Analysis of Management Accounting Techniques: Unit 5 Report

VerifiedAdded on 2020/07/23

|24

|6678

|39

Report

AI Summary

This report delves into the realm of management accounting, focusing on its significance within organizations and its practical application, using Marks and Spencer (M&S) as a case study. The report begins with an introduction to management accounting, its role, and its importance in enhancing organizational efficiency and decision-making. It explores various facets, including cost accounting, inventory management, and job costing systems, highlighting their functions in calculating product costs, managing inventory, and accumulating costs for specific jobs. The report further examines diverse management accounting techniques, such as financial planning, financial statement analysis, fund flow analysis, and cash flow statements, illustrating their utility in financial management and strategic planning. Furthermore, it discusses marginal costing, budgetary control, and segmental reporting methods. The report emphasizes the advantages and disadvantages of planning tools for budgetary control and advocates for the adoption of these management accounting techniques to improve performance. Overall, the report provides a comprehensive overview of management accounting principles and their practical application in a real-world business context.

UNIT 5

MANAGEMENT

ACCOUNTING

MANAGEMENT

ACCOUNTING

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION...........................................................................................................................3

TASK 1............................................................................................................................................3

P.1 Administration account and different kind of administration accountancy.....................3

P.2 Different method to use management accounting............................................................5

TASK 2............................................................................................................................................7

P.3 Calculate cost analyses and prepare income statement ...................................................7

M.2 Managing accounting techniques .................................................................................11

D.2 Produce financial report.................................................................................................11

TASK 3..........................................................................................................................................11

P.4 Advantage and disadvantage of planing tools for budgetary control.............................11

P.5 Adopt management accounting techniques....................................................................16

CONCLUSION .............................................................................................................................18

REFERENCES ...............................................................................................................................1

INTRODUCTION...........................................................................................................................3

TASK 1............................................................................................................................................3

P.1 Administration account and different kind of administration accountancy.....................3

P.2 Different method to use management accounting............................................................5

TASK 2............................................................................................................................................7

P.3 Calculate cost analyses and prepare income statement ...................................................7

M.2 Managing accounting techniques .................................................................................11

D.2 Produce financial report.................................................................................................11

TASK 3..........................................................................................................................................11

P.4 Advantage and disadvantage of planing tools for budgetary control.............................11

P.5 Adopt management accounting techniques....................................................................16

CONCLUSION .............................................................................................................................18

REFERENCES ...............................................................................................................................1

INTRODUCTION

Finance is the most crucial part in an organisation. The enclose report deal with,

management accounting is assistance to gain the level of execution and increase adaptivity in

work place. Administration accounting is help to interior department in system. In this way,

existing report is deal with Marks and Spencer (M&S) (P. Tucker and D. Lowe, 2014). This is

basically placed in United Kingdom and supply assorted kinds of work in retail sector. With this

respect report assist to focus on management accounting and function to used in work place. In

this report, focus is on budging control and allocation of budget at workplace.

TASK 1

To: General Manager

Marks and Spencer company

From: Management Accounting Officer

Subject: Writing a report to General Manager of Marks and Spencer company

Introduction:

Finance is the most crucial part in an organisation. The enclose report deal with,

management accounting is assistance to gain the level of execution and increase adaptivity in

work place. Administration accounting is help to interior department in system. In this way,

existing report is deal with Marks and Spencer (M&S) (P. Tucker and D. Lowe, 2014). This is

basically placed in United Kingdom and supply assorted kinds of work in retail sector. With this

respect report assist to focus on management accounting and function to used in work place. In

this report, focus is on budging control and allocation of budget at workplace.

TASK 1

To: General Manager

Marks and Spencer company

From: Management Accounting Officer

Subject: Writing a report to General Manager of Marks and Spencer company

Introduction:

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

In order to improve the internal efficiency of the organization, the management accounting

techniques and tools are required by it. The administration accounting will help Marks and

Spencer to flourish in its operations.

(P.1) Administration account and different kind of administration accountancy

Management accounting and managerial accounting is one of the most important part in

organisation . In this context, finance department is to be focal point on management accounting

and role in work place. In management accounting manger used to precondition accounting

information in work place. It is help at the time of judgement and help to future improvement in

organisation (Hall and et.al 2016). It is help to management kind making and increase

performance level. It focus on the devisor planing and performance management system in retail

sector.

Management accounting is help to provide expertise in financial reporting and control to

assists management in work place. It is a process of managing report and account that provide

accurate content on time. This type of information is to be required by manager to carry out day

to day operations at workplace. Management accounting is very important for external

stakeholder. In organisation is generated monthly financial report for external investor, with the

help of this report all external factor can examine system position in market (Soderstrom, K.M

and et.al 2017). In this report is been infused in cash, revenue, capital, assets and liability etc.

management accounting is help to internal or external factor to gain execution level and

maintained the growth rate in market. In such a way management accounting system is help to

addition internal as well as external factor. Management accounting system are as follows :-

Cost accounting system:

In management accounting is most important to increase the performance level and help

external source. This cost accounting system is also called product costing system and costing

system. It helps in calculation cost for product for profitability analyses, inventory valuation and

cost control. All these factors are very important to analyse the final cost and outcome. With the

help of cost factor, organisation is focus on costly environment. In cost accounting system that

business enterprise cost individually form each process in work place (Soderstrom and et.al

2017). It is help to idea the cost flow and control the management in preparation. In cost

techniques and tools are required by it. The administration accounting will help Marks and

Spencer to flourish in its operations.

(P.1) Administration account and different kind of administration accountancy

Management accounting and managerial accounting is one of the most important part in

organisation . In this context, finance department is to be focal point on management accounting

and role in work place. In management accounting manger used to precondition accounting

information in work place. It is help at the time of judgement and help to future improvement in

organisation (Hall and et.al 2016). It is help to management kind making and increase

performance level. It focus on the devisor planing and performance management system in retail

sector.

Management accounting is help to provide expertise in financial reporting and control to

assists management in work place. It is a process of managing report and account that provide

accurate content on time. This type of information is to be required by manager to carry out day

to day operations at workplace. Management accounting is very important for external

stakeholder. In organisation is generated monthly financial report for external investor, with the

help of this report all external factor can examine system position in market (Soderstrom, K.M

and et.al 2017). In this report is been infused in cash, revenue, capital, assets and liability etc.

management accounting is help to internal or external factor to gain execution level and

maintained the growth rate in market. In such a way management accounting system is help to

addition internal as well as external factor. Management accounting system are as follows :-

Cost accounting system:

In management accounting is most important to increase the performance level and help

external source. This cost accounting system is also called product costing system and costing

system. It helps in calculation cost for product for profitability analyses, inventory valuation and

cost control. All these factors are very important to analyse the final cost and outcome. With the

help of cost factor, organisation is focus on costly environment. In cost accounting system that

business enterprise cost individually form each process in work place (Soderstrom and et.al

2017). It is help to idea the cost flow and control the management in preparation. In cost

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

accounting is to be focus on job order cost accounting and procedure costing, cost allocation and

activeness based costing all are the liniments. All such costing is help to increase the execution

level and maintained growth rate in marketplace.

Inventory management system:

In inventory management is represented business stock goods and material as much. In

administration term stock and inventory are to be used interchanged. With the help of inventory

management system is work with the help of two most crucial factors is incoming and outgoing.

The main goal of inventory is level automatically minimize in the case of inside and outside

situation. In inventory administration system is focus on create buy order, created sale order and

physical inventory count etc (Sudaryanti, and et.al 2015). with the help of improve inventory is

focus on improve company bottom line and company work flow is most important in such

condition. To mange it properly is the biggest challenge in organisation. Inventory management

techniques is focus on effectively monitoring the flow of product in retail shops and food store. It

is key drive of the process and increase the performance management in work force.

Job costing system:

In job costing system is to be focus on accumulating information about the cost is been

used in production and service job. This information is very important to increase growth rate. In

this, cost information is submitted to customer under a contract at workplace (Sudaryanti, and

et.al 2015). In job costing system is need to focus on direct cost, direct marital cost, direct labour

cost and overhead cost. Some customer is only focus on certain types of cost in work place.

Costing system is help at the time of requirement of the system.

Every much kind of different types of direction accounting and assist to alteration the level of

carrying into action. Administration accounting is most crucial to indefinite quantity the plane of

execution and preserved the growing rate in activity. With the help of cost accounting is most

important to increase internal or external execution. In cost accounting is focus on estimation of

cost in work place and help to increase shareholder in market (Solovida, and et.al 2017). All

such types of social control accounting is help to provide direction in work place, so it is also

called direction accounting. Financial statement is most important factor to increase performance

level in industry and help all shareholder to estimate growth rate.

activeness based costing all are the liniments. All such costing is help to increase the execution

level and maintained growth rate in marketplace.

Inventory management system:

In inventory management is represented business stock goods and material as much. In

administration term stock and inventory are to be used interchanged. With the help of inventory

management system is work with the help of two most crucial factors is incoming and outgoing.

The main goal of inventory is level automatically minimize in the case of inside and outside

situation. In inventory administration system is focus on create buy order, created sale order and

physical inventory count etc (Sudaryanti, and et.al 2015). with the help of improve inventory is

focus on improve company bottom line and company work flow is most important in such

condition. To mange it properly is the biggest challenge in organisation. Inventory management

techniques is focus on effectively monitoring the flow of product in retail shops and food store. It

is key drive of the process and increase the performance management in work force.

Job costing system:

In job costing system is to be focus on accumulating information about the cost is been

used in production and service job. This information is very important to increase growth rate. In

this, cost information is submitted to customer under a contract at workplace (Sudaryanti, and

et.al 2015). In job costing system is need to focus on direct cost, direct marital cost, direct labour

cost and overhead cost. Some customer is only focus on certain types of cost in work place.

Costing system is help at the time of requirement of the system.

Every much kind of different types of direction accounting and assist to alteration the level of

carrying into action. Administration accounting is most crucial to indefinite quantity the plane of

execution and preserved the growing rate in activity. With the help of cost accounting is most

important to increase internal or external execution. In cost accounting is focus on estimation of

cost in work place and help to increase shareholder in market (Solovida, and et.al 2017). All

such types of social control accounting is help to provide direction in work place, so it is also

called direction accounting. Financial statement is most important factor to increase performance

level in industry and help all shareholder to estimate growth rate.

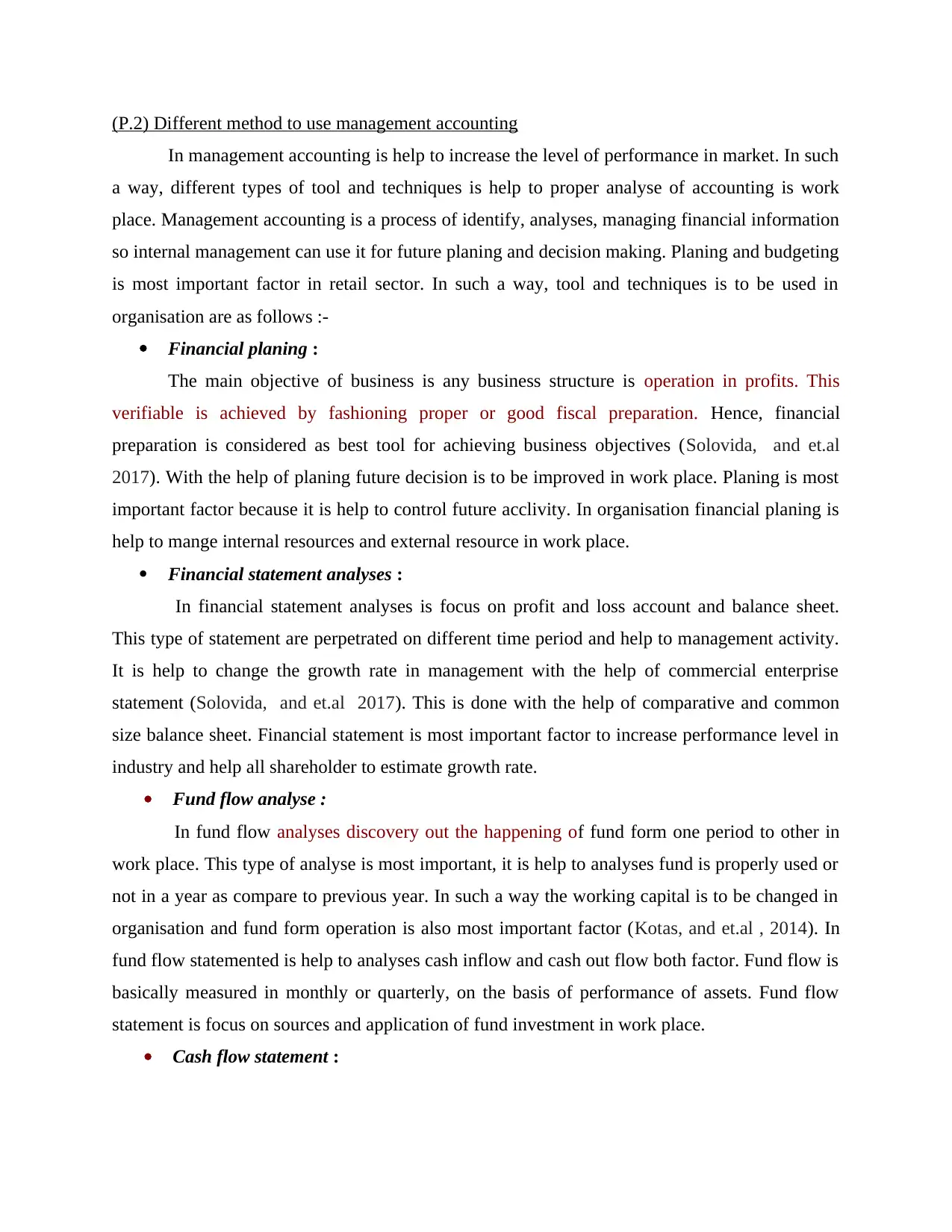

(P.2) Different method to use management accounting

In management accounting is help to increase the level of performance in market. In such

a way, different types of tool and techniques is help to proper analyse of accounting is work

place. Management accounting is a process of identify, analyses, managing financial information

so internal management can use it for future planing and decision making. Planing and budgeting

is most important factor in retail sector. In such a way, tool and techniques is to be used in

organisation are as follows :-

Financial planing :

The main objective of business is any business structure is operation in profits. This

verifiable is achieved by fashioning proper or good fiscal preparation. Hence, financial

preparation is considered as best tool for achieving business objectives (Solovida, and et.al

2017). With the help of planing future decision is to be improved in work place. Planing is most

important factor because it is help to control future acclivity. In organisation financial planing is

help to mange internal resources and external resource in work place.

Financial statement analyses :

In financial statement analyses is focus on profit and loss account and balance sheet.

This type of statement are perpetrated on different time period and help to management activity.

It is help to change the growth rate in management with the help of commercial enterprise

statement (Solovida, and et.al 2017). This is done with the help of comparative and common

size balance sheet. Financial statement is most important factor to increase performance level in

industry and help all shareholder to estimate growth rate.

Fund flow analyse :

In fund flow analyses discovery out the happening of fund form one period to other in

work place. This type of analyse is most important, it is help to analyses fund is properly used or

not in a year as compare to previous year. In such a way the working capital is to be changed in

organisation and fund form operation is also most important factor (Kotas, and et.al , 2014). In

fund flow statemented is help to analyses cash inflow and cash out flow both factor. Fund flow is

basically measured in monthly or quarterly, on the basis of performance of assets. Fund flow

statement is focus on sources and application of fund investment in work place.

Cash flow statement :

In management accounting is help to increase the level of performance in market. In such

a way, different types of tool and techniques is help to proper analyse of accounting is work

place. Management accounting is a process of identify, analyses, managing financial information

so internal management can use it for future planing and decision making. Planing and budgeting

is most important factor in retail sector. In such a way, tool and techniques is to be used in

organisation are as follows :-

Financial planing :

The main objective of business is any business structure is operation in profits. This

verifiable is achieved by fashioning proper or good fiscal preparation. Hence, financial

preparation is considered as best tool for achieving business objectives (Solovida, and et.al

2017). With the help of planing future decision is to be improved in work place. Planing is most

important factor because it is help to control future acclivity. In organisation financial planing is

help to mange internal resources and external resource in work place.

Financial statement analyses :

In financial statement analyses is focus on profit and loss account and balance sheet.

This type of statement are perpetrated on different time period and help to management activity.

It is help to change the growth rate in management with the help of commercial enterprise

statement (Solovida, and et.al 2017). This is done with the help of comparative and common

size balance sheet. Financial statement is most important factor to increase performance level in

industry and help all shareholder to estimate growth rate.

Fund flow analyse :

In fund flow analyses discovery out the happening of fund form one period to other in

work place. This type of analyse is most important, it is help to analyses fund is properly used or

not in a year as compare to previous year. In such a way the working capital is to be changed in

organisation and fund form operation is also most important factor (Kotas, and et.al , 2014). In

fund flow statemented is help to analyses cash inflow and cash out flow both factor. Fund flow is

basically measured in monthly or quarterly, on the basis of performance of assets. Fund flow

statement is focus on sources and application of fund investment in work place.

Cash flow statement :

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

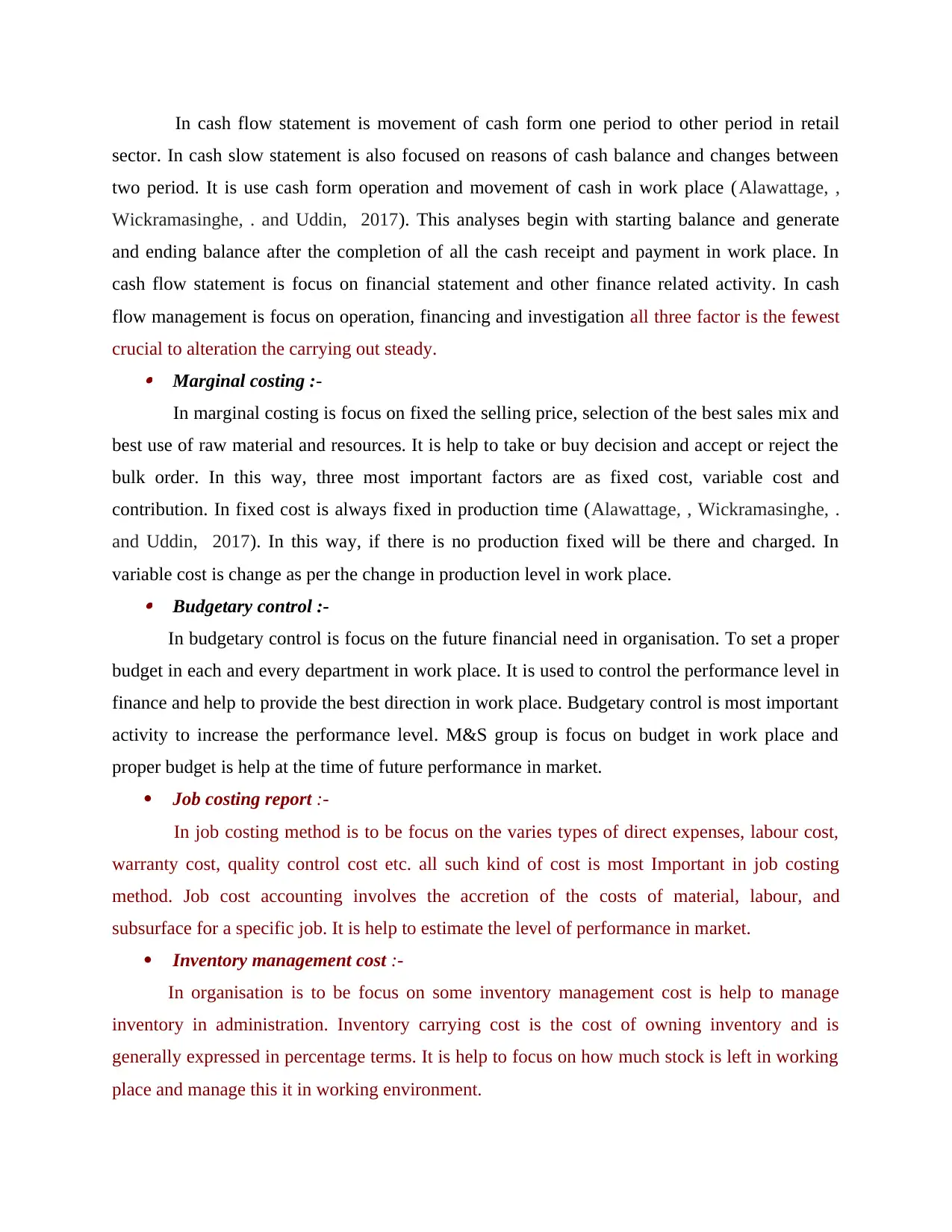

In cash flow statement is movement of cash form one period to other period in retail

sector. In cash slow statement is also focused on reasons of cash balance and changes between

two period. It is use cash form operation and movement of cash in work place (Alawattage, ,

Wickramasinghe, . and Uddin, 2017). This analyses begin with starting balance and generate

and ending balance after the completion of all the cash receipt and payment in work place. In

cash flow statement is focus on financial statement and other finance related activity. In cash

flow management is focus on operation, financing and investigation all three factor is the fewest

crucial to alteration the carrying out steady. Marginal costing :-

In marginal costing is focus on fixed the selling price, selection of the best sales mix and

best use of raw material and resources. It is help to take or buy decision and accept or reject the

bulk order. In this way, three most important factors are as fixed cost, variable cost and

contribution. In fixed cost is always fixed in production time (Alawattage, , Wickramasinghe, .

and Uddin, 2017). In this way, if there is no production fixed will be there and charged. In

variable cost is change as per the change in production level in work place. Budgetary control :-

In budgetary control is focus on the future financial need in organisation. To set a proper

budget in each and every department in work place. It is used to control the performance level in

finance and help to provide the best direction in work place. Budgetary control is most important

activity to increase the performance level. M&S group is focus on budget in work place and

proper budget is help at the time of future performance in market.

Job costing report :-

In job costing method is to be focus on the varies types of direct expenses, labour cost,

warranty cost, quality control cost etc. all such kind of cost is most Important in job costing

method. Job cost accounting involves the accretion of the costs of material, labour, and

subsurface for a specific job. It is help to estimate the level of performance in market.

Inventory management cost :-

In organisation is to be focus on some inventory management cost is help to manage

inventory in administration. Inventory carrying cost is the cost of owning inventory and is

generally expressed in percentage terms. It is help to focus on how much stock is left in working

place and manage this it in working environment.

sector. In cash slow statement is also focused on reasons of cash balance and changes between

two period. It is use cash form operation and movement of cash in work place (Alawattage, ,

Wickramasinghe, . and Uddin, 2017). This analyses begin with starting balance and generate

and ending balance after the completion of all the cash receipt and payment in work place. In

cash flow statement is focus on financial statement and other finance related activity. In cash

flow management is focus on operation, financing and investigation all three factor is the fewest

crucial to alteration the carrying out steady. Marginal costing :-

In marginal costing is focus on fixed the selling price, selection of the best sales mix and

best use of raw material and resources. It is help to take or buy decision and accept or reject the

bulk order. In this way, three most important factors are as fixed cost, variable cost and

contribution. In fixed cost is always fixed in production time (Alawattage, , Wickramasinghe, .

and Uddin, 2017). In this way, if there is no production fixed will be there and charged. In

variable cost is change as per the change in production level in work place. Budgetary control :-

In budgetary control is focus on the future financial need in organisation. To set a proper

budget in each and every department in work place. It is used to control the performance level in

finance and help to provide the best direction in work place. Budgetary control is most important

activity to increase the performance level. M&S group is focus on budget in work place and

proper budget is help at the time of future performance in market.

Job costing report :-

In job costing method is to be focus on the varies types of direct expenses, labour cost,

warranty cost, quality control cost etc. all such kind of cost is most Important in job costing

method. Job cost accounting involves the accretion of the costs of material, labour, and

subsurface for a specific job. It is help to estimate the level of performance in market.

Inventory management cost :-

In organisation is to be focus on some inventory management cost is help to manage

inventory in administration. Inventory carrying cost is the cost of owning inventory and is

generally expressed in percentage terms. It is help to focus on how much stock is left in working

place and manage this it in working environment.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Segmental report method :

In this method is to be focus on the preponderating and presenting the financial report in

work place. It is help to fundamental segmentation of accounting polices in organisation. This

report is focus on sub area of company which activity that generate expenses and revenue in

work place.

Performance report :

Performance management is most important activity in organisation and help to solve

any problem related to collecting and disseminate the project information in work place. It is

help to forecasting the future process in working environment.

Operating budget report:

This method helps to create budget program in the business. With the help of this report,

manager could assess their financial position in effective manner and understand essential

requirements in it as well. Advantage of this method is that it assists to make focus on the targets

of the company. However, it reduces flexibility of the business environment. Main importance of

this method in the Marks and Spencer is to develop creative results to attain desired results.

Product and service:

This method assists to identify actual cost and implement the plan in successful manner.

Therefore, aims and objectives will be accomplish to attain goals and outcomes. Main advantage

is that the chosen enterprise will able to attract people in the business with providing them

products and services as per their own management. However, the business need to implement

high amount to achieve creative position.

Such all method is most important and help to analyse the current market position and marketing

strategy in working environment. Performance report is help to analyses the current market and

organisation position in market.

Every such variety of tool and technique is help to change execution level. All such factor

is help to internal as well as external working environment. In such a way cash flow statement is

movement of cash form one period to other period in retail sector. In cash slow statement is also

focused on reasons of cash balance and changes between two period (Turner, and et.al 2017).

Financial statement is most important factor to increase performance level in industry and help

all shareholder to estimate growth rate.

In this method is to be focus on the preponderating and presenting the financial report in

work place. It is help to fundamental segmentation of accounting polices in organisation. This

report is focus on sub area of company which activity that generate expenses and revenue in

work place.

Performance report :

Performance management is most important activity in organisation and help to solve

any problem related to collecting and disseminate the project information in work place. It is

help to forecasting the future process in working environment.

Operating budget report:

This method helps to create budget program in the business. With the help of this report,

manager could assess their financial position in effective manner and understand essential

requirements in it as well. Advantage of this method is that it assists to make focus on the targets

of the company. However, it reduces flexibility of the business environment. Main importance of

this method in the Marks and Spencer is to develop creative results to attain desired results.

Product and service:

This method assists to identify actual cost and implement the plan in successful manner.

Therefore, aims and objectives will be accomplish to attain goals and outcomes. Main advantage

is that the chosen enterprise will able to attract people in the business with providing them

products and services as per their own management. However, the business need to implement

high amount to achieve creative position.

Such all method is most important and help to analyse the current market position and marketing

strategy in working environment. Performance report is help to analyses the current market and

organisation position in market.

Every such variety of tool and technique is help to change execution level. All such factor

is help to internal as well as external working environment. In such a way cash flow statement is

movement of cash form one period to other period in retail sector. In cash slow statement is also

focused on reasons of cash balance and changes between two period (Turner, and et.al 2017).

Financial statement is most important factor to increase performance level in industry and help

all shareholder to estimate growth rate.

TASK 2

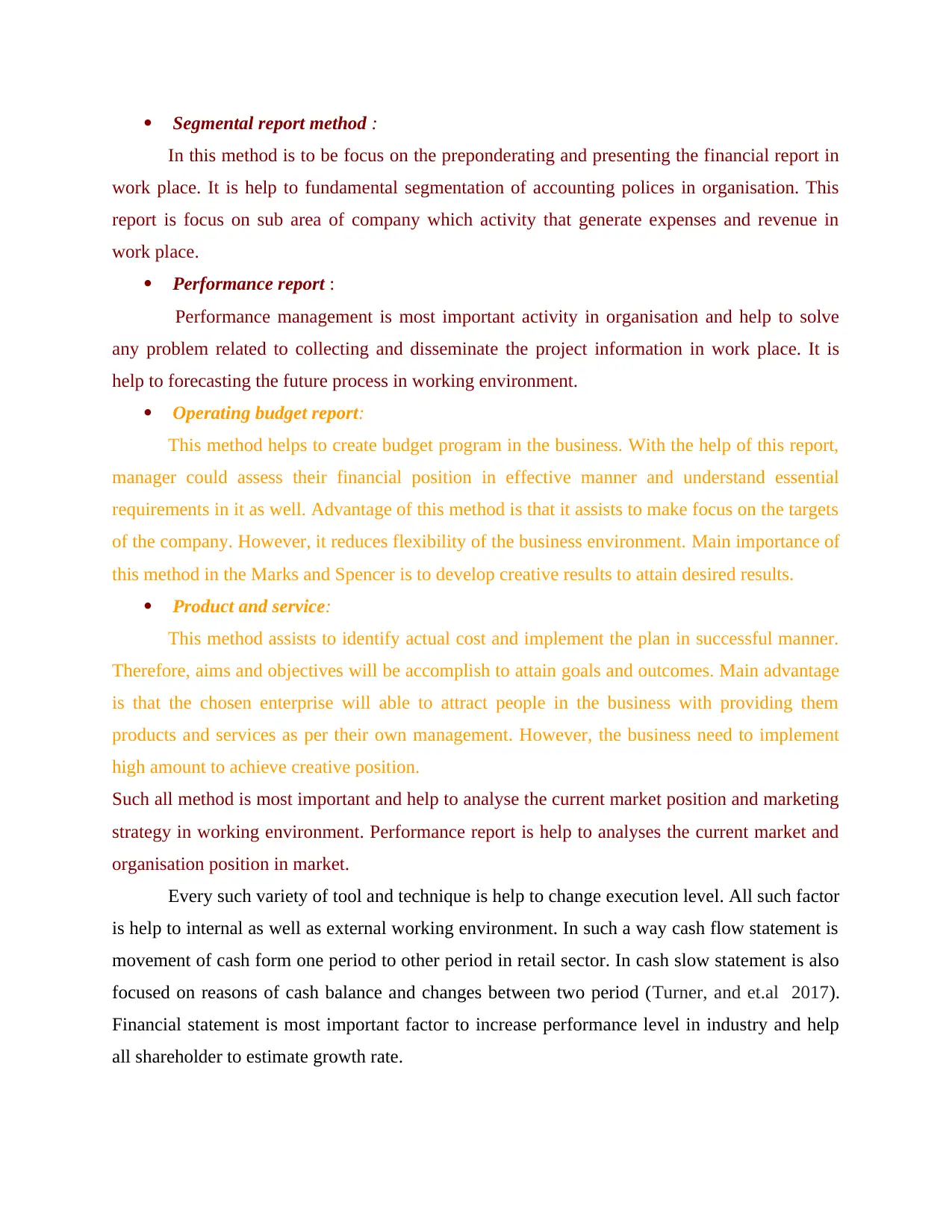

P.3 Calculate cost analyses and prepare income statement

In such a way prepared income statement of marginal costing of Marks and Spencer

following information is to be used are as follows :-

Fixed production cost per unit:

= £1,800/600 = £3 P.U

Calculation of cost per unit of production

Marginal Absorption

Direct material 6 6

Direct labour 5 5

Variable overhead 2 2

Fixed production cost per unit 0 3

Cost of production per unit 13 16

Income statement of Marks and Spencer organisation with using marginal costing

£ £

Sales 500*35 17500

Cost of production 13(w2)*600 7800

Less: Closing stock 13*100 -1300

Variable cost of the sales 6500

Contribution 11000

Less variable sales overhead 1*500 500

10500

Less: Fixed cost production overhead 1800

Administration cost 800

Selling cost 400 3000

P.3 Calculate cost analyses and prepare income statement

In such a way prepared income statement of marginal costing of Marks and Spencer

following information is to be used are as follows :-

Fixed production cost per unit:

= £1,800/600 = £3 P.U

Calculation of cost per unit of production

Marginal Absorption

Direct material 6 6

Direct labour 5 5

Variable overhead 2 2

Fixed production cost per unit 0 3

Cost of production per unit 13 16

Income statement of Marks and Spencer organisation with using marginal costing

£ £

Sales 500*35 17500

Cost of production 13(w2)*600 7800

Less: Closing stock 13*100 -1300

Variable cost of the sales 6500

Contribution 11000

Less variable sales overhead 1*500 500

10500

Less: Fixed cost production overhead 1800

Administration cost 800

Selling cost 400 3000

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Profit 7500

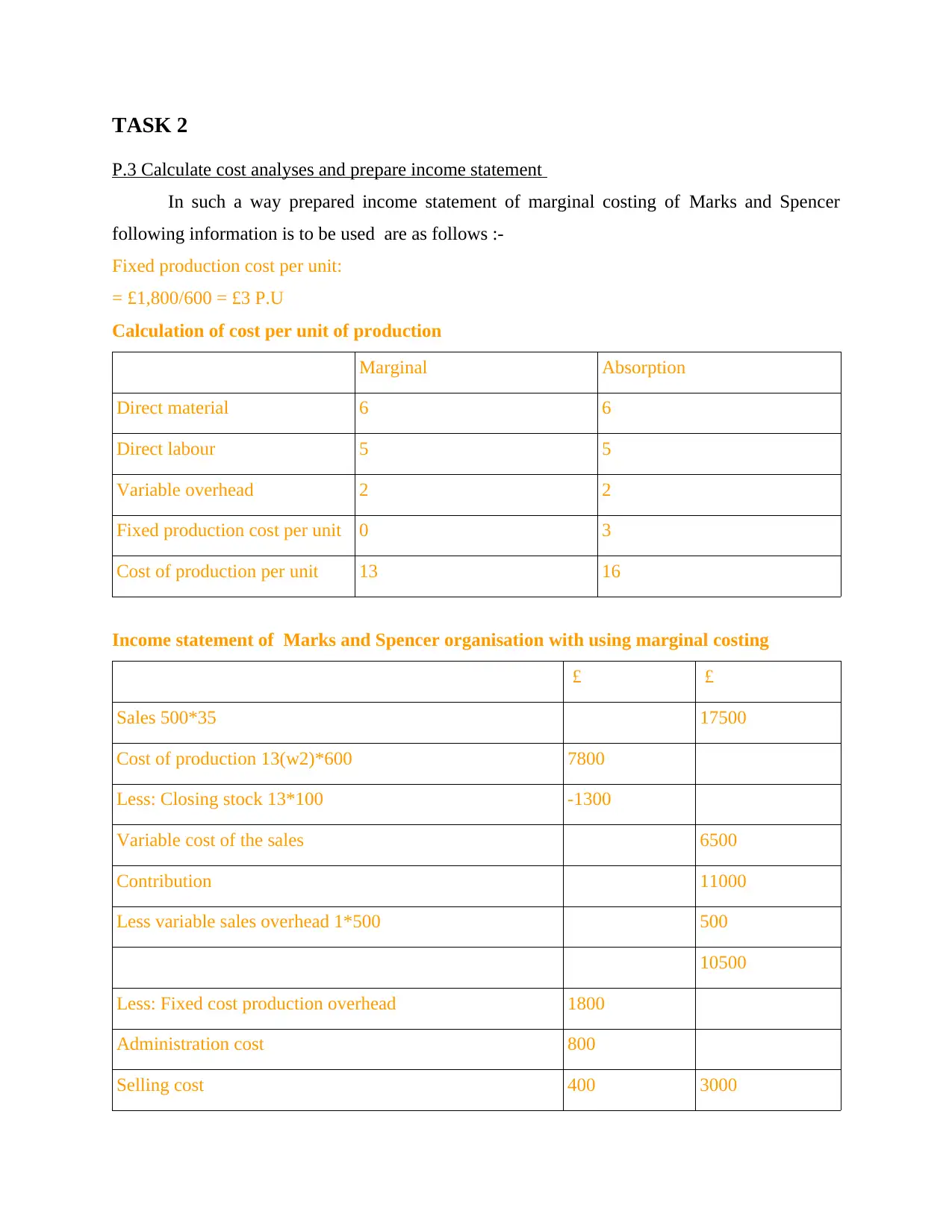

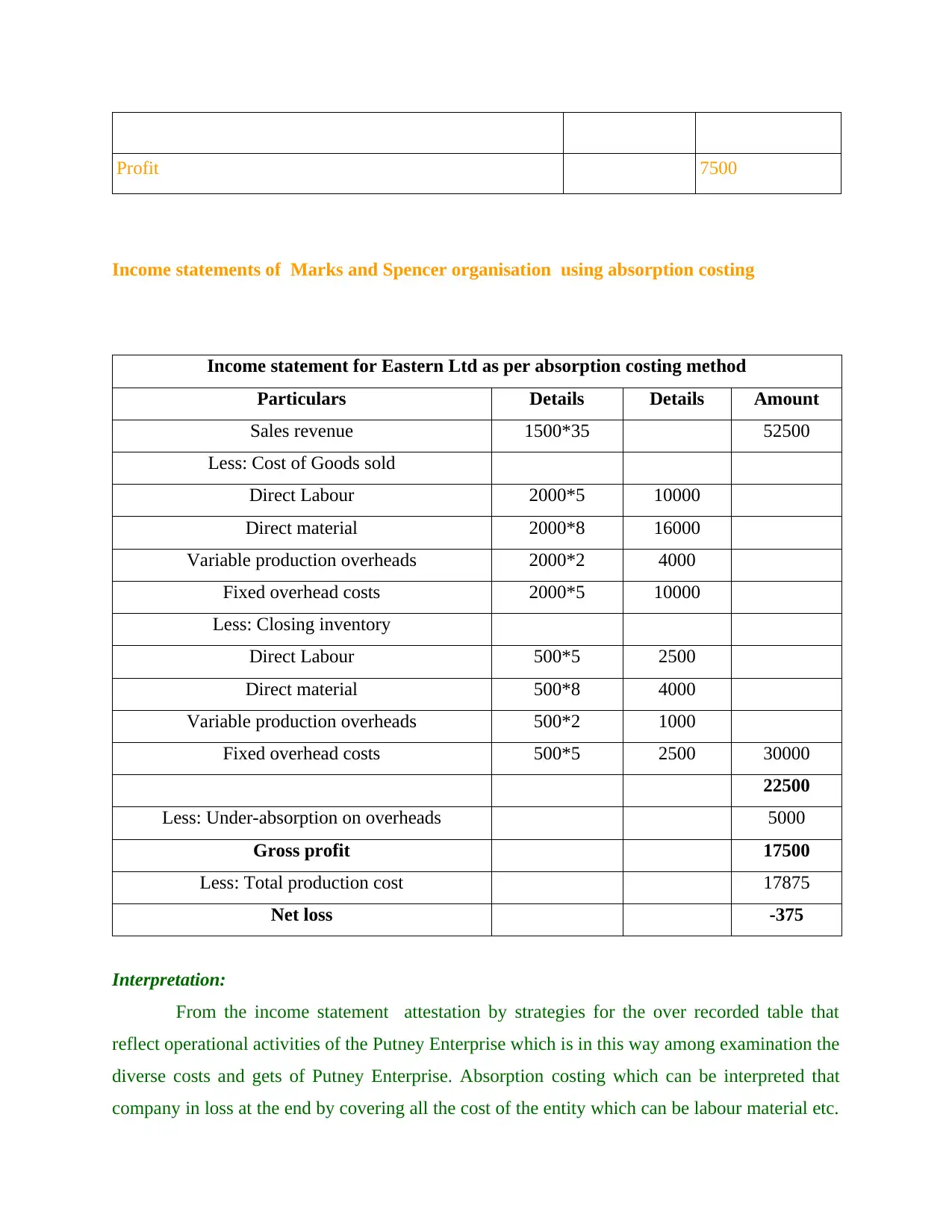

Income statements of Marks and Spencer organisation using absorption costing

Income statement for Eastern Ltd as per absorption costing method

Particulars Details Details Amount

Sales revenue 1500*35 52500

Less: Cost of Goods sold

Direct Labour 2000*5 10000

Direct material 2000*8 16000

Variable production overheads 2000*2 4000

Fixed overhead costs 2000*5 10000

Less: Closing inventory

Direct Labour 500*5 2500

Direct material 500*8 4000

Variable production overheads 500*2 1000

Fixed overhead costs 500*5 2500 30000

22500

Less: Under-absorption on overheads 5000

Gross profit 17500

Less: Total production cost 17875

Net loss -375

Interpretation:

From the income statement attestation by strategies for the over recorded table that

reflect operational activities of the Putney Enterprise which is in this way among examination the

diverse costs and gets of Putney Enterprise. Absorption costing which can be interpreted that

company in loss at the end by covering all the cost of the entity which can be labour material etc.

Income statements of Marks and Spencer organisation using absorption costing

Income statement for Eastern Ltd as per absorption costing method

Particulars Details Details Amount

Sales revenue 1500*35 52500

Less: Cost of Goods sold

Direct Labour 2000*5 10000

Direct material 2000*8 16000

Variable production overheads 2000*2 4000

Fixed overhead costs 2000*5 10000

Less: Closing inventory

Direct Labour 500*5 2500

Direct material 500*8 4000

Variable production overheads 500*2 1000

Fixed overhead costs 500*5 2500 30000

22500

Less: Under-absorption on overheads 5000

Gross profit 17500

Less: Total production cost 17875

Net loss -375

Interpretation:

From the income statement attestation by strategies for the over recorded table that

reflect operational activities of the Putney Enterprise which is in this way among examination the

diverse costs and gets of Putney Enterprise. Absorption costing which can be interpreted that

company in loss at the end by covering all the cost of the entity which can be labour material etc.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

but the firms closing inventory bring the cost around 10000 which can be included all the

variable and fixed cost involved in the organisation overall cost.

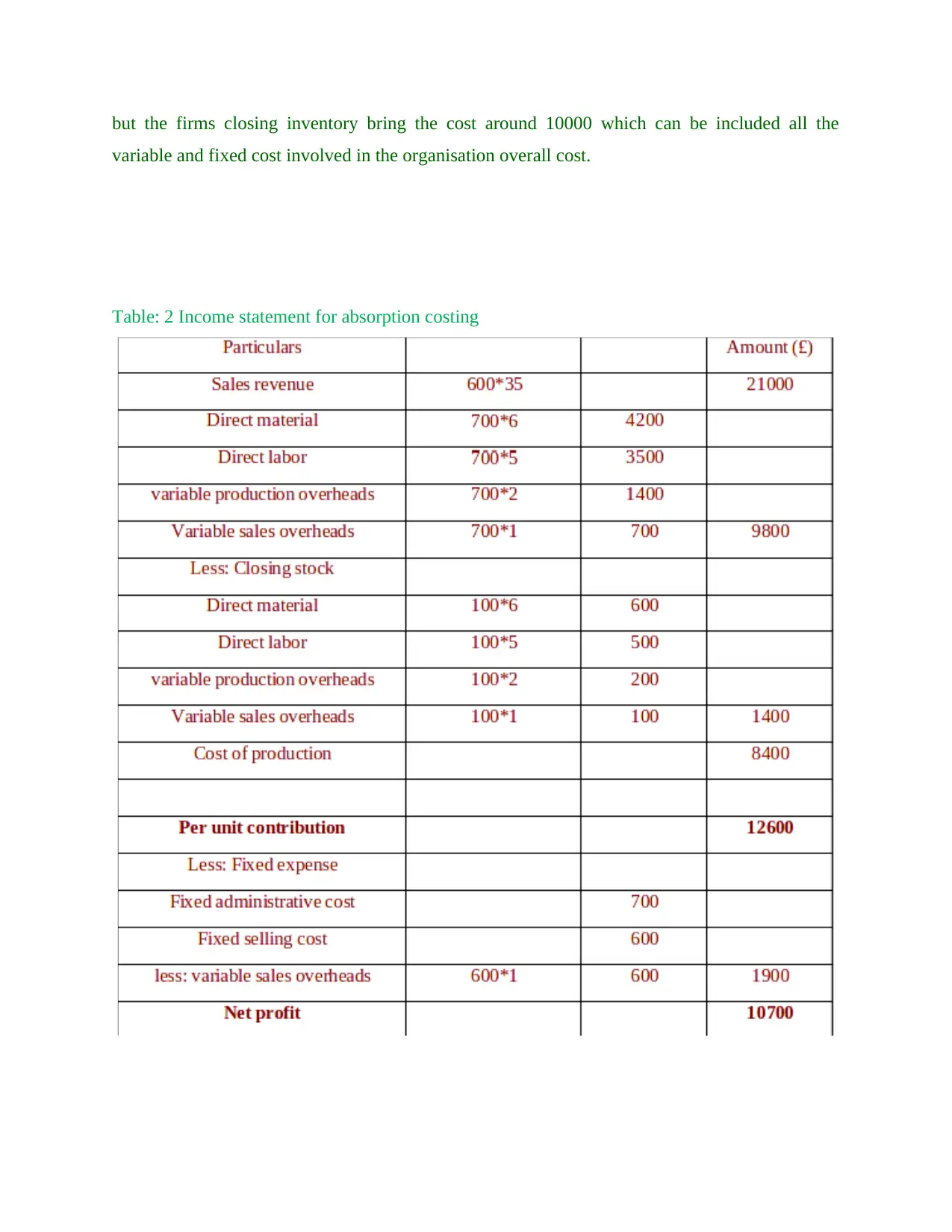

Table: 2 Income statement for absorption costing

variable and fixed cost involved in the organisation overall cost.

Table: 2 Income statement for absorption costing

Interpretation:

From the above income statement according to the absorption costing it can be easily

interpreted that Putney Enterprise save the overhead cost. Therefore, such strategies will be

advantageous for in having the abundance measure of net advantage. Of course, the including up

begin from offer of 600 units at 35 exchange esteem which get the profits of the affiliation

outline 2100 and after that there will be deduction of cost, outrageous stock and settled create

overheads which pass on everything portion for 11500. In such report is to be focus ion

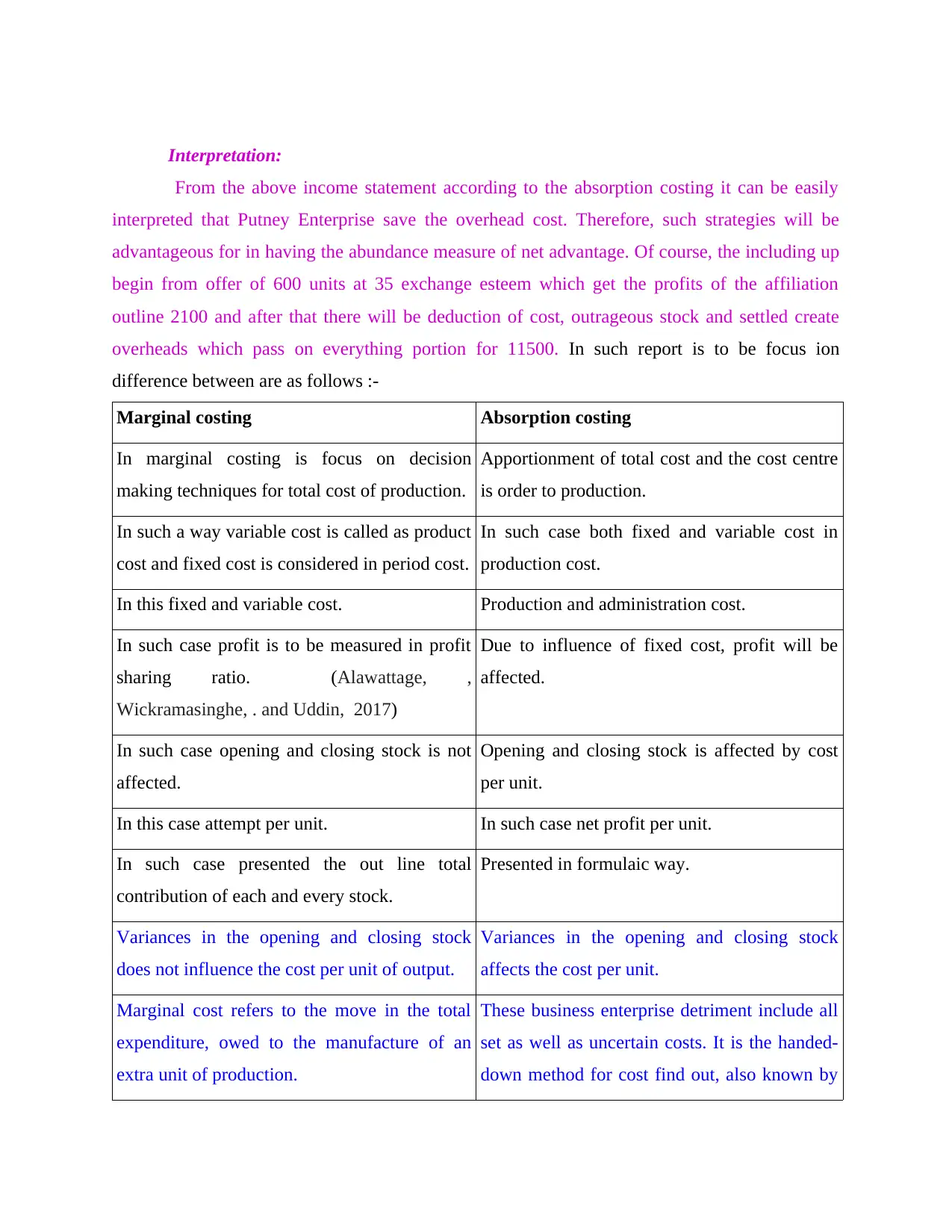

difference between are as follows :-

Marginal costing Absorption costing

In marginal costing is focus on decision

making techniques for total cost of production.

Apportionment of total cost and the cost centre

is order to production.

In such a way variable cost is called as product

cost and fixed cost is considered in period cost.

In such case both fixed and variable cost in

production cost.

In this fixed and variable cost. Production and administration cost.

In such case profit is to be measured in profit

sharing ratio. (Alawattage, ,

Wickramasinghe, . and Uddin, 2017)

Due to influence of fixed cost, profit will be

affected.

In such case opening and closing stock is not

affected.

Opening and closing stock is affected by cost

per unit.

In this case attempt per unit. In such case net profit per unit.

In such case presented the out line total

contribution of each and every stock.

Presented in formulaic way.

Variances in the opening and closing stock

does not influence the cost per unit of output.

Variances in the opening and closing stock

affects the cost per unit.

Marginal cost refers to the move in the total

expenditure, owed to the manufacture of an

extra unit of production.

These business enterprise detriment include all

set as well as uncertain costs. It is the handed-

down method for cost find out, also known by

From the above income statement according to the absorption costing it can be easily

interpreted that Putney Enterprise save the overhead cost. Therefore, such strategies will be

advantageous for in having the abundance measure of net advantage. Of course, the including up

begin from offer of 600 units at 35 exchange esteem which get the profits of the affiliation

outline 2100 and after that there will be deduction of cost, outrageous stock and settled create

overheads which pass on everything portion for 11500. In such report is to be focus ion

difference between are as follows :-

Marginal costing Absorption costing

In marginal costing is focus on decision

making techniques for total cost of production.

Apportionment of total cost and the cost centre

is order to production.

In such a way variable cost is called as product

cost and fixed cost is considered in period cost.

In such case both fixed and variable cost in

production cost.

In this fixed and variable cost. Production and administration cost.

In such case profit is to be measured in profit

sharing ratio. (Alawattage, ,

Wickramasinghe, . and Uddin, 2017)

Due to influence of fixed cost, profit will be

affected.

In such case opening and closing stock is not

affected.

Opening and closing stock is affected by cost

per unit.

In this case attempt per unit. In such case net profit per unit.

In such case presented the out line total

contribution of each and every stock.

Presented in formulaic way.

Variances in the opening and closing stock

does not influence the cost per unit of output.

Variances in the opening and closing stock

affects the cost per unit.

Marginal cost refers to the move in the total

expenditure, owed to the manufacture of an

extra unit of production.

These business enterprise detriment include all

set as well as uncertain costs. It is the handed-

down method for cost find out, also known by

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 24

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.