Woolworths Group Financial Statement Analysis - HI5020 Assignment

VerifiedAdded on 2023/06/12

|13

|2976

|249

Report

AI Summary

This report provides a detailed analysis of Woolworths Group's financial statements, focusing on the cash flow statement, other comprehensive income statement, and income tax accounting. The cash flow statement analysis includes an item-by-item breakdown for 2016 and 2017, highlighting changes in operating, investing, and financing activities. The other comprehensive income statement is examined to identify items reported and explain why certain items are excluded from the regular income statement. The report also delves into the accounting of income tax, analyzing tax expenses, deferred tax assets and liabilities, and reconciling reported tax expenses with calculations based on the statutory tax rate. The analysis utilizes data from Woolworths Group's annual reports to provide insights into the company's financial health and performance.

1

Corporate Accounting

Corporate Accounting

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

2

Contents

Introduction......................................................................................................................................3

Part 1: Understanding the cash flow statement of Woolworth Group.............................................3

Part 2: Understanding the other comprehensive income statement of the Woolworth Group........6

Part 3: Understanding the accounting of income tax in the annual report of Woolworth Group....7

Conclusion.......................................................................................................................................9

References......................................................................................................................................10

Contents

Introduction......................................................................................................................................3

Part 1: Understanding the cash flow statement of Woolworth Group.............................................3

Part 2: Understanding the other comprehensive income statement of the Woolworth Group........6

Part 3: Understanding the accounting of income tax in the annual report of Woolworth Group....7

Conclusion.......................................................................................................................................9

References......................................................................................................................................10

3

Introduction

The present report is undertaken in order to analyze the financial statements of a public

listed company listed on the Australian Securities Exchange (ASX). The financial statements

evaluation is carried out to gain an insight into the present and potential future growth prospects

of a company. The major financial statements developed by a company to provide disclosure of

its financial position are cash flow statement, balance sheet, profit and loss statement and

statement of equity. In this context, the report is developed to present an evaluation of the cash

flow statement and income statement of the selected company. The cash flow statement analysis

has specifically emphasized on providing an in-depth understanding of each item reported in the

statement and depicting a comparative analysis of the three major categories of cash flows. The

income statement evaluation is undertaken for depicting the major items reported in the

statement and explaining the reason of the financial items that are not reported in the income

statement. In addition to this, the report also evaluates the accounting for corporate income tax in

the financial statement of the selected company. In this context, the report has carried out an

analysis of the tax expenses, deferred tax assets or liabilities, income tax payable reported in the

financial statement. The public listed company selected for the analysis purpose is Woolworths

Ltd, a leading retail company in Australia. Woolworths is known to be a major supermarket

company that has occupied a prominent position in the retail sector of the country owing to its

unique portfolio of products and services. The company specializes mainly in providing

groceries, magazines health and beauty products, household products, baby supplies and

stationery items.

Part 1: Understanding the cash flow statement of Woolworth Group

1.1: Items listed in the cash flow statement and understanding of each item

Cash Flow (Financial Items listed for year 2016 and 2017)

Woolworth Group

Amount in $ million

Particulars 2017 2016 Change

Amount in %

Introduction

The present report is undertaken in order to analyze the financial statements of a public

listed company listed on the Australian Securities Exchange (ASX). The financial statements

evaluation is carried out to gain an insight into the present and potential future growth prospects

of a company. The major financial statements developed by a company to provide disclosure of

its financial position are cash flow statement, balance sheet, profit and loss statement and

statement of equity. In this context, the report is developed to present an evaluation of the cash

flow statement and income statement of the selected company. The cash flow statement analysis

has specifically emphasized on providing an in-depth understanding of each item reported in the

statement and depicting a comparative analysis of the three major categories of cash flows. The

income statement evaluation is undertaken for depicting the major items reported in the

statement and explaining the reason of the financial items that are not reported in the income

statement. In addition to this, the report also evaluates the accounting for corporate income tax in

the financial statement of the selected company. In this context, the report has carried out an

analysis of the tax expenses, deferred tax assets or liabilities, income tax payable reported in the

financial statement. The public listed company selected for the analysis purpose is Woolworths

Ltd, a leading retail company in Australia. Woolworths is known to be a major supermarket

company that has occupied a prominent position in the retail sector of the country owing to its

unique portfolio of products and services. The company specializes mainly in providing

groceries, magazines health and beauty products, household products, baby supplies and

stationery items.

Part 1: Understanding the cash flow statement of Woolworth Group

1.1: Items listed in the cash flow statement and understanding of each item

Cash Flow (Financial Items listed for year 2016 and 2017)

Woolworth Group

Amount in $ million

Particulars 2017 2016 Change

Amount in %

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

4

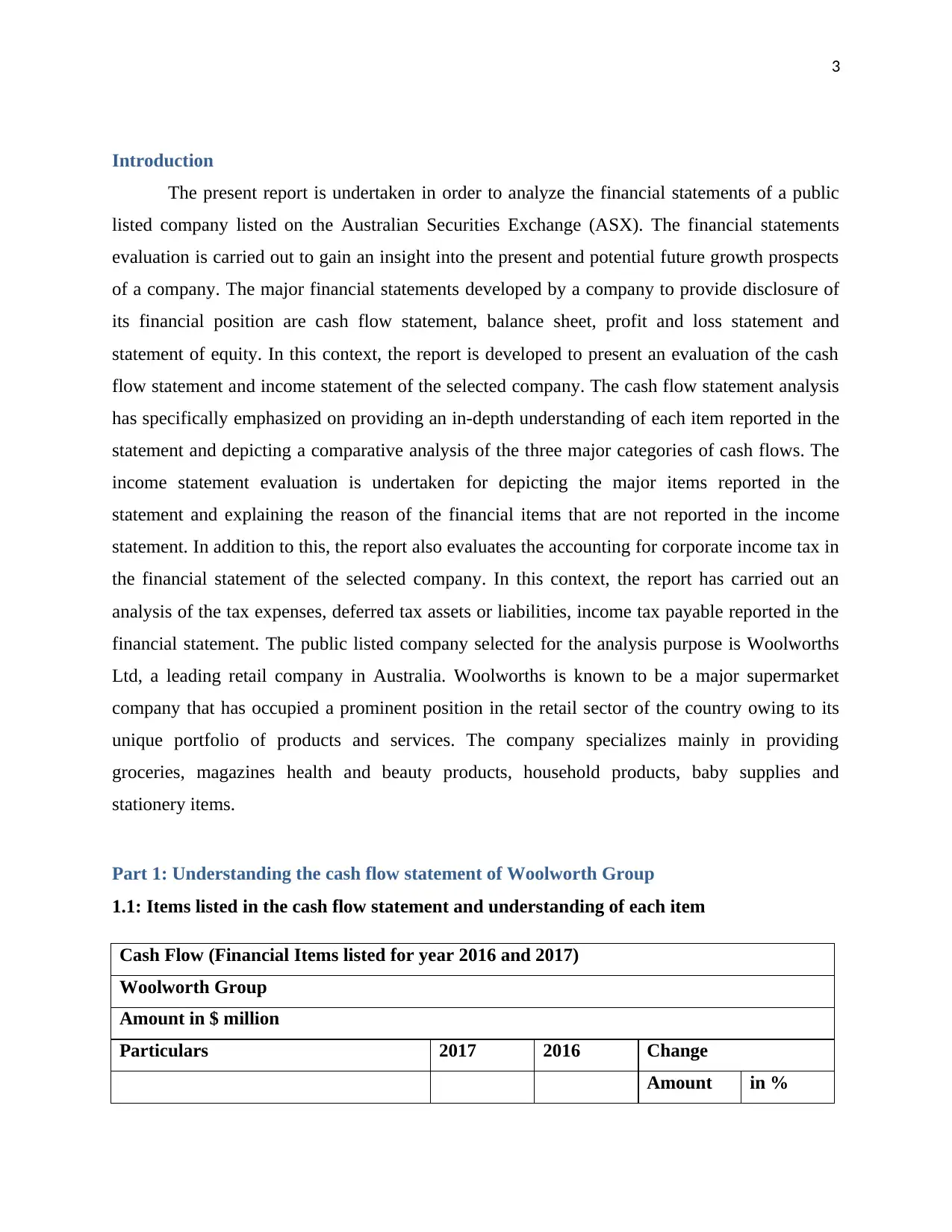

Cash flows items from the operating

activity

Cash collected from the customers

$

65,498.90

$

65,329.80

$

169.10 0.26%

Payments made to suppliers and

employees in cash

$

(61,474.80)

$

(61,834.50)

$

359.70 0.58%

Cash used for payment of interest

charge

$

(234.00)

$

(289.30)

$

55.30 19.12%

Income tax paid in cash to tax

authorities

$

(668.10)

$

(848.50)

$

180.40 21.26%

Cash flows items from the investing

activity

Cash used to purchase property, plant

and equipment (It excludes any

payments for property development)

$

(1,633.60)

$

(1,465.00)

$

(168.60) -11.51%

Cash used to purchase property, plant

and equipment -Property Development

$

(253.20)

$

(473.30)

$

220.10 46.50%

Cash received from the sale of property,

plant and equipment

$

279.80

$

722.00

$

(442.20) -61.25%

Cash collected from the sale of

subsidiaries and other investments

$

200.70

$

15.00

$

185.70 1238.00%

Cash flows items from the financing

activity

Cash Collected through issue of

common shares

$

55.50

$

-

$

55.50

Cash gain through issue of equity shares

in subsidiaries

$

-

$

120.00

$

(120.00)

Cash received through increase in

borrowings

$

184.10

$

628.50

$

(444.40) -70.71%

Cash flows items from the operating

activity

Cash collected from the customers

$

65,498.90

$

65,329.80

$

169.10 0.26%

Payments made to suppliers and

employees in cash

$

(61,474.80)

$

(61,834.50)

$

359.70 0.58%

Cash used for payment of interest

charge

$

(234.00)

$

(289.30)

$

55.30 19.12%

Income tax paid in cash to tax

authorities

$

(668.10)

$

(848.50)

$

180.40 21.26%

Cash flows items from the investing

activity

Cash used to purchase property, plant

and equipment (It excludes any

payments for property development)

$

(1,633.60)

$

(1,465.00)

$

(168.60) -11.51%

Cash used to purchase property, plant

and equipment -Property Development

$

(253.20)

$

(473.30)

$

220.10 46.50%

Cash received from the sale of property,

plant and equipment

$

279.80

$

722.00

$

(442.20) -61.25%

Cash collected from the sale of

subsidiaries and other investments

$

200.70

$

15.00

$

185.70 1238.00%

Cash flows items from the financing

activity

Cash Collected through issue of

common shares

$

55.50

$

-

$

55.50

Cash gain through issue of equity shares

in subsidiaries

$

-

$

120.00

$

(120.00)

Cash received through increase in

borrowings

$

184.10

$

628.50

$

(444.40) -70.71%

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

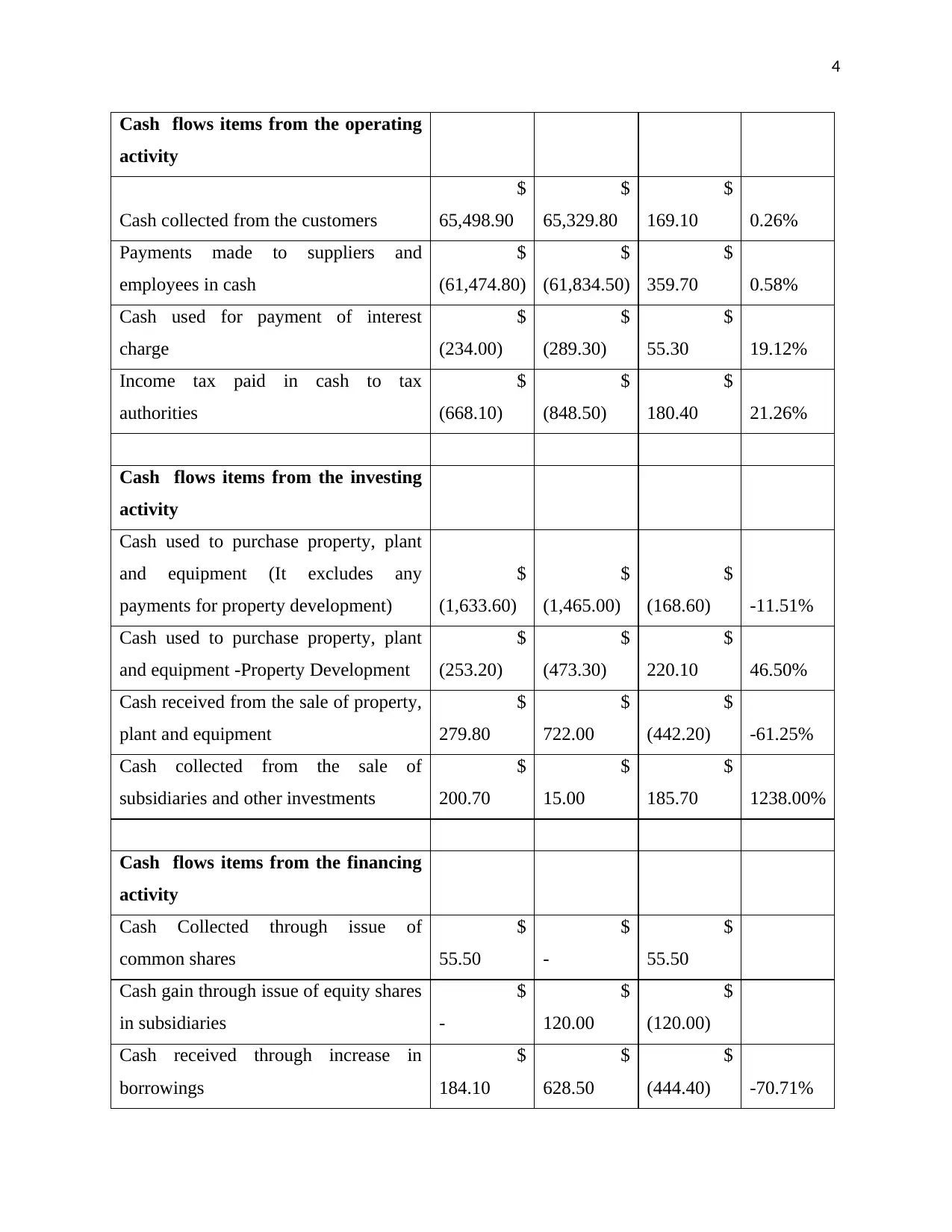

5

Cash used to the repayment of

borrowings

$

(1,406.50)

$

(994.10)

$

(412.40) 41.48%

Cash used to pay the cash dividends to

the equity shareholders

$

(540.90)

$

(1,184.80)

$

643.90 -54.35%

(Annual Report, 2017, Woolworth Group)

Explanation of cash flow items of operating activity:

Cash Collection from Customers: The cash received from the customers when goods and

services are provided to them. It is clearly depicted from the above table that there is a

percentage increase in the cash collected from customers. It can be due to improved sales

realization from the customers or due to high level of management efficiency for

collecting the debts.

Cash Payment to Suppliers: There is a net cash outflow due to the payment made to

suppliers that can be due to increase in sale of its products and services from the year

2016 and 2017.

Interest Expenses: There is an increase in the cash outflow incurred due to expenses made

in relation to the interest paid on its debt.

Payment for Tax: The Company is paying tax on a regular basis and it has increased over

the period 2016-2017 (Ramachandran and Kakani, 2010).

Explanation of cash flow items of investing activity:

Cash outflow due to investment incurred in purchase of PPE: The Company is

continually involved in acquiring of PPE for realizing profitability through its use

(Klammer, 2018).

Cash received from sale of PPE: The Company has realized less sales in the year 2017 as

compared to the year 2016 from the use of its property, plant and equipment asset base.

Cash Inflow due to Subsidiaries Sale: It has improved in the year 2017 over the year 2016

depicting that its cash realization from selling of its business unit has increased to a large

extent.

Explanation of cash flow items of financing activity:

Cash used to the repayment of

borrowings

$

(1,406.50)

$

(994.10)

$

(412.40) 41.48%

Cash used to pay the cash dividends to

the equity shareholders

$

(540.90)

$

(1,184.80)

$

643.90 -54.35%

(Annual Report, 2017, Woolworth Group)

Explanation of cash flow items of operating activity:

Cash Collection from Customers: The cash received from the customers when goods and

services are provided to them. It is clearly depicted from the above table that there is a

percentage increase in the cash collected from customers. It can be due to improved sales

realization from the customers or due to high level of management efficiency for

collecting the debts.

Cash Payment to Suppliers: There is a net cash outflow due to the payment made to

suppliers that can be due to increase in sale of its products and services from the year

2016 and 2017.

Interest Expenses: There is an increase in the cash outflow incurred due to expenses made

in relation to the interest paid on its debt.

Payment for Tax: The Company is paying tax on a regular basis and it has increased over

the period 2016-2017 (Ramachandran and Kakani, 2010).

Explanation of cash flow items of investing activity:

Cash outflow due to investment incurred in purchase of PPE: The Company is

continually involved in acquiring of PPE for realizing profitability through its use

(Klammer, 2018).

Cash received from sale of PPE: The Company has realized less sales in the year 2017 as

compared to the year 2016 from the use of its property, plant and equipment asset base.

Cash Inflow due to Subsidiaries Sale: It has improved in the year 2017 over the year 2016

depicting that its cash realization from selling of its business unit has increased to a large

extent.

Explanation of cash flow items of financing activity:

6

Issue of Shares: The Company in the year 2017 has also realized cash inflows due to

issue of its shares as depicted from its cash flow statement.

Cash Flow due to Borrowings: There is also less cash inflow in the year 2017 as

compared to the year 2017 by the use of debt sources. It means that the company is

adopting less use of debt in its capital structure at present.

Cash flow due to repayment of borrowings: There is increase in the cash outflow due to

repaying the borrowings it means that the company is effectively meeting its debt

obligations.

Divided payment: The cash outflow due to payment of dividend has decreased in the year

2017 as compared to the year 2016 which means less return to shareholders.

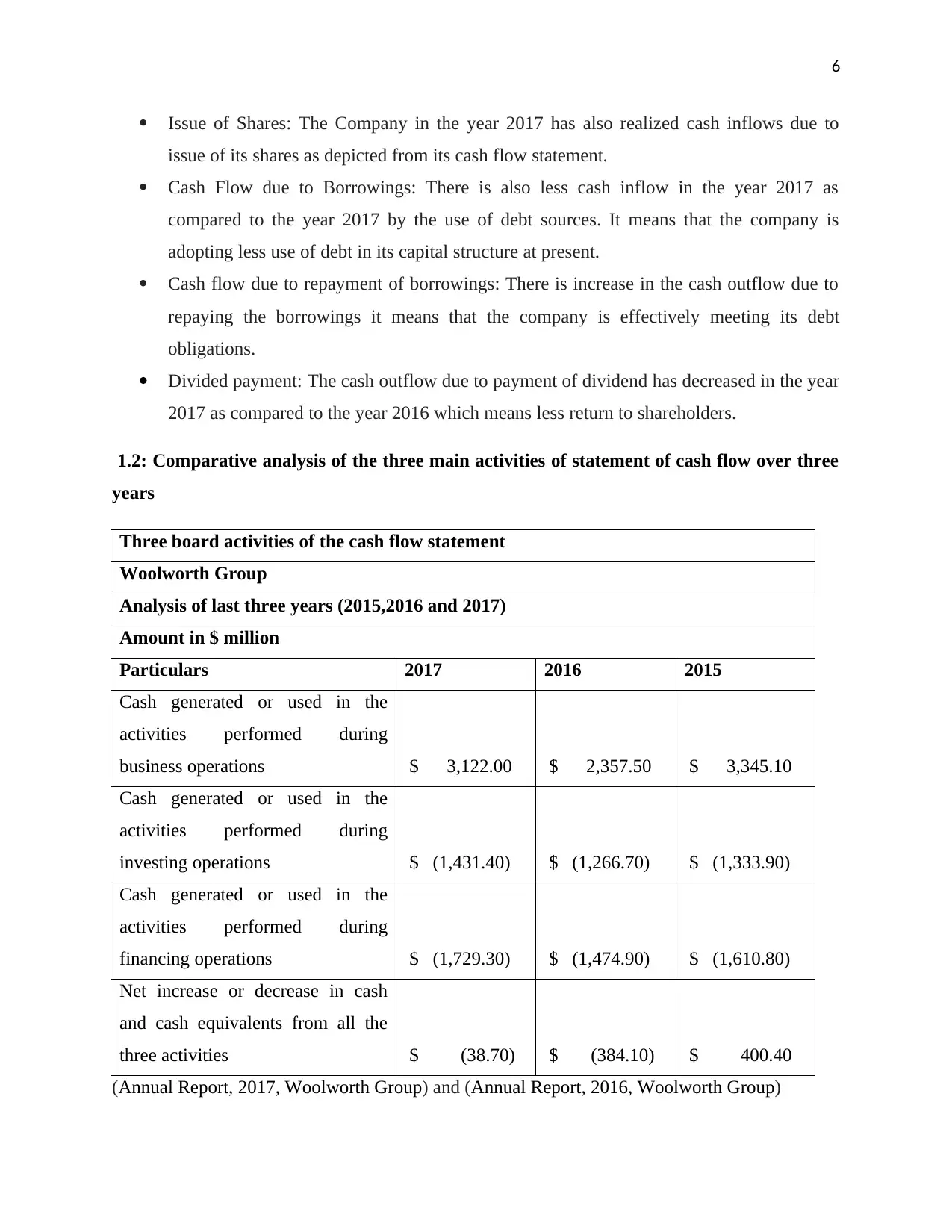

1.2: Comparative analysis of the three main activities of statement of cash flow over three

years

Three board activities of the cash flow statement

Woolworth Group

Analysis of last three years (2015,2016 and 2017)

Amount in $ million

Particulars 2017 2016 2015

Cash generated or used in the

activities performed during

business operations $ 3,122.00 $ 2,357.50 $ 3,345.10

Cash generated or used in the

activities performed during

investing operations $ (1,431.40) $ (1,266.70) $ (1,333.90)

Cash generated or used in the

activities performed during

financing operations $ (1,729.30) $ (1,474.90) $ (1,610.80)

Net increase or decrease in cash

and cash equivalents from all the

three activities $ (38.70) $ (384.10) $ 400.40

(Annual Report, 2017, Woolworth Group) and (Annual Report, 2016, Woolworth Group)

Issue of Shares: The Company in the year 2017 has also realized cash inflows due to

issue of its shares as depicted from its cash flow statement.

Cash Flow due to Borrowings: There is also less cash inflow in the year 2017 as

compared to the year 2017 by the use of debt sources. It means that the company is

adopting less use of debt in its capital structure at present.

Cash flow due to repayment of borrowings: There is increase in the cash outflow due to

repaying the borrowings it means that the company is effectively meeting its debt

obligations.

Divided payment: The cash outflow due to payment of dividend has decreased in the year

2017 as compared to the year 2016 which means less return to shareholders.

1.2: Comparative analysis of the three main activities of statement of cash flow over three

years

Three board activities of the cash flow statement

Woolworth Group

Analysis of last three years (2015,2016 and 2017)

Amount in $ million

Particulars 2017 2016 2015

Cash generated or used in the

activities performed during

business operations $ 3,122.00 $ 2,357.50 $ 3,345.10

Cash generated or used in the

activities performed during

investing operations $ (1,431.40) $ (1,266.70) $ (1,333.90)

Cash generated or used in the

activities performed during

financing operations $ (1,729.30) $ (1,474.90) $ (1,610.80)

Net increase or decrease in cash

and cash equivalents from all the

three activities $ (38.70) $ (384.10) $ 400.40

(Annual Report, 2017, Woolworth Group) and (Annual Report, 2016, Woolworth Group)

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

7

There is increase in the cash inflow realized from the operational activities over the

period 2015-2017 for AGL Energy Limited. This depicts the increase in the ability of the

company to realize sales from its business operations. The cash outflow due to investment in the

business operations has also increased depicting that it is investing more in its asset base for

improving its sales revenue. There is also a net increase in the cash outflow resulting from the

financing operations depicting that the company is utilizing greater cash resources in financing

its business operations. The company’s overall cash position has been worst in the year 2016 as

there is highest cash outflow of $384.10 million in this year. The cash outflow made by the

company is significantly less in the year 2017 as compared to the year 2016 that is clearly

depicted in the above table (Klammer, 2018).

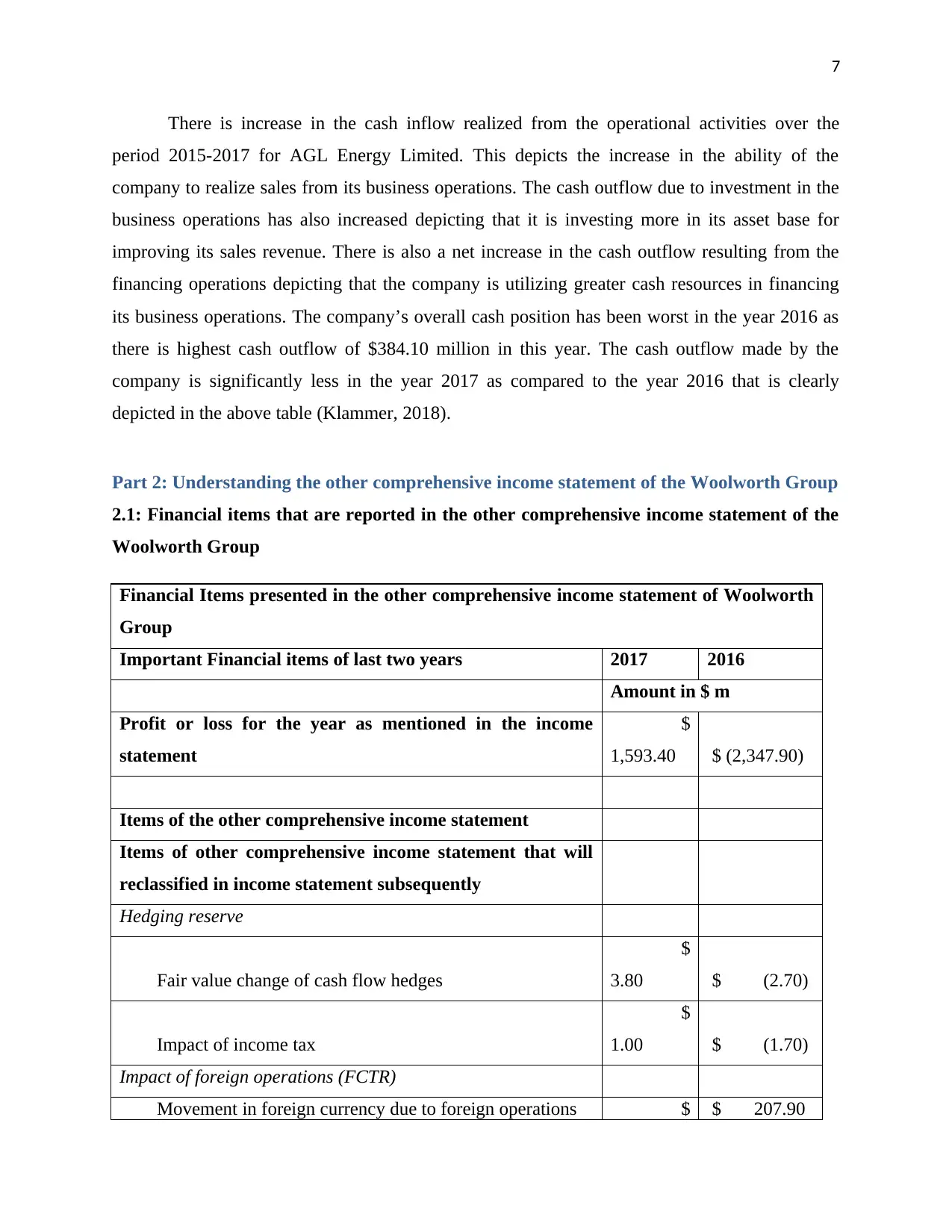

Part 2: Understanding the other comprehensive income statement of the Woolworth Group

2.1: Financial items that are reported in the other comprehensive income statement of the

Woolworth Group

Financial Items presented in the other comprehensive income statement of Woolworth

Group

Important Financial items of last two years 2017 2016

Amount in $ m

Profit or loss for the year as mentioned in the income

statement

$

1,593.40 $ (2,347.90)

Items of the other comprehensive income statement

Items of other comprehensive income statement that will

reclassified in income statement subsequently

Hedging reserve

Fair value change of cash flow hedges

$

3.80 $ (2.70)

Impact of income tax

$

1.00 $ (1.70)

Impact of foreign operations (FCTR)

Movement in foreign currency due to foreign operations $ $ 207.90

There is increase in the cash inflow realized from the operational activities over the

period 2015-2017 for AGL Energy Limited. This depicts the increase in the ability of the

company to realize sales from its business operations. The cash outflow due to investment in the

business operations has also increased depicting that it is investing more in its asset base for

improving its sales revenue. There is also a net increase in the cash outflow resulting from the

financing operations depicting that the company is utilizing greater cash resources in financing

its business operations. The company’s overall cash position has been worst in the year 2016 as

there is highest cash outflow of $384.10 million in this year. The cash outflow made by the

company is significantly less in the year 2017 as compared to the year 2016 that is clearly

depicted in the above table (Klammer, 2018).

Part 2: Understanding the other comprehensive income statement of the Woolworth Group

2.1: Financial items that are reported in the other comprehensive income statement of the

Woolworth Group

Financial Items presented in the other comprehensive income statement of Woolworth

Group

Important Financial items of last two years 2017 2016

Amount in $ m

Profit or loss for the year as mentioned in the income

statement

$

1,593.40 $ (2,347.90)

Items of the other comprehensive income statement

Items of other comprehensive income statement that will

reclassified in income statement subsequently

Hedging reserve

Fair value change of cash flow hedges

$

3.80 $ (2.70)

Impact of income tax

$

1.00 $ (1.70)

Impact of foreign operations (FCTR)

Movement in foreign currency due to foreign operations $ $ 207.90

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

8

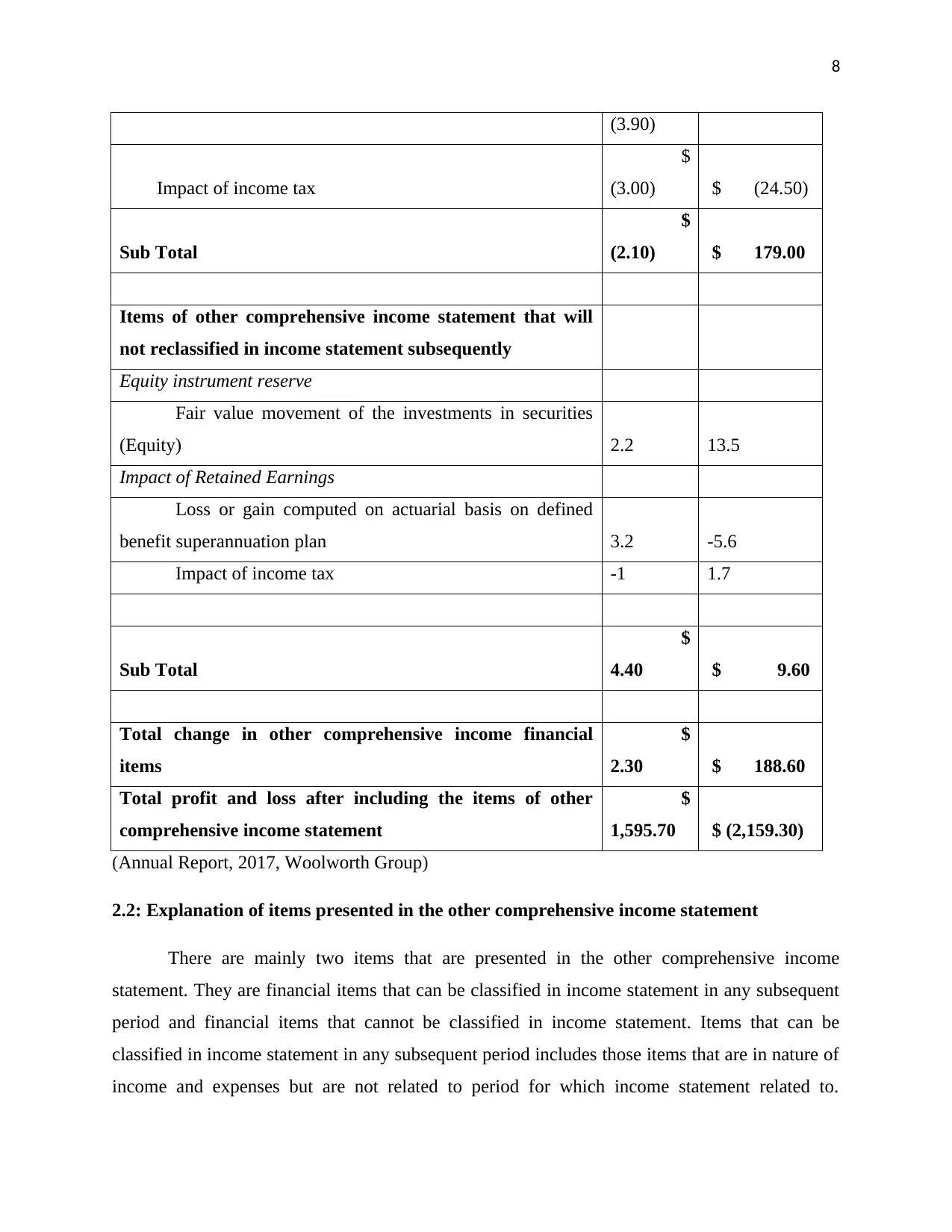

(3.90)

Impact of income tax

$

(3.00) $ (24.50)

Sub Total

$

(2.10) $ 179.00

Items of other comprehensive income statement that will

not reclassified in income statement subsequently

Equity instrument reserve

Fair value movement of the investments in securities

(Equity) 2.2 13.5

Impact of Retained Earnings

Loss or gain computed on actuarial basis on defined

benefit superannuation plan 3.2 -5.6

Impact of income tax -1 1.7

Sub Total

$

4.40 $ 9.60

Total change in other comprehensive income financial

items

$

2.30 $ 188.60

Total profit and loss after including the items of other

comprehensive income statement

$

1,595.70 $ (2,159.30)

(Annual Report, 2017, Woolworth Group)

2.2: Explanation of items presented in the other comprehensive income statement

There are mainly two items that are presented in the other comprehensive income

statement. They are financial items that can be classified in income statement in any subsequent

period and financial items that cannot be classified in income statement. Items that can be

classified in income statement in any subsequent period includes those items that are in nature of

income and expenses but are not related to period for which income statement related to.

(3.90)

Impact of income tax

$

(3.00) $ (24.50)

Sub Total

$

(2.10) $ 179.00

Items of other comprehensive income statement that will

not reclassified in income statement subsequently

Equity instrument reserve

Fair value movement of the investments in securities

(Equity) 2.2 13.5

Impact of Retained Earnings

Loss or gain computed on actuarial basis on defined

benefit superannuation plan 3.2 -5.6

Impact of income tax -1 1.7

Sub Total

$

4.40 $ 9.60

Total change in other comprehensive income financial

items

$

2.30 $ 188.60

Total profit and loss after including the items of other

comprehensive income statement

$

1,595.70 $ (2,159.30)

(Annual Report, 2017, Woolworth Group)

2.2: Explanation of items presented in the other comprehensive income statement

There are mainly two items that are presented in the other comprehensive income

statement. They are financial items that can be classified in income statement in any subsequent

period and financial items that cannot be classified in income statement. Items that can be

classified in income statement in any subsequent period includes those items that are in nature of

income and expenses but are not related to period for which income statement related to.

9

Examples of such items are hedging reserve and foreign currency translation reserve (FCTR).

The tax impact of these changes is also included into the other comprehensive income statement

(Wahlen, Baginski and Bradshaw, 2010).

2.3: Reason why items of other comprehensive income statement are not reported in

income statement

The main reason why the items of the other comprehensive income statement are not

reported in the income statement is because they do not satisfy the criteria of income and

expenses to be reported in the income statement and also some items that satisfy the criteria but

does not belong to the same period as income statement shows (Gibson, 2012).

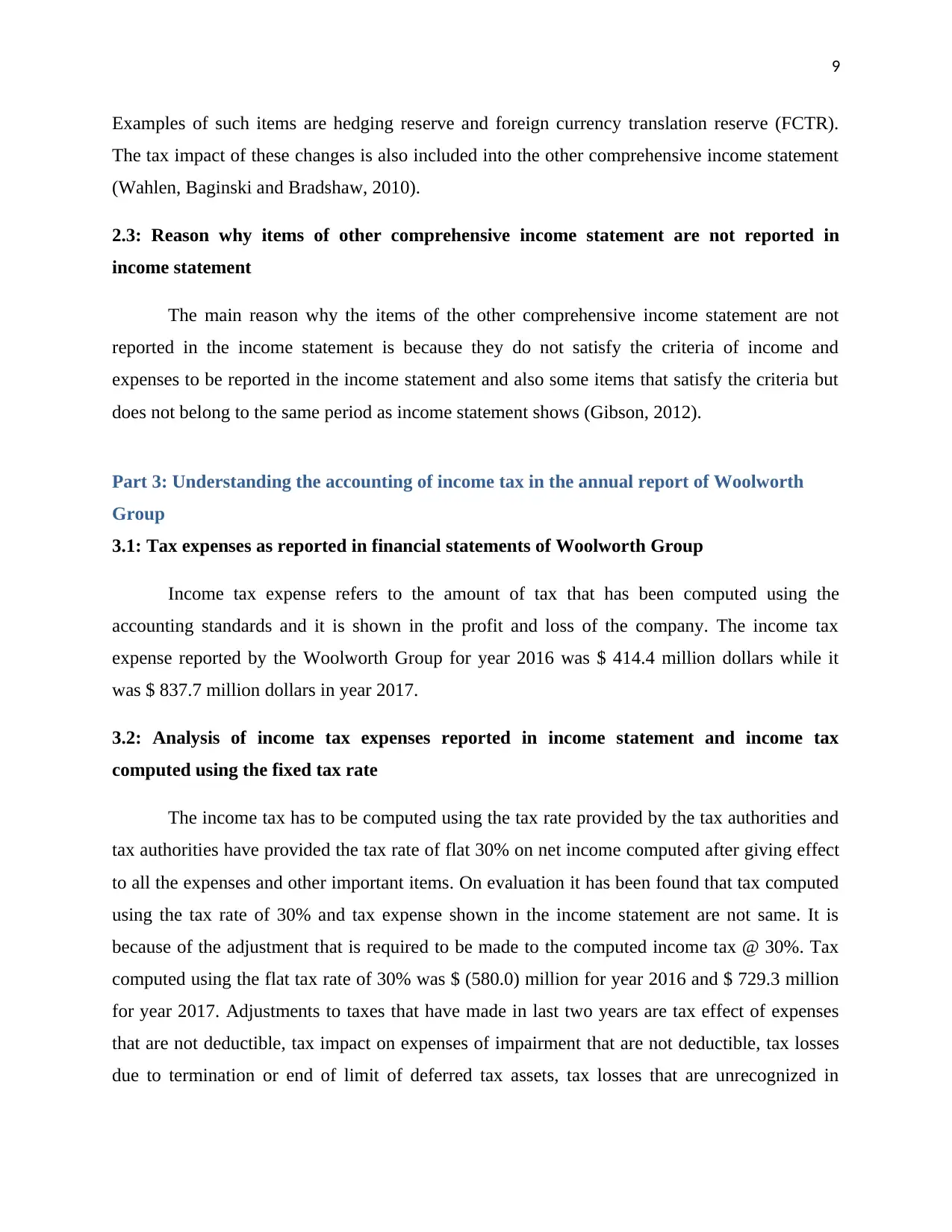

Part 3: Understanding the accounting of income tax in the annual report of Woolworth

Group

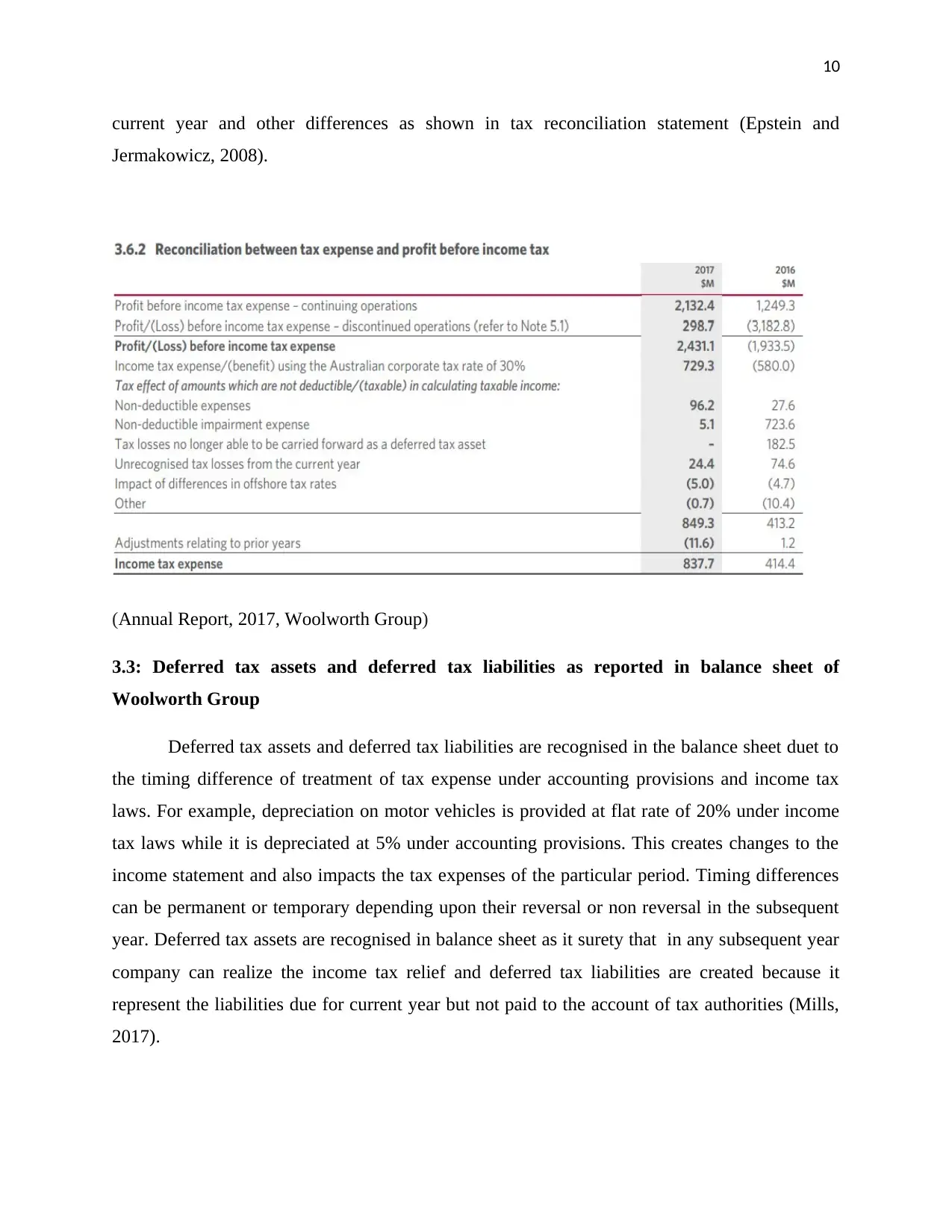

3.1: Tax expenses as reported in financial statements of Woolworth Group

Income tax expense refers to the amount of tax that has been computed using the

accounting standards and it is shown in the profit and loss of the company. The income tax

expense reported by the Woolworth Group for year 2016 was $ 414.4 million dollars while it

was $ 837.7 million dollars in year 2017.

3.2: Analysis of income tax expenses reported in income statement and income tax

computed using the fixed tax rate

The income tax has to be computed using the tax rate provided by the tax authorities and

tax authorities have provided the tax rate of flat 30% on net income computed after giving effect

to all the expenses and other important items. On evaluation it has been found that tax computed

using the tax rate of 30% and tax expense shown in the income statement are not same. It is

because of the adjustment that is required to be made to the computed income tax @ 30%. Tax

computed using the flat tax rate of 30% was $ (580.0) million for year 2016 and $ 729.3 million

for year 2017. Adjustments to taxes that have made in last two years are tax effect of expenses

that are not deductible, tax impact on expenses of impairment that are not deductible, tax losses

due to termination or end of limit of deferred tax assets, tax losses that are unrecognized in

Examples of such items are hedging reserve and foreign currency translation reserve (FCTR).

The tax impact of these changes is also included into the other comprehensive income statement

(Wahlen, Baginski and Bradshaw, 2010).

2.3: Reason why items of other comprehensive income statement are not reported in

income statement

The main reason why the items of the other comprehensive income statement are not

reported in the income statement is because they do not satisfy the criteria of income and

expenses to be reported in the income statement and also some items that satisfy the criteria but

does not belong to the same period as income statement shows (Gibson, 2012).

Part 3: Understanding the accounting of income tax in the annual report of Woolworth

Group

3.1: Tax expenses as reported in financial statements of Woolworth Group

Income tax expense refers to the amount of tax that has been computed using the

accounting standards and it is shown in the profit and loss of the company. The income tax

expense reported by the Woolworth Group for year 2016 was $ 414.4 million dollars while it

was $ 837.7 million dollars in year 2017.

3.2: Analysis of income tax expenses reported in income statement and income tax

computed using the fixed tax rate

The income tax has to be computed using the tax rate provided by the tax authorities and

tax authorities have provided the tax rate of flat 30% on net income computed after giving effect

to all the expenses and other important items. On evaluation it has been found that tax computed

using the tax rate of 30% and tax expense shown in the income statement are not same. It is

because of the adjustment that is required to be made to the computed income tax @ 30%. Tax

computed using the flat tax rate of 30% was $ (580.0) million for year 2016 and $ 729.3 million

for year 2017. Adjustments to taxes that have made in last two years are tax effect of expenses

that are not deductible, tax impact on expenses of impairment that are not deductible, tax losses

due to termination or end of limit of deferred tax assets, tax losses that are unrecognized in

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

10

current year and other differences as shown in tax reconciliation statement (Epstein and

Jermakowicz, 2008).

(Annual Report, 2017, Woolworth Group)

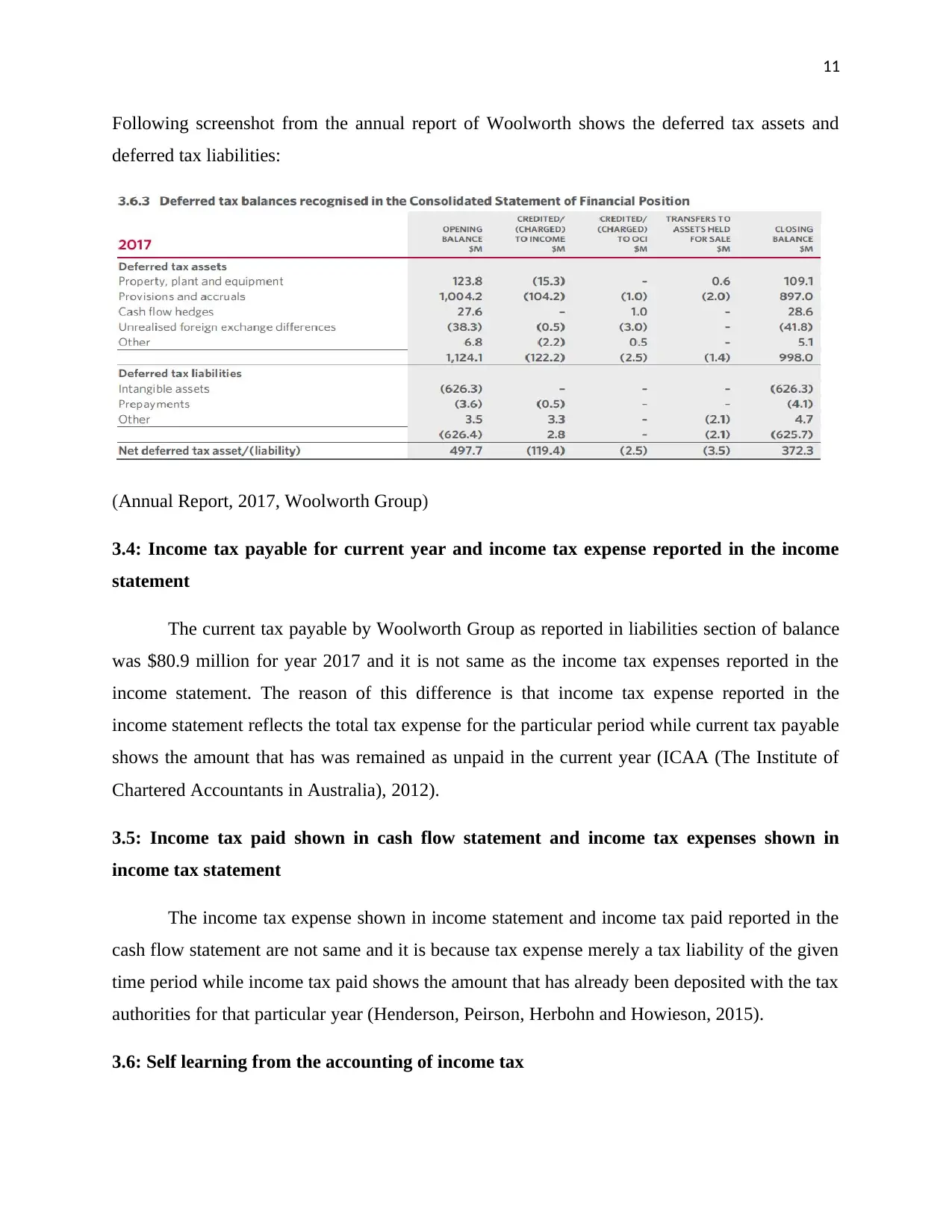

3.3: Deferred tax assets and deferred tax liabilities as reported in balance sheet of

Woolworth Group

Deferred tax assets and deferred tax liabilities are recognised in the balance sheet duet to

the timing difference of treatment of tax expense under accounting provisions and income tax

laws. For example, depreciation on motor vehicles is provided at flat rate of 20% under income

tax laws while it is depreciated at 5% under accounting provisions. This creates changes to the

income statement and also impacts the tax expenses of the particular period. Timing differences

can be permanent or temporary depending upon their reversal or non reversal in the subsequent

year. Deferred tax assets are recognised in balance sheet as it surety that in any subsequent year

company can realize the income tax relief and deferred tax liabilities are created because it

represent the liabilities due for current year but not paid to the account of tax authorities (Mills,

2017).

current year and other differences as shown in tax reconciliation statement (Epstein and

Jermakowicz, 2008).

(Annual Report, 2017, Woolworth Group)

3.3: Deferred tax assets and deferred tax liabilities as reported in balance sheet of

Woolworth Group

Deferred tax assets and deferred tax liabilities are recognised in the balance sheet duet to

the timing difference of treatment of tax expense under accounting provisions and income tax

laws. For example, depreciation on motor vehicles is provided at flat rate of 20% under income

tax laws while it is depreciated at 5% under accounting provisions. This creates changes to the

income statement and also impacts the tax expenses of the particular period. Timing differences

can be permanent or temporary depending upon their reversal or non reversal in the subsequent

year. Deferred tax assets are recognised in balance sheet as it surety that in any subsequent year

company can realize the income tax relief and deferred tax liabilities are created because it

represent the liabilities due for current year but not paid to the account of tax authorities (Mills,

2017).

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

11

Following screenshot from the annual report of Woolworth shows the deferred tax assets and

deferred tax liabilities:

(Annual Report, 2017, Woolworth Group)

3.4: Income tax payable for current year and income tax expense reported in the income

statement

The current tax payable by Woolworth Group as reported in liabilities section of balance

was $80.9 million for year 2017 and it is not same as the income tax expenses reported in the

income statement. The reason of this difference is that income tax expense reported in the

income statement reflects the total tax expense for the particular period while current tax payable

shows the amount that has was remained as unpaid in the current year (ICAA (The Institute of

Chartered Accountants in Australia), 2012).

3.5: Income tax paid shown in cash flow statement and income tax expenses shown in

income tax statement

The income tax expense shown in income statement and income tax paid reported in the

cash flow statement are not same and it is because tax expense merely a tax liability of the given

time period while income tax paid shows the amount that has already been deposited with the tax

authorities for that particular year (Henderson, Peirson, Herbohn and Howieson, 2015).

3.6: Self learning from the accounting of income tax

Following screenshot from the annual report of Woolworth shows the deferred tax assets and

deferred tax liabilities:

(Annual Report, 2017, Woolworth Group)

3.4: Income tax payable for current year and income tax expense reported in the income

statement

The current tax payable by Woolworth Group as reported in liabilities section of balance

was $80.9 million for year 2017 and it is not same as the income tax expenses reported in the

income statement. The reason of this difference is that income tax expense reported in the

income statement reflects the total tax expense for the particular period while current tax payable

shows the amount that has was remained as unpaid in the current year (ICAA (The Institute of

Chartered Accountants in Australia), 2012).

3.5: Income tax paid shown in cash flow statement and income tax expenses shown in

income tax statement

The income tax expense shown in income statement and income tax paid reported in the

cash flow statement are not same and it is because tax expense merely a tax liability of the given

time period while income tax paid shows the amount that has already been deposited with the tax

authorities for that particular year (Henderson, Peirson, Herbohn and Howieson, 2015).

3.6: Self learning from the accounting of income tax

12

On the basis of treatment of income tax by the Woolworth Group, I find it very

interesting the way they have presented the tax reconciliation and deferred tax assets/liabilities. It

is little confusion regarding the creation of some of deferred tax liabilities.

Conclusion

Financial reporting is the complex part while preparing the annual report and it is very

important to understand its important aspects such as accounting of income tax, treatment of

various income statement items and other important financial items.

On the basis of treatment of income tax by the Woolworth Group, I find it very

interesting the way they have presented the tax reconciliation and deferred tax assets/liabilities. It

is little confusion regarding the creation of some of deferred tax liabilities.

Conclusion

Financial reporting is the complex part while preparing the annual report and it is very

important to understand its important aspects such as accounting of income tax, treatment of

various income statement items and other important financial items.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 13

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.