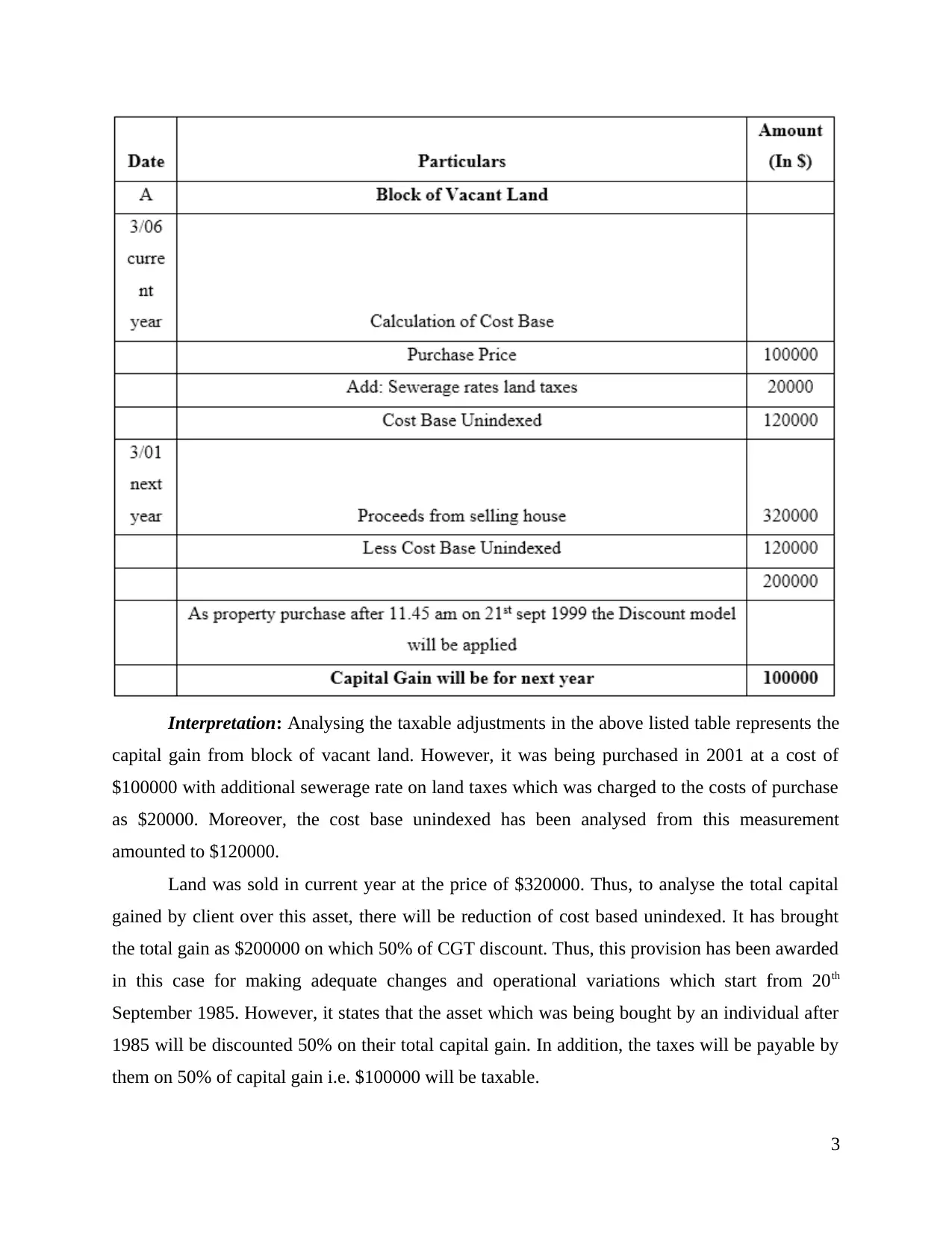

Interpretation: Analysing the taxable adjustments in the above listed table represents the

capital gain from block of vacant land. However, it was being purchased in 2001 at a cost of

$100000 with additional sewerage rate on land taxes which was charged to the costs of purchase

as $20000. Moreover, the cost base unindexed has been analysed from this measurement

amounted to $120000.

Land was sold in current year at the price of $320000. Thus, to analyse the total capital

gained by client over this asset, there will be reduction of cost based unindexed. It has brought

the total gain as $200000 on which 50% of CGT discount. Thus, this provision has been awarded

in this case for making adequate changes and operational variations which start from 20th

September 1985. However, it states that the asset which was being bought by an individual after

1985 will be discounted 50% on their total capital gain. In addition, the taxes will be payable by

them on 50% of capital gain i.e. $100000 will be taxable.

3

capital gain from block of vacant land. However, it was being purchased in 2001 at a cost of

$100000 with additional sewerage rate on land taxes which was charged to the costs of purchase

as $20000. Moreover, the cost base unindexed has been analysed from this measurement

amounted to $120000.

Land was sold in current year at the price of $320000. Thus, to analyse the total capital

gained by client over this asset, there will be reduction of cost based unindexed. It has brought

the total gain as $200000 on which 50% of CGT discount. Thus, this provision has been awarded

in this case for making adequate changes and operational variations which start from 20th

September 1985. However, it states that the asset which was being bought by an individual after

1985 will be discounted 50% on their total capital gain. In addition, the taxes will be payable by

them on 50% of capital gain i.e. $100000 will be taxable.

3

(b) Antique bed

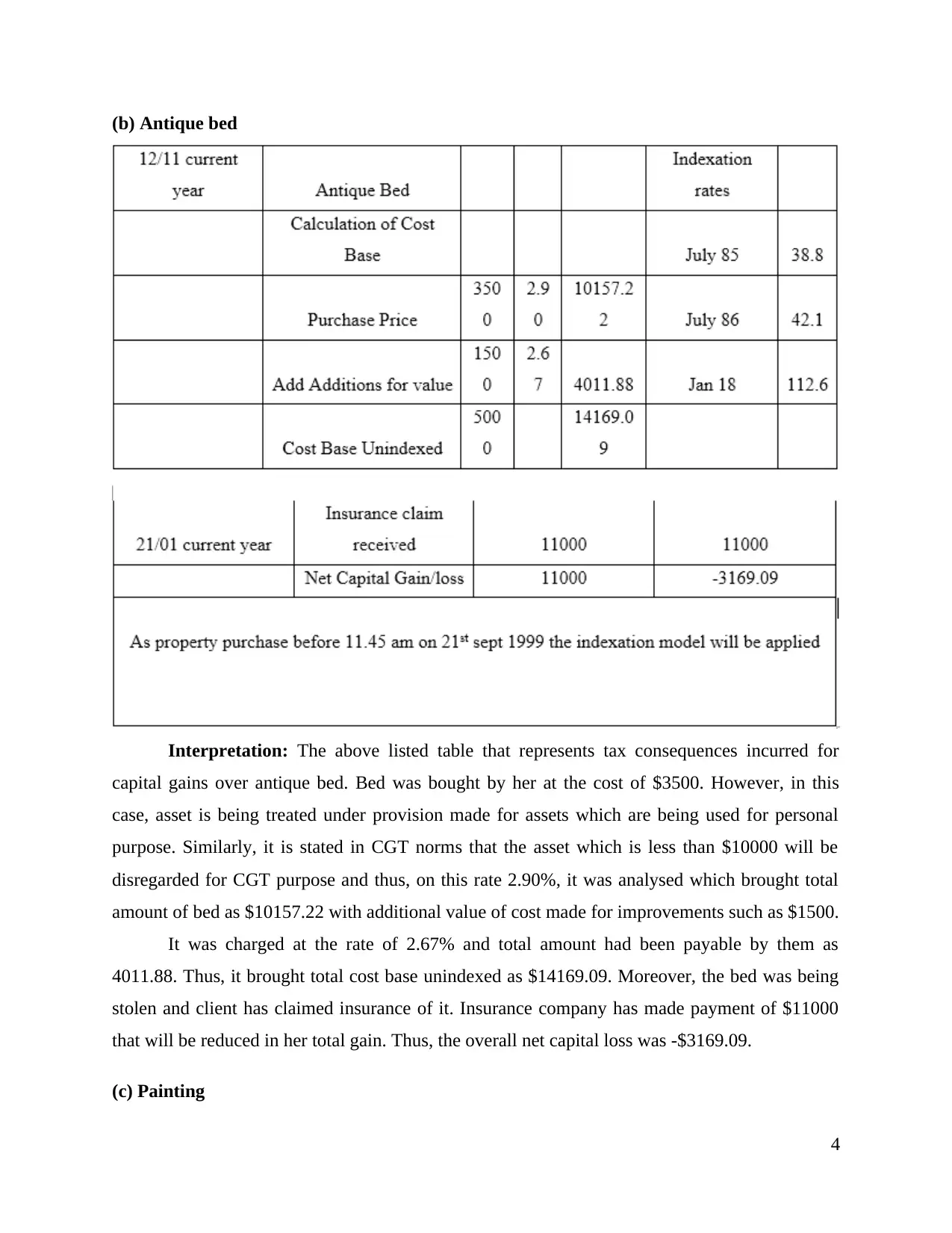

Interpretation: The above listed table that represents tax consequences incurred for

capital gains over antique bed. Bed was bought by her at the cost of $3500. However, in this

case, asset is being treated under provision made for assets which are being used for personal

purpose. Similarly, it is stated in CGT norms that the asset which is less than $10000 will be

disregarded for CGT purpose and thus, on this rate 2.90%, it was analysed which brought total

amount of bed as $10157.22 with additional value of cost made for improvements such as $1500.

It was charged at the rate of 2.67% and total amount had been payable by them as

4011.88. Thus, it brought total cost base unindexed as $14169.09. Moreover, the bed was being

stolen and client has claimed insurance of it. Insurance company has made payment of $11000

that will be reduced in her total gain. Thus, the overall net capital loss was -$3169.09.

(c) Painting

4

Interpretation: The above listed table that represents tax consequences incurred for

capital gains over antique bed. Bed was bought by her at the cost of $3500. However, in this

case, asset is being treated under provision made for assets which are being used for personal

purpose. Similarly, it is stated in CGT norms that the asset which is less than $10000 will be

disregarded for CGT purpose and thus, on this rate 2.90%, it was analysed which brought total

amount of bed as $10157.22 with additional value of cost made for improvements such as $1500.

It was charged at the rate of 2.67% and total amount had been payable by them as

4011.88. Thus, it brought total cost base unindexed as $14169.09. Moreover, the bed was being

stolen and client has claimed insurance of it. Insurance company has made payment of $11000

that will be reduced in her total gain. Thus, the overall net capital loss was -$3169.09.

(c) Painting

4

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

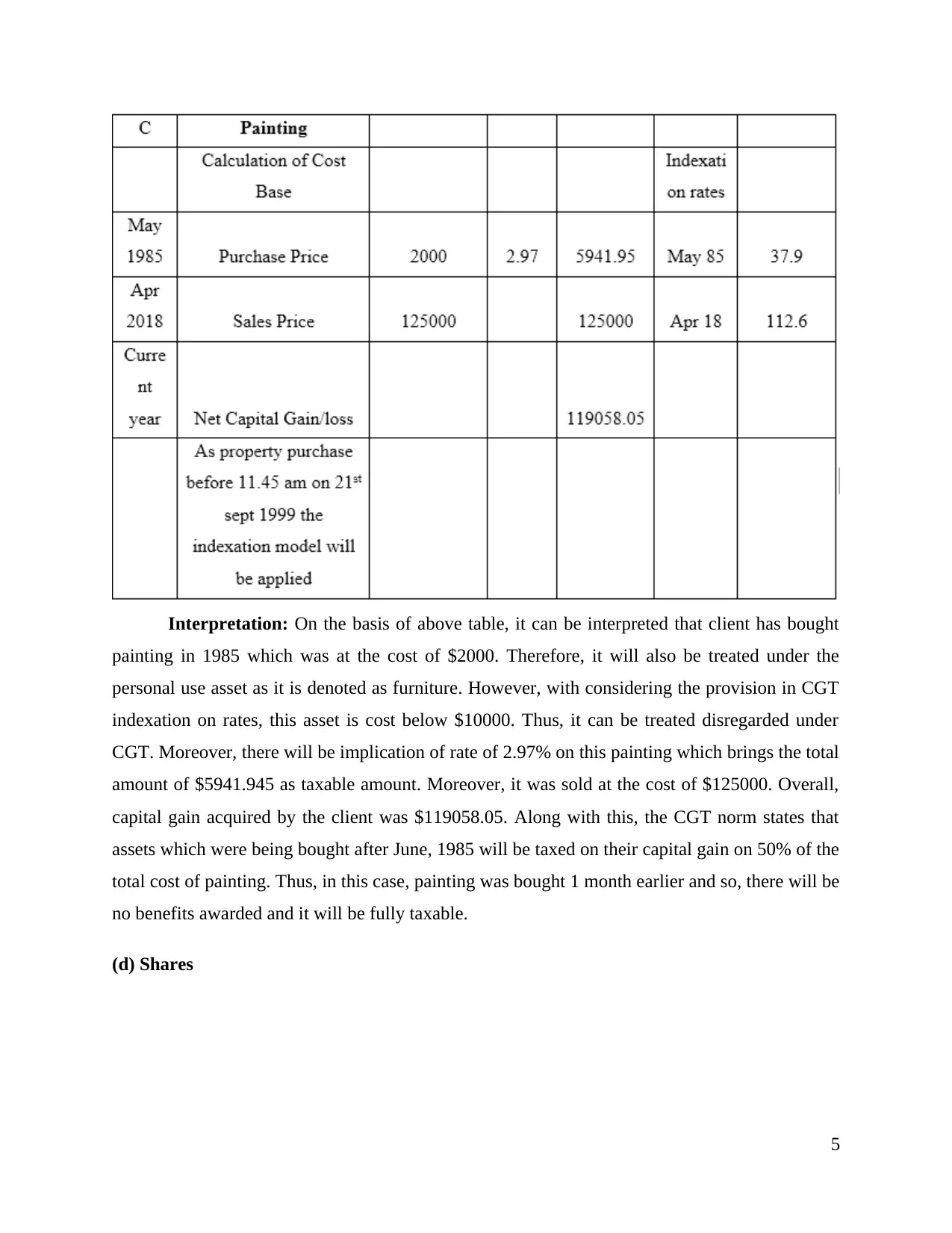

Interpretation: On the basis of above table, it can be interpreted that client has bought

painting in 1985 which was at the cost of $2000. Therefore, it will also be treated under the

personal use asset as it is denoted as furniture. However, with considering the provision in CGT

indexation on rates, this asset is cost below $10000. Thus, it can be treated disregarded under

CGT. Moreover, there will be implication of rate of 2.97% on this painting which brings the total

amount of $5941.945 as taxable amount. Moreover, it was sold at the cost of $125000. Overall,

capital gain acquired by the client was $119058.05. Along with this, the CGT norm states that

assets which were being bought after June, 1985 will be taxed on their capital gain on 50% of the

total cost of painting. Thus, in this case, painting was bought 1 month earlier and so, there will be

no benefits awarded and it will be fully taxable.

(d) Shares

5

painting in 1985 which was at the cost of $2000. Therefore, it will also be treated under the

personal use asset as it is denoted as furniture. However, with considering the provision in CGT

indexation on rates, this asset is cost below $10000. Thus, it can be treated disregarded under

CGT. Moreover, there will be implication of rate of 2.97% on this painting which brings the total

amount of $5941.945 as taxable amount. Moreover, it was sold at the cost of $125000. Overall,

capital gain acquired by the client was $119058.05. Along with this, the CGT norm states that

assets which were being bought after June, 1985 will be taxed on their capital gain on 50% of the

total cost of painting. Thus, in this case, painting was bought 1 month earlier and so, there will be

no benefits awarded and it will be fully taxable.

(d) Shares

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

6

7

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

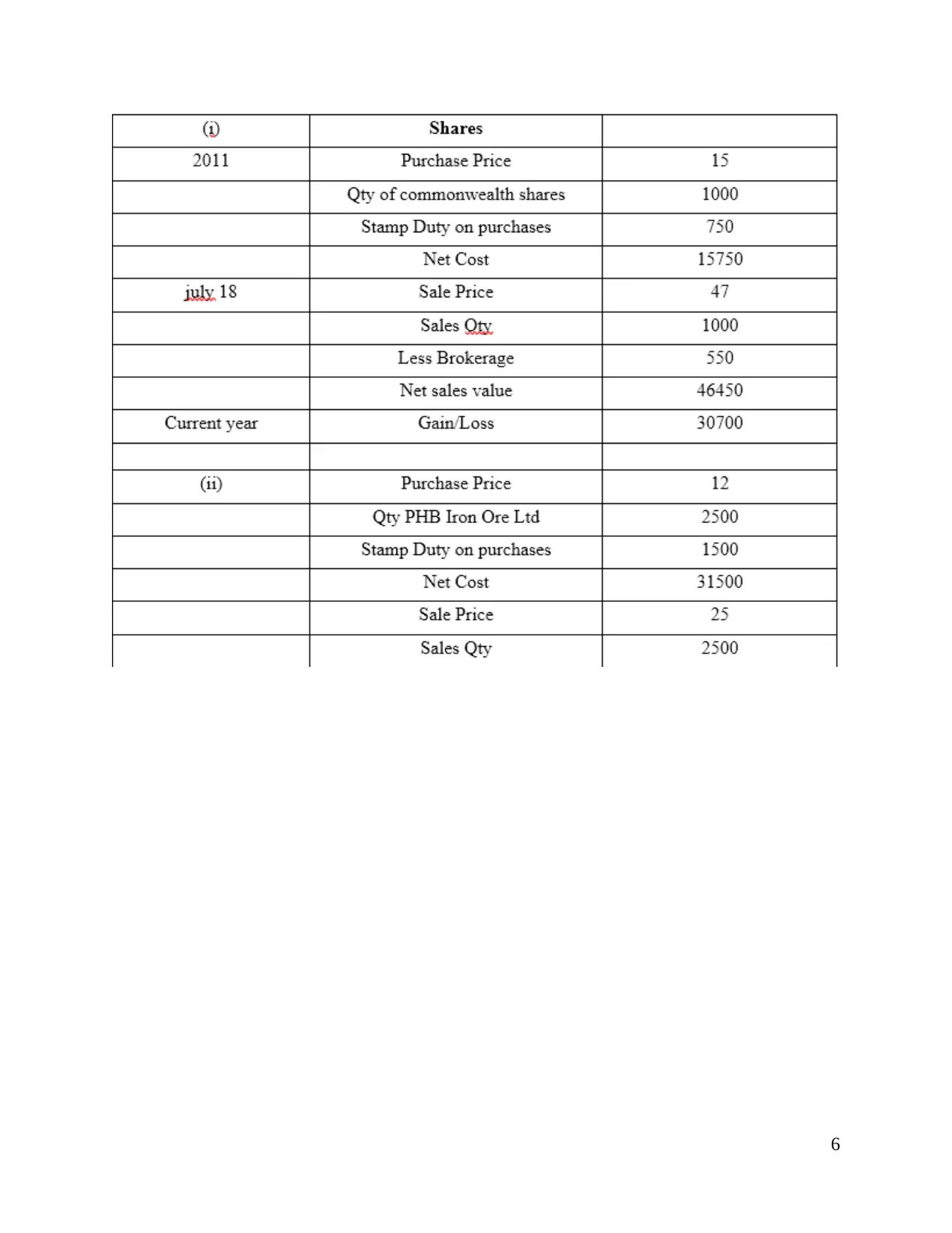

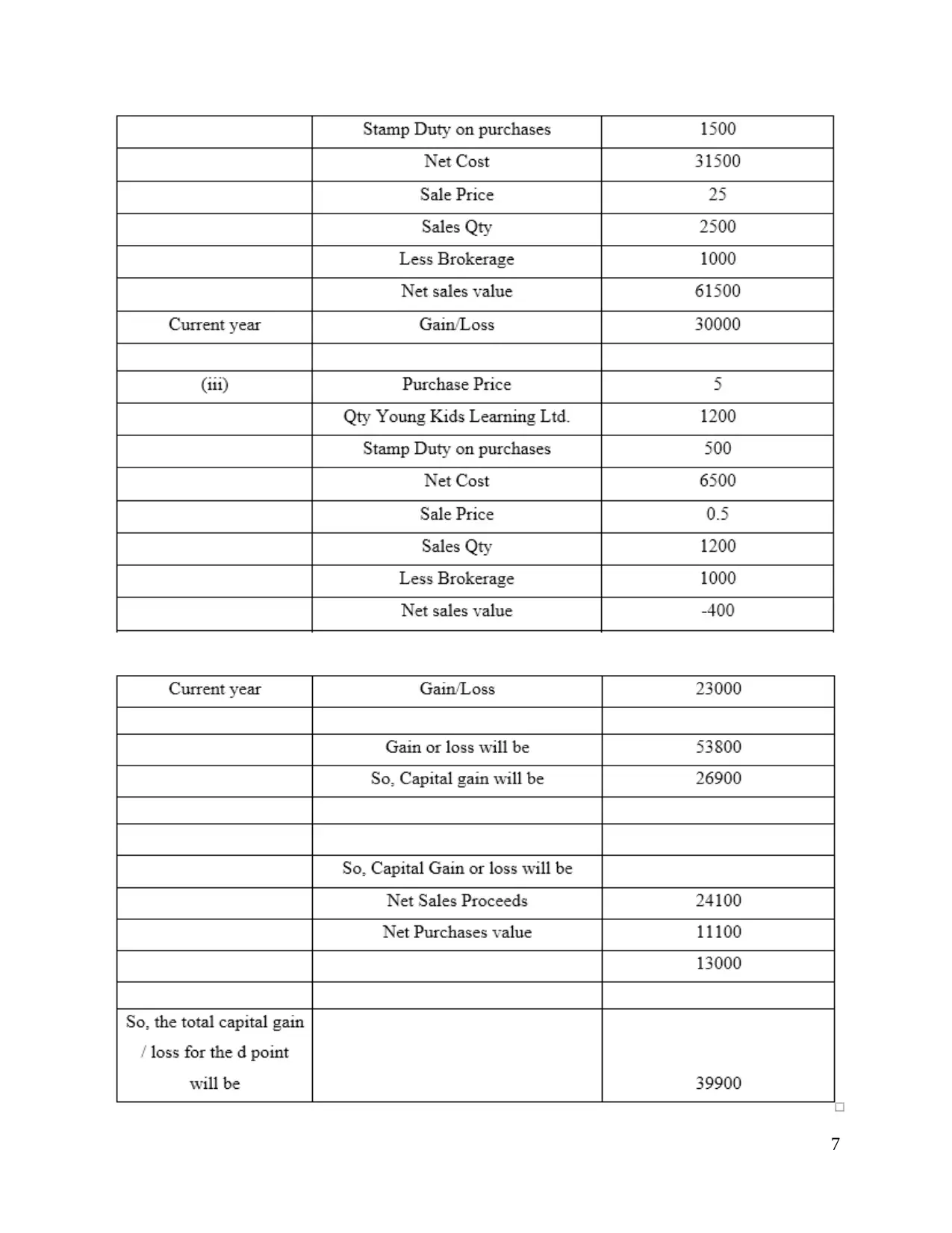

Interpretation: On the basis of above listed analysis, it can be said that Client has bought

4 shares on different rates and time. 1000 shares of commonwealth have been bought by her at

the rate of $15 per share which was amounted to $15000. This share has been charged

additionally with the stamp duty of $750 that brought the total purchase cost of this capital asset

as $15750. Moreover, these shares were being sold at the rate $47 which were amounted to

$47000. There has been reduction of $550 as the brokerage cost. Total selling cost was of

$46450 which was being analysed for making the adequate operational determination. Thus, total

gain on the sale on these shares was $30700.

In relation with this, PHB Iron Ore Ltd 2500 shares were purchased at the rate of $12.

Therefore, it was amounted to $30000 on which stamp duty has been paid by her of $1500.

Moreover, total net cost on the purchase on these shares was $31500. These shares were sold by

her at the rate of $25 amounted to $62500 with reducing brokerage fees paid by her as $1000.

Further, the overall net gain on these shares was $30000.

On the other side, 1200 shares of Young Kids Learning Ltd at the rate of $5 per share

was amounted at $6000. The stamp duty has been paid by her amounted to $500 which brought

total purchasing cost of $6500. Moreover, it was sold at the loss for $0.5 and thus, total amount

of shares was sold as $600 on which she had paid the brokerage fee of $1000 which defined net

loss at the sale amounted to -$400. In relation with analysing the outcomes, it insists that there

was total capital loss of -$6900.

There were 10000 marketable securities of Share Build Ltd which have been purchased at

the cost of $1 along with the stamp duty amounted to $1100. Therefore, net purchase cost of

these shares was 11100. These were sold by her at the rate of $2.5 each which was amounted to

$25000. She has made payment of $900 as brokerage fees on these shares and therefore, the total

capital has been collected on these shares was $23000.

However, as per summing up overall gains and losses made on these shares were $53800.

Thus, as per considering provision or norms stated under CGT is that taxes will be levied on 50%

of the total gains retained by an individual on a particular asset which were being bought after

1985. Thus, in this case, share was being sold by her within 12 months of period which

determines total gain of $26900. It had been sold by her at the amount of $24100 that brought

total cost of $13000. However, with considering such provision, total capital gain over these

shares was $39900.

8

4 shares on different rates and time. 1000 shares of commonwealth have been bought by her at

the rate of $15 per share which was amounted to $15000. This share has been charged

additionally with the stamp duty of $750 that brought the total purchase cost of this capital asset

as $15750. Moreover, these shares were being sold at the rate $47 which were amounted to

$47000. There has been reduction of $550 as the brokerage cost. Total selling cost was of

$46450 which was being analysed for making the adequate operational determination. Thus, total

gain on the sale on these shares was $30700.

In relation with this, PHB Iron Ore Ltd 2500 shares were purchased at the rate of $12.

Therefore, it was amounted to $30000 on which stamp duty has been paid by her of $1500.

Moreover, total net cost on the purchase on these shares was $31500. These shares were sold by

her at the rate of $25 amounted to $62500 with reducing brokerage fees paid by her as $1000.

Further, the overall net gain on these shares was $30000.

On the other side, 1200 shares of Young Kids Learning Ltd at the rate of $5 per share

was amounted at $6000. The stamp duty has been paid by her amounted to $500 which brought

total purchasing cost of $6500. Moreover, it was sold at the loss for $0.5 and thus, total amount

of shares was sold as $600 on which she had paid the brokerage fee of $1000 which defined net

loss at the sale amounted to -$400. In relation with analysing the outcomes, it insists that there

was total capital loss of -$6900.

There were 10000 marketable securities of Share Build Ltd which have been purchased at

the cost of $1 along with the stamp duty amounted to $1100. Therefore, net purchase cost of

these shares was 11100. These were sold by her at the rate of $2.5 each which was amounted to

$25000. She has made payment of $900 as brokerage fees on these shares and therefore, the total

capital has been collected on these shares was $23000.

However, as per summing up overall gains and losses made on these shares were $53800.

Thus, as per considering provision or norms stated under CGT is that taxes will be levied on 50%

of the total gains retained by an individual on a particular asset which were being bought after

1985. Thus, in this case, share was being sold by her within 12 months of period which

determines total gain of $26900. It had been sold by her at the amount of $24100 that brought

total cost of $13000. However, with considering such provision, total capital gain over these

shares was $39900.

8

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

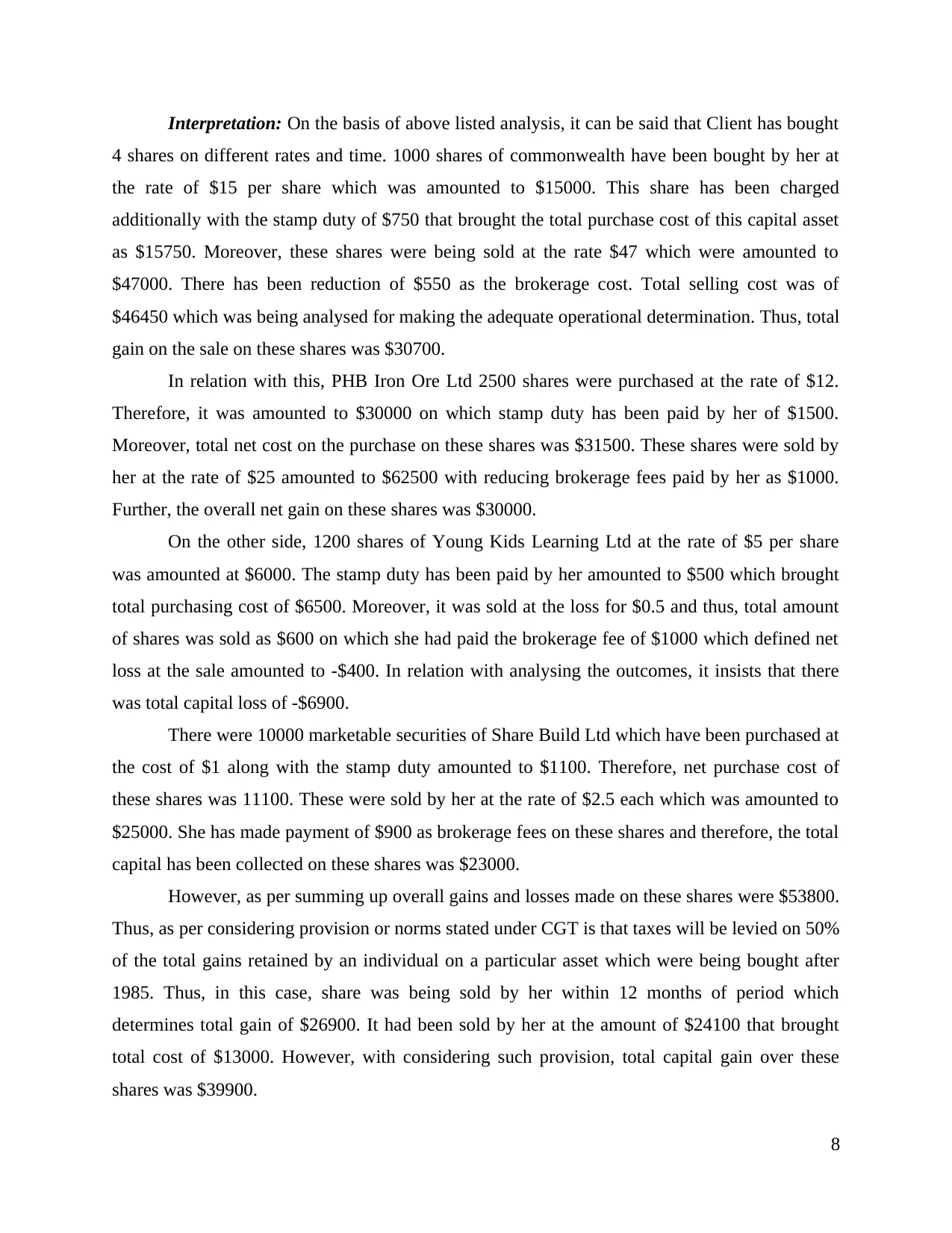

(e) Violin

Interpretation: By considering the above listed adjustments, client has bought a violin at

cost of $5500 which has been denoted as personal use of asset. Thus, the cost of violin is below

$10000 which is degraded in CGT norms. Moreover, it will be charged taxable on the rate of

1.65% that amounts to $9093.98. It was sold at the amount of $12000. Moreover, the total capital

gain has been analysed on this asset as $2906.02 respectively.

Total capital gain tax analysis:

9

Interpretation: By considering the above listed adjustments, client has bought a violin at

cost of $5500 which has been denoted as personal use of asset. Thus, the cost of violin is below

$10000 which is degraded in CGT norms. Moreover, it will be charged taxable on the rate of

1.65% that amounts to $9093.98. It was sold at the amount of $12000. Moreover, the total capital

gain has been analysed on this asset as $2906.02 respectively.

Total capital gain tax analysis:

9

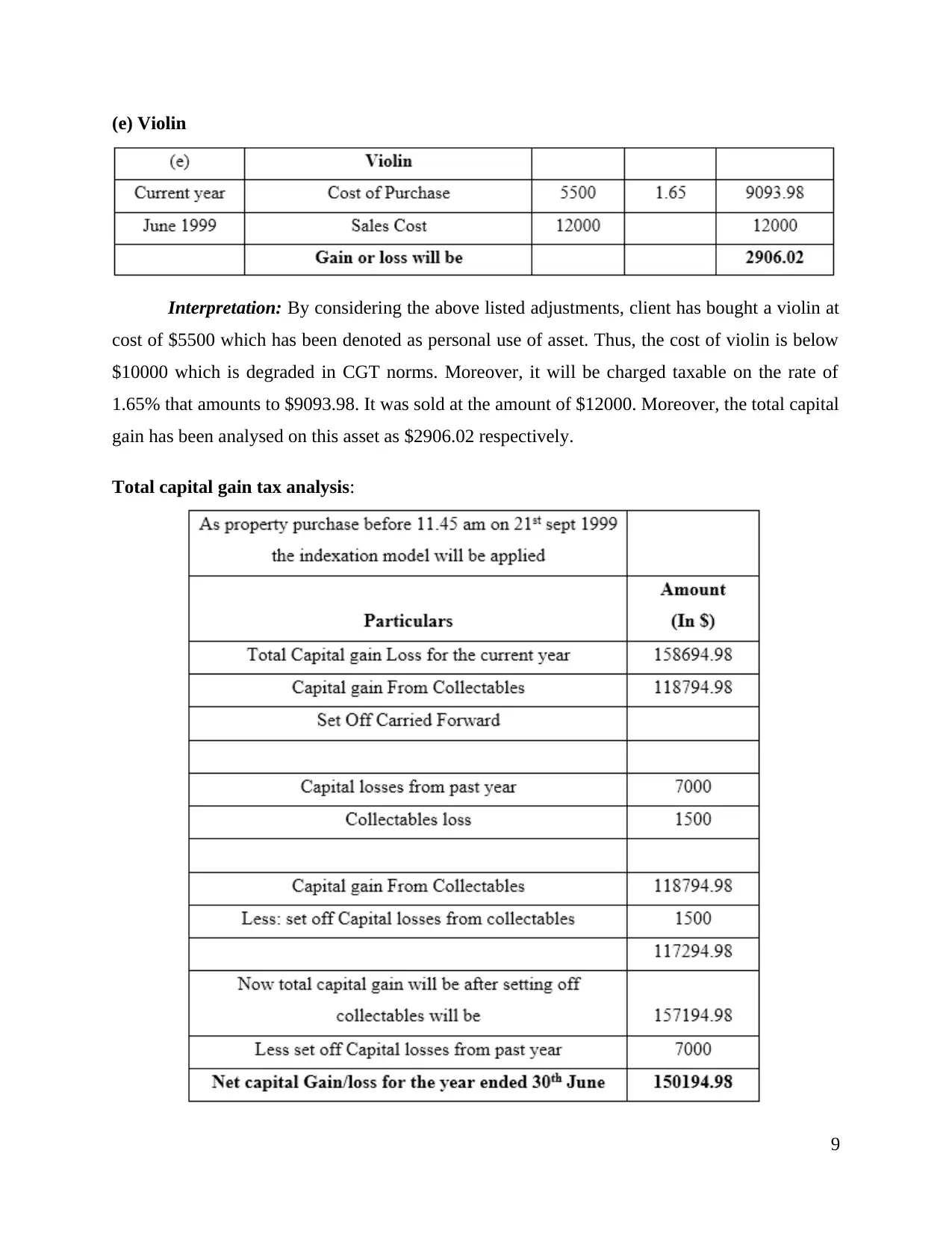

Interpretation: In relation with analysing capital gains and losses incurred by purchasing

and selling assets of client in current year. After analysing individual indexation of earnings, the

total gains derived from all assets was $158694.98, capital gain from collectables are amounted

to $118794.98 which were being set off and carried forward. Moreover, there was loss on such

assets amounted to $7000 and the collectable losses of amount $1500.

As per analysing the total taxable gain which will be paid by client in current year were

being analysed. Capital gains from collectables has been analysed as $118794.98 which was

adjusted in terms of reducing the set off capital losses from collectables amounted to $1500.

Thus, the total amount that has been analysed here was $117294.98. Thus, after setting off

collectables, the total capital was $157194.98. To analyse the net capital gains obtained by

individual in current years was analysed after reducing set off capital losses from past year such

as $7000. Net gains earned on such assets were amounted to $150194.98.

QUESTION 2

Car provided to employee

(a)

There is manufacturer of Electric Heater known as Rapid Heat Pty Ltd. who has been

providing Fringe Benefits to employees. They are providing different benefits to employee

which are chargeable to Fringe Benefit Tax Act 1986.

Section 7 of FBTA states that any motor vehicle that has been provided as benefit to

employee will not be treated for business use if vehicle has not been parked in business premises

and had parked in the house of employee. The definition of motor vehicle has been provided

under this act:

1. Motor cars, Station Wagons, Vans, etc.

2. Vehicle that is having goods carrying capacity should not be more than 1 tonne.

3. Car must not carry passengers more than 9.

The Fringe Benefit Tax act provides different methods to calculate chargeable FBT:

1. Cost Method: It states that actual value will be shown as gross taxable value.

2. Statutory Method: Gross taxable value will not be shown as actual value as fringe

benefits

10

and selling assets of client in current year. After analysing individual indexation of earnings, the

total gains derived from all assets was $158694.98, capital gain from collectables are amounted

to $118794.98 which were being set off and carried forward. Moreover, there was loss on such

assets amounted to $7000 and the collectable losses of amount $1500.

As per analysing the total taxable gain which will be paid by client in current year were

being analysed. Capital gains from collectables has been analysed as $118794.98 which was

adjusted in terms of reducing the set off capital losses from collectables amounted to $1500.

Thus, the total amount that has been analysed here was $117294.98. Thus, after setting off

collectables, the total capital was $157194.98. To analyse the net capital gains obtained by

individual in current years was analysed after reducing set off capital losses from past year such

as $7000. Net gains earned on such assets were amounted to $150194.98.

QUESTION 2

Car provided to employee

(a)

There is manufacturer of Electric Heater known as Rapid Heat Pty Ltd. who has been

providing Fringe Benefits to employees. They are providing different benefits to employee

which are chargeable to Fringe Benefit Tax Act 1986.

Section 7 of FBTA states that any motor vehicle that has been provided as benefit to

employee will not be treated for business use if vehicle has not been parked in business premises

and had parked in the house of employee. The definition of motor vehicle has been provided

under this act:

1. Motor cars, Station Wagons, Vans, etc.

2. Vehicle that is having goods carrying capacity should not be more than 1 tonne.

3. Car must not carry passengers more than 9.

The Fringe Benefit Tax act provides different methods to calculate chargeable FBT:

1. Cost Method: It states that actual value will be shown as gross taxable value.

2. Statutory Method: Gross taxable value will not be shown as actual value as fringe

benefits

10

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 16

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.