Financial Management Assignment: Beta, Portfolio Analysis and Risk

VerifiedAdded on 2022/08/29

|9

|1548

|13

Homework Assignment

AI Summary

This document presents a comprehensive solution to a financial management assignment. The assignment involves analyzing the beta coefficients of six companies (General Motors, Boeing, Amazon, Exxon-Mobil, Expedia, and General Electric) to assess their risk positions and market volatility. The student calculates and interprets beta values, explaining how they relate to systematic risk and potential returns. The solution includes a table summarizing key financial data for each company, including ticker symbols, stock prices, and earnings per share (EPS). The assignment also addresses portfolio management, calculating a portfolio's beta based on the investments in these companies and analyzing the impact of changes in stock holdings on the overall portfolio risk. Finally, the assignment explores how risk can be evaluated using beta coefficients, even without standard deviation data. The student also calculates the new portfolio beta after rebalancing the portfolio.

FINANCIAL MANAGEMENT

Running Head: Financial Management

Running Head: Financial Management

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Financial Management

Contents

Question 1, 2, 3, 4, & 5.........................................................................................................................2

Answer 1, 2, 3, 4 & 5..........................................................................................................................2

Question 6.............................................................................................................................................2

Answer 6............................................................................................................................................2

Question 7.............................................................................................................................................3

Answer 7............................................................................................................................................3

Question 8.............................................................................................................................................5

Answer 8............................................................................................................................................5

Question 9.............................................................................................................................................5

Answer 9............................................................................................................................................5

References.............................................................................................................................................7

Appendix...............................................................................................................................................8

1

Contents

Question 1, 2, 3, 4, & 5.........................................................................................................................2

Answer 1, 2, 3, 4 & 5..........................................................................................................................2

Question 6.............................................................................................................................................2

Answer 6............................................................................................................................................2

Question 7.............................................................................................................................................3

Answer 7............................................................................................................................................3

Question 8.............................................................................................................................................5

Answer 8............................................................................................................................................5

Question 9.............................................................................................................................................5

Answer 9............................................................................................................................................5

References.............................................................................................................................................7

Appendix...............................................................................................................................................8

1

Financial Management

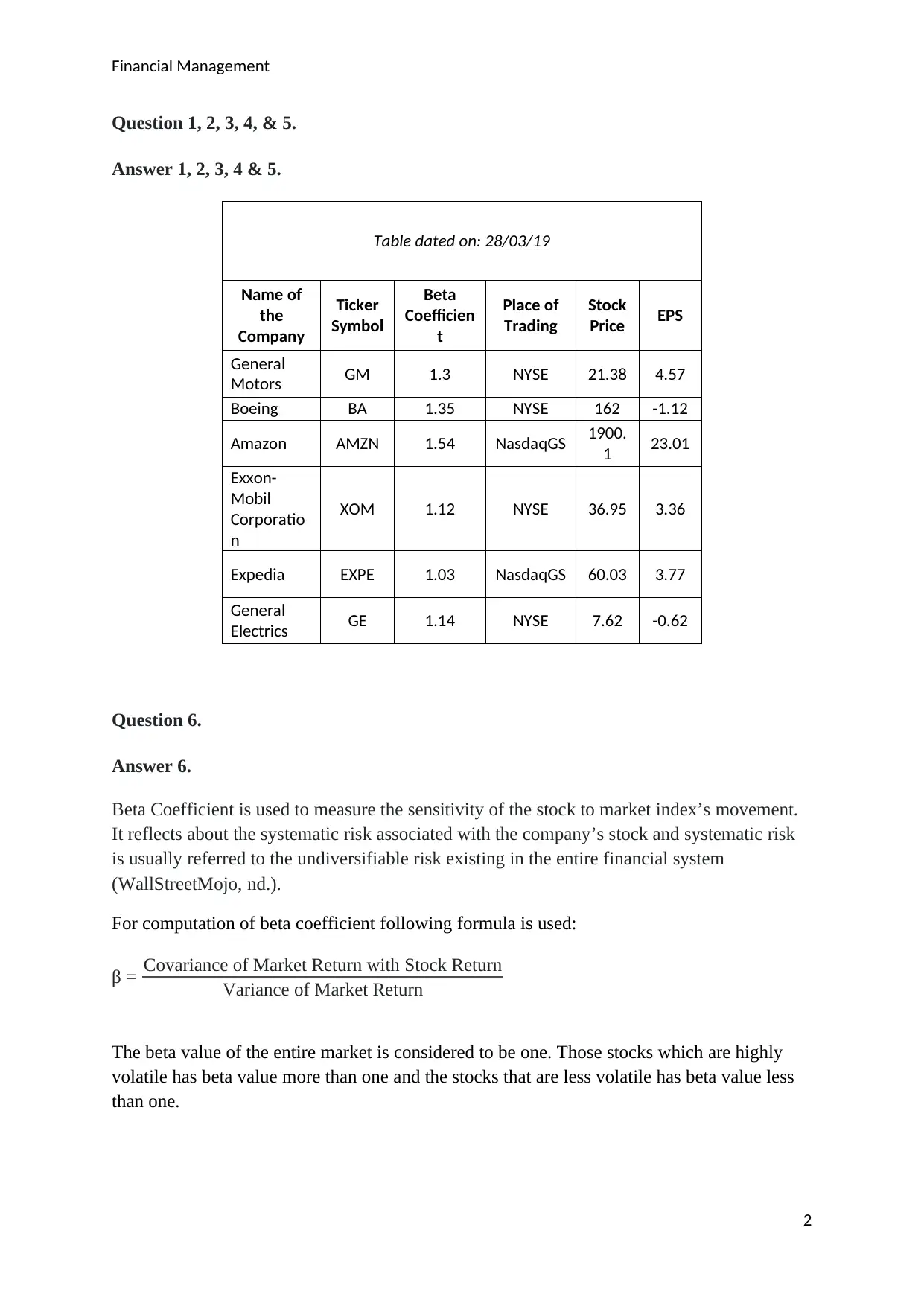

Question 1, 2, 3, 4, & 5.

Answer 1, 2, 3, 4 & 5.

Table dated on: 28/03/19

Name of

the

Company

Ticker

Symbol

Beta

Coefficien

t

Place of

Trading

Stock

Price EPS

General

Motors GM 1.3 NYSE 21.38 4.57

Boeing BA 1.35 NYSE 162 -1.12

Amazon AMZN 1.54 NasdaqGS 1900.

1 23.01

Exxon-

Mobil

Corporatio

n

XOM 1.12 NYSE 36.95 3.36

Expedia EXPE 1.03 NasdaqGS 60.03 3.77

General

Electrics GE 1.14 NYSE 7.62 -0.62

Question 6.

Answer 6.

Beta Coefficient is used to measure the sensitivity of the stock to market index’s movement.

It reflects about the systematic risk associated with the company’s stock and systematic risk

is usually referred to the undiversifiable risk existing in the entire financial system

(WallStreetMojo, nd.).

For computation of beta coefficient following formula is used:

β = Covariance of Market Return with Stock Return

Variance of Market Return

The beta value of the entire market is considered to be one. Those stocks which are highly

volatile has beta value more than one and the stocks that are less volatile has beta value less

than one.

2

Question 1, 2, 3, 4, & 5.

Answer 1, 2, 3, 4 & 5.

Table dated on: 28/03/19

Name of

the

Company

Ticker

Symbol

Beta

Coefficien

t

Place of

Trading

Stock

Price EPS

General

Motors GM 1.3 NYSE 21.38 4.57

Boeing BA 1.35 NYSE 162 -1.12

Amazon AMZN 1.54 NasdaqGS 1900.

1 23.01

Exxon-

Mobil

Corporatio

n

XOM 1.12 NYSE 36.95 3.36

Expedia EXPE 1.03 NasdaqGS 60.03 3.77

General

Electrics GE 1.14 NYSE 7.62 -0.62

Question 6.

Answer 6.

Beta Coefficient is used to measure the sensitivity of the stock to market index’s movement.

It reflects about the systematic risk associated with the company’s stock and systematic risk

is usually referred to the undiversifiable risk existing in the entire financial system

(WallStreetMojo, nd.).

For computation of beta coefficient following formula is used:

β = Covariance of Market Return with Stock Return

Variance of Market Return

The beta value of the entire market is considered to be one. Those stocks which are highly

volatile has beta value more than one and the stocks that are less volatile has beta value less

than one.

2

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Financial Management

General Motors: General Motors has a beta value of 1.3 which is more than 1. Therefore,

the stock of General Motors is highly volatile in nature. The risk associated with the General

Motor’s stock is high but the probability of getting a high return in future also stands high.

Boeing: Boeing has a beta value of 1.35 which is almost equal to the beta value of General

Motors. Therefore, like General Motor’s stock the stock of Boeing is highly volatile in

nature. The risk associated with Boeing’s stock is also high but again the probability of

getting a high return in future stands high.

Amazon: The beta value of Amazon is 1.54 which is higher than the beta value of above

stated companies. This means the risk associated with Amazon’s stock is comparatively

higher than GM’s and Boeing’s stock. However, the chances of receiving high return on the

stock of Amazon is also high as compared to the above two.

Exxon-Mobil Corporation: The stock of Exxon-Mobil Corporation has a beta value of 1.12.

Since, its beta value is more than 1, it is a high volatile stock and has high risk but as

mentioned the possibility of getting high return in future is also high.

Expedia: Expedia’s beta value is 1.03 much close to 1 which means the risk associated with

this stock is quite less and the probability of receiving high return is also less. However, we

still cannot ignore the fact that its beta value is little more than 1 which makes the stock little

volatile which increases the stock’s risk.

General Electrics: The beta value of General Electrics is 1.14. Again, it is higher than 1 and

therefore the risk associated with this stock is on a higher side and the probability of getting

higher return on this stock is also high.

At the end, after studying the beta value of all the above companies we can conclude that the

stock of Amazon is the riskiest with 1.54 beta value and the stock of Expedia is the least risky

with the beta value of 1.03.

Question 7.

Answer 7.

In absence of standard deviation, the risk associated with any company’s stock can be

evaluated by referring to the value of stock’s beta. Beta computes the market risk or market

volatility. It reflects the extent to which the stock’s price is likely to fluctuate as compared to

the other listed stocks.

The value of all stock indexes fluctuates i.e., goes up and down constantly. At the end of each

day, market is evaluated to see whether it went up or down. The investors planning to buy

any company’s stock is always interested to know whether that particular stocks shows the

same up and down movement as reflected by other listed stocks (YCharts, n.d.).

3

General Motors: General Motors has a beta value of 1.3 which is more than 1. Therefore,

the stock of General Motors is highly volatile in nature. The risk associated with the General

Motor’s stock is high but the probability of getting a high return in future also stands high.

Boeing: Boeing has a beta value of 1.35 which is almost equal to the beta value of General

Motors. Therefore, like General Motor’s stock the stock of Boeing is highly volatile in

nature. The risk associated with Boeing’s stock is also high but again the probability of

getting a high return in future stands high.

Amazon: The beta value of Amazon is 1.54 which is higher than the beta value of above

stated companies. This means the risk associated with Amazon’s stock is comparatively

higher than GM’s and Boeing’s stock. However, the chances of receiving high return on the

stock of Amazon is also high as compared to the above two.

Exxon-Mobil Corporation: The stock of Exxon-Mobil Corporation has a beta value of 1.12.

Since, its beta value is more than 1, it is a high volatile stock and has high risk but as

mentioned the possibility of getting high return in future is also high.

Expedia: Expedia’s beta value is 1.03 much close to 1 which means the risk associated with

this stock is quite less and the probability of receiving high return is also less. However, we

still cannot ignore the fact that its beta value is little more than 1 which makes the stock little

volatile which increases the stock’s risk.

General Electrics: The beta value of General Electrics is 1.14. Again, it is higher than 1 and

therefore the risk associated with this stock is on a higher side and the probability of getting

higher return on this stock is also high.

At the end, after studying the beta value of all the above companies we can conclude that the

stock of Amazon is the riskiest with 1.54 beta value and the stock of Expedia is the least risky

with the beta value of 1.03.

Question 7.

Answer 7.

In absence of standard deviation, the risk associated with any company’s stock can be

evaluated by referring to the value of stock’s beta. Beta computes the market risk or market

volatility. It reflects the extent to which the stock’s price is likely to fluctuate as compared to

the other listed stocks.

The value of all stock indexes fluctuates i.e., goes up and down constantly. At the end of each

day, market is evaluated to see whether it went up or down. The investors planning to buy

any company’s stock is always interested to know whether that particular stocks shows the

same up and down movement as reflected by other listed stocks (YCharts, n.d.).

3

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Financial Management

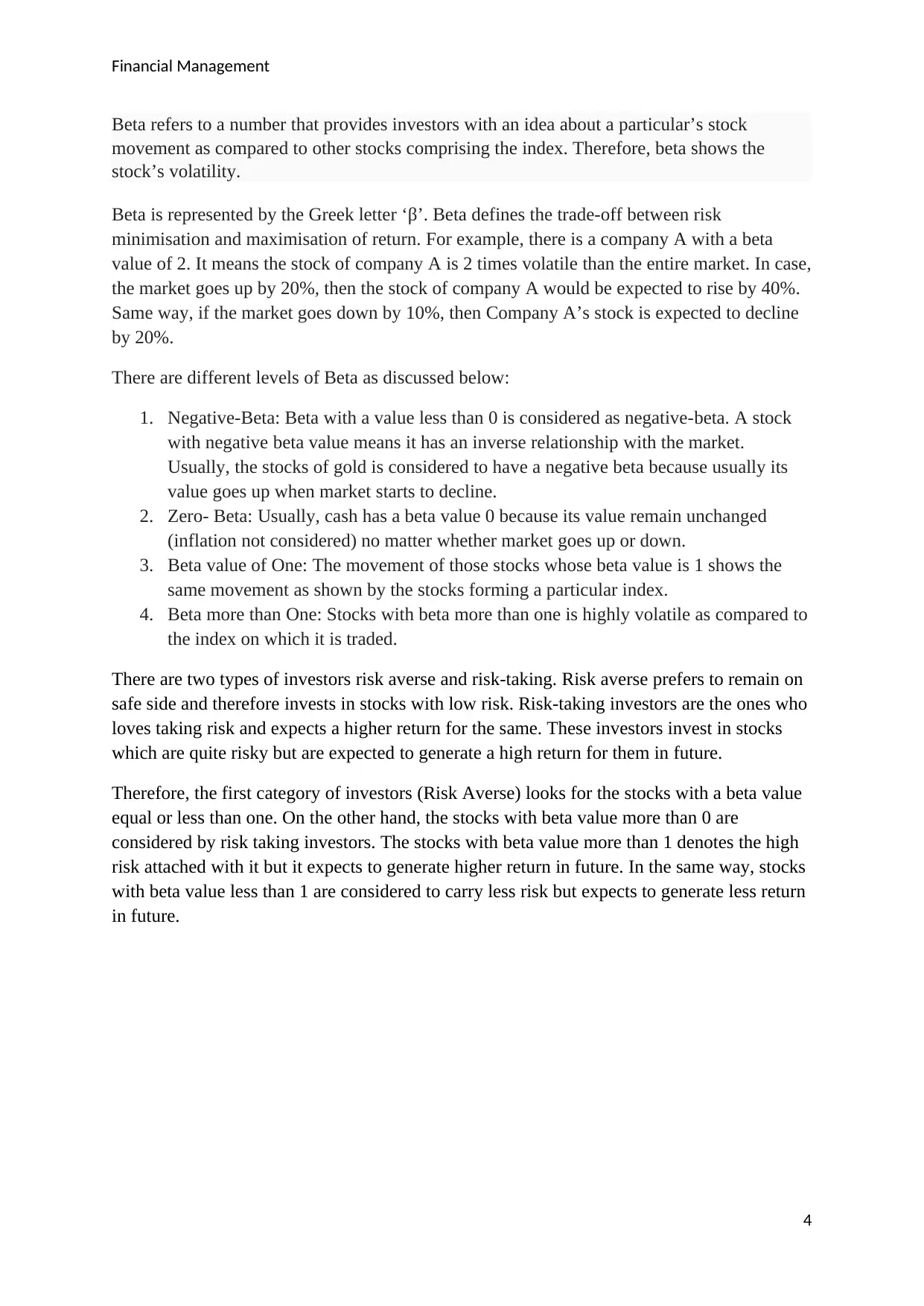

Beta refers to a number that provides investors with an idea about a particular’s stock

movement as compared to other stocks comprising the index. Therefore, beta shows the

stock’s volatility.

Beta is represented by the Greek letter ‘β’. Beta defines the trade-off between risk

minimisation and maximisation of return. For example, there is a company A with a beta

value of 2. It means the stock of company A is 2 times volatile than the entire market. In case,

the market goes up by 20%, then the stock of company A would be expected to rise by 40%.

Same way, if the market goes down by 10%, then Company A’s stock is expected to decline

by 20%.

There are different levels of Beta as discussed below:

1. Negative-Beta: Beta with a value less than 0 is considered as negative-beta. A stock

with negative beta value means it has an inverse relationship with the market.

Usually, the stocks of gold is considered to have a negative beta because usually its

value goes up when market starts to decline.

2. Zero- Beta: Usually, cash has a beta value 0 because its value remain unchanged

(inflation not considered) no matter whether market goes up or down.

3. Beta value of One: The movement of those stocks whose beta value is 1 shows the

same movement as shown by the stocks forming a particular index.

4. Beta more than One: Stocks with beta more than one is highly volatile as compared to

the index on which it is traded.

There are two types of investors risk averse and risk-taking. Risk averse prefers to remain on

safe side and therefore invests in stocks with low risk. Risk-taking investors are the ones who

loves taking risk and expects a higher return for the same. These investors invest in stocks

which are quite risky but are expected to generate a high return for them in future.

Therefore, the first category of investors (Risk Averse) looks for the stocks with a beta value

equal or less than one. On the other hand, the stocks with beta value more than 0 are

considered by risk taking investors. The stocks with beta value more than 1 denotes the high

risk attached with it but it expects to generate higher return in future. In the same way, stocks

with beta value less than 1 are considered to carry less risk but expects to generate less return

in future.

4

Beta refers to a number that provides investors with an idea about a particular’s stock

movement as compared to other stocks comprising the index. Therefore, beta shows the

stock’s volatility.

Beta is represented by the Greek letter ‘β’. Beta defines the trade-off between risk

minimisation and maximisation of return. For example, there is a company A with a beta

value of 2. It means the stock of company A is 2 times volatile than the entire market. In case,

the market goes up by 20%, then the stock of company A would be expected to rise by 40%.

Same way, if the market goes down by 10%, then Company A’s stock is expected to decline

by 20%.

There are different levels of Beta as discussed below:

1. Negative-Beta: Beta with a value less than 0 is considered as negative-beta. A stock

with negative beta value means it has an inverse relationship with the market.

Usually, the stocks of gold is considered to have a negative beta because usually its

value goes up when market starts to decline.

2. Zero- Beta: Usually, cash has a beta value 0 because its value remain unchanged

(inflation not considered) no matter whether market goes up or down.

3. Beta value of One: The movement of those stocks whose beta value is 1 shows the

same movement as shown by the stocks forming a particular index.

4. Beta more than One: Stocks with beta more than one is highly volatile as compared to

the index on which it is traded.

There are two types of investors risk averse and risk-taking. Risk averse prefers to remain on

safe side and therefore invests in stocks with low risk. Risk-taking investors are the ones who

loves taking risk and expects a higher return for the same. These investors invest in stocks

which are quite risky but are expected to generate a high return for them in future.

Therefore, the first category of investors (Risk Averse) looks for the stocks with a beta value

equal or less than one. On the other hand, the stocks with beta value more than 0 are

considered by risk taking investors. The stocks with beta value more than 1 denotes the high

risk attached with it but it expects to generate higher return in future. In the same way, stocks

with beta value less than 1 are considered to carry less risk but expects to generate less return

in future.

4

Financial Management

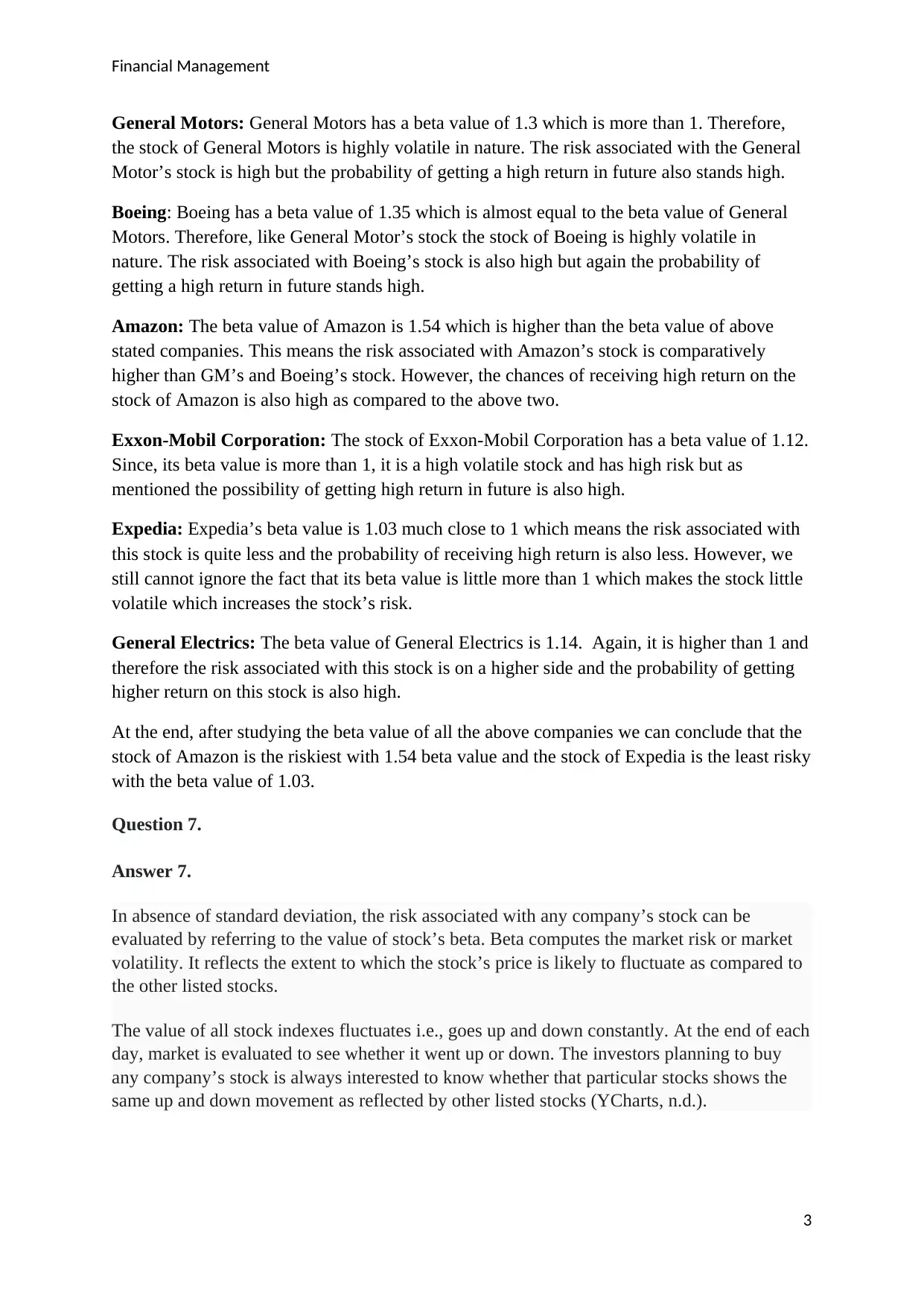

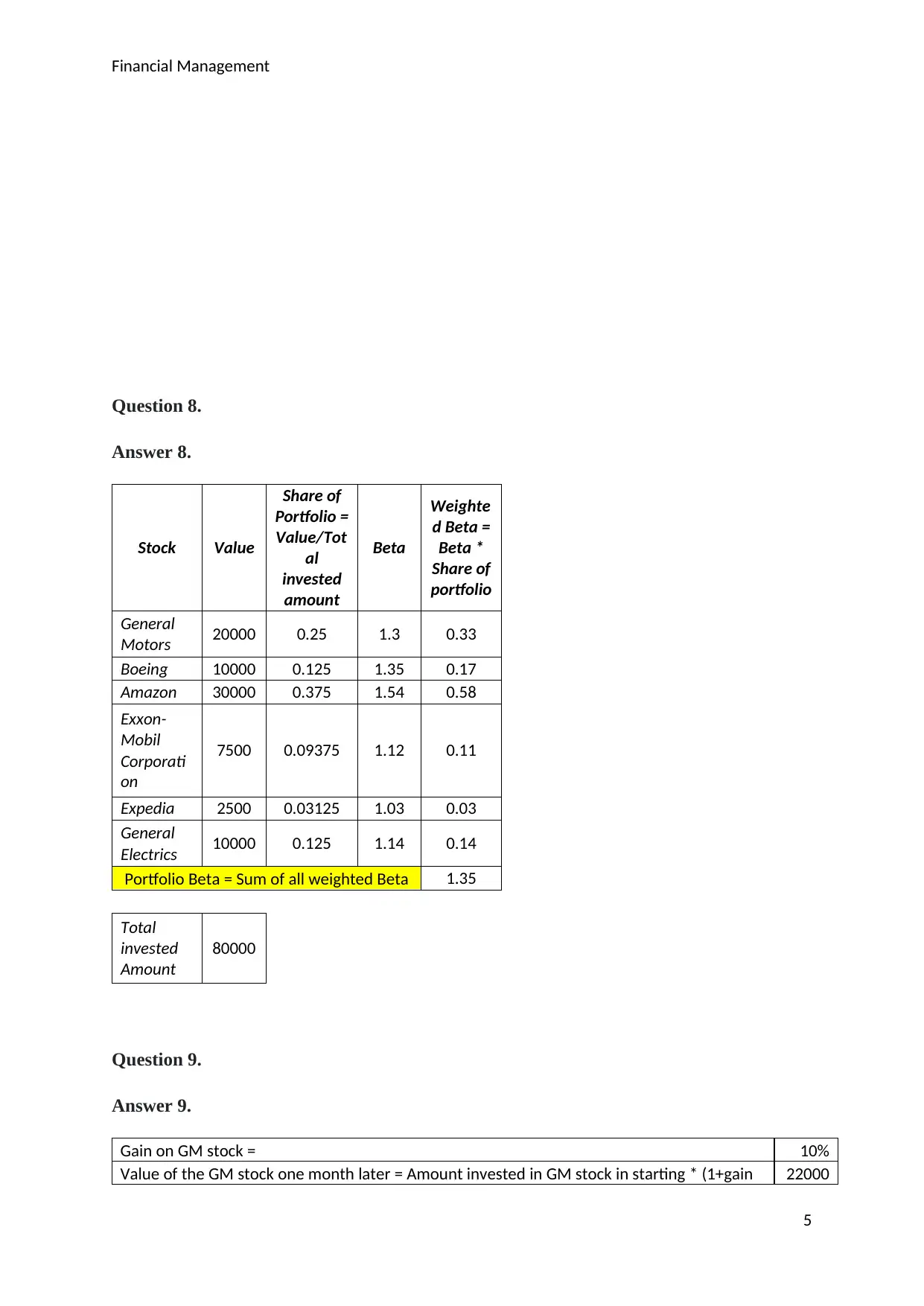

Question 8.

Answer 8.

Stock Value

Share of

Portfolio =

Value/Tot

al

invested

amount

Beta

Weighte

d Beta =

Beta *

Share of

portfolio

General

Motors 20000 0.25 1.3 0.33

Boeing 10000 0.125 1.35 0.17

Amazon 30000 0.375 1.54 0.58

Exxon-

Mobil

Corporati

on

7500 0.09375 1.12 0.11

Expedia 2500 0.03125 1.03 0.03

General

Electrics 10000 0.125 1.14 0.14

Portfolio Beta = Sum of all weighted Beta 1.35

Total

invested

Amount

80000

Question 9.

Answer 9.

Gain on GM stock = 10%

Value of the GM stock one month later = Amount invested in GM stock in starting * (1+gain 22000

5

Question 8.

Answer 8.

Stock Value

Share of

Portfolio =

Value/Tot

al

invested

amount

Beta

Weighte

d Beta =

Beta *

Share of

portfolio

General

Motors 20000 0.25 1.3 0.33

Boeing 10000 0.125 1.35 0.17

Amazon 30000 0.375 1.54 0.58

Exxon-

Mobil

Corporati

on

7500 0.09375 1.12 0.11

Expedia 2500 0.03125 1.03 0.03

General

Electrics 10000 0.125 1.14 0.14

Portfolio Beta = Sum of all weighted Beta 1.35

Total

invested

Amount

80000

Question 9.

Answer 9.

Gain on GM stock = 10%

Value of the GM stock one month later = Amount invested in GM stock in starting * (1+gain 22000

5

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

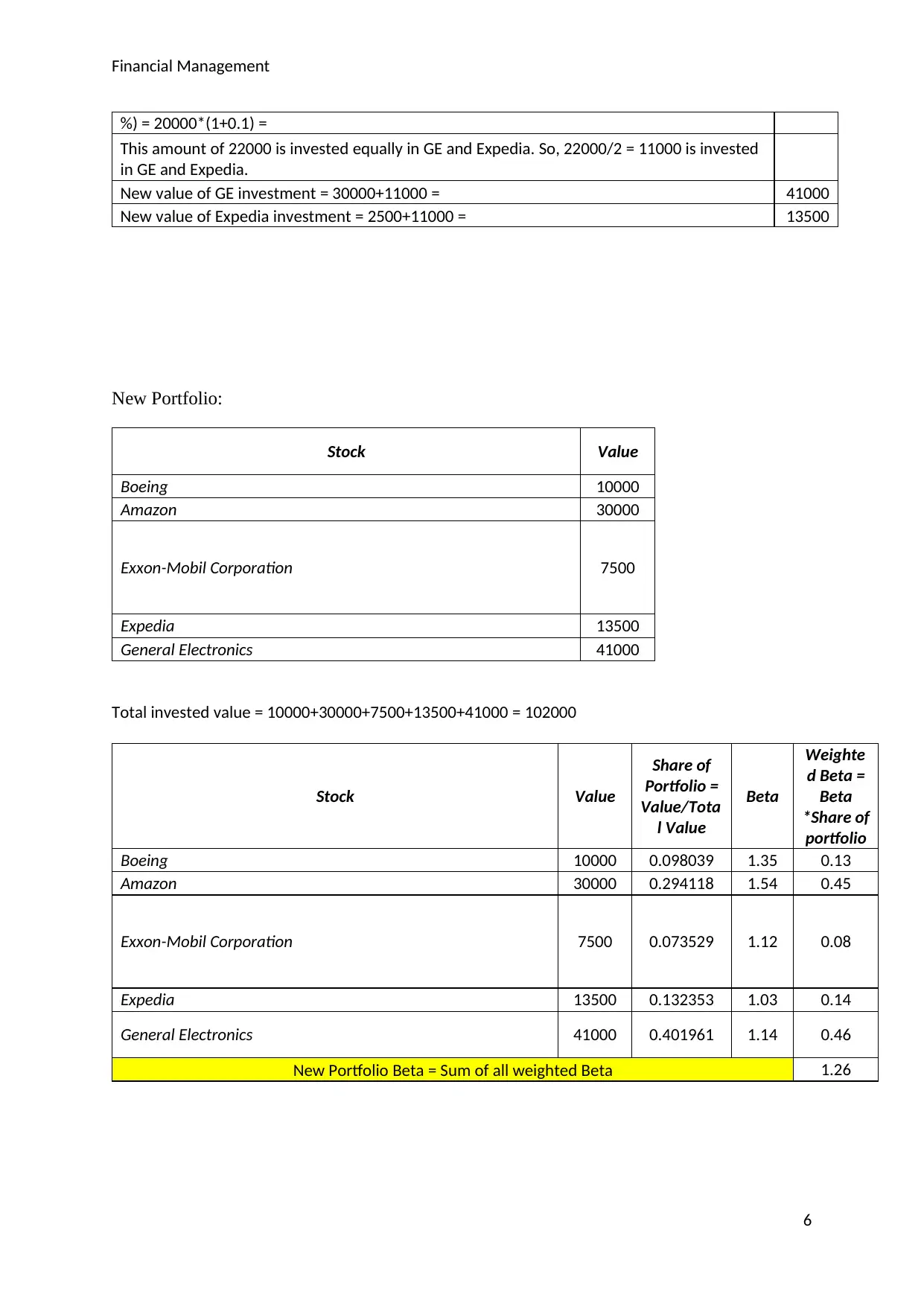

Financial Management

%) = 20000*(1+0.1) =

This amount of 22000 is invested equally in GE and Expedia. So, 22000/2 = 11000 is invested

in GE and Expedia.

New value of GE investment = 30000+11000 = 41000

New value of Expedia investment = 2500+11000 = 13500

New Portfolio:

Stock Value

Boeing 10000

Amazon 30000

Exxon-Mobil Corporation 7500

Expedia 13500

General Electronics 41000

Total invested value = 10000+30000+7500+13500+41000 = 102000

Stock Value

Share of

Portfolio =

Value/Tota

l Value

Beta

Weighte

d Beta =

Beta

*Share of

portfolio

Boeing 10000 0.098039 1.35 0.13

Amazon 30000 0.294118 1.54 0.45

Exxon-Mobil Corporation 7500 0.073529 1.12 0.08

Expedia 13500 0.132353 1.03 0.14

General Electronics 41000 0.401961 1.14 0.46

New Portfolio Beta = Sum of all weighted Beta 1.26

6

%) = 20000*(1+0.1) =

This amount of 22000 is invested equally in GE and Expedia. So, 22000/2 = 11000 is invested

in GE and Expedia.

New value of GE investment = 30000+11000 = 41000

New value of Expedia investment = 2500+11000 = 13500

New Portfolio:

Stock Value

Boeing 10000

Amazon 30000

Exxon-Mobil Corporation 7500

Expedia 13500

General Electronics 41000

Total invested value = 10000+30000+7500+13500+41000 = 102000

Stock Value

Share of

Portfolio =

Value/Tota

l Value

Beta

Weighte

d Beta =

Beta

*Share of

portfolio

Boeing 10000 0.098039 1.35 0.13

Amazon 30000 0.294118 1.54 0.45

Exxon-Mobil Corporation 7500 0.073529 1.12 0.08

Expedia 13500 0.132353 1.03 0.14

General Electronics 41000 0.401961 1.14 0.46

New Portfolio Beta = Sum of all weighted Beta 1.26

6

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Financial Management

References

WallStreetMojo. (n.d.). Beta Coefficient. [online]. Available at:

https://www.wallstreetmojo.com/beta-coefficient-calculate/ (28 March,2020).

YCharts. (n.d.). Beta. [online]. Available at: https://ycharts.com/glossary/terms/beta (28

March,2020).

7

References

WallStreetMojo. (n.d.). Beta Coefficient. [online]. Available at:

https://www.wallstreetmojo.com/beta-coefficient-calculate/ (28 March,2020).

YCharts. (n.d.). Beta. [online]. Available at: https://ycharts.com/glossary/terms/beta (28

March,2020).

7

Financial Management

Appendix

8

Appendix

8

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 9

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.