Detailed Valuation Report: Nike's Financial Performance

VerifiedAdded on 2019/09/19

|22

|3201

|503

Report

AI Summary

This report presents a comprehensive valuation analysis of Nike, Inc., covering various financial aspects. It begins with an overview of Nike's financial ratios, including current, receivables, inventory, and fixed assets turnover, along with profitability and market value ratios from 2014 to 2016, highlighting consistent profitability and efficient asset management. The report then calculates Nike's free cash flow and projects it over the next five years, estimating the return on equity. The weighted average cost of capital (WACC) is determined using the Capital Asset Pricing Model (CAPM), considering the risk-free rate, beta, and market risk premium, along with the cost of debt. The terminal value is calculated, and the firm's total value is derived by summing the present value of free cash flows and the terminal value. Sensitivity analysis is performed to assess the impact of changes in the terminal value. The intrinsic value per share is calculated, followed by an evaluation of Economic Value Added (EVA) and Market Value Added (MVA) to assess Nike's operating and market performance. The report concludes with a discussion of Nike's financial health and value creation for stakeholders.

Valuation Report: Nike

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Valuation Report: Nike

Table of Contents

Question 1.............................................................................................................................................2

Question 2.............................................................................................................................................5

Question 3.............................................................................................................................................6

Question 4.............................................................................................................................................7

Question 5...........................................................................................................................................10

Question 6...........................................................................................................................................11

Question 7...........................................................................................................................................13

Question 8...........................................................................................................................................14

Question 9...........................................................................................................................................16

Question 10.........................................................................................................................................17

Question 11.........................................................................................................................................18

Question 12.........................................................................................................................................19

Question 13.........................................................................................................................................20

Question 14.........................................................................................................................................21

Question 15.........................................................................................................................................23

References...........................................................................................................................................24

1

Table of Contents

Question 1.............................................................................................................................................2

Question 2.............................................................................................................................................5

Question 3.............................................................................................................................................6

Question 4.............................................................................................................................................7

Question 5...........................................................................................................................................10

Question 6...........................................................................................................................................11

Question 7...........................................................................................................................................13

Question 8...........................................................................................................................................14

Question 9...........................................................................................................................................16

Question 10.........................................................................................................................................17

Question 11.........................................................................................................................................18

Question 12.........................................................................................................................................19

Question 13.........................................................................................................................................20

Question 14.........................................................................................................................................21

Question 15.........................................................................................................................................23

References...........................................................................................................................................24

1

Valuation Report: Nike

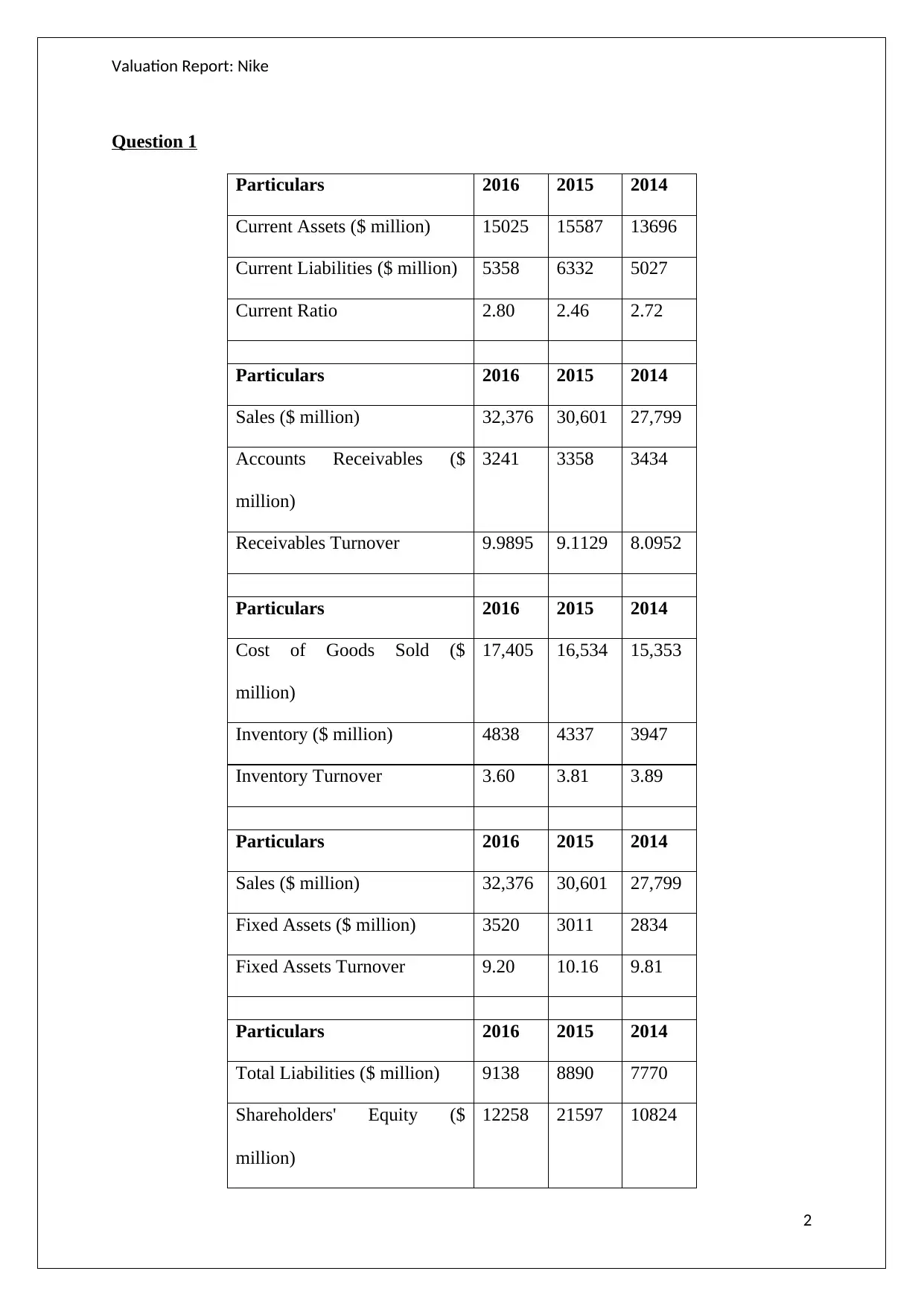

Question 1

Particulars 2016 2015 2014

Current Assets ($ million) 15025 15587 13696

Current Liabilities ($ million) 5358 6332 5027

Current Ratio 2.80 2.46 2.72

Particulars 2016 2015 2014

Sales ($ million) 32,376 30,601 27,799

Accounts Receivables ($

million)

3241 3358 3434

Receivables Turnover 9.9895 9.1129 8.0952

Particulars 2016 2015 2014

Cost of Goods Sold ($

million)

17,405 16,534 15,353

Inventory ($ million) 4838 4337 3947

Inventory Turnover 3.60 3.81 3.89

Particulars 2016 2015 2014

Sales ($ million) 32,376 30,601 27,799

Fixed Assets ($ million) 3520 3011 2834

Fixed Assets Turnover 9.20 10.16 9.81

Particulars 2016 2015 2014

Total Liabilities ($ million) 9138 8890 7770

Shareholders' Equity ($

million)

12258 21597 10824

2

Question 1

Particulars 2016 2015 2014

Current Assets ($ million) 15025 15587 13696

Current Liabilities ($ million) 5358 6332 5027

Current Ratio 2.80 2.46 2.72

Particulars 2016 2015 2014

Sales ($ million) 32,376 30,601 27,799

Accounts Receivables ($

million)

3241 3358 3434

Receivables Turnover 9.9895 9.1129 8.0952

Particulars 2016 2015 2014

Cost of Goods Sold ($

million)

17,405 16,534 15,353

Inventory ($ million) 4838 4337 3947

Inventory Turnover 3.60 3.81 3.89

Particulars 2016 2015 2014

Sales ($ million) 32,376 30,601 27,799

Fixed Assets ($ million) 3520 3011 2834

Fixed Assets Turnover 9.20 10.16 9.81

Particulars 2016 2015 2014

Total Liabilities ($ million) 9138 8890 7770

Shareholders' Equity ($

million)

12258 21597 10824

2

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Valuation Report: Nike

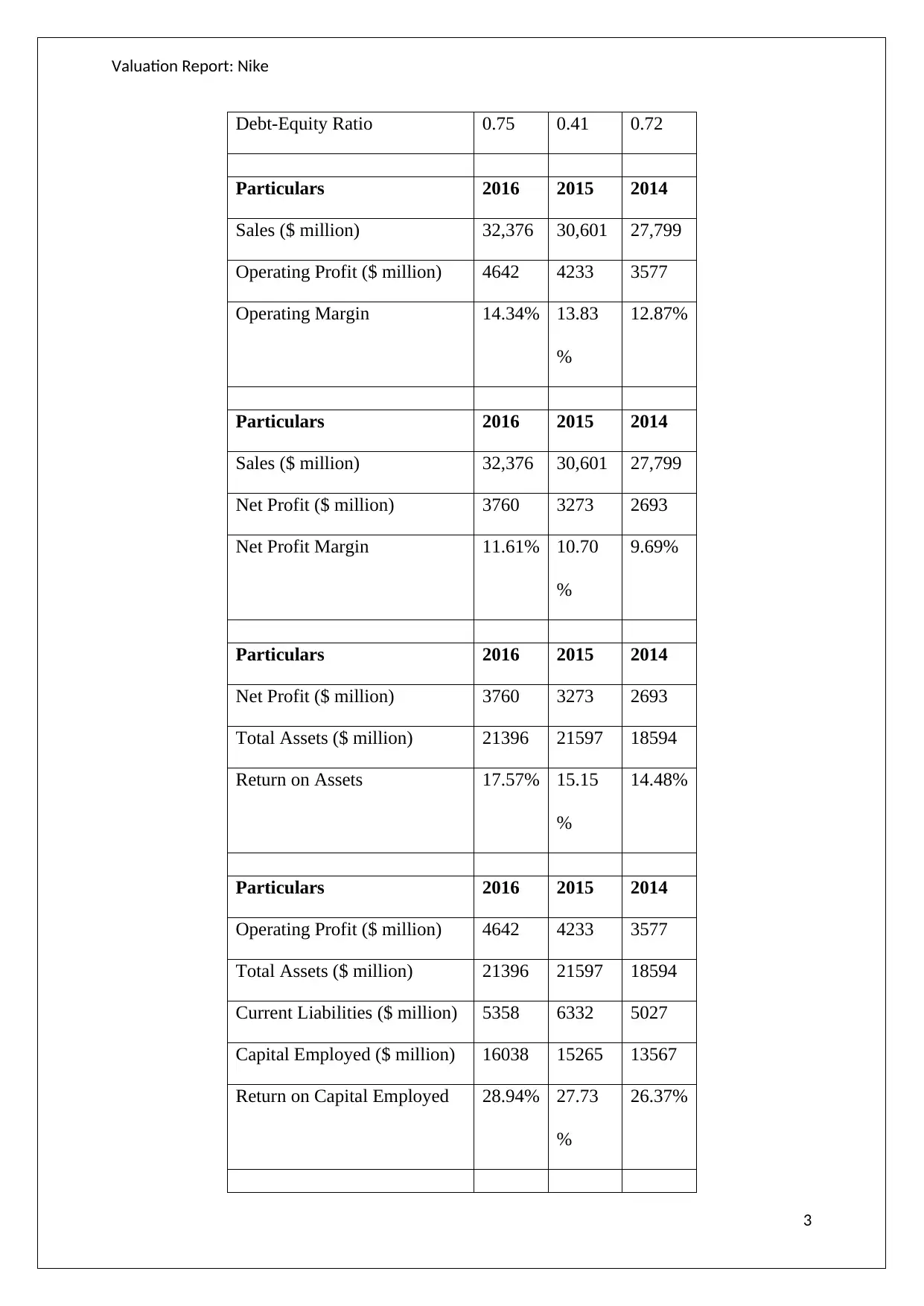

Debt-Equity Ratio 0.75 0.41 0.72

Particulars 2016 2015 2014

Sales ($ million) 32,376 30,601 27,799

Operating Profit ($ million) 4642 4233 3577

Operating Margin 14.34% 13.83

%

12.87%

Particulars 2016 2015 2014

Sales ($ million) 32,376 30,601 27,799

Net Profit ($ million) 3760 3273 2693

Net Profit Margin 11.61% 10.70

%

9.69%

Particulars 2016 2015 2014

Net Profit ($ million) 3760 3273 2693

Total Assets ($ million) 21396 21597 18594

Return on Assets 17.57% 15.15

%

14.48%

Particulars 2016 2015 2014

Operating Profit ($ million) 4642 4233 3577

Total Assets ($ million) 21396 21597 18594

Current Liabilities ($ million) 5358 6332 5027

Capital Employed ($ million) 16038 15265 13567

Return on Capital Employed 28.94% 27.73

%

26.37%

3

Debt-Equity Ratio 0.75 0.41 0.72

Particulars 2016 2015 2014

Sales ($ million) 32,376 30,601 27,799

Operating Profit ($ million) 4642 4233 3577

Operating Margin 14.34% 13.83

%

12.87%

Particulars 2016 2015 2014

Sales ($ million) 32,376 30,601 27,799

Net Profit ($ million) 3760 3273 2693

Net Profit Margin 11.61% 10.70

%

9.69%

Particulars 2016 2015 2014

Net Profit ($ million) 3760 3273 2693

Total Assets ($ million) 21396 21597 18594

Return on Assets 17.57% 15.15

%

14.48%

Particulars 2016 2015 2014

Operating Profit ($ million) 4642 4233 3577

Total Assets ($ million) 21396 21597 18594

Current Liabilities ($ million) 5358 6332 5027

Capital Employed ($ million) 16038 15265 13567

Return on Capital Employed 28.94% 27.73

%

26.37%

3

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Valuation Report: Nike

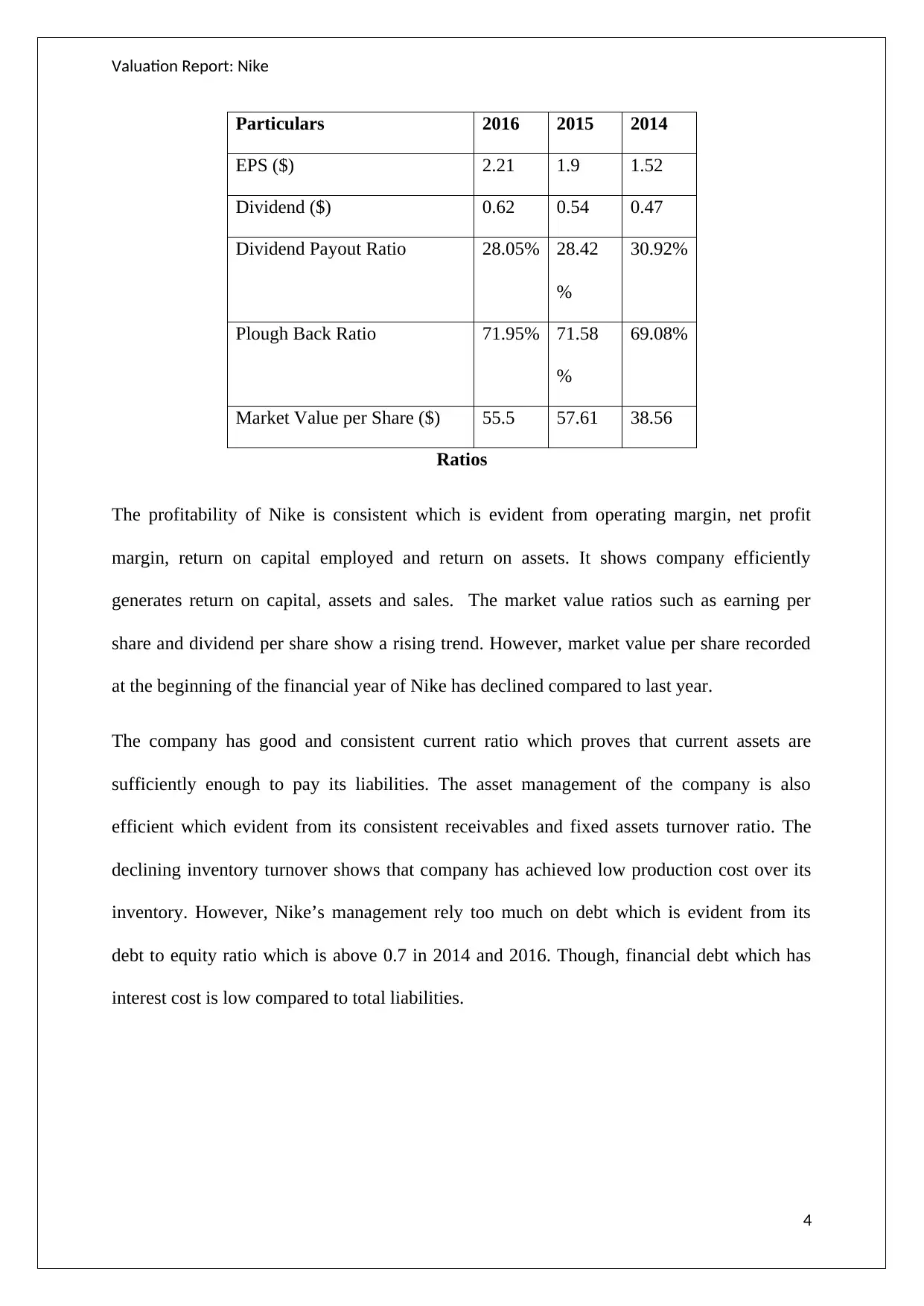

Particulars 2016 2015 2014

EPS ($) 2.21 1.9 1.52

Dividend ($) 0.62 0.54 0.47

Dividend Payout Ratio 28.05% 28.42

%

30.92%

Plough Back Ratio 71.95% 71.58

%

69.08%

Market Value per Share ($) 55.5 57.61 38.56

Ratios

The profitability of Nike is consistent which is evident from operating margin, net profit

margin, return on capital employed and return on assets. It shows company efficiently

generates return on capital, assets and sales. The market value ratios such as earning per

share and dividend per share show a rising trend. However, market value per share recorded

at the beginning of the financial year of Nike has declined compared to last year.

The company has good and consistent current ratio which proves that current assets are

sufficiently enough to pay its liabilities. The asset management of the company is also

efficient which evident from its consistent receivables and fixed assets turnover ratio. The

declining inventory turnover shows that company has achieved low production cost over its

inventory. However, Nike’s management rely too much on debt which is evident from its

debt to equity ratio which is above 0.7 in 2014 and 2016. Though, financial debt which has

interest cost is low compared to total liabilities.

4

Particulars 2016 2015 2014

EPS ($) 2.21 1.9 1.52

Dividend ($) 0.62 0.54 0.47

Dividend Payout Ratio 28.05% 28.42

%

30.92%

Plough Back Ratio 71.95% 71.58

%

69.08%

Market Value per Share ($) 55.5 57.61 38.56

Ratios

The profitability of Nike is consistent which is evident from operating margin, net profit

margin, return on capital employed and return on assets. It shows company efficiently

generates return on capital, assets and sales. The market value ratios such as earning per

share and dividend per share show a rising trend. However, market value per share recorded

at the beginning of the financial year of Nike has declined compared to last year.

The company has good and consistent current ratio which proves that current assets are

sufficiently enough to pay its liabilities. The asset management of the company is also

efficient which evident from its consistent receivables and fixed assets turnover ratio. The

declining inventory turnover shows that company has achieved low production cost over its

inventory. However, Nike’s management rely too much on debt which is evident from its

debt to equity ratio which is above 0.7 in 2014 and 2016. Though, financial debt which has

interest cost is low compared to total liabilities.

4

Valuation Report: Nike

Question 2

The corporate debt rating of Nike is AA- which is given by Standard and Poor’s. It shows

very low chances of company defaulting on its debt. Nike is an international brand because of

which its management has been able to achieve consistent returns to pay of its debt without

any major concerns. The financial debt and operating debt levered by payables and debtors

have different cost associated. The financial debt is high in cost due to interest which is paid

on such debt. However, the operating debt has low cost and it is used to run operations almost

free of cost. Thus, two types of debt have different risk associated. Given the company’s

consistent returns over time, it is completely justifiable to maintain high debt-equity ratio.

5

Question 2

The corporate debt rating of Nike is AA- which is given by Standard and Poor’s. It shows

very low chances of company defaulting on its debt. Nike is an international brand because of

which its management has been able to achieve consistent returns to pay of its debt without

any major concerns. The financial debt and operating debt levered by payables and debtors

have different cost associated. The financial debt is high in cost due to interest which is paid

on such debt. However, the operating debt has low cost and it is used to run operations almost

free of cost. Thus, two types of debt have different risk associated. Given the company’s

consistent returns over time, it is completely justifiable to maintain high debt-equity ratio.

5

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Valuation Report: Nike

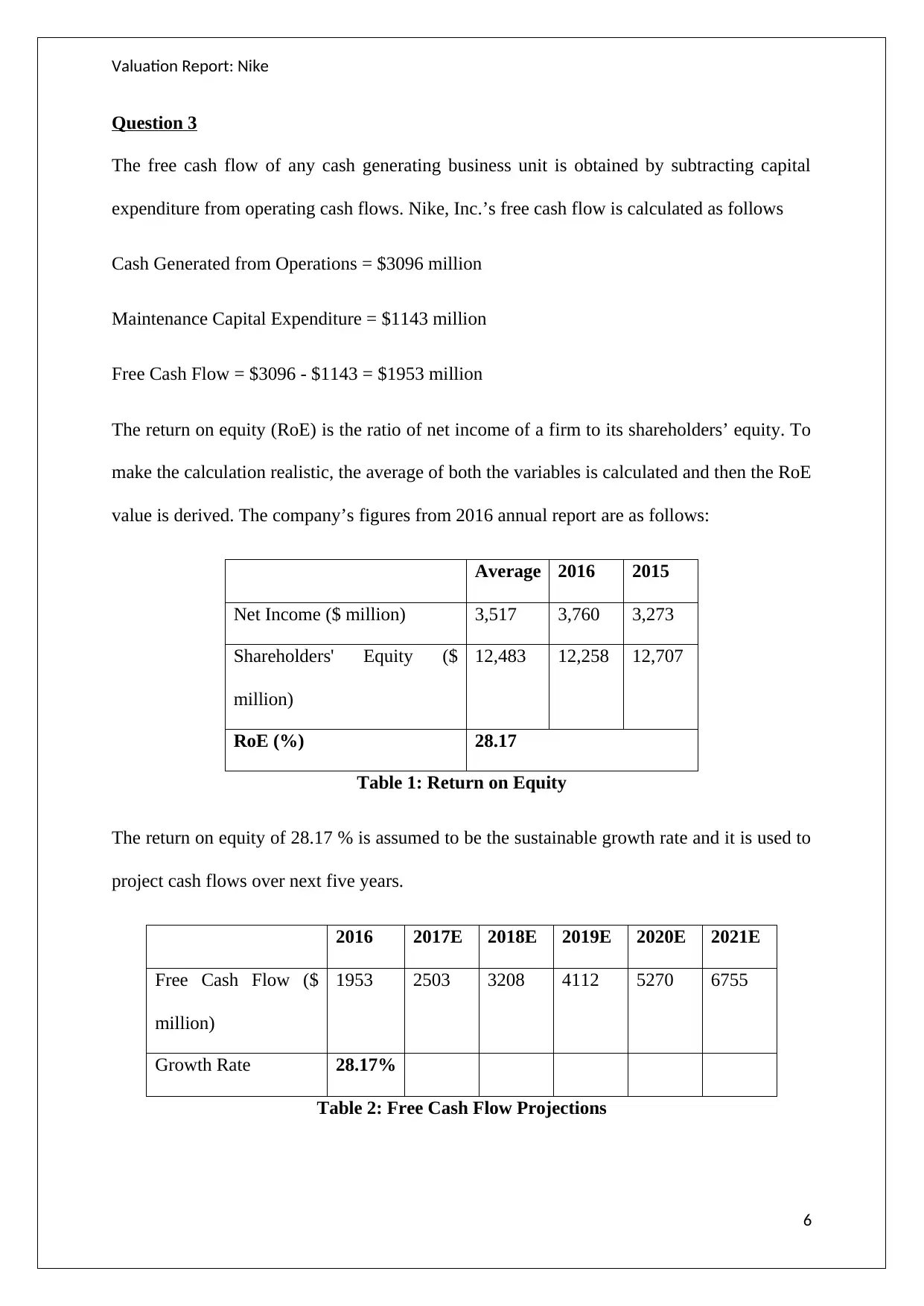

Question 3

The free cash flow of any cash generating business unit is obtained by subtracting capital

expenditure from operating cash flows. Nike, Inc.’s free cash flow is calculated as follows

Cash Generated from Operations = $3096 million

Maintenance Capital Expenditure = $1143 million

Free Cash Flow = $3096 - $1143 = $1953 million

The return on equity (RoE) is the ratio of net income of a firm to its shareholders’ equity. To

make the calculation realistic, the average of both the variables is calculated and then the RoE

value is derived. The company’s figures from 2016 annual report are as follows:

Average 2016 2015

Net Income ($ million) 3,517 3,760 3,273

Shareholders' Equity ($

million)

12,483 12,258 12,707

RoE (%) 28.17

Table 1: Return on Equity

The return on equity of 28.17 % is assumed to be the sustainable growth rate and it is used to

project cash flows over next five years.

2016 2017E 2018E 2019E 2020E 2021E

Free Cash Flow ($

million)

1953 2503 3208 4112 5270 6755

Growth Rate 28.17%

Table 2: Free Cash Flow Projections

6

Question 3

The free cash flow of any cash generating business unit is obtained by subtracting capital

expenditure from operating cash flows. Nike, Inc.’s free cash flow is calculated as follows

Cash Generated from Operations = $3096 million

Maintenance Capital Expenditure = $1143 million

Free Cash Flow = $3096 - $1143 = $1953 million

The return on equity (RoE) is the ratio of net income of a firm to its shareholders’ equity. To

make the calculation realistic, the average of both the variables is calculated and then the RoE

value is derived. The company’s figures from 2016 annual report are as follows:

Average 2016 2015

Net Income ($ million) 3,517 3,760 3,273

Shareholders' Equity ($

million)

12,483 12,258 12,707

RoE (%) 28.17

Table 1: Return on Equity

The return on equity of 28.17 % is assumed to be the sustainable growth rate and it is used to

project cash flows over next five years.

2016 2017E 2018E 2019E 2020E 2021E

Free Cash Flow ($

million)

1953 2503 3208 4112 5270 6755

Growth Rate 28.17%

Table 2: Free Cash Flow Projections

6

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Valuation Report: Nike

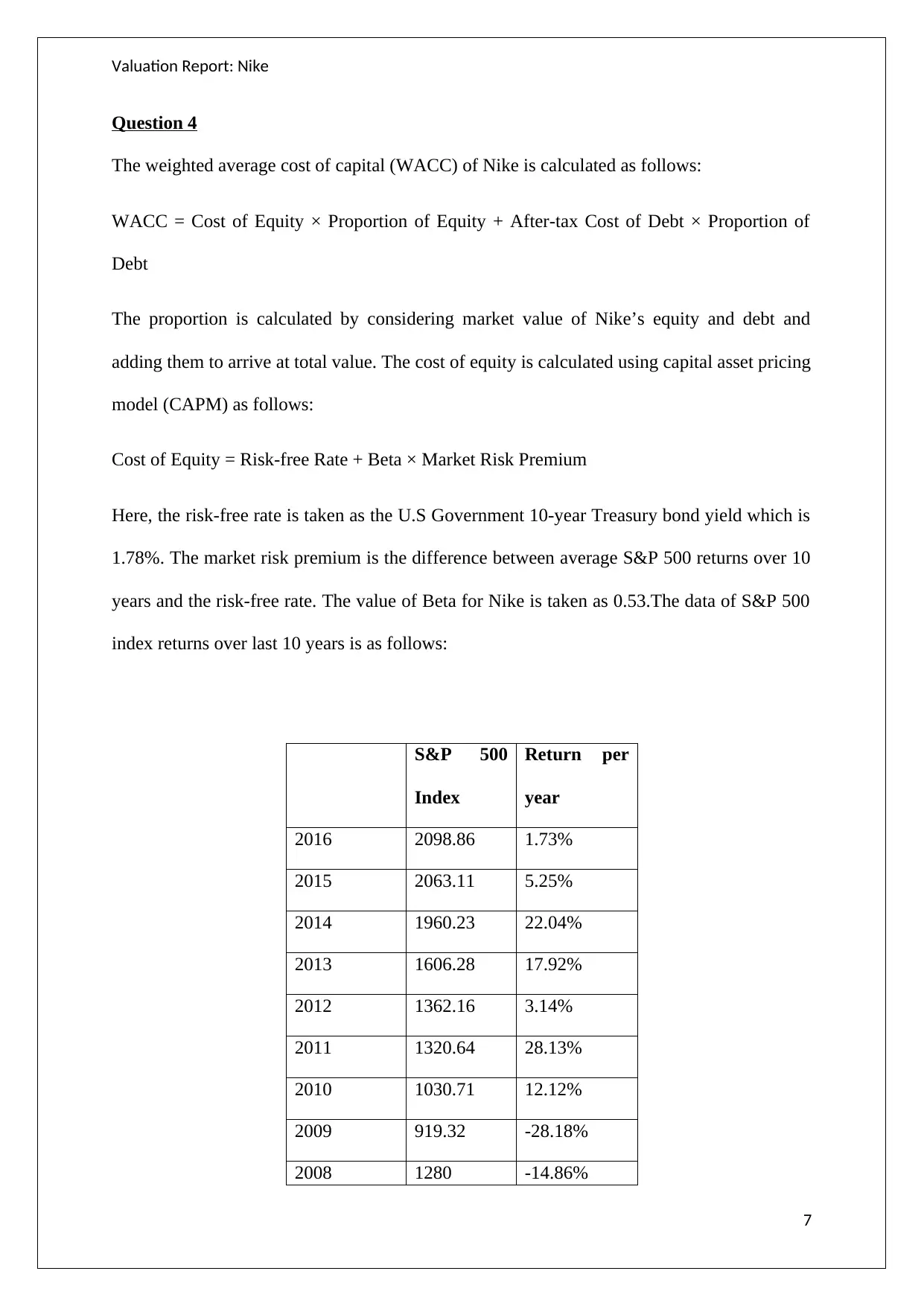

Question 4

The weighted average cost of capital (WACC) of Nike is calculated as follows:

WACC = Cost of Equity × Proportion of Equity + After-tax Cost of Debt × Proportion of

Debt

The proportion is calculated by considering market value of Nike’s equity and debt and

adding them to arrive at total value. The cost of equity is calculated using capital asset pricing

model (CAPM) as follows:

Cost of Equity = Risk-free Rate + Beta × Market Risk Premium

Here, the risk-free rate is taken as the U.S Government 10-year Treasury bond yield which is

1.78%. The market risk premium is the difference between average S&P 500 returns over 10

years and the risk-free rate. The value of Beta for Nike is taken as 0.53.The data of S&P 500

index returns over last 10 years is as follows:

S&P 500

Index

Return per

year

2016 2098.86 1.73%

2015 2063.11 5.25%

2014 1960.23 22.04%

2013 1606.28 17.92%

2012 1362.16 3.14%

2011 1320.64 28.13%

2010 1030.71 12.12%

2009 919.32 -28.18%

2008 1280 -14.86%

7

Question 4

The weighted average cost of capital (WACC) of Nike is calculated as follows:

WACC = Cost of Equity × Proportion of Equity + After-tax Cost of Debt × Proportion of

Debt

The proportion is calculated by considering market value of Nike’s equity and debt and

adding them to arrive at total value. The cost of equity is calculated using capital asset pricing

model (CAPM) as follows:

Cost of Equity = Risk-free Rate + Beta × Market Risk Premium

Here, the risk-free rate is taken as the U.S Government 10-year Treasury bond yield which is

1.78%. The market risk premium is the difference between average S&P 500 returns over 10

years and the risk-free rate. The value of Beta for Nike is taken as 0.53.The data of S&P 500

index returns over last 10 years is as follows:

S&P 500

Index

Return per

year

2016 2098.86 1.73%

2015 2063.11 5.25%

2014 1960.23 22.04%

2013 1606.28 17.92%

2012 1362.16 3.14%

2011 1320.64 28.13%

2010 1030.71 12.12%

2009 919.32 -28.18%

2008 1280 -14.86%

7

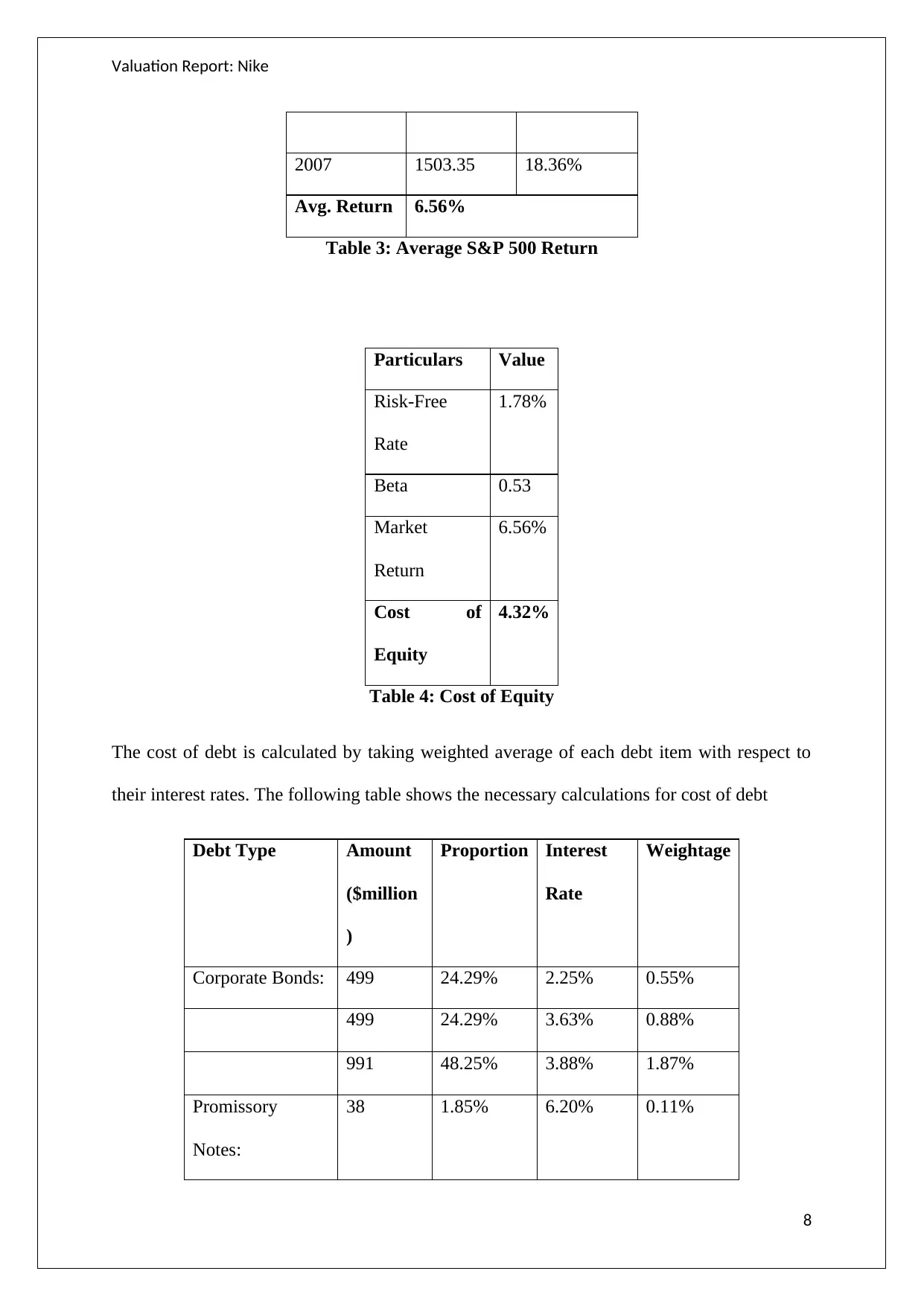

Valuation Report: Nike

2007 1503.35 18.36%

Avg. Return 6.56%

Table 3: Average S&P 500 Return

Particulars Value

Risk-Free

Rate

1.78%

Beta 0.53

Market

Return

6.56%

Cost of

Equity

4.32%

Table 4: Cost of Equity

The cost of debt is calculated by taking weighted average of each debt item with respect to

their interest rates. The following table shows the necessary calculations for cost of debt

Debt Type Amount

($million

)

Proportion Interest

Rate

Weightage

Corporate Bonds: 499 24.29% 2.25% 0.55%

499 24.29% 3.63% 0.88%

991 48.25% 3.88% 1.87%

Promissory

Notes:

38 1.85% 6.20% 0.11%

8

2007 1503.35 18.36%

Avg. Return 6.56%

Table 3: Average S&P 500 Return

Particulars Value

Risk-Free

Rate

1.78%

Beta 0.53

Market

Return

6.56%

Cost of

Equity

4.32%

Table 4: Cost of Equity

The cost of debt is calculated by taking weighted average of each debt item with respect to

their interest rates. The following table shows the necessary calculations for cost of debt

Debt Type Amount

($million

)

Proportion Interest

Rate

Weightage

Corporate Bonds: 499 24.29% 2.25% 0.55%

499 24.29% 3.63% 0.88%

991 48.25% 3.88% 1.87%

Promissory

Notes:

38 1.85% 6.20% 0.11%

8

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

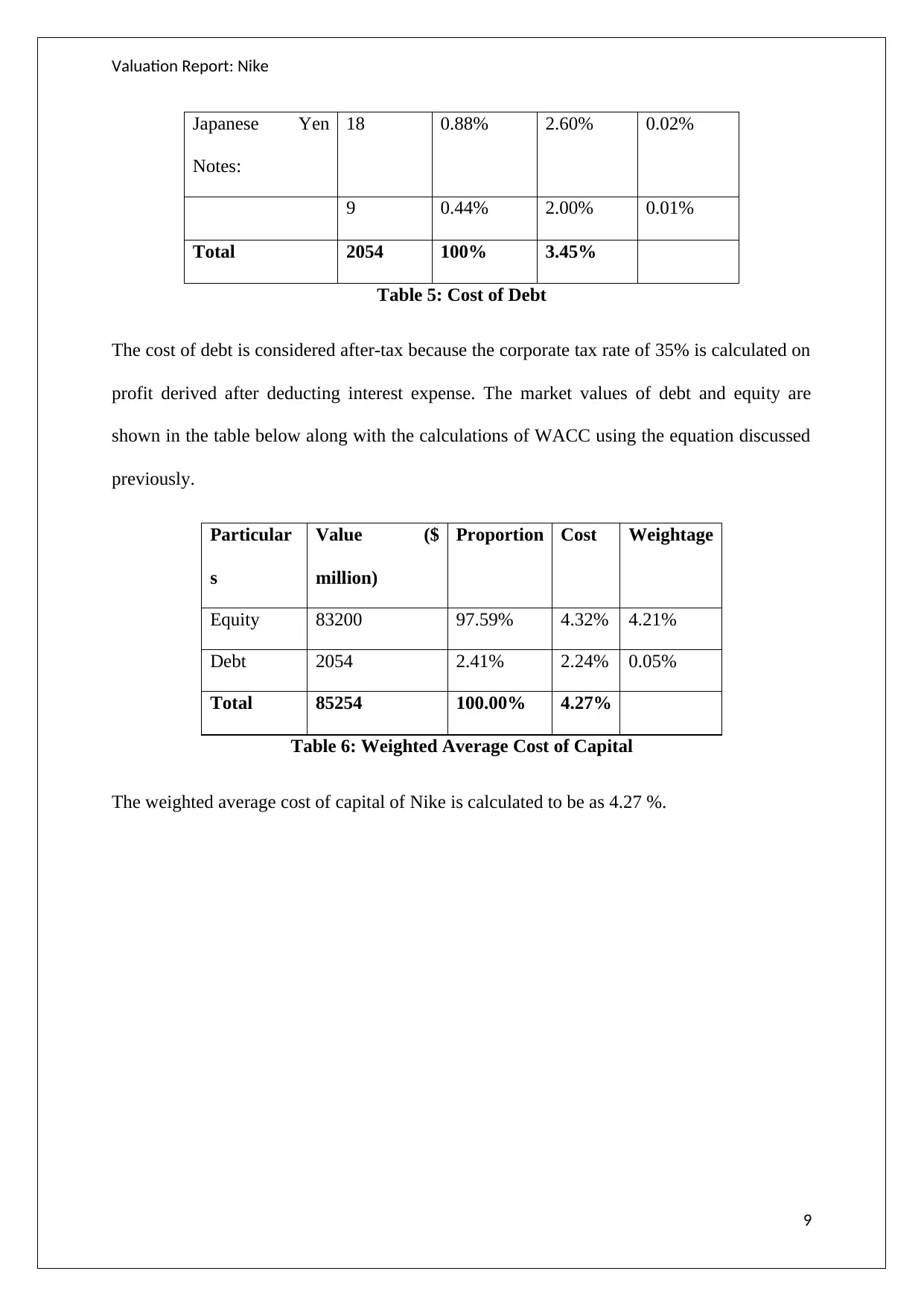

Valuation Report: Nike

Japanese Yen

Notes:

18 0.88% 2.60% 0.02%

9 0.44% 2.00% 0.01%

Total 2054 100% 3.45%

Table 5: Cost of Debt

The cost of debt is considered after-tax because the corporate tax rate of 35% is calculated on

profit derived after deducting interest expense. The market values of debt and equity are

shown in the table below along with the calculations of WACC using the equation discussed

previously.

Particular

s

Value ($

million)

Proportion Cost Weightage

Equity 83200 97.59% 4.32% 4.21%

Debt 2054 2.41% 2.24% 0.05%

Total 85254 100.00% 4.27%

Table 6: Weighted Average Cost of Capital

The weighted average cost of capital of Nike is calculated to be as 4.27 %.

9

Japanese Yen

Notes:

18 0.88% 2.60% 0.02%

9 0.44% 2.00% 0.01%

Total 2054 100% 3.45%

Table 5: Cost of Debt

The cost of debt is considered after-tax because the corporate tax rate of 35% is calculated on

profit derived after deducting interest expense. The market values of debt and equity are

shown in the table below along with the calculations of WACC using the equation discussed

previously.

Particular

s

Value ($

million)

Proportion Cost Weightage

Equity 83200 97.59% 4.32% 4.21%

Debt 2054 2.41% 2.24% 0.05%

Total 85254 100.00% 4.27%

Table 6: Weighted Average Cost of Capital

The weighted average cost of capital of Nike is calculated to be as 4.27 %.

9

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Valuation Report: Nike

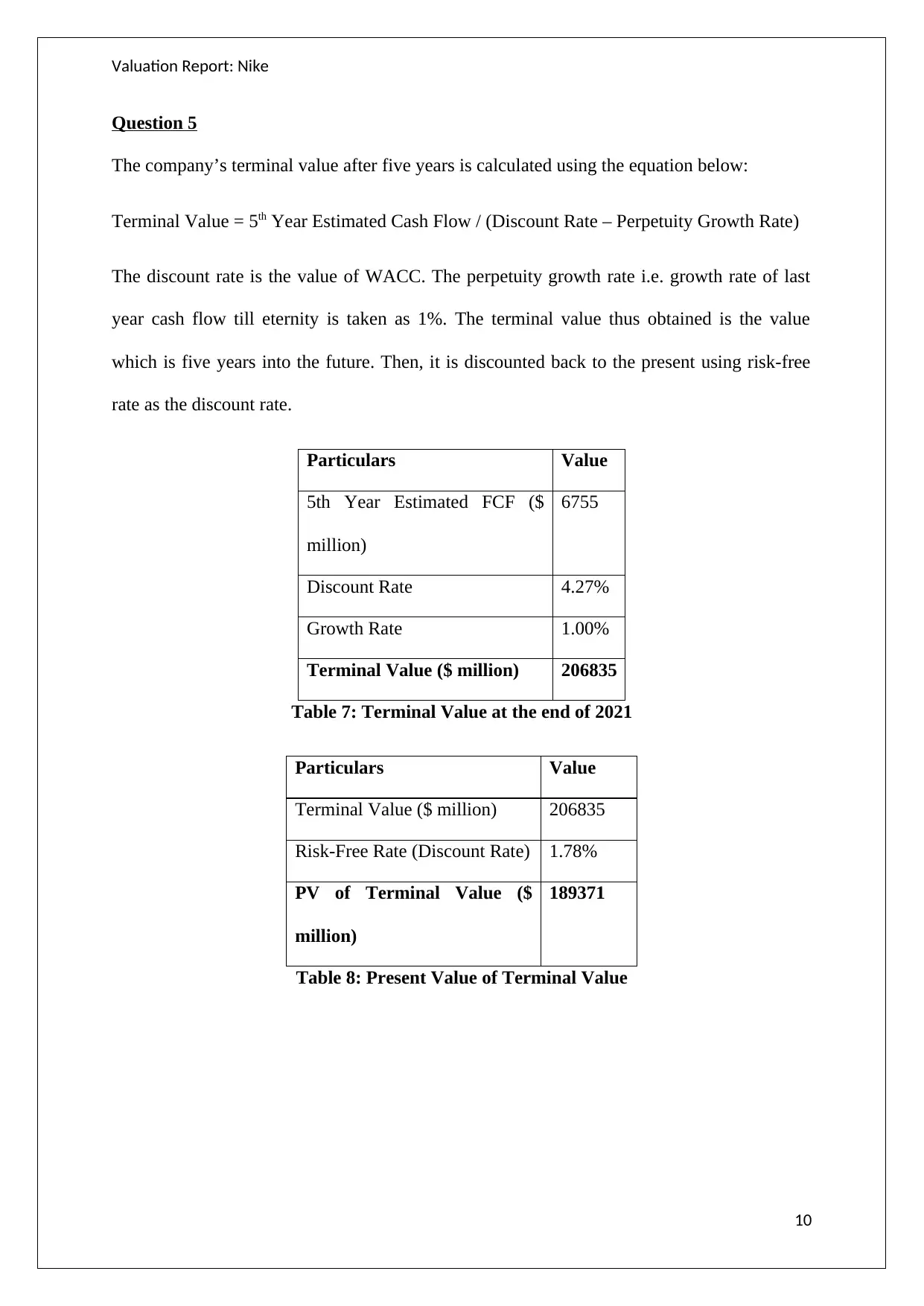

Question 5

The company’s terminal value after five years is calculated using the equation below:

Terminal Value = 5th Year Estimated Cash Flow / (Discount Rate – Perpetuity Growth Rate)

The discount rate is the value of WACC. The perpetuity growth rate i.e. growth rate of last

year cash flow till eternity is taken as 1%. The terminal value thus obtained is the value

which is five years into the future. Then, it is discounted back to the present using risk-free

rate as the discount rate.

Particulars Value

5th Year Estimated FCF ($

million)

6755

Discount Rate 4.27%

Growth Rate 1.00%

Terminal Value ($ million) 206835

Table 7: Terminal Value at the end of 2021

Particulars Value

Terminal Value ($ million) 206835

Risk-Free Rate (Discount Rate) 1.78%

PV of Terminal Value ($

million)

189371

Table 8: Present Value of Terminal Value

10

Question 5

The company’s terminal value after five years is calculated using the equation below:

Terminal Value = 5th Year Estimated Cash Flow / (Discount Rate – Perpetuity Growth Rate)

The discount rate is the value of WACC. The perpetuity growth rate i.e. growth rate of last

year cash flow till eternity is taken as 1%. The terminal value thus obtained is the value

which is five years into the future. Then, it is discounted back to the present using risk-free

rate as the discount rate.

Particulars Value

5th Year Estimated FCF ($

million)

6755

Discount Rate 4.27%

Growth Rate 1.00%

Terminal Value ($ million) 206835

Table 7: Terminal Value at the end of 2021

Particulars Value

Terminal Value ($ million) 206835

Risk-Free Rate (Discount Rate) 1.78%

PV of Terminal Value ($

million)

189371

Table 8: Present Value of Terminal Value

10

Valuation Report: Nike

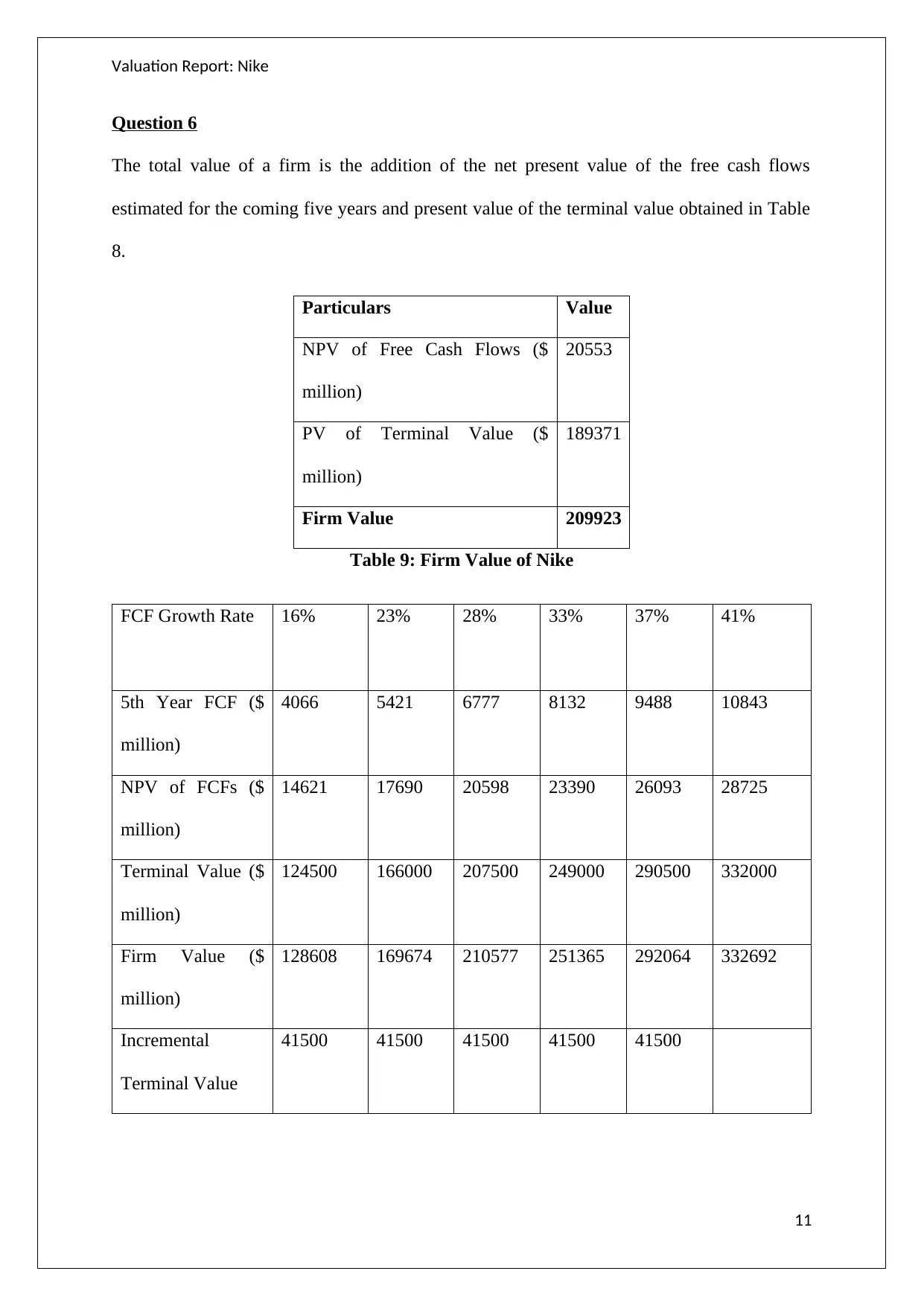

Question 6

The total value of a firm is the addition of the net present value of the free cash flows

estimated for the coming five years and present value of the terminal value obtained in Table

8.

Particulars Value

NPV of Free Cash Flows ($

million)

20553

PV of Terminal Value ($

million)

189371

Firm Value 209923

Table 9: Firm Value of Nike

FCF Growth Rate 16% 23% 28% 33% 37% 41%

5th Year FCF ($

million)

4066 5421 6777 8132 9488 10843

NPV of FCFs ($

million)

14621 17690 20598 23390 26093 28725

Terminal Value ($

million)

124500 166000 207500 249000 290500 332000

Firm Value ($

million)

128608 169674 210577 251365 292064 332692

Incremental

Terminal Value

41500 41500 41500 41500 41500

11

Question 6

The total value of a firm is the addition of the net present value of the free cash flows

estimated for the coming five years and present value of the terminal value obtained in Table

8.

Particulars Value

NPV of Free Cash Flows ($

million)

20553

PV of Terminal Value ($

million)

189371

Firm Value 209923

Table 9: Firm Value of Nike

FCF Growth Rate 16% 23% 28% 33% 37% 41%

5th Year FCF ($

million)

4066 5421 6777 8132 9488 10843

NPV of FCFs ($

million)

14621 17690 20598 23390 26093 28725

Terminal Value ($

million)

124500 166000 207500 249000 290500 332000

Firm Value ($

million)

128608 169674 210577 251365 292064 332692

Incremental

Terminal Value

41500 41500 41500 41500 41500

11

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 22

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.