Financial Statements Comparison: Wesfarmers and Woolworths Analysis

VerifiedAdded on 2020/04/15

|13

|783

|41

Report

AI Summary

This report provides a comparative analysis of the financial statements of Wesfarmers and Woolworths, two prominent Australian retail companies. The analysis covers their balance sheets, income statements, cash flow statements, and statements of changes in equity. The report highlights similarities and differences in their financial reporting practices, adhering to Australian Accounting Standards Board (AASB) and International Financial Reporting Standards (IFRS). Key aspects include the structure and presentation of financial data, the use of the balance sheet equation, and the level of detail in income statements. Furthermore, the report examines the structure of cash flow statements and the differences in the presentation of the statement of changes in equity. The report utilizes data from their 2017 annual reports to provide a comprehensive overview of their financial positions.

Running head: COMPARISON OF FINANCIAL STATEMENTS

Comparison of Financial Statements

Name of the Student

Name of the University

Author’s Note

Comparison of Financial Statements

Name of the Student

Name of the University

Author’s Note

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1COMPARISON OF FINANCIAL STATEMENTS

Wesfarmers Limited and Woolworths Limited are two of the major retail companies of

Australia. It needs to be mentioned that the financial statements of Wesfarmers and Woolworths

have some similarities as well as some differences. The major similarities and differences are

discussed below:

Balance Sheet

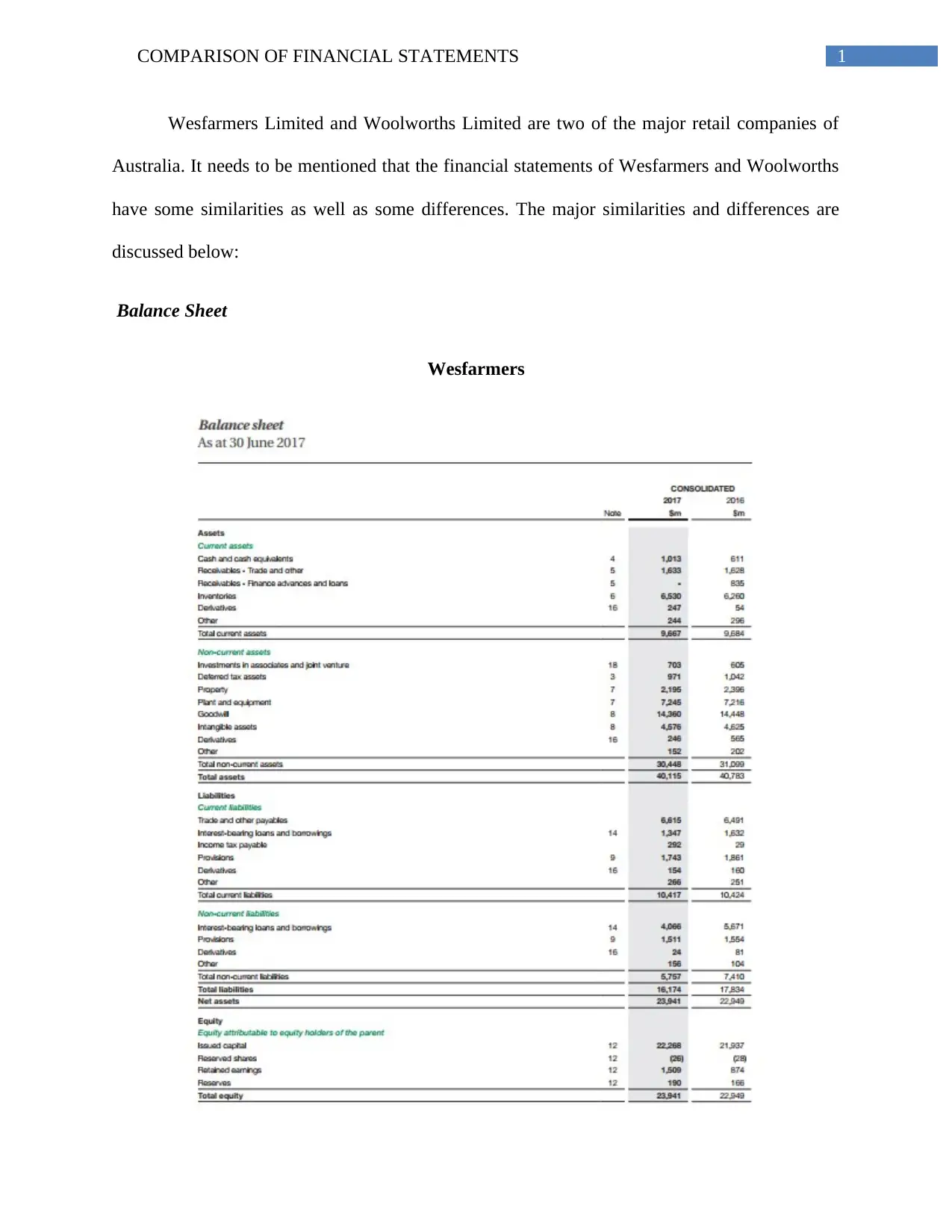

Wesfarmers

Wesfarmers Limited and Woolworths Limited are two of the major retail companies of

Australia. It needs to be mentioned that the financial statements of Wesfarmers and Woolworths

have some similarities as well as some differences. The major similarities and differences are

discussed below:

Balance Sheet

Wesfarmers

2COMPARISON OF FINANCIAL STATEMENTS

Table 1: Statement of Balance Sheet

(Source: wesfarmers.com.au, 2017)

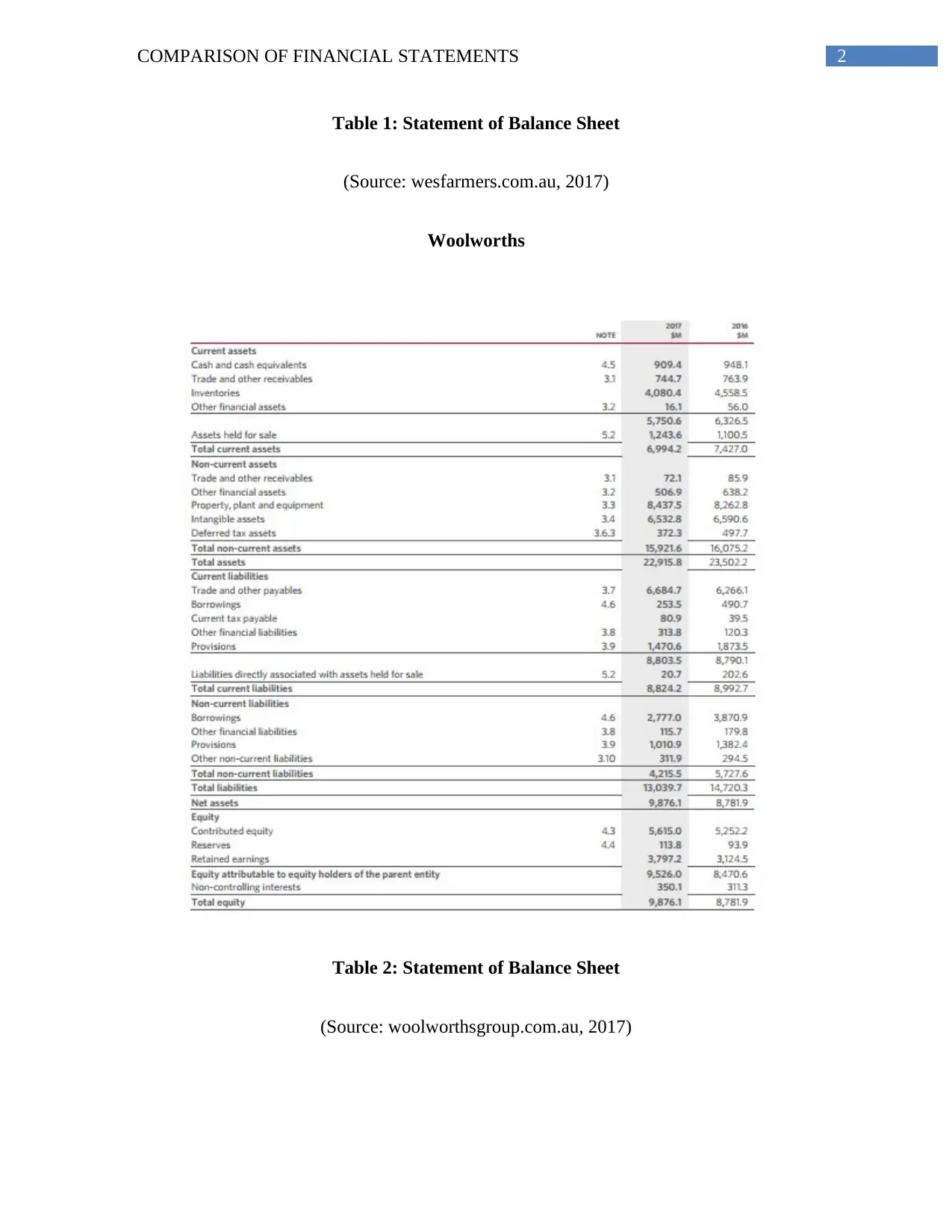

Woolworths

Table 2: Statement of Balance Sheet

(Source: woolworthsgroup.com.au, 2017)

Table 1: Statement of Balance Sheet

(Source: wesfarmers.com.au, 2017)

Woolworths

Table 2: Statement of Balance Sheet

(Source: woolworthsgroup.com.au, 2017)

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3COMPARISON OF FINANCIAL STATEMENTS

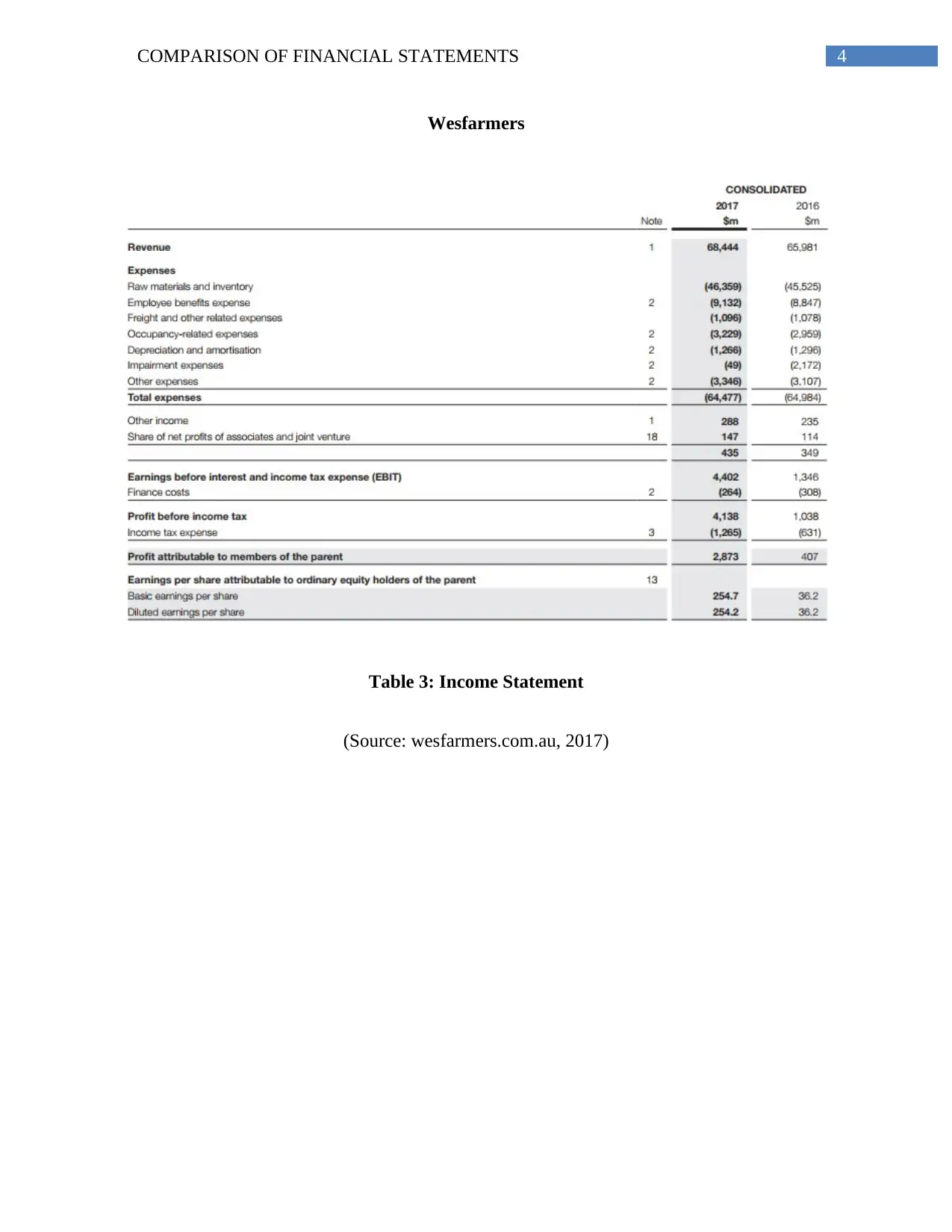

According to the above tables, it can be seen that both Wesfarners and Woolworths

follow a specific structure for presenting various aspects in the balance sheets; they are current

assets, non-current assets, total assets, current liabilities, non-current liabilities, total liabilities,

shareholder’s equity and total equity. Thus, it is clear that both the companies have adopted

narrative format for their balance sheets. Both the companies follow the principles and standards

of Australian Accounting Standard Board (AASB) and International Financial Reporting

Standards (IFRS). The main balance sheet equation of these two companies is:

Assets = Liabilities + Equity

However, in case of Wesfarmers, the carrying value of recognized assets and liabilities are

adjusted to record the changes while this is not done in case of Woolworths (wesfarmers.com.au,

2017).

Income Statements

According to the above tables, it can be seen that both Wesfarners and Woolworths

follow a specific structure for presenting various aspects in the balance sheets; they are current

assets, non-current assets, total assets, current liabilities, non-current liabilities, total liabilities,

shareholder’s equity and total equity. Thus, it is clear that both the companies have adopted

narrative format for their balance sheets. Both the companies follow the principles and standards

of Australian Accounting Standard Board (AASB) and International Financial Reporting

Standards (IFRS). The main balance sheet equation of these two companies is:

Assets = Liabilities + Equity

However, in case of Wesfarmers, the carrying value of recognized assets and liabilities are

adjusted to record the changes while this is not done in case of Woolworths (wesfarmers.com.au,

2017).

Income Statements

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4COMPARISON OF FINANCIAL STATEMENTS

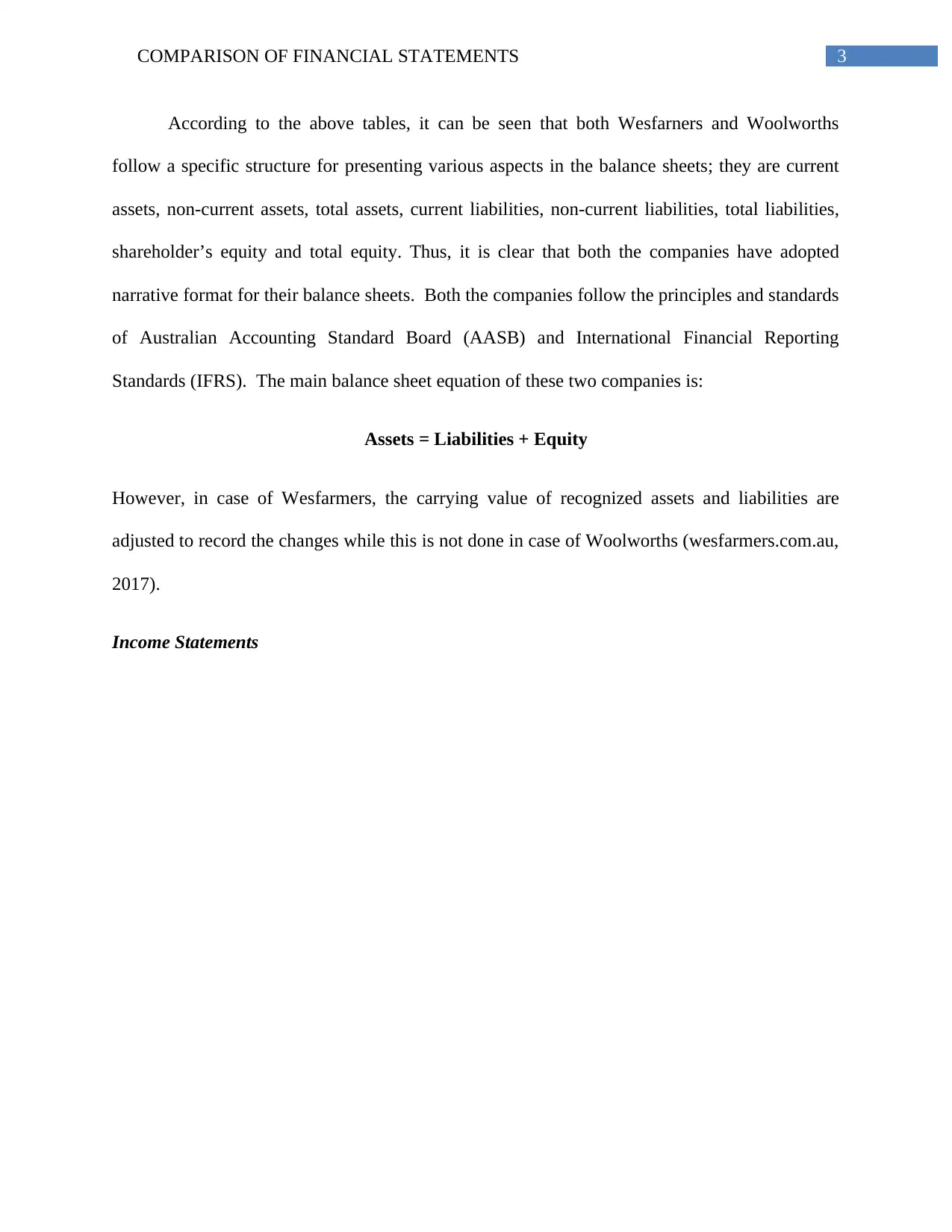

Wesfarmers

Table 3: Income Statement

(Source: wesfarmers.com.au, 2017)

Wesfarmers

Table 3: Income Statement

(Source: wesfarmers.com.au, 2017)

5COMPARISON OF FINANCIAL STATEMENTS

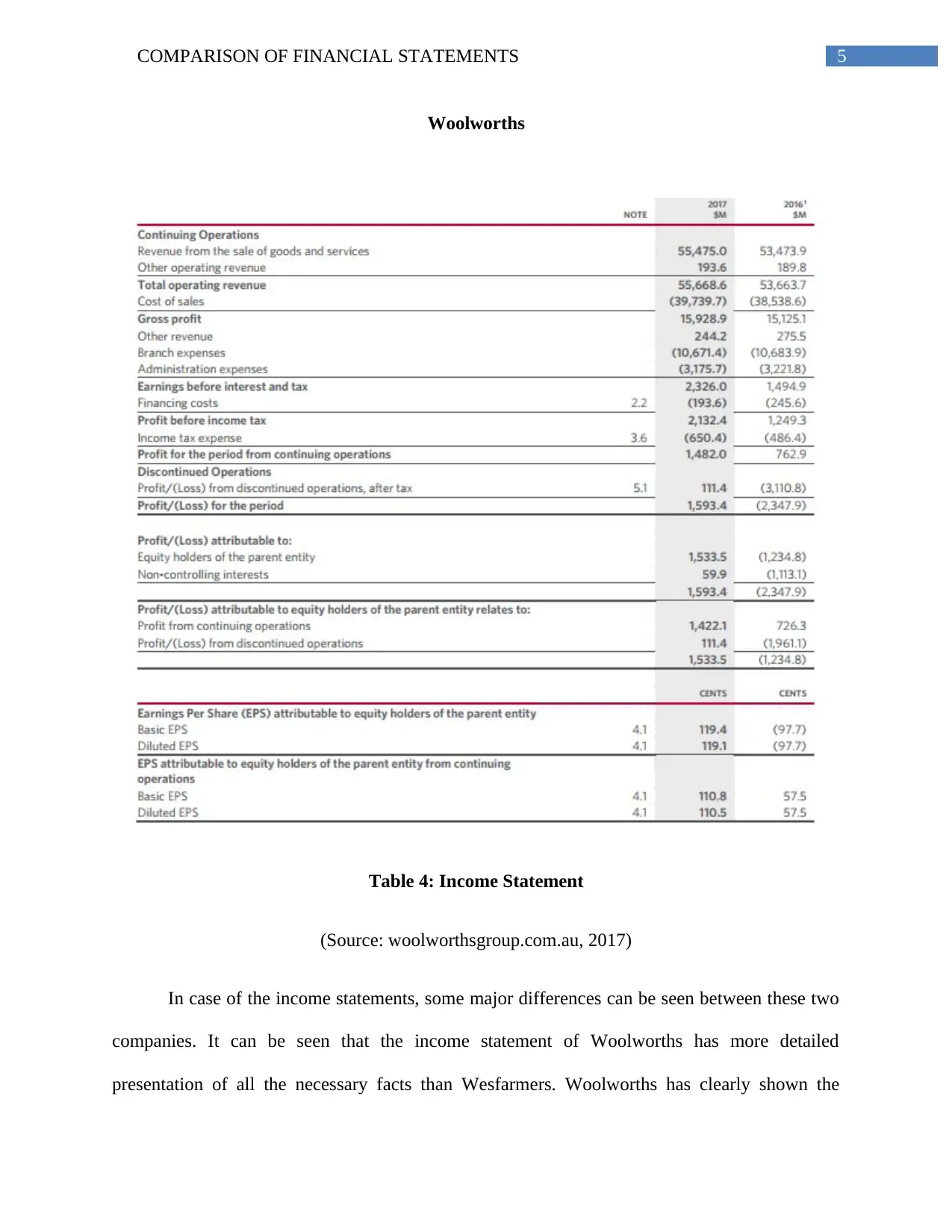

Woolworths

Table 4: Income Statement

(Source: woolworthsgroup.com.au, 2017)

In case of the income statements, some major differences can be seen between these two

companies. It can be seen that the income statement of Woolworths has more detailed

presentation of all the necessary facts than Wesfarmers. Woolworths has clearly shown the

Woolworths

Table 4: Income Statement

(Source: woolworthsgroup.com.au, 2017)

In case of the income statements, some major differences can be seen between these two

companies. It can be seen that the income statement of Woolworths has more detailed

presentation of all the necessary facts than Wesfarmers. Woolworths has clearly shown the

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6COMPARISON OF FINANCIAL STATEMENTS

arrival of gross profit in their income statements while the income statement of Wesfarners does

not have any details about gross profit (wesfarmers.com.au, 2017). Both the companies have

shown the amount of Earnings before Interest and Tax (EBIT) in their income statements. After

that, both the companies have shown the amount of profit or loss attributed to the equity

shareholders in their income statements. Some common aspects can be seen in the income

statement of both the companies; they are revenue, financial costs, tax expenses, profit, earnings

per share and others. In addition, it can be seen that both the companies have provided notes of

their income statements in their financial statements.

Cash Flows

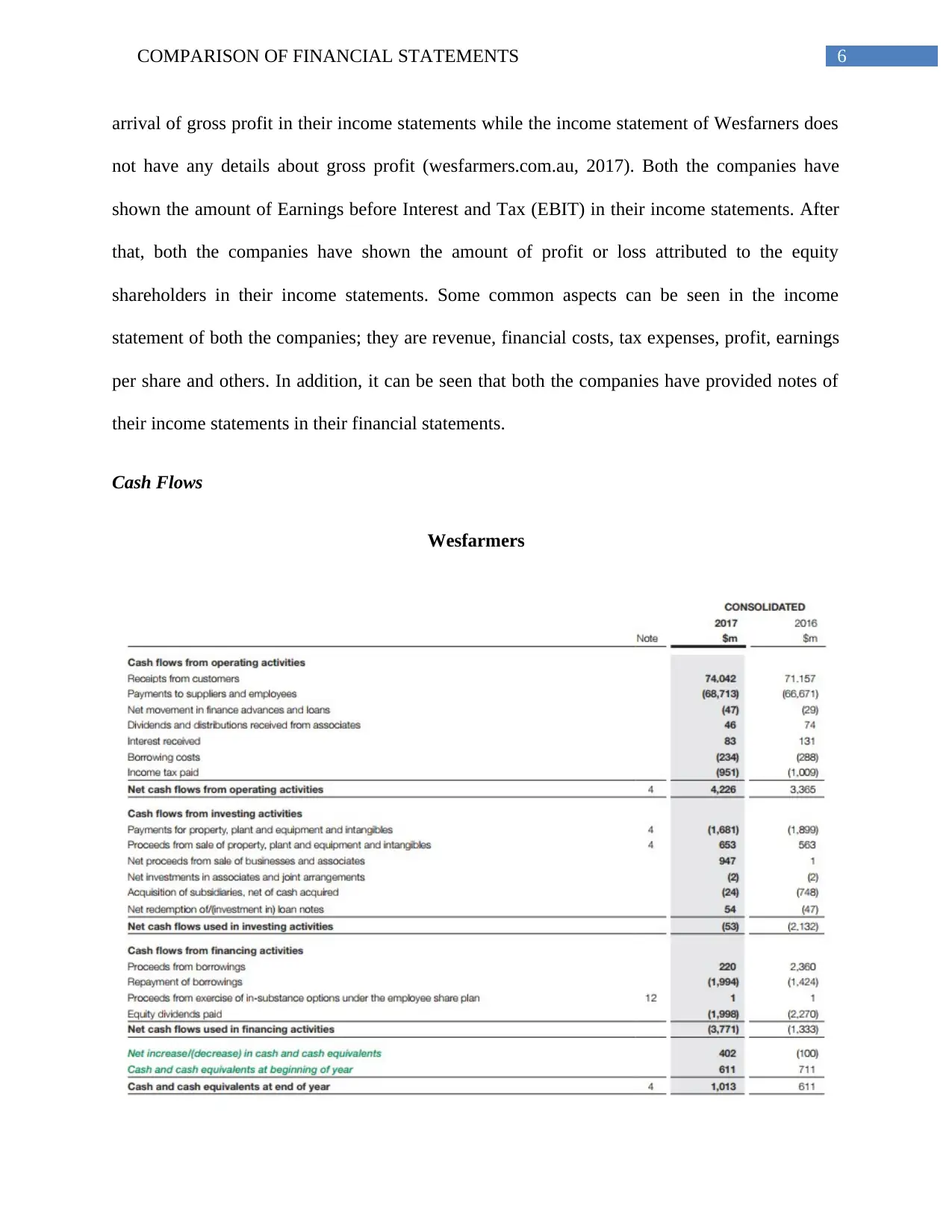

Wesfarmers

arrival of gross profit in their income statements while the income statement of Wesfarners does

not have any details about gross profit (wesfarmers.com.au, 2017). Both the companies have

shown the amount of Earnings before Interest and Tax (EBIT) in their income statements. After

that, both the companies have shown the amount of profit or loss attributed to the equity

shareholders in their income statements. Some common aspects can be seen in the income

statement of both the companies; they are revenue, financial costs, tax expenses, profit, earnings

per share and others. In addition, it can be seen that both the companies have provided notes of

their income statements in their financial statements.

Cash Flows

Wesfarmers

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7COMPARISON OF FINANCIAL STATEMENTS

Table 5: Statement of Cash Flows

(Source: wesfarmers.com.au, 2017)

Table 5: Statement of Cash Flows

(Source: wesfarmers.com.au, 2017)

8COMPARISON OF FINANCIAL STATEMENTS

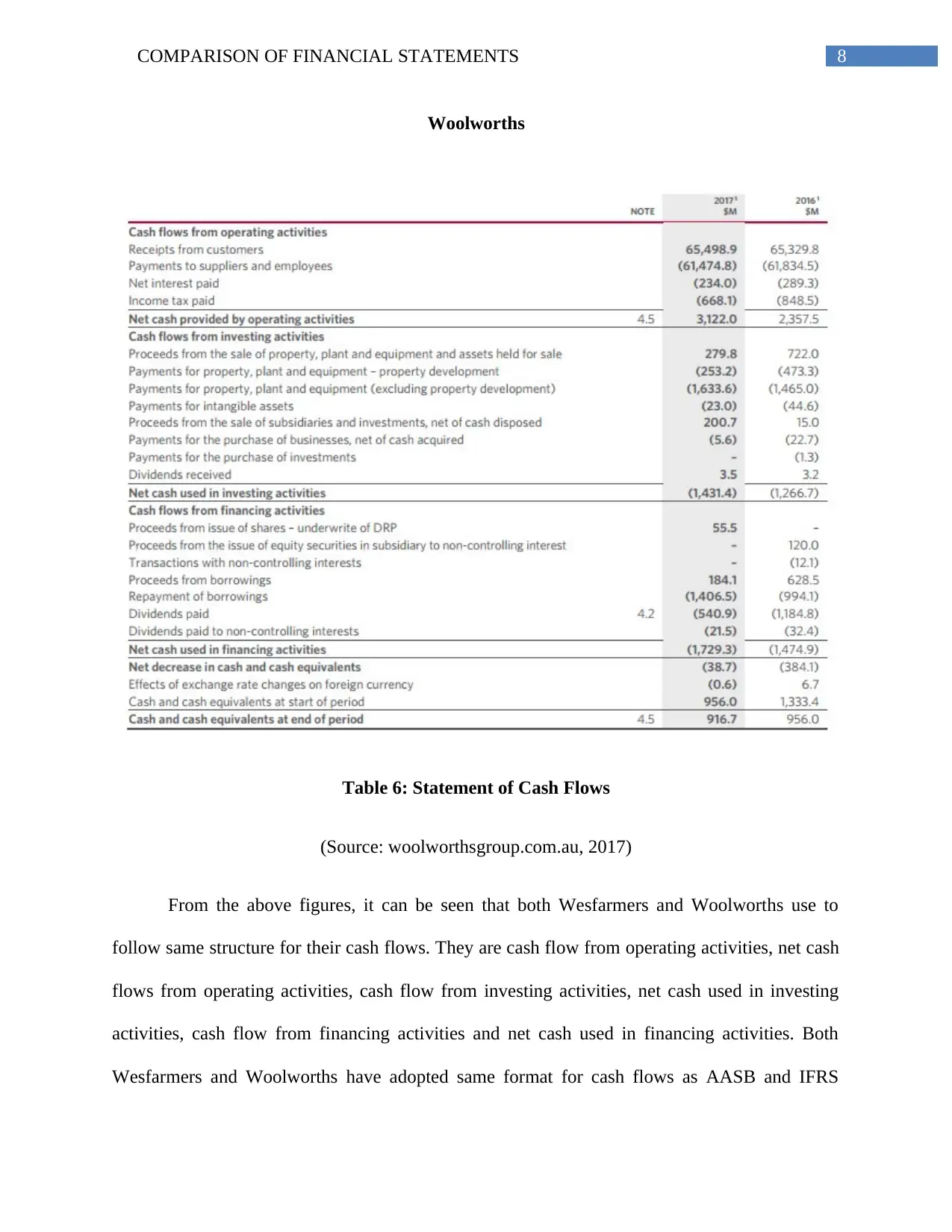

Woolworths

Table 6: Statement of Cash Flows

(Source: woolworthsgroup.com.au, 2017)

From the above figures, it can be seen that both Wesfarmers and Woolworths use to

follow same structure for their cash flows. They are cash flow from operating activities, net cash

flows from operating activities, cash flow from investing activities, net cash used in investing

activities, cash flow from financing activities and net cash used in financing activities. Both

Wesfarmers and Woolworths have adopted same format for cash flows as AASB and IFRS

Woolworths

Table 6: Statement of Cash Flows

(Source: woolworthsgroup.com.au, 2017)

From the above figures, it can be seen that both Wesfarmers and Woolworths use to

follow same structure for their cash flows. They are cash flow from operating activities, net cash

flows from operating activities, cash flow from investing activities, net cash used in investing

activities, cash flow from financing activities and net cash used in financing activities. Both

Wesfarmers and Woolworths have adopted same format for cash flows as AASB and IFRS

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9COMPARISON OF FINANCIAL STATEMENTS

govern various activities of cash flows (woolworthsgroup.com.au, 2017). However, based on the

business activities of these two companies, the amounts of various activities vary from each

other. The above figures also show that both the companies have almost same activities in their

cash flows.

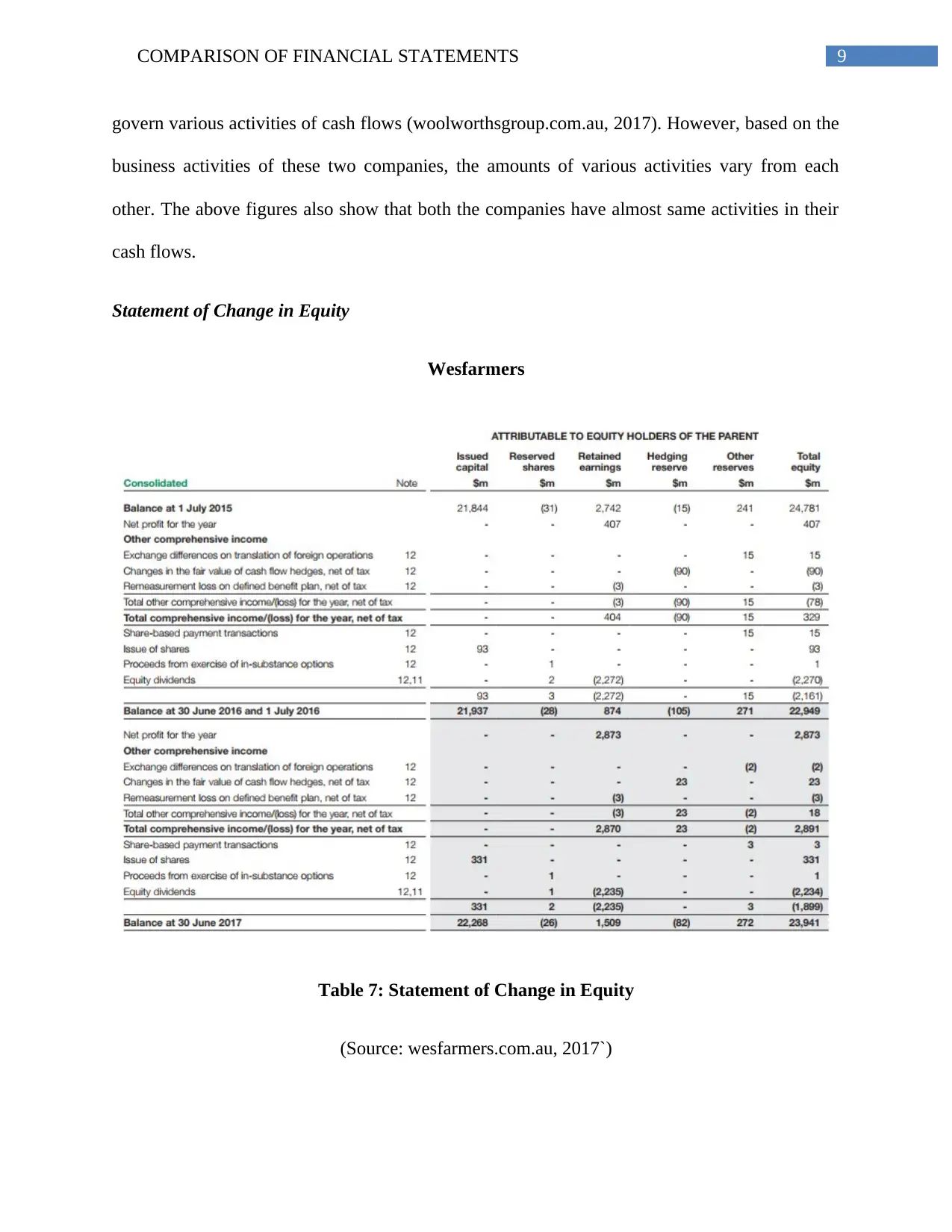

Statement of Change in Equity

Wesfarmers

Table 7: Statement of Change in Equity

(Source: wesfarmers.com.au, 2017`)

govern various activities of cash flows (woolworthsgroup.com.au, 2017). However, based on the

business activities of these two companies, the amounts of various activities vary from each

other. The above figures also show that both the companies have almost same activities in their

cash flows.

Statement of Change in Equity

Wesfarmers

Table 7: Statement of Change in Equity

(Source: wesfarmers.com.au, 2017`)

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10COMPARISON OF FINANCIAL STATEMENTS

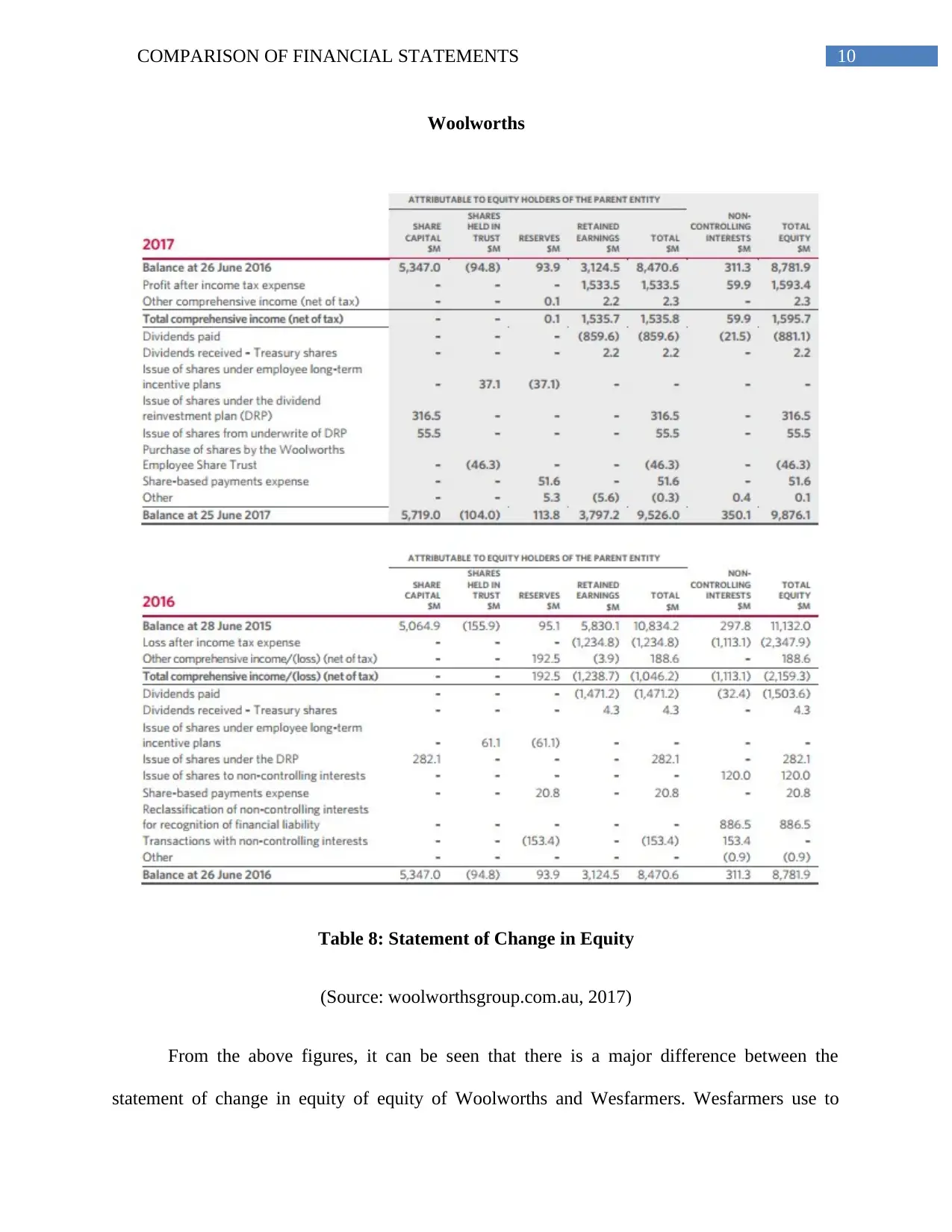

Woolworths

Table 8: Statement of Change in Equity

(Source: woolworthsgroup.com.au, 2017)

From the above figures, it can be seen that there is a major difference between the

statement of change in equity of equity of Woolworths and Wesfarmers. Wesfarmers use to

Woolworths

Table 8: Statement of Change in Equity

(Source: woolworthsgroup.com.au, 2017)

From the above figures, it can be seen that there is a major difference between the

statement of change in equity of equity of Woolworths and Wesfarmers. Wesfarmers use to

11COMPARISON OF FINANCIAL STATEMENTS

follow one statement to show change in equities while there are two statements of change in

equity for Woolworths for 2016 and 2017 (woolworthsgroup.com.au, 2017).

Thus, the above discussion shows the major similarities and differences between the

financial statements of Woolworths and Wesfarmers.

follow one statement to show change in equities while there are two statements of change in

equity for Woolworths for 2016 and 2017 (woolworthsgroup.com.au, 2017).

Thus, the above discussion shows the major similarities and differences between the

financial statements of Woolworths and Wesfarmers.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 13

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.