Unit 5 – Management Accounting L-4

VerifiedAdded on 2023/01/16

|18

|5160

|38

AI Summary

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Management

Accounting

Accounting

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Table of Contents

INTRODUCTION...........................................................................................................................1

TASK1.............................................................................................................................................1

P1 Explain management accounting and give the essential requirements of different types of

management accounting systems...........................................................................................1

P2 Explain different methods used for management accounting reporting...........................3

M1 Evaluate the benefits of management accounting systems and their application within an

organisational context.............................................................................................................4

D1 Critically evaluate how management accounting systems and management accounting

reporting is integrated within organisational processes..........................................................5

TASK 2............................................................................................................................................5

P3 Calculate costs using appropriate techniques of cost analysis to prepare an income

statement using marginal and absorption costs......................................................................5

M2 Accurately apply a range of management accounting techniques and produce appropriate

financial reporting documents................................................................................................7

D2 Produce financial reports that accurately apply and interpret data for a range of business

activities..................................................................................................................................7

TASK 3............................................................................................................................................8

P4 Explain the advantages and disadvantages of different types of planning tools used for

budgetary control....................................................................................................................8

M3 Analyse the use of different planning tools and their application for preparing and

forecasting budgets...............................................................................................................10

TASK 4..........................................................................................................................................10

P5 Compare how organisations are adapting management accounting systems to respond to

financial problems................................................................................................................10

M4 Analysis of usage of management accounting to deal with financial issues faced by the

company...............................................................................................................................12

D3 Evaluate how planning tools for accounting respond appropriately to solving financial

problems to lead organisations to sustainable success.........................................................12

CONCLUSION..............................................................................................................................12

REFERENCES..............................................................................................................................14

INTRODUCTION...........................................................................................................................1

TASK1.............................................................................................................................................1

P1 Explain management accounting and give the essential requirements of different types of

management accounting systems...........................................................................................1

P2 Explain different methods used for management accounting reporting...........................3

M1 Evaluate the benefits of management accounting systems and their application within an

organisational context.............................................................................................................4

D1 Critically evaluate how management accounting systems and management accounting

reporting is integrated within organisational processes..........................................................5

TASK 2............................................................................................................................................5

P3 Calculate costs using appropriate techniques of cost analysis to prepare an income

statement using marginal and absorption costs......................................................................5

M2 Accurately apply a range of management accounting techniques and produce appropriate

financial reporting documents................................................................................................7

D2 Produce financial reports that accurately apply and interpret data for a range of business

activities..................................................................................................................................7

TASK 3............................................................................................................................................8

P4 Explain the advantages and disadvantages of different types of planning tools used for

budgetary control....................................................................................................................8

M3 Analyse the use of different planning tools and their application for preparing and

forecasting budgets...............................................................................................................10

TASK 4..........................................................................................................................................10

P5 Compare how organisations are adapting management accounting systems to respond to

financial problems................................................................................................................10

M4 Analysis of usage of management accounting to deal with financial issues faced by the

company...............................................................................................................................12

D3 Evaluate how planning tools for accounting respond appropriately to solving financial

problems to lead organisations to sustainable success.........................................................12

CONCLUSION..............................................................................................................................12

REFERENCES..............................................................................................................................14

INTRODUCTION

Management accounting is regarded as the application of professional techniques,

knowledge as well as aspects to prepare information related to accounting in such a way that

assists entities administration in such a way that assist their administration to formulate plans and

policies, controlling its business operations, decision making, optimal utilisation of resources ,

disclosure to administration as well as safeguard the assets. It includes formation as well as

facilitating time to time financial and statistical data to the manager of enterprises in order to

develop regular and short term decision of administration (Andersén and Samuelsson, 2016). As

per the given scenario the undertaken organisation for this report is OSHODI PLC which is

manufacturing firm. It is mainly specialises in producing JOJO fruit juice across whole age

bracket. This report covers various topics that are management accounting system, management

accounting reporting, computation of costs with the assistance of cost analysis. Moreover,

several tools of planning for budgetary control with its benefits and drawbacks are described.

Apart from this, application of management accounting system for an intent to respond the

financial issues are discussed in this report.

TASK1

P1 Explain management accounting and give the essential requirements of different types of

management accounting systems

Management accounting is considered as the processing as well as presentation

accounting and economical information. It will aids in assessing management performance,

preparing plan of action, performing comparison, budgeting, forecasting and many others. This is

vital for entities like OSHODI PLC to focus upon the effective management accounting at

continuous basis so that its stakeholders may examine actual performance of firm.

The entities internal system that is followed to perform practices in predetermined way is

known as management accounting system. With the assistance of this manager may evaluate

recent enterprise position as well as try to accumulate described data for business so that they can

able to develop strategies for future betterment (Chan, 2015). In OSHODI PLC, various kinds of

system that is utilised through administration to perform practices in appropriate way. Some of

these systems and its essential requirements are described underneath:

1

Management accounting is regarded as the application of professional techniques,

knowledge as well as aspects to prepare information related to accounting in such a way that

assists entities administration in such a way that assist their administration to formulate plans and

policies, controlling its business operations, decision making, optimal utilisation of resources ,

disclosure to administration as well as safeguard the assets. It includes formation as well as

facilitating time to time financial and statistical data to the manager of enterprises in order to

develop regular and short term decision of administration (Andersén and Samuelsson, 2016). As

per the given scenario the undertaken organisation for this report is OSHODI PLC which is

manufacturing firm. It is mainly specialises in producing JOJO fruit juice across whole age

bracket. This report covers various topics that are management accounting system, management

accounting reporting, computation of costs with the assistance of cost analysis. Moreover,

several tools of planning for budgetary control with its benefits and drawbacks are described.

Apart from this, application of management accounting system for an intent to respond the

financial issues are discussed in this report.

TASK1

P1 Explain management accounting and give the essential requirements of different types of

management accounting systems

Management accounting is considered as the processing as well as presentation

accounting and economical information. It will aids in assessing management performance,

preparing plan of action, performing comparison, budgeting, forecasting and many others. This is

vital for entities like OSHODI PLC to focus upon the effective management accounting at

continuous basis so that its stakeholders may examine actual performance of firm.

The entities internal system that is followed to perform practices in predetermined way is

known as management accounting system. With the assistance of this manager may evaluate

recent enterprise position as well as try to accumulate described data for business so that they can

able to develop strategies for future betterment (Chan, 2015). In OSHODI PLC, various kinds of

system that is utilised through administration to perform practices in appropriate way. Some of

these systems and its essential requirements are described underneath:

1

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Cost accounting system: This is regarded as the vital system that is usages through

manufacturing entities for keeping cost records which are utilised to manufacture and

other practices. Thus, manager of OSHODI PLC used cost accounting system to analyse

the actual cost of overall bottles units that re produced through respective entities.

Moreover, it will aids them in reducing expenditure that are not so much essential or

outcomes into cost reduction. This is needed through OSHODI PLC as it facilitates

direction to their manager for formulation decision to minimise the unnecessary expenses

that may outcomes in reducing useless cost in futuristic period.

Price optimisation system: For all entities whether large or small, this is vital to fix

efficacious prices of whole goods which are sold through them to their audiences. For

instance, price optimisation system is utilised through managers to fulfil the users desires

(Chiwamit, Modell and Scapens, 2017). Therefore, manager of OSHODI PLC used this

particular system to set the efficacious price for their goods which are produced by them.

It will aids them to get knowledge regarded its audiences in terms of JOJO fruit juice

cost. Moreover, it will also aids them to attain longer objectives like increasing

profitability by grabbing the attention of more audiences.

Job order costing: It is regarded as the system that is basically utilised for maintaining

the all practices records that is carries out through them. So, the manager of OSHODI

PLC applied this particular system for analysing the manufacturing process outcomes that

are carried out as per the audiences specification. This is vital for entities as it aids them

in as ascertaining their practices cost.

Inventory management system: It is regarded as key element that influence product

cost net income and many more related to entities. Inventory management system aids

them in formulating controlling framework over inventory procedures in order to justify

several types of issues. Many entities are so much concentrated towards personal

utilisation through staff members, loses of stock and many more. In addition to this, with

the aids of this system firms may become competent for developing process which help

them in controlling inflows as well as outflows of stock and also ascertain the re-ordering

period of stock (Christ and Burritt, 2015). The manufacturing company such as

OSHODI PLC manufacture JOJO fruit juice so this is vital for them to used this to

2

manufacturing entities for keeping cost records which are utilised to manufacture and

other practices. Thus, manager of OSHODI PLC used cost accounting system to analyse

the actual cost of overall bottles units that re produced through respective entities.

Moreover, it will aids them in reducing expenditure that are not so much essential or

outcomes into cost reduction. This is needed through OSHODI PLC as it facilitates

direction to their manager for formulation decision to minimise the unnecessary expenses

that may outcomes in reducing useless cost in futuristic period.

Price optimisation system: For all entities whether large or small, this is vital to fix

efficacious prices of whole goods which are sold through them to their audiences. For

instance, price optimisation system is utilised through managers to fulfil the users desires

(Chiwamit, Modell and Scapens, 2017). Therefore, manager of OSHODI PLC used this

particular system to set the efficacious price for their goods which are produced by them.

It will aids them to get knowledge regarded its audiences in terms of JOJO fruit juice

cost. Moreover, it will also aids them to attain longer objectives like increasing

profitability by grabbing the attention of more audiences.

Job order costing: It is regarded as the system that is basically utilised for maintaining

the all practices records that is carries out through them. So, the manager of OSHODI

PLC applied this particular system for analysing the manufacturing process outcomes that

are carried out as per the audiences specification. This is vital for entities as it aids them

in as ascertaining their practices cost.

Inventory management system: It is regarded as key element that influence product

cost net income and many more related to entities. Inventory management system aids

them in formulating controlling framework over inventory procedures in order to justify

several types of issues. Many entities are so much concentrated towards personal

utilisation through staff members, loses of stock and many more. In addition to this, with

the aids of this system firms may become competent for developing process which help

them in controlling inflows as well as outflows of stock and also ascertain the re-ordering

period of stock (Christ and Burritt, 2015). The manufacturing company such as

OSHODI PLC manufacture JOJO fruit juice so this is vital for them to used this to

2

manage their inventory appropriately and efficaciously. This facilitates direction to them

for formulating proper decision to accomplish organisational stock needs.

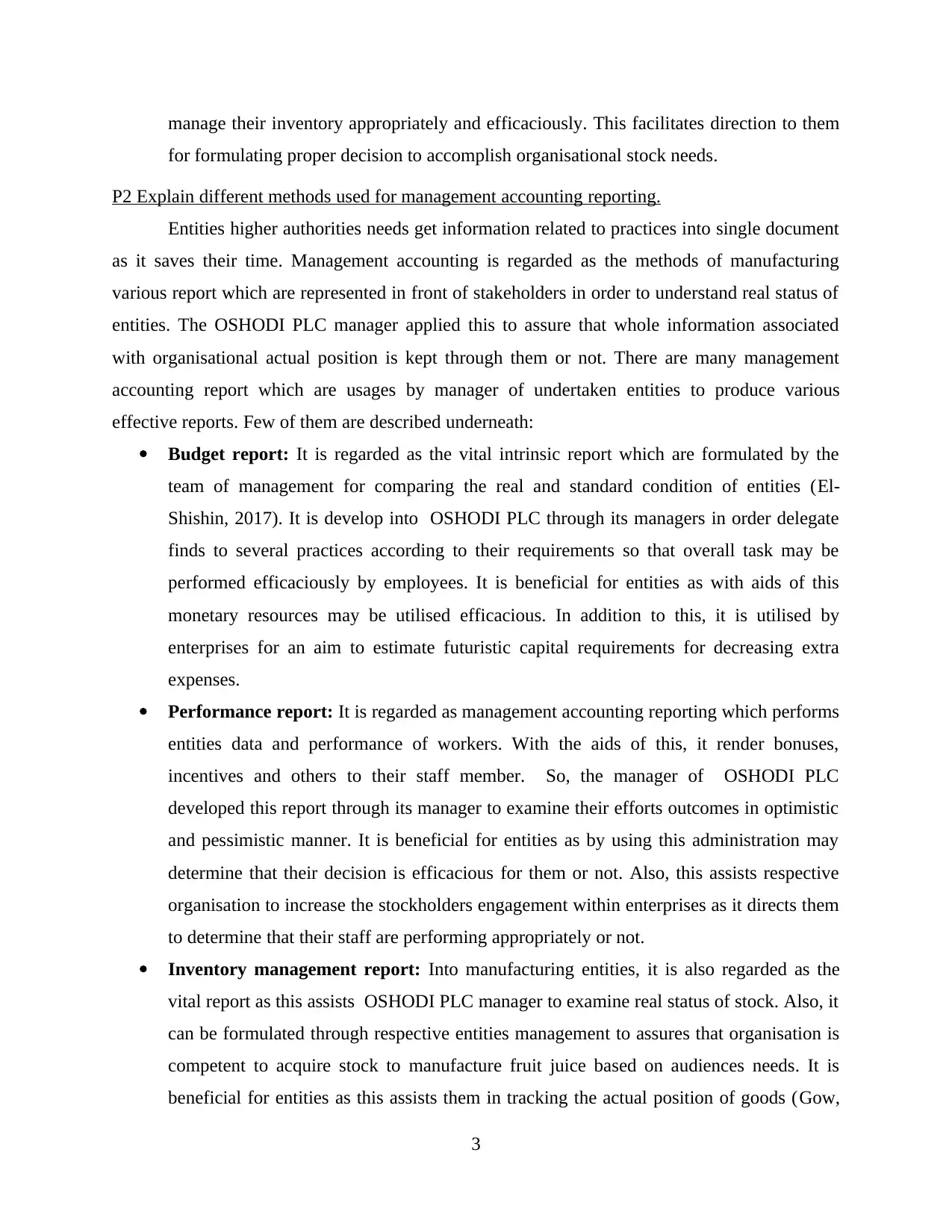

P2 Explain different methods used for management accounting reporting.

Entities higher authorities needs get information related to practices into single document

as it saves their time. Management accounting is regarded as the methods of manufacturing

various report which are represented in front of stakeholders in order to understand real status of

entities. The OSHODI PLC manager applied this to assure that whole information associated

with organisational actual position is kept through them or not. There are many management

accounting report which are usages by manager of undertaken entities to produce various

effective reports. Few of them are described underneath:

Budget report: It is regarded as the vital intrinsic report which are formulated by the

team of management for comparing the real and standard condition of entities (El-

Shishin, 2017). It is develop into OSHODI PLC through its managers in order delegate

finds to several practices according to their requirements so that overall task may be

performed efficaciously by employees. It is beneficial for entities as with aids of this

monetary resources may be utilised efficacious. In addition to this, it is utilised by

enterprises for an aim to estimate futuristic capital requirements for decreasing extra

expenses.

Performance report: It is regarded as management accounting reporting which performs

entities data and performance of workers. With the aids of this, it render bonuses,

incentives and others to their staff member. So, the manager of OSHODI PLC

developed this report through its manager to examine their efforts outcomes in optimistic

and pessimistic manner. It is beneficial for entities as by using this administration may

determine that their decision is efficacious for them or not. Also, this assists respective

organisation to increase the stockholders engagement within enterprises as it directs them

to determine that their staff are performing appropriately or not.

Inventory management report: Into manufacturing entities, it is also regarded as the

vital report as this assists OSHODI PLC manager to examine real status of stock. Also, it

can be formulated through respective entities management to assures that organisation is

competent to acquire stock to manufacture fruit juice based on audiences needs. It is

beneficial for entities as this assists them in tracking the actual position of goods (Gow,

3

for formulating proper decision to accomplish organisational stock needs.

P2 Explain different methods used for management accounting reporting.

Entities higher authorities needs get information related to practices into single document

as it saves their time. Management accounting is regarded as the methods of manufacturing

various report which are represented in front of stakeholders in order to understand real status of

entities. The OSHODI PLC manager applied this to assure that whole information associated

with organisational actual position is kept through them or not. There are many management

accounting report which are usages by manager of undertaken entities to produce various

effective reports. Few of them are described underneath:

Budget report: It is regarded as the vital intrinsic report which are formulated by the

team of management for comparing the real and standard condition of entities (El-

Shishin, 2017). It is develop into OSHODI PLC through its managers in order delegate

finds to several practices according to their requirements so that overall task may be

performed efficaciously by employees. It is beneficial for entities as with aids of this

monetary resources may be utilised efficacious. In addition to this, it is utilised by

enterprises for an aim to estimate futuristic capital requirements for decreasing extra

expenses.

Performance report: It is regarded as management accounting reporting which performs

entities data and performance of workers. With the aids of this, it render bonuses,

incentives and others to their staff member. So, the manager of OSHODI PLC

developed this report through its manager to examine their efforts outcomes in optimistic

and pessimistic manner. It is beneficial for entities as by using this administration may

determine that their decision is efficacious for them or not. Also, this assists respective

organisation to increase the stockholders engagement within enterprises as it directs them

to determine that their staff are performing appropriately or not.

Inventory management report: Into manufacturing entities, it is also regarded as the

vital report as this assists OSHODI PLC manager to examine real status of stock. Also, it

can be formulated through respective entities management to assures that organisation is

competent to acquire stock to manufacture fruit juice based on audiences needs. It is

beneficial for entities as this assists them in tracking the actual position of goods (Gow,

3

Larcker and Reiss, 2016). The vital aim to generate respective report is to render

information to its manager regarding inventory requirements for business practices.

Account receivable report: It is regarded as the report which is developed to keep

records of an amount which is outstanding through users. The essential aim to generate

this report is to examine debts that are owned through many audiences. As OSHODI PLC

is leading entities it manager develop this report so that they become competent to render

credit facilities to its suppliers and also track the outstanding amount. It is beneficial for

entities to to determine its finances which are going to received at futuristics duration. In

addition to this, this assists them they can make strict credit policies by administration for

decreasing the possibilities of debts.

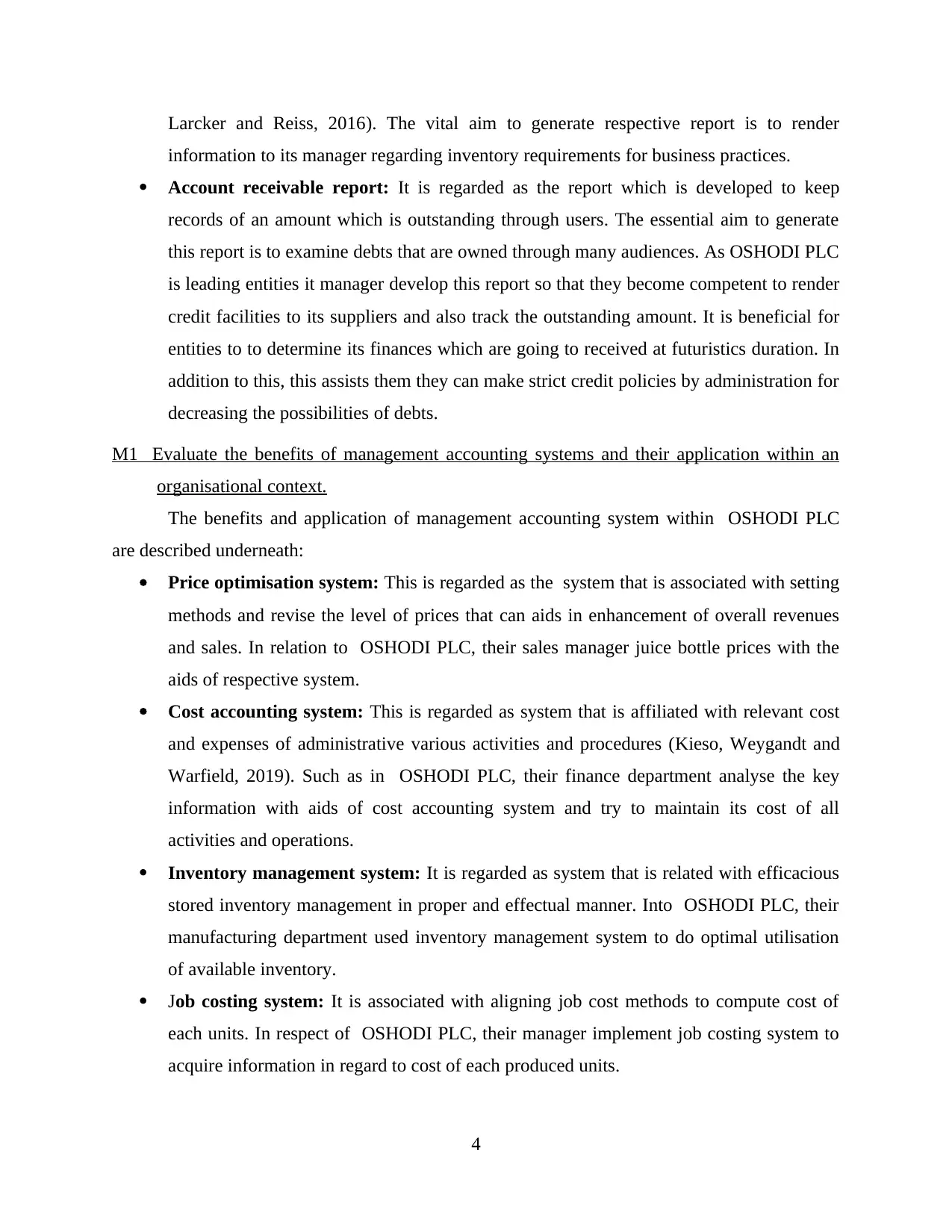

M1 Evaluate the benefits of management accounting systems and their application within an

organisational context.

The benefits and application of management accounting system within OSHODI PLC

are described underneath:

Price optimisation system: This is regarded as the system that is associated with setting

methods and revise the level of prices that can aids in enhancement of overall revenues

and sales. In relation to OSHODI PLC, their sales manager juice bottle prices with the

aids of respective system.

Cost accounting system: This is regarded as system that is affiliated with relevant cost

and expenses of administrative various activities and procedures (Kieso, Weygandt and

Warfield, 2019). Such as in OSHODI PLC, their finance department analyse the key

information with aids of cost accounting system and try to maintain its cost of all

activities and operations.

Inventory management system: It is regarded as system that is related with efficacious

stored inventory management in proper and effectual manner. Into OSHODI PLC, their

manufacturing department used inventory management system to do optimal utilisation

of available inventory.

Job costing system: It is associated with aligning job cost methods to compute cost of

each units. In respect of OSHODI PLC, their manager implement job costing system to

acquire information in regard to cost of each produced units.

4

information to its manager regarding inventory requirements for business practices.

Account receivable report: It is regarded as the report which is developed to keep

records of an amount which is outstanding through users. The essential aim to generate

this report is to examine debts that are owned through many audiences. As OSHODI PLC

is leading entities it manager develop this report so that they become competent to render

credit facilities to its suppliers and also track the outstanding amount. It is beneficial for

entities to to determine its finances which are going to received at futuristics duration. In

addition to this, this assists them they can make strict credit policies by administration for

decreasing the possibilities of debts.

M1 Evaluate the benefits of management accounting systems and their application within an

organisational context.

The benefits and application of management accounting system within OSHODI PLC

are described underneath:

Price optimisation system: This is regarded as the system that is associated with setting

methods and revise the level of prices that can aids in enhancement of overall revenues

and sales. In relation to OSHODI PLC, their sales manager juice bottle prices with the

aids of respective system.

Cost accounting system: This is regarded as system that is affiliated with relevant cost

and expenses of administrative various activities and procedures (Kieso, Weygandt and

Warfield, 2019). Such as in OSHODI PLC, their finance department analyse the key

information with aids of cost accounting system and try to maintain its cost of all

activities and operations.

Inventory management system: It is regarded as system that is related with efficacious

stored inventory management in proper and effectual manner. Into OSHODI PLC, their

manufacturing department used inventory management system to do optimal utilisation

of available inventory.

Job costing system: It is associated with aligning job cost methods to compute cost of

each units. In respect of OSHODI PLC, their manager implement job costing system to

acquire information in regard to cost of each produced units.

4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

D1 Critically evaluate how management accounting systems and management accounting

reporting is integrated within organisational processes

Into management accounting, the vital system and report are included that assists entities

to get efficacious information related to various aspects to internal management. For example:

OSHODI PLC are using various kinds of system related to management accounting such as job

costing, cost accounting and others whole these are aligned with many division. Such as price

optimisation is integrated with sales one and others (Kraus, Håkansson and Lind, 2015). Also,

the management accounting reports are also incorporated within OSHODI PLC production

process. This is because the account receivables report is associated with finance division and

performance report with human resource department. It represents that both system and reports

of management accounting are incorporated with production methods of undertaken entities.

TASK 2

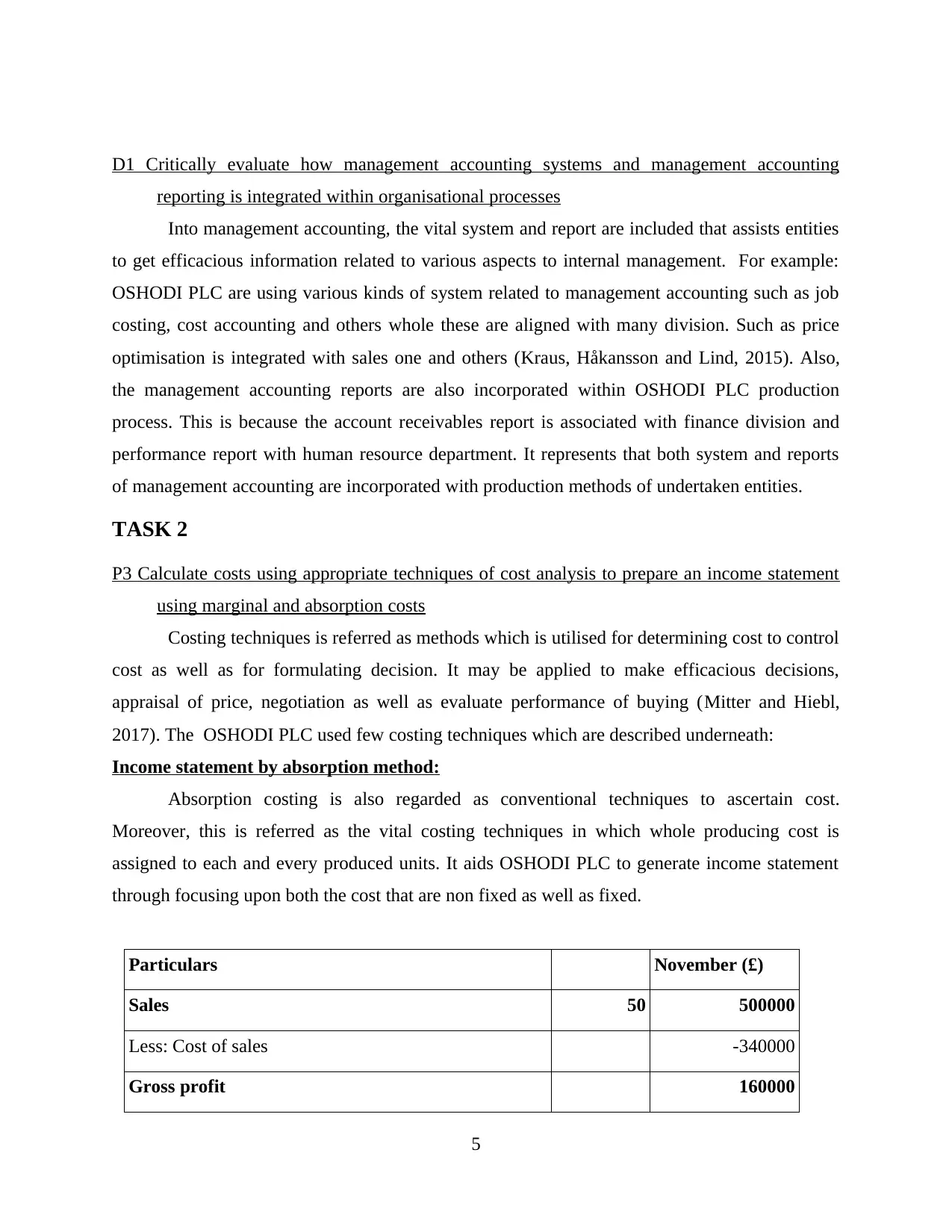

P3 Calculate costs using appropriate techniques of cost analysis to prepare an income statement

using marginal and absorption costs

Costing techniques is referred as methods which is utilised for determining cost to control

cost as well as for formulating decision. It may be applied to make efficacious decisions,

appraisal of price, negotiation as well as evaluate performance of buying (Mitter and Hiebl,

2017). The OSHODI PLC used few costing techniques which are described underneath:

Income statement by absorption method:

Absorption costing is also regarded as conventional techniques to ascertain cost.

Moreover, this is referred as the vital costing techniques in which whole producing cost is

assigned to each and every produced units. It aids OSHODI PLC to generate income statement

through focusing upon both the cost that are non fixed as well as fixed.

Particulars November (£)

Sales 50 500000

Less: Cost of sales -340000

Gross profit 160000

5

reporting is integrated within organisational processes

Into management accounting, the vital system and report are included that assists entities

to get efficacious information related to various aspects to internal management. For example:

OSHODI PLC are using various kinds of system related to management accounting such as job

costing, cost accounting and others whole these are aligned with many division. Such as price

optimisation is integrated with sales one and others (Kraus, Håkansson and Lind, 2015). Also,

the management accounting reports are also incorporated within OSHODI PLC production

process. This is because the account receivables report is associated with finance division and

performance report with human resource department. It represents that both system and reports

of management accounting are incorporated with production methods of undertaken entities.

TASK 2

P3 Calculate costs using appropriate techniques of cost analysis to prepare an income statement

using marginal and absorption costs

Costing techniques is referred as methods which is utilised for determining cost to control

cost as well as for formulating decision. It may be applied to make efficacious decisions,

appraisal of price, negotiation as well as evaluate performance of buying (Mitter and Hiebl,

2017). The OSHODI PLC used few costing techniques which are described underneath:

Income statement by absorption method:

Absorption costing is also regarded as conventional techniques to ascertain cost.

Moreover, this is referred as the vital costing techniques in which whole producing cost is

assigned to each and every produced units. It aids OSHODI PLC to generate income statement

through focusing upon both the cost that are non fixed as well as fixed.

Particulars November (£)

Sales 50 500000

Less: Cost of sales -340000

Gross profit 160000

5

Variable selling overheads (10% sale value) 10000*5 -50000

Fixed selling expenses -14000

Fixed Administration Overhead -26000

Under/over absorbed production expenses 9000

Net Profit 79000

Particulars December (£)

Sales 50 600000

Less: Cost of sales -408000

Gross profit 192000

Under/over absorbed production expenses -9000

Variable selling overheads (10% sale value) 12000*5 -60000

Fixed selling expenses -14000

Fixed Administration Overhead -26000

Net Profit 83000

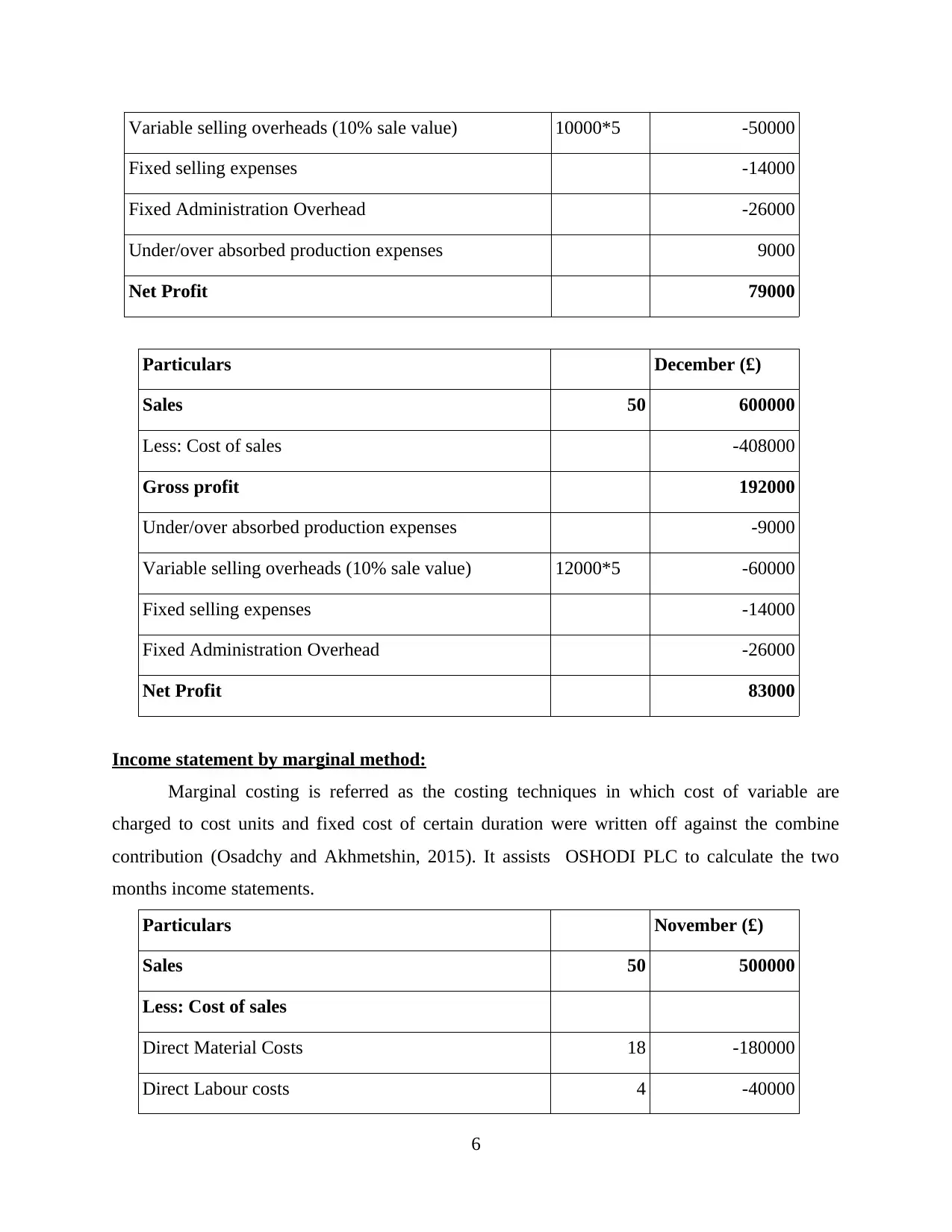

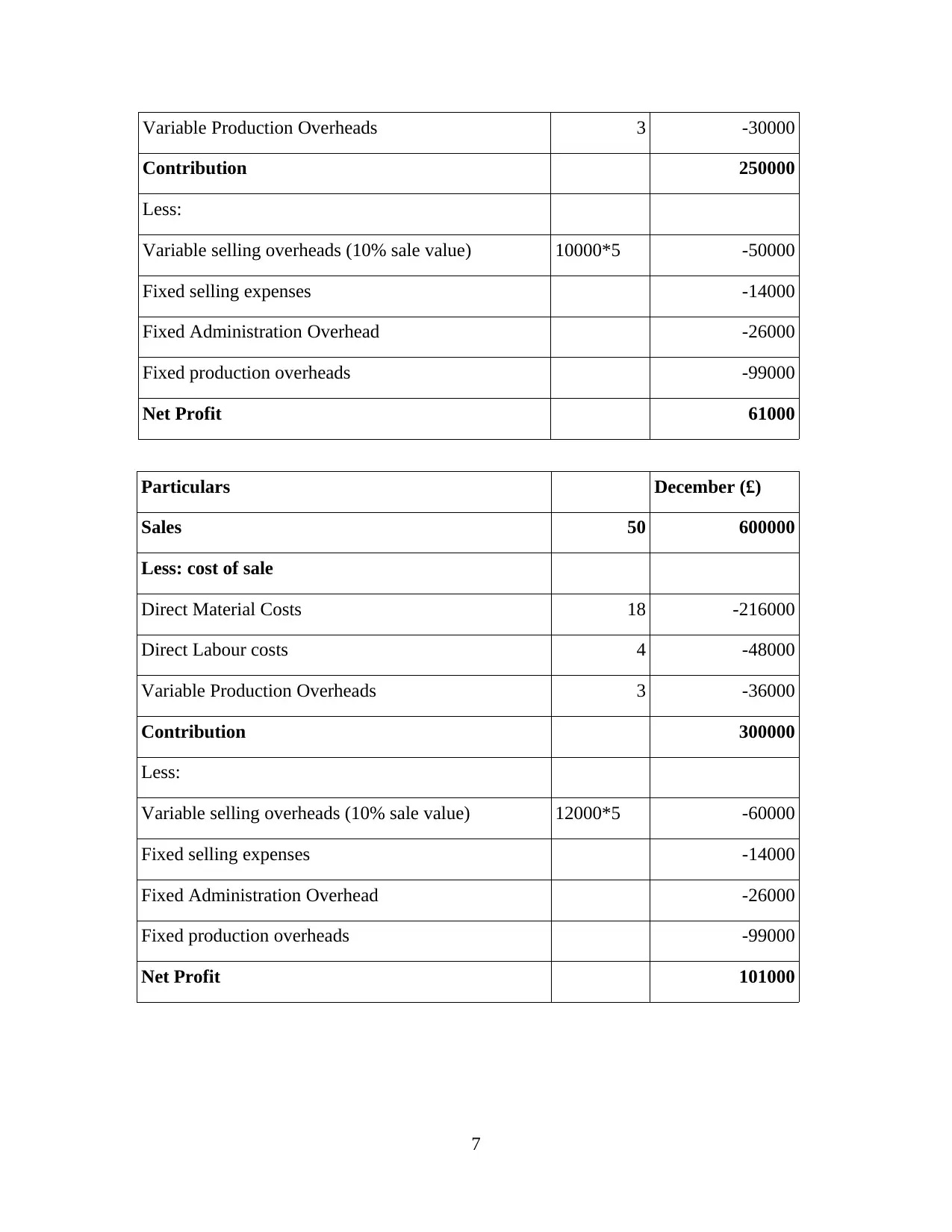

Income statement by marginal method:

Marginal costing is referred as the costing techniques in which cost of variable are

charged to cost units and fixed cost of certain duration were written off against the combine

contribution (Osadchy and Akhmetshin, 2015). It assists OSHODI PLC to calculate the two

months income statements.

Particulars November (£)

Sales 50 500000

Less: Cost of sales

Direct Material Costs 18 -180000

Direct Labour costs 4 -40000

6

Fixed selling expenses -14000

Fixed Administration Overhead -26000

Under/over absorbed production expenses 9000

Net Profit 79000

Particulars December (£)

Sales 50 600000

Less: Cost of sales -408000

Gross profit 192000

Under/over absorbed production expenses -9000

Variable selling overheads (10% sale value) 12000*5 -60000

Fixed selling expenses -14000

Fixed Administration Overhead -26000

Net Profit 83000

Income statement by marginal method:

Marginal costing is referred as the costing techniques in which cost of variable are

charged to cost units and fixed cost of certain duration were written off against the combine

contribution (Osadchy and Akhmetshin, 2015). It assists OSHODI PLC to calculate the two

months income statements.

Particulars November (£)

Sales 50 500000

Less: Cost of sales

Direct Material Costs 18 -180000

Direct Labour costs 4 -40000

6

Variable Production Overheads 3 -30000

Contribution 250000

Less:

Variable selling overheads (10% sale value) 10000*5 -50000

Fixed selling expenses -14000

Fixed Administration Overhead -26000

Fixed production overheads -99000

Net Profit 61000

Particulars December (£)

Sales 50 600000

Less: cost of sale

Direct Material Costs 18 -216000

Direct Labour costs 4 -48000

Variable Production Overheads 3 -36000

Contribution 300000

Less:

Variable selling overheads (10% sale value) 12000*5 -60000

Fixed selling expenses -14000

Fixed Administration Overhead -26000

Fixed production overheads -99000

Net Profit 101000

7

Contribution 250000

Less:

Variable selling overheads (10% sale value) 10000*5 -50000

Fixed selling expenses -14000

Fixed Administration Overhead -26000

Fixed production overheads -99000

Net Profit 61000

Particulars December (£)

Sales 50 600000

Less: cost of sale

Direct Material Costs 18 -216000

Direct Labour costs 4 -48000

Variable Production Overheads 3 -36000

Contribution 300000

Less:

Variable selling overheads (10% sale value) 12000*5 -60000

Fixed selling expenses -14000

Fixed Administration Overhead -26000

Fixed production overheads -99000

Net Profit 101000

7

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

M2 Accurately apply a range of management accounting techniques and produce appropriate

financial reporting documents.

The entities accountant produce income statement with the assistance of absorption and

marginal costing. Therefore, OSHODI PLC accountants formulate income statement according

to used costing techniques. Instead of these techniques, the cost of futuristic techniques is

estimated and based upon this variance is calculated by comparing the actual results. Whiles

applying some more techniques such as activity based costing, the cost were delegated as per

each activities. Due to this, manager have knowledge about whole person cost and cost of each

output.

D2 Produce financial reports that accurately apply and interpret data for a range of business

activities

After examining OSHODI PLC income statement , it is clarify that with the help of

absorption costing the profitability within November is (79000). Where as with the assistance of

marginal the profit will be (61000) in same month. So, as an outcomes it is less than absorption

costing. Also, the profitability into December is (83000) while computing through absorption

costing where as in same month the profit is (101000) with the aids of marginal costing. This is

so the cost of fixed overheads is considered differently within both methods. Therefore, the

consequences of this is that several amount is considered to calculate closing and opening stock.

Therefore, after analysing results of both costing techniques, this have been analysed that

marginal costing technique is more suitable to generate OSHODI PLC income statement.

TASK 3

P4 Explain the advantages and disadvantages of different types of planning tools used for

budgetary control.

Budget is regarded as the monetary plan which is set up by manager to carry out the

overall futuristic practices efficaciously. For whole entities, it is so much vital to analyse that this

is formulated effectively to determine the real position of the entities (Ratnatunga, Tse and

Wahyuni, 2015). Into firms such as OSHODI PLC develop budget to anticipate the futuristic

expenses and revenue to attain their goals which are targeted for longer duration.

Budgetary control is regarded as the methods of determining various exact results with

budgeted amount for futuristic duration of entities and set the standards thereafter compared the

8

financial reporting documents.

The entities accountant produce income statement with the assistance of absorption and

marginal costing. Therefore, OSHODI PLC accountants formulate income statement according

to used costing techniques. Instead of these techniques, the cost of futuristic techniques is

estimated and based upon this variance is calculated by comparing the actual results. Whiles

applying some more techniques such as activity based costing, the cost were delegated as per

each activities. Due to this, manager have knowledge about whole person cost and cost of each

output.

D2 Produce financial reports that accurately apply and interpret data for a range of business

activities

After examining OSHODI PLC income statement , it is clarify that with the help of

absorption costing the profitability within November is (79000). Where as with the assistance of

marginal the profit will be (61000) in same month. So, as an outcomes it is less than absorption

costing. Also, the profitability into December is (83000) while computing through absorption

costing where as in same month the profit is (101000) with the aids of marginal costing. This is

so the cost of fixed overheads is considered differently within both methods. Therefore, the

consequences of this is that several amount is considered to calculate closing and opening stock.

Therefore, after analysing results of both costing techniques, this have been analysed that

marginal costing technique is more suitable to generate OSHODI PLC income statement.

TASK 3

P4 Explain the advantages and disadvantages of different types of planning tools used for

budgetary control.

Budget is regarded as the monetary plan which is set up by manager to carry out the

overall futuristic practices efficaciously. For whole entities, it is so much vital to analyse that this

is formulated effectively to determine the real position of the entities (Ratnatunga, Tse and

Wahyuni, 2015). Into firms such as OSHODI PLC develop budget to anticipate the futuristic

expenses and revenue to attain their goals which are targeted for longer duration.

Budgetary control is regarded as the methods of determining various exact results with

budgeted amount for futuristic duration of entities and set the standards thereafter compared the

8

budgeted figure with real performance for computing the variances. In addition to this, it is an

ongoing process which aids to plan and coordinate. It will aids OSHODI PLC in obviating

unnecessary expenses of financial resources as its essential intent is to enhance profit as well as

control desirable expenses. With assistance of this, it may become competent to assure that

whole resources are used effectively. Thus, during developing budgets OSHODI PLC manager

has to examine real status of entities as well as find requirements so that needs resources may be

available on appropriate time. In order to formulate budgets undertaken entities have to explain

and gather proper information in respect of entities needs. Thereafter gather data are examined

through them for evaluating its accuracy (Speckbacher, 2017). Thus, it formulate budget

consequently as well as represent its top executives for taking approvals form them. So, when

this get approved the OSHODI PLC manager prepare budget appropriately.

Several planning tools

There are many planning tools for budgetary control that are utilised through OSHODI

PLC manager are described underneath: Cash budget: It is regarded as cash flows estimation such as inflows and outflows for

entities across certain time duration yearly, quarterly and monthly. This is used to

evaluate whether firm has effective cash to perform practices. The main intent of

respective budget is to render the status of entities cash position (Taylor and Scapens,

2016). Therefore, the OSHODI PLC manager produce budget to avoid the lack of funds

during period when they has to bear higher expenditure. In addition to this, it formulated

for dividing as well as improving weaker areas and reduce the chances of pessimistic

results within cash flows. Its benefits and drawbacks are discussed underneath:

Benefits:

It will aids OSHODI PLC in accumulating cash to manage as well as control their

futuristic practices efficaciously and also preclude them from lack of liquidity. Moreover, this assist OSHODI PLC to keep the records of overall transaction which is

related to cash for efficacious management of cash.

Drawbacks:

At the time of developing cash budget, overall transaction is not undertaken only some

are considered and it is so much time taking. Also, it bound the consumers buying power and OSHODI PLC as well.

9

ongoing process which aids to plan and coordinate. It will aids OSHODI PLC in obviating

unnecessary expenses of financial resources as its essential intent is to enhance profit as well as

control desirable expenses. With assistance of this, it may become competent to assure that

whole resources are used effectively. Thus, during developing budgets OSHODI PLC manager

has to examine real status of entities as well as find requirements so that needs resources may be

available on appropriate time. In order to formulate budgets undertaken entities have to explain

and gather proper information in respect of entities needs. Thereafter gather data are examined

through them for evaluating its accuracy (Speckbacher, 2017). Thus, it formulate budget

consequently as well as represent its top executives for taking approvals form them. So, when

this get approved the OSHODI PLC manager prepare budget appropriately.

Several planning tools

There are many planning tools for budgetary control that are utilised through OSHODI

PLC manager are described underneath: Cash budget: It is regarded as cash flows estimation such as inflows and outflows for

entities across certain time duration yearly, quarterly and monthly. This is used to

evaluate whether firm has effective cash to perform practices. The main intent of

respective budget is to render the status of entities cash position (Taylor and Scapens,

2016). Therefore, the OSHODI PLC manager produce budget to avoid the lack of funds

during period when they has to bear higher expenditure. In addition to this, it formulated

for dividing as well as improving weaker areas and reduce the chances of pessimistic

results within cash flows. Its benefits and drawbacks are discussed underneath:

Benefits:

It will aids OSHODI PLC in accumulating cash to manage as well as control their

futuristic practices efficaciously and also preclude them from lack of liquidity. Moreover, this assist OSHODI PLC to keep the records of overall transaction which is

related to cash for efficacious management of cash.

Drawbacks:

At the time of developing cash budget, overall transaction is not undertaken only some

are considered and it is so much time taking. Also, it bound the consumers buying power and OSHODI PLC as well.

9

Capital budget: It is regarded as budget that is produced through entities to keep records

of huge investment. Thus, OSHODI PLC prepare respective budgets for formulating plans for

futuristics duration to increase entity's performance. The benefits as well as drawbacks are

discussed underneath:

Benefits:

It assists OSHODI PLC to know about many forms of risk that is included within

projects to obtain various opportunities. Also, with aids of it, they may become competent to identify project that is profitable for

OSHODI PLC then do investment in order to gain profitability.

Drawbacks:

The main drawbacks of capital budget is that OSHODI PLC can formulate this after

longer planning as it may not render optimistic outcomes in lesser duration.

Moreover, this is considered as an costly budget as well as all kinds of entities can not

able to afford this particular tool easily.

M3 Analyse the use of different planning tools and their application for preparing and

forecasting budgets

Into the planning tools of budgetary control, many forms of budget are included which

aids to develop other budgets. Such as OSHODI PLC accountant usage different budget types

such as sales, capital and many others for doing the effectual anticipation of realised outputs. It is

only possible for undertaken company as based on last financial information their accountant

may able to track the anticipated outcomes for developing many types of budget in effectual as

well as efficient way.

TASK 4

P5 Compare how organisations are adapting management accounting systems to respond to

financial problems

Monetary issue- In the business entities vital range of issues occurs and financial issues is

one of them. Under this issue, companies fail to complete their activities and functions on time

10

of huge investment. Thus, OSHODI PLC prepare respective budgets for formulating plans for

futuristics duration to increase entity's performance. The benefits as well as drawbacks are

discussed underneath:

Benefits:

It assists OSHODI PLC to know about many forms of risk that is included within

projects to obtain various opportunities. Also, with aids of it, they may become competent to identify project that is profitable for

OSHODI PLC then do investment in order to gain profitability.

Drawbacks:

The main drawbacks of capital budget is that OSHODI PLC can formulate this after

longer planning as it may not render optimistic outcomes in lesser duration.

Moreover, this is considered as an costly budget as well as all kinds of entities can not

able to afford this particular tool easily.

M3 Analyse the use of different planning tools and their application for preparing and

forecasting budgets

Into the planning tools of budgetary control, many forms of budget are included which

aids to develop other budgets. Such as OSHODI PLC accountant usage different budget types

such as sales, capital and many others for doing the effectual anticipation of realised outputs. It is

only possible for undertaken company as based on last financial information their accountant

may able to track the anticipated outcomes for developing many types of budget in effectual as

well as efficient way.

TASK 4

P5 Compare how organisations are adapting management accounting systems to respond to

financial problems

Monetary issue- In the business entities vital range of issues occurs and financial issues is

one of them. Under this issue, companies fail to complete their activities and functions on time

10

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

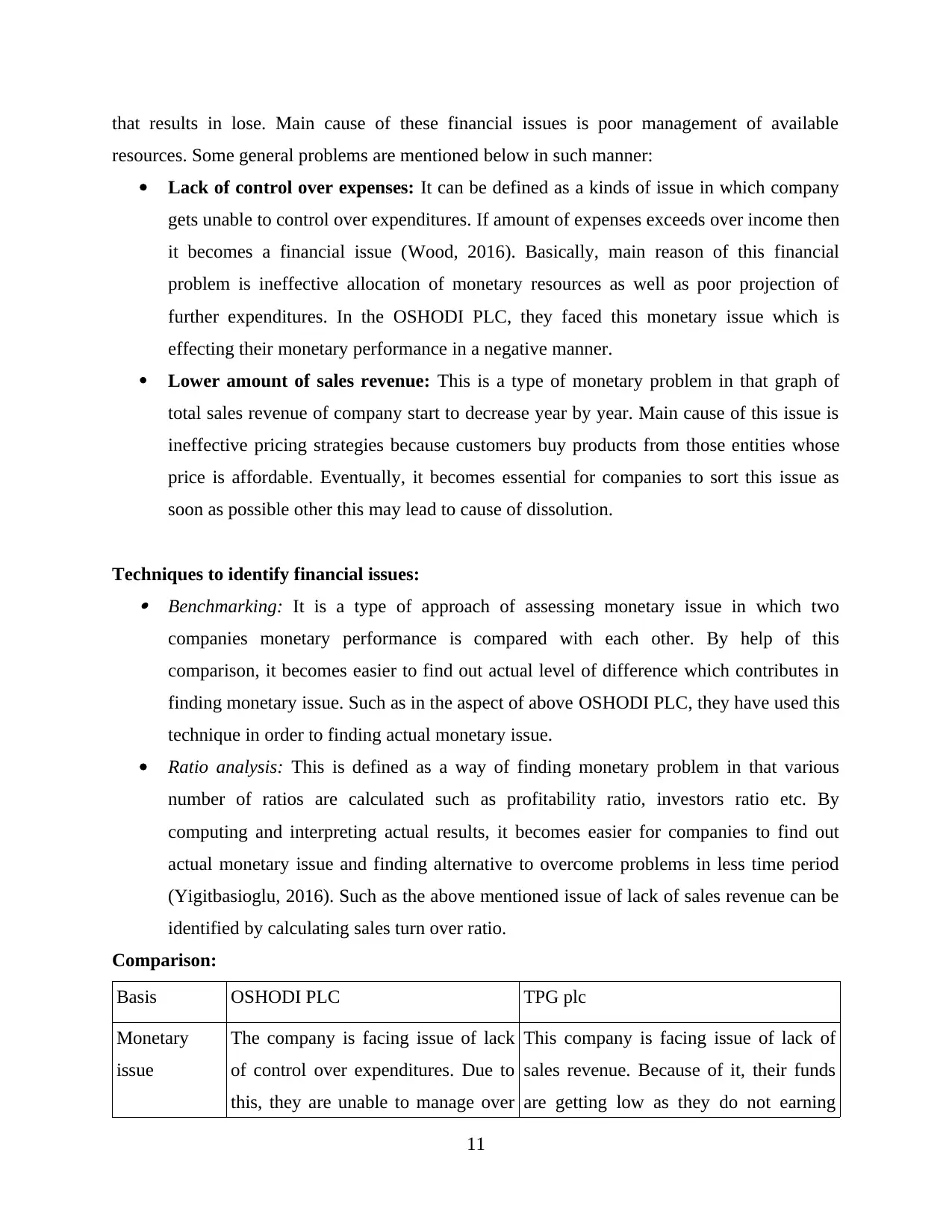

that results in lose. Main cause of these financial issues is poor management of available

resources. Some general problems are mentioned below in such manner:

Lack of control over expenses: It can be defined as a kinds of issue in which company

gets unable to control over expenditures. If amount of expenses exceeds over income then

it becomes a financial issue (Wood, 2016). Basically, main reason of this financial

problem is ineffective allocation of monetary resources as well as poor projection of

further expenditures. In the OSHODI PLC, they faced this monetary issue which is

effecting their monetary performance in a negative manner.

Lower amount of sales revenue: This is a type of monetary problem in that graph of

total sales revenue of company start to decrease year by year. Main cause of this issue is

ineffective pricing strategies because customers buy products from those entities whose

price is affordable. Eventually, it becomes essential for companies to sort this issue as

soon as possible other this may lead to cause of dissolution.

Techniques to identify financial issues: Benchmarking: It is a type of approach of assessing monetary issue in which two

companies monetary performance is compared with each other. By help of this

comparison, it becomes easier to find out actual level of difference which contributes in

finding monetary issue. Such as in the aspect of above OSHODI PLC, they have used this

technique in order to finding actual monetary issue.

Ratio analysis: This is defined as a way of finding monetary problem in that various

number of ratios are calculated such as profitability ratio, investors ratio etc. By

computing and interpreting actual results, it becomes easier for companies to find out

actual monetary issue and finding alternative to overcome problems in less time period

(Yigitbasioglu, 2016). Such as the above mentioned issue of lack of sales revenue can be

identified by calculating sales turn over ratio.

Comparison:

Basis OSHODI PLC TPG plc

Monetary

issue

The company is facing issue of lack

of control over expenditures. Due to

this, they are unable to manage over

This company is facing issue of lack of

sales revenue. Because of it, their funds

are getting low as they do not earning

11

resources. Some general problems are mentioned below in such manner:

Lack of control over expenses: It can be defined as a kinds of issue in which company

gets unable to control over expenditures. If amount of expenses exceeds over income then

it becomes a financial issue (Wood, 2016). Basically, main reason of this financial

problem is ineffective allocation of monetary resources as well as poor projection of

further expenditures. In the OSHODI PLC, they faced this monetary issue which is

effecting their monetary performance in a negative manner.

Lower amount of sales revenue: This is a type of monetary problem in that graph of

total sales revenue of company start to decrease year by year. Main cause of this issue is

ineffective pricing strategies because customers buy products from those entities whose

price is affordable. Eventually, it becomes essential for companies to sort this issue as

soon as possible other this may lead to cause of dissolution.

Techniques to identify financial issues: Benchmarking: It is a type of approach of assessing monetary issue in which two

companies monetary performance is compared with each other. By help of this

comparison, it becomes easier to find out actual level of difference which contributes in

finding monetary issue. Such as in the aspect of above OSHODI PLC, they have used this

technique in order to finding actual monetary issue.

Ratio analysis: This is defined as a way of finding monetary problem in that various

number of ratios are calculated such as profitability ratio, investors ratio etc. By

computing and interpreting actual results, it becomes easier for companies to find out

actual monetary issue and finding alternative to overcome problems in less time period

(Yigitbasioglu, 2016). Such as the above mentioned issue of lack of sales revenue can be

identified by calculating sales turn over ratio.

Comparison:

Basis OSHODI PLC TPG plc

Monetary

issue

The company is facing issue of lack

of control over expenditures. Due to

this, they are unable to manage over

This company is facing issue of lack of

sales revenue. Because of it, their funds

are getting low as they do not earning

11

all cost. As well as their level of

generating revenues is also

decreasing in a significant manner.

enough amount in return.

The finance department of this

company has implemented cost

accounting system. By use of this

system, they focused on those aspects

which are causing as higher cost. As

well as they accurately predicted their

cost which helped them a lot in

sorting financial issue.

They have applied price optimisation

system because cause of lower sales was

ineffective pricing strategy. By applying

this accounting system, they revised their

prices in accordance of market demand

which helped them in increasing total

sales revenues.

M4 Analysis of usage of management accounting to deal with financial issues faced by the

company

The manager of OSHODI PLC applied various management accounting system and

other planning techniques like financial governance, Key performance indicators and so on to

acknowledge and considering action against financial problems such as lack of control over

expenses, lower amount of sales revenue and others by utilising whole these tools the personnel

of administration may become capable for observing or analysing adverse situation within

company and bring new changes by effectual decision to sort out issues appropriately

(Vasarhelyi, Kogan and Tuttle, 2015). As KPI that is key performance indicators facilitates

direction to administration personnel to analyse both aspects of problems that are favourable and

unfavourable. On other hand, benchmarking render guidances to formulate comparative analysis

of decision and policies of entities while considering their competitors plans.

D3 Evaluate how planning tools for accounting respond appropriately to solving financial

problems to lead organisations to sustainable success.

There are various budgetary control planning tools such as sales budget, operating budget

and many more which are applied by OSHODI PLC for an aim to control budget but it may be

usages within process to respond financial issues such as lack of control over expenses, lower

amount of sales revenue and others thus, whole these techniques aids managers of OSHODI

12

generating revenues is also

decreasing in a significant manner.

enough amount in return.

The finance department of this

company has implemented cost

accounting system. By use of this

system, they focused on those aspects

which are causing as higher cost. As

well as they accurately predicted their

cost which helped them a lot in

sorting financial issue.

They have applied price optimisation

system because cause of lower sales was

ineffective pricing strategy. By applying

this accounting system, they revised their

prices in accordance of market demand

which helped them in increasing total

sales revenues.

M4 Analysis of usage of management accounting to deal with financial issues faced by the

company

The manager of OSHODI PLC applied various management accounting system and

other planning techniques like financial governance, Key performance indicators and so on to

acknowledge and considering action against financial problems such as lack of control over

expenses, lower amount of sales revenue and others by utilising whole these tools the personnel

of administration may become capable for observing or analysing adverse situation within

company and bring new changes by effectual decision to sort out issues appropriately

(Vasarhelyi, Kogan and Tuttle, 2015). As KPI that is key performance indicators facilitates

direction to administration personnel to analyse both aspects of problems that are favourable and

unfavourable. On other hand, benchmarking render guidances to formulate comparative analysis

of decision and policies of entities while considering their competitors plans.

D3 Evaluate how planning tools for accounting respond appropriately to solving financial

problems to lead organisations to sustainable success.

There are various budgetary control planning tools such as sales budget, operating budget

and many more which are applied by OSHODI PLC for an aim to control budget but it may be

usages within process to respond financial issues such as lack of control over expenses, lower

amount of sales revenue and others thus, whole these techniques aids managers of OSHODI

12

PLC in delegating funds to whole practices of enterprises in appropriate manner which results in

minimising possibilities of issues related to finance as well as may become competent to survive

for long period properly (Velasquez, Suomala and Järvenpää, 2015).

CONCLUSION

As per the above report, this have been concluded that management accounting is a

systematised framework that is usages through entities of business for an intent to keep records

of overall intrinsic practices. Moreover, there are many types of management accounting system

such as price optimisation, inventory management,cost accounting system and many others. All

these systems aids them to evaluate the present business position and formulate effective

strategies for future. Also, there are many management accounting reports such as performance

report, account receivable report and many more. Marginal as well as absorption costing are

costing techniques which are applied through manager for analysing the business actual cost.

Budgetary control is regarded as the methods of determining various exact results with budgeted

amount for futuristic duration of entities and set the standards thereafter compared the budgeted

figure with real performance for computing the variances. In addition to this, it is an ongoing

process which aids to plan and coordinate. In addition to this, for preparing as well as forecasting

budget for responding financial problems.

13

minimising possibilities of issues related to finance as well as may become competent to survive

for long period properly (Velasquez, Suomala and Järvenpää, 2015).

CONCLUSION

As per the above report, this have been concluded that management accounting is a

systematised framework that is usages through entities of business for an intent to keep records

of overall intrinsic practices. Moreover, there are many types of management accounting system

such as price optimisation, inventory management,cost accounting system and many others. All

these systems aids them to evaluate the present business position and formulate effective

strategies for future. Also, there are many management accounting reports such as performance

report, account receivable report and many more. Marginal as well as absorption costing are

costing techniques which are applied through manager for analysing the business actual cost.

Budgetary control is regarded as the methods of determining various exact results with budgeted

amount for futuristic duration of entities and set the standards thereafter compared the budgeted

figure with real performance for computing the variances. In addition to this, it is an ongoing

process which aids to plan and coordinate. In addition to this, for preparing as well as forecasting

budget for responding financial problems.

13

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

REFERENCES

Books and journal

Andersén, J. and Samuelsson, J., 2016. Resource organization and firm performance: How

entrepreneurial orientation and management accounting influence the profitability of

growing and non-growing SMEs. International Journal of Entrepreneurial Behavior &

Research. 22(4). pp.466-484.

Chan, J. L., 2015. New development: China promotes government financial accounting and

management accounting. Public Money & Management. 35(6). pp.451-454.

Chiwamit, P., Modell, S. and Scapens, R. W., 2017. Regulation and adaptation of management

accounting innovations: The case of economic value added in Thai state-owned

enterprises. Management Accounting Research. 37. pp.30-48.

Christ, K. L. and Burritt, R. L., 2015. Material flow cost accounting: a review and agenda for

future research. Journal of Cleaner Production. 108. pp.1378-1389.

El-Shishini, H. M., 2017. The use of management accounting techniques at hotels in

Bahrain. Review of Integrative Business and Economics Research. 6(2). p.78.

Gow, I. D., Larcker, D. F. and Reiss, P. C., 2016. Causal inference in accounting

research. Journal of Accounting Research. 54(2). pp.477-523.

Kieso, D. E., Weygandt, J. J. and Warfield, T. D., 2019. Intermediate accounting. John Wiley &

Sons.

Kraus, K., Håkansson, H. and Lind, J., 2015. The marketing-accounting interface–problems and

opportunities. Industrial Marketing Management. 46. pp.3-10.

Mitter, C. and Hiebl, M. R., 2017. The role of management accounting in international

entrepreneurship. Journal of Accounting & Organizational Change. 13(3). pp.381-409.

Osadchy, E. A. and Akhmetshin, E. M., 2015. Accounting and control of indirect costs of

organization as a condition of optimizing its financial and economic

activities. International Business Management. 9(7). pp.1705-1709.

Ratnatunga, J., Tse, M. S. and Wahyuni, D., 2015. Societal role expectations of management

accounting professionals: An Australian study. In Advances in management

accounting(pp. 29-48). Emerald Group Publishing Limited.

Speckbacher, G., 2017. Creativity research in management accounting: A commentary. Journal

of Management Accounting Research. 29(3). pp.49-54.

Taylor, L. C. and Scapens, R. W., 2016. The role of identity and image in shaping management

accounting change. Accounting, Auditing & Accountability Journal. 29(6). pp.1075-

1099.

Vasarhelyi, M. A., Kogan, A. and Tuttle, B. M., 2015. Big Data in accounting: An

overview. Accounting Horizons. 29(2). pp.381-396.

Velasquez, S., Suomala, P. and Järvenpää, M., 2015. Cost consciousness: conceptual

development from a management accounting perspective. Qualitative Research in

Accounting & Management. 12(1). pp.55-86.

Wood, D. A., 2016. Comparing the publication process in accounting, economics, finance,

management, marketing, psychology, and the natural sciences. Accounting

Horizons. 30(3). pp.341-361.

Yigitbasioglu, O., 2016. Firms’ information system characteristics and management accounting

adaptability. International Journal of Accounting and Information Management. 24(1).

pp.20-37.

14

Books and journal

Andersén, J. and Samuelsson, J., 2016. Resource organization and firm performance: How

entrepreneurial orientation and management accounting influence the profitability of

growing and non-growing SMEs. International Journal of Entrepreneurial Behavior &

Research. 22(4). pp.466-484.

Chan, J. L., 2015. New development: China promotes government financial accounting and

management accounting. Public Money & Management. 35(6). pp.451-454.

Chiwamit, P., Modell, S. and Scapens, R. W., 2017. Regulation and adaptation of management

accounting innovations: The case of economic value added in Thai state-owned

enterprises. Management Accounting Research. 37. pp.30-48.

Christ, K. L. and Burritt, R. L., 2015. Material flow cost accounting: a review and agenda for

future research. Journal of Cleaner Production. 108. pp.1378-1389.

El-Shishini, H. M., 2017. The use of management accounting techniques at hotels in

Bahrain. Review of Integrative Business and Economics Research. 6(2). p.78.

Gow, I. D., Larcker, D. F. and Reiss, P. C., 2016. Causal inference in accounting

research. Journal of Accounting Research. 54(2). pp.477-523.

Kieso, D. E., Weygandt, J. J. and Warfield, T. D., 2019. Intermediate accounting. John Wiley &

Sons.

Kraus, K., Håkansson, H. and Lind, J., 2015. The marketing-accounting interface–problems and

opportunities. Industrial Marketing Management. 46. pp.3-10.

Mitter, C. and Hiebl, M. R., 2017. The role of management accounting in international

entrepreneurship. Journal of Accounting & Organizational Change. 13(3). pp.381-409.

Osadchy, E. A. and Akhmetshin, E. M., 2015. Accounting and control of indirect costs of

organization as a condition of optimizing its financial and economic

activities. International Business Management. 9(7). pp.1705-1709.

Ratnatunga, J., Tse, M. S. and Wahyuni, D., 2015. Societal role expectations of management

accounting professionals: An Australian study. In Advances in management

accounting(pp. 29-48). Emerald Group Publishing Limited.

Speckbacher, G., 2017. Creativity research in management accounting: A commentary. Journal

of Management Accounting Research. 29(3). pp.49-54.

Taylor, L. C. and Scapens, R. W., 2016. The role of identity and image in shaping management

accounting change. Accounting, Auditing & Accountability Journal. 29(6). pp.1075-

1099.

Vasarhelyi, M. A., Kogan, A. and Tuttle, B. M., 2015. Big Data in accounting: An

overview. Accounting Horizons. 29(2). pp.381-396.

Velasquez, S., Suomala, P. and Järvenpää, M., 2015. Cost consciousness: conceptual

development from a management accounting perspective. Qualitative Research in

Accounting & Management. 12(1). pp.55-86.

Wood, D. A., 2016. Comparing the publication process in accounting, economics, finance,

management, marketing, psychology, and the natural sciences. Accounting

Horizons. 30(3). pp.341-361.

Yigitbasioglu, O., 2016. Firms’ information system characteristics and management accounting

adaptability. International Journal of Accounting and Information Management. 24(1).

pp.20-37.

14

15

1 out of 18

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.