Management Accounting and Cost Analysis

VerifiedAdded on 2020/02/14

|18

|3165

|106

AI Summary

This assignment tasks students with preparing a report for the Board of Directors of Smart Looks Limited. The report must analyze the reasons behind discrepancies between actual and budgeted costs, attributing them to factors like resource overutilization and ineffective management systems. Recommendations are expected to focus on improving resource utilization through machinery implementation, reducing labor costs, and implementing robust forecasting strategies for better decision-making.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

MANAGEMENT

ACCOUNTING

ACCOUNTING

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

TABLE OF CONTENTS

INTRODUCTION...........................................................................................................................5

TASK 1............................................................................................................................................5

Q1...........................................................................................................................................5

a) Classify the costs into Fixed, Variable and Semi-variable cost.........................................5

b) Explain other ways of classifying cost...............................................................................5

Q2...........................................................................................................................................7

a) Calculate total and unit costs.............................................................................................7

b) Analyze the cost data.........................................................................................................7

Q3. Calculation of inventory..................................................................................................8

1.FIFO Method ......................................................................................................................8

2.LIFO Method.......................................................................................................................8

3.Average Cost Method..........................................................................................................9

Q4. Prepare report of cost of goods sold................................................................................9

Q5.........................................................................................................................................10

a) Suggest 2 critical factors and performance indicators .....................................................10

B (1) How costs can be reduced...........................................................................................10

B (2) How value and quality can be enhanced.....................................................................11

TASK 2..........................................................................................................................................11

Q6. Usefulness of preparing budget.....................................................................................11

Q7. Preparation of budgets...................................................................................................12

Q8. Preparation of cash budget............................................................................................13

TASK 3..........................................................................................................................................14

Q9) 4.2 Comparison of budgeted and actual profit for Smart Looks Ltd............................14

Computation of selling price by considering the marginal costing technique.....................14

CONCLUSION..............................................................................................................................17

REFERENCES..............................................................................................................................18

INTRODUCTION...........................................................................................................................5

TASK 1............................................................................................................................................5

Q1...........................................................................................................................................5

a) Classify the costs into Fixed, Variable and Semi-variable cost.........................................5

b) Explain other ways of classifying cost...............................................................................5

Q2...........................................................................................................................................7

a) Calculate total and unit costs.............................................................................................7

b) Analyze the cost data.........................................................................................................7

Q3. Calculation of inventory..................................................................................................8

1.FIFO Method ......................................................................................................................8

2.LIFO Method.......................................................................................................................8

3.Average Cost Method..........................................................................................................9

Q4. Prepare report of cost of goods sold................................................................................9

Q5.........................................................................................................................................10

a) Suggest 2 critical factors and performance indicators .....................................................10

B (1) How costs can be reduced...........................................................................................10

B (2) How value and quality can be enhanced.....................................................................11

TASK 2..........................................................................................................................................11

Q6. Usefulness of preparing budget.....................................................................................11

Q7. Preparation of budgets...................................................................................................12

Q8. Preparation of cash budget............................................................................................13

TASK 3..........................................................................................................................................14

Q9) 4.2 Comparison of budgeted and actual profit for Smart Looks Ltd............................14

Computation of selling price by considering the marginal costing technique.....................14

CONCLUSION..............................................................................................................................17

REFERENCES..............................................................................................................................18

Index of Tables

Table 1: Calculation of total costs and unit costs...........................................................................7

Table 2: Analysis of cost data..........................................................................................................7

Table 3: FIFO Method.....................................................................................................................8

Table 4: LIFO Method.....................................................................................................................8

Table 5: Average Cost Method........................................................................................................9

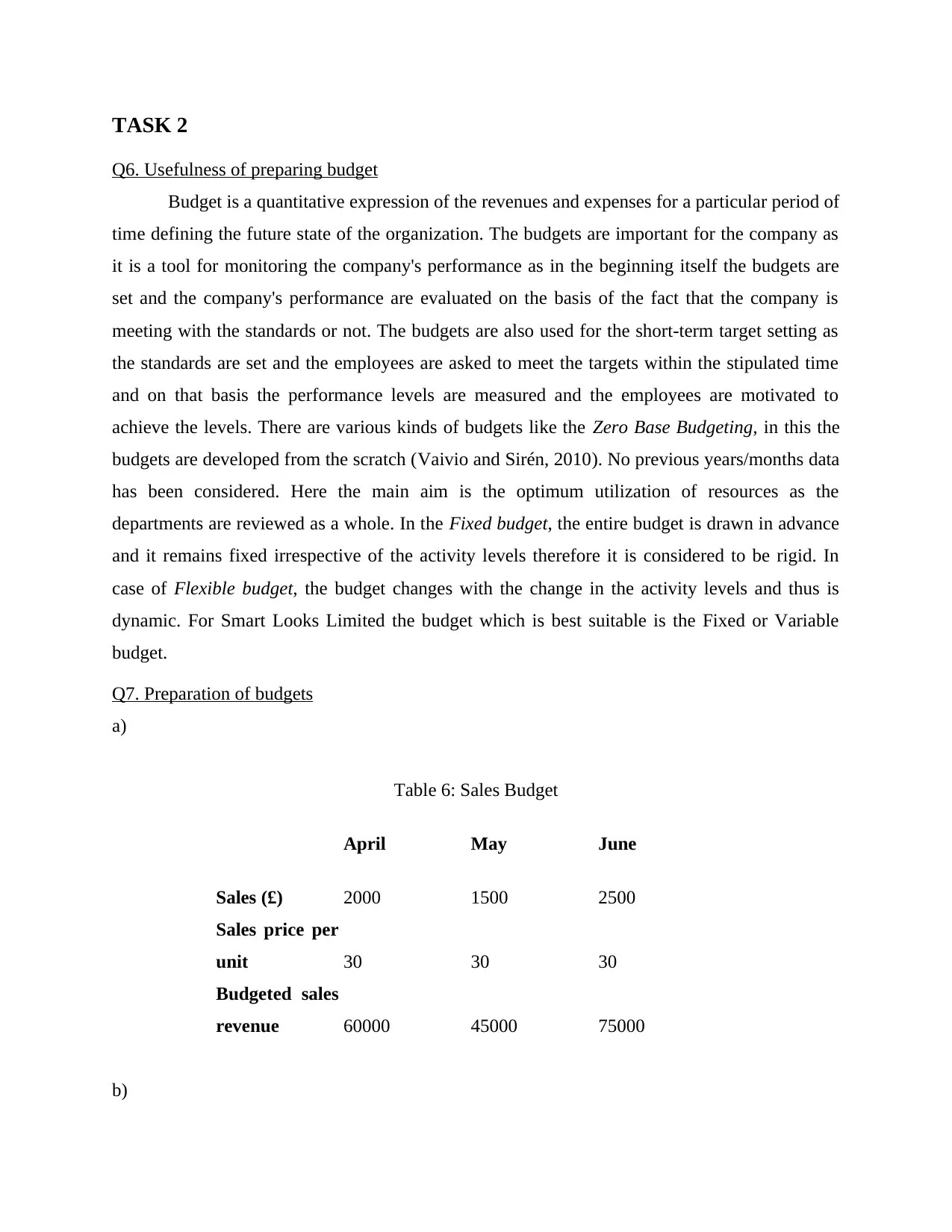

Table 6: Sales Budget....................................................................................................................12

Table 7: Production budget............................................................................................................12

Table 8: Raw Material purchases budget.......................................................................................12

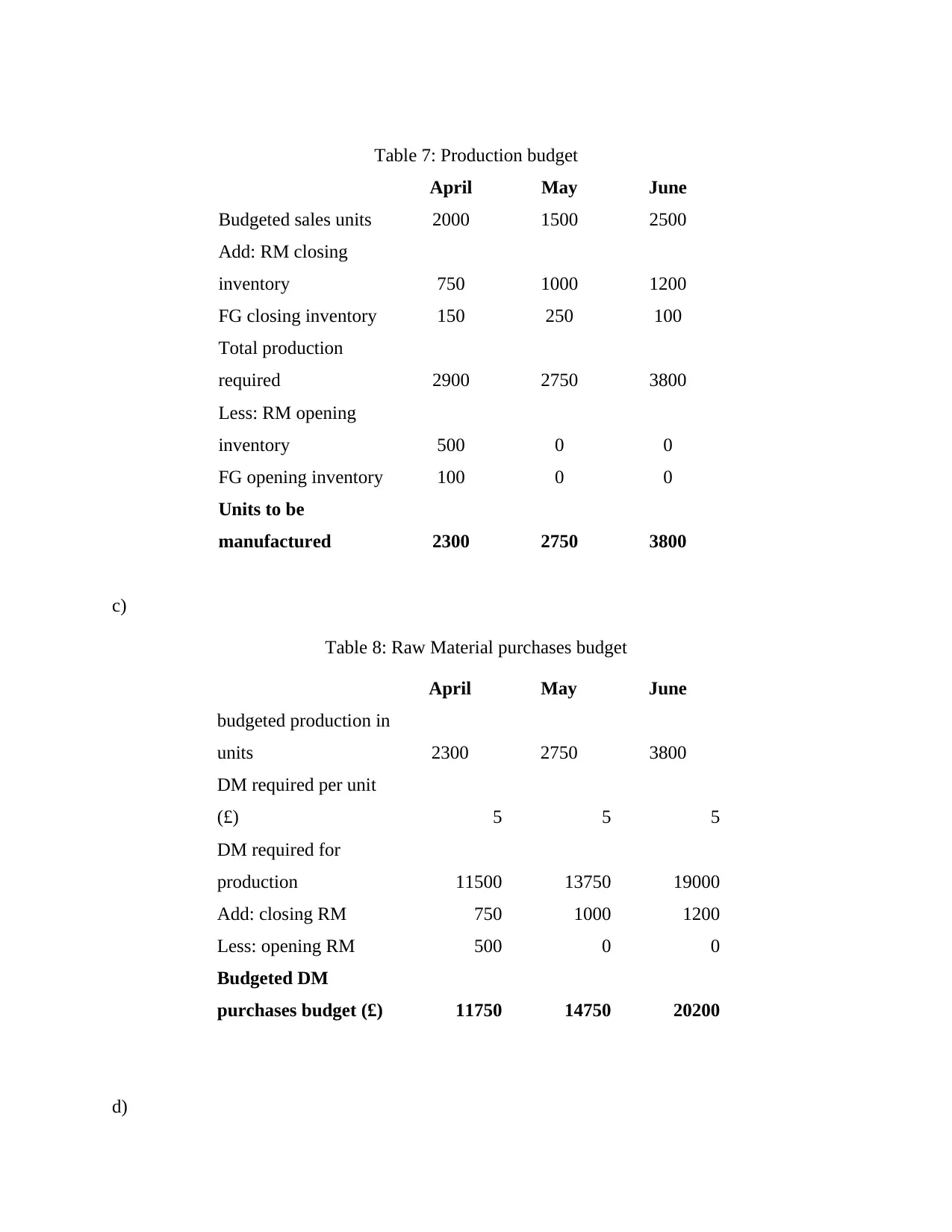

Table 9: Labor budget....................................................................................................................13

Table 10: overhead budget.............................................................................................................13

Table 11: Cash Budget...................................................................................................................14

Table 1: Calculation of total costs and unit costs...........................................................................7

Table 2: Analysis of cost data..........................................................................................................7

Table 3: FIFO Method.....................................................................................................................8

Table 4: LIFO Method.....................................................................................................................8

Table 5: Average Cost Method........................................................................................................9

Table 6: Sales Budget....................................................................................................................12

Table 7: Production budget............................................................................................................12

Table 8: Raw Material purchases budget.......................................................................................12

Table 9: Labor budget....................................................................................................................13

Table 10: overhead budget.............................................................................................................13

Table 11: Cash Budget...................................................................................................................14

Illustration Index

Illustration 1: Cost Classificationsource:http://www.yourarticlelibrary.com..................................6

Illustration 1: Cost Classificationsource:http://www.yourarticlelibrary.com..................................6

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

INTRODUCTION

Smart looks limited is a clothing retailer based in UK. management accounting is a

approach which enables the managers to take timely decision aiming at providing the right

information. this report enables us to understand various management tools like costing,

budgeting and inventory level tools, calculation of marginal costing and calculation of the actual

and budgeted costs and preparation of report and these tools are useful for understanding and

also forecasting the decision making process of smart looks limited. it also aims at determining

the differences between the actual and the standards costs and the reasons for deviations and

corrections taken thereafter.

TASK 1

Q1.

a) Classify the costs into Fixed, Variable and Semi-variable cost

Costs Classification

Material for clothes Variable cost

Factory rent Fixed cost

Power for sewing machines in

the factory

Variable cost

Factory supervisor's wages Semi-variable cost

Packaging materials Variable cost

Telephone Semi-variable cost

Office rates Variable cost

Delivery driver's pay Semi-variable cost

Factory heating Fixed cost

Smart looks limited is a clothing retailer based in UK. management accounting is a

approach which enables the managers to take timely decision aiming at providing the right

information. this report enables us to understand various management tools like costing,

budgeting and inventory level tools, calculation of marginal costing and calculation of the actual

and budgeted costs and preparation of report and these tools are useful for understanding and

also forecasting the decision making process of smart looks limited. it also aims at determining

the differences between the actual and the standards costs and the reasons for deviations and

corrections taken thereafter.

TASK 1

Q1.

a) Classify the costs into Fixed, Variable and Semi-variable cost

Costs Classification

Material for clothes Variable cost

Factory rent Fixed cost

Power for sewing machines in

the factory

Variable cost

Factory supervisor's wages Semi-variable cost

Packaging materials Variable cost

Telephone Semi-variable cost

Office rates Variable cost

Delivery driver's pay Semi-variable cost

Factory heating Fixed cost

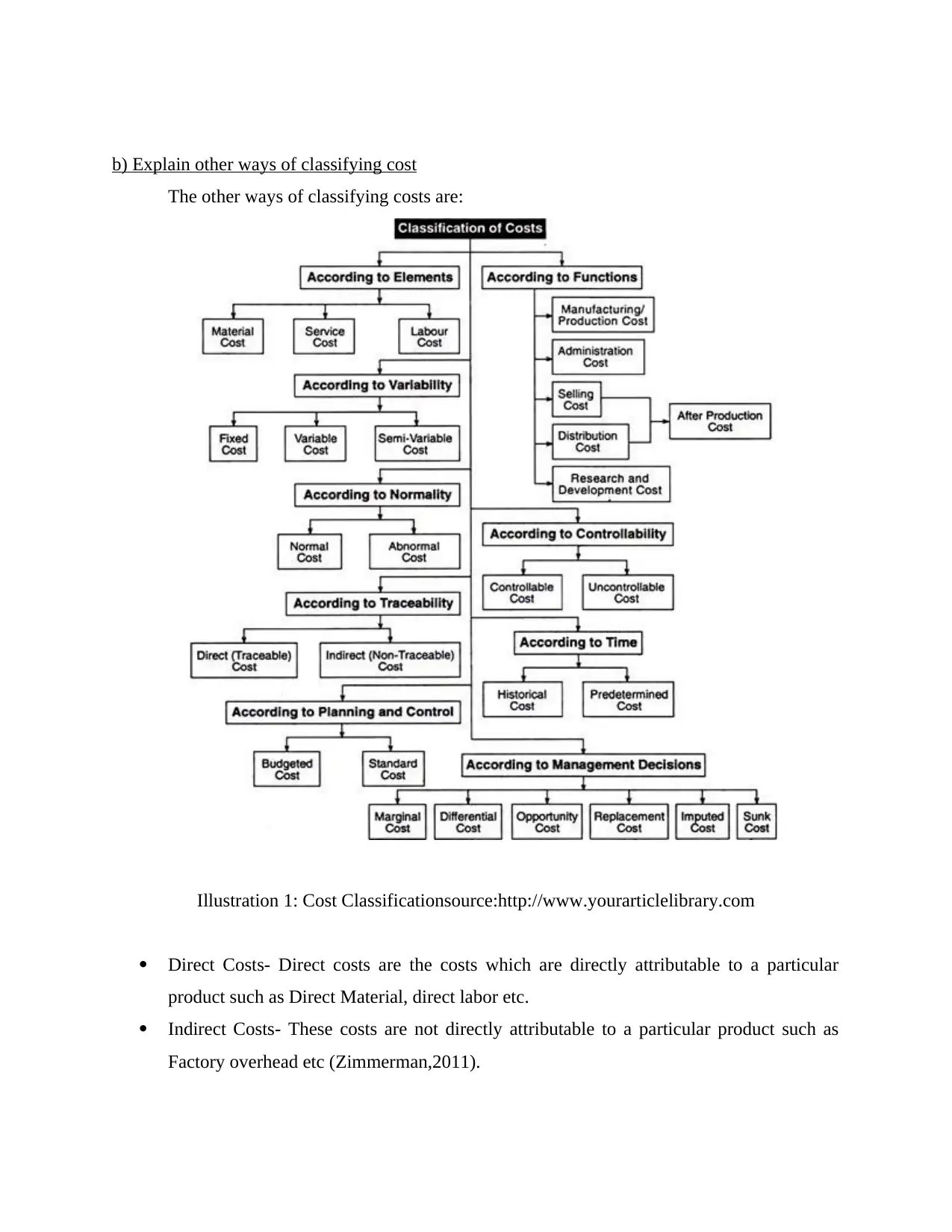

b) Explain other ways of classifying cost

The other ways of classifying costs are:

Illustration 1: Cost Classificationsource:http://www.yourarticlelibrary.com

Direct Costs- Direct costs are the costs which are directly attributable to a particular

product such as Direct Material, direct labor etc.

Indirect Costs- These costs are not directly attributable to a particular product such as

Factory overhead etc (Zimmerman,2011).

The other ways of classifying costs are:

Illustration 1: Cost Classificationsource:http://www.yourarticlelibrary.com

Direct Costs- Direct costs are the costs which are directly attributable to a particular

product such as Direct Material, direct labor etc.

Indirect Costs- These costs are not directly attributable to a particular product such as

Factory overhead etc (Zimmerman,2011).

Product Costs- These costs can be identifies to a individual product. It is the cost which is

incurred when we create a product. Examples are direct material, Factory overhead etc.

Period Costs- These costs cannot be identifies on the individual product and these cost

continues for a period of time like depreciation, advertising expenses etc.

Controllable costs- Controllable costs are the costs can be controlled by the management

like direct expenses, labor etc.

Sunk Costs- As the name suggests, these are the costs which cannot be recovered as they

have already been incurred and thus they are not even considered for decision making.

Example can the cost incurred on training (Pitkänen and Lukka, 2011).

Opportunity Costs- When once alternative is chosen over the another and the cost so

foregone is opportunity costs. These are costs which are considered for decision making.

Q2.

a) Calculate total and unit costs

Table 1: Calculation of total costs and unit costs

15000 units 20000 units 25000 units

Material £5 £75000 £100000 £125000

Labor £6 £90000 £120000 £150000

Total fixed costs £50000 £50000 £50000

Unit Costs ( Total cost /

number of units)

£14.33 £13.5 £13

Material £5 £75000 £100000 £125000

Labor £6 £90000 £120000 £150000

Total fixed costs £50000 £50000 £50000

Total Costs £215000 £270000 £325000

incurred when we create a product. Examples are direct material, Factory overhead etc.

Period Costs- These costs cannot be identifies on the individual product and these cost

continues for a period of time like depreciation, advertising expenses etc.

Controllable costs- Controllable costs are the costs can be controlled by the management

like direct expenses, labor etc.

Sunk Costs- As the name suggests, these are the costs which cannot be recovered as they

have already been incurred and thus they are not even considered for decision making.

Example can the cost incurred on training (Pitkänen and Lukka, 2011).

Opportunity Costs- When once alternative is chosen over the another and the cost so

foregone is opportunity costs. These are costs which are considered for decision making.

Q2.

a) Calculate total and unit costs

Table 1: Calculation of total costs and unit costs

15000 units 20000 units 25000 units

Material £5 £75000 £100000 £125000

Labor £6 £90000 £120000 £150000

Total fixed costs £50000 £50000 £50000

Unit Costs ( Total cost /

number of units)

£14.33 £13.5 £13

Material £5 £75000 £100000 £125000

Labor £6 £90000 £120000 £150000

Total fixed costs £50000 £50000 £50000

Total Costs £215000 £270000 £325000

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

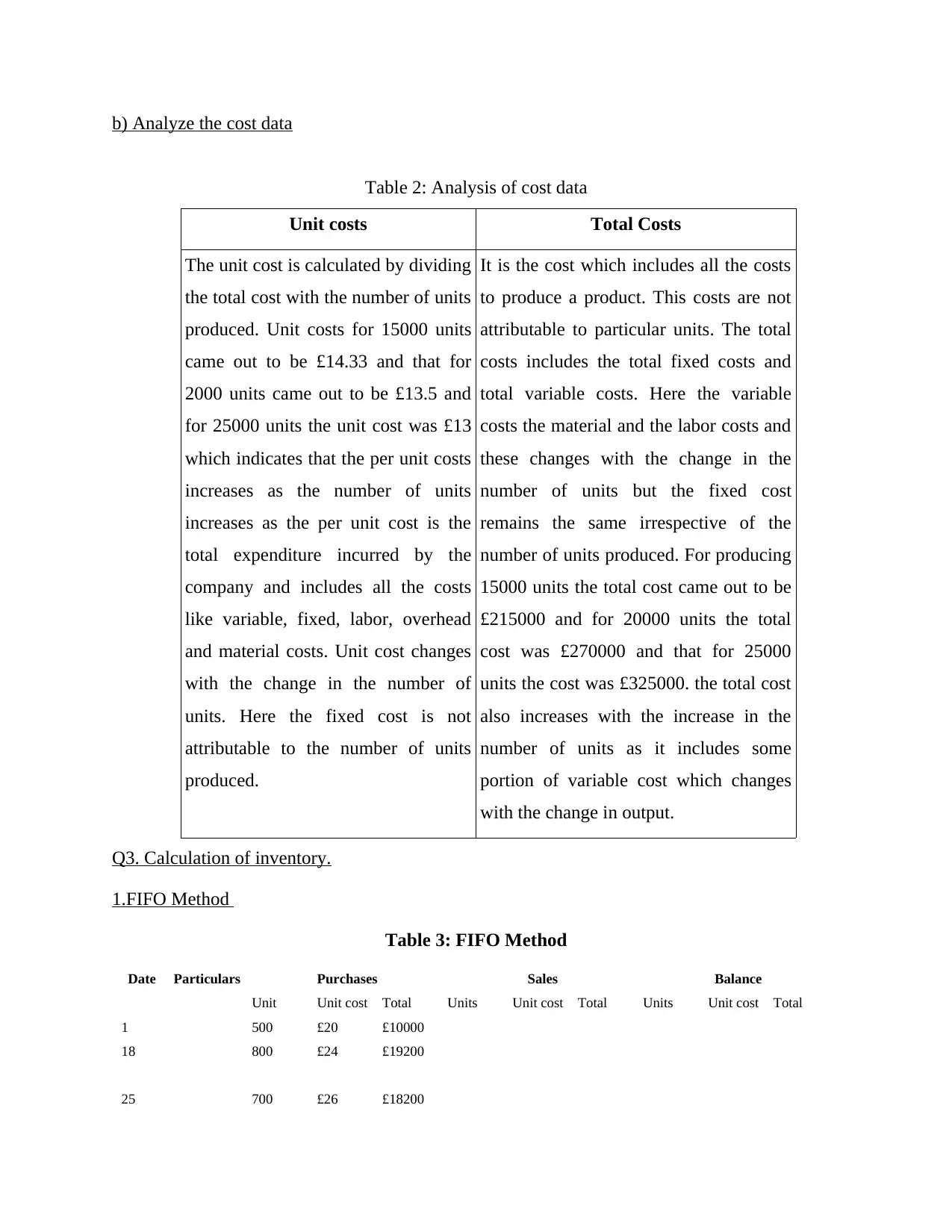

b) Analyze the cost data

Table 2: Analysis of cost data

Unit costs Total Costs

The unit cost is calculated by dividing

the total cost with the number of units

produced. Unit costs for 15000 units

came out to be £14.33 and that for

2000 units came out to be £13.5 and

for 25000 units the unit cost was £13

which indicates that the per unit costs

increases as the number of units

increases as the per unit cost is the

total expenditure incurred by the

company and includes all the costs

like variable, fixed, labor, overhead

and material costs. Unit cost changes

with the change in the number of

units. Here the fixed cost is not

attributable to the number of units

produced.

It is the cost which includes all the costs

to produce a product. This costs are not

attributable to particular units. The total

costs includes the total fixed costs and

total variable costs. Here the variable

costs the material and the labor costs and

these changes with the change in the

number of units but the fixed cost

remains the same irrespective of the

number of units produced. For producing

15000 units the total cost came out to be

£215000 and for 20000 units the total

cost was £270000 and that for 25000

units the cost was £325000. the total cost

also increases with the increase in the

number of units as it includes some

portion of variable cost which changes

with the change in output.

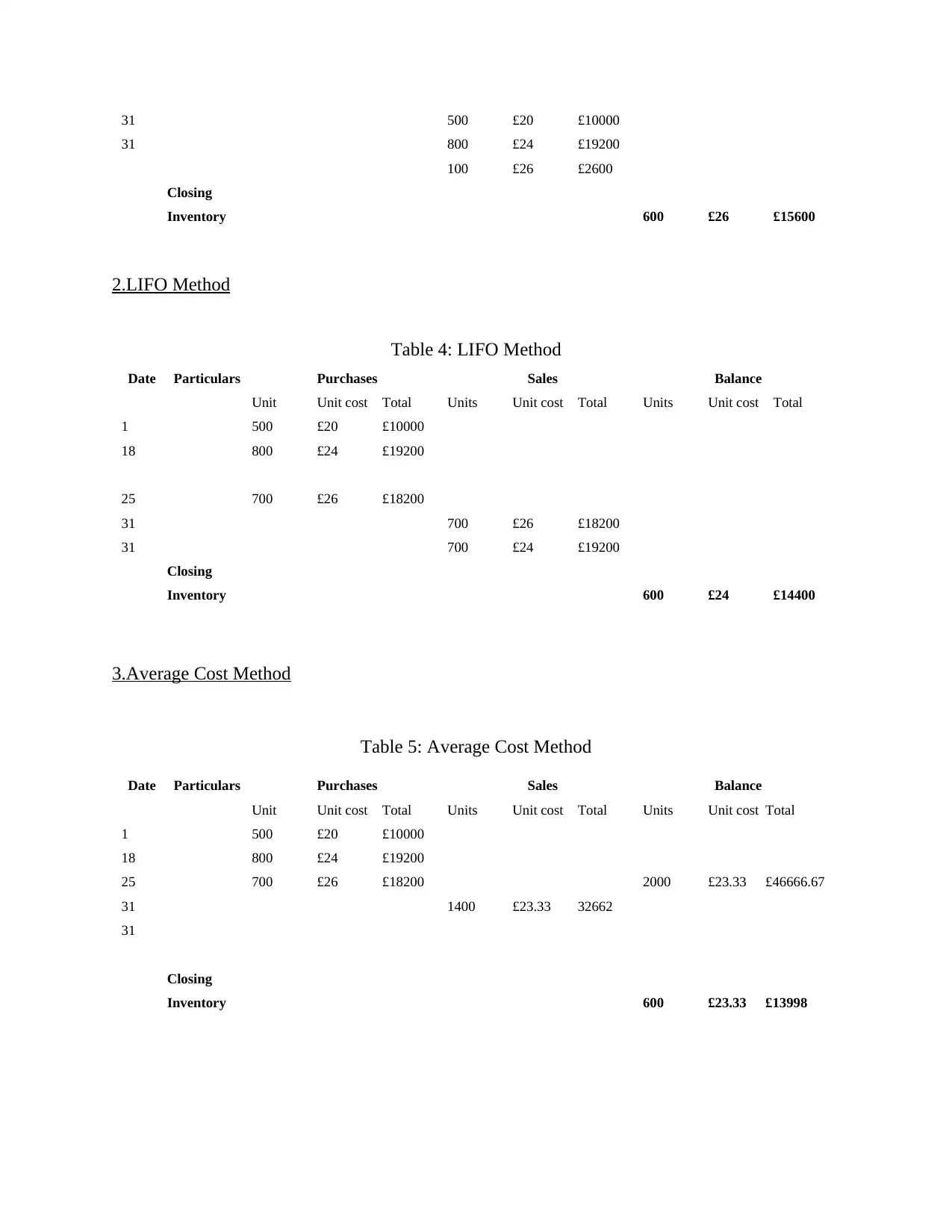

Q3. Calculation of inventory.

1.FIFO Method

Table 3: FIFO Method

Date Particulars Purchases Sales Balance

Unit Unit cost Total Units Unit cost Total Units Unit cost Total

1 500 £20 £10000

18 800 £24 £19200

25 700 £26 £18200

Table 2: Analysis of cost data

Unit costs Total Costs

The unit cost is calculated by dividing

the total cost with the number of units

produced. Unit costs for 15000 units

came out to be £14.33 and that for

2000 units came out to be £13.5 and

for 25000 units the unit cost was £13

which indicates that the per unit costs

increases as the number of units

increases as the per unit cost is the

total expenditure incurred by the

company and includes all the costs

like variable, fixed, labor, overhead

and material costs. Unit cost changes

with the change in the number of

units. Here the fixed cost is not

attributable to the number of units

produced.

It is the cost which includes all the costs

to produce a product. This costs are not

attributable to particular units. The total

costs includes the total fixed costs and

total variable costs. Here the variable

costs the material and the labor costs and

these changes with the change in the

number of units but the fixed cost

remains the same irrespective of the

number of units produced. For producing

15000 units the total cost came out to be

£215000 and for 20000 units the total

cost was £270000 and that for 25000

units the cost was £325000. the total cost

also increases with the increase in the

number of units as it includes some

portion of variable cost which changes

with the change in output.

Q3. Calculation of inventory.

1.FIFO Method

Table 3: FIFO Method

Date Particulars Purchases Sales Balance

Unit Unit cost Total Units Unit cost Total Units Unit cost Total

1 500 £20 £10000

18 800 £24 £19200

25 700 £26 £18200

31 500 £20 £10000

31 800 £24 £19200

100 £26 £2600

Closing

Inventory 600 £26 £15600

2.LIFO Method

Table 4: LIFO Method

Date Particulars Purchases Sales Balance

Unit Unit cost Total Units Unit cost Total Units Unit cost Total

1 500 £20 £10000

18 800 £24 £19200

25 700 £26 £18200

31 700 £26 £18200

31 700 £24 £19200

Closing

Inventory 600 £24 £14400

3.Average Cost Method

Table 5: Average Cost Method

Date Particulars Purchases Sales Balance

Unit Unit cost Total Units Unit cost Total Units Unit cost Total

1 500 £20 £10000

18 800 £24 £19200

25 700 £26 £18200 2000 £23.33 £46666.67

31 1400 £23.33 32662

31

Closing

Inventory 600 £23.33 £13998

31 800 £24 £19200

100 £26 £2600

Closing

Inventory 600 £26 £15600

2.LIFO Method

Table 4: LIFO Method

Date Particulars Purchases Sales Balance

Unit Unit cost Total Units Unit cost Total Units Unit cost Total

1 500 £20 £10000

18 800 £24 £19200

25 700 £26 £18200

31 700 £26 £18200

31 700 £24 £19200

Closing

Inventory 600 £24 £14400

3.Average Cost Method

Table 5: Average Cost Method

Date Particulars Purchases Sales Balance

Unit Unit cost Total Units Unit cost Total Units Unit cost Total

1 500 £20 £10000

18 800 £24 £19200

25 700 £26 £18200 2000 £23.33 £46666.67

31 1400 £23.33 32662

31

Closing

Inventory 600 £23.33 £13998

Q4. Prepare report of cost of goods sold

To

Director,

Smart Looks Ltd.

Cost Of Goods Sold is the summation of all the costs which are incurred in the creation

of that product. As Smart Looks Ltd (Smart Look Ltd, 2016). is using periodic inventory

system, the cost of goods sold includes the beginning inventory, purchases and deducting the

ending inventory. When First in, first out method is used to calculate the ending inventory one

assumes that the oldest units of inventory are sold first. Hence the calculation of 600 units of

closing inventory were valued at £26 so it came out to be the total of £15600. whereas when last

in, first out method is used than the newest inventory are sold first than any other inventory so

the calculation goes like the 600 units were sold at £24 with the total of £14400. Lastly, in the

average cost method, it is based on the average cost per unit and on that basis the cost of goods

sold is calculated. The average cost is calculated by calculating the mean of the data then the

average cost so calculated is multiplied with the number of units 600 and the cost comes out to

be £23.33 (20+24+26=70/3=23.33 ) and the total comes out to be £13998. here as the periodic

methods is used, the inventory count happens at the end of each period. Hence the highest cost

of goods sold came the first in, first out (FIFO) method with the total of £15600.

Q5.

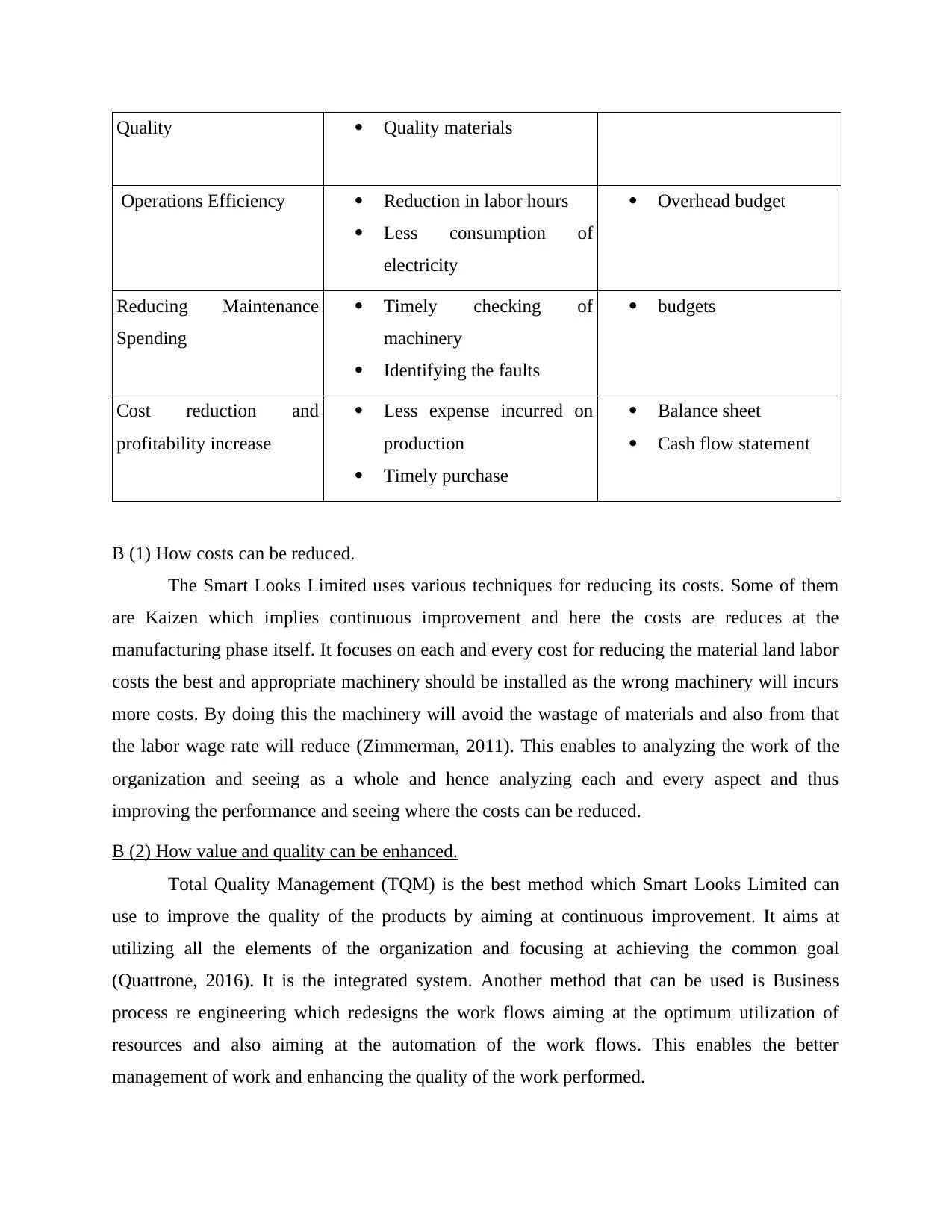

a) Suggest 2 critical factors and performance indicators

The two critical factors for determining customer experience are coordination among the

managers and timeliness and the performance indicators are overall satisfaction, conversion rate.

Critical Factors Performance indicators

Customer Experience Coordination among the

managers

timeliness

Overall satisfaction

Conversion rate

Supplier and Product Materials Repeated purchase

To

Director,

Smart Looks Ltd.

Cost Of Goods Sold is the summation of all the costs which are incurred in the creation

of that product. As Smart Looks Ltd (Smart Look Ltd, 2016). is using periodic inventory

system, the cost of goods sold includes the beginning inventory, purchases and deducting the

ending inventory. When First in, first out method is used to calculate the ending inventory one

assumes that the oldest units of inventory are sold first. Hence the calculation of 600 units of

closing inventory were valued at £26 so it came out to be the total of £15600. whereas when last

in, first out method is used than the newest inventory are sold first than any other inventory so

the calculation goes like the 600 units were sold at £24 with the total of £14400. Lastly, in the

average cost method, it is based on the average cost per unit and on that basis the cost of goods

sold is calculated. The average cost is calculated by calculating the mean of the data then the

average cost so calculated is multiplied with the number of units 600 and the cost comes out to

be £23.33 (20+24+26=70/3=23.33 ) and the total comes out to be £13998. here as the periodic

methods is used, the inventory count happens at the end of each period. Hence the highest cost

of goods sold came the first in, first out (FIFO) method with the total of £15600.

Q5.

a) Suggest 2 critical factors and performance indicators

The two critical factors for determining customer experience are coordination among the

managers and timeliness and the performance indicators are overall satisfaction, conversion rate.

Critical Factors Performance indicators

Customer Experience Coordination among the

managers

timeliness

Overall satisfaction

Conversion rate

Supplier and Product Materials Repeated purchase

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Quality Quality materials

Operations Efficiency Reduction in labor hours

Less consumption of

electricity

Overhead budget

Reducing Maintenance

Spending

Timely checking of

machinery

Identifying the faults

budgets

Cost reduction and

profitability increase

Less expense incurred on

production

Timely purchase

Balance sheet

Cash flow statement

B (1) How costs can be reduced.

The Smart Looks Limited uses various techniques for reducing its costs. Some of them

are Kaizen which implies continuous improvement and here the costs are reduces at the

manufacturing phase itself. It focuses on each and every cost for reducing the material land labor

costs the best and appropriate machinery should be installed as the wrong machinery will incurs

more costs. By doing this the machinery will avoid the wastage of materials and also from that

the labor wage rate will reduce (Zimmerman, 2011). This enables to analyzing the work of the

organization and seeing as a whole and hence analyzing each and every aspect and thus

improving the performance and seeing where the costs can be reduced.

B (2) How value and quality can be enhanced.

Total Quality Management (TQM) is the best method which Smart Looks Limited can

use to improve the quality of the products by aiming at continuous improvement. It aims at

utilizing all the elements of the organization and focusing at achieving the common goal

(Quattrone, 2016). It is the integrated system. Another method that can be used is Business

process re engineering which redesigns the work flows aiming at the optimum utilization of

resources and also aiming at the automation of the work flows. This enables the better

management of work and enhancing the quality of the work performed.

Operations Efficiency Reduction in labor hours

Less consumption of

electricity

Overhead budget

Reducing Maintenance

Spending

Timely checking of

machinery

Identifying the faults

budgets

Cost reduction and

profitability increase

Less expense incurred on

production

Timely purchase

Balance sheet

Cash flow statement

B (1) How costs can be reduced.

The Smart Looks Limited uses various techniques for reducing its costs. Some of them

are Kaizen which implies continuous improvement and here the costs are reduces at the

manufacturing phase itself. It focuses on each and every cost for reducing the material land labor

costs the best and appropriate machinery should be installed as the wrong machinery will incurs

more costs. By doing this the machinery will avoid the wastage of materials and also from that

the labor wage rate will reduce (Zimmerman, 2011). This enables to analyzing the work of the

organization and seeing as a whole and hence analyzing each and every aspect and thus

improving the performance and seeing where the costs can be reduced.

B (2) How value and quality can be enhanced.

Total Quality Management (TQM) is the best method which Smart Looks Limited can

use to improve the quality of the products by aiming at continuous improvement. It aims at

utilizing all the elements of the organization and focusing at achieving the common goal

(Quattrone, 2016). It is the integrated system. Another method that can be used is Business

process re engineering which redesigns the work flows aiming at the optimum utilization of

resources and also aiming at the automation of the work flows. This enables the better

management of work and enhancing the quality of the work performed.

TASK 2

Q6. Usefulness of preparing budget

Budget is a quantitative expression of the revenues and expenses for a particular period of

time defining the future state of the organization. The budgets are important for the company as

it is a tool for monitoring the company's performance as in the beginning itself the budgets are

set and the company's performance are evaluated on the basis of the fact that the company is

meeting with the standards or not. The budgets are also used for the short-term target setting as

the standards are set and the employees are asked to meet the targets within the stipulated time

and on that basis the performance levels are measured and the employees are motivated to

achieve the levels. There are various kinds of budgets like the Zero Base Budgeting, in this the

budgets are developed from the scratch (Vaivio and Sirén, 2010). No previous years/months data

has been considered. Here the main aim is the optimum utilization of resources as the

departments are reviewed as a whole. In the Fixed budget, the entire budget is drawn in advance

and it remains fixed irrespective of the activity levels therefore it is considered to be rigid. In

case of Flexible budget, the budget changes with the change in the activity levels and thus is

dynamic. For Smart Looks Limited the budget which is best suitable is the Fixed or Variable

budget.

Q7. Preparation of budgets

a)

Table 6: Sales Budget

April May June

Sales (£) 2000 1500 2500

Sales price per

unit 30 30 30

Budgeted sales

revenue 60000 45000 75000

b)

Q6. Usefulness of preparing budget

Budget is a quantitative expression of the revenues and expenses for a particular period of

time defining the future state of the organization. The budgets are important for the company as

it is a tool for monitoring the company's performance as in the beginning itself the budgets are

set and the company's performance are evaluated on the basis of the fact that the company is

meeting with the standards or not. The budgets are also used for the short-term target setting as

the standards are set and the employees are asked to meet the targets within the stipulated time

and on that basis the performance levels are measured and the employees are motivated to

achieve the levels. There are various kinds of budgets like the Zero Base Budgeting, in this the

budgets are developed from the scratch (Vaivio and Sirén, 2010). No previous years/months data

has been considered. Here the main aim is the optimum utilization of resources as the

departments are reviewed as a whole. In the Fixed budget, the entire budget is drawn in advance

and it remains fixed irrespective of the activity levels therefore it is considered to be rigid. In

case of Flexible budget, the budget changes with the change in the activity levels and thus is

dynamic. For Smart Looks Limited the budget which is best suitable is the Fixed or Variable

budget.

Q7. Preparation of budgets

a)

Table 6: Sales Budget

April May June

Sales (£) 2000 1500 2500

Sales price per

unit 30 30 30

Budgeted sales

revenue 60000 45000 75000

b)

Table 7: Production budget

April May June

Budgeted sales units 2000 1500 2500

Add: RM closing

inventory 750 1000 1200

FG closing inventory 150 250 100

Total production

required 2900 2750 3800

Less: RM opening

inventory 500 0 0

FG opening inventory 100 0 0

Units to be

manufactured 2300 2750 3800

c)

Table 8: Raw Material purchases budget

April May June

budgeted production in

units 2300 2750 3800

DM required per unit

(£) 5 5 5

DM required for

production 11500 13750 19000

Add: closing RM 750 1000 1200

Less: opening RM 500 0 0

Budgeted DM

purchases budget (£) 11750 14750 20200

d)

April May June

Budgeted sales units 2000 1500 2500

Add: RM closing

inventory 750 1000 1200

FG closing inventory 150 250 100

Total production

required 2900 2750 3800

Less: RM opening

inventory 500 0 0

FG opening inventory 100 0 0

Units to be

manufactured 2300 2750 3800

c)

Table 8: Raw Material purchases budget

April May June

budgeted production in

units 2300 2750 3800

DM required per unit

(£) 5 5 5

DM required for

production 11500 13750 19000

Add: closing RM 750 1000 1200

Less: opening RM 500 0 0

Budgeted DM

purchases budget (£) 11750 14750 20200

d)

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table 9: Labor budget

April May June

Budgeted production

in units 2300 2750 3800

labor hours (£) 6 6 6

Total labor cost 13800 16500 22800

e)

Table 10: overhead budget

April May June

Budgeted production in

units 2300 2750 3800

variable overhead rate

(£) 3 3 3

total variable overhead

rate 6900 8250 11400

Less: fixed overhead

(£) 2000 2000 2000

Total overheads 4900 6250 9400

Q8. Preparation of cash budget

Table 11: Cash Budget

April May June

Opening balance 1200 39650 46625

Sales 60000 45000 75000

April May June

Budgeted production

in units 2300 2750 3800

labor hours (£) 6 6 6

Total labor cost 13800 16500 22800

e)

Table 10: overhead budget

April May June

Budgeted production in

units 2300 2750 3800

variable overhead rate

(£) 3 3 3

total variable overhead

rate 6900 8250 11400

Less: fixed overhead

(£) 2000 2000 2000

Total overheads 4900 6250 9400

Q8. Preparation of cash budget

Table 11: Cash Budget

April May June

Opening balance 1200 39650 46625

Sales 60000 45000 75000

Total 61200 84650 121625

Direct Material 9200 13300 17950

variable overhead 10350 22725 46575

fixed overheads 2000 2000 2000

Total 21550 38025 66525

surplus/deficit 39650 46625 55100

TASK 3

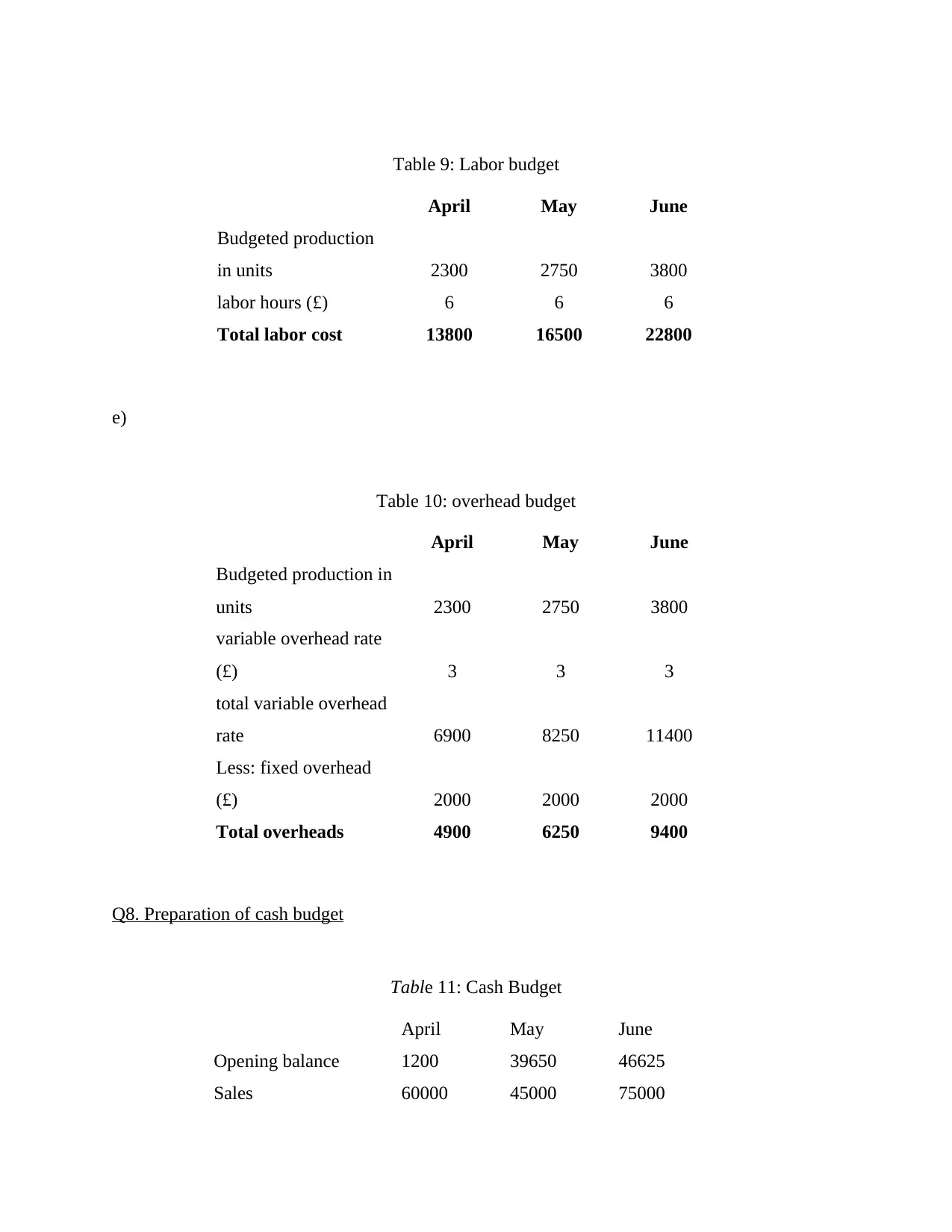

Q9) 4.2 Comparison of budgeted and actual profit for Smart Looks Ltd

Computation of selling price by considering the marginal costing technique

The management accountant of smart looks ltd compares the budget as per the actual and

standard position of the entrepreneurs so that it is useful for implementing the strategies for

running the further business. Calculation of the budgeted profit and actual profit is as follows;

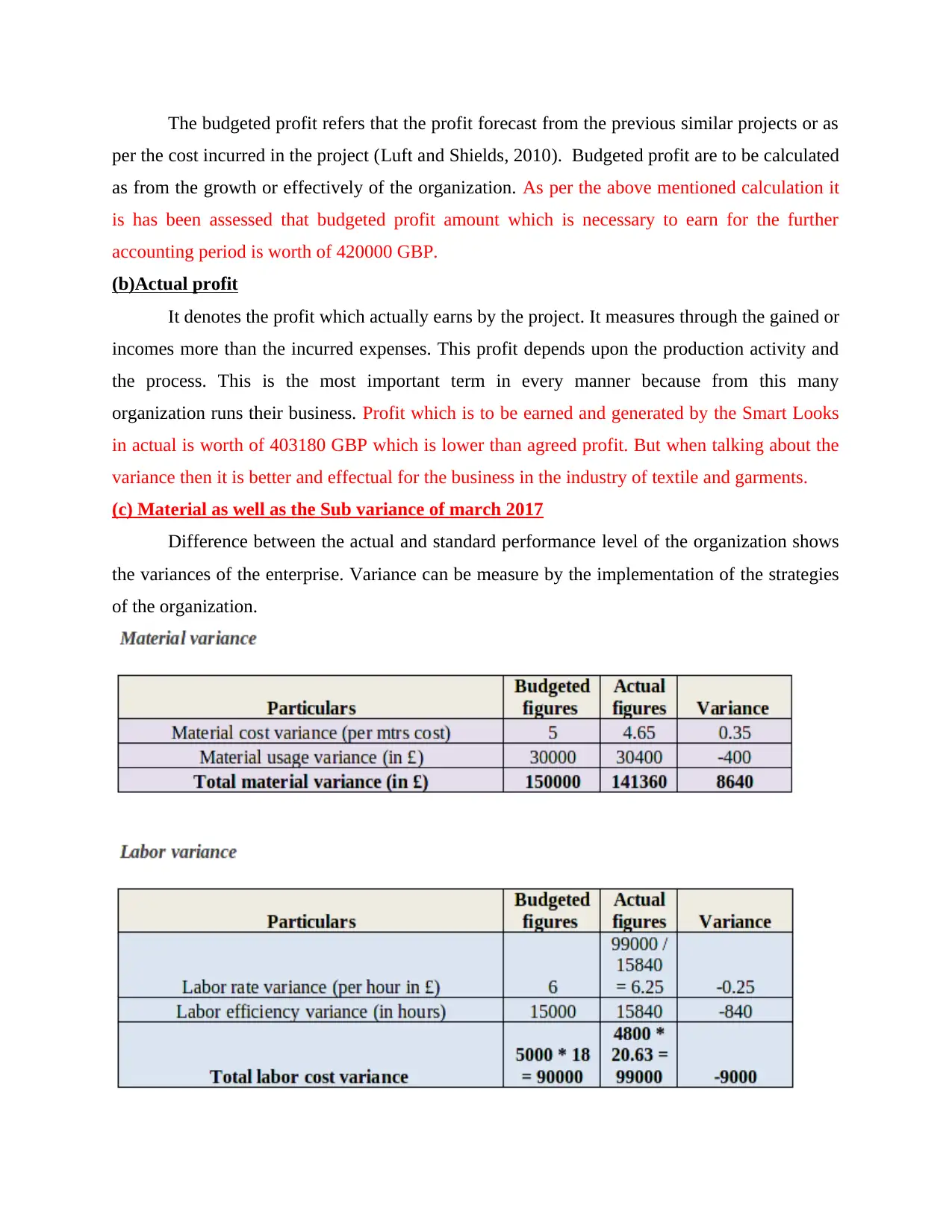

Particulars Budgeted figures Actual figures Variance

Direct material cost (per unit) 5 4.65 0.35

Direct labour cost (per unit) 6 6.25 -0.25

Fixed production cots 12500 12500 0

Budgeted sales (in units) 5000 4800 200

Selling price (per unit) 97.5 97.5 0

Sales Revenue (in GBP) 487500 468000 19500

Net Profit 420000 403180 16820

(a) Budgeted profit

Direct Material 9200 13300 17950

variable overhead 10350 22725 46575

fixed overheads 2000 2000 2000

Total 21550 38025 66525

surplus/deficit 39650 46625 55100

TASK 3

Q9) 4.2 Comparison of budgeted and actual profit for Smart Looks Ltd

Computation of selling price by considering the marginal costing technique

The management accountant of smart looks ltd compares the budget as per the actual and

standard position of the entrepreneurs so that it is useful for implementing the strategies for

running the further business. Calculation of the budgeted profit and actual profit is as follows;

Particulars Budgeted figures Actual figures Variance

Direct material cost (per unit) 5 4.65 0.35

Direct labour cost (per unit) 6 6.25 -0.25

Fixed production cots 12500 12500 0

Budgeted sales (in units) 5000 4800 200

Selling price (per unit) 97.5 97.5 0

Sales Revenue (in GBP) 487500 468000 19500

Net Profit 420000 403180 16820

(a) Budgeted profit

The budgeted profit refers that the profit forecast from the previous similar projects or as

per the cost incurred in the project (Luft and Shields, 2010). Budgeted profit are to be calculated

as from the growth or effectively of the organization. As per the above mentioned calculation it

is has been assessed that budgeted profit amount which is necessary to earn for the further

accounting period is worth of 420000 GBP.

(b)Actual profit

It denotes the profit which actually earns by the project. It measures through the gained or

incomes more than the incurred expenses. This profit depends upon the production activity and

the process. This is the most important term in every manner because from this many

organization runs their business. Profit which is to be earned and generated by the Smart Looks

in actual is worth of 403180 GBP which is lower than agreed profit. But when talking about the

variance then it is better and effectual for the business in the industry of textile and garments.

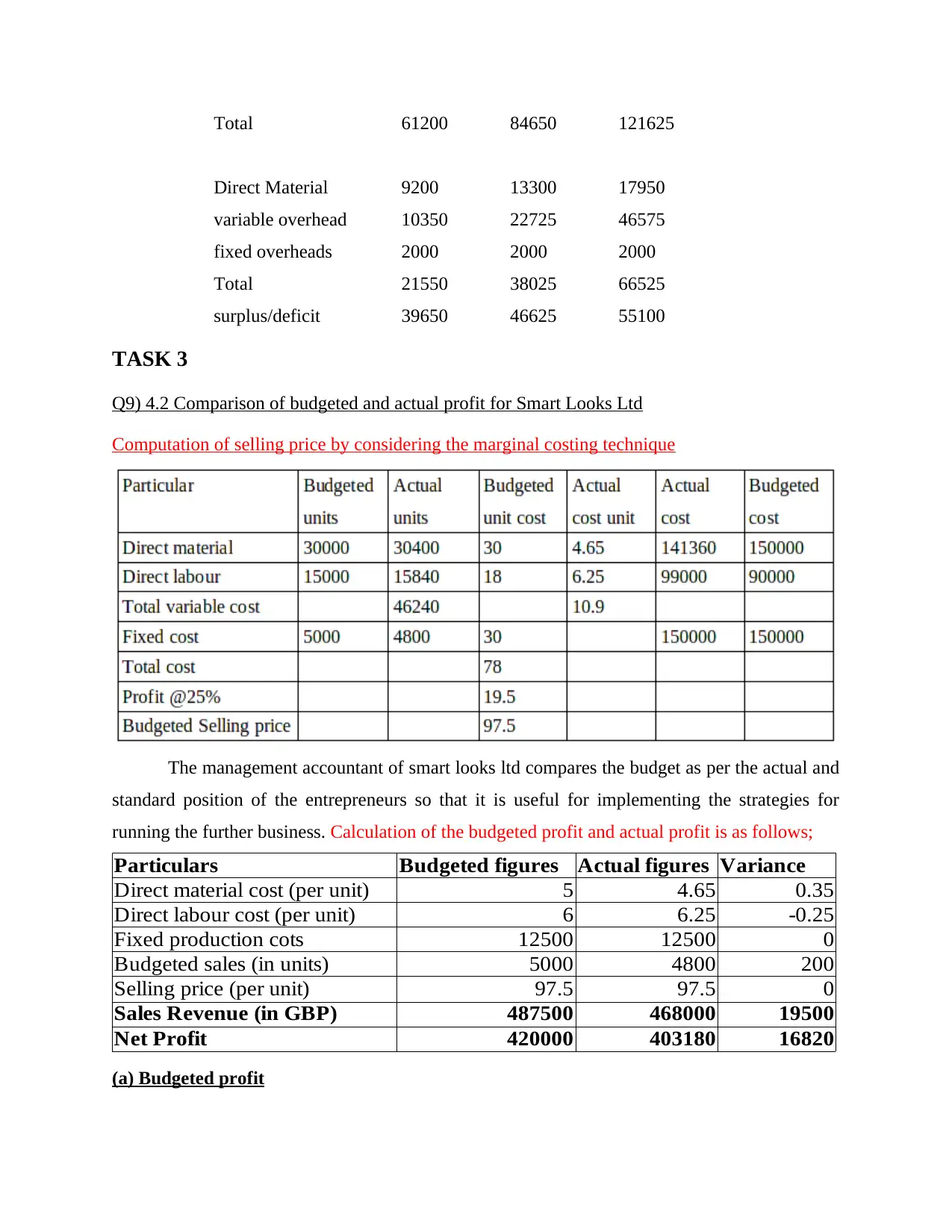

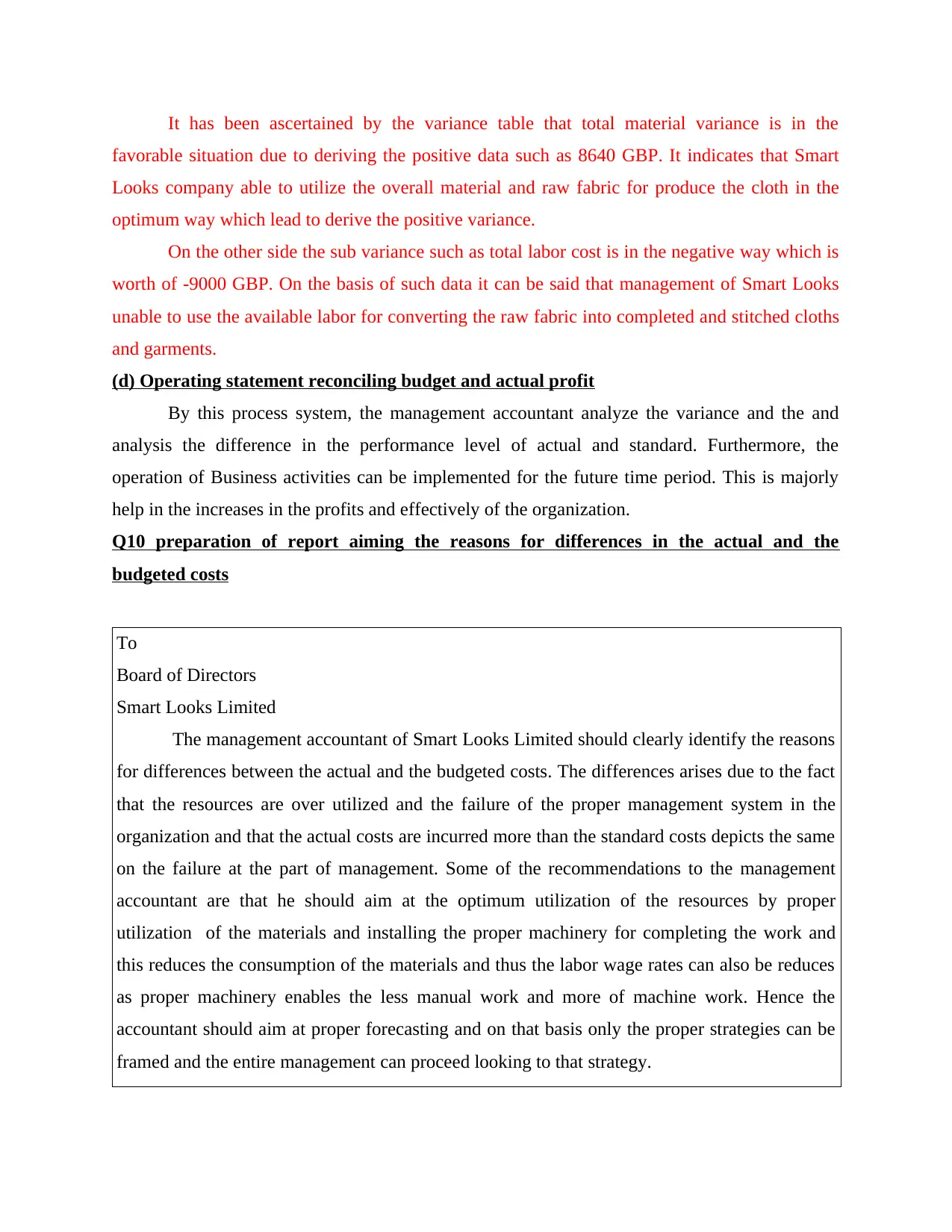

(c) Material as well as the Sub variance of march 2017

Difference between the actual and standard performance level of the organization shows

the variances of the enterprise. Variance can be measure by the implementation of the strategies

of the organization.

per the cost incurred in the project (Luft and Shields, 2010). Budgeted profit are to be calculated

as from the growth or effectively of the organization. As per the above mentioned calculation it

is has been assessed that budgeted profit amount which is necessary to earn for the further

accounting period is worth of 420000 GBP.

(b)Actual profit

It denotes the profit which actually earns by the project. It measures through the gained or

incomes more than the incurred expenses. This profit depends upon the production activity and

the process. This is the most important term in every manner because from this many

organization runs their business. Profit which is to be earned and generated by the Smart Looks

in actual is worth of 403180 GBP which is lower than agreed profit. But when talking about the

variance then it is better and effectual for the business in the industry of textile and garments.

(c) Material as well as the Sub variance of march 2017

Difference between the actual and standard performance level of the organization shows

the variances of the enterprise. Variance can be measure by the implementation of the strategies

of the organization.

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

It has been ascertained by the variance table that total material variance is in the

favorable situation due to deriving the positive data such as 8640 GBP. It indicates that Smart

Looks company able to utilize the overall material and raw fabric for produce the cloth in the

optimum way which lead to derive the positive variance.

On the other side the sub variance such as total labor cost is in the negative way which is

worth of -9000 GBP. On the basis of such data it can be said that management of Smart Looks

unable to use the available labor for converting the raw fabric into completed and stitched cloths

and garments.

(d) Operating statement reconciling budget and actual profit

By this process system, the management accountant analyze the variance and the and

analysis the difference in the performance level of actual and standard. Furthermore, the

operation of Business activities can be implemented for the future time period. This is majorly

help in the increases in the profits and effectively of the organization.

Q10 preparation of report aiming the reasons for differences in the actual and the

budgeted costs

To

Board of Directors

Smart Looks Limited

The management accountant of Smart Looks Limited should clearly identify the reasons

for differences between the actual and the budgeted costs. The differences arises due to the fact

that the resources are over utilized and the failure of the proper management system in the

organization and that the actual costs are incurred more than the standard costs depicts the same

on the failure at the part of management. Some of the recommendations to the management

accountant are that he should aim at the optimum utilization of the resources by proper

utilization of the materials and installing the proper machinery for completing the work and

this reduces the consumption of the materials and thus the labor wage rates can also be reduces

as proper machinery enables the less manual work and more of machine work. Hence the

accountant should aim at proper forecasting and on that basis only the proper strategies can be

framed and the entire management can proceed looking to that strategy.

favorable situation due to deriving the positive data such as 8640 GBP. It indicates that Smart

Looks company able to utilize the overall material and raw fabric for produce the cloth in the

optimum way which lead to derive the positive variance.

On the other side the sub variance such as total labor cost is in the negative way which is

worth of -9000 GBP. On the basis of such data it can be said that management of Smart Looks

unable to use the available labor for converting the raw fabric into completed and stitched cloths

and garments.

(d) Operating statement reconciling budget and actual profit

By this process system, the management accountant analyze the variance and the and

analysis the difference in the performance level of actual and standard. Furthermore, the

operation of Business activities can be implemented for the future time period. This is majorly

help in the increases in the profits and effectively of the organization.

Q10 preparation of report aiming the reasons for differences in the actual and the

budgeted costs

To

Board of Directors

Smart Looks Limited

The management accountant of Smart Looks Limited should clearly identify the reasons

for differences between the actual and the budgeted costs. The differences arises due to the fact

that the resources are over utilized and the failure of the proper management system in the

organization and that the actual costs are incurred more than the standard costs depicts the same

on the failure at the part of management. Some of the recommendations to the management

accountant are that he should aim at the optimum utilization of the resources by proper

utilization of the materials and installing the proper machinery for completing the work and

this reduces the consumption of the materials and thus the labor wage rates can also be reduces

as proper machinery enables the less manual work and more of machine work. Hence the

accountant should aim at proper forecasting and on that basis only the proper strategies can be

framed and the entire management can proceed looking to that strategy.

CONCLUSION

It is concluded that management accounting is useful for each and every organization and

the major decisions like budgeting is aimed at determining the standards and comparing on that

basis and taking measures to improve the same. For improving the quality, the methods which

are used are aiming at the optimum utilization of the resources and reducing the costs incurred

aiming at improving the overall performance of the company and efficiently implementing the

strategies for improving the future performance.

It is concluded that management accounting is useful for each and every organization and

the major decisions like budgeting is aimed at determining the standards and comparing on that

basis and taking measures to improve the same. For improving the quality, the methods which

are used are aiming at the optimum utilization of the resources and reducing the costs incurred

aiming at improving the overall performance of the company and efficiently implementing the

strategies for improving the future performance.

1 out of 18

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.