Financial Analysis: Management Accounting Report for Tech (UK) Limited

VerifiedAdded on 2021/05/30

|24

|4541

|39

Report

AI Summary

This report provides a comprehensive analysis of management accounting principles and their application within the context of Tech (UK) Limited. It begins with an introduction to management accounting, differentiating it from financial accounting and highlighting its importance in decision-making for department managers. The report then delves into cost accounting systems, including actual, normal, and standard costing, alongside inventory management and job costing systems. Task 1 also covers different types of managerial accounting reports. Task 2 focuses on absorption and marginal costing, providing calculations and income statements. Task 3 explores various budgeting types, their advantages and disadvantages, the budget preparation process, and the significance of budgeting for planning and control. Finally, Task 4 examines the Balanced Scorecard approach as a response to financial problems, comparing it to another management accounting approach used in a different organization, providing relevant financial information for comparison. The report concludes with a summary of the findings and a list of references.

Management Accounting

1

1

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Contents

Introduction:...............................................................................................................................4

Task 1.........................................................................................................................................5

(ii) The importance of management accounting information as a decision-making tool for

department managers:............................................................................................................6

(iii) Cost Accounting Systems-..............................................................................................7

(iv)- Inventory management work system.............................................................................8

(v) Job Costing System-.........................................................................................................8

(b) (I) Different types if managerial accounting reports-.......................................................8

(M1) Evaluation of the benefits of management accounting systems and their application

within the context of Tech (UK) Limited..............................................................................9

Task 2.......................................................................................................................................10

Absorption Costing..............................................................................................................10

Marginal Costing..................................................................................................................12

Task 3.......................................................................................................................................15

(a)Different types of budgets and their advantages and disadvantages...............................15

(b) The budget preparation process including determination of pricing and different costing

systems that can be used......................................................................................................18

(c)The importance of budget as a tool for planning and control purposes...........................18

Task 4.......................................................................................................................................19

Explain ways by which the Balanced Scorecard approach suggested by the auditors can be

used to respond its financial problem and compare this approach to another management

accounting approach used in another organisation of your choice. You must provide

2

Introduction:...............................................................................................................................4

Task 1.........................................................................................................................................5

(ii) The importance of management accounting information as a decision-making tool for

department managers:............................................................................................................6

(iii) Cost Accounting Systems-..............................................................................................7

(iv)- Inventory management work system.............................................................................8

(v) Job Costing System-.........................................................................................................8

(b) (I) Different types if managerial accounting reports-.......................................................8

(M1) Evaluation of the benefits of management accounting systems and their application

within the context of Tech (UK) Limited..............................................................................9

Task 2.......................................................................................................................................10

Absorption Costing..............................................................................................................10

Marginal Costing..................................................................................................................12

Task 3.......................................................................................................................................15

(a)Different types of budgets and their advantages and disadvantages...............................15

(b) The budget preparation process including determination of pricing and different costing

systems that can be used......................................................................................................18

(c)The importance of budget as a tool for planning and control purposes...........................18

Task 4.......................................................................................................................................19

Explain ways by which the Balanced Scorecard approach suggested by the auditors can be

used to respond its financial problem and compare this approach to another management

accounting approach used in another organisation of your choice. You must provide

2

relevant financial information about the other organisation you have selected for

comparison...........................................................................................................................19

Conclusion................................................................................................................................22

References................................................................................................................................23

3

comparison...........................................................................................................................19

Conclusion................................................................................................................................22

References................................................................................................................................23

3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Introduction:

With the ramified economic changes and complex business structure, financial

management plays an important role for the business success. There are several financial

tools which could be used by the investors to analysis whether the particular company has

potential to create value on the investment or not. It is observed that the evaluation of the

financial statements is required to identify whether the company is performing well in the

market or not. In this report, critical understanding has been made on the working of the Tech

(UK) which has been working as manufacturing company since very long time. There are

several financial tools have been used that are given in this report in the different report tasks.

This report emphasises upon the insight of the managerial accounting system, budgeting and

other managerial tools that could be adopted by the Tech (UK) for the effective functioning

of the organization.

4

With the ramified economic changes and complex business structure, financial

management plays an important role for the business success. There are several financial

tools which could be used by the investors to analysis whether the particular company has

potential to create value on the investment or not. It is observed that the evaluation of the

financial statements is required to identify whether the company is performing well in the

market or not. In this report, critical understanding has been made on the working of the Tech

(UK) which has been working as manufacturing company since very long time. There are

several financial tools have been used that are given in this report in the different report tasks.

This report emphasises upon the insight of the managerial accounting system, budgeting and

other managerial tools that could be adopted by the Tech (UK) for the effective functioning

of the organization.

4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Task 1

Management accounting is the process to evaluate the available financial information before

making investment decision. This management accounting helps managers to take the

imperative decisions and assists employees to take tactical decision in organization

Management accounting is used by the managers of the Tech (UK) to understand the

concept of the managerial accounting and helps in taking the effective financial decision

making in long run.

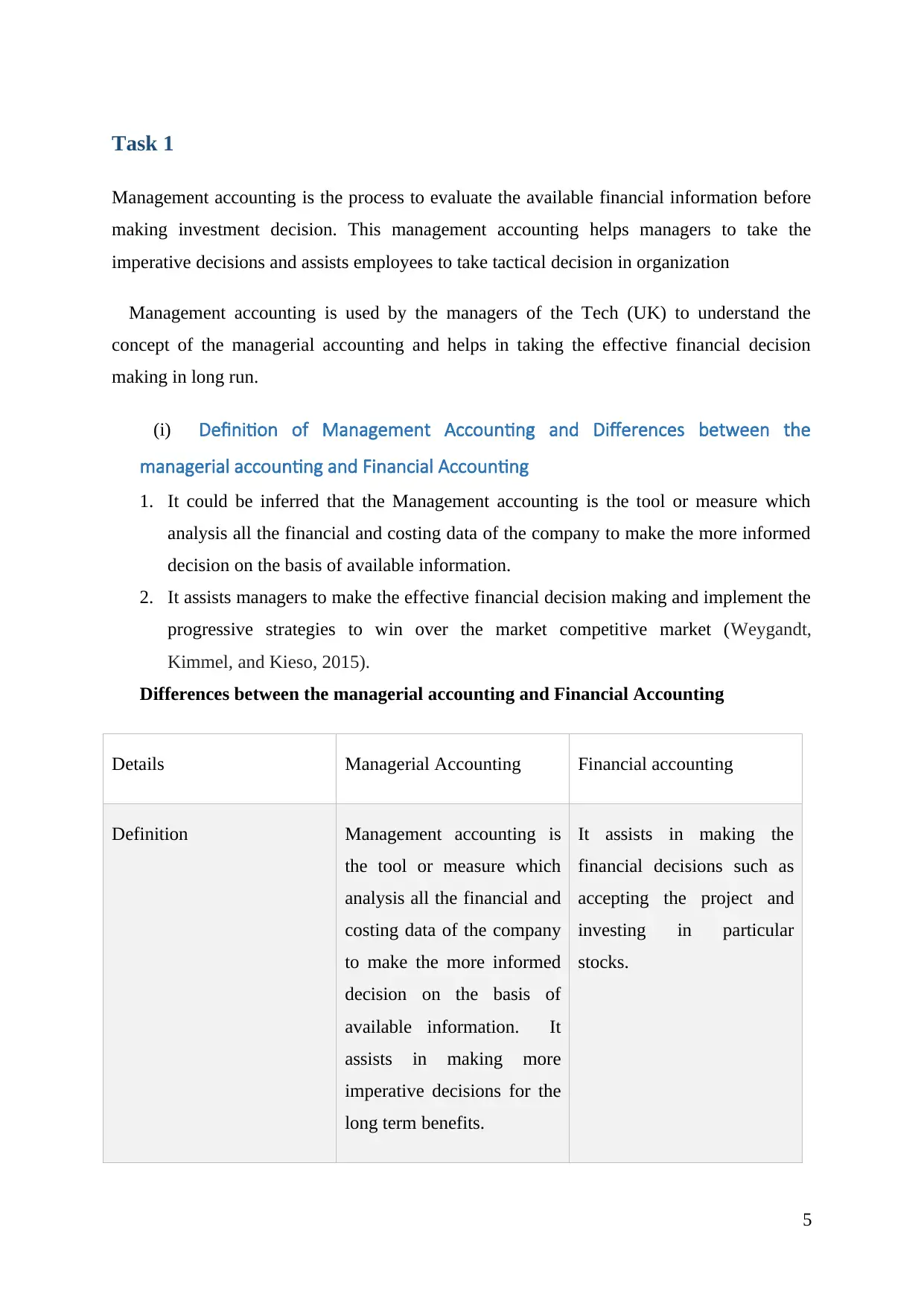

(i) Definition of Management Accounting and Differences between the

managerial accounting and Financial Accounting

1. It could be inferred that the Management accounting is the tool or measure which

analysis all the financial and costing data of the company to make the more informed

decision on the basis of available information.

2. It assists managers to make the effective financial decision making and implement the

progressive strategies to win over the market competitive market (Weygandt,

Kimmel, and Kieso, 2015).

Differences between the managerial accounting and Financial Accounting

Details Managerial Accounting Financial accounting

Definition Management accounting is

the tool or measure which

analysis all the financial and

costing data of the company

to make the more informed

decision on the basis of

available information. It

assists in making more

imperative decisions for the

long term benefits.

It assists in making the

financial decisions such as

accepting the project and

investing in particular

stocks.

5

Management accounting is the process to evaluate the available financial information before

making investment decision. This management accounting helps managers to take the

imperative decisions and assists employees to take tactical decision in organization

Management accounting is used by the managers of the Tech (UK) to understand the

concept of the managerial accounting and helps in taking the effective financial decision

making in long run.

(i) Definition of Management Accounting and Differences between the

managerial accounting and Financial Accounting

1. It could be inferred that the Management accounting is the tool or measure which

analysis all the financial and costing data of the company to make the more informed

decision on the basis of available information.

2. It assists managers to make the effective financial decision making and implement the

progressive strategies to win over the market competitive market (Weygandt,

Kimmel, and Kieso, 2015).

Differences between the managerial accounting and Financial Accounting

Details Managerial Accounting Financial accounting

Definition Management accounting is

the tool or measure which

analysis all the financial and

costing data of the company

to make the more informed

decision on the basis of

available information. It

assists in making more

imperative decisions for the

long term benefits.

It assists in making the

financial decisions such as

accepting the project and

investing in particular

stocks.

5

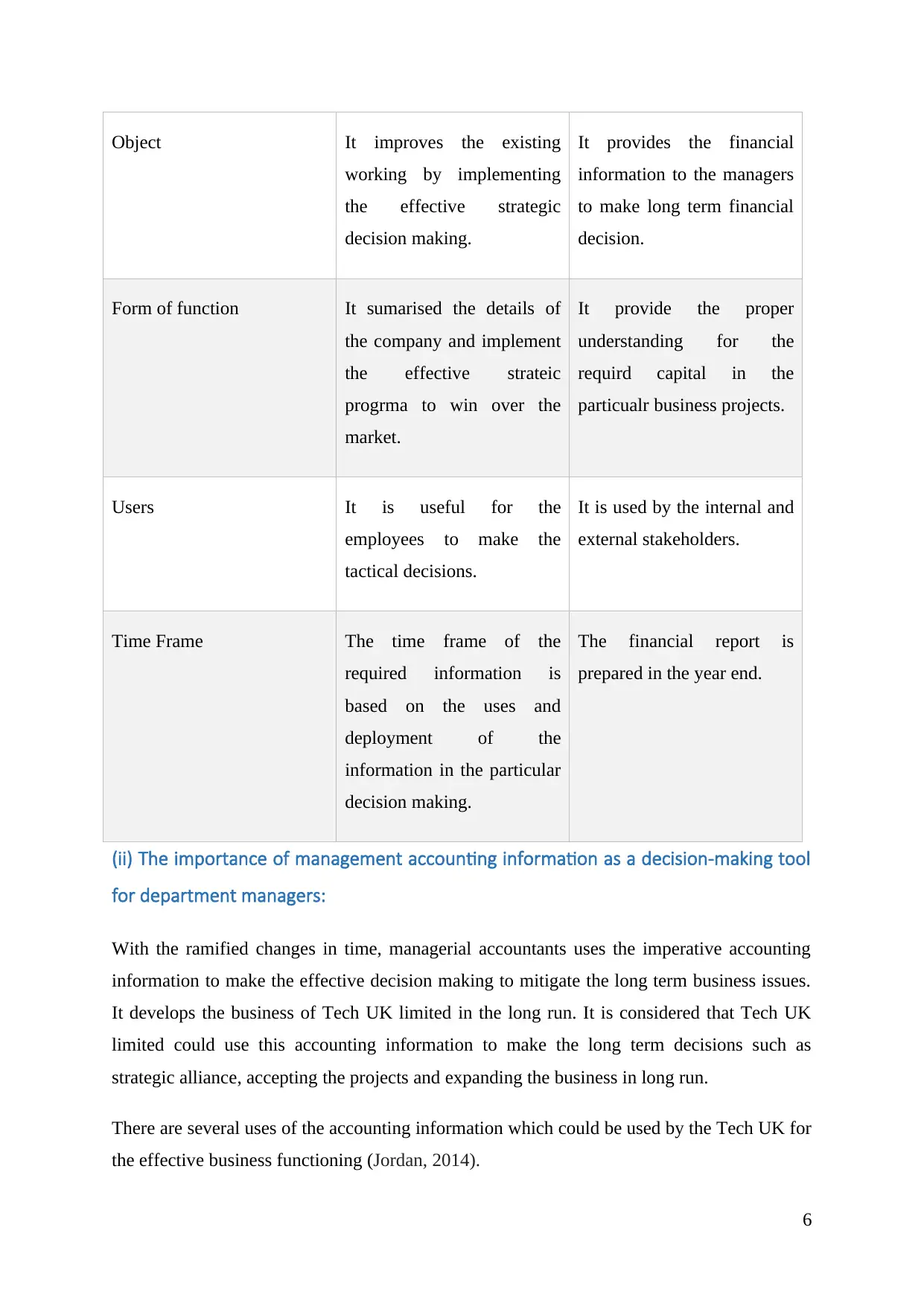

Object It improves the existing

working by implementing

the effective strategic

decision making.

It provides the financial

information to the managers

to make long term financial

decision.

Form of function It sumarised the details of

the company and implement

the effective strateic

progrma to win over the

market.

It provide the proper

understanding for the

requird capital in the

particualr business projects.

Users It is useful for the

employees to make the

tactical decisions.

It is used by the internal and

external stakeholders.

Time Frame The time frame of the

required information is

based on the uses and

deployment of the

information in the particular

decision making.

The financial report is

prepared in the year end.

(ii) The importance of management accounting information as a decision-making tool

for department managers:

With the ramified changes in time, managerial accountants uses the imperative accounting

information to make the effective decision making to mitigate the long term business issues.

It develops the business of Tech UK limited in the long run. It is considered that Tech UK

limited could use this accounting information to make the long term decisions such as

strategic alliance, accepting the projects and expanding the business in long run.

There are several uses of the accounting information which could be used by the Tech UK for

the effective business functioning (Jordan, 2014).

6

working by implementing

the effective strategic

decision making.

It provides the financial

information to the managers

to make long term financial

decision.

Form of function It sumarised the details of

the company and implement

the effective strateic

progrma to win over the

market.

It provide the proper

understanding for the

requird capital in the

particualr business projects.

Users It is useful for the

employees to make the

tactical decisions.

It is used by the internal and

external stakeholders.

Time Frame The time frame of the

required information is

based on the uses and

deployment of the

information in the particular

decision making.

The financial report is

prepared in the year end.

(ii) The importance of management accounting information as a decision-making tool

for department managers:

With the ramified changes in time, managerial accountants uses the imperative accounting

information to make the effective decision making to mitigate the long term business issues.

It develops the business of Tech UK limited in the long run. It is considered that Tech UK

limited could use this accounting information to make the long term decisions such as

strategic alliance, accepting the projects and expanding the business in long run.

There are several uses of the accounting information which could be used by the Tech UK for

the effective business functioning (Jordan, 2014).

6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1. Estimation of the future results- The management accounting information helps in

identifying the future problems and issues which managers will face. It helps

managers to prepare the effective decision making to mitigate eh future problems at

spot.

2. The Management accounting information also assists in identifying the variances

which arise due to the differences in the expected and actual result.

3. It helps in determining the inflow and outflow of the cash in the business.

4. It also identify the rate of return and capital employed in the business. It helps in

dettermining the futrue cash flow and required cost of captial in business.

(iii) Cost Accounting Systems-

It is evaluated that the accounting system of the Tech UK limited estimates the cost of the

products and return on capital employed. The cost of the capital and return on capital

employed could be used by the organization to control the cost of the business. It becomes

complex to determine the overall cost of the business if company does not use the proper

management accounting. The main use of the cost accounting system is to lower down the

overall cost of the production which eventually helps company to increase the overall return

on capital employed (Jordan, 2014).

7

identifying the future problems and issues which managers will face. It helps

managers to prepare the effective decision making to mitigate eh future problems at

spot.

2. The Management accounting information also assists in identifying the variances

which arise due to the differences in the expected and actual result.

3. It helps in determining the inflow and outflow of the cash in the business.

4. It also identify the rate of return and capital employed in the business. It helps in

dettermining the futrue cash flow and required cost of captial in business.

(iii) Cost Accounting Systems-

It is evaluated that the accounting system of the Tech UK limited estimates the cost of the

products and return on capital employed. The cost of the capital and return on capital

employed could be used by the organization to control the cost of the business. It becomes

complex to determine the overall cost of the business if company does not use the proper

management accounting. The main use of the cost accounting system is to lower down the

overall cost of the production which eventually helps company to increase the overall return

on capital employed (Jordan, 2014).

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Actual Costing

This actual cost is the cost incurred for the effective business functioning and injecting the

capital in the operating works of the Tech UK. It includes payment for the raw material and

labour cost.

Normal Costing

The Normal costing of the products is determined by using the payment to labour and

material added by the overhead expenses made over the cost of the production. The

accounting system assists in implementing the effective decision making (Flannery, 2016).

Standards work cost

The computation of the standard cost is done by using the proper accounting method and

deducting the estimated cost form the actual cost incurred. The recorded of the variance

between the actual and estimated cost is done by using the standard work cost.

(iv)- Inventory management work system

Inventory is required to be managed for the effective level of working in organization.

Effective inventory management work system assists in reducing the overall cost of the

business and increasing the overall business outputs. The inventory management work

system assists in implementing the proper inventory management in business. It determines

the inventory turnover, minimum and maximum stock and the cost of capital increased due to

the blockage of inventory.

(v) Job Costing System-

The job costing system is used to identify the specific products and groups of the products. It

is used to determine the job costing to the mangers and evaluating the business functions

program. This type of the job costing system is suitable when there is lot of products cost is

there to determine. This job costing is the most suitable for the organization which have high

complex business recording system. It assists in bifurcating the costs in the different work

process.

8

This actual cost is the cost incurred for the effective business functioning and injecting the

capital in the operating works of the Tech UK. It includes payment for the raw material and

labour cost.

Normal Costing

The Normal costing of the products is determined by using the payment to labour and

material added by the overhead expenses made over the cost of the production. The

accounting system assists in implementing the effective decision making (Flannery, 2016).

Standards work cost

The computation of the standard cost is done by using the proper accounting method and

deducting the estimated cost form the actual cost incurred. The recorded of the variance

between the actual and estimated cost is done by using the standard work cost.

(iv)- Inventory management work system

Inventory is required to be managed for the effective level of working in organization.

Effective inventory management work system assists in reducing the overall cost of the

business and increasing the overall business outputs. The inventory management work

system assists in implementing the proper inventory management in business. It determines

the inventory turnover, minimum and maximum stock and the cost of capital increased due to

the blockage of inventory.

(v) Job Costing System-

The job costing system is used to identify the specific products and groups of the products. It

is used to determine the job costing to the mangers and evaluating the business functions

program. This type of the job costing system is suitable when there is lot of products cost is

there to determine. This job costing is the most suitable for the organization which have high

complex business recording system. It assists in bifurcating the costs in the different work

process.

8

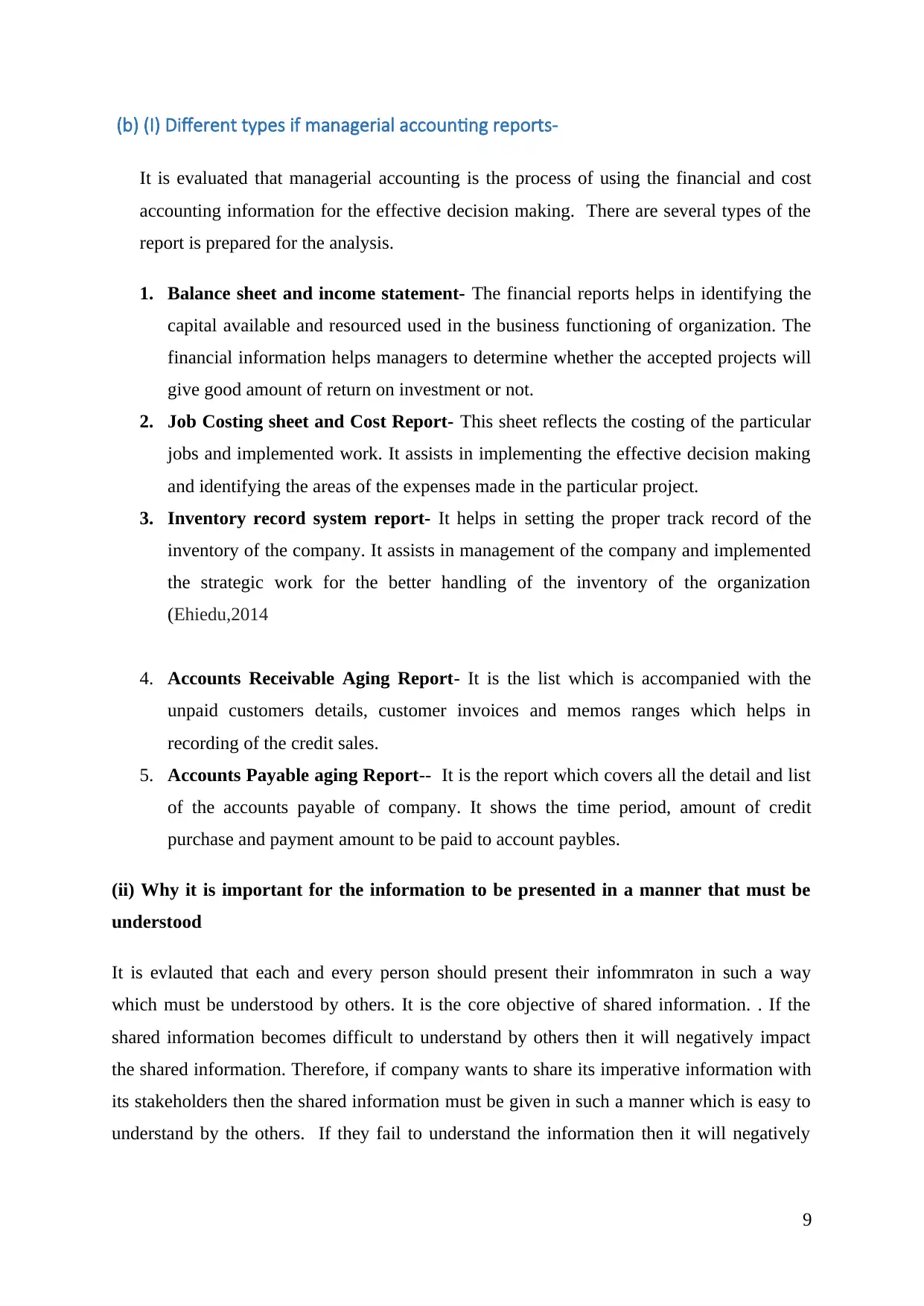

(b) (I) Different types if managerial accounting reports-

It is evaluated that managerial accounting is the process of using the financial and cost

accounting information for the effective decision making. There are several types of the

report is prepared for the analysis.

1. Balance sheet and income statement- The financial reports helps in identifying the

capital available and resourced used in the business functioning of organization. The

financial information helps managers to determine whether the accepted projects will

give good amount of return on investment or not.

2. Job Costing sheet and Cost Report- This sheet reflects the costing of the particular

jobs and implemented work. It assists in implementing the effective decision making

and identifying the areas of the expenses made in the particular project.

3. Inventory record system report- It helps in setting the proper track record of the

inventory of the company. It assists in management of the company and implemented

the strategic work for the better handling of the inventory of the organization

(Ehiedu,2014

4. Accounts Receivable Aging Report- It is the list which is accompanied with the

unpaid customers details, customer invoices and memos ranges which helps in

recording of the credit sales.

5. Accounts Payable aging Report-- It is the report which covers all the detail and list

of the accounts payable of company. It shows the time period, amount of credit

purchase and payment amount to be paid to account paybles.

(ii) Why it is important for the information to be presented in a manner that must be

understood

It is evlauted that each and every person should present their infommraton in such a way

which must be understood by others. It is the core objective of shared information. . If the

shared information becomes difficult to understand by others then it will negatively impact

the shared information. Therefore, if company wants to share its imperative information with

its stakeholders then the shared information must be given in such a manner which is easy to

understand by the others. If they fail to understand the information then it will negatively

9

It is evaluated that managerial accounting is the process of using the financial and cost

accounting information for the effective decision making. There are several types of the

report is prepared for the analysis.

1. Balance sheet and income statement- The financial reports helps in identifying the

capital available and resourced used in the business functioning of organization. The

financial information helps managers to determine whether the accepted projects will

give good amount of return on investment or not.

2. Job Costing sheet and Cost Report- This sheet reflects the costing of the particular

jobs and implemented work. It assists in implementing the effective decision making

and identifying the areas of the expenses made in the particular project.

3. Inventory record system report- It helps in setting the proper track record of the

inventory of the company. It assists in management of the company and implemented

the strategic work for the better handling of the inventory of the organization

(Ehiedu,2014

4. Accounts Receivable Aging Report- It is the list which is accompanied with the

unpaid customers details, customer invoices and memos ranges which helps in

recording of the credit sales.

5. Accounts Payable aging Report-- It is the report which covers all the detail and list

of the accounts payable of company. It shows the time period, amount of credit

purchase and payment amount to be paid to account paybles.

(ii) Why it is important for the information to be presented in a manner that must be

understood

It is evlauted that each and every person should present their infommraton in such a way

which must be understood by others. It is the core objective of shared information. . If the

shared information becomes difficult to understand by others then it will negatively impact

the shared information. Therefore, if company wants to share its imperative information with

its stakeholders then the shared information must be given in such a manner which is easy to

understand by the others. If they fail to understand the information then it will negatively

9

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

impact the investor’s decisions and will render company less transparent in terms of sharing

required information (Siguenza-Guzman et al., 2016).

Hence, Proper use of methods and tools plays imperative role in sharing information with the

stakeholders.

Evaluation of the benefits of management accounting systems and their application

within the context of Tech (UK) Limited

There are several benefits that could be used by Tech (UK) Limited by using the management

accounting information in its business.

It will help managers of the Tech UK to take all the imperative decision and develop

an effective decision making system.

It will assist company to reduce the overall cost of productions and eventually

increase the overall profitability in determined approach.

It also assists in maintain the effective inventory management program and implement

the inventory management program.

It helps in prepraito of the job sheet for the employee and unit per cost of the

operating work department of the Tech (UK)

It increases the profitability of the business by reducing the overall cost of capital of

business.

Task 2

Absorption Costing

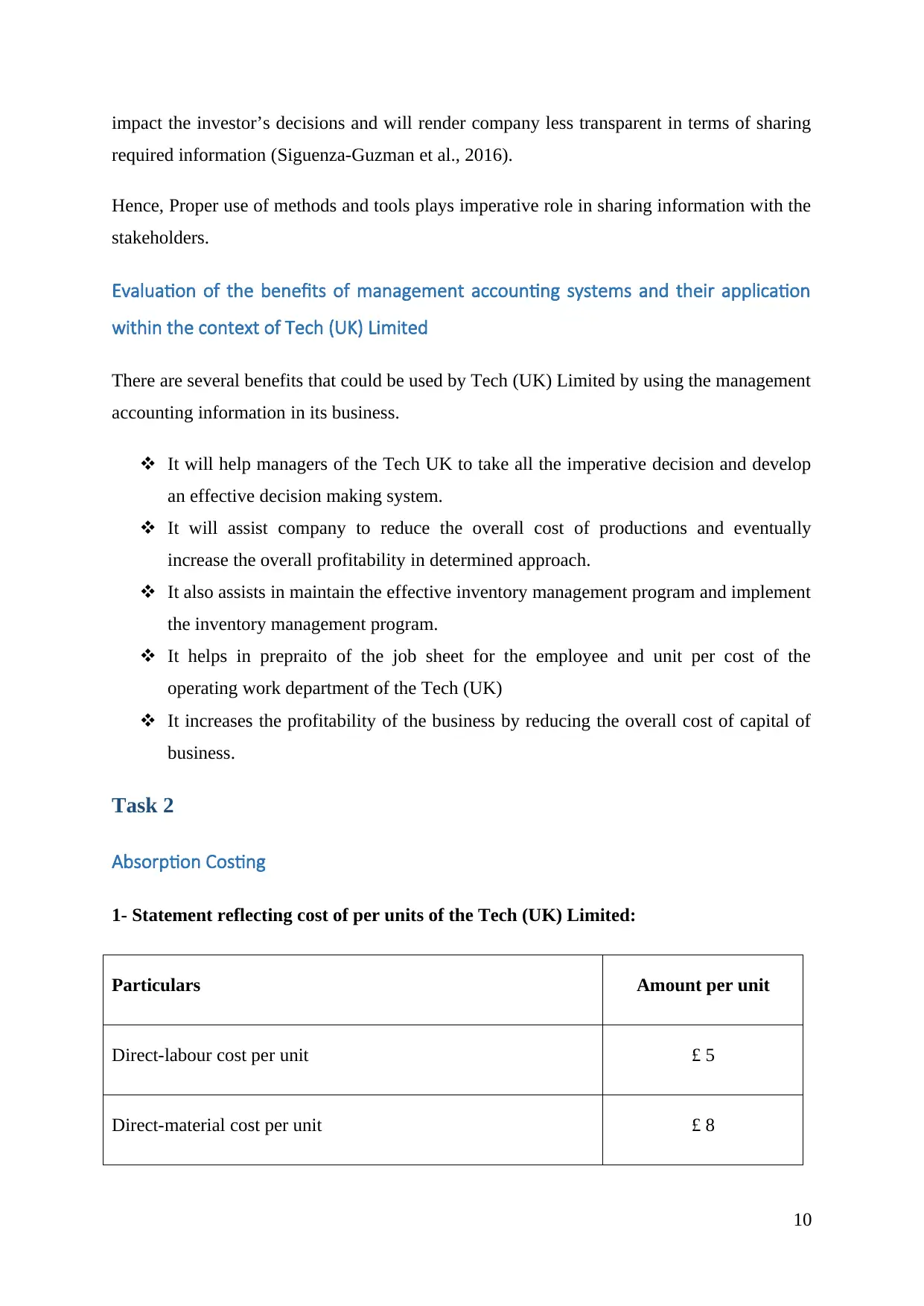

1- Statement reflecting cost of per units of the Tech (UK) Limited:

Particulars Amount per unit

Direct-labour cost per unit £ 5

Direct-material cost per unit £ 8

10

required information (Siguenza-Guzman et al., 2016).

Hence, Proper use of methods and tools plays imperative role in sharing information with the

stakeholders.

Evaluation of the benefits of management accounting systems and their application

within the context of Tech (UK) Limited

There are several benefits that could be used by Tech (UK) Limited by using the management

accounting information in its business.

It will help managers of the Tech UK to take all the imperative decision and develop

an effective decision making system.

It will assist company to reduce the overall cost of productions and eventually

increase the overall profitability in determined approach.

It also assists in maintain the effective inventory management program and implement

the inventory management program.

It helps in prepraito of the job sheet for the employee and unit per cost of the

operating work department of the Tech (UK)

It increases the profitability of the business by reducing the overall cost of capital of

business.

Task 2

Absorption Costing

1- Statement reflecting cost of per units of the Tech (UK) Limited:

Particulars Amount per unit

Direct-labour cost per unit £ 5

Direct-material cost per unit £ 8

10

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Variable-production o/h per unit £ 2

Fixed-production o/h incurred in the month £ 15,000

Total-units manufactured in a month 2000 units

Fixed-production o/h per unit [£ 15000 / 2000 units] £ 7.50 per unit

Standard production cost [£ 5 per unit + £ 8 per unit + £ 2 per

unit + £ 7.50 per unit]

£ 22.50 per unit and per

month

2- Calculation of Total Cost of Production of Tech (UK) Limited:

Particulars Amount

Cost of production (Standard) £ 22.50 per unit

Total units produced in a month 2,000 units in a month

Cost of production [2000 units X 22.50 per unit] £ 45,000

3 – Calculation of Total Closing Stock of Tech (UK) Limited:

Particulars Units

Total production in a month 2000 units

Total units sold in a month 1500 units

Closing stock [2000 units – 1500 unit] 500 units

11

Fixed-production o/h incurred in the month £ 15,000

Total-units manufactured in a month 2000 units

Fixed-production o/h per unit [£ 15000 / 2000 units] £ 7.50 per unit

Standard production cost [£ 5 per unit + £ 8 per unit + £ 2 per

unit + £ 7.50 per unit]

£ 22.50 per unit and per

month

2- Calculation of Total Cost of Production of Tech (UK) Limited:

Particulars Amount

Cost of production (Standard) £ 22.50 per unit

Total units produced in a month 2,000 units in a month

Cost of production [2000 units X 22.50 per unit] £ 45,000

3 – Calculation of Total Closing Stock of Tech (UK) Limited:

Particulars Units

Total production in a month 2000 units

Total units sold in a month 1500 units

Closing stock [2000 units – 1500 unit] 500 units

11

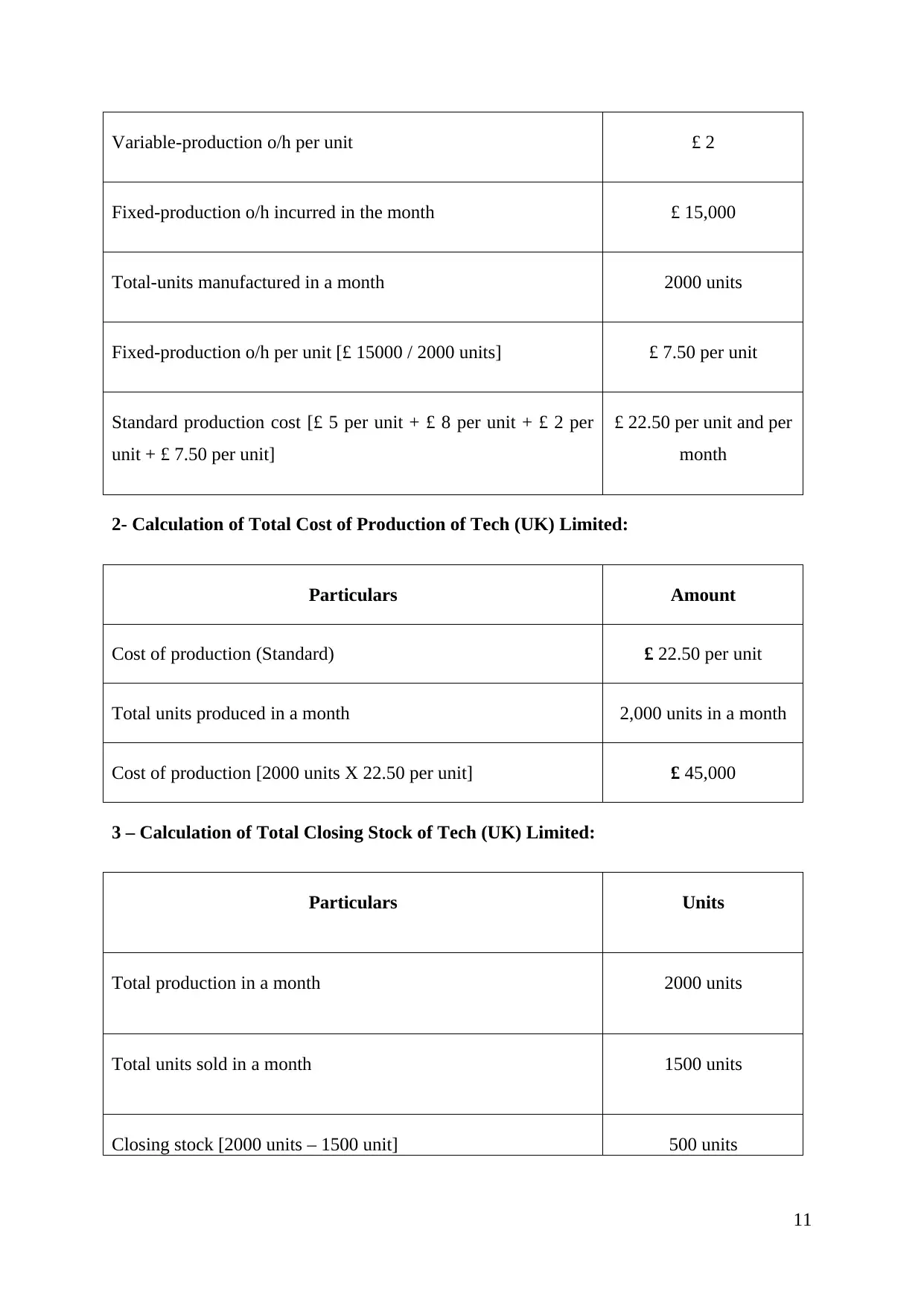

Income Statement of Tech (UK) Limited using Absorption Costing

Particulars Amount

Sales [15,000 units x £ 35 per unit] £ 52,500

Cost of goods £ 45, 000

Add: Opening stock Nil

Less: Closing stock [500 units X £ 20 per unit] (10,000)

Gross Profit £ 17,5000

Selling, Distribution, and Administration Expenses

Fixed expenses = £ 10,000

Variable expenses = £ 7, 875 (15 % of £ 52,500)

£ 17,875

Net Loss (£ 375)

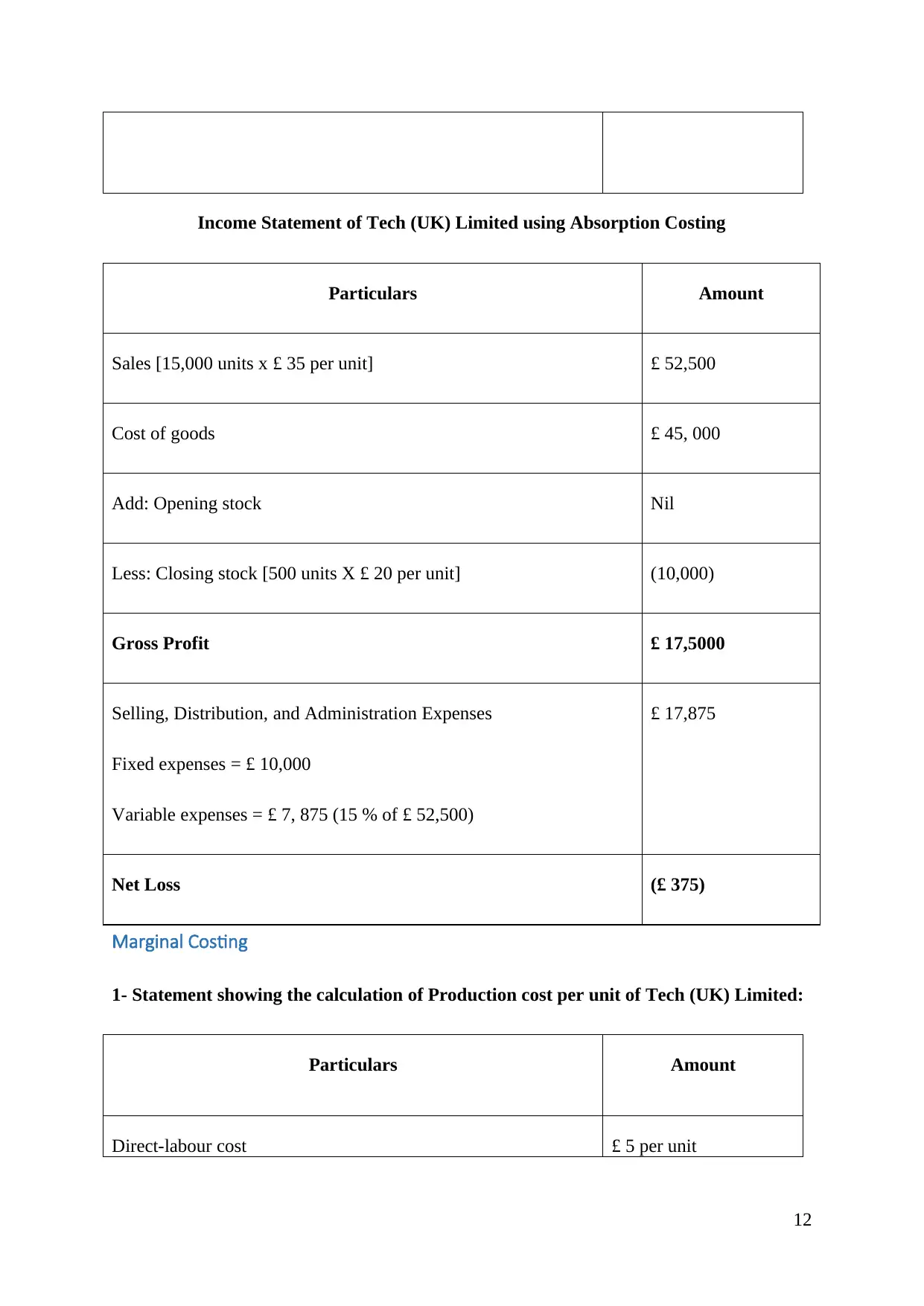

Marginal Costing

1- Statement showing the calculation of Production cost per unit of Tech (UK) Limited:

Particulars Amount

Direct-labour cost £ 5 per unit

12

Particulars Amount

Sales [15,000 units x £ 35 per unit] £ 52,500

Cost of goods £ 45, 000

Add: Opening stock Nil

Less: Closing stock [500 units X £ 20 per unit] (10,000)

Gross Profit £ 17,5000

Selling, Distribution, and Administration Expenses

Fixed expenses = £ 10,000

Variable expenses = £ 7, 875 (15 % of £ 52,500)

£ 17,875

Net Loss (£ 375)

Marginal Costing

1- Statement showing the calculation of Production cost per unit of Tech (UK) Limited:

Particulars Amount

Direct-labour cost £ 5 per unit

12

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 24

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.