Tutorial Questions 2

VerifiedAdded on 2023/01/10

|12

|2364

|42

AI Summary

This document provides answers to tutorial questions on various topics such as income tax payable, journal entries for income tax accounting, consolidated worksheet entries, non-controlling interest calculation, and more. It includes detailed explanations and calculations for each question.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Tutorial Questions 2

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Contents

MAIN BODY...................................................................................................................................4

Question 1:.......................................................................................................................................4

Determining the net aggregate income tax payable for year before 30 Jun. 2020:................4

Determining by what sum deferred liability balances as well as deferred tax assets would rise

or decline for year to Jun 30, 2020 due to the depreciation amount, doubtful debts and

other long-service leave:.........................................................................................................4

Making the journal entries needed to account income tax, so the recognition requirements are

fulfilled:..................................................................................................................................5

Deferred tax liabilities account balances and deferred tax assets as on June 30, 2020:.........5

Question 2:.......................................................................................................................................5

1. On July 1, 2019...................................................................................................................5

2. On July 1, 2019...................................................................................................................6

Question 3........................................................................................................................................6

a).............................................................................................................................................6

i) Preparing consolidated worksheet entries with respect to Liala Ltd as on 30th Jun. 2017 with

regards to intragroup transfers of inventories:........................................................................6

ii) Computation of figure of the cost of goods sold which is to be stated within consolidated

income statements for year 2017 with respect to intra-group revenues:................................7

b) Entering journal entries as of 30 Jun. 2017 to minimise or eliminate any intra-group

transfers of equipment:...........................................................................................................8

Question 4:.......................................................................................................................................9

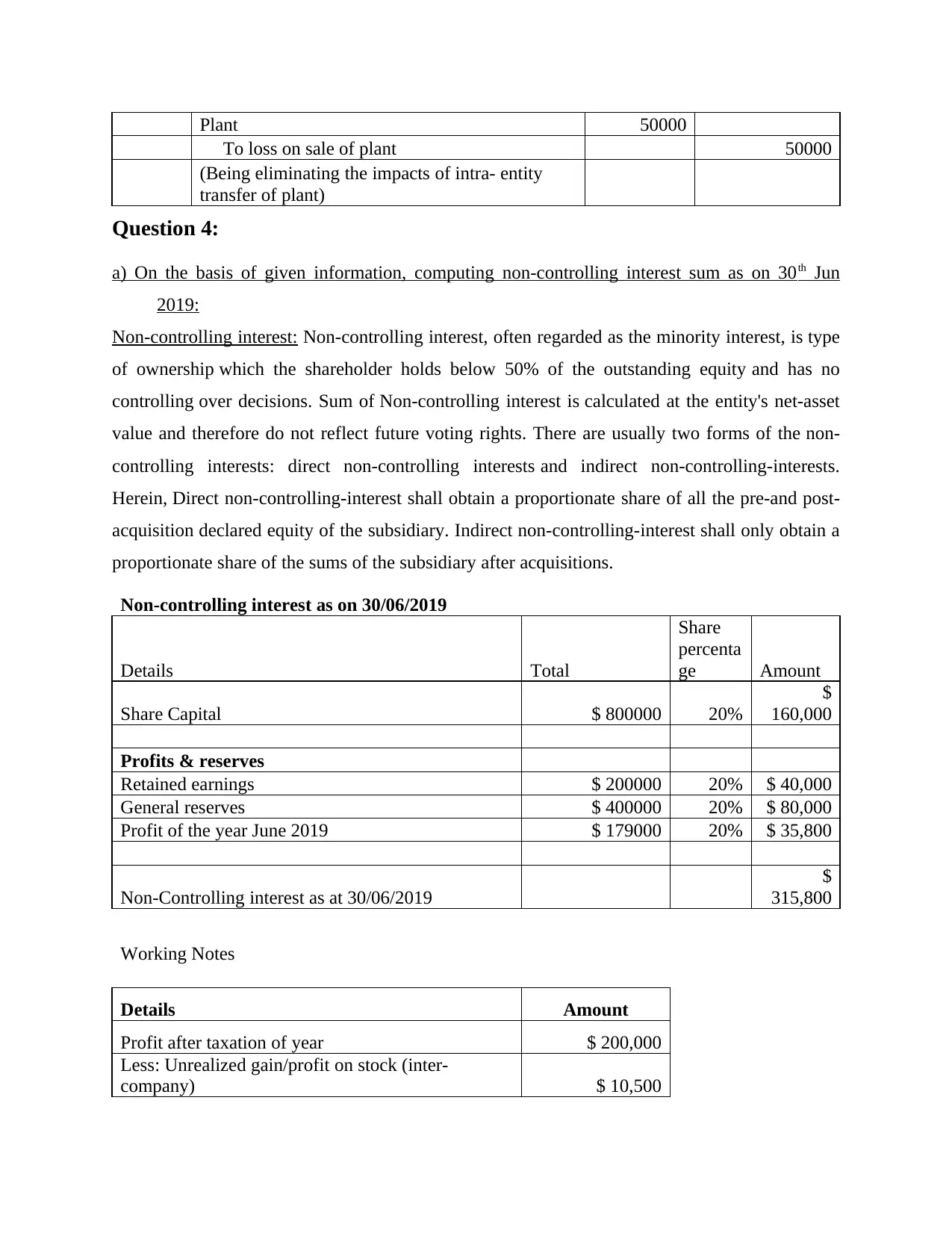

a) On the basis of given information, computing non-controlling interest sum as on 30th Jun

2019:.......................................................................................................................................9

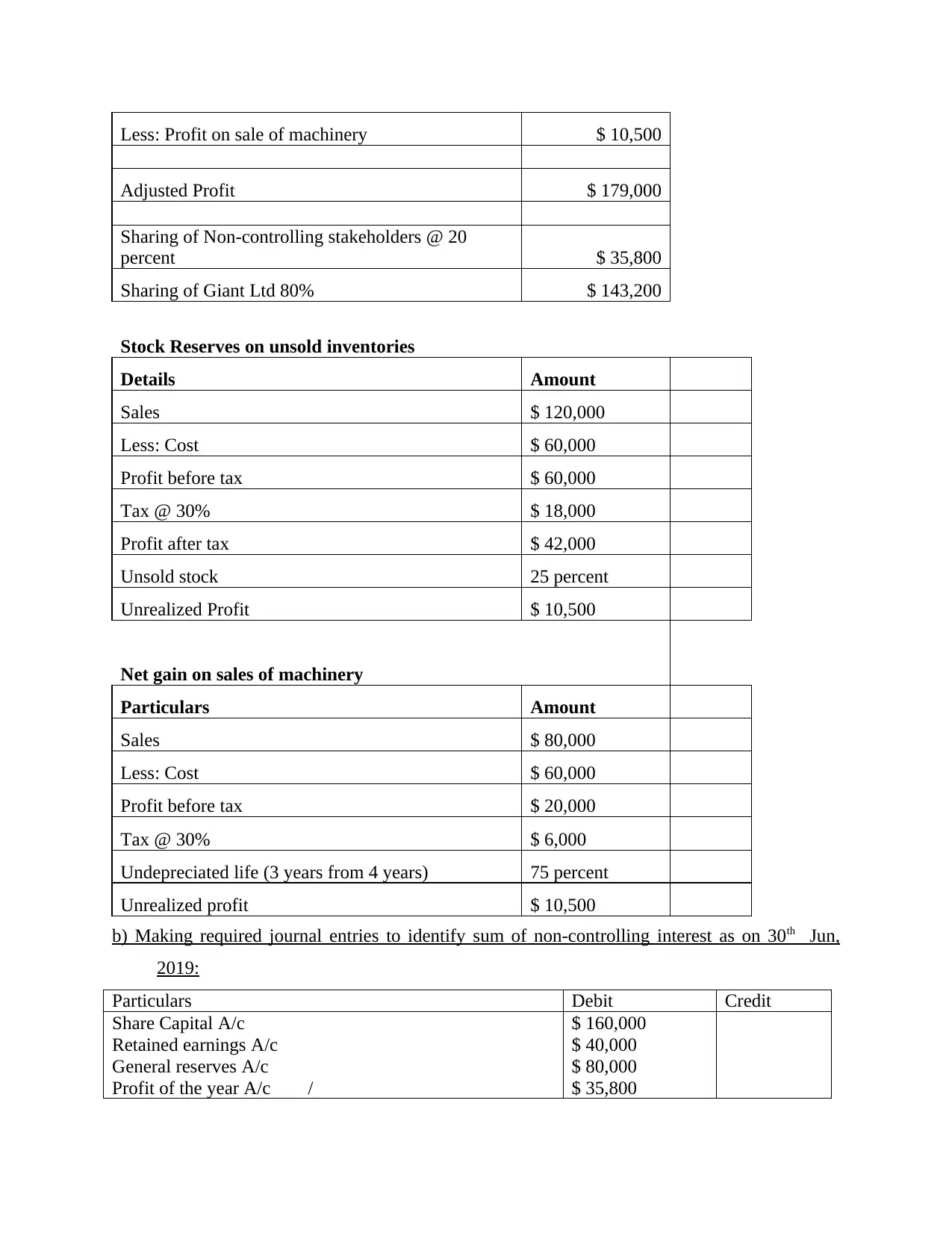

b) Making required journal entries to identify sum of non-controlling interest as on 30th Jun,

2019:.....................................................................................................................................10

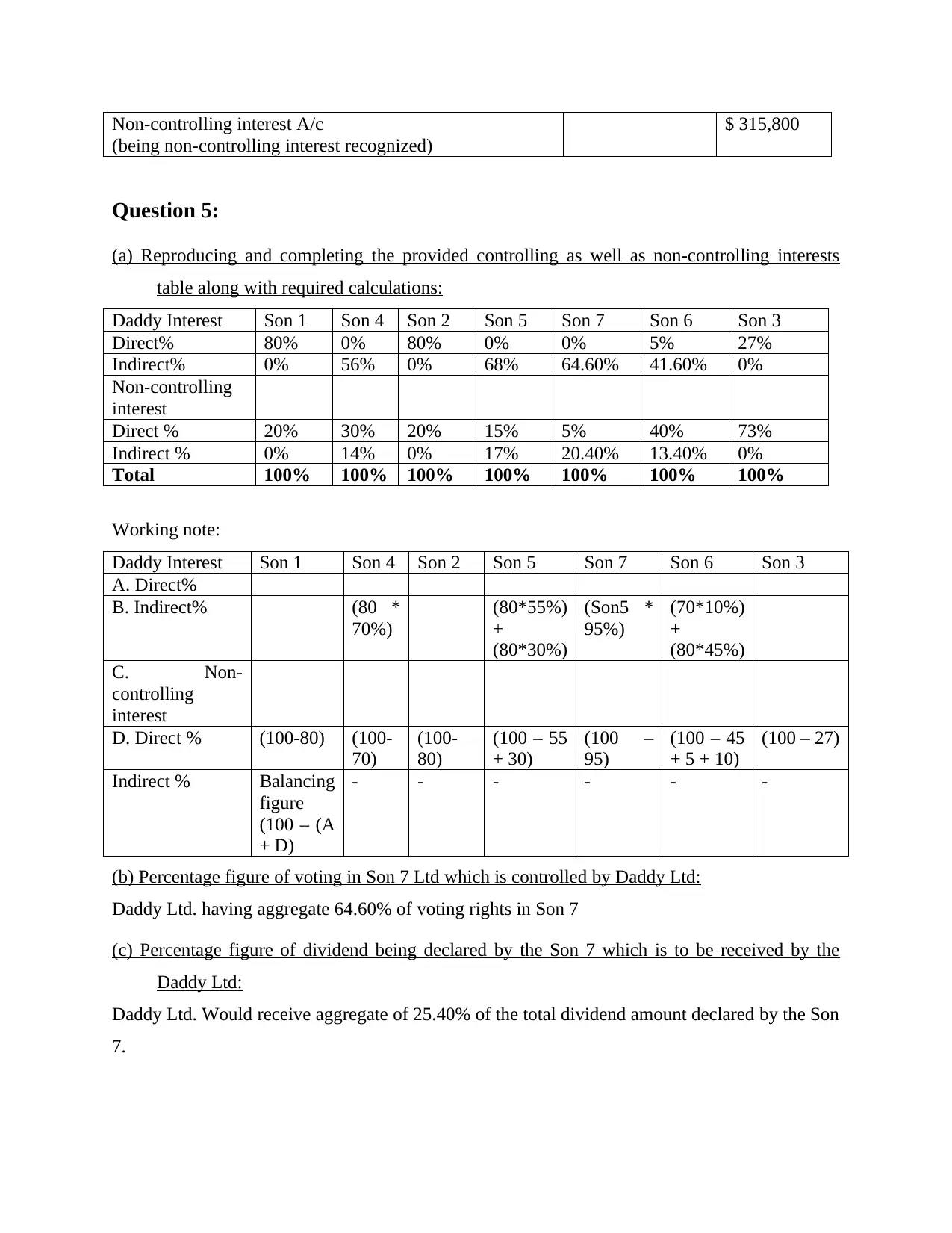

Question 5:.....................................................................................................................................10

(a) Reproducing and completing the provided controlling as well as non-controlling interests

table along with required calculations:.................................................................................10

(b) Percentage figure of voting in Son 7 Ltd which is controlled by Daddy Ltd:................11

MAIN BODY...................................................................................................................................4

Question 1:.......................................................................................................................................4

Determining the net aggregate income tax payable for year before 30 Jun. 2020:................4

Determining by what sum deferred liability balances as well as deferred tax assets would rise

or decline for year to Jun 30, 2020 due to the depreciation amount, doubtful debts and

other long-service leave:.........................................................................................................4

Making the journal entries needed to account income tax, so the recognition requirements are

fulfilled:..................................................................................................................................5

Deferred tax liabilities account balances and deferred tax assets as on June 30, 2020:.........5

Question 2:.......................................................................................................................................5

1. On July 1, 2019...................................................................................................................5

2. On July 1, 2019...................................................................................................................6

Question 3........................................................................................................................................6

a).............................................................................................................................................6

i) Preparing consolidated worksheet entries with respect to Liala Ltd as on 30th Jun. 2017 with

regards to intragroup transfers of inventories:........................................................................6

ii) Computation of figure of the cost of goods sold which is to be stated within consolidated

income statements for year 2017 with respect to intra-group revenues:................................7

b) Entering journal entries as of 30 Jun. 2017 to minimise or eliminate any intra-group

transfers of equipment:...........................................................................................................8

Question 4:.......................................................................................................................................9

a) On the basis of given information, computing non-controlling interest sum as on 30th Jun

2019:.......................................................................................................................................9

b) Making required journal entries to identify sum of non-controlling interest as on 30th Jun,

2019:.....................................................................................................................................10

Question 5:.....................................................................................................................................10

(a) Reproducing and completing the provided controlling as well as non-controlling interests

table along with required calculations:.................................................................................10

(b) Percentage figure of voting in Son 7 Ltd which is controlled by Daddy Ltd:................11

(c) Percentage figure of dividend being declared by the Son 7 which is to be received by the

Daddy Ltd:............................................................................................................................11

Daddy Ltd:............................................................................................................................11

MAIN BODY

Question 1:

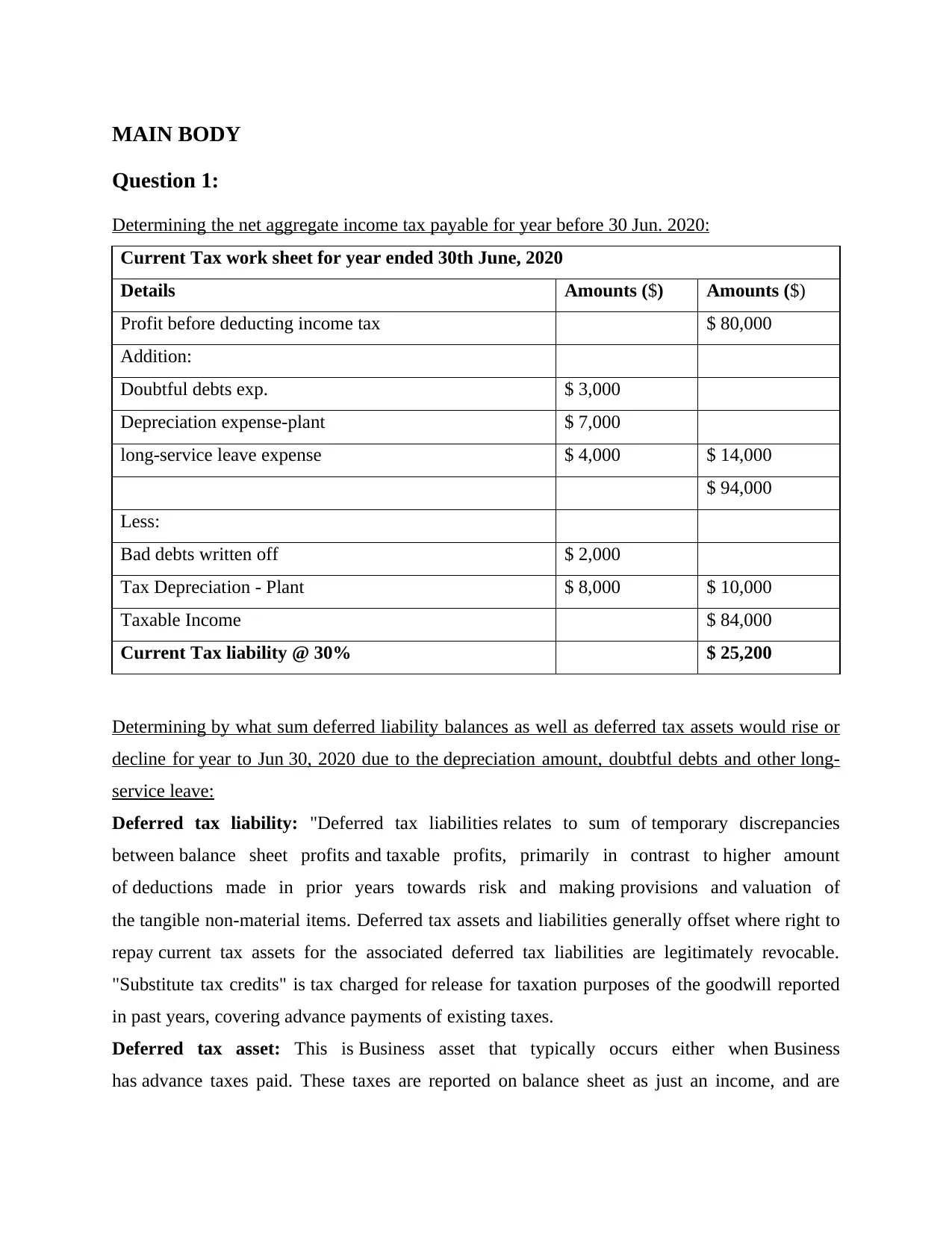

Determining the net aggregate income tax payable for year before 30 Jun. 2020:

Current Tax work sheet for year ended 30th June, 2020

Details Amounts ($) Amounts ($)

Profit before deducting income tax $ 80,000

Addition:

Doubtful debts exp. $ 3,000

Depreciation expense-plant $ 7,000

long-service leave expense $ 4,000 $ 14,000

$ 94,000

Less:

Bad debts written off $ 2,000

Tax Depreciation - Plant $ 8,000 $ 10,000

Taxable Income $ 84,000

Current Tax liability @ 30% $ 25,200

Determining by what sum deferred liability balances as well as deferred tax assets would rise or

decline for year to Jun 30, 2020 due to the depreciation amount, doubtful debts and other long-

service leave:

Deferred tax liability: "Deferred tax liabilities relates to sum of temporary discrepancies

between balance sheet profits and taxable profits, primarily in contrast to higher amount

of deductions made in prior years towards risk and making provisions and valuation of

the tangible non-material items. Deferred tax assets and liabilities generally offset where right to

repay current tax assets for the associated deferred tax liabilities are legitimately revocable.

"Substitute tax credits" is tax charged for release for taxation purposes of the goodwill reported

in past years, covering advance payments of existing taxes.

Deferred tax asset: This is Business asset that typically occurs either when Business

has advance taxes paid. These taxes are reported on balance sheet as just an income, and are

Question 1:

Determining the net aggregate income tax payable for year before 30 Jun. 2020:

Current Tax work sheet for year ended 30th June, 2020

Details Amounts ($) Amounts ($)

Profit before deducting income tax $ 80,000

Addition:

Doubtful debts exp. $ 3,000

Depreciation expense-plant $ 7,000

long-service leave expense $ 4,000 $ 14,000

$ 94,000

Less:

Bad debts written off $ 2,000

Tax Depreciation - Plant $ 8,000 $ 10,000

Taxable Income $ 84,000

Current Tax liability @ 30% $ 25,200

Determining by what sum deferred liability balances as well as deferred tax assets would rise or

decline for year to Jun 30, 2020 due to the depreciation amount, doubtful debts and other long-

service leave:

Deferred tax liability: "Deferred tax liabilities relates to sum of temporary discrepancies

between balance sheet profits and taxable profits, primarily in contrast to higher amount

of deductions made in prior years towards risk and making provisions and valuation of

the tangible non-material items. Deferred tax assets and liabilities generally offset where right to

repay current tax assets for the associated deferred tax liabilities are legitimately revocable.

"Substitute tax credits" is tax charged for release for taxation purposes of the goodwill reported

in past years, covering advance payments of existing taxes.

Deferred tax asset: This is Business asset that typically occurs either when Business

has advance taxes paid. These taxes are reported on balance sheet as just an income, and are

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

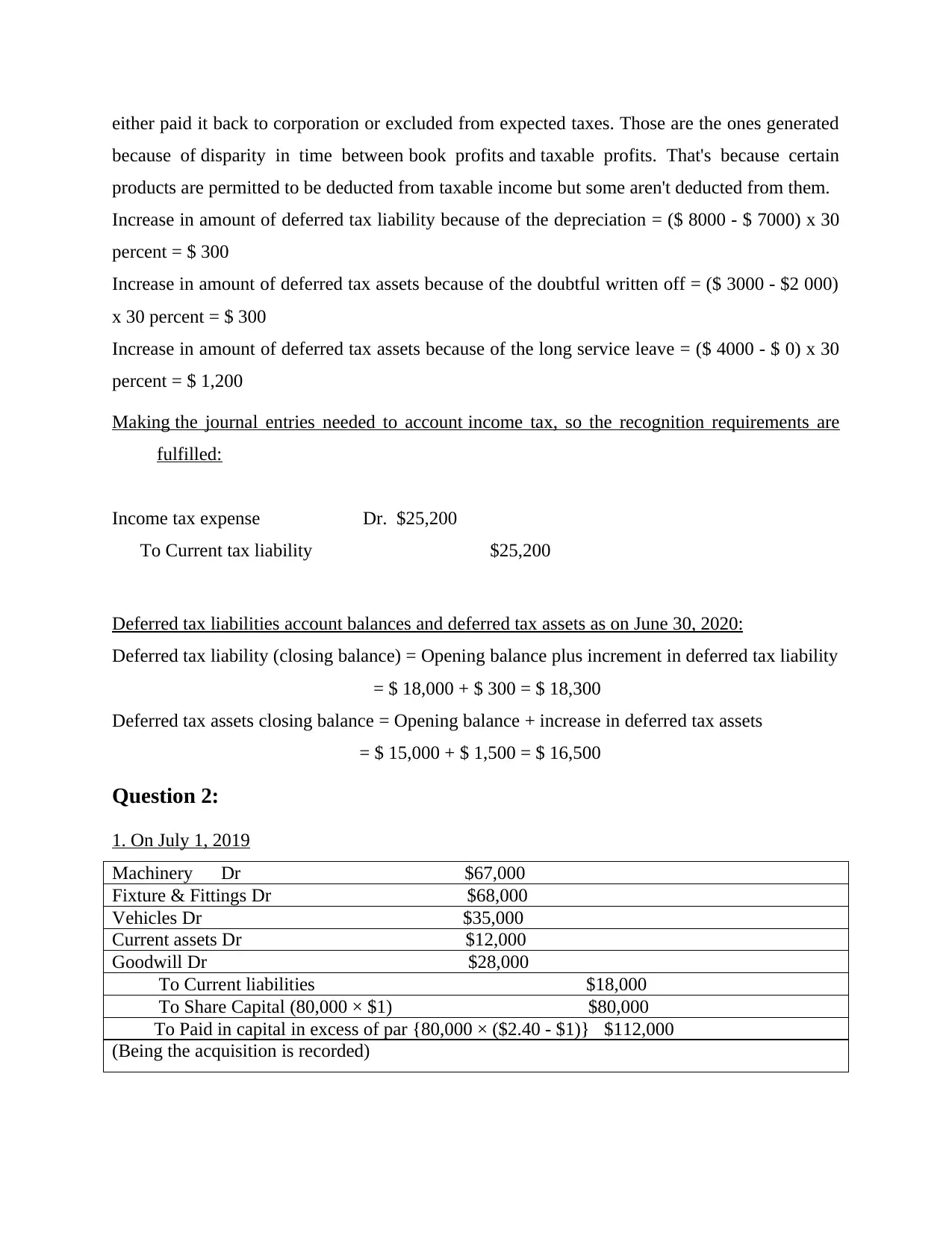

either paid it back to corporation or excluded from expected taxes. Those are the ones generated

because of disparity in time between book profits and taxable profits. That's because certain

products are permitted to be deducted from taxable income but some aren't deducted from them.

Increase in amount of deferred tax liability because of the depreciation = ($ 8000 - $ 7000) x 30

percent = $ 300

Increase in amount of deferred tax assets because of the doubtful written off = ($ 3000 - $2 000)

x 30 percent = $ 300

Increase in amount of deferred tax assets because of the long service leave = ($ 4000 - $ 0) x 30

percent = $ 1,200

Making the journal entries needed to account income tax, so the recognition requirements are

fulfilled:

Income tax expense Dr. $25,200

To Current tax liability $25,200

Deferred tax liabilities account balances and deferred tax assets as on June 30, 2020:

Deferred tax liability (closing balance) = Opening balance plus increment in deferred tax liability

= $ 18,000 + $ 300 = $ 18,300

Deferred tax assets closing balance = Opening balance + increase in deferred tax assets

= $ 15,000 + $ 1,500 = $ 16,500

Question 2:

1. On July 1, 2019

Machinery Dr $67,000

Fixture & Fittings Dr $68,000

Vehicles Dr $35,000

Current assets Dr $12,000

Goodwill Dr $28,000

To Current liabilities $18,000

To Share Capital (80,000 × $1) $80,000

To Paid in capital in excess of par {80,000 × ($2.40 - $1)} $112,000

(Being the acquisition is recorded)

because of disparity in time between book profits and taxable profits. That's because certain

products are permitted to be deducted from taxable income but some aren't deducted from them.

Increase in amount of deferred tax liability because of the depreciation = ($ 8000 - $ 7000) x 30

percent = $ 300

Increase in amount of deferred tax assets because of the doubtful written off = ($ 3000 - $2 000)

x 30 percent = $ 300

Increase in amount of deferred tax assets because of the long service leave = ($ 4000 - $ 0) x 30

percent = $ 1,200

Making the journal entries needed to account income tax, so the recognition requirements are

fulfilled:

Income tax expense Dr. $25,200

To Current tax liability $25,200

Deferred tax liabilities account balances and deferred tax assets as on June 30, 2020:

Deferred tax liability (closing balance) = Opening balance plus increment in deferred tax liability

= $ 18,000 + $ 300 = $ 18,300

Deferred tax assets closing balance = Opening balance + increase in deferred tax assets

= $ 15,000 + $ 1,500 = $ 16,500

Question 2:

1. On July 1, 2019

Machinery Dr $67,000

Fixture & Fittings Dr $68,000

Vehicles Dr $35,000

Current assets Dr $12,000

Goodwill Dr $28,000

To Current liabilities $18,000

To Share Capital (80,000 × $1) $80,000

To Paid in capital in excess of par {80,000 × ($2.40 - $1)} $112,000

(Being the acquisition is recorded)

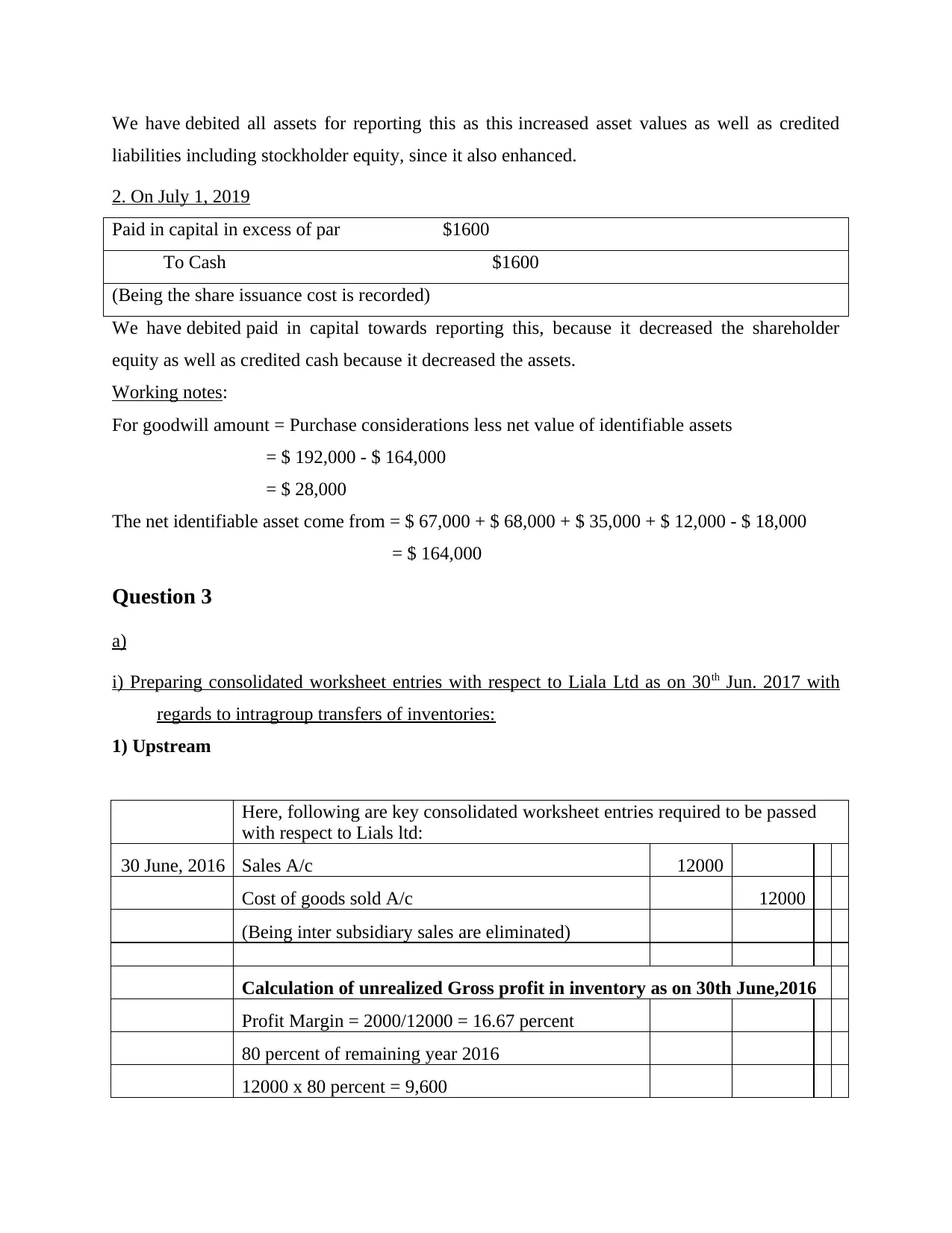

We have debited all assets for reporting this as this increased asset values as well as credited

liabilities including stockholder equity, since it also enhanced.

2. On July 1, 2019

Paid in capital in excess of par $1600

To Cash $1600

(Being the share issuance cost is recorded)

We have debited paid in capital towards reporting this, because it decreased the shareholder

equity as well as credited cash because it decreased the assets.

Working notes:

For goodwill amount = Purchase considerations less net value of identifiable assets

= $ 192,000 - $ 164,000

= $ 28,000

The net identifiable asset come from = $ 67,000 + $ 68,000 + $ 35,000 + $ 12,000 - $ 18,000

= $ 164,000

Question 3

a)

i) Preparing consolidated worksheet entries with respect to Liala Ltd as on 30th Jun. 2017 with

regards to intragroup transfers of inventories:

1) Upstream

Here, following are key consolidated worksheet entries required to be passed

with respect to Lials ltd:

30 June, 2016 Sales A/c 12000

Cost of goods sold A/c 12000

(Being inter subsidiary sales are eliminated)

Calculation of unrealized Gross profit in inventory as on 30th June,2016

Profit Margin = 2000/12000 = 16.67 percent

80 percent of remaining year 2016

12000 x 80 percent = 9,600

liabilities including stockholder equity, since it also enhanced.

2. On July 1, 2019

Paid in capital in excess of par $1600

To Cash $1600

(Being the share issuance cost is recorded)

We have debited paid in capital towards reporting this, because it decreased the shareholder

equity as well as credited cash because it decreased the assets.

Working notes:

For goodwill amount = Purchase considerations less net value of identifiable assets

= $ 192,000 - $ 164,000

= $ 28,000

The net identifiable asset come from = $ 67,000 + $ 68,000 + $ 35,000 + $ 12,000 - $ 18,000

= $ 164,000

Question 3

a)

i) Preparing consolidated worksheet entries with respect to Liala Ltd as on 30th Jun. 2017 with

regards to intragroup transfers of inventories:

1) Upstream

Here, following are key consolidated worksheet entries required to be passed

with respect to Lials ltd:

30 June, 2016 Sales A/c 12000

Cost of goods sold A/c 12000

(Being inter subsidiary sales are eliminated)

Calculation of unrealized Gross profit in inventory as on 30th June,2016

Profit Margin = 2000/12000 = 16.67 percent

80 percent of remaining year 2016

12000 x 80 percent = 9,600

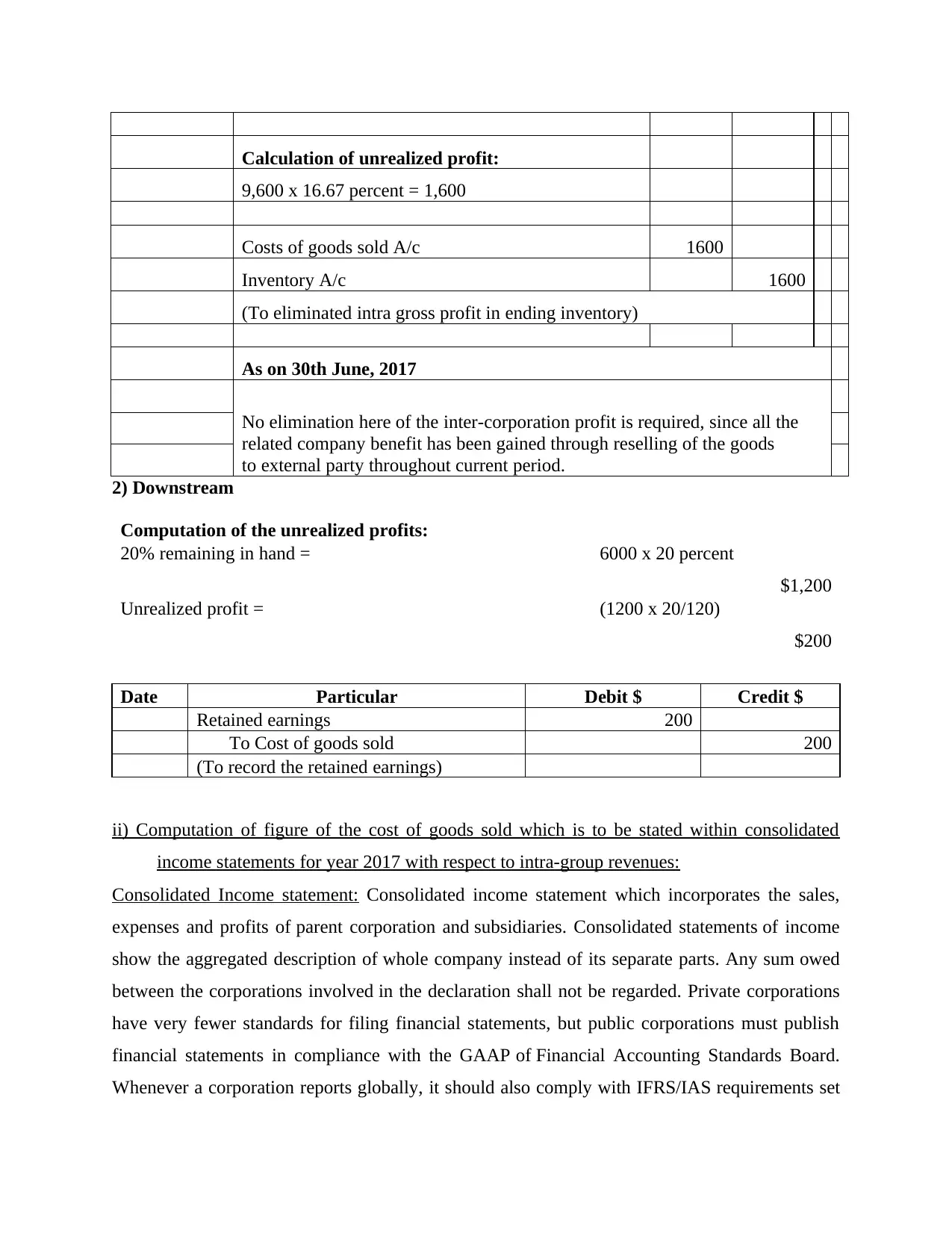

Calculation of unrealized profit:

9,600 x 16.67 percent = 1,600

Costs of goods sold A/c 1600

Inventory A/c 1600

(To eliminated intra gross profit in ending inventory)

As on 30th June, 2017

No elimination here of the inter-corporation profit is required, since all the

related company benefit has been gained through reselling of the goods

to external party throughout current period.

2) Downstream

Computation of the unrealized profits:

20% remaining in hand = 6000 x 20 percent

$1,200

Unrealized profit = (1200 x 20/120)

$200

Date Particular Debit $ Credit $

Retained earnings 200

To Cost of goods sold 200

(To record the retained earnings)

ii) Computation of figure of the cost of goods sold which is to be stated within consolidated

income statements for year 2017 with respect to intra-group revenues:

Consolidated Income statement: Consolidated income statement which incorporates the sales,

expenses and profits of parent corporation and subsidiaries. Consolidated statements of income

show the aggregated description of whole company instead of its separate parts. Any sum owed

between the corporations involved in the declaration shall not be regarded. Private corporations

have very fewer standards for filing financial statements, but public corporations must publish

financial statements in compliance with the GAAP of Financial Accounting Standards Board.

Whenever a corporation reports globally, it should also comply with IFRS/IAS requirements set

9,600 x 16.67 percent = 1,600

Costs of goods sold A/c 1600

Inventory A/c 1600

(To eliminated intra gross profit in ending inventory)

As on 30th June, 2017

No elimination here of the inter-corporation profit is required, since all the

related company benefit has been gained through reselling of the goods

to external party throughout current period.

2) Downstream

Computation of the unrealized profits:

20% remaining in hand = 6000 x 20 percent

$1,200

Unrealized profit = (1200 x 20/120)

$200

Date Particular Debit $ Credit $

Retained earnings 200

To Cost of goods sold 200

(To record the retained earnings)

ii) Computation of figure of the cost of goods sold which is to be stated within consolidated

income statements for year 2017 with respect to intra-group revenues:

Consolidated Income statement: Consolidated income statement which incorporates the sales,

expenses and profits of parent corporation and subsidiaries. Consolidated statements of income

show the aggregated description of whole company instead of its separate parts. Any sum owed

between the corporations involved in the declaration shall not be regarded. Private corporations

have very fewer standards for filing financial statements, but public corporations must publish

financial statements in compliance with the GAAP of Financial Accounting Standards Board.

Whenever a corporation reports globally, it should also comply with IFRS/IAS requirements set

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

down by relevant authorities. All GAAP and IFRS provide different requirements for businesses

who want to disclose consolidated accounts to subsidiaries. Generally, consolidation of income

statements needs a company to incorporate and merge all its revenue recognition functions in

attempt to generate annual financial reports showing outcomes in balance sheet and income

statement. Decisions to file consolidated accounts with subsidiary companies is generally made

on year-by-year basis but is often determined on basis of taxes or other benefits that occur. The

conditions for reporting consolidated financial statement including subsidiaries are largely

determined by amount of equity of parent company in subsidiary.

Steps to assess cost of goods sold that is to be recorded in company’s consolidated Income

statement:

Details Amount in $

Cost of goods sold of Upstream 9600

Add: Cost of goods sold downstream 6000

15600

Less: Unrealized profits -200

Cost of goods sold in consolidated Income statement 15400

b) Entering journal entries as of 30 Jun. 2017 to minimise or eliminate any intra-group transfers

of equipment:

Consolidation Journal Entry:

1. Corporation records Plant at amount of $150,000 that is acquisition/purchase price.

2. At period ended, intra-entry impact of such transaction required to be eliminated to fulfil

consolidation purposes.

Date Particulars Debit $ Credit $

Plant 50000

To loss on sale of plant 50000

(Being eliminating impacts of intra-entity

transfers of plant)

Note:

For each subsequent consolidation till plant is being sold, elimination process must

be repeated

Date Particulars Debit $ Credit $

who want to disclose consolidated accounts to subsidiaries. Generally, consolidation of income

statements needs a company to incorporate and merge all its revenue recognition functions in

attempt to generate annual financial reports showing outcomes in balance sheet and income

statement. Decisions to file consolidated accounts with subsidiary companies is generally made

on year-by-year basis but is often determined on basis of taxes or other benefits that occur. The

conditions for reporting consolidated financial statement including subsidiaries are largely

determined by amount of equity of parent company in subsidiary.

Steps to assess cost of goods sold that is to be recorded in company’s consolidated Income

statement:

Details Amount in $

Cost of goods sold of Upstream 9600

Add: Cost of goods sold downstream 6000

15600

Less: Unrealized profits -200

Cost of goods sold in consolidated Income statement 15400

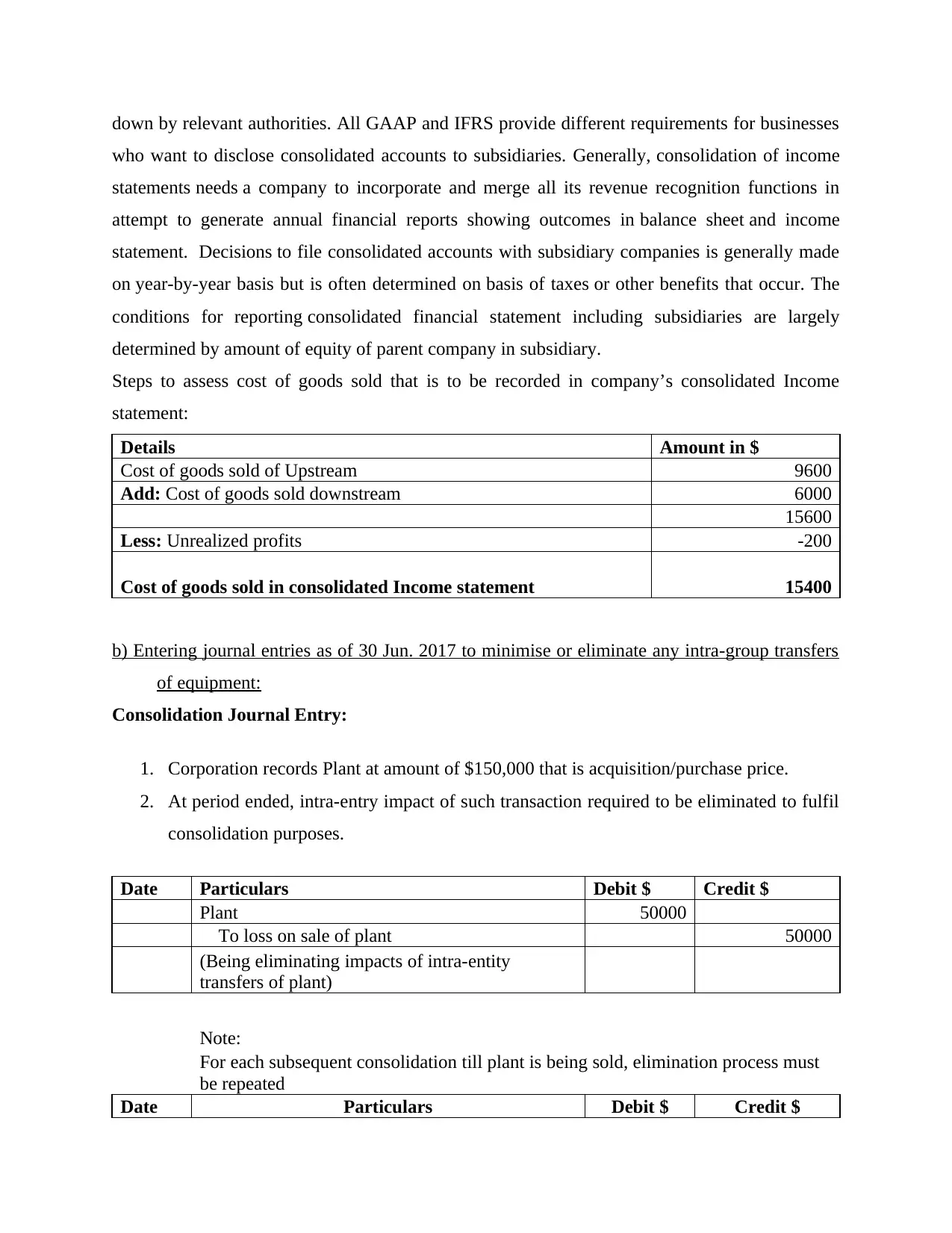

b) Entering journal entries as of 30 Jun. 2017 to minimise or eliminate any intra-group transfers

of equipment:

Consolidation Journal Entry:

1. Corporation records Plant at amount of $150,000 that is acquisition/purchase price.

2. At period ended, intra-entry impact of such transaction required to be eliminated to fulfil

consolidation purposes.

Date Particulars Debit $ Credit $

Plant 50000

To loss on sale of plant 50000

(Being eliminating impacts of intra-entity

transfers of plant)

Note:

For each subsequent consolidation till plant is being sold, elimination process must

be repeated

Date Particulars Debit $ Credit $

Plant 50000

To loss on sale of plant 50000

(Being eliminating the impacts of intra- entity

transfer of plant)

Question 4:

a) On the basis of given information, computing non-controlling interest sum as on 30th Jun

2019:

Non-controlling interest: Non-controlling interest, often regarded as the minority interest, is type

of ownership which the shareholder holds below 50% of the outstanding equity and has no

controlling over decisions. Sum of Non-controlling interest is calculated at the entity's net-asset

value and therefore do not reflect future voting rights. There are usually two forms of the non-

controlling interests: direct non-controlling interests and indirect non-controlling-interests.

Herein, Direct non-controlling-interest shall obtain a proportionate share of all the pre-and post-

acquisition declared equity of the subsidiary. Indirect non-controlling-interest shall only obtain a

proportionate share of the sums of the subsidiary after acquisitions.

Non-controlling interest as on 30/06/2019

Details Total

Share

percenta

ge Amount

Share Capital $ 800000 20%

$

160,000

Profits & reserves

Retained earnings $ 200000 20% $ 40,000

General reserves $ 400000 20% $ 80,000

Profit of the year June 2019 $ 179000 20% $ 35,800

Non-Controlling interest as at 30/06/2019

$

315,800

Working Notes

Details Amount

Profit after taxation of year $ 200,000

Less: Unrealized gain/profit on stock (inter-

company) $ 10,500

To loss on sale of plant 50000

(Being eliminating the impacts of intra- entity

transfer of plant)

Question 4:

a) On the basis of given information, computing non-controlling interest sum as on 30th Jun

2019:

Non-controlling interest: Non-controlling interest, often regarded as the minority interest, is type

of ownership which the shareholder holds below 50% of the outstanding equity and has no

controlling over decisions. Sum of Non-controlling interest is calculated at the entity's net-asset

value and therefore do not reflect future voting rights. There are usually two forms of the non-

controlling interests: direct non-controlling interests and indirect non-controlling-interests.

Herein, Direct non-controlling-interest shall obtain a proportionate share of all the pre-and post-

acquisition declared equity of the subsidiary. Indirect non-controlling-interest shall only obtain a

proportionate share of the sums of the subsidiary after acquisitions.

Non-controlling interest as on 30/06/2019

Details Total

Share

percenta

ge Amount

Share Capital $ 800000 20%

$

160,000

Profits & reserves

Retained earnings $ 200000 20% $ 40,000

General reserves $ 400000 20% $ 80,000

Profit of the year June 2019 $ 179000 20% $ 35,800

Non-Controlling interest as at 30/06/2019

$

315,800

Working Notes

Details Amount

Profit after taxation of year $ 200,000

Less: Unrealized gain/profit on stock (inter-

company) $ 10,500

Less: Profit on sale of machinery $ 10,500

Adjusted Profit $ 179,000

Sharing of Non-controlling stakeholders @ 20

percent $ 35,800

Sharing of Giant Ltd 80% $ 143,200

Stock Reserves on unsold inventories

Details Amount

Sales $ 120,000

Less: Cost $ 60,000

Profit before tax $ 60,000

Tax @ 30% $ 18,000

Profit after tax $ 42,000

Unsold stock 25 percent

Unrealized Profit $ 10,500

Net gain on sales of machinery

Particulars Amount

Sales $ 80,000

Less: Cost $ 60,000

Profit before tax $ 20,000

Tax @ 30% $ 6,000

Undepreciated life (3 years from 4 years) 75 percent

Unrealized profit $ 10,500

b) Making required journal entries to identify sum of non-controlling interest as on 30th Jun,

2019:

Particulars Debit Credit

Share Capital A/c

Retained earnings A/c

General reserves A/c

Profit of the year A/c /

$ 160,000

$ 40,000

$ 80,000

$ 35,800

Adjusted Profit $ 179,000

Sharing of Non-controlling stakeholders @ 20

percent $ 35,800

Sharing of Giant Ltd 80% $ 143,200

Stock Reserves on unsold inventories

Details Amount

Sales $ 120,000

Less: Cost $ 60,000

Profit before tax $ 60,000

Tax @ 30% $ 18,000

Profit after tax $ 42,000

Unsold stock 25 percent

Unrealized Profit $ 10,500

Net gain on sales of machinery

Particulars Amount

Sales $ 80,000

Less: Cost $ 60,000

Profit before tax $ 20,000

Tax @ 30% $ 6,000

Undepreciated life (3 years from 4 years) 75 percent

Unrealized profit $ 10,500

b) Making required journal entries to identify sum of non-controlling interest as on 30th Jun,

2019:

Particulars Debit Credit

Share Capital A/c

Retained earnings A/c

General reserves A/c

Profit of the year A/c /

$ 160,000

$ 40,000

$ 80,000

$ 35,800

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Non-controlling interest A/c

(being non-controlling interest recognized)

$ 315,800

Question 5:

(a) Reproducing and completing the provided controlling as well as non-controlling interests

table along with required calculations:

Daddy Interest Son 1 Son 4 Son 2 Son 5 Son 7 Son 6 Son 3

Direct% 80% 0% 80% 0% 0% 5% 27%

Indirect% 0% 56% 0% 68% 64.60% 41.60% 0%

Non-controlling

interest

Direct % 20% 30% 20% 15% 5% 40% 73%

Indirect % 0% 14% 0% 17% 20.40% 13.40% 0%

Total 100% 100% 100% 100% 100% 100% 100%

Working note:

Daddy Interest Son 1 Son 4 Son 2 Son 5 Son 7 Son 6 Son 3

A. Direct%

B. Indirect% (80 *

70%)

(80*55%)

+

(80*30%)

(Son5 *

95%)

(70*10%)

+

(80*45%)

C. Non-

controlling

interest

D. Direct % (100-80) (100-

70)

(100-

80)

(100 – 55

+ 30)

(100 –

95)

(100 – 45

+ 5 + 10)

(100 – 27)

Indirect % Balancing

figure

(100 – (A

+ D)

- - - - - -

(b) Percentage figure of voting in Son 7 Ltd which is controlled by Daddy Ltd:

Daddy Ltd. having aggregate 64.60% of voting rights in Son 7

(c) Percentage figure of dividend being declared by the Son 7 which is to be received by the

Daddy Ltd:

Daddy Ltd. Would receive aggregate of 25.40% of the total dividend amount declared by the Son

7.

(being non-controlling interest recognized)

$ 315,800

Question 5:

(a) Reproducing and completing the provided controlling as well as non-controlling interests

table along with required calculations:

Daddy Interest Son 1 Son 4 Son 2 Son 5 Son 7 Son 6 Son 3

Direct% 80% 0% 80% 0% 0% 5% 27%

Indirect% 0% 56% 0% 68% 64.60% 41.60% 0%

Non-controlling

interest

Direct % 20% 30% 20% 15% 5% 40% 73%

Indirect % 0% 14% 0% 17% 20.40% 13.40% 0%

Total 100% 100% 100% 100% 100% 100% 100%

Working note:

Daddy Interest Son 1 Son 4 Son 2 Son 5 Son 7 Son 6 Son 3

A. Direct%

B. Indirect% (80 *

70%)

(80*55%)

+

(80*30%)

(Son5 *

95%)

(70*10%)

+

(80*45%)

C. Non-

controlling

interest

D. Direct % (100-80) (100-

70)

(100-

80)

(100 – 55

+ 30)

(100 –

95)

(100 – 45

+ 5 + 10)

(100 – 27)

Indirect % Balancing

figure

(100 – (A

+ D)

- - - - - -

(b) Percentage figure of voting in Son 7 Ltd which is controlled by Daddy Ltd:

Daddy Ltd. having aggregate 64.60% of voting rights in Son 7

(c) Percentage figure of dividend being declared by the Son 7 which is to be received by the

Daddy Ltd:

Daddy Ltd. Would receive aggregate of 25.40% of the total dividend amount declared by the Son

7.

1 out of 12

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.