Analyzing Internal and External Environment of Waitrose using SWOT, VRIO, PESTLE and Porter's Five Forces Framework

VerifiedAdded on 2023/06/17

|12

|3910

|270

AI Summary

This report analyzes the internal and external environment of Waitrose using SWOT, VRIO, PESTLE and Porter's Five Forces Framework. It examines the strengths, weaknesses, opportunities and threats of the brand, and evaluates the impact of competitive forces.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Strategy Enterprise and

Innovation

Innovation

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Table of Contents

INTRODUCTION.....................................................................................................................................3

TASK..........................................................................................................................................................3

Analyze the internal resources and capabilities of an organization..........................................................3

Examine the external environment of the business..................................................................................5

Using Porter’s Five Force framework to evaluate the impact of competitive forces................................7

CONCLUSION........................................................................................................................................10

REFERENCES........................................................................................................................................11

Books and journals:...............................................................................................................................11

INTRODUCTION.....................................................................................................................................3

TASK..........................................................................................................................................................3

Analyze the internal resources and capabilities of an organization..........................................................3

Examine the external environment of the business..................................................................................5

Using Porter’s Five Force framework to evaluate the impact of competitive forces................................7

CONCLUSION........................................................................................................................................10

REFERENCES........................................................................................................................................11

Books and journals:...............................................................................................................................11

INTRODUCTION

Waitrose is one of the famous supermarket in British administration. In 1904, it was

founded as Waite, Rose and Taylor, later it shortened to Waitrose. In 1937, the company was

acquired by John Lewis Partnership that is an employee owned retailer, which sells merchandise

under the name of this company. It was headquartered in Bracknell, Berkshire and Victoria,

London, UK. It is recognized as the eighth largest groceries retailer in the country (Amit and

Zott, 2020). It has 332 shops, involving 65 “little Waitrose” convenience shops across the UK. It

has allocated their business in over 52 countries. It owns royal warrant to supply spirits, wine and

groceries to Queen Elizabeth II. The following report will analyze internal and external business

environment as well as porter's five forces framework will be used in order to identify the impact

of competitive forces.

TASK

Analyze the internal resources and capabilities of an organization.

Business strategies defines a sum of competitive moves or actions that a company uses to

strengthening its performance, attract customers, achieve organizational goals as well as to

complete successfully.

SWOT analysis helps to examine the strengths, weaknesses, threats and opportunities of

business. In context of Waitrose, it is a management tool that enables it to benchmark its

performance and competitive edge in the market. The following is the SWOT analysis to

examine the internal environment of the brand:

Strengths-

One of the biggest strengths of the brand is that it has its own brand in order to sell its

product with private label, which are mostly all of them faitrade or organic, free range, consisting

their own products which encourage their new and healthy lifestyle of their consumers. The

chosen company owns farms working with its farmers, suppliers and growers. It also ensures to

maintain its business standards in safety, quality, animal welfare and environment across its

chain of supply assisted by its own farm insurance schemes and inspections. A healthy bond with

their farmers is also essential as it can guarantee that the goods will be reliable and expected. The

chosen company shares a significant partnership with John Lewis, which advances the brand

image and reputation in the market. This partnership also helps to diversify the risks.

Diversification in product range would be helpful to achieve competitive edge in the

marketplace.

Weaknesses-

There are several customers who have the perceptions that the chosen company as a

retailer for few high earners and do not shop from the Waitrose stores. Various writers,

independent analysist and newspapers also described as having “an upmarket image”. This kind

of perception about the brand is very costly, resulting big loss of market. It is popular as one of

the largest store which has 5.1% market share, but somehow, it is far behind the Tesco which has

Waitrose is one of the famous supermarket in British administration. In 1904, it was

founded as Waite, Rose and Taylor, later it shortened to Waitrose. In 1937, the company was

acquired by John Lewis Partnership that is an employee owned retailer, which sells merchandise

under the name of this company. It was headquartered in Bracknell, Berkshire and Victoria,

London, UK. It is recognized as the eighth largest groceries retailer in the country (Amit and

Zott, 2020). It has 332 shops, involving 65 “little Waitrose” convenience shops across the UK. It

has allocated their business in over 52 countries. It owns royal warrant to supply spirits, wine and

groceries to Queen Elizabeth II. The following report will analyze internal and external business

environment as well as porter's five forces framework will be used in order to identify the impact

of competitive forces.

TASK

Analyze the internal resources and capabilities of an organization.

Business strategies defines a sum of competitive moves or actions that a company uses to

strengthening its performance, attract customers, achieve organizational goals as well as to

complete successfully.

SWOT analysis helps to examine the strengths, weaknesses, threats and opportunities of

business. In context of Waitrose, it is a management tool that enables it to benchmark its

performance and competitive edge in the market. The following is the SWOT analysis to

examine the internal environment of the brand:

Strengths-

One of the biggest strengths of the brand is that it has its own brand in order to sell its

product with private label, which are mostly all of them faitrade or organic, free range, consisting

their own products which encourage their new and healthy lifestyle of their consumers. The

chosen company owns farms working with its farmers, suppliers and growers. It also ensures to

maintain its business standards in safety, quality, animal welfare and environment across its

chain of supply assisted by its own farm insurance schemes and inspections. A healthy bond with

their farmers is also essential as it can guarantee that the goods will be reliable and expected. The

chosen company shares a significant partnership with John Lewis, which advances the brand

image and reputation in the market. This partnership also helps to diversify the risks.

Diversification in product range would be helpful to achieve competitive edge in the

marketplace.

Weaknesses-

There are several customers who have the perceptions that the chosen company as a

retailer for few high earners and do not shop from the Waitrose stores. Various writers,

independent analysist and newspapers also described as having “an upmarket image”. This kind

of perception about the brand is very costly, resulting big loss of market. It is popular as one of

the largest store which has 5.1% market share, but somehow, it is far behind the Tesco which has

27% shares of market. It is also struggling to compete with Lidl and Aldi (Vătămănescu and

et.al., 2020).

Opportunities-

The chosen organization can opt for market penetration strategies to advances its sales

and secure its market share in the nation. This can be attained by facilitating consumers with

effective schemes and value for money. Additionally, further expansion of business at global

level and franchise agreement is worth exploring.

Threats-

It has huge competitors in the market such as Tesco, Aldi, Lidl, ASDA, Sainsbury's,

Morrison's, Iceland, Co-op and many more. All such companies heavily impact profits and

market shares of Waitrose.

VRIO Analysis

Waitrose uses the VRIO analysis addressing the customer happiness and satisfaction,

competitive benefits and value additions. The use of this framework has been very crucial for the

company in determining the methods in which all the business operations corporate. The

structure of VRIO have four issues that consist value, rarity, imitability and ability. For chosen

organization, it has been working vigorously to enhance its value of its goods and services

(Blank, 2019). The VRIO analysis of Waitrose company mentioned at each point whether these

resources could be enhanced to take comparative benefits:

Valuable:

Employees are valuable human resources for the company as they are highly skilled and

trained, also their loyal to the company which aids company to be more productive.

It delivers local food products.

Brand reputation.

Financial resources are valuable to the company as they are support combatting outer

threats and assists in investing in external growth opportunities.

Rarity:

Financial resources are rare for the company as it is strong and it can be found only in

rare companies.

Local food products are not rare as these are easily available in the market but quality

products are rare for the company (Lin, 2021).

Employees are rare for the company as they provide special training programs to improve

their skills and knowledge which make business profitable.

Brand reputation is rare for the Waitrose.

Imitable:

et.al., 2020).

Opportunities-

The chosen organization can opt for market penetration strategies to advances its sales

and secure its market share in the nation. This can be attained by facilitating consumers with

effective schemes and value for money. Additionally, further expansion of business at global

level and franchise agreement is worth exploring.

Threats-

It has huge competitors in the market such as Tesco, Aldi, Lidl, ASDA, Sainsbury's,

Morrison's, Iceland, Co-op and many more. All such companies heavily impact profits and

market shares of Waitrose.

VRIO Analysis

Waitrose uses the VRIO analysis addressing the customer happiness and satisfaction,

competitive benefits and value additions. The use of this framework has been very crucial for the

company in determining the methods in which all the business operations corporate. The

structure of VRIO have four issues that consist value, rarity, imitability and ability. For chosen

organization, it has been working vigorously to enhance its value of its goods and services

(Blank, 2019). The VRIO analysis of Waitrose company mentioned at each point whether these

resources could be enhanced to take comparative benefits:

Valuable:

Employees are valuable human resources for the company as they are highly skilled and

trained, also their loyal to the company which aids company to be more productive.

It delivers local food products.

Brand reputation.

Financial resources are valuable to the company as they are support combatting outer

threats and assists in investing in external growth opportunities.

Rarity:

Financial resources are rare for the company as it is strong and it can be found only in

rare companies.

Local food products are not rare as these are easily available in the market but quality

products are rare for the company (Lin, 2021).

Employees are rare for the company as they provide special training programs to improve

their skills and knowledge which make business profitable.

Brand reputation is rare for the Waitrose.

Imitable:

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Employees of the chosen organization are not costly to imitate as found by the VRIO

analysis. It is because other companies also provide training facilities for their employees

to improve their knowledge and skills.

Financial resources are costly to imitate is found by the analysis. Financial resources have

been acquired by the business through prolonged revenue over the past years.

Local food products are not costly to imitate as found in the analysis. It can be acquired

by its competitors very easily.

The brand reputation is imitable.

Organization:

Financial resources are very well organized to gain the value for the business. These

resources are utilized very tactically to invest in the appropriate places, combatting

threats as well as making use of opportunities.

The company is highly organized its brand reputation.

Employees are organized by the company as every functional department in the company

is filled by the right knowledge and talent.

Local food products for the company are well-organized.

Examine the external environment of the business.

Pestle analysis is a proven tool of management used to achieve a big picture of the

external environment of the industry. It includes factors such as political, social, legal, economic,

environmental and technological (Brandenburger, 2019). In context of Waitrose, in order to

know the impact of such factors on the business, the following is pestle analysis:

Political factors:

There are lots of political issues that have been faced by the company that led to the

boosted market holds and ineffective results of the financial progress. One of the major issue was

found in South Africa. In this regards, it has been found that citrus fruits that were produced by

the business in South Africa led to the creation of different production levels, due to the

differences in political issues of the nation. Moreover, the political issues have been solved by

the company by providing healthy scheme of payments to the growers (Zahari and Romli, 2019).

Another issue raised in the UK is Brexit which results in financial crisis. However, the brand has

a good image in the market so it was able to recover.

Economic factors:

It has been observed that economic stability of the Waitrose has been sustained in the

past years as its financial stability facilitates them with the infrastructure to face the recession. It

has been due to the strong financial stability of the UK and rigidity in their business strategies in

order to continue manufacturing the foods superior quality in comparison with other retailers in

the country (Sanders and Wood, 2019).

Social factors:

analysis. It is because other companies also provide training facilities for their employees

to improve their knowledge and skills.

Financial resources are costly to imitate is found by the analysis. Financial resources have

been acquired by the business through prolonged revenue over the past years.

Local food products are not costly to imitate as found in the analysis. It can be acquired

by its competitors very easily.

The brand reputation is imitable.

Organization:

Financial resources are very well organized to gain the value for the business. These

resources are utilized very tactically to invest in the appropriate places, combatting

threats as well as making use of opportunities.

The company is highly organized its brand reputation.

Employees are organized by the company as every functional department in the company

is filled by the right knowledge and talent.

Local food products for the company are well-organized.

Examine the external environment of the business.

Pestle analysis is a proven tool of management used to achieve a big picture of the

external environment of the industry. It includes factors such as political, social, legal, economic,

environmental and technological (Brandenburger, 2019). In context of Waitrose, in order to

know the impact of such factors on the business, the following is pestle analysis:

Political factors:

There are lots of political issues that have been faced by the company that led to the

boosted market holds and ineffective results of the financial progress. One of the major issue was

found in South Africa. In this regards, it has been found that citrus fruits that were produced by

the business in South Africa led to the creation of different production levels, due to the

differences in political issues of the nation. Moreover, the political issues have been solved by

the company by providing healthy scheme of payments to the growers (Zahari and Romli, 2019).

Another issue raised in the UK is Brexit which results in financial crisis. However, the brand has

a good image in the market so it was able to recover.

Economic factors:

It has been observed that economic stability of the Waitrose has been sustained in the

past years as its financial stability facilitates them with the infrastructure to face the recession. It

has been due to the strong financial stability of the UK and rigidity in their business strategies in

order to continue manufacturing the foods superior quality in comparison with other retailers in

the country (Sanders and Wood, 2019).

Social factors:

Economic factors are stable in the country, the demand for the superior quality products

was the initial demand for the citizen of the country and this has been positively fulfilled by the

organization by providing finest products in the country (Andre and et.al., 2018). It is found that

it was the first organization which deliver organic products among the citizen of UK.

Technological factors:

These factors include and relate to modifications in technologies that may impact the

business operations of the market and industry favourably or unfavorably (Gallegos-Baeza and

et.al., 2021). In context of Waitrose, these are research and development, automation and the

amount of awareness related to technology that market owns.

Legal factors:

These factors affect the working environment of the chosen company such as health and

safety laws, competition laws or workers’ laws. In UK, workers’ laws are highly regulated such

that an organization has to abide by the sex discrimination, disability, pension laws, racial and

many more (Fava, 2019). These laws in turn impact the business of Waitrose, so they have to

formulate the policies in accordance to these laws. For instance, in South Africa formulation of

policies help farmers as they give education facilities, several medical benefits and many more.

Environmental factors:

These factors are often affecting the external environment of business. It involves

environmental protection laws, energy consumption and waste disposal. The chosen company is

majorly affected by these factors as they deal into vegetables and fruits which are in turn

impacted by these changes. Hence, the company have to keep a close eye on environmental

issues (Ilmudeen and Bao, 2020). Also, the company has reduced the energy consumption and

try to source electricity from sources which are renewable in nature.

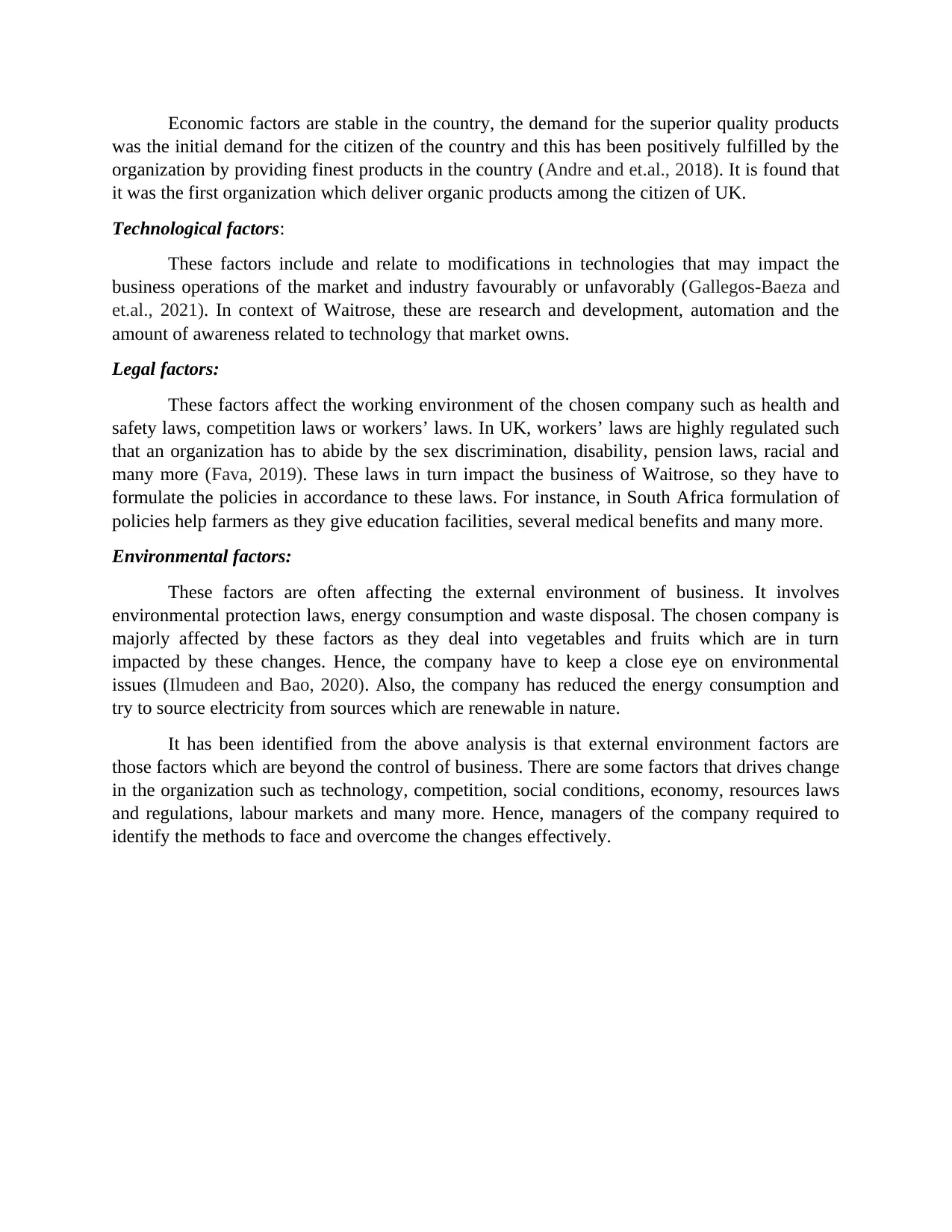

It has been identified from the above analysis is that external environment factors are

those factors which are beyond the control of business. There are some factors that drives change

in the organization such as technology, competition, social conditions, economy, resources laws

and regulations, labour markets and many more. Hence, managers of the company required to

identify the methods to face and overcome the changes effectively.

was the initial demand for the citizen of the country and this has been positively fulfilled by the

organization by providing finest products in the country (Andre and et.al., 2018). It is found that

it was the first organization which deliver organic products among the citizen of UK.

Technological factors:

These factors include and relate to modifications in technologies that may impact the

business operations of the market and industry favourably or unfavorably (Gallegos-Baeza and

et.al., 2021). In context of Waitrose, these are research and development, automation and the

amount of awareness related to technology that market owns.

Legal factors:

These factors affect the working environment of the chosen company such as health and

safety laws, competition laws or workers’ laws. In UK, workers’ laws are highly regulated such

that an organization has to abide by the sex discrimination, disability, pension laws, racial and

many more (Fava, 2019). These laws in turn impact the business of Waitrose, so they have to

formulate the policies in accordance to these laws. For instance, in South Africa formulation of

policies help farmers as they give education facilities, several medical benefits and many more.

Environmental factors:

These factors are often affecting the external environment of business. It involves

environmental protection laws, energy consumption and waste disposal. The chosen company is

majorly affected by these factors as they deal into vegetables and fruits which are in turn

impacted by these changes. Hence, the company have to keep a close eye on environmental

issues (Ilmudeen and Bao, 2020). Also, the company has reduced the energy consumption and

try to source electricity from sources which are renewable in nature.

It has been identified from the above analysis is that external environment factors are

those factors which are beyond the control of business. There are some factors that drives change

in the organization such as technology, competition, social conditions, economy, resources laws

and regulations, labour markets and many more. Hence, managers of the company required to

identify the methods to face and overcome the changes effectively.

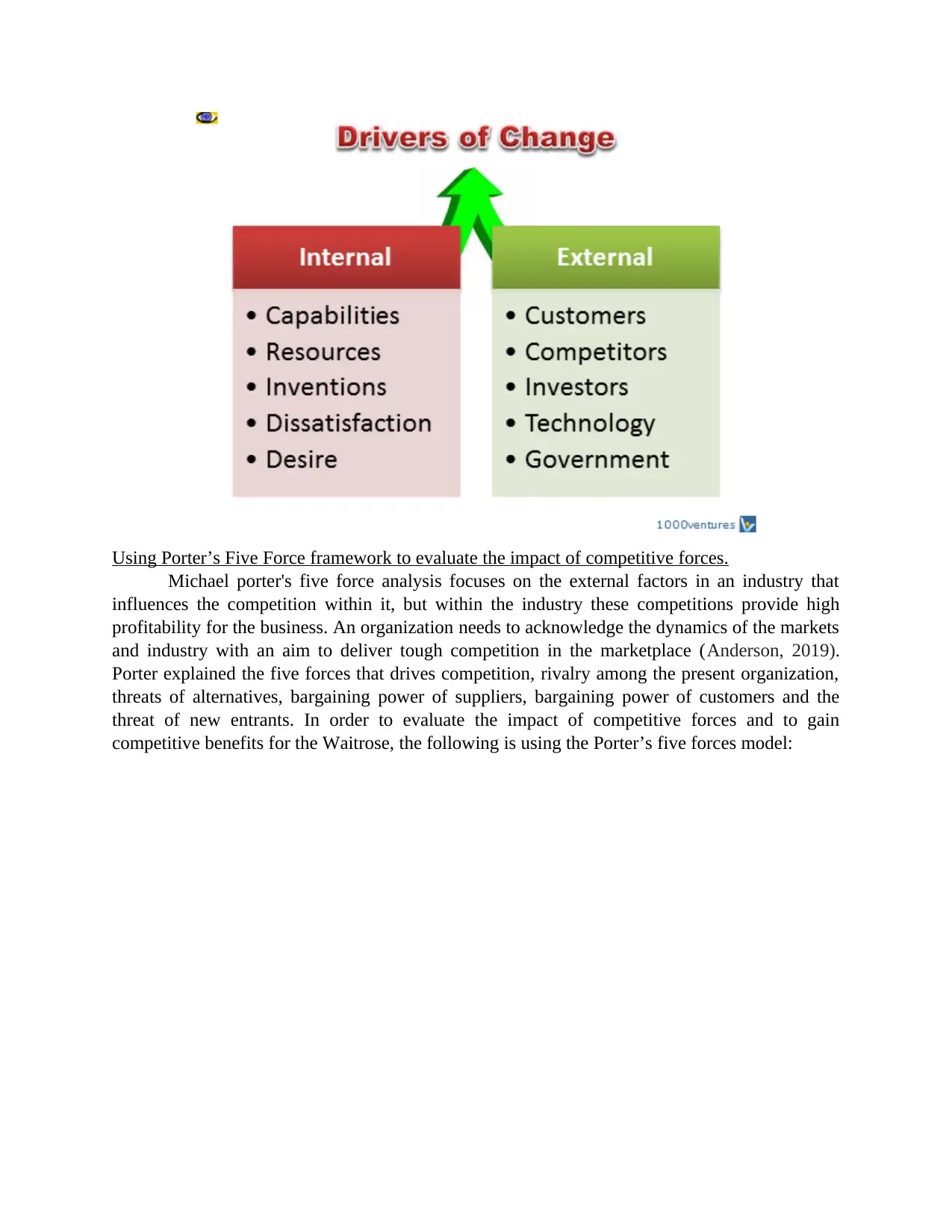

Using Porter’s Five Force framework to evaluate the impact of competitive forces.

Michael porter's five force analysis focuses on the external factors in an industry that

influences the competition within it, but within the industry these competitions provide high

profitability for the business. An organization needs to acknowledge the dynamics of the markets

and industry with an aim to deliver tough competition in the marketplace (Anderson, 2019).

Porter explained the five forces that drives competition, rivalry among the present organization,

threats of alternatives, bargaining power of suppliers, bargaining power of customers and the

threat of new entrants. In order to evaluate the impact of competitive forces and to gain

competitive benefits for the Waitrose, the following is using the Porter’s five forces model:

Michael porter's five force analysis focuses on the external factors in an industry that

influences the competition within it, but within the industry these competitions provide high

profitability for the business. An organization needs to acknowledge the dynamics of the markets

and industry with an aim to deliver tough competition in the marketplace (Anderson, 2019).

Porter explained the five forces that drives competition, rivalry among the present organization,

threats of alternatives, bargaining power of suppliers, bargaining power of customers and the

threat of new entrants. In order to evaluate the impact of competitive forces and to gain

competitive benefits for the Waitrose, the following is using the Porter’s five forces model:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

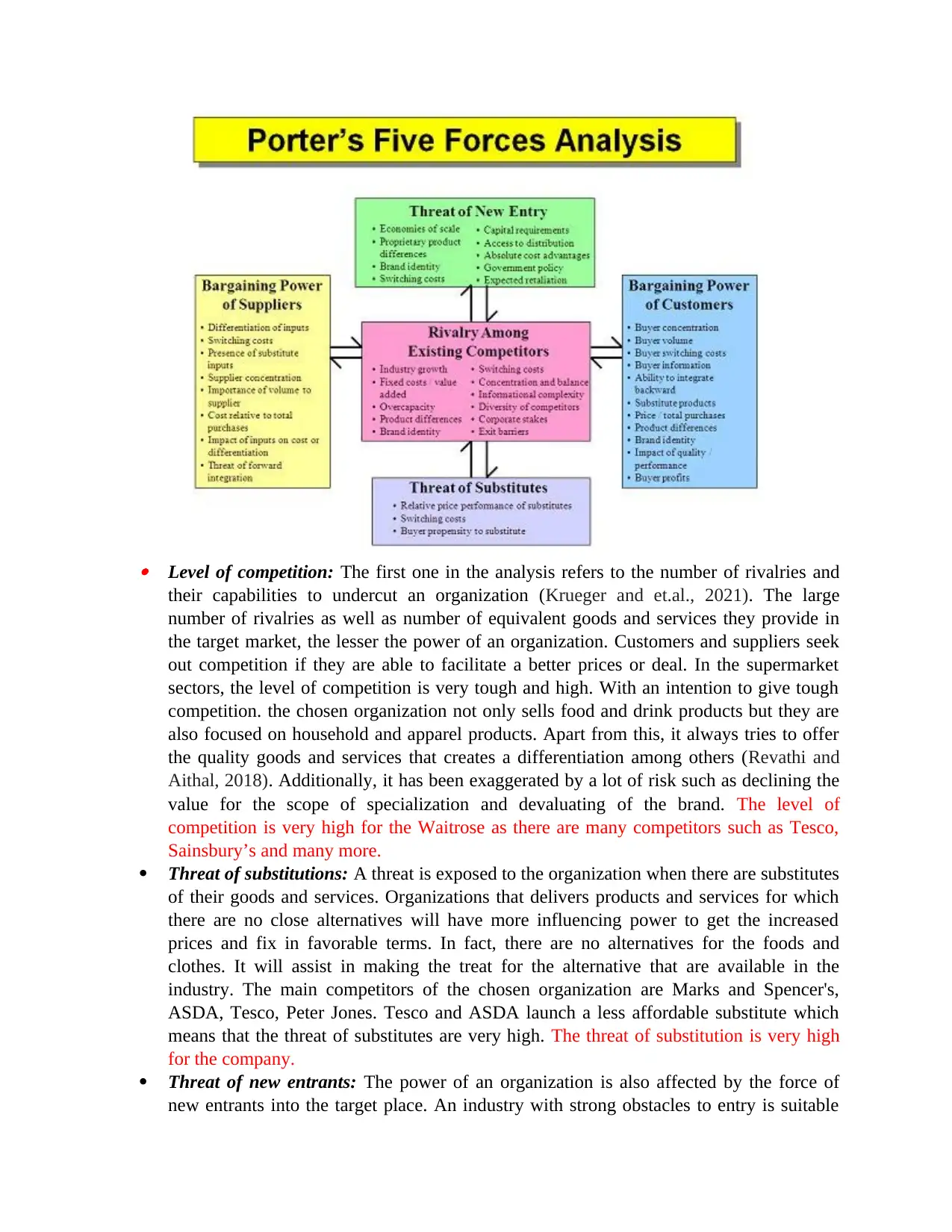

Level of competition: The first one in the analysis refers to the number of rivalries and

their capabilities to undercut an organization (Krueger and et.al., 2021). The large

number of rivalries as well as number of equivalent goods and services they provide in

the target market, the lesser the power of an organization. Customers and suppliers seek

out competition if they are able to facilitate a better prices or deal. In the supermarket

sectors, the level of competition is very tough and high. With an intention to give tough

competition. the chosen organization not only sells food and drink products but they are

also focused on household and apparel products. Apart from this, it always tries to offer

the quality goods and services that creates a differentiation among others (Revathi and

Aithal, 2018). Additionally, it has been exaggerated by a lot of risk such as declining the

value for the scope of specialization and devaluating of the brand. The level of

competition is very high for the Waitrose as there are many competitors such as Tesco,

Sainsbury’s and many more.

Threat of substitutions: A threat is exposed to the organization when there are substitutes

of their goods and services. Organizations that delivers products and services for which

there are no close alternatives will have more influencing power to get the increased

prices and fix in favorable terms. In fact, there are no alternatives for the foods and

clothes. It will assist in making the treat for the alternative that are available in the

industry. The main competitors of the chosen organization are Marks and Spencer's,

ASDA, Tesco, Peter Jones. Tesco and ASDA launch a less affordable substitute which

means that the threat of substitutes are very high. The threat of substitution is very high

for the company.

Threat of new entrants: The power of an organization is also affected by the force of

new entrants into the target place. An industry with strong obstacles to entry is suitable

their capabilities to undercut an organization (Krueger and et.al., 2021). The large

number of rivalries as well as number of equivalent goods and services they provide in

the target market, the lesser the power of an organization. Customers and suppliers seek

out competition if they are able to facilitate a better prices or deal. In the supermarket

sectors, the level of competition is very tough and high. With an intention to give tough

competition. the chosen organization not only sells food and drink products but they are

also focused on household and apparel products. Apart from this, it always tries to offer

the quality goods and services that creates a differentiation among others (Revathi and

Aithal, 2018). Additionally, it has been exaggerated by a lot of risk such as declining the

value for the scope of specialization and devaluating of the brand. The level of

competition is very high for the Waitrose as there are many competitors such as Tesco,

Sainsbury’s and many more.

Threat of substitutions: A threat is exposed to the organization when there are substitutes

of their goods and services. Organizations that delivers products and services for which

there are no close alternatives will have more influencing power to get the increased

prices and fix in favorable terms. In fact, there are no alternatives for the foods and

clothes. It will assist in making the treat for the alternative that are available in the

industry. The main competitors of the chosen organization are Marks and Spencer's,

ASDA, Tesco, Peter Jones. Tesco and ASDA launch a less affordable substitute which

means that the threat of substitutes are very high. The threat of substitution is very high

for the company.

Threat of new entrants: The power of an organization is also affected by the force of

new entrants into the target place. An industry with strong obstacles to entry is suitable

for the current organization within the sector since the organization will be able to

negotiate or charge higher prices (Macchi, Savino and Roda, 2020). The threat of new

entrants is very low because of the requirement of massive capital investment for a

successful chain store. Moreover, the retail and supermarket factors are also considered

as the mature and new entrants in such markets is quite difficult.

Bargaining power of suppliers: This factor addresses that how suppliers can run the

costs of raw materials. If there are lots of suppliers in an industry than the organization

has more bargaining power or vice versa. In retail industry, the bargaining power of

suppliers is low due to the high availability of substitutes. The chosen company is having

a high turnover which becomes the reason that customers purchase products from their

stores. Additionally, the company also prefers to purchase raw materials instead of final

goods in order to increase the profit margin for the business (Morozko, Morozko and

Didenko, 2018). The bargaining power of suppliers is low to moderate.

Bargaining power of customers: It is one of the vital factor in the analysis which

addresses the abilities of buyers to drive the prices of products lower. Whether the

company has strong or smaller customer base, the buyer has more power to bargain on

negotiate for the reasonable prices. In the supermarket or retail industry the bargaining

power of customers is very high. There is high concentration of the customers that give

the privilege to consume or taste new goods and services (Mat Noor and et.al., 2021).

The cost of switching the goods and services is very minimal that is why the alternatives

are present in high number. The bargaining power of buyers is very high because there

are many options available for them for which they can switch.

Value Net Framework-

The value net model explains that competition and cooperation between companies are both

desirable and necessary when conducting business. This framework explains and examine the

behavior of various players within the industry. In this framework cooperation is needed to boost

the advantages to all competitors where as competition is required to categorize the current

advantages among such competitors (Han and et.al., 2021). In case of Waitrose, to produce a

framework it is supportive to consider the five elements of players, added value, rules, tactics as

well as scope:

Players: It is the first step in which organization should determine its competitors or

players in the relevant industry or game that it operates in. These players include

suppliers, customers, competitors and complementors. External players who are not the

part of the game should also be focused. In case of the chosen organization, it must

examine each and every player to determine the potentiality for the future strategic

alliance.

Added value: It explains what each player in their particular role can deliver a potential

alliance. The company conducting this model should also be determined the value it

delivers through competitive advantage or USP.

Rules: Each game and industry has its own regulations as well as rules and these can

hinder the growth and development of a business (Wolf, 2018). In case of Waitrose, it

negotiate or charge higher prices (Macchi, Savino and Roda, 2020). The threat of new

entrants is very low because of the requirement of massive capital investment for a

successful chain store. Moreover, the retail and supermarket factors are also considered

as the mature and new entrants in such markets is quite difficult.

Bargaining power of suppliers: This factor addresses that how suppliers can run the

costs of raw materials. If there are lots of suppliers in an industry than the organization

has more bargaining power or vice versa. In retail industry, the bargaining power of

suppliers is low due to the high availability of substitutes. The chosen company is having

a high turnover which becomes the reason that customers purchase products from their

stores. Additionally, the company also prefers to purchase raw materials instead of final

goods in order to increase the profit margin for the business (Morozko, Morozko and

Didenko, 2018). The bargaining power of suppliers is low to moderate.

Bargaining power of customers: It is one of the vital factor in the analysis which

addresses the abilities of buyers to drive the prices of products lower. Whether the

company has strong or smaller customer base, the buyer has more power to bargain on

negotiate for the reasonable prices. In the supermarket or retail industry the bargaining

power of customers is very high. There is high concentration of the customers that give

the privilege to consume or taste new goods and services (Mat Noor and et.al., 2021).

The cost of switching the goods and services is very minimal that is why the alternatives

are present in high number. The bargaining power of buyers is very high because there

are many options available for them for which they can switch.

Value Net Framework-

The value net model explains that competition and cooperation between companies are both

desirable and necessary when conducting business. This framework explains and examine the

behavior of various players within the industry. In this framework cooperation is needed to boost

the advantages to all competitors where as competition is required to categorize the current

advantages among such competitors (Han and et.al., 2021). In case of Waitrose, to produce a

framework it is supportive to consider the five elements of players, added value, rules, tactics as

well as scope:

Players: It is the first step in which organization should determine its competitors or

players in the relevant industry or game that it operates in. These players include

suppliers, customers, competitors and complementors. External players who are not the

part of the game should also be focused. In case of the chosen organization, it must

examine each and every player to determine the potentiality for the future strategic

alliance.

Added value: It explains what each player in their particular role can deliver a potential

alliance. The company conducting this model should also be determined the value it

delivers through competitive advantage or USP.

Rules: Each game and industry has its own regulations as well as rules and these can

hinder the growth and development of a business (Wolf, 2018). In case of Waitrose, it

can find the players who can remove some of these barriers through collaboration and

partnerships

Tactics: Competitive organization is dynamic, complicated as well as uncertain game.

Most of the organizations also use strategies or tactics to influence the behavior of other

players in the game (Albishri, Shah and Lee, 2019).

Scope: By its nature, games are not static entities. Businessman should always be

prepared for the scope that can shrink or expands according to the market conditions or

its fluctuations.

CONCLUSION

It has been concluded from the report is that business strategy involves a set of actions

which helps company to gain long-term objectives for the business. The report is mentioned with

different tools to analyze the internal and external environment of working. In order to analyze

the external environment, Pestle framework is used which involves factors such as political,

economic, technological and many more. SWOT analysis helps to know the inner capabilities of

the business. Porter’s five forces framework consists with five forces that are competition,

bargaining power of customers, bargaining power of suppliers, threat of substitutes and threat of

new entrants. This will help to gain the competitive benefits in the industry.

partnerships

Tactics: Competitive organization is dynamic, complicated as well as uncertain game.

Most of the organizations also use strategies or tactics to influence the behavior of other

players in the game (Albishri, Shah and Lee, 2019).

Scope: By its nature, games are not static entities. Businessman should always be

prepared for the scope that can shrink or expands according to the market conditions or

its fluctuations.

CONCLUSION

It has been concluded from the report is that business strategy involves a set of actions

which helps company to gain long-term objectives for the business. The report is mentioned with

different tools to analyze the internal and external environment of working. In order to analyze

the external environment, Pestle framework is used which involves factors such as political,

economic, technological and many more. SWOT analysis helps to know the inner capabilities of

the business. Porter’s five forces framework consists with five forces that are competition,

bargaining power of customers, bargaining power of suppliers, threat of substitutes and threat of

new entrants. This will help to gain the competitive benefits in the industry.

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

REFERENCES

Books and journals:

Albishri, A. A., Shah, S. J. H. and Lee, Y., 2019, November. CU-Net: Cascaded U-Net model for

automated liver and lesion segmentation and summarization. In 2019 IEEE

International Conference on Bioinformatics and Biomedicine (BIBM) (pp. 1416-1423).

IEEE.

Amit, R. and Zott, C., 2020. Business model innovation strategy: Transformational concepts and

tools for entrepreneurial leaders. John Wiley & Sons.

Anderson, P. L., 2019. Business strategy and firm location decisions: Testing traditional and

modern methods. Business Economics, 54(1), pp.35-60.

Andre, A. and et.al., 2018. Distillation contra pervaporation: Comprehensive investigation of

isobutanol-water separation. Journal of Cleaner Production, 187, pp.804-818.

Blank, J. R., 2019. The Impacts of DoD ACQUISITION INITIATIVES on Defense Industry

Business Strategy. Defense Acquisition Research Journal: A Publication of the Defense

Acquisition University, 26(3).

Brandenburger, A., 2019. Strategy needs creativity: an analytic framework alone won't reinvent

your business. Harvard Business Review, 97(2), pp.59-66.

Fava, V., 2019. Between business interests and ideological marketing: the USSR and the Cold

War in Fiat corporate strategy, 1957–1972. Journal of Cold War Studies, 20(4), pp.26-

64.

Gallegos-Baeza, D. and et.al., 2021. Aligning business strategy and information technologies in

local governments using enterprise architectures. Information Development,

p.02666669211030619.

Han, L. and et.al., 2021. Convective precipitation nowcasting using U-Net Model. IEEE

Transactions on Geoscience and Remote Sensing.

Ilmudeen, A. and Bao, Y., 2020. IT strategy and business strategy mediate the effect of

managing IT on firm performance: empirical analysis. Journal of Enterprise

Information Management.

Krueger, N. and et.al., 2021. Advancing family business science through context theorizing: The

case of the Arab world. Journal of Family Business Strategy, 12(1), p.100377.

Lin, Y. E., 2021. Corporate social responsibility and investment efficiency: Does business

strategy matter?. International Review of Financial Analysis, 73, p.101585.

Macchi, M., Savino, M. and Roda, I., 2020. Analysing the support of sustainability within the

manufacturing strategy through multiple perspectives of different business

functions. Journal of Cleaner Production, 258, p.120771.

Books and journals:

Albishri, A. A., Shah, S. J. H. and Lee, Y., 2019, November. CU-Net: Cascaded U-Net model for

automated liver and lesion segmentation and summarization. In 2019 IEEE

International Conference on Bioinformatics and Biomedicine (BIBM) (pp. 1416-1423).

IEEE.

Amit, R. and Zott, C., 2020. Business model innovation strategy: Transformational concepts and

tools for entrepreneurial leaders. John Wiley & Sons.

Anderson, P. L., 2019. Business strategy and firm location decisions: Testing traditional and

modern methods. Business Economics, 54(1), pp.35-60.

Andre, A. and et.al., 2018. Distillation contra pervaporation: Comprehensive investigation of

isobutanol-water separation. Journal of Cleaner Production, 187, pp.804-818.

Blank, J. R., 2019. The Impacts of DoD ACQUISITION INITIATIVES on Defense Industry

Business Strategy. Defense Acquisition Research Journal: A Publication of the Defense

Acquisition University, 26(3).

Brandenburger, A., 2019. Strategy needs creativity: an analytic framework alone won't reinvent

your business. Harvard Business Review, 97(2), pp.59-66.

Fava, V., 2019. Between business interests and ideological marketing: the USSR and the Cold

War in Fiat corporate strategy, 1957–1972. Journal of Cold War Studies, 20(4), pp.26-

64.

Gallegos-Baeza, D. and et.al., 2021. Aligning business strategy and information technologies in

local governments using enterprise architectures. Information Development,

p.02666669211030619.

Han, L. and et.al., 2021. Convective precipitation nowcasting using U-Net Model. IEEE

Transactions on Geoscience and Remote Sensing.

Ilmudeen, A. and Bao, Y., 2020. IT strategy and business strategy mediate the effect of

managing IT on firm performance: empirical analysis. Journal of Enterprise

Information Management.

Krueger, N. and et.al., 2021. Advancing family business science through context theorizing: The

case of the Arab world. Journal of Family Business Strategy, 12(1), p.100377.

Lin, Y. E., 2021. Corporate social responsibility and investment efficiency: Does business

strategy matter?. International Review of Financial Analysis, 73, p.101585.

Macchi, M., Savino, M. and Roda, I., 2020. Analysing the support of sustainability within the

manufacturing strategy through multiple perspectives of different business

functions. Journal of Cleaner Production, 258, p.120771.

Mat Noor, D. and et.al., 2021. The Mediation Effect of Strategic Leadership in the Relationship

between Knowledge Management, Competitive Intelligence and Business Strategy

Formulation. Journal of Contemporary Issues in Business and Government, 27(1),

pp.2271-2285.

Morozko, N., Morozko, N. and Didenko, V., 2018. Rationale for the development strategy of

small business organizations using the real options method. Academy of Strategic

Management Journal, 17(2), pp.1-11.

Pang, C. and et.al., 2019. Integrative capability, business model innovation and performance:

Contingent effect of business strategy. European Journal of Innovation Management.

Revathi, R. and Aithal, P. S., 2018. Business Strategy of Top Indian Company: L&T

InfoTech. International Journal of Case Studies in Business, IT, and Education

(IJCSBE), 2(1), pp.64-89.

Sanders, N. R. and Wood, J. D., 2019. Foundations of sustainable business: Theory, function,

and strategy. John Wiley & Sons.

Vătămănescu, E. M. and et.al., 2020. From the deliberate managerial strategy towards

international business performance: A psychic distance vs. global mindset

approach. Systems Research and Behavioral Science, 37(2), pp.374-387.

Wolf, K., 2018, June. Petri net model checking with LoLA 2. In International Conference on

Applications and Theory of Petri Nets and Concurrency (pp. 351-362). Springer, Cham.

Zahari, A. R. and Romli, F. I., 2019. Analysis of suborbital flight operation using

PESTLE. Journal of Atmospheric and Solar-Terrestrial Physics, 192, p.104901.

between Knowledge Management, Competitive Intelligence and Business Strategy

Formulation. Journal of Contemporary Issues in Business and Government, 27(1),

pp.2271-2285.

Morozko, N., Morozko, N. and Didenko, V., 2018. Rationale for the development strategy of

small business organizations using the real options method. Academy of Strategic

Management Journal, 17(2), pp.1-11.

Pang, C. and et.al., 2019. Integrative capability, business model innovation and performance:

Contingent effect of business strategy. European Journal of Innovation Management.

Revathi, R. and Aithal, P. S., 2018. Business Strategy of Top Indian Company: L&T

InfoTech. International Journal of Case Studies in Business, IT, and Education

(IJCSBE), 2(1), pp.64-89.

Sanders, N. R. and Wood, J. D., 2019. Foundations of sustainable business: Theory, function,

and strategy. John Wiley & Sons.

Vătămănescu, E. M. and et.al., 2020. From the deliberate managerial strategy towards

international business performance: A psychic distance vs. global mindset

approach. Systems Research and Behavioral Science, 37(2), pp.374-387.

Wolf, K., 2018, June. Petri net model checking with LoLA 2. In International Conference on

Applications and Theory of Petri Nets and Concurrency (pp. 351-362). Springer, Cham.

Zahari, A. R. and Romli, F. I., 2019. Analysis of suborbital flight operation using

PESTLE. Journal of Atmospheric and Solar-Terrestrial Physics, 192, p.104901.

1 out of 12

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.