Comprehensive Analysis of Management Accounting & Costing Methods

VerifiedAdded on 2023/06/08

|23

|4392

|281

Report

AI Summary

This report provides a comprehensive overview of management accounting, including an explanation of management accounting systems and various methods used, such as product costing, cash flow analysis, margin analysis, break-even analysis, capital budgeting, and inventory valuation. It includes the preparation of income statements using both marginal and absorption costing methods, highlighting the differences in profit calculation under varying production and sales scenarios. The report also discusses the advantages and disadvantages of different planning tools and compares various approaches to adopting management accounting systems to address financial challenges. It emphasizes the role of management accounting in forecasting, organizing, coordinating, controlling performance, financial analysis, communication, and protecting business assets. Desklib provides access to this and many other solved assignments for students.

MANAGEMENT

ACCOUNTING

ACCOUNTING

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION ..........................................................................................................................3

TASK...............................................................................................................................................3

Explanation of management accounting system ........................................................................3

Explanation different methods used for the management accounting........................................5

Preparation of Income statement using Marginal and Absorption cost......................................7

Advantages and disadvantages of different types of planning tools .......................................16

Comparison of different ways in adopting the management accounting systems to deal with

financial problems ....................................................................................................................18

REFERENCES..............................................................................................................................20

INTRODUCTION ..........................................................................................................................3

TASK...............................................................................................................................................3

Explanation of management accounting system ........................................................................3

Explanation different methods used for the management accounting........................................5

Preparation of Income statement using Marginal and Absorption cost......................................7

Advantages and disadvantages of different types of planning tools .......................................16

Comparison of different ways in adopting the management accounting systems to deal with

financial problems ....................................................................................................................18

REFERENCES..............................................................................................................................20

INTRODUCTION

Management accounting is the application of the principles of accounting and financial

management to create, protect and increase value of the investors of for-profit-oriented

organisation and not- profit- oriented organisation. It is the integral part of management function.

It provides information to management for planning, controlling and decision making. It is wider

in scope because it includes financial accounting, budgeting, taxation and planning. It focuses

with the projection of figures for future. It does not contain any rules and regulations. It helps in

divide of the cost of products and inventories for both external and internal users. It is also

known as managerial accounting (Alsaid and et.al, 2020). The person is set up an information

system environment is known as Management Information System. In this report, explain the

management accounting , different types of management accounting system and different

methods used for management accounting report. Further it also includes the techniques to

calculate cost to prepare income statement using marginal and absorption costs, advantage and

disadvantage of budgetary control and compare how organisations are adapting management

accounting system (Bakhodirovna, A.N., 2019).

TASK

Explanation of management accounting system

The accounting is used as a tool in analysing the business activities. Accounting

information is presented in different ways. There are two types of accounting provides the

information such as financial accounting and management accounting. In this report discuss the

management accounting. It is the process of providing information to the managers in decision

making. It gives special consideration on the internal team of the organisation. The main

objective is to use the data analysis and take a better decision. Management accounting includes

many aspects of accounting. It focuses at improving the quality of information relating to the

cost and sales revenue of goods and services of the company. Management accountants work in

both public and private sectors. It gives the information both monetary and non monetary (Burritt

and et.al, 2021). There are many functions of the management accounting but the main functions

are as follow-

1. forecasting- It plays an important role in management accounting. Its objective is to

provide the information for making short term and long term decision. The management

Management accounting is the application of the principles of accounting and financial

management to create, protect and increase value of the investors of for-profit-oriented

organisation and not- profit- oriented organisation. It is the integral part of management function.

It provides information to management for planning, controlling and decision making. It is wider

in scope because it includes financial accounting, budgeting, taxation and planning. It focuses

with the projection of figures for future. It does not contain any rules and regulations. It helps in

divide of the cost of products and inventories for both external and internal users. It is also

known as managerial accounting (Alsaid and et.al, 2020). The person is set up an information

system environment is known as Management Information System. In this report, explain the

management accounting , different types of management accounting system and different

methods used for management accounting report. Further it also includes the techniques to

calculate cost to prepare income statement using marginal and absorption costs, advantage and

disadvantage of budgetary control and compare how organisations are adapting management

accounting system (Bakhodirovna, A.N., 2019).

TASK

Explanation of management accounting system

The accounting is used as a tool in analysing the business activities. Accounting

information is presented in different ways. There are two types of accounting provides the

information such as financial accounting and management accounting. In this report discuss the

management accounting. It is the process of providing information to the managers in decision

making. It gives special consideration on the internal team of the organisation. The main

objective is to use the data analysis and take a better decision. Management accounting includes

many aspects of accounting. It focuses at improving the quality of information relating to the

cost and sales revenue of goods and services of the company. Management accountants work in

both public and private sectors. It gives the information both monetary and non monetary (Burritt

and et.al, 2021). There are many functions of the management accounting but the main functions

are as follow-

1. forecasting- It plays an important role in management accounting. Its objective is to

provide the information for making short term and long term decision. The management

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

accountant uses the probability, regression and correlation, budgeted and standard

costing and cash fund flows statements for the planning of the business.

2. Organising- It is the managerial process which defines the function of each manager and

operator. In the first step of the organising is to determination of all activities which are

important for the organisation objectives. It identifies the total work load that need for

realizing objectives. After determining all objectives must be divided that is related

activities at one place in the subgroup. In the next step of organising delegation of

authority to each manager of the job assigned. In the final step of organising to create

the relationship between authority and all personnel managers and operators.

3. Coordinating- It helps the management by reconcile the cost and financial accounts, by

preparing budgets and evaluate the standard cost. The management accountant helps in

increasing profits by providing different tools of budgeting (Diab and et.al, 2020).

4. Control performance- To use of the standard costing, accounting ratios and cost

reduction technique help in controlling the performance of the organisation.

5. Financial analysis and interpretation- The management accountant analyses the data in

simple manner so that the owners may understand and to take decision without and

difficulty.

6. Communication- The accountant prepares reports to communicate the results to

different departments like top management, middle management and employees. It also

provides the information with the external world about the growth of the business.

7. Protection of business assets- It is responsible for the conservation of business assets.

The management account looks the sufficient funds are available in the business for

repairing of fixed assets so that the production may not be affected (Gerdin and et.al,

2021).

There are many benefits of the management accounting system but the most important

objective is to help the management team of an organisation in improving the quality of decision.

Some benefits of management accounting-

1. Decision making- The management uses the costing economics and statistics techniques

that makes the process of decision making easier.

costing and cash fund flows statements for the planning of the business.

2. Organising- It is the managerial process which defines the function of each manager and

operator. In the first step of the organising is to determination of all activities which are

important for the organisation objectives. It identifies the total work load that need for

realizing objectives. After determining all objectives must be divided that is related

activities at one place in the subgroup. In the next step of organising delegation of

authority to each manager of the job assigned. In the final step of organising to create

the relationship between authority and all personnel managers and operators.

3. Coordinating- It helps the management by reconcile the cost and financial accounts, by

preparing budgets and evaluate the standard cost. The management accountant helps in

increasing profits by providing different tools of budgeting (Diab and et.al, 2020).

4. Control performance- To use of the standard costing, accounting ratios and cost

reduction technique help in controlling the performance of the organisation.

5. Financial analysis and interpretation- The management accountant analyses the data in

simple manner so that the owners may understand and to take decision without and

difficulty.

6. Communication- The accountant prepares reports to communicate the results to

different departments like top management, middle management and employees. It also

provides the information with the external world about the growth of the business.

7. Protection of business assets- It is responsible for the conservation of business assets.

The management account looks the sufficient funds are available in the business for

repairing of fixed assets so that the production may not be affected (Gerdin and et.al,

2021).

There are many benefits of the management accounting system but the most important

objective is to help the management team of an organisation in improving the quality of decision.

Some benefits of management accounting-

1. Decision making- The management uses the costing economics and statistics techniques

that makes the process of decision making easier.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

2. Planning- it is a continuous and ongoing process. The financial information is presented

to the management at weekly, monthly and yearly. The managers use this information to

plan the activities of the organisation (Habib and et.al, 2019).

3. Identifying business problem areas- Management accounting helps to identify those

product is not work well or some department is going into unexpected losses. It also helps

to identify ways to solve the business problem.

4. Strategic management- It is not necessary method to followed by company. It focuses

on core areas and provides the information to management for take strategic decisions.

The limitations of management accounting-

1. Less knowledge- The management has less knowledge of economics finance and

statistics.

2. Data based on financial accounting- The management take decision on the basis of

financial accounting so that it is not completed and accurately. These data identifies the

strength and weakness of management accounting system.

3. Outdated data- Data is based on the historical so that management may change while

taking decision.

4. Expensive- the setup cost of management accounting system is very expensive so that the

small organisation can not bear this cost. This accounting is restricted to big organisation.

5. Management accounting is only tool- It is only the tool which provides the information to

management for decision making. The implementation is the prerogative of the

management (Heinzelmann, R., 2018).

Explanation different methods used for the management accounting

There are different methods which is used in management accountant by an organisation.

They are as follow-

1. Product costing and Valuation- It identifies the total cost involved in the production of

goods and services. Costs includes variable, fixed, direct and indirect costs. It is used to

determine the cost to each type of product crated by the company. To used direct costs

method, the management accountants determine the actual value of goods sold and

inventory that may be in different stages of production. Marginal costing is also known as

cost volume profit analysis. It is useful for taking short term economic decision. The

to the management at weekly, monthly and yearly. The managers use this information to

plan the activities of the organisation (Habib and et.al, 2019).

3. Identifying business problem areas- Management accounting helps to identify those

product is not work well or some department is going into unexpected losses. It also helps

to identify ways to solve the business problem.

4. Strategic management- It is not necessary method to followed by company. It focuses

on core areas and provides the information to management for take strategic decisions.

The limitations of management accounting-

1. Less knowledge- The management has less knowledge of economics finance and

statistics.

2. Data based on financial accounting- The management take decision on the basis of

financial accounting so that it is not completed and accurately. These data identifies the

strength and weakness of management accounting system.

3. Outdated data- Data is based on the historical so that management may change while

taking decision.

4. Expensive- the setup cost of management accounting system is very expensive so that the

small organisation can not bear this cost. This accounting is restricted to big organisation.

5. Management accounting is only tool- It is only the tool which provides the information to

management for decision making. The implementation is the prerogative of the

management (Heinzelmann, R., 2018).

Explanation different methods used for the management accounting

There are different methods which is used in management accountant by an organisation.

They are as follow-

1. Product costing and Valuation- It identifies the total cost involved in the production of

goods and services. Costs includes variable, fixed, direct and indirect costs. It is used to

determine the cost to each type of product crated by the company. To used direct costs

method, the management accountants determine the actual value of goods sold and

inventory that may be in different stages of production. Marginal costing is also known as

cost volume profit analysis. It is useful for taking short term economic decision. The

impact of the contribution margin of a specific product on the overall profit of the

company.

2. Cash flow analysis- The management accountant is used this technique to determine the

cash impact of business decision. Most of the companies follow the accrual concept of

accounting to determine the accurate picture of company's financial statements. It also

helps in implement working capital management strategies in order to optimize cash flow

(Kenno, S.A. and Free, C., 2018).

3. Margin analysis- It identifies the amount of profit or cash inflow and outflow from a

specific product, store and customer. The three profit margin ratios such as gross profit

margins, operating profit margins and net profit margins. Companies use large profit

margins with competitive advantage over other companies in their industry. Gross profit

margin determines the profit a company after deduct cost of good sold. Net profit margin

analyses the net profit after minus interest and taxes expenses. Operating profit margin

shows the company generating income from the operation of the business.

4. Break even analysis- It is a financial calculation used by companies to determine break

even point. It reveals how many unit will have sold to cover all of cost that is company

will have neither lost money nor made a profit.

5. Capital budgeting analysis- It is a method of determining how invest in capital assets that

generate cash flow benefit for more than one year. It focuses three stages such as decision

analysis for knowledge building, option pricing to establish position and discounted cash

flow for making the investment decision.

6. Inventory valuation- It is a method that is followed by companies and other corporate

entities to determine the direct cost of goods sold and inventory items. Inventory is a

current asset of the company and record in balance sheet. To valuation of inventory the

following costs are included – direct materials, direct labour, factory overheads and

import duties (Liu, Y., 2021).

7. Trend analysis- It is technique that used in technical analysis to identify the future stock

price based on the current trend data. It analysis three typical time horizons- short,

medium and long term.

company.

2. Cash flow analysis- The management accountant is used this technique to determine the

cash impact of business decision. Most of the companies follow the accrual concept of

accounting to determine the accurate picture of company's financial statements. It also

helps in implement working capital management strategies in order to optimize cash flow

(Kenno, S.A. and Free, C., 2018).

3. Margin analysis- It identifies the amount of profit or cash inflow and outflow from a

specific product, store and customer. The three profit margin ratios such as gross profit

margins, operating profit margins and net profit margins. Companies use large profit

margins with competitive advantage over other companies in their industry. Gross profit

margin determines the profit a company after deduct cost of good sold. Net profit margin

analyses the net profit after minus interest and taxes expenses. Operating profit margin

shows the company generating income from the operation of the business.

4. Break even analysis- It is a financial calculation used by companies to determine break

even point. It reveals how many unit will have sold to cover all of cost that is company

will have neither lost money nor made a profit.

5. Capital budgeting analysis- It is a method of determining how invest in capital assets that

generate cash flow benefit for more than one year. It focuses three stages such as decision

analysis for knowledge building, option pricing to establish position and discounted cash

flow for making the investment decision.

6. Inventory valuation- It is a method that is followed by companies and other corporate

entities to determine the direct cost of goods sold and inventory items. Inventory is a

current asset of the company and record in balance sheet. To valuation of inventory the

following costs are included – direct materials, direct labour, factory overheads and

import duties (Liu, Y., 2021).

7. Trend analysis- It is technique that used in technical analysis to identify the future stock

price based on the current trend data. It analysis three typical time horizons- short,

medium and long term.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

8. Target costing- It is an approach to determine a product life cycle. It includes all cost

from production level to component level. It is the maximum cost that incurred on a

product.

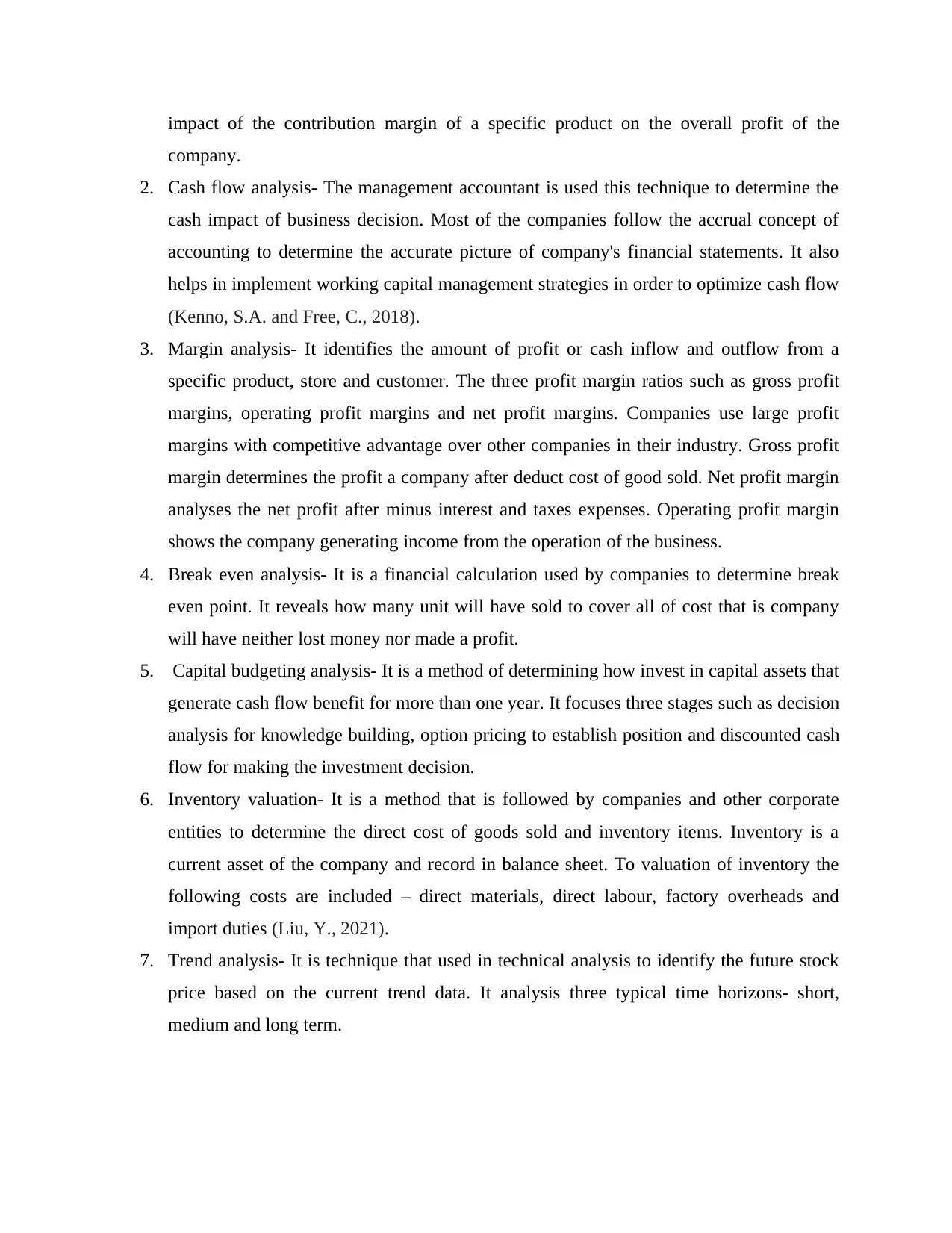

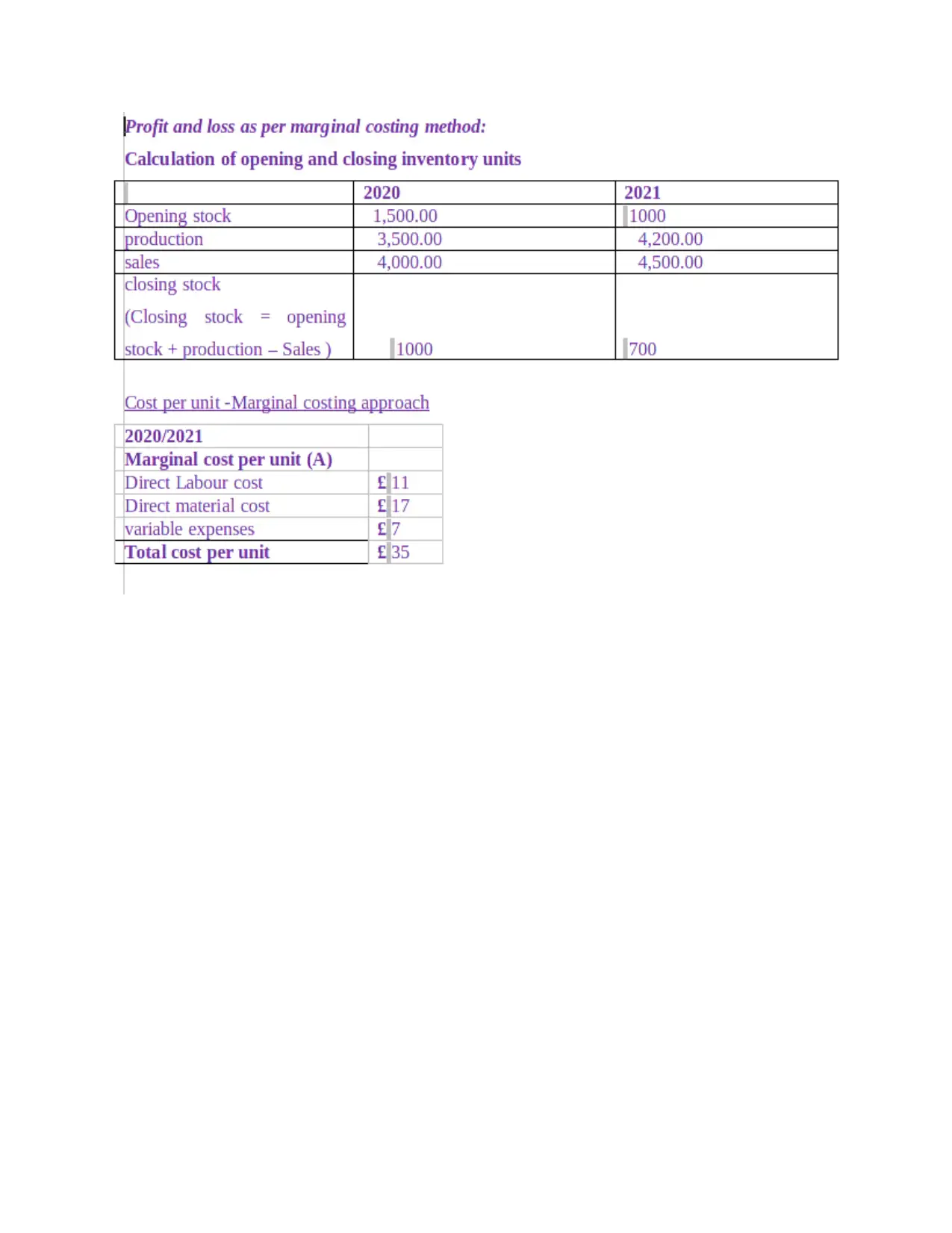

Preparation of Income statement using Marginal and Absorption cost

Marginal costing- It is an important concept in managerial accounting. Company can earn more

profit when marginal cost equals to marginal revenue. It is a method the variable costs are

assume the product cost and the fixed costs are considered as period's cost. Under this method

the opening and closing stocks does not affect the cost per unit. The cost can be divided into

fixed and variable. The main objective of marginal cost shows forth the contribution of the

production cost (Miles, S. and Miles, S., 2019).

Absorption Costing- It is method that assumes both fixed and variable costs as production costs.

It is also known as full costing. Under this costing more expenses are included in closing

inventory, so that it becomes assets of the company for the next year. To use of absorption

costing generates a situation that the manufacturing more items that go unsold by the year ending

so that net income increases. The direct materials, direct labour and indirect expenses such as

rent, insurance are accounted for by using this method.

There are four methods to preparation of income statement using marginal and absorption

cost. They are as follow-

1. Where there is production but no sale- In this method the profit may reflect when no

sales has been made. This is occur due to fixed manufacturing overheads have been over

absorbed above average capacity production than its actual fixed manufacturing overheads. The

income statement shows loss as there are no sales. The income statement shows gross profit

equal to the amount of over absorption of fixed manufacturing overheads when sales have not

made. Under this method the profit is influenced many factors such as unit sold, selling price and

cost of production (Mohammad Rezaei, F., 2018). The format of income statements using

absorption costing and marginal costing method.

Income statement( Absorption Costing)

Sales -

Variable cost xxx

Fixed manufacturing overheads xxx

from production level to component level. It is the maximum cost that incurred on a

product.

Preparation of Income statement using Marginal and Absorption cost

Marginal costing- It is an important concept in managerial accounting. Company can earn more

profit when marginal cost equals to marginal revenue. It is a method the variable costs are

assume the product cost and the fixed costs are considered as period's cost. Under this method

the opening and closing stocks does not affect the cost per unit. The cost can be divided into

fixed and variable. The main objective of marginal cost shows forth the contribution of the

production cost (Miles, S. and Miles, S., 2019).

Absorption Costing- It is method that assumes both fixed and variable costs as production costs.

It is also known as full costing. Under this costing more expenses are included in closing

inventory, so that it becomes assets of the company for the next year. To use of absorption

costing generates a situation that the manufacturing more items that go unsold by the year ending

so that net income increases. The direct materials, direct labour and indirect expenses such as

rent, insurance are accounted for by using this method.

There are four methods to preparation of income statement using marginal and absorption

cost. They are as follow-

1. Where there is production but no sale- In this method the profit may reflect when no

sales has been made. This is occur due to fixed manufacturing overheads have been over

absorbed above average capacity production than its actual fixed manufacturing overheads. The

income statement shows loss as there are no sales. The income statement shows gross profit

equal to the amount of over absorption of fixed manufacturing overheads when sales have not

made. Under this method the profit is influenced many factors such as unit sold, selling price and

cost of production (Mohammad Rezaei, F., 2018). The format of income statements using

absorption costing and marginal costing method.

Income statement( Absorption Costing)

Sales -

Variable cost xxx

Fixed manufacturing overheads xxx

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Cost of goods manufactured xxx

Less- closing inventory (xxx)

Cost of goods sold xxx

Less- Over absorption of overheads (xxx)

Gross profit xxx

Less- other fixed expenses (xxx)

Net income xxx

Income statement( Marginal Costing)

Sales Nil

Variable cost:

Cost of goods manufactured xxx

Less- closing inventory (xxx)

Cost of goods sold xxx

Contribution:

Less- Fixed manufacturing overhead xxx

Other fixed expenses xxx (xxx)

Net loss (xxx)

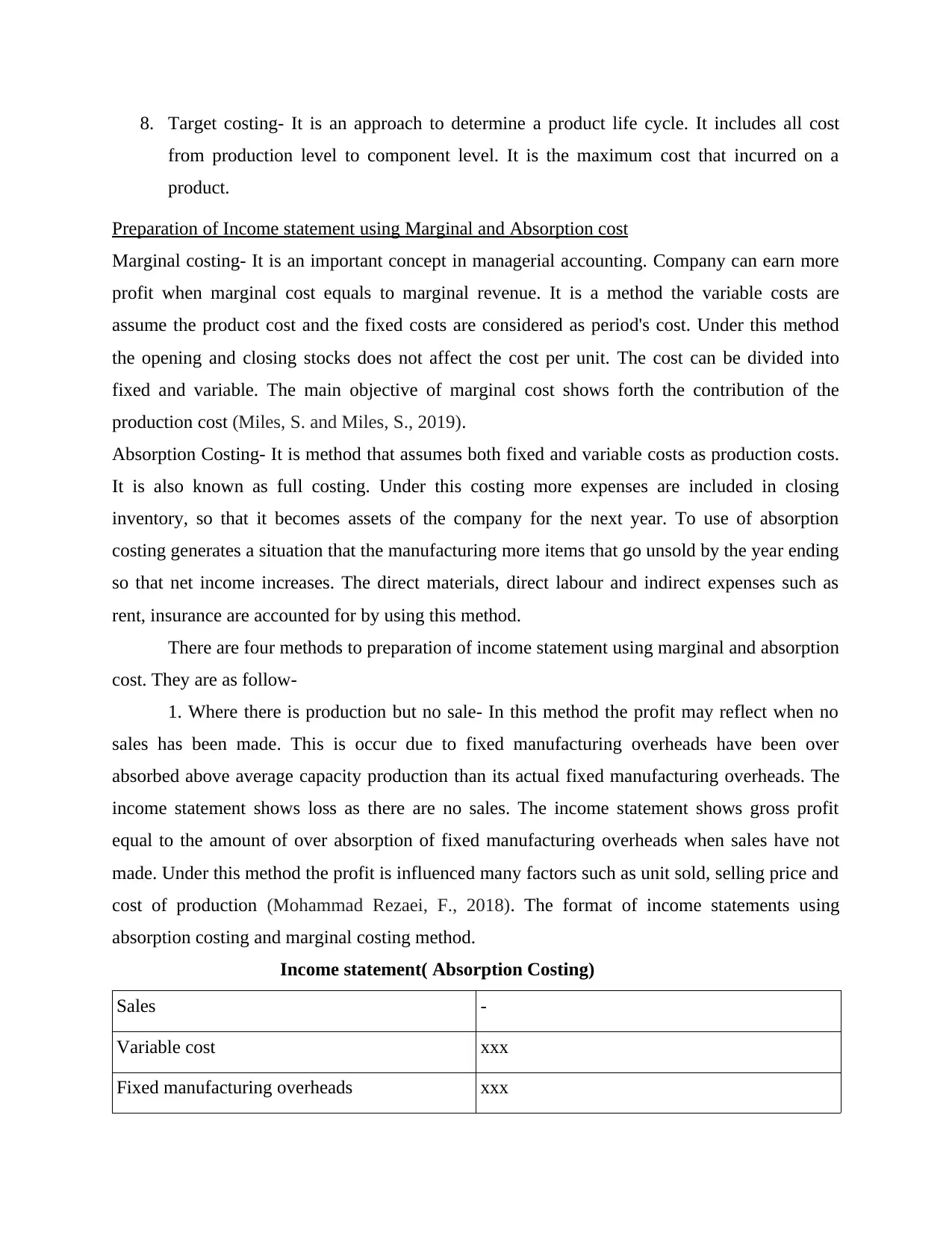

2.When production is equal to sales: There is no opening and closing stock because

production is equal to sales. Under this method the profit will be remain same because the

closing stock of finished goods does not change (Quinn and et.al, 2018).

Income statement(Absorption costing)

Sales xxx

Less- cost of goods manufactured:

Material and labour cost xxx

Less- closing inventory (xxx)

Cost of goods sold xxx

Less- Over absorption of overheads (xxx)

Gross profit xxx

Less- other fixed expenses (xxx)

Net income xxx

Income statement( Marginal Costing)

Sales Nil

Variable cost:

Cost of goods manufactured xxx

Less- closing inventory (xxx)

Cost of goods sold xxx

Contribution:

Less- Fixed manufacturing overhead xxx

Other fixed expenses xxx (xxx)

Net loss (xxx)

2.When production is equal to sales: There is no opening and closing stock because

production is equal to sales. Under this method the profit will be remain same because the

closing stock of finished goods does not change (Quinn and et.al, 2018).

Income statement(Absorption costing)

Sales xxx

Less- cost of goods manufactured:

Material and labour cost xxx

Variable manufacturing overheads xxx

Fixed manufacturing overheads xxx (xxx)

Gross profit xxx

Less- other fixed overheads (xxx)

Net income xxx

Income statements(Marginal Costing)

Sales xxx

Less- variable cost:

Material and labour cost xxx

Variable manufacturing overheads xxx (xxx)

Contribution xxx

Less- fixed cost:

Manufacturing overheads xxx

Other fixed cost xxx (xxx)

Net income xxx

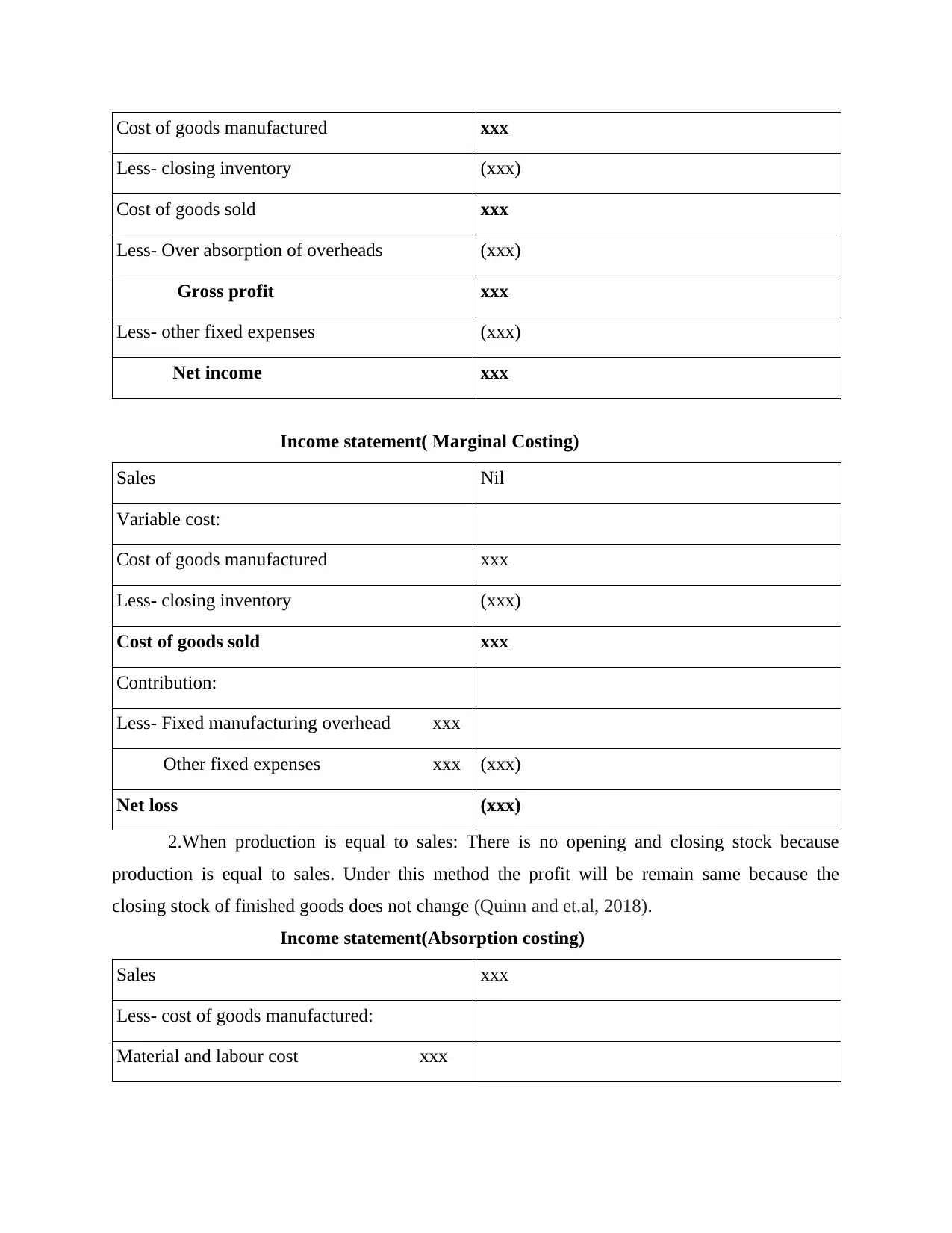

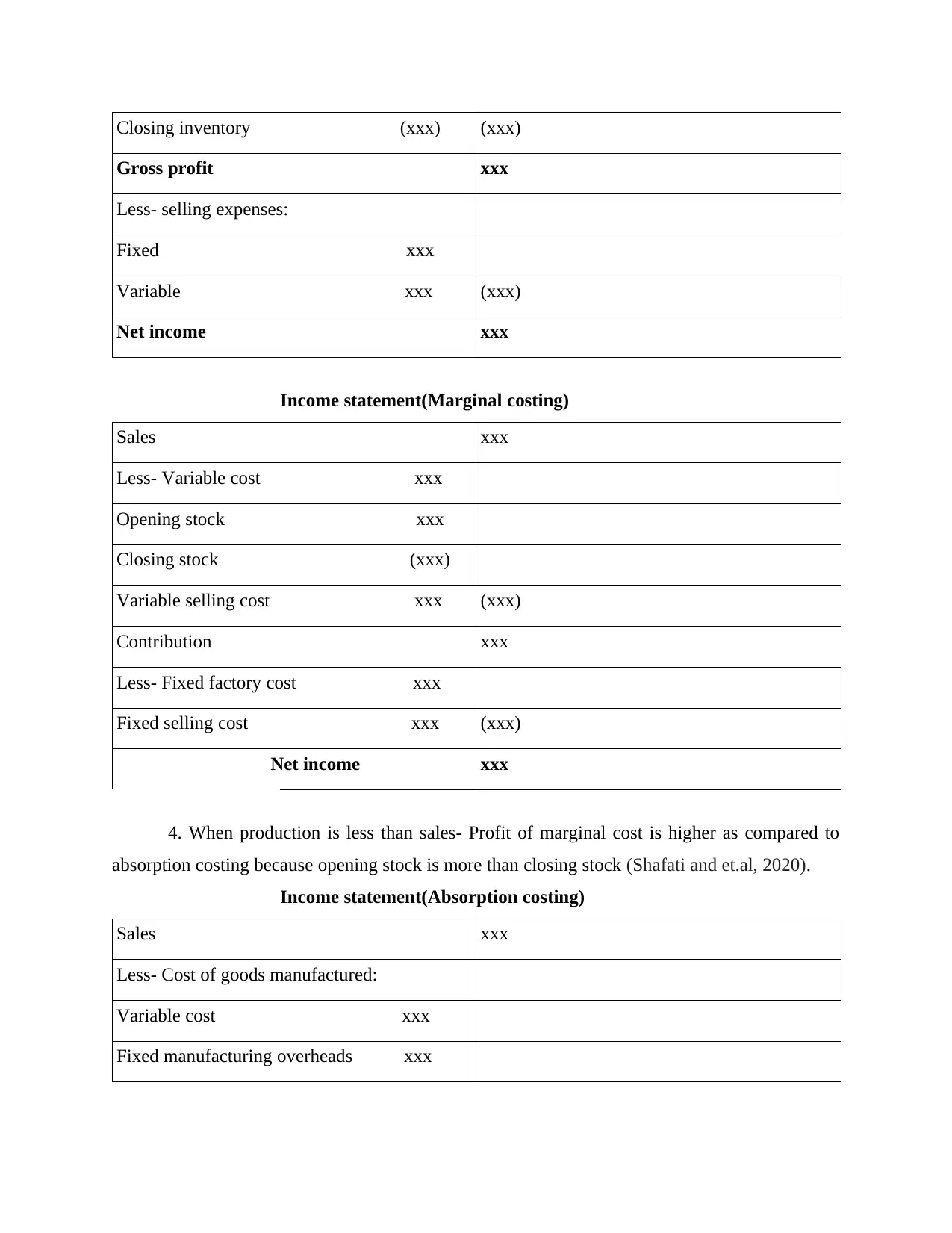

3. When production is more than sales- In absorption costing profit is more than as

compare to marginal costing because closing stock is more than opening stock that is production

is more than sales (Saliy and et.al, 2021).

Income statement(Absorption costing)

Sales xxx

Less- Cost of goods manufactured:

Variable cost xxx

Fixed manufacturing overheads xxx

Opening stock xxx

Fixed manufacturing overheads xxx (xxx)

Gross profit xxx

Less- other fixed overheads (xxx)

Net income xxx

Income statements(Marginal Costing)

Sales xxx

Less- variable cost:

Material and labour cost xxx

Variable manufacturing overheads xxx (xxx)

Contribution xxx

Less- fixed cost:

Manufacturing overheads xxx

Other fixed cost xxx (xxx)

Net income xxx

3. When production is more than sales- In absorption costing profit is more than as

compare to marginal costing because closing stock is more than opening stock that is production

is more than sales (Saliy and et.al, 2021).

Income statement(Absorption costing)

Sales xxx

Less- Cost of goods manufactured:

Variable cost xxx

Fixed manufacturing overheads xxx

Opening stock xxx

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Closing inventory (xxx) (xxx)

Gross profit xxx

Less- selling expenses:

Fixed xxx

Variable xxx (xxx)

Net income xxx

Income statement(Marginal costing)

Sales xxx

Less- Variable cost xxx

Opening stock xxx

Closing stock (xxx)

Variable selling cost xxx (xxx)

Contribution xxx

Less- Fixed factory cost xxx

Fixed selling cost xxx (xxx)

Net income xxx

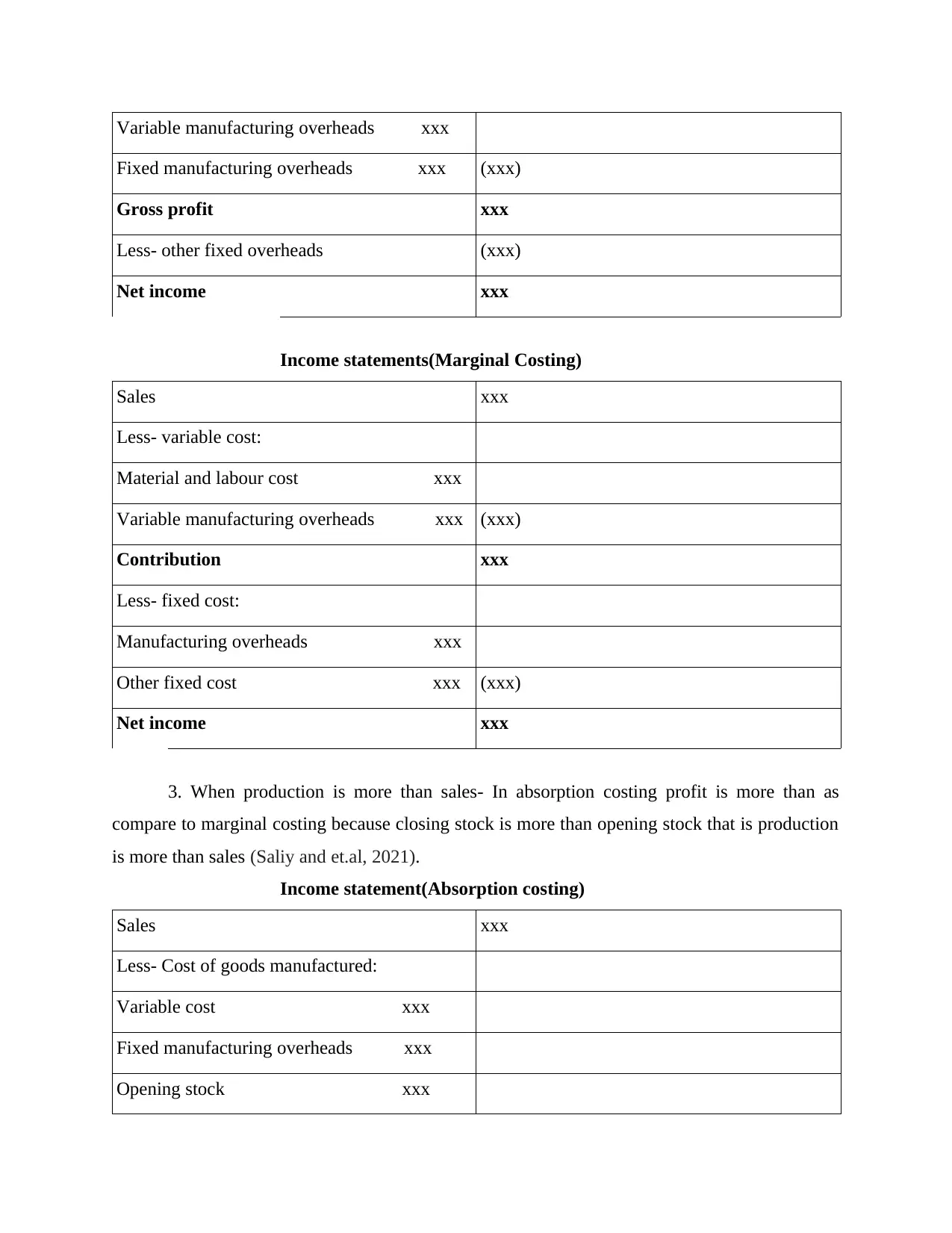

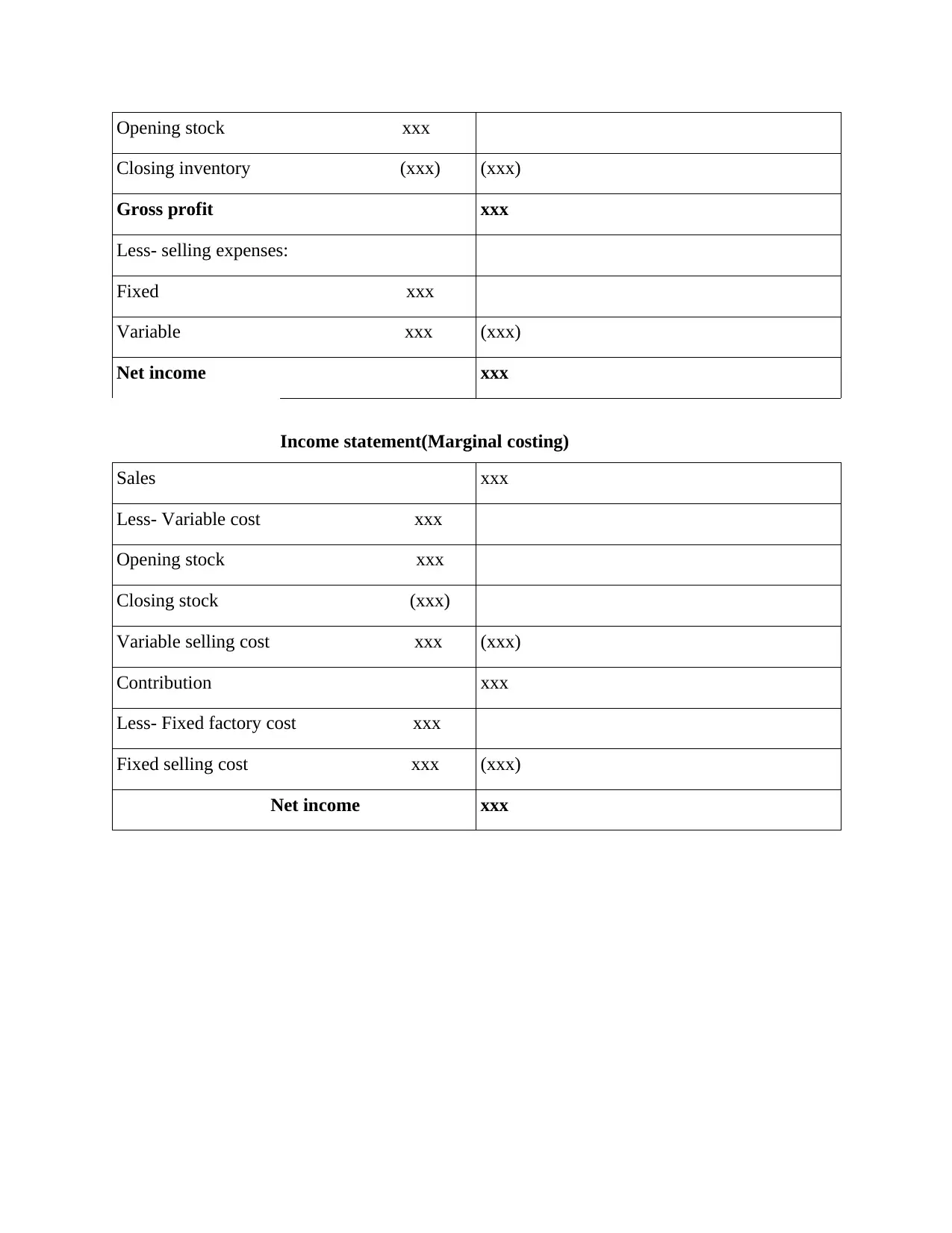

4. When production is less than sales- Profit of marginal cost is higher as compared to

absorption costing because opening stock is more than closing stock (Shafati and et.al, 2020).

Income statement(Absorption costing)

Sales xxx

Less- Cost of goods manufactured:

Variable cost xxx

Fixed manufacturing overheads xxx

Gross profit xxx

Less- selling expenses:

Fixed xxx

Variable xxx (xxx)

Net income xxx

Income statement(Marginal costing)

Sales xxx

Less- Variable cost xxx

Opening stock xxx

Closing stock (xxx)

Variable selling cost xxx (xxx)

Contribution xxx

Less- Fixed factory cost xxx

Fixed selling cost xxx (xxx)

Net income xxx

4. When production is less than sales- Profit of marginal cost is higher as compared to

absorption costing because opening stock is more than closing stock (Shafati and et.al, 2020).

Income statement(Absorption costing)

Sales xxx

Less- Cost of goods manufactured:

Variable cost xxx

Fixed manufacturing overheads xxx

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Opening stock xxx

Closing inventory (xxx) (xxx)

Gross profit xxx

Less- selling expenses:

Fixed xxx

Variable xxx (xxx)

Net income xxx

Income statement(Marginal costing)

Sales xxx

Less- Variable cost xxx

Opening stock xxx

Closing stock (xxx)

Variable selling cost xxx (xxx)

Contribution xxx

Less- Fixed factory cost xxx

Fixed selling cost xxx (xxx)

Net income xxx

Closing inventory (xxx) (xxx)

Gross profit xxx

Less- selling expenses:

Fixed xxx

Variable xxx (xxx)

Net income xxx

Income statement(Marginal costing)

Sales xxx

Less- Variable cost xxx

Opening stock xxx

Closing stock (xxx)

Variable selling cost xxx (xxx)

Contribution xxx

Less- Fixed factory cost xxx

Fixed selling cost xxx (xxx)

Net income xxx

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 23

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.