Taxation Theory, Practice & Law: Case Study Analysis Report

VerifiedAdded on 2020/10/22

|12

|3237

|342

Report

AI Summary

This report provides a detailed analysis of taxation theory, practice, and law within the Australian context. It presents two case scenarios, the first involving an investor and antique collector dealing with capital gains tax on assets such as vacant land, antique beds, paintings, shares, and a violin. The report calculates tax liabilities based on relevant regulations and provides calculations for each asset, including capital gains and losses. The second scenario involves advising a company on Fringe Benefits Tax (FBT) consequences. The report covers various aspects of Australian taxation, including capital gains tax, pre-CGT assets, and insurance claim tax. The report aims to clarify tax calculations, providing insights for tax consultants and students alike.

Taxation Theory, Practice

& Law

& Law

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION...........................................................................................................................1

TASK 1............................................................................................................................................1

Block of vacant land....................................................................................................................1

Antique bed.................................................................................................................................2

Painting.......................................................................................................................................3

Shares..........................................................................................................................................4

Violin...........................................................................................................................................5

TASK 2............................................................................................................................................7

Advice Rapid Heat Pty Ltd about FBT consequences................................................................7

Variation in the answer if Jasmine has used $50000 as share investment..................................8

CONCLUSION................................................................................................................................9

REFERENCES..............................................................................................................................10

INTRODUCTION...........................................................................................................................1

TASK 1............................................................................................................................................1

Block of vacant land....................................................................................................................1

Antique bed.................................................................................................................................2

Painting.......................................................................................................................................3

Shares..........................................................................................................................................4

Violin...........................................................................................................................................5

TASK 2............................................................................................................................................7

Advice Rapid Heat Pty Ltd about FBT consequences................................................................7

Variation in the answer if Jasmine has used $50000 as share investment..................................8

CONCLUSION................................................................................................................................9

REFERENCES..............................................................................................................................10

INTRODUCTION

Taxation theory is a group of different systems that are concerned with various tax blocks

in order to allot tax liabilities to an individual, company or a group of different companies

(Boadway, 2012). Tax policy is a choice of the government of a country to decide the amount

and percentages of tax and on whom it is going to be implemented. There are different laws for

different tax liabilities. As a tax consultant in Mayfield, New South Wales Australia, it is a

liability to calculate the taxable amount of the client who have bought and sold assets.

This project report is based on the tax calculation of two different case scenarios. In first

case scenario the client have bought and sold different assets and the tax consultant have to

calculate the tax liability of capital gain head. In second scenario an advice to a company is

provided by assisting them in tax. The main objective of this project reports is to understand the

concept of taxation law.

TASK 1

Mayfield, New South Wales is an Australian Community in which Australian taxation

law are applicable. As a tax consultant, calculation of taxable income is a liability. The client is

an investor and antique collector. In year 2017, the client have purchased and bought different

assets. The client belongs to Australia, hence all the Australian taxations laws like, income tax

law, GST law etc. are going to be followed while calculating taxation liability for client. It has

been identified that the client is not carrying a business so the laws will be followed on

individual basis and tax rates of an individual will be applicable on client. For this particular

scenario Capital Gain Tax and Insurance claim Tax is used. Total taxation income and tax

liability for the client is calculated as follows.

Block of vacant land

Case scenario: The client for this scenarios is an antique collector and investor, who has

signed a contract to sell a vacant land for $320000 which was acquired in January 2001 for the

value of $100000 and the client has paid $20000 for water and sewerage. Selling of land is a

capital gain activity so for this scenario capital gain taxation laws are going to be followed.

Related tax regulations: From the case scenarios it has been identified that the capital

gain taxation rates are going to be applied on the client. According to CGT, vacant land is type of

non moveable asset, which is treated as investment and it was acquired after 20 September 1985.

1

Taxation theory is a group of different systems that are concerned with various tax blocks

in order to allot tax liabilities to an individual, company or a group of different companies

(Boadway, 2012). Tax policy is a choice of the government of a country to decide the amount

and percentages of tax and on whom it is going to be implemented. There are different laws for

different tax liabilities. As a tax consultant in Mayfield, New South Wales Australia, it is a

liability to calculate the taxable amount of the client who have bought and sold assets.

This project report is based on the tax calculation of two different case scenarios. In first

case scenario the client have bought and sold different assets and the tax consultant have to

calculate the tax liability of capital gain head. In second scenario an advice to a company is

provided by assisting them in tax. The main objective of this project reports is to understand the

concept of taxation law.

TASK 1

Mayfield, New South Wales is an Australian Community in which Australian taxation

law are applicable. As a tax consultant, calculation of taxable income is a liability. The client is

an investor and antique collector. In year 2017, the client have purchased and bought different

assets. The client belongs to Australia, hence all the Australian taxations laws like, income tax

law, GST law etc. are going to be followed while calculating taxation liability for client. It has

been identified that the client is not carrying a business so the laws will be followed on

individual basis and tax rates of an individual will be applicable on client. For this particular

scenario Capital Gain Tax and Insurance claim Tax is used. Total taxation income and tax

liability for the client is calculated as follows.

Block of vacant land

Case scenario: The client for this scenarios is an antique collector and investor, who has

signed a contract to sell a vacant land for $320000 which was acquired in January 2001 for the

value of $100000 and the client has paid $20000 for water and sewerage. Selling of land is a

capital gain activity so for this scenario capital gain taxation laws are going to be followed.

Related tax regulations: From the case scenarios it has been identified that the capital

gain taxation rates are going to be applied on the client. According to CGT, vacant land is type of

non moveable asset, which is treated as investment and it was acquired after 20 September 1985.

1

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

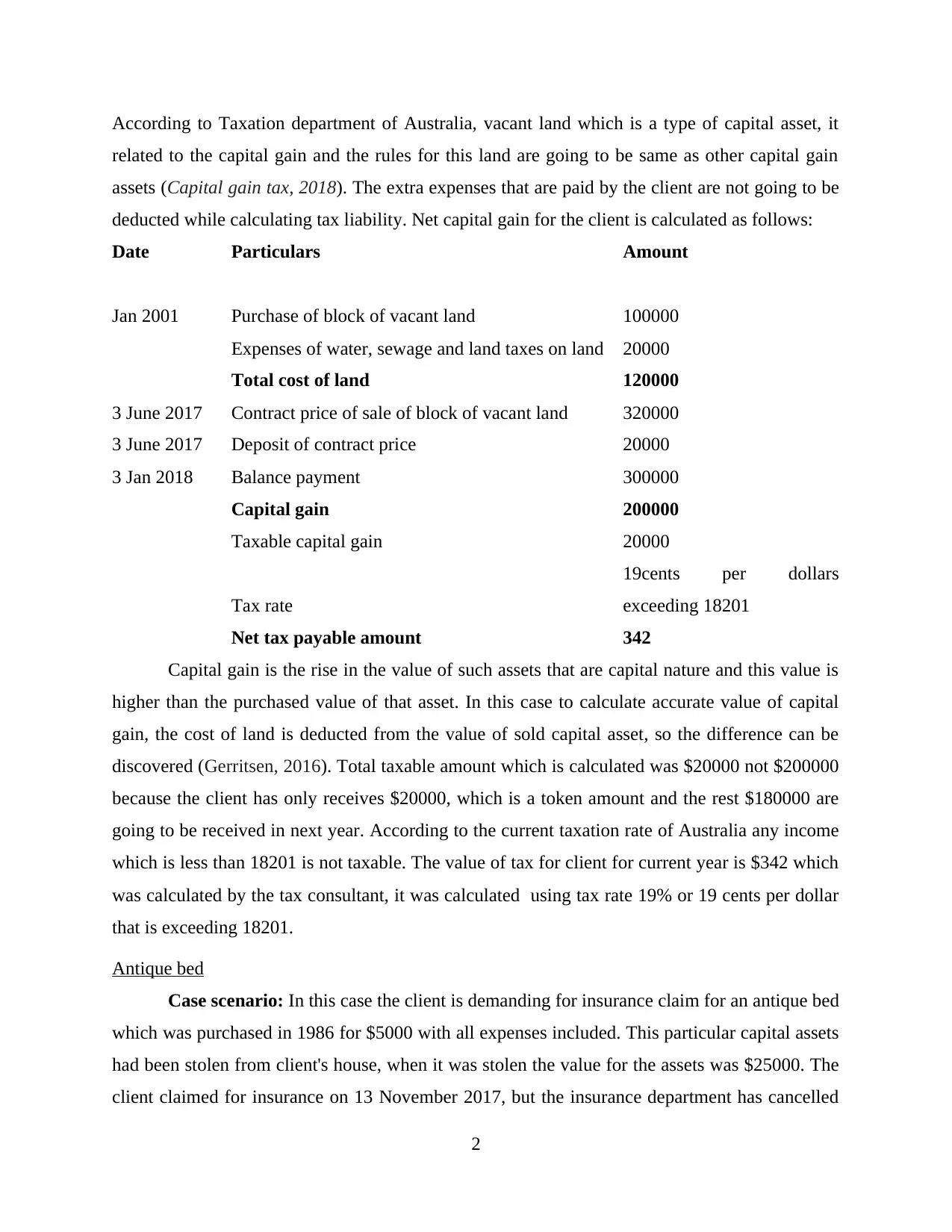

According to Taxation department of Australia, vacant land which is a type of capital asset, it

related to the capital gain and the rules for this land are going to be same as other capital gain

assets (Capital gain tax, 2018). The extra expenses that are paid by the client are not going to be

deducted while calculating tax liability. Net capital gain for the client is calculated as follows:

Date Particulars Amount

Jan 2001 Purchase of block of vacant land 100000

Expenses of water, sewage and land taxes on land 20000

Total cost of land 120000

3 June 2017 Contract price of sale of block of vacant land 320000

3 June 2017 Deposit of contract price 20000

3 Jan 2018 Balance payment 300000

Capital gain 200000

Taxable capital gain 20000

Tax rate

19cents per dollars

exceeding 18201

Net tax payable amount 342

Capital gain is the rise in the value of such assets that are capital nature and this value is

higher than the purchased value of that asset. In this case to calculate accurate value of capital

gain, the cost of land is deducted from the value of sold capital asset, so the difference can be

discovered (Gerritsen, 2016). Total taxable amount which is calculated was $20000 not $200000

because the client has only receives $20000, which is a token amount and the rest $180000 are

going to be received in next year. According to the current taxation rate of Australia any income

which is less than 18201 is not taxable. The value of tax for client for current year is $342 which

was calculated by the tax consultant, it was calculated using tax rate 19% or 19 cents per dollar

that is exceeding 18201.

Antique bed

Case scenario: In this case the client is demanding for insurance claim for an antique bed

which was purchased in 1986 for $5000 with all expenses included. This particular capital assets

had been stolen from client's house, when it was stolen the value for the assets was $25000. The

client claimed for insurance on 13 November 2017, but the insurance department has cancelled

2

related to the capital gain and the rules for this land are going to be same as other capital gain

assets (Capital gain tax, 2018). The extra expenses that are paid by the client are not going to be

deducted while calculating tax liability. Net capital gain for the client is calculated as follows:

Date Particulars Amount

Jan 2001 Purchase of block of vacant land 100000

Expenses of water, sewage and land taxes on land 20000

Total cost of land 120000

3 June 2017 Contract price of sale of block of vacant land 320000

3 June 2017 Deposit of contract price 20000

3 Jan 2018 Balance payment 300000

Capital gain 200000

Taxable capital gain 20000

Tax rate

19cents per dollars

exceeding 18201

Net tax payable amount 342

Capital gain is the rise in the value of such assets that are capital nature and this value is

higher than the purchased value of that asset. In this case to calculate accurate value of capital

gain, the cost of land is deducted from the value of sold capital asset, so the difference can be

discovered (Gerritsen, 2016). Total taxable amount which is calculated was $20000 not $200000

because the client has only receives $20000, which is a token amount and the rest $180000 are

going to be received in next year. According to the current taxation rate of Australia any income

which is less than 18201 is not taxable. The value of tax for client for current year is $342 which

was calculated by the tax consultant, it was calculated using tax rate 19% or 19 cents per dollar

that is exceeding 18201.

Antique bed

Case scenario: In this case the client is demanding for insurance claim for an antique bed

which was purchased in 1986 for $5000 with all expenses included. This particular capital assets

had been stolen from client's house, when it was stolen the value for the assets was $25000. The

client claimed for insurance on 13 November 2017, but the insurance department has cancelled

2

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

the request for that insurance claim because such type of asset was not mentioned in insurance

claim. The client has received $11000 in full settlement by compromising (Hebert and Wagner,

2013).

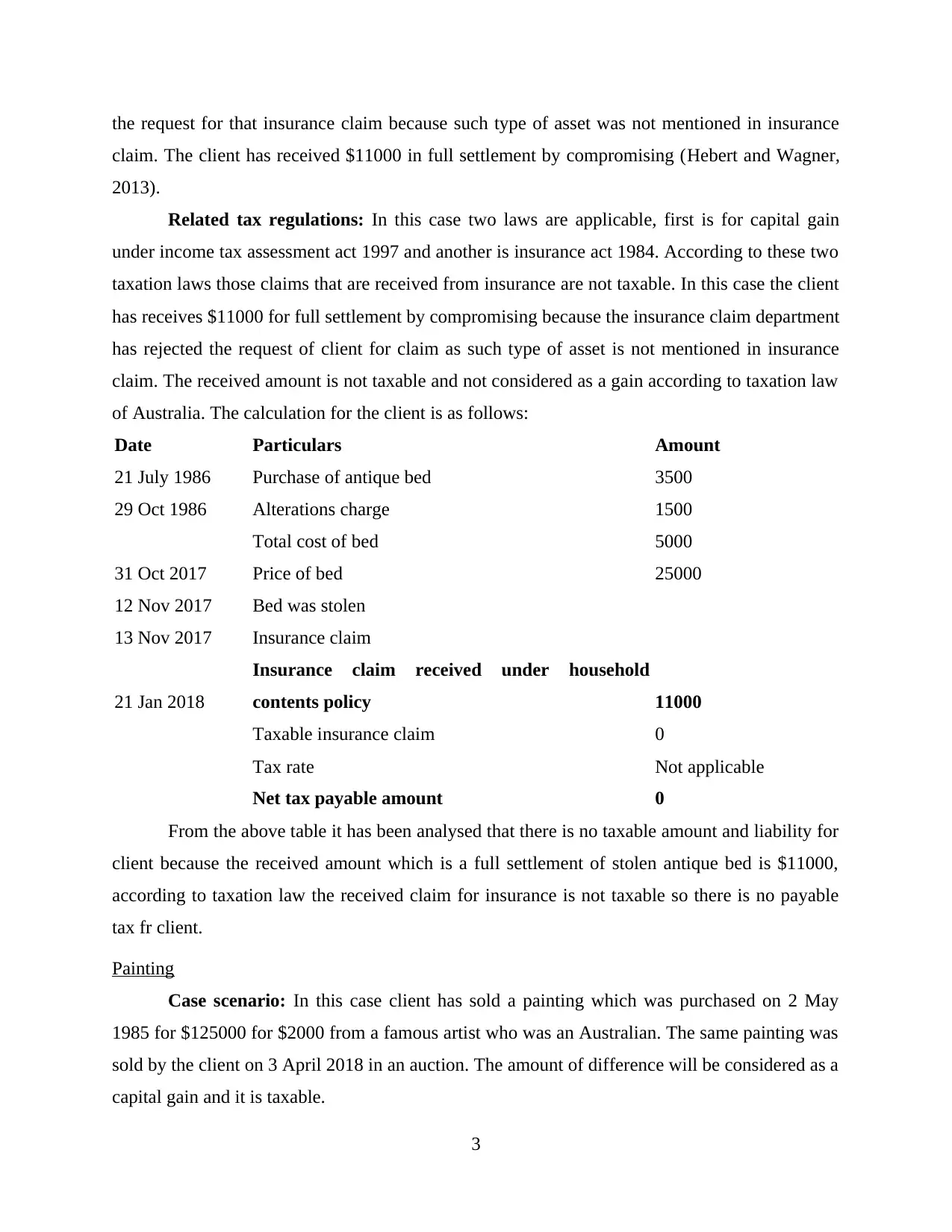

Related tax regulations: In this case two laws are applicable, first is for capital gain

under income tax assessment act 1997 and another is insurance act 1984. According to these two

taxation laws those claims that are received from insurance are not taxable. In this case the client

has receives $11000 for full settlement by compromising because the insurance claim department

has rejected the request of client for claim as such type of asset is not mentioned in insurance

claim. The received amount is not taxable and not considered as a gain according to taxation law

of Australia. The calculation for the client is as follows:

Date Particulars Amount

21 July 1986 Purchase of antique bed 3500

29 Oct 1986 Alterations charge 1500

Total cost of bed 5000

31 Oct 2017 Price of bed 25000

12 Nov 2017 Bed was stolen

13 Nov 2017 Insurance claim

21 Jan 2018

Insurance claim received under household

contents policy 11000

Taxable insurance claim 0

Tax rate Not applicable

Net tax payable amount 0

From the above table it has been analysed that there is no taxable amount and liability for

client because the received amount which is a full settlement of stolen antique bed is $11000,

according to taxation law the received claim for insurance is not taxable so there is no payable

tax fr client.

Painting

Case scenario: In this case client has sold a painting which was purchased on 2 May

1985 for $125000 for $2000 from a famous artist who was an Australian. The same painting was

sold by the client on 3 April 2018 in an auction. The amount of difference will be considered as a

capital gain and it is taxable.

3

claim. The client has received $11000 in full settlement by compromising (Hebert and Wagner,

2013).

Related tax regulations: In this case two laws are applicable, first is for capital gain

under income tax assessment act 1997 and another is insurance act 1984. According to these two

taxation laws those claims that are received from insurance are not taxable. In this case the client

has receives $11000 for full settlement by compromising because the insurance claim department

has rejected the request of client for claim as such type of asset is not mentioned in insurance

claim. The received amount is not taxable and not considered as a gain according to taxation law

of Australia. The calculation for the client is as follows:

Date Particulars Amount

21 July 1986 Purchase of antique bed 3500

29 Oct 1986 Alterations charge 1500

Total cost of bed 5000

31 Oct 2017 Price of bed 25000

12 Nov 2017 Bed was stolen

13 Nov 2017 Insurance claim

21 Jan 2018

Insurance claim received under household

contents policy 11000

Taxable insurance claim 0

Tax rate Not applicable

Net tax payable amount 0

From the above table it has been analysed that there is no taxable amount and liability for

client because the received amount which is a full settlement of stolen antique bed is $11000,

according to taxation law the received claim for insurance is not taxable so there is no payable

tax fr client.

Painting

Case scenario: In this case client has sold a painting which was purchased on 2 May

1985 for $125000 for $2000 from a famous artist who was an Australian. The same painting was

sold by the client on 3 April 2018 in an auction. The amount of difference will be considered as a

capital gain and it is taxable.

3

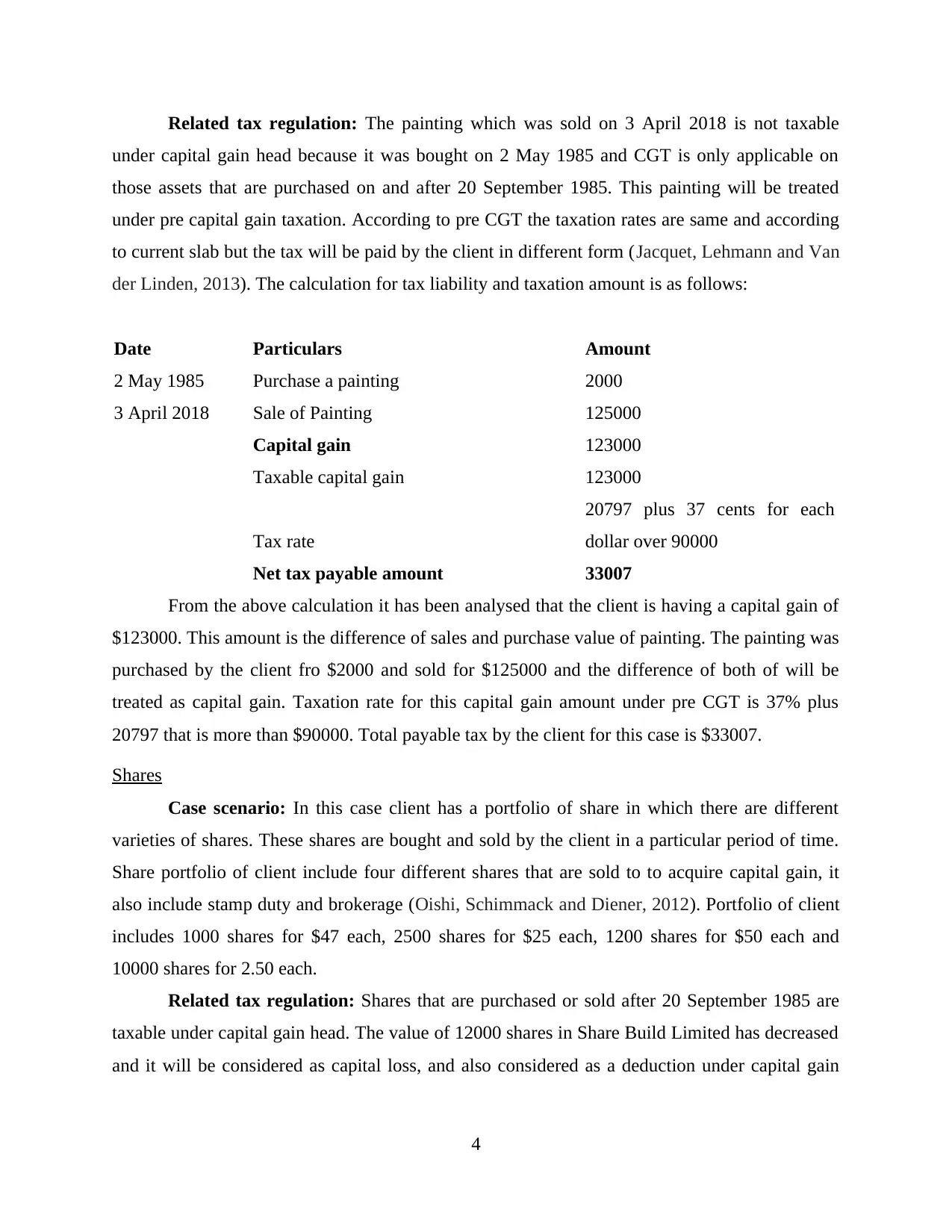

Related tax regulation: The painting which was sold on 3 April 2018 is not taxable

under capital gain head because it was bought on 2 May 1985 and CGT is only applicable on

those assets that are purchased on and after 20 September 1985. This painting will be treated

under pre capital gain taxation. According to pre CGT the taxation rates are same and according

to current slab but the tax will be paid by the client in different form (Jacquet, Lehmann and Van

der Linden, 2013). The calculation for tax liability and taxation amount is as follows:

Date Particulars Amount

2 May 1985 Purchase a painting 2000

3 April 2018 Sale of Painting 125000

Capital gain 123000

Taxable capital gain 123000

Tax rate

20797 plus 37 cents for each

dollar over 90000

Net tax payable amount 33007

From the above calculation it has been analysed that the client is having a capital gain of

$123000. This amount is the difference of sales and purchase value of painting. The painting was

purchased by the client fro $2000 and sold for $125000 and the difference of both of will be

treated as capital gain. Taxation rate for this capital gain amount under pre CGT is 37% plus

20797 that is more than $90000. Total payable tax by the client for this case is $33007.

Shares

Case scenario: In this case client has a portfolio of share in which there are different

varieties of shares. These shares are bought and sold by the client in a particular period of time.

Share portfolio of client include four different shares that are sold to to acquire capital gain, it

also include stamp duty and brokerage (Oishi, Schimmack and Diener, 2012). Portfolio of client

includes 1000 shares for $47 each, 2500 shares for $25 each, 1200 shares for $50 each and

10000 shares for 2.50 each.

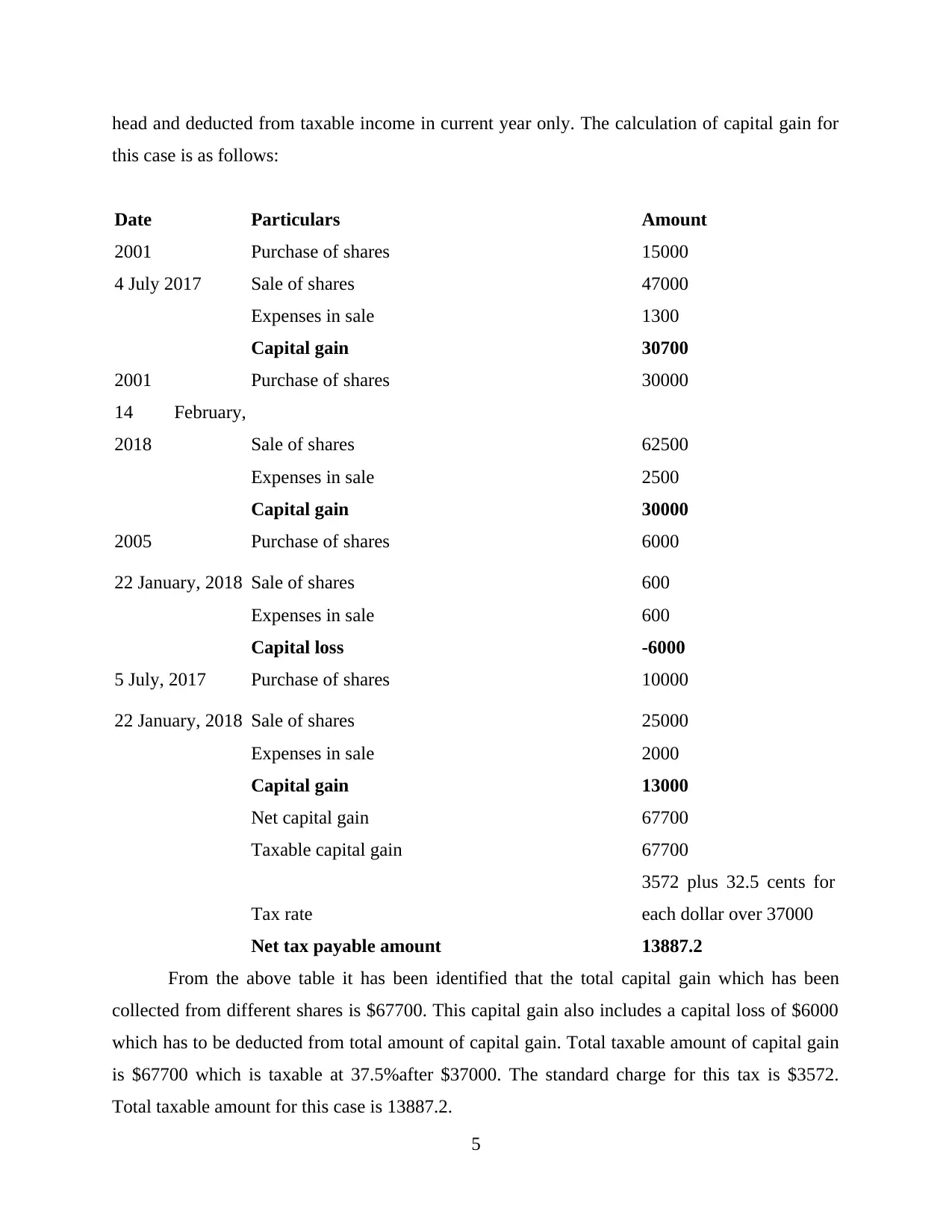

Related tax regulation: Shares that are purchased or sold after 20 September 1985 are

taxable under capital gain head. The value of 12000 shares in Share Build Limited has decreased

and it will be considered as capital loss, and also considered as a deduction under capital gain

4

under capital gain head because it was bought on 2 May 1985 and CGT is only applicable on

those assets that are purchased on and after 20 September 1985. This painting will be treated

under pre capital gain taxation. According to pre CGT the taxation rates are same and according

to current slab but the tax will be paid by the client in different form (Jacquet, Lehmann and Van

der Linden, 2013). The calculation for tax liability and taxation amount is as follows:

Date Particulars Amount

2 May 1985 Purchase a painting 2000

3 April 2018 Sale of Painting 125000

Capital gain 123000

Taxable capital gain 123000

Tax rate

20797 plus 37 cents for each

dollar over 90000

Net tax payable amount 33007

From the above calculation it has been analysed that the client is having a capital gain of

$123000. This amount is the difference of sales and purchase value of painting. The painting was

purchased by the client fro $2000 and sold for $125000 and the difference of both of will be

treated as capital gain. Taxation rate for this capital gain amount under pre CGT is 37% plus

20797 that is more than $90000. Total payable tax by the client for this case is $33007.

Shares

Case scenario: In this case client has a portfolio of share in which there are different

varieties of shares. These shares are bought and sold by the client in a particular period of time.

Share portfolio of client include four different shares that are sold to to acquire capital gain, it

also include stamp duty and brokerage (Oishi, Schimmack and Diener, 2012). Portfolio of client

includes 1000 shares for $47 each, 2500 shares for $25 each, 1200 shares for $50 each and

10000 shares for 2.50 each.

Related tax regulation: Shares that are purchased or sold after 20 September 1985 are

taxable under capital gain head. The value of 12000 shares in Share Build Limited has decreased

and it will be considered as capital loss, and also considered as a deduction under capital gain

4

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

head and deducted from taxable income in current year only. The calculation of capital gain for

this case is as follows:

Date Particulars Amount

2001 Purchase of shares 15000

4 July 2017 Sale of shares 47000

Expenses in sale 1300

Capital gain 30700

2001 Purchase of shares 30000

14 February,

2018 Sale of shares 62500

Expenses in sale 2500

Capital gain 30000

2005 Purchase of shares 6000

22 January, 2018 Sale of shares 600

Expenses in sale 600

Capital loss -6000

5 July, 2017 Purchase of shares 10000

22 January, 2018 Sale of shares 25000

Expenses in sale 2000

Capital gain 13000

Net capital gain 67700

Taxable capital gain 67700

Tax rate

3572 plus 32.5 cents for

each dollar over 37000

Net tax payable amount 13887.2

From the above table it has been identified that the total capital gain which has been

collected from different shares is $67700. This capital gain also includes a capital loss of $6000

which has to be deducted from total amount of capital gain. Total taxable amount of capital gain

is $67700 which is taxable at 37.5%after $37000. The standard charge for this tax is $3572.

Total taxable amount for this case is 13887.2.

5

this case is as follows:

Date Particulars Amount

2001 Purchase of shares 15000

4 July 2017 Sale of shares 47000

Expenses in sale 1300

Capital gain 30700

2001 Purchase of shares 30000

14 February,

2018 Sale of shares 62500

Expenses in sale 2500

Capital gain 30000

2005 Purchase of shares 6000

22 January, 2018 Sale of shares 600

Expenses in sale 600

Capital loss -6000

5 July, 2017 Purchase of shares 10000

22 January, 2018 Sale of shares 25000

Expenses in sale 2000

Capital gain 13000

Net capital gain 67700

Taxable capital gain 67700

Tax rate

3572 plus 32.5 cents for

each dollar over 37000

Net tax payable amount 13887.2

From the above table it has been identified that the total capital gain which has been

collected from different shares is $67700. This capital gain also includes a capital loss of $6000

which has to be deducted from total amount of capital gain. Total taxable amount of capital gain

is $67700 which is taxable at 37.5%after $37000. The standard charge for this tax is $3572.

Total taxable amount for this case is 13887.2.

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

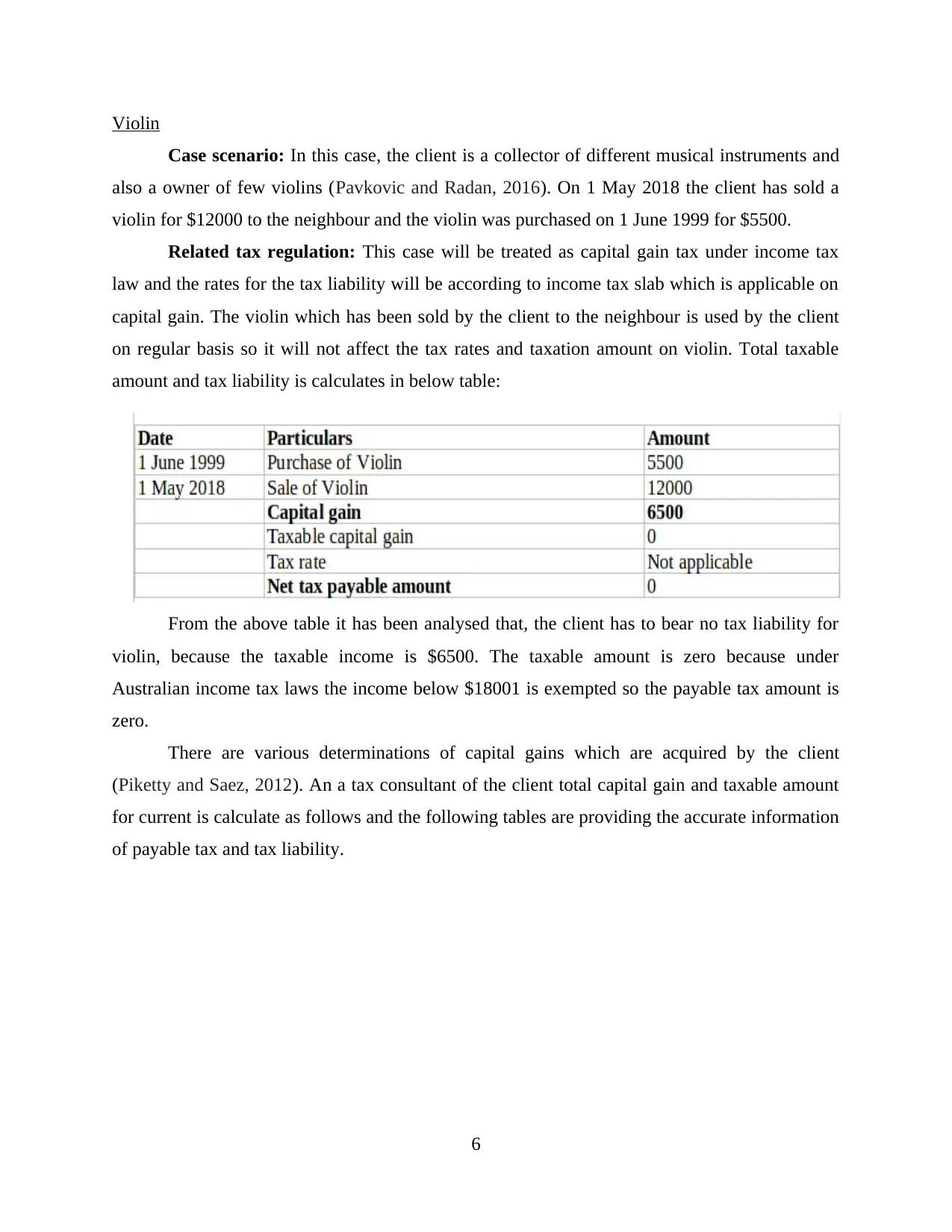

Violin

Case scenario: In this case, the client is a collector of different musical instruments and

also a owner of few violins (Pavkovic and Radan, 2016). On 1 May 2018 the client has sold a

violin for $12000 to the neighbour and the violin was purchased on 1 June 1999 for $5500.

Related tax regulation: This case will be treated as capital gain tax under income tax

law and the rates for the tax liability will be according to income tax slab which is applicable on

capital gain. The violin which has been sold by the client to the neighbour is used by the client

on regular basis so it will not affect the tax rates and taxation amount on violin. Total taxable

amount and tax liability is calculates in below table:

From the above table it has been analysed that, the client has to bear no tax liability for

violin, because the taxable income is $6500. The taxable amount is zero because under

Australian income tax laws the income below $18001 is exempted so the payable tax amount is

zero.

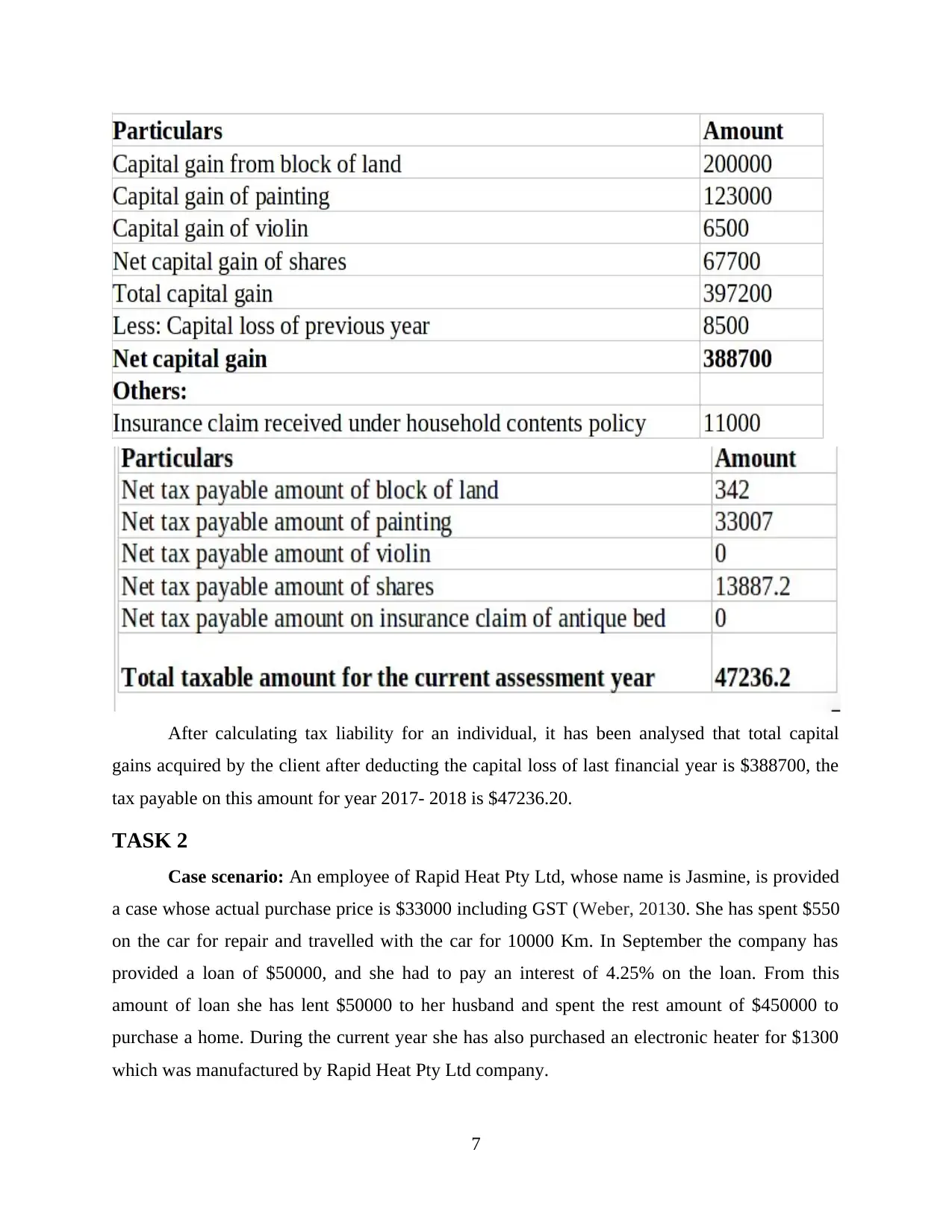

There are various determinations of capital gains which are acquired by the client

(Piketty and Saez, 2012). An a tax consultant of the client total capital gain and taxable amount

for current is calculate as follows and the following tables are providing the accurate information

of payable tax and tax liability.

6

Case scenario: In this case, the client is a collector of different musical instruments and

also a owner of few violins (Pavkovic and Radan, 2016). On 1 May 2018 the client has sold a

violin for $12000 to the neighbour and the violin was purchased on 1 June 1999 for $5500.

Related tax regulation: This case will be treated as capital gain tax under income tax

law and the rates for the tax liability will be according to income tax slab which is applicable on

capital gain. The violin which has been sold by the client to the neighbour is used by the client

on regular basis so it will not affect the tax rates and taxation amount on violin. Total taxable

amount and tax liability is calculates in below table:

From the above table it has been analysed that, the client has to bear no tax liability for

violin, because the taxable income is $6500. The taxable amount is zero because under

Australian income tax laws the income below $18001 is exempted so the payable tax amount is

zero.

There are various determinations of capital gains which are acquired by the client

(Piketty and Saez, 2012). An a tax consultant of the client total capital gain and taxable amount

for current is calculate as follows and the following tables are providing the accurate information

of payable tax and tax liability.

6

After calculating tax liability for an individual, it has been analysed that total capital

gains acquired by the client after deducting the capital loss of last financial year is $388700, the

tax payable on this amount for year 2017- 2018 is $47236.20.

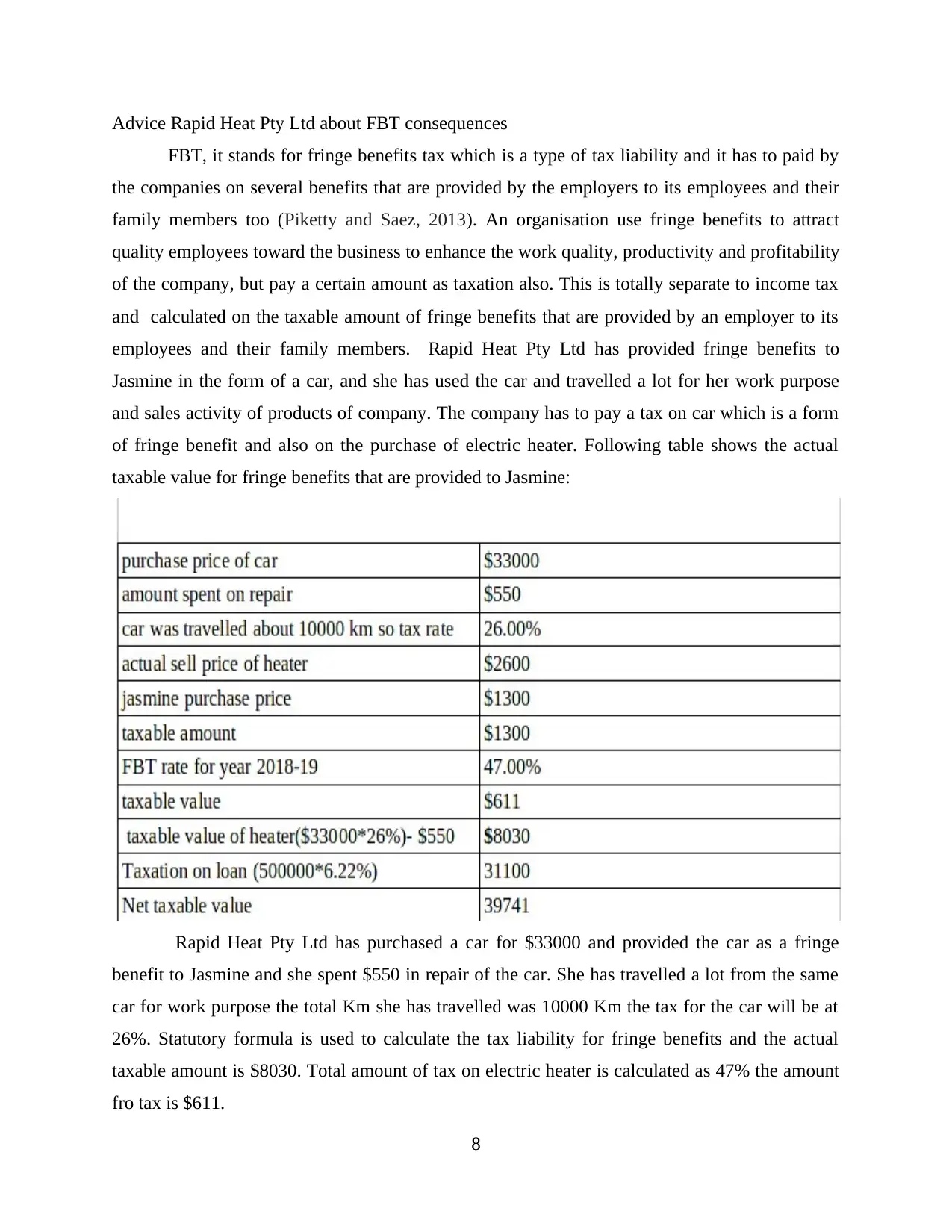

TASK 2

Case scenario: An employee of Rapid Heat Pty Ltd, whose name is Jasmine, is provided

a case whose actual purchase price is $33000 including GST (Weber, 20130. She has spent $550

on the car for repair and travelled with the car for 10000 Km. In September the company has

provided a loan of $50000, and she had to pay an interest of 4.25% on the loan. From this

amount of loan she has lent $50000 to her husband and spent the rest amount of $450000 to

purchase a home. During the current year she has also purchased an electronic heater for $1300

which was manufactured by Rapid Heat Pty Ltd company.

7

gains acquired by the client after deducting the capital loss of last financial year is $388700, the

tax payable on this amount for year 2017- 2018 is $47236.20.

TASK 2

Case scenario: An employee of Rapid Heat Pty Ltd, whose name is Jasmine, is provided

a case whose actual purchase price is $33000 including GST (Weber, 20130. She has spent $550

on the car for repair and travelled with the car for 10000 Km. In September the company has

provided a loan of $50000, and she had to pay an interest of 4.25% on the loan. From this

amount of loan she has lent $50000 to her husband and spent the rest amount of $450000 to

purchase a home. During the current year she has also purchased an electronic heater for $1300

which was manufactured by Rapid Heat Pty Ltd company.

7

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Advice Rapid Heat Pty Ltd about FBT consequences

FBT, it stands for fringe benefits tax which is a type of tax liability and it has to paid by

the companies on several benefits that are provided by the employers to its employees and their

family members too (Piketty and Saez, 2013). An organisation use fringe benefits to attract

quality employees toward the business to enhance the work quality, productivity and profitability

of the company, but pay a certain amount as taxation also. This is totally separate to income tax

and calculated on the taxable amount of fringe benefits that are provided by an employer to its

employees and their family members. Rapid Heat Pty Ltd has provided fringe benefits to

Jasmine in the form of a car, and she has used the car and travelled a lot for her work purpose

and sales activity of products of company. The company has to pay a tax on car which is a form

of fringe benefit and also on the purchase of electric heater. Following table shows the actual

taxable value for fringe benefits that are provided to Jasmine:

Rapid Heat Pty Ltd has purchased a car for $33000 and provided the car as a fringe

benefit to Jasmine and she spent $550 in repair of the car. She has travelled a lot from the same

car for work purpose the total Km she has travelled was 10000 Km the tax for the car will be at

26%. Statutory formula is used to calculate the tax liability for fringe benefits and the actual

taxable amount is $8030. Total amount of tax on electric heater is calculated as 47% the amount

fro tax is $611.

8

FBT, it stands for fringe benefits tax which is a type of tax liability and it has to paid by

the companies on several benefits that are provided by the employers to its employees and their

family members too (Piketty and Saez, 2013). An organisation use fringe benefits to attract

quality employees toward the business to enhance the work quality, productivity and profitability

of the company, but pay a certain amount as taxation also. This is totally separate to income tax

and calculated on the taxable amount of fringe benefits that are provided by an employer to its

employees and their family members. Rapid Heat Pty Ltd has provided fringe benefits to

Jasmine in the form of a car, and she has used the car and travelled a lot for her work purpose

and sales activity of products of company. The company has to pay a tax on car which is a form

of fringe benefit and also on the purchase of electric heater. Following table shows the actual

taxable value for fringe benefits that are provided to Jasmine:

Rapid Heat Pty Ltd has purchased a car for $33000 and provided the car as a fringe

benefit to Jasmine and she spent $550 in repair of the car. She has travelled a lot from the same

car for work purpose the total Km she has travelled was 10000 Km the tax for the car will be at

26%. Statutory formula is used to calculate the tax liability for fringe benefits and the actual

taxable amount is $8030. Total amount of tax on electric heater is calculated as 47% the amount

fro tax is $611.

8

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

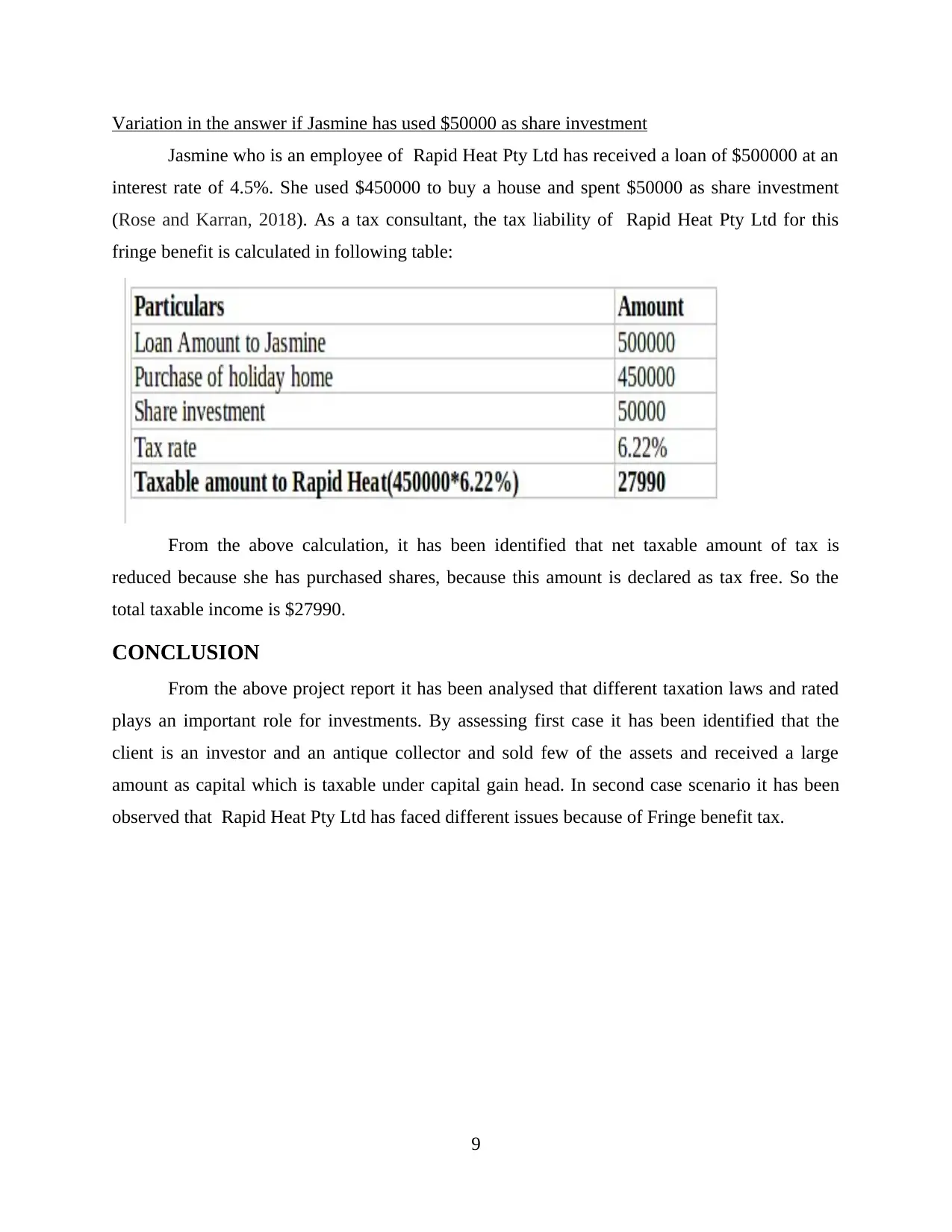

Variation in the answer if Jasmine has used $50000 as share investment

Jasmine who is an employee of Rapid Heat Pty Ltd has received a loan of $500000 at an

interest rate of 4.5%. She used $450000 to buy a house and spent $50000 as share investment

(Rose and Karran, 2018). As a tax consultant, the tax liability of Rapid Heat Pty Ltd for this

fringe benefit is calculated in following table:

From the above calculation, it has been identified that net taxable amount of tax is

reduced because she has purchased shares, because this amount is declared as tax free. So the

total taxable income is $27990.

CONCLUSION

From the above project report it has been analysed that different taxation laws and rated

plays an important role for investments. By assessing first case it has been identified that the

client is an investor and an antique collector and sold few of the assets and received a large

amount as capital which is taxable under capital gain head. In second case scenario it has been

observed that Rapid Heat Pty Ltd has faced different issues because of Fringe benefit tax.

9

Jasmine who is an employee of Rapid Heat Pty Ltd has received a loan of $500000 at an

interest rate of 4.5%. She used $450000 to buy a house and spent $50000 as share investment

(Rose and Karran, 2018). As a tax consultant, the tax liability of Rapid Heat Pty Ltd for this

fringe benefit is calculated in following table:

From the above calculation, it has been identified that net taxable amount of tax is

reduced because she has purchased shares, because this amount is declared as tax free. So the

total taxable income is $27990.

CONCLUSION

From the above project report it has been analysed that different taxation laws and rated

plays an important role for investments. By assessing first case it has been identified that the

client is an investor and an antique collector and sold few of the assets and received a large

amount as capital which is taxable under capital gain head. In second case scenario it has been

observed that Rapid Heat Pty Ltd has faced different issues because of Fringe benefit tax.

9

REFERENCES

Books and Journals:

Boadway, R. W., 2012. From optimal tax theory to tax policy: retrospective and prospective

views. MIT Press.

Gerritsen, A., 2016. Optimal taxation when people do not maximize well-being. Journal of

Public Economics. 144. pp.122-139.

Hebert, D. and Wagner, R. E., 2013. Taxation as a quasi-market process: Explanation,

exhortation, and the choice of analytical windows.

Jacquet, L., Lehmann, E. and Van der Linden, B., 2013. Optimal redistributive taxation with

both extensive and intensive responses. Journal of Economic Theory. 148(5). pp.1770-

1805.

Oishi, S., Schimmack, U. and Diener, E., 2012. Progressive taxation and the subjective well-

being of nations. Psychological science. 23(1). pp.86-92.

Pavkovic, A. and Radan, P., 2016. Creating new states: theory and practice of secession.

Routledge.

Piketty, T. and Saez, E., 2012. A theory of optimal capital taxation (No. w17989). National

Bureau of Economic Research.

Piketty, T. and Saez, E., 2013. Optimal labor income taxation. In Handbook of public economics

(Vol. 5. pp. 391-474). Elsevier.

Rose, R. and Karran, T., 2018. Taxation by political inertia: Financing the growth of

government in Britain. Routledge.

Weber, R., 2014. Tax increment financing in theory and practice. In Financing economic

development in the 21st century (pp. 297-315). Routledge.

Online:

Capital gain tax. 2018. [Online]. Available through:

<https://www.ato.gov.au/General/Capital-gains-tax/>

10

Books and Journals:

Boadway, R. W., 2012. From optimal tax theory to tax policy: retrospective and prospective

views. MIT Press.

Gerritsen, A., 2016. Optimal taxation when people do not maximize well-being. Journal of

Public Economics. 144. pp.122-139.

Hebert, D. and Wagner, R. E., 2013. Taxation as a quasi-market process: Explanation,

exhortation, and the choice of analytical windows.

Jacquet, L., Lehmann, E. and Van der Linden, B., 2013. Optimal redistributive taxation with

both extensive and intensive responses. Journal of Economic Theory. 148(5). pp.1770-

1805.

Oishi, S., Schimmack, U. and Diener, E., 2012. Progressive taxation and the subjective well-

being of nations. Psychological science. 23(1). pp.86-92.

Pavkovic, A. and Radan, P., 2016. Creating new states: theory and practice of secession.

Routledge.

Piketty, T. and Saez, E., 2012. A theory of optimal capital taxation (No. w17989). National

Bureau of Economic Research.

Piketty, T. and Saez, E., 2013. Optimal labor income taxation. In Handbook of public economics

(Vol. 5. pp. 391-474). Elsevier.

Rose, R. and Karran, T., 2018. Taxation by political inertia: Financing the growth of

government in Britain. Routledge.

Weber, R., 2014. Tax increment financing in theory and practice. In Financing economic

development in the 21st century (pp. 297-315). Routledge.

Online:

Capital gain tax. 2018. [Online]. Available through:

<https://www.ato.gov.au/General/Capital-gains-tax/>

10

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 12

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.